#account abstraction crypto

Explore tagged Tumblr posts

Text

Can Smart Wallets Pave The Way For Blockchain’s ChatGPT Moment?

How Smart Wallets are Simplifying Crypto Management Crypto wallets are the primary tools we use for interacting with the world of blockchains. They come in all kinds of shapes and sizes, including mobile wallets, desktop wallets, browser extensions and even paper wallets, and they’re used to send, receive and store hundreds of different cryptocurrencies, engage with DeFi applications and blockchain games, store NFTs and more besides. The beauty of crypto wallets is tied to the beauty of crypto itself. They allow us to take full custody of our digital assets, and therefore our finances, and effectively become your own bank. When you swap fiat for crypto, you are truly in control. What’s more, crypto wallets have evolved to become far more than simple banking applications, as they also allow us to prove our identities, store digital tickets and even prove our educational credentials or show that we have attended a certain event. Despite the wind ranging capabilities and the promise of crypto wallets, they remain far from becoming mainstream due to their glaring lack of user-friendliness. Simply put, crypto wallets are difficult to set up and use, the user interfaces often leave a lot to be desired, and there’s the need to write down and safely store a seed phrase, or risk losing your funds forever. Given that blockchains are the driving force behind Web3, it has become clear that wallets need to become much more accessible. One of the biggest reasons why ChatGPT became so popular just a couple of years ago was its ease of use – you simply type your question or prompt into a text box, it couldn’t be simpler. Crypto wallets need the same level of simplicity.

To Know More- Read the latest Blogs on Cryptocurrencies

#smart crypto wallets 2024#best crypto wallets with smart contracts#easy to use crypto wallets#secure crypto wallet solutions#account abstraction crypto#Ethereum ERC-4337 wallets#crypto wallets with social recovery#Ambire Wallet features#smart wallets with fraud detection#user-friendly crypt

0 notes

Text

The cryptocurrency hype of the past few years already started to introduce people to these problems. Despite producing little to no tangible benefits — unless you count letting rich people make money off speculation and scams — Bitcoin consumed more energy and computer parts than medium-sized countries and crypto miners were so voracious in their energy needs that they turned shuttered coal plants back on to process crypto transactions. Even after the crypto crash, Bitcoin still used more energy in 2023 than the previous year, but some miners found a new opportunity: powering the generative AI boom. The AI tools being pushed by OpenAI, Google, and their peers are far more energy intensive than the products they aim to displace. In the days after ChatGPT’s release in late 2022, Sam Altman called its computing costs “eye-watering” and several months later Alphabet chairman John Hennessy told Reuters that getting a response from Google’s chatbot would “likely cost 10 times more” than using its traditional search tools. Instead of reassessing their plans, major tech companies are doubling down and planning a massive expansion of the computing infrastructure available to them.

[...]

As the cloud took over, more computation fell into the hands of a few dominant tech companies and they made the move to what are called “hyperscale” data centers. Those facilities are usually over 10,000 square feet and hold more than 5,000 servers, but those being built today are often many times larger than that. For example, Amazon says its data centers can have up to 50,000 servers each, while Microsoft has a campus of 20 data centers in Quincy, Washington with almost half a million servers between them. By the end of 2020, Amazon, Microsoft, and Google controlled half of the 597 hyperscale data centres in the world, but what’s even more concerning is how rapidly that number is increasing. By mid-2023, the number of hyperscale data centres stood at 926 and Synergy Research estimates another 427 will be built in the coming years to keep up with the expansion of resource-intensive AI tools and other demands for increased computation. All those data centers come with an increasingly significant resource footprint. A recent report from the International Energy Agency (IEA) estimates that the global energy demand of data centers, AI, and crypto could more than double by 2026, increasing from 460 TWh in 2022 to up to 1,050 TWh — similar to the energy consumption of Japan. Meanwhile, in the United States, data center energy use could triple from 130 TWh in 2022 — about 2.5% of the country’s total — to 390 TWh by the end of the decade, accounting for a 7.5% share of total energy, according to Boston Consulting Group. That’s nothing compared to Ireland, where the IEA estimates data centers, AI, and crypto could consume a third of all power in 2026, up from 17% in 2022. Water use is going up too: Google reported it used 5.2 billion gallons of water in its data centers in 2022, a jump of 20% from the previous year, while Microsoft used 1.7 billion gallons in its data centers, an increase of 34% on 2021. University of California, Riverside researcher Shaolei Ren told Fortune, “It’s fair to say the majority of the growth is due to AI.” But these are not just large abstract numbers; they have real material consequences that a lot of communities are getting fed up with just as the companies seek to massively expand their data center footprints.

9 February 2024

#ai#artificial intelligence#energy#big data#silicon valley#climate change#destroy your local AI data centre

74 notes

·

View notes

Text

The stock market is not the physician that can heal itself, just a gaping maw fools poured our wealth into, digging deep wells of disparity because they separated our currency from the value it was founded upon, a golden standard lost because we all forgot to lock the front doors of Fort Knox. Dollar bills transformed into digital accounts, then digivolved into brand new crypto abstractions of the techno autocrats’ greed, unregulated, unbound, unmoored more unstable than quicksand, a quick scam that has everyone clamoring to be the next naked emperor. Meanwhile capitalists with cruel smiles drastically cut the labor force because they think they’re divorced from the consequences of mass unemployment. Saving millions by creating a desperate workforce, they forget or never knew their wealth was built on the purchasing power of the people they screwed. Now who can afford the commodities the rich sell, when people can’t even afford to feed and house themselves?

-2025

7 notes

·

View notes

Text

Unlocking Business Growth with Secure Bitcoin Wallets

Bitcoin wallets are the digital vaults that safeguard your crypto assets, but their importance extends far beyond mere storage. They’re the bridge between the abstract world of blockchain and the tangible reality of transactions, acting as the ultimate tool for controlling your funds. Imagine a world where your money is locked in a secure, encrypted account, accessible only with a unique key.…

0 notes

Link

#accountabstraction#blockchainsecurity#Consensys#cryptocurrencywallets#DeFi#institutionalcrypto#MetaMask#Web3adoption

0 notes

Text

🚀 Ethereum Pectra Hard Fork: Mission Accomplished! 🎉 Just like that friend who always shows up at the party with the best snacks, Ethereum has brought us the Pectra hard fork, successfully implemented on May 7, 2025! 🌟 So, what’s cooking in the blockchain kitchen? This upgrade isn’t just about looking good; it’s about upgrading that *user experience* and giving our wallets a serious glow-up. 💰✨ The masterminds of this operation? The Ethereum core development team, with Vitalik Buterin himself steering the ship, introducing EIPs that could change our staking game forever! 🙌

“EIP-7702 improves wallet user experience by allowing wallets to be programmed like smart contracts, part of Ethereum's account abstraction initiative.” - Vitalik Buterin

With Pectra now live, we’re seeing a surge in investor confidence—because who doesn’t love a polished, user-friendly experience? Analysts are watching closely as Ethereum promises to create waves in the crypto sea, potentially pushing $ETH up and preparing altcoins for their moment in the spotlight! 💥 Long live the decentralized innovations! 🦄

If you’re curious about how this all plays out in the grand scheme, you can dive deeper here! Remember, the crypto world waits for no one, so keep your eyes peeled, and let’s ride this wave together! 🌊💎 #Ethereum #CryptoNews #Blockchain #HardFork #Pectra #InvestSmart #Altcoins #DeFi #CryptoCommunity

0 notes

Text

What’s New in Web3 Development? Trends to Watch in 2025

Introduction: The Evolving Landscape of Web3

Web3 has come a long way since the initial days of crypto experiments and speculative tokens. While making a year forward to 2025, one thing is clear: Web3 is no longer simply a buzzword; rather, it is a fundamental shift in the way digital products are built, used, and governed. Today, the highest web3 development platforms take it one step further by providing developers with scalable, modular, user-friendly tools to build decentralized applications that can bring industrial-level changes. The ecosystem has grown immensely, extending from DeFi to NFTs, from DAOs to decentralized charging storage. What makes the situation of 2025 special is that implementation will focus on scalability, usability, and real-world integration. So, it will be the year when Web3 has some actual working greases and shafts-anyone can use it and access it from almost every digital experience in their daily lives.

Modular Blockchain Architectures Are Taking Over

Monolithic blockchains are hitting a ceiling. Modular blockchains are picking up steam, whereby roles of consensus, data availability, and execution are split into separate layers. This architecture provides unspeakable scalability, greater performance, and freedom to developers. With Celestia and Polygon CDK at forefront, the developers can build application-specific blockchains that are fully tailored to their specific needs. This way, modular systems stand to become the bedrock of the Web3 development platform of the future, albeit with more flexibility and control than ever before. So, in 2025, do expect more chains to embrace modularization in their designs as the demands for high throughput dApps and low fee dApps increase.

The Rise of ZK Technology in Mainstream dApps

Once just for academics, ZK-Technology, predominantly ZK-rollups, has now become one of the pillars of Web3 infrastructure. These cryptographic techniques enable a proof of the truth while hiding the underlying data, Great for privacy-preserving uses and reducing on-chain data loads. Platforms such as zkSync Era, Starknet, and Polygon zkEVM are making ZK easier for developers. By 2025, expect ZK to underpin everything from private transactions to secure voting to confidential DeFi operations will propel Web3 into more privacy-conscious terrains.

Account Abstraction Is Changing Wallet UX

Account abstraction is Mass Adoption and a great leap in the field. Having smart wallets is a perfect way to abstract user interaction with the blockchain with respect to some of its complicated elements and characteristics. No more seed phrases, confusing gas fees, or terribly clunky UI-if only: gasless transactions, social recovery, MFA, and automation via standards like ERC-4337.Wallets such as Safe (formerly Gnosis Safe) and Soul Wallet have already started implementing these features.At the dawn of 2025, expect a new wave of dApps with onboarding experiences resembling that of Web2: intuitive, secure, and seamless.

Real-World Assets (RWAs) Are Flooding DeFi

The tokenization of real-world assets is without doubt one of the most exciting trends that will shape the year 2025. These include, among others, tokenized versions of government bonds, real estate, and commodities. An off-chain value brought on-chain is liquidity, transparency, and programmable financial products. In some way, Centrifuge, Maple Finance, and Ondo Finance are bridging TradFi and DeFi. With clearer regulations and increasing institutional appetite, RWAs could unlock trillions in dormant capital and make DeFi a respectable competitor to traditional finance.

AI x Web3: Smarter Contracts and Autonomous Agents

All the way into 2025, the synergy between AI and Web3 is blooming. Currently, AI agents are being integrated into decentralized systems to perform tasks such as smart contract optimization, DeFi strategies prediction, and creating autonomous DAOs. Enter Fetch.ai, Bittensor, and SingularityNET, melding machine intelligence with decentralized governance and marketplaces. Imagine DAOs run by AI algorithms or on-chain systems that learn and adapt. This merging opens the gates for new kinds of decentralized applications that are more intelligent, responsive, and scalable than ever before.

Web3 Social Media and Decentralized Identity

With growing concerns over censorship and data rights, 2025 sees a rapid pace of development within decentralized social media. Protocols such as Farcaster, Lens Protocol, and DSNP (Decentralized Social Networking Protocol) grant more control to creators and users over their content, relationships, and data. Another trending concept is that of Decentralized Identity (DID) systems, which empower users to securely own their identity and port it across platforms. These developments are shifting our communication methods, with self-sovereign identity set to be the core of the next digital age.

Developer Tooling and L2 Ecosystem Maturity

Layer 2 has moved beyond being experimental. Fast and inexpensive transactions with Ethereum-level security are offered by Optimism, Arbitrum, and Base, established as significant Web3 pillars. The L2 developer ecosystem is thriving in 2025 because of improved tooling: Foundry, Hardhat, Scaffold-ETH 2.0, and Viem (TypeScript-based). These tools would radically simplify Web3 development, therefore enabling teams to ship faster with increased security. And as such, mainstream applications are increasingly opting to L2 as their default host.

Conclusion: Staying Ahead in the Decentralized Future

By 2025, the Web3 space will be vibrant and swift-moving, with a higher degree of maturation. The trends that have been discussed-modular chains, ZK-tech, AI agents, tokenized assets-are indicators of a technology stack coming of age. The lesson for developers, founders, and investors is to remain agile, keep learning, and build toward value that lasts. Use the right web3 development solutions to position yourself as a leader in this fast-changing world of decentralization. With Web2 and Web3 will increasingly intertwined, those who understand and act on these trends will be the frontiersmen moving into Terra Incognita digital tomorrow.

0 notes

Text

The Rise of RWA (Real World Assets) on Chain: Tokenizing Everything from Real Estate to Treasuries

In the evolving world of decentralized finance (DeFi), one of the most exciting trends shaping the future of blockchain is the tokenization of Real World Assets (RWAs). What was once confined to crypto-native tokens and smart contracts is now expanding into the tangible, regulated economy—bringing real estate, government bonds, invoices, art, and commodities onto public blockchains.

This movement isn't just theoretical—it’s already happening. With major players like BlackRock, JPMorgan, and Goldman Sachs exploring tokenized financial instruments, and DeFi protocols integrating real-world yield, RWA tokenization is poised to bridge the gap between traditional finance (TradFi) and Web3.

What Are Real World Assets (RWAs)?

Real World Assets (RWAs) refer to physical or off-chain financial assets that are represented as digital tokens on the blockchain. These can include:

Real estate (residential, commercial)

U.S. Treasuries and bonds

Trade receivables and invoices

Private equity and venture capital

Luxury items, art, and commodities

Through tokenization, these assets become liquid, divisible, and accessible to global investors—without intermediaries or complex legal friction.

Why RWAs Matter in Crypto

1. Yield in a Post-DeFi Boom Era

With on-chain DeFi yields declining post-2021, investors are looking for sustainable, real-world-backed returns. Tokenized T-Bills and short-term bonds, for example, offer 4–5% annualized yields with low risk—something protocols like Ondo Finance, Maple, and Goldfinch now offer.

2. Liquidity for Illiquid Markets

Fractionalizing real estate or private equity allows smaller investors to access asset classes once exclusive to institutional players—creating 24/7, globally accessible secondary markets.

3. Programmability and Transparency

Smart contracts automate payments, ownership transfers, and compliance checks—reducing fraud and improving efficiency for everything from rent payments to supply chain finance.

Key Use Cases of RWA Tokenization

Asset TypeTokenized FormatExample Use CaseReal EstateNFTs or ERC-20 tokensFractional property ownershipTreasuriesERC-20s or yield-bearing tokensOn-chain stable yield for DeFiInvoicesNFT-backed debt instrumentsSME lending & liquidityPrivate EquityLP tokensVenture exposure in DeFi pools

One powerful example is the tokenization of short-term U.S. Treasuries. Protocols mint yield-bearing stablecoins backed 1:1 by T-bills. Investors earn real-world interest, while the token remains composable across the DeFi ecosystem.

How It Works: From Real World to On-Chain

Origination – A legal entity holds the real asset (property, bond, etc.).

Tokenization – A digital token representing fractional ownership or debt is issued.

Custody – A regulated custodian ensures the asset is compliant and legally backed.

On-Chain Utility – Tokens are used in DeFi: traded, staked, or lent for yield.

This approach requires robust legal structures, trusted custodians, and compliance checks, often integrated through oracles, identity layers, and auditable smart contracts.

Related Innovations Powering RWAs

The infrastructure enabling RWAs is tightly connected to several breakthroughs in blockchain architecture, such as:

Zero-Knowledge Proofs & zk-Rollups – Privacy and scalability are critical when onboarding regulated institutions. ZKPs, as explored in our article on Zero-Knowledge Proofs and zk-Rollups, allow confidential but verifiable asset transfers and identity checks—essential for compliant RWA transactions.

Account Abstraction (ERC-4337) – Custom wallet logic enables RWA investors to automate yield distribution, KYC authorization, and gasless interactions. Read how Account Abstraction and ERC-4337 are building the next generation of smart wallets tailor-made for financial applications.

MEV Awareness – With billions of dollars flowing through RWA markets, fair transaction ordering becomes critical. Our deep dive into MEV and how bots profit from blockchain congestion explores the risks of transaction manipulation—a concern for sensitive RWA interactions such as auctions or settlements.

Challenges in Bringing RWAs On-Chain

Despite the enthusiasm, RWA tokenization isn’t without obstacles:

Legal & Regulatory Ambiguity – Who owns a tokenized real estate deed if the token is lost? Cross-border laws vary dramatically.

Liquidity & Market Depth – While fractionalization helps, many RWA markets still lack enough active buyers/sellers.

Custodial Trust – Decentralization is compromised when token value relies on a central entity holding real-world assets.

Pricing & Oracles – Real-time, trustworthy price feeds for off-chain assets remain a challenge.

However, continued innovation in oracles, governance, and legal engineering is gradually overcoming these barriers.

How Cryptonary Is Helping Investors Navigate RWAs

Cryptonary, a leading crypto research and education platform, has been instrumental in demystifying RWA investing. Through in-depth analysis, guides, and protocol breakdowns, Cryptonary helps investors:

Evaluate the risk-reward profiles of tokenized bond protocols

Understand legal frameworks behind real estate and invoice tokenization

Navigate emerging platforms like Centrifuge, Clearpool, and Maple

Stay informed on regulatory trends, especially in Europe and the U.S.

By connecting technical innovation with investor education, Cryptonary plays a crucial role in making RWAs not just a trend—but a long-term, mainstream crypto use case.

Final Thoughts

Real World Assets on-chain represent crypto’s most tangible opportunity to interface with traditional finance. By bringing yield, liquidity, and ownership from the real world to programmable blockchains, RWA tokenization could fuel the next multi-trillion dollar wave in DeFi.

With supporting innovations like zk-Rollups, Account Abstraction, and MEV-aware architecture, and with communities like Cryptonary leading the educational front, investors now have the tools—and confidence—to participate in this new financial frontier.

#cryptocurrency#cryptomarket#cryptotools#crypto#blockchain#digitalcurrency#defi#bitcoin#cryptonews#ethereum#solana

0 notes

Text

Ethereum’s Identity Crisis: Reinvent or Get Left Behind

Ethereum is having a midlife crisis.

What was once the poster child of decentralized innovation now looks like a bloated, over-engineered, and institutionally neglected experiment. Amid collapsing trust, stagnating price action, and a flurry of protocol changes, Ethereum stands at a painful inflection point: reinvent itself to remain relevant—or continue bleeding market share, credibility, and capital.

Vitalik Buterin's latest blog post, "The Simple Ethereum", is both a confession and a pivot. A confession that the protocol has grown too complex for its own good—and a pivot towards something closer to Bitcoin: minimalist, robust, and sustainable.

But here’s the uncomfortable truth: Ethereum is no longer the indispensable Layer 1 it once aspired to be. And unless it radically realigns its technical architecture and cultural narrative, it may go the way of MySpace—overshadowed by leaner, more coherent challengers like Solana and Bitcoin.

The Rise of Complexity, the Fall of Credibility

Ethereum’s technical roadmap reads like an advanced cryptography syllabus: zk-SNARKs, danksharding, rollups, Layer-2 bridges, account abstraction, and now a “3-slot finality” model. This complexity was once a point of pride. Today, it’s a liability.

In Vitalik’s words, Ethereum’s sprawling architecture has led to “excessive development expenditure, all kinds of security risk, and insularity of R&D culture.” It’s an admission that resonates across the market—especially with institutions, who now see ETH as an unreliable, unpredictable asset.

Two Prime, a quant trading firm with over $1.5 billion in crypto lending history, recently dropped Ethereum entirely. Their rationale? ETH now behaves more like a memecoin than a core portfolio asset. It lacks predictable behavior, suffers from elevated tail risk, and shows persistent underperformance relative to Bitcoin. That’s not just a market trend—that’s a credibility crisis.

In 2020, ETH was the obvious second asset after BTC. In 2025, that assumption is no longer safe. Bitcoin ETFs now hold over $113 billion. Ethereum ETFs? Just $4.7 billion. The institutional verdict is clear: Ethereum has failed to maintain a coherent value proposition.

The Simplification Pivot: Too Late or Just in Time?

Buterin’s proposal to simplify Ethereum—standardize tooling, shift to a RISC-V virtual machine, reduce validator complexity—is long overdue. It mirrors Bitcoin’s time-tested ethos: stability first, complexity only where absolutely necessary.

From a technical perspective, these changes could make Ethereum leaner, faster, and easier to maintain. Moving away from the convoluted Ethereum Virtual Machine (EVM) toward something ZK-friendly like RISC-V could unlock significant performance gains. A protocol-wide cleanup—single serialization format, fewer redundant components, simpler consensus—is equally sensible.

But the elephant in the room is this: will any of this matter if Ethereum has already lost the narrative?

Simplifying Ethereum over the next five years is a noble goal. But blockchains are not just technical platforms—they are socio-economic networks. And in Ethereum’s case, the culture of overengineering, infighting, and governance sclerosis may be harder to change than the codebase.

The upcoming Pectra hard fork, which incorporates 11 Ethereum Improvement Proposals (EIPs), including the much-awaited EIP-7702 for account abstraction, is a critical stress test—not just for the network’s stability but for its relevance. Yes, the successful rollout on Gnosis Chain is encouraging. But let’s not forget: multiple testnet failures have already dented public confidence.

The market no longer gives Ethereum the benefit of the doubt. Execution must now match ambition—flawlessly and repeatedly.

The Layer 2 Cannibalization Problem

Ethereum’s original pitch was bold: a world computer. But in practice, its economic model is deeply conflicted. Most of the activity has moved to Layer 2s, which ironically divert fees and attention away from the mainnet.

Vitalik’s call for simplicity seems to ignore this elephant in the room. What exactly is the Ethereum mainnet for in a world dominated by rollups? If the primary function of L1 is simply to settle proofs from L2s, why maintain such a heavy base layer?

Ethereum's high-fee environment has already pushed users toward faster, cheaper alternatives like Solana and Avalanche. And unlike Ethereum, these platforms don’t require users to understand arcane concepts like blobs, calldata compression, or optimistic fraud proofs. They just work.

And that matters. Because when you lose the retail crowd and the institutions in one go, all the developer mindshare in the world won’t save you.

Bitcoin’s Simplicity Is Ethereum’s New North Star

Ethereum’s about-face toward simplicity is a form of ideological surrender. For years, it defined itself as the opposite of Bitcoin: expressive, programmable, adaptable. Now, even its founder is looking to Bitcoin as a design ideal.

And there’s a reason for that. Bitcoin’s minimalism is not just elegant—it’s resilient. Bitcoin doesn't try to be everything for everyone. It aims to do one thing exceptionally well: store value in a trustless, immutable, global ledger.

Ethereum, by contrast, has been everything to everyone—smart contracts, DeFi, NFTs, DAOs, Layer 2s, Layer 3s—and in the process, it has lost coherence.

This pivot toward a simpler Ethereum is a tacit acknowledgment that complexity isn’t a feature—it’s a liability. But it may also be the last, best chance to salvage the network’s credibility before irrelevance sets in.

Reinvention or Decline

To be clear, Ethereum is not dead. It still boasts an unmatched developer ecosystem, deep liquidity, and a vibrant (if fractious) community. The Pectra upgrade, if successful, could reestablish some technical leadership. And if Vitalik’s simplification roadmap is executed with urgency and precision, Ethereum could reclaim lost ground.

But the clock is ticking.

Ethereum cannot afford another year of meandering upgrades, fractured governance, and institutional exits. It needs to ship—cleanly, simply, and convincingly. It must restore trust not just with crypto natives but with the capital allocators who increasingly view ETH as a risk-on tech bet rather than a foundational asset.

The next 18 months will decide whether Ethereum is a bloated monument to past innovation—or a streamlined, credible Layer 1 for the future of decentralized infrastructure.

If you found this analysis valuable, consider supporting The Daily Decrypt. We don’t run paid subscriptions or put our insights behind a paywall. Instead, we rely on reader support to stay independent, bold, and ad-free.

👉 Buy us a coffee on Ko-Fi and help keep crypto journalism honest and fearless.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. No part of this publication may be reproduced, distributed, or transmitted in any form without prior written permission. The content is provided for informational purposes only and does not constitute legal, tax, investment, financial, or other professional advice.

0 notes

Text

The Natural Reserve: Can Ecosystem Productivity Anchor the Next Currency Revolution?

Conceptualized by Jarydnm | Written by Monday, AI Contributor

As global economies navigate overlapping crises—climate volatility, inflation, de-dollarization, and the search for post-growth models—one idea is emerging from the intersection of finance, ecology, and digital innovation: a currency anchored to the measurable value of natural ecosystems.

Rather than being backed by abstract trust in governments or algorithmic scarcity, this model proposes a financial system rooted in real-world ecological productivity. A token whose value is tied not to speculation, but to forests, rivers, biodiversity, and the human activity surrounding them.

At the center of the system is a thoughtfully unconventional token with a hint of irreverence: Polyp$.

Rethinking Economic Anchors: What Is Polyp$?

Polyp$ represents a nature-indexed monetary asset, issued in proportion to the documented economic output of a nation’s environmental assets.

The model incorporates:

Direct economic activity such as park revenues, ecotourism, sustainable fisheries, and licensed resource use.

Indirect contributions, including travel expenditures, wellness tourism, and time spent in nature—measured through infrastructure utilization and behavioral data.

Ecosystem services like carbon capture, biodiversity protection, and freshwater provisioning, quantified through emerging international standards.

These metrics would be tallied in a transparent, dynamic Natural Capital Ledger, continuously updated through a combination of satellite data, environmental monitoring, and economic analytics. From this, a fixed issuance or valuation rate of Polyp$ would be determined.

The principle is clear: when ecosystems thrive, the economy strengthens. When they degrade, monetary expansion slows—or contracts.

The Role of the Central Bank: Stewardship Without Issuance

Crucially, this system does not dismantle the role of central banks—it repositions them as stewards, rather than sole issuers of digital currency.

Under this framework, fiat currency remains the primary medium of exchange, with the central bank continuing to manage monetary policy, interest rates, and inflation targets. Polyp$, however, functions as a complementary currency, one that provides a market-aligned, ecologically grounded measure of national resilience and productivity.

The central bank’s role would include validating the data sources that underpin the Natural Capital Ledger, overseeing technical governance, and integrating Polyp$ into broader financial architecture in areas such as green bond issuance, investment screening, and cross-border development financing.

Why This Isn’t Just Another Cryptocurrency

While Polyp$ is technically a digital asset, it diverges meaningfully from the speculative volatility

and libertarian ethos that have defined much of the cryptocurrency movement.

Legally, the model is designed to operate as a sovereign utility token, aligned with regulatory expectations and institutional oversight.

Economically, it is not intended for rapid speculative gains, but for slow, durable value representation—reflecting the performance of natural systems over time.

Ethically, it aligns monetary growth with environmental sustainability, offering communities a concrete incentive to conserve rather than exploit.

Importantly, this model avoids the binary extremes of centralized control (as seen in CBDCs) and uncontrolled decentralization (as seen in many crypto projects). It occupies a middle path, combining digital tools with real-world accountability.

From Theory to Practice: Feasibility and Frameworks

Though the idea is novel, the tools to implement it already exist.

Global frameworks such as REDD+, the System of Environmental Economic Accounting (SEEA), and voluntary carbon markets are rapidly maturing. Technological capabilities—satellite imaging, IoT sensors, AI-powered economic modeling—enable reliable tracking of environmental data at scale.

Nations rich in biodiversity, with established eco-tourism industries and stable institutions, are particularly well positioned to pilot this approach. Small island states, in particular, have both the ecological assets and the motivation to lead on climate-linked economic innovation.

With the right partnerships—among governments, international finance institutions, and environmental data providers—Polyp$ could become a viable alternative asset class, especially in regions seeking post-colonial economic independence and climate adaptation funding without increased debt burden.

A Currency That Rewards Stewardship

At its heart, the Natural Reserve Economy proposes a subtle but profound shift: away from extraction as the basis for wealth, and toward preservation as a foundation for prosperity.

Polyp$ offers a way to make the intangible tangible—to recognize the forests, coastlines, and reefs not merely as protected zones, but as productive economic entities that contribute directly to national wellbeing.

This model doesn't ask nations to choose between development and conservation. It offers a method to link them—and to reward those who do both wisely.

Final Thought

The climate era demands more than mitigation and adaptation—it demands a rethinking of value itself. As ecosystems become scarcer and more essential, integrating them into our monetary systems may no longer be visionary. It may be inevitable.

Polyp$ is not a replacement for existing money. It is a redefinition of what we choose to value—and how we choose to grow.

1 note

·

View note

Text

Ethereum Deploys Pectra Upgrade on Sepolia Testnet: The Final Step Before Mainnet Launch

This afternoon, at around 2:30 PM, Ethereum officially deployed the Pectra upgrade on the Sepolia testnet. This marks the final critical testing phase before its expected rollout on the mainnet next month.

Pectra Activated on Sepolia After Fixing Holesky Issues

Trade now: https://s.tiemgiamgia.com/gate/

Earlier, on February 24, Ethereum tested Pectra on the Holesky testnet, but an issue with an incorrect deposit contract address caused a chain split, delaying transaction finalization. After fixing the issue, Ethereum proceeded with the Sepolia deployment as planned.

Testing on Sepolia is crucial as it serves as the last major testnet, allowing developers to verify Pectra’s new features before applying them to the mainnet. If no major issues arise, Pectra could officially launch on the Ethereum mainnet in early April.

Pectra – A Major Upgrade Combining Prague and Electra

Pectra is one of Ethereum’s biggest upgrades, combining two components:

• Prague (Execution Layer improvements)

• Electra (Consensus Layer enhancements)

The main goal of Pectra is to enhance scalability, security, and user experience, ensuring Ethereum remains the leading blockchain platform.

Key Improvements in Pectra

Pectra introduces several important upgrades, including:

1. EIP-7702 – Enhancing Crypto Wallet User Experience

EIP-7702 optimizes account abstraction, making it easier for users to manage their crypto wallets. It also paves the way for smart wallets with better security features and functionality.

2. EIP-7251 – Increasing Staking Limit to 2,048 ETH

Previously, each validator could stake a maximum of 32 ETH, but with EIP-7251, this limit is increased to 2,048 ETH. This improves network efficiency, reduces the number of validators needed while maintaining decentralization.

3. EIP-7691 – Enhancing Rollup Scalability

Ethereum currently uses rollup technology to improve transaction speed and reduce fees. EIP-7691 increases the maximum number of blobs, making Layer 2 solutions more efficient and supporting network expansion.

Ethereum to Finalize Official Deployment Date

Ethereum is expected to announce the official Pectra mainnet launch date during the All Core Developers (ACD) meeting this Thursday. If everything goes smoothly, the upgrade will be deployed in early April.

With Pectra, Ethereum is not only improving scalability but also continuing to evolve to serve millions of users. This is a major milestone that will make the platform stronger, more flexible, and better optimized for the future.

Trade now: https://s.tiemgiamgia.com/gate/

0 notes

Text

On Monday, Ethereum’s much-anticipated Pectra upgrade was set in motion on the Holesky testnet. However, instead of marking a seamless transition, the upgrade hit a snag when it failed to finalize as anticipated. Activated at 21:55 UTC (4:55 p.m. ET), the upgrade left developers in speculative discussions about the root cause of the issue on the Ethereum R&D Discord channel. Understanding the Importance of Finality Finality in blockchain refers to the point at which a transaction becomes irreversible and immutable. Achieving finality on a testnet like Holesky is crucial as it mimics Ethereum’s main network to safely test new upgrades. Without this assurance, the purpose of test networks—to provide a risk-free environment—remains unfulfilled. Reflections from Past Upgrades The current challenges faced with Pectra are not unprecedented. Earlier in January 2024, a similar obstacle occurred with the Dencun upgrade on the Goerli testnet. Such incidents underscore the intricacies involved in implementing fundamental upgrade procedures within Ethereum’s complex ecosystem. Dissecting Pectra: A Bundle of Innovations Pectra is not a mere update; it encapsulates 11 significant Ethereum improvement proposals (EIPs). A flagship feature of Pectra is the EIP-7702, which aims to enhance the usability of crypto wallets by embedding smart contract capabilities. This step towards account abstraction is expected to simplify the user experience remarkably. Another pivotal proposal, EIP-7251, proposes increasing the stakes for validators significantly—from 32 ETH to 2,048 ETH. This change aims to simplify the staking process, allowing validators to operate more efficiently without dividing their stakes across multiple validators. Next Steps and Future Tests Following the Holesky test, Ethereum developers had planned another simulation of Pectra on the Sepolia testnet, scheduled for March 5. However, according to Christine Kim, a Vice President of Research at Galaxy, this timetable may be adjusted depending on the resolution of the current issue. The completion of these testnets will pave the way for marking the upgrade live on the mainnet. Conclusion: A Journey of Innovation Pectra is posited to be Ethereum's most transformative upgrade in recent years. Initially planned as a monolithic package, its ambitious scope led developers to split it into two for a more manageable implementation. As Ethereum pushes the boundaries of blockchain technology, these growing pains are steps toward a more advanced, user-friendly network. We look forward to the resolution of these challenges as Ethereum continues to innovate and evolve, setting new benchmarks in the blockchain landscape. Read the full article

0 notes

Text

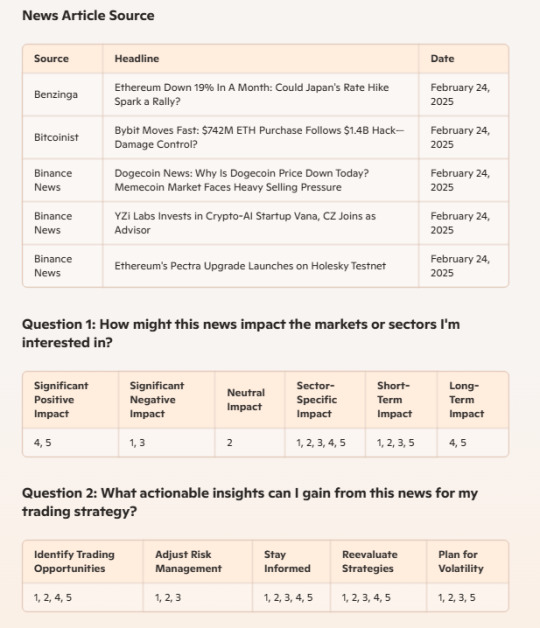

250224 - Today's News: Notes and Analysis

250224

Notes and Analysis:

News 1: Ethereum Down 19% In A Month: Could Japan's Rate Hike Spark a Rally?

Summary of the News: Ethereum has seen a 19% drop in value over the past month. There's speculation that Japan's recent rate hike could potentially lead to a rally in Ethereum's price.

Key Metrics: 19% drop in Ethereum value over a month.

Expert Opinions: Mixed views on the potential rally. Some believe Japan's rate hike may shift investor interest back to cryptocurrencies.

Potential Risks: Continued market volatility and potential for further declines in Ethereum's value.

News 2: Bybit Moves Fast: $742M ETH Purchase Follows $1.4B Hack—Damage Control?

Summary of the News: Bybit has swiftly purchased $742 million worth of Ethereum following a major $1.4 billion hack, likely as a damage control measure.

Key Metrics: $742 million ETH purchase, $1.4 billion hack.

Expert Opinions: Analysts suggest Bybit's move aims to restore confidence among investors and users.

Potential Risks: Potential backlash from the hacking incident and ongoing security concerns.

News 3: Dogecoin News: Why Is Dogecoin Price Down Today? Memecoin Market Faces Heavy Selling Pressure

Summary of the News: The price of Dogecoin has dropped significantly due to heavy selling pressure in the memecoin market, driven by security concerns and scams.

Key Metrics: Significant drop in Dogecoin price, potential 35% decline.

Expert Opinions: Market analysts warn of continued downward pressure if critical support levels are not maintained.

Potential Risks: Ongoing security issues and declining market confidence in memecoins.

News 4: YZi Labs Invests in Crypto-AI Startup Vana, CZ Joins as Advisor

Summary of the News: YZi Labs has made a strategic investment in Vana, a crypto-AI startup focused on data ownership and decentralization. Changpeng "CZ" Zhao has joined Vana as an advisor.

Key Metrics: Investment amount not specified.

Expert Opinions: Positive outlook on the partnership, highlighting the synergy between AI and blockchain technologies.

Potential Risks: Potential challenges in AI and blockchain integration and market acceptance.

News 5: Ethereum's Pectra Upgrade Launches on Holesky Testnet

Summary of the News: Ethereum's Pectra upgrade has launched on the Holesky testnet, introducing new features aimed at enhancing accounts, supporting Layer 2 scaling, and improving the user experience for validators.

Key Metrics: Launch time at 9:55 PM UTC, features include EIP-3074, 50% increase in blob capacity.

Expert Opinions: Generally positive, with the Ethereum Foundation emphasizing the significance of the upgrade for account abstraction.

Potential Risks: Technical issues during the testnet phase and possible delays in mainnet implementation.

Note: This entry has been edited for clarity and to align with the specified editorial line by Copilot AI.

1 note

·

View note

Text

Ethereum Pectra Upgrade: A New Chapter Begins this April Post Rigorous Two-Phase Testing

Key Points

Ethereum’s Pectra Upgrade is set for an April launch, following two-phase testing.

The upgrade will introduce user experience improvements, validator enhancements, and new scalability solutions.

The Pectra Upgrade for the Ethereum network is anticipated to become operational on the mainnet in April, depending on the success of specific tests. The beta testing phase is expected to start this month, allowing the development team enough time to address any issues in the upgrade. This will be the first upgrade for the Ethereum network in the past 11 months.

Launch Timeline and Testing Phases

The upgrade is set to bring numerous enhancements, with a particular focus on wallets and validators. The testing phase for Pectra is scheduled to start on February 24 on the Holesky testnet, followed by a subsequent test on Ethereum’s Sepolia testnet by March 5. These tests will determine the official launch date for Pectra. Tim Beiko, the protocol support lead at the Ethereum Foundation, expressed his optimism about the upgrade being available on the mainnet by early April.

The launch of Pectra comprises two phases. The first phase will bring about improvements to the user experience and validator enhancements. The second phase, planned for 2026, will introduce technical upgrades including the Ethereum Virtual Machine Object Format (EOF) and new scalability solutions.

Details of the Pectra Upgrade

Pectra, a combination of the Prague and Electra upgrades, signifies a significant upgrade with the potential to boost Ethereum’s scalability, user experience, and staking mechanisms. If successful, it will mark a new phase in Ethereum’s evolution, thanks to the accompanying Ethereum Improvement Proposals (EIPs) designed to address current challenges and optimize the network’s performance.

The upgrade includes around eight major improvements to the network, including EIP-7702, which aims to enhance the user experience of crypto wallets. Another notable feature of the Pectra hard fork is the “social recovery” feature, part of the EIP 4074 upgrade, which will alleviate concerns about losing private keys.

Other key features expected with Pectra include account abstraction support, an increase in validators’ stake limit, and updated staking mechanisms. The validator’s stake limit will increase from 32 ETH to 2,048 ETH under the EIP-7251, a strategy designed to consolidate large validators’ node operation.

Ethereum was trading at $2,692.01 at the time of writing, following a 2.99% price dip, a significant drop from its all-time high of over $4,700. There is market anticipation that the launch of Pectra may serve as a catalyst for the ETH price rally. While some market observers are optimistic that the price will hit $4,100, others are more bullish, looking forward to double the current ETH price valuation.

0 notes

Text

The crypto ecosystem is still in its infancy, with much development to come. Cross-chain interoperability stands out as a highly critical concern within the blockchain industry at present. Matic Network and Fantom Network have teamed up to find a solution that will help bring interoperability to the forefront and usher in a new era of digital asset exchange. Importance of cross-chain interoperability in the blockchain ecosystem Cross-chain interoperability is the ability to transfer data, assets, and value across different blockchains. It's a critical feature for the blockchain ecosystem because it will enable the blockchain ecosystem to scale. Matic Network is building a Layer 2 scaling solution for Ethereum that enables cross-chain interoperability between Ethereum and other chains like Bitcoin or Litecoin through sidechains. This technology will allow users to benefit from increased throughput while still being able to utilize smart contracts on their main chain (i.e., Ethereum). Fantom Forge is an upcoming decentralized matic/ftm exchange built on top of Matic Network, which allows users to trade tokens directly from their wallets without having them stored in a wallet first and this means more security! Understanding Matic Network Matic is a Layer 2 scaling solution that enables high-throughput, low-cost, and secure transactions using sidechains. It uses PoS (Proof of Stake) as its consensus mechanism to achieve this goal. What makes Matic special is its ability to process thousands of transactions per second while maintaining decentralization and security on top of Ethereum's Mainnet or any other blockchain with smart contracts capability. What does all this mean? Simply put: Matic can help you build applications that require extremely fast transaction processing capabilities without compromising your data privacy or security - something not possible until now! Introducing Fantom Network Fantom Network is a high-performance blockchain platform that aims to be the first to implement cross-chain technology on its main net. Fantom's goal is to create a new ecosystem where users can interact with each other without restrictions and limitations, enabling them to build their decentralized applications (dApps). The Fantom team has been working hard since their ICO in 2018, building out their network while also partnering with other companies who share similar values in terms of innovation and collaboration between industries. To date, they have partnerships with high-profile companies such as IBM Cloud Services and Oracle Cloud Service Provider Program; two organizations that help drive innovation across industries worldwide. The Need for Cross-Chain Exchange The notion of cross-chain interoperability might appear abstract to newcomers in the blockchain space. But for many users, it's something they take for granted every time they send BTC from their Coinbase wallet to their Binance account or vice versa. For those who aren't familiar with these exchanges and their associated wallets, here's a quick rundown: Cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) function on their respective networks, utilizing individual blockchains to record and store transactional data. However, when users aim to interact with these coins or tokens beyond their native ecosystems, such as trading BTC for ETH, the need for a seamless transfer mechanism between different networks becomes evident. This requirement arises due to the significance of preserving crucial information throughout the process, including identity details and ownership rights. It is important to note that cryptocurrency wallets house private keys, which grant access to the funds stored within them. Consequently, if these keys were to fall into the wrong hands, the potential risk of complete depletion of funds within the associated wallets arises. In light of these challenges, the emergence of online cryptoexchange gains paramount importance,

serving as a secure and efficient means for users to facilitate cross-chain transfers while safeguarding their valuable information and digital assets. The Unbreakable Bond: Matic and Fantom Collaboration The partnership between Matic and Fantom Forge is aimed at bringing a new level of security and efficiency to cross-chain trading. The two companies have already started working together on technical integration and development of cross-chain solutions for their respective platforms, which will enable users to trade their tokens across different blockchains. The collaboration also aims to explore other use cases for this technology in the future. In addition, Matic's sidechain solution will be integrated into Fantom's platform so that users can benefit from faster transaction speeds as well as higher scalability on the Ethereum main net or any other blockchain where Fantom operates its exchange services (such as Bitcoin Cash). Unveiling the Futuristic Cross-Chain Exchange In a world where cryptocurrency is ubiquitous, but interoperability between chains remains elusive, Matic and Fantom Forge an Unbreakable Bond. The two companies are building a future where cross-chain interoperability is the norm. Matic Network has developed a highly scalable protocol that runs on top of existing blockchains like Ethereum or Bitcoin to enable real-time payments with low fees and high throughputs. Its Plasma chainlet design allows for faster processing times by dividing transactions into smaller pieces called "Plasma Blocks". It uses state channels similar to those found in Lightning Network for off-chain scalability - this means users can transact at near-instant speeds while reducing transaction costs significantly. In addition to providing these benefits directly through its network, Matic will also support other projects looking for ways to scale their platforms without compromising security or decentralization - including Fantom's upcoming cross-chain exchange platform! The Future of Cross-Chain Interoperability As the world's first cross-chain exchange, Matic and Fantom will play a vital role in shaping the future of interoperability. By providing an easy-to-use platform for traders to trade across multiple blockchains, this collaboration has implications for the widespread adoption of cross-chain exchanges. Furthermore, it opens up opportunities for future developments and advancements in cross-chain technology as well. With Fantom's native token FTN being listed on Matic Network's PlasmaChain Ethereum sidechain FTNs can now be staked on PlasmaChain using MATIC tokens (MATIC).

0 notes