#small cap stock investing

Text

Investing in Small-Cap vs. Large-Cap Stocks: Pros and Cons

#small cap stocks#large cap stocks#investing#small cap investing#investing in small cap stocks#mid cap stocks#stocks#investing for beginners#investing in small cap etfs#value investing#small cap stock investing#what are small cap stocks#large cap mid cap and small cap stocks#small cap vs large cap stocks#buying and selling small cap stocks#small cap investing strategies#how to invest in penny stocks#how to analyze stocks to buy#penny stocks

3 notes

·

View notes

Text

In the current market environment, small-cap Canadian stocks present an intriguing opportunity for investors looking to tap into growth potential outside of large, well-established companies. While global economic uncertainty and fluctuating commodity prices can affect market sentiment, many small-cap companies have demonstrated resilience and innovation in sectors like technology, healthcare, and renewable energy.

Three such Canadian Stocks to have a look at are:

Headwater Exploration Inc. (TSX: HWX)

Trading at $6.42, this security is a key player in the crude oil industry, with a significant land base that facilitates ongoing exploration and expansion efforts. This proactive strategy has resulted in steady resource growth and production increases, with output climbing from an average of 7,393 Boe/day in 2021 to an anticipated 20,000 Boe/day by 2024........Read more

0 notes

Text

Understanding Stock Market Basics: What New Investors Need to Know

For those new to investing, navigating the stock market can seem daunting. The world of finance is full of jargon and complexity that can overwhelm even the most enthusiastic beginner. To facilitate this exciting journey, it is important that you understand the basics of the stock market and understand how to seek reliable investment advice. In this guide, we’ll break down the basic concepts and explore how to identify the best stocks to invest in right now.

What is the Stock Market?

Stock market is a platform where shares of publicly traded companies are bought and sold. When you invest in a stock market, you buy a small ownership stake in these companies. Companies issue securities to raise capital for growth and development, while investors buy securities in the hope of reaping a return on their investments through inflation or delay.

Fundamentals of the Stock Market

Stock Exchanges: These are places where stocks are traded. Major exchanges include the New York Stock Exchange (NYSE) and Nasdaq. Each exchange has its own listing rules and requirements, but all act as a marketplace for buying and selling stocks.

Stocks: Stocks represent the ownership of a company. They come in two main types:

Common stock: Provides voting rights and dividends but is last in line if the company faces liquidation.

Preferred stock: Generally, does not give voting rights but it gives fixed dividends and has a greater claim to the assets in case of liquidation.

Indices: Stock indexes such as the S&P 500 and the Dow Jones Industrial Average (DJIA) track the performance of the stock group. They provide insight into all aspects of the market and can help investors gauge the performance of their investments.

Brokers: You will need a broker to buy or sell stocks. Brokers act as intermediaries between you and the stock exchange. Today, many online marketers offer forums with tools and resources to help you make informed decisions.

How to choose the Best Stock to Invest Right Now:

Currently, it takes research and strategic decisions to choose the best stocks to invest. Here’s an easy way to find your promising stocks:

Research and Analysis: Start by researching companies that interest you. Assess their financial health, industry status and growth potential. Key factors to consider are earnings per share (EPS), price to earnings (P/E) ratio and return on equity (ROE). Utilizing stock market consulting services can provide valuable insights and recommendations.

Industry Trends: Analyze current industry trends and economic conditions. Some businesses may be performing better because of economic changes, technological advances, or changes in consumer behavior. For example, the industrial and renewable energy industries were booming.

Fundamental vs. Technical Analysis: Use fundamental analysis to assess the financial health and viability of the company. But technical analysis involves analyzing stock price patterns and policies to predict future trends. Combining both methods can improve your decision-making process.

Diversification: Avoid investing all your money in one stock. Diversifying your portfolio across different industries and assets can help manage risk and improve return potential.

Get Professional Advice: If you are unsure about choosing the best stocks to invest in right now, consider consulting a stock market consulting firm. Advisors will provide expert analysis, personalized recommendations and strategic insights tailored to your financial goals.

Important Considerations for New Investors

Diversification: Investment diversification involves spreading your investments across different assets and sectors to reduce risk. By not putting all your eggs in one basket, you reduce the impact of one inefficient investment on your overall portfolio.

Risk Tolerance: Understanding risk tolerance is important. It reflects how much risk you have to invest. Factors that affect risk tolerance include your financial situation, investment goals, and your response to market fluctuations.

Investment: Your investment is the length of time you plan to invest before you need the money. Long-term investors generally have a higher tolerance for risk and are better able to withstand market fluctuations than short-term investors.

Stock Market Advisory: Expert opinion and strategic guidance can be obtained by using stock market advisory services. Advisors analyze market trends, recommend investments, and help you make tough investment decisions, which can be especially useful for beginners.

Understanding Orders: When trading stocks, you use different orders

The market system takes effect immediately at the current market price.

The limit order only works at or better than the specified price, allowing you to control the price you pay or receive for the stock.

Conclusion:

Understanding the basics of the stock market is important for someone who asks, “How do I invest in the stock market?”. By identifying important concepts, conducting comprehensive research, and considering the advice of stock market professionals, you can make informed investment decisions and identify the best investments now Remember that there are risks involved in investing, including the possibility of losing principal It is important, therefore, to stay informed, diversify investments, and make your choices with your finances aligning objectives and risk tolerance With the right strategy and resources, you will be well on your way to building a successful investment portfolio.

#best stock market advisor#best trading advisory services#small cap stocks#stock market advisory services#best stock to invest in right now

0 notes

Text

https://www.apsense.com/article/best-5-innovative-smallcap-stocks-with-high-returns.html

Are you on the lookout for exciting investment opportunities that offer high returns? Look no further! Small-cap stocks hold immense potential for growth and can be a game-changer in your investment portfolio. In this blog post, we will explore the best 5 innovative small-cap stocks with high returns in 2024. Discover how investing in small cap stocks in India can pave the way to financial success and long-term wealth accumulation. Let's dive into the world of small-cap stocks and unlock their hidden potential together!

#Best Smallcap Stocks#Best 5 Innovative Small-Cap Stocks#Small Cap Stocks in India#Small cap stocks#Why Invest in Smallcap Stocks#Small Cap Stocks for Long Term

0 notes

Text

Which stocks segment is good for investment??

Image by freepik

Investing in the Indian equity markets—whether in small cap, mid cap, or large cap stocks—depends on your investment goals, risk tolerance, and time horizon. Here’s a brief overview of each category to help you decide:

1. Large Cap

Characteristics: Companies with a large market capitalization, typically well-established and financially stable.

Risk: Lower compared to small…

#equity market#financial planning#growth stocks#Indian equities#Investment Strategy#large cap investing#mid cap investing#small cap investing#Stock Market#value investing

0 notes

Text

Small and Medium-sized Enterprises (SME): Definition and Examples explained! Dive into the world of SMEs and their impact on business and innovation.

#Small and Medium-sized Enterprises#sme ipo#micro-cap stocks#investment plans#stock market news#risk management process#investing stocks#stock market analysis

0 notes

Text

Small-Cap Solar Power Multibagger Share

#solar energy#solar power#renewable energy#small cap stocks#multibagger stocks India#investing#finance#stock market#business#economy

0 notes

Text

14 Best Stocks for Long Term Investments in India

आज में आपकों 14 Best Stocks for Long Term Investments in India के बारें में बतानें वाला हूँ मुझे उमीद हैं की यह आपकों पसंद आएगी।

भारत में लंबी अवधि के लिए निवेश करने के लिए सबसे अच्छे स्टॉक्स कौन से हैं? यह प्रश्न हर निवेशक के मन में होता है, जो अपने पैसों को समय के साथ बढ़ाना चाहता है। लंबी अवधि का निवेश का मतलब है कि आप कम से कम 1 से 3 साल तक किसी स्टॉक में पैसा लगाते हैं, और उसकी कीमत में…

View On WordPress

#10 best shares to buy today for long term#14 long term stocks to buy now#best long term stocks to buy right now#best share to buy for long term#best share to buy today for long term#best shares to buy today for long term#best small cap stocks for long term#best stocks for long term#best stocks for long term growth#best stocks for long term investors#best stocks to buy for long term in india#long term investment stocks#stocks to buy for long term#stocks to buy today long term#top 14 stocks to buy for long term

0 notes

Text

This Small-Cap stock gave 54% returns to investors in one year

This small-cap company whose share worth is below Rs 100 has posted strong results in the last quarter of 2023. The company results show its revenue has increased by 99% and its AUM has increased up to 134% in the last year.

Star Housing Financing Company, which has a market valuation of Rs. 470.47, this private financing company has announced its quarterly results with solid revenue growth.…

View On WordPress

0 notes

Text

How equity research platforms are transforming investment decisions in India

Equity research platforms offer access to a wealth of information, including company research, financial analysis, industry trends, and other relevant market information. Investors can leverage this research and information to gain a deeper understanding of companies and sectors, enabling more informed investment decisions. Investors can stay updated on the latest developments and make timely investment decisions based on accurate and up-to-date information. The Equity Research Platform in India uses both quantitative and qualitative analysis to analyse potential investment ideas. They provide valuable insights and recommendations based on historical performance, financial ratios, valuation metrics, and other relevant factors. This data-driven analysis helps investors identify investment opportunities and assess the potential risks associated with their portfolio. These platforms offer customization options, allowing investors to define their investment preferences, risk appetite, and financial goals. Equity research platforms enable investors to get access to detailed research and thorough due diligence before making investment decisions. Investors can assess the financial health, governance practises, and growth prospects of companies, helping them make more informed and prudent investment choices.

What is the role of equity research in providing information to investors?

The role of equity research is to provide valuable information and analysis to investors, enabling them to make informed investment decisions. Equity research encompasses in-depth analysis of companies, industries, and markets to assess their financial performance, growth prospects, risks, and potential investment opportunities. Here's how equity research serves as a vital source of information for investors:

Company Analysis: Equity research provides detailed insights into individual companies, including their financial statements, business models, competitive positioning, and management quality. This analysis helps investors understand the company's operations, profitability, and potential future performance.

Industry Analysis: They examines various industries and sectors, identifying trends, market dynamics, and key factors influencing their growth. By studying industry dynamics, investors can evaluate the potential opportunities and risks associated with investing in specific sectors.

Financial Performance Evaluation: Also analyses financial statements, such as income statements, balance sheets, and cash flow statements, to assess a company's financial health. Investors can gain insights into a company's revenue growth, profitability, debt levels, and cash flow generation, which are crucial factors in evaluating its investment potential.

Valuation Analysis: They provides valuation analysis, helping investors determine the intrinsic value of a company's stock. This analysis considers various valuation methodologies, such as discounted cash flow (DCF) analysis, price-to-earnings (P/E) ratios, and price-to-sales (P/S) ratios, to assess whether a stock is overvalued or undervalued.

How are equity research platforms empowering self-directed investing and transforming investment decisions in India?

Access to Information: These platforms provide investors with easy access to a vast amount of information, including company profiles, financial statements, research reports, and market data. By having comprehensive information readily available, investors can conduct their own analysis and make informed investment decisions without relying solely on traditional sources.

Research Tools and Resources: Equity research platforms offer a wide range of research tools and resources that enable self-directed investors to perform detailed analysis. These tools may include financial calculators, stock screeners, charting software, and portfolio trackers, among others. By leveraging these resources, investors can gain insights, track their investments, and manage their portfolios effectively.

Education and Learning Materials: Many equity research platforms offer educational resources, tutorials, and webinars to help investors enhance their investment knowledge and skills. These resources empower self-directed investors to improve their understanding of investment concepts, strategies, and market dynamics, enabling them to make more informed decisions.

Cost-effectiveness: Equity research platforms provide cost-effective alternatives to traditional investment research. They often offer affordable subscription models, eliminating the need for expensive brokerage services or investment advisory fees. This cost-effectiveness enables self-directed investors to access high-quality research and analysis at a fraction of the cost.

Is equity research part of investment management?

Yes, equity research is an integral part of investment management. Investment management involves the professional management of various investment instruments, such as stocks, bonds, mutual funds, and other assets, to achieve specific investment objectives. An equity research platform plays a crucial role in the investment management process by providing valuable insights and analysis on individual companies, industries, and markets. Equity research helps investment managers make informed decisions regarding the selection, allocation, and management of equity investments. It involves conducting a detailed analysis of financial statements, evaluating company performance, assessing industry trends, and identifying potential investment opportunities and risks. By leveraging equity research, investment managers gain a deeper understanding of the companies and industries in which they invest, allowing them to make well-informed decisions to optimize portfolio performance. Equity research assists investment managers in conducting thorough due diligence, formulating investment strategies, and making buy, sell, or hold recommendations. It provides the necessary information and analysis to evaluate the financial health, growth potential, valuation, and risk profile of companies. This helps investment managers construct diversified portfolios, manage risks, and generate attractive returns for their clients.

What is the role of an equity research analyst in India?

The role of an equity research analyst in India is to analyze financial data, conduct research, and provide insights and recommendations on investment opportunities in the equity market. Here are the key responsibilities and functions of an equity research analyst:

Financial Analysis

Company Valuation

Investment Recommendations

Building Financial Models

Client Communication

Monitoring and Updates

Market insights and strategy

Empowering investors with data-driven insights and transforming investment decisions in India

Many equity research platforms in India are revolutionizing investment decisions by empowering investors with data-driven insights. These platforms provide comprehensive information, analysis tools, and personalized recommendations that enable self-directed investing and informed decision-making. By leveraging advanced data analytics and real-time market updates, investors gain access to a wealth of information to make informed choices. With increased access, customization, and cost-effectiveness, these platforms, including Coin Street, are transforming the investment landscape in India, empowering investors to take control of their financial future and achieve their investment goals.

If you want to know more about our services, please feel free to contact us at:

Mobile: 9004880627

Email: [email protected]

Website: www.coinstreet.in

#equity research platform in india#multibagger stocks for india#small cap stocks india#coin street#share to buy today india#equity research platform#long term investment plan#long term trading ideas#long term wealth building plan

0 notes

Text

Top 10 Mixed Stock Portfolio - Multibagger returns potential - Stock 2022

Top 10 Mixed Stock Portfolio – Multibagger returns potential – Stock 2022

Mixed Portfolio : Means a managed portfolio, which is primarily comprised of investments in securities or collective investment schemes other than futures and options.

1# Central Depository Services (India) Ltd.

CDSL operates as a securities depository in India. It offers various services, such as account opening, dematerialization, processing delivery and receipt instructions, account…

View On WordPress

0 notes

Text

Top 10 Mixed Stock Portfolio - Multibagger returns potential - Stock 2022

Top 10 Mixed Stock Portfolio – Multibagger returns potential – Stock 2022

Mixed Portfolio : Means a managed portfolio, which is primarily comprised of investments in securities or collective investment schemes other than futures and options.

1# Central Depository Services (India) Ltd.

CDSL operates as a securities depository in India. It offers various services, such as account opening, dematerialization, processing delivery and receipt instructions, account…

View On WordPress

0 notes

Text

The best advisory services for stock market success unlocked in India

Introduction:

With its dynamic nature and huge investment opportunities, the Indian stock market attracts investors looking to create wealth. However, navigating this challenging financial environment requires strategic decision-making and reliable advisory services. In this blog, we will explore some of India’s leading stock market advisory services and how they help unlock stock market success.

Motilal Oswal Finance Services:

Motilal Oswal has earned a reputation as a powerful figure in the Indian financial industry. Known for its comprehensive advisory services, Motilal Oswal provides research reports, stock recommendations and personalized investment strategies. Their panel of experts provides valuable insights into market trends, empowering investors to make informed decisions.

Angel Broking:

Angel Broking stands out for its strong presence in the Indian banking industry. The platform’s ARQ Advisor Engine uses advanced algorithms and artificial intelligence to analyze market trends and deliver customized investment recommendations. Angel Broking caters to investors with a knowledge base, offering personalized advisory services.

Sharekhan:

With its easy-to-use platform and extensive analytics offering, Sherkhan has created a niche in the consulting business landscape. The platform’s advisory services include stock recommendations, market insights and personal investment planning. Investors benefit from research reports that cover a wide range of sectors, and help build portfolios.

Kotak Securities:

As a subsidiary of Kotak Mahindra Bank, Kotak Securities provides advisory services to Indian investors. The company’s research team provides market insights, stock recommendations and research reports. Investors can use these services to align their investment decisions with their investment objectives.

Edelweiss Wealth Management:

Edelweiss has established itself as a leading firm in the financial services industry, offering a full range of wealth management and advisory services. Their research department offers in-depth market research, investment strategies and personalized recommendations. Edelweiss caters to a diverse range of investors from startups to high-net-worth individuals.

IIFL Securities:

IIFL Securities stands out for its research-backed advisory services designed to meet the needs of investors. The company provides market research, stock recommendation and financial planning services. With a focus on client education, IIFL Securities empowers investors to understand market dynamics and make informed decisions.

5 Paisa:

Recognized for its investment friendly approach, 5Paisa offers advisory services. The platform provides stock recommendations, research reports and market insights to help investors make the best decisions. Its user-friendly interface caters to both beginners and experienced investors.

Kamayakya:

Kamayakya has emerged as an outstanding figure in the Indian consulting industry. Known for its innovative approach and commitment to customer success, Kamayakya offers a comprehensive range of services. These include personalized advice, market research and investment strategies aimed at helping investors navigate the complexity of the stock markets.

Conclusion:

In a fast-growing banking industry like India, choosing the right advisory services is vital for investors to succeed. The said advisory services, which include Motilal Oswal Financial Services, Angel Broking, Sherkhan, Kotak Securities, Edelweiss Wealth Management, IIFL Securities and 5Paisa, KamayaKya have developed a proven track record of providing quality research and personalized advice.

With his innovative approach, Kamayakya adds value to the landscape. Investors should carefully examine their objectives, risk tolerance and preferences before choosing an advisory service. Armed with the right knowledge, investors backed by this advisory service can unlock the full potential to succeed in the banking market in India.

#best stock market advisor#best trading advisory services#stock market advisory services#stock market advisory#small cap stocks#sme stocks#how to trade sme stocks#stock investment ideas#stock market investment advice

0 notes

Text

Top 10 Mixed Stock Portfolio - Multibagger returns potential - Stock 2022

Top 10 Mixed Stock Portfolio – Multibagger returns potential – Stock 2022

Mixed Portfolio : Means a managed portfolio, which is primarily comprised of investments in securities or collective investment schemes other than futures and options.

1# Central Depository Services (India) Ltd.

CDSL operates as a securities depository in India. It offers various services, such as account opening, dematerialization, processing delivery and receipt instructions, account…

View On WordPress

0 notes

Text

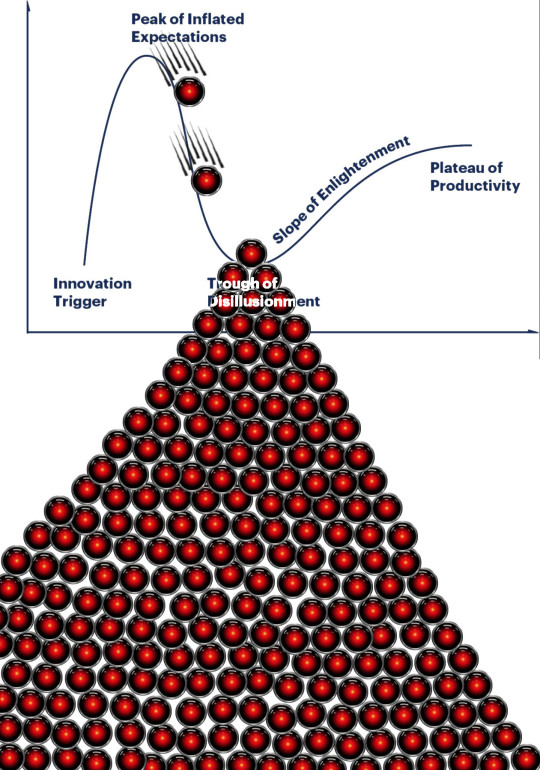

The AI hype bubble is the new crypto hype bubble

Back in 2017 Long Island Ice Tea — known for its undistinguished, barely drinkable sugar-water — changed its name to “Long Blockchain Corp.” Its shares surged to a peak of 400% over their pre-announcement price. The company announced no specific integrations with any kind of blockchain, nor has it made any such integrations since.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/09/autocomplete-worshippers/#the-real-ai-was-the-corporations-that-we-fought-along-the-way

LBCC was subsequently delisted from NASDAQ after settling with the SEC over fraudulent investor statements. Today, the company trades over the counter and its market cap is $36m, down from $138m.

https://cointelegraph.com/news/textbook-case-of-crypto-hype-how-iced-tea-company-went-blockchain-and-failed-despite-a-289-percent-stock-rise

The most remarkable thing about this incredibly stupid story is that LBCC wasn’t the peak of the blockchain bubble — rather, it was the start of blockchain’s final pump-and-dump. By the standards of 2022’s blockchain grifters, LBCC was small potatoes, a mere $138m sugar-water grift.

They didn’t have any NFTs, no wash trades, no ICO. They didn’t have a Superbowl ad. They didn’t steal billions from mom-and-pop investors while proclaiming themselves to be “Effective Altruists.” They didn’t channel hundreds of millions to election campaigns through straw donations and other forms of campaing finance frauds. They didn’t even open a crypto-themed hamburger restaurant where you couldn’t buy hamburgers with crypto:

https://robbreport.com/food-drink/dining/bored-hungry-restaurant-no-cryptocurrency-1234694556/

They were amateurs. Their attempt to “make fetch happen” only succeeded for a brief instant. By contrast, the superpredators of the crypto bubble were able to make fetch happen over an improbably long timescale, deploying the most powerful reality distortion fields since Pets.com.

Anything that can’t go on forever will eventually stop. We’re told that trillions of dollars’ worth of crypto has been wiped out over the past year, but these losses are nowhere to be seen in the real economy — because the “wealth” that was wiped out by the crypto bubble’s bursting never existed in the first place.

Like any Ponzi scheme, crypto was a way to separate normies from their savings through the pretense that they were “investing” in a vast enterprise — but the only real money (“fiat” in cryptospeak) in the system was the hardscrabble retirement savings of working people, which the bubble’s energetic inflaters swapped for illiquid, worthless shitcoins.

We’ve stopped believing in the illusory billions. Sam Bankman-Fried is under house arrest. But the people who gave him money — and the nimbler Ponzi artists who evaded arrest — are looking for new scams to separate the marks from their money.

Take Morganstanley, who spent 2021 and 2022 hyping cryptocurrency as a massive growth opportunity:

https://cointelegraph.com/news/morgan-stanley-launches-cryptocurrency-research-team

Today, Morganstanley wants you to know that AI is a $6 trillion opportunity.

They’re not alone. The CEOs of Endeavor, Buzzfeed, Microsoft, Spotify, Youtube, Snap, Sports Illustrated, and CAA are all out there, pumping up the AI bubble with every hour that god sends, declaring that the future is AI.

https://www.hollywoodreporter.com/business/business-news/wall-street-ai-stock-price-1235343279/

Google and Bing are locked in an arms-race to see whose search engine can attain the speediest, most profound enshittification via chatbot, replacing links to web-pages with florid paragraphs composed by fully automated, supremely confident liars:

https://pluralistic.net/2023/02/16/tweedledumber/#easily-spooked

Blockchain was a solution in search of a problem. So is AI. Yes, Buzzfeed will be able to reduce its wage-bill by automating its personality quiz vertical, and Spotify’s “AI DJ” will produce slightly less terrible playlists (at least, to the extent that Spotify doesn’t put its thumb on the scales by inserting tracks into the playlists whose only fitness factor is that someone paid to boost them).

But even if you add all of this up, double it, square it, and add a billion dollar confidence interval, it still doesn’t add up to what Bank Of America analysts called “a defining moment — like the internet in the ’90s.” For one thing, the most exciting part of the “internet in the ‘90s” was that it had incredibly low barriers to entry and wasn’t dominated by large companies — indeed, it had them running scared.

The AI bubble, by contrast, is being inflated by massive incumbents, whose excitement boils down to “This will let the biggest companies get much, much bigger and the rest of you can go fuck yourselves.” Some revolution.

AI has all the hallmarks of a classic pump-and-dump, starting with terminology. AI isn’t “artificial” and it’s not “intelligent.” “Machine learning” doesn’t learn. On this week’s Trashfuture podcast, they made an excellent (and profane and hilarious) case that ChatGPT is best understood as a sophisticated form of autocomplete — not our new robot overlord.

https://open.spotify.com/episode/4NHKMZZNKi0w9mOhPYIL4T

We all know that autocomplete is a decidedly mixed blessing. Like all statistical inference tools, autocomplete is profoundly conservative — it wants you to do the same thing tomorrow as you did yesterday (that’s why “sophisticated” ad retargeting ads show you ads for shoes in response to your search for shoes). If the word you type after “hey” is usually “hon” then the next time you type “hey,” autocomplete will be ready to fill in your typical following word — even if this time you want to type “hey stop texting me you freak”:

https://blog.lareviewofbooks.org/provocations/neophobic-conservative-ai-overlords-want-everything-stay/

And when autocomplete encounters a new input — when you try to type something you’ve never typed before — it tries to get you to finish your sentence with the statistically median thing that everyone would type next, on average. Usually that produces something utterly bland, but sometimes the results can be hilarious. Back in 2018, I started to text our babysitter with “hey are you free to sit” only to have Android finish the sentence with “on my face” (not something I’d ever typed!):

https://mashable.com/article/android-predictive-text-sit-on-my-face

Modern autocomplete can produce long passages of text in response to prompts, but it is every bit as unreliable as 2018 Android SMS autocomplete, as Alexander Hanff discovered when ChatGPT informed him that he was dead, even generating a plausible URL for a link to a nonexistent obit in The Guardian:

https://www.theregister.com/2023/03/02/chatgpt_considered_harmful/

Of course, the carnival barkers of the AI pump-and-dump insist that this is all a feature, not a bug. If autocomplete says stupid, wrong things with total confidence, that’s because “AI” is becoming more human, because humans also say stupid, wrong things with total confidence.

Exhibit A is the billionaire AI grifter Sam Altman, CEO if OpenAI — a company whose products are not open, nor are they artificial, nor are they intelligent. Altman celebrated the release of ChatGPT by tweeting “i am a stochastic parrot, and so r u.”

https://twitter.com/sama/status/1599471830255177728

This was a dig at the “stochastic parrots” paper, a comprehensive, measured roundup of criticisms of AI that led Google to fire Timnit Gebru, a respected AI researcher, for having the audacity to point out the Emperor’s New Clothes:

https://www.technologyreview.com/2020/12/04/1013294/google-ai-ethics-research-paper-forced-out-timnit-gebru/

Gebru’s co-author on the Parrots paper was Emily M Bender, a computational linguistics specialist at UW, who is one of the best-informed and most damning critics of AI hype. You can get a good sense of her position from Elizabeth Weil’s New York Magazine profile:

https://nymag.com/intelligencer/article/ai-artificial-intelligence-chatbots-emily-m-bender.html

Bender has made many important scholarly contributions to her field, but she is also famous for her rules of thumb, which caution her fellow scientists not to get high on their own supply:

Please do not conflate word form and meaning

Mind your own credulity

As Bender says, we’ve made “machines that can mindlessly generate text, but we haven’t learned how to stop imagining the mind behind it.” One potential tonic against this fallacy is to follow an Italian MP’s suggestion and replace “AI” with “SALAMI” (“Systematic Approaches to Learning Algorithms and Machine Inferences”). It’s a lot easier to keep a clear head when someone asks you, “Is this SALAMI intelligent? Can this SALAMI write a novel? Does this SALAMI deserve human rights?”

Bender’s most famous contribution is the “stochastic parrot,” a construct that “just probabilistically spits out words.” AI bros like Altman love the stochastic parrot, and are hellbent on reducing human beings to stochastic parrots, which will allow them to declare that their chatbots have feature-parity with human beings.

At the same time, Altman and Co are strangely afraid of their creations. It’s possible that this is just a shuck: “I have made something so powerful that it could destroy humanity! Luckily, I am a wise steward of this thing, so it’s fine. But boy, it sure is powerful!”

They’ve been playing this game for a long time. People like Elon Musk (an investor in OpenAI, who is hoping to convince the EU Commission and FTC that he can fire all of Twitter’s human moderators and replace them with chatbots without violating EU law or the FTC’s consent decree) keep warning us that AI will destroy us unless we tame it.

There’s a lot of credulous repetition of these claims, and not just by AI’s boosters. AI critics are also prone to engaging in what Lee Vinsel calls criti-hype: criticizing something by repeating its boosters’ claims without interrogating them to see if they’re true:

https://sts-news.medium.com/youre-doing-it-wrong-notes-on-criticism-and-technology-hype-18b08b4307e5

There are better ways to respond to Elon Musk warning us that AIs will emulsify the planet and use human beings for food than to shout, “Look at how irresponsible this wizard is being! He made a Frankenstein’s Monster that will kill us all!” Like, we could point out that of all the things Elon Musk is profoundly wrong about, he is most wrong about the philosophical meaning of Wachowksi movies:

https://www.theguardian.com/film/2020/may/18/lilly-wachowski-ivana-trump-elon-musk-twitter-red-pill-the-matrix-tweets

But even if we take the bros at their word when they proclaim themselves to be terrified of “existential risk” from AI, we can find better explanations by seeking out other phenomena that might be triggering their dread. As Charlie Stross points out, corporations are Slow AIs, autonomous artificial lifeforms that consistently do the wrong thing even when the people who nominally run them try to steer them in better directions:

https://media.ccc.de/v/34c3-9270-dude_you_broke_the_future

Imagine the existential horror of a ultra-rich manbaby who nominally leads a company, but can’t get it to follow: “everyone thinks I’m in charge, but I’m actually being driven by the Slow AI, serving as its sock puppet on some days, its golem on others.”

Ted Chiang nailed this back in 2017 (the same year of the Long Island Blockchain Company):

There’s a saying, popularized by Fredric Jameson, that it’s easier to imagine the end of the world than to imagine the end of capitalism. It’s no surprise that Silicon Valley capitalists don’t want to think about capitalism ending. What’s unexpected is that the way they envision the world ending is through a form of unchecked capitalism, disguised as a superintelligent AI. They have unconsciously created a devil in their own image, a boogeyman whose excesses are precisely their own.

https://www.buzzfeednews.com/article/tedchiang/the-real-danger-to-civilization-isnt-ai-its-runaway

Chiang is still writing some of the best critical work on “AI.” His February article in the New Yorker, “ChatGPT Is a Blurry JPEG of the Web,” was an instant classic:

[AI] hallucinations are compression artifacts, but — like the incorrect labels generated by the Xerox photocopier — they are plausible enough that identifying them requires comparing them against the originals, which in this case means either the Web or our own knowledge of the world.

https://www.newyorker.com/tech/annals-of-technology/chatgpt-is-a-blurry-jpeg-of-the-web

“AI” is practically purpose-built for inflating another hype-bubble, excelling as it does at producing party-tricks — plausible essays, weird images, voice impersonations. But as Princeton’s Matthew Salganik writes, there’s a world of difference between “cool” and “tool”:

https://freedom-to-tinker.com/2023/03/08/can-chatgpt-and-its-successors-go-from-cool-to-tool/

Nature can claim “conversational AI is a game-changer for science” but “there is a huge gap between writing funny instructions for removing food from home electronics and doing scientific research.” Salganik tried to get ChatGPT to help him with the most banal of scholarly tasks — aiding him in peer reviewing a colleague’s paper. The result? “ChatGPT didn’t help me do peer review at all; not one little bit.”

The criti-hype isn’t limited to ChatGPT, of course — there’s plenty of (justifiable) concern about image and voice generators and their impact on creative labor markets, but that concern is often expressed in ways that amplify the self-serving claims of the companies hoping to inflate the hype machine.

One of the best critical responses to the question of image- and voice-generators comes from Kirby Ferguson, whose final Everything Is a Remix video is a superb, visually stunning, brilliantly argued critique of these systems:

https://www.youtube.com/watch?v=rswxcDyotXA

One area where Ferguson shines is in thinking through the copyright question — is there any right to decide who can study the art you make? Except in some edge cases, these systems don’t store copies of the images they analyze, nor do they reproduce them:

https://pluralistic.net/2023/02/09/ai-monkeys-paw/#bullied-schoolkids

For creators, the important material question raised by these systems is economic, not creative: will our bosses use them to erode our wages? That is a very important question, and as far as our bosses are concerned, the answer is a resounding yes.

Markets value automation primarily because automation allows capitalists to pay workers less. The textile factory owners who purchased automatic looms weren’t interested in giving their workers raises and shorting working days.

‘

They wanted to fire their skilled workers and replace them with small children kidnapped out of orphanages and indentured for a decade, starved and beaten and forced to work, even after they were mangled by the machines. Fun fact: Oliver Twist was based on the bestselling memoir of Robert Blincoe, a child who survived his decade of forced labor:

https://www.gutenberg.org/files/59127/59127-h/59127-h.htm

Today, voice actors sitting down to record for games companies are forced to begin each session with “My name is ______ and I hereby grant irrevocable permission to train an AI with my voice and use it any way you see fit.”

https://www.vice.com/en/article/5d37za/voice-actors-sign-away-rights-to-artificial-intelligence

Let’s be clear here: there is — at present — no firmly established copyright over voiceprints. The “right” that voice actors are signing away as a non-negotiable condition of doing their jobs for giant, powerful monopolists doesn’t even exist. When a corporation makes a worker surrender this right, they are betting that this right will be created later in the name of “artists’ rights” — and that they will then be able to harvest this right and use it to fire the artists who fought so hard for it.

There are other approaches to this. We could support the US Copyright Office’s position that machine-generated works are not works of human creative authorship and are thus not eligible for copyright — so if corporations wanted to control their products, they’d have to hire humans to make them:

https://www.theverge.com/2022/2/21/22944335/us-copyright-office-reject-ai-generated-art-recent-entrance-to-paradise

Or we could create collective rights that belong to all artists and can’t be signed away to a corporation. That’s how the right to record other musicians’ songs work — and it’s why Taylor Swift was able to re-record the masters that were sold out from under her by evil private-equity bros::

https://doctorow.medium.com/united-we-stand-61e16ec707e2

Whatever we do as creative workers and as humans entitled to a decent life, we can’t afford drink the Blockchain Iced Tea. That means that we have to be technically competent, to understand how the stochastic parrot works, and to make sure our criticism doesn’t just repeat the marketing copy of the latest pump-and-dump.

Today (Mar 9), you can catch me in person in Austin at the UT School of Design and Creative Technologies, and remotely at U Manitoba’s Ethics of Emerging Tech Lecture.

Tomorrow (Mar 10), Rebecca Giblin and I kick off the SXSW reading series.

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

[Image ID: A graph depicting the Gartner hype cycle. A pair of HAL 9000's glowing red eyes are chasing each other down the slope from the Peak of Inflated Expectations to join another one that is at rest in the Trough of Disillusionment. It, in turn, sits atop a vast cairn of HAL 9000 eyes that are piled in a rough pyramid that extends below the graph to a distance of several times its height.]

#pluralistic#ai#ml#machine learning#artificial intelligence#chatbot#chatgpt#cryptocurrency#gartner hype cycle#hype cycle#trough of disillusionment#crypto#bubbles#bubblenomics#criti-hype#lee vinsel#slow ai#timnit gebru#emily bender#paperclip maximizers#enshittification#immortal colony organisms#blurry jpegs#charlie stross#ted chiang

2K notes

·

View notes

Text

How To Get Started Investing In The Stock Market

Educate yourself: Before investing in the stock market, it's important to educate yourself about the basics of investing, including the different types of investments, the risks involved, and how to build a diversified portfolio. There are many resources available, including books, online courses, and investment blogs.

Determine your investment goals: It's important to have clear investment goals before investing in the stock market. Are you investing for retirement, a down payment on a house, or to generate passive income? Your investment goals will help determine the types of investments that are appropriate for you.

Open a brokerage account: To invest in the stock market, you'll need to open a brokerage account with a reputable brokerage firm. Some popular options include Fidelity, TD Ameritrade, and Charles Schwab. When choosing a brokerage firm, consider factors such as fees, investment options, and customer service.

Build a diversified portfolio: Diversification is key to successful investing. By investing in a mix of stocks, bonds, and other assets, you can reduce your risk and increase your chances of long-term success. Consider investing in a mix of large-cap and small-cap stocks, domestic and international investments, and bonds with varying maturities.

Start investing: Once you have a brokerage account and have determined your investment strategy, it's time to start investing. Consider starting with a small amount of money and gradually increasing your investments over time.

WAYS TO INVEST

There are several ways to invest in the stock market, including:

Individual Stocks: This involves buying shares of individual companies on the stock market. You can buy shares through a broker or an online trading platform.

Mutual Funds: Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks. This allows you to invest in a variety of companies with a single investment.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds, but they trade like individual stocks on an exchange. This allows you to buy and sell ETFs throughout the trading day.

Index Funds: Index funds track the performance of a specific index, such as the S&P 500. This provides exposure to a broad range of companies and can be a good option for long-term investors.

TOOLS TO START INVESTING

Online Trading Platforms: Many brokers offer online trading platforms that allow you to buy and sell stocks and funds. These platforms typically provide research tools and stock charts to help you make informed investment decisions.

Robo-Advisors: Robo-advisors are digital platforms that use algorithms to create and manage investment portfolios for you. They can be a good option for beginner investors who want a hands-off approach.

Investment Apps: There are several investment apps available that allow you to buy and sell stocks and funds from your mobile device. These apps are often designed for beginner investors and offer low fees and user-friendly interfaces.

PLATFORMS

A few popular options:

Robinhood: Robinhood is a commission-free trading app that offers stocks, ETFs, and cryptocurrency trading. It’s designed for beginner investors and offers a user-friendly interface.

Acorns: Acorns is an investment app that automatically invests your spare change. It rounds up your purchases to the nearest dollar and invests the difference in a diversified portfolio of ETFs.

TD Ameritrade: TD Ameritrade is a popular trading platform that offers stocks, ETFs, mutual funds, options, futures, and forex trading. It offers a variety of trading tools and research resources.

ETRADE: ETRADE is a popular online broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of trading tools and resources, including a mobile app.

Fidelity: Fidelity is a full-service broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of investment tools and research resources, including a mobile app.

INVESTMENT STRATEGIES

Value Investing: Value investing involves buying stocks that are undervalued by the market and holding them for the long term. This approach requires patience and a thorough analysis of a company’s financial statements and growth potential.

Growth Investing: Growth investing involves buying stocks in companies that are expected to grow faster than the market average. This approach often involves investing in companies that are at the cutting edge of technology or have innovative business models.

Dividend Investing: Dividend investing involves buying stocks in companies that pay a dividend. This can provide a steady stream of income for investors and can be a good option for those looking for more conservative investments.

Passive Investing: Passive investing involves investing in a diversified portfolio of low-cost index funds or ETFs. This approach is designed to match the performance of the overall market and requires minimal effort on the part of the investor.

Real Estate Investing: Real estate investing involves buying and holding real estate assets for the purpose of generating income or appreciation. This can include investing in rental properties, real estate investment trusts (REITs), or crowdfunding platforms.

Options trading: is a type of trading strategy that involves buying and selling options contracts, which are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as stocks, at a specific price within a certain time frame. Options trading can be used to generate income, hedge against risk, or speculate on market movements.

Swing trading is a type of trading strategy that aims to capture short- to medium-term gains in a financial asset, such as stocks, currencies, or commodities. Swing traders typically hold their positions for a few days to several weeks, taking advantage of price swings or "swings" in the market. Swing traders use technical analysis to identify trends and patterns in the market, and they often employ a combination of charting tools and indicators to help them make trading decisions. They look for stocks or other assets that have a clear trend, either up or down, and then try to enter and exit positions at opportune times to capture profits.

TECHNICAL ANALYSIS TOOLS

There are many technical analysis resources available for traders to use in their analysis of financial markets. Here are some popular options:

TradingView: TradingView is a web-based charting and technical analysis platform that provides users with real-time data, customizable charts, and a variety of technical indicators and drawing tools.

StockCharts: StockCharts is another web-based platform that provides a wide range of technical analysis tools, including charting capabilities, technical indicators, and scanning tools to help traders identify potential trading opportunities.

Thinkorswim: Thinkorswim is a trading platform provided by TD Ameritrade that offers advanced charting and technical analysis tools, as well as a wide range of other features for traders, including paper trading, news and research, and risk management tools.

MetaTrader 4/5: MetaTrader is a popular trading platform used by many traders around the world. It provides a range of technical analysis tools, including customizable charts, indicators, and automated trading strategies.

Investing.com: Investing.com is a website that provides real-time quotes, charts, news, and analysis for a wide range of financial markets, including stocks, currencies, commodities, and cryptocurrencies.

Yahoo Finance: Yahoo Finance is a website that provides real-time stock quotes, news, and analysis, as well as customizable charts and a variety of other tools for traders and investors.

Finviz: is a popular web-based platform for traders and investors that provides a wide range of tools and information to help them analyze financial markets. The platform offers real-time quotes, customizable charts, news and analysis, and a variety of other features.

435 notes

·

View notes