#ShortTermTrading

Explore tagged Tumblr posts

Text

Smarter & Safer Crypto Trading Starts with Base8

Step into a new era of Crypto Trading where intelligence meets security. With Base8, manage your digital assets confidently using real-time data, advanced watchlists, and industry-grade protection. Experience effortless, secure trading—designed for both beginners and pros. Download Now: https://shorturl.at/7PgRu

1 note

·

View note

Text

What Makes Technical Stocks So Effective in Fast Markets?

In a world of rapid market fluctuations and data-driven strategies, Technical Stocks remain a central focus for short-term traders and tactical investors. These stocks are evaluated through price action and trading patterns, not just earnings or revenue. As markets evolve with increased volatility and liquidity, technical analysis continues to offer practical, real-time insights into stock behavior.

Breaking Down the Basics of Technical Analysis

The foundation of analyzing Technical Stocks lies in understanding historical price movements, volume, and recurring chart patterns. Instead of relying on company fundamentals, this approach uses technical indicators to identify trends, reversals, and breakout levels. Traders use candlestick charts, support and resistance zones, and trendlines to make actionable decisions in fast-moving markets.

Whether the goal is scalping small intraday movements or capturing multi-day trends, these tools offer a clear roadmap for timing entries and exits.

Core Indicators That Drive Trading Decisions

To evaluate Technical Stocks, traders depend on a range of technical indicators. Moving averages like the 50-day and 200-day provide insight into momentum and long-term trends. Meanwhile, tools such as the Relative Strength Index (RSI), Bollinger Bands, and MACD help identify overbought or oversold conditions.

Each indicator offers a unique perspective. When combined, they enhance the accuracy of market signals, allowing traders to refine their approach and reduce risk exposure.

How Emotions and Psychology Shape Technical Moves

Market psychology is a key element behind price movements in Technical Stocks. Fear, greed, and uncertainty often drive rapid shifts in sentiment, especially around earnings announcements, geopolitical events, or economic data releases. Technical analysis captures this behavior in chart formations like head-and-shoulders, double tops, and bullish flags.

Understanding these patterns allows traders to anticipate reactions and adjust their strategies accordingly—an essential skill when navigating emotionally charged markets.

The Double-Edged Sword of Technical Trading

Volatility is both a challenge and an opportunity when it comes to Technical Stocks. These stocks often experience significant price swings, which can create short-term profit potential. However, high volatility also increases the risk of losses if trades are not managed carefully.

Using tools like Average True Range (ATR) and volatility bands, traders can set stop losses, adjust position sizes, and manage trades with discipline—ensuring volatility is leveraged strategically rather than reactively.

Timeframes and Strategy Short-Term vs. Swing Trading

While technical analysis is often associated with day trading, it also supports longer-term strategies. Scalpers might focus on one-minute charts, whereas swing traders analyzing Technical Stocks might rely on daily or weekly setups. The time horizon influences everything from chart selection to indicator settings and risk tolerance.

Having a clearly defined trading plan tailored to your chosen timeframe is crucial for success. It ensures consistent decision-making and reduces emotional interference in trade execution.

Tech-Driven Tools Changing the Game

Technology has revolutionized how traders analyze Technical Stocks. Platforms now offer algorithmic trading, AI-powered alerts, and real-time charting features. Machine learning models can scan multiple securities simultaneously, identify pattern breakouts, and suggest high-probability setups.

These tools enhance speed and efficiency, helping traders react to market changes in seconds. For those seeking a competitive edge, integrating technology with a solid technical foundation is a game-changer.

Risk Management: Protecting Capital with Precision

The key to surviving and thriving in volatile markets lies in managing downside risk. Traders focused on Technical Stocks must know how to place stop-loss orders, set realistic profit targets, and determine the ideal trade size relative to portfolio value.

Tools such as risk-reward ratios, position-sizing calculators, and drawdown metrics allow traders to structure positions methodically—protecting gains while minimizing exposure to large losses.

News, Events, and the Unexpected

Although technical analysis is rooted in price and volume, external factors like earnings reports, central bank decisions, and geopolitical developments often trigger major moves in Technical Stocks. These events can invalidate patterns or cause false breakouts.

Successful technical traders stay aware of the macro calendar, using event timing as a backdrop when planning trades. Combining market awareness with technical setups results in more informed decisions and fewer surprises.

The Future of Technical Trading

As more investors adopt quantitative approaches, the importance of real-time analysis and adaptability is growing. The role of Technical Stocks is expected to expand as automation becomes more prevalent. Traders will need to continue learning, testing strategies, and integrating new tools to maintain an edge.

Staying updated on platform innovations, learning from past trades, and continuously refining entry/exit strategies are critical habits in the modern technical trader’s toolkit.

Technical Stocks as a Tactical Asset Class

Whether you're a day trader or a long-term trend follower, Technical Stocks offer a powerful way to capitalize on market behavior. By mastering indicators, understanding trader psychology, managing risk, and embracing tech innovations, investors can navigate short-term volatility with greater confidence.

As markets remain unpredictable, technical strategies provide the structure and discipline needed to respond effectively. For those willing to study the charts and respect the patterns, Technical Stocks offer opportunity, flexibility, and tactical advantage in today’s complex trading landscape.

0 notes

Text

#GoldTrading#GoldAnalysis#BearishGoldTargets#GoldResistanceLevels#GoldMarketUpdate#TechnicalAnalysis#GoldTradeSetups#GoldPriceTrends#ShortTermTrading

0 notes

Text

What is scalping??

Scalping is a short-term trading strategy in the stock market where traders aim to make small, quick profits by buying and selling stocks within minutes or even seconds. The key idea behind scalping is to exploit small price movements in highly liquid stocks, making numerous trades throughout the day. How Scalping Works Scalping involves buying a large number of shares and selling them as soon…

View On WordPress

#DayTrading#HighLiquidity#IndianStockMarket#IntradayTrading#MarketVolatility#NSE#QuickProfits#RelianceIndustries#RiskManagement#Scalping#ShortTermTrading#StockMarketStrategy#StopLoss#TradingTips

0 notes

Text

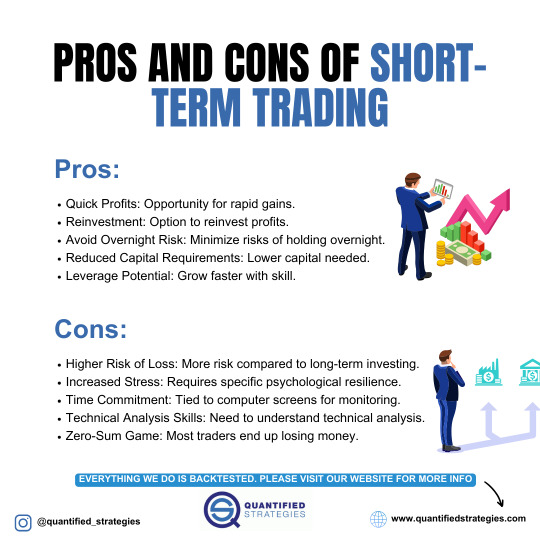

PROS AND CONS OF SHORT- TERM TRADING

Short-term trading offers the potential for quick profits and the ability to reinvest gains rapidly while avoiding overnight risks. However, it comes with higher risks, increased stress, and demands strong technical analysis skills, making it a challenging endeavor where most traders may end up losing money.

#tradingstrategies#ShortTermTrading#DayTrading#TradingProsAndCons#StockMarket#RiskManagement#TechnicalAnalysis

0 notes

Video

youtube

Boost your Bitcoin trading strategy with BingX: Tips and tricks for successful trades!

#BitcoinTrading #Cryptocurrency #TradingStrategy #BingX #ReferralCode #MarketCycles #TechnicalAnalysis #RiskManagement #StopLoss #PositionSizing #NewsAndDevelopments #CryptoWorld #Diversification #EmotionalIntelligence #MentalGame #Volatility #LongTermInvestments #ShortTermTrading #SupportAndResistance #MovingAverages #CandlestickPatterns #CryptoMarket #PortfolioManagement #EducationalResources #EmotionalIntelligenceStrategy #SustainableTrading

#youtube#bitcointrading#cryptocurrency#tradingstrategy#bingx#bingxcopytrade#marketcycles#technicalanalysis#technical analysis

0 notes

Photo

Pipbreaker is an indicator to trade the trend.But can it spot the pullbacks?Here is your answer in USD/CHF where it got both the trend and pullback move precisely and yielded 270 pips. Get the best FX indicator now. https://wetalktrade.com/best-indicator-for-mt4/

#pipbreaker#forexindicator#USDCHF#nonrepaintforextool#scalping#shorttermtrading#swingtraders#profitearningindicator#wetalktrade

1 note

·

View note

Text

Unlock the Secret to Successful Short-Term Trading on the Crypto Market

Are you ready to join the crypto trading game but don't know where to start? Look no further! This video will guide you through the latest tips and strategies for making short-term trades on the cryptocurrency market. Discover how to navigate this fast-paced and highly volatile market, with key insights on market trends, technical analysis, and risk management. With the rise of digital assets, the crypto market has become a hotbed of activity, attracting investors from all over the world. But, with its rapid changes and unpredictable swings, it can be difficult to make informed trades. In this video, you'll learn from experienced traders and gain valuable knowledge on how to maximize profits and minimize risks in the crypto market. Don't miss out on the opportunity to be a successful crypto trader. Get the inside scoop on crypto trading tools and techniques, market indicators, and popular cryptocurrencies like Bitcoin, Ethereum, and Ripple. Boost your confidence and make informed trades with our comprehensive guide to short-term trading on the crypto market. Join the crypto revolution today! Watch the video and start your journey to successful short-term trades. In this video,we're talking about following survey sites

Watch Now :

youtube

If you liked it please like, comment, and subscribe as it really helps! Thank you for watching and stay tuned to this space for more inspirational and motivational videos from the world of Motivation

------------------------------------------------------------------------------

►Video footage: All video footage used is either licensed through either CC-BY or from various stock footage websites. All creative commons footage is listed at the end of the video and is licensed under CC-BY 3.0. ------------------------------------------------------------------------------

FAIR-USE COPYRIGHT DISCLAIMER * Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, commenting, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statutes that might otherwise be infringing. Non-profit, educational, or personal use tips the balance in favor of fair use. Disclaimer: The content covered on this channel is NOT to be considered as any financial or investment advice. All posted content is to add value and awareness to the viewers. This video or audio has no negative impact on the original content ~~~~~~~~~~~ tion,scalping strategy

#crypto#cryptocurrency#blockchain#shorttermtrading#2023crypto#crypto trading#bitcoin#crypto trading strategies#btc#day trading#crypto day trading#bitcoin news#ethereum#trading crypto#eth#crypto news today#bitcoin price prediction#bitcoin news today#bitcoin analysis#crypto news#crypto futures trading#cryptocurrency news#day trading crypto#swing trading crypto#stock market#trading strategy#swing trading#1 min scalping strategy#stocks#scalping trading strategy

0 notes

Photo

Avoid these saves you from a great deal of trouble.

#forextrading#daytrading#forexmistakes#scalpers#shorttermtrading#trade#timeframe#marketexchange#traderpulse

0 notes

Text

Essential Features Every Short Term Bitcoin Trading Platform Should Have

When it comes to crypto, every second counts—especially if you're focused on short-term trades. A solid short term Bitcoin trading platform can be your edge in the fast-moving digital currency market. But what exactly should you look for when choosing the right one?

Here are the essential features every trader should consider:

🔹 1. Real-Time Market Data

Accurate and instant price updates are crucial. A delay of even a few seconds can result in lost opportunities. Ensure your platform provides real-time charts, order books, and trade feeds.

🔹 2. Low Latency Execution

Speed matters in short-term trading. The platform should support high-frequency order execution with minimal delays. Look for platforms built with modern infrastructure designed for speed.

🔹 3. Intuitive User Interface

A cluttered dashboard slows down decisions. Choose a platform that’s clean, easy to navigate, and customizable. This helps you act quickly without confusion.

🔹 4. Advanced Order Types

Basic market orders aren’t enough. Tools like stop-loss, take-profit, and trailing stop orders give you more control in volatile conditions.

🔹 5. Strong Security Measures

Even the fastest platform isn’t worth using if it’s not secure. Two-factor authentication (2FA), encryption, and cold wallet storage are a must for protecting your assets.

🔹 6. Mobile Trading Support

Markets move 24/7. With mobile support, you can stay on top of trades wherever you are—no missed chances when you're away from your desk.

In conclusion, a reliable short term Bitcoin trading platform should combine speed, security, and smart tools to help traders thrive in a fast-paced environment. Evaluate carefully before choosing—your trading success depends on it.

#BitcoinTrading#CryptoTools#ShortTermTrading#CryptoStrategy#DigitalAssets#DayTrading#CryptoTips#BTCPlatform

0 notes

Photo

Si può guadagnare durante un bear market facendo investimenti LONG a breve termine? La risposta è si, ma attenzione ai rischi. Tendenzialmente una fase ribassista segue delle precise regole di trading, facendo muovere il prezzo all'interno di canali o triangoli ben definiti. Nel caso di Intesa Sanpaolo (ISP), il mercato ha dato avvio ad un impulso ribassiste di secondo livello (start: 9 ottobre) con conseguente formazione di un canale ribassista di media entità. Con l'apertura della sessione odierna, il titolo ha risentito del forte ribasso causato dall'agitazione dei mercati, portando il prezzo sul supporto del canale ed innescando una fase rialzista di brevissima durata che ha generato in 30 minuti un gain del 2,7%. Se vuoi scoprire di più, visita il nostro sito. www.coneicom.com #isp #intesasanpaolo #tradingonline #technicalanalysis #tradingforli #shorttermtrading #coneicom https://www.instagram.com/p/CG4it6RKjqH/?igshid=vridinicldhc

0 notes

Text

https://theinvestingforex.com/Gold-price-update

Gold is testing critical support at 2639 – 2631, with bulls defending the level. Explore potential trade setups for long positions if bullish patterns emerge or short trades if the price breaks support, targeting 2553 – 2536.

#GoldTrading#GoldPriceAnalysis#SupportAndResistance#BullishTargets#BearishSignals#GoldMarketTrends#GoldTechnicalAnalysis#ShortTermTrading#GoldTradeSetups

0 notes

Photo

Difference between Intraday and Short Term Trading Styles-Sai Proficient ::

There are different styles available for the traders to trade in the Stock Market. The intraday trading and the Short Term trading are the common one. The Short term trading is also known as swing trading. In the case of Intraday Trading the trading period is one day and in case of short term trading the trading period is more than one day. The advisory firms like Sai Proficient Research provide accurate tips on all the Trading Styles.

Read More@ http://www.saiproficient.com/

#MCXFreeTips#SaiProficient#FreeIntradayTradingTips#StockCashTips#EquityTradingTips#LongTermTradingTips#ShortTermTrading

0 notes

Photo

Pipbreaker renders a top-notch in minor pairs as well.Here is a recent example from CAD/CHF where it scored 89 pips. Get Pipbreaker, the best indicator for every market and every currency pair. https://wetalktrade.com/best-indicator-for-mt4/

#pipbreaker#forexindicator#nonrepaintforextool#scalping#shorttermtrading#CADCHF#swingtraders#profitearningindicator#wetalktrade

1 note

·

View note

Text

Unlock the Secret to Successful Short-Term Trading on the Crypto Market

Are you ready to join the crypto trading game but don't know where to start? Look no further! This video will guide you through the latest tips and strategies for making short-term trades on the cryptocurrency market. Discover how to navigate this fast-paced and highly volatile market, with key insights on market trends, technical analysis, and risk management. With the rise of digital assets, the crypto market has become a hotbed of activity, attracting investors from all over the world. But, with its rapid changes and unpredictable swings, it can be difficult to make informed trades. In this video, you'll learn from experienced traders and gain valuable knowledge on how to maximize profits and minimize risks in the crypto market. Don't miss out on the opportunity to be a successful crypto trader. Get the inside scoop on crypto trading tools and techniques, market indicators, and popular cryptocurrencies like Bitcoin, Ethereum, and Ripple. Boost your confidence and make informed trades with our comprehensive guide to short-term trading on the crypto market. Join the crypto revolution today! Watch the video and start your journey to successful short-term trades. In this video,we're talking about following survey sites

Watch Now :

youtube

If you liked it please like, comment, and subscribe as it really helps! Thank you for watching and stay tuned to this space for more inspirational and motivational videos from the world of Motivation

------------------------------------------------------------------------------

►Video footage: All video footage used is either licensed through either CC-BY or from various stock footage websites. All creative commons footage is listed at the end of the video and is licensed under CC-BY 3.0. ------------------------------------------------------------------------------

FAIR-USE COPYRIGHT DISCLAIMER * Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, commenting, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statutes that might otherwise be infringing. Non-profit, educational, or personal use tips the balance in favor of fair use. Disclaimer: The content covered on this channel is NOT to be considered as any financial or investment advice. All posted content is to add value and awareness to the viewers. This video or audio has no negative impact on the original content ~~~~~~~~~~~

#crypto#cryptocurrency#blockchain#shorttermtrading#2023crypto#crypto trading#bitcoin#crypto trading strategies#btc#day trading#crypto day trading#bitcoin news#ethereum#trading crypto#eth#crypto news today#bitcoin price prediction#bitcoin news today#bitcoin analysis#crypto news#crypto futures trading#cryptocurrency news#day trading crypto#swing trading crypto#stock market#trading strategy#swing trading#1 min scalping strategy#stocks#scalping trading strategy

0 notes

Photo

Identifying the market mover wins half the battle in short-term trading.

0 notes