#accounting company

Text

تخفیف ویژه قیمت نرم افزار سپیدار در سپیدار سیستم

برای خرید و قیمت نرم افزار حسابداری سپیدار، ابتدا میتوانید سیستمها، زیرسیستمها و امکانات مورد نظر خود را انتخاب کرده و درخواست مشاوره ثبت کنید. پس از ثبت درخواست، کارشناسان ما با شما تماس خواهند گرفت و یک جلسه دمو رایگان برای شما برگزار میکنند. در نهایت، بر اساس نیاز شما، نمایندگان سپیدار سیستم پیش فاکتور صادر خواهند کرد و در صورت تمایل به خرید، میتوانید نرمافزار سپیدار را تهیه کنید.

0 notes

Text

Learn the Different Kinds of Assessments in Income Tax

ECS is the best tax consultancy firm in Chennai. ECS Accounting delivers legal provisions related to income tax audits so that you may run your business legally and correctly. Section 44AB of the Income Tax Act of 1961 requires tax audits for some persons, requiring qualified Chartered Accountants to audit their financial records before filing their income tax returns.

Income tax assessments can take many different forms, ranging from self-assessment to tax avoidance. To comply with tax requirements, you need to understand the different kinds of assessments and how they work.

Income Tax Assessment Meaning

After each fiscal year, qualified individuals and entities are required to submit income tax returns (ITRs) and pay taxes based on their net taxable income. After you submit your ITR, the income tax department evaluates and confirms it. This process is known as income tax assessment. Your ITR can be selected for a special evaluation based on criteria defined by the Central Board of Direct Taxes (CBDT).

Types of Income Tax Assessments Under the Income Tax Act

Here are the several types of assessments you need to know:

Regular Assessment

The Income Tax Department assigns an Assessing Officer (AO) or an income tax officer to undertake this assessment. They focus on:

The accuracy of the income you've reported

The accuracy with which the tax and final payment are calculated

Whether you have undervalued the revenue, inflated the expenses or losses, or underpaid the taxes

The CBDT defined the following criteria for this assessment:

If the officer believes you are under investigation, a notice will be given within 6 months for the end of the fiscal year in which you filed the return.

You must submit evidence of declared income before the assessing officer approves or changes your return; the latter may result in tax demands.

Self-Assessment

This tax assessment requires you to calculate your tax burden. Here's all you should know about it:

The tax agency provides a variety of forms for filing returns.

Consolidate your revenue from multiple sources and adjust it to reflect any losses, deductions, or exemptions available throughout the year.

This will give you the net taxable income and calculate the tax based on the slab rates.

You must subtract the tax deducted at source, or TDS and Advance Tax, from the total taxes to be calculated.

This will determine whether you need to pay additional taxes or receive a refund.

Summary Assessment

This type of tax assessment is carried out without the intervention of individuals. Here's what happens.

The information you provide in your ITR is cross-checked against the data in the income tax department database.

Throughout the procedure, the department guarantees that your ITR is fair and accurate.

The return is completed online, and any corrections for mathematical errors, incorrect claims, and disallowances are made immediately.

If the modifications result in a tax increase due, you will get a notice under Section 143(1).

Scrutiny Assessment

After you've submitted your return, the IT department may assign an officer to review your ITR. It works like this:

Section 143(2) provides notification that an officer has been appointed to assess your return.

The officer may request documents, books of accounts, and any other essential data for the assessment.

The officer determines your income tax liability, and if there is a discrepancy, you must pay the difference or receive a refund.

If you are dissatisfied with the assessment, you can request rectification under section 154 or submit a revision application under sections 263, and 264.

If the Scrutiny Assessment verdict is still judged unconstitutional, you may file an appeal with the following higher authorities: CIT (A), ITAT, the High Court, and the Supreme Court.

Income Escaping Assessments

This assessment in taxation occurs when the IT department believes that taxable revenue has eluded assessment. A notice and evaluation can be opened within four years at the end of the assessment year. Reassessment occurs in the following scenarios:

If you have taxable income but have not filed a return

If you have underestimated your income or claimed excess allowances or deductions.

If you have not produced reports on international transactions, as required.

Evaluation of the Best Judgment

This assessment applies in the following situations:

If you do not respond to an IT notice concerning specific information or books of accounts

If you do not comply with a special audit issued by the IT department.

If you fail to file the return by the due date or the grace period

If you do not comply with the terms set under Summary Assessment.

After hearing your arguments, the Administrative Officer considers all relevant evidence before making a decision. This is known as the Best Judgment Assessment. Paying close attention to the different sorts of assessments will help you follow the Income Tax Act's standards and avoid penalties for noncompliance.

You can obtain the necessary funding at competitive interest rates. In addition, you can make easy repayments by selecting a flexible duration of up to 36 months.

ECS Accounting provides legal provisions regarding income tax audits so that you can run your business lawfully and correctly. ECS Accounting Firm provides comprehensive tax auditing services in Chennai. We prioritize privacy protection and strive to improve our client services. We believe in providing professional services with specific abilities in a variety of industries.

#accounting#accounting firm#accounting services#income tax#tax consultant#tax consulting services#tax services#accounting company

0 notes

Text

The Importance of Hiring an Accounting Company

Dubai’s dynamic business environment requires businesses to maintain good financial management practices. Hiring an expert accounting firm is one of the best methods to accomplish this. These companies offer crucial services that guarantee businesses run efficiently and continue to adhere to local laws. These are the top five reasons why your firm must work with an accounting company in Dubai.

0 notes

Text

Why Outsourcing Your Accounting Services Could Be The Best Decision You Make?

Outsourcing accounting services has become an increasingly popular option for businesses of all sizes, offering numerous benefits that can significantly impact their bottom line and overall success. From cost savings to access to specialized expertise, outsourcing accounting services can streamline operations, improve efficiency, and enhance financial performance.

Let’s explore why engaging in outsourced accounting services in Mayfield Heights OH could be the best decision you make for your business.

Cost Savings: One of the most compelling reasons to outsource accounting services is the potential for significant cost savings. Outsourcing eliminates the need to hire and train in-house accounting staff, saving on salaries, benefits, and overhead costs associated with maintaining an internal accounting department. Moreover, outsourcing providers often operate on a variable cost model, allowing businesses to scale services up or down based on their needs, further optimizing costs and maximizing flexibility.

Access to Specialized Expertise: Outsourcing accounting services provides businesses with access to a team of highly skilled professionals with specialized expertise in accounting, tax, and financial management. These experts possess in-depth knowledge of industry best practices, regulations, and compliance requirements, enabling them to deliver accurate, timely, and value-added solutions to clients. Whether it’s tax planning, financial analysis, or strategic advisory services, outsourcing partners offer a breadth and depth of expertise that may be challenging to replicate in-house.

Focus on Core Business Activities: By outsourcing accounting services, businesses can free up valuable time and resources to focus on core business activities and strategic initiatives. Rather than spending time on administrative tasks or navigating complex accounting issues, business owners and managers can devote their energy to driving growth, innovation, and customer satisfaction. Outsourcing allows businesses to leverage external expertise and support, enabling them to optimize operations and remain competitive in their respective industries.

Scalability and Flexibility: Outsourcing accounting services offers businesses scalability and flexibility to adapt to changing needs and circumstances. Whether experiencing rapid growth, seasonal fluctuations, or economic uncertainty, outsourcing providers can adjust service levels and resources to meet evolving requirements. This scalability ensures that businesses have access to the right level of support at the right time, without the constraints of hiring and training additional staff or investing in infrastructure.

Improved Accuracy and Compliance: Outsourcing accounting services can enhance accuracy and compliance by leveraging the expertise of experienced professionals and robust quality control processes. Outsourcing providers adhere to strict accounting standards, regulatory requirements, and internal policies and procedures to ensure the accuracy, reliability, and integrity of financial reporting. By mitigating the risk of errors, discrepancies, and non-compliance, outsourcing helps businesses maintain transparency, accountability, and trust with stakeholders.

Enhanced Technology and Innovation: Outsourcing accounting services enable businesses to leverage advanced technology and innovative solutions that may be beyond their reach internally. Outsourcing providers invest in cutting-edge accounting software, automation tools, and data analytics platforms to streamline processes, improve efficiency, and deliver actionable insights to clients. By harnessing the power of technology, businesses can gain real-time visibility into their financial performance, optimize resource allocation, and make data-driven decisions that drive growth and profitability.

Focus on Strategic Partnerships: Outsourcing accounting services fosters strategic partnerships between businesses and outsourcing providers, built on trust, collaboration, and mutual success. Rather than viewing outsourcing as a transactional relationship, businesses can cultivate long-term partnerships with providers who understand their unique needs, goals, and challenges. These partnerships enable businesses to tap into a network of resources, expertise, and support, driving innovation, resilience, and competitive advantage in an ever-evolving marketplace.

In conclusion, outsourcing accounting services offers numerous benefits that can transform the financial health and performance of businesses. From cost savings and access to specialized expertise to scalability, flexibility, and enhanced technology, outsourcing enables businesses to optimize operations, improve efficiency, and focus on core business activities. By deciding to outsource accounting services, businesses can unlock new opportunities for growth, innovation, and success in today’s dynamic business environment.

0 notes

Text

Scarlet Nguyen and Kevin Ngo founded Clarity Tax in 2016 with a vision to bridge a significant gap they saw in the market. They recognized that many small business owners and entrepreneurs excelled in their core business areas, achieving visionary goals and driving sales, but often fell short when it came to financial decision-making.

1 note

·

View note

Text

0 notes

Note

Arw you really the author John Green? The same person who wrote The Fault in Our Stars and Looking for Alaska?

Yes, but I published one of those books 19 (?!?!?!) years ago and the other 12 (!?!?!?!?) years ago. What have I been up to since then?

My brother Hank and I started Good.store, which delivers high-quality socks, coffee, and soap to your home and donates 100% of its profit to charity. Through good store, we've raised over $7,500,000 to support efforts to radically reduce maternal mortality in Sierra Leone, where as recently as 2019, one in seventeen women could expect to die in pregnancy or childbirth.

(In fact, technically I am here on tumblr as an unpaid intern for the awesome coffee club, which you should really sign up for if you like ethically sourced coffee that tastes delicious and doesn't enrich billionaires.)

I wrote the novel Turtles All the Way Down and then had a little existential crisis and wrote a nonfiction book called The Anthropocene Reviewed, the latter of which is my first book for adults and my first attempt to write as myself.

I helped produce made a movie adaptation (streaming now on Max!) of Turtles all the Way Down.

I helped raise my kids and supported my spouse as she wrote her book You Are An Artist and created a PBS show about art called The Art Assignment.

I ran the educational media company Complexly and the merch company dftba.com while my brother had cancer.

I bought around 2% of a fourth-tier English football team called AFC Wimbledon. Wimbledon are different from most football clubs because they are owned by their fans, each of whom gets one vote in the club's leadership regardless of how much money they put into the club.

I became obsessed with tuberculosis, the world's deadliest infectious disease (it will kill over a million people this year despite being curable), and how TB both exemplifies and reinforces human-built structures of injustice, which is the subject of a book I'm writing that will come out next year.

#what i've been doing#since a lot of people are new here#which is a little terrifying#but we'll probably get through it#and if not i can always deactivate this account and start a new one#as one does#john green#coffee company

4K notes

·

View notes

Text

Top accounting service in Australia | Webcodetree

We understand the needs of businesses and help them reach their full potential and marketing goals. We possess great knowledge and skills in handling the bookkeeping and accounting process. We know how important it is to have a trusted accounting service company that genuinely provides authentic accounting services. That is why, we assure you that data and transactions, tax issues, and funding allocation systems, among others, everything is kept safe in our secure environment.

0 notes

Text

Tax Consulting Services in San Antonio: All You Need to Know

Are you looking for reliable tax consulting services in San Antonio? If so, then you’ve come to the right place! This article is designed to provide an overview of the tax consulting options available in San Antonio and the benefits associated with these services. Whether you are a business owner or an individual resident, working with a reputable tax consultant is a great way to ensure that you are compliant with all applicable laws and regulations.

Understanding the Benefits of Tax Consulting Services

Tax consulting services can help individuals and businesses understand the complex world of taxation and compliance. They can provide advice on how best to structure your taxes, taking into account factors such as income level, deductions, credits, and other essential elements. Additionally, they can explain recent changes in tax laws and advise on how best to take advantage of them.

Tax consultants at an accounting firm in San Antonio also play an important role in helping businesses remain compliant with changing regulations. Companies must be able to adapt their practices quickly when there are changes in rules or laws. A competent tax consultant can often help companies stay ahead of the curve, making sure they are not at risk for any potential penalties or fines due to non-compliance.

Finding Quality Tax Consultants in San Antonio

It is important that you do your research before selecting a tax consultant from San Antonio. Look for professionals with experience working with individuals and businesses alike—ideally those who specialize in specific areas such as corporate taxes or estate planning. Additionally, make sure that your chosen consultant is licensed by the Texas State Board of Public Accountancy (TSBPA). Finally, always look for recommendations from friends or family who may have used similar services previously.

Conclusion:

Whatever your needs may be—whether it’s setting up payroll systems or filing complex returns—working with quality tax consulting North San Antonio company is a great way to ensure that your finances are handled properly and efficiently. With this information, we hope you feel more confident about choosing the right professional for your needs! Make sure you do thorough research before deciding on the right service provider for yourself or your business – it could save you time and money down the road! Good luck!

#tax planning#tax consulting#tax preparation#tax consultant#accounting firm#accounting company#tax services

0 notes

Text

Like when I talk about the level of negligence here, please understand.

These are a group of the most obnoxiously privileged people in the universe, who paid obscene amounts of money for the sole purpose of gawking at a mass fucking grave and acting like this made them Awesome Explorers Who Did Totally Real Science while gushing about how it’s just like a movie with zero respect or reverence for the reality of what they were seeing. Just for the cool factor.

So when I say that the level of arrogant disregard for their safety on the part of the company that knowingly, willingly sent them down there in unsafe and unrated death cannisters while lying to them about it is so egregious that the entitled billionaire pricks who fucked around and found out have my complete and total sympathy as victims?

It’s that bad. It’s very, very fucking bad.

#in any other circumstances I would not care about rich fucks experiencing the consequences of their arrogance#but this is just#this is horrific#this did not have to happen#literally anyone with common sense could have told them this would happen#many did and were ignored#but the thing is#even over-wealthy entitled pricks with the brains that god gave rocks#have the right to have the people who are RESPONSIBLE FOR THEIR SAFETY be held accountable#this insane sub company had a duty of care and they FUCKED it#it's not about deserving it's about basic ethics and morality

3K notes

·

View notes

Text

1K notes

·

View notes

Text

فروش نرم افزار سپیدار در سپینود سیستم

جهت خرید نرم افزار سپیدار با قیمت مناسب با ما در تماس باشید

https://sepinoodsystem.com/sepidar/

0 notes

Text

Filing the Indian Income Tax Return for Resident Indians

Is it mandatory to file an income tax return?

Yes, it is essential to file income tax returns if:

1. Income exceeds Rs. 2.5 lakhs for the year (before deductions under Chapter VI-A and capital gains exemptions).

2. There are two categories of people, regardless of income:

Have assets outside India - Deposited greater than Rs.1 crore in current accounts throughout the year - Deposited at least Rs.50 lakhs in savings bank accounts in the preceding year

If a company's total sales, turnover, or gross receipts surpasses sixty lakh.

If a person's total sales, turnover, or gross receipts in a business exceeds sixty lakh rupees within the previous year,

If their total gross receipts in a profession exceed ten lakh rupees in the previous year or in the event, that the aggregate of tax deducted at source and collected at source throughout the previous year is 25 thousand rupees or more,

Expended more than Rs.1 lakh on energy

Expenditure of more than Rs. 2 lakh on travel outside India from both personal and company bank accounts

3. Any taxable capital gain, regardless of the basic tax slab exemption (2.5L).

In other circumstances, it is not necessary to file an income tax return. However, there are some advantages to filing voluntarily.

What are the benefits of voluntarily filing income tax returns?

▪️ Requesting reimbursement for withholding taxes (TDS deducted).

▪️ Carry forward losses to offset future incomes.

Contact us right away to submit your income tax returns and become an honest and honored Indian. Visit us @ https://www.excellentcorporateservices.com/income-tax-return-filing-consultants-chennai.php

0 notes

Text

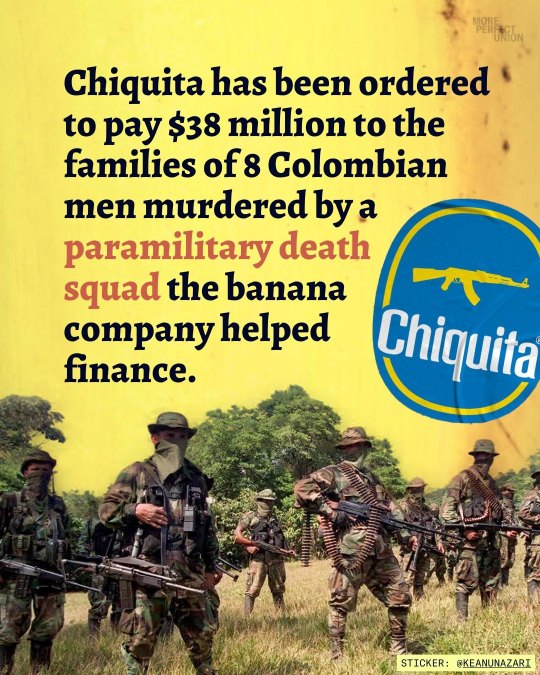

wow. "chiquita" and "death squads" are not things i expected to see in the same sentence.

#chiquita banana#human rights abuses#paramilitary death squad#florida jury#earthrights international#autodefensas unidas#colombia civil war#united fruit company#1928 strike#colombian military#corporate accountability#chiquita lawsuit#compensation#human rights violations#worker rights#historical violence#international law#jury verdict#colombian workers#american corporation

513 notes

·

View notes

Text

How to Find the Right Accounting Firm for Your Business?

To find the right accounting firm for your business, assess your specific needs, consider industry expertise, check qualifications and certifications, evaluate client reviews, and inquire about communication and technology practices. The professional accounting companies in Mayfield Heights OH align with your business size, and goals, and offer tailored services. Prioritize reliability, transparency, and a proactive approach to financial management.

0 notes

Note

Hi Penny, I’m wondering what is your stance on Game Preservation?

i think all video games are bad

#sorry im being a little mean#a tumblr account with no posts coming in hot with a 'what is ur stance on...' ask out of nowhere drives me to exhaustion though haha#obvs companies should let their games be accessible full stop we literally gain nothing from shoving them into a vault

1K notes

·

View notes