#Quick Payment

Explore tagged Tumblr posts

Text

Seamless Travel Payments with PAYN: A Game Changer

The Traveler’s Edge Lila stood at Suvarnabhumi Airport in Bangkok. Her phone buzzed with a last-minute booking confirmation. It was for a beach villa in Phuket. The air was filled with the chatter of travelers. The scent of street food lingered, and people rushed to their gates. As a travel vlogger with a dynamic lifestyle, Lila thrived on spontaneity. Her audience adored her fearless pivots,…

0 notes

Text

What's that? Like me, you're perfectly normal and want to hoard various references from the Saltburn Costume/Prop auction that's going on?

Fear not, for I have used my computer skills and can provide you with this:

That is every image I could get my paws on for the current lot of items, all organized into a nice folder hierarchy for all your art ref/writing/crying/screaming needs.

I will do the same thing once the remaining lots are up, so if something's missing, look out for part 2!

Love, Leif.

#i accept payment in YAH art btw#saltburn#saltburn costumes#saltburn props#yah!posting#oliver quick#felix catton#venetia catton#sir james catton#lady elspeth catton

22 notes

·

View notes

Text

low key having a crisis over finances right now actually

#liz losing her mind#you would think growing up poor and working at a bank would make me good at money#i make all my payments on time and everything but right now im paying down my credit card just enough to max it out again#literally it was just pay day and i’m already fucked and i’m genuinely not sure all the automatic charges i have coming are going to work#i don’t know how i got here i know i get a little impulsive but im usually so good with not spending too much#how did my credit card balance get that high#i’m gonna cry#how do i make some extra money really quick#i haven’t even bought groceries for this pay cycle#oh my god i’m supposed to go get coffee with some friends tomorrow and i genuinely can’t afford it#like i probably need to go apply for another credit card but i don’t want it to get worse#what if i max that one out too#why did i get such a nice car#why do my parents think i’m rich i have nothing#i genuinely have no savings whatsoever#i don’t know how i’m going to afford that trip to florida in the fall#and my friend wants me to visit her in new york#and my aunt wants me to visit her in hawaii#and i would LOVE to#but how#and i want to go see roby so so so bad#i don’t even think i can blame capitalism for this one#i’m so so fucked actually

5 notes

·

View notes

Text

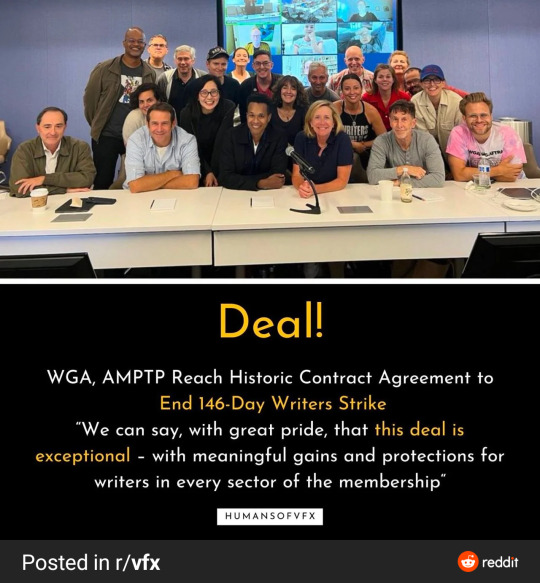

🎉HUGE PROGRESS🎉

With WGA, SAG-AFTRA

And Writers Strike.

r/vfx

But it's not over yet.

Still membership needs to vote. And SAG-AFTRA has to come to agreement too. Which may take awhile. But progress has been made

🖕Fuck Greedy Corporations🖕

Like to charge, Reblog to cast.

Let's complete this.

#wga strike#wga strong#support the wga#sag aftra#sag strike#writers strike#tumblr#news#tumblr news#great news#so for a quick post low on data and loadshedding schedual.#i fucking love a lot of writers and have major respect for them. i love every person who works and every department on tv shows / movies#practically anything the worked on and they should get the rewards and payment they deserve.

92 notes

·

View notes

Text

LET’S GO, ON MY FIRST TEN PULL

#I was hoping when I got the Epic intro#but I’m shocked I actually got it this quick#I guess it’s payment for it taking forever for me to get Peach Blossom earlier#had to get him via Soulstones#cookie run#cookie run kingdom#dark cacao cookie#random stuff

21 notes

·

View notes

Text

no actually it is kind of a wonder to me how pb is operating with whb like it is bc. arent yall also hosted (i believe anyways im not sure if their partnership w/ erolabs goes beyond that) by another company w/ SEVERAL gachas under its belt. so whats goin on here. nobody taking notes? are we doing market research? is anyone even play testing. hello. its so dark in here

#cliffnotes/.txt#whb#LIKE. atp im just here to see how long it lasts#not even a full year yet and honestly it srarted going downhill december....#i feared back in march they were gonna be trying to do passes monthly and its not a good look. thats like ~60 per month#thats a bill payment.#even subscription based mmos dont cost that much.#and lets be frank the game is not of any sort of quality that justifies $60 for a jpeg (and imo a lackluster side story)#like sry u can only use the company size as an excuse for so long and i will never dickride a company ever#but its. man.#i am interested in the game and its characters and story if we could GET TO ITTTTT#RAHHHH#atp im like is anyone trying to make sure this game lasts. it feels like its gotta be fully aware sabotage now#bc these choices arent making sense unless the point is truly just a quick buck#theres some useful little changes here and there but. man#it get overshadowed by the greed real quickly#i dont even care abt beel either just on principle. this is. a real head scratcher.#also this has been in my drafts since may if that means anything.#i just rewrote my tags 😭

13 notes

·

View notes

Text

.

#sorry let me rant real quick in the tags#cw personal#once again hitting an insurance pothole bc the psych says she accepts my OHP plan HOWEVER the therapy group she is contacted with says#THEY don't#they only accept the insurance if it's through my employer but NOT through the government??????????????#so there's still some kind of payment???#anyway I want to scream why is this so complicated#like will she take my insurance or not who's right here#anyway called her back directly and went to voicemail so now I've done all I can for now#why the hell is this so hard man#the person on the phone didn't know really how to explain#once again no one knows what they're talking about#like can y'all not communicate and figure this out?#AHHHHHHHHHHHHHHH#i need to get an ADHD eval before my next PCP appointment in june so that they will continue giving me my meds#and the psychiatry through the hospital has a limited number of visits that insurance will cover#*contracted#not retyping all of that#and once again the only reason this is so stressful is because the psychiatry group at the hospital fumbled the communication ball last tim#and the psychiatrist I was with never put the ADHD on the chart#and now somehow it's MY responsibility to fix that>#UGH#like I am grateful to have some kind of coverage but holy shit is the US healthcare system in shambles#the bureaucracy is INSANE#i had to just sit down and put my head in my hands for a second#and then go 'right okay nothing i can do about that rn moving on'#uGH#literally said 'what the FUCK' out loud a couple times#like not on the phone after I hung up obvs

14 notes

·

View notes

Text

i'm being so fr when i say my bio father does NOT like to give money unless if it's to try and bribe me. yes he pays important things butttt he bitches about it and if he doesn't have to give the money he simply won't

#he was so quick to stop trying to pay child support the moment i turned 18 despite the fact that i was still in hs. i would have understood#if i had graduated but he literally only had like. 4-5 more months left where he had to make a payment a month#that is genuinely nothing especially since it was i think 350 a month out of the amount of money he has like he gets paid well#like even without bills he still has money but from when he bitches about it it seems like he doesn't#but yea that pissed me off

4 notes

·

View notes

Text

Tired of the hassle of selling your house in Manchester, NH?

Tired of the hassle of selling your house in Manchester, NH?

We buy houses fast for cash, no matter the condition. We're local real estate investors who specialize in helping homeowners like you sell their properties quickly and easily.

Here's why you should choose us:

We buy houses in any condition, so you don't have to worry about making repairs.

We offer fair cash offers, so you can get the money you need quickly.

We close quickly, so you can move on with your life.

Ready to sell your house in Manchester, NH?

Visit our website at WeBuyHousesInNH.com to get a free cash offer.

We look forward to helping you sell your house!

#cash home buyers#foreclosure#manchester nh#nashua nh#real estate#manchesternh#Manchester New Hampshire#Manchester NH Real Estate#Manchester NH Homes#NH Real Estate#Motivated Seller#sell my house fast#quick home sale#fast cash home buyers#need to sell my house fast#cash for houses#we buy houses#sell for cash#Inherited property#fixer upper#Vacant House#Behind on payments#tax liens#relocation#divorce#job loss#downsizing#home selling tips#home selling process#property

3 notes

·

View notes

Text

i was gonna have a delicious hotdog i was craving for days for all the wrong reasons but my digestive system decided to grieve the piece of lasagna i had last night like almost 24h later and i cannot tell you enough how disheartened i am rn

#3am posting#insaneposting#weirdcore#bastardcore#you know i used to have fun tagging these and knowing exactly my target audience with no kind of payment other than my satisfaction#payment aint exactly the word im looking for but i dont wanna think rn im still shitting in the toilet while writting this#but after well everything that's been happening in the world this silly frivolous thing just didnt make sense anymore#i used to just like tagging shit and seeing which weirdos would relate to it even if just enough to leave a like#but now it's just a bunch of nothing. it doesn't matter anymore. not even for a quick chuckle#what a weird little feeling it is

2 notes

·

View notes

Text

Anyone want a funny little pumpkin YCH? Any [humanoid] species, any gender, $25. Can be OCs or canon characters, I don't mind either. I'd like to fill two slots! If you're interested, shoot me a PM!

[pic on the right is a finished example, character belongs to @hiredpencil !!]

#my art#ych#pumpkin#halloween#these will be finished before monday :)#if you order REAL quick i can finish before today is over#payment is up front and through paypal!

16 notes

·

View notes

Text

i think all airline companies should be burnt to the fucking ground

#nearly £700 for a trip that's only 4 days for 2 people?!?!#you have to pay extra for fucking seats?!?#what the actual fuck are they even doing with that money#i'll tell you what they're NOT doing#and that's investing in a decent fucking website or app that fucking works#i am so fucking pissed#also they still havent fucking sent me a confirmation email so i havent even GOT my fucking tickets yet#but ohhhoho the £700 payment went through to them SUPER fucking quick hmmm fucking funny that#my sister is lucky i love her cos this is INSANE#anyway#fuck airlines fuck airports fuck boarders honestly

4 notes

·

View notes

Text

when i feel bad about myself i read my ebay buyers reviews

#fast payment#easy transaction#quick response#excellent buyer#thank u guys <33#if no one has got me i know i have the 40 year old men whom i buy records and books from !!!

4 notes

·

View notes

Text

Capifina: Smart Equipment Financing Options

Need new equipment but tight on budget? For many small business owners, purchasing new gear outright can cripple cash flow. That’s where our team steps in. With flexible equipment financing for small business needs, we helps you upgrade critical tools—whether it’s construction machinery, medical devices, or office technology—without draining your working capital. Their low-APR solutions are designed to make funding simple, fast, and tailored to your needs, so you can keep building your success with confidence.

Why Choose Capifina’s Equipment Financing for Small Business?

When it comes to securing the tools you need to grow, we offers a clear advantage. Their equipment financing for small business delivers a hassle-free experience with fast approvals, minimal paperwork, and personalized support. Unlike traditional lenders, ou financing institution tailors every solution to fit your business timeline, credit profile, and long-term growth strategy. Whether you're upgrading machinery, investing in new tech, or expanding your operations, this flexible financing option gives you access to the equipment you need—while preserving both your cash flow and credit lines.

What Is Equipment Financing for Small Business?

Equipment financing for small business refers to a strategic funding solution that allows companies to acquire essential machinery, tools, or technology through manageable, scheduled payments instead of a large upfront investment. This approach helps businesses—especially startups and growing enterprises—preserve their working capital while gaining access to the equipment they need to operate efficiently. With flexible terms and competitive interest rates, it’s an ideal option for companies looking to expand, upgrade, or replace outdated assets without disrupting cash flow.

Benefits of Equipment Financing for Small Business

Conserve cash by avoiding large upfront equipment purchases, keeping more liquidity in your business.

Spread costs over time with predictable monthly payments that fit your budget and ease financial planning.

Maintain working capital for essential day-to-day operations like payroll, inventory, and utilities.

Access modern, high-performing tools that boost productivity and operational efficiency.

Improve cash flow forecasting and minimize financial strain during growth phases.

Perfect for industries like construction, healthcare, and tech where equipment upgrades are ongoing.

How Small Businesses Use Equipment Financing

Upgrade aging construction machinery to maintain performance and safety without interrupting daily operations.

Acquire advanced medical or dental equipment to enhance patient care and expand service offerings in healthcare practices.

Finance retail tools like point-of-sale systems or inventory management software to improve efficiency and customer experience.

Equip offices with modern computers, servers, and printers for improved productivity and tech reliability.

Scale manufacturing operations using high-capacity, precision production tools.

Stay compliant by upgrading outdated hardware or software to meet industry regulations.

Grow Smarter with Capifina’s Flexible Equipment Financing

If you're looking to grow without draining your working capital, Capifina’s equipment financing for small business offers a smart solution. With a transparent process, competitive rates, and fast funding, you can upgrade essential tools without delay. Stay focused on scaling your operations while we handles the financing. Visit Capifina today to discover flexible funding options designed to help your business succeed—on your terms.

#Capifina#business equipment leasing#machinery loans#small business financing#tech equipment funding#medical equipment loans#flexible payment plans#commercial equipment finance#tools and equipment funding#office equipment financing#heavy equipment lease#quick approval business loans#low interest financing#upgrade business tools#SME equipment funding#lease-to-own equipment

0 notes

Text

This is what happened to a great-great grandmother of mine. She was an immigrant to the U.S. and had no formal education in English. Her husband worked on boilers. One day one blew and killed him, leaving her a widow with many children.

She couldn't get a decent job. She worked herself to an early grave trying to provide for her kids off the wages of an illiterate housecleaner, and her kids were left orphaned. My great-grandfather was sent first to an orphanage and then out on the orphan trains. Some of his siblings he never saw again.

When that great-grandfather grew up and married and had kids, he made damn sure that his daughters, and then granddaughters, had a college education. And that was a good thing, because his first daughter's husband left her and she was only able to provide for her daughter, my mother, because she had a college degree and could work as a teacher. My grandma's ex-husband did everything he could to discourage my mom, his daughter, from going to college, because he didn't believe in that sort of thing for women. My mom got her degree anyway, with the encouragement of her grandfather, and even though she was a homemaker for most of my childhood, she made sure me and my sisters went on for higher education too.

My husband and I both work. He temporarily lost his job earlier this year. Without my wages, we wouldn't have been able to pay the mortgage for those months he was without a job, and without my benefits, we wouldn't have had the health insurance I'm using right now, pregnant with our first child.

I don't care if you go to college or into the trades. But if you're a woman, you need a professional education. Even if your husband is a good man, and even (and perhaps especially) if you intend to be a homemaker.

maybe i’m a joyless bitch but i actually do NOT think it’s funny to see women being like “the house is just in my husbands name” or “my husband makes all the money” or “i don’t even know who our mortgage is with” or “the only bank account/credit card is his and i get an allowance” like i do NOT find that cute or romantic and i am begging these women to Stand Up. you should at least be named on the deed to your house and the title to your car and the bank accounts even if you don’t pay for them/earn all the money. you can’t stop existing in the eyes of the law and the credit unions simply because you have a husband. if you’re raising his children and washing his socks half of everything he’s got is yours and it needs to be yours LEGALLY BY NAME. "he takes such good care of me :)" girl you are a PRISONER!! that’s all

#Quick-start guide to your own finances:#1.) Set your bills to auto-pay. “Paying bills on time” stress can be a thing of the last century.#2.) For health insurance watch the Brian David Gilbert guide to health insurance. Then if your work has a plan sign up for one.#(Usually you will only need one of the standard plans on offer unless you or one of your dependents has medical issues.)#If your work doesn't have one then you'll have to look into the market.#3.) Retirement. Your work might have a plan; if so you'll want to contribute at least 10-15% of your paycheck if you can.#If your work has a matching plan (like with a 401k or 403b etc.) then find out whatever number they're willing to match (e.g. 3%)#you want to contribute whatever it takes to add to that number to hit 10-15% (so you contribute 7% they “match” i.e. contribute 3%.)#If your work doesn't have one look into someplace like Vanguard and get it set up on your own with auto-withdrawls. Again 10-15% is ideal.#IMHO if you don't know how to play the stock market don't do it yourself.#That's what your 401k is for. Let the people in charge of it handle it.#The stock market will rise and fall; ignore any panics and just keep chucking 10-15% of your paycheck in there each month.#4.) Credit cards: Only use them if you can use them like a debit card.#They're great for building credit but NOT if you can't pay your monthly statement balance.#Never do minimum payments. Always try to do your statement balance. Set it to auto-pay if you can.#Remember that anything you don't pay off that statement balance from last month you have to pay next month PLUS the 15-20% interest.

40K notes

·

View notes

Text

Capifina|How Business Line of Credit Keep Cash Flow Positive

Unlock Financial Flexibility with Capifina’s Business Line of Credit, Maintaining positive cash flow is essential for business success. A business line of credit offers financial flexibility, helping companies manage unexpected expenses, seize growth opportunities, and maintain working capital. At Capifina, we provide tailored business funding solutions to keep your operations running smoothly. Whether you need short-term liquidity or ongoing support, our revolving credit options ensure you have access to funds exactly when you need them, allowing your business to stay financially stable and prepared for future opportunities.

Why Choose Capifina for Your Business Line of Credit?

Capifina provides businesses with a dependable source of working capital, ensuring financial stability and flexibility. With a business line of credit, companies can borrow, repay, and borrow again as needed, offering revolving credit access for ongoing financial support. Flexible repayment terms align payments with cash flow, while quick access to funds ensures businesses secure financing when needed. Additionally, lower interest costs mean paying interest only on the amount used. This funding option supports business growth, making it easier to invest in inventory, payroll, or expansion without disrupting cash flow.

What is a Business Line of Credit?

A business line of credit is a revolving credit option that allows businesses to borrow up to a predetermined limit and repay on flexible terms. Unlike traditional loans, it offers financial flexibility, enabling businesses to withdraw funds only when needed. This makes it an excellent solution for managing seasonal fluctuations, covering operational costs, or handling unexpected expenses. By maintaining access to working capital, businesses can ensure smooth operations while keeping debt levels manageable and avoiding unnecessary financial strain.

Benefits of a Business Line of Credit

Improved Cash Flow – Maintain a steady cash flow by covering short-term expenses and managing day-to-day operations without financial strain.

Financial Flexibility – Access funds whenever needed without the hassle of reapplying for loans, ensuring seamless business operations.

Lower Borrowing Costs – Pay interest only on the amount used, reducing overall borrowing expenses and improving financial efficiency.

Fast Approval Process – Secure funds quickly with a streamlined application

Supports Business Growth – Invest in payroll, inventory, or expansion, ensuring long-term success and stability.

How to Use a Business Line of Credit Effectively

Cover Seasonal Expenses – Manage cash flow fluctuations effectively during peak and off-peak seasons, ensuring your business runs smoothly year-round.

Invest in Growth – Use funds to expand operations, purchase essential inventory, or hire staff to support business development.

Handle Unexpected Costs – Be prepared for emergencies or unforeseen expenses without putting a strain on your finances.

Take Advantage of Opportunities – Secure funding to seize new projects, negotiate bulk discounts on supplies, or invest in strategic business opportunities.

Secure the Best Business Line of Credit with Capifina

A business line of credit is an essential tool for maintaining financial flexibility and keeping operations running smoothly. At Capifina, we offer customized business funding solutions designed to help you manage cash flow, cover expenses, and invest in growth. Whether you need short-term support or long-term stability, we’re here to help. Visit Capifina today to explore your financing options and keep your business thriving!

#Capifina#Business credit line#Small business financing#Revolving credit#Working capital solutions#Business funding options#Flexible financing#Cash flow management#Short-term business loans#Credit line approval#Financial flexibility#Interest-only payments#Capital access#Quick business loans#Business liquidity#Alternative financing

0 notes