#Risks Associated with Perpetual Futures Contracts

Text

Unlocking Perpetual Futures Contracts: Essential 2024 Guide for Beginners

Are you ready to take your trading to the next level with a financial instrument that offers endless opportunities and flexibility?

Perpetual futures contracts have emerged as a revolutionary tool in the trading arena, particularly for cryptocurrency enthusiasts. These contracts, unlike traditional futures, do not have an expiration date, allowing traders to hold positions indefinitely. This feature provides a significant advantage, enabling continuous trading and the ability to take advantage of long-term market trends. The funding rate mechanism, which periodically adjusts to keep contract prices in line with the spot prices of the underlying assets, ensures a balanced and fair trading environment.

Leverage is a key feature of perpetual futures contracts, allowing traders to control larger positions with a smaller capital investment. This can significantly amplify profits, but also poses a risk of larger losses, making risk management a crucial aspect of trading these contracts. The real-time mark-to-market settlement process adjusts traders' margin balances continuously, ensuring that gains and losses are promptly accounted for. This mechanism helps prevent sudden liquidations and keeps traders informed about their margin requirements.

Despite the numerous benefits, perpetual futures come with their own set of risks, including market volatility and fluctuating funding rates. Traders must have a solid understanding of these risks and employ effective strategies to mitigate them.

Intelisync, a pioneer in blockchain technology and exchange development, offers advanced solutions to enhance the security and functionality of perpetual futures trading. Explore how Intelisync can enhance your trading experience and provide the tools you need to succeed in the dynamic world of perpetual futures.

Discover how Intelisync can transform your trading journey and provide you with the tools needed to succeed in the dynamic world of perpetual futures. Contact Intelisync today! Ready to revolutionize your trading journey? Contact Intelisync today and Learn more....

#Advantages of Perpetual Contracts#Crypto Market Liquidity#Cryptocurrency Trading#Funding Rate#Funding Rate Mechanism#Futures Trading Guide#How do Future contract work?#How does trading on perpetual contracts work?#Intelisync Blockchain solution#Main Features of Perpetual Futures#Margin Requirements#Market Volatility#PERP DEX Development: Intelisync’s Expertise in Perpetual Future Contracts#perpetual futures trading.#Perpetual Futures vs. Traditional Futures#Risks Associated with Perpetual Futures Contracts#Trading Strategies#What is Perpetual Futures Contracts

0 notes

Text

Vaccines: The Unsung Heroes of Modern Medicine

Ah, vaccines, those delightful concoctions of scientific marvel that so many seem to inexplicably vilify. Indeed, in an age where ignorance is often worn as a badge of honor, it is imperative to extol the virtues of these minuscule miracles. Vaccines, the unsung heroes of modern medicine, have achieved what the mightiest of warriors and the most eloquent of diplomats could not: the near-eradication of pernicious diseases that once decimated populations with impunity.

Consider, if you will, the formidable polio virus. In the pre-vaccine era, this insidious pathogen wreaked havoc, leaving countless in a state of perpetual paralysis. Yet, thanks to the advent of the polio vaccine, cases have plummeted by a staggering 99%, relegating this scourge to the annals of history in most parts of the world. Similarly, the measles vaccine has orchestrated a precipitous decline in mortality, saving an estimated 21.1 million lives between 2000 and 2017. Such statistics are not mere numbers; they represent the cessation of unimaginable suffering and the preservation of human potential.

Yet, in the grand theater of the absurd, there are those who decry vaccines as the harbingers of doom. Their arguments, oftentimes, are predicated on anecdotal evidence and a profound misunderstanding of scientific rigor. Adverse reactions, while existent, are exceedingly rare and typically manifest as mild, transient phenomena. The likelihood of a severe reaction to a vaccine is approximately one in a million—akin to the probability of being struck by lightning. Comparatively, the risks associated with contracting vaccine-preventable diseases are exponentially greater, a fact conveniently overlooked by the purveyors of misinformation.

To elucidate further, the adverse reactions to vaccines are meticulously documented and scrutinized. The vast majority of these reactions are minor, such as a sore arm or a low-grade fever, ephemeral inconveniences when juxtaposed with the potential lethality of diseases like diphtheria, pertussis, and influenza. In stark contrast, the complications arising from these diseases can be catastrophic, encompassing severe neurological damage, chronic respiratory issues, and death. The evidence is unequivocal: the benefits of vaccination vastly outweigh the risks.

In a world beleaguered by misinformation, it is imperative to recognize the otiose nature of arguments against vaccines. Such arguments, devoid of empirical support, serve only to obfuscate the truth and endanger public health. The science of vaccines is not a matter of opinion but of incontrovertible fact, a testament to human ingenuity and resilience.

Thus, let us celebrate vaccines for what they are: the protectors of our progeny, the bastions of public health, and the quintessence of scientific achievement. In the grand tapestry of human progress, vaccines are the threads that bind us together, safeguarding our collective future against the capricious whims of nature.

#otiose#science#disease#immunity#vaccine#bacteria#virus#pathogens#climate change#scientific-method#reality#facts#evidence#research#study#knowledge#wisdom#truth#honesty

0 notes

Text

The Perils of Procuring Fake Driver's Licenses Online

Introduction

In the digital age, the allure of Buy driver's lience online obtaining a driver's license with the click of a button has become increasingly tempting for many individuals. However, the practice of purchasing fake or forged driver's licenses online is fraught with legal, ethical, and personal risks that far outweigh any potential benefits. This comprehensive article examines the dangers of this illicit trade, the consequences of engaging in it, and the importance of obtaining a legitimate driver's license through proper channels.

The Lure of Buying Driver's Licenses Online

The desire to obtain a driver's license quickly and conveniently has driven some individuals to seek out online vendors offering counterfeit or fraudulent documents. This trend is fueled by various factors, including:

The Promise of Immediate Gratification

Online marketplaces, particularly those on the dark web, often promise fast and discreet delivery of forged driver's licenses, appealing to those who are unwilling or unable to navigate the traditional application process.

Circumventing Age Restrictions

Underage individuals may be tempted to purchase fake driver's licenses to gain access to activities or privileges typically reserved for those of legal driving age.

Overcoming Bureaucratic Obstacles

Some individuals may perceive the online purchase of a forged driver's license as a way to bypass the time-consuming and sometimes complex requirements of the traditional licensing system.

Anonymity and Perceived Ease of Access

The anonymity and perceived accessibility of the online marketplace can create a false sense of security, leading some to believe that the risks of purchasing a fake driver's license are minimal.

The Dangers of Buying Fake Driver's Licenses Online

Legal Consequences

Purchasing, possessing, or using a forged or counterfeit driver's license is a serious criminal offense in most jurisdictions, often carrying heavy fines and the potential for imprisonment.

Implications for Road Safety

Individuals driving with fake licenses lack the proper training, knowledge, and skills required to operate a motor vehicle safely, putting themselves and others at significant risk of accidents and injury.

Financial Risks and Identity Theft

The personal information used to create a fake driver's license can be exploited for identity theft, leading to financial losses, credit damage, and further criminal activities under the victim's name.

Limitations on Future Opportunities

A criminal record associated with the possession or use of a forged driver's license can have long-lasting consequences, potentially limiting future employment, educational, and travel opportunities.

Potential for Detention and Deportation

For non-citizens, the use of a fake driver's license can result in detention, deportation, and the revocation of legal immigration status.

The Ethical Dilemma of Buying Fake Driver's Licenses

Undermining the Integrity of the Licensing System

The widespread use of forged driver's licenses undermines the credibility and effectiveness of the entire licensing system, compromising public safety and eroding trust in government institutions.

Contributing to Organized Crime and Corruption

The demand for fake driver's licenses fuels the operations of criminal networks involved in the production and distribution of these fraudulent documents, perpetuating a cycle of illegal activity.

Disregard for the Rule of Law

Purchasing a fake driver's license involves a deliberate violation of the law, demonstrating a disregard for the principles of good governance and the social contract that binds citizens to their communities.

Moral Implications for Personal Responsibility

The decision to buy a fake driver's license reflects a failure to take personal responsibility for one's actions and the potential consequences that may result.

Alternatives to Buying Fake Driver's Licenses Online

Navigating the Legitimate Licensing Process

Individuals should familiarize themselves with the proper procedures for obtaining a driver's license in their respective jurisdictions, including any necessary documentation, testing requirements, and fees.

Seeking Assistance from Authorized Agencies

Government agencies, driving schools, and other authorized institutions can provide guidance and support to individuals navigating the driver's license application process.

Exploring Alternative Transportation Options

In some cases, individuals may be able to rely on public transportation, ride-sharing services, or other modes of travel to meet their transportation needs without the need for a driver's license.

Conclusion

The temptation to purchase a fake driver's license online may seem like a quick and convenient solution, but the risks and consequences far outweigh any potential benefits. By understanding the legal, ethical, and personal dangers associated with this illicit trade, individuals can make informed decisions that prioritize public safety, the rule of law, and their own long-term well-being. Ultimately, the responsible choice is to obtain a legitimate driver's license through the proper channels, ensuring that one's right to operate a motor vehicle is earned through the proper training and testing, rather than obtained through fraudulent means.

0 notes

Text

Complex Securities Valuations: Your Go-to Guide

In today’s ever-evolving financial landscape, the investment universe has expanded beyond traditional stocks and bonds to include a wide array of complex securities. These instruments, such as earnouts, exotic options, phantom shares, rollovers, SAFEs and hybrid financial interests, provide unique advantages, but can also be difficult to accurately value. This blog will discuss the complexities that one needs to be aware of for Complex Securities Valuations, along with the methods, considerations, and risks associated with it.

Understanding the realm of Complex Securities:

Complex securities are financial instruments or assets with intricate and often non-standard features or structures. Some of these instruments can result in non-standard payouts and may incorporate various elements to meet specific investment objectives or risk profiles.

These types of assets are becoming increasingly popular among corporates and startups for fund-raising, employee benefits, M&A, transactions, and external financing. These complex securities often incorporate various financial derivatives or structured elements, making their valuation and risk assessment more complex. Valuation Services for these complex securities are hence gaining importance in today’s economy for various accounting, reporting, and taxation purposes and often have significant implications. Some common examples of complex securities include:

1. Derivative Instruments

Options, swaps, futures, and other derivative contracts can be considered complex securities.

2. Convertible Securities

These are bonds or preferred stocks that can be converted into common stock. The conversion terms and conditions can add complexity. Some complex forms of equity include preferred shares, profits interests, warrants, etc.

3. Structured Products

These are securities created by bundling various financial assets and derivatives. They may include collateralized debt obligations (CDOs), mortgage-backed securities (MBS), and other structured notes.

4. Hybrid Securities

These securities combine characteristics of both debt and equity. For example, perpetual bonds may have no maturity date, blurring the line between debt and equity.

Why are Complex Securities Valuations required?

1. Risk Assessment

Complex securities often come with intricate features and underlying assets, making it challenging to assess their associated risks. Valuation helps investors and financial institutions gauge the potential risks involved in holding or trading these securities.

2. Regulatory Compliance

Financial regulators and accounting standards often require the valuation of complex securities to ensure transparency and accurate reporting. Compliance with these regulations is essential for financial institutions and investment funds.

3. Investment Decision-Making

Investors need accurate valuations to make informed decisions about buying, selling, or holding complex securities. The valuation process provides insights into whether a security is overvalued, undervalued, or fairly priced.

4. Financial Reporting

For companies that hold complex securities on their balance sheets, accurate valuations are necessary for financial reporting purposes. This includes determining fair values for financial statement disclosure and compliance with accounting standards (e.g., International Financial Reporting Standards - IFRS or Generally Accepted Accounting Principles - GAAP).

5. Investor Confidence

Providing transparent and reliable valuations of complex securities enhances investor confidence. When investors trust the valuation process and the information provided, they are more likely to participate in the market.

6. Portfolio Management

Portfolio managers and fund managers need to value the various assets held within their portfolios, including complex securities. Accurate valuations help them assess portfolio performance, make allocation decisions, and manage risk.

Complex Securities Valuations Methodologies

In the case of complex securities, the pay-off or the future expected outflow is non-linear, and hence the traditional approach of projecting one likely situation doesn’t work. Further, the risk of non-linearity cannot be adjusted to the discount rate. Some of the common methodologies used by providers of valuation services for determining the fair value of complex securities are:

1. Black-Scholes Model

The Black-Scholes model is a widely used theoretical option model for valuing complex securities such as options, warrants, and conversion elements with a variety of features. The model considers the parameters of stock price, exercise price, time, volatility, and risk-free rate to determine the price of the security. The Black-Scholes model has the following critical inputs: the total equity value for the company, the exercise price for each breakpoint, the expected time to liquidity, the volatility of the equity for the company, and the risk-free rate.

The Black-Scholes Model makes several assumptions, including constant volatility, no dividends, and continuous trading. It is important to note that these assumptions may not always hold in real-world scenarios.

2. Binomial Model

The Binomial Model is a numerical method used to value complex securities such as options, warrants, and conversion elements with a variety of features. The model is based on the description of an underlying instrument over a period, rather than a single point, making it able to handle a variety of conditions for which other models cannot easily be applied. The Binomial Model combines an option with the underlying asset to create a risk-free portfolio in which the proportion of the option to the underlying security is adjusted to eliminate risk. The Binomial Model is used to value American options that are exercisable at any time in a given interval as well as Bermudan options that are exercisable at specific instances of time.

The Binomial Model can handle various features, such as dividends, early exercise, and different interest rates for borrowing and lending. It provides a flexible framework for valuing a wide range of financial derivatives.

3. Monte Carlo Simulation

Monte Carlo Simulation is a computational technique used to model and analyze complex systems through random sampling. It is particularly useful in finance for valuing options, pricing derivatives, and assessing risk. The method derives its name from the Monte Carlo Casino in Monaco, known for its games of chance and randomness.

The Monte Carlo Simulation method uses a model to simulate the possible outcomes of a security based on different scenarios. The model considers the underlying assets, market conditions, and other variables to determine the fair market value of the security. Monte Carlo Simulation is a flexible method that can handle complex securities with multiple variables and uncertainties. The method is particularly useful for securities that are not traded frequently, making it difficult to obtain market data to determine their fair market value.

The number of trials for Monte Carlo Simulation is an important consideration in determining the accuracy of the valuation. The optimal number of trials depends on the complexity of the security and the desired level of accuracy. Monte Carlo Simulation is a powerful tool for valuing complex securities, but it requires a thorough understanding of the underlying assets and market conditions to produce accurate results.

One of the main advantages of Monte Carlo Simulation is its flexibility and ability to handle complex, non-linear models with multiple sources of uncertainty.

Monte Carlo Simulation is widely used in finance for various purposes, including:

Option Pricing: Valuing options and other financial derivatives under uncertainty.

Portfolio Management: Assessing the risk and return of investment portfolios.

Financial Forecasting: Generating probabilistic forecasts for financial metrics.

Risk Management: Evaluating the impact of various risks on financial performance.

Challenges in complex securities valuation

Valuing complex securities presents numerous challenges due to their unique characteristics, intricate cash flow patterns, and the inherent uncertainty in financial markets. Some of the key challenges in complex securities valuation include:

Lack of Market Liquidity: Many complex securities trade infrequently, if at all, leading to illiquidity. This lack of market liquidity can make it difficult to obtain accurate and up-to-date market prices, which are essential for valuation.

Parameter Estimation: Models require input parameters, such as volatility, interest rates, and correlation coefficients. Estimating these parameters accurately is challenging, and small changes in parameter values can significantly affect the valuation result.

Complex Payoff Structures: Many complex securities, such as exotic options or structured products, have intricate payoff structures that depend on various contingent events. Evaluating these structures requires advanced modeling techniques.

Model Risk: Valuation often relies on mathematical models, such as the Black-Scholes model or Monte Carlo simulations. These models make simplifying assumptions about market dynamics and may not fully capture the complexities of real-world markets, leading to model risk.

Credit Risk: Complex securities often involve credit risk, where the issuer’s ability to make payments or meet obligations may be uncertain. Valuing the credit risk component of these securities accurately can be challenging, especially for securities with embedded credit derivatives.

Market Assumptions: Valuation models often assume that market participants are rational and that asset prices follow certain stochastic processes. These assumptions may not hold in all market conditions, especially during crises or periods of extreme volatility.

Conclusion

The valuation of complex securities is a complex and nuanced process that requires a deep understanding of financial markets, mathematical modeling, and risk management. As the financial industry continues to innovate, the importance of accurately valuing complex securities becomes even more critical. Investors and financial professionals must remain vigilant, adapt to changing market conditions, and apply rigorous valuation methods to navigate the complexity and uncertainty inherent in these instruments.

At ValAdvisor, our dedicated team of experts specializes in determining the value of a business or assets, for transactional, accounting, taxation, regulatory, financing, distressed asset resolution, litigation, insurance, strategic, planning, and operational purposes. Our expertise in various advanced models and simulation techniques helps us in delivering reliable and accurate valuations. Count on us to provide tailored solutions that empower you to make informed decisions with confidence.

Blog Source :- https://valadvisor.com/complex-securities-valuations-your-go-to-guide/

0 notes

Text

does vpn work with bitmex

🔒🌍✨ Get 3 Months FREE VPN - Secure & Private Internet Access Worldwide! Click Here ✨🌍🔒

does vpn work with bitmex

VPN compatibility with BitMEX

When it comes to trading on BitMEX, ensuring your online privacy and security is crucial. One way to enhance your security measures is by using a Virtual Private Network (VPN) while accessing the BitMEX platform.

A VPN encrypts your internet connection and routes it through a server in a location of your choice, masking your IP address and making it appear as if you are accessing the internet from a different location. This added layer of security helps protect your personal information and online activities from prying eyes, including hackers and potential cyber threats.

Using a VPN with BitMEX offers several advantages. Firstly, it helps safeguard your trading activities and sensitive information from potential cyber attacks. By encrypting your connection, a VPN prevents third parties from intercepting your data and monitoring your online behavior. This is especially important when trading cryptocurrencies, as the industry is often targeted by hackers due to its decentralized and digital nature.

Moreover, a VPN can also help you bypass geo-restrictions and access BitMEX from anywhere in the world. Some regions impose restrictions on cryptocurrency trading platforms like BitMEX, making it challenging for users to access their accounts. By connecting to a VPN server in a different location, you can circumvent these restrictions and trade on BitMEX without any limitations.

In conclusion, using a VPN with BitMEX is a smart choice for traders looking to enhance their online security, protect their privacy, and access the platform from any location. By encrypting your connection and masking your IP address, a VPN provides peace of mind while navigating the volatile world of cryptocurrency trading.

BitMEX functionality with VPN

BitMEX is a popular cryptocurrency trading platform known for its advanced trading features and high leverage options. However, due to regulatory restrictions, BitMEX is not available in certain countries. One way traders in these restricted regions can access BitMEX is by using a Virtual Private Network (VPN).

A VPN allows users to mask their IP address and connect to servers in countries where BitMEX is accessible. By using a VPN to access BitMEX, traders can enjoy the platform's full functionality, including trading various cryptocurrencies, futures contracts, and perpetual swaps.

When using a VPN with BitMEX, it's essential to choose a reliable VPN service provider to ensure security and privacy. Traders should opt for VPNs that offer strong encryption, a no-log policy, and a kill switch feature to protect their data and identity while trading on BitMEX.

While using a VPN to access BitMEX can help traders bypass geographic restrictions, it's important to note that this practice may violate BitMEX's terms of service. Users should be aware of the legal implications and risks associated with using a VPN to access restricted platforms like BitMEX.

In conclusion, leveraging a VPN to access BitMEX can provide traders in restricted regions with the opportunity to utilize the platform's features and potentially benefit from cryptocurrency trading. However, traders should proceed with caution and consider the potential risks involved in using a VPN for this purpose.

VPN integration for BitMEX trading

Title: Enhancing BitMEX Trading Security with VPN Integration

In the realm of cryptocurrency trading, security is paramount. With hackers constantly probing for vulnerabilities, traders must employ robust measures to safeguard their assets. One such method gaining traction is the integration of Virtual Private Networks (VPNs) into BitMEX trading practices.

BitMEX, a leading cryptocurrency derivatives trading platform, offers traders the opportunity to engage in leveraged trading of various digital assets. While BitMEX employs advanced security protocols, traders can further fortify their defenses by utilizing VPNs.

A VPN creates a secure, encrypted connection over the internet, effectively masking the user's IP address and encrypting data transmission. By connecting to a VPN server, traders can obscure their location and browsing activity from potential threats, including hackers and surveillance entities.

Integration of VPNs into BitMEX trading provides several key benefits. Firstly, it enhances privacy by preventing third parties from monitoring trading activities and accessing sensitive information such as account credentials and transaction details. Additionally, VPNs mitigate the risk of Distributed Denial of Service (DDoS) attacks by hiding the trader's IP address, making it more difficult for attackers to target their trading activities.

Furthermore, VPNs enable traders to bypass geo-restrictions that may hinder access to BitMEX in certain regions. By connecting to servers located in permitted jurisdictions, traders can ensure uninterrupted access to the platform, regardless of their physical location.

However, traders must exercise caution when selecting a VPN provider, opting for reputable services with strong encryption protocols and a strict no-logs policy to safeguard their data effectively.

In conclusion, VPN integration offers BitMEX traders an additional layer of security, privacy, and accessibility. By harnessing the power of VPNs, traders can mitigate potential risks and trade with confidence in the ever-evolving landscape of cryptocurrency markets.

BitMEX accessibility via VPN

When it comes to accessing BitMEX via VPN, users often resort to using a Virtual Private Network (VPN) to bypass any potential restrictions imposed by their geographic location. BitMEX is a popular cryptocurrency trading platform that offers advanced trading tools and features to its users. However, due to regulatory restrictions or limitations in certain countries, accessing BitMEX directly may be challenging for some individuals.

By utilizing a VPN, users can mask their IP address and connect to a server located in a different region where BitMEX is accessible. This allows individuals to circumvent any geo-blocks or restrictions that may prevent them from accessing the platform. It is important to note that while using a VPN can help users bypass these restrictions, it is crucial to comply with the platform's terms of service and any local regulations regarding cryptocurrency trading.

When selecting a VPN provider for accessing BitMEX, users should consider factors such as server locations, connection speed, and security features. Opting for a reputable VPN service that offers strong encryption protocols and a strict no-logs policy can help ensure data privacy and security while trading on BitMEX.

Overall, using a VPN to access BitMEX can be a viable solution for individuals looking to trade cryptocurrencies on the platform despite any access limitations in their location. By taking the necessary precautions and choosing a reliable VPN provider, users can enjoy a seamless trading experience on BitMEX from anywhere in the world.

VPN performance on BitMEX trading platform

Title: Maximizing VPN Performance for Seamless BitMEX Trading

BitMEX, the popular cryptocurrency trading platform, offers traders the opportunity to engage in leveraged trading of various digital assets. While BitMEX provides a secure environment for trading, some users prefer to enhance their privacy and security by using a Virtual Private Network (VPN). However, it's crucial to understand how VPNs can impact performance when trading on BitMEX.

One of the primary concerns when using a VPN on BitMEX is latency. VPNs route your internet connection through servers located in different geographical regions, which can introduce latency or delay in data transmission. This latency can affect the execution speed of trades, potentially leading to missed opportunities or slippage.

To mitigate latency issues, traders should choose a VPN provider known for its high-speed servers and low latency connections. Opting for a VPN server located close to the BitMEX servers can also help minimize latency.

Furthermore, VPN encryption protocols can impact performance. While encryption is essential for securing your data and maintaining privacy, it can also introduce overhead and slow down internet speeds. Traders should select VPN protocols that strike a balance between security and performance, such as OpenVPN or IKEv2/IPsec.

Additionally, VPN server congestion can affect performance during peak trading hours. Choosing a VPN provider with a large network of servers and dynamic server allocation can help distribute traffic more efficiently, reducing the risk of slowdowns or bottlenecks.

In conclusion, while using a VPN can enhance privacy and security when trading on BitMEX, traders must consider its impact on performance. By selecting a high-speed VPN provider, optimizing server locations, and choosing appropriate encryption protocols, traders can enjoy seamless trading experiences while safeguarding their online activities.

0 notes

Text

Decoding Cryptocurrency Dynamics: The Significance and Functionality of Perpetual Future Contracts

Introduction:

Perpetual futures contracts have become a focal point in the crypto derivative landscape, captivating traders with their unique features and potential rewards. In this article, we delve into the strategies employed by traders to navigate the complexities of perpetual futures, unraveling the advantages and disadvantages inherent in these dynamic financial instruments.

Strategies for Trading Perpetual Futures:

Speculation Strategy:

Objective: High-risk, high-reward speculation on future price movements.

Execution: Traders assume long or short positions based on anticipated asset price movements.

Example: Taking a long position on Bitcoin if anticipating an upward price movement.

Arbitrage Strategy:

Objective: Exploiting price disparities between perpetual futures and the spot market for profit.

Execution: Buying and selling assets at different periods or simultaneously in different markets.

Hedging: Traders utilize perpetual futures to protect existing positions, minimizing losses in the event of adverse market trends.

Trend Trading: Identifying market trends through technical analysis, traders align positions with the prevailing trend and exit as trends reverse.

Advantages and Disadvantages:

Advantages:

No expiration date, allowing indefinite position holding.

Cash settlements and leverage options enhance liquidity.

Effective hedging possibilities for risk reduction.

Disadvantages:

Potential for substantial losses alongside profit opportunities.

High counterparty risks in unregulated environments.

Not ideal for novice traders due to elevated risks.

Conclusion: Perpetual futures contracts offer a compelling avenue for traders, characterized by their unique features and opportunities. While the absence of an expiration date and leverage options provide flexibility and profit potential, traders must navigate the associated risks diligently. A comprehensive understanding of perpetual futures contracts is crucial for leveraging their benefits while mitigating potential downsides.

0 notes

Text

Bitcoin Miners Experience Stock Drop after Late-Night Crash: Volatility and Halving Worries

Bitcoin miners saw a significant drop in their stock value following a late-night crash in Bitcoin's price. After trading above $43,900 earlier in the day, the value of Bitcoin dropped to $40,900 in just a matter of minutes. This sudden decline impacted mining companies, as they generate Bitcoin through mining operations and hold it on their balance sheets. The leveraged nature of the industry meant that the drop in Bitcoin's price affected both their income statements and balance sheets. Trading on weekends often has less liquidity, which contributed to the larger price movement.

Miners were hit harder than Bitcoin itself as they are a leveraged play on the industry, relying on mining operations and holding Bitcoin as assets. Investors are also concerned about the upcoming Bitcoin halving in 2024, which will reduce the number of Bitcoins miners receive per block and lower the profitability of mining companies. The exact cause of the late-night drop in Bitcoin's price is unclear, but it has been suggested that funding rates of perpetual futures contracts may have played a role in the decline. Funding rates, which indicate market leverage, dropped, signaling reduced leverage from previously bullish traders.

Bitcoin is a volatile asset, and it is important for investors to understand the risks associated with both the cryptocurrency itself and the mining industry. While Bitcoin is often viewed as a store of digital value and a trading asset, there are concerns about its practicality as a form of payment compared to other cryptocurrencies and blockchains that offer faster and more efficient transactions. Given the current market conditions and the upcoming halving, buying mining stocks is considered risky. A significant decline in revenue from each block mined could put these companies in a precarious position.

Source: Read more

p { text-align: justify; } .source { text-align: right; font-size: 12px; color: #888; }

0 notes

Text

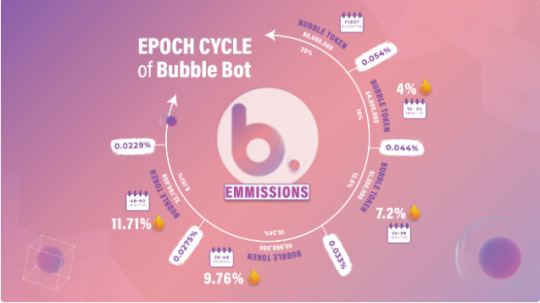

Bubblebot

In a single Telegram bot, Bubblebot offers a full range of services, including spot trading, futures trading, multi-token staking, and hedging/risk management for several crypto assets. The goal of this all-in-one platform is to provide traders and cryptocurrency fans with a practical and adaptable experience.

Our main goal is to strengthen the Telegram bot ecosystem, promoting development and innovation within this thriving community. We are dedicated to giving our consumers a rich and satisfying experience so they may explore the many opportunities presented by Bubble Token.

BubbleBot has many features to boost your chances of success

· The main problem with on-chain trading is that it suffers from limited liquidity. Due to low liquidity, forced liquidations may occur as a result of pricing and financing manipulations. As a result, market makers (MMs) don’t always have an incentive to provide liquidity on the blockchain.

· These contracts provide the same flexibility as traditional futures or perpetual contracts, allowing for long and short trades throughout their duration.

· Trading cryptocurrencies may be difficult, whether you’re using a controlled exchange (CEX) or a decentralized exchange (DEX). Like the need for collateral, weighing risks, interest rates, liquidity, and the unknown nature of regulations.

· Self-directed trading calls for expertise in technical and fundamental analysis, trading methods, and risk management, as well as the willingness to make all trading choices independently. The human emotions of greed and fear might influence trading decisions.

· Stablecoins are susceptible to risk due to the likelihood of their peg breaking, which would result in a decrease in value relative to the underlying asset due to factors such as market circumstances, liquidity concerns, and regulatory changes.

· Tokens staked by one user will provide rewards in the same token staked by another user, thus the name “single token staking rewards.” This method is simple, however Multi-Token staking presents more of a challenge and potentially higher rewards for the community as a whole.

· The Bitcoin industry is full of inflationary initiatives. In which fresh tokens are generated and added to the existing supply on a regular basis.

A DeFi insurance system called Hedge/Risk enables outside users to make predictions about the performance of different pegged assets, including USDC, DAI, USDT, and countless other stable tokens, based on those assets’ prior performance data.

Bubblebot is an innovative multi-token staking platform that is closely associated with bot tokens. By utilizing the capabilities of multi-token technology on the Ethereum network, anyone within the community has the opportunity to safely deposit their Bubble tokens into Bubble bot staking pools. Consequently, individuals have the potential to get rewards in many bot token currencies, including UniBot, OCD, AIM Bot, and ETH. Bubblebot functions as the primary staking token for any BOT token currencies that implement a comparable approach. The website offers users the opportunity to access a wide range of staking pools that cater to their individual interests and investment objectives.

It’s critical for you to evaluate your trading patterns as a member of the Bubblebot community, whether you trend toward riskier or more volatile trading, and choose the techniques that best meet your goals. Our Hedge/Risk vault uses a bubble-catastrophe bond (BCP) to make this procedure easier. The BCP bond is an essential financial tool that rewards users for conducting thorough analyses and evaluating the durability of pegged crypto assets. Users who correctly estimate the value of the underlying asset are rewarded with BCP. Users also have the choice to protect themselves against pegged assets by investing ETH in exchange for $Bubble tokens.

Users initially have the choice to protect themselves against a small selection of cryptocurrencies, such as USDC, USDT, and DAI. The future expansion of this product is predicted, nevertheless.

Consider the case when a user is concerned that the stablecoin USDT would deviate from its market-pegged value. They have the choice in this scenario to place some of their ETH as collateral in the Bubble vault. They receive Bubble tokens in exchange, which would appreciate in value if the stablecoin USDT really deviates from its fixed price.

Highly secure, convenient, and sustainable are all characteristics of bubble farms. The neighborhood may invest in these farms with confidence and perhaps earn an amazing APR of up to 9,860% over each seven-day period. It’s important to note that the smart contracts powering these farms have passed meticulous audits to make sure there are no security flaws, giving customers additional piece of mind.

For more information visit:

Website

Whitepaper

Twitter

Telegram

Discord

AUTHOR

Bitcoin talk Username: Caplex

Bitcoin talk profile link: https://bitcointalk.org/index.php?action=profile;u=3414222

BEP-20 Wallet Address: 0x93eB3A28E59a6541A5fa9d27e84dA1c7abb3ceCE

0 notes

Text

This big news enthused every crypto enthusiast this week. Coinbase International Exchange obtained the license to facilitate futures trading on its platform. The Bermuda Monetary Authority (BMA) had already granted the exchange a Class F license. For so many years, this has been a landmark moment for the entire crypto industry. Let’s find out why this news has a great impact on the crypto space.

A Big Step For Coinbase And Crypto Industry

Coinbase has been trying to bring mainstream trading into the crypto sphere for some time now. It made crypto derivatives services accessible to institutional users in May 2023. With this regulatory approval, it would now give customers entry to duly regulated perpetual futures contracts. On this occasion, the exchange stated that 75% of its crypto trading volume comes from the derivatives market.

The offering of futures contracts empowers the exchange to approach mainstream traders. It enables them to reach more traders in the crypto derivates domain. So far, this niche has been dominated by institutional entities only. But now, it would be more democratic and better. It would allow the platform to offer more liquidity to its traders. Furthermore, they would be doing everything under the regulatory ambit.

Available For Non-US Coinbase Users Only Now

Though the exchange has received major approval, it can’t serve US customers now. As per the sanction conditions, the exchange can offer services only to non-US customers. Investors from select nations will have to first go through the eligibility assessment. Once they make the grade, they will be able to invest in the instruments.

Notably, Coinbase International procured another important approval from the National Futures Association a little earlier. The body allowed the exchange to offer crypto futures exclusively to qualified institutional entities from the US. And now, it has gotten one step ahead with the permit to offer perpetual futures to retail customers. Though it’s limited in nature, the regulatory nod means a lot for the platform.

Significance Of This Event In Crypto Space

It marked a critical point in the crypto sphere and broadened its possibilities. Now, retail traders will also be able to access the derivatives market. However, there are a few factors that might be a little worrying for some. First of all, retail investors will now be exposed to more risks of losses. Of course, they’ll willingly make these choices. But the possibility has arisen because of this regulatory nod.

Secondly, the ongoing battle with the SEC puts Coinbase in a tentative position. If the verdict doesn’t go in its favor, investors will find it difficult to rely on the exchange. Despite all that, it’s a big step for a lot of crypto users. It also brings limitless possibilities for the crypto sphere as its trading range has widened. Traders are happy because they will have more options now. They’ll invest in major instruments using their digital assets.

More options and a wider scope make trading better for sure. However, one has to wait and see how this pans out for the crypto space.

0 notes

Text

Merkle Tree: Turnkey digital asset mining operations; focused on building, operating, and maintaining crypto mining facilities

Merkle Tree INTRODUCTION

Merkle Tree is a non-fungible digital asset providing bespoke access and utility to holders. Crypto-assets (e.g. crypto coins, tokens, NFTs) are either currently not regulated globally or the regulations may vary, sometimes significantly, between jurisdictions. Cryptocurrencies, NFTs and other blockchain and Web3 technologies are in constant flux. This Merkle Tree NFT is not intended to be the comprehensive or final design of Merkle Tree or its services, products or offerings. It is not intended to create either explicitly or implicitly any contractual relationship or elements. Merkle Tree’s primary purpose is to provide potential token holders, partners or associates with sufficient pertinent information to enable an informed analysis and decision while taking into account the individual’s or entity’s current and future circumstances.

It is strongly advised to fully study Merkle Tree and its attendant documents, and seek, where necessary, professional advice in order to come to an informed and appropriate decision. Given rapidly changing technological advancements and global factors, the volatility of which are unlikely to change in the short to middle term, certain statements, estimates and financial disclosures in this MerkleTree document are forward looking statements, subject to change, and, although they are based on a rigorous consideration of known and unknown facts, risks and contingencies, the eventual actuality may differ factually or substantially from the forward-looking statements expressed herein.

Merkle Tree has three distinct value propositions:

1. Faster ROI

Merkle Tree NFT holders gain access to the onchain annuity, including daily $BTC dividend payments. Through this onchain annuity, NFT holders earn an immediate return on their investment. Once the additional Merkle Tree facility is operational, both facilities will generate BTC dividends for NFT holders and follow a daily recoupment schedule in perpetuity.

2. Greater Financial Returns

Returns on this offering are positively correlated to Bitcoin’s price increase while input costs remain unchanged. As the price of BTC rises, margins will increase significantly, generating a faster ROI and a faster delivery of investors' capital.

3. Efficient Infrastructure

a. Low-Rate Power

Merkle Tree has an exclusive agreement with the Venezuelan government which includes locked-in, pre-negotiated electricity rates that provide the most affordable electricity across all of South America at just 0.01/KW.

b. Low Cost Hardware

Merkle Tree has negotiated with their mining vendors, resulting in an exclusive agreement to provide WhatsMiner M30 rigs at the lowest price available today. These efficient mining devices feature a hash capacity of 100TH+ per rig.

c. Greatest Operational Efficiency

The market, the remaining mining farms can earn larger BTC rewards. Merkle Tree has brokered industry-best hardware and electricity pricing to help generate some of the most profitable BTC output in South America. As long as the price of Bitcoin stays above Merkle Tree’s breakeven point, the facility will remain profitable.

THE NFT OFFERING

Merkle Tree is the first onchain annuity to be delivered via NFT.

Merkle Tree is selling 12,000 dividend-generating NFTs in exchange for $12,000,000 US. Each NFT represents a 1:1 contract between Merkle Tree and the NFT holder.

These onchain annuities delivered via NFTs with daily BTC dividends provide exposure into the lowest cost Bitcoin producing mine in South America.

Onchain Annuity NFTs can be traded or sold on the open market.

Provides early-stage access to upcoming Merkle Tree venture investment opportunities.

Daily Bitcoin dividend rewards in perpetuity; the most cost effective daily-cost-average investment plan for building a Bitcoin portfolio.

Merkle Tree Team

Merkle Tree Partnership

CONCLUSION

Spend some time reading up on the potential drawbacks of using Merkle Tree, and make sure you fully grasp them. It is crucial, particularly if you have a restricted amount of financial resources. Keep in mind that the value of your investment might change at any time, and as a result, you could stand to lose part or all of your money. This is an inherent risk associated with any type of investment. Merkle Tree is committed to becoming your trusted advisor in the exciting world of digital assets, and we will do all in our power to fulfill this role. Your trip is our top priority, and we hope to make it go off without a hitch. Therefore, take the plunge, investigate the options, and use Merkle Tree to serve as your entry point into a new era of technological and regulatory advancements in the financial sector.

Merkle Tree Social media link:

Website: https://linktr.ee/merkletree.io

Telegram group: https://t.me/merkletreetheeofficial

Discord group: https://discord.gg/RzWFZyRZdr

Official Twitter: https://twitter.com/Merkle__Tree

Official Instagram : https://www.instagram.com/merkle_tree/

Medium: https://medium.com/@info_64307

Author:

Bitcointalk username: Lift Core

Bitcointalk profile link : https://bitcointalk.org/index.php?action=profile;u=3403164

Telegram username: @LiftCore

Wallet address: 0xC8199E8A032D41953a403Aa88c8131b83ccC44df

0 notes

Text

Merkle Tree: IBBA Financials turnkey digital asset mining operation

Merkle Tree INTRODUCTION

Merkle Tree is a non-fungible digital asset providing bespoke access and utility to holders. Crypto-assets (e.g. crypto coins, tokens, NFTs) are either currently not regulated globally or the regulations may vary, sometimes significantly, between jurisdictions. Cryptocurrencies, NFTs and other blockchain and Web3 technologies are in constant flux. This Merkle Tree NFT is not intended to be the comprehensive or final design of Merkle Tree or its services, products or offerings. It is not intended to create either explicitly or implicitly any contractual relationship or elements. Merkle Tree’s primary purpose is to provide potential token holders, partners or associates with sufficient pertinent information to enable an informed analysis and decision while taking into account the individual’s or entity’s current and future circumstances.

It is strongly advised to fully study Merkle Tree and its attendant documents, and seek, where necessary, professional advice in order to come to an informed and appropriate decision. Given rapidly changing technological advancements and global factors, the volatility of which are unlikely to change in the short to middle term, certain statements, estimates and financial disclosures in this MerkleTree document are forward looking statements, subject to change, and, although they are based on a rigorous consideration of known and unknown facts, risks and contingencies, the eventual actuality may differ factually or substantially from the forward-looking statements expressed herein.

Merkle Tree has three distinct value propositions:

1. Faster ROI

Merkle Tree NFT holders gain access to the onchain annuity, including daily $BTC dividend payments. Through this onchain annuity, NFT holders earn an immediate return on their investment. Once the additional Merkle Tree facility is operational, both facilities will generate BTC dividends for NFT holders and follow a daily recoupment schedule in perpetuity.

2. Greater Financial Returns

Returns on this offering are positively correlated to Bitcoin’s price increase while input costs remain unchanged. As the price of BTC rises, margins will increase significantly, generating a faster ROI and a faster delivery of investors' capital.

3. Efficient Infrastructure

a. Low-Rate Power

Merkle Tree has an exclusive agreement with the Venezuelan government which includes locked-in, pre-negotiated electricity rates that provide the most affordable electricity across all of South America at just 0.01/KW.

b. Low Cost Hardware

Merkle Tree has negotiated with their mining vendors, resulting in an exclusive agreement to provide WhatsMiner M30 rigs at the lowest price available today. These efficient mining devices feature a hash capacity of 100TH+ per rig.

c. Greatest Operational Efficiency

The market, the remaining mining farms can earn larger BTC rewards. Merkle Tree has brokered industry-best hardware and electricity pricing to help generate some of the most profitable BTC output in South America. As long as the price of Bitcoin stays above Merkle Tree’s breakeven point, the facility will remain profitable.

THE NFT OFFERING

Merkle Tree is the first onchain annuity to be delivered via NFT.

Merkle Tree is selling 12,000 dividend-generating NFTs in exchange for $12,000,000 US. Each NFT represents a 1:1 contract between Merkle Tree and the NFT holder.

These onchain annuities delivered via NFTs with daily BTC dividends provide exposure into the lowest cost Bitcoin producing mine in South America.

Onchain Annuity NFTs can be traded or sold on the open market.

Provides early-stage access to upcoming Merkle Tree venture investment opportunities.

Daily Bitcoin dividend rewards in perpetuity; the most cost effective daily-cost-average investment plan for building a Bitcoin portfolio.

Merkle Tree Team

Merkle Tree Partnership

CONCLUSION

Spend some time reading up on the potential drawbacks of using Merkle Tree, and make sure you fully grasp them. It is crucial, particularly if you have a restricted amount of financial resources. Keep in mind that the value of your investment might change at any time, and as a result, you could stand to lose part or all of your money. This is an inherent risk associated with any type of investment. Merkle Tree is committed to becoming your trusted advisor in the exciting world of digital assets, and we will do all in our power to fulfill this role. Your trip is our top priority, and we hope to make it go off without a hitch. Therefore, take the plunge, investigate the options, and use Merkle Tree to serve as your entry point into a new era of technological and regulatory advancements in the financial sector.

Merkle Tree Social media link:

Website: https://linktr.ee/merkletree.io

Telegram group: https://t.me/merkletreetheeofficial

Discord group: https://discord.gg/RzWFZyRZdr

Official Twitter: https://twitter.com/Merkle__Tree

Official Instagram : https://www.instagram.com/merkle_tree/

Medium: https://medium.com/@info_64307

Writer Info:

Bitcointalk username : TimeAndSpeed

Bitcointalk profile link : https://bitcointalk.org/index.php?action=profile;u=3381069

Telegram name : @TimeAndSpeed

Wallet address: 0x09c054362e1bf3f954cc7c74955a575535533caf

0 notes

Text

Merkle Tree: connects investors to the lowest-cost bitcoin mining operation

Merkle Tree INTRODUCTION

Merkle Tree is a non-fungible digital asset providing bespoke access and utility to holders. Crypto-assets (e.g. crypto coins, tokens, NFTs) are either currently not regulated globally or the regulations may vary, sometimes significantly, between jurisdictions. Cryptocurrencies, NFTs and other blockchain and Web3 technologies are in constant flux. This Merkle Tree NFT is not intended to be the comprehensive or final design of Merkle Tree or its services, products or offerings. It is not intended to create either explicitly or implicitly any contractual relationship or elements. Merkle Tree’s primary purpose is to provide potential token holders, partners or associates with sufficient pertinent information to enable an informed analysis and decision while taking into account the individual’s or entity’s current and future circumstances.

It is strongly advised to fully study Merkle Tree and its attendant documents, and seek, where necessary, professional advice in order to come to an informed and appropriate decision. Given rapidly changing technological advancements and global factors, the volatility of which are unlikely to change in the short to middle term, certain statements, estimates and financial disclosures in this MerkleTree document are forward looking statements, subject to change, and, although they are based on a rigorous consideration of known and unknown facts, risks and contingencies, the eventual actuality may differ factually or substantially from the forward-looking statements expressed herein.

Merkle Tree has three distinct value propositions:

1. Faster ROI

Merkle Tree NFT holders gain access to the onchain annuity, including daily $BTC dividend payments. Through this onchain annuity, NFT holders earn an immediate return on their investment. Once the additional Merkle Tree facility is operational, both facilities will generate BTC dividends for NFT holders and follow a daily recoupment schedule in perpetuity.

2. Greater Financial Returns

Returns on this offering are positively correlated to Bitcoin’s price increase while input costs remain unchanged. As the price of BTC rises, margins will increase significantly, generating a faster ROI and a faster delivery of investors' capital.

3. Efficient Infrastructure

a. Low-Rate Power

Merkle Tree has an exclusive agreement with the Venezuelan government which includes locked-in, pre-negotiated electricity rates that provide the most affordable electricity across all of South America at just 0.01/KW.

b. Low Cost Hardware

Merkle Tree has negotiated with their mining vendors, resulting in an exclusive agreement to provide WhatsMiner M30 rigs at the lowest price available today. These efficient mining devices feature a hash capacity of 100TH+ per rig.

c. Greatest Operational Efficiency

The market, the remaining mining farms can earn larger BTC rewards. Merkle Tree has brokered industry-best hardware and electricity pricing to help generate some of the most profitable BTC output in South America. As long as the price of Bitcoin stays above Merkle Tree’s breakeven point, the facility will remain profitable.

THE NFT OFFERING

Merkle Tree is the first onchain annuity to be delivered via NFT.

Merkle Tree is selling 12,000 dividend-generating NFTs in exchange for $12,000,000 US. Each NFT represents a 1:1 contract between Merkle Tree and the NFT holder.

These onchain annuities delivered via NFTs with daily BTC dividends provide exposure into the lowest cost Bitcoin producing mine in South America.

Onchain Annuity NFTs can be traded or sold on the open market.

Provides early-stage access to upcoming Merkle Tree venture investment opportunities.

Daily Bitcoin dividend rewards in perpetuity; the most cost effective daily-cost-average investment plan for building a Bitcoin portfolio.

Merkle Tree Team

Merkle Tree Partnership

CONCLUSION

Spend some time reading up on the potential drawbacks of using Merkle Tree, and make sure you fully grasp them. It is crucial, particularly if you have a restricted amount of financial resources. Keep in mind that the value of your investment might change at any time, and as a result, you could stand to lose part or all of your money. This is an inherent risk associated with any type of investment. Merkle Tree is committed to becoming your trusted advisor in the exciting world of digital assets, and we will do all in our power to fulfill this role. Your trip is our top priority, and we hope to make it go off without a hitch. Therefore, take the plunge, investigate the options, and use Merkle Tree to serve as your entry point into a new era of technological and regulatory advancements in the financial sector.

Merkle Tree Social media link:

Website: https://linktr.ee/merkletree.io

Telegram group: https://t.me/merkletreetheeofficial

Discord group: https://discord.gg/RzWFZyRZdr

Official Twitter: https://twitter.com/Merkle__Tree

Official Instagram : https://www.instagram.com/merkle_tree/

Medium: https://medium.com/@info_64307

AUTHOR

Bitcointalk name: Whitley Keaton

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3475199

Telegram username: @WhitleyKeaton

Wallet address: 0x976e606a138c18B03C504889b36B1fd3424DaBf8

0 notes

Text

Merkle Tree: IBBA Financials turnkey digital asset mining operation

Merkle Tree INTRODUCTION

Merkle Tree is a non-fungible digital asset providing bespoke access and utility to holders. Crypto-assets (e.g. crypto coins, tokens, NFTs) are either currently not regulated globally or the regulations may vary, sometimes significantly, between jurisdictions. Cryptocurrencies, NFTs and other blockchain and Web3 technologies are in constant flux. This Merkle Tree NFT is not intended to be the comprehensive or final design of Merkle Tree or its services, products or offerings. It is not intended to create either explicitly or implicitly any contractual relationship or elements. Merkle Tree’s primary purpose is to provide potential token holders, partners or associates with sufficient pertinent information to enable an informed analysis and decision while taking into account the individual’s or entity’s current and future circumstances.

It is strongly advised to fully study Merkle Tree and its attendant documents, and seek, where necessary, professional advice in order to come to an informed and appropriate decision. Given rapidly changing technological advancements and global factors, the volatility of which are unlikely to change in the short to middle term, certain statements, estimates and financial disclosures in this MerkleTree document are forward looking statements, subject to change, and, although they are based on a rigorous consideration of known and unknown facts, risks and contingencies, the eventual actuality may differ factually or substantially from the forward-looking statements expressed herein.

Merkle Tree has three distinct value propositions:

1. Faster ROI

Merkle Tree NFT holders gain access to the onchain annuity, including daily $BTC dividend payments. Through this onchain annuity, NFT holders earn an immediate return on their investment. Once the additional Merkle Tree facility is operational, both facilities will generate BTC dividends for NFT holders and follow a daily recoupment schedule in perpetuity.

2. Greater Financial Returns

Returns on this offering are positively correlated to Bitcoin’s price increase while input costs remain unchanged. As the price of BTC rises, margins will increase significantly, generating a faster ROI and a faster delivery of investors' capital.

3. Efficient Infrastructure

a. Low-Rate Power

Merkle Tree has an exclusive agreement with the Venezuelan government which includes locked-in, pre-negotiated electricity rates that provide the most affordable electricity across all of South America at just 0.01/KW.

b. Low Cost Hardware

Merkle Tree has negotiated with their mining vendors, resulting in an exclusive agreement to provide WhatsMiner M30 rigs at the lowest price available today. These efficient mining devices feature a hash capacity of 100TH+ per rig.

c. Greatest Operational Efficiency

The market, the remaining mining farms can earn larger BTC rewards. Merkle Tree has brokered industry-best hardware and electricity pricing to help generate some of the most profitable BTC output in South America. As long as the price of Bitcoin stays above Merkle Tree’s breakeven point, the facility will remain profitable.

THE NFT OFFERING

Merkle Tree is the first onchain annuity to be delivered via NFT.

Merkle Tree is selling 12,000 dividend-generating NFTs in exchange for $12,000,000 US. Each NFT represents a 1:1 contract between Merkle Tree and the NFT holder.

These onchain annuities delivered via NFTs with daily BTC dividends provide exposure into the lowest cost Bitcoin producing mine in South America.

Onchain Annuity NFTs can be traded or sold on the open market.

Provides early-stage access to upcoming Merkle Tree venture investment opportunities.

Daily Bitcoin dividend rewards in perpetuity; the most cost effective daily-cost-average investment plan for building a Bitcoin portfolio.

Merkle Tree Team

Merkle Tree Partnership

CONCLUSION

Spend some time reading up on the potential drawbacks of using Merkle Tree, and make sure you fully grasp them. It is crucial, particularly if you have a restricted amount of financial resources. Keep in mind that the value of your investment might change at any time, and as a result, you could stand to lose part or all of your money. This is an inherent risk associated with any type of investment. Merkle Tree is committed to becoming your trusted advisor in the exciting world of digital assets, and we will do all in our power to fulfill this role. Your trip is our top priority, and we hope to make it go off without a hitch. Therefore, take the plunge, investigate the options, and use Merkle Tree to serve as your entry point into a new era of technological and regulatory advancements in the financial sector.

Merkle Tree Social media link:

Website: https://linktr.ee/merkletree.io

Telegram group: https://t.me/merkletreetheeofficial

Discord group: https://discord.gg/RzWFZyRZdr

Official Twitter: https://twitter.com/Merkle__Tree

Official Instagram : https://www.instagram.com/merkle_tree/

Medium: https://medium.com/@info_64307

Author

Bitcointalk name: Makena Peta

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3475164

Telegram username: @MakenaPeta

Wallet address: 0xe5A6b141C771f20765AAE815D3AbD117dd3F82e7

0 notes

Text

Merkle Tree: focused on building, operating, and maintaining crypto mining facilities across South America.

Merkle Tree INTRODUCTION

Merkle Tree is a non-fungible digital asset providing bespoke access and utility to holders. Crypto-assets (e.g. crypto coins, tokens, NFTs) are either currently not regulated globally or the regulations may vary, sometimes significantly, between jurisdictions. Cryptocurrencies, NFTs and other blockchain and Web3 technologies are in constant flux. This Merkle Tree NFT is not intended to be the comprehensive or final design of Merkle Tree or its services, products or offerings. It is not intended to create either explicitly or implicitly any contractual relationship or elements. Merkle Tree’s primary purpose is to provide potential token holders, partners or associates with sufficient pertinent information to enable an informed analysis and decision while taking into account the individual’s or entity’s current and future circumstances.

It is strongly advised to fully study Merkle Tree and its attendant documents, and seek, where necessary, professional advice in order to come to an informed and appropriate decision. Given rapidly changing technological advancements and global factors, the volatility of which are unlikely to change in the short to middle term, certain statements, estimates and financial disclosures in this MerkleTree document are forward looking statements, subject to change, and, although they are based on a rigorous consideration of known and unknown facts, risks and contingencies, the eventual actuality may differ factually or substantially from the forward-looking statements expressed herein.

Merkle Tree has three distinct value propositions:

1. Faster ROI

Merkle Tree NFT holders gain access to the onchain annuity, including daily $BTC dividend payments. Through this onchain annuity, NFT holders earn an immediate return on their investment. Once the additional Merkle Tree facility is operational, both facilities will generate BTC dividends for NFT holders and follow a daily recoupment schedule in perpetuity.

2. Greater Financial Returns

Returns on this offering are positively correlated to Bitcoin’s price increase while input costs remain unchanged. As the price of BTC rises, margins will increase significantly, generating a faster ROI and a faster delivery of investors' capital.

3. Efficient Infrastructure

a. Low-Rate Power

Merkle Tree has an exclusive agreement with the Venezuelan government which includes locked-in, pre-negotiated electricity rates that provide the most affordable electricity across all of South America at just 0.01/KW.

b. Low Cost Hardware

Merkle Tree has negotiated with their mining vendors, resulting in an exclusive agreement to provide WhatsMiner M30 rigs at the lowest price available today. These efficient mining devices feature a hash capacity of 100TH+ per rig.

c. Greatest Operational Efficiency

The market, the remaining mining farms can earn larger BTC rewards. Merkle Tree has brokered industry-best hardware and electricity pricing to help generate some of the most profitable BTC output in South America. As long as the price of Bitcoin stays above Merkle Tree’s breakeven point, the facility will remain profitable.

THE NFT OFFERING

Merkle Tree is the first onchain annuity to be delivered via NFT.

Merkle Tree is selling 12,000 dividend-generating NFTs in exchange for $12,000,000 US. Each NFT represents a 1:1 contract between Merkle Tree and the NFT holder.

These onchain annuities delivered via NFTs with daily BTC dividends provide exposure into the lowest cost Bitcoin producing mine in South America.

Onchain Annuity NFTs can be traded or sold on the open market.

Provides early-stage access to upcoming Merkle Tree venture investment opportunities.

Daily Bitcoin dividend rewards in perpetuity; the most cost effective daily-cost-average investment plan for building a Bitcoin portfolio.

Merkle Tree Team

Merkle Tree Partnership

CONCLUSION

Spend some time reading up on the potential drawbacks of using Merkle Tree, and make sure you fully grasp them. It is crucial, particularly if you have a restricted amount of financial resources. Keep in mind that the value of your investment might change at any time, and as a result, you could stand to lose part or all of your money. This is an inherent risk associated with any type of investment. Merkle Tree is committed to becoming your trusted advisor in the exciting world of digital assets, and we will do all in our power to fulfill this role. Your trip is our top priority, and we hope to make it go off without a hitch. Therefore, take the plunge, investigate the options, and use Merkle Tree to serve as your entry point into a new era of technological and regulatory advancements in the financial sector.

Merkle Tree Social media link:

Website: https://linktr.ee/merkletree.io

Telegram group: https://t.me/merkletreetheeofficial

Discord group: https://discord.gg/RzWFZyRZdr

Official Twitter: https://twitter.com/Merkle__Tree

Official Instagram : https://www.instagram.com/merkle_tree/

Medium: https://medium.com/@info_64307

Author Details

Bitcointalk name : Silas Kai

Bitcointalk Profile link : https://bitcointalk.org/index.php?action=profile;u=3382086

Telegram username : @SilasKai

Wallet: 0x5ADCD956C149f463031896f2a2155527b78FDaC5

0 notes

Text

Merkle Tree: connects investors to the lowest-cost bitcoin mining operation

Merkle Tree INTRODUCTION

Merkle Tree is a non-fungible digital asset providing bespoke access and utility to holders. Crypto-assets (e.g. crypto coins, tokens, NFTs) are either currently not regulated globally or the regulations may vary, sometimes significantly, between jurisdictions. Cryptocurrencies, NFTs and other blockchain and Web3 technologies are in constant flux. This Merkle Tree NFT is not intended to be the comprehensive or final design of Merkle Tree or its services, products or offerings. It is not intended to create either explicitly or implicitly any contractual relationship or elements. Merkle Tree’s primary purpose is to provide potential token holders, partners or associates with sufficient pertinent information to enable an informed analysis and decision while taking into account the individual’s or entity’s current and future circumstances.

It is strongly advised to fully study Merkle Tree and its attendant documents, and seek, where necessary, professional advice in order to come to an informed and appropriate decision. Given rapidly changing technological advancements and global factors, the volatility of which are unlikely to change in the short to middle term, certain statements, estimates and financial disclosures in this MerkleTree document are forward looking statements, subject to change, and, although they are based on a rigorous consideration of known and unknown facts, risks and contingencies, the eventual actuality may differ factually or substantially from the forward-looking statements expressed herein.

Merkle Tree has three distinct value propositions:

1. Faster ROI

Merkle Tree NFT holders gain access to the onchain annuity, including daily $BTC dividend payments. Through this onchain annuity, NFT holders earn an immediate return on their investment. Once the additional Merkle Tree facility is operational, both facilities will generate BTC dividends for NFT holders and follow a daily recoupment schedule in perpetuity.

2. Greater Financial Returns

Returns on this offering are positively correlated to Bitcoin’s price increase while input costs remain unchanged. As the price of BTC rises, margins will increase significantly, generating a faster ROI and a faster delivery of investors' capital.

3. Efficient Infrastructure

a. Low-Rate Power

Merkle Tree has an exclusive agreement with the Venezuelan government which includes locked-in, pre-negotiated electricity rates that provide the most affordable electricity across all of South America at just 0.01/KW.

b. Low Cost Hardware

Merkle Tree has negotiated with their mining vendors, resulting in an exclusive agreement to provide WhatsMiner M30 rigs at the lowest price available today. These efficient mining devices feature a hash capacity of 100TH+ per rig.

c. Greatest Operational Efficiency

The market, the remaining mining farms can earn larger BTC rewards. Merkle Tree has brokered industry-best hardware and electricity pricing to help generate some of the most profitable BTC output in South America. As long as the price of Bitcoin stays above Merkle Tree’s breakeven point, the facility will remain profitable.

THE NFT OFFERING

Merkle Tree is the first onchain annuity to be delivered via NFT.

Merkle Tree is selling 12,000 dividend-generating NFTs in exchange for $12,000,000 US. Each NFT represents a 1:1 contract between Merkle Tree and the NFT holder.

These onchain annuities delivered via NFTs with daily BTC dividends provide exposure into the lowest cost Bitcoin producing mine in South America.

Onchain Annuity NFTs can be traded or sold on the open market.

Provides early-stage access to upcoming Merkle Tree venture investment opportunities.

Daily Bitcoin dividend rewards in perpetuity; the most cost effective daily-cost-average investment plan for building a Bitcoin portfolio.

Merkle Tree Team

Merkle Tree Partnership

CONCLUSION

Spend some time reading up on the potential drawbacks of using Merkle Tree, and make sure you fully grasp them. It is crucial, particularly if you have a restricted amount of financial resources. Keep in mind that the value of your investment might change at any time, and as a result, you could stand to lose part or all of your money. This is an inherent risk associated with any type of investment. Merkle Tree is committed to becoming your trusted advisor in the exciting world of digital assets, and we will do all in our power to fulfill this role. Your trip is our top priority, and we hope to make it go off without a hitch. Therefore, take the plunge, investigate the options, and use Merkle Tree to serve as your entry point into a new era of technological and regulatory advancements in the financial sector.

Merkle Tree Social media link:

Website: https://linktr.ee/merkletree.io

Telegram group: https://t.me/merkletreetheeofficial

Discord group: https://discord.gg/RzWFZyRZdr

Official Twitter: https://twitter.com/Merkle__Tree

Official Instagram : https://www.instagram.com/merkle_tree/

Medium: https://medium.com/@info_64307

Author details

Bitcointalk name: Darkleaf

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=3474915

Telegram username: @Darkleaff

Wallet address: 0xA3144F1E128e0Ef75Bbed31b28e7dB9D07f67579

0 notes

Text

Gemini Unveils Perpetual Contracts for XRP/GUSD Pair – What Lies Ahead?

Gemini Foundation, the derivatives platform associated with the well-known U.S. cryptocurrency exchange Gemini, has made a significant announcement with the introduction of XRP/GUSD perpetual contracts. This move, expanding Gemini's derivatives offerings, provides traders in more than 30 countries with a new risk management tool. The listing, effective from January 26, 2024, follows a series of cryptic tweets from Gemini, reminiscent of their communication strategy leading up to the relisting of XRP on their spot trading platform in July 2023.

The introduction of the XRP/GUSD perpetual contract is part of Gemini Foundation's broader strategy, adding to their existing contracts for BTC/GUSD, ETH/GUSD, and PEPE/GUSD, enabling traders to leverage their crypto holdings up to 100x.