#Synthetic Graphite Synthetic Graphite Industry

Explore tagged Tumblr posts

Text

Title: The Unsung Hero of Sealing Solutions: Exploring the World of Gaskets

Introduction

In the intricate world of engineering and machinery, there exists a crucial component that often goes unnoticed, yet plays a vital role in ensuring the smooth operation of various systems: the gasket. These unassuming pieces of material are the unsung heroes of sealing solutions, preventing leaks, minimizing energy loss, and maintaining the integrity of countless applications. In this blog, we will dive into the fascinating world of gaskets, exploring their types, applications, and significance in various industries.

What Is a Gasket?

A gasket is a mechanical seal that fills the gap between two or more mating surfaces to prevent the leakage of gases or liquids under compression. Gaskets are typically made from a wide range of materials, such as rubber, metal, cork, silicone, and composite materials. The choice of gasket material depends on the specific application, including the temperature, pressure, and chemical compatibility requirements.

Types of Gaskets

Rubber Gaskets: These gaskets are made from various elastomers like neoprene, EPDM, and nitrile rubber. They are known for their flexibility and resistance to moisture and temperature variations. Rubber gaskets find applications in plumbing, automotive, and HVAC systems.

Metal Gaskets: Composed of materials like stainless steel, copper, or aluminum, metal gaskets excel in high-temperature and high-pressure environments. They are commonly used in the oil and gas industry and for sealing flange connections.

Spiral Wound Gaskets: These gaskets are formed by winding a metal strip and a filler material into a spiral. They are ideal for applications where high pressures and temperatures are involved, making them a favorite choice for the chemical and petrochemical industries.

Graphite Gaskets: Known for their excellent heat and chemical resistance, graphite gaskets are often used in high-temperature and high-pressure applications, such as steam systems and refineries.

Non-Asbestos Gaskets: In response to health concerns associated with asbestos, non-asbestos gaskets have become popular. They use materials like aramid fibers and synthetic rubber to provide a safe and effective sealing solution.

Applications of Gaskets

Automotive Industry: Gaskets are used in engines, transmissions, and exhaust systems to prevent leaks and maintain the efficiency of these crucial components.

Plumbing: Gaskets ensure watertight seals in plumbing fixtures and pipelines, preventing water leaks and minimizing water wastage.

Aerospace: Gaskets are employed in aircraft engines and hydraulic systems to withstand extreme temperatures and pressures, ensuring safe and reliable operation.

Oil and Gas: The industry relies heavily on gaskets to seal flange connections, valves, and pipelines, preventing the escape of hazardous materials.

Chemical Industry: Gaskets play a crucial role in chemical processing, where they must withstand aggressive chemicals and high temperatures.

Significance of Gaskets

Gaskets are the unsung heroes of various industries, silently performing their duties to maintain the integrity and safety of systems and equipment. Their significance can be summarized as follows:

Leak Prevention: Gaskets are designed to create a barrier between mating surfaces, preventing the escape of fluids or gases, which is critical for safety, efficiency, and environmental protection.

Energy Efficiency: Properly sealed systems help conserve energy by preventing leaks and reducing heat loss, ultimately leading to cost savings and reduced environmental impact.

Safety: In industries like oil and gas and chemical processing, gaskets are crucial for containing hazardous materials and preventing accidents.

Conclusion

Gaskets may not be the most glamorous components in the world of engineering, but their role in sealing solutions is indispensable. From the engines of our cars to the pipelines of the oil and gas industry, gaskets quietly ensure that everything runs smoothly and safely. As technology advances, gasket materials and designs will continue to evolve, contributing to more efficient and sustainable systems across various industries. So, the next time you see a gasket, remember the unsung hero that it is, working tirelessly to keep our world sealed and secure.

#home & lifestyle#kitchen appliances#cookware#kitchen#gaskets#kitchenware#cooker#daily blog#daily update#home cooking#home lifestyle

2 notes

·

View notes

Text

Hard Carbon Anodes for Sodium Ion Batteries (NIBs) Market Growth Analysis, Market Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

The global Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market was valued at USD 43.20 million in 2023. With a Compound Annual Growth Rate (CAGR) of 32.50%, the market is projected to soar to USD 543.78 million by 2032. This exponential growth can be attributed to several converging factors, including rising demand for cost-efficient and sustainable energy storage solutions, increasing investments in electric mobility, and technological advancements in battery chemistry.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/915/Hard-Carbon-Anodes-for-Sodium-Ion-Batteries-Market

Hard Carbon Anodes for Sodium Ion Batteries (NIBs) refer to carbon-based, non-graphitizable materials used in the anode component of sodium-ion batteries. Unlike graphite, which is extensively used in lithium-ion batteries, hard carbon demonstrates superior compatibility with sodium ions due to its disordered microstructure, which allows for easier sodium ion insertion and extraction. These anodes are derived from various sources including biomass, polymers, and other organic compounds. Their significance lies in enabling efficient charge-discharge cycles, improved capacity, and prolonged battery life critical for the adoption of sodium-ion technology in industrial energy storage and electric vehicle (EV) applications.

The global market for hard carbon anodes used in sodium-ion batteries (NIBs) is witnessing accelerating growth, driven by the rising demand for sustainable and cost-effective alternatives to lithium-ion batteries. Hard carbon, with its disordered structure and large interlayer spacing, has emerged as the most promising anode material for NIBs due to its ability to accommodate the larger sodium ions more efficiently than graphite. Real-world adoption is gaining momentum for example, Chinese battery manufacturer HiNa Battery has commercialized sodium-ion cells using hard carbon anodes for grid-scale storage and electric two-wheelers

Market Size

Regionally, North America holds a significant share, with an estimated market size of USD 18.40 million in 2023. This region is expected to maintain robust growth at a CAGR of 27.86% during the forecast period. The strong regional performance is driven by policy support for clean energy, strategic government initiatives, and a growing base of R&D and manufacturing facilities in battery technology.

Market Dynamics (Drivers, Restraints, Opportunities, and Challenges)

Drivers:

Rising Demand for Cost-Effective Energy Storage Solutions

One of the primary drivers propelling the hard carbon anodes market for sodium-ion batteries is the surging demand for affordable and scalable energy storage technologies. Unlike lithium-ion batteries, sodium-ion batteries utilize abundant and low-cost raw materials primarily sodium and hard carbon derived from biomass or synthetic precursors. This makes them especially attractive for large-scale stationary applications and emerging markets where cost constraints are significant. For instance, India’s push for rural electrification and China’s focus on grid stabilization are creating a fertile ground for sodium-ion battery deployment. Companies like Natron Energy in the U.S. and Faradion in the UK are developing sodium-ion battery systems tailored for stationary energy storage, highlighting a growing global shift toward alternatives that are not only sustainable but economically viable. This cost advantage is directly contributing to the increased investment and research into high-performance hard carbon anodes.

Restraints:

Lower Energy Density Compared to Lithium-Ion Batteries

A significant restraint in the growth of the hard carbon anodes market for sodium-ion batteries is the comparatively lower energy density of sodium-ion cells versus their lithium-ion counterparts. Sodium ions are larger and heavier than lithium ions, which limits how much energy can be stored per unit of weight or volume. This makes sodium-ion batteries less suitable for high-performance electric vehicles (EVs) or compact consumer electronics that demand long runtimes and lightweight battery systems. For example, while CATL has announced sodium-ion cells with energy densities around 160 Wh/kg, mainstream lithium-ion batteries are already exceeding 250 Wh/kg. This performance gap restricts sodium-ion technology to niche or complementary roles, such as stationary energy storage, electric scooters, or backup systems, and could slow adoption unless breakthroughs in hard carbon structure or hybrid battery designs are achieved.

Opportunities:

Expansion into Grid-Scale and Low-Speed Electric Mobility Markets

There are significant growth prospects in the sodium-ion battery hard carbon anode market, especially for grid-scale energy storage and low-speed electric mobility applications. The demand for affordable, long-duration storage solutions is growing as nations seek to increase the use of renewable energy. For grid stabilization and solar or wind energy storage, sodium-ion batteries with hard carbon anodes present a strong substitute for lithium-based systems. For Instance, India is investigating sodium-based storage to support its solar mission under the National Energy Storage Mission (NESM), while China's State Grid is actively deploying sodium-ion batteries for renewable integration projects.Additionally, low-speed electric vehicles such as e-rickshaws and electric two-wheelers in Asia and Africa present a massive untapped market. These applications do not require the high energy density of lithium-ion but benefit greatly from the lower cost and thermal stability of sodium-ion batteries. As governments push for localized energy solutions and low-emission transport, hard carbon anodes are positioned to be a key enabler in the next wave of battery innovation.

Challenges:

Manufacturing Scalability and Performance Consistency of Hard Carbon Anodes

One of the key challenges facing the hard carbon anodes market for sodium-ion batteries is achieving scalable, cost-effective manufacturing while maintaining consistent performance. Hard carbon materials can be derived from a wide range of precursors—such as pitch, biomass, or synthetic polymers—but the variability in source materials often leads to inconsistency in electrochemical properties like capacity, initial Coulombic efficiency, and cycling stability. This lack of standardization hampers large-scale adoption and complicates integration into commercial battery production lines. For example, while some startups like Faradion and HiNa Battery have optimized proprietary synthesis processes, many manufacturers still struggle with reproducibility and cost control at scale. Furthermore, the energy-intensive high-temperature pyrolysis required for hard carbon production can add to operational expenses, potentially offsetting the low cost of raw materials. Overcoming these technical and logistical hurdles will be essential to unlocking the full commercial potential of sodium-ion batteries.

Regional Analysis

Regional Analysis

Asia-Pacific dominates the global hard carbon anodes market for sodium-ion batteries, with China leading in both production and deployment. Chinese battery giants like CATL and HiNa Battery are actively commercializing sodium-ion technologies, supported by strong government backing and abundant access to raw materials. India is also emerging as a key player, driven by its focus on affordable energy storage and electrification of rural transport. Europe is investing heavily in sodium-ion R&D, with companies like Faradion and Tiamat developing advanced hard carbon materials tailored for grid storage and light mobility. The region’s emphasis on reducing dependence on imported lithium further fuels this shift. In North America, interest is growing with players like Natron Energy targeting stationary storage for data centers and telecom. Meanwhile, Latin America and Africa show potential for adoption due to the low cost and safety of sodium-ion batteries, particularly for off-grid and remote energy access solutions.

Competitor Analysis (in brief)

The competitive landscape is characterized by both established giants and innovative startups. Major players are focusing on R&D, strategic partnerships, and vertical integration to gain a competitive edge.

· Kuraray and Kureha are leveraging their polymer chemistry expertise to develop next-gen hard carbon materials.

· JFE Chemical and Sumitomo have diversified portfolios with robust manufacturing capacities.

· Stora Enso and Indigenous Energy are innovating in the biomass-derived hard carbon segment.

· Chinese companies like Shengquan Group, HiNa Battery Technology, and BTR are expanding rapidly, supported by domestic demand and government backing.

· EnerG2 and Best Graphite are focusing on niche, high-performance applications within the NIB space.

January 2024, Altris, a leader in sustainable sodium-ion battery technology, and Clarios, a world leader in cutting-edge low-voltage battery solutions, announced they were forming a partnership to develop low-voltage sodium-ion batteries for the automotive sector.

August 2024, Natron Energy, a manufacturer of sodium-ion battery energy storage systems, has announced the plan to open $1.4 billion factory in North Carolina.

October 2024, CATL launched in a new era for high-capacity EREV and PHEV batteries with the introduction of the Freevoy Super Hybrid Battery, the first hybrid vehicle battery in the world to achieve a pure electric range of over 400 kilometers and 4C superfast charging.

Global Hard Carbon Anodes for Sodium Ion Batteries (NIBs) Market: Market Segmentation Analysis

This report provides a deep insight into the global Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market, covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and assessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Hard Carbon Anodes for Sodium Ion Batteries (NIBs). This report introduces in detail the market share, market performance, product situation, operation situation, etc., of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) in any manner.

Market Segmentation (by Material Type)

· Biomass-derived Hard Carbon

· Polymer-derived Hard Carbon

· Petroleum-based Hard Carbon

· Other Synthetic Precursors

Market Segmentation (by Application)

· Sodium-Ion Batteries (NIBs)

· Electric Vehicles (EVs) & E-Mobility

· Consumer Electronics

· Industrial & Power Tools

· Other

Market Segmentation (by End Use Industry)

· Automotive

· Energy & Power

· Consumer Electronics

· Industrial

· Telecommunications

· Others

Key Company

· Kuraray

· JFE Chemical

· Kureha

· Sumitomo

· Stora Enso

· Indigenous Energy

· Shengquan Group

· HiNa Battery Technology

· Best Graphite

· BTR

· EnerG2

Geographic Segmentation

· North America (USA, Canada, Mexico)

· Europe (Germany, UK, France, Russia, Italy, Rest of Europe)

· Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

· South America (Brazil, Argentina, Columbia, Rest of South America)

· The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of MEA)

FAQ

▶ What is the current market size of the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market?

As of 2023, the global market size stands at USD 43.20 million, with projections indicating it will grow to USD 543.78 million by 2032.

▶ Which are the key companies operating in the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market?

Major players include Kuraray, JFE Chemical, Kureha, Sumitomo, Stora Enso, Indigenous Energy, Shengquan Group, HiNa Battery Technology, Best Graphite, BTR, and EnerG2.

▶ What are the key growth drivers of the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market?

Key drivers include the abundance of sodium resources, rising demand for renewable energy storage, electric vehicle adoption, and ongoing advancements in material science.

▶ Which region is expected to dominate the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market?

Asia-Pacific is expected to lead due to its manufacturing capacity, research initiatives, and strong demand from energy and EV sectors.

▶ What are the major challenges facing the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market?

Challenges include scaling up production, competition from lithium-ion technologies, and navigating regulatory complexities across global markets.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/915/Hard-Carbon-Anodes-for-Sodium-Ion-Batteries-Market

0 notes

Text

A Deep Dive into PTFE and CNAF Gaskets from Asian Sealing Products

In the vast landscape of industrial sealing, selecting the right gasket material is paramount to ensuring operational integrity, safety, and efficiency. Two materials stand out for their distinct properties and widespread applications: Polytetrafluoroethylene (PTFE) and Compressed Non-Asbestos Fiber (CNAF). At Asian Sealing Products, we understand the critical role these materials play, and we offer a comprehensive range of high-quality PTFE and CNAF gaskets designed to meet diverse industrial demands.

Let's explore the unique characteristics, applications, and advantages of each, helping you make an informed decision for your specific sealing challenges.

PTFE Gaskets: The Chemical Resistance Champion

PTFE, a fluoropolymer, is renowned for its exceptional chemical inertness and non-stick properties. These characteristics make PTFE gaskets an indispensable choice in industries where chemical compatibility and purity are non-negotiable.

Key Advantages of PTFE Gaskets:

Unrivaled Chemical Resistance: PTFE is virtually impervious to most chemicals, acids, bases, and solvents across a wide temperature range. This makes it ideal for highly corrosive media where other materials would quickly degrade.

Excellent Temperature Range: PTFE gaskets maintain their integrity from cryogenic temperatures up to approximately 260°C (500°F), offering versatility across various thermal conditions.

Low Friction & Non-Contaminating: Its low coefficient of friction prevents sticking, and its non-toxic nature makes it suitable for food, pharmaceutical, and other contamination-sensitive applications.

Hygienic Properties: PTFE does not absorb moisture, preventing bacterial growth, which is critical in sanitary environments.

UV and Weather Resistance: PTFE stands up well to outdoor exposure, including UV radiation, without degrading.

Typical Applications for PTFE Gaskets:

Chemical processing plants

Pharmaceutical manufacturing

Food and beverage industries

Semiconductor manufacturing

Oil & gas (where chemical attack is a concern)

Water treatment facilities

Important Considerations for PTFE: While excellent in many aspects, virgin PTFE can exhibit "cold flow" or creep under sustained compression, especially at higher temperatures. To counteract this, filled PTFE gaskets (e.g., with glass, carbon, or graphite fillers) are often used to enhance mechanical strength, reduce creep, and improve wear resistance. Expanded PTFE (ePTFE) is also popular for its excellent conformability and sealing capabilities on irregular flanges.

CNAF Gaskets: The Versatile & Robust Solution

Compressed Non-Asbestos Fiber (CNAF) gaskets emerged as a safer and highly effective alternative to asbestos-containing materials. These gaskets are manufactured from a blend of synthetic fibers (like aramid, carbon, or glass), high-quality elastomeric binders (e.g., NBR, SBR, EPDM), and fillers, compressed into sheets. The composition can be tailored to provide specific properties.

Key Advantages of CNAF Gaskets:

Broad Application Range: CNAF gaskets are incredibly versatile, suitable for sealing water, steam, oils, fuels, mild acids, and general industrial fluids.

Good Pressure and Temperature Resistance: Depending on the specific blend, CNAF gaskets can handle significant pressures and temperatures, making them a cost-effective solution for many standard and moderately demanding applications.

Excellent Sealing Performance: The fiber-elastomer matrix provides good compressibility and recovery, allowing for effective sealing even on less-than-perfect flange surfaces.

Cost-Effective: Generally more economical than specialty materials like PTFE or metallic gaskets, making them a popular choice for general utility applications.

Safety: Asbestos-free composition ensures a safer work environment and compliance with health regulations.

Typical Applications for CNAF Gaskets:

General piping and pipelines

Water and wastewater treatment

HVAC systems

Steam lines (within temperature limits)

Industrial engines

Compressors and pumps

Choosing Between PTFE and CNAF: Making the Right Decision

The choice between PTFE and CNAF hinges on your specific operational requirements:

For extreme chemical resistance, purity, and sanitary applications: PTFE is the clear winner.

For versatile general-purpose sealing with good temperature/pressure limits and cost-effectiveness: CNAF is an excellent choice.

At Asian Sealing Products, we not only offer a wide array of PTFE (virgin, filled, ePTFE) and CNAF gasket materials but also possess the expertise to help you select the precise gasket solution for your unique challenge. Our commitment to quality ensures that every gasket provides reliable, long-lasting performance.

0 notes

Text

LIB Anode Market Emerging Trends Shaping Next-Generation Battery Technologies

The LIB anode market is undergoing significant transformation as new technologies, materials, and manufacturing processes emerge. These innovations are largely driven by the surging demand for energy storage in electric vehicles (EVs), portable electronics, and renewable energy systems. As industries move toward greener alternatives and higher energy efficiencies, the LIB anode market is poised to play a crucial role in enabling superior battery performance, cost reduction, and environmental sustainability.

Rise of Silicon-Based Anodes

One of the most prominent trends in the LIB anode market is the shift from traditional graphite anodes to silicon-based alternatives. Silicon offers significantly higher theoretical capacity than graphite, making it attractive for next-generation batteries. While pure silicon has posed challenges due to volume expansion during charge-discharge cycles, advancements in silicon-graphite composites and nano-structuring have started to overcome these limitations. Companies are increasingly investing in hybrid materials to enhance cycle life and energy density without compromising stability.

Graphite Innovation and Supply Chain Development

Despite the rise of silicon, graphite remains dominant in commercial LIB anodes due to its stability and mature supply chain. However, innovations in synthetic graphite and improved purification techniques are helping boost its performance. The development of environmentally friendly and cost-effective graphite production methods is gaining traction, especially in light of concerns over the sustainability of natural graphite mining. Countries outside China are also ramping up efforts to localize graphite supply chains, ensuring resilience against geopolitical risks and trade disruptions.

Emergence of Solid-State Batteries

The shift toward solid-state batteries is another transformative trend impacting the LIB anode market. Solid-state batteries offer enhanced safety, higher energy density, and better longevity compared to conventional liquid electrolyte systems. These batteries enable the use of lithium metal or silicon-rich anodes, which are incompatible with liquid electrolytes. The development of suitable solid electrolytes is accelerating the commercialization of these batteries, pushing manufacturers to redesign anode materials for compatibility and performance.

Sustainable and Recycled Anode Materials

With the rise in environmental awareness, sustainability has become a major focus in the LIB anode market. Manufacturers are exploring ways to incorporate recycled graphite and other materials into anode production. Technologies that extract usable anode components from end-of-life batteries are gaining momentum, driven by stricter regulations and the need to close the loop in battery manufacturing. The circular economy approach not only reduces waste but also alleviates pressure on raw material supply.

3D Structured Anodes and Advanced Manufacturing

Another trend gaining popularity is the use of 3D-structured anodes. These architectures increase surface area and enable more efficient lithium-ion diffusion, improving charging speed and battery performance. Advanced manufacturing techniques such as atomic layer deposition (ALD), laser structuring, and 3D printing are being used to create innovative anode designs. These methods also allow better control over material distribution and thickness, helping in miniaturization and higher capacity output for compact devices.

Regional Dynamics and Strategic Investments

Emerging trends in the LIB anode market are closely tied to regional investment and development strategies. Asia-Pacific, particularly China, South Korea, and Japan, remains the global hub for LIB production and innovation. However, North America and Europe are ramping up their capabilities through government incentives, private investments, and joint ventures. The growing interest in localizing battery supply chains, especially for EV production, is leading to the establishment of anode material production facilities closer to end-use markets.

Integration with AI and Data Analytics

Smart manufacturing and AI integration are emerging as game-changers in anode development. Machine learning models are being used to predict material behaviors, optimize production parameters, and accelerate R&D. This trend is helping manufacturers reduce time-to-market and enhance the performance consistency of anode materials. Predictive maintenance of production equipment and real-time monitoring of anode properties during manufacturing also improve efficiency and quality control.

Conclusion

The LIB anode market is at the cusp of a technological revolution driven by emerging trends such as silicon integration, solid-state compatibility, sustainable sourcing, and advanced manufacturing techniques. These developments are not only improving battery performance but also addressing critical challenges related to cost, supply chain stability, and environmental impact. As demand for lithium-ion batteries continues to surge across sectors, stakeholders in the anode market are investing in innovation and strategic partnerships to stay competitive and contribute to a more electrified, sustainable future.

0 notes

Text

Global Pocket Lighters Market Analysis Report (2025–2031)

"

The global Pocket Lighters market is expected to experience consistent growth between 2025 and 2031. This in-depth report offers expert insights into emerging trends, leading companies, regional performance, and future growth opportunities. Its a valuable resource for businesses, investors, and stakeholders seeking data-driven decisions.

Access the Full Report Now https://marketsglob.com/report/pocket-lighters-market/1365/

What’s Inside:

Latest advancements in Pocket Lighters product development

Impact of synthetic sourcing on production workflows

Innovations in cost-efficient manufacturing and new use cases

Leading Companies Profiled:

BIC

Tokai

Flamagas

Swedish Match

NingBo Xinhai

Baide International

Ningbo Shunhong

Shaodong Maosheng

Zhuoye Lighter

Benxi Fenghe Lighter

Wansfa

Hefeng Industry

Shaodong Huanxing

Shaodong Lianhua

Strong focus on R&D and next-generation Pocket Lighters products

Shift toward synthetic sourcing techniques

Real-world examples from top players using cost-effective strategies

The report showcases top-performing companies in the Pocket Lighters industry, examining their strategic initiatives, innovations, and future roadmaps. This helps you understand the competitive landscape and plan ahead effectively.

Product Types Covered:

Flint Lighters

Electronic Lighters

Others

Applications Covered:

Super and Hypermarkets

Convenience Stores

Specialist Retailers

Online Retailers

Directly Sales

Sales Channels Covered:

Direct Channel

Distribution Channel

Regional Analysis:

North America (United States, Canada, Mexico)

Europe (Germany, United Kingdom, France, Italy, Russia, Spain, Benelux, Poland, Austria, Portugal, Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, Australia, Taiwan, Rest of Asia Pacific)

South America (Brazil, Argentina, Colombia, Chile, Peru, Venezuela, Rest of South America)

Middle East & Africa (UAE, Saudi Arabia, South Africa, Egypt, Nigeria, Rest of Middle East & Africa)

Key Takeaways:

Market size, share, and CAGR forecast to 2031

Strategic insights into emerging opportunities

Demand outlook for standard vs. premium products

Company profiles, pricing trends, and revenue projections

Insights into licensing, co-development, and strategic partnerships

This detailed report offers a full picture of where the Pocket Lighters market stands today and where its headed. Whether you are a manufacturer, investor, or strategist, this report can help you identify key opportunities and make informed business decisions.

" Siphonic Toilet RAID Controller Card for SSD Atomic Layer Deposition (ALD) Valves Ultrahigh-Purity Diaphragm Valves FBG Temperature Sensors Harness Connector High Voltage Harness Connector Single Sided Chip On Flex Current Sense Shunt Resistors Stage Lighting Fixture Architainment Lighting Fixture Piezoelectric MEMS Sensors Specialty Graphite Products Specialty Graphite for Semiconductor Composite Rebars Strain Wave Gear 8 Bit Microcontroller Unit(MCU) 16 Bit Microcontroller Unit(MCU) 32 Bit Microcontroller Unit(MCU)

0 notes

Text

Hard Carbon Anodes for Sodium Ion Batteries (NIBs) Market 2025

The global Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market was valued at USD 43.20 million in 2023. With a Compound Annual Growth Rate (CAGR) of 32.50%, the market is projected to soar to USD 543.78 million by 2032. This exponential growth can be attributed to several converging factors, including rising demand for cost-efficient and sustainable energy storage solutions, increasing investments in electric mobility, and technological advancements in battery chemistry.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/915/Hard-Carbon-Anodes-for-Sodium-Ion-Batteries-Market

Hard Carbon Anodes for Sodium Ion Batteries (NIBs) refer to carbon-based, non-graphitizable materials used in the anode component of sodium-ion batteries. Unlike graphite, which is extensively used in lithium-ion batteries, hard carbon demonstrates superior compatibility with sodium ions due to its disordered microstructure, which allows for easier sodium ion insertion and extraction. These anodes are derived from various sources including biomass, polymers, and other organic compounds. Their significance lies in enabling efficient charge-discharge cycles, improved capacity, and prolonged battery life critical for the adoption of sodium-ion technology in industrial energy storage and electric vehicle (EV) applications.

The global market for hard carbon anodes used in sodium-ion batteries (NIBs) is witnessing accelerating growth, driven by the rising demand for sustainable and cost-effective alternatives to lithium-ion batteries. Hard carbon, with its disordered structure and large interlayer spacing, has emerged as the most promising anode material for NIBs due to its ability to accommodate the larger sodium ions more efficiently than graphite. Real-world adoption is gaining momentum for example, Chinese battery manufacturer HiNa Battery has commercialized sodium-ion cells using hard carbon anodes for grid-scale storage and electric two-wheelers

Market Size

Regionally, North America holds a significant share, with an estimated market size of USD 18.40 million in 2023. This region is expected to maintain robust growth at a CAGR of 27.86% during the forecast period. The strong regional performance is driven by policy support for clean energy, strategic government initiatives, and a growing base of R&D and manufacturing facilities in battery technology.

Market Dynamics (Drivers, Restraints, Opportunities, and Challenges)

Drivers:

Rising Demand for Cost-Effective Energy Storage Solutions

One of the primary drivers propelling the hard carbon anodes market for sodium-ion batteries is the surging demand for affordable and scalable energy storage technologies. Unlike lithium-ion batteries, sodium-ion batteries utilize abundant and low-cost raw materials primarily sodium and hard carbon derived from biomass or synthetic precursors. This makes them especially attractive for large-scale stationary applications and emerging markets where cost constraints are significant. For instance, India’s push for rural electrification and China’s focus on grid stabilization are creating a fertile ground for sodium-ion battery deployment. Companies like Natron Energy in the U.S. and Faradion in the UK are developing sodium-ion battery systems tailored for stationary energy storage, highlighting a growing global shift toward alternatives that are not only sustainable but economically viable. This cost advantage is directly contributing to the increased investment and research into high-performance hard carbon anodes.

Restraints:

Lower Energy Density Compared to Lithium-Ion Batteries

A significant restraint in the growth of the hard carbon anodes market for sodium-ion batteries is the comparatively lower energy density of sodium-ion cells versus their lithium-ion counterparts. Sodium ions are larger and heavier than lithium ions, which limits how much energy can be stored per unit of weight or volume. This makes sodium-ion batteries less suitable for high-performance electric vehicles (EVs) or compact consumer electronics that demand long runtimes and lightweight battery systems. For example, while CATL has announced sodium-ion cells with energy densities around 160 Wh/kg, mainstream lithium-ion batteries are already exceeding 250 Wh/kg. This performance gap restricts sodium-ion technology to niche or complementary roles, such as stationary energy storage, electric scooters, or backup systems, and could slow adoption unless breakthroughs in hard carbon structure or hybrid battery designs are achieved.

Opportunities:

Expansion into Grid-Scale and Low-Speed Electric Mobility Markets

There are significant growth prospects in the sodium-ion battery hard carbon anode market, especially for grid-scale energy storage and low-speed electric mobility applications. The demand for affordable, long-duration storage solutions is growing as nations seek to increase the use of renewable energy. For grid stabilization and solar or wind energy storage, sodium-ion batteries with hard carbon anodes present a strong substitute for lithium-based systems. For Instance, India is investigating sodium-based storage to support its solar mission under the National Energy Storage Mission (NESM), while China's State Grid is actively deploying sodium-ion batteries for renewable integration projects.Additionally, low-speed electric vehicles such as e-rickshaws and electric two-wheelers in Asia and Africa present a massive untapped market. These applications do not require the high energy density of lithium-ion but benefit greatly from the lower cost and thermal stability of sodium-ion batteries. As governments push for localized energy solutions and low-emission transport, hard carbon anodes are positioned to be a key enabler in the next wave of battery innovation.

Challenges:

Manufacturing Scalability and Performance Consistency of Hard Carbon Anodes

One of the key challenges facing the hard carbon anodes market for sodium-ion batteries is achieving scalable, cost-effective manufacturing while maintaining consistent performance. Hard carbon materials can be derived from a wide range of precursors—such as pitch, biomass, or synthetic polymers—but the variability in source materials often leads to inconsistency in electrochemical properties like capacity, initial Coulombic efficiency, and cycling stability. This lack of standardization hampers large-scale adoption and complicates integration into commercial battery production lines. For example, while some startups like Faradion and HiNa Battery have optimized proprietary synthesis processes, many manufacturers still struggle with reproducibility and cost control at scale. Furthermore, the energy-intensive high-temperature pyrolysis required for hard carbon production can add to operational expenses, potentially offsetting the low cost of raw materials. Overcoming these technical and logistical hurdles will be essential to unlocking the full commercial potential of sodium-ion batteries.

Regional Analysis

Regional Analysis

Asia-Pacific dominates the global hard carbon anodes market for sodium-ion batteries, with China leading in both production and deployment. Chinese battery giants like CATL and HiNa Battery are actively commercializing sodium-ion technologies, supported by strong government backing and abundant access to raw materials. India is also emerging as a key player, driven by its focus on affordable energy storage and electrification of rural transport. Europe is investing heavily in sodium-ion R&D, with companies like Faradion and Tiamat developing advanced hard carbon materials tailored for grid storage and light mobility. The region’s emphasis on reducing dependence on imported lithium further fuels this shift. In North America, interest is growing with players like Natron Energy targeting stationary storage for data centers and telecom. Meanwhile, Latin America and Africa show potential for adoption due to the low cost and safety of sodium-ion batteries, particularly for off-grid and remote energy access solutions.

Competitor Analysis (in brief)

The competitive landscape is characterized by both established giants and innovative startups. Major players are focusing on R&D, strategic partnerships, and vertical integration to gain a competitive edge.

Kuraray and Kureha are leveraging their polymer chemistry expertise to develop next-gen hard carbon materials.

JFE Chemical and Sumitomo have diversified portfolios with robust manufacturing capacities.

Stora Enso and Indigenous Energy are innovating in the biomass-derived hard carbon segment.

Chinese companies like Shengquan Group, HiNa Battery Technology, and BTR are expanding rapidly, supported by domestic demand and government backing.

EnerG2 and Best Graphite are focusing on niche, high-performance applications within the NIB space.

January 2024, Altris, a leader in sustainable sodium-ion battery technology, and Clarios, a world leader in cutting-edge low-voltage battery solutions, announced they were forming a partnership to develop low-voltage sodium-ion batteries for the automotive sector.

August 2024, Natron Energy, a manufacturer of sodium-ion battery energy storage systems, has announced the plan to open $1.4 billion factory in North Carolina.

October 2024, CATL launched in a new era for high-capacity EREV and PHEV batteries with the introduction of the Freevoy Super Hybrid Battery, the first hybrid vehicle battery in the world to achieve a pure electric range of over 400 kilometers and 4C superfast charging.

Global Hard Carbon Anodes for Sodium Ion Batteries (NIBs) Market: Market Segmentation Analysis

This report provides a deep insight into the global Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market, covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and assessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Hard Carbon Anodes for Sodium Ion Batteries (NIBs). This report introduces in detail the market share, market performance, product situation, operation situation, etc., of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) in any manner.

Market Segmentation (by Material Type)

Biomass-derived Hard Carbon

Polymer-derived Hard Carbon

Petroleum-based Hard Carbon

Other Synthetic Precursors

Market Segmentation (by Application)

Sodium-Ion Batteries (NIBs)

Electric Vehicles (EVs) & E-Mobility

Consumer Electronics

Industrial & Power Tools

Other

Market Segmentation (by End Use Industry)

Automotive

Energy & Power

Consumer Electronics

Industrial

Telecommunications

Others

Key Company

Kuraray

JFE Chemical

Kureha

Sumitomo

Stora Enso

Indigenous Energy

Shengquan Group

HiNa Battery Technology

Best Graphite

BTR

EnerG2

Geographic Segmentation

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Russia, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

South America (Brazil, Argentina, Columbia, Rest of South America)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of MEA)

FAQ

▶ What is the current market size of the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market?

As of 2023, the global market size stands at USD 43.20 million, with projections indicating it will grow to USD 543.78 million by 2032.

▶ Which are the key companies operating in the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market?

Major players include Kuraray, JFE Chemical, Kureha, Sumitomo, Stora Enso, Indigenous Energy, Shengquan Group, HiNa Battery Technology, Best Graphite, BTR, and EnerG2.

▶ What are the key growth drivers of the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market?

Key drivers include the abundance of sodium resources, rising demand for renewable energy storage, electric vehicle adoption, and ongoing advancements in material science.

▶ Which region is expected to dominate the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market?

Asia-Pacific is expected to lead due to its manufacturing capacity, research initiatives, and strong demand from energy and EV sectors.

▶ What are the major challenges facing the Hard Carbon Anodes for Sodium Ion Batteries (NIBs) market?

Challenges include scaling up production, competition from lithium-ion technologies, and navigating regulatory complexities across global markets.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/915/Hard-Carbon-Anodes-for-Sodium-Ion-Batteries-Market

0 notes

Text

High and low temperature planetary gearboxes will be delivered to Slovenia

A high and low temperature planetary gearbox is a specialized type of planetary gearbox designed to operate reliably under extreme temperature conditions, ranging from very low (e.g., -60°C or below) to very high (e.g., 200°C or above) temperatures. These gearboxes are used in industries where standard gearboxes would fail due to thermal expansion, material degradation, or lubrication issues. High and low temperature planetary gearboxes provide the reliability needed in such challenging environments. Key Features of High and Low Temperature Planetary Gearboxes 1. Specialized Materials Gear Components: Made from high-performance alloys (e.g., stainless steel, titanium, or heat-treated steels) to resist thermal deformation. Housing: Often aluminum alloy or stainless steel with thermal-resistant coatings. These materials are essential for planetary gearboxes operating at high and low temperatures. Bearings: Ceramic or high-temperature steel bearings to prevent failure under thermal stress. 2. High-Temperature Lubrication Synthetic lubricants (e.g., perfluoropolyether (PFPE) or silicone-based greases) that remain stable across a wide temperature range, crucial for high-low temperature planetary operations. Solid lubricants (e.g., graphite or molybdenum disulfide) for vacuum or ultra-high-temperature applications. 3. Thermal Management Heat-resistant seals to prevent lubricant leakage are important in maintaining planetary gearboxes under high and low temperature conditions. Thermal insulation or cooling systems (e.g., heat sinks or forced air cooling) for extreme environments. 4. Precision Engineering Tight tolerances to account for thermal expansion/contraction. Precision is key when engineering planetary gearboxes that withstand high and low temperatures. Optimized gear meshing to prevent binding or excessive wear. Applications Aerospace & Defense: Satellite mechanisms, drone actuators, missile systems. Oil & Gas: Downhole drilling equipment, high-temperature pumps. Industrial Automation: Furnace conveyors, steel mill machinery. Automotive: Electric vehicle (EV) drivetrains in extreme climates. These high and low temperature planetary gear reducers ensure effective operation across varied conditions. Scientific & Research: Cryogenic systems, space exploration rovers. Would you like recommendations for a specific application? You are welcome to watch more projects or visit our website to check other series or load down e-catalogues for further technical data. Youtube: https://www.youtube.com/@tallmanrobotics Facebook: https://www.facebook.com/tallmanrobotics Linkedin: https://www.linkedin.com/in/tallman-robotics Read the full article

#Backlash-FreePrecisionPlanetaryGearboxes#IndustrialPlanetaryGearboxes#PlanetaryGearBox#Planetarygeartransmissions#PlanetaryGearboxes#Planetarygearheadsformaximumtorque#PrecisionPlanetaryGearboxes

0 notes

Text

Global Green Coke Market Report: Trends, Opportunities, and Forecast 2025-2032

Global Green Coke Market by Player, Region, Type, Application 2025-2032

The global Green Coke Market is experiencing robust expansion, with its valuation reaching USD 21.3 billion in 2024. According to comprehensive industry analysis, the market is projected to grow at a CAGR of 6.5%, reaching approximately USD 40 billion by 2033. This sustained growth trajectory is primarily fueled by increasing demand from aluminum smelting operations and steel production, particularly in rapidly industrializing economies where infrastructure development is accelerating.

Green coke, a critical byproduct of oil refining, serves as the essential raw material for producing calcined petroleum coke. Its unique properties make it indispensable for anode production in aluminum electrolysis, while fuel-grade variants are gaining traction in energy-intensive industries seeking cost-effective carbon solutions. The market's evolution is being shaped by environmental regulations pushing for cleaner industrial processes and the aluminum sector's insatiable appetite for high-quality carbon materials.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/291524/green-coke-market

Market Overview & Regional Analysis

Asia-Pacific commands the global green coke landscape with over 50% market share, driven by China's dominance in both aluminum production and petroleum refining. The region's massive smelting capacity and expanding steel industry create consistent demand for anode-grade coke, while growing power needs fuel consumption of fuel-grade product. China's position is further strengthened by vertical integration among state-owned refiners and aluminum producers.

North America maintains steady demand through its established aluminum sector and increasing use of green coke in steel electric arc furnaces. Europe's market is characterized by stringent environmental standards pushing adoption of low-sulfur coke variants, though reliance on imports persists. The Middle East is emerging as a production hub, leveraging abundant heavy crude supplies and strategic partnerships with Asian consumers.

Key Market Drivers and Opportunities

The market's momentum stems from aluminum's irreplaceable role in lightweight automotive and aerospace applications, with global production expected to exceed 85 million metric tons by 2030. Simultaneously, steelmakers' transition to electric arc furnace technology creates new demand streams, as green coke offers 15-20% lower emissions than traditional metallurgical coke. The cement industry's search for alternative fuels presents a $3.5 billion opportunity by 2030, with trials showing successful 20-30% coke substitution in kiln operations.

Emerging opportunities include the development of specialized low-sulfur cokes for premium aluminum applications and the utilization of CFB boiler technology to consume higher-sulfur variants in power generation. The circular economy push is also driving innovation in coke recycling processes, potentially unlocking new value chains in the coming decade.

Challenges & Restraints

The market faces headwinds from crude oil price volatility, with 30% quarterly swings creating pricing uncertainty throughout the supply chain. Environmental compliance costs are rising sharply, particularly in Europe and North America, where new regulations require sulfur content below 3% and impose stricter emissions standards on calcination plants. Quality consistency remains an ongoing challenge, with metal impurity thresholds below 500 ppm for anode-grade material forcing smelters to maintain larger safety stocks.

Trade dynamics add another layer of complexity, with recent export restrictions in some producing countries causing localized price spikes up to 40%. The threat of substitution looms as synthetic graphite and carbon block technologies advance, though their current 35-40% cost premium provides temporary insulation for green coke producers.

Market Segmentation by Type

Anode Grade Coke

Fuel Grade Coke

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/291524/green-coke-market

Market Segmentation by Application

Aluminum Production

Steel Manufacturing

Cement Industry

Power Generation

Other Industrial Uses

Market Segmentation and Key Players

Sinopec

CNPC

Shell

BP

Chevron

Rosneft

Saudi Aramco

Essar Oil

Valero Energy

Petrobras

TotalEnergies

Reliance Industries

Pemex

Phillips 66

Report Scope

This report provides a comprehensive analysis of the global and regional Green Coke markets, covering the period from 2024 to 2033. It delivers detailed insights into current market dynamics and future outlook across key geographies, with particular focus on:

Market size, volume, and revenue projections

Detailed segmentation by product type and end-use applications

The report also features in-depth profiles of major industry participants, including:

Corporate overviews and strategic positioning

Production capabilities and technology portfolios

Capacity expansions and investment trends

Financial performance and market share analysis

Our analysis extends to the competitive environment, identifying key vendors and evaluating factors that may influence future market development. The research incorporates extensive interviews with industry executives and technical experts, covering:

Demand patterns and consumption trends

Product innovation and technological advancements

Strategic initiatives and partnership activities

Regulatory impacts and operational challenges

Get Full Report Here: https://www.24chemicalresearch.com/reports/291524/green-coke-market

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

Plant-level capacity tracking

Real-time price monitoring

Techno-economic feasibility studies

With a dedicated team of researchers possessing over a decade of experience, we focus on delivering actionable, timely, and high-quality reports to help clients achieve their strategic goals. Our mission is to be the most trusted resource for market insights in the chemical and materials industries.

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch

0 notes

Text

An Overview of Advanced Ceramics

Advanced ceramics can be divided into structural ceramics, tool ceramics, and functional ceramics according to their different uses.

Structural Ceramics

The main materials of structural ceramics are alumina (Al2O3), silicon nitride (Si3N4), silicon carbide (SiC), and hexagon boron nitride ceramics (BN).

Alumina (Al2O3)

The main composition is Al2O3, and the general content is more than 45%. Alumina ceramics have various excellent properties such as high-temperature resistance, corrosion resistance and high strength, which is 2~3 ordinary ceramics. However, alumina ceramics have the disadvantage of being brittle and unable to accept sudden changes in ambient temperature. Alumina ceramics are widely used as the crucible, engine spark plug, high-temperature refractory, thermocouple sleeve, sealing ring and so on.

Silicon nitride (Si3N4) ceramics

Si3N4 is the main component of silicon nitride ceramics, which is a kind of high-temperature ceramics with high strength, high hardness, abrasion resistance, corrosion resistance, and self-lubrication. The linear expansion coefficient of silicon nitride is the smallest among all kinds of ceramics, and it has excellent electrical insulation and radiation resistance. It has excellent corrosion resistance, and it can withstand the corrosion of various acids except the hydrofluoric acid, as well as alkali, corrosion of various metals. Silicon nitride ceramics can be used as high-temperature bearings, sealing rings used in corrosive media, thermocouple sleeves, and metal cutting tools.

Silicon carbide ceramics (SiC)

Silicon carbide ceramics are mainly composed of SiC, which is a kind of high-temperature ceramic with high strength and high hardness. When used in the high temperature of 1200 ℃ ~ 1400 ℃, silicon carbide ceramics can still maintain a high bending strength. In addition, silicon carbide ceramics also have good thermal conductivity, oxidation resistance, electrical conductivity, and high impact toughness. It is a good high-temperature structural material and can be used for rocket tail nozzle, thermocouple sleeve, furnace tube, and other high-temperature components.

Hexagonal boron nitride (h-BN)

The main composition of hexagonal boron nitride ceramics is BN, and the crystal structure is hexagonal crystal system. The structure and performance of hexagonal boron nitride ceramics are similar to graphite, so it is known as “White Graphite “. Hexagonal boron nitride ceramics are of low hardness and can be machined with self-lubricating properties, and they can also be made into self-lubricating high-temperature bearings and glass-forming molds.

Tool Ceramics

The main materials of tool ceramics are cemented carbide, natural diamond (diamond), cubic boron nitride (CBN), etc.

Cemented carbide

Carbides are mainly composed of carbides and binders. Carbides mainly include WC, TiC, TaC, NBC, VC, etc., and binders are mainly cobalt (Co). Compared with the tool steel, cemented carbide has a high hardness (87 ~ 91 HRA), good red hardness (1000 ℃) and excellent wear resistance. When used as a cutter, its cutting speed is 4~7 times higher than that of HSS, and its service life is 5~8 times higher. However, its disadvantages are high hardness, brittle, and difficult to be machined, so it is often made into a blade and welded on the tool rod for use. Carbide is mainly used for machining tools; Various dies, including drawing die, drawing die, cold heading die; Mining tools, geology, and petroleum use a variety of drill bits, etc.

Natural diamond (diamond)

Natural diamond (diamond) is a precious ornament, while synthetic diamond is widely used in the industry. Diamond is the hardest material in nature and has a very high elastic modulus, and the thermal conductivity of diamond is the highest among known materials. Besides, diamond has good insulation, which can be used as the drill bit, cutter, grinding tool, drawing die, dressing tool. However, the thermal stability of the diamond tool is poor, and the affinity with iron group elements is large, so it cannot be used for processing iron, nickel-based alloy, but mainly for processing non-iron metal and non-metal, widely used in ceramics, glass, stone, concrete, gem, agate and other processing.

Tool Ceramics

• Cubic boron nitride (CBN)

Cubic boron nitride (CBN) has a cubic crystal structure, and its hardness is second only to diamond. The thermal and chemical stability of cubic boron nitride is better than that of diamond, and it can be used for cutting hardened steel, wear-resisting cast iron, thermal spraying material, nickel, and other difficult materials.

• Other tool ceramics

Other tool ceramics are alumina, zirconia, silicon nitride, and other ceramics, but they are not as good as the above three tool ceramics from the comprehensive performance and engineering applications.

Functional Ceramics

Functional ceramics usually have special physical properties and cover many fields, and the characteristics and applications of common functional ceramics are as follows.

• Dielectric ceramics

Performance: Insulation, thermoelectric, piezoelectric, strong dielectric

Material composition: Al2O3, Mg2SiO4, BaTiO3, PbTiO3, LiNbO3

Application: Integrated circuit substrates, thermistors, oscillators, capacitors

• Optical ceramic

Performance: Fluorescence, luminescence, infrared transmittance, high transparency, the electrochromic effect

Material composition: Al2O3CrNd glass, CaAs, CdTe, SiO2, WO3

Application: Laser, infrared window, optical fiber, display

Functional Ceramics

• Magnetic Ceramics

Performance: Soft magnetism and hard magnetism

Material composition: ZnFe2O, SrO, y-Fe2O3

Application: Magnetic tape, all kinds of the high-frequency magnetic core, electro-acoustic devices, instruments and control devices of the magnetic core

• Semiconductive ceramics

Performance: Photoelectric effect, resistance temperature change effect, thermionic emission effect

Material composition: CdS, Ca2Sx, VO2, NiO, LaB6, BaO

Application: Solar cells, temperature sensors, the hot cathode

Development of advanced ceramics

Advanced ceramic is a significant piece of new material, broadly utilized in correspondence, hardware, flying, aviation, military, and other fields, and has significant applications in data and correspondence innovation.

Most utilitarian pottery are broadly utilized in the gadgets business, which is frequently alluded to as electronic artistic materials. For instance, clay protection materials utilized in chip producing, fired substrate materials, earthenware bundling materials, and capacitor ceramics, piezoelectric ceramics, ferrite attractive materials utilized in electronic gadgets fabricating.

As of now, progressed pottery has framed a high-tech industry. Overall deals of high-tech earthenware production surpass the US $30 billion and are developing at a yearly pace of over l0%, with the United States and Japan driving the field. Progressed earthenware materials assume an undeniably significant part in industry, conventional industry change, and public guard and military industry because of their great high-temperature mechanical properties and their special composite impacts of light, sound, power, attraction, warmth, or capacity.

0 notes

Text

Feed Premixes Market Size, Analysis, Demand, Business Challenges and Future Opportunities 2034: SPER Market Research

Feed premixes are custom blends of ingredients incorporated into animal feed to provide essential nutrients for optimal health, growth, and productivity. These premixes generally include a mix of vitamins, minerals, amino acids, antioxidants, and other vital nutrients, carefully formulated to meet the specific dietary needs of various animals, such as poultry, pigs, cattle, and aquaculture species. By offering a precise nutrient balance, feed premixes support better animal health, improve feed efficiency, and boost overall productivity.

According to SPER market research, ‘Global Feed Premixes Market Size- By Form, By Product, By Livestock - Regional Outlook, Competitive Strategies and Segment Forecast to 2034’ state that the Global Feed Premixes Market is predicted to reach 32.2 Billion by 2034 with a CAGR 8.81%.

Drivers:

The growing demand for livestock-based products such as dairy, meat, and eggs is anticipated to drive the use of feed additives to support the growth of farm animals. Poultry meat is expected to be a key driver of this growth due to its high demand, low production costs, and affordable prices in both developed and developing countries. Emerging markets in regions like Asia Pacific and Latin America are playing a significant role in global demand, with developing countries in Asia Pacific expected to see continued growth in meat consumption over the coming years. This increased demand is fueling the need for high-quality feed concentrates and premixes to improve meat quality. The rising demand for protein, increased awareness of animal health, and technological advancements have contributed to the development of more advanced feed products.

Request a Free Sample Report: https://www.sperresearch.com/report-store/Feed-Premixes-Market?sample=1

Restraints:

The global feed industry focuses on improving feed efficiency by enhancing feed conversion rates for livestock and farmed fish. To achieve sustainability, it is essential to develop a unified environmental footprint methodology based on life cycle analysis across the entire supply chain. This can help establish consistent metrics for resource efficiency. By using feed ingredients more efficiently, the environmental impact of livestock farming can be reduced, and utilizing co-products from other industries can ease the strain on land-grown crops. In 2006, the European Union banned antibiotics as growth promoters due to microbial resistance, prompting a global decline in antibiotic use, especially in countries like China, India, and the US. This restriction has led to the removal of antibiotics from feed premixes, creating challenges for manufacturers who previously relied on these products.

In 2024, the Asia Pacific region captured the largest revenue share, primarily due to its large livestock populations in countries such as China, India, and Bangladesh. The region is home to some of the leading animal feed producers, with China at the forefront, while nations like Japan, Indonesia, and Thailand also have strong feed production capabilities. According to Alltech, many of the world’s top feed companies are located in the Asia Pacific region, contributing to its highly competitive market. Some significant market players are ADM, BASF SE, Cargill Inc., Danish Agro, DLG, dsm-firmenich, ForFarmers, Godrej Agrovet Limited, InVivo Group, and Land O'Lakes Inc.

For More Information, refer to below link: –

Feed Premixes Market Growth

Related Reports:

Carbon & Graphite Felt Market Growth, Size, Trends Analysis- By Product Type, By Purity, By Application - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Synthetic Lubricants Market Growth, Size, Trends Analysis - By Product, By Application - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant — USA

SPER Market Research

+1–347–460–2899

#Feed Premixes Market#Feed Premixes Market Share#Fishing Drones Global Market#Global Feed Premixes Market Size#Feed Premixes Market Size#Feed Premixes Market Growth#Feed Premixes Market Demand#Feed Premixes Market Growing CAGR#Feed Premixes Market CAGR Status#Feed Premixes Market Challenges#Feed Premixes Market Analysis#Feed Premixes Market Future Opportunities#Feed Premixes Market Future Outlook#Feed Premixes Market Trends

0 notes

Text

Graphite Prices: Market Analysis, Trend, News, Graph and Demand

Graphite prices in North America continued on a downward trajectory, shaped by a mix of market uncertainties and geopolitical influences. The region remained reliant on imports from key suppliers such as China, Madagascar, and Mozambique, with global production shifts disrupting established supply chains. While U.S. government investments in alternative graphite sources and domestic manufacturing facilities highlighted a strategic move toward supply chain diversification, progress was hindered by persistent challenges in scaling local production. By the end of the quarter, graphite flake prices stood at USD 1013/MT CFR Houston.

Demand across the United States was uneven. The electric vehicle (EV) sector—traditionally a major consumer of graphite—saw fluctuating demand, as automakers adjusted production in response to global supply chain constraints. The construction sector experienced seasonal weakness, with activity slowing in multi-family housing projects amid high mortgage rates and low housing inventory. On the other hand, industrial sectors such as steel production and lubricants demonstrated relative stability, though overall market sentiment remained cautious. Geopolitical concerns surrounding China’s dominance in graphite supply and ongoing shifts in trade policies further contributed to market pressure.

Despite these headwinds, the U.S. market made notable strides in securing long-term supply agreements, offering a foundation for potential recovery in 2025 as economic conditions improve and new domestic manufacturing initiatives advance.

Get Real time Prices for Graphite : https://www.chemanalyst.com/Pricing-data/graphite-1433

The European graphite market continued to experience a steady decline in prices, with Germany at the forefront of this downward trend. This drop was largely attributed to weak demand and evolving supply conditions across the region. The quarter began with a modest 0.7% decrease in prices, influenced by sufficient domestic availability, falling freight costs, and additional supply inflows from Madagascar. However, any optimism was short-lived as demand remained underwhelming, particularly in key industries such as steel and batteries. Battery electric vehicle (BEV) registrations declined by 5% year-over-year, underscoring reduced momentum in one of graphite's most important end-use sectors.

Germany’s economy struggled throughout the quarter, with continued stagnation in manufacturing and no clear signs of recovery. Demand across major sectors, including construction and EV production, remained consistently low, prompting further reductions in graphite prices. A significant 22% drop in BEV registrations during the quarter contributed to a year-to-date decline of 26%, reflecting a marked slowdown in the region's green mobility transition. Factory input costs also trended lower, mirroring the broader downturn in industrial activity and reflecting the uncertainty surrounding political and economic developments in the region. Moreover, a gradual industry shift toward synthetic graphite further eroded demand for natural graphite, compounding market challenges.

Annual EV sales fell sharply by 27.4%, while the construction sector faced persistent weakness amid tightening credit conditions and project delays. These factors led to an oversupply of graphite in the market, adding further downward pressure on prices and creating a sluggish trading environment. By the end of the quarter, prices for graphite flakes (94%, -100 mesh) had fallen to USD 797 per metric ton Ex Hamburg, highlighting a difficult close to the year for the European graphite industry.

The graphite market across the Asia-Pacific region saw a 3% decline in prices, shaped by softening demand and changing supply-side dynamics. Production levels throughout the region remained consistent, with key contributions from major suppliers such as Madagascar and Brazil, complemented by ongoing improvements in processing technologies. Despite this stable output, demand signals were mixed across core sectors like construction and automotive, with buyers exhibiting cautious purchasing behavior due to prevailing economic uncertainties and an emphasis on maintaining lean inventories.

The battery industry continued to play a central role in driving graphite consumption; however, growth was tempered as manufacturers prioritized inventory optimization rather than aggressive restocking. In China, the world’s largest graphite producer, prices came under persistent downward pressure, ending the quarter at USD 656 per metric ton for graphite flakes (94%, -100 mesh) FOB Shanghai. Market sentiment was weighed down by strategic production cutbacks as several producers scaled back operations in response to soft demand and seasonal market fluctuations.

The construction industry in the region showed further signs of contraction, while the automotive sector faced a slowdown in the adoption of new energy vehicles, limiting graphite usage. Adding to these challenges were heightened export restrictions and ongoing geopolitical tensions, which led to reduced international shipments and created uncertainty around trade flows. Domestically, consumption remained uneven, with some sectors more resilient than others. Nonetheless, the region maintained steady production levels, and there was a sense of cautious optimism about a potential rebound in 2025, driven by recovery in downstream industries and improved global demand. Overall, the graphite market in APAC during the quarter reflected a nuanced blend of regional supply steadiness and variable consumption trends, shaped by both internal and external pressures.

Get Real time Prices for Graphite : https://www.chemanalyst.com/Pricing-data/graphite-1433

Our Blog:

Automotive Tyre Raw Materials Prices: https://www.chemanalyst.com/Industry-data/automotive-tyre-raw-materials-1

Automotive Interior Chemicals Prices: https://www.chemanalyst.com/Industry-data/automotive-interior-chemicals-2

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

#Graphite Pricing#Graphite News#Graphite Price Monitor#Graphite Database#India#united kingdom#united states#Germany#business#research#chemicals#Technology#Market Research#Canada#Japan#China

0 notes

Text

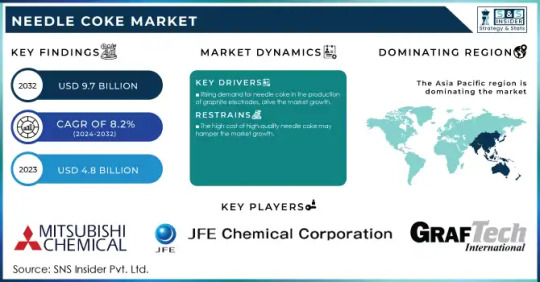

Soaring EV Demand Boosts Needle Coke Consumption in Lithium-Ion Batteries

Surging Demand from Graphite Electrode Production and Lithium-Ion Battery Applications Fuels Growth in the Needle Coke Market.

The Needle Coke Market size was valued at USD 4.8 Billion in 2023. It is expected to grow to USD 9.7 Billion by 2032 and grow at a CAGR of 8.2% over the forecast period of 2024-2032.

The Needle Coke Market is driven by increasing demand from the steel industry and the rapidly expanding electric vehicle (EV) battery sector. Needle coke is a premium-grade, high-purity carbon material used primarily in the production of graphite electrodes for electric arc furnaces (EAFs) and anodes for lithium-ion batteries. Known for its superior crystallinity, low coefficient of thermal expansion, and high electrical conductivity, needle coke plays a crucial role in industries focused on performance and efficiency.

Key Players

GrafTech International

JFE Chemical Corporation

Mitsubishi Chemical Corporation

Indian Oil Corporation Limited

Shaanxi Coal and Chemical Industry

Asbury Carbons

Koch Industries

Sinosteel Corporation

China National Petroleum Corporation (CNPC)

Phillips 66

Future Scope & Emerging Trends

The global demand for needle coke is set to surge with the growth of the electric arc furnace (EAF) steelmaking process, which is favored for its lower carbon footprint compared to traditional blast furnaces. Additionally, the expanding electric vehicle market is significantly boosting the need for synthetic graphite anodes, where needle coke is a critical raw material. A prominent emerging trend is the development of coal-based needle coke alternatives, particularly in China, aimed at reducing dependence on petroleum-based inputs. Moreover, R&D investments into improving the efficiency and environmental sustainability of needle coke production are expected to shape the competitive landscape. With the shift toward green steel production and battery technology innovation, the needle coke market is poised for long-term growth.

Key Points

Primarily used in graphite electrodes and lithium-ion battery anodes

High demand from steelmaking and electric vehicle battery sectors

Rising adoption of EAFs for eco-friendly steel production

Growth of coal-based needle coke production, especially in Asia

North America and Asia-Pacific dominate in production and consumption

Conclusion

The Needle Coke Market is on an upward trajectory, supported by critical applications in sustainable steel production and advanced energy storage solutions. As industries continue to prioritize efficiency, performance, and sustainability, needle coke will remain an essential material in meeting the energy and infrastructure demands of the future.

Read Full Report: https://www.snsinsider.com/reports/needle-coke-market-4972

Contact Us:

Jagney Dave — Vice President of Client Engagement

Phone: +1–315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Needle Coke Market#Needle Coke Market Size#Needle Coke Market Share#Needle Coke Market Report#Needle Coke Market Forecast

0 notes

Text

The Evolution Of Non-Metallic Gaskets

Gaskets play a crucial role across various sectors by providing a seal between surfaces to prevent leaks and maintain system integrity. Over time, the technology surrounding gaskets has undergone substantial advancements, with non-metallic gaskets becoming increasingly favoured for their versatility, cost efficiency, and capability to accommodate diverse applications. This blog delves into the historical evolution of non-metallic gaskets, the advancements in materials, and their significance in contemporary industries.

The emergence of non-metallic gaskets

The application of sealing materials dates back thousands of years. Ancient civilizations utilized natural materials such as clay, plant fibres, and animal skins to seal containers and rudimentary machinery. However, the industrial revolution of the 18th and 19th centuries spurred the need for more efficient sealing solutions.

Rubber and fibre-based gaskets