#Car Loan Market UAE

Text

UAE Online Loan Aggregation Industry Holds Potential 7x Revenue Growth By 2024. Will UAE Online Loan Aggregation Industry Stand On This Projected Figure? Ken Research

REQUEST FOR SAMPLE REPORT

Buy Now

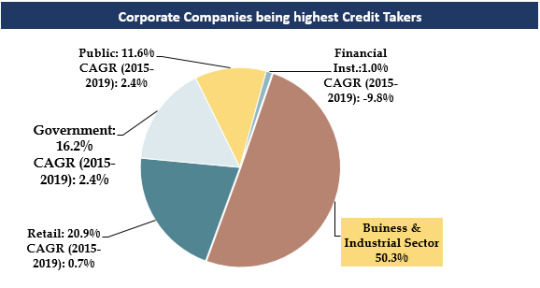

1. With rich, diverse & unparalleled infrastructure, the UAE Loan Industry driven by high corporate loan demand.

Trends and Developments in UAE Online Loan Aggregator Industry

Lending majorly dominated by national banks with wide distribution network, occupying >90% of all banks credit disbursal.

With major investment in hydrocarbon projects & other infrastructure projects, credit demand by government has been rising & expected to further rise in future as well.

Traditional methods of lending (Friends/family) are still preferred choice for availing loans by people with below avg credit history.

Banks are undertaking consolidation activities thereby reducing number of branches, cash offices & promoting digital banking services.

2. Technological Evolution in UAE Banking Services.

To Know More about this report, download a Free Sample Report

Adoption of Blockchain technology in enhancing “Know- Your-Customer” processes, useful in client onboarding, cross border transfers, payments & compliance reporting.

Tasharuk Platform: Launched by UBF to fight against cyber-attacks on banks. Platform enables cyber threat information sharing, identify threats & enhance defense systems.

Incorporating Artificial Intelligence in data analytics, combatting fraudulent activities & compliance improvement, further increasing focus on customer dealing & decision-making processes.

Increased penetration of virtual banking channels including Mobile (>85%), Online Banking (>90%), Branch/Call center (>90%) and ATMs (~100%).

Noticeable shift among customers to online medium for undertaking non-cash transactions of balance enquiries, fund transfers etc.

3. Housing Loan, one of the fastest growing retail loan segments.

Visit This link:- Request for Custom Report

In 2019, average house price in Dubai decreased by ~12% reaching to ~AED 2.58 Mn, thereby, shifting from investor led market to owner-occupied market.

While borrower’s previously preferred fixed interest rates but with Fed Reserve Predictions (2019), noticeable trend was observed for variable rate schemes.

Customers rising preferences for loan providers/aggregators offering other benefits like property management services & post-handover assistance services.

Dubai is dominated by expat population (11 times of Emirati population), who are observed to be preferring indirect channels due to high documentation & eligibility requirements.

Current lending process in The UAE is partially offline; however; with advancements & relaxations in regulations could help in making the process online.

For more insights on the market intelligence, refer to the link below:-

UAE Online Loan Aggregator Market

#BankOnUs Credit Cards Online Market Revenue#Car Loan Market UAE#Commercial Loan Market UAE#Commission Rate Online Aggregators UAE#COVID 19 Impact on UAE Loan Industry#Credit Cards Market UAE#Credit Outstanding in the UAE#Fee rate Loan disbursement UAE#Investments UAE Online Loan Aggregator Startups#Leading players of Loan Aggregator Market#Major Companies Loan Aggregator Market#Major Loan Providers in UAE#Number of Car Loans UAE#Number of Credit Card Users UAE#Number of House Loans UAE#Number of Loans Disbursed UAE#Number of Online Loan Market End Users#Number of Online Loans Disbursed UAE#Online Broker vs Online Aggregators UAE#Online Brokers in UAE#Online Distribution Loan UAE#Online Loan Aggregator Industry UAE#Outstanding Loans UAE#Personal Loan Market UAE#PolicyBazaar UAE Credit Cards Revenue#PolicyBazaar UAE Online Loan Market Share#Souqalmal UAE Personal Loan Revenue#Top 5 Online Loan Aggregator Startups UAE Top companies UAE Car Rental Market#Top Players Loan Aggregator Market#UAE Cash Loans Online Loan Market

0 notes

Text

MARKET GROWTH PROSPECTS OF BANKING SECTOR IN INDIA, 2023- 24 – DART CONSULTING FORECASTS HIGHER GROWTH IN THE NEXT FIVE YEARS

India’s banking sector is sufficiently capitalized and well-regulated. The financial and economic conditions are comparatively better even by comparing with well developed economies. Indian banks are generally resilient and have withstood the global downturn well as can be noted by reviewing previous years records.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years, the Banks are increasingly focusing widening banking reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. The rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Here is a quick overview of key players in the industry.

HDFC Bank Ltd

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE, and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

ICICI Bank Ltd

ICICI Bank Ltd (ICICI Bank) provides personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance solutions, securities broking, and asset management services to corporate and retail clients, high-net-worth individuals, and SMEs. It offers a wide range of products such as deposits accounts including savings and current accounts, and resident foreign currency accounts; investment products; and consumer and commercial cards. ICICI Bank offers to lend for home purchase, commercial business requirements, automobiles, personal needs, and agricultural needs. The bank offers services such as foreign exchange, remittance, import and export financing, advisory, trade services, personal finance management, cash management, and wealth management. It has an operational presence in Europe, Middle East, and Africa (EMEA), the Americas, and Asia. ICICI Bank is headquartered in Mumbai, Maharashtra, India.

State Bank of India

State Bank of India (SBI) is a universal bank. It provides a range of retail banking, corporate banking, and treasury services. The bank serves individuals, corporates, and institutional clients. Its major offerings include deposits services, personal and business banking cards, and loans and financing. The bank provides services such as mobile banking, internet banking, ATM services, foreign inward remittance, safe deposit locker, money transfer, mobile wallet, trade finance, merchant banking, project export finance, treasury, offshore banking, and cash management services. It operates in Asia, the Middle East, Europe, Africa, and North and South America. SBI is headquartered in Mumbai, Maharashtra, India.

Punjab National Bank

Punjab National Bank (PNB) offers retail and commercial banking, agricultural and international banking, and other financial services. Its retail and commercial banking portfolio offers credit and debit cards, corporate and retail loans, deposit services, cash management, and trade finance. Its international banking portfolio includes foreign currency accounts, money transfers, letters of guarantee, and world travel cards, and solutions to non-resident Indians. PNB also offers merchant banking, mutual funds, depository services, insurance, and e-services. The bank operates in India and has overseas operations in the UK, Bhutan, Myanmar, Bangladesh, Nepal, and the UAE. PNB is headquartered in New Delhi, India.

Bank of Baroda

Bank of Baroda (BOB) offers retail, agriculture, private and commercial banking, and other related financial solutions. It includes loans, deposit services, and payment cards. The bank offers loans for homes, vehicles, education, agriculture, personal and corporate requirements, mortgage, securities, and rent receivables, among others. It provides current and savings accounts; fixed and recurring deposits; debit, credit, and prepaid cards. The bank also provides insurance coverage for life, health, and general purposes. It offers services such as treasury, financing, mutual funds, cash management, international banking, digital banking, internet banking, start-Up banking, and wealth management. The bank has operations in Asia-Pacific, Europe, North America, and the Middle East and Africa. BOB is headquartered in Baroda, Gujarat, India.

Industry Performance

The health of the banking system in India has shown steady improvement, according to the Reserve Bank of India’s latest report on trends in the sector. From capital adequacy ratio to profitability metrics to bad loans, both public and private sector banks have shown visible improvement. And as credit growth has also witnessed an acceleration in 2021-22, banks have seen an expansion in their balance sheet at a pace that is a multi-year high. As of November 4, 2022, bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion). As of November 4, 2022, credit to non-food industries stood at Rs. 128.87 lakh crore (US$ 1.58 trillion).

Given the increasing intensity, spread, and duration of the pandemic, economic recovery the performances of key companies in the industry was positive. The reported margin of the industry by analyzing the key players was around 13.7% by taking into consideration the last 3 years’ data. Details are as follows.

Companies Net Margin EBITDA/Sales

HDFC Bank Ltd. 23.5% 31.2%

ICICI Bank Ltd. 22.3% 30.4%

State Bank of India 10.0% 25.7%

Punjab National Bank 4.0% 10.0%

Bank of Baroda 8.9% 13.9%

Industry Margins 13.7% 22.2%

Industry Trends

The macroeconomic picture for 2023 portends mixed fortunes for consumer payment players. Higher rates should boost banks’ net interest margins for card portfolios, but persistent inflation, depletion of savings, and a potential economic slowdown could weigh on consumers’ appetite for spending. Digital identity is expected to evolve as a counterbalancing force to mitigate fraud risks in the long run. Transaction banking businesses are standing firm despite recent market uncertainties. For many banks, these divisions have been a steady source of revenues and profits.

Over the long term, banks will need to pursue new sources of value beyond product, industry, or business model boundaries. The new economic order that will likely emerge over the next few years will require bank leaders to forge ahead with conviction and remain true to their purpose as guardians and facilitators of capital flows. With these factors in mind, the industry is still showing huge growth potential, some of the growth divers that is propelling the industry are:

Rising rural income pushing up demand for banking

Rapid urbanisation, decreasing household size & easier availability of home loans has been driving demand for housing.

Growth in disposable income has been encouraging households to raise their standard of living and boost demand for personal credit.

The industry is attracting major investments as follows.

On June 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totaled Rs. 1.68 trillion (US$ 21.56 billion).

Some of the major initiatives taken by the government to promote the industry in India are as follows:

As per the Union Budget 2022-23:

National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crores (US$ 6.70 billion) from the banks.

National payments corporation India (NPCI) has plans to launch UPI lite this will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly know as Digital Rupee.

Through analyzing the performance of the contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 9.9% at the end of 2022. Details are as below.

Companies CAGR

HDFC Bank Ltd. 14.02%

ICICI Bank Ltd. 7.3%

State Bank of India 8.4%

Punjab National Bank 9.2%

Bank of Baroda 10.7%

Industry CAGR 9.9%

Working through partnerships both with NBFCs and FinTech is high on the agenda of the Indian banking sector, and this is an area of focus of the FICCI National Committee on Banking. Banks will have to play a very constructive role as India aspires to be the leading economy in future. The strengthened banking sector has the potential to contribute directly and indirectly to GDP, increase job creation and enhance median income. Technology interventions to strengthen the quality and quantity of credit flow to the priority sector will be an important aspect. The need for sustainable finance / green financing is also gaining importance.

With these attributes boosting the sector, the Indian banking industry is likely to grow 5% more than the reported growth rate and is expected to exhibit CAGR of 10.4% in the next five years from 2023 to 2027.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

Auto Loan Seekers Mailing List

Auto Loan Seekers Mailing List - Auto Loan Seekers Email List in USA, UK, Canada, Australia, Germany, France, UAE and Europe. Our Auto Loan Seekers Mailing List - Auto Loan Seekers Email List provides high-quality data that can be used to help your direct marketing campaign reach maximum revenue potential. The contacts have been extensively vetted for accuracy and all postal records have been verified by the USPS. This comprehensive Auto Loan Seekers Mailing List - Auto Loan Seekers Email List includes names, complete address details, email addresses, phone numbers, and a range of other demographic information. With it, marketers can enhance their ROI and cultivate meaningful relationships with their target customers.

The Auto Loan Seekers Mailing List - Auto Loan Seekers Email List include the following fields:

Name

Address

City

State

Zipcode

Email

Phone Number

Use our Ready-Made Auto Loan Seekers Mailing List - Auto Loan Seekers Email List to advertise on Facebook. To create a custom audience on Facebook, upload the Auto Loan Seekers Mailing List - Auto Loan Seekers email list you purchase to match the information within Facebook profiles, enabling you to target only the Facebook profiles that match the emails you uploaded.

Auto Loan Seekers Email List

Are you a lender looking to increase customer loyalty and find new auto loan applicants? If so, the Auto Loan Seekers Mailing List - Auto Loan Seekers Email List is the perfect solution. This Auto Loan Seekers Mailing List - Auto Loan Seekers Email List provides lenders with access to potential customers who are actively seeking auto loans. It offers a direct connection to those interested in taking loans, helping lenders reach out to them with their offers. The Auto Loan Seekers Mailing List - Auto Loan Seekers Email List includes detailed information about each qualified lead, allowing lenders to target their marketing strategies towards specific segments of the population. With this Auto Loan Seekers Mailing List - Auto Loan Seekers Email List, lenders can better target their campaigns and maximize the effectiveness of their efforts.

What Are The Benefits Of Being On The Auto Loan Seekers Mailing List?

When you join the Auto Loan Seekers Mailing List - Auto Loan Seekers Email List, you will receive a number of benefits that can help you save money on your car loan. You will be able to do things like:

- Receive exclusive offers and discounts on car loans.

- Access to a dedicated customer service team.

- Obtain a loan approval before shopping for a vehicle.

- Save time by having the entire latest auto loan offers sent directly to your inbox.

Industry-Based Mailing List

Auto Repair Shop Email Lists

Automotive Industry Email Database

Surgeon Email Database

Pharmaceutical Mailing Database

Manufacturer Database

Schools Email Database

USA Church Database

Accountants Directory Data Scraping

Registered Nurses Mailing List

Personal Trainer Mailing List

Art Galleries Mailing Database

Financial Advisor Database

Building Contractors Database

Targeted Keywords

Auto Financing Seekers Mailing List

Auto Financing Seekers Email List

Car Loan Seekers Email List

Automotive Mailing Lists

Automotive Email Lists

Car Loan Seekers Mailing List

Best Auto Loan Seekers Mailing List - Auto Loan Seekers Email List In Various Cities Of USA:

Baltimore, Wichita, Austin, Charlotte, Los Angeles, Colorado Springs, Virginia Beach, Fresno, Bakersfield, Oklahoma City, Houston, Kansas City, Tulsa, Arlington, Long Beach, Indianapolis, Denver, Las Vegas, Boston, Raleigh, Milwaukee, Honolulu, Dallas, Louisville, New Orleans, Orlando, San Jose, Sacramento, Omaha, D.C., San Francisco, Columbus, Fort Worth, Seattle, San Antonio, Detroit, Nashville, New York, Washington, Chicago, Albuquerque, Atlanta, Portland, San Diego, Memphis, Jacksonville, Miami, Mesa, Philadelphia, Phoenix, Tucson, El Paso.

If you are looking for Auto Loan Seekers Mailing List - Auto Loan Seekers Email List then drop us an email at [email protected].

#autoloanseekersmailinglist#autoloanseekersemaillist#datascrapingservices#webscrapingservices#webscrapingexperts#emaillistprovider

0 notes

Text

How to Start a Used Car Business in UAE

Starting a used car business in the United Arab Emirates (UAE) can be a profitable venture, given the consistent demand for pre-owned vehicles in the region. The UAE’s growing economy, expatriate population, and a robust second-hand car market make it an attractive destination for entrepreneurs looking to enter the automotive industry. In this guide, we’ll walk you through the process of starting a used car business in the UAE, covering key aspects from market demand to cost analysis.

1. Demand for Used Cars in the UAE

Before diving into the nitty-gritty of starting your used car business, it’s essential to understand the market demand. The UAE has a thriving market for used cars, primarily driven by several factors:

Expatriate Population: The UAE is home to a diverse expatriate community with a high demand for affordable transportation options.

Affordability: Used cars offer a cost-effective alternative to brand new vehicles, making them an attractive option for both residents and businesses.

Tourism: The tourism industry necessitates a constant supply of rental and pre-owned vehicles.

2. Process of Starting a Used Car Business in UAE

Here are nine essential steps to kickstart your used car business in the UAE:

a. Business Plan

Begin with a comprehensive business plan. Define your target market, business structure, location, and strategies for growth. Identify your niche, whether it’s luxury cars, budget-friendly options, or specific brands.

b. Legal Requirements

Ensure you comply with UAE’s legal requirements for business setup. This includes registering your company, obtaining licenses, and adhering to zoning regulations.

c. Location

Choose a strategic location for your dealership. High visibility and accessibility are key, so consider setting up shop in an area with significant foot traffic.

d. Inventory

Source your inventory of used cars. You can purchase vehicles from auctions, individuals, or even consider trade-ins. Thoroughly inspect and refurbish the cars to ensure their quality.

e. Pricing Strategy

Set competitive yet profitable prices for your cars. Market research will help you understand the pricing dynamics in the region.

f. Marketing

Invest in a strong online and offline marketing strategy. Create a user-friendly website, utilize social media, and consider partnerships with other businesses in the automotive industry.

g. Financing and Insurance

Arrange financing options for your customers. You can partner with banks or financial institutions to provide car loans. Additionally, ensure your cars are adequately insured.

h. Legal Contracts

Prepare legally sound contracts for your transactions, including warranties, sales agreements, and any financing contracts. Seek legal advice to ensure compliance with UAE laws.

i. Staffing

Hire experienced staff for sales, administration, and vehicle maintenance. Professionalism and expertise are vital in building trust with customers.

3. Cost of Starting a Used Car Business in UAE

The cost of starting a used car business can vary widely, depending on factors like location, the size of your inventory, and operational expenses. You can use a cost calculator to estimate your startup costs, including expenses for licensing, rent, vehicle acquisition, marketing, and staffing.

4. Accelerate Your UAE Used Car Business with Private Wolf

To streamline your operations and gain a competitive edge in the UAE’s used car market, consider utilizing automotive software solutions like Private Wolf. Private Wolf offers a range of features to assist used car dealers, from inventory management to customer relationship management (CRM). Such tools can help you stay organized, improve customer service, and ultimately drive your business forward.

Starting a used car business in the UAE requires careful planning, market research, and adherence to legal requirements. With the right strategy and resources, your venture can thrive in a market with a constant demand for quality used vehicles.

M.Hussnain

Private Wolf

facebook

Instagram

Twitter

Linkedin

#second hand car business#start used car business#used car business cost#Used car business in dubai#used car license in dubai#used car trading license

0 notes

Text

The Ultimate Guide to Buying a Car in Dubai

Dubai, with its stunning skyline and luxurious lifestyle, is a city where having your own car is not just a convenience but also a status symbol. Whether you're a resident or an expatriate, getting behind the wheel of your dream car in this glamorous city is a tempting proposition. But before you rev up the engine, it's essential to understand the ins and outs of car sales in Dubai.

1. The Thriving Dubai Car Market

Dubai boasts one of the most dynamic car markets in the world, with a dazzling array of options for buyers. From sleek sports cars to rugged SUVs, you'll find almost every make and model here. To make an informed decision, it's crucial to research thoroughly. Consider factors like your budget, the purpose of the car (daily commute, family trips, or flaunting), and the associated costs (fuel, insurance, maintenance).

2. New vs. Used: Which is Right for You?

One of the first decisions you'll face is whether to buy a brand-new car or a used one. New cars come with the latest technology, warranties, and that fresh-off-the- lot feeling. However, they also come with a higher price tag. Used cars, on the other hand, offer significant cost savings but may require more maintenance.

3. Dealerships and Private Sellers

When it comes to purchasing a vehicle, you have two primary options: buying from a dealership or a private seller. Dealerships often offer certified pre-owned cars, which have been inspected, refurbished, and come with warranties. Private sellers may have more competitive prices, but you'll need to do your due diligence to ensure the car is in good condition.

4. Understanding the Paperwork

Dubai's strict regulations govern vehicle ownership, and navigating the paperwork can be a daunting task. Be prepared to provide your Emirates ID, a valid UAE driving license, and proof of insurance. The seller should provide the car's registration card (Mulkiya) and a valid passing certificate (passed vehicle inspection).

5. Financing and Insurance

Most buyers in Dubai opt for car loans to finance their purchase. Many banks and financial institutions offer car loans with competitive interest rates and flexible repayment terms. Additionally, car insurance is mandatory in the UAE. Shop around for insurance quotes to get the best coverage for your vehicle.

6. Vehicle Inspection and Test Drive

Never skip the essential step of inspecting and test-driving the car. Look for signs of wear and tear, accidents, or hidden issues. A trusted mechanic's inspection can also reveal any potential problems.

7. Negotiating the Price

Dubai's car market is known for its competitive pricing. Don't hesitate to negotiate with the seller to get the best deal. Remember that buying a car involves more than just the sticker price; factor in other costs like registration fees, insurance, and any modifications or upgrades you plan to make.

8. Finalizing the Deal

Once you're satisfied with the car's condition and the price, it's time to finalize the deal. Sign the necessary paperwork, transfer ownership, and ensure you have all the required documents for registration. You'll need to pay any outstanding fines, which can be checked online through the Dubai Police website.

9. Enjoy Your Ride

Congratulations! You've successfully navigated the process of buying a car in Dubai. Now, it's time to hit the road and explore the stunning landscapes, futuristic architecture, and thrilling experiences this city has to offer.

If you’re looking for used cars for sale sharjah, you have several options for finding listings and making a purchase.

Remember, buying a car is a significant investment, so take your time, do your research, and make a decision that suits your needs and budget. With the right approach, purchasing a car in Dubai can be an exciting and rewarding experience.

0 notes

Text

Customs Tariff of an Import Export Business

What do we need to start a business?

There are a few things which are necessary when starting an import export business. Five important steps to start your business are:

The market research

In starting an import and export business is conducting thorough market research. Doing this research will tell you whether the product you are going to be manufacturing, selling , importing, exporting etc will be successful or not.

A business plan

Second step is to have a proper export and import business plan. This plan will be a map of your company, your company’s structure and how you will run and grow your company. Let’s take Japan for an example. Japan is the market leader for manufacturing cars and car parts. The brand names like Toyota, Honda, Suzuki and many more are all Japanese brands. They had a business plan and beautifully executed it. This led to building a successful export and import business and a good brand name. PL Global Impex Pte Ltd will guide you further if you are thinking of starting an import export business.

Funding your business

Starting an import export business does require you to invest a lot in your business fund. Even with minimum funding starting an import export business is possible. This initial investment in your business is your capital. This capital is a liability. It is a business liability to pay this capital back to the owner. But one doesn’t always need high investment to start an export and import business. You can start an import export business with minimum investments too. For securing a funding, you can loan it from a bank or from any investors of your business. Alternatively, you can also borrow money from your family or relatives.

Picking a suitable business location

Picking a suitable business location can change the game for your business. Let’s take an example. Your business is a restaurant whose menu consists of very high end Italian pasta and European cuisines. The price of the food is also on the higher end. But you choose a location away from the city center in a dodgy alley. Would this business succeed? It may succeed with a stroke of luck. But a business should be based on surety and solid planning.

Opening a business bank account and registering your business

A business needs a bank account where all the transactions happen from. You also need an account for the legal taxes. For a business you need to open a current bank account. It’s pretty easy to open a bank account especially if you have the right paperwork for it.

Are you stuck and need more professional help while starting an import export business? You can visit our website P.L Global Impex Pte Ltd and find the perfect solution to your business needs.

Foreign Trade

Just like the name suggests, Foreign trade is an exchange of goods which happen mutually. This exchange is between International regions and borders. In this trade there are varieties ie; Import and Export. These concepts are necessary for the national economy. All the country’s goals are in line with these concepts.

The foreign trade policy consists of decisions, measures and many other things which are implemented by the countries in order to attain their goals. The foreign trade policy is very old but still remains one of the most important forms of international division of labor.

To explain foreign trade in simple terms, a country engages in foreign trade to fulfill requirements. We can take the example of India. India needs to meet its crude oil requirements. So, in order to fulfill this requirement, India imports crude oil from foreign countries like Russia, Saudi Arabia and other middle eastern countries. Similarly, India is the biggest exporter of Petroleum. India’s biggest trading partners are China, United states, United Arab Emirates (UAE), Netherlands among many others.

Import and Export are very important aspects of Foreign trade. Some of the major exporting companies in India are Tata steel, Tata motors, Reliance Industries etc. One can start their own import and export business following a few steps.

Read more, click here…

Website: https://plglobal.com/

Email: [email protected]

0 notes

Text

Mashreqbank PSC Company Market Analysis Report - Company Market size - Company profile

Mashreqbank PSC (Mashreqbank) is a provider of retail, corporate, and international banking products; and a host of related financial services. The bank’s offerings consist of retail and business banking products and services that include current, savings, certificate of deposits, and fixed deposits accounts; loans for home, car, business, and personal requirements; credit and debit cards; overdraft facility; and trade, project, and contract finance. Mashreqbank PSC market analysis Mashreqbank PSC Company Profile

It provides private banking, cash management, and acts as an insurance agent, and provides coverage for life, auto, travel, personal accident, home, and employment. The bank caters to the financial needs of individuals and corporate customers. Its operations are spanned across the UAE, Kuwait, Bahrain, India, Bangladesh, Pakistan, Nepal, Egypt, Qatar, Hong Kong, the UK, and the US. Mashreqbank is headquartered in Dubai, the UAE.

Access in-depth analysis, premium industry data, predictive signals, and more on Mashreqbank … for 12 months starting at $395 on our Company Analytics platform

Access in-depth analysis, premium industry data, predictive signals, and more on Mashreqbank … for 12 months starting at $395 on our Company Analytics platform

0 notes

Text

Automotive Finance Market New Innovations Trends, Research and Growth Factor

Research Nester assesses the growth of global automotive finance market over the forecast period, i.e., 2023-2033, and evaluates its future prospects. Rising share of financial services and growing sales of vehicles to drive market growth.

New York – October 31, 2022 - Research Nester’s recent market research analysis on “Automotive Finance Market: Global Demand Analysis & Opportunity Outlook 2033” delivers a detailed competitor analysis and a detailed overview of the global automotive finance market in terms of market segmentation by finance, provider, purpose, vehicle type, and by region.

Growing Penetration of Financed Vehicles to Drive Growth of Global Automotive Finance Market

The global automotive finance market is estimated to grow majorly on account of the increased demand for vehicles with more people opting for auto loans or leases. For instance, as per data, over 80% of new vehicles in United States were financed with a lease or a loan in 2019.

The market research report on global automotive finance encompasses an in-depth analysis of the industry growth indicators, restraints, supply and demand risk, along with a detailed discussion of current and future market trends. These analyses help organizations identify a continuous flow of growth opportunities to succeed in an unpredictable future. Additionally, the growth opportunities exposed by the market are poised to gain significant momentum in the next few years.

By vehicle type, the global automotive finance market is segmented into passenger vehicles and commercial vehicles. The passenger vehicles segment is to garner a highest revenue by the end of 2033 by growing at a CAGR of ~ 7% over the forecast period. Rise in the sale of passenger cars.

By region, the Europe automotive finance market is to generate the highest revenue by the end of 2033. This growth is anticipated by a higher share of the automotive industry in the gross domestic product.

The research is global in nature and covers a detailed analysis of the automotive finance market in North America (U.S., Canada), Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC [Finland, Sweden, Norway, Denmark], Poland, Turkey, Russia, Rest of Europe), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), Asia-Pacific (China, India, Japan, South Korea, Indonesia, Singapore, Malaysia, Australia, New Zealand, Rest of Asia-Pacific), Middle East and Africa (Israel, GCC [Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman], North Africa, South Africa, Rest of Middle East and Africa). In addition, an analysis comprising of global automotive finance market size, Y-O-Y growth & opportunity analysis, market players’ competitive study, investment opportunities, demand for future outlook, etc. has also been covered and displayed in the research report.

This report also provides the existing competitive scenario of some of the key players of the global automotive finance market which includes company profiling of Axis Auto Finance Inc., Bank of America Corporation, Mercedes-Benz Group AG, Ford Motor Company, KPMG International Limited, Genpact, General Motors LLC, PricewaterhouseCoopers LLP, Ally Financial Inc., Mitsubishi HC Capital UK PLC, and others. The profiling enfolds key information of the companies which encompasses business overview, products and services, key financials, and recent news and developments. On the whole, the report depicts a detailed overview of the global automotive finance market that will help industry consultants, equipment manufacturers, existing players searching for expansion opportunities, new players searching for possibilities, and other stakeholders to align their market centric strategies according to the ongoing and expected trends in the future.

Research Nester is a leading service provider for strategic market research and consulting. We aim to provide unbiased, unparalleled market insights and industry analysis to help industries, conglomerates, and executives to take wise decisions for their future marketing strategy, expansion and investment, etc. We believe every business can expand to its new horizon, provided the right guidance at a right time is available through strategic minds. Our out of box thinking helps our clients to take wise decisions in order to avoid future uncertainties.

Contact for more Info:

AJ Daniel

Email: [email protected]

U.S. Phone: +1 646 586 9123

U.K. Phone: +44 203 608 5919

0 notes

Text

Here some something that will intrigue you of you needs to sell your vehicle in UAE

Having a vehicle is an expensive vehicle city like UAE is surely fundamental. It is of incredible assistance. Anyway because of different reasons, Sell My Car Dubai one can wish to auction their vehicle. Presently here come the heaps of troubles that one may look during the endeavor of auctioning their vehicle off.

One merits an issue free vehicle selling experience and that must be accomplished through an appropriate organization. Commonly the expense of notice and the charges cited for such advancement and furthermore mediating outsiders can be an issue. An appropriate organization can deal with such a difficulty. There are some regarded organizations in the Unified Middle Easterner Emirates who can take your vehicle that you need to sell inadequate money installment. These organizations have a cycle whereby you can comprehend the estimated estimation of the vehicle in the current market. This can give you a thought of the amount to expect or cite.

Search for an organization that offers reasonable value dealings and has no such shrouded cost. In such cases passing by the standing of the organization is extremely useful. Audits express the fulfillment of the customers and set up the organization as a brand name who is reasonable for fulfilling the client needs.

Additionally, the method of installment ought to be checked also. Be it bank move or in real money, you can pay in both and that the most helpful alternative.

Numerous organizations offer unique administrations too. These customized administrations incorporate characterized advertisements, marking, Sell Any Car Dubai or advancing deals, providing a decent cost estimate. The specialists who are named by the organizations are additionally master experts who can deftly complete your work and that too in a problem free way. Having a customized specialist is a colossal assistance as it saves a great deal of time and challenges too.

Presently sell any vehicle Dubai-Think about the best organization where you can sell any vehicle in Dubai

In the car business, the organization has just about 20 years' experience. They in reality guarantee their clients the best costs and a smooth encounter. The organization is RTA affirmed. All the managing is protected and made sure about and is totally recorded to evade any doubt of fabrication.

In Dubai, this organization is one of the flawless vehicle sellers that you can depend on. So on the off chance that you are looking through where to sell my carin Dubai, at that point this is the opportune spot for you. They will sell your vehicle at the most punctual conceivable and will hand you over with the money. Truth be told, in thirty minutes you can sell your vehicle.

This organization additionally buys vehicles barring the exceptional home loans. The most amazing aspect is it helps in the freedom of the home loan too. Every one of your fines are additionally handled by this organization. Vehicle Sell Zone strives to give every one of its clients an overall answer for any issue or inquiries in the event that you need to sell my vehicle. Sign on to http://carsellzone.com/for additional subtleties in the event that you need to sell vehicle in Dubai.

For more info:- https://www.facebook.com/carsellzone/

1 note

·

View note

Text

Luxury Car for Sale

The complete guide to buying and selling cars in Dubai

It is hard to manage a life in this city without a car. Almost, entire infrastructure of the city is built around its use. All newcomers goes through the process of buying cars and we have decided to write this post to explain them all the steps involved in buying and selling cars in UAE.

Buying a new VS Used Car

This is a very important decision that every expat makes. In UAE, you get really attractive deals on new cars with easy bank financing options. The process is completely hassle free and in most of the cases you can avail the required bank financing without even visiting any bank as most showrooms handle financing requests by themselves.

On the other hand, a car that is on a bank loan is not really under your ownership until the loan is fully paid-off. This is a long term obligation as you need to ensure that you are ready to cut a small percentage of your salary for few years. Once you have cleared all the loan on the car, its value won’t be same as it will be a 3 to 5 year old car at that time.

Pros of buying a new car:

Drives awesome without worrying about any considerable maintenance cost

New cars comes with warranties

Easy financing solutions with nominal instalment plans

New cars comes with free service for at least couple of years

Comfort and ease

Cons of buying a new car:

Long term liability if car is financed by a bank

Cars in UAE depreciate really fast

High insurance premium on new cars

Buying a used car is also a very convenient option as there are hundreds of cars posted daily on Dubizzle and you have lots of options to look at. The prices of used cars are affordable and this option comes with no long term obligation

You own your car and you can sell it anytime

Second hand cars in UAE are cheap as compared to various other parts of the world

You have option to avail third party insurance coverage that has quite nominal annual premium.

Cons of buying a used car

Hidden defects

High maintenance and service cost

No warranties

How to buy used cars in Dubai?

There are number of options to buy a used car and lets go through all of the one by one.

2) Dubizzle

Buying a used car through Dubizzle is by far the best option you have as on dubizzle you are buying the car directly from the current owner and there is no third party involved and buying a car directly from the owner always adds to the confidence.

2) Used Car Dealers

You can also buy a car from used car market located in Ras Al Khor Dubai and at various other places too. Before going to the used car market make sure you know the car prices well and you need to ensure that you are getting the desired value for money you are going to spend.

3) Used Car Showrooms

You can buy used cars from various used car showrooms as well. These cars are normally of high quality and some of the used car showrooms are owned by big brands like AL Futtaim and you can trust on the prices and quality of cars in these showrooms.

How to sell a car in dubai?

1) Dubizzle

If you are willing to sell a car at the right value then there is no better platform than dubizzle. The process of selling a car on dubizzle can take some time as you may need to show your car to number of potential buyers before actually selling it. This option is best for people who have time to sell and they are looking to maximize return on their cars.

2) Selling cars to cash buyers

There are many online car buying companies like Beep UAE, where you can sell a car for instant cash. The prices offered by these companies are normally less than the market value but there is absolutely no hassle involved in selling cars to instant buyers.

3) Let them sell my cars

Some companies also offer services to sell your car on your behalf. They will post your car on Dubizzle and will sell it for you for a small percentage on the final price of the car.

1 note

·

View note

Text

5 Simple Facts About Quick Money Loans Explained

If you happen to're in the market for a car and have below-average credit, you've in all probability been asked by a automotive supplier or two about whether or not or not you could have money to put down. Arduous money loans key elements are fastest processing, not linked with Online Money Loan lender's credit score document, earnings degree and source, terms: versatile mortgage phrases in 6months and 20 years, could be borrowed even in case of legal and operation issues, loan measurement, collateral: property and other mounted or liquid properties and special state of affairs financing structure introduced for all type of business or residential property development that can not be funded by the standard lender.

We are pleased to provide auto title loans, payday loans, and installment loans with no added fees and a speedy approval course of. Use a few of that money to pay balances down on your credit cards. Jackpot winnings are often set up as structured payments for tax purposes. When you have a spotty credit historical past with many excellent debts, you'll not be offered a great fee from a financial institution. These could embrace approval fees, repayment charges, institution charges and redraw fees just to call just a few. Some lenders will consider you Quick Money Loans for a mortgage while you're not at the moment employed, however you will need to be earning some type of income or have suitable revenue-earning assets to repay the mortgage. The first distinction is a home fairness mortgage is a second loan, and it's a must to make payments on each the primary mortgage and the home fairness loan. Get quotes from a couple of vs mortgage lenders since they set their very own interest rates and impose their own minimal credit score rating necessities. While you use a private mortgage to consolidate debt, however, you might be able to increase your credit score rating. When you have decrease credit and less money accessible for a down cost, you may be eligible for the federally backed fha loans, which generally have higher interest rates.

Loanmoney can provide business mortgage in rohtak from hdfc bank, axis financial institution, icici financial institution, idbi financial institution, punjab and sind bank vijaya financial institution, punjab nationwide bank indian bank, financial institution of baroda, oriental bank of commerce, dena financial institution, inside financial institution, allahabad bank. Get a payday mortgage quick with speedy cash. For instance, if you get short term personal loans , it's possible you'll need to pay back $5000+ in complete over a couple of months. Please note that part cost will have no affect on your credit standing. I might recommend loan me to my Money To Loan Bad Credit associates who needed money so badly and get it proper on time. Securing a loan implies that there is something of worth that the private lender good points possession and control over if the borrower doesn't pay of the mortgage. General i was given a fantastic price and a payback time that match my needs. The commerce-off for borrowing quick cash might be a sky-high annual proportion charge and curiosity funds that depart you in debt for years. Spotloansm is a brand owned by bluechip financial, a tribally-owned entity organized under and ruled by the laws of the turtle mountain band of chippewa indians of north dakota, a federally recognized indian tribe.

Vets will pay no cash down so long as the home worth would not exceed the mortgage limits for the county. Remember: a payday mortgage is a excessive-value financial product. After a credit score verify, which does not decide eligibility for a mortgage, the credit score union loans the cash to the person and places a maintain on st. Vincent de paul's account within the amount of the mortgage. I've a friend who signed a promossory be aware basically stating that he promised to pay his father in legislation back $$$ (a hefty credit card balance) Get Money Now Loan that had 1) no date as to when the cash would be paid back, 2) no rate of interest mentioned in the word and 3) absolutely no point out of payments or a cost plan. Uae has licensed cash lenders spread out there which might be fulfilling the financial wants of individuals. The first step is to search out brief term mortgage lenders. It supplies personal loans at minimal documentation and flexible emi's. But division of finance information shows the share of unregulated lenders has shot to 12.5 per cent of canada's $1.6-trillion mortgage market in 2015, up from 6.6 per cent in 2007. What's more, these loans usually have variable mortgage rates, extreme or hidden fees, and even malicious phrases and situations hooked up to them, so ensure to learn the lender's privacy coverage beforehand.

1 note

·

View note

Text

The Ultimate Guide to Buying a Car in Dubai

Dubai, with its stunning skyline and luxurious lifestyle, is a city where having your own car is not just a convenience but also a status symbol. Whether you're a resident or an expatriate, getting behind the wheel of your dream car in this glamorous city is a tempting proposition. But before you rev up the engine, it's essential to understand the ins and outs of car sales dubai.

1. The Thriving Dubai Car Market

Dubai boasts one of the most dynamic car markets in the world, with a dazzling array of options for buyers. From sleek sports cars to rugged SUVs, you'll find almost every make and model here. To make an informed decision, it's crucial to research thoroughly. Consider factors like your budget, the purpose of the car (daily commute, family trips, or flaunting), and the associated costs (fuel, insurance, maintenance).

2. New vs. Used: Which is Right for You?

One of the first decisions you'll face is whether to buy a brand-new car or a used one. New cars come with the latest technology, warranties, and that fresh-off-the- lot feeling. However, they also come with a higher price tag. Used cars, on the other hand, offer significant cost savings but may require more maintenance.

3. Dealerships and Private Sellers

When it comes to purchasing a vehicle, you have two primary options: buying from a dealership or a private seller. Dealerships often offer certified pre-owned cars, which have been inspected, refurbished, and come with warranties. Private sellers may have more competitive prices, but you'll need to do your due diligence to ensure the car is in good condition.

4. Understanding the Paperwork

Dubai's strict regulations govern vehicle ownership, and navigating the paperwork can be a daunting task. Be prepared to provide your Emirates ID, a valid UAE driving license, and proof of insurance. The seller should provide the car's registration card (Mulkiya) and a valid passing certificate (passed vehicle inspection).

5. Financing and Insurance

Most buyers in Dubai opt for car loans to finance their purchase. Many banks and financial institutions offer car loans with competitive interest rates and flexible repayment terms. Additionally, car insurance is mandatory in the UAE. Shop around for insurance quotes to get the best coverage for your vehicle.

6. Vehicle Inspection and Test Drive

Never skip the essential step of inspecting and test-driving the car. Look for signs of wear and tear, accidents, or hidden issues. A trusted mechanic's inspection can also reveal any potential problems.

7. Negotiating the Price

Dubai's car market is known for its competitive pricing. Don't hesitate to negotiate with the seller to get the best deal. Remember that buying a car involves more than just the sticker price; factor in other costs like registration fees, insurance, and any modifications or upgrades you plan to make.

8. Finalizing the Deal

Once you're satisfied with the car's condition and the price, it's time to finalize the deal. Sign the necessary paperwork, transfer ownership, and ensure you have all the required documents for registration. You'll need to pay any outstanding fines, which can be checked online through the Dubai Police website.

9. Enjoy Your Ride

Congratulations! You've successfully navigated the process of buying a car in Dubai. Now, it's time to hit the road and explore the stunning landscapes, futuristic architecture, and thrilling experiences this city has to offer.

Remember, buying a car is a significant investment, so take your time, do your research, and make a decision that suits your needs and budget. With the right approach, purchasing a car in Dubai can be an exciting and rewarding experience.

0 notes

Text

Save the scrapping cost and money both on the old car sale in Emirates

Do you think your car is not working anymore and the only place it deserves now is scrap-yard? But scrapping car in Emirates is expensive more than your expectations. People think for scrapping their car because of car destruction in road accident or engine failure, transmission line failure or other defects a car can get as it gets old. Scrapping a car involves many things for instance you have to get a car disposal certificate before handing it to scrap yard owners. This certificate prevents any further sale of your vehicle in UAE. You need to contact your car insurance provider to terminate insurance of your old car. If your cover was unused you can ask for a refund. Further, you have to transport your damaged car to the authorized treatment facility or a scrap yard. Scrapping the vehicle and decommissioning it costs a huge amount to the owner of the car. Therefore, scrap car owner in UAE look for the optimal choice of scrapping of car without avoiding its scrapping cost. The solution to their problem is with the best scrap car buyers in Dubai, Abu Dhabi and other vicinities of Arab world.

How we support you when you sell your old/broken car in UAE?

What people do not know that a simple and private alternative of scrapping is to sell your scrap car online in Emirates. Crazycarcorner.com is one of such online scrap car selling facilities. Through this platform you can sell your old, broken, damaged or towed car in UAE. Car owners in Dubai, Abu Dhabi and Sharjah can contact crazy car corner.com for selling their junk as well as old car. Whenever you make mind to sell you can online, browse crazy car corner.com and make a personal appointment with the mentioned scrap car buyer and get your car inspection to negotiate the best price. Damaged car buyers in UAE take themselves the responsibility to manage your entire sale process regarding documentation, insurance or transportation. Once your terms are fixed, scrap car buyers in UAE will collect your road banger and reward you with the highest monetary value in return. They ensure complete transparency and peace of mind for the sellers of scrap cars in Emirates. Usually old car seller gets a lot of money on their old car sale in Dubai and Sharjah. This is because quality of roads is very high in Emirates and usually good condition of car can be maintained easily. Therefore, old car seller can bring a favorable amount of money. What should be your old car sale value in Dubai, Abu Dhabi, Sharjah or other regions of UAE? Answer is again with the crazy car corner.com where you can have a competitive estimate and cannot be deceived. You can find here scrap car dealers of Nissan, Suzuki, Toyota, Mercedes and almost all models of all car brands. We have representation in major cities for vehicle dealership in Dubai, Abu Dhabi, Sharjah, Riyadh and other regions of UAE.

How value of your damaged car in UAE is determined?

We determine value of your car on the basis of following checks:

· Accessibility cost of your car location in UAE

· Condition of your damaged/old car in Dubai

· Presence of complete body parts of your damaged vehicles in emirates.

· Conditions of tyres of your accident damaged car in Abu Dhabi

· Insurance refunds availability on your vehicle in Arab

· Extent of damage of your impaired car

· Condition of engine of your scrap car in Dubai

· Model of engine of your scrap vehicle in UAE

· Availability of genuine documents of your registered car

· Value of recyclable components of your scrap car in UAE

· Extent of repairing needs of your broken car in UAE

We offer an immaculate service to our clients who contact us for selling their old/broken or damaged car/vehicle.

Which cars you can sell online in UAE?

We are the best old car dealers sin UAE. We take following categories of vehicles/cars:

· Accident damaged vehicles in UAE

· Used working vehicles and cars in UAE

· Used damaged cars and vehicles

· Abandoned vehicles including cars in UAE

· RTA/Tasjeel/Adnoc rejected or failed vehicles and cars in UAE

· Vehicles and cars with bank mortgage and loans in UAE

· cars and vehicles with overheating problems in UAE

· Junk vehicles and cars in UAE

· Scrap cars and vehicles in UAE

· Nonworking cars and vehicles in UAE

· Cars and vehicles with expired registration in UAE

· Cars and vehicles with transmission issues in UAE

· Cars and vehicles with expired registration and insurance in UAE

What should be worth of your old car sale?

Car users in Dubai should have an idea which car depreciate more than other so that they may sell their old car and buy a new and better model. But this knowledge is of value if you learn it before the purchase of car. You consider your budget and needs while making car trade in UAE and ignore the aspect of making right choice and can regret later. Passage of time and car market analysis further intrigues you to go for a car replace. Now you may look for old car buyers in UAE through the window of crazy car corner.com. With us you can sell best vehicles of every make, state and age at a reasonably fair price.

Customer care issues of old car sale in Emirates

May be you did not want to sell you damaged car but you don’t find any choice because cost of its repair is exceeding the actual cost, so what should you do then? Or you may be thinking whether you can sell your car in Dubai if it is registered in another emirate. Yes, no worries as crazy car corner.com offers solutions to all such issues. For example, in this case of registration difficulty, you have to first deregister your old car in emirate and then transfer to the new car owner. In first case, repair may restore the original price, but in no way it can increase the value of car. Therefore, large costly repairs to broken automobiles are uneconomical. However, repairs save the cars from scrapping immediately. So it is worthwhile to sell your damaged car. This will earn you some money and saves you from disposal costs. From this money you can think to buy a new car.

1 note

·

View note

Text

BLOM Bank SAL Company Market Analysis Report - Company Market size - Company profile

BLOM Bank SAL (BLOM) is a provider of retail, commercial, private, and Islamic banking solutions. The bank offers current and savings accounts, debit and credit cards, deposits, car, home, motorcycle, and personal loans, term loans, investment plans, and structured products. BLOM Bank market analysis BLOM Bank Company Profile

It also offers private banking and wealth management, investment and Islamic banking, trade finance, custody, loan syndication, capital markets and brokerage, foreign exchange, insurance and real estate project financing services. The bank distributes these products and services through a network of branches and ATMs in Lebanon, Egypt, Jordan, Qatar, the UAE, France, Switzerland, the UK, Cyprus, Saudi Arabia, and Romania. BLOM is headquartered in Beirut, Lebanon.

Subscribe to access BLOM Bank SA… interactive dashboard for 12 months get access to premium industry data, predictive signals and more

Subscribe to access BLOM Bank SA… interactive dashboard for 12 months get access to premium industry data, predictive signals and more

0 notes

Text

Mortgage Loans in UAE: Things to Consider

Mortgage loans in UAE come in a variety of formats and terms. Here are the most common types:

-Fixed Rate Mortgage:

This is the most common type of mortgage loan. The loan agreement sets a fixed rate for the entire term of the loan, usually for a set period of time such as 10 or 15 years. The interest rate on a fixed-rate mortgage will usually stay constant throughout the term of the loan. If you want to get out of your mortgage before it's due, you will likely have to pay back the entire amount at once, plus interest.

-Variable Rate Mortgage:

A variable-rate mortgage is one where the interest rate fluctuates over the life of the loan. The lender sets a base rate at which they offer loans in UAE and then allows lenders to set their own rates above and below this base rate. If you want to take out a variable-rate mortgage, make sure you understand how much your rate could potentially change over time.

-Conforming Loan:

A conforming loan is one that meets certain criteria laid out by the lender, such as having an origination fee that's within certain limits. Conforming loans are usually

Types of Collateral

In today’s world, lenders are looking for different forms of collateral when offering mortgages. With the rise in the popularity of home ownership, lenders are looking for ways to make loans to more people.

One common form of collateral for a mortgage loan is property. This means that the lender can take ownership of the property in question and use it as security for the loan. Property can also be used as security for other types of loans, such as credit cards and car loans.

Another type of collateral that lenders may require is personal finance products. These products include things like stocks and bonds. Lenders may require that you have these products in order to get a mortgage loan.

Sometimes, lenders will accept other forms of collateral, like business assets or vehicles. It all depends on the specific lending criteria that a lender is using when evaluating a potential mortgage borrower.

Types of Financing

Mortgage loans are a type of lending that helps homeowners purchase or refinance a home. There are many types of mortgage loans available in Dubai, so it is important to choose the one that is best for your needs.

There are several types of mortgage loans available in Dubai. The most popular types of mortgages in Dubai are the fixed-rate and adjustable-rate mortgages. A fixed-rate mortgage is a loan that has a set interest rate for the entire term of the loan. An adjustable-rate mortgage, on the other hand, has an interest rate that can change over time.

Another type of mortgage loan is the hybrid loan. A hybrid loan combines features of both a fixed-rate and an adjustable-rate mortgage. Hybrid loans have an interest rate that is set at a predetermined level, but it can also be adjusted up or down depending on market conditions.

If you are looking to purchase a home in Dubai, you should consider using a personal credit score as part of your decision-making process. A personal credit score is a number that reflects your creditworthiness. A high personal credit score indicates that you have a good history of paying your bills on time and that you have good credit

There are a few types of mortgages available in Dubai, and it is important to understand the differences between them so that you can make the best choice for your needs. A home loan is a long-term commitment, and it is important to choose the right mortgage type for your circumstances. If you are looking to buy a property in Dubai, it is important to speak with an expert who can help you find the right mortgage product for your needs.

0 notes