#PositionTrading

Explore tagged Tumblr posts

Link

#CapitalAppreciation#EconomicTrends#FundamentalAnalysis#InvestmentStrategy#Long-TermTrading#MarketCycles#markettrends#PortfolioGrowth#PositionTrading#riskmanagement#StockMarket#technicalanalysis#TradingStrategy#TrendFollowing#WealthBuilding

0 notes

Text

Types of trading in stock market

Types of trading in stock market

The stock market is a thrilling ecosystem, buzzing with activity and filled with countless strategies. Whether you're a seasoned investor or just starting your journey, understanding the various types of trading can help you navigate this complex world with confidence. Each trading style offers its own unique approach, risks, and rewards. Let’s explore these diverse trading types and discover which might suit your investment goals.

Day Trading

Day trading is akin to the adrenaline rush of a high-speed race. Day traders engage in buying and selling stocks within the same trading day, aiming to capitalize on short-term price movements. Picture a day trader as a high-stakes gambler, meticulously analyzing real-time data and making split-second decisions to seize fleeting opportunities.

This approach requires a deep understanding of technical analysis, as traders use charts, indicators, and market news to predict price changes. The excitement of day trading lies in its rapid pace—positions are held for minutes or hours, and traders often execute multiple trades in a single day. However, the fast-moving nature of this style can also be its downside: the high frequency of trades can lead to significant transaction costs, and the constant need for vigilance can be mentally taxing.

Swing Trading

If day trading is a sprint, swing trading is more of a strategic marathon. Swing traders aim to capture gains over a period of several days to weeks, positioning themselves to profit from short- to medium-term trends. Imagine a swing trader as a surfer catching and riding the perfect wave—each trade is an opportunity to capitalize on the market's natural ebb and flow.

Swing trading blends technical analysis with market trends. Traders look for patterns and signals that indicate potential price swings, holding onto stocks for a few days to a few weeks. This style demands less time than day trading, but it still requires a keen eye for timing and an ability to adapt to market shifts. The reward is the potential for significant gains from well-timed trades, though it also carries the risk of overnight market changes.

Position Trading

Position trading is a more patient and methodical approach. Position traders hold onto their stocks for weeks, months, or even years, aiming to benefit from significant, long-term trends. Picture a position trader as a chess player, carefully planning moves and waiting for the right moment to capitalize on broader market trends.

This style relies on fundamental analysis and long-term market trends rather than short-term fluctuations. Position traders focus on the underlying value of stocks, making decisions based on economic indicators, company performance, and overall market conditions. While this approach requires less frequent trading and can be less stressful day-to-day, it demands patience and the ability to weather market volatility over longer periods.

Scalping

Scalping is the art of making numerous trades to capture tiny price movements. Scalpers are like rapid-fire shooters, executing trades within seconds or minutes to exploit minute fluctuations in stock prices. They aim to accumulate small gains that can add up to significant profits over time.

Scalping requires advanced technology and precise execution. Traders use high-speed trading platforms and algorithms to enter and exit trades with lightning speed. The strategy demands intense focus and quick decision-making, with traders making dozens or even hundreds of trades in a single day. While it can be highly profitable, scalping also involves high transaction costs and the challenge of maintaining constant concentration.

Options trading is a financial strategy that lets investors buy or sell the right to purchase or sell an underlying asset at a predetermined price, known as the strike price, on or before a specific future date. The key aspect of options trading is that the buyer of the option has the choice—often referred to as "having the option"��to exercise the contract, but is not obligated to do so.

Options trading allows investors to speculate on the future direction of asset prices or to hedge against potential losses. While it offers potential for significant returns, it also comes with risks, including the possibility of losing the premium paid for the option if the market doesn’t move as anticipated.

Algorithmic Trading

Algorithmic trading represents the cutting edge of stock market strategies. This approach relies on computer algorithms to execute trades based on predefined criteria and complex models. Imagine a high-speed robot handling trades with unparalleled efficiency and precision, making decisions faster than any human could.

Algorithmic trading leverages vast amounts of data and sophisticated algorithms to identify trading opportunities and execute trades at lightning speed. While it reduces emotional bias and increases trading efficiency, it also demands a deep understanding of programming and algorithm development. The reliance on technology also introduces the risk of technical glitches or system failures.

The stock market offers a rich tapestry of trading styles, each with its own unique flavor and appeal. Whether you're drawn to the high-paced excitement of day trading, the strategic patience of position trading, or the high-tech sophistication of algorithmic trading, there’s a strategy that matches your personal investment style and goals. By understanding these different approaches, you can find the right fit for your trading journey and navigate the exhilarating world of the stock market with greater confidence. So, take a deep breath, choose your strategy, and dive into the fascinating world of stock market trading!

#StockTrading#Laabhum#TradingTypes#EquityTrading#OptionsTrading#DayTrading#SwingTrading#IntradayTrading#LongTermInvesting#Scalping#PositionTrading#FinancialMarkets#TradingStrategies#MarketInsights#InvestmentTips#LearnToTrade

0 notes

Text

Forex Trading Strategies Explained:

1. Scalping:

- Quick trades for small profits.

- Use 1-5 minute charts.

2. Day Trading:

- Trades within the same day.

- Use 15-minute to 1-hour charts.

3. Swing Trading:

- Hold trades for days to weeks.

- Use 1-hour to daily charts.

4. Position Trading:

- Long-term trades held for weeks to months.

- Use daily to weekly charts.

5. Breakout Trading:

- Trade when price breaks support/resistance.

- Use 15-minute to daily charts.

6. Trend Following:

- Trade in the direction of the trend.

- Use 1-hour to daily charts.

7. Counter-Trend Trading:

- Trade against the trend during corrections.

- Use 1-hour to daily charts.

💡 Pro Tip: Always manage your risk with stop-loss orders!

#ForexTrading TradingStrategies Investing Forex DayTrading SwingTrading Scalping BreakoutTrading TrendFollowing PositionTrading#forex#forextrader#forexasia#forexmentor#forexsignalservice#forex analysis#forexmoney#forexsignals

0 notes

Photo

Why pros are successful? Pros are calculative, meticulous and follow stringent risk-reward principles. You can too, with this EA.

Learn more and Trade like a pro now! https://wetalktrade.com/best-mt4-expert-advisor-mt5-expert-trading-robot/

#expertadvisor#marketanalysis#mt4#mt5#stoploss#pips#positiontrading#scalpers#traders#robottrading#wetalktrade

2 notes

·

View notes

Link

0 notes

Text

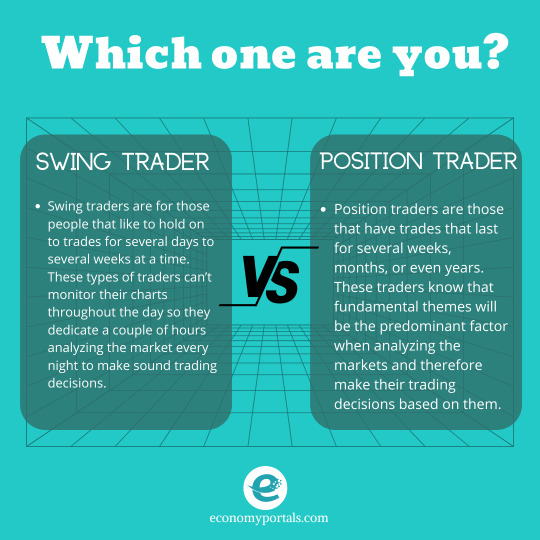

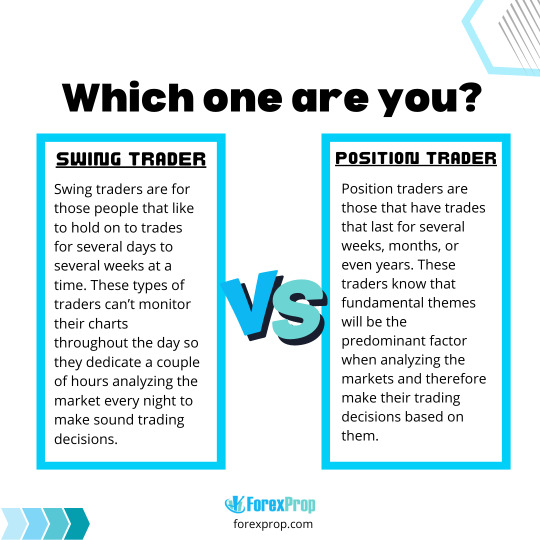

Are you a Swing Trader or Position Trader? Or you are about to start trading and wondering which one is more profitable?

See the differences below!

0 notes

Text

Hôm nay Brokervn sẽ giới thiệu đến bạn Position trading (giao dịch vị thế) là phương pháp giao dịch dài hạn nhất trong bốn phong cách giao dịch ngoại hối cơ bản, cùng tìm hiểu để áp dụng sao cho hiệu quả nhé

Link: https://brokervn.net/position-trading-la-gi/

0 notes

Photo

Hạn chế tối đa thua lỗ và Tối ưu lợi nhuận là con đường duy nhất để tăng trưởng bền vững. hãy dẹp hết mấy kiểu scalping, martingale nhồi volume, những kiểu lướt sóng ngắn "chộp giật" để kiếm % mỗi ngày và tập trung trading ăn dầy. Xem thêm chuyên mục hiểu chuyên sâu về cách đánh giá lịch sử giao dịch nhằm tìm ra điểm yếu khiến trade mãi vẫn hòa tới thua lỗ tại đây: https://www.youtube.com/playlist?list=PLN0WUd9_KhzI-0OrEZnLDnnsk_m9S5F7P _________ #FXVIET #QUANLYVON #KIEMSOATRUIRO #XACSUATTHONGKE #DANHGIAHIEUQUATRADING #MONEYMANAGEMENT #POSITIONTRADING https://www.instagram.com/p/CSE3QtQhNhV/?utm_medium=tumblr

#fxviet#quanlyvon#kiemsoatruiro#xacsuatthongke#danhgiahieuquatrading#moneymanagement#positiontrading

0 notes

Photo

You can point out the disadvantages in the comments.

#forex#fxtrading#positiontrading#forexmarket#marketmovement#marketanalysis#fluctuations#tradingtips#traderpulse

0 notes

Photo

To the moon! 🚀 #daytrader #daytradingmommy #daytradingmemes #daytraderlife #daytraderbrasil #daytraderslife #daytraders #swingtrader #swingtraders #swingtrading #positiontrader #positiontrading #scalptrader #scalpingforex #traderforex #cryptotrading #cryptotrader #cryptotraders #cryptocurrencies #babymemes #toddlermemes #childmemes #tradingmemes #moonboy #thewallstreetjunior #tradingforbabies #investingforbabies (at CME Group) https://www.instagram.com/p/CEbZ1e6HFIu/?igshid=1vw4a5hf0ha5j

#daytrader#daytradingmommy#daytradingmemes#daytraderlife#daytraderbrasil#daytraderslife#daytraders#swingtrader#swingtraders#swingtrading#positiontrader#positiontrading#scalptrader#scalpingforex#traderforex#cryptotrading#cryptotrader#cryptotraders#cryptocurrencies#babymemes#toddlermemes#childmemes#tradingmemes#moonboy#thewallstreetjunior#tradingforbabies#investingforbabies

0 notes

Photo

A forex trader can get a goodnight's sleep too if you follow these.

#forextrader#tradingplan#lotsize#positiontrading#tradingtrend#forexmarket#tradingtips#fxtrade#wetalktrade

4 notes

·

View notes

Link

0 notes

Photo

What Kind of Trader Are You? https://blog.iqoption.com/en/what-type-of-trader-are-you/

#Scalping#tradingstyle#Swingtrading#stoplosslevel#Positiontrading#longtermtrades#pricemovements#Forexmarket#tradersir

0 notes

Text

Do you know who is called a swing trader and who is called a position trader?

Well, it is described down below.

1 note

·

View note

Text

What sort of trading do you prefer the most to perform? Yes, Your trading type makes you that type of a trader!

0 notes

Photo

What it takes to succeed in forex.

#forex#tradingmistakes#fxeducation#riskmanagement#moneymanagement#fundamentalanalysis#positiontrading#marketmovement#strategies#tradingtips#traderpulse

0 notes