#Number of Online Loan Market End Users

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

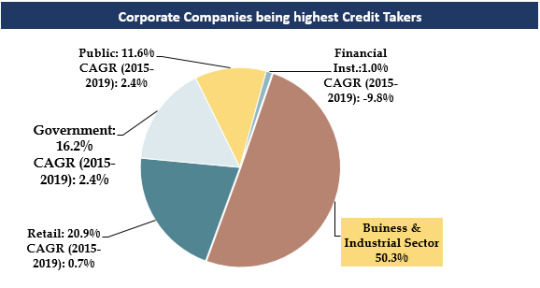

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

Top Considerations When Choosing a Car Leasing Company

Leasing a car offers the opportunity to drive a new car every few years, potentially with lower monthly payments than car loans. However, with various leasing companies in the market, choosing the right one requires careful consideration.

Like selecting the perfect car, finding the right leasing company hinges on understanding your needs and comparing different options. Here's a breakdown of key factors before signing a lease agreement.

Reputation Matters: Reviews And Recommendations

The reputation of a car leasing company is paramount. Start your research by looking for online reviews and testimonials from past customers. Reputable review sites with verified purchases allow you to gauge customer experiences with different leasing companies. Industry forums or websites of consumer protection agencies might also offer insights and recommendations on reputed companies, such as various car leasing companies in India.

Transparency Is Key: Understanding Lease Terms And Fees

Leasing agreements are often complex documents filled with jargon. Don't be afraid to ask questions! A reputable leasing company will be transparent about all lease terms and fees associated with the agreement. Here are some crucial aspects to pay close attention to:

Capitalized Cost Reduction (CCR)

This represents the down payment you make to reduce the capitalized cost (essentially the car's value), which impacts your monthly payments.

Residual Value

Understanding this value is important if you plan to purchase the car at the end of the lease.

Money Factor

This number helps determine your lease interest rate and might not be readily displayed. Ask the leasing company to explain the money factor and its impact on your monthly payments.

Mileage Allowance

Lease agreements typically have mileage limitations. Going over the limit can result in excess mileage charges.

Lease Term Length

A longer lease term might offer lower monthly payments but lock you into the car longer.

car lease companies in india

Leasing companies offer a diverse range of car models and lease options. Here are some key considerations:

Car Selection

Does the company offer many car models that cater to your needs and preferences? Are you looking for a fuel-efficient sedan or a spacious SUV? Ensure the company has options that fit your lifestyle.

Lease Options

Beyond mileage allowances, some companies offer flexible lease terms for length or potential customization options like excess wear-and-tear coverage. Compare options to find a lease that best suits your requirements.

Beyond The Contract: Importance Of Customer Service And Support

Leasing a car doesn't end with signing the paperwork. A good leasing company offers excellent customer service and support throughout your lease term. Look for companies that provide:

Responsive Communication Channels

Whether it's phone support, email assistance, or a user-friendly online portal, you should have easy ways to reach the leasing company with questions or concerns.

Knowledgeable Staff

Customer service representatives should be well-versed in lease terms and able to answer your questions clearly and accurately.

Transparent Billing

Your monthly statements should be easy to understand and detail all charges and fees associated with your lease.

Final Thoughts

By prioritizing these key considerations, you can confidently navigate the world of car leasing companies. Take your time, research, compare options, and don't hesitate to ask questions. With the right approach, you can find a car leasing company that offers a transparent and hassle-free experience, allowing you to get behind the wheel of your dream car.

0 notes

Text

Inrplus Home loan Service providing in Ghaziabad

Purchasing a home is a lifelong dream for many individuals and families. However, making this dream a reality often requires financial assistance through home loans. If you are looking for a reliable, customer-centric home loan service provider in Ghaziabad, your search ends with Inrplus Home Loan Service.

Buying a home can be a complex and overwhelming process, especially when it comes to arranging finances. Inrplus Home Loan Service aims to simplify this process and help potential home loan in Ghaziabad secure the funding they need. With a commitment to customer service and a seamless loan application process, Inrplus Home Loan Service has earned an excellent reputation in the market.

One of the key factors that sets Inrplus Home Loan Service apart from its competitors is its personalized approach to customer service. The team at Inrplus understands that every individual or family has unique financial circumstances. With this in mind, they offer personalized loan solutions that cater to the specific needs of each customer.

The loan officers at Inrplus Home Loan in Ghaziabad Service are experts in their field and have extensive knowledge of the mortgage market in Ghaziabad. They work closely with customers, providing guidance, and answering any queries or concerns throughout the loan application process. By being responsive and approachable, they ensure a stress-free experience for their customers.

Inrplus Home Loan Service offers a wide range of loan products tailored to suit various requirements. Whether you are a first-time homebuyer or looking to refinance an existing loan, they have options to meet your needs. They offer competitive interest rates, flexible repayment plans, and transparent terms and conditions. By carefully analyzing your financial situation, Inrplus Home Loan Service will guide you toward the best available loan product.

Ghaziabad is a rapidly developing city that offers numerous real estate opportunities. Inrplus Home Loan Service has deep knowledge of the local market and collaborates with leading builders and developers in the area. This partnership allows them to provide attractive financing options and exclusive deals to their customers.

When it comes to the online home loan application process, Inrplus Home Loan Service prides itself on efficiency and simplicity. They have embraced technology to streamline the process, making it quick and convenient for their customers. Through their user-friendly home loan online platform, borrowers can easily submit their applications, track their progress, and access important documents.

Moreover, Inrplus Home Loan Service ensures transparency by keeping customers informed at every stage of the loan approval process. They provide regular updates, ensuring that borrowers have a clear understanding of the timeline and any additional documents or information required.

Inrplus Home Loan online Service has built a strong reputation for its reliability and commitment to customer satisfaction. The testimonials of satisfied customers speak volumes about their exceptional service and professionalism. Their dedication to delivering quality service has resulted in a high success rate of loan approvals.

So, if you are in the market for a home loan in Ghaziabad, look no further than Inrplus Home Loan Service. With their personalized approach, competitive loan products, and seamless application process, they are poised to make your dreams of owning a home in Ghaziabad a reality. Contact Inrplus Home Loan Service today and take the first step towards securing your dream home.

Contact us for more details:-

https://inrplus.in/blog/2024/03/12/home-loan-in-noida-and-other-ncr-regions-eligibility-features-and-tips/

Contact Number:- 9891751729

"Rainbow Fincorp

101, Vardhman Prakash Plaza Sector -20 Dwarka

Near Hyundai Showroom. New Delhi-110075"

1 note

·

View note

Text

Increase the number of users

Compared with handing out flyers and cooperating with supermarkets, there is no HE Tuber need for printing, rent and other costs. Compared with new media, the time cost is lower. Reduce costs and increase efficiency for merchants by providing technological means, such as AI services such as "Smart Chicken Raising"

Summary

Through the above analysis, we can find that compared with other loan consumption methods, Anyihua better meets the needs of fund demanders, fund suppliers, and consumer suppliers, and thus has higher user value for them. This This is also one of the reasons why it can develop smoothly and rise rapidly.

Business value analysis

Anyihua's core business is consumer loans, and its main source of income is interest income.

An important indicator to judge whether a business can develop healthily is revenue.

Here we refer to the GMV calculation formula, the most commonly used data indicator in the e-commerce industry, to analyze whether Anyihua's core business is healthy.

GMV = number of users * conversion rate * unit price per customer

An increase in the number of users, conversion rate, or customer unit price will have a positive impact on the overall revenue growth, so next we will focus on analyzing the means by which Anyihua improves these three key indicators.

Reduced costs:

To achieve sustained revenue growth, a steady stream of registered new users is the most basic guarantee. So how does Anyihua attract new users?

(1) Advertising

Online advertising:

Direct advertising through various online channels (such as Baidu search engine advertising, Douyin, WeChat Moments promotion)

Settled in the service platform (such as Alipay service window, WeChat official account, etc.)

Cooperating with mainstream media (joining hands with "Southern Weekend" to promote joint documentaries)

Cooperate with other brands for promotion (jointly with Qianshan to launch gift boxes)

Initiate/sponsor event promotion and other means of publicity

Offline advertising:

Distributing leaflets in public places

Promote through public transportation (such as launching a public welfare video on the Shenzhen Metro)

Cooperate with supermarkets and stores (such as Chongqing Department Store, Wumart, and China Mobile stores)

Cooperate with other brand merchants for promotion (such as joining hands with Wanglaoji to send cool drinks)

Initiate/sponsor promotion activities (such as assisting rural revitalization, financial knowledge promotion and education activities, etc.)

(2) Offline promotion

Conduct nationwide promotion through cooperation with local promotion platforms to guide new users to obtain credit

(3) Word-of-mouth communication

Word of mouth plays a very critical role in attracting new customers.

The platform provides users with loan and installment services. If the platform not only meets the needs of users, but also has a lower cost of use, a very good product experience, and wins user recognition, it will easily form word-of-mouth communication through customer reviews and social media posts. Increase brand awareness and reputation through word-of-mouth and other methods. Anyihua has made a lot of efforts to this end, and the results are very good. It is because of its good reputation that it has become popular on the Internet.

Here are a few examples:

The total monthly interest-free consumption in Anyihua Mall is 1,000. Consumers who purchase less than 1,000 per month in the mall are equivalent to interest-free shopping.

Anyihua launches special assistance for public welfare activities and the daily supply season. Users have the opportunity to receive assistance and supplies.

Anyihua's "New Citizen Character Integrated Marketing Project" pays close attention to the new citizen groups and launches a number of exclusive welfare activities for new citizens such as financial welfare coupons and surprise physical gifts to effectively provide warmer services to the new citizen groups.

0 notes

Text

Government cooperation projects

Transaction frequency is HE Tuber high, with nearly 70% of residents visiting supermarkets at least once a month, and more than 30% of residents going to supermarkets for shopping between 1 and 3 times a month.

Reduce marketing costs.

The time cost is low. The minimum interest-free period for a credit card is 20 days, and the maximum cannot exceed 56 days.

shortcoming:

The trading scope is small, and large supermarkets basically cover nearby residents, so their influence is limited.

The single consumption amount is small, and the user's single shopping consumption amount is generally between 100-1,000 yuan, which is lower than the unit price of a mortgage.

(3) Small and micro enterprise loans

Banks cooperate with small and micro enterprises to provide loan services to small and micro enterprises.

advantage:

The scope of transactions is large. By the end of 2022, the number of small, medium and micro enterprises in China has exceeded 52 million

The transaction amount is large, and the loan limit for small and micro enterprises is generally within a maximum of 3 million or 5 million for a single transaction. If it is a small and micro enterprise business loan involving mortgage, it is based on the value of the collateral. Generally, the maximum single loan is within 20 million or 2,500. The loan amount for small and micro enterprises is higher than the unit price of consumer loans for supermarkets.

The frequency of transactions is high. In the face of economic fluctuations and market changes, small and micro enterprises need to adjust their strategies at any time to remain competitive and need to apply for loans more frequently. According to a major survey report released by WeBank Huang Zhengchuan, small and micro enterprises within one year The average number of borrowings is 2.8 times, and nearly 50% of small and micro enterprise loan terms are between half a year and one year.

shortcoming:

The cost is relatively high:

The business operations and development prospects of small and micro companies are relatively unstable, which may lead to an increase in bank non-performing assets.

The loan cycle is relatively long, with nearly 50% of small and micro enterprise loan terms ranging from half a year to one year.

(4) Government cooperation projects

Banks work with government cooperative projects to provide loan services for government projects.

advantage:

The transaction scope is large, the government is a provider of public services, and has long-term business needs

The transaction amount is large and the investment capital is more than other cooperation channels.

shortcoming:

Low bargaining power, such as investment in infrastructure such as transportation and electricity, is a non-productive project.

The capital occupation cycle is long, and the transaction cycle is longer than that of shopping malls and small and micro enterprises.

Based on the above, the above four methods each have their own advantages and disadvantages, and none of them can meet the current needs of banks very well.

3. Consumer and supply side

After the customer group obtains loan capital from the platform, consumption mainly flows into offline consumption scenarios and online consumption scenarios. In offline consumption scenarios, funds mostly flow into consumption scenarios such as food and catering, tourism, travel and accommodation, shopping and entertainment.

In online consumption scenarios, e-commerce platforms are a relatively concentrated entry point for consumption traffic, and digital electronic products are an important consumer category. In addition, home appliances, beauty products, and luxury goods are also product categories favored by consumers.

Consumer finance platforms are generally connected to traffic platforms or brand manufacturers, such as China Mobile, Tencent, Xiaomi, OPPO, VIVO, HP, thinkpad, Vipshop, iQiyi, NIKE, Xinri, etc.

As merchants, their common core desire is to facilitate transactions and maximize benefits. Profit = revenue - cost.

The core needs of sellers are:

0 notes

Text

ProfitClass Review - Brand New AI-Powered "MasterClass Killer"

If you've ever attempted creating a membership website for online courses or marketing them, you are aware of how difficult and time-consuming it can be. It's a massive task that involves everything from generating items to managing members, recording course content, putting up technology, promoting your website, and providing customer service.

It's for this reason that I'm thrilled to be reviewing ProfitClass today—a cutting-edge piece of software that uses artificial intelligence to make creating, running, and making money from an online membership business simpler and faster than before.

In this comprehensive ProfitClass review, I'll give you an insider's perspective of this revolutionary platform, so keep reading.

ProfitClass Review – Introduction

Produce & Host unlimited pall class spots in any niche for yourself or guests Just tell the AI what you want and watch it produce it in twinkles Included Original AI- generated videotape courses, infoproducts & highticket services Dozens of done- for- you niche templates erected- in the ultimate “ Kajabi killer ” Drag & drop point creator & editor with SSL encryption, stoner operation and payment processing produce class spots for yourself, or vend them to original businesses for massive gains right down No coding, no development, no hosting needed – 100 newbie friendly! Guaranteed business erected- in from the progenygo The AI works24/7 to make you unique videotape courses in 250 different niches AND entrapments them right into your class platform. Nothing to download, install or customize – get started in seconds Get briskly loading websites than ever ahead with 99 uptime shoot THOUSANDS of red-hot Empty callers that ca n’t stay to buy your training Let our support platoon handle tickets, delivery, and processing vend anything with our erected- in shops, stoner operation and payment gateways software, chapter offers, physical products, readymade spots & services each- by- one dashboard takes care of EVERYTHING( hosting, point creation, shopping wain, payments, product delivery) Multiple business aqueducts & hundreds of ready- to- sell products erected- in Done- for- you dispatch autoresponder with erected- in business leads

ProfitClass Review – Overview

Creator

Mike McKay, Calin Loan, and Radu Hahaianu

Product

ProfitClass app

The official page

>>>Click Here To Access

Front-end price

$9.93 – $14.90 (one-time payment)

The discount coupon

Use my coupon code “PROCLASS4” – $4 OFF for the entire funnel.

Bonus

Yes, Huge Bonus

Guarantee

30-day money-back guarantee!

Vendor’s support

Send your question via: [email protected]

ProfitClass Review: What Is It?

ProfitClass is cloud-based software that gives online business owners and instructors a one-stop shop for building, hosting, and managing membership websites, producing online video courses, delivering goods, increasing traffic, and handling payments—all from a single, user-friendly dashboard.

When it comes to starting an online membership education business, it takes care of everything from A to Z. It manages all the technical kinks so you can concentrate on making money off of your knowledge and experience.

ProfitClass offers several notable attributes and advantages, such as:

Ø Ø For you or your clients, create and host an infinite number of cloud membership websites in any niche.

Ø Just tell the AI what you need, and it will provide it in a matter of minutes.

Ø Included are premium services, info products, and original AI-generated video courses.

Ø Numerous pre-made specialized templates included in... the ultimate murderer of Kajabi

Ø Drag and drop website editor and creator with user management, SSL encryption, and payment processing

Ø Make membership websites for yourself or to immediately sell to nearby companies for enormous revenues.

Ø And many More……

ProfitClass Review - How Does It Work?

It works in the steps described below.

Step 1: - With our stable servers, you can create and host unlimited membership websites from dozens of templates.

Step 2: - Utilize the integrated AI to create an extensive range of products effortlessly, ranging from video courses and informational products to high-value services such as coaching programs – all accessible with just a single click!

Step 3: - Place your trust in us for traffic, sales, and processing needs. We take care of everything, from attracting eager visitors to handling payment processing, user management, and even providing technical support!

ProfitClass Review - Explore The Full Range Of Offerings Available With ProfitClass...

>> Generate and host limitless cloud-based membership sites in any niche, whether for yourself or your clients!

>> Simply convey your desires to the AI, and observe as it swiftly brings them to fruition in minutes!

>> Included: Unique video courses, informational products, and premium services, all generated by AI!

>> Dozens of done-for-you niche templates built-in… the ultimate “Kajabi killer”!

>> Drag & drop site creator & editor with SSL encryption, user management and payment processing!

>> Create membership sites for yourself, or sell them to local businesses for massive profits right away!

>> And Many More…..

ProfitClass Review - Additionally, We Are Currently Employing It In Our Own Business With Remarkable Success...

Let's Review…

Here's What You Get Today:

1. Create & Host unlimited cloud membership sites in any niche for yourself or clients! VALUE $997

2. Just tell the AI what you want and watch it create it in minutes! VALUE $997

3. Included: Original AI-generated video courses, infoproducts & high-ticket services! VALUE $997

4. Dozens of done-for-you niche templates built-in…the ultimate “Kajabi killer”! VALUE $997

5. Drag & drop site creator & editor with SSL encryption, user management and payment processing! VALUE $997

6. Create membership sites for yourself, or sell them to local businesses for massive profits right away! VALUE $997

7. Guaranteed traffic built-in from the get-go! VALUE $997

8. The AI works 24/7 to build you unique video courses in 250+ different niches AND plugs them right into your membership platform! VALUE $997

9. Nothing to download, install or customize – get started in seconds! VALUE $997

10. Get faster loading websites than ever before with 99% uptime! VALUE $997

11. Send THOUSANDS of red-hot HUNGRY visitors that can’t wait to buy your training! VALUE $997

12. Let our support team handle tickets, delivery, and processing! VALUE $997

13. Sell anything with our built-in shops, user management and payment gateways: software, affiliate offers, physical products, readymade sites & services! VALUE $997

14. All-in-one dashboard takes care of EVERYTHING (hosting, site creation, shopping cart, payments, product delivery!) VALUE $997

15. Multiple traffic streams & hundreds of ready-to-sell products built-in! VALUE $997

16. Done-for-you email autoresponder with built-in business leads! VALUE $997

17. SEO Built-In Gets You #1 Rankings For Yourself Or Clients! VALUE $497

18. Subaccounts For Clients So They Can Login To Their Own Sites & Edit Them (Get Paid Without Lifting A Finger!) VALUE $497

19. Bill Clients Monthly For Courses & The ProfitClass Platform And Let Us Handle Everything For You! VALUE $397

20. AutoResponder Integration Builds Your List & Lets You Email Your Customers On Complete Autopilot! VALUE $397

21. Proprietary Technology Automates 24/7 Social Media Traffic For You! VALUE $397

22. Unlimited Free SSL Certificates & Encryption: Your Data Is 100% Secure! VALUE $297

23. ProfitClass Automatically Delivers The Product To The Buyer (You Just Collect Payment!) VALUE $297

24. Payment Processing + Shopping Cart Enabled: Just Connect Your Paypal (or 6 other processors) & Start Collecting Payments! VALUE $297

ProfitClass Review - Authentic Feedback From Genuine Experts!

ProfitClass Review - Frequently Asked Questions

Is ProfitClass cloud based?

Yes, ProfitClass is a cloud-based hosting solution easy to access from anywhere. Works with Mac, PC and mobile.

Does ProfitClass Cost A Monthly Fee?

When you act now, you’re getting one-time access to ProfitClass without EVER having to pay a monthly fee

Are Others Using ProfitClass Already?

Yes – we have over 7000 websites and products on our servers already. We know what we’re doing & you can rest assured your sites will be safe on our servers. Some of the feedback from our users is being represented on this very same page.

Do I Need Any Tech Skills Or Experience To Make This Work?

NO – ProfitClass Is Seamless & 100% Newbie Friendly.

Is Support & Training Included?

Absolutely. By purchasing today you can get instant access to the training portal and the 24/7 support desk

ProfitClass Review – My Recommendation

ProfitClass is a robust and user-friendly platform that enables anyone to create and monetize successful membership sites effortlessly. With its comprehensive set of features, one-time payment model, and emphasis on user-friendly design, ProfitClass is an attractive option for entrepreneurs, educators, and content creators looking to establish a thriving online presence. Its strengths lie in its simplicity, affordability, and the added support of AI-powered assistance.

If you're ready to take charge of your online income and build a profitable membership business, ProfitClass is a valuable companion on your entrepreneurial journey.

Thanks

#digitalmarketing#artificial intelligence#success#technology#degital marketing#online earning#viral Income

1 note

·

View note

Text

P2P Lending Market Trends: What Lies Ahead

Low operational expenses and reduced market risk for lenders and borrowers are to blame for the market’s expansion. During the projected period, increased digitization in the banking industry is anticipated to present the market with sizable business prospects. By the end of 2032, the worldwide peer-to-peer lending market is predicted to have grown from US$ 407.2 billion in 2022 to US$ 1.3 trillion. From 2022 to 2032, the market is anticipated to grow at a CAGR of 12.7%.

P2P lending is also being effectively utilised by a variety of end users, including the real estate industry, as its popularity has grown. Additionally, it is anticipated that increased player initiatives to work together will eventually help the market.

For instance, in May 2022, Fable Fintech, an eminent banking infrastructure enterprise, announced its strategic partnership with XeOPAR. XeOPAR is ready to make the most of the Fable Growth Suite (Retail) by establishing its first P2P remittances corridor from the United Kingdom to India, among others in SE Asia, East Africa, West Africa, the USA, Singapore, and the Middle East.

Request a Sample of this Report @

https://www.futuremarketinsights.com/reports/sample/rep-gb-14675

Owing to such initiatives, the market is anticipated to expand significantly in the forecast period. On the contrary, risks associated with peer-to-peer lending are expected to limit the market growth in the forecast period. Also, with less awareness about P2P lending, the market is expected to suffer.

However, with rising development in APAC along with the increasing number of small business entities, the market will counter the inhibiting factors, thus, supporting the industry expansion.

Key Takeaways from the Market Study:

Market in the U.S to value US$ 568.2 Billion by 2032

Chinese market to expand at a CAGR of 11.3% from 2022- to 2032

By end-user, the small business segment is expected to exhibit a CAGR of 10.3% during the assessment period

The marketplace lending model segment to exhibit a CAGR of 12.9% in the assessment period

Market in France to garner US% 39.7 Billion by 2032

S to exhibit a CAGR of 14% from 2022 to 2032

Competitive Landscape

With the help of alternative distribution channels such as online sales, Players in the global peer-to-peer lending market are focusing to enhance their market presence across the globe. Major players in the market include Prosper Marketplace, Inc., LendingClub Corporation, CommonBond Inc., Funding Circle Limited, and Upstart Network Inc. among others.

In August 2021, CRED, an eminent player in the peer-to-peer lending market rolled out a new peer-to-peer lending platform called CRED Mint. It can be used as a cred-card repayment platform, and it allows members to earn interest on money by lending to other high-earning consumers.

In January 2021, LendingClub, an eminent peer-to-peer lending market player, announced the acquisition of Radius Bancorp, Inc, and its digital bank subsidiary to expand the revenue of the company.

Ask An Analyst @

https://www.futuremarketinsights.com/ask-the-analyst/rep-gb-14675

More Valuable Insights

Future Market Insights, in its new offering, presents an unbiased analysis of the global peer-to-peer lending market, presenting a historical analysis from 2015 to 2021 and forecast statistics for the period of 2022-2032.

Key Segments Profiled in the Peer-to-Peer Lending Market Analysis

Peer-to-Peer Lending by End User:

Peer-to-Peer Lending for Consumer Credit

Peer-to-Peer Lending for Small Business

Peer-to-Peer Lending for Student Loans

Peer-to-Peer Lending for Real Estate

Peer-to-Peer Lending by Business Model:

Traditional Peer-to-Peer Lending Model

Marketplace Peer-to-Peer Lending Model

Peer-to-Peer Lending by Region:

North America Peer-to-Peer Lending Market

Europe Peer-to-Peer Lending Market

Asia Pacific Peer-to-Peer Lending Market

Middle East & Africa Peer-to-Peer Lending Market

Latin America Peer-to-Peer Lending Market

Request for Customization @

https://www.futuremarketinsights.com/customization-available/rep-gb-14675

About Us

Future Market Insights, Inc. (ESOMAR certified, Stevie Award – recipient market research organization and a member of Greater New York Chamber of Commerce) provides in-depth insights into governing factors elevating the demand in the market. It discloses opportunities that will favor the market growth in various segments on the basis of Source, Application, Sales Channel and End Use over the next 10-years.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

For Sales Enquiries: [email protected]

Browse Other Reports: https://www.futuremarketinsights.com/reports

LinkedIn| Twitter| Blogs

0 notes

Text

Get some transformation in life with My Loan Bazar app

There could be many ways to get your loan approved. But when we need to choose the best application for short term loan in India, then we start to collect some data or we started searching here and there. Many available loan app will promise you that they are the best loan app on internet. And they will get ready to provide you various services or financial services because they are best. But, who is going to decide that which loan app is best? Or who is there to provide best loan services to the loan seekers. In general terms, every loan app is good or best and this could be only decided by the users only. Because, at the very end they are going to use your loan app, so if users are satisfied with your loan services or financial services then only you are best. There is a boom in the market where you will find many loan applications, for your personal loan, salary loan, cash loan, hassle free loan mini loan, short term loan, etc.

Well this is clearly mentioned by all the loan service providers that they provide best services to their users and they are best loan provider, but before driving yourself towards any conclusion you need to think about certain points so you can independently decide that which loan application is best for you. This is very clear that in the market there is a tradition of cut throat competition and everyone is going to promise you that they are ready to provide best of the best. So, some point needs to be considered before finalizing any loan app for you.

Rate of approving loan: This point should be on the first priority list as you need instant approval for your loan, so before selecting any app, just find out what is the rate of that app to approve your loan. If they have maximum number of loan application rejection in comparison to approval then do not consider them. Find that loan app that is always ready to approve your loan in any situation.

Loan disbursal period: As you have finalized your best loan app for short term loan, now you have to find out the time period they really take just to disburse your loan amount. This is true that finding any loan application but that loan app should be fast in disbursing your loan amount. As many loan app are there in the market like My Loan Bazar who are ready to disburse your loan amount with the 30 mins of getting your loan application selected.

Documentation process: a crucial step that always play a very significant role in deciding that whether your loan application will face rejection or selection by the loan provider will depend on the documentation process. If you are really seeking your personal loan or advance salary loan to be approved then you have to find the easiest way of getting documentation done. Find that loan app only that is providing online documentation process.

Many more things could be considered before finding out the best loan application for smart loan, but its upto you. This is also true that many loan providers are ready to lure you with exciting loan offers and you have to decide that on what parameters you will finalize your loan provider.

0 notes

Text

Commercial Banking Market to Witness Excellent Revenue Growth Owing to Rapid Increase in Demand

A Latest intelligence report published by AMA Research with title "Global Commercial Banking Market Outlook to 2027. This detailed report on Commercial Banking Market provides a detailed overview of key factors in the Global Commercial Banking Market and factors such as driver, restraint, past and current trends, regulatory scenarios and technology development.

Commercial banking is a division within the bank or financial institution that only focuses on the products or services specifically offered to businesses. It includes various types of services like merchant services, payment processing, commercial loans, deposit accounts, and many more. The increasing number of startups and small & medium industries will accelerate the growth of commercial banking during the forecast period as it provides finance to the SMEs or startups to foster the development of a corporate bond market and stimulate its development. Commercial banking helps to make it easy to manage the day-to-day financial tasks of any organization.

Major Players in this Report Include are

JPMorgan Chase (United States)

HSBC Holdings plc (United Kingdom)

Genpact (United States)

Accenture (Ireland)

Fiserv (United States)

WNS (India)

Wells Fargo (United States)

RBL Bank (India)

ICICI Bank (India)

Infosys (India)

PwC (United Kingdom)

Oracle Corporation (United States)

M&T Bank (United States)

Ernst & Young (United Kingdom)

Market Drivers: Increasing Digitalization and Adoption of Technological Advancement to Serve Customers Online and Offer Enhanced Services

Surging Demand for Commercial Banking Service Among the Small & Medium-Sized Businesses and Startups

Market Trend: Increased Focus on the Development of Innovative Commercial Banking Solutions with Advanced Technologies like AI and Machine Learning

Emerging Trend of Open Banking in the Commercial Banking Market

Opportunities: High Growth of Commercial Banking and Increasing Digital Transformation of Commercial Banking in the United States

Increased Integration of Cloud-based Technology Due to Enhances Flexibility

The Global Commercial Banking Market segments and Market Data Break Downby Components (Solutions, Services), Services (Deposit Accounts, Lines of Credit, Merchant Services, Payment Processing, Commercial Loans, Global Trade Services, Treasury Services, Others), End Users (Startups, Small & Medium Enterprises, Large Enterprises)

Geographically World Commercial Banking markets can be classified as North America, Europe, Asia Pacific (APAC), Middle East and Africa and Latin America. North America has gained a leading position in the global market and is expected to remain in place for years to come. The growing demand for Global Commercial Banking markets will drive growth in the North American market over the next few years.

Presented By

AMA Research & Media LLP

0 notes

Text

Commercial Banking Market Unidentified Segments - The Biggest Opportunity Of 2023

Global Commercial Banking Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, players market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions to improved profitability. In addition, the study helps venture or private players in understanding the companies in more detail to make better informed decisions.

Major Players in This Report Include:

JPMorgan Chase (United States)

HSBC Holdings plc (United Kingdom)

Genpact (United States)

Accenture (Ireland)

Fiserv (United States)

WNS (India)

Wells Fargo (United States)

RBL Bank (India)

ICICI Bank (India)

Infosys (India)

PwC (United Kingdom)

Oracle Corporation (United States)

M&T Bank (United States)

Ernst & Young (United Kingdom)

Commercial banking is a division within the bank or financial institution that only focuses on the products or services specifically offered to businesses. It includes various types of services like merchant services, payment processing, commercial loans, deposit accounts, and many more. The increasing number of startups and small & medium industries will accelerate the growth of commercial banking during the forecast period as it provides finance to the SMEs or startups to foster the development of a corporate bond market and stimulate its development. Commercial banking helps to make it easy to manage the day-to-day financial tasks of any organization.

Market Drivers Increasing Digitalization and Adoption of Technological Advancement to Serve Customers Online and Offer Enhanced Services

Surging Demand for Commercial Banking Service Among the Small & Medium-Sized Businesses and Startups

Market Trend Increased Focus on the Development of Innovative Commercial Banking Solutions with Advanced Technologies like AI and Machine Learning

Emerging Trend of Open Banking in the Commercial Banking Market

Opportunities High Growth of Commercial Banking and Increasing Digital Transformation of Commercial Banking in the United States

Increased Integration of Cloud-based Technology Due to Enhances Flexibility

Challenges The Expensiveness of Commercial Banking and Business Accounts Compared to Traditional Bank Accounts

The Commercial Banking market study is being classified by Components (Solutions, Services), Services (Deposit Accounts, Lines of Credit, Merchant Services, Payment Processing, Commercial Loans, Global Trade Services, Treasury Services, Others), End Users (Startups, Small & Medium Enterprises, Large Enterprises)

Presented By

AMA Research & Media LLP

0 notes

Text

Latest Guide to Find Cash App Bank Name Instantly-

The innovation has created the need for online transactions and hence you can see the increased preference for cash apps. But having the cash app bank name is another important thing that you cannot neglect.

Users of the cash app need to remember that the cash app partners with two banks “Lincoln Savings Bank” and “Sutton Bank”. You may find more details in a systematic way here:-

Learn Briefly About Cash App Bank:

You already know that the cash app collaborates with two different banks named “Lincoln Savings Bank” and “Sutton Bank”. The most crucial aspect is that you must know the cash app bank name is vital if you are trying to set up the direct deposit system.

On the other hand, you need to explore which bank is associated with your bank account. You must know these steps as these are basic aspects of the cash app:

You need to access your cash app account.

Further, you must move to the banking tab for a later process.

In the last step, you have to tap on the routing and account number that you may find below your balance option.

Is the cash app a bank?

Many cash app users are coming up with concerns like is cash app a bank. Such a thing is another crucial aspect and you must have clear information. You know that the cash app emerged as the most preferred app because of its high-end security features.

The company square cash creates such an app for the ease of common folks. You may find it one of the most secure platforms that work effectively in terms of sending and receiving money. People who want to have an instant and secure method of transaction may install the cash app on their mobile.

Another important aspect is that you need to realize that the cash app is not a bank but provides users with banking services and debit cards. It has an alliance with the banks to help you carry on transactions quite easily.

How to find the account number and the routing number?

Further, you must know how to look for the account number and the routing number. This is another side of the cash app and is important for direct deposit aspects. These two are quite important for setting up direct deposits.

Therefore, you have to take care of these things to use the cash app efficiently. To get the account number and the routing number, you will require the following these steps:

Step 1: Click on the banking tab:

First of all, you will require clicking on the banking tab that is available on the cash app home screen

Step 2: Next, you have to Scroll down

In the Next step, you need to look for the account number and routing number of the cash app. you simply will require scrolling down for the account balance.

Step 3: In the last, you have to share on request:

In the last step, you just have to copy and share the numbers that you receive as a request from depositors. Such a factor arises during the deposit process.

A Like Post - Can You Delete Transaction History On Cash App

What are cash app partner banks?

Being cash app users, you should know which banks partner with the cash app. However, the cash app is associated with two banks that is “Lincoln Savings Bank” and “Sutton Bank”. If you talk about Sutton bank then you can find that it delivers the cash app card to help the cash app users in terms of transactions. It is available as a medium-sized, full-service bank.

This specific bank offers services that include money market accounts, IRAs, CDs, credit cards, and mortgages. Further, you can see that Sutton bank is also linked with FinTech companies such as Robinhood, and Monzo. You can also find the following information:

Sutton Bank

PO Box 505

Attica, OH 44807-0505

Member FDIC

Another is Lincoln Savings Bank:

This specific bank came into existence for offering services related to deposit accounts, loans, and other traditional services. The vital aspect is that you need to learn about the important things that you must know about the Lincoln Savings Bank.

The cash app has its policy on which it works. Therefore, you need to be attentive to learning the system that helps you organize your cash app. You must have the appropriate knowledge about Lincoln Savings as it supports direct deposit services. Further, you can observe thatLincoln Savings Bank is linked with FinTech companies and its address is the following:

Address of Lincoln Savings Bank

Lincoln Savings Bank

508 Main, PO Box E

Reinbeck, IA 50669

Member FDIC

Does the cash app work efficiently?

Like other cash app users, you need to know whether the cash app works efficiently or not. You need to have the proper information so that you may have the understanding for appropriate use of the cash app.

This is the crucial thing that you should follow ever. The cash app is a new and systematic platform to help users send and receive money easily. Therefore, you need to be careful with its proper utilization.

Final words:

The necessity for having the Cash App Bank Name arises due to the direct deposit system. This is the simple aspect but you should be able to find the sources that may let you get the bank name. This is part of the policy as you need to mention it while going ahead with the direct deposit factor.

Reference Link - https://www.square-cash-app.com/blog/how-to-delete-cash-app-history/

0 notes

Text

Payday Loans Market to Witness Revolutionary Growth by 2027 | Money Mart, Speedy Cash, CashNetUSA

Advance Market Analytics published a new research publication on “Global Payday Loans Market Insights, to 2027” with 232 pages and enriched with self-explained Tables and charts in presentable format. In the study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Payday Loans market was mainly driven by the increasing R&D spending across the world.

Major players profiled in the study are:

CashNetUSA (United States), Speedy Cash (United States), Approved Cash Advance (United States), Check n’ Go (United States), Ace Cash Express (United States), Money Mart (United States), LoanPig (United Kingdom), Street UK (United Kingdom), Peachy (United Kingdom), Satsuma Loans (United Kingdom), OppLoans (United States)

Get Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/124850-global-payday-loans-market#utm_source=DigitalJournalVinay

Scope of the Report of Payday Loans

Payday loans are small amount, short-term, unsecured loans that borrowers promise to repay out of their next paycheck or regular income payment. The loans are generally for USD 500 or less than USD 1000 and come due within two to four weeks after receiving the loan and are usually priced at a fixed fee, which signifies the finance charge to the borrower. These unsecured loans have a short repayment period and are called payday loans because the duration of a loan usually matches the borrower’s payday period. According to the Federal Reserve Bank of St. Louis, in 2017, there were 14,348 payday loan storefronts in the United States. Approx. 80% of payday loan applicants are re-borrowing to pay a previous payday loan. The regulations for payday loans are strictest in the Netherlands.

The Global Payday Loans Market segments and Market Data Break Down are illuminated below:

by Type (One Hour, Instant Online, Cash Advance), Application (Mortgage or Rent, Food & Groceries, Regular Expense (Utilities, Car Payment, Credit Card Bill, or Prescription Drugs), Unexpected Expense (Emergency Medical Expense), Others), Repayment Period (Upto 14 Days, 1-2 Months, 3-4 Months, More than 4 Months), End-User (Men, Women)

Market Opportunities:

Growing Adoption of Payday Loan in Developing Countries

Market Drivers:

Increasing Number of User for Payday Loan in North America and Payday Loans Are Only Legal In 36 US States

Rising Use of Quick Cash for Emergencies

Market Trend:

~43% Use 6 or More Installments Loans A Year And 16% Use More Than 12 Small Loan Products Each Year

Payday Loans are Attractive Alternative to the Highly Sought after Credit Cards

What can be explored with the Payday Loans Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Payday Loans Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Payday Loans

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Payday Loans Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/124850-global-payday-loans-market#utm_source=DigitalJournalVinay

Strategic Points Covered in Table of Content of Global Payday Loans Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Payday Loans market

Chapter 2: Exclusive Summary – the basic information of the Payday Loans Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Payday Loans

Chapter 4: Presenting the Payday Loans Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2016-2021

Chapter 6: Evaluating the leading manufacturers of the Payday Loans market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2022-2027)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Payday Loans Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=124850#utm_source=DigitalJournalVinay

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

#Payday Loans market analysis#Payday Loans Market forecast#Payday Loans Market growth#Payday Loans Market Opportunity#Payday Loans Market share#Payday Loans Market trends

0 notes

Text

Large shopping malls and supermarkets

Banks cooperate with large shopping malls and supermarkets to provide consumers with credit card installment services.

advantage:

Transaction frequency is HE Tuber high, with nearly 70% of residents visiting supermarkets at least once a month, and more than 30% of residents going to supermarkets for shopping between 1 and 3 times a month.

Reduce marketing costs.

The time cost is low. The minimum interest-free period for a credit card is 20 days, and the maximum cannot exceed 56 days.

shortcoming:

The trading scope is small, and large supermarkets basically cover nearby residents, so their influence is limited.

The single consumption amount is small, and the user's single shopping consumption amount is generally between 100-1,000 yuan, which is lower than the unit price of a mortgage.

(3) Small and micro enterprise loans

Banks cooperate with small and micro enterprises to provide loan services to small and micro enterprises.

advantage:

The scope of transactions is large. By the end of 2022, the number of small, medium and micro enterprises in China has exceeded 52 million

The transaction amount is large, and the loan limit for small and micro enterprises is generally within a maximum of 3 million or 5 million for a single transaction. If it is a small and micro enterprise business loan involving mortgage, it is based on the value of the collateral. Generally, the maximum single loan is within 20 million or 2,500. The loan amount for small and micro enterprises is higher than the unit price of consumer loans for supermarkets.

The frequency of transactions is high. In the face of economic fluctuations and market changes, small and micro enterprises need to adjust their strategies at any time to remain competitive and need to apply for loans more frequently. According to a major survey report released by WeBank Huang Zhengchuan, small and micro enterprises within one year The average number of borrowings is 2.8 times, and nearly 50% of small and micro enterprise loan terms are between half a year and one year.

shortcoming:

The cost is relatively high:

The business operations and development prospects of small and micro companies are relatively unstable, which may lead to an increase in bank non-performing assets.

The loan cycle is relatively long, with nearly 50% of small and micro enterprise loan terms ranging from half a year to one year.

(4) Government cooperation projects

Banks work with government cooperative projects to provide loan services for government projects.

advantage:

The transaction scope is large, the government is a provider of public services, and has long-term business needs

The transaction amount is large and the investment capital is more than other cooperation channels.

shortcoming:

Low bargaining power, such as investment in infrastructure such as transportation and electricity, is a non-productive project.

The capital occupation cycle is long, and the transaction cycle is longer than that of shopping malls and small and micro enterprises.

Based on the above, the above four methods each have their own advantages and disadvantages, and none of them can meet the current needs of banks very well.

3. Consumer and supply side

After the customer group obtains loan capital from the platform, consumption mainly flows into offline consumption scenarios and online consumption scenarios. In offline consumption scenarios, funds mostly flow into consumption scenarios such as food and catering, tourism, travel and accommodation, shopping and entertainment.

In online consumption scenarios, e-commerce platforms are a relatively concentrated entry point for consumption traffic, and digital electronic products are an important consumer category. In addition, home appliances, beauty products, and luxury goods are also product categories favored by consumers.

Consumer finance platforms are generally connected to traffic platforms or brand manufacturers, such as China Mobile, Tencent, Xiaomi, OPPO, VIVO, HP, thinkpad, Vipshop, iQiyi, NIKE, Xinri, etc.

As merchants, their common core desire is to facilitate transactions and maximize benefits. Profit = revenue - cost.

The core needs of sellers are:

(1) Increase brand exposure and exposure scope

(2) Improve user conversion rate

(3) Increase unit price (sales, unit price)

(4) Reduce costs

So what methods can merchants use to meet the above needs?

0 notes

Text

How To Start A Credit Repair Business

It’s no secret that credit repair is an incredibly lucrative industry, but it can be overwhelming to figure out how to get started. Where do you even begin? The good news is that starting a credit repair business isn’t as difficult as it may seem.

With a little bit of research and planning, you can get your business up and running in no time. In this article, we will discuss the steps needed to start a successful credit repair business from scratch. From learning the ins-and-outs of the industry to determining your target market and setting up your professional website, we’ll cover everything you need to know in order to launch your business quickly and efficiently!

What is credit repair?

Credit repair is the process of identifying errors on your credit report and taking steps to correct them. This can include disputing incorrect information with the credit bureau, paying off outstanding debts, and making payments on time.

Credit repair is a great way to improve your credit score and get back on track with your finances. It can be difficult to do on your own, but there are plenty of resources available to help you get started.

If you're thinking about starting a credit repair business, there are a few things you need to know. First, you'll need to obtain a business license from your state or local government. You'll also need to have a good understanding of the Fair Credit Reporting Act (FCRA), which governs how credit reporting agencies operate.

Once you have your business set up, you can start marketing your services to potential clients. There are a number of ways to do this, including online advertising, direct mail marketing, and even referrals from friends and family.

If you're serious about starting a credit repair business, then you need to put in the work required to make it successful. This includes educating yourself on the industry, building a strong network of contacts, and providing quality service to your clients.

The credit repair process

Credit repair is the process of fixing your credit score so that you can get approved for loans and lines of credit. There are many ways to improve your credit score, but the most effective method is to dispute negative items on your credit report.

The first step in the credit repair process is to order a copy of your credit report from all three major credit bureaus. Once you have your reports, review them carefully to identify any errors or negative items. If you find any inaccuracies, you will need to file a dispute with the appropriate bureau.

The next step is to develop a plan to improve your payment history. This can be done by making all of your payments on time, paying down high balances, and avoiding new debt. You should also avoid using too much of your available credit, as this can lower your score.

Once you have made strides in improving your payment history and reducing debt, you will need to begin building positive credit. This can be done by applying for a secured credit card or becoming an authorized user on someone else’s account. You should also make sure to keep updated records of your payments so that you can show lenders that you are a responsible borrower.

By following these steps, you can improve your credit score and get approved for the loans and lines of credit you need. The key is to be patient and consistent with your efforts; it will take time to see results, but it will be worth it in the end

The benefits of starting a credit repair business

Credit repair businesses offer a much needed service to consumers. By helping people improve their credit scores, these businesses can give them the opportunity to get better interest rates on loans and new lines of credit. In some cases, a good credit score can even lead to employment opportunities.

There are many benefits to starting a credit repair business, but there are also some important things to keep in mind. First, you will need to research the credit repair process and learn as much as you can about the Fair Credit Reporting Act (FCRA). This law governs how credit reporting agencies must treat consumers and how disputes over information on credit reports must be handled.

You will also need to develop strong relationships with creditors and lenders. These relationships will be key in helping your clients get the results they need. Finally, you should always remember that repairing someone's credit is a sensitive process. Be sure to treat your clients with respect and understanding throughout the process.

How to start a credit repair business

If you're looking to start your own credit repair business, there are a few things you'll need to do in order to get started. First, you'll need to obtain a credit repair software license. Next, you'll need to find a reputable credit reporting agency to partner with. Finally, you'll need to set up your business structure and marketing plan.

Obtaining a credit repair software license is the first step to starting your credit repair business. There are a few different ways to go about this, but the easiest way is to contact a credit repair software provider like Home Credit Repair Software. They will provide you with everything you need in order to get started, including access to their software and support from their team of experts.

Once you have your license, it's time to find a reputable credit reporting agency (CRA) to partner with. The best way to find a CRA is by asking for recommendations from other businesses in the industry or searching online for "credit reporting agencies". When you've found a few CRAs that meet your needs, reach out and introduce yourself. Be sure to let them know that you're interested in partnering with them and offer them a brief overview of your business plan.

The last step is to put together your business structure and marketing plan. This includes deciding on the legal structure of your business (e.g., sole proprietorship, LLC), obtaining any necessary licenses and permits, and creating marketing materials such as a website or business

Tips for success in the credit repair business

There are a few key things you need to do in order to be successful in the credit repair business. First, you need to understand the credit reporting process and the laws that govern it. This will allow you to identify errors on credit reports and dispute them effectively. Second, you need to develop strong relationships with the major credit bureaus and creditors. These relationships will give you access to information and resources that can help you repair your clients' credit. Finally, you need to stay organized and keep track of your clients' progress. This will help you ensure that you are providing the best possible service and achieving the best results for your clients.

Conclusion

Starting a credit repair business can be a great way to help people with their finances and build a profitable enterprise at the same time. With the proper research, planning, and dedication, you can successfully launch your own credit repair business that specializes in improving clients’ financial standings. Credit repair is an essential service for those who have been dealing with burdensome debt or unfair reporting errors by creditors. By utilizing these tips on how to start up your own credit repair business, you will be well on the path towards making it successful!

0 notes

Text

Digital Lending Platforms Market Analysis By Applications, Regions and Revenue Forecast To 2032

The Digital Lending Platforms Market is anticipated to record sizeable growth over 2032. Digital lending and digital mortgage have emerged as prominent concepts in the field of online banking. Over the past few years, the financial sector has undergone rapid digitization with the emergence of novel banking needs.

Digital mortgage is rapidly replacing traditional loan processing systems as it provides a holistic experience to lenders as well as borrowers. Lenders are increasingly implementing modern digital mortgage strategies across targeted marketing, auditing, loan closing, and lead generation activities. Owing to the ease and level of sophistication, a combination of hyper-automated tools, big data analytics, and real-time digital mortgage applications are gaining demand among businesses.

Request for a sample copy of this research report @ https://www.gminsights.com/request-sample/detail/3019

In November 2022, Navi Technologies, an Indian financial service provider, unveiled its cloud-based real-time co-lending platform, called Navi Lending Cloud (NLC). The platform aims to support direct assignment collaboration and digital management co-lending with banks and NBFCs.

Based on solution, Point of Sale (POS) systems held more than a 10% share of the digital lending platform market in 2022. POS systems enable lenders to source and validate documents and e-signatures of credit customers and facilitate conditional decisions instantly. Advancements in mortgage POS systems allow lenders to process loans more efficiently and manage large volumes of data regarding lending rates, borrower behavior, and risks.

In terms of service, the digital lending platform market share from design & implementation is anticipated to record over 21.5% CAGR from 2023-2032. Design and implementation service providers are expected to address the growing need for robust and validated digital asset management processes. Technological advancements and rapid integration of artificial intelligence (AI) will enable the automation of services pertaining to the design & implementation of industry.

By deployment, the market landscape is fragmented into cloud and on-premise deployment. The cloud segment is projected to exhibit over 20% CAGR through 2032. Due to low maintenance features and cost-effectiveness, cloud-based digital lending is picking up pace. Increasing demand for fast processing, documentation storage, and reduced cost and time consumption associated with loan processing will proliferate cloud-based digital lending platform market.

With regards to the business model, the industry is segregated into staff-driven, and customer driven. The staff-driven segment is expected to witness promising growth between 2023-2032. Digital lending platform market cater to staff needs including loan disbursement, customer acquisition, and repayment. Growing end-user requirements to reduce the risk of fraud, and improve loan processing efficiencies will accelerate the segment growth.

Browse report summary @ https://www.gminsights.com/industry-analysis/digital-lending-platform-market

Based on product, mortgage loan accounted for more than 15% share of the digital lending platform market in 2022. Large mortgage banks are increasingly implementing digital strategies and technologies to boost the traction of credit seekers for mortgage loan. Digital mortgage solutions reduce costs per loan, allowing considerable savings. The influx of smart technologies will advance the capabilities of mortgage lifecycles on industry.

From a regional perspective, North America digital lending platform market share was more than 38% in 2022. Rapid digitization of banking services in the region has resulted in the acquisition of open-banking platforms. A large number of fintech giants in the U.S. and Canada are ramping up efforts to digitize lending processes and safeguard financial services. For instance, in September 2022, J.P. Morgan announced plans to acquire Renovite Technologies, Inc., a cloud-native payments technology firm to modernize payment infrastructure.

Global Digital Lending Platform Market growth will be positively affected by the notable presence of reputed organizations, such as Base-Net Informatik AG, ARGO Data Resource Corporation, Built Technologies, Inc., Decimal Technologies Pvt. Ltd., and CU Direct

About Global Market Insights Inc.

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.

Contact Us:Aashit Tiwari

Corporate Sales, USA

Global Market Insights Inc.

Toll Free: 1-888-689-0688

USA: +1-302-846-7766

Europe: +44-742-759-8484

APAC: +65-3129-7718

Email: [email protected]

0 notes

Text

PayPal leads the global BNPL market on the back of strong growth achieved in Q3 2022

The buy now pay later (BNPL) market was all rage when the pandemic forced consumers to look for alternative payment methods. Giving consumers more purchasing power and supplementing their expenses at zero cost, the BNPL industry recorded robust growth in 2020 and 2021. Notably, the low-interest period also assisted the market growth. However, the interest rate hikes announced by central banks and the resulting funding winter in 2022, meant that BNPL services were no longer cheap to offer to consumers. The situation has been further worsened by stringent regulatory approach adopted by authorities around the world.

However, even during the funding winter and the growing regulatory distress, BNPL firms have continued to witness strong demand for their short-term loan products. For instance,

PayPal, one of the leading BNPL providers, has recorded strong growth in volume in Q3 2022, and therefore, claimed the top spot in the global BNPL industry. Notably, the firm processed nearly US$5 billion in volume, representing a growth of 157% year over year. Ever since the firm launched its BNPL services, more than 25 million consumers have used the payment method approximately 150 million times. The robust merchant network of 280,000 offering the payment method at checkout has allowed the firm to record strong growth.

As inflation continues to plague the monthly budget of consumers around the world, shoppers are seeking any sort of monetary relief possible. This has become the single largest factor that is driving the demand for BNPL services among shoppers globally. Like PayPal, Affirm, another leading player in the segment, also reported strong BNPL numbers in Q3 2022. For instance,

In Q3 2022, the firm reported a growth of 62% year over year in gross merchandise value. Furthermore, the platform also reported a strong surge in its active users. At end of Q3 2022, Affirm had a user base of 14.7 million, representing a growth of 69% year over year. Like PayPal, Affirm also had a strong merchant network of 245,000 at the end of September 2022. In the United States, one of its leading growth markets, Affirm is approaching 2% of all e-commerce spending.

The numbers reported by these two BNPL firms clearly indicate the demand for BNPL is strong among consumers and the trend will further continue over the next few quarters, as inflation continues to threaten the monthly budget of shoppers globally.

Among the many factors that have driven the growth in transaction volume for PayPal and Affirm are their growing active customer and merchant base. Furthermore, the shift in consumer spending habits, including spending on travel and everyday purchases, is driving the volumes for BNPL providers. To tap into consumer spending habits and drive their BNPL transaction volume, firms are forging alliances with travel partners. For instance,

In November 2022, Afterpay, another leading global BNPL firm based in Australia, announced that the firm has entered into a strategic collaboration with Expedia, the global online travel booking platform. Under the partnership, Afterpay will allow its users to book flights and hotels on Expedia using the BNPL payment method.

In Australia, home to many global players including Afterpay and Zip, the BNPL sector is recording strong growth. While the sector continues to experience strong demand and adoption among consumers, talks about BNPL regulations are also growing in the industry. For instance,

In November 2022, the government proposed three options to BNPL providers. The first option suggested by the government allows firms to self-regulate while conducting stringent affordability tests. In the second option, the government proposed to bring the BNPL industry under the Credit Act. It means that providers will have to obtain a credit license to offer services. In the third option, firms will be fully regulated under the Credit Act, meaning they will have to adhere to the same responsible lending standards as that of credit card companies in Australia.

The government has asked BNPL providers to offer their input on all these options to better regulate the industry in the country. PayPal, which is also operational in Australia, will have to adhere to the regulatory standards as implemented by the government going forward. While regulatory activities are expected to gain further momentum over the next few quarters, the industry is projected to experience robust demand as well.

In Q4 2022, all these BNPL providers are expected to record further growth in their transaction volume and value on the back of year-end travel and holiday spending. From clothing to electronics, shoes, and travel tickets, consumers are looking to fund all types of purchases through BNPL spending. Notably, the latest financial performance of BNPL providers such as PayPal and Affirm provides hope that the BNPL business model can be profitable over the next three to four years, provided the fact that BNPL firms continue to adopt a responsible lending approach, which will ultimately assist them to reduce their default rates.

To know more and gain a deeper understanding of the global BNPL market, click here.

0 notes