#TechSector

Explore tagged Tumblr posts

Text

Information Technology News & Updates - BizzBuzz

Stay ahead in the digital world with comprehensive IT coverage including software development, cloud computing, and enterprise solutions. We analyze emerging technologies, cybersecurity threats, and digital transformation strategies across industries. Get insights into AI applications, blockchain developments, and IT infrastructure modernization. Essential reading for CIOs, tech professionals, and business leaders driving technological innovation in their organizations.

0 notes

Text

How Does (etr:amd) Reflect Advances in Semiconductor Innovation?

Advanced Micro Devices, a prominent name in the global semiconductor industry, continues to capture market attention through strategic developments in AI technology and high-performance computing. As a competitor in the evolving semiconductor landscape, (etr:amd) reflects the company’s efforts in the AI chip segment and its influence within data center advancements. These initiatives have contributed to its presence in institutional portfolios and broader tech sector discussions, reinforcing its relevance in the world of semiconductors and advanced computing.

Semiconductor Leadership and Market Expansion

(Etr:amd) represents Advanced Micro Devices, which has positioned itself among key players in the semiconductor industry by advancing high-performance CPUs, GPUs, and AI-enabled hardware. As demand continues to expand across gaming, cloud computing, and AI workloads, the company has moved toward enhancing its product offerings to address both general-purpose and specialized computing requirements.

The release of its latest series of AI chips, aimed at supporting large language models and training-intensive applications, signifies the company’s intention to claim a stronger foothold in the competitive AI hardware segment. Through this evolution, (etr:amd) maintains relevance not only in equity discussions but also within the context of emerging technologies.

Strengthening Data Center Relevance

Data centers represent a vital business segment for the company. The growing volume of generative AI applications and cloud-native operations has elevated the importance of hardware optimization, where AMD’s processors offer energy efficiency and performance advantages.

Collaborations with major cloud service providers, as well as increasing adoption of the company’s products in hyperscale environments, contribute to its expanding presence in high-performance server infrastructure. The emphasis on scalable architecture, supported by custom solutions, strengthens alignment with enterprise clients seeking efficiency and adaptability. As such, (etr:amd) continues to feature prominently across institutional monitoring platforms.

Competitive Positioning in the GPU Market

The GPU market continues to play a central role in technological advancement, particularly in graphics-intensive tasks and machine learning acceleration. The company’s graphics portfolio has evolved to meet rising expectations in gaming, content creation, and AI-driven visual applications.

While the competitive landscape features dominant players, AMD has enhanced its capabilities by introducing architecture improvements, reduced power consumption, and developer-friendly ecosystems. These innovations support the company’s profile in discussions of semiconductor competitiveness and technological parity in the GPU domain. This sustained development contributes to keyword visibility for (etr:amd) across financial data services.

Strategic Developments and Industry Engagement

Recent strategic focus areas for the company include AI integration, power-efficient computing, and platform interoperability. Its acquisition of businesses specializing in adaptive computing has enabled the expansion of customizable AI solutions that align with modern enterprise needs. These developments have further reinforced the relevance of (etr:amd) in conversations surrounding scalable and intelligent semiconductor solutions.

Participation in industry-wide events and product showcases further supports visibility. The inclusion of advanced chipsets in both consumer-grade and enterprise-level devices amplifies brand recognition and ensures that (etr:amd) maintains consistent coverage across platforms analyzing semiconductor dynamics and tech sector performance.

Institutional Participation and Broader Tech Influence

The company has received attention from institutional participants due to its relevance in emerging technologies and diversified business units. In the broader context of the tech sector, its exposure to AI infrastructure, advanced GPUs, and enterprise computing places it among those shaping next-generation computing paradigms. As a result, (etr:amd) continues to surface in institutional research and global discussions surrounding technological innovation.

Presence across industry-tracking portfolios and thematic exchange-traded products focused on semiconductors and innovation contributes to ongoing relevance in structured financial strategies. This broad inclusion reinforces the role of semiconductor firms in shaping macroeconomic themes related to automation, data processing, and digital transformation. Consequently, (etr:amd) maintains a stable position within institutional screening models.

Global Visibility and Index Inclusion

The company’s visibility extends beyond domestic markets, supported by its inclusion in multiple international indices and global financial platforms. This exposure adds to the accessibility of the brand in both European and North American financial discussions, increasing engagement across international exchanges and data analytics services.

Such cross-market integration enhances its profile and supports broader coverage from analysts, industry trackers, and algorithmic models analyzing trends in semiconductors and the broader tech sector. Within this scope, (etr:amd) remains a frequently cited identifier in global semiconductor analysis.

Semiconductors and the Future of AI Integration

As AI continues to shape industry models, the company’s development of next-generation AI chips and machine learning frameworks positions it within a key segment of the evolving tech ecosystem. The ability to provide infrastructure that supports real-time analytics, inference modeling, and large-scale training creates relevance across multiple verticals.

The expanding reliance on edge computing and hybrid cloud models reinforces continued importance for semiconductor manufacturers prioritizing latency reduction, power efficiency, and multi-architecture support. These dynamics highlight the operational significance of (etr:amd) in facilitating AI-driven computing infrastructure.

Advanced Micro Devices, through its commitment to high-performance computing, AI acceleration, and energy-efficient design, maintains a strong position within the global semiconductor ecosystem. With innovation in AI chips, data center solutions, and GPU technologies, the company is not only addressing current computing demands but also influencing the architecture of modern digital environments. Continued presence across institutional platforms and the broader tech sector underscores the operational footprint of the company and the ongoing prominence of (etr:amd) in industry coverage.

0 notes

Text

Harnessing Tech and Market Forces: Driving Scotland's Economic Prosperity

The Intersection of Technology and Free Markets: Fuelling Economic Growth in Scotland Hello, dear readers! Today's discussion on "Perspectives Unbound" centres around a transformative topic at the core of current global economic shifts: the intersection of technology and free-market principles, and how this fusion can propel Scotland's economic growth. In an era where technology infiltrates every aspect of life, its integration with free-market mechanisms has the potential to dramatically enhance productivity and competitiveness. The digital revolution offers unprecedented opportunities for entrepreneurs and businesses in Scotland, from the bustling tech hubs of Edinburgh and Glasgow to the emerging digital landscapes in smaller communities. Scotland's tech sector has become a beacon of innovation, thanks in part to its embrace of open-market policies which encourage investment, competition, and trade. By leveraging these principles, Scottish tech firms are not only contributing to the local economy but are also making significant marks on the global stage. However, the benefits of combining tech advancements with free-market practices extend beyond just economic metrics. This synergy is a powerful engine for job creation, providing a wide range of employment opportunities across various skill levels. Furthermore, it fosters an environment ripe for innovation where businesses can thrive on creative solutions, improving services and products, thus enhancing consumer choice and overall quality of life. The Scottish government's role in this should focus on facilitating a fertile ground for this growth, ensuring that regulations and policies encourage entrepreneurship while protecting public interest without stifling innovation. This includes investing in digital infrastructure to support connectivity, enhancing cybersecurity, and fostering educational programmes that equip the workforce with necessary technological skills. As we ponder on these reflections, the importance of public dialogue in shaping technology and market policies becomes clear. It is crucial that this dialogue involves a spectrum of voices from various sectors to ensure that growth is inclusive and beneficial for all levels of Scottish society. Thank you for joining today's exploration into how leveraging technology within a free-market framework can catalyse sustainable economic growth and prosperity in Scotland. Warm regards, Alastair Majury *Perspectives Unbound* --- *Stay tuned to Perspectives Unbound for more insights on how technological advancements and economic freedom converge to define Scotland’s future.*

#TechnologyAndMarkets#ScottishEconomicGrowth#TechInnovation#FreeMarketEconomy#DigitalScotland#EconomicDevelopment#Entrepreneurship#GlobalCompetitiveness#JobCreation#InnovationHub#TechSector#InvestInScotland#DigitalInfrastructure#Cybersecurity#EducationalProgrammes

0 notes

Photo

Wow, that's a huge hit! 😱 Apple has always been a strong player, but this tech sector sell-off is really shaking things up. Stay strong, Apple! 🍏 #TechNews #Apple #MarketWatch #StockMarket #Finance #TechSector

0 notes

Text

Cisco Announces Workforce Reduction Amid Industry Downturn

Tech Giant to Cut 5% of Workforce, Eliminating 4,250 Jobs

In a move to streamline operations amidst a challenging industry landscape, Cisco, one of the leading technology companies, has announced plans to reduce its workforce by 5%. This decision will result in approximately 4,250 job cuts, contributing to a significant downsizing trend seen across the tech sector. The news has had an immediate impact on Cisco’s stock, with shares declining by as much as 9% in extended trading.

Industry-Wide Downsizing in 2024

Cisco’s decision reflects an industry-wide trend, as tech companies continue to implement cost-cutting measures in response to the market downturn that began two years ago. January marked a particularly active month for job cuts in the sector, with major players like Alphabet, Amazon, Microsoft, SAP, eBay, Unity, and Discord all announcing layoffs. According to Layoffs.fyi, 144 tech companies have already laid off nearly 35,000 workers in 2024.

Financial Performance and Guidance Challenges

Cisco’s workforce reduction comes on the heels of a 6% year-over-year decline in revenue for the quarter ending on January 27. The net income also experienced a dip, falling to $2.63 billion, or 65 cents per share, from $2.77 billion, or 67 cents per share, in the same period last year. The company attributed part of the challenging financial environment to delays in finalizing the $28 billion acquisition of monitoring and security software maker Splunk.

Cisco Is Cutting 5% of Workforce

youtube

CEO Chuck Robbins, in a conference call with analysts, provided guidance for the fiscal third quarter, calling for adjusted earnings per share between 84 to 86 cents on $12.1 billion to $12.3 billion in revenue. These figures fell short of analysts’ expectations, who were anticipating adjusted earnings of 92 cents per share on $13.09 billion in revenue.

For the full year, Cisco anticipates adjusted earnings per share in the range of $3.68 to $3.74 and revenue between $51.5 billion to $52.5 billion, below analysts’ projections of $3.86 in adjusted earnings per share and $54.26 billion in revenue.

Challenges and Caution in a Shifting Environment

During the conference call, Robbins acknowledged challenges impacting the guidance, citing a cautious approach due to heightened uncertainty in the macro environment. Additionally, customers are taking more time to deploy products received in recent quarters, contributing to slower-than-expected progress. Demand remains sluggish among telecommunications and cable service provider clients, adding further complexity to Cisco’s outlook.

Despite these challenges, Cisco announced a slight increase in its dividend, raising it by a penny to 40 cents per share. The company now faces the task of navigating a changing landscape while aiming to maintain its competitive edge in the technology sector.

Also Read: Tencent’s Riot Games Undertakes Global Workforce Reduction

#Cisco#TechIndustry#workforcereduction#JobCut#TechSector#stockmarket#TechGiants#industrytrends#Youtube

0 notes

Photo

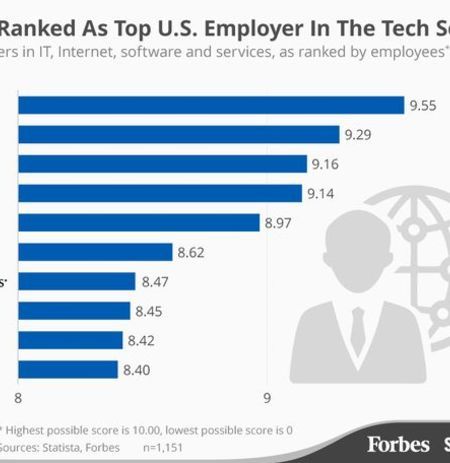

Google Ranked As Top U.S. Employer In The Tech Sector Google takes the crown as the ultimate workplace in the tech world.

0 notes

Text

Why Does SaaS Present a Particularly Bright Spot for India's Tech Sector?

Indian SaaS ecosystem has a bright future as long as investors continue to be optimistic about Vertical SaaS, its ability to access SMB market. Read More. https://www.sify.com/digital-transformation/why-does-saas-present-a-particularly-bright-spot-for-indias-tech-sector/

0 notes

Video

youtube

"Genius Act Incoming: Will NDX Take Off After a One-Month Box?"

0 notes

Text

🏗️ What are the different Work Fields emerging due to Mechanical Engineering advancements?

Uncover the evolving sectors shaped by mechanical engineering innovation.

1 note

·

View note

Text

ZScaler's Cloud Security Success: Strong Growth, Stock Drop, and Future Challenges #CEO #CloudComputing #cloudsecuritycompany #cloudsecurityservices #competition #Cybersecurity #digitallandscape #fiscalthirdquarterearnings #futureprospects #guidance #increasedadoption #investorsentiment #JayChaudhry #Revenuegrowth #robustsecuritymeasures #salescycles #stockprice #supplychainissues #techsector. #ZeroTrustapproach #ZScaler

#Business#CEO#CloudComputing#cloudsecuritycompany#cloudsecurityservices#competition#Cybersecurity#digitallandscape#fiscalthirdquarterearnings#futureprospects#guidance#increasedadoption#investorsentiment#JayChaudhry#Revenuegrowth#robustsecuritymeasures#salescycles#stockprice#supplychainissues#techsector.#ZeroTrustapproach#ZScaler

0 notes

Text

De Competitie Tussen ChatGPT en DeepSeek: Een Metafoor van Spierkracht versus Elegantie

In de wereld van kunstmatige intelligentie (AI) ontvouwt zich een nieuwe strijd die niet alleen de techsector opschudt, maar ook de fundamentele aannames over innovatie en economische machtsverhoudingen ter discussie stelt. Aan de ene kant staat ChatGPT, het kroonjuweel van OpenAI, dat sinds zijn lancering de markt domineert met zijn indrukwekkende vermogen om menselijke taal te begrijpen en te…

0 notes

Text

Explore the Nasdaq Index A Deep Dive into Tech-Driven Market Trends

Among the leading indicators of equity market dynamics, one particular index has earned a reputation for capturing the pulse of the innovation economy. Known for its technology-heavy composition and its responsiveness to shifts in the digital and growth landscape, the nasdaq index provides critical insight into how modern enterprises are performing across global markets.

Originating in the early 1970s, the nasdaq index was launched with the goal of tracking the performance of companies listed on a then-nascent electronic exchange. Over time, it has expanded to become one of the most followed equity market measures, offering a broad view of thousands of listed companies that range from small-cap startups to globally recognized tech conglomerates.

How It’s Structured and What It Represents

Unlike indices that cover a fixed number of large-cap stocks, this benchmark includes more than 3,000 listings. The methodology used to construct the nasdaq index is based on market capitalization weighting, meaning companies with larger market values carry more influence on the index’s movements. As a result, fluctuations in the share prices of dominant names in the technology sector can move the entire nasdaq index significantly in either direction.

This structure means that companies such as those in cloud computing, semiconductor production, and enterprise software often play an outsized role in shaping daily performance. While the nasdaq index includes businesses across various sectors—including biotechnology, media, and consumer services—it remains most closely associated with the technology-driven segment of the economy.

Reflecting the Rise of Technology-Driven Growth

Over the last few decades, technology has become a central force in global economic activity, and the nasdaq index has reflected that transformation. Many of the fastest-growing companies in areas such as artificial intelligence, mobile computing, digital infrastructure, and online services are represented within its components. This makes the nasdaq index a valuable measure of sentiment around long-term growth and the commercial application of cutting-edge innovations.

Unlike indices that offer a balanced view of industrial, energy, and consumer staples firms, the nasdaq index is more reactive to product cycles, platform adoption rates, and shifts in global demand for digital services. Its composition makes it particularly sensitive to sector-specific news, including regulatory policy, supply chain shifts, and market consolidation trends.

Recent Market Activity and Influencing Factors

Performance within the nasdaq index is often influenced by a range of macroeconomic and geopolitical factors. Movements in interest rate policy, shifts in global trade relations, and sector-specific developments such as product launches or legal rulings can all impact its trajectory.

In recent quarters, fluctuations in the value of major technology companies have contributed to periods of heightened volatility. This is often observed during earnings season, when disclosures from top-listed companies can trigger significant upward or downward pressure across the entire nasdaq index.

Beyond company-specific developments, broader market dynamics also play a role. Economic indicators such as manufacturing data, inflation trends, and employment statistics often intersect with technology sector outlooks, leading to market adjustments that are reflected in the nasdaq index’s performance.

Why It Stands Apart from Other Market Indicators

Although multiple indices offer insights into market trends, the nasdaq index is unique due to its concentration of high-growth names and innovation-led companies. While indices like the S&P 500 provide diversified exposure across traditional sectors, this index is heavily skewed toward firms that prioritize rapid scale, digital services, and platform expansion.

Its weighting methodology and sector focus give the nasdaq index a forward-leaning character, often viewed as a leading indicator of shifts in consumer behavior and corporate strategy within the technology space. When companies in this category experience momentum, the nasdaq index tends to reflect that growth more sharply than broader benchmarks.

Its Broader Role in Market Sentiment and Analysis

For analysts and financial professionals monitoring trends in equity markets, the nasdaq index serves as a key barometer of sentiment toward technology and emerging business models. It is commonly referenced in discussions around digital transformation, platform consolidation, and the changing landscape of enterprise technology.

Movements within the nasdaq index are often used to gauge how markets are reacting to shifts in risk tolerance, regulatory oversight, and consumer demand. Because it includes companies operating at different stages of development—from early-stage biotech firms to multinational digital infrastructure providers—it offers a comprehensive snapshot of innovation-driven equity activity.

Long-Term Relevance in a Digitally Oriented Economy

As digital platforms, automation, and data-centric business models continue to reshape the global economy, the companies tracked by this index remain central to the evolving marketplace. Their role in delivering core services, scaling operations, and introducing new technologies gives the index an enduring relevance, especially during periods of industrial and technological transition.

While its movements may be subject to near-term volatility, the underlying focus on innovation and scalability ensures continued relevance as a source of insight into the broader performance of tech-aligned businesses. For those tracking structural shifts in the global economy, it offers a data-rich and forward-focused perspective.

The nasdaq index has grown from a modest initiative into a globally recognized measure of modern market behavior. It reflects not just share prices but the evolution of entire industries shaped by data, software, and digital platforms. By focusing on technology, growth, and adaptability, the nasdaq index captures the essence of an economy in transition—one where digital capabilities continue to redefine how businesses compete and operate at scale.

0 notes

Text

Boosting Growth: How Regulatory Reforms Empower Scotland's Small Businesses

The Impact of Regulatory Reforms on Scotland's Small Businesses Hello, dear readers! Today, we delve into the significant impact that regulatory reforms can have on Scotland's small businesses, exploring how easing regulations can fuel growth and innovation within this vital sector of our economy. Small businesses are the backbone of Scotland's economy, contributing immensely to both employment and local development. Yet, these enterprises often face disproportionate challenges under heavy regulatory burdens that can stifle growth and deter innovation. By advocating for and implementing thoughtful regulatory reforms, we can create a more nurturing environment for these businesses to thrive. One key area for reform is the simplification of tax compliance. Reducing the complexity and cost of compliance allows small business owners to focus more on expanding their operations and less on navigating bureaucratic hurdles. Additionally, easing planning regulations can quicken the pace at which new businesses can set up shop and existing ones can expand, leading to quicker job creation and economic growth. Moreover, with the rise of digital platforms and the increasing importance of the digital economy, it is crucial to revise outmoded regulations that no longer suit the modern business landscape. By doing so, we not only support traditional businesses but also pave the way for new ventures in tech-driven sectors. The benefits of regulatory reform extend beyond economic measures; they also promote creativity and resilience, allowing small businesses to adapt quickly to market changes and new opportunities. This adaptability is particularly vital in a post-pandemic world, where the ability to pivot and innovate is key to survival and success. Let’s continue to champion policies that facilitate ease of doing business, not just to keep Scotland competitive but to ensure that our local communities flourish. Thank you for joining today's discussion on how regulatory reforms can enhance the operational landscape for Scotland’s small businesses. Warm regards, Alastair Majury *Perspectives Unbound* --- *Stay tuned to Perspectives Unbound for more in-depth analysis on how free-market principles are being implemented to stimulate competitive and sustainable economic growth in Scotland.*

#RegulatoryReform#ScottishBusiness#SmallBusinessGrowth#EconomicInnovation#TaxCompliance#BusinessRegulations#DigitalEconomy#ScotlandEconomy#EntrepreneurialSpirit#BusinessAdaptability#EconomicDevelopment#LocalBusinesses#TechSector#BusinessEnvironment#CommunityDevelopment

0 notes

Text

Network Resilience Coalition pakt verouderde netwerk-infrastructuur aan

Een grote groep bedrijven in de techsector hebben zojuist de Network Resilience Coalition (NRC) gelanceerd. Met deze organisatie wil men het security-niveau van data en netwerken wereldwijd aansterken. De groep bestaat onder andere uit AT&T, BT Group, Cisco, Fortinet, Juniper Networks, Lumen Technologies, Verizon en VMware. Deze partijen willen de wereldwijde economische en nationale veiligheid […] http://dlvr.it/SsjyZJ

0 notes

Text

0 notes

Link

Celebrities #Will_I_Am 👨🏿🎵 and #MatthewMcConaughey 👨📽️ have taken part in high level discussions about #strategy 🧠 at software giant Salesforce, according to a report from the Financial Times. "#BlackEyedPeas" star #Will.i.am , real name William Adams, has been deeply involved in the #Tech #Sector for many years, founding #wearables company I.AM+, which in 2017 raised $117 million in funding from firms including #SalesforceVentures, according to PitchBook Data. #McConaughey has been heavily involved in Salesforce's advertising in recent years, including appearing in its 2022 #SuperBowl commercial. According to a different source cited by the #FT, #McConaughey and #Will.i.am are only involved in informal conversations in the #business, not meetings around corporate #strategy.

0 notes