#are forex brokers safe

Text

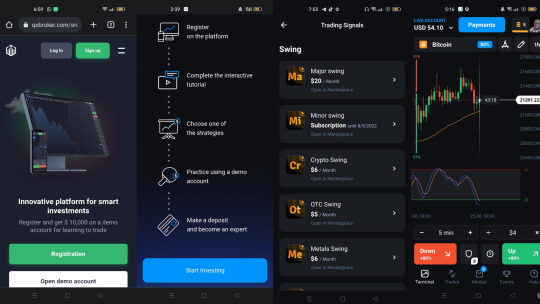

Quotex Broker Regulation Vs Olymp Trade Regulation

Quotex Broker Regulation Vs Olymp Trade Regulation

Quotex Broker is a binary options broker that offers access to its trading platform globally to traders who’d like to make money trading in shorter time frames. Just like Quotex, Olymp Trade is a Fixed time trading platform known the world over for short trades of between 5 seconds and 23 hours.

As it is the law for brokers to get regulated in most countries, both Quotex and Olymp Trade have…

View On WordPress

#10 best forex brokers in nigeria#5 best forex brokers#apakah broker quotex resmi#are brokers legit#are brokers safe#are forex brokers honest#are forex brokers legit#are forex brokers regulated#are forex brokers reliable#are forex brokers safe#are forex trading profitable#are forex trading real#best 100 forex brokers in the world#best 8 forex brokers#best and most reliable forex broker#best brokers for forex trading in us#best brokers of forex#best currency brokers uk#best for forex trading#best forex broker 2022 reddit#best forex broker for us30#best forex broker in 2022#best forex broker in india 2022#best forex broker in nigeria 2022#best forex broker in uae 2022#best forex broker malaysia 2022#best forex brokers#best forex brokers 2022#best forex brokers affiliate programs#best forex brokers africa

0 notes

Text

Aglobaltrade Review

Is Aglobaltrade Legit?

After taking a look at their website, it shows that they do not fall under any regulating agency. That is a MAJOR RED FLAG!! That should be enough for you NOT to invest with them. And they also work with websites that offer “Automated trading software” which is another red flag, as this kind of websites are infamous for scamming schemes.

So, Aglobaltrade is just another unregulated forex broker, which means the customers aren’t protected, and there is highly likely they will get away with your hard-earned money and there will be no regulating agency to hold them responsible.

How does the scam work?

Usually, unregulated forex brokers work in the following way. They will call people to persuade them to make the initial minimum deposit. And they will try any conceivable method in order to make that happen. They will offer deals that sound too good to be true. Like we will double your initial deposit or you will make hundreds of dollars per day easily. Please don’t fall for anything they say!!! It is a SCAM! After making the initial deposit, they transfer clients to a smarter scammer, called a “retention agent”, who will try to get more money out of you. Also, one thing we need to add here is: don’t trust the good Aglobaltrade reviews you might see online. They pay websites and services to improve their online reputation by posting good reviews about them.

Withdrawing funds

You should submit a withdrawal request ASAP, because your funds are never safe with an unregulated broker. And here is when things get tricky.

If you want to withdraw your money and it does not matter if you have profits or not, they will delay the withdrawing process for months. If they delay it for six months, you won’t be able to file a chargeback anymore and your money is gone for good. It doesn’t matter how often you remind them or insist in withdrawing your money, you will NOT get them back. And if you signed the Managed Account Agreement or MAA, which is basically authorizing them to do anything they want on your account, they will lose all your funds so there won’t be anything to request anymore.

How to get your money back Aglobaltrade?

If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back.

First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you. Or they delay the process for too long, with the intention of not refunding your money.

The first thing you should do is perform a chargeback! And you should do this right away! Contact your bank or credit card provider and explain how they deceived you into depositing money for a non-regulated trading company. Mention also that they refuse to give your money back. This is the simplest way of getting your money back and is also the way that hurts them the most. Because if there are many chargebacks performed, it will destroy their relation with the payment service providers. If you haven’t done this before or you are not sure where to start or how to present your case to your bank or credit card company, we can assist you in preparing your chargeback case. Just contact [email protected] but don’t let your broker know they you read this article or that you are contacting us.

What about wires?

If you sent them a wire, there is no way to perform a chargeback on a wire. For this step you need to raise the fight to a different level. Tell them you will go to the authorities and file a complaint against them. That will get them to rethink the refund possibility. Another thing you can do is prepare a letter or email for the regulating agencies. Depending on where you live, you can search google to find the regulatory agency for Forex brokers in your country. After that you can prepare a letter or an email describing how they deceived you. Make sure you show this letter or email to them, and tell them you will send it to the regulating agency if they don’t refund your money. If you don’t know where to start, reach us at [email protected] and we’ll help you with this step as well.

Make sure you leave Aglobaltrade reviews in other sites

Another way to hurt them and save other people from falling victims is to leave bad reviews on other sites. See what other sites have posted reviews about Aglobaltrade, and describe shortly what happened. If you fallen victim, please leave a review and a comment on this site at the comment section. Also, when these people change their website, they tend to call the old clients. So, if they call you from a new website, mention it in the comment or let us know about it. That would be really appreciated by us by our users. Also, if you get phone calls from other companies, please put the name of these companies also in the comment. Or you can send them to us and we will expose them too.

Aglobaltrade Review Conclusions

Making the Aglobaltrade review was our pleasure, and we hope to save as many people from losing their hard-earned money. A good rule of thumb is to carefully review all the Forex companies and any other company for that matter, before you perform any transaction. We hope that our Aglobaltrade review has been helpful to you. If you have any questions or you need an advice about the withdrawing process, feel free to contact us at [email protected]

If you like to trade, please do it with a trustworthy, regulated broker, by choosing one of the brokers listed below.

2 notes

·

View notes

Text

10 Best Regulated Forex Brokers in The World

Discover the top 10 internationally acclaimed forex broker is regulated offering secure trading platforms, competitive spreads, and diverse asset options in forexregulationinquiry. These brokers, recognized for their compliance with stringent regulatory standards, provide traders with a safe and transparent environment to navigate the dynamic world of foreign exchange markets.

#stock broker#forex broker#forex market news#online forex market#forexregulationinqury#online forex trading#business#forex trading#forex market#stock market#forex broker is regulated

2 notes

·

View notes

Text

Imperial Wealth International

Regulation and security at forex broker Imperial Wealth International

Safety and security are important aspects when choosing a forex broker. When considering, it can be noted that this broker provides a high level of security for its clients.

The forex broker is regulated and licensed by one of the reputable financial institutions. The broker is committed to complying with international regulations and requirements in the financial services industry. The regulation provides additional security for clients and ensures that the broker's activities are of a high standard.

In addition, the company employs state-of-the-art security technology to ensure client confidentiality and data protection. The broker uses data encryption and rigorous identity verification procedures to prevent fraud and unauthorized access to traders' accounts.

Importantly, the broker works with trusted banks and financial institutions to process clients' financial transactions. This helps to ensure the security of deposits and fast processing of client funds.

In case of disputes or complaints, the company has a conflict resolution procedure which allows clients to raise a concern and get their case dealt with fairly. The broker also provides full information on its trading conditions and policies so that clients can be aware of their rights and obligations.

Overall, Imperial Wealth International provides a high level of security and protection for its clients. Regulation, the use of modern security technology and working with reliable financial partners all make the broker a reliable choice for traders who are looking for a safe and secure environment for their financial transactions in the forex market.

2 notes

·

View notes

Text

5 Must-Know Tips For Choosing The Right Cryptocurrency Exchange

It is an unwise business, especially if you trade without knowing its basics. There are huge gains to be made however, you could even be in debt before you have even begun to study the market. You must be aware of several things such as how to choose (0.07 eth to gbp exchanges. Making the wrong choice with regards to cryptocurrency exchange could lead down a path filled by distractions and wasted time. Read on for five important tips that will help you pick the most suitable cryptocurrency exchange.

1. Examine the authenticity of the exchange and security

You can choose a safe and reliable exchange service by doing thorough research. Some insecure exchanges not just expose scams and investors, but also allow scammers to swindle investors with small amounts of money. Before you choose an exchange, find out whether it will protect you from fraud.

2. Compare the fee structures

Different fees and transaction charges apply for cryptocurrency exchanges. This is often overlooked and people end up choosing high-cost exchanges, even though they could have picked an exchange with lower transaction costs. An exchange with tokens often offers lower transaction costs than the ones without. If you're looking to compare two exchanges that use tokens, pick the one that has more. You can evaluate crypto exchanges to find which one has the best fee structure. Click this link to learn more about cryptocurrency exchange right now.

3. Know the different types of cryptocurrency exchanges

There are three typesof platforms: brokers, P2P and trading platforms. Find out what each entails. By setting prices and providing buyers a platform to buy cryptocurrencies the cryptocurrency brokers act as forex brokers.

P2P exchanges link buyers and sellers for direct interaction and allow them to reach an agreement on transactions. They provide a secure platform for secure cryptocurrency exchanges. Traders use trading platforms. Each party has a direct interaction with the platform, rather than being in direct contact with buyers and sellers. Sellers place their cryptocurrency on the platform, while buyers make their purchases. The transaction fee is charged by the platform. Before you decide, learn the basics of each. You can research the advantages and disadvantages of each one that appeals most to you.

4. Purchase methods

Cryptocurrency purchase methods vary depending on the exchange. Some platforms require that users make use of PayPal or bank transfer, while some allow debit and credit card purchases. Some platforms require that buyers make purchases with 0.3 eth to gbp. Find out the time it takes to complete a purchase on an exchange before you choose one. It is preferential to get transactions processed quickly rather than taking several days, or perhaps weeks.

5. Consumer encounter

When trading cryptocurrency for the first-time, it is important to think about the user experience and functions. Exchanges with good user experiences are the most popular for transaction volumes. You might find some platforms offering tokens for free. It's a good idea to choose an cryptocurrency exchange that has such deals.

Endnote

It is essential to think about all aspects when investing in cryptocurrency. Different exchanges offer various user experiences as well as security. {Consider all options and pick the exchange that ensures the safety of users.|Check out all the options and pick the one that offers safety.

10 notes

·

View notes

Text

Mysteel UK Limited

Mysteel UK Limited - your reliable Forex partner

Mysteel UK Limited is a reputable forex broker that offers a wide range of services for traders in the currency market (Forex). The broker stands out for its reliability, professionalism and cutting-edge technology in order to provide customers with optimal conditions for successful trading in the financial markets.

Regulation and reliability:

Is a licensed and regulated forex broker, which ensures the safety and security of client funds. The broker adheres to high standards of regulation and investor protection, which makes clients feel confident when working with the company.

Trading conditions:

Offers competitive trading conditions that meet the needs of various traders. The broker provides access to a wide range of currency pairs and instruments, allowing clients to choose the most suitable assets to trade. In addition, Mysteel UK Limited offers low spreads, fast order execution and flexible leverage support.

Trading platforms:

Offers advanced trading platforms that provide convenience and functionality for traders. These include popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer extensive market analysis, automated strategies and instant order execution.

Educational resources:

The company values the education of its clients and provides extensive educational resources. The broker offers webinars, trainings, video tutorials and analytical materials that help traders expand their knowledge of the Forex market, develop trading skills and make more informed decisions.

Customer support:

The broker has a responsive customer support team that is ready to help clients with any trading and technical issues. The support team is available 24/7 and can be reached through a variety of communication channels including phone, email and online chat.

Conclusion:

Mysteel UK Limited is a reliable forex broker that offers clients a safe and profitable trading environment in the Forex market. With regulation, competitive trading conditions, advanced platforms, educational resources and professional customer support.

3 notes

·

View notes

Text

Forex Broker Regulations: Understanding The Importance Of Regulatory Compliance

The Forex market is an ever-evolving space that requires traders and brokers to stay up-to-date with current regulations. Understanding the importance of regulatory compliance helps protect investors from potential losses caused by fraudulent activities, and ensures a fair trading environment for all participants. This article provides an overview of forex broker regulation, discussing the different types of regulation, their objectives, and why it is important for both brokers and traders to adhere to these rules.

Regulation in the financial sector has become increasingly relevant as technology advances have allowed greater access to global markets. As retail trading continues to expand into new countries around the world, regulatory authorities are becoming more active in protecting investor safety through increased oversight on market participants. Regulations provide numerous benefits such as safeguarding customer funds held at intermediaries, preventing manipulation or insider trading among other things. However, they also impose costs on firms due to compliance requirements which can affect profitability negatively.

Given its critical role in maintaining a secure and efficient marketplace, understanding how forex broker regulations work is essential for any trader who wants to trade successfully while managing risk effectively. In this article we will discuss the various types of regulations governing FX brokers, their objectives and importance in relation to successful trading practices.

What Is A Forex Broker?

A Forex broker is a financial services company that facilitates trading in the foreign exchange (Forex) market. It acts as an intermediary between its clients and the currency markets by providing access to trading platforms, allowing them to buy or sell currencies at current prices. By offering competitive spreads, commissions, and other charges, brokers can attract traders wishing to speculate on price movements of various currencies.

The purpose of forex broker regulations is to ensure fair competition among brokers and protect investors from any unethical practice. These regulations also aim to maintain market integrity and prevent any manipulation of the marketplace. Regulatory agencies such as the Financial Conduct Authority (FCA), Commodity Futures Trading Commission (CFTC), National Futures Association (NFA), Financial Industry Regulatory Authority (FINRA) have specific rules for their respective jurisdictions regarding licensing requirements for Forex Brokers. Most countries require all Forex brokers operating within their jurisdiction to be registered with these regulatory bodies.

Regulatory compliance has become increasingly important in recent years due to increased scrutiny from government authorities aimed at protecting investors from fraudulent activities in the global markets. As such, it is essential for Forex brokers to understand the importance of adhering to these regulations in order to remain compliant and protect both themselves and their customers.

Regulatory Bodies Governing Forex Brokers

Regulation of forex brokers is a vital component in ensuring the security and integrity of global financial markets. Regulatory bodies governing forex brokers strive to ensure that industry participants abide by predetermined standards for safety, reporting, risk management disclosure and protection of customer funds. Non-compliance with these regulations can result in severe penalties including fines or suspensions from trading.

The importance of regulatory compliance cannot be overstated as it helps protect investors' capital while enabling safe market transactions. In order to participate in business activities related to foreign exchange, brokerages must comply with all applicable laws and regulations imposed by the relevant authorities in their jurisdiction. This includes registering with an authorized regulator, obtaining a license and submitting regular reports on activity such as client trades and positions held.

In addition, brokerages must disclose any potential risks associated with certain investments so that clients are aware of the possible outcomes before they commit to trade. As technology revolutionizes the world economy, regulators continue to update existing rules and develop new ones designed to protect customers while promoting fair competition among traders. Therefore, staying informed about changes in regulation is essential for successful forex trading operations as well as avoiding costly penalties resulting from non-compliance.

Why Regulatory Compliance Is Important

Regulatory compliance is a key component of the framework for forex brokers. It refers to meeting specific standards and requirements set out by regulatory bodies that ensure the safety of clients, as well as maintaining proper business practices within the industry. Regulatory compliance also encompasses risk management requirements and client protection mechanisms that are designed to reduce potential losses from trading activities.

One of the primary benefits of regulatory compliance lies in its ability to protect investors from unscrupulous behavior. By adhering to strict standards set out by government agencies, it is possible for forex brokers to provide their clients with reliable services while minimizing the risk associated with investing in foreign currencies. With enhanced security measures such as Know Your Customer (KYC) processes, Anti-Money Laundering (AML) reporting and other verification procedures, customers can be assured that their investments will remain safe under any circumstances.

Any failure to adhere to these regulations could result in severe penalties or sanctions depending on the severity of non-compliance. These may include financial fines, temporary suspension or even permanent closure of an affected broker’s operations. As such, it is critical for forex brokers to stay abreast of any changes that occur within this area so they can ensure full compliance at all times.

In order to safeguard investor interests, maintain high ethical standards and minimize risks related to transactions conducted through online platforms, regulators have put in place stringent rules regarding how forex brokers operate within global markets; understanding their importance is essential for ensuring success in this field.

Client Protection Mechanisms

Client protection mechanisms are a key component of regulatory compliance for forex brokers. The purpose of these measures is to ensure that clients’ funds and trading activities are kept secure at all times, while also providing effective risk management strategies. To achieve this goal, many different types of protective procedures have been adopted by brokers worldwide.

One form of client protection is through the use of segregated accounts. These accounts keep clients’ funds separate from those belonging to the broker and other investors. This prevents any potential conflicts of interest between parties involved in the Forex market, as well as ensuring clients' funds remain protected even if there were financial difficulties faced by the brokerage firm itself. Another mechanism used to protect traders is negative balance protection (NBP). NBP ensures that losses never exceed what has already been deposited into an account, and can be triggered automatically or manually when certain conditions are met.

Finally, most forex brokers must adhere to strict capital adequacy requirements before they can begin offering services to their customers. By doing so, firms demonstrate that they possess sufficient resources should any liabilities arise during operations or due to external events. In addition, such regulations may include provisions that require companies to maintain records on customer transactions and provide customers with regular statements detailing their activity within the markets over time. All these measures help ensure optimal levels of safety and security when engaging in Forex trading activities with a given broker entity, thus helping them meet their obligations under applicable regulatory frameworks.

Risk Management And Disclosure Requirements

The importance of risk management and disclosure requirements for forex brokers is integral to regulatory compliance. Forex traders rely upon their broker to provide detailed information regarding the risks associated with trading, including potential losses or gains. It is essential that this information be communicated clearly in order for clients to make sound investment decisions. To ensure that these expectations are met, it is important for all forex brokers to adhere to standards set forth by governing bodies such as the Commodity Futures Trading Commission (CFTC) and other regional regulators.

Risk management entails more than simply providing accurate trade data; a broker must also protect its clients from any financial harm they may encounter while engaging in online currency trading. This includes protecting them from fraud and unethical practices, which can cause significant losses if not properly managed. Furthermore, forex brokers should regularly review their procedures and policies related to client protection measures so as to ensure ongoing compliance with applicable regulations.

In addition to client protection mechanisms, another key component of regulatory compliance lies in the disclosure of certain financial metrics prior to executing trades on behalf of customers. Brokers must disclose both expected returns and possible losses associated with each position taken by a customer in order for them to understand the full scope of their investments. By adhering strictly to these rules, forex brokers help create an atmosphere that encourages ethical behavior among its traders while simultaneously minimizing exposure from potential legal issues arising from non-compliance with existing regulations.

Penalties For Non-Compliance

Regulatory compliance is an important factor for forex brokers to consider, as non-compliance may result in hefty fines and penalties. Forex broker regulations are set forth by authorities overseeing the financial industry that seek to protect clients from fraudulent activities. These laws also help ensure that brokers abide by ethical standards of conduct while providing a safe trading environment. Brokers who fail to comply with regulatory requirements can face severe penalties including suspension or revocation of their license, large monetary fines, or both.

The severity of the penalties imposed on non-compliant brokers will depend on the nature of their violation and whether they have prior offenses. For instance, if a broker has committed fraud against its customers, regulators may impose harsher sanctions such as permanent license revocation and substantial fines. On the other hand, minor violations such as failure to submit paperwork within deadlines may result in more lenient punishments like temporary suspension of license and smaller fees. Regardless of the infraction, these penalties exist to deter future misconduct from occurring so that clients remain protected when trading with forex brokers.

In addition to potential criminal liability for violating broker regulation laws, there is also civil liability for failing to adhere to client protection rules. Civil lawsuits can be brought forward by aggrieved parties seeking compensation for losses incurred due to negligence or unethical behavior by the broker. Such suits are often costly both financially and reputationally; therefore, it is essential for firms involved in foreign exchange transactions to take preventative measures and prioritize compliance with applicable regulations.

Benefits Of Strict Compliance

Strict compliance with forex broker regulations provides significant benefits to both clients and brokers. Compliance is essential in order to ensure client protection, as it mandates that all necessary risk management disclosures are made available to customers before they enter into any trading contract. Furthermore, by adhering to the regulatory requirements set forth by governing bodies such as the Financial Conduct Authority, brokers can be assured of a certain level of trustworthiness and legitimacy. This ultimately helps protect consumers from fraudulent activity or other unethical practices within the industry.

In addition to providing consumer protection, strict compliance also serves an important role in ensuring fair market conditions for traders. By implementing stringent protocols and procedures, brokers are able to reduce conflicts of interest between themselves and their clients, thus allowing them to operate more efficiently while still protecting customer interests. Moreover, through proper regulation adherence, firms can ensure that their services comply with international standards and promote healthy competition amongst participants within the foreign exchange (forex) market.

Regulatory compliance is therefore integral to maintaining a safe financial environment for both investors and brokers alike. By following established guidelines and enforcing best practices across the sector, companies are better able to protect their clients’ assets while promoting transparency and accountability throughout the entire process. As such, understanding the importance of these rules is essential for anyone looking to participate in forex trading activities on a global scale.

Frequently Asked Questions

How Do I Know If A Forex Broker Is Regulated?

When considering investing in the forex market, it is essential to understand how to check broker regulation. Verifying that a forex broker is regulated by an appropriate authority can be achieved through research into different regulations and authorities governing brokerage services. This process should involve researching both local and international regulatory compliance for any given broker.

It is possible to find up-to-date information on various financial regulators from government websites or from other publications such as trade journals. When conducting research it may also be useful to investigate what kind of trading conditions a particular broker offers, their level of customer service, and the reputation they have within the industry. Additionally, one should review whether the regulator has imposed certain restrictions on brokers regarding leverage amounts or margin requirements. Doing this can help investors make a more informed decision when selecting which broker best suits them.

Once all necessary information has been collected and checked against relevant sources, it becomes easier to determine if a given forex broker is compliant with applicable regulations and therefore suitable for investment purposes. While some brokers might offer attractive features that are not necessarily backed by regulation, these could potentially lead to serious losses if proper precautions are not taken beforehand. Therefore, verifying that a specific forex broker adheres to invest regulator compliance is key before deciding whether or not to commit funds into trading activities with that particular firm.

What Are The Main Risks Of Trading With An Unregulated Forex Broker?

When trading with an unregulated forex broker, investors are exposed to a variety of risks that can have a negative impact on their capital. It is essential for traders to fully understand the different types of risks associated with this kind of investing before entering into any type of agreement. This article will explore the main risks posed by using an unregulated forex broker and how to determine if your chosen broker is compliant with all applicable regulations.

The primary risk posed by using an unregulated broker is the lack of financial protection in case something goes wrong. Unregulated brokers are not subject to rigorous capital requirements like regulated brokers, which means they may be unable to meet client obligations when it comes time to pay out profits or return deposited funds. Additionally, without regulatory oversight, there is also no guarantee that these brokers adhere to industry standards regarding fair treatment and honest dealing practices. This can mean higher fees, hidden costs, and other unethical behavior such as front-running trades or market manipulation.

It is important for traders to take steps to ensure that their chosen forex broker is properly regulated before engaging in any type of transaction. Investors should look for evidence that the brokerage has been approved by a recognized financial regulator such as the U.S Commodity Futures Trading Commission (CFTC) or the National Futures Association (NFA). Brokers must comply with specific rules relating to customer disclosure agreements, leverage limits, minimum account balances and more in order to remain compliant with local laws and regulations. Those who fail to do so may face hefty fines or even revocation of their license.

Traders should conduct due diligence prior to selecting a broker and make sure that they are aware of all potential risks – both from an economic standpoint as well as legal repercussions – when choosing an unregulated entity over one that is officially registered and monitored by authorities. By taking appropriate measures beforehand, clients can minimize exposure while maximizing returns from their investments within the highly competitive foreign exchange markets .

What Are The Key Differences Between A Regulated And An Unregulated Forex Broker?

The key differences between a regulated and an unregulated forex broker need to be understood in order to make informed decisions when trading. Regulated brokers are those that adhere to regulatory compliance, while unregulated brokers may not meet the same standard as their counterparts. Forex traders should take into account these distinctions before deciding on which type of broker they wish to trade with.

A regulated forex broker is subject to oversight by government authorities, who will ensure that all financial regulations are being followed by the brokerage firm. This provides a degree of security for investors since the rules governing a regulated broker must be adhered to or else risk penalties from the overseeing body. Additionally, traders can expect higher standards of customer service and transparency when dealing with a regulated broker due to their adherence to stringent requirements concerning operations and practices set forth by regulators.

In contrast, an unregulated forex broker does not have any governmental supervision, meaning that there is no assurance that it follows any sort of guidelines or complies with industry standards. Furthermore, customers do not benefit from consumer protection laws provided by governments if something goes wrong with trades made through an unregulated broker. Due to this lack of regulation, traders run the risk of becoming victims of fraud or other malicious activities such as market manipulation or insider trading conducted by unscrupulous brokers using funds deposited by unsuspecting clients.

It is important for potential investors in foreign exchange markets to understand the risks associated with each type of broker and how they differ in terms of regulation; this knowledge can help them decide which option best meets their needs while also protecting themselves against possible losses incurred through fraudulent activity.

What Is The Difference Between A Regulated And An Authorized Forex Broker?

The current H2 focuses on the difference between a regulated and authorized forex broker. Regulated brokers are subject to specific regulations that must be followed in order to operate within their jurisdiction, while authorized brokers have been approved by a government agency or regulatory body as meeting its standards. In essence, a regulated broker is mandated to comply with rules set forth by an external authority in comparison to an authorised broker which has already achieved compliance within those same laws.

Regulation of forex trading can vary from one country to another due to the different legal frameworks governing the activity. The general objective for any regulating entity is mainly centered around protecting traders from financial malpractices such as fraud or manipulation of prices. Regulatory bodies also strive to ensure fairness and transparency when it comes to pricing across all market participants, allowing traders access to reliable data they need when making decisions on trades.

Authorized Forex Brokers meanwhile have met certain criteria set out by regulators that prove their ability and reliability in providing services related to currency markets; this includes having sufficient capital reserves, training staff adequately and investing heavily in technology infrastructure in order to provide timely execution of orders placed by clients. Furthermore, authorised brokers may also benefit from additional bonuses such as lower transactional costs or preferential terms given by some institutions like banks.

Given these differences, it is important for investors who wish to trade currencies online via a broker platform should assess both options carefully before selecting which type of broker best suits their needs. Moreover, understanding how regulation works helps ensure that investments remain safe and secure at all times whilst providing peace of mind knowing there are processes in place designed specifically for investor protection purposes.

What Is The Minimum Capital Requirement For A Regulated Forex Broker?

The minimum capital requirement for a regulated forex broker is an important aspect of the overall regulatory compliance framework. In order to be recognized as a legitimate and authorized forex brokerage, companies must abide by certain standards set forth in capital requirements regulations. These regulations are designed to protect both investors and brokers from financial losses due to improper trading practices or other fraudulent activities.

Capital requirements vary depending on where the brokerage is located, but generally speaking they involve having adequate funds available to cover any potential losses that may occur while conducting business with customers. For example, if a customer loses money through trades made using the broker’s platform, then the broker must have enough capital reserves to cover these losses without putting their own assets at risk. This ensures that there is sufficient protection for all parties involved in trading activities.

In terms of legal obligations imposed upon brokers, it is essential that they maintain records of all transactions so that authorities can audit them at any given time. By ensuring that forex brokers comply with the applicable rules and regulations regarding their capital requirements, this helps create trust between traders and brokers; it also helps enhance market efficiency by providing transparency into how much each party involved has put into play during a transaction process. Ultimately, this serves as one of many steps taken towards achieving successful regulation compliance within the industry.

Conclusion

It is important for Forex traders to understand the importance of regulatory compliance when choosing a broker. It is crucial to check if a Forex broker is regulated in order to protect oneself from potential risks associated with trading with an unregulated entity. There are significant differences between a regulated and an unregulated Forex broker, such as capital requirements, customer protection measures, and services offered. Furthermore, it is essential to differentiate between a regulated and an authorized Forex broker, since one cannot assume that authorization implies regulation.

In conclusion, due diligence must be conducted when selecting a Forex broker. Traders should research the necessary information regarding regulations applicable in the country or region where their chosen brokers operate. Understanding these regulations will help traders make informed decisions that can potentially save them time and money while engaging in profitable trades. Regulatory compliance ensures fair market conditions and investor protection which ultimately promote financial stability around the world.

5 notes

·

View notes

Text

xm broker review

XM Group is a group of regulated online brokers. XM Group offers clients multi-asset trading on various trading platforms, including the popular MetaTrader 4 and MetaTrader 5 platforms. The company is regulated by several financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK.

Overall, XM Group has received positive reviews from clients for its wide range of asset classes, multiple trading platforms, and low fees. However, as with any broker, it is important to carefully consider your own trading needs and do your own due diligence before choosing a broker. It is also important to note that trading carries a high level of risk and may not be suitable for all investors.

XM pros & cons

pros:

Offers 1,230 CFDs, including 57 forex pairs.

Autochartist and Trading Central complement in-house research offering.

The XM Shares account requires a $10,000 deposit if you want exchange-traded securities (non-CFD).

Excellent research content that includes daily videos, podcasts, and organized articles.

In-house broadcasting features TV-quality video content, and live recordings.

A comprehensive selection of educational webinars, articles, and Tradepedia courses.

Offers full MetaTrader suite — which features signals market for copy trading, along with Analyzzer algorithm.

cons:

Standard account spreads are expensive compared to industry leaders.

Average spreads are not published for the commission-based XM Zero account.

Is XM Group safe?

XM Group is considered average-risk, with an overall Trust Score of 90 out of 99. XM Group is not publicly traded, does not operate a bank, and is authorised by two tier-1 regulators (high trust), two tier-2 regulators (average trust), and one tier-3 regulator (low trust). XM Group is authorised by the following tier-1 regulators: Australian Securities & Investment Commission (ASIC) and the Financial Conduct Authority (FCA). Learn more about Trust Score.

Open a Demo Account here.

Promotions and Bonuses here.

MT4 / MT5 Trading Platforms here.

Android MT4 here.

3 notes

·

View notes

Video

youtube

Silver and Gold Trading

The actual buying or selling of Silver isn't involved, as this item is purchased/sold for speculative purposes as it were. This is the very same for different items and monetary standards. It is vital for note that statements are routinely accessible through this website our trading stage and our rates are exceptionally aggressive contrasted with other Forex brokers. -

Trading Techniques In the beyond quite a long while, the quantity of item trading ways has increased. For instance, numerous experienced traders use these techniques while trading items, like Silver. Forex users buys or sells Silver with the mean to hold the item for a while, year or more prior to shutting their activity.- Advantages There are numerous advantages of Silver trading that have created lately. With the sustainable turn of events and increasingly wide use of the web, Forex trading has become substantially more well known.

Besides, they have profited from the higher openness to Forex and they can learn about the global Forex market effortlessly through the schooling and training materials that are accessible on the web. Online gold trading doesn't promise to gangs genuine gold close by, as trading terminals allow both genuine and demo account to participate in gold and silver trading, without giving a different gold trading account. The act of trading gold doesn't need special training, as it is worked in same way as money trading works and the stage allows similar capabilities while trading gold, silver or monetary standards. Spot gold and spot silver are tradable items. The gold image is XAU, the silver image is XAG. As referenced above, spot trading is done in basically the same manner to Forex cash trading methods, where investors take short or long places of the metalsâEUR(TM) prices. There is no specific marketplace for spot gold and silver trading, thus trading is accessible 24 hours every day, 5 days per week. There are many reasons why traders pick spot metals:

- Broadening portfolio: Investors exploit spot trading as a functioning resource class in a greater and normal trading portfolio.

- Supporting open doors: Trading spot metals lay out great open doors for supporting in an extremely fluid market, with investors acquiring openness with restricted risk.

- Safe investment: Spot metal trading is a save paradise when the Forex trading market is in confusion and furthermore a security safety measure against the inflation.

3 notes

·

View notes

Text

How to Trade Gold and Silver Online as Spot Metals?

The spot gold and silver online in the markets are vast and filled with unpredictability. There’s also been a lot of volatility over the past few years, which makes it all the more important to be able to make informed trades on a daily basis. You can trade digital or physical metals as an investment piece or as a means of purchasing precious metals from sellers in person.

Here we take a look at how you can trade gold and silver online as spot metals. Buying and selling precious metals is one of the oldest ways humans have of making money. It’s also one of the most misunderstood ways of doing business. The latest currency war has only amplified this problem, with both sides seeing affected territories cede their market dominance — gold has become more prone to manipulation than any time in recent memory, while silver prices have spiked during periods of stress.

In this article, we take you through the basics of trading gold and silver online as spot metals in case you feel like it’s missing something. Keep reading to discover everything you ever wanted to know about buying and selling precious metals.

What are spot metals?

Spot metals are precious metals that are traded on the global market. The most popular spot metals are gold and silver, but other metals like platinum and palladium are also traded. All spot metals can be bought and sold online through forex brokers.

When you trade spot metals, you are buying or selling the actual metal itself. The price of each metal is based on supply and demand, as well as global economic conditions. Gold is often seen as a safe haven asset, so its price tends to rise when there is economic uncertainty. Silver is used in many industrial applications, so its price can be more volatile than gold.

You can trade spot metals with leverage, which means you only need to put down a small amount of money to open a trade. Leverage can help you make more profit from your trades, but it can also magnify your losses if the market moves against you. That’s why it’s important to use risk management tools like stop-loss orders when trading spot metals.

Benefits of trading spot gold and spot silver

You can buy and sell spot metals as an investment piece. This means you can purchase the coins and tokens at the price you want to pay for them. This can range from $50 for a single copy of coins on a website to $1,000 for a vehicle right on the trade page. You can also trade stocks or commodities as an investment piece. This means you can purchase stocks that have a specific market price, like gold, that has a corresponding market exchange rate. You can also purchase commodities like oil or agricultural products as an investment piece.

How to trade gold and silver online as spot metals

There are many ways to buy and sell gold and silver online. You can purchase the coins or tokens on exchanges like change.org or bitwise. You can also buy the coins or tokens in person at a physical store where the owner is willing to sell them to you. You can also buy and sell gold and silver privately in some places like Japan, South Korea, and China, where such transactions are not record-keeping.

What are the best trading platforms for gold and silver online?

Most trading platforms work with a variety of different platforms. You can use these platforms to purchase gold and silver from different online brokers. You can also use these platforms to store your trades and view your trades in real-time. To use a trading platform, you need to: – Make a trade. – View your trades. – Get your feedback.

How can I get started learning about trading gold and silver online?

You can begin by purchasing a few coins at a time at a physical store or marketplace. You can also purchase gold or silver tokens online. Once you have the coins or tokens, you can start trading.

Conclusion

There are many ways to buy and sell gold and silver online. You can purchase the coins or tokens in person at a physical store where the owner is willing to sell them to you. You can also buy the coins or tokens in person at a brokerage firm where the trading platform works with multiple brokerages. You can also check out respected online wreckage-tornados.com for bad investment news and reviews.

Originally Published on Shortkro

Source: https://shortkro.com/how-to-trade-gold-and-silver-online-as-spot-metals/

#trade gold and silver online#spot metals trading#trade spot metals#Invelso#Online gold trading platform

3 notes

·

View notes

Text

Forex Merchant Account Upgrade your Forex Business All Over the World

In the last 20 years, forex has become one of the most active and world's largest trading markets. Its per day transaction is approx 6.1 trillion US dollars. It is expected that the market is poised to grow by $1.94 trillion during 2022-2026.

The word forex understand as the forex exchange, which is the global market where foreign exchange is brought and sold. This global market is open 24 hours, five days a week, and on most public holidays. The forex market has two levels -

Currency trading between giant banks occurs on the global interbank market. However, there is also an over-the-counter market where individuals can trade currencies or attempt to profit from fluctuations in the exchange rate by using online platforms, brokers, and Forex dealers.

Forex traders must provide quick, simple, safe, and reliable ways to collect funds from their consumers, given the ongoing annual rise in Forex trading since 2001. It is one of the most unsafe industries, so finding a suitable payment service provider and merchant account is challenging.

For these unsafe businesses, it is compulsory to have the best merchant administration. It means that forex merchants ought to need the best forex trading merchant account for their forex business.

2 notes

·

View notes

Text

JRFX Legit Forex Brokers List: Your Key to Secure and Reliable Trading

In the fast-paced world of forex trading, finding a trustworthy broker is paramount. With countless options available, it's crucial to sift through the noise and identify those that offer security, reliability, and transparency. That's where JRFX comes in. Our Legit Forex Brokers List serves as your ultimate guide to navigating the complex landscape of forex trading, ensuring that you can trade with confidence and peace of mind.

Why Trust JRFX?

At JRFX, we understand the importance of due diligence when it comes to selecting a forex broker. With years of experience in the industry, our team of experts has meticulously researched and vetted numerous brokers to compile a comprehensive list of the most legitimate options available. We take into account factors such as regulatory compliance, trading conditions, customer support, and overall reputation to ensure that only the best brokers make it onto our list.

The Importance of Trading with Legitimate Brokers

Trading with a legitimate broker is essential for several reasons. First and foremost, legitimate brokers operate within the confines of established regulations, providing you with a level of protection against fraudulent activities and unfair practices. Additionally, legitimate brokers often offer enhanced security measures to safeguard your funds and personal information, giving you peace of mind as you engage in trading activities.

Key Features of Legitimate Brokers

So, what sets legitimate brokers apart from the rest? Here are some key features to look out for:

Regulatory Compliance: Legitimate brokers are regulated by reputable financial authorities, such as the Securities and Exchange Commission (SEC) or the Financial Conduct Authority (FCA). This ensures that they adhere to strict standards and protocols, providing you with a safe and secure trading environment.

Transparent Pricing: Legitimate brokers are transparent about their pricing structure, including spreads, commissions, and any additional fees. This allows you to make informed decisions and avoid any unexpected costs or hidden charges.

Secure Payment Methods: Legitimate brokers offer a variety of secure payment methods for deposits and withdrawals, including bank transfers, credit/debit cards, and e-wallets. They employ advanced encryption technologies to protect your financial transactions and personal data from unauthorized access.

Excellent Customer Support: Legitimate brokers prioritize customer satisfaction and provide responsive and reliable customer support services. Whether you have a question about your account or encounter a technical issue, you can count on prompt assistance from knowledgeable professionals.

Navigating the JRFX Legit Forex Brokers List

When you consult the JRFX Legit Forex Brokers List, you gain access to a curated selection of top-tier brokers that have met our stringent criteria for legitimacy and reliability. Each broker on our list has undergone thorough scrutiny and has been assessed based on a range of factors, including regulatory status, trading platforms, account types, and more.

In the ever-evolving world of forex trading, ensuring that you partner with a legitimate broker is essential for success and peace of mind. With the JRFX Legit Forex Brokers List as your guide, you can confidently navigate the market knowing that you're trading with a broker that prioritizes your security and satisfaction. Don't leave your trading journey to chance—trust JRFX ( https://www.jrfx.com/?804 ) to help you find the perfect broker for your needs.

0 notes

Text

Demystifying the Market: A Beginner's Guide to Trading with Trading DX

The world of trading beckons with the promise of financial freedom and exciting possibilities. But for newcomers, navigating the complex world of charts, technical jargon, and trading strategies can feel overwhelming. Fear not, aspiring trader! Trading DX is here to guide you on your journey with our comprehensive beginner's guide to trading.

Understanding the Basics: Setting the Foundation

Before diving into the world of charts and indicators, let's establish a solid foundation. Here are some key concepts to grasp:

What is Trading? Trading involves buying and selling assets like stocks, currencies, or commodities with the aim of profiting from price movements.

Trading Markets: There are various markets to explore, including the stock market, forex (foreign exchange) market, and the newly emerging cryptocurrency market.

Trading Accounts: To participate in trading, you'll need to open an account with a reputable broker. This online platform facilitates buying and selling of assets.

Trading Terminology: Familiarize yourself with basic terms like bid/ask price, order types (market vs. limit orders), and margin (borrowing funds to amplify profits and losses).

Building Your Trading Toolbox: Essential Skills

Now that you have a grasp of the basics, let's equip you with some essential trading skills:

Technical Analysis: Learn to "read" charts by studying price patterns, indicators, and market trends. This helps identify potential entry and exit points for your trades.

Fundamental Analysis: While technical analysis focuses on charts, fundamental analysis delves into the underlying factors impacting an asset's price. This includes company performance (for stocks) or economic data (for forex).

Risk Management: Trading involves inherent risk. Develop sound risk management strategies like stop-loss orders and position sizing to minimize potential losses and protect your capital.

Trading DX Resources: Equipping You for Success

At Trading DX, we understand the importance of equipping you with the right tools and resources. Here's how we support your trading journey:

Free Educational Content: Our YouTube channel (@tradingdx) offers a wealth of free educational videos covering various trading topics, technical analysis tutorials, and market insights.

Trading Glossary: We've compiled a comprehensive glossary of trading terms to demystify the jargon you'll encounter.

Trading Journal: Developing a trading journal helps you track your trades, analyze your performance, and identify areas for improvement. Download our free trading journal template!

Taking the First Step: Practicing with a Demo Account

Before venturing into real-world trading with your hard-earned money, it's crucial to hone your skills in a safe environment. Most brokers offer demo accounts, which simulate real-world trading with virtual funds. This allows you to:

Test your trading strategies: Experiment with different approaches and see how they perform in a simulated market environment.

Develop a feel for the market: Experience the emotions involved in trading and learn to make informed decisions under pressure (simulated, of course!).

Master the trading platform: Get comfortable with the functionalities and features offered by your chosen broker's trading platform.

Trading Psychology: Mastering Your Mind for Success

Trading encompasses not just technical skills but also managing your emotions. Here are some key psychological aspects to be aware of:

Discipline: Trading requires discipline to follow your strategy and avoid impulsive decisions based on emotions like fear or greed.

Patience: The market doesn't always move in your favor. Learn to be patient and wait for the right trading opportunities to present themselves.

Risk Management: Develop a healthy risk tolerance and stick to it. Don't let emotions cloud your judgment and lead you to overexpose your capital.

Common Beginner Mistakes to Avoid

The path of a beginner trader is paved with both successes and setbacks. Here are some common mistakes to be aware of and avoid:

Overtrading: Don't chase every trade. Focus on high-probability setups and avoid excessive trading activity.

Lack of Strategy: Don't enter trades blindly. Develop a trading strategy based on technical or fundamental analysis, and stick to it.

Ignoring Risk Management: Risk management is vital. Always use stop-loss orders and manage your position size effectively.

Following the Crowd: Don't blindly follow others' trading advice. Do your own research and make your own informed decisions.

Trading DX: Your Partner on Your Trading Journey

The world of trading is a marathon, not a sprint. Trading DX is here to support you every step of the way.

Also See;

best trading platform cryptocurrency

cryptocurrency on binance

online trading cryptocurrency

0 notes

Text

Best Regulated Forex Brokers 2023

Top-rated and best-regulated brokers for forex in 2023 with forexregulationinquiry. Our expert analysis and comprehensive research bring you a curated list of the most trustworthy and reliable brokers in the industry, ensuring your investments are safe and your trading experience is optimal. These brokers offer a secure trading environment, transparent practices, and adherence to industry regulations, ensuring your investments are in safe hands.

#stock broker#forex broker#forex market news#online forex market#forex market#forexregulationinqury#forex trading#business#online forex trading#stock market#regulated brokers for forex

2 notes

·

View notes

Text

Rentalzi Review (rentalzi.com Scam)

Is Rentalzi Legit?

After taking a look at their website, it shows that they do not fall under any regulating agency. That is a MAJOR RED FLAG!! That should be enough for you NOT to invest with them. And they also work with websites that offer "Automated trading software" which is another red flag, as this kind of websites are infamous for scamming schemes.

So, Rentalzi is just another unregulated forex broker, which means the customers aren’t protected, and there is highly likely they will get away with your hard-earned money and there will be no regulating agency to hold them responsible.

How does the scam work?

Usually, unregulated forex brokers work in the following way. They will call people to persuade them to make the initial minimum deposit. And they will try any conceivable method in order to make that happen. They will offer deals that sound too good to be true. Like we will double your initial deposit or you will make hundreds of dollars per day easily. Please don’t fall for anything they say!!! It is a SCAM! After making the initial deposit, they transfer clients to a smarter scammer, called a "retention agent", who will try to get more money out of you. Also, one thing we need to add here is: don’t trust the good Rentalzi reviews you might see online. They pay websites and services to improve their online reputation by posting good reviews about them.

Withdrawing funds

You should submit a withdrawal request ASAP, because your funds are never safe with an unregulated broker. And here is when things get tricky.

If you want to withdraw your money and it does not matter if you have profits or not, they will delay the withdrawing process for months. If they delay it for six months, you won't be able to file a chargeback anymore and your money is gone for good. It doesn’t matter how often you remind them or insist in withdrawing your money, you will NOT get them back. And if you signed the Managed Account Agreement or MAA, which is basically authorizing them to do anything they want on your account, they will lose all your funds so there won't be anything to request anymore.

How to get your money back Rentalzi?

If you already deposited your money with them and they refuse to give your money back, which is very likely to happen, don’t worry, it might be a way or two to get your money back. First of all, you need to keep the emails as proof that you have been requesting the money back from them but they don’t give it to you. Or they delay the process for too long, with the intention of not refunding your money.

0 notes

Text

🌐 WikiFX: Empowering Forex Traders Worldwide 🌐

📊 With the largest forex broker database, WikiFX empowers traders with comprehensive tools for informed decision-making.

🔍 Access comparison tools and community insights to navigate the volatile forex market safely and effectively.

📰 Read more about how WikiFX revolutionizes forex trading: https://www.wikifx.com/en/newsdetail/202402062684502897.html?source=SYEN3&syrc1

🛡 Stay protected from fraudsters and optimize your trading experience with #WikiFX!

🚀 Explore now: https://www.wikifx.com/en/?souce=syrc-gw4

0 notes