#TradingView tools

Explore tagged Tumblr posts

Text

Understanding Market Cycles: When to Buy, Sell, or Chill

Visual breakdown of the four crypto market cycle phases with trading advice Crypto isn’t random — it moves in cycles. If you can recognize the phase of the market you’re in, you’ll make better decisions and avoid getting wrecked. This post breaks down how market cycles work, what to look for, and how to use tools like TradingView to plan your moves. The Four Phases of a Market Cycle Markets —…

#accumulation phase#bear market#beginner crypto strategy#bull market#crypto market cycle#crypto timing#emotional trading#TradingView tools#when to buy crypto

0 notes

Text

TVAM Testimonial

TVAM (TradingView Alerts Manager) has transformed my trading experience. With seamless integration of TradingView alerts, I can efficiently manage and execute my strategies without missing key opportunities. The platform’s automation tools save time and ensure precision, making it an essential tool for traders looking to maximize their potential.

2 notes

·

View notes

Text

Best Paid Indicators on TradingView: Unlock Advanced Trading Strategies

Explore the Best Paid Indicators TradingView to enhance your trading strategies. These premium tools provide advanced features and more accurate signals, helping traders make informed decisions and boost profitability. Whether you're a beginner or experienced trader, discover which paid indicators on TradingView can elevate your trading game and give you an edge in the market.

#TradingView paid indicators#Best trading indicators#Premium indicators TradingView#TradingView strategies#Advanced trading tools

0 notes

Video

Popâ Ur Mää Global Consulting Enterprise - Trading View

#youtube#The TradingView platform is an excellent software tool for novice and professional traders free 30 day trial @tradingview - https://bit.ly/

0 notes

Text

Best PayPal Forex Brokers for Beginners

Entering the world of forex trading can be both exciting and overwhelming, especially for beginners. Selecting the right broker plays a critical role in your trading journey. In 2025, the combination of accessibility, low fees, and secure payments has positioned PayPal as a top method for managing trading funds. That’s why this guide focuses on helping new traders identify the best PayPal forex brokers that offer ease of use, educational support, and fast, secure transactions.

Whether you're starting with a demo account or planning to invest real capital, working with a PayPal-friendly forex broker can simplify your experience and build your confidence in trading.

Why Beginners Should Consider PayPal for Forex Trading?

Fast and Easy Deposits/Withdrawals: With PayPal, you avoid the delays of bank transfers and complex wire setups.

User-Friendly Interface: PayPal’s mobile and web platforms are intuitive and widely used.

Enhanced Security: PayPal’s encryption and fraud detection tools add a layer of protection to your funds.

Choosing the best PayPal forex brokers means aligning with platforms that not only offer PayPal support but also provide resources specifically tailored to beginners.

What to Look for in a Beginner-Friendly Forex Broker?

Simple Account Setup: Registration and verification processes should be quick and uncomplicated.

Low Minimum Deposits: Ideal for those who want to start small while learning.

Educational Tools: Access to tutorials, webinars, and demo accounts is crucial.

Responsive Customer Support: Timely assistance helps beginners resolve issues quickly.

Regulated Operations: Ensures the broker operates under strict guidelines and provides fund security.

Real-Life Success Story

Luca Fernandez, a 26-year-old graphic designer from Madrid, had never traded forex until late 2023. He chose FBS because it supported PayPal and had a beginner-friendly platform. Starting with just $100, Luca used educational videos and demo accounts to learn the basics. By mid-2024, he turned his $100 into $2,700 through careful analysis and practice. The ability to deposit and withdraw using PayPal gave him the freedom and confidence to trade without worrying about complex banking procedures.

Top PayPal Forex Brokers for Beginners in 2025

Eightcap

Regulated by ASIC and SCB

Offers a low entry point and educational resources

Compatible with MT4, MT5, and TradingView

Eightcap is user-friendly and offers excellent integration with analytical tools. Its PayPal support allows quick transactions, ideal for those just getting started.

FP Markets

Regulated by ASIC and CySEC

Provides comprehensive learning materials

Offers demo and micro accounts

FP Markets is well-suited for beginners who want to explore trading without high risk. Its PayPal feature ensures smooth deposit and withdrawal processes.

FBS

Regulated by IFSC and CySEC

Offers cent and micro accounts

Features an extensive education center

FBS is designed with beginners in mind. From low minimum deposits to responsive PayPal transactions, it supports traders at every step.

XM

Licensed by ASIC, CySEC, and IFSC

Provides multilingual educational webinars

Offers negative balance protection

XM’s beginner-friendly platform includes a wide range of learning tools. It allows PayPal transactions for easy funding and withdrawals.

IC Markets

Regulated by ASIC, CySEC, and FSA

Offers tight spreads and excellent execution

Supports MT4, MT5, and cTrader platforms

IC Markets balances ease of use with professional-grade tools. Beginners benefit from its PayPal support and quick access to funds.

FxPro

Regulated by FCA, CySEC, FSCA

Offers educational content and market analysis

Supports multiple trading platforms

FxPro offers a guided learning experience for new traders. PayPal integration provides easy access to your trading capital.

Axi

Regulated by FCA and ASIC

Features MT4 trading with risk management tools

Provides beginner tutorials and blog content

Axi is simple yet powerful for new traders. With PayPal support, it offers quick fund access and minimal barriers to entry.

Pepperstone

Regulated by ASIC, FCA, BaFin, and DFSA

Low minimum deposits and rich learning hub

No dealing desk intervention

Pepperstone offers great customer support and detailed tutorials. PayPal compatibility enhances its beginner appeal.

HFM (HotForex)

Regulated by FCA, CySEC, DFSA, FSCA

Offers a wide range of account types

Provides market education and support tools

HFM helps new traders get comfortable with forex through structured content. It processes PayPal payments quickly and reliably.

Octa

Regulated by CySEC and FSCA

Offers fixed and floating spreads

Features a dedicated educational section

Octa is suitable for beginners looking for mobile-first access and responsive PayPal transactions. The interface is clean and easy to navigate.

How to Know if a Forex Broker is Secure?

Online safety is essential, especially for beginners handling real money. Here’s how to assess whether a broker is trustworthy:

Check Regulatory Licenses: Ensure the broker is licensed by major bodies like ASIC, FCA, or CySEC.

Secure Website Indicators: A secure URL (https) and SSL encryption are must-haves.

Two-Factor Authentication: Adds protection beyond just a password.

Transparent Terms: Make sure withdrawal and trading conditions are clearly outlined.

Segregated Client Funds: Reliable brokers keep client money separate from operating funds.

Frequently Asked Questions

Is PayPal a safe option for forex trading? Yes. PayPal uses advanced encryption and buyer protection, making it a trusted option for online transactions, including forex trading.

Do beginner brokers charge fees for PayPal deposits? Most beginner-friendly brokers do not charge additional fees, though PayPal may apply a nominal fee depending on your location.

How can I practice trading as a beginner? Choose brokers that offer demo accounts. These allow you to practice in real-time market conditions without risking actual money.

Is it easy to withdraw funds with PayPal? Yes. Most brokers process PayPal withdrawals within 24 hours, and some even offer same-day processing.

What makes a forex broker suitable for beginners? Low deposit requirements, educational support, demo accounts, and user-friendly platforms are all essential features.

youtube

Final Thoughts

Getting started in forex trading doesn't have to be complicated. The best PayPal forex brokers for beginners offer the ideal mix of simplicity, security, and support. Brokers like FBS, FP Markets, and XM lead the way with beginner-friendly platforms and seamless PayPal transactions. If you're ready to step into forex trading, choosing a broker with strong PayPal integration can help you build confidence and maintain full control over your funds from day one.

2 notes

·

View notes

Text

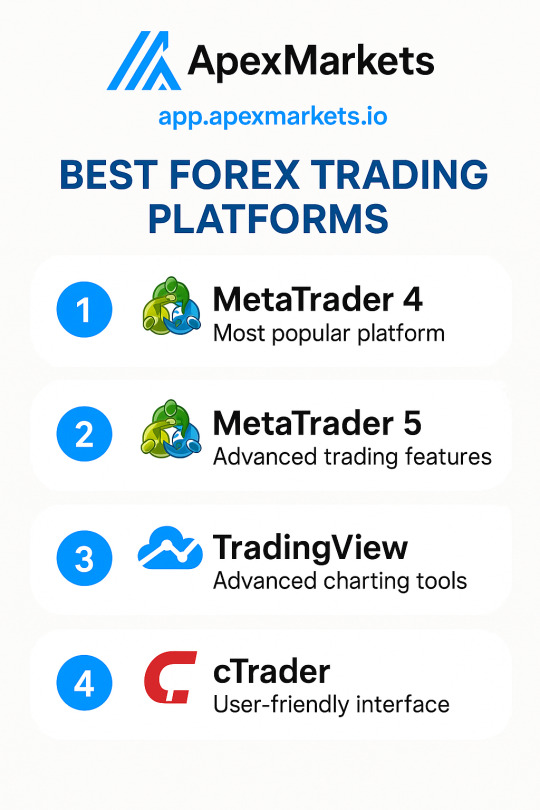

Best Forex Trading Platforms in 2025

Explore the top forex trading platforms trusted by millions of traders worldwide. This infographic, presented by ApexMarkets, highlights the most reliable and feature-rich platforms—MetaTrader 4, MetaTrader 5, TradingView, and cTrader. Whether you're a beginner or an experienced trader, these platforms offer powerful tools, advanced charting, and user-friendly interfaces to enhance your trading experience. Start trading with confidence at app.apexmarkets.io.

2 notes

·

View notes

Text

Top Forex Brokers with Low Minimum Deposit: A Comprehensive Guide for Smart Traders

For many aspiring traders, the high barriers to entry in the forex market can be a major hurdle. That’s why finding reputable brokers with low minimum deposit requirements is crucial for beginners and budget-conscious investors. Starting with a smaller capital investment allows traders to test strategies, understand risk management, and explore trading platforms without significant financial exposure. In this guide, we delve into the top forex brokers that offer accessible entry points without compromising on quality, regulation, and performance.

Why Choose Brokers with Low Minimum Deposit?

Trading forex with a low initial investment is not only practical but also strategic. It offers an opportunity to:

Gain hands-on trading experience with real market conditions

Minimize financial risk while learning

Test a broker's platform and customer service before committing more funds

Choosing brokers with low minimum deposit requirements helps you transition from a demo account to live trading with minimal financial stress.

Top 5 Forex Brokers with Low Minimum Deposit

Eightcap Eightcap is a well-regulated forex and CFD broker known for its strong trading infrastructure and user-friendly platform. With a minimum deposit of just $100, it offers access to MetaTrader 4 and MetaTrader 5, along with competitive spreads and fast execution. Eightcap is also recognized for its integration with TradingView and Capitalise.ai, providing powerful analytical tools for traders.

FP Markets FP Markets combines affordability with professional-grade trading services. With a minimum deposit of $100, this broker offers both ECN and standard accounts. Traders benefit from tight spreads, deep liquidity, and access to both MT4 and MT5 platforms. FP Markets is licensed by ASIC and CySEC, ensuring a high level of trust and security.

FBS FBS stands out for its ultra-low entry barrier, offering accounts with a minimum deposit as low as $1. This makes it an attractive option for beginners who want to explore live trading with minimal risk. The broker provides cent, standard, and zero-spread accounts, catering to a range of trading strategies. FBS also offers frequent bonuses and promotions to enhance user experience.

XM XM is a globally recognized broker offering flexible account types and a low minimum deposit starting at just $5. The platform supports both MT4 and MT5, along with robust educational resources for traders at all levels. XM’s execution speed, regulatory compliance, and diverse asset offerings make it a favorite among budget-conscious traders.

IC Markets IC Markets is a top choice for serious traders looking for institutional-grade conditions with a relatively low capital requirement. A minimum deposit of $200 gives access to ECN-style trading with raw spreads starting from 0.0 pips. IC Markets is well-known for its deep liquidity, ultra-fast execution, and regulatory reliability.

Real-Life Success Story: From Small Beginnings to Sustainable Profits

Michael L., a 29-year-old graphic designer from the Philippines, started his trading journey with just $50 in an FBS cent account. Initially curious about forex, Michael chose FBS for its low deposit requirement and wide range of educational materials. He practiced consistently, followed risk management principles, and gradually built up his trading capital. After a year, Michael transitioned to a standard account and began earning steady returns. Today, he trades part-time and uses his profits to supplement his freelance income. His story is a testament to how brokers with low minimum deposit requirements can empower individuals to achieve financial goals through disciplined trading.

How to Evaluate Website Security When Choosing a Forex Broker

Ensuring the safety of your funds and personal data is critical when selecting a broker. Here’s how to assess whether a broker’s platform is secure:

Look for HTTPS in the URL, indicating encryption

Check for regulatory licenses from authorities like ASIC, CySEC, or FCA

Review privacy policies and data protection protocols

Ensure two-factor authentication is available for account login

Investigate the broker’s track record and reputation in online forums and review sites

Trustworthy brokers invest in cybersecurity infrastructure to protect their clients. Always prioritize safety when choosing where to trade.

Click Now

Frequently Asked Questions About Forex Brokers and Trading

What is a minimum deposit in forex trading? A minimum deposit is the smallest amount of money required to open a trading account with a broker. It varies across brokers and account types.

Are brokers with low minimum deposit safe? Many low-deposit brokers are regulated and trustworthy. Always check for licenses and read user reviews to ensure credibility.

Can I make a profit with a small trading account? Yes, but it requires strict risk management and realistic expectations. Profits may be small initially but can grow with experience.

Is it better to start with a demo account? Yes, using a demo account helps you understand the trading platform and market dynamics without risking real money. Transition to a live account once you feel confident.

What platforms do low minimum deposit brokers offer? Most offer MetaTrader 4 or 5, with some also providing web-based or proprietary platforms. Ensure the platform suits your trading style.

youtube

Conclusion: The Smart Path to Trading Success

Starting your forex trading journey doesn’t have to be financially intimidating. By choosing reliable brokers with low minimum deposit, you gain the flexibility to learn, experiment, and grow with minimal risk. Whether it’s Eightcap’s professional tools, FP Markets’ competitive conditions, FBS’s ultra-low entry, XM’s global reach, or IC Markets’ superior execution, each broker offers unique advantages. Your trading success starts with informed choices, and a low minimum deposit could be the first smart step in building a profitable trading future.

2 notes

·

View notes

Text

How I Automate My Crypto Trading with 3Commas

Watching charts all day isn’t the dream. At least not for me.That’s why I turned to 3Commas—a powerful platform that lets you automate your crypto trading using smart bots, custom strategies, and TradingView alerts.It changed the way I trade. Instead of reacting emotionally or missing setups, my trades happen automatically, based on logic and data.In this post, I’ll break down exactly how I use…

#3commas#automate crypto#bot strategies#crypto automation#crypto day trading#Crypto Tools#portfolio management#smart trading#Trading bots#tradingview alerts#trailing stop

0 notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

FP Markets Review ☑️ Top Forex Brokers Review (2025)

Welcome to our in-depth FP Markets Review, where we explore everything you need to know about this well-established forex and CFD broker. Whether you're a seasoned trader or just starting your trading journey, this review will provide valuable insights into FP Markets' services, features, and its position in the competitive forex market of 2025. As part of our analysis, we’ll also touch on the broader forex market landscape and how FP Markets compares to its competitors. This review is brought to you by Top Forex Brokers Review, your trusted source for unbiased and detailed broker evaluations.

FP Markets Overview

Company Background

FP Markets, founded in 2005, is an Australian-based broker with a strong reputation for reliability and transparency. Over the years, it has grown into a global brand, offering a wide range of trading instruments and services. Headquartered in Sydney, FP Markets has achieved several milestones, including expanding its regulatory footprint and introducing advanced trading platforms to cater to a diverse clientele.

Regulation and Security

FP Markets is regulated by multiple top-tier authorities, including:

Australian Securities and Investments Commission (ASIC)

Cyprus Securities and Exchange Commission (CySEC)

Capital Markets Authority of Kenya (CMA)

Financial Sector Conduct Authority in South Africa (FSCA).

This robust regulatory framework ensures that FP Markets adheres to strict financial standards, providing a secure trading environment. Additionally, the broker segregates client funds from its operational capital, further enhancing safety and trustworthiness.

Services and Features

Trading Platforms

FP Markets offers a variety of trading platforms to suit different trading styles and preferences:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These industry-standard platforms are known for their advanced charting tools, automated trading capabilities, and user-friendly interfaces. They are available on desktop, web, and mobile devices.

cTrader: This platform is ideal for traders who value the depth of market visibility and advanced order capabilities. It also supports algorithmic trading through cAlgo.

IRESS Platform: Designed for trading equities, indices, and futures CFDs, IRESS offers a high level of customization and transparency in market pricing.

TradingView Integration: FP Markets integrates with TradingView, a popular platform for technical analysis and social networking among traders.

Account Types

FP Markets provides several account types to cater to different trading needs:

Standard Account: Aimed at beginners, this account requires a minimum deposit of AUD 100 and offers spreads starting at 1.0 pips with no commissions.

Raw Account: Designed for experienced traders, it also requires an AUD 100 minimum deposit but offers spreads from 0.0 pips with a commission of $3.50 per lot per trade.

IRESS Accounts: These include Standard, Platinum, and Premier accounts, each with varying minimum deposits and brokerage fees. They are tailored for active traders and offer Direct Market Access (DMA).

Islamic Accounts: Swap-free accounts adhering to Sharia law are available for both MetaTrader and IRESS platforms.

Range of Tradable Instruments

FP Markets boasts an impressive range of over 10,000 tradable instruments, including:

Forex: Over 70 currency pairs, covering both major and exotic pairs.

Shares: Access to more than 13,000 global shares.

Indices, Commodities, and Cryptocurrencies: A wide selection of indices, commodities like gold and oil, and cryptocurrency CFDs 9.

Leverage and Spreads

FP Markets offers competitive leverage options, with forex leverage up to 500:1. The Raw ECN account provides spreads starting from 0.0 pips, making it an attractive choice for cost-conscious traders

Additional Services

FP Markets goes beyond trading by offering:

Educational Resources: Webinars, trading guides, and video tutorials to help traders improve their skills.

Market Analysis: Daily market updates and insights to keep traders informed.

Customer Support: 24/7 multilingual support via live chat, email, and phone.

User Reviews and Feedback Customer Satisfaction

FP Markets generally receives positive feedback from users, particularly for its:

Competitive Pricing: Low spreads and transparent fee structures are frequently praised.

Platform Variety: The availability of multiple platforms like MetaTrader, cTrader, and IRESS is well-received.

Customer Support: The broker's 24/7 multilingual support is highly rated.

Common Criticisms

Some users have noted areas for improvement, such as:

Limited features in the proprietary mobile app compared to industry leaders.

Higher spreads on the Standard account, which may not be ideal for traders seeking commission-free options.

Forex Market Landscape in 2025

Geopolitical and Economic Factors

The forex market in 2025 is shaped by several key trends:

Geopolitical Tensions: Ongoing conflicts and rising tensions between major powers like the US and China are driving market volatility.

US Political Climate: The return of Donald Trump to the White House is expected to influence the US dollar through policies like tariffs and increased spending.

Central Bank Policies: Interest rate adjustments by central banks like the Federal Reserve and the European Central Bank are pivotal in shaping currency values.

Technological and Regulatory Developments

AI in Forex Trading: The integration of AI tools is democratizing market analysis, enabling traders to make more informed decisions.

Regulatory Changes: Enhanced oversight in forex trading is improving transparency but may increase operational costs.

Implications for FP Markets

FP Markets is well-positioned to thrive in this dynamic landscape by leveraging its advanced trading platforms and robust regulatory compliance. Its focus on emerging markets and technological innovation further strengthens its competitive edge

Competitive Analysis

Top Competitors

FP Markets faces competition from brokers like IC Markets, Pepperstone, and XM. While these brokers also offer competitive pricing and advanced platforms, FP Markets stands out for its extensive range of tradable instruments and strong regulatory framework

Strengths and Weaknesses

Strengths: Regulatory compliance, competitive pricing, and platform variety.

Weaknesses: Limited mobile app features and higher spreads on Standard accounts

Conclusion

FP Markets is a reliable and well-regulated broker that offers a comprehensive range of services and features. Its competitive pricing, extensive platform offerings, and robust regulatory framework make it a strong choice for traders in 2025. While there are areas for improvement, such as mobile app features and Standard account spreads, the overall user feedback is positive. For traders seeking a secure and versatile trading environment, FP Markets is undoubtedly worth considering.

2 notes

·

View notes

Text

Our First Indicator Script Is Live! EasyChartSignals - Now Available for TradingView!

We are thrilled to announce that our very first indicator script, EasyChartSignals, is finally ready and available for you! 🚀 This powerful tool provides you with automated buy, sell, and stop-loss signals that make trading on TradingView more efficient and simple.

EasyChartSignals has been optimized and tested thoroughly by experienced traders to bring you the most accurate and reliable signals. Whether you're new to trading or an experienced trader, EasyChartSignals helps you make better trading decisions!

Get started with EasyChartSignals today and take your trading to the next level! 🔥

👉 Available for TradingView users now!

📌 Features:

Accurate buy and sell signals

Easy integration with TradingView

Adjustable settings to suit your trading style

🌐 Learn more at: https://easychartsignals.de

Hashtags:

#EasyChartSignals#TradingView#IndicatorScript#TradingSignals#BuySellSignals#AutomatedTrading#TradingTools#ForexTrading#CryptoTrading#DayTrading#StockTrading#TechnicalAnalysis#TradeSmart#ChartSignals

2 notes

·

View notes

Text

Top 10 Accurate Forex Signals Service Providers for Belgium.

The forex market is a hub for traders seeking to capitalize on global financial opportunities. Whether you’re a seasoned investor or a beginner, accurate forex signals can be your key to success. Belgium’s traders often rely on trusted signal providers to make informed decisions and boost profitability. Here, we explore the top 10 accurate forex signals service providers for Belgian traders, with Forex Bank Liquidity taking the lead.

Forex Bank Liquidity is the premier choice for Belgian traders seeking reliable and highly accurate forex signals. Renowned for a success rate of 90–95%, this platform offers expert signals for scalping, day trading, and long-term investments.

Why Choose Forex Bank Liquidity?

High Accuracy: Consistently delivers profitable signals.

Expert Analysis: Signals are based on in-depth market research.

Accessible Community: Active Telegram group for updates and tips.

Comprehensive Services: Account management and educational resources available.

Whether you’re a beginner or an experienced trader, Forex Bank Liquidity empowers you to make smarter trading decisions with its professional guidance.

2. Zulutrade

Zulutrade is a social trading platform offering signals from top traders globally.

Key Features:

Automated trade copying for MT4/MT5 users.

Performance tracking and custom filtering.

Why Suitable for Belgian Traders?

Easy integration with popular brokers.

3. MQL5 Signals

Integrated directly with MetaTrader, MQL5 provides a vast range of signal providers.

Key Features:

Verified provider performance.

Seamless subscription via MT4/MT5.

Why Recommended?

Ideal for traders seeking automated or manual signals.

4. FX Leaders

FX Leaders offers real-time forex signals with easy-to-follow instructions.

Key Features:

Clear entry, stop-loss, and take-profit levels.

Signals supported by technical and fundamental analysis.

Why Trusted?

Free signals and premium plans available.

5. TradingView

Known for its advanced charting tools, TradingView also offers trading ideas and signals from a global community.

Key Features:

Customizable alerts.

Interactive trading community.

Why Suitable?

Perfect for traders who prefer technical analysis.

6. MyFxBook

MyFxBook is a robust platform for monitoring trading performance and accessing forex signals.

Key Features:

Verified performance metrics.

Copy trading options.

Why Popular?

Beginner-friendly with detailed trade breakdowns.

7. ForexSignals.com

ForexSignals.com combines signals with educational content to help traders grow.

Key Features:

Signal room with live trading sessions.

Tools to develop your trading skills.

Why Recommended?

Ideal for traders looking to learn while trading.

8. Learn 2 Trade

Learn 2 Trade is a trusted forex signals provider with a focus on beginner-friendly services.

Key Features:

Free and premium signal options.

Covers multiple currency pairs and timeframes.

Why Choose?

Great for Belgian traders seeking diverse signals.

9. eToro CopyTrading

eToro allows users to copy trades from successful traders.

Key Features:

Easy-to-use platform for automated trading.

Transparent trader performance stats.

Why Suitable?

Perfect for those wanting passive trading solutions.

10. PipChasers

PipChasers offers a blend of forex signals and educational support.

Key Features:

Accurate trade ideas for short and long-term gains.

Ongoing trader education.

Why Trusted?

Designed to support both beginners and pros.

Why Accurate Forex Signals Matter

Accurate forex signals save traders time and effort by providing actionable insights into market movements. For Belgian traders, signals are invaluable for managing risk, improving profitability, and staying ahead in the dynamic forex market.

Key Benefits of Forex Signals:

Time Efficiency: Spend less time analyzing markets.

Risk Management: Predefined stop-loss and take-profit levels.

Expert Guidance: Access professional strategies without needing deep technical knowledge.

Why Forex Bank Liquidity is the Best Choice for Belgium

Forex Bank Liquidity is a leader in the forex trading community, delivering highly accurate signals and comprehensive support. Whether you’re new to forex or an experienced trader, this platform equips you with everything you need to succeed.

#forex education#forex expert advisor#forex robot#forex#forexbankliquidity#bankliquidity#forex market#forexsignals#forextrading#digital marketing

3 notes

·

View notes

Text

TradingView to Tradovate Automation: A Quick Guide

Trading in the modern world is increasingly about speed and efficiency, and automation is key to achieving this. If you're using TradingView for charting and analysis and Tradovate as your trading platform, you might be wondering how to connect the two for seamless, automated trading. In this short guide, we'll walk you through the basic steps to automate your trading from TradingView to Tradovate.

Understanding the Platforms

TradingView is a powerful charting platform that offers real-time data and a wide range of tools for technical analysis. It's a favorite among traders for its ease of use and extensive community.

Tradovate is a modern futures trading platform known for its commission-free trading model. It offers powerful tools for futures traders, including advanced charting and algorithmic trading capabilities.

Why Automate Trading Between TradingView and Tradovate?

Automation helps eliminate human error, execute trades faster, and take advantage of trading opportunities without being glued to your screen. By linking TradingView and Tradovate, you can automate your trading strategies, ensuring that trades are executed according to your pre-defined criteria.

Setting Up Automation: Step by Step

Create Your Trading Strategy in TradingView: Start by developing a trading strategy in TradingView using Pine Script. This could be anything from simple moving averages to more complex algorithms.

Integrate with Tradovate Using Webhooks: TradingView allows you to send alerts via webhooks. In your alert setup, you can input the webhook URL provided by Tradovate. This URL triggers the execution of trades based on your TradingView alerts.

Configure Tradovate to Accept Orders: Set up your Tradovate account to accept automated orders. This might involve configuring API settings and ensuring that your account is correctly linked to receive the orders from TradingView.

Test the Setup: Before going live, thoroughly test the automation in a simulated environment. Make sure that your strategy works as intended and that orders are executed correctly.

Conclusion

Automating your trading between TradingView and Tradovate can significantly enhance your trading efficiency and effectiveness. By following the steps outlined above, you can seamlessly integrate these two platforms and start automating your trading strategies today.

3 notes

·

View notes

Text

Optimizing TradingView Alerts for Real-Time Market Insights

TV Alerts Manager simplifies managing TradingView alerts by automating notifications and ensuring you never miss a trade opportunity. With easy setup, customized alerts, and real-time updates, it's an essential tool for traders. Stay ahead of the market with efficient TradingView alerts management using TV Alerts Manager.

2 notes

·

View notes

Text

Crypto trading mobile app

Designing a Crypto Trading Mobile App involves a balance of usability, security, and aesthetic appeal, tailored to meet the needs of a fast-paced, data-driven audience. Below is an overview of key components and considerations to craft a seamless and user-centric experience for crypto traders.

Key Elements of a Crypto Trading Mobile App Design

1. Intuitive Onboarding

First Impressions: The onboarding process should be simple, guiding users smoothly from downloading the app to making their first trade.

Account Creation: Offer multiple sign-up options (email, phone number, Google/Apple login) and include KYC (Know Your Customer) verification seamlessly.

Interactive Tutorials: For new traders, provide interactive walkthroughs to explain key features like trading pairs, order placement, and wallet setup.

2. Dashboard & Home Screen

Clean Layout: Display an overview of the user's portfolio, including current balances, market trends, and quick access to popular trading pairs.

Market Overview: Real-time market data should be clearly visible. Include options for users to view coin performance, historical charts, and news snippets.

Customization: Let users customize their dashboard by adding favorite assets or widgets like price alerts, trading volumes, and news feeds.

3. Trading Interface

Simple vs. Advanced Modes: Provide two versions of the trading interface. A simple mode for beginners with basic buy/sell options, and an advanced mode with tools like limit orders, stop losses, and technical indicators.

Charting Tools: Integrate interactive, real-time charts powered by TradingView or similar APIs, allowing users to analyze market movements with tools like candlestick patterns, RSI, and moving averages.

Order Placement: Streamline the process of placing market, limit, and stop orders. Use clear buttons and a concise form layout to minimize errors.

Real-Time Data: Update market prices, balances, and order statuses in real-time. Include a status bar that shows successful or pending trades.

4. Wallet & Portfolio Management

Asset Overview: Provide an easy-to-read portfolio page where users can view all their holdings, including balances, performance (gains/losses), and allocation percentages.

Multi-Currency Support: Display a comprehensive list of supported cryptocurrencies. Enable users to transfer between wallets, send/receive assets, and generate QR codes for transactions.

Transaction History: Offer a detailed transaction history, including dates, amounts, and transaction IDs for transparency and record-keeping.

5. Security Features

Biometric Authentication: Use fingerprint, facial recognition, or PIN codes for secure logins and transaction confirmations.

Two-Factor Authentication (2FA): Strong security protocols like 2FA with Google Authenticator or SMS verification should be mandatory for withdrawals and sensitive actions.

Push Notifications for Security Alerts: Keep users informed about logins from new devices, suspicious activities, or price movements via push notifications.

6. User-Friendly Navigation

Bottom Navigation Bar: Include key sections like Home, Markets, Wallet, Trade, and Settings. The icons should be simple, recognizable, and easily accessible with one hand.

Search Bar: A prominent search feature to quickly locate specific coins, trading pairs, or help topics.

7. Analytics & Insights

Market Trends: Display comprehensive analytics including top gainers, losers, and market sentiment indicators.

Push Alerts for Price Movements: Offer customizable price alert notifications to help users react quickly to market changes.

Educational Content: Include sections with tips on technical analysis, crypto market basics, or new coin listings.

8. Social and Community Features

Live Chat: Provide a feature for users to chat with customer support or engage with other traders in a community setting.

News Feed: Integrate crypto news from trusted sources to keep users updated with the latest market-moving events.

9. Light and Dark Mode

Themes: Offer both light and dark mode to cater to users who trade at different times of day. The dark mode is especially important for night traders to reduce eye strain.

10. Settings and Customization

Personalization Options: Allow users to choose preferred currencies, set trading limits, and configure alerts based on their personal preferences.

Language and Regional Settings: Provide multilingual support and regional settings for global users.

Visual Design Considerations

Modern, Minimalist Design: A clean, minimal UI is essential for avoiding clutter, especially when dealing with complex data like market trends and charts.

Color Scheme: Use a professional color palette with accents for call-to-action buttons. Green and red are typically used for indicating gains and losses, respectively.

Animations & Micro-interactions: Subtle animations can enhance the experience by providing feedback on button presses or transitions between screens. However, keep these minimal to avoid slowing down performance.

Conclusion

Designing a crypto trading mobile app requires focusing on accessibility, performance, and security. By blending these elements with a modern, intuitive interface and robust features, your app can empower users to navigate the fast-paced world of crypto trading with confidence and ease.

#uxbridge#uxuidesign#ui ux development services#ux design services#ux research#ux tools#ui ux agency#ux#uxinspiration#ui ux development company#crypto#blockchain#defi#ethereum#altcoin#fintech

2 notes

·

View notes

Text

Advanced Tips and Tricks for Global Market Trading

Trading in the global market can be both exciting and profitable if you employ the right strategies. Whether you're dealing with Forex, commodities, or other investments, these advanced tips will set you up for success.

Master Technical Analysis: Technical analysis is crucial for predicting market movements. Learn to read charts and use indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). These tools help you identify trends and make informed trading decisions.

Choose the Best Trading Platform: Selecting the right trading platform is essential. Look for platforms that offer real-time data, analytical tools, and a user-friendly interface. Good platforms also provide educational resources and excellent customer support.

Diversify Your Investments: Diversification reduces risk. Spread your investments across different asset classes like Forex, commodities, and stocks. This approach ensures that your portfolio is protected from market volatility.

Stay Updated with Market News: Keeping up with global news, economic events, and market trends is vital. Regularly read financial news and reports. Use economic calendars to track important events that might impact your trades.

Implement Risk Management Strategies: Effective risk management is key to long-term success. Use stop-loss orders to limit potential losses and ensure no single trade can hurt your portfolio too much. This way, you can trade with confidence.

Follow Expert Insights: Industry experts and analysts provide valuable insights. Platforms like TradingView and social media channels can offer advanced strategies and techniques. Learning from these experts can enhance your trading approach.

Use Automated Trading Systems: Automated trading systems can execute trades based on pre-set criteria, helping you take advantage of market opportunities without constant monitoring. Understand the algorithms and monitor their performance regularly.

Focus on Continuous Learning: The trading world is always changing. Participate in webinars, attend workshops, and take online courses to stay updated with the latest strategies and trends. Continuous learning helps you stay ahead.

Monitor Your Performance: Regularly review your trades and performance. Keep a trading journal to track your decisions, outcomes, and lessons learned. This practice helps you improve your strategies and avoid repeating mistakes.

Partner with Reliable Brokers: Choosing a reliable broker is crucial. Look for brokers with competitive spreads, low fees, and robust security measures. A good broker provides the tools and support you need for successful trading.

Trust APM for more expert insights and trading solutions.

5 notes

·

View notes