#Payment Automation Software

Explore tagged Tumblr posts

Text

Did you know? ❓ 💡 Research shows that organizations using HRIS solutions experience a 35% reduction in time spent on administrative tasks and a 50% increase in the accuracy of employee data. Visit : https://www.transformify.org

#Contingent Workforce Management#Human Resource Information System#HRIS#Applicant Tracking System#HR Software#HR Management Software#Hiring Freelancers Management#Payment Automation Software#Billing Automation Software#Automated Billing Software#Payments to Freelancers

0 notes

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

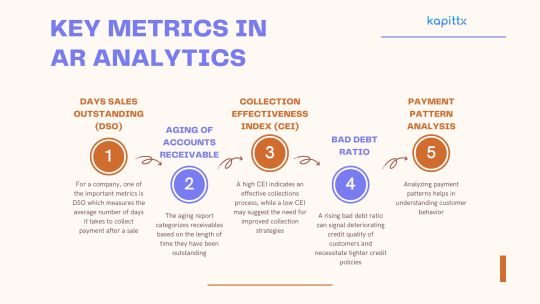

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

Case Study: AR Analytics in Action

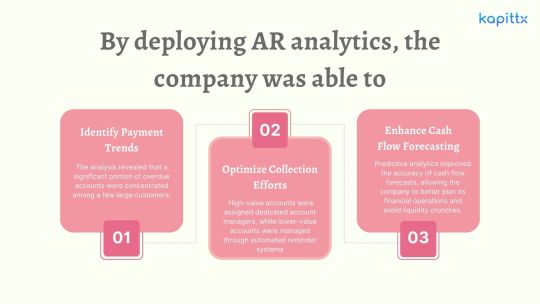

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes

Text

Efficient Payroll Management Solutions for Accurate and Timely Employee Compensation

Efficient payroll management is essential for maintaining employee trust and ensuring compliance with financial regulations. Payroll software simplifies the process by automating salary calculations, tax deductions, and payment scheduling. This technology reduces errors, saves time, and provides detailed reports for compliance and transparency. A modern payroll solution integrates seamlessly with other HR functions, offering scalability and customization to meet the unique needs of businesses. Streamline your payroll process to enhance accuracy, reduce administrative burden, and ensure timely employee payments.

More info: https://ahalts.com/solutions/hr-services/complete-payroll

#Payroll Management#Payroll Software#Salary Processing#Tax Deductions#Employee Compensation#Wage Calculation#Automated Payroll#Compliance Reporting#Payment Schedules#HR Payroll Solutions

0 notes

Text

Billing Software Development Services IBR Infotech

IBR Infotech specializes in providing custom billing software development services designed to streamline your invoicing, payment processing, and transaction management. Our solutions offer seamless integration with existing systems, ensuring accurate, automated billing processes that enhance financial operations.

With a focus on user-friendly interfaces and robust security, our billing software helps businesses reduce manual errors, improve cash flow, and maintain compliance. Whether you're a small business or a large enterprise, our scalable solutions can be tailored to meet your specific needs, ensuring efficiency and accuracy across your billing cycles. Let IBR Infotech transform your billing system into a powerful tool for financial management and business growth. Read more -https://www.ibrinfotech.com/solutions/custom-billing-software-development #BillingSoftware #SoftwareDevelopment #CustomBilling #InvoicingSoftware #PaymentProcessing #TransactionManagement #AutomatedBilling #FinancialManagement #SecureBilling #BillingSolutions #ScalableSoftware #BusinessSoftware #CashFlowManagement #BillingSystem #TechSolutions #EnterpriseSoftware #BillingServices #FinancialTech #SoftwareDevelopmentServices

#billing software development#custom billing software#invoicing software solutions#payment processing software#transaction management system#automated billing#secure billing software#financial management software#billing system integration#custom invoicing software#user-friendly billing system#billing software for businesses#financial operations software#automated invoicing solutions

0 notes

Text

Streamlining Business Operations with Smart Invoicing Tools

As a small business owner, managing daily tasks efficiently has always been a top priority for me. One of the most time-consuming aspects of running my business used to be invoicing. It felt like a constant struggle to create professional invoices, keep track of payments, and stay organized. But recently, I came across a tool that has completely transformed the way I handle invoicing.

This tool is incredibly easy to use, and it has streamlined my entire billing process. Now, I can create professional invoices in just a few clicks, track payments effortlessly, and even automate recurring payments. What used to take hours is now completed in minutes, giving me more time to focus on what truly matters—growing my business and connecting with customers.

Having the right tools to simplify operations is a game-changer for any business, whether you’re just starting out or are already established. Tools like these not only save time but also reduce stress, helping you stay organised and productive.

If invoicing has ever been a challenge for you, I highly recommend exploring software that can make the process efficient and hassle-free. It’s made a huge difference for me, and I believe it can do the same for you!

#invoicing solution for small businesses#automate payments#Reliable Invoicing#GST Calculator#invoicing software

0 notes

Text

Simplifying My Business Operations with the Right Tools

As the owner of Anais Fashions, I know firsthand how demanding it can be to manage a small business. Between curating stylish collections, connecting with customers, and handling daily operations, there’s always a lot on my plate. One of the biggest challenges I faced was managing invoices efficiently—it used to take up so much of my time.

Recently, I started using a tool designed to simplify invoicing, and it’s been a total game-changer for my business. It allows me to create professional invoices quickly and track payments seamlessly, which has helped me stay organized and stress-free. Not only does it save me time, but it also ensures my records are accurate and up to date, which is crucial for a business like mine.

As someone who loves sharing tips and good experiences, I want to encourage fellow small business owners to explore tools that can make their lives easier. Whether it’s for invoicing, inventory, or customer management, the right tools can free up your time so you can focus on growing your business and doing what you love. Running a business is hard work, but smart solutions can make it a whole lot easier!

1 note

·

View note

Text

Ticket-Based Parking: Reliable Access Control and Revenue Management Manage parking operations efficiently with Parkomax’s ticket-based solution, offering robust access control, revenue tracking, and a smooth flow for vehicles entering and exiting your facility.

#Ticket-based parking system#Parking management solutions#Automated parking entry#Ticket-based access control#Parking payment integration#Parking revenue management#Vehicle tracking system#Parking control software#Secure parking management#Efficient parking operations

0 notes

Text

#Housecall Pro review#Home service business software#Business management software#Field service management#Scheduling software for service businesses#Invoicing and payment processing tools#Customer management software#Marketing tools for service pros#Home service industry solutions#Business software for plumbers#HVAC business management#Landscaping business software#Electrical service software#Service business automation#Small business technology solutions#Streamlining business operations#Growing a service business#Software for service professionals#Home service scheduling tools#Best software for service businesses

0 notes

Text

Prompt Payments: How Automated Billing Software Benefits Freelancers

As the gig economy thrives, freelancers play a crucial role in various industries. However, one common challenge they face is ensuring timely service payments. Late or delayed payments can significantly impact freelancers' cash flow and hinder their business sustainability. Payments must consistently maintain cash flow, avoid financial stress, and hamper freelance businesses. Automated billing software has emerged as a powerful tool for freelancers to address this issue.

In this blog post, we will explore the benefits of automated billing software to ensure prompt payments. We will also discuss how it streamlines freelancers' invoicing processes.

Benefits of Payment Automation Software

Streamlined Invoicing Process

Manual invoicing can be time-consuming and error-prone. Payment automation software simplifies invoicing by generating professional-looking invoices quickly and accurately. Freelancers can customize templates with their branding, add project details, and set payment terms, ensuring clear communication with clients. By automating this administrative task, freelancers can save valuable time and focus more on their core work.

Invoice Tracking and Reminders

Late payments often occur due to oversight or forgetfulness by the client and the freelancer. Automated billing software keeps track of sent invoices and reminds us of pending or overdue payments. These reminders can be scheduled to be sent automatically, reducing manual follow-ups. By automating invoice tracking and reminders, freelancers can maintain better control over their payment schedules and improve cash flow.

Recurring invoices

Automatic billing is crucial for freelancers who work on long-term projects or offer subscription-based services. Billing automation software enables freelancers to set up recurring invoices that are automatically generated and sent at specified intervals. It ensures a steady stream of invoices and payments, eliminating repeated manual invoicing. With recurring payments, freelancers can create predictable revenue streams and focus on delivering quality work.

Online Payment Options

Many clients prefer online payment methods like credit cards, debit cards, or digital wallets. Automated billing software integrates with various payment gateways, allowing freelancers to offer multiple online payment options to their clients. By providing a seamless online payment experience, freelancers can expedite the payment process and reduce barriers that hinder prompt payments.

Expense Tracking and Reporting

Freelancers often incur business-related expenses that must be tracked for accurate billing and taxation purposes. Automated billing software can help track expenses by allowing freelancers to categories and record business expenses. Payments to Freelancers are made easier, and the accounting process is simplified by this feature, as is maintaining organized financial records and generating comprehensive tax reports.

Financial Insights and Analytics

Financial management is essential for freelancers to understand their business's fiscal health and make informed decisions. Automated billing software offers financial insights and analytics, giving freelancers an overview of their invoicing, payments received, outstanding payments, and revenue trends. By accessing such data, freelancers can identify potential issues, optimize invoicing strategies, and plan for future growth.

Reliable Payment Automation Software Provider Timely payments are vital to freelance businesses' success and sustainability. TFY's automated billing software offers freelancers a range of benefits, including streamlined invoicing processes, invoice tracking and reminders, recurring invoicing, online payment options, expense tracking and reporting, and financial insights. By leveraging these features, freelancers can reduce administrative burdens, enhance cash flow, and ensure prompt client payments. Embracing automation through billing software empowers freelancers to focus on their work. The software handles invoicing and payment, fostering a more efficient and prosperous freelancing journey. To know more about it, contact the TFY solution provider.

#Contingent Workforce Management#Human Resource Information System#HRIS#Applicant Tracking System#HR Software#HR Management Software#Hiring Freelancers Management#Payment Automation Software#Billing Automation Software#Automated Billing Software#Payments to Freelancers

0 notes

Text

#Ordering and Payment Solution#Supply Chain Management Software#Supply Chain Management System#Minivend Driver App#automate credit card payments#Ecommerce Website#Online Accounting Software#Supplier and Distributor Management Solutions#supply chain management software provider

0 notes

Text

#zoho#zoho crm#zoho partner#zoho creator#automation#payment management#razorpay#software#business#technology#crm

1 note

·

View note

Text

What is Cash Application and How AI is Revolutionizing Cash Application Management?

What is Cash Application and How AI is Revolutionizing Cash Application Management?

Managing cash flow efficiently is the lifeblood of any business, especially for companies dealing with high volumes of transactions. Cash application has emerged as one of the most critical functions for businesses, as it directly impacts both cash flow and customer relationships. But what is cash application process, and how is AI transforming this fundamental process to enhance speed, accuracy, and efficiency?

Why Cash Application is Crucial for Companies

Cash application, while often overshadowed by other financial processes, is an essential part of accounts receivable (AR) management. It entails matching incoming customer payments to open invoices, and keeping accounts current and precise. When cash application management is done efficiently, it ensures that businesses maintain healthy cash flow, avoid disruptions, and provide superior customer service. Conversely, poor cash application management can lead to customer dissatisfaction, increased operational costs, and strained cash flow.

In mature as well as fast-growing markets, medium to large-scale businesses operate with complex payment systems, and the stakes are even higher. Delayed or inaccurate cash application management can result in collection inefficiencies, with businesses wasting time chasing already settled invoices. Moreover, mismanagement of the cash application process can tarnish a company’s reputation, as frustrated customers deal with errors like duplicated collection efforts or unapplied payments.

What is Cash Application Process?

Cash application is the process of matching incoming customer payments with the respective invoices. In a typical B2B setup, customers pay their bills or invoices via various payment methods, including checks, ACH (Automated Clearing House) transfers, and online payments. Each payment must be reconciled with the correct invoice to ensure the customer’s account is updated accurately.

Data Collection: Data is pulled from multiple sources like ERPs (Enterprise Resource Planning), billing systems, bank statements, and customer payment advices. Payments may also arrive through various channels such as check payments, wire transfers, and online transactions.

Matching Payments to Invoices: Payments are matched to open invoices based on the remittance advice from customers. This requires close attention to discrepancies like deductions, credit notes, and partial payments.

Reconciliation: Once matched, payments are reconciled against the company’s bank statements to ensure accuracy.

4. Handling Discrepancies: Issues such as short payments, overpayments, deductions, and disputed amounts must be resolved to maintain accurate records.

Common Challenges in Manual Cash Application

“Manual cash application processes are time-consuming and prone to human error. This process can be broken down into two main categories: Payment Reconciliation and Cash Posting.“

Payment Reconciliation

The most time-consuming part of the cash application process is payment reconciliation. This involves matching invoice amounts with remittance information and bank statements. For cash application specialists, visibility into accounts receivable and expected payments is crucial. This information is typically available in the accounts ERP. Keeping track of these payments ensures they are received in a timely manner and properly allocated to the appropriate accounts.

Depending on the payment mode and channel, these formats will vary. For instance, lockbox formats differ from ACH payment reports, and online payment information differs from wire transfers. Additionally, if the payments involve multiple currencies, FX conversion rates can further complicate the process. While bank formats are generally standard, the data still needs to be retrieved for payment reconciliation from either PDFs or Excel sheets.

During the payment reconciliation process, it’s key to segregate mismatched transactions from matched transactions by taking inputs from ERP data, customer remittance information, and bank statements.

Common types of mismatches are due to following:

1. Deductions: Deductions occur when customers reduce the payment amount due to various reasons like returns, discounts, or allowances. Reconciling these requires matching the deduction details with the corresponding invoice and ensuring the justification for the deduction is valid.

2. Short Payments: Short payments happen when customers pay less than the invoiced amount. These discrepancies need to be investigated to understand the cause—whether it’s an error, a dispute, or an approved discount.

3. FX Differences: When dealing with international transactions, FX (foreign exchange) differences arise due to fluctuations in currency exchange rates. Accurate reconciliation involves converting payments to the base currency and accounting for any exchange rate discrepancies.

4. Tax Holds: Tax holds can occur if there’s an issue with the tax calculations on an invoice. These need to be reviewed to ensure compliance with tax regulations and to adjust the accounts accordingly.

5. Refunds & Chargebacks: Refunds and chargebacks require meticulous tracking. Refunds are payments returned to the customer, while chargebacks are transactions disputed by the customer and reversed by the bank. Proper documentation and validation are essential for reconciling these entries.

6. Payment Processing Charges: When using payment gateways or ACH processing services, fees are often deducted from the payment amount before it reaches the company’s account. Reconciling these charges involves matching the net payment with the gross amount and the associated fees.

Once these mismatches are identified and addressed, the transaction-level payment reconciliation provides a clear picture, enabling accurate cash posting entries into the ERP system. This clarity ensures that all payments are correctly allocated, improving cash flow management and financial reporting accuracy.

What is Cash Posting :

Cash posting is a critical step in the cash application process where payments are recorded in the ERP system to reflect accurate account balances.

What are Cash Posting Challenges

Some of the main challenges businesses face include:

Unapplied Payments: Payments that remain unapplied for days or weeks after receipt cause significant delays. These unapplied payments can create redundancy in collection efforts, as the finance team might continue to contact customers for payments that have already been made but not yet matched and applied.

Misapplied Payments: Incorrectly posting payments to the wrong account or invoice can lead to extensive rework. This mistake requires manual corrections, consumes valuable time, and frustrates customers, potentially leading to disputes and delayed future payments.

Payment Without Remittance Advice: When customers do not provide clear instructions on how their payments should be applied, businesses may struggle to identify the correct account or invoice. This often results in unapplied or misapplied payments, further complicating the reconciliation process.

Multiple Payment Channels: Companies dealing with various payment gateways (e.g., Stripe, PayPal, and Dwolla) or handling both online and traditional check payments face the challenge of reconciling payments in different formats. The diverse formats increase the risk of mismatched data and complicate the reconciliation process.

These challenges create inefficiencies, directly affecting cash flow and customer satisfaction. Research shows that companies with poor cash application processes can experience a 20-30% delay in receiving payments due to manual errors and system inefficiencies. Streamlining and automating the cash posting process can significantly improve the accuracy and speed of payment reconciliation, leading to better financial management and enhanced customer relationships.

The Role of AI in Cash Application Process

Enter AI: artificial intelligence is now revolutionizing cash application process by automating much of the manual work and improving accuracy. Let’s understand how AI powered cash application process will create an impact on your cash flow management:

Automated Matching: AI powered cash application process can process vast amounts of payment data from multiple sources and automatically match payments to open invoices, eliminating the need for human intervention. This drastically reduces the time it takes to apply cash and ensures accuracy.

Error Reduction: AI powered cash application automation software reduces the risk of human error, particularly with misapplied or unapplied payments. By leveraging machine learning, AI systems can learn from past applications and improve their matching algorithms over time.

Handling Payment Discrepancies: AI powered cash application process can flag discrepancies such as short payments, overpayments, or missing remittance advices, and automatically suggest resolutions. For instance, if a payment doesn’t match the invoice amount, the system can identify potential deductions or adjustments based on past transactions.

4. Faster Reconciliation: AI powered cash application automation software accelerates the reconciliation process by matching payments with bank statements in real-time, minimizing delays and ensuring accurate financial records.

5. Handling Complex Payment Structures: AI powered cash application process systems can manage various payment types (check payments, ACH, online payments) and integrate with multiple payment gateways (like PayPal, Stripe, and Aydan), providing a seamless cash application process regardless of the payment method used.

Benefits of AI-Powered Cash Application Process

The introduction of AI into cash application automation software offers numerous benefits:

Speed: What once took days or even weeks can now be accomplished in minutes. AI significantly reduces processing times by automating the matching and reconciliation process.

Accuracy: AI systems are highly accurate, meaning fewer errors, less rework, and improved cash flow.

Scalability: AI can easily scale to accommodate growing transaction volumes, making it ideal for large businesses with high payment frequencies.

Cost Reduction: By automating processes, AI reduces the need for large accounts receivable teams, saving on labor costs.

Should Cash Application Be Outsourced?

While outsourcing cash application to third-party providers is an option, businesses must weigh the pros and cons. Outsourcing can reduce the need for in-house expertise and can be a more affordable option in the short term. However, it may introduce delays and limit control over sensitive financial processes.

On the other hand, AI-driven cash application solutions can offer a middle ground by automating processes while keeping them in-house. This provides greater control and ensures that the company maintains direct oversight of payment processing, while still reaping the benefits of automation.

Conclusion

The adoption of AI powered cash application automation software is transforming how businesses handle one of their most critical functions. By eliminating manual errors, speeding up payment processing, and ensuring accurate application of payments, AI offers a robust solution that allows businesses to streamline their operations and improve cash flow. As AI continues to evolve, it is poised to become an indispensable tool for finance departments looking to stay competitive in the fast-paced world of business.

Investing in AI powered cash application automation software can lead to improved customer relationships, faster cash cycles, and enhanced operational efficiency, positioning companies for long-term success in an increasingly digital economy.

#ai based accounts receivable#cashflow management#payment reminder#Cash application process#accounts receivable automation software#ai in accounts receivable#payment reconciliation#ar management

0 notes

Text

Marg ERP: Easy Invoicing and Billing Software Marg ERP Limited offers user-friendly invoicing and billing software, simplifying financial processes for businesses. With features like automated invoicing, inventory management and GST compliance, it streamlines operations. Marg ERP ensures efficient tracking of sales, purchases, and payments, enhancing business productivity and financial management.

#inventory software#billing software#billing solutions#inventory management#bussiness#pos software#business#management#technology#Invoicing software#automated invoicing#erp solution#GST compliance#sales tracking#payment tracking#business productivity

0 notes

Text

Faster Withdrawals, Happier You: Streamline Your Finances with PayTrackster

PayTrackster, payment analytics software is not just an automated payment processor, but something more enduring. It’s a one-and-only solution that keeps you under control of e-commerce finances, expedites PayPal’s withdrawal approval, and allows you to save on chargebacks and other costly inconveniences. Through automating processes, eliminating errors and providing real-time insights, PayTrackster saves you valuable time and resources so you can focus on fundamentals — your business growth and success.

0 notes

Text

Explore the importance of cloud billing software for businesses. Discover the key reasons why integrating billing software is crucial for enhancing efficiency, accuracy and financial management in your organization. From faster invoicing to improving customer experience, learn how this essential tool can streamline processes and drive growth. Unlock insights into the benefits and features of online billing & accounting software to make informed decisions for optimizing your business operations.

#billing software#invoicing software#accounting software#online billing#invoice generator#small business billing#cloud billing software#automated billing#subscription billing#payment processing software

0 notes

Text

Maximizing Sales: The Ultimate Guide to Payment System Integrations on Shopify

In today’s digital age, having a strong online presence is imperative for businesses looking to thrive in the competitive market. Among the myriad of e-commerce platforms available, Shopify stands out as a leading choice for entrepreneurs seeking to establish and grow their online stores. With its user-friendly interface, customizable design options, and robust features, Shopify provides a powerful foundation for e-commerce success. However, to truly maximize sales potential, seamless integration with a reliable payment system is crucial.

In this comprehensive guide, we will delve into the intricacies of integrating Shopify with a payment system to streamline transactions, enhance customer experience, and ultimately boost sales.

Understanding the Importance of Integration:

Integrating a payment system with your Shopify store is more than just a convenience – it’s a strategic move that can significantly impact your bottom line. By offering multiple payment options and ensuring a smooth checkout process, you remove barriers to purchase and increase the likelihood of conversion. Moreover, seamless integration eliminates manual handling of transactions, reducing the risk of errors and enhancing efficiency.

Choosing the Right Payment System:

When selecting a payment system to integrate with Shopify, it’s essential to consider factors such as reliability, security, and compatibility with your target market. Popular options include PayPal, Stripe, Square, and Authorize.Net, each offering unique features and pricing structures. Conduct thorough research and choose a payment system that aligns with your business needs and customer preferences.

Step-by-Step Integration Process:

Integrating a payment system with Shopify may seem daunting, but with the right approach, it can be a straightforward process. Here’s a step-by-step guide to help you navigate the integration seamlessly:

Select Your Payment System: Begin by choosing the payment system you wish to integrate with Shopify. Consider factors such as transaction fees, supported currencies, and compatibility with Shopify’s API.

Set Up Your Payment Gateway: Log in to your Shopify account and navigate to the “Settings” tab. Select “Payment providers” and choose the option to add a payment gateway. Follow the prompts to configure the settings for your chosen payment system.

Test Transactions: Before making your payment system live, conduct thorough testing to ensure that transactions process smoothly and without errors. This step is crucial for identifying any potential issues and ensuring a seamless customer experience.

Go Live: Once you’re confident that everything is working correctly, activate your payment system and make it live on your Shopify store. Monitor transactions closely in the initial days to address any unforeseen issues promptly.

Maximizing Sales with Cloudify:

While integrating Shopify with a payment system is essential for optimizing sales, managing multiple integrations can be complex. That’s where Cloudify comes in. Cloudify offers a comprehensive integration platform that simplifies the process of connecting Shopify with various payment systems, eliminating the need for manual coding and streamlining operations. With Cloudify, you can seamlessly manage transactions, track sales data, and optimize your e-commerce strategy for maximum success.

In conclusion, integrating Shopify with a reliable payment system is a critical step in maximizing sales and ensuring a seamless shopping experience for your customers. By following the steps outlined in this guide and leveraging tools like Cloudify, you can streamline operations, drive conversions, and take your e-commerce business to new heights of success.

Ready to elevate your Shopify store? Explore the possibilities with Cloudify today!

#crm#erpsoftware#automation services#business growth#crm software#integration#saas#b2b saas#businessintelligence#pipedrive#shopify#shopify integration#payment gateway

0 notes