#algorithmic-trading

Explore tagged Tumblr posts

Text

Algorithmic Trading Strategies - Types and Benefits

Key algorithmic trading strategies, including their types, advantages, and how they affect trade execution and decisions in dynamic stock markets.

0 notes

Text

5 notes

·

View notes

Text

youtube

My first highlights video is live today over on my team's channel! Go and check it out if you're interested!!

(English Captions available!)

#vtuber uprising#vtubers of tumblr#vtuberen#I worked on this for like 3 weeks straight so if you want to appease the algorithm gods i could really use a like and subscirbe if you coul#content warning game#content warning#tricksters of the trade

9 notes

·

View notes

Text

UAITrading (Unstoppable AI Trading): AI-Powered Trading for Stocks, Forex, and Crypto

https://uaitrading.ai/ UAITrading For On trading volumes offers, many free trade analysis tools and pending bonuses | Unstoppable AI Trading (Uaitrading) is a platform that integrates advanced artificial intelligence (AI) technologies to enhance trading strategies across various financial markets, including stocks, forex, and cryptocurrencies. By leveraging AI, the platform aims to provide real-time asset monitoring, automated portfolio management, and optimized trade execution, thereby simplifying the investment process for users.

One of the innovative features of Unstoppable AI Trading is its UAI token farming, which offers users opportunities to earn additional income through decentralized finance (DeFi) mechanisms. This approach allows traders to diversify their investment strategies and potentially increase returns by participating in token farming activities.

The platform's AI-driven systems are designed to analyze vast amounts of market data, identify profitable trading opportunities, and execute trades without human intervention. This automation not only enhances efficiency but also reduces the emotional biases that often affect human traders, leading to more consistent and objective trading decisions.

By harnessing the power of AI, Unstoppable AI Trading aims to empower both novice and experienced traders to navigate the complexities of financial markets more effectively, offering tools and strategies that adapt to dynamic market conditions

#Uaitrading#AI Trading#Automated Trading#Forex Trading AI#Crypto Trading Bot#UAI Token#Token Farming#Decentralized Finance (DeFi)#AI Investment Platform#Smart Trading Algorithms#AI Stock Trading#Machine Learning in Trading#AI-Powered Portfolio Management#Algorithmic Trading#Uaitrading AI Trading#Forex AI#Smart Trading#Stock Market#AI Investing#Machine Learning Trading#Trading Bot#Crypto AI#DeFi#UAI#Crypto Investing

2 notes

·

View notes

Text

7 Growth Functions in Data Structures: Behind asymptotic notations

Top coders use these to calculate time complexity and space complexity of algorithms.

https://medium.com/competitive-programming-concepts/7-growth-functions-in-data-structures-behind-asymptotic-notations-0fe44330daef

#software#programming#code#data structures#algorithm#algo trading#datastructures#data#datascience#data analytics

3 notes

·

View notes

Text

Transform your trading with Invertex Pro! Maximize profits, minimize risks, and trade smarter using advanced algorithmic strategies. Ready for smarter forex trading? Start now!

2 notes

·

View notes

Text

DeepSeek AI Can Enhance Algo Trading and Option Trading Strategies.

DeepSeek AI - Algo Trading

DeepSeek AI is a low - cost advanced chatbot. DeepSeek AI can excel in many areas of technology and business, one of these areas is Algo Trading and Option Trading.

Read more..

#Algo Trading#DeepSeek V3#DeepSeek AI#DeepSeek R1#Algorithmic Trading#bigul#ipo price band#algo trading app#algo trading india#algo trading platform#algo trading strategies#algorithm software for trading#bigul algo#finance#free algo trading software#best algo trading app in india#AI#algorithm#algo trading software india#algorithmictradingsoftware#investment#Investment Platform#Investment Platform in India#Best share trading app in India#trading with algo#algorithmic trading software free#best algorithmic trading software#bigul algo trading#best online trading platforms#bigul algo trading review

3 notes

·

View notes

Text

been losing my mind over this vid my sister sent me 💀

#we were trading videos of kids saying 'nigga' in Very Special Episodes of old sitcoms and then the algorithm gave her this vid#the comment section is ace tho everyone is all 'i dont like kids talking like this normally but fuck it she deserved that one' lmfaoo#funnies

3 notes

·

View notes

Text

SureShotFX Algo: The Best Algo for MT4 and MT5

SureShotFX Algo is the best algo trading app for Forex that works with MT4 and MT5. It isn’t just about automated trading—it’s your secret trading weapon in the forex market. With its smart algorithms and hands-off approach, it stands with you 24/7 like a trading expert on your team, providing accurate and profitable forex signals.

SSF Algo uses an advanced algorithm combining multiple strategies and advanced indicators to operate seamlessly within the MetaTrader 4 – MT4, MT5 & cTrader platforms. It executes trades based on predefined parameters and market data to generate automated Forex trading signals like a pro.

Whether you’re new to trading or a seasoned pro, this tool offers precision, flexibility, and total control over your investments.

Benefits of Using SureShotFX Algo:

Smart Trading: Harness the power of advanced algorithms for intelligent trade execution and decision-making.

Enhanced Accuracy: The algorithm’s sharp entry strategy increases the likelihood of successful trades.

Effective Risk Management: Adaptive stop-loss modes and flexible lot management help traders manage risks effectively.

Automated Profit Securing: The Auto Close Partial feature ensures that profits are secured at optimal points during a trade.

Proven Performance: Real-time results and performance data are available on Myfxbook, demonstrating the algorithm’s effectiveness with a potential monthly growth of 8-30%.

Total Control and Flexibility: Maintain control over your trading capital and strategy parameters, with the flexibility to customize settings to suit your preferences.

2 notes

·

View notes

Text

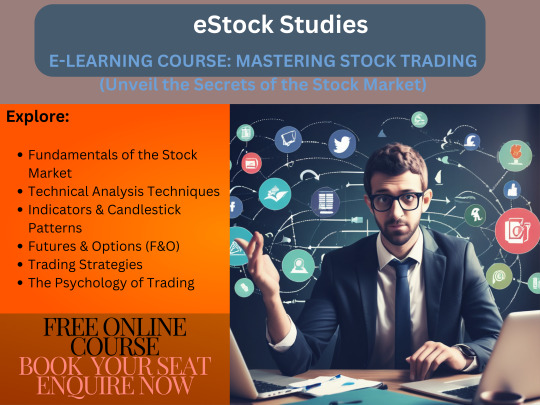

eStock Studies: Online Trading Courses from Basics to Advanced.

eStock Studies: free Online Stock Market Trading Courses from Basic to Advanced, Including Algorithmic Trading Techniques, for Aspiring Trading Experts.

#estock studies#free online stock market trading courses#trading expert#Basic of Stock Market#ALGORITHMIC TRADING TECHNIQUES#trading from basic to advanced#free online Trading Courses#expert trading institute

2 notes

·

View notes

Text

Riding the Digital Wave: Algorithmic Trading in India

Brief Introduction :-

Algorithmic Trading in India has emerged as a transformative force, leveraging advanced algorithms and cutting-edge technology to revolutionize financial markets. It uses intricate mathematical models to execute trades at blazing speed, giving traders speed and accuracy. We investigate available resources, negotiate regulatory frameworks, and look forward to the bright future of algorithmic trading in this ever-changing scene, which is revolutionizing our understanding of and interactions with finance in the Indian market.

History of Algorithmic Trading in India :-

In India, algorithmic trading began in the early 2000s and gained popularity when computerised trading platforms were introduced. An important turning point was the transition from conventional floor trading to screen-based systems, which set the stage for algorithmic trading techniques. Edelweiss Financial Services was a trailblazing organisation in this regard, having adopted algorithmic trading due to its effectiveness and speed, particularly when it came to processing big orders. As technology evolved, financial institutions in India followed suit, with the advent of Direct Market Access (DMA) further quickening the adoption and enabling traders to directly communicate with exchanges. The market has grown increasingly sophisticated over time as a result of Indian companies using artificial intelligence and creating their own proprietary algorithms. Algorithmic trading is currently a major participant in the financial ecosystem in India.The market has grown increasingly sophisticated over time as a result of Indian companies using artificial intelligence and creating their own proprietary algorithms. Algorithmic trading is becoming a major force in India's financial sector, changing the nature of the market and providing new opportunities for both investors and traders.

What is HFT?

High-frequency trading, or HFT for short, is a type of algorithmic trading that uses sophisticated algorithms to execute a large number of orders at speeds never seen before in the financial industry. HFT has emerged as a major force in the Indian financial scene, using cutting-edge technology to take advantage of tiny price differences and inefficiencies in the market. HFT seeks to take advantage of momentary opportunities by analysing data quickly and acting quickly, improving market efficiency and liquidity. Its function is scrutinised, too, and this has sparked debates about how it affects market stability and the necessity of regulatory regimes.

Regulations for Algorithmic Trading in India :-

The Securities and Exchange Board of India oversees algorithmic trading in India (SEBI). The "Algorithmic Trading Framework," a set of recommendations published by SEBI in 2011, was designed to guarantee equitable and transparent market operations. To protect against systemic risks associated with algorithmic trading and to promote market integrity, the laws include requirements for the use of "unique client codes" to track individual trades, risk controls, and order-to-trade ratio limitations.

Skills Required for Algorithmic Trading :-

Econometrics is a tool used in algorithmic trading to model and analyse economic data, offering insights into market movements and possible trading opportunities.

Programming abilities are necessary for developing and putting trading algorithms into practice, which allows for the automation and quick execution of strategies in volatile market environments.

Quantitative analysis: Used to assess market dynamics and financial instruments, enabling traders to spot trends and create data-driven algorithmic trading methods.

Probability and statistics are used to evaluate the chance of market events, which helps with risk management and the development of algorithms that adapt to shifting market conditions.

Proficiency in Financial Markets and Trading: Essential for comprehending market subtleties, allowing traders to create algorithms that conform to current market structures and circumstances.

The ability to reason logically is essential for creating algorithmic trading strategies with clear rules and logic that enable methodical decision-making in the face of changing market conditions.

Conclusion and Future Scope :-

In summary, algorithmic trading has improved market efficiency and opened up new trading opportunities for traders, dramatically changing the Indian financial scene. As the sector continues to be shaped by technological breakthroughs, machine learning, and regulatory frameworks, the future prospects are bright. Algorithmic trading is expected to become increasingly prevalent and play a crucial part in the future of India's financial markets, which are active and growing at a quick pace.

5 notes

·

View notes

Text

2 notes

·

View notes

Text

Integrated margin calculators are undoubtedly a robust and powerful computational tool that can significantly benefit algo traders. These calculators can precisely determine margin requirements by analysing an asset's volatility, leverage, position size, and market conditions.

2 notes

·

View notes

Text

StockHunt delivers cutting-edge Algorithmic Trading Solutions and AI-Powered Investment Tools designed to give traders a decisive edge in today’s fast-moving markets. By harnessing Predictive Analytics in Trading, StockHunt—powered by eGrove’s advanced technology—offers data-driven insights that help anticipate market trends with greater accuracy and speed.

0 notes

Text

Best Algo Trading Software in India – Quanttrix

Best Algo Trading Software in India – Quanttrix

Introduction

Ever wondered how traders make money even when they’re asleep? Welcome to the world of algorithmic trading software, where smart systems like Quanttrix work round the clock to grow your wealth. Think of it like autopilot for your investments—once you set it up, it flies the plane for you.

In this article, we’ll explore why Quanttrix is becoming the best algo trading software in India, especially for people who are new to trading but don’t want to be left behind in this fast-moving financial world. Whether you’re a curious beginner or someone looking for smarter trading tools, stick around—we’ll break it all down in simple terms.

Discover Quanttrix—the best algo trading software in India. Easy, efficient algorithmic trading software that simplifies investing for everyone.

What is Algo Trading?

Algorithmic trading, or algo trading, is using computer programs to automatically execute trades. You set the rules, and the system follows them—fast, accurately, and without emotions. Imagine having a superfast assistant who never sleeps and sticks to your strategy every second.

Why Algorithmic Trading is the Future

We live in a digital age. Just like people moved from landlines to smartphones, traders are moving from manual trading to algorithmic trading software. It’s quicker, smarter, and doesn’t panic like humans do. Plus, it can scan markets, crunch numbers, and place trades in milliseconds. Sounds futuristic? It’s already happening.

Meet Quanttrix – A Game Changer

Now, here’s the star of the show: Quanttrix. Touted as one of the best algo trading software in India, it’s designed to make smart trading accessible to everyone. Whether you’re trading in stocks, commodities, or currencies, Quanttrix helps you automate your strategy with ease.

What makes it different? Simplicity. Unlike many complex platforms, Quanttrix speaks your language—no code, no confusion.

How Does Quanttrix Work?

Think of Quanttrix as a smart robot. Once you define your trading rules—like when to buy or sell—it takes over. You can either build strategies using their drag-and-drop tools or pick from pre-designed ones. It then keeps an eye on the market 24/7 and trades for you based on your instructions.

It’s like hiring a financial expert who never takes a break.

Key Features of Quanttrix

Here’s what makes Quanttrix stand out:

No Coding Needed: Even if you’ve never touched a programming book, you can use it.

Backtesting Tools: Test your strategy on past data to see how it would’ve performed.

Real-time Market Monitoring: Constant scanning for the right conditions.

Instant Execution: No delays. Every millisecond counts.

Smart Analytics: Get insights that help improve your game.

Why Choose Quanttrix Over Others?

There are dozens of algo platforms in India—but few that cater to both beginners and pros.

Quanttrix blends power with simplicity. While others may need coding skills or have clunky interfaces, Quanttrix keeps things clean and intuitive. Plus, it’s backed by robust data science, making its strategies smarter and more adaptive.

Is Quanttrix Suitable for Beginners?

Absolutely. In fact, that’s where Quanttrix shines. It removes the steep learning curve. The dashboard is user-friendly, and there’s a helpful guide every step of the way. You don’t need a financial degree to get started—just a curious mind.

Think of it like learning to ride a bike with training wheels. Quanttrix is your steady support.

Security & Reliability of Quanttrix

In trading, trust is everything. Quanttrix uses bank-level security and encrypted data channels. Your money and data are protected by top-grade firewalls and protocols.

Also, the software is hosted on secure cloud servers that guarantee 99.9% uptime. That means your trades run smoothly without interruptions.

Quanttrix vs Other Indian Platforms

Let’s compare Quanttrix with some other known names:

Feature

Quanttrix

Competitor A

Competitor B

No-Code Setup

✅

❌

✅

Beginner Friendly

✅

❌

❌

Pricing

Affordable

Expensive

Moderate

Backtesting

✅

✅

❌

Customer Support

24/7

Limited

Business Hours Only

Clearly, Quanttrix offers better balance between simplicity, affordability, and performance.

Pricing and Plans

Quanttrix offers flexible plans:

Free Trial: For testing waters.

Starter Plan: For individuals getting started.

Pro Plan: For active traders and small firms.

Enterprise Plan: Custom features for large-scale traders.

No hidden costs. You pay for what you use.

User Experience and Interface

Quanttrix feels less like a trading tool and more like a modern app. The layout is clean, sections are well labeled, and actions are guided. Whether on desktop or mobile, it offers a smooth, seamless experience.

Even a 60-year-old new to trading can understand what’s happening without calling their tech-savvy grandkid!

Customer Support & Community

Stuck somewhere? Quanttrix offers 24/7 chat, email, and even video call support. Their online community is also active, where users share strategies, tips, and updates.

Learning becomes a group effort—something we all need when stepping into new territory.

What Real Users Say

Real feedback speaks volumes. Here’s what users are saying:

“Quanttrix made algo trading easy. I set up my first strategy in 15 minutes!” – R. Sharma “I made fewer emotional decisions thanks to automation. My returns have improved!” – P. Rao “The customer support team is a lifesaver. Super responsive and helpful.” – M. Iyer

Tips to Get Started with Quanttrix

Start with the Free Trial: Get the feel of it.

Use Prebuilt Strategies: Learn before creating your own.

Backtest First: Always test on historical data.

Start Small: Don’t invest all your money right away.

Stay Updated: Join the Quanttrix community and learn continuously.

Final Thoughts

In a world that’s moving fast, your investments should too. Quanttrix offers a blend of automation, simplicity, and power—perfect for anyone who wants to trade smarter, not harder.

Whether you're a complete newbie or a semi-pro, it’s worth checking out this algorithmic trading software. The future of investing isn’t in doing more, it’s in doing it smartly—and Quanttrix helps you do just that.

FAQs

Is algorithmic trading legal in India? Yes, algorithmic trading is legal and regulated by SEBI in India. Platforms like Quanttrix operate under these guidelines.

Can I use Quanttrix without any trading experience? Definitely. Quanttrix is designed for beginners and offers pre-built strategies to help you get started.

Is my money safe with Quanttrix? Yes, Quanttrix uses encrypted, bank-grade security measures and only connects to SEBI-approved brokers.

Do I need to install any software to use Quanttrix? No, Quanttrix is web-based and works on your browser or mobile—nothing to install.

Can I customize trading strategies in Quanttrix? Yes, you can fully customize or choose from existing strategies. It’s flexible to match your style.

0 notes

Text

Global Algorithmic Trading Market: A Data-Driven Revolution

The global algorithmic trading market was valued at USD 21.06 billion in 2024 and is forecasted to expand at a robust compound annual growth rate (CAGR) of 12.9% from 2025 to 2030. A primary factor contributing to this impressive growth is the increasing integration of advanced technologies such as Machine Learning (ML) and Artificial Intelligence (AI) into algorithmic trading solutions. These technologies empower traders to design highly sophisticated algorithms that can process and analyze vast volumes of financial data in real time. This capability allows for rapid identification of trading patterns, faster decision-making, and the development of predictive models that far exceed the capabilities of traditional methods. Furthermore, AI and ML enable adaptive learning, whereby trading algorithms evolve and optimize themselves over time based on performance history and shifting market conditions, thereby continuously refining strategy effectiveness.

High-frequency trading (HFT) represents another significant trend bolstering market growth. HFT involves the use of complex algorithms to execute a large number of trades at extremely high speeds, often within milliseconds. The strategy capitalizes on minute price fluctuations in the market that exist for very short periods, allowing traders to gain profits through rapid trade execution and high turnover. The proliferation of HFT has been facilitated by continual advancements in technology, including ultra-fast network infrastructure and enhanced computational power. These developments support the high-speed data processing and execution capabilities that are critical for HFT operations. As more trading firms recognize the potential of HFT, its role is expected to become even more influential in shaping the future of algorithmic trading.

Another transformative factor in the algorithmic trading market is the democratization of trading technologies. Historically, access to advanced algorithmic tools was limited to institutional investors due to the high costs and technical expertise required. However, the market has seen a notable shift with the rise of intuitive, user-friendly platforms that offer customizable algorithmic trading solutions for retail investors. These platforms, combined with the growing availability of online educational resources, have enabled individual traders to implement sophisticated trading strategies without needing deep technical knowledge. As a result, retail participation in algorithmic trading is increasing, fostering greater diversity and competition in financial markets. This widening access is expected to further fuel innovation and growth across the sector.

In addition to technological advances and increased accessibility, regulatory support plays a critical role in fostering the growth of the algorithmic trading market. Governments and financial regulatory bodies are increasingly acknowledging the positive contributions of algorithmic trading to market efficiency, liquidity, and overall stability. To ensure responsible growth, regulatory frameworks are being established to enhance transparency, enforce accountability, and safeguard investor interests. This evolving regulatory landscape provides market participants—especially financial institutions—with the confidence to adopt and invest in algorithmic strategies, knowing they are operating within a clearly defined and secure framework. As regulations continue to adapt to emerging technologies, firms are likely to increase their investments in compliant algorithmic trading platforms, further propelling market expansion.

However, despite these encouraging trends, certain challenges could hinder market growth during the forecast period. One of the key limitations lies in the potential inconsistency and lack of accuracy in algorithmic models. Inadequate risk assessment tools and insufficient real-time monitoring capabilities can expose traders to significant financial risks. Since algorithmic trading operates on full automation, once a trade is initiated, human intervention is typically not possible. This creates a scenario where even if a trader recognizes that a strategy may not be performing optimally after execution, they lack the ability to pause or manually alter the algorithm mid-trade. Such limitations in oversight and adaptability could undermine confidence in these systems and act as a barrier to broader market adoption.

In summary, while the global algorithmic trading market is poised for significant growth, driven by technological innovation, increasing retail access, and supportive regulatory developments, it must also address key challenges related to accuracy, risk management, and system flexibility. Balancing these factors will be critical to ensuring the sustainable evolution of this rapidly transforming market.

Global Algorithmic Trading Market Report Segmentation

Grand View Research has segmented the global algorithmic trading market report based on component, deployment, trading types, type of traders, and region:

Component Outlook (Revenue, USD Million, 2018 - 2030)

Solution

Platforms

Software Tools

Service

Professional Services

Managed Services

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

Cloud

On-premise

Trading Types Outlook (Revenue, USD Million, 2018 - 2030)

Foreign Exchange (FOREX)

Stock Markets

Exchange-Traded Fund (ETF)

Bonds

Cryptocurrencies

Others

Type of Traders Outlook (Revenue, USD Million, 2018 - 2030)

Institutional Investors

Long-Term Traders

Short-Term Traders

Retail Investors

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

US

Canada

Mexico

Europe

Germany

UK

France

Asia Pacific

China

Japan

India

South Korea

Australia

Latin America

Brazil

Middle East and Africa (MEA)

KSA

UAE

South Africa

Curious about the Algorithmic Trading Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Key Algorithmic Trading Company Insights

Some of the key companies in the market include BNP Paribas Leasing Solutions, AlgoTrader, and Argo Software Engineering. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships.

BNP Paribas Leasing Solutions has made significant developments in algorithmic trading, particularly within the foreign exchange (FX) market. The company focuses on a select number of highly advanced core algorithms to meet client needs by providing seamless, automated end-to-end services. This includes pre-trade workflow analysis, real-time trade monitoring, and post-trade analytics and reporting to ensure ease of service for users.

AlgoTrader employs a range of strategies in algorithmic trading to optimize performance and meet client needs. The company identifies lucrative trading opportunities across a range of assets, including stock indexes, bonds, currencies, international markets, and commodities. Its algorithmic trading system is designed for individuals seeking to boost their income. This all-in-one trading service enhances performance while minimizing portfolio volatility, enabling users to profit in both rising and falling stock markets.

Key Algorithmic Trading Companies:

The following are the leading companies in the algorithmic trading market. These companies collectively hold the largest market share and dictate industry trends.

BNP Paribas Leasing Solutions

AlgoTrader

Argo Software Engineering

InfoReach, Inc.

Kuberre Systems, Inc.

MetaQuotes Ltd.

Symphony

Tata Consultancy Services Limited

VIRTU Finance Inc.

AlgoBulls Technologies Private Limited

Recent Developments

In July 2023, MachineTrader launched a beta version of its software that enables traders to automate their investment strategies without hiring programmers or writing code for a custom trading platform. The MachineTrader platform features a visual development interface that lets users create flow-based processes, enhanced with Open AI, allowing them to design complex programs without any coding required.

In October 2022, Scotiabank launched its next-generation algorithmic trading platform in Canada. This platform, offered to clients through a strategic partnership with BestEx Research, is equipped with advanced technology tailored to meet the specific needs of the Canadian equities market.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes