#new bank account opening app

Text

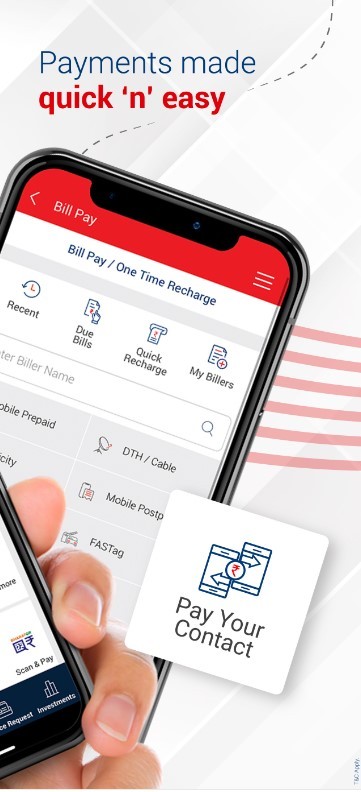

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#apply for bank account online#new bank account open app#banking app#bank online account opening#new bank account open#new bank account opening app#online banking#account opening app#digital savings account#instant online bank account opening

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#saving account#zero balance account online#debit card online apply#open new account online#digital account#zero balance account open#open savings account#digital banking app#premium banking#mobile banking app#new account open bank online 0 balance

1 note

·

View note

Text

Step-by-Step Process to Open Saving Account Online

A savings account is the basic account you can use to save money. Opening a savings account helps you earn interest, and you can easily deposit and withdraw funds. Many banks provide you with the feature of an online bank account opening app zero balance. It is easy and convenient for you to open your bank account online as the steps to open your account are simple and similar in most banks. Here is the step-by-step procedure to open a new savings account online:

Choose Your Bank:

Before opening a savings account, choose the bank that best fits your requirements. Some of the important features to consider before opening the account are:

Minimum balance requirement

Interest rate

Branches nearby

ATM facility

Monthly charges

Comparing between banks gives you a good understanding of the features available in the bank and helps you to make a proper decision.

Choose Your Account:

Checking or savings account: A checking account is best suited for regular transactions, ATM withdrawals, and bill payments. A savings account is best for saving your money safely. There may be some withdrawal limitations in savings accounts.

Joint account or Single account: A joint account is shared between two or more individuals, generally the child or the family members. A joint account is similar to a single account, but one or more individuals have access to that particular account. In a single account, you are the only owner of your account.

Required Documents:

It is important to provide proper documents while opening a new bank account online. Here is a list of documents you may need when opening the account.

Aadhar number linked to your mobile number

Address proof(PAN card or voter ID)

Date Of Birth

Recent passport-size photo

Some banks may ask you to submit a copy of your ID proof to the bank branch before opening an online account.

If you are opening a joint account, make sure you to keep the required documents for your partner also.

Use the app or visit the bank website:

After gathering the necessary documents, you can now visit the bank website or use the new bank account open app. Use a secure internet connection during this process to avoid cyber breaches. Navigate to the account opening section and fill in the required information. Make sure to give the correct information. Some banks may ask you to mail or fax a copy of the required documents for verification.

Complete KYC Process:

KYC is a simple process of verifying a customer’s identity before opening a new account online and there are two ways in which you can complete your KYC process. They are Aadhar-based biometrics and Aadhar OTP.

Fund You Account:

After completing all the steps mentioned above, log in to your account. It may take a few hours or days, depending on the bank. Once you log in to your account, start funding your account. You can fund your account by transferring money from your existing account if you have one, or you can mail a cheque. You can also visit the local branch to deposit the funds.

Bottom Line:

New bank account open app makes it easy for you to open a savings account effortlessly. Use the entire feature provided by the bank online. Choose the bank that meets all your requirements. Complete all the necessary information carefully and have a safe banking.

#online bank account opening#bank account kholna#online bank account opening app#open online bank account#bank account app#open bank account#open bank account online#online open bank account#new bank account open

0 notes

Text

Maximizing Your Small Business with a Business Savings Account

In the realm of small business management, having a dedicated business savings account plays a pivotal role in ensuring financial stability and flexibility. By leveraging the features of a business savings account, entrepreneurs can effectively manage their finances and navigate through various challenges. Here's how a savings account can bolster your small business:

1. Emergency Fund Protection:

A business savings account serves as a safety net, allowing you to set aside funds for unexpected emergencies or downturns in your business. Much like personal savings, having a financial cushion can provide peace of mind and prevent you from making hasty decisions during challenging times.

2. Access to Liquid Assets:

By regularly depositing funds into your business savings account, you create a readily accessible pool of liquid assets. This ensures that you have quick access to cash whenever you encounter unexpected expenses or opportunities that require immediate financial support.

3. Credit Rating Enhancement:

Maintaining a business savings account demonstrates financial responsibility and can positively impact your company's credit rating. A strong credit score enhances your credibility with banks and lenders, making it easier to secure loans or financing for future business endeavors.

4. Contribution to Retirement Funds:

In addition to serving as a buffer for emergencies, funds accumulated in your business savings account can also contribute to your retirement planning. These savings can complement other retirement accounts, such as IRAs, and provide financial security for your post-business years.

By prioritizing the establishment of a business savings account, entrepreneurs can effectively safeguard their businesses, improve their financial standing, and plan for future growth. Explore options for free bank account opening online to access the best mobile banking app and streamline your small business finances with ease and efficiency.

#online banking app#best mobile banking app#apply online account opening#new bank account open app#mobile banking account app#digital account opening app

0 notes

Text

Why Opening a Minor Savings Account for Your Children is Essential

In today's digital age, the safety and security of banking are paramount, especially when considering your children's financial future. Opening an online bank account for them is a crucial step towards instilling financial literacy and responsibility. Through a bank account app, children can learn invaluable lessons about saving, investing, managing debts, and budgeting from an early age, setting them on the path to financial independence. Let's delve into why every child should have a minor savings account, while highlighting the importance of mobile banking app for their financial education.

Fundamentals of Finance: A minor savings account serves as a child's first interaction with the financial system, providing hands-on experience in managing money. While online banking has become prevalent for adults, children may lack exposure to fundamental banking activities. By operating their own savings account, children learn essential skills like checking balances, receiving deposits, and making withdrawals, fostering a deeper understanding of financial principles.

Enhanced Savings Habit: Through regular deposits and monitoring of their savings account balance, children develop a habit of saving. Witnessing their savings grow encourages them to continue saving and resist impulsive spending. This early exposure to responsible financial behavior helps children avoid debt and work towards achieving their financial goals in the future.

Understanding the Value of Money: Opening a savings account teaches children the value of money and the effort required to earn it. Unlike in households where needs are readily met, children with savings accounts learn that money is finite and must be managed wisely. Parents can encourage this understanding by requiring children to deposit a portion of their allowance or gift money into their savings account, instilling a sense of responsibility and respect for money.

Introduction to Investments: While savings accounts may offer modest interest rates, they introduce children to the concept of investments. As their savings grow, children can explore investment opportunities such as fixed deposits, recurring deposits, and mutual funds. This early exposure to investing lays the foundation for financial growth and instills a mindset of wealth building from a young age.

In conclusion, opening a minor savings account for children is a valuable investment in their financial future. Through the use of online banking and bank account apps, children gain practical experience in financial management and develop essential money management skills. By instilling the habit of saving, teaching the value of money, and introducing them to investment opportunities, parents empower their children to navigate the complexities of finance with confidence.

#online open account bank#mobile banking app#bank open account online#mobile banking apps#online new account open#bank online open account#bank account open online app#open bank account online#bank accounts to open online#bank online account open

0 notes

Text

Kotak Mobile Banking app for iPhone

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://apps.apple.com/in/app/kotak-mobile-banking-app/id622363400

#online banking account opening#bank new account opening online#account opening online#create bank account online#apply for bank account online#free bank account opening online#apply online account opening#new bank account open app

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#online open bank account app#open savings account#apply for bank account online#mobile banking app#mobile banking apps#mobile banking account#account online opening#opening account online

1 note

·

View note

Text

Unlocking Seamless Banking: The Kotak Mobile Banking App for iPhone

In an era dominated by technology, the role of banking apps has become paramount in shaping our financial landscape. Among the myriad of options, the Kotak Mobile Banking App for iPhone stands out as a beacon of innovation, offering a comprehensive suite of features designed to redefine the way we bank.

Revolutionizing Banking with Technology

Best Banking App: A Cut Above the Rest

In the digital realm, being the best is not just a label; it's a commitment to excellence. The Kotak Mobile Banking App has earned its stripes as the best banking app, providing users with an unparalleled banking experience. With a sleek and user-friendly interface, navigating through your financial landscape becomes not just a task but a seamless journey.

Online Bank Account Opening App: Redefining Accessibility

Gone are the days of tedious paperwork and long queues. The Kotak Mobile Banking App for iPhone introduces a new era of convenience with its online bank account opening feature. Opening an account is no longer a cumbersome process; it's a swift and secure journey that you can embark on directly from your iPhone. Embrace the freedom to initiate your banking relationship at your pace, anytime, anywhere.

Bank Account App: Your Financial Companion

Your bank account is not just a number; it's your gateway to financial freedom. The Kotak Mobile Banking App transforms your iPhone into a powerful bank account app, putting the control in your hands. From checking your balance to managing transactions and setting alerts, everything you need is just a tap away. Your financial companion goes wherever you go, ensuring that you're always in charge of your money.

Seamless Onboarding with Mobile Banking Account Opening

Open Bank Account Online App: Convenience Redefined

The convenience of the Kotak Mobile Banking App extends beyond routine transactions. It redefines accessibility with its open bank account online app feature. Now, the power to start your banking journey lies within the palm of your hand. A few simple steps on your iPhone, and you're on your way to experiencing banking like never before.

Swift and Secure Process: Embracing Efficiency

The account opening process is a crucial first step, and Kotak understands the value of your time. The app ensures a swift and secure process, combining efficiency with robust security measures. Your information is safeguarded, and the journey from initiation to activation is streamlined for your convenience. No more waiting in queues or dealing with extensive paperwork – it's banking on your terms.

Mobile Banking Advancements: Future-Ready Banking

The Kotak Mobile Banking App is not just a solution for today; it's a glimpse into the future of mobile banking. With continuous advancements, the app stays ahead of the curve, offering features that anticipate and meet your evolving needs. Stay connected to your finances with innovative tools and technologies that make banking a delightful experience.

Conclusion: Elevating Your Banking Experience

In conclusion, the Kotak Mobile Banking App for iPhone is more than just a banking app; it's a lifestyle. With the best banking app title, seamless online account opening, and a user-friendly bank account app, Kotak brings banking to the forefront of your daily life. Embrace the future of banking with an app that not only meets but exceeds your expectations, making financial management a breeze in the digital age. Download the Kotak Mobile Banking App for iPhone today and witness the evolution of seamless, secure, and innovative banking at your fingertips.

#best banking app#online bank account opening app#open bank account online app#open online bank account app#bank account app#open bank account app#online open account bank#apply online bank account#online banking account opening#bank new account opening online

1 note

·

View note

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#open savings account#apply online bank account#apply for bank account online#mobile banking app#mobile banking apps#online new account open#online banking#saving account opening

0 notes

Text

Eligibility and Documents Required to Obtain a Credit Card

Credit cards have become an essential financial tool, offering convenience and flexibility in managing expenses, since it is optional to get one. It involves meeting certain eligibility criteria and submitting specific documents to the issuing bank or financial institution. You can now try it on a digital account by opening the app itself. Many of you may need a credit card but don't know how. Understanding these requirements is crucial for them to ensure a smooth application process and increase the chances of approval. So, let us clarify the eligibility to apply for a credit card.

Factors influencing credit card eligibility:

Banks and financial institutions establish specific eligibility criteria to assess an individual's creditworthiness before approving a credit card application. While the eligibility criteria may vary slightly among different issuers, the following are common factors considered:

Age - Applicants must usually be at least 18 to be eligible for a credit card. Age requirement may differ for various financial institutions.

Income - A regular source of income is a primary factor in determining eligibility. The income requirement varies based on the type of card and the issuing bank.

Employment Status - Whether you're salaried, self-employed, or a business owner, your employment status plays a role in eligibility.

Credit History - A good credit history will be a positive sign to get a credit card. Issuers may consider your credit score, which reflects your creditworthiness.

Nationality and Residence - Credit card eligibility is often restricted to citizens or residents of the country where the card is issued. Some institutions also consider the duration of your stay in that country.

Existing Debts - Your existing debt obligations, such as loans or outstanding credit card balances, might influence your eligibility. A high debt-to-income ratio could lead to a rejection.

Documents Required:

You'll be instructed to submit specific documents along with your credit card application to substantiate your eligibility and provide the necessary information. The exact list of required documents may vary by institution, but generally, the following are commonly requested:

1. Identity Proof includes documents such as a valid passport, driver's license, Aadhaar card, or voter ID card.

2. Address Proof - Utility bill payments, rental agreements, or a recent bank statement can serve as address proof.

3. Income Proof - Salaried individuals usually must provide salary slips for the last few months. Self-employed individuals might need to submit income tax returns or audited financial statements.

4. Passport-sized Photographs - These are required for identity verification.

5. Employment Proof - For salaried applicants, an employment verification or appointment letter can be requested.

6. Bank Statements- Some issuers might ask for your recent bank statements to assess your financial stability.

7. PAN Card - The Permanent Account Number (PAN) card is essential for income verification and tax purposes.

8. Business Proof - If you're self-employed or a business owner, you might need to provide documents related to your business, such as business registration certificates.

Closing thoughts:

Many digital account opening apps provide the facility to apply for a credit card online. Acquiring a credit card requires meeting specific eligibility criteria and submitting essential documents that validate your identity, financial stability, and creditworthiness.

#digital account app#new bank account open app#apply online account opening#open bank account#zero account opening online#online new account open#account opening form online#best online account opening

0 notes

Text

online banking account open app

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#new savings account#neft bank transfer#credit card apply app#upi payment app#safe mobile banking#net banking#saving account opening#digital account opening

0 notes

Text

Zero balance account: How small business can benefit from it:

Suppose you are a small business owner and want to make transactions without worrying about fraudulent activity and to keep track of the account you can choose a zero balance account. Typically, the company's main account contains zero balance to avoid suspicious activity. The secondary account includes the company's funds in which the interest rates are high while the zero balance account contains low or no interest. Opening a zero balance account provides so many features.

How does it work?

Consider having both accounts in the same bank. Transactions will be made easily from the primary account to the secondary account. The secondary account contains the main balance. If any charge is posted on the primary account, the secondary account transfers money to the primary account. Only the required amount will be transferred, not more than that.

At the end of the day, if any amount is left in the primary account, it will be automatically transferred to the secondary account if you use the same bank.

Benefits of having a zero balance account.

Reduce risk:

The main advantage of having a zero balance account is that it reduces fraud activity. The primary account, which is the main account of the business, contains zero balance, which reduces the risk of suspicious activity or being stolen.

Track cash flow:

Another advantage of having a zero-balance account is that it helps keep track of the cash flow. You can easily identify the overspending transactions. If you want to provide some funds, and your accounts are linked, you can easily transfer the amount and keep track of the transaction activity.

Saves time:

It helps you to manage the task easily as the accounts are linked, and the transactions are automatic, which saves your time. You can have multiple zero-balance accounts. For example, you can have one account for funds, another for paying the amount, and another for receiving the amount.

Reduce transactional Fees:

Banks charge a certain amount for transactions from one account to another, but having a zero-balance account linked to the main account eliminates the need for transactional fees.

Reduce Maintenance Fee:

Having one main account and another account as a zero balance account helps you reduce the maintenance fee as the bank charges a certain amount for maintaining the balance in the savings account, it helps reduce the maintenance fees.

Overdraft facility:

Some banks allow overdraft facilities, which means you can withdraw more than the available balance. You need pre-approval for this feature. This overdraft facility is helpful in emergency situations.

Services:

The bank provides the necessary 360-degree services to this account, thus helping small business owners. Opening an online zero balance account is a faster and simpler process and does not require more documentation.

In closing:

Zero balance accounts are best suited for small business owners and startups to maintain their balance and keep track of their transactions. It offers several benefits for your account maintenance if you look forward to opening a zero-balance account check for banks that meet your needs.

#zero balance account opening app#online new account opening zero balance#free online bank account opening with zero balance#bank account zero balance open#zero balance open account online#open zero bank account#open new bank account online zero balance#online bank zero account opening#new zero account opening

0 notes

Text

Contactless payment and the details of its working

The process of transacting is becoming simpler each year. Payments can be made in a variety of simple methods, and the contactless payment mechanism is one of these. Contactless payment methods are one of the important inventions of this era. Customers can use their debit or credit cards with RFID technology to make contactless payments for goods and services.

When making an in-store purchase, using contactless banking is among the most widely used payment options. Because the customer can use these cards to pay without making physical contact, transactions go more smoothly.

To learn more about contactless payment and how it functions, continue reading.

What is contactless payment?

Customers can make purchases utilizing contactless payment instead of cash or card swipes. Tapping and waving on the card reader is required to pay using contactless payment. The terminal will then establish a connection with the bank account, and the payment will be processed immediately.

How does contactless payment work?

Radio Frequency Identification (RFID) technology is used in contactless payment cards. The card connects with the scanner when it is in close proximity to one to complete the transaction.

When tapped or waved over the reader, the card reader verifies the information on the card. Following that, the transaction is sent to the card issuer by the merchant's point-of-sale system. After reviewing it, the card issuer approves the transaction.

If individuals desire to do financial transactions using their phones, contactless payment is an additional choice.

The invention of contactless banking has taken payment methods to a whole new level. The quickness and security of contactless banking is unbeatable. The features of contactless banking will get better in the coming years.

Strong authorization

People could believe that contactless payment is hazardous since anyone can take cardholder data. Contactless payments, however, are quite secure. Contactless payment is difficult to hack or breach because they need validation to be completed.

On the card, the information is encrypted. As a result, it is more challenging to steal card information and perform unauthorized logins.

It’s a secure payment method.

Due to its ability to let users complete transactions fast, contactless payments are growing in popularity. Customers can make payments faster because they don't need to input their PIN.

Customers also don't need to carry cash. Contactless payments eliminate this bother, making transactions simple.

What benefits do contactless payments offer?

Contactless payments, facilitated by a bank account app, can significantly expedite the checkout process while also enhancing security. These payments are not only quicker than cash transactions but also take less time compared to typical credit card payments. As a result, contactless payments are particularly well-suited for micropayments and other low-value transactions, making the bank account app a convenient and efficient tool for managing your finances.

Using contactless payment methods can speed up transactions at parking garage checkout stations, turnstiles for public transportation, and toll booths. Although the actual amount of time saved for every transaction may be less than a minute, the minutes saved can pile up and drastically lessen the amount of time clients must wait in queues.

Final thoughts

Institutions and third-party payment processors are experimenting with ways to make checkout more seamless as upi money transfer app technology becomes more widely used. To assist mobile users in finding ATMs, certain payment providers offer GPS technology. Other carriers give clients the option to participate in loyalty marketing run through focused geofenced campaigns.

#bank account online#create bank account online#bank open account online#open account online#bank accounts to open online#online account opening bank#new bank account open#phone banking app#online bank account opening

0 notes

Text

Reasons to switch to online banking

Recent years have seen significant changes in the banking industry, and many people now find banking simpler due to technological advancements. Those days of waiting in a queue at the bank or spending hours on the phone to resolve transactions are long gone. With a free online bank account, you may accomplish all of your daily tasks from the convenience and privacy of your home. Indeed, this has become a very popular banking approach in the last several years. Here mentioned are the reasons to switch to online banking:

No monthly fees:

Your checking and savings accounts are maintained by most traditional banks every month for a cost. These needless fees deplete your hard-earned money. For certain accounts, if you keep a specific balance or get a certain amount of direct deposits each month, the monthly maintenance charge is waived. However, you shouldn't have to worry about whether you can meet those obligations every month.

Convenience:

Money management is easy with online banking. You can check your bank statements, make bill payments, and transfer money whenever you can access the Internet. Bank-to-bank transfers, bill payments, mobile cheque deposits, and paperless statements are popular aspects of Internet banking. Certain online banks have tools and apps on their websites that are intended to help you save more money.

Stay in control:

You should consider free online bank accounts because they make it easier to maintain financial control. You have quick and simple access to watch what comes in and goes out of your account, keep an eye on your spending, schedule payments, and carry out financial activities. You gain complete comfort and convenience in handling your finances and bank accounts, making it much easier to maintain control over your finances.

No balance requirement:

For savings and checking accounts, large banks may have multiple balance requirements. Additionally, they might ask you to keep a minimum daily balance. Not everyone can accomplish this. Less stringent balance requirements apply to online banks. Many have no requirements at all for a starting deposit. Usually, the ones that do are a few. Most also don't demand you to keep a specific monthly balance.

Save time:

Giving online banking a try is also encouraged because many individuals are surprised by how much time and hassle they may save using its services. It used to take a lot of time for customers to call bank employees or to visit offices and wait in long lines. You can easily handle everything online from the comfort of your home when you have internet banking, so this is no longer a problem. You can handle your finances much more quickly and easily as a result.

Bottom line:

These are just a few reasons to make opening an online bank account wise. An online new account open has made simpler nowadays. Due to benefits like reasonable rates, no fees, and digital capabilities that can make managing your accounts and increasing your savings easier, online banks frequently provide substantial advantages over traditional banks.

#open online bank account#bank online account open#online opening account#bank account online opening#zero balance account online#online banking app#open new account online#online open bank account app#open savings account

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online banking account open app#bank account open online#savings bank account#online bank account opening#phone banking app#new bank account open#online account opening bank#bank accounts to open online#open account online#online account open

1 note

·

View note

Text

How Does Online Savings Account Work?

In this digital age, everyone is aware of and switched to online bank accounts. You may begin saving money after making an initial contribution to your online savings account. You may manage your funds with an online savings account anytime, anywhere. While many banks and credit unions frequently offer unique benefits on online account management capabilities, completely online savings accounts. It is also important to note to open savings bank account online, so you do not have to worry about entering a branch and depositing or withdrawing your money. In this post, you will learn about how does online savings account works:

What is an online savings account?

An online savings bank account, commonly called a digital account, including the process of open savings bank account online conducted entirely digitally. Financial technology frequently provides these online accounts in collaboration with large, well-known banks or small finance banks. As you are familiar with conventional banks, they are governed by the Reserve Bank of India. They must follow all the laws and guidelines established by the regulatory authorities.

How to open an online savings account?

Opening an online savings account is much easier than opening in the bank. First, you need to research and choose your desired banking sector. Before choosing it, check that your chosen bank has all the online banking features like mobile applications and high-interest rates paid to customers. Your account opening methods can change from bank to bank.

Once and for all, when you finalize your desired bank, you may need to download their mobile application or online account opening form on their website. Your bank will require basic information like your name, age, address, phone number, mail ID, etc. In addition, for identity proof, they may ask for your Aadhaar card.

After verification, they ask you to complete the KYC form like Know Your Customer. With e-KYC and video KYC development, proving your identity by sharing a brief video or your Aadhaar-OTP can be done quickly with biometrics.

Benefits of online savings account

Easy to use: You can manage your funds whenever and wherever you want without adding another stop to your schedule or waiting for the bank to open because all of your interactions with your account occur digitally.

User-friendly apps: Online banks frequently invest a lot of effort to make sure their websites and mobile banking apps are optimized and simple to use. This enables you to shift your money without any problems with just a few clicks on your bank's website.

Security: Online savings accounts intensely focus on encrypting user data and ongoing monitoring to protect your accounts. With the help of two-factor authentications like passwords and biometrics, your online accounts are safeguarded efficiently.

Customer support: Many online savings accounts offers a 24-hour in-app service and toll-free calling feature because their main goal is to give a hassle-free banking experience.

Final Thoughts

By opening a savings account in online you can easily and flexibly able to manage your money. It is crucial that you should compare bank accounts in order to determine which one best suits your banking requirements.

#bank khata kholna#best banking app#savings bank account#online saving account opening#digital savings account#open savings account#new savings account#saving account opening#saving account#online savings account

0 notes