#Small cap stocks

Text

Small Caps Heat Up

Three weeks ago we gave you a heads up that it was Open Season for Small Caps. The Russell 2000 small cap index was beginning to rally off its new multi-year low at the end of October. Though it was still lagging big caps. Small caps are leading again today. But beware there still may be some chop as you can see here in the chart before small cap season officially opens mid-December.

4 notes

·

View notes

Text

Investing in Small-Cap vs. Large-Cap Stocks: Pros and Cons

#small cap stocks#large cap stocks#investing#small cap investing#investing in small cap stocks#mid cap stocks#stocks#investing for beginners#investing in small cap etfs#value investing#small cap stock investing#what are small cap stocks#large cap mid cap and small cap stocks#small cap vs large cap stocks#buying and selling small cap stocks#small cap investing strategies#how to invest in penny stocks#how to analyze stocks to buy#penny stocks

3 notes

·

View notes

Text

In the current market environment, small-cap Canadian stocks present an intriguing opportunity for investors looking to tap into growth potential outside of large, well-established companies. While global economic uncertainty and fluctuating commodity prices can affect market sentiment, many small-cap companies have demonstrated resilience and innovation in sectors like technology, healthcare, and renewable energy.

Three such Canadian Stocks to have a look at are:

Headwater Exploration Inc. (TSX: HWX)

Trading at $6.42, this security is a key player in the crude oil industry, with a significant land base that facilitates ongoing exploration and expansion efforts. This proactive strategy has resulted in steady resource growth and production increases, with output climbing from an average of 7,393 Boe/day in 2021 to an anticipated 20,000 Boe/day by 2024........Read more

0 notes

Text

The Role of Small-Cap Stocks in Market Cycles: Timing Your Investments

Investing in small-caps can yield high returns, but requires nuanced understanding of market cycles and timing. Defined as shares in companies with relatively low market capitalization, smaller funds may offer greater growth potential and diversified returns but their performance capabilities are more sensitive to market conditions. Understanding how these stocks behave during market cycles and using small cap stock advisory services can improve your investment strategy. This blog explores the role small-cap stocks play in market cycles and provides insights on when to invest properly.

Understanding Small Stocks

Small-cap stocks represent companies with market capitalizations typically between $300 million and $2 billion. These companies are generally in the early stages of growth, and that their stock prices can be highly volatile relative to companies’ sizes of a. Potentially higher returns come with increased risk, making small-cap investments more attractive and challenging.

Small-cap Stocks in Bull Markets

In bull markets, as the economy grows and investor confidence increases, small cap stocks tend to outperform their larger counterparts. This is for several reasons:

Growth Potential: Small cap stocks are often in a growth phase, which means they can expand quickly and benefit greatly from a growing economy. Their compact size allows them to adapt quickly to market trends and opportunities.

Increased Risk Appetite: In a bull market, investors are generally more willing to take risks for higher returns. This increased risk appetite benefits small businesses, as they are often viewed as high-risk, high-reward investments.

Acquisition Targets: Subcontractors can be attractive targets for larger companies looking to expand their market share or product offerings This can increase the value of small businesses.

Small-Cap Stocks are in Bear Markets

Conversely, in bear markets, where economic conditions deteriorate and investor sentiment is negative, smaller funds can plummet Here’s why:

High Volatility: Small-caps stocks are more vulnerable to market volatility. In a recession, their share prices can fall more sharply than larger companies because their liquidity is lower and their beta is higher.

Limited Resources: Small cap stocks generally have fewer resources and lower financial stability than larger firms. This makes them more vulnerable to recessions and can lead to reduced earnings or even bankruptcy.

Increased Risk Appetite: In bear markets, investors are less risk averse, and shift their focus towards safer and more stable portfolios Small-cap stocks, with higher risk, may cause investors to lose interest and stock prices have fallen.

Time to Invest in Smaller Amounts

Successful small-cap investing often depends on timing and understanding market cycles. Here are some strategies to help you make the right decision:

Monitoring Economic Indicators: Keep a close eye on economic indicators such as GDP growth, employment levels and consumer spending. Positive economic growth can mean good conditions for small banks, while negative growth can mean potential risks.

Using Small Cap Stock Advisory Services: Engaging with small cap stock advisory services can provide valuable insights and recommendations tailored to market conditions. This role uses expert analysis and data to identify promising sub-investments and guide investment decisions based on current market trends.

Diversify your investments: While smaller funds can offer higher returns, it is important to diversify your investments to manage risk. Include a mix of asset classes and stock sizes to balance potential reward and risk.

Look for value opportunities: Some small-cap stocks may be devalued during market downturns. Identifying these opportunities can provide attractive entry points for long-term investors willing to accept short-term flexibility.

Keep Informed: Stay abreast of market trends, industry trends, and the financial health of the small companies you are interested in. By regularly reviewing your investments and adjusting your strategy based on new information, it can improve your chances of winning.

The Role of Small-Cap Stock Advisory Firms

Navigating the complexities of small-cap investing can be challenging. Small-cap stock advisory services play an important role in helping investors make informed decisions. This service provides expert analysis, research reports and recommendations that are invaluable in understanding market cycles and identifying promising microfinance stocks.

Advisory Services Can Help You:

Know the market trends: Professionals in the industry can provide you with insights into emerging trends and opportunities in the microfinance market, helping you stay ahead of the curve.

Review stock performance: They can help gauge the performance of small stocks and make recommendations based on comprehensive analysis and data.

Creating Investment Strategies: Tailored advice can help you develop strategies that align with your investment goals and risk tolerance, and adapt your investment strategy to market conditions.

Conclusion

Small-caps play a large role in market cycles, and their performance is closely linked to economic conditions and investor sentiment. By understanding how these funds react to bull and bear markets, as well as utilizing small-cap advisory services, investors can make more informed decisions and shape their investments plans effectively time investment and not informed of market trends -The key is to capitalize on potential growth in cap stocks and manage the associated risks.

#best stock market advisor#small cap stocks#stock market advisory#top micro cap stocks#small cap stock advisory services

0 notes

Text

https://www.apsense.com/article/best-5-innovative-smallcap-stocks-with-high-returns.html

Are you on the lookout for exciting investment opportunities that offer high returns? Look no further! Small-cap stocks hold immense potential for growth and can be a game-changer in your investment portfolio. In this blog post, we will explore the best 5 innovative small-cap stocks with high returns in 2024. Discover how investing in small cap stocks in India can pave the way to financial success and long-term wealth accumulation. Let's dive into the world of small-cap stocks and unlock their hidden potential together!

#Best Smallcap Stocks#Best 5 Innovative Small-Cap Stocks#Small Cap Stocks in India#Small cap stocks#Why Invest in Smallcap Stocks#Small Cap Stocks for Long Term

0 notes

Text

Buying into Big Tech: Strategic or are we now the Greater Fool

Big Tech’s Market Influence

Walmart’s Earnings Report as an economic indicator

Small Cap Stocks – Is this the beginning of a sustained rally?

Fed – Can they pull off a soft landing

When the Fed will cut

By David Nelson, CFA CMT Bad news is good news. Good news is bad news. That’s been the guiding light for investors the last 22 months. It wasn’t the only focus, but it was certainly the force…

View On WordPress

0 notes

Text

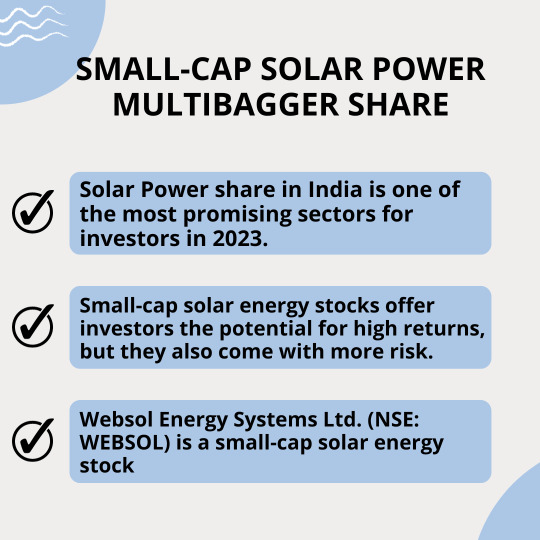

Small-Cap Solar Power Multibagger Share

#solar energy#solar power#renewable energy#small cap stocks#multibagger stocks India#investing#finance#stock market#business#economy

0 notes

Text

Wall Street Rotating Back To Risk On - And Here's The Proof

Bullish information printing on the 10-minute charts!

#sp500 #spy #bullmarket #bearmarket #newsletter #trading #earnings $iwm #iwm $tran #tran $util #util

SENSITIVE MARKET AREA RATIOS SHOWING SIGNS OF QUIET ROTATION TO RISK-ON INDICATING STRONG POTENTIAL FOR A 4TH QUARTER RALLY

It’s easy for Wall Street to manipulate the charts and throw off investors attempting to use technical analysis to gauge their next move. It’s only natural they would do so. Besides, if everyone is looking at the same data, couldn’t Wall Street profit from that very fact if…

View On WordPress

#bears#bulls#earnings#stockmarket#$iwm#$tran#$util#bull market#iwm#qqq#small cap stocks#stock market#stock trading

0 notes

Text

5 Best Small-cap stocks with Huge growth potential

Conservative investors avoid small-cap stocks, but they are regarded as yielding significant rewards to risk-taking investors. Small-cap stocks in the USA stock market hold incredible growth prospects over a five-year horizon and will turn out to be very attractive to investors looking to make capital gains over the long term. Read more

0 notes

Text

Which stocks segment is good for investment??

Image by freepik

Investing in the Indian equity markets—whether in small cap, mid cap, or large cap stocks—depends on your investment goals, risk tolerance, and time horizon. Here’s a brief overview of each category to help you decide:

1. Large Cap

Characteristics: Companies with a large market capitalization, typically well-established and financially stable.

Risk: Lower compared to small…

#equity market#financial planning#growth stocks#Indian equities#Investment Strategy#large cap investing#mid cap investing#small cap investing#Stock Market#value investing

0 notes

Text

In the vast landscape of the stock market, investors encounter various categories of stocks, each with its unique characteristics and role in a well-balanced portfolio. Among these categories, large cap stocks stand out as stalwarts of stability and reliability. Let’s explore the nuances of large cap stocks, their characteristics, and their significance for building a resilient portfolio.

0 notes

Text

How to Assess the Risk and Reward of Small-Cap Stocks: A Comprehensive Guide

Investing in small stocks can be both exciting and scary. Small-cap stocks — companies with market caps typically between $300 million and $2 billion — offer the potential for high returns but come with their own set of risks It is important for investors considering small-cap funds to understand how risk and reward will be evaluated under. This comprehensive guide will delve into the key factors to evaluate when investing in small cap stocks and how small cap stock advisory services can assist in this process.

Understanding Small Cap Stocks

Small cap stocks are often viewed as opportunities for high growth. Unlike their larger counterparts, these companies tend to operate in niche markets and can be at the forefront of innovation. Their size, however, can mean more volatility and more economic strain, making a thorough investigation necessary.

Basic Measures of Risk and Reward

1. Financial Health

Before diving into small cap stocks, it’s important to assess the company’s financial health. Key reference points include:

· Revenue Growth: Stable revenue growth means that a company is able to expand and compete effectively. Look for companies with a history of revenue growth and a strong business model.

· Profitability: Look at the profitability of a company to measure its efficiency in converting sales into profit. Subcontractors with consistently high revenue tend to exhibit strong performance and operational efficiency.

· Debt Ratio: Determine the company’s debt-to-equity ratio. Rising debt can be a disaster, especially for smaller companies with limited financial flexibility. Lower numbers generally indicate greater economic stability.

2. Market Potential

Growth potential is key when investing in small stocks. consider:

· Industry Trends: Analyze the industry in which the company operates. Is it growing? Are there any upcoming trends that could help the company? In rapidly expanding industries, small-cap groups often present opportunities for further growth.

· Competitive Advantage: Determine whether the company has a competitive advantage — such as unique technology, patents, or strong customer relationships — that can help it outperform competitors.

3. Management Team

A skilled and experienced management team is crucial to the success of a small cap stocks company. assess:

· Track Record: Look at the background of key executives. Have they successfully led companies through growth stages in the past? A skilled workforce can handle challenges effectively.

· Strategic Vision: Review the company’s strategic plan. Are the goals realistic and achievable? A clear and well-defined strategy can have a significant impact on a company’s growth trajectory.

4. Market Liquidity

Liquidity is an important consideration for small-caps. These stocks are generally less expensive than large-cap stocks, which means they can be harder to buy or sell without impacting stock prices. Do the research:

· Trading Volume: A high trading volume usually indicates better cash flow. Low trading volumes can lead to high price volatility and difficulty in executing trades.

· Bid-Ask Spread: The difference between the bid and ask prices can indicate potential buy-in. In general, narrower spreads indicate better liquidity and lower risk.

The role of small-cap stock advisory firms

Navigating the small cap stock market can be challenging, and microfinance consulting firms can provide valuable assistance. Here’s how these services can improve your budget.

1. Expert Research

The advisory service provides in-depth research and analysis that can help identify promising sub-funds. They typically provide comprehensive reporting and insights into financial health, market power and management teams, saving you more time and more comprehensive analysis

2. Risk Management

Effective advisory services include risk management strategies for small-cap investments. They can help diversify your portfolio to reduce risks and advise on how to balance small-caps and other asset classes.

3. Market Trends

Advisors remain aware of market trends and economic indicators that may affect smaller banks. Their expertise can help you make informed decisions based on current and forecast market conditions.

4. Investment Strategies

Small-cap stock advisory services can provide you with the right investment options based on your investment goals and risk tolerance. They can guide you through tough decisions and help you build a strong portfolio.

Conclusion:

Comprehensive assessment of financial health, trading, efficiency and liquidity in assessing the risks and rewards of small cap stocks. Using small cap stock advisory services can provide significant returns with expert analysis, including risk management and tailored investment plans by utilizing these features, investors can more effectively navigate the small-cap market and leverage its growth potential while managing associated risks the solution of the.

Investing in small cap stocks can be a worthwhile endeavor with the right approach and resources. Armed with the right information and support, you can make informed decisions and can make incredible profits in this dynamic industry.

#best stock market advisor#small cap stocks#stock market advisory#stock market advisory services#stock advisory services#best sebi registered research analyst#small cap stocks advisory services

0 notes

Text

Panic In Mid, Small Caps Shows SEBI’s Warning Has Hit Markets Hard

In the wake of SEBI's recent directives impacting mid and small-cap stocks, the markets have witnessed heightened volatility. At Pragati Funds, we understand the importance of informed investment decisions during such times. Our expert advisors provide tailored solutions to navigate market uncertainties, ensuring your investments align with your goals and risk tolerance—Trust Pragati Funds to guide you through turbulent market conditions and seize opportunities for long-term growth. Contact us today for expert assistance. Call +91 97254 10042.

For Information Visit our Blog: https://pragatifunds.com/Home/Blogdetails/30/panic-in-mid-small-caps-shows-sebis-warning-has-hit-markets-hard

0 notes

Text

Best Small Cap Chemical Stocks in India -2024

Best Small Cap Chemical Stocks in India -2024

In the dynamic landscape of the Indian stock market, investors are often on the lookout for opportunities that promise growth and value. Small-cap stocks, known for their potential to deliver substantial returns, are gaining attention. In the chemical sector, several small-cap stocks are emerging as promising contenders for investors seeking exposure to this industry. Here, we delve into some of the best small-cap chemical stocks in India for 2024.

Bodal Chemicals Limited (BODALCHEM):

Bodal Chemicals Limited is a key player in the dye and dye intermediates segment. With a diversified product portfolio and a strong focus on innovation, Bodal Chemicals has positioned itself as a potential growth stock. The company's commitment to sustainability and expanding global presence make it an interesting choice for investors eyeing the chemical sector.

Aarti Industries Limited (AARTIIND):

Aarti Industries Limited is a leading player in the specialty chemicals space. Known for its robust R&D capabilities, Aarti Industries has been consistently expanding its product offerings. With a focus on high-margin products and a customer base spread across various industries, the company is well-poised for growth in the coming years.

NOCIL Limited (NOCIL):

NOCIL Limited is a significant player in the rubber chemicals segment. As the demand for rubber-based products continues to rise, NOCIL stands to benefit. The company's consistent financial performance and strategic expansion plans make it an attractive choice for investors seeking exposure to the chemical industry.

Sudarshan Chemical Industries Limited (SUDARSCHEM):

Sudarshan Chemical Industries Limited is a leading pigment manufacturer with a global footprint. The company's focus on research, innovation, and sustainability aligns with the industry trends. Sudarshan Chemical Industries is well-positioned to capitalize on the increasing demand for pigments in various sectors, making it a stock to watch in 2024.

Vinati Organics Limited (VINATIORGA):

Vinati Organics Limited specializes in specialty chemicals, primarily serving the polymer and agrochemical industries. The company's consistent financial performance, emphasis on innovation, and strategic expansions make it an interesting Best Small Cap Chemical Stocks in India -2024

Conclusion:

Investing in Best Small Cap Chemical Stocks in India -2024 requires thorough research and understanding of market dynamics. While the potential for higher returns exists, it is crucial for investors to assess their risk tolerance and investment goals. The mentioned small-cap chemical stocks present compelling opportunities, but investors should conduct their due diligence and consider consulting financial experts before making investment decisions in 2024.

1 note

·

View note

Text

Small and Medium-sized Enterprises (SME): Definition and Examples explained! Dive into the world of SMEs and their impact on business and innovation.

#Small and Medium-sized Enterprises#sme ipo#micro-cap stocks#investment plans#stock market news#risk management process#investing stocks#stock market analysis

0 notes

Text

Two Weak Spots In The Stock Market Investors Should Be Aware Of

Signs are bullish, but it's critically important to keep an eye on these two areas of the market...

#bulls #bears #sp500 #earnings #stockmarket #spy #newsletter #QQQ #xlk #BullMarket #BearMarket #smallcaps #banks

OUTLOOK FOR 2023 REMAINS BULLISH, BUT TWO SOFT SPOTS IN MARKET DATA ARE SIGNALING CAUTIOUS OPTIMISM

Mark Twain once said: “A banker is a fellow who lends his umbrella when the sun is shining and wants it back the minute it begins to rain.“

Well, for banks, it began to rain in February of 2023. Many regional banks began to weaken and a handful of banking stocks collapsed, starting with the…

View On WordPress

0 notes