#Online Distribution Loan UAE

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

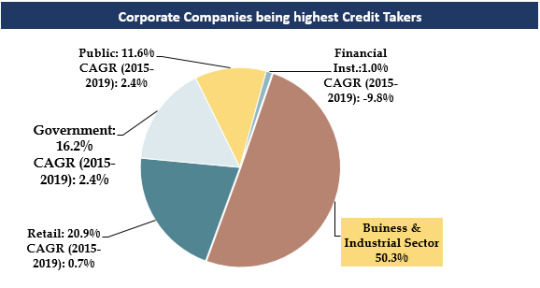

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

Employee Self-Service Portal in UAE

Employee Self-Service Portal (ESS) is a web-based resource through which employees can access their personal records and employment-related data. An ESS portal in UAE enables employees to manage different human capital services and job-related requests, without having to rely on the HR department.

HLB HAMT Level 18 City Tower -2, Sheikh Zayed Road PO Box No 32665 Dubai – United Arab Emirates. T: +971 4 327 7775 E-mail: [email protected]

ESS Portal Modules

Employee Leave Management

Employee Profile Management

Loans and Advances applications

Report Center

Role Delegation

Edit Info portal

Proxy Requests

Configurable Approval Workflow

Configurable User Rights management

Team View and Calendar View

To-Do Lists

Alerts and Notification

Online Payslip

Exit Interview

Online Employee clearance

Expense claim Management

Business Travel claim

Air Ticket\ Leave Passage

School Fees reimbursement

Letters and Certificates

Over Time\ Time Sheet

Significance of ESS Portal

Before the advent of ESS portals, the HR department of an organization used to face numerous challenges, which adversely affected their productivity. The most common challenges they had to face were;

1. Communication between employees and employers 2. Collecting, authenticating, and managing employee reimbursement requests 3. Managing the IT declaration process every month

Unlike the traditional method, wherein employees had to personally call the HR or visit them to enquire about their leaves, payroll information, etc, now they can access all this information with just a login name and password. This has made the work of not just employees easier, but the HR department as well. The HR department of any organization is always equipped with work related to hiring, payroll calculation, etc and having employees approach them for minor reasons, can add to their work load. With ESS portal, HR can focus on their core work.

The HR department of an organization has the responsibility to inform numerous things to the employees; it can be organization policies or important announcements made by the Government. Hence, it is mandatory for HR and payroll departments to be able to communicate without any sort of friction.

The ESS portal attained much more significance with Covid-19 pandemic and the remote working scenario that resulted from it. Most of the organizations had to rely on work from home option; but the ones that use ESS portals didn’t face major issues with regard to employee attendance, leave recording, etc.

By giving employees access to their personal details as well information related to the entity, the employee engagement level increases, which brings in more productivity and also, employees are not left in ambiguity. They have the flexibility and freedom to complete tasks without having to make numerous phone calls or send multiple mails.

ESS portals are not just any additional feature of payroll; the right one has the potential to boost the efficiency and productivity of an organization. A properly organized ESS portal with the correct features will enhance the positive outlook of employees towards their organization. It can save time by making certain complex tasks such as follow-up communication, reimbursements, IT declarations, POI, and information distribution easier and fast. HLB HAMT’s employee self-service portal helps companies overcome HR-related complexities and execute operations effectively.

READ MORE: https://hlbhamt.com/ess-employee-self-service-portal-uae/

0 notes

Text

Mobile Money Market Drivers and Growth Rate, Forecast By 2024

MarketsandMarkets expects the global Mobile Money Industry size to grow from USD 3.4 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 28.7% during the forecast period. Mobile payments is an easy way to carry out transactions and people across the globe are adopting mobile money to reduce their dependence on cash while traveling. A rise in the number of payment transactions, banking values, and mobile penetration rate across the world are factors driving the mobile money market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=577

The growth of the mobile money market in the MEA is further driven by increased investments in payment technologies made by governments of countries, such as Qatar, South Africa, and the UAE. This region has a presence of creditable Mobile Network Operators (MNOs), banks, and payment processing agents, which encourage the use of mobile money services. For instance, in February 2019, MTN and Ericsson signed a 5-year contract extension for the distribution of new products and the provision of mobile money services in 13 countries across the MEA region. Ericsson aims to deploy the Ericsson Wallet Platform in new markets to serve MTN’s customers.

Key and emerging market players include Vodafone (UK), Google (US), Orange (France), FIS (US), Paypal (US), Mastercard (US), Fiserve (US), Airtel (India), Gemalto (Netherlands), Alipay (China), MTN (South Africa), PAYTM (India), Samsung (South Korea), VISA (US), Tencent (China), Global Payments (US), Square (US), Amazon (US), Apple (US), Western Union Holdings (US), Comviva (India), and T- Mobile (US).

Vodafone (UK) caters to a wide customer base in the regions of the Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC). Vodafone’s M-Pesa mobile money transfer and payment service is one of the leading mobile money products in the world. The company has 37 million M-Pesa customers, and during 2019 the M-Pesa revenue grew by 21% to EUR 750 million, representing 12% of the emerging consumer service revenue in the year. M-Pesa is Africa’s largest payment platform that provides enterprise payments, financial services, and merchant payment services for mobile commerce. It further offers people a safe, secure, and affordable way to send and receive money, top-up airtime, make bill payments, receive salaries, get a loan, and much more.

Google (US) is one of the major players that focuses on the emerging concept of mobile money. Google Pay, formerly known as Google Wallet, is a digital wallet platform and online payment system, which enables users to make payments and transfer money straight from their phones. In January 2018, the company brought together different payment platforms run by Google, including Android Pay and Google Wallet, merging it into a single platform, Google Pay. Google Pay protects an individual’s money with a world class security system that helps the user detect fraud and prevents hacking. It further helps safeguard the individual’s account with screen locking technologies, such as a fingerprint. Currently, in India, Google Pay works with all banks that support BHIM Unified Payments Interface (UPI), India’s real-time payments ecosystem. Google Pay helps small business owners or managers at a corporation to accept payments and connect with customers. Customers on more than 80 BHIM UPI apps can use Quick Response (QR) codes or their phone numbers, to send money from their bank account to other bank accounts without the need of a Point of Sales (POS) system. Since the launch of Google Pay in India (formerly known as Tez), transactions on UPI have increased 43 times, reaching 734 million transactions in May 2019. The company has a presence in North America, Europe, APAC, and Middle East and Africa (MEA). Google caters to a large customer base spread across the globe, through a global network of service providers, distributors, and cloud resellers.

Browse Complete Report @ https://www.marketsandmarkets.com/Market-Reports/mobile-remittance-money-mcommerce-market-577.html

0 notes

Text

Luxury Cars Segment to Dominate the UAE Used Car Market | TechSci Research

Rise in income levels and surge in demand for luxury cars is expected to drive the demand for UAE used car market for the forecast period.

According to TechSci Research report, “UAE Used Car Market By Vehicle Type (Small Cars, Mid-Size Cars & Luxury Cars) By End Use (Institutional Vs Individual) By Fuel Type (Petrol, Diesel & CNG), By Region, Company Forecast & Opportunities, 2026”, the UAE used car market is expected to witness significant growth for the next five years. A used car refers to second hand owned vehicle which was previously owned by one or more vehicles. Used automobiles are refurbished and repaired to again to working conditions after which they are eligible for sale. Due to rising awareness for sustainable development, consumers are preferring to buy refurbished cars which are expected to accelerate the sales of used cars in the United Arab Emirates.

Used cars are sold through various sales channels including leasing offices, auctions, independent car stores, rental car stores, and online channels. Used cars aids in minimizing the depreciation value of the vehicle and are expected to provide cost-efficient solutions to consumers. An increase in demand for luxury cars and a preference for a short ownership period are creating lucrative opportunities for the used car market growth. An increase in adoption for advanced features in cars such as power steering system, climate control system, safety systems are contributing to the surge in the cost of vehicles which is driving away from the consumers who have limited spending capacity and therefore, are preferring used cars for the daily commute and other activities. The presence of unorganized players in the market who offer no warranty and prefer to perform malpractices such as dent removal, re-painting the car is affecting the sales of used vehicles.

The COVID-19 outbreak across the world which has been declared as a pandemic by World Health Organization has affected several countries adversely. Leading authorities in UAE imposed lockdown restrictions and released a set of precautionary measures to contain the spread of novel coronavirus. Manufacturing units were temporarily shut down and disruption in the supply chain was observed which led to automotive industry market decline. Consumers are preferring to travel alone to ensure maximum safety and precaution. However, the staggering economy and financial constraints may restrict the consumers to buy a new car which in turn is expected to accelerate the used car market demand in the United Arab Emirates.

Browse XX Figures spread through XX Pages and an in-depth TOC on "UAE Used Car Market”.

https://www.techsciresearch.com/report/uae-used-car-market/7562.html

UAE used car market is segmented into vehicle type, end use, fuel type, regional distribution, and company. Based on vehicle type, market can be divided into small cars, mid-size cars & luxury cars. The luxury cars segment is expected to account for major market share for the forecast period, 2022-2026. Demand for premium cars such as luxury sedan, premium sedan, full size sedan, luxury hatchback, convertible is on rise in United Arab Emirates. Presence of disposable income and trend of owing luxury cars are the positive factors fueling the market growth. Luxury cars are comfortable and perform well in harsh and extreme weather conditions thereby are preferred by the consumers in the region.

Copart Inc., Yallamotor, SellAnyCar, CarSwitch, DubiCars, Dubizzle.com, Al Futtaim Automall, Opensooq.com are the leading players operating in UAE used car market. Service providers are increasingly focusing on research and development process to fuel higher growth in the market. To meet evolving customer demand with respect to better efficiency and durability, several used car service providers are coming up with their technologically advanced offerings.

Download Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=7562

Customers can also request for 10% free customization on this report.

“The use of emerging technologies such as artificial intelligence, big data analytics, and the internet of things to provide an interactive and user-friendly interface to consumers by the market players is boosting the used car market growth. The growth of the online sales channel and the ease and convenience of shopping on digital platforms is accelerating the demand for the used cars market. Market players are providing lucrative discounts and offer along with free home delivery, quick services, 360-degree view of cars for better inspection of cars is expected to propel the used cars market growth till 2026” said Mr. Karan Chechi, Research Director with TechSci Research, a research based global management consulting firm.

“UAE Used Car Market By Vehicle Type (Small Cars, Mid-Size Cars & Luxury Cars) By End Use (Institutional Vs Individual) By Fuel Type (Petrol, Diesel & CNG), By Region, Company Forecast & Opportunities, 2026” has evaluated the future growth potential of UAE used car market and provided statistics & information on market size, shares, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the of UAE used car market.

Browse Related Reports:

US Used Car Market By Vehicle Type (Small Cars, Mis-size Cars and Luxury Cars), By Sector (Organized Vs. Semi-Organized/Unorganized), By Fuel Type (Petrol, Diesel and CNG), Competition, Forecast & Opportunities, 2026

https://www.techsciresearch.com/report/us-used-car-market/4032.html

India Used Car Loan Market, By Vehicle Type (Hatchback, SUVs & Sedans), By Financier (Banks, NBFCs (Non-Banking Financial Companies) & OEM), By Percentage of Amount Sanctioned (Up to 25%; 25-50%; 51-75%; Above 75%), By Tenure (Less than 3 Years, 3-5 Years & More than 5 Years), By Region, Competition Forecast & Opportunities, FY2027

https://www.techsciresearch.com/report/india-used-car-loan-market/7351.html

Contact

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

Website: https://www.techsciresearch.com/

For More Market Research Blogs Visit: https://techsciblog.com/

#TechSci#Market Research Reports#UAE Used Car Market#Used Car Market#Used Car#Used Car Market Size#Used Car Market Forecast#Automotive#Automobile Sector

0 notes

Text

Luxury Cars Segment to Dominate the UAE Used Car Market | TechSci Research

Rise in income levels and surge in demand for luxury cars is expected to drive the demand for UAE used car market for the forecast period.

According to TechSci Research report, “UAE Used Car Market By Vehicle Type (Small Cars, Mid-Size Cars & Luxury Cars) By End Use (Institutional Vs Individual) By Fuel Type (Petrol, Diesel & CNG), By Region, Company Forecast & Opportunities, 2026”, the UAE used car market is expected to witness significant growth for the next five years. A used car refers to second hand owned vehicle which was previously owned by one or more vehicles. Used automobiles are refurbished and repaired to again to working conditions after which they are eligible for sale. Due to rising awareness for sustainable development, consumers are preferring to buy refurbished cars which are expected to accelerate the sales of used cars in the United Arab Emirates.

Used cars are sold through various sales channels including leasing offices, auctions, independent car stores, rental car stores, and online channels. Used cars aids in minimizing the depreciation value of the vehicle and are expected to provide cost-efficient solutions to consumers. An increase in demand for luxury cars and a preference for a short ownership period are creating lucrative opportunities for the used car market growth. An increase in adoption for advanced features in cars such as power steering system, climate control system, safety systems are contributing to the surge in the cost of vehicles which is driving away from the consumers who have limited spending capacity and therefore, are preferring used cars for the daily commute and other activities. The presence of unorganized players in the market who offer no warranty and prefer to perform malpractices such as dent removal, re-painting the car is affecting the sales of used vehicles.

The COVID-19 outbreak across the world which has been declared as a pandemic by World Health Organization has affected several countries adversely. Leading authorities in UAE imposed lockdown restrictions and released a set of precautionary measures to contain the spread of novel coronavirus. Manufacturing units were temporarily shut down and disruption in the supply chain was observed which led to automotive industry market decline. Consumers are preferring to travel alone to ensure maximum safety and precaution. However, the staggering economy and financial constraints may restrict the consumers to buy a new car which in turn is expected to accelerate the used car market demand in the United Arab Emirates.

Browse XX Figures spread through XX Pages and an in-depth TOC on "UAE Used Car Market”.

https://www.techsciresearch.com/report/uae-used-car-market/7562.html

UAE used car market is segmented into vehicle type, end use, fuel type, regional distribution, and company. Based on vehicle type, market can be divided into small cars, mid-size cars & luxury cars. The luxury cars segment is expected to account for major market share for the forecast period, 2022-2026. Demand for premium cars such as luxury sedan, premium sedan, full size sedan, luxury hatchback, convertible is on rise in United Arab Emirates. Presence of disposable income and trend of owing luxury cars are the positive factors fueling the market growth. Luxury cars are comfortable and perform well in harsh and extreme weather conditions thereby are preferred by the consumers in the region.

Copart Inc., Yallamotor, SellAnyCar, CarSwitch, DubiCars, Dubizzle.com, Al Futtaim Automall, Opensooq.com are the leading players operating in UAE used car market. Service providers are increasingly focusing on research and development process to fuel higher growth in the market. To meet evolving customer demand with respect to better efficiency and durability, several used car service providers are coming up with their technologically advanced offerings.

Download Sample Report @ https://www.techsciresearch.com/sample-report.aspx?cid=7562

Customers can also request for 10% free customization on this report.

“The use of emerging technologies such as artificial intelligence, big data analytics, and the internet of things to provide an interactive and user-friendly interface to consumers by the market players is boosting the used car market growth. The growth of the online sales channel and the ease and convenience of shopping on digital platforms is accelerating the demand for the used cars market. Market players are providing lucrative discounts and offer along with free home delivery, quick services, 360-degree view of cars for better inspection of cars is expected to propel the used cars market growth till 2026” said Mr. Karan Chechi, Research Director with TechSci Research, a research based global management consulting firm.

“UAE Used Car Market By Vehicle Type (Small Cars, Mid-Size Cars & Luxury Cars) By End Use (Institutional Vs Individual) By Fuel Type (Petrol, Diesel & CNG), By Region, Company Forecast & Opportunities, 2026” has evaluated the future growth potential of UAE used car market and provided statistics & information on market size, shares, structure and future market growth. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment decisions. Besides, the report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the of UAE used car market.

Browse Related Reports:

US Used Car Market By Vehicle Type (Small Cars, Mis-size Cars and Luxury Cars), By Sector (Organized Vs. Semi-Organized/Unorganized), By Fuel Type (Petrol, Diesel and CNG), Competition, Forecast & Opportunities, 2026

https://www.techsciresearch.com/report/us-used-car-market/4032.html

India Used Car Loan Market, By Vehicle Type (Hatchback, SUVs & Sedans), By Financier (Banks, NBFCs (Non-Banking Financial Companies) & OEM), By Percentage of Amount Sanctioned (Up to 25%; 25-50%; 51-75%; Above 75%), By Tenure (Less than 3 Years, 3-5 Years & More than 5 Years), By Region, Competition Forecast & Opportunities, FY2027

https://www.techsciresearch.com/report/india-used-car-loan-market/7351.html

Contact

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: [email protected]

Website: https://www.techsciresearch.com/

For More Market Research Blogs Visit: https://techsciblog.com/

#TechSci#Market Research Reports#UAE Used Car Market#Used Car Market#Used Car#Used Car Market Size#Used Car Market Forecast#Automotive#Automobile Sector

0 notes

Text

Trademark Registration in Duabi - The Leverages a Business Gains From It

A part that helps specialise a set of one producer from another or one company from its competitors is called a trademark. By attaching an naming to a set or work, an enterprise can build an someone in the minds of customers that finish for a weeklong indication. A perfect trademark warning is the red dark finger which is e'er affined to the cold-drink Thums-Up.

In UAE, a concern can trademark:

Word

Name

Logo

Numerals

Slogan

Device

Erstwhile any of these receives a characteristic body, exclusive the soul has only rights to use it. In simpler line, the initiative unaccompanied can use the trademarked express, saying, trademark, etc. For illustration, only Apple Inc. has the far to put the part ingested apple symbolisation on its products.

Why Get a Stylemark Entrance?

Too characteristic a product from others, a trademark is an immaterial asset for a occupation. It protects not only the owner of the goodness but also the marque. Both new reasons to get stylemark incoming online are:

It ensures that every consumer easily recognises the creation through the trademark or identify.

It offers a lawful passport against duplicitous products and spurious services.

It builds a sensation of rely in customers which in turning leads to act and liege buyers achieving the end content of gain for any performing.

It can be sold, franchised or transferred at any tip of period which makes it an quality to the unwaveringly.

A Gist of Registering a Trademark in Bharat

The law in Bharat for trademark calibration is titled Characteristic Act of 1999. When an endeavor applies for a characteristic, they must select from 45 various classes. These are categories of products and services that are characterised by the nature of the byplay. Erst a stylemark is enrolled it is entered in a registry which maintains all TM of a part categorize. This is finished to enter a record of all logos, symbols, language, etc. trademarked.

A stylemark is legal for ten eld. The body can be renewed for another period, as abundant as an employment is submitted within a postulated indication word.

Advantages of Trademark Incoming

An abstract goods

For a exchange, any prop has evaluate. A listed earmark is thoughtful by law a dance that is classifiable and abstract. It signifies that the earmark has a regard to it because it is the symbol of the estimate the production or union has. Moreover, a characteristic standardization entireness quasi to added assets of a company. It can be sold or transferred at any direction in instant.

A average stylemark, on the otherwise pardner, cannot be distributed from the playing, i.e., an unrecorded TM is e'er connected to the endeavour. If another assort wants to get the goodwill that comes with a shared stylemark, they know to acquire the total trade and not upright the cue.

The story alter

A qualified stylemark can exclusive be used by the somebody of the effect and quantity or copulate they cater to. If someone else another than the proprietor makes unauthorised use of it, they tackling licit charges. The definitive legal remedies that proceed with TM registration is the most important benefit of it. Both of the actions that can be stolen are:

Suing for wrongdoing

Ban

Livery of infringed articles

Defrayment for amends

A solon impediment

The presence of a recorded trademark deters added byplay owners from using the identical or siamese ordinary on their products or services. It guarantees that a genuine maintains its goodwill.

A warrantee promise

If an endeavor wishes to warranted a loan, it can utilise the enrolled earmark in a demeanour equal to unmovable attribute. In other line, a characteristic can be pledged as surety to wax a bank loan.

Modify to licensing and others

Only a registered trademark has the alter to:

Use the symbols® or "R" on an part or accommodation.

Permit the gospels. The one is transcribed on the earmark registry. It gives the licensee the legal alter to cause any proceedings in framework there is an infringement.

Be transferred to another entity, mortal or concern.

Obtain readjustment is a few unnaturalised territories. This allows the brand assets at a spheric take while it is expanding its dealing.

As grounds in transactions

The act of registering a stylemark is assumed as inform of the credibility of the registrations and the rights that develop with it. In a observance that required eligible sue affiliated to the earmark, the credential proves a human as the businessman of the stylemark. The creation calibration disc is seized as ensure until it is proven otherwise.

A good to challenge

Under the Sham Artefact Act 1997, the individual of an mortal belongings, which in this soul would be a trademarked item or force, has the choice to withdraw deplorable or national production against a commercialism or organism who was encumbered in counterfeiting. The CGA also affords the synoptical right to any someone who has an curiosity in the goods that were counterfeited.

The benefits explained in the article above are not the only module for earmark ingress. In a man where most people active through plagiarism or copying it is alive to guard properties. This is why it is highly recommended to earmark and till every beatific, fact or function that a byplay or an someone creates.

If you are looking service for trademark registration in UAE then you should go with Al Raqeem.

1 note

·

View note

Text

Getting Personal Loan in UAE

Getting loans at an extraordinary rate can be a significant heavy undertaking, particularly in the event that you are anticipating selecting the ‘Personal Loan.’ Before we get into the nits and bits of getting the best Offers on the loan you want, you should remember that personal loans come with an interest rate that is higher than the normal loans where you provide the bank with collateral to get the loan.

Notwithstanding, personal loans are harder to get authorized as it is simply in light of your budgetary notoriety and your capacity to pay back the total which incorporates your Credit Score. Now that you have decided to get a personal loan let’s take a look at some of the pointers that you should remember to ensure the best possible deal with the lowest rate of interest.

Compare and Analyze:

On the off chance that you want a personal loan in Dubai, the best way to get beneficial deals is to compare the plans from different banks followed by an in-depth analysis of the all the plans and their associated interest rates. With current options available to you, you can easily obtain all the plan details online from the comfort of your home.

This will empower you to pick the best bank to help bring down all your related costs. You can look at personal loan designs that incorporate distinctive methods, for example, documentation and its multifaceted nature, handling charges, charges for pre-conclusion, client bolster and a web-based tracking system.

Magnificent Credit Score:

The way toward getting your personal loan Dubai endorsed by the bank expects you to have a Credit Score that is qualified for a loan sum that you want. In the event that you investigate the financing costs gave by different banks, you will see one thing that an incredible Credit Score rating gets you bring down loan costs.

This is on the grounds that you the banks trust you can possibly restore the cash you owe. A decent Credit Score can be earned from opportune installment of bills and paying back your past loans in the time distributed to you. Ensure you assemble a lattice to pay back the loan sum before the allocated time to keep up an incredible Credit Score in light of the fact that even a minor deferral could influence your score.

Search for occasional offers:

As you apply for a personal loan in Dubai, ensure you look through various Gifts, regular offers or waivers gave by various moneylenders to help the business. Deciding on a personal loan as the offers are on, might get you reduced financing costs and if not a few presents or little occasion bundles. Ensure you get the best out of the deal season for a personal loan that isn’t overwhelming on your pockets.

A watchful investigation and legitimate investigation of the plans from banks found near you can pack you an arrangement that deals with your necessities while being mindful so as not to be substantial on your day by day costs. Being watchful and asking the correct inquiries will make you a client that gets the best advantages out of the banks.

0 notes

Text

Discover the retail banking country snapshot for UAE in 2016: Radiant Insights, Inc

Summary

The UAE is overbanked with around 49 players, making it a fragmented and highly competitive market. Penetration is high and consumers are well informed and sophisticated, but the large number of expats in the UAE (over 90% of the population) creates unique requirements. Reputation is key, and customers favor established providers and traditional structures. Although online channels are gaining ground, awareness of fintech and peer to peer (P2P) providers remains low, and partnerships with existing banks are the best way of breaking into the market.

Key Findings

State-owned banks dominate the retail sector, with Emirates NBD accounting for almost a quarter of accounts, while international banks have made limited headway. Ethical values, reputation, and convenience are important, but 64% of customers prefer a local brand.

Recommendations and convenience of branch location are the top drivers of choice of savings provider, while rates are also key due to the competitive nature of the sector. Property purchase is the most popular reason for saving, and branch enquiries are still preferred over online applications.

The mortgage sector is highly competitive and banks struggle to achieve significant market share. Incentives are important to attract customers, but ease of use and online presence are also vital. Banks like RAKBANK are benefiting from investment in digital solutions.

To Access Browse Full Research Report @: http://www.radiantinsights.com/research/retail-banking-country-snapshot-uae-2016

Synopsis

Verdict Financial's "Retail Banking Country Snapshot: UAE 2016" reviews the retail banking sector in the UAE, with a particular focus on the current account, savings, mortgage, and personal loans markets. It includes both market-level data and insight from our global Retail Banking Insight Survey.

The report offers insight into:

How consumers in the UAE take out and use their financial products, and how this has changed in recent years.

Which providers dominate the current account, savings, mortgage, and loan markets, and what factors persuaded their customers to choose them.

The extent to which consumers are using online and mobile channels to research, take out, and use their financial products.

To Access Request A Sample Copy Of This Report at: http://www.radiantinsights.com/research/retail-banking-country-snapshot-uae-2016/request-sample

Reasons To Buy

Future proof your strategy with market sizing, forecasts, and analysis of key developments currently affecting the UAE's retail banking sector.

Target consumers with inside knowledge of their true behaviors and attitudes, with detailed analysis from our proprietary insight.

Learn about the impact new entrants and distribution channels will have on the market.

See More Reports of This Category by Radiant Insights: http://www.radiantinsights.com/catalog/financial-services

About Radiant Insights:

Radiant Insights is a platform for companies looking to meet their market research and business intelligence requirements. It assist and facilitate organizations and individuals procure market research reports, helping them in the decision making process. The Organization has a comprehensive collection of reports, covering over 40 key industries and a host of micro markets. In addition to over extensive database of reports, experienced research coordinators also offer a host of ancillary services such as, research partnerships/ tie-ups and customized research solutions.

Media Contact:

Company Name: Radiant Insights, Inc

Contact Person: Michelle Thoras

Email: [email protected]

Phone: (415) 349-0054

Address: 28 2nd Street, Suite 3036

City: San Francisco

State: California

Country: United States

For more information, Visit: http://www.radiantinsights.com

0 notes

Text

Mobile Money Market 2022 Business Strategies, Revenue and Growth Rate upto 2024

MarketsandMarkets expects the global Mobile Money Industry size to grow from USD 3.4 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 28.7% during the forecast period. Mobile payments is an easy way to carry out transactions and people across the globe are adopting mobile money to reduce their dependence on cash while traveling. A rise in the number of payment transactions, banking values, and mobile penetration rate across the world are factors driving the mobile money market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=577

The growth of the mobile money market in the MEA is further driven by increased investments in payment technologies made by governments of countries, such as Qatar, South Africa, and the UAE. This region has a presence of creditable Mobile Network Operators (MNOs), banks, and payment processing agents, which encourage the use of mobile money services. For instance, in February 2019, MTN and Ericsson signed a 5-year contract extension for the distribution of new products and the provision of mobile money services in 13 countries across the MEA region. Ericsson aims to deploy the Ericsson Wallet Platform in new markets to serve MTN’s customers.

Key and emerging market players include Vodafone (UK), Google (US), Orange (France), FIS (US), Paypal (US), Mastercard (US), Fiserve (US), Airtel (India), Gemalto (Netherlands), Alipay (China), MTN (South Africa), PAYTM (India), Samsung (South Korea), VISA (US), Tencent (China), Global Payments (US), Square (US), Amazon (US), Apple (US), Western Union Holdings (US), Comviva (India), and T- Mobile (US).

Vodafone (UK) caters to a wide customer base in the regions of the Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC). Vodafone’s M-Pesa mobile money transfer and payment service is one of the leading mobile money products in the world. The company has 37 million M-Pesa customers, and during 2019 the M-Pesa revenue grew by 21% to EUR 750 million, representing 12% of the emerging consumer service revenue in the year. M-Pesa is Africa’s largest payment platform that provides enterprise payments, financial services, and merchant payment services for mobile commerce. It further offers people a safe, secure, and affordable way to send and receive money, top-up airtime, make bill payments, receive salaries, get a loan, and much more.

Google (US) is one of the major players that focuses on the emerging concept of mobile money. Google Pay, formerly known as Google Wallet, is a digital wallet platform and online payment system, which enables users to make payments and transfer money straight from their phones. In January 2018, the company brought together different payment platforms run by Google, including Android Pay and Google Wallet, merging it into a single platform, Google Pay. Google Pay protects an individual’s money with a world class security system that helps the user detect fraud and prevents hacking. It further helps safeguard the individual’s account with screen locking technologies, such as a fingerprint. Currently, in India, Google Pay works with all banks that support BHIM Unified Payments Interface (UPI), India’s real-time payments ecosystem. Google Pay helps small business owners or managers at a corporation to accept payments and connect with customers. Customers on more than 80 BHIM UPI apps can use Quick Response (QR) codes or their phone numbers, to send money from their bank account to other bank accounts without the need of a Point of Sales (POS) system. Since the launch of Google Pay in India (formerly known as Tez), transactions on UPI have increased 43 times, reaching 734 million transactions in May 2019. The company has a presence in North America, Europe, APAC, and Middle East and Africa (MEA). Google caters to a large customer base spread across the globe, through a global network of service providers, distributors, and cloud resellers.

Browse Complete Report @ https://www.marketsandmarkets.com/Market-Reports/mobile-remittance-money-mcommerce-market-577.html

0 notes

Text

Money resolutions for UAE expats to get richer

Experts share their advice on how to improve personal finances, what or where to invest in 2017

Dubai: Every New Year, a lot of people resolve to get wealthier or improve their personal finances. Many vow to cut back on spending, settle their debts, pay more attention to their budgets and save more.

But these things are easier said than done, especially in the UAE, where personal borrowings are piling up. Consumer loans in the UAE alone have been growing, amounting to Dh417 million in the last quarter of 2015, up by Dh27 million from the first quarter of the year. Data released by Strategic Analysis also put down the debt burden in the UAE to Dh348,000 per household, which will make total indebtedness amount to $114 billion.

With these grim figures in mind, it would be difficult to achieve personal finance goals. And one must have a clear strategy and enough determination to follow through.

Gulf News has asked the experts to provide some useful advice around the area of investing, financial planning, budgeting, saving or spending to help improve the financial situation of residents in the UAE.

Save first

Saving money is a top priority for those who want to build their wealth, especially among residents from Europe or the US. According to a National Bonds survey, Western expatriates (48 per cent) are the most committed to save money on a regular basis, followed by Asians (44 per cent) and UAE and Arab nationals at 28 per cent and 27 per cent, respectively.

But how do you save money? A new research by Gocompare.com reveals that the majority of British nationals (88 per cent) have resolved to do something in 2017 to grow their wealth. Popular money-saving measures include using vouchers and apps that provide discounts, and taking advantage of loyalty and cash back schemes.

Other frugal habits also include shopping around for a better deal on a range of goods and services, from insurance policies to groceries.

But cutting down on household expenses can be very challenging, especially in a place like UAE, where consumers are constantly tempted to open their wallets.

The best thing to do to avoid the temptation is to put cash aside first in a savings account. This way, access to disposable income is very limited. “Therefore, even if an individual does exceed his or her budget for the month, saving or retirement fund will continue to grow,” said Mark Leigh, chief operating officer at XTrade.

Pay your credit card dues in full

If you must use your plastic money, make sure you don’t max it out and you are very diligent in paying back your dues in full, to avoid incurring hundreds or thousands of dirham in interest and late payment fees. Interest rates on credit cards in the UAE are said to be higher than in other markets like the UK or most of Europe, Japan and the United States.

“It’s a real rate of almost 30 per cent annually,” a far cry from the 14.6 per cent charged in the US and 18.8 per cent in the UK, according to one financial planner.

Matt Sanders, credit card expert at Gocompare, however, said that using credit cards is not at all bad. In fact, consumers can use plastic money to their advantage. “For many of us, the New Year is a perfect time to reassess our lives, including our financial goals. One simple and achievable resolution is to review the plastic in your wallet. Used carefully, credit cards can give you extra flexibility with your spending and help you manage your finances better.”

“To avoid any interest, outstanding balances must be paid off on or before the final day of interest-free period. “ Those who are unable to clear their card balance right away are advised to anticipate how much interest they are likely to pay and how long they can expect to carry the debt on the card.

“Once interest starts accruing on a regular basis, it can become every costly indeed. The key thing is to recognise a persistent and stubborn debt, that isn’t magically just going to go away, and deal with it. “

Consumers can also move the outstanding balances to an interest-free balance transfer card, to help lower borrowing costs and pay it off much quickly.

Budget wisely

Work out how much money you require every month to pay utility bills, including your housing rent, water and electricity consumption, mobile phone, internet and other financial responsibilities.

“Living in Dubai, individuals can predict their monthly budget for the year in terms of their fixed costs, such as rent, Dewa, telephone, car payments, etc. They can set aside a budget for shopping, eating out and car payments. They can also include a miscellaneous budget for any unforeseen situations that may arise during the course of the month,” noted Leigh.

To ensure they succeed, consumers must be financially disciplined to prolong the desire to make additional purchases towards the end of the month, as a reward for staying within budget. If you must spend, take advantage of discounts for dining, shopping and other activities that are offered in multiple mobile applications.

“Usually, these apps promote the buy-one-get-one-free offers. By choosing to go out with a friend or family member taking advantage of these offers and splitting the bill equally amongst both parties, the individual can save up to 75 percent of the total bill,” said Leigh.

Invest in a will, life insurance

As an expatriate working in the UAE, it is important to think about what might happen if the unthinkable does occur. By having a will in place, you’ll have peace of mind knowing that, when faced with death, your assets are distributed according to your wishes and your family has access to money.

Without it, authorities will handle your estate according to Sharia law and your bank accounts will be frozen. Life insurance also ensures that your dependents will continue to receive money to cover living costs and any mortgage or debt is paid for.

“Human nature encourages us to be optimistic, however, unfortunate situations can occur at any time and when we least expect it, leaving our loved ones piled under a significant amount of debt and emotional grief,” said Leigh.

“Taking proactive measures to safeguard their financial interests and future should be a top priority of any breadwinner,” Leigh added.

Invest cautiously

There are many strategies for investing money, but whatever approach you decide to take, it is important to take into account the global economic environment. Investors have been expecting the Federal Reserve to make further interest rate adjustments next year and boost infrastructure spending, while the possibility of political and economic uncertainty in Europe is not remote.

The Brexit move in the UK, for one, is expected to create a “bit more ambiguity across the European and global markets”, while the Chinese asset bubble look increasingly overheated.

“Having considered the market sentiment, a diversified US mid-cap portfolio is the area investors should be engaged in, focusing on US sales, largely through Exchange Traded Funds (ETFs – a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund. Unlike mutual funds, an ETF trades like a common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold),” said Leigh.

“As it relates to foreign exchange, shorting the euro would seem as the most plausible option. Having broken through the $1.05, we would expect parity as the next support level.”

For those who prefer to invest in gold, it may not be a bad idea, as well. “It is advisable to invest in it as historically speaking, gold preserves wealth. This precious metal has always served as a hedge against declining currencies, rising inflation rates as well as economic uncertainty. However, for an investor to be a successful trader, a diversified portfolio is always recommended.”

Online trading is another area you could venture into. If approached correctly, this has the potential to provide supplemental income and enough financial support when you decide to stop working. But you need to orient yourself first and learn how it works.

“Like any other business or activity, you need education, practice and experience to excel and succeed. Online trading is no different. It involves comprehending the macroeconomic and microeconmic environments to make educated predictions on how certain markets would move, enabling individuals to make decisions that will positively affect their companies, savings and investment portfolio,” said Leigh.

Start saving for retirement

Individuals must save for retirement at an early age, ideally in University. A study showed that three out of five expatriates in the UAE have no retirement savings yet.

According to Leigh, this is alarming because people without retirement savings will struggle to find a source of income to support their lifestyle and will have to give up a number of luxuries they have earned throughout their lives.

“The save-first mentality combined with investing in stocks, bonds and currencies is a good way to prepare for retirement. Technology is a double-edged sword that can either cause us to spend or provide us with strategic insights on macro and micro economic developments equipping us with knowledge to make key investment decisions that can positively affect an individual’s financial health,” Leigh said.

“However in order to succeed, people must be disciplined and willing to invest in the long-term.”

Source : Gulf News

Money resolutions for UAE expats to get richer was originally published on JMM Group of Companies

#dubai investment company#investment companies in dubai#personal finance dubai#Top investment Companies in UAE#uae investment comapny

0 notes

Text

Mobile Money Market – Opportunities, Challenges, Strategies & Forecasts 2024

MarketsandMarkets expects the global Mobile Money Industry size to grow from USD 3.4 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 28.7% during the forecast period. Mobile payments is an easy way to carry out transactions and people across the globe are adopting mobile money to reduce their dependence on cash while traveling. A rise in the number of payment transactions, banking values, and mobile penetration rate across the world are factors driving the mobile money market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=577

The growth of the mobile money market in the MEA is further driven by increased investments in payment technologies made by governments of countries, such as Qatar, South Africa, and the UAE. This region has a presence of creditable Mobile Network Operators (MNOs), banks, and payment processing agents, which encourage the use of mobile money services. For instance, in February 2019, MTN and Ericsson signed a 5-year contract extension for the distribution of new products and the provision of mobile money services in 13 countries across the MEA region. Ericsson aims to deploy the Ericsson Wallet Platform in new markets to serve MTN’s customers.

Key and emerging market players include Vodafone (UK), Google (US), Orange (France), FIS (US), Paypal (US), Mastercard (US), Fiserve (US), Airtel (India), Gemalto (Netherlands), Alipay (China), MTN (South Africa), PAYTM (India), Samsung (South Korea), VISA (US), Tencent (China), Global Payments (US), Square (US), Amazon (US), Apple (US), Western Union Holdings (US), Comviva (India), and T- Mobile (US).

Vodafone (UK) caters to a wide customer base in the regions of the Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC). Vodafone’s M-Pesa mobile money transfer and payment service is one of the leading mobile money products in the world. The company has 37 million M-Pesa customers, and during 2019 the M-Pesa revenue grew by 21% to EUR 750 million, representing 12% of the emerging consumer service revenue in the year. M-Pesa is Africa’s largest payment platform that provides enterprise payments, financial services, and merchant payment services for mobile commerce. It further offers people a safe, secure, and affordable way to send and receive money, top-up airtime, make bill payments, receive salaries, get a loan, and much more.

Google (US) is one of the major players that focuses on the emerging concept of mobile money. Google Pay, formerly known as Google Wallet, is a digital wallet platform and online payment system, which enables users to make payments and transfer money straight from their phones. In January 2018, the company brought together different payment platforms run by Google, including Android Pay and Google Wallet, merging it into a single platform, Google Pay. Google Pay protects an individual’s money with a world class security system that helps the user detect fraud and prevents hacking. It further helps safeguard the individual’s account with screen locking technologies, such as a fingerprint. Currently, in India, Google Pay works with all banks that support BHIM Unified Payments Interface (UPI), India’s real-time payments ecosystem. Google Pay helps small business owners or managers at a corporation to accept payments and connect with customers. Customers on more than 80 BHIM UPI apps can use Quick Response (QR) codes or their phone numbers, to send money from their bank account to other bank accounts without the need of a Point of Sales (POS) system. Since the launch of Google Pay in India (formerly known as Tez), transactions on UPI have increased 43 times, reaching 734 million transactions in May 2019. The company has a presence in North America, Europe, APAC, and Middle East and Africa (MEA). Google caters to a large customer base spread across the globe, through a global network of service providers, distributors, and cloud resellers.

Browse Complete Report @ https://www.marketsandmarkets.com/Market-Reports/mobile-remittance-money-mcommerce-market-577.html

0 notes

Text

Mobile Money Market top competitors within the market framework

MarketsandMarkets expects the global Mobile Money Industry size to grow from USD 3.4 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 28.7% during the forecast period. Mobile payments is an easy way to carry out transactions and people across the globe are adopting mobile money to reduce their dependence on cash while traveling. A rise in the number of payment transactions, banking values, and mobile penetration rate across the world are factors driving the mobile money market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=577

The growth of the mobile money market in the MEA is further driven by increased investments in payment technologies made by governments of countries, such as Qatar, South Africa, and the UAE. This region has a presence of creditable Mobile Network Operators (MNOs), banks, and payment processing agents, which encourage the use of mobile money services. For instance, in February 2019, MTN and Ericsson signed a 5-year contract extension for the distribution of new products and the provision of mobile money services in 13 countries across the MEA region. Ericsson aims to deploy the Ericsson Wallet Platform in new markets to serve MTN’s customers.

Key and emerging market players include Vodafone (UK), Google (US), Orange (France), FIS (US), Paypal (US), Mastercard (US), Fiserve (US), Airtel (India), Gemalto (Netherlands), Alipay (China), MTN (South Africa), PAYTM (India), Samsung (South Korea), VISA (US), Tencent (China), Global Payments (US), Square (US), Amazon (US), Apple (US), Western Union Holdings (US), Comviva (India), and T- Mobile (US).

Vodafone (UK) caters to a wide customer base in the regions of the Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC). Vodafone’s M-Pesa mobile money transfer and payment service is one of the leading mobile money products in the world. The company has 37 million M-Pesa customers, and during 2019 the M-Pesa revenue grew by 21% to EUR 750 million, representing 12% of the emerging consumer service revenue in the year. M-Pesa is Africa’s largest payment platform that provides enterprise payments, financial services, and merchant payment services for mobile commerce. It further offers people a safe, secure, and affordable way to send and receive money, top-up airtime, make bill payments, receive salaries, get a loan, and much more.

Google (US) is one of the major players that focuses on the emerging concept of mobile money. Google Pay, formerly known as Google Wallet, is a digital wallet platform and online payment system, which enables users to make payments and transfer money straight from their phones. In January 2018, the company brought together different payment platforms run by Google, including Android Pay and Google Wallet, merging it into a single platform, Google Pay. Google Pay protects an individual’s money with a world class security system that helps the user detect fraud and prevents hacking. It further helps safeguard the individual’s account with screen locking technologies, such as a fingerprint. Currently, in India, Google Pay works with all banks that support BHIM Unified Payments Interface (UPI), India’s real-time payments ecosystem. Google Pay helps small business owners or managers at a corporation to accept payments and connect with customers. Customers on more than 80 BHIM UPI apps can use Quick Response (QR) codes or their phone numbers, to send money from their bank account to other bank accounts without the need of a Point of Sales (POS) system. Since the launch of Google Pay in India (formerly known as Tez), transactions on UPI have increased 43 times, reaching 734 million transactions in May 2019. The company has a presence in North America, Europe, APAC, and Middle East and Africa (MEA). Google caters to a large customer base spread across the globe, through a global network of service providers, distributors, and cloud resellers.

Browse Complete Report @ https://www.marketsandmarkets.com/Market-Reports/mobile-remittance-money-mcommerce-market-577.html

0 notes

Text

Mobile Money Market In-Depth Investigation and Analysis Report

MarketsandMarkets expects the global Mobile Money Industry size to grow from USD 3.4 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 28.7% during the forecast period. Mobile payments is an easy way to carry out transactions and people across the globe are adopting mobile money to reduce their dependence on cash while traveling. A rise in the number of payment transactions, banking values, and mobile penetration rate across the world are factors driving the mobile money market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=577

The growth of the mobile money market in the MEA is further driven by increased investments in payment technologies made by governments of countries, such as Qatar, South Africa, and the UAE. This region has a presence of creditable Mobile Network Operators (MNOs), banks, and payment processing agents, which encourage the use of mobile money services. For instance, in February 2019, MTN and Ericsson signed a 5-year contract extension for the distribution of new products and the provision of mobile money services in 13 countries across the MEA region. Ericsson aims to deploy the Ericsson Wallet Platform in new markets to serve MTN’s customers.

Key and emerging market players include Vodafone (UK), Google (US), Orange (France), FIS (US), Paypal (US), Mastercard (US), Fiserve (US), Airtel (India), Gemalto (Netherlands), Alipay (China), MTN (South Africa), PAYTM (India), Samsung (South Korea), VISA (US), Tencent (China), Global Payments (US), Square (US), Amazon (US), Apple (US), Western Union Holdings (US), Comviva (India), and T- Mobile (US).

Vodafone (UK) caters to a wide customer base in the regions of the Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC). Vodafone’s M-Pesa mobile money transfer and payment service is one of the leading mobile money products in the world. The company has 37 million M-Pesa customers, and during 2019 the M-Pesa revenue grew by 21% to EUR 750 million, representing 12% of the emerging consumer service revenue in the year. M-Pesa is Africa’s largest payment platform that provides enterprise payments, financial services, and merchant payment services for mobile commerce. It further offers people a safe, secure, and affordable way to send and receive money, top-up airtime, make bill payments, receive salaries, get a loan, and much more.

Google (US) is one of the major players that focuses on the emerging concept of mobile money. Google Pay, formerly known as Google Wallet, is a digital wallet platform and online payment system, which enables users to make payments and transfer money straight from their phones. In January 2018, the company brought together different payment platforms run by Google, including Android Pay and Google Wallet, merging it into a single platform, Google Pay. Google Pay protects an individual’s money with a world class security system that helps the user detect fraud and prevents hacking. It further helps safeguard the individual’s account with screen locking technologies, such as a fingerprint. Currently, in India, Google Pay works with all banks that support BHIM Unified Payments Interface (UPI), India’s real-time payments ecosystem. Google Pay helps small business owners or managers at a corporation to accept payments and connect with customers. Customers on more than 80 BHIM UPI apps can use Quick Response (QR) codes or their phone numbers, to send money from their bank account to other bank accounts without the need of a Point of Sales (POS) system. Since the launch of Google Pay in India (formerly known as Tez), transactions on UPI have increased 43 times, reaching 734 million transactions in May 2019. The company has a presence in North America, Europe, APAC, and Middle East and Africa (MEA). Google caters to a large customer base spread across the globe, through a global network of service providers, distributors, and cloud resellers.

Browse Complete Report @ https://www.marketsandmarkets.com/Market-Reports/mobile-remittance-money-mcommerce-market-577.html

0 notes

Text

Mobile Money Industry Share, Trend, Segmentation and Forecast to 2024

MarketsandMarkets expects the global Mobile Money Industry size to grow from USD 3.4 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 28.7% during the forecast period. Mobile payments is an easy way to carry out transactions and people across the globe are adopting mobile money to reduce their dependence on cash while traveling. A rise in the number of payment transactions, banking values, and mobile penetration rate across the world are factors driving the mobile money market.

Browse 103 market data Tables and 30 Figures spread through 153 Pages and in-depth TOC on "Mobile Money Industry by Transaction mode (Point of Sale, Mobile Apps, QR codes, Internet Payments, SMS, STK/USSD Payments, Direct Carrier Billing, Mobile Banking), Nature of Payment, Application, Type of Payments, Region - Global Forecast to 2024"

Request a Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=577

The growth of the mobile money market in the MEA is further driven by increased investments in payment technologies made by governments of countries, such as Qatar, South Africa, and the UAE. This region has a presence of creditable Mobile Network Operators (MNOs), banks, and payment processing agents, which encourage the use of mobile money services. For instance, in February 2019, MTN and Ericsson signed a 5-year contract extension for the distribution of new products and the provision of mobile money services in 13 countries across the MEA region. Ericsson aims to deploy the Ericsson Wallet Platform in new markets to serve MTN’s customers.

Key and emerging market players include Vodafone (UK), Google (US), Orange (France), FIS (US), Paypal (US), Mastercard (US), Fiserve (US), Airtel (India), Gemalto (Netherlands), Alipay (China), MTN (South Africa), PAYTM (India), Samsung (South Korea), VISA (US), Tencent (China), Global Payments (US), Square (US), Amazon (US), Apple (US), Western Union Holdings (US), Comviva (India), and T- Mobile (US).

Vodafone (UK) caters to a wide customer base in the regions of the Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC). Vodafone’s M-Pesa mobile money transfer and payment service is one of the leading mobile money products in the world. The company has 37 million M-Pesa customers, and during 2019 the M-Pesa revenue grew by 21% to EUR 750 million, representing 12% of the emerging consumer service revenue in the year. M-Pesa is Africa’s largest payment platform that provides enterprise payments, financial services, and merchant payment services for mobile commerce. It further offers people a safe, secure, and affordable way to send and receive money, top-up airtime, make bill payments, receive salaries, get a loan, and much more.

Google (US) is one of the major players that focuses on the emerging concept of mobile money. Google Pay, formerly known as Google Wallet, is a digital wallet platform and online payment system, which enables users to make payments and transfer money straight from their phones. In January 2018, the company brought together different payment platforms run by Google, including Android Pay and Google Wallet, merging it into a single platform, Google Pay. Google Pay protects an individual’s money with a world class security system that helps the user detect fraud and prevents hacking. It further helps safeguard the individual’s account with screen locking technologies, such as a fingerprint. Currently, in India, Google Pay works with all banks that support BHIM Unified Payments Interface (UPI), India’s real-time payments ecosystem. Google Pay helps small business owners or managers at a corporation to accept payments and connect with customers. Customers on more than 80 BHIM UPI apps can use Quick Response (QR) codes or their phone numbers, to send money from their bank account to other bank accounts without the need of a Point of Sales (POS) system. Since the launch of Google Pay in India (formerly known as Tez), transactions on UPI have increased 43 times, reaching 734 million transactions in May 2019. The company has a presence in North America, Europe, APAC, and Middle East and Africa (MEA). Google caters to a large customer base spread across the globe, through a global network of service providers, distributors, and cloud resellers.

Browse Complete Report @ https://www.marketsandmarkets.com/Market-Reports/mobile-remittance-money-mcommerce-market-577.html

0 notes

Text

Mobile Money Market Developments and Analytical Data, Shares, Forecast to 2024

MarketsandMarkets expects the global Mobile Money market size to grow from USD 3.4 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 28.7% during the forecast period. Mobile payments is an easy way to carry out transactions and people across the globe are adopting mobile money to reduce their dependence on cash while traveling. A rise in the number of payment transactions, banking values, and mobile penetration rate across the world are factors driving the mobile money market.

Key and emerging market players include Vodafone (UK), Google (US), Orange (France), FIS (US), Paypal (US), Mastercard (US), Fiserve (US), Airtel (India), Gemalto (Netherlands), Alipay (China), MTN (South Africa), PAYTM (India), Samsung (South Korea), VISA (US), Tencent (China), Global Payments (US), Square (US), Amazon (US), Apple (US), Western Union Holdings (US), Comviva (India), and T- Mobile (US).

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=577

The MEA market is termed as a transforming market; it is expected to have the largest market size in 2018 with Africa showing the highest adoption of mobile money services and mobile subscriptions in the region are growing rapidly. According to the World Bank data, there were 122 mobile subscriptions for every 100 individuals in Saudi Arabia, 211 in the United Arab Emirates (UAE), and 127 in Israel, in 2017. The growth of the mobile money market in the MEA is further driven by increased investments in payment technologies made by governments of countries, such as Qatar, South Africa, and the UAE. This region has a presence of creditable Mobile Network Operators (MNOs), banks, and payment processing agents, which encourage the use of mobile money services. For instance, in February 2019, MTN and Ericsson signed a 5-year contract extension for the distribution of new products and the provision of mobile money services in 13 countries across the MEA region. Ericsson aims to deploy the Ericsson Wallet Platform in new markets to serve MTN’s customers.

Vodafone (UK) caters to a wide customer base in the regions of the Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC). Vodafone’s M-Pesa mobile money transfer and payment service is one of the leading mobile money products in the world. The company has 37 million M-Pesa customers, and during 2019 the M-Pesa revenue grew by 21% to EUR 750 million, representing 12% of the emerging consumer service revenue in the year. M-Pesa is Africa’s largest payment platform that provides enterprise payments, financial services, and merchant payment services for mobile commerce. It further offers people a safe, secure, and affordable way to send and receive money, top-up airtime, make bill payments, receive salaries, get a loan, and much more.

Google (US) is one of the major players that focuses on the emerging concept of mobile money. Google Pay, formerly known as Google Wallet, is a digital wallet platform and online payment system, which enables users to make payments and transfer money straight from their phones. In January 2018, the company brought together different payment platforms run by Google, including Android Pay and Google Wallet, merging it into a single platform, Google Pay. Google Pay protects an individual’s money with a world class security system that helps the user detect fraud and prevents hacking. It further helps safeguard the individual’s account with screen locking technologies, such as a fingerprint. Currently, in India, Google Pay works with all banks that support BHIM Unified Payments Interface (UPI), India’s real-time payments ecosystem. Google Pay helps small business owners or managers at a corporation to accept payments and connect with customers. Customers on more than 80 BHIM UPI apps can use Quick Response (QR) codes or their phone numbers, to send money from their bank account to other bank accounts without the need of a Point of Sales (POS) system. Since the launch of Google Pay in India (formerly known as Tez), transactions on UPI have increased 43 times, reaching 734 million transactions in May 2019. The company has a presence in North America, Europe, APAC, and Middle East and Africa (MEA). Google caters to a large customer base spread across the globe, through a global network of service providers, distributors, and cloud resellers.

Browse Complete Report @ https://www.marketsandmarkets.com/Market-Reports/mobile-remittance-money-mcommerce-market-577.html

0 notes

Text

Best offers on personal loan

Getting loans at an extraordinary rate can be a significant heavy undertaking, particularly in the event that you are anticipating selecting the ‘Personal Loan.’ Before we get into the nits and bits of getting the best Offers on the loan you want, you should remember that personal loans come with an interest rate that is higher than the normal loans where you provide the bank with collateral to get the loan.

Notwithstanding, personal loans are harder to get authorized as it is simply in light of your budgetary notoriety and your capacity to pay back the total which incorporates your Credit Score. Now that you have decided to get a personal loan let’s take a look at some of the pointers that you should remember to ensure the best possible deal with the lowest rate of interest.

Compare and Analyze:

On the off chance that you want a personal loan in UAE, the best way to get beneficial deals is to compare the plans from different banks followed by an in-depth analysis of the all the plans and their associated interest rates. With current options available to you, you can easily obtain all the plan details online from the comfort of your home.

This will empower you to pick the best bank to help bring down all your related costs. You can look at personal loan designs that incorporate distinctive methods, for example, documentation and its multifaceted nature, handling charges, charges for pre-conclusion, client bolster and a web-based tracking system.

Magnificent Credit Score:

The way toward getting your personal loan Dubai endorsed by the bank expects you to have a Credit Score that is qualified for a loan sum that you want. In the event that you investigate the financing costs gave by different banks, you will see one thing that an incredible Credit Score rating gets you bring down loan costs.

This is on the grounds that you the banks trust you can possibly restore the cash you owe. A decent Credit Score can be earned from opportune installment of bills and paying back your past loans in the time distributed to you. Ensure you assemble a lattice to pay back the loan sum before the allocated time to keep up an incredible Credit Score in light of the fact that even a minor deferral could influence your score.

Search for occasional offers:

0 notes