#online new account open

Text

Why Opening a Minor Savings Account for Your Children is Essential

In today's digital age, the safety and security of banking are paramount, especially when considering your children's financial future. Opening an online bank account for them is a crucial step towards instilling financial literacy and responsibility. Through a bank account app, children can learn invaluable lessons about saving, investing, managing debts, and budgeting from an early age, setting them on the path to financial independence. Let's delve into why every child should have a minor savings account, while highlighting the importance of mobile banking app for their financial education.

Fundamentals of Finance: A minor savings account serves as a child's first interaction with the financial system, providing hands-on experience in managing money. While online banking has become prevalent for adults, children may lack exposure to fundamental banking activities. By operating their own savings account, children learn essential skills like checking balances, receiving deposits, and making withdrawals, fostering a deeper understanding of financial principles.

Enhanced Savings Habit: Through regular deposits and monitoring of their savings account balance, children develop a habit of saving. Witnessing their savings grow encourages them to continue saving and resist impulsive spending. This early exposure to responsible financial behavior helps children avoid debt and work towards achieving their financial goals in the future.

Understanding the Value of Money: Opening a savings account teaches children the value of money and the effort required to earn it. Unlike in households where needs are readily met, children with savings accounts learn that money is finite and must be managed wisely. Parents can encourage this understanding by requiring children to deposit a portion of their allowance or gift money into their savings account, instilling a sense of responsibility and respect for money.

Introduction to Investments: While savings accounts may offer modest interest rates, they introduce children to the concept of investments. As their savings grow, children can explore investment opportunities such as fixed deposits, recurring deposits, and mutual funds. This early exposure to investing lays the foundation for financial growth and instills a mindset of wealth building from a young age.

In conclusion, opening a minor savings account for children is a valuable investment in their financial future. Through the use of online banking and bank account apps, children gain practical experience in financial management and develop essential money management skills. By instilling the habit of saving, teaching the value of money, and introducing them to investment opportunities, parents empower their children to navigate the complexities of finance with confidence.

#online open account bank#mobile banking app#bank open account online#mobile banking apps#online new account open#bank online open account#bank account open online app#open bank account online#bank accounts to open online#bank online account open

0 notes

Text

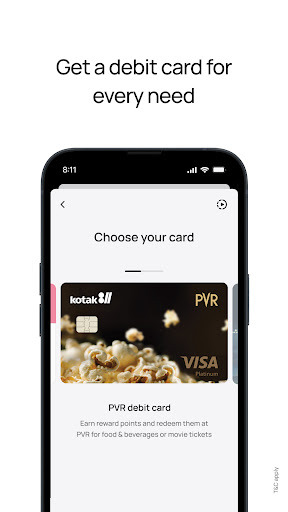

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open new account online#digital account#open savings account#apply online bank account#apply for bank account online#mobile banking app#mobile banking apps#online new account open#online banking#saving account opening

0 notes

Text

Eligibility and Documents Required to Obtain a Credit Card

Credit cards have become an essential financial tool, offering convenience and flexibility in managing expenses, since it is optional to get one. It involves meeting certain eligibility criteria and submitting specific documents to the issuing bank or financial institution. You can now try it on a digital account by opening the app itself. Many of you may need a credit card but don't know how. Understanding these requirements is crucial for them to ensure a smooth application process and increase the chances of approval. So, let us clarify the eligibility to apply for a credit card.

Factors influencing credit card eligibility:

Banks and financial institutions establish specific eligibility criteria to assess an individual's creditworthiness before approving a credit card application. While the eligibility criteria may vary slightly among different issuers, the following are common factors considered:

Age - Applicants must usually be at least 18 to be eligible for a credit card. Age requirement may differ for various financial institutions.

Income - A regular source of income is a primary factor in determining eligibility. The income requirement varies based on the type of card and the issuing bank.

Employment Status - Whether you're salaried, self-employed, or a business owner, your employment status plays a role in eligibility.

Credit History - A good credit history will be a positive sign to get a credit card. Issuers may consider your credit score, which reflects your creditworthiness.

Nationality and Residence - Credit card eligibility is often restricted to citizens or residents of the country where the card is issued. Some institutions also consider the duration of your stay in that country.

Existing Debts - Your existing debt obligations, such as loans or outstanding credit card balances, might influence your eligibility. A high debt-to-income ratio could lead to a rejection.

Documents Required:

You'll be instructed to submit specific documents along with your credit card application to substantiate your eligibility and provide the necessary information. The exact list of required documents may vary by institution, but generally, the following are commonly requested:

1. Identity Proof includes documents such as a valid passport, driver's license, Aadhaar card, or voter ID card.

2. Address Proof - Utility bill payments, rental agreements, or a recent bank statement can serve as address proof.

3. Income Proof - Salaried individuals usually must provide salary slips for the last few months. Self-employed individuals might need to submit income tax returns or audited financial statements.

4. Passport-sized Photographs - These are required for identity verification.

5. Employment Proof - For salaried applicants, an employment verification or appointment letter can be requested.

6. Bank Statements- Some issuers might ask for your recent bank statements to assess your financial stability.

7. PAN Card - The Permanent Account Number (PAN) card is essential for income verification and tax purposes.

8. Business Proof - If you're self-employed or a business owner, you might need to provide documents related to your business, such as business registration certificates.

Closing thoughts:

Many digital account opening apps provide the facility to apply for a credit card online. Acquiring a credit card requires meeting specific eligibility criteria and submitting essential documents that validate your identity, financial stability, and creditworthiness.

#digital account app#new bank account open app#apply online account opening#open bank account#zero account opening online#online new account open#account opening form online#best online account opening

0 notes

Text

Kotak Mobile Banking App

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online bank account opening app#apply online bank account#bank new account opening online#apply for bank account online#free bank account opening online#online banking app#mobile banking apps#online new account open

0 notes

Text

it sucks because I’d love to get into games that predate ace attorney and lay the groundwork for it genre-wise but almost all games that fall into that category never got official localisations because it was assumed at that point there wasn’t a market for these types of games outside of japan. hell ace attorney itself didn’t get localised at first. it’s frustrating

#shut up abe#ace attorney#this is inspired by me just discovering the famicom detective club franchise on account of the new game#and like WOW the gameplay is so strikingly similar to the gameplay in aa’s investigation sections it’s hard not to think it was probably#one of aa’s inspirations#and I’d love to play it but the original games aren’t!!! in english!!!!#ik there are remakes that got an english release but that doesn’t help me when part of the reason I want to play is to experience what an#older game was like#looking online I *think* there’s a fan translation for the 2nd game but not the first?? idk#I do wanna look more into it#regardless I gotta start trying to learn japanese again dude so much stuff is gonna open up for me when I do

10 notes

·

View notes

Text

I'm not sure if it's too early to mention it...but have any of you heard of Sheezy?

(Not the early 2000s site, but the revival project from 2020-2022)

#Becaaause it's coming back soon~#and yours truly is going to be a moderator on it heehee!#It might be a bit early to mention it because it's still being built/currently in a supporter-only beta while it's being put back together#but if you had an account in the 2020-2022 revival project youll be able to return to your account in a few weeks when the beta opens up to#all returning users!#and then after that registration for the site will open in chunks#For those who don't know! Sheezy is an art community site!#I was on it in 2021-2022 for a few months before it shut down and it was genuinely one of the most pleasant experiences ive had as an onlin#artist#The focus isn't numbers so much as community and discovering new people#and I'm honored to be a part of bringing it back now that the team has a proper foundation and time to dedicate to our little project C:#exli speaks#Im just so excited for it!#It isnt perfect and we're fleshing things out as we go and the website will improve exponentially over time#but AAHH#I might link the subcription page in the comments if people are interested ($3 gets you into the supporter beta while the website is built#and the bugs these supporters discover are fixed for the official launch)#but honestly it might be more exciting to join for the official launch too...

7 notes

·

View notes

Text

I'm debating if it would just be easier to get a whole new phone/phone number and just have my grandpa cancel my line once I get it

#the thing is ive had this number since i got my first phone#so i would have to contact a LOT of places about the updated number#including: literally any job ive applied for. health insurance. uni. ALL online accounts that ask for phone number. friends. banks.#but on the other hand. i KNOW my grandpa will make it as difficult as possible#as in: i will have to do everything myself if he agrees to let me remove my number from the line#he will complain every second of having to unlock it#and i will have to spend hours with that man figuring out how to remove the number#meanwhile. i COULD just go down to a provider and ask about getting a new phone.#get a new phone/phone plan for myself (bc i dont wanna stay w this provider it sucks). and just tell him to cancel my line#i could transfer everything over after getting the new line/before he cancels my old one so if anything needs a verification i can do it#just fine - especially the uni and bank stuff#or maybe wait until my semester starts and i have a job already so that if i do have any issues transferring stuff#my uni tech help is more likely to be open and if i have a job i could easily update my resume and just like#contact whoever im working for with updating the number#i might just do that actually#it will suck getting a whole new number tho bc my current number is so easy and again ive had it for years so it is ingrained in my mind#amber's shit you can ignore

3 notes

·

View notes

Text

Need someone to make a “you wouldn’t last an hour in the asylum where they raised me” meme but with old school runescape

#GOD it was such a ride#my first ever account got hacked by someone who was doing that ‘runescape censors your password even if you type it backwards’ scam lol#another time i got scammed in a trade#someone pretended they were going to give me this whole set of armour in exchange for some gems i had#then took them back at the last second so i lost my gems#it was just uncut emeralds but i was really upset about it#i hadn’t figured out what to do with them yet so i thought they were valuable#some people there were SUPER nice though#i remember cutting down some trees on a new account; trying to get my woodcutting skill up#and a level 3 person with the default avatar walked up and started cutting down a yew tree. i & everyone else around was shook#someone said like ‘yo are you a bot or an alt or something’ and he said ‘oh i just don’t train combat. i don’t find it interesting’#he had like level 70 in woodcutting and a lot of others but never did combat#i also befriended somebody who was way higher level than me just randomly and we used to talk whenever we were both online lol#i complimented her ‘socks’ (actually boots) and she straight up showed me the dungeon you can go through to get them#which was awesome#and then when the grand exchange opened i lost like a weekend of my life#i was always getting nerfed by random events as well. that was the other thing#i really miss it sometimes. i don’t miss how grindy it was though#i think that was why i liked to train combat. it felt like less of a grind because you could break it up by picking up loot and organising#your loot. i used to always train prayer by burying the bones as well lol#on my best account i had probably level 20 prayer due to this#tl;dr you wouldn’t last an hour in the asylum where they raised me (2006 runescape)#personal

2 notes

·

View notes

Text

Why do people prefer banks to save money over a locker at their home?

The continuous dispute over whether to store money in a bank or a personal home locker hinges on critical variables such as security, accessibility, interest, and convenience. To protect against financial uncertainty and theft, banks provide enhanced security measures such as government-backed insurance, alarms, and surveillance. They offer various financial services, interest-earning accounts, and inflation protection, all increasing growth potential. On the other hand, home lockers need a more controlled atmosphere and ease of access banks give to maximize stored funds and provide minimal protection and no room for expansion. Instant account opening is easy in today's banking culture. Make sure you are choosing the right bank. In this post, you will learn why people prefer banks:

Security:

Bank security outperforms home storage due to comprehensive anti-theft procedures such as surveillance, alarms, and safety deposit boxes. Hence, Instant account opening is highly recommended. Deposits are protected against bank failure by government insurance. Banks provide FDIC insurance, protection against currency fluctuations, erosion from inflation, and interest growth, in contrast to home lockers. Additional safeguards include maintaining tax records, adhering to regulations, and accessing international monies through ATMs and Net banking app. Banks offer a more comprehensive security cover than home storage, guaranteeing growth, safety, and accessibility for cash stored.

Interest And Growth:

Banks enable interest and growth by offering a variety of accounts, such as savings and CDs. Money that is deposited earns interest, which promotes economic growth. These organizations provide more investing possibilities than just storing something at home, which increases possible returns. Bank accounts offer interest in contrast to idle cash, which counteracts the devaluing impacts of inflation on purchasing power. Banks also offer financial guidance, which supports the selection of wise investments for increased expansion. Because interest income isn't possible with home storage, banks become dynamic venues for financial growth and capital gain, providing a variety of ways to optimize the potential of the deposited cash.

Convenience and accessibility

Through a variety of services, banks excel in accessibility and ease. Online banking services are more convenient than home storage since they provide access to account information, financial transfers, and bill payments around the clock. Global ATM networks guarantee financial flexibility by offering instant cash access from multiple places. Additionally, banks simplify financial administration and investment by providing a wide range of financial products and professional guidance. The combination of digital availability, worldwide presence, and all-inclusive offerings positions banks as unrivaled centers, significantly surpassing the ease of use and restricted accessibility of home storage options.

Inflation and Currency Value

Banks protect against the degradation of currency value caused by inflation by paying interest on deposits, which offsets the decline in buying power experienced with kept cash. They also offer stability by reducing the dangers connected with currency swings by protecting money in regulated currency systems. In contrast to domestic cash, which is vulnerable to inflationary pressures, bank deposits provide a buffer against this kind of devaluation by offering a shelter where money can grow and retain its value in the face of inflation and exchange rate swings.

Bottom line:

The above points emphasize why people choose banks over their lockers to save money. Instant account opening bank should have high security, hence go through their reviews and ratings.

#mobile banking apps#free online bank account#open account online#online new account open#online bank account opening 0 balance#zero balance bank account open#online banking#online new account opening app

0 notes

Text

I have so many photos I need to post. 15 years worth!!! I started posting them on my old tumblr's side blog but never finished and then I abandoned tumblr for years. but tbh I feel like posting my work doesn't benefit me and it's just more pointless work for me 😭 especially instagram and twitter where my posts get maybe 1 like from a follower if i'm lucky and that's it. why do I even bother 😭 no one is excited to see my work so it'd hard to motivate myself to actually share anything when it doesn't benefit me and when no one else is excited for or looking forward to it. sometimes I lose that "I made a thing I want to share it like a kid hanging their finger painting on the fridge" mentality 😅 even kids can get discouraged and give up sharing if you don't ooo and ahhh over their work. does that make sense?

#also can we talk about how horrible social media is?#i was told instagram is so easy. you get many quick likes and followers. ive SEEN new accounts get thousands kf followers and hundreds#of likes in a couple weeks. ive been on there for years and have 20 followers and get 1 like sometimes#new accounts with one post will get 1k followers and 300 likes in a week. i just dont get it lmao im so confused 🤣#and twitter is now pay to win. i only got maybe 5 likes per post before. now i get none at all. which is expected...#so why am i bothering!#at least on tumblr my art will get maybe 20 notes and my photography maybe 10. so it doesnt feel as pointless to share 😅#i really want to open a shop for my art and photography and stuff but with the lack of attention im afraid to#because its A LOT OF WORK and i hate wasting my time and energy and money for no reason 😭#my last shop i opened got a grand total of 0 sales in the 2 years i had it open LOL it took me months to set it up and print everything#artist struggles#is there anywhere actually good to post your work online? (besides tiktok. i refuse) most social media has become useless!!!#lee text#sorry for whining 😅 just questioning my entire existence and why i even bother to do anything

1 note

·

View note

Text

Sparta Management Consultancies offers specialized services related to the Golden Visa program in Dubai, catering to individuals seeking long-term residency in the United Arab Emirates. This program is designed to attract foreign investors, entrepreneurs, and skilled professionals by providing them with the opportunity to secure residency in one of the most dynamic and rapidly growing cities in the world. With a deep understanding of the local regulations and requirements, Sparta Management Consultancies ensures that clients receive comprehensive guidance throughout the application process.

The Golden Visa initiative in Dubai is a strategic move by the UAE government to enhance its appeal as a global business hub. Sparta Management Consultancies plays a pivotal role in facilitating this process for potential applicants by offering tailored solutions that address their unique needs and circumstances. The firm’s expertise encompasses not only the intricacies of the visa application but also the broader implications of living and working in Dubai, including investment opportunities and lifestyle considerations.

#business setup in dubai#law firms in dubai#pro services in dubai#Bank account opening#Trade license renewal dubai#new company formation#Business cancelation dubai#Online bank account opening dubai#Business bank account dubai#business setup services dubai#mainland company formation in dubai#offshore formation dubai#out source pro services in dubai

1 note

·

View note

Text

The Beginner's Guide to Online Trading and Demat Accounts with Integrated Enterprises (India) Pvt. Ltd

In this comprehensive beginner's guide, we will explore the world of online trading, demat accounts and the best practices for stock buying and investing. Integrated Enterprises (India) Pvt. Ltd, a leading wealth management service provider, will be our focal point as we delve into the essentials of online trading and demat accounts for beginners.

Understanding the Basics of Online Trading

Before diving into the details of demat accounts and stock buying, let's first understand what online trading entails and how it can be a valuable tool for investors.

What is Online Trading?

Online trading is the process of buying and selling financial instruments such as equity stocks, bonds and commodities through an online platform provided by Integrated Enterprises (India) Pvt. Ltd. This method offers investors the convenience of trading from anywhere with an internet connection.

Benefits of Online Trading

Convenience: Trade from the comfort of your home or on the go.

Access to Markets: Easily access a wide range of financial markets and instruments.

Real-Time Data: Get instant updates on stock prices and market conditions.

Cost-Effective: Online trading often comes with lower brokerage fees compared to traditional methods.

Demat Accounts: A demat account is a prerequisite for trading and investing in the stock market. Let's explore the key aspects of demat accounts and how they facilitate seamless online trading.

What is a Demat Account?

A demat account, short for dematerialized account, is an electronic account that holds securities such as stocks, bonds, and mutual funds in digital form. This eliminates the need for physical share certificates and simplifies the trading process.

Benefits of a Demat Account

Safe and Secure: Eliminates the risk of loss or damage to physical share certificates.

Easy Monitoring: Track your investments in real-time and access transaction history easily.

Quick Settlement: Facilitates seamless and quick settlement of trades in the stock market.

Opening a Demat Account Online with Integrated Enterprises

Integrated Enterprises offers a hassle-free process for opening a free demat account online, ensuring a smooth entry into the world of online trading.

Steps to Opening a Demat Account Online

After visiting our website click on the A/c. opening link,

➤ Enter your personal details & bank details

➤ Submit documents through DigiLocker

➤ Nominate your loved ones

➤ Submit Signature & Cancelled Cheque

➤ Capture your live Photo

➤ Opt for Term Insurance if needed for you

➤ eSign

Your onboarding process over!

Choosing the Best Broker for Your Demat Account

When selecting a brokerage service provider for your demat account, consider factors such as reliability, customer service, and fee structure. Integrated Enterprises stands out as a top choice for investors seeking a seamless and user-friendly trading experience.

Why Choose Integrated Enterprises (India) Pvt. Ltd?

Zero AMC Charges: Enjoy the benefit of zero Annual Maintenance Charges for your demat account.

User-Friendly Platform: Access a user-friendly online trading platform with real-time data and market updates.

Dedicated Support: Benefit from dedicated customer support and relationship managers for personalized assistance.

Getting Started with Online Trading

Now that you have your demat account set up with Integrated Enterprises, it's time to kickstart your online trading journey with confidence.

Tips for Beginners in Online Trading

Start Small: Begin with a small investment to familiarize yourself with the trading process.

Educate Yourself: Stay informed about market trends and investment strategies.

Diversify Your Portfolio: Spread your investments across different sectors to minimize risk.

#open free demat account online#open demat#open demat account online#demat and trading account#new demat account#free demat and trading account

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#saving account#zero balance account online#debit card online apply#open new account online#digital account#zero balance account open#open savings account#digital banking app#premium banking#mobile banking app#new account open bank online 0 balance

1 note

·

View note

Text

All GST registered businesses have to file monthly or quarterly GST returns and an annual GST return based on the type of business. GST Return Filing is mandatory in nature and non – filing will attract penalty and may result of GST Cancellation also. Simplify the GST return filing process for your small business with our comprehensive guide. Stay compliant with India’s GST regulations effortlessly.

Read More >> https://setupfiling.in/gst-return-filing/

#gst registration check#tax system#e file income tax return#tax portal#tax tutorial#free online certificate courses in taxation in india#apply for gstin number#one tax#gst account opening#gst registration requirements#tax ser#file your taxes login#gst website india#invoice without tax#search gst number by name#my gst certificate#online tax app#us gov tax filing#goods and services tax e invoice system#apply for gstin#tax filing india#register with gst#new gst registration online

0 notes

Text

Kotak811 Mobile Banking App

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc for low risk customers#instant zero account opening#zero balance instant account opening#zero balance instant account opening online#instant savings account online#open new savings account#open new account

0 notes

Text

Kotak Mobile Banking app for iPhone

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

Source : https://apps.apple.com/in/app/kotak-mobile-banking-app/id622363400

#online banking account opening#bank new account opening online#account opening online#create bank account online#apply for bank account online#free bank account opening online#apply online account opening#new bank account open app

1 note

·

View note