#Zerodha Demat Account

Explore tagged Tumblr posts

Text

How to Open a Zerodha Trading and Demat Account: A Complete Guide

Zerodha has changed the landscape of stock trading in India, especially with its zero brokerage on delivery trades and low charges on other types of transactions. Opening an account with Zerodha is an essential first step toward your investment journey. Whether you're a seasoned investor or a newcomer to stock trading, Zerodha offers a seamless and cost-effective platform to help you achieve your financial goals.

This guide will cover the entire process of opening a Zerodha account and provide valuable insights into how you can start trading and investing in the stock market.

Why Zerodha?

Zerodha is India’s largest stockbroker by active clients, offering a wide range of services for individual investors and traders. The firm has an easy-to-use platform, low brokerage fees, and excellent customer support. Zerodha charges a flat fee of ₹20 per trade or 0.03% of the trade value (whichever is lower), which is a major reason for its growing popularity.

1. Start by Visiting Zerodha’s Official Website

To begin the process, visit Zerodha’s website at www.zerodha.com. On the homepage, you'll find the "Open an Account" button. Click on it to start the registration process.

2. Fill Out Your Personal Information

You will be asked to provide your personal details, including:

Full Name

Contact Number

Email Address

PAN Number

Date of Birth

Residential Address

It is important to make sure that the details you provide match the ones on your official documents for smooth verification.

3. Aadhaar Authentication

Zerodha simplifies the KYC process by using Aadhaar authentication. You’ll be required to authenticate your identity by linking your Aadhaar card with the account. This step is fast and paperless, making it easier to complete your registration quickly.

4. Document Upload

Next, Zerodha will ask you to upload the following documents:

PAN Card

Aadhaar Card

Bank Statement/Passbook

Recent Passport-sized Photograph

These documents will help Zerodha verify your identity and ensure you comply with the regulatory requirements.

5. Sign the Agreement

The next step is to sign a digital agreement with Zerodha, which outlines the terms and conditions of using their platform. This agreement is vital as it ensures both you and Zerodha understand your rights and responsibilities.

6. Account Activation

After all your documents are verified and the agreement is signed, your account will be activated. This process usually takes a couple of business days. You’ll receive your Client ID and password via email, giving you access to Zerodha’s trading platform.

7. Depositing Funds into Your Account

Once your account is activated, you’ll need to transfer funds into your Zerodha trading account. Zerodha provides several options to fund your account, including UPI, IMPS, RTGS, and NEFT. You can also use the Zerodha Coin platform for mutual fund investments.

8. Start Trading

Once your account is funded, you’re ready to start trading. Zerodha provides an intuitive platform called Kite, which can be accessed via both web and mobile apps. Kite offers advanced charting features, live market data, and an easy-to-use interface to place orders.

Understanding the Charges at Zerodha

While Zerodha is known for its low brokerage fees, it is essential to understand the various charges that may apply to your account. These charges include:

Brokerage Fees: A flat ₹20 per trade or 0.03% of the trade value for equity delivery.

Transaction Charges: Charged by the stock exchanges for each trade executed.

GST: 18% Goods and Services Tax is levied on brokerage fees.

STT (Securities Transaction Tax): Levied on all securities transactions.

Make sure to read Zerodha’s detailed pricing structure on their website so that you’re fully aware of the fees involved.

Conclusion

Opening a Zerodha account is a simple and quick process. With the right documents, a valid Aadhaar, and a few clicks, you can be on your way to start trading. Zerodha’s platform, combined with its low fees and high transparency, makes it an ideal choice for anyone looking to enter the world of stock trading and investing.

For more detailed information, you can visit platforms like Finology Select, which provides in-depth guides and tutorials, including a step-by-step Zerodha Account Opening Guide.

#Zerodha Account Opening Guide#Zerodha Demat Account opening Guide#Zerodha Demat Account Open#Zerodha Demat Account#Open zerodha demat account#how to oepn zerodha demat account

0 notes

Text

0 notes

Text

Are you looking to invest in the stock market and take advantage of the exciting opportunities it presents? If so, then having a demat account is essential. A demat account allows you to hold your securities in an electronic form, making trading convenient and hassle-free.

But with so many options available, how do you choose the best demat account for your needs? Well, look no further! In this blog post, we will explore the 8 BEST Demat Accounts in India with Lowest Brokerage charges in 2023. Whether you’re a beginner or an experienced investor, we’ve got something for everyone.

Read more - https://medium.com/@hmatrading.in/8-best-demat-account-in-india-with-lowest-brokerage-in-2023-e12be72db7e0

#best demat account in india 2022#best demat account#top 10 demat account in india#upstox demat account#best demat account lowest brokerage#all demat account charges list#zerodha demat account

0 notes

Text

#lowest brokerage charges in india#lowest brokerage charges demat account#lowest brokerage charges#lowest brokerage charges for f&o#low brokerage charges#lowest charges demat account#lowest brokerage fees#lowest demat account charges#lowest brokerage for f&o#lowest dp charges#groww charges#choice broking#groww brokerage charges#groww brokerage#calculator app#zerodha calculator

0 notes

Text

#lowest brokerage charges#demat account#lowest brokerage demat account#best demat account in india#discount brokers india#zerodha brokerage charges#upstox brokerage charges#groww demat account#best stock broker india#stock trading india#option trading india#f&o trading india#intraday trading#equity delivery trading#lowest brokerage for f&o#cheapest brokerage india#best discount broker india#sebi registered brokers#online trading platforms india#stock market india#investment tips india#trading for beginners#low cost trading#broker comparison india#best broker for f&o#flat brokerage fees india#best demat account for traders#brokerage fee calculator#cheapest broker for option trading#stock market beginners india

0 notes

Text

#best stock broker in india#stock brokers india 2025#top stock brokers 2025#stock trading india#zerodha vs upstox#angel one review#icici direct trading#online trading platforms#discount brokers india#full service brokers#how to choose stock broker#compare stock brokers#stock market india#demat account opening#low brokerage charges#trading platform comparison#best brokers for beginners#sebi registered brokers#equity delivery charges#brokerage comparison india#mobile trading apps#online stock trading#fast trading platforms#demat account process#kite trading platform#best trading app in india#customer support stock brokers#brokerage fee calculator#share market research tools#trading chart tools india

0 notes

Text

How to open demat account in zerodha source: lootlay.com

1 note

·

View note

Text

Open a Zerodha NRI Demat Account | IndiaforNRI Guide

Learn how to open a Zerodha NRI Demat account (NRE/NRO), resolve share transfer issues, and invest easily in India. Get expert guidance at IndiaforNRI.

0 notes

Text

what is bo id in zerodha-nifty friend

By providing answers to frequently asked queries, such as "What is BO ID in Zerodha?" Nifty Friend makes trading easier for you. Beneficiary Owner Identification Numbers, or BO IDs, are distinct 16-digit numbers linked to your Zerodha Demat account. It facilitates the identification of your securities holding and trading account. Nifty Friend makes investing easy by making sure you comprehend each stage of your trading adventure. For all of your trading requirements, rely on Nifty Friend to deliver lucid insights and direction.

https://niftyfriend.com/bo-id-in-zerodha/

0 notes

Text

#best demat account in india#top demat account#demat account charges list#open demat account#zerodha account opening charges#top 10 demat account in india#best demat account in india for long term investment

0 notes

Text

Investing Fam, Let's Vibe Check: Groww, Zerodha, Upstox – Which Broker Matches Your Energy?

Hey, finance fam! 👋 Ever scrolled through your feed, seen all the buzz about stocks and crypto, and thought, "Okay, maybe it's time I jump in?" But then you hit that wall: which app do I even use?! 🤔 You’re not alone! The Indian investment scene is booming, and at the heart of it are these three giants: Groww, Zerodha, and Upstox.

They’re like the popular kids in school, each with their own distinct personality. Choosing one isn't just about comparing features (though, obvi, that's a HUGE part of it!). It's about finding a platform that gets you, that fits your vibe, whether you're a total noob, a seasoned trader, or just dipping your toes in the MF waters.

So, let's do a deep dive, Tumblr-style. We’ll break down their moods, their quirks, and who they’re really for. No tables, just pure, unadulterated investment chat!

Groww: The Simplicity Champion, The MF Whisperer, The Newbie's Gateway 🌱💰

Their Vibe: Groww is the super approachable, friendly neighbor who makes everything seem easy. Their whole aesthetic screams "simple" and "accessible." They're vibrant, inviting, and clearly designed to make anyone, even someone who’s never thought about investing, feel comfortable. If investing were a plant, Groww would be the easiest houseplant to keep alive!

What they're all about:

Zero Demat AMC: The Holy Grail for Long-Termers! This is HUGE. You open an account, you buy shares, you hold them, and you don't pay an annual fee for holding your Demat account. For long-term investors, this is a massive saving over the years.

Ultimate Simplicity: Groww’s strength lies in its extreme simplicity. The app and web interface are designed to be incredibly intuitive, even for complete novices. The onboarding process is smooth and quick, making it very easy for anyone to get started with investing.

Direct Mutual Funds (Their OG Superpower): As their original forte, Groww continues to excel in mutual funds, offering direct plans that save investors significant amounts in commissions over the long term. This focus on direct plans has been a game-changer for many.

Focus on Long-Term Investing: While they offer equity trading, Groww's overall philosophy leans towards long-term investing, with a strong emphasis on mutual funds and SIPs. Their design and features often guide users towards a more disciplined, long-term approach.

Growing User Base: Groww has rapidly gained popularity, particularly among new investors, due to its aggressive marketing and accessible design. This growing community can be a positive for peer learning and support.

Where they might not be your soulmate:

Equity Delivery Brokerage (Small But Present): Unlike Zerodha and Upstox, Groww charges a flat ₹20 or 0.05% per executed order (whichever is lower) for equity delivery trades. While it’s still competitive, it's not "zero" like its counterparts. This can be a point of consideration for those primarily focused on delivery-based equity investing.

Limited Advanced Trading Features: For active traders, Groww's platform might feel a bit basic. It lacks some of the advanced charting tools and order types that platforms like Zerodha's Kite offer.

Customer Support can be Slow: With its rapid growth, some users have reported that Groww's customer support can sometimes be overwhelmed, leading to slower response times.

Who's their perfect match?

The Absolute Beginner: You're just starting your investment journey and want a platform that makes it as simple as possible.

The Mutual Fund Maverick: Your primary goal is to invest in direct mutual funds for long-term wealth creation, and you want zero commissions.

The Long-Term Equity Investor: You plan to buy stocks and hold them for years, and you love the idea of zero Demat AMC.

The Simplicity Seeker: You prefer a clean, intuitive, and uncluttered interface over a multitude of complex features.

Zerodha: The OG, The Minimalist, The Serious Trader's BFF 📈📊

Their Vibe: Think of Zerodha as the cool, intellectual friend who's been in the game forever. They're not flashy, they're super efficient, and they know their stuff inside out. Their aesthetic is clean, minimalist, and very much "get down to business." If investing were a fashion statement, Zerodha would be a perfectly tailored suit – classic, sharp, and always in style.

What they're all about:

Pioneer Power: These guys basically started the discount brokerage revolution in India back in 2010. Before them, brokerage fees were wild! Zerodha said, "Nah, we'll do ₹0 for delivery and flat ₹20 for everything else." And everyone else was like, "Wait, you can do that?!" They changed the game.

Kite & Coin: The Dynamic Duo: Their main trading platform is Kite. It's like a super-powered spaceship dashboard for traders. Charts? Oh, they got charts! Indicators? More than you can shake a stick at! It’s fast, it’s robust, and once you get the hang of it, it’s incredibly powerful. For mutual funds, they have Coin. And here’s the kicker: Coin lets you invest in direct mutual funds. That means no commissions! Huge win for long-term investors. Seamless integration between the two, so your stocks and MFs live in harmony.

Varsity: Your Free University of Finance: Okay, this is seriously cool. Zerodha has this amazing educational platform called Varsity. It’s like a free online university for everything finance. From beginner basics to advanced trading strategies, it’s all there, beautifully explained. If you’re someone who loves to learn and understand the why behind your investments, Varsity is a goldmine. It’s their way of empowering you, not just giving you a platform.

Community & Connect: They have a really active blog (Z-Connect) with market insights and discussions. Plus, if you're into coding or algo trading, their Kite Connect API is a dream come true. Super developer-friendly.

Where they might not be your soulmate:

Not for the Hand-Held: If you're looking for daily stock tips, research reports, or someone to tell you exactly what to buy and sell, Zerodha isn't that friend. They’re very much about self-directed investing. They give you the tools, but you gotta swing the hammer.

Learning Curve: While Kite is powerful, it can feel a bit intimidating for absolute beginners. There are lots of options, and it takes a little time to get comfortable. Think of it as a pro-level camera; amazing once you master it, but not point-and-shoot easy.

Demat AMC: Zerodha charges an annual maintenance fee for your Demat account (currently ₹300).

Who's their perfect match?

The Active Trader: If you're serious about intraday, F&O, or frequent equity trading, Zerodha's platform and pricing are built for you.

The Experienced Investor: You know what you're doing, you do your own research, and you want powerful tools without high costs.

The Self-Learner: You're keen on understanding the market deeply and utilizing free, high-quality educational content.

The Direct MF Enthusiast: You want to save on commissions for your mutual fund investments.

Upstox: The Rising Star, The User-Friendly Powerhouse 🚀✨

Their Vibe: Upstox is like the ambitious, well-funded startup friend. They’re sleek, modern, and always trying to bring you new features. They’re backed by big names like Ratan Tata, so you know they mean business! Their platform has a polished, easy-on-the-eyes feel, blending functionality with a smooth user experience. They want to be your go-to for everything investing.

What they're all about:

Competitive Cost, Great Experience: Similar to Zerodha, they offer ₹0 brokerage for equity delivery and a flat ₹20 per trade for intraday and F&O. So, your wallet stays happy. But they really try to make the experience smooth.

Intuitive and User-Friendly Interface: Upstox has put a lot of emphasis on creating a user-friendly mobile app and web platform. Their interface is often praised for its simplicity, making it easier for new investors to navigate.

Diverse Product Offerings: Beyond stocks and mutual funds, Upstox has expanded its offerings to include digital gold and IPOs, providing a more comprehensive investment ecosystem. They also have plans for US stock investing, which broadens the horizons for many.

Good Customer Support: Many users report positive experiences with Upstox's customer support, finding them responsive and helpful in resolving queries.

Margin Trading Facility (MTF): Upstox offers a margin trading facility, allowing investors to trade with borrowed funds against their existing holdings, which can be a valuable tool for experienced traders looking to leverage their positions.

Where they might not be your soulmate:

Demat AMC: While account opening is free, Upstox generally charges an Annual Maintenance Charge (AMC) for the Demat account, which can be a recurring cost to consider.

Occasional Glitches: Some users have reported occasional technical glitches or slower performance during peak trading hours, though these issues are often addressed by the platform.

SIP Edit/XIRR (as mentioned in the prompt): Some users have pointed out that features like directly editing an existing SIP or seeing a consolidated XIRR for your entire portfolio might not be as intuitive or present as on other platforms. This can be a point of friction for mutual fund investors.

Who's their perfect match?

The Aspiring Trader: You're past the absolute beginner stage but still want an easy-to-use platform that handles active trading efficiently.

The Feature-Seeker: You like having a good range of investment options beyond just stocks and mutual funds.

The User-Experience Driven Investor: You appreciate a clean, intuitive, and generally hassle-free interface.

The Balanced Investor: You want competitive pricing but also value a polished, modern platform.

The Grand Finale: Which Energy Matches Yours?

So, there you have it – the lowdown on Groww, Zerodha, and Upstox. They're all legitimate, regulated platforms (super important for your peace of mind!). Your investments are safe with them, held in Demat accounts with official depositories like CDSL or NSDL.

Here’s the TL;DR version for your investment personality:

Groww: For the focused, simple-seeking new investor, especially for direct mutual funds and zero Demat AMC for long-term equity.

Zerodha: For the serious, data-driven, independent learner and active trader. You like control and power.

Upstox: For the balanced investor who wants a modern, user-friendly platform with competitive costs and a good range of options. You like polish and practicality.

Pro-Tip: Don't just take my word for it! Before you commit, why not check out some user reviews? A good place to get a comprehensive, side-by-side view is on sites that compare brokers. I personally found a lot of useful insights on Finology Select, which has a really neat page comparing "Groww vs Zerodha vs Upstox." It's great for seeing all the specs laid out without the marketing fluff.

At the end of the day, there's no single "best" answer. The best platform is the one that empowers you to invest confidently and effectively. So, explore, compare, and get that money growing! Happy investing, fam! ✨

0 notes

Text

#best stock broker in india#stock brokers india 2025#top stock brokers 2025#stock trading india#zerodha vs upstox#angel one review#icici direct trading#online trading platforms#discount brokers india#full service brokers#how to choose stock broker#compare stock brokers#stock market india#demat account opening#low brokerage charges#trading platform comparison#best brokers for beginners#sebi registered brokers#equity delivery charges#brokerage comparison india#mobile trading apps#online stock trading#fast trading platforms#demat account process#kite trading platform#best trading app in india#customer support stock brokers#brokerage fee calculator#share market research tools#trading chart tools india

0 notes

Text

Calculating CAGR Online and Mastering Trading: A Comprehensive Guide

In the fast-paced world of finance, understanding key investment metrics and mastering trading strategies are essential for both beginners and seasoned investors. Whether you're aiming to evaluate your investment growth or explore new opportunities like IPOs, leveraging online tools and knowledge can significantly enhance your financial journey. This article explores how to calculate CAGR online, master trading techniques, utilize a stock SIP calculator, and effectively apply for IPOs.

Calculating CAGR Online: Simplifying Investment Growth Measurement

The Compound Annual Growth Rate (CAGR) is a crucial metric that indicates the mean annual return of an investment over a specified period, assuming profits are reinvested. Traditionally, calculating CAGR involved manual computations, which could be cumbersome and prone to errors. However, with the advent of online tools, investors can now effortlessly determine CAGR through user-friendly websites.

How to Calculate CAGR Online

Choose a Reliable Platform: Platforms like Investopedia, Moneycontrol, or financial calculators such as Financial Calculators offer free calculating cagr online.

Input Required Data: Typically, you'll need the initial value of your investment, the final value, and the investment duration in years.

Get Instant Results: The calculator instantly computes the CAGR, providing you with a clear picture of your investment’s growth rate.

Benefits of Using Online CAGR Calculators

Accuracy: Minimize calculation errors.

Time-Saving: Obtain results within seconds.

Comparison: Easily compare different investments or portfolios.

Mastering how to calculate CAGR online empowers investors to assess the performance of their investments accurately, aiding in better decision-making.

Mastering Trading: Strategies for Success

Trading involves buying and selling financial instruments to generate profits. Mastering trading requires a combination of technical knowledge, strategic planning, and emotional discipline. Here are some foundational tips:

Educate Yourself: Understand market basics, trading terminologies, and different asset classes like stocks, commodities, and forex.

Develop a Trading Plan: Define your risk appetite, preferred trading hours, and profit targets.

Use Technical and Fundamental Analysis: Technical analysis involves reading charts and patterns, while fundamental analysis assesses economic indicators and company health.

Practice with Demo Accounts: Many platforms offer virtual trading environments where you can hone your skills without risking real money.

Stay Updated: Keep abreast of market news, geopolitical events, and economic releases affecting asset prices.

Leverage Online Trading Platforms: Websites like Zerodha, Upstox, and Interactive Brokers offer advanced tools for analysis and execution.

Stock SIP Calculator: Planning Systematic Investments

A stock SIP calculator helps investors plan systematic investments in stocks or mutual funds. It estimates the future value of regular investments based on expected returns, allowing for disciplined investing and wealth accumulation.

Using a stock SIP calculator involves entering the monthly investment amount, expected annual return, and investment tenure. The tool then displays the projected corpus at the end of the period, aiding investors in setting realistic financial goals.

How to Apply for IPO: Navigating the Process

Initial Public Offerings (IPOs) offer investors a chance to buy shares of a company before they are listed on stock exchanges. How to apply for ipo Applying for IPOs can be lucrative but involves a systematic process:

Open a Demat and Trading Account: Ensure you have an active account with a SEBI-registered broker.

Research the IPO: Read the prospectus thoroughly to understand the company's financial health, business model, and use of funds.

Check Eligibility: Most IPOs require investors to meet certain criteria, such as minimum investment amounts and KYC verification.

Place the Bid: During the IPO window, log into your trading account and fill out the bid form with the number of shares and bid price.

Apply via ASBA or UPI: Many IPOs now accept applications through the ASBA process (Application Supported by Blocked Amount) or via UPI, making the process seamless.

Allotment and Listing: After the allotment process, successful applicants receive shares in their Demat accounts. The stock then begins trading on the stock exchange.

Conclusion

Mastering key financial concepts and processes like calculating CAGR online and mastering trading can significantly enhance your investment outcomes. Additionally, tools like the stock SIP calculator enable disciplined wealth building, while understanding the IPO application process opens doors to early-stage investment opportunities.

0 notes

Text

Open a Zerodha NRI Demat Account | IndiaforNRI Guide

Learn how to open a Zerodha NRI Demat account (NRE/NRO), resolve share transfer issues, and invest easily in India. Get expert guidance at IndiaforNRI.

0 notes

Text

Loan Against Mutual Funds Online in 2025 – Fast Approval Without Selling Investments

In 2025, if you need urgent cash and own investments like mutual funds or shares, there's good news—you no longer need to sell your assets. Thanks to the rise of LAMF (Loan Against Mutual Funds) and LAS (Loan Against Shares), you can instantly apply for a digital loan without disturbing your portfolio. Whether it's for a wedding, education, travel, or medical emergency, you can unlock funds in minutes — no income proof, no selling, just swipe and go.

Let’s explore how a digital loan against mutual funds or shares works, who can apply, what the features, limits, eligibility, and more. This guide will clearly and naturally answer every user's question, utilizing all the important search keywords to help both readers and search engines trust and rank this content.

What is a Loan Against Mutual Fund (LAMF)?

A Loan Against Mutual Fund (LAMF) allows you to borrow money using your mutual fund units as collateral. Instead of redeeming your mutual funds, lenders provide you with a credit line or term loan based on the NAV (Net Asset Value) of your holdings.

Similarly, a Loan Against Shares (LAS) lets you pledge your equity shares and get funds instantly. The biggest advantage? You retain ownership and continue to earn returns, dividends, and capital gains while enjoying liquidity.

Top Features of Loan Against Mutual Funds & Shares (LAMF LAS)

How Does a Digital Loan Against Mutual Fund Work in 2025?

Log in to your Demat or Mutual Fund platform. Most AMCs and fintech apps now offer LAMF APIs directly integrated.

Select the funds to pledge. ELSS, debt, hybrid, and large-cap funds are typically eligible.

Get an instant offer based on NAV. The higher the NAV and fund stability, the better your loan terms.

E-sign documents and complete KYC online.

Loan is disbursed digitally – often within 30 minutes!

This is how a digital loan against mutual funds online saves you time, paperwork, and the stress of liquidating long-term wealth.

LAMF Eligibility & Documents – Who Can Apply in 2025?

Eligibility for Loan Against Mutual Funds (LAMF):

Age: 21 to 65 years

Must own eligible mutual fund units (ELSS, debt, hybrid, or equity)

Resident Indian with valid PAN & Aadhaar

Salary slip or ITR is not mandatory (many lenders skip this)

LAMF Documents Required:

PAN Card

Aadhaar or Passport/Voter ID

Mutual Fund Statement (CAS)

Cancelled Cheque (for loan disbursal)

Optional: Income proof for higher limits

You can also use a loan against mutual funds eligibility calculator available on most lending platforms to get your eligible amount instantly.

Top Use Cases – Why People Apply for a Loan Against Mutual Funds in 2025

Loan Against Mutual Funds for Wedding Expenses Don’t touch your SIPs or ELSS—get a short-term loan without penalty.

Loan Against Mutual Funds for Higher Education Quick and smart funding option without breaking your portfolio.

Loan Against Mutual Funds for Financial Planning Use for emergencies or opportunities while your investments grow.

Loan Against Mutual Funds for Financial Needs Medical emergencies, travel, family events, or even down payments.

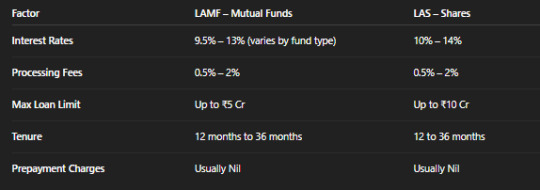

Interest Rates, Processing Fees & Limits – All You Need to Know

Digital loan platforms use LAMF APIs to instantly evaluate, process, and disburse loans, making the loan against mutual funds processing fees and interest rates transparent and user-friendly.

How to Apply for a Loan Against Mutual Funds Online – Step-by-Step (2025)

Visit a digital lending platform (like Groww, Zerodha, Paytm Money, or a Bank site)

Click on “Apply for Loan Against Mutual Fund.”

Enter PAN & link your MF folio or Demat

Select eligible funds (ELSS, debt, equity)

View the loan offer via the LAMF eligibility calculator

E-sign documents and submit KYC

Get instant disbursal to your linked bank account

Some fintech apps offer a loan against shares interest rates comparison to help you choose LAS vs LAMF smartly.

FAQs – Loan Against Mutual Funds or Shares in 2025

1. What is a loan against a mutual fund?

A Loan Against Mutual Fund (LAMF) allows you to borrow money without selling your investments by pledging them digitally.

2. Who can apply for a loan against mutual funds in India?

Any Indian citizen above 21 who holds mutual funds in their name can apply. Many platforms don’t require income proof or a high CIBIL.

3. Can I apply for a loan against ELSS mutual funds?

Yes, loan against ELSS is allowed, but with certain lock-in caveats. Many lenders accept ELSS if held for over 3 years.

4. How much can I borrow through LAMF?

Using a loan against mutual funds eligibility calculator, most users can obtain a loan of up to 70%-80% of their mutual fund's NAV.

5. Is LAS or LAMF better in 2025?

If you hold mutual funds, go for LAMF. If you own equity shares, LAS offers better liquidity options. Compare both using the Loan Against Securities Interest Rates before choosing.

Final Thoughts: Borrow Smart, Invest Smarter

In 2025, you no longer need to choose between growth and liquidity. With smart fintech platforms offering digital loans against mutual funds or shares, you get the best of both worlds — access to instant funds without selling your long-term assets.

Whether you’re planning a big event or tackling a financial emergency, LAMF or LAS ensures you get cash on tap with low documentation, transparent interest rates, and minimal stress. Just a few clicks, and you’re good to go — No Sell, Just Swipe.

#lamf#loan against mutual funds online#lamf eligibilty & documents#loan against elss#digital loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds explained#features of loan against mutual funds#how does a loan against mutual fund work#loan against mutual funds faqs#lamf api#loan against mutual funds processing fees and interest rates#what is a loan against mutual fund#loan against mutual funds max limit#lamf eligibility#lamf loan#loan against mutual funds for wedding#loan against mutual funds eligibility calculator#loan against mutual funds for financial planning#apply for loan against mutual fund#loan against mutual funds for financial needs#loan against mutual funds features#loan against mutual funds for higher education#loan against mutual funds limit#loan against mutual funds eligibility and documents#digital loan against mutual funds interest rate#who can apply for loan against mutual funds#lamf documents#LAS#Loan Against Securities Interest Rates

0 notes