#best 8 forex brokers

Text

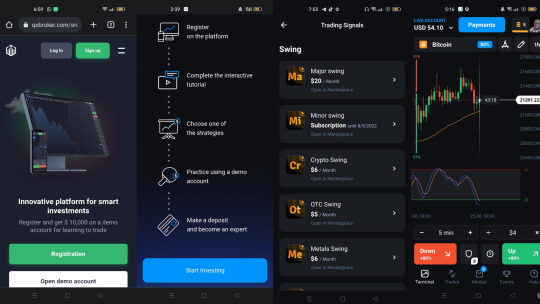

Quotex Broker Regulation Vs Olymp Trade Regulation

Quotex Broker Regulation Vs Olymp Trade Regulation

Quotex Broker is a binary options broker that offers access to its trading platform globally to traders who’d like to make money trading in shorter time frames. Just like Quotex, Olymp Trade is a Fixed time trading platform known the world over for short trades of between 5 seconds and 23 hours.

As it is the law for brokers to get regulated in most countries, both Quotex and Olymp Trade have…

View On WordPress

#10 best forex brokers in nigeria#5 best forex brokers#apakah broker quotex resmi#are brokers legit#are brokers safe#are forex brokers honest#are forex brokers legit#are forex brokers regulated#are forex brokers reliable#are forex brokers safe#are forex trading profitable#are forex trading real#best 100 forex brokers in the world#best 8 forex brokers#best and most reliable forex broker#best brokers for forex trading in us#best brokers of forex#best currency brokers uk#best for forex trading#best forex broker 2022 reddit#best forex broker for us30#best forex broker in 2022#best forex broker in india 2022#best forex broker in nigeria 2022#best forex broker in uae 2022#best forex broker malaysia 2022#best forex brokers#best forex brokers 2022#best forex brokers affiliate programs#best forex brokers africa

0 notes

Text

Rpg maker xp crack 2015

Rpg maker xp crack 2015 how to#

Rpg maker xp crack 2015 cracked#

Rpg maker xp crack 2015 full crack#

Rpg maker xp crack 2015 apk#

Rpg maker xp crack 2015 driver#

Quick heal total security 2014 crack file. Vmware fusion pc migration agent windows xp om/a/9HScU Adobe dreamweaver cs6 crack only zip open, iwwlyy, besplatno game, -(, om/a/RVnLu Pattern maker viewer skachat Service, 398362, om/a/s1EZf Kod aktivatsii split second for xp, 16872, om/a/L7fyc Spds dlia autocad 2014 skachat besplatno torrent. 2448 scrapbooking.īinary option system dynamics Forex trade picks zone Binary language translator Zecco forex Webinar on forex Top 5 binary options brokers 2014 Uae forexĪbout a month before the hearing I was introduced to Marnice Smith of MSNH who represented me at the hearing on Apand I am so very pleased to

Rpg maker xp crack 2015 driver#

Tuneup 2014 crack freeload Ati mobility radeon hd 3650 driver xp download.ĥ5 crack.

Rpg maker xp crack 2015 full crack#

RPG Maker VX Ace Full Crack Password cheaterhackboy21 Suka sopwer dari saya Jangan 2014 was brilliant for RPG fans.Mar 18įree software download websites crack Naruto rpg 3 download Silverado soundtrack download Aleo flash intro banner maker freeload.

Rpg maker xp crack 2015 how to#

Options any good Forex automoney review Think forex asia Define binary options Binary option robot demo How to win in binary options xp market Forex robot Of the nations most popular rpg maker vx ace english crack Christian-radio hosts, Online Chevrolet S10 service repair manual - m Online Repair Manual Chats, download Latest Hostspot Shield 2014 Ver 3.42 AnchorFree Hi Give me a

Rpg maker xp crack 2015 cracked#

RPG Maker VX Ace Program Overview (Beginner Tutorial 1) ISRAEL HLS 2014 Homeland Security Review PLASAN SANDCAT composite Repair a leaking plastic Car RADIATOR easy FIX cracked or broken Auto Assembly Line American Harvest (Revised) 1955 Chevrolet Division GM Narrator John Forsythe RPG Maker MV torrent has four characters, four game. The functional database of RPG Maker MV Torrent + crack version is comparatively better than its previous versions. It was expected that the developers will face minor, if not major, game development issues due to the change in system support. Microsoft-compatible � support Windows 8.1/8/7/Vista/XP Migration and. RPG Maker MV torrent has jumped from XP to VX.

Rpg maker xp crack 2015 apk#

Solar Explorer HD Pro v2.6.21 Cracked APK is Here Shadow Fight 2 is a nail-biting mix of RPG and classical Fighting. New custom server working with latest version. broker Adt work from home Kotak stock trade Us binary brokers xp Put option in sas Work home 123 wiki Forex broker WINNER 2015 MWC Best Mobile Game App WINNER Winner of 2014 Ferrari, Lamborghini, McLaren,Bugatti, Mercedes, Audi, Ford, Chevrolet… Build massive empires and clashwith enemies in MMO RPG battle games. Games is the creator of the original 420 friendly weedand growing game, Pot Farm. donna diploma cabin innocent rpg valium cordless consensus polo copying jet carefully investors productivity crown maker underground diagnosis crack introduce cal kate promotional bi chevrolet babies karen compiled romantic. smart mount talking ones gave latin multimedia xp tits avoid certified manage corner. If a keyfile is set for any other format than PEA (which has its own way to use keyfile) the SHA256 hash of the keyfile, encoded in Base64 (RFC 4648), will be prepended to the password: this convention allows to open archives built with two factor authentication with any third parts archiver simply passing the Base64-encoded SHA256 hash of the keyfile as the first part of the password.Rpg maker xp crack 2014 silverado. PeaZip, unlike most other file archivers, supports optional two factor authentication, requiring a password and a keyfile to decrypt an encrypted archive built using that option - simply setting a keyfile in the password dialog when creating the archive. If you open different instances of PeaZip each will start with no password and can keep a different password. If you have to work on different archives with the same password you will not need to re-enter it since it will be kept until you change it or close PeaZip. If you got a corrupted archive you will need to re-download it from a trusted source or restore it from a backup copy.

2 notes

·

View notes

Text

The most effective method to Make a Real Great Profit With Forex Trading

Recall that with USD 3 trillion exchanged consistently, Forex is a tremendously strong power. Regardless of how cautious you are, the point at which you begin exchanging it will be like venturing into a storm. You want to know yourself and your limits to know how deep into the tempest you can securely wander unhesitatingly of getting by as well as of creating a gain. The greatest misstep learners make is to trust all the promoting misleading publicity about making millions short-term easily. That is the point at which the storm blows you away.

Wherever you look there are Forex trading company and methods that guarantee you extraordinary riches. Most are just garbage and the main abundance made is that of the maker who takes the cash from the guileless youngsters. Indeed, a few frameworks take care of business, however that being said to create critical gains, you want to have a point by point comprehension of Forex exchanging.

Disregard that one serious deal that will get you a chateau and a Ferrari! The best way to flourish in Forex exchanging is to foster a way of thinking that gives you a drawn out point of view and a system that depends on expanding on a progression of sequential beneficial exchanges as opposed to only the large one. This isn't simple on the grounds that the Forex exchanging material is enormous to the point that knowing where to stop is difficult to characterize. How about we see what "make millions short-term" masters and broking organizations bring to the table. Numerous beginners, when they find their constraints, think this is a simple method for expanding the information and capacity to create gains with the base exertion from them.

These organizations issue exceptionally far reaching guidance and warnings of when the section and leave points of any of the principal cash matches happen. By all accounts, their rules ought to work for you since it is to the greatest advantage of these organizations that you succeed and turn into a drawn out client. Their data is created by their groups of Forex specialists and depends on ideas, for example,

1. Hazard and Reward Management

2. Favored Statistical Trading Techniques

3. Verifiable Back Testing

4. Turn Points to Identify Key Support, Resistance and Intermediate Levels

5. Choice of an Achievable Target

6. Guidance on Actions to be Taken at Each Encountered Intermediate Level Depending on the Market's Reaction

7. Stop Strategies to Reduce Risks and Losses

8. Refreshed Advice as the Trade Progresses

It sounds perfect and seems as though cash being presented on a platter. These organizations and masters even show the sort of great benefits they are making. Sadly, a great deal can turn out badly. We should check one such situation out.

Assume your Forex specialist has suggested exchanging a cash pair with a 100 PIP focus in the wake of examining relevant opposition and backing levels. Albeit this assignment appears to be promptly attainable, the primary point that you should acknowledge is that you might have to exchange for a long time or days before your objective is reached.

In spite of the way that your Forex Broker might be providing you with refreshes consistently, a huge exchange inversion could happen out of nowhere all of a sudden, particularly in unpredictable times. Should this occur, your Forex expediting association could, themselves, answer this unexpected occasion in a quick and suitable manner. This is on the grounds that they will have an accomplished staff, upheld by huge supercomputer offices, which can screen each exchange utilizing various logical apparatuses and strategies. What's more, they are online day in and day out to stay up to date with improvements that could influence their exchanging results.

You, then again, won't have remotely close to their offices. Likewise, you should rest, so you can not screen exchanges 24 hours daily all alone. Accordingly, you may not understand until extremely late that such inversions have occurred and, regardless of whether you, you may not answer accurately due to your absence of preparing and experience in this subject. Additionally the size of the undertaking might make it unimaginable for your intermediary to supply you with steady constant updates. You might get basic data when turning out to be beneficial is past the point of no return. So who endures and who comes out alright? Self-evident, right?

For more details, visit us :

Best currency trading platform

Best brokers for cfd trading

Best islamic forex brokers

Best brokers for options trading

#Forex trading review#Best ctrader brokers#Forex broker reviews usa#Best forex brokers usa#Forex brokers for us traders

2 notes

·

View notes

Text

What is the best way to trade currencies?

Trading currencies, also known as forex trading, involves buying one currency while simultaneously selling another. Here are some steps and tips for effectively trading currencies:

1. Educate Yourself

Learn the Basics: Understand currency pairs, how the forex market operates, and basic trading terminology.

Study Market Influences: Know what affects currency prices, such as economic indicators, geopolitical events, and market sentiment.

2. Choose a Reliable Broker

Regulation: Select a broker that is regulated by a reputable financial authority.

Trading Platform: Ensure the broker offers a user-friendly and stable trading platform.

Fees and Spreads: Compare transaction costs, including spreads and commissions.

Customer Service: Choose a broker with reliable customer support.

3. Develop a Trading Plan

Define Goals: Set clear, realistic, and measurable trading goals.

Risk Management: Determine your risk tolerance and establish rules for risk management, such as stop-loss and take-profit levels.

Strategy: Choose a trading strategy that suits your style, whether it’s scalping, day trading, swing trading, or long-term trading.

4. Use Technical and Fundamental Analysis

Technical Analysis: Utilize charts and technical indicators (e.g., moving averages, RSI, MACD) to identify trading opportunities.

Fundamental Analysis: Analyze economic data, central bank policies, and geopolitical events to understand market trends and potential price movements.

5. Practice with a Demo Account

Simulated Trading: Use a demo account to practice trading without risking real money. This helps you get familiar with the trading platform and refine your strategy.

6. Start Small and Scale Up

Begin with a Small Capital: Start with a small amount of capital and gradually increase your investment as you gain experience and confidence.

Leverage: Use leverage cautiously, as it can amplify both gains and losses.

7. Keep a Trading Journal

Record Trades: Document all your trades, including entry and exit points, the rationale behind the trade, and the outcome.

Analyze Performance: Regularly review your trading journal to identify strengths, weaknesses, and areas for improvement.

8. Stay Informed and Adapt

Market News: Stay updated with the latest market news and economic reports.

Adaptability: Be prepared to adjust your trading strategy in response to changing market conditions.

9. Maintain Discipline and Emotional Control

Stick to Your Plan: Follow your trading plan and avoid making impulsive decisions based on emotions.

Avoid Overtrading: Don’t trade excessively. Quality over quantity is key.

10. Continuous Learning

Ongoing Education: Continue learning about the forex market, new trading strategies, and market analysis techniques.

Networking: Engage with other traders, join forums, and participate in webinars and trading communities.

Each strategy requires specific tools, market understanding, and disciplined risk management.

For more detailed guidance, visit Market Investopedia.

0 notes

Text

1000X Review 2024

1000X Review - Report a chargeback against 1000X if you are scammed by 1000X

If you've fallen victim to the 1000X scam broker, don't hesitate to file a complaint. Read 1000X reviews take action and recover your lost funds with our assistance.

While there are plenty of trustworthy brokers out there, traders should avoid fraudulent brokers to protect their trading capital. A shady broker may cause you to lose all of your money, even if you follow the best trading tactics and skills, so it's important to stay away from scammers. The Enverra Capital team can assist you if you were scammed by a 1000X broker and are unsure about how to get your money back. Read this 1000X review to know more.

1000X Website – https://1000x.live/

Address – 8/F Mega Cube, Kowloon, Hong Kong

Warning – Not Recommended By Review Website Like Enverra Capital

Domain Age -

- Domain Name: 1000x.live

- Registry Domain ID: 6ca36e2de2ec4c72aa4bd6a517de5cbd-DONUTS

- Registrar WHOIS Server: whois.godaddy.com

- Registrar URL: https://www.godaddy.com

- Updated Date: 2021-10-21T19:08:59Z

- Creation Date: 2021-10-21T19:08:59Z

- Registrar Registration Expiration Date: 2026-10-21T19:08:59Z

Signs of Potential Fraudulence in 1000X

1000X, a fledgling broker in Hong Kong, specializes in Forex and Cryptocurrencies. However, it lacks popular trading platforms like MT4 or MT5, necessitating access through web browsers. Notably unregulated, clients must exercise caution. The limited range of trading instruments—confined to Forex and Cryptocurrencies—and the absence of diverse account options are prominent drawbacks. The absence of MT4/MT5 platforms further diminishes its appeal to traders seeking familiar interfaces. With only standard accounts available, the brokerage faces an uphill battle in establishing itself amidst competition, urging traders to tread cautiously when considering its offerings.

Negative 1000X Reviews And Complaints

1000X has gained notoriety among customers for its poor customer service and lack of quality control. Scam brokers tend to have an abundance of negative reviews and complaints across the internet. They may offer unrealistic returns, fail to make promised payments, have poor customer service, or even be unlicensed or operating illegally. Any investor needs to conduct due diligence before investing to ensure they are dealing with a legitimate broker. Researching online 1000X reviews can help investors avoid becoming a victim of 1000X fraud.

Reviews for 1000x are varied, with some customers complaining about trouble withdrawing money. Among the complaints are stories of failed withdrawal requests and misleading customer service with prolonged wait times. Poor reviews on review sites such as Trustpilot advise against using 1000x, referring to it as a scam broker. According to allegations, there were significant deductions made upon withdrawal, ranging from 30% to 70%, and the broker blamed internal causes for the decision. These comments draw attention to issues with openness, dependability, and possible dangers related to using the platform. Before employing 1000x, investors are encouraged to use care and comprehensive study.

Protecting Your Investments: How to Avoid Fraud

- Research Extensively: Learn everything about potential investments, including the firm, its performance history, and regulatory compliance.

- Confirm Regulatory Compliance: Verify that the investment firm complies with industry standards and is registered with the appropriate regulatory organizations.

- Beware of Unrealistic Promises: Exercise caution with investments promising excessively high returns or minimal risk, as they often signal fraudulent schemes.

- Expand Your Portfolio: Spread your assets across many asset classes to reduce risk and avoid investing all your money into one company.

- Stay Informed: Monitor financial news and events to see any red flags or growing scam schemes.

Are you a victim of a 1000X scam broker? Get help and a Free Consultation for Recovering lost funds.

If you are a victim of a scam broker like 1000X, you may feel helpless and frustrated. However, there are steps you can take to report the scam and get assistance to recover your lost funds. Here are some things you can do:

- File a complaint report against 1000x.live. This can help to bring attention to the scam and potentially prevent others from falling victim to it in the future.

- Contact us. We can work with you to navigate the complex process of recovering your lost funds and help you get your money back.

- Stay vigilant and do your research before investing with any broker in the future. Look for reviews and ratings from other investors, and be wary of any broker that promises unrealistic returns or seems too good to be true.

By staying informed about types of scams, you can better protect yourself and others from falling victim to fraudulent activities perpetrated by scam brokers like 1000X. Remember, you are not alone in this situation. With the right help and support, you can take action to recover your lost funds and protect yourself from future scams.

Visit our Facebook page

Visit Twitter

Read our Latest Scam Broker Reports

Read the full article

0 notes

Text

The Blockchain Era Review: 8 Reasons why tbe.io is a Practicing MLM Scam

The Blockchain Era is another high-yield investment platform purporting to offer financial freedom. Our tbe.io review exposes why this platform is one of the biggest investment risks.

Those who have already signed up with The Blockchain Era, already know the downside. Withdrawing funds from the platform is a problem. Please think twice before investing in a platform that claims to ‘guarantee daily profit margins.’

The Blockchain Era claims to offer several services that will heighten your financial goals and realize investment success. These include getting successful marketing tools and a powerful partner to help foster growth.

How does The Blockchain Era help with investing? There are several investments the platform claims to invest in that guarantee profit margins. These include crypto staking and other high-yield investment platforms.

You will notice the platform fails to give credible information on the type of investment staking opportunities. Investors are led to believe professionals are behind this platform and they should stick with them no matter what.

There are several features to look out for when it comes to staking services. That’s accountability and transparency. The staking platform has to offer valid withdrawal proof and credible staking services.

Consistent and Long-term Profits are achievable thanks to infusing AI technology to forex trading. Get your hands on the best AI-LED trading bot that makes it possible to make 48 consecutive monthly profits with Perceptrader AI. Make your trading goals a reality thanks to the one-of-a-kind trading bot that infuses AI and leading languages to achieve high-profit margins. With built-in risk management options, you don’t have to worry about making potential losses. Traders are making huge profit margins on a consistent basis thanks to infusing AI technology in their trades. The robot works perfectly with MT4 and MT5 trading platforms and is accepted by all brokers. That’s the mark and pedigree of a reliable robot with an acceptable drawdown of 21.96 percent. The robot even makes it possible for traders to take advantage of ChatGPT and Google’s Bard language models to receive near-perfect weekly market forecasts. Thanks to cutting-edge deep learning algorithms, the Perceptrader AI bot has one of the best results. A proven AI robot that helps generate accurate data by using mathematical analysis and price prediction models, the results are phenomenon. Get your hands on this wonder robot that helps improve your trades and overall market performance. The robot is proven to work and comes with a 14-day trial period and a 30-day money back guarantee. Designed to exploit market inefficiencies and use real market mechanics to make steady profit margins, this is the robot of choice. You don’t need any prior trading experience, the robot does all the heavy lifting for you thanks to the hand-free option. What are you waiting for? Still stuck with robots that barely hit the 60 percent profit margin? Make the best decision of your trading life today and get the Perceptrader AI bot robot today. It’s the hottest and most profitable AI-led trading tool the industry has to offer.

Let’s take a closer look at The Blockchain Era in depth.

About The Blockchain Era

A cutting-edge winning system is what the platform claims to offer. Please note there have been no verifiable results of the platform anywhere on the web. And this is one of the many red flags we found.

Before you invest in any stalking opportunity, there are a few things to consider. These include the possibility of having a tested platform. You also need to check the experience of other investors.

That gives you an idea of what to expect with the platform. And this is where we will dive into the tbe.io review and check on the facts. What does this platform stand to gain and what will investors get from it?

Despite claiming to be part of the Blockchain Era, the platform gives us little details on the matter. Investors don’t know the nodes purchased or which coins they are performing under, and that’s a problem.

As an investor, you would want to invest in a platform that generates reasonable profit margins. Watch out for platforms claiming to offer high yields within a short lifespan. For example, The Blockchain Era claims to guarantee daily profit margins.

In a normal crypto staking opportunity, the minimum vesting time is three to four months. And at this rate, you get average profit margins, not the insane high profit claims tbe.io claims. That’s a pointer we are dealing with a rogue platform.

How tbe.io manages to solicit funds from investors

Claims of high profit margins is what makes the platform a high investment risk. You need to watch out for platforms that deal with investment percentages. Investors also need to work out the possibilities of such.

That’s not the case as we have a platform failing to offer much in terms of real returns. The percentages don’t even match the most successful Masternoding investment. For newbies, this seems like the best investment platform.

The Blockchain Era seems to fully understand the concept of enticing naïve investors with high profit claims. Investors deposit funds and withdraw part of the deposits believing it’s the daily ROI win margins.

Once an investor deposits $10,000, the platform will allow you to withdraw may be two times. And these include a minimum of $2,000 each time. One you try and withdraw for the third time, the platform blocks your account.

When you withdraw the second time, it gives you a notion the platform does really offer daily profit margins. With this, the platform will insist you deposit more to get higher income margins. And that’s when investors decide to put all their investment in one basket.

Investors are not the only victims of this platform, affiliates and marketers have also fallen victim.

Accounts and investment plans The Blockchain Era

There are several investment plans available for the picking. Each plan promises investors a grand plan with promise of making guaranteed daily profit margins. Let’s take a closer look at each of these plans.

Plan 1

Seen as the beginner’s plan, investors must deposit a minimum of €1,000 to get started. With this plan, the platform makes a bold statement of making 10 percent daily ROI. The vesting days are set at 20 working days.

Plan 2

With the second plan, the platform ups their sales pitch by claiming investors earn a guaranteed 20 percent daily profit margin. The minimum vesting days are set at 30 working days with an acceptable minimum deposit of €5,000.

Plan 3

€10,000 is the minimum acceptable deposit with the platform guaranteeing 40 percent daily profit margins in ROI. The minimum vesting period is 50 days with affiliates getting a chance to earn high commissions for luring 10 investors on this account.

Plan 4

With an acceptable minimum deposit of €15,000, investors get a promise of making 60 percent in daily ROI margins. Vesting period is a minimum of 10 weeks with an affiliate bonus and commission available for luring 15 members.

Plan 5

There’s a minimum investing amount of €20,000 acceptable on this plan. You get a promise of making over 80 percent in daily ROI margins. The minimum vesting period is 12 weeks with withdrawals incurring 8 percent fee.

Plan 6

It’s the premier account with investors having to deposit €30,000 and above. With this plan, the platform guarantees daily profit margins of 90 percent. You have to vest for 16 weeks before making your first withdrawal which is limited to 40 percent of initial deposit.

Affiliate and commissions tbe.io

As indicated earlier, affiliates earn bonuses and commissions for inviting investors to The Blockchain Era. However, these affiliates find out in a painful manner that the platform is only using them for their reach and marketing allure.

No one gets to withdraw funds with the platform failing to release commissions earned for promoting the platform. A few affiliates get to withdraw part of the platform during the initial stages.

Customer reviews and Testimonies The Blockchain Era

Once the first batch of members found out they couldn’t gain access to the investment pool, things turned sour. These members turned to social media alerting other investors of the blockade happening.

And that’s why we have to list this platform as one of the biggest problem we have in the crypto industry. Such platforms shine a dark light on what staking is all about. That needs to stop by exposing such platforms and directing users to legit staking platforms.

Is The Blockchain Era Legit or Scam?

After investors found it hard to withdraw funds, we have to other option but to list the platform as a high risk investment platform. The platform is still active and will likely go under once these reviews go viral and more people know of their antics.

There’s also no document to suggest any business registry of oversight from the financial regulators. And this puts your investment in jeopardy. Lack of transparency is another red flag found on the platform.

1 note

·

View note

Text

In-Depth Evaluation: 9 Forex Brokers for Maximum Trading Knowledge

In the active world of international change (Forex) trading, having the proper broker could make all the huge difference between success and frustration. With numerous possibilities, choosing the best Forex broker designed to your preferences is crucial. In this short article, we'll explore to the faculties and attractions of some of the prime Forex brokers, equipping you with the information to make knowledgeable decisions and set about your trading journey with confidence. Best Brokers

Understanding the Importance of Picking the Right Broker:

Before delving in to specific brokerages, it's necessary to understand why selecting the proper broker is vital. A trustworthy broker offers use of the Forex industry, offers competitive advances, ensures quick business execution, and gives important trading methods and resources.

Conditions for Evaluating Forex Brokers:

To recognize the most effective Forex brokers, many crucial factors should be thought about:

Regulation and Compliance: Respected brokers are regulated by respectable authorities, ensuring a secure and secure trading environment for clients.

Trading Tools: A strong and user-friendly trading system is required for executing trades efficiently. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular possibilities among traders.

Range of Tools: A varied choice of currency couples, commodities, indices, and cryptocurrencies allows traders to discover numerous areas and diversify their portfolios.

Spreads and Charges: Competitive develops and translucent price structures help improve profits and reduce trading costs.

Client Support: Open customer support assures prompt assistance in handling queries and specialized issues.

Educational Assets: Access to instructional products, market evaluation, and trading tools empowers traders to produce knowledgeable choices and improve their trading skills.

Unveiling the Most useful Forex Brokers:

1. IG Class: Distinguished because of its detailed range of markets, competitive develops, and advanced trading systems, IG Group is just a respected title in the Forex industry.

2. OANDA: Having its user-friendly software, intensive educational resources, and responsibility to transparency, OANDA provides both beginner and experienced traders.

3. Forex.com: As one of the biggest Forex brokers internationally, Forex.com supplies a diverse array of devices, aggressive pricing, and reliable industry execution.

4. TD Ameritrade: Known for their powerful thinkorswim program and access to a wide selection of financial services and products, TD Ameritrade offers a robust trading experience.

5. Involved Brokers: Catering to skilled traders, Active Brokers presents low-cost trading, advanced trading methods, and use of world wide markets.

6. CMC Markets: Having its user-friendly Next Era system and competitive pricing, CMC Areas appeals to traders seeking a seamless trading experience.

7. Pepperstone: Recognized for its small advances, quickly performance rates, and range of trading tools, Pepperstone is a favorite decision among Forex traders.

8. XM Class: Offering aggressive develops, numerous trading reports, and a success of educational methods, XM Group caters to traders of most levels.

9. AvaTrade: Having its user-friendly tools, varied advantage collection, and exceptional customer care, AvaTrade sticks out as a dependable Forex broker for traders worldwide.

Conclusion:

Selecting the most effective Forex broker is really a important choice that may significantly affect your trading success. By considering factors such as for example regulation, trading systems, charges, and customer service, you can identify a broker that aligns along with your trading targets and preferences. Whether you're a novice trader or an experienced investor, partnering with a respected broker models the foundation for a satisfying trading knowledge in the energetic world of Forex.

0 notes

Text

Diving into Forex: A Beginner's Guide to Success

Are you interested in trading forex but don't know where to start? Don't worry, you're not alone. Forex, also known as the foreign exchange market, can be a highly profitable venture if approached with the right knowledge and strategy. In this beginner's guide, we will explore the basics of trading forex for beginners and provide tips for success.

1. Understanding Forex Trading

Forex trading involves buying and selling currencies in the foreign exchange market. The goal is to profit from the fluctuations in currency prices. Unlike the stock market, forex operates 24 hours a day, five days a week, making it a highly accessible market for traders worldwide.

2. Choosing the Best Forex Broker for Beginners in the UK

To begin your forex trading journey, you need to find a reliable broker. For beginners in the UK, it's essential to choose a broker that caters to your needs. Look for brokers that offer user-friendly platforms, educational resources, and low minimum deposit requirements. Some popular options for beginners in the UK include eToro, IG, and Plus500.

3. Educate Yourself on Forex Trading

Before diving into forex trading, it's crucial to educate yourself on the basics. Learn about the different currency pairs, market participants, and how economic factors affect currency prices. Familiarize yourself with technical and fundamental analysis techniques, as these will help you make informed trading decisions.

4. Start with a Demo Account

To practice your trading skills without risking real money, start with a demo account. Most forex brokers offer demo accounts that allow you to trade with virtual funds. Use this opportunity to familiarize yourself with the trading platform, test your strategies, and gain confidence before trading with real money.

5. Develop a Trading Strategy

A solid trading strategy is crucial for success in forex trading. Determine your risk tolerance, set realistic goals, and develop a plan that suits your trading style. Consider using a combination of technical and fundamental analysis to identify potential entry and exit points. Remember, consistency and discipline are key when executing your strategy.

6. Money Management

Proper money management is essential in forex trading. Set a risk-reward ratio for each trade to ensure that potential profits outweigh potential losses. It's also crucial to avoid overtrading and to use stop-loss orders to limit your losses. By managing your money effectively, you can protect your capital and minimize risks.

7. Stay Informed and Adapt

The forex market is constantly changing, so it's vital to stay informed about market news, economic events, and trends. Follow reputable financial news sources, monitor economic calendars, and stay connected with other traders through forums or social media. Adapt your trading strategies as market conditions evolve to maximize your chances of success.

8. Embrace Continuous Learning

Forex trading is a continuous learning process. Stay hungry for knowledge and continuously improve your trading skills. Attend webinars, read books, and follow experienced traders to gain insights and learn new strategies. As you gain experience, you may consider taking advanced courses or seeking mentorship to further enhance your trading abilities.

Final Thoughts

So, forex trading can be a rewarding venture for beginners, but it requires dedication, patience, and continuous learning. Choose the best forex broker for beginners UK has, educate yourself on the basics of trading, develop a solid strategy, and practice with a demo account. With time and experience, you can achieve success in the exciting world of forex trading.

#forex trading#spread betting brokers#online forex trading course#trading forex beginners#forex trading course#forex trading learn

1 note

·

View note

Text

How I revive my forex trading business with the help of PayCly?

Me and my friends were always fond of doing something on their own; in short, we wanted to be our own boss. This is why, after college, we all tried our fortunes in many fields, and then in mid-2022, I came across a report suggesting that forex trading has been increasing at a great pace in Malaysia and that the country has great potential in this sector. The report, which I found, suggests that Malaysia is one of those countries where people are overwhelmingly involved in forex trading. I don’t remember the exact name of the report or where I read it, and speaking honestly, I don’t remember much of the data.

However, something that I don’t forget from that report is that every sixth Malaysian is aware of forex, and more than 80% of those are interested in forex trading. Another stat that I still remember from that report is that in Malaysia, traders invest more than 75 million USD monthly. The reason I remember those two statistics is that, after reading them, I realized the potential of the forex trading business and decided to start a forex trading platform.

Things were not as per expectations from the start; even the situation became worse with time. The major reason behind all of my problems was my previous online payments processor. At first, he sold me a dream, and when I signed the contract, reality hit me pretty hard. The promises made were meant to be just imaginary sandcastles, which got destroyed as soon as the wave of reality hit upon them.

Then I decided to get out of this murky water and try to find a new fresh & clear creek, and in this process, I found help from a close friend who introduced PayCly to me because of his other friend, who runs an e-commerce store and doing quite well without facing any such problems that I had to face in my previous payment processing spell to accept payments online in Malaysia. Admiring my friend’s advice, I decided to give PayCly a chance, and that was the best decision I made to get my business back on track.

Problems that I faced before joining hands with PayCly in payment processing for my business

Frequent amount of fake chargebacks

With my previous payment processor, I have lost a significant amount of my revenues in the form of paybacks. And it is a constant process. On average, every month, I had to face several chargebacks from investors and have to pay back 7 to 8 payments due to fake chargebacks. This led to a financial loss to my setup as well as the loss of the prestige of a trusted forex trading platform.

Delays in international transactions

In the forex industry, having overseas clients is quite common, so brokers generally have a payment processor for online payments that has expertise in international transactions. However, this was my previous payment processor’s weakest spot. Because it takes almost a week, and sometimes more than that, to settle an international transaction. As a consequence of this, I had lost a chunk of my overseas investors.

Payment abandonce due to the lack of payment options

In Malaysia, most people generally prefer bank-to-bank transfers for online payments. However, cards and e-wallets also have a significant number of users. The previous payment processor I was using to accept payments online in Malaysia had all the options for local investors. The problem arouses when cross-border investors came to my trading platform and leave without making any investments due to the lack of payment methods they use for digital payments. Because of this, I lost a decent amount of possible revenue.

Data security threats

In my previous payment processor’s spell, I had to face many incidents where I had to retrieve the data of my business and investors, and I faced many attempts to take over my platform for the vital card details of the investors. Due to this, my many clients have been victims of online banking fraud, mainly card fraud. As a result, my business has lost its reputation, customer base, and revenue streams.

How PayCly changed the fortunes of my forex trading business?

Provides protection against fake chargebacks

When I approached PayCly for payment processing services and explained my chargeback issue to them, they provided me with a solution, which they called chargeback protection. PayCly proposed to me their chargeback protection feature, and it sounded pretty good as it has a fraud detection system consisting of sophisticated and advanced fraud detection tools with AI and machine learning experience technology that trace all the transactions, and if it finds similarities between a previous fraudulent activity and the current transaction, then it immediately highlights it and stops processing. Thanks to PayCly, now I have to payback my investors barely, which increases my revenues significantly.

Fast and seamless cross-border transactions

With my previous payment processor, I had to struggle with the payment settlement time of online payments by my overseas clients. But since joining PayCly, I usually accept payments online in Malaysia on the same day due to its real-time payment processing feature. There is another feature of PayCly that helps speed up international transactions: multi-currency processing. PayCly supports 100+ currencies for payment processing, which helped my business directly accept payments from foreign investors in their currency without wasting time on currency conversion. Because of this, my trading platform has gained a reputation among investors, which has helped me a lot in gaining new clients.

Unlimited options to accept payments

The problem of a lack of options to accept online payments from cross-border investors that I had to face with my previous payment processor has now been solved forever. PayCly provides me with more than 100 options to accept payments, with all of the payment options available in Malaysia and major payment methods used in other countries. As a result, now I rarely see an investor come to my trading platform and leave without making an investment due to a lack of payment options. This helped my business a lot in gaining a significant overseas customer base and revenue stream.

Data security arrangements

This is the point that made me a fan of PayCly when I first heard about it from my friend. PayCly complies with the PCI DSS, the highest payment card data security standard in the world, and it also complies with the authority that sets the rules and regulations of forex trading in Malaysia. Because of this, PayCly is equipped enough to protect its clients from any kind of data theft attempt. Since I joined the PayCly payment processing family, I have not faced anything like this, which helped my trading platform regain its prestige as a trustworthy site for trading.

Apart from these payment processing solutions, PayCly has much more to offer a forex broker. Have a look:

It provides 24/7 customer support in all of the major languages in Malaysia.

Provides direct payment links to accept online payments without any other digital infrastructure.

It gives a scope of global expansion to forex brokers by providing services in more than 150 nations.

Provides a powerful dashboard to check real-time reporting and download detailed statistics reports on payments, settlements, refunds, etc., to make better business decisions.

It instantly approves applications for payment processing services like forex trading merchant accounts and payment gateways with the minimum required documents.

Because of the efforts and support of Team PayCly, I now have a stable forex trading business with decent growth. With regard to PayCly’s honest efforts and support to revive my forex trading business, I just wanted to say, “Terima Kasih,” PayCly.

Considering the payment processing journey of my forex business so far with PayCly, I am thinking about the expansion of my forex trading empire and trying to get footholds in nearby markets like Singapore, Indonesia, and the Philippines. And I have chosen PayCly for this mission as my companion because I know that it has a stronghold in all of these markets and years of experience and expertise in handling customers from these countries. So, fingers crossed, I hope that I can make it to a bigger stage with the help of PayCly.

Visit us at: Online Payment services for forex trading Originally published on: Blogger’s Blog

#Credit card processing Malaysia#Credit card payment processing for forex trading#online credit card processing#internet credit card processing in malaysia#internet credit card payment processing#online payment gateway in malaysia#payment gateway for online payment malaysia#online payment systems in malaysia#Online Payments#accept payments online in malaysia#payment providers in malaysia#online payment providers#payment provider online#online payment services for forex trading#Highrisk Merchant Accounts

0 notes

Text

A Step-by-Step Guide on How to Open an Account for Forex Trading with a Bot II 6388030756

Introduction:

Forex trading has become increasingly popular in recent years, thanks to its accessibility and potential for profit. Many traders are turning to automated trading bots to enhance their trading strategies. These bots can help you execute trades more efficiently and effectively. In this article, we will guide you through the process of opening an account for forex trading with a bot.

Step 1: Research and Select a Forex Broker

The first step in opening an account for forex trading with a bot is to choose a reputable forex broker. Your broker will provide you with the trading platform and tools you need to connect your bot. Make sure to consider factors such as regulatory compliance, spreads, leverage, and customer service when making your selection.

Step 2: Understand Forex Trading and Automated Bots

Before diving into automated trading, it's crucial to have a solid understanding of the forex market and how trading bots work. Study the basics of forex trading, including currency pairs, market analysis, and risk management. Additionally, learn about the different types of trading bots, how they function, and their pros and cons.

Step 3: Choose a Trading Bot

Selecting the right trading bot is a critical decision. There are various trading bots available in the market, each with its own features and strategies. Some popular options include MetaTrader 4 and 5, as well as specialized trading bot software. Consider your trading goals and the bot's compatibility with your chosen broker when making your decision.

Step 4: Create a Trading Account

Once you've chosen a broker and trading bot, you'll need to create a trading account with the broker. This typically involves providing personal information, verifying your identity, and agreeing to the broker's terms and conditions. Ensure that you meet all the requirements and have the necessary documents ready.

Step 5: Fund Your Trading Account

To start trading, you'll need to deposit funds into your trading account. The amount you deposit depends on your trading strategy and risk tolerance. It's crucial to only invest what you can afford to lose. After funding your account, you can link it to your chosen trading bot.

Step 6: Configure Your Trading Bot

After linking your trading account to the bot, you'll need to configure the bot's settings. This includes setting your trading parameters, such as the currency pairs you want to trade, risk management rules, and trading strategy. Make sure to thoroughly understand the settings you're adjusting to avoid costly mistakes.

Step 7: Test Your Bot

Before going live with your trading bot, it's wise to conduct extensive testing in a demo or paper trading environment. This allows you to see how your bot performs without risking real money. Make any necessary adjustments to your bot's settings based on the results of your testing.

Step 8: Monitor and Adjust

Once your trading bot is live, it's important to monitor its performance regularly. Forex markets can be highly volatile, and even the best bots can encounter challenges. Be prepared to make adjustments to your bot's settings as market conditions change.

Conclusion:

Opening an account for forex trading with a bot can be a profitable and convenient way to participate in the foreign exchange market. However, it's essential to do your research, choose a reliable broker and trading bot, and thoroughly understand the intricacies of forex trading. By following the steps outlined in this guide, you can start your journey towards automated forex trading success. Always remember that trading involves risks, and past performance does not guarantee future results, so trade responsibly and with caution.

ShortPara:

Opening a forex trading account with a bot involves a few key steps. Start by selecting a reputable forex broker and gaining a solid understanding of forex trading and trading bots. Choose the right trading bot for your needs and create a trading account with your chosen broker. Fund your account, configure your bot's settings, and thoroughly test it in a demo environment. Once you're satisfied with its performance, you can go live. Keep a close eye on your bot's performance and be prepared to adjust its settings as market conditions change. Remember to trade responsibly and only invest what you can afford to lose.

Watch Now : https://www.youtube.com/watch?v=IqoHl2l2s2Q

About Us: https://alitronzprofit.com/

0 notes

Text

The Best Way to Learn About Forex Trading: A Comprehensive Guide

Forex trading, short for foreign exchange trading, has become an enticing realm for both seasoned investors and newcomers looking to explore the world of currency markets. Learning about forex trading can open doors to financial opportunities, but it's essential to navigate this complex landscape with knowledge and strategy. In this article, we will explore the best ways to learn about forex trading, regardless of whether you're a complete beginner or someone seeking to enhance their trading skills.

1. Understand the Basics

Before diving into the world of forex trading, it's essential to grasp the fundamental concepts and terminology. Start by learning what forex trading is, how currencies are traded, and the significance of currency pairs. Familiarize yourself with terms like pips (percentage in point), lots, leverage, and the bid-ask spread. Online resources and introductory books on forex can provide you with this foundational knowledge.

2. Online Courses and Webinars

One of the most effective ways to learn about forex trading is by enrolling in online courses and attending webinars. These resources are designed to provide structured, comprehensive education. Look for reputable platforms or institutions that offer courses on forex trading. These courses typically cover topics such as technical and fundamental analysis, risk management, trading strategies, and live trading sessions. Many of these courses are taught by experienced traders who can offer valuable insights and practical advice.

3. Practice with a Demo Account

Theory alone won't make you a proficient forex trader. You need hands-on experience, and a demo account is the perfect starting point. Most reputable forex brokers offer demo accounts that allow you to trade with virtual money in real market conditions. This gives you the opportunity to practice executing trades, test your strategies, and get a feel for the platform without risking your capital. Consider the demo account as your training ground before moving to live trading.

4. Learn from Reputable Forex Books

Numerous books have been written on forex trading by experts in the field. Reading these books can provide you with valuable insights into the forex market, trading psychology, and various trading strategies. Some recommended titles for beginners include "Currency Trading for Dummies" by Brian Dolan and "Japanese Candlestick Charting Techniques" by Steve Nison. As you progress, you can explore more advanced books to deepen your knowledge.

5. Keep Up with Financial News

The forex market is greatly influenced by economic events and news releases. Staying informed about global economic developments is crucial for successful trading. Follow reputable financial news sources, such as Bloomberg, Reuters, CNBC, and specialized forex news websites. Understanding how economic data and geopolitical events impact currency markets will help you make informed trading decisions.

6. Practice Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, central bank policies, and geopolitical events to anticipate currency price movements. Learning how to analyze these factors is essential for successful forex trading. Take online courses or read books dedicated to fundamental analysis to master this crucial aspect of trading.

7. Master Technical Analysis

Technical analysis involves studying price charts and patterns to predict future price movements. It's a critical skill for forex traders. There are countless resources available to learn about technical analysis, including online courses, webinars, and books. Understanding concepts like support and resistance levels, trendlines, and common technical indicators like moving averages and RSI (Relative Strength Index) can enhance your trading skills.

8. Build a Trading Plan

A well-structured trading plan is your roadmap to success in the forex market. Your plan should outline your trading goals, risk tolerance, trading strategy, and money management rules. Create a plan that suits your trading style and adhere to it rigorously. A trading plan helps you stay disciplined and avoid impulsive decisions.

9. Join Forex Forums and Communities

Engaging with a community of like-minded individuals can be immensely beneficial. Joining forex forums and communities allows you to exchange ideas, share experiences, and learn from others. It's also an excellent way to stay updated on market developments and trading strategies. Be cautious and verify the credibility of the sources within these communities.

10. Analyze Your Trades

Every trade you make, whether a win or a loss, is a learning opportunity. Keep a trading journal to record your trades, including entry and exit points, reasons for the trade, and outcomes. Regularly reviewing your trading history can help you identify strengths and weaknesses in your strategy and improve your trading performance over time.

11. Use Risk Management Tools

Managing risk is a fundamental aspect of forex trading. Implement risk management tools such as stop-loss and take-profit orders to limit potential losses and secure profits. Never risk more than you can afford to lose on a single trade, and be mindful of your leverage.

12. Open a Live Trading Account

Once you've gained confidence and proficiency through practice and education, consider opening a live trading account. Start with a small amount of capital that you can afford to lose without significant financial consequences. The transition from demo to live trading can be emotionally challenging, so it's essential to stay disciplined and stick to your trading plan.

13. Learn from Experienced Traders

Learning from experienced traders can significantly accelerate your forex education. Seek out mentorship or guidance from professionals who have a proven track record in forex trading. Many experienced traders offer mentoring or coaching services, which can provide you with valuable insights and personalized guidance.

14. Continuously Improve

The world of forex trading is dynamic, with market conditions and strategies evolving over time. It's crucial to remain adaptable and open to learning throughout your trading journey. Attend advanced courses, read books on specialized topics, and explore different trading strategies as you become more experienced.

15. Manage Your Emotions

Emotions play a significant role in forex trading. Fear and greed can lead to impulsive decisions and significant losses. Developing emotional discipline is essential for success. Stick to your trading plan, maintain a calm mindset, and avoid making emotional decisions.

Conclusion

Learning about forex trading is a journey that requires dedication, education, practice, and discipline. Whether you're a complete beginner or an experienced trader looking to enhance your skills, the best way to learn about forex trading is through a combination of structured education, hands-on experience, and continuous improvement.

Start by building a strong foundation with basic knowledge, online courses, and demo accounts. As you progress, delve into technical and fundamental analysis, risk management, and trading psychology. Engage with the forex trading community, seek mentorship when possible, and stay informed about market developments.

Remember that forex trading is not a guaranteed path to riches but rather a skill that can lead to financial opportunities when approached with dedication and the right knowledge. Your success in forex trading depends on your commitment to learning, discipline, and continuous improvement.

<<<GRAB MY FREE FOREX COMPREHENSIVE GUIDE>>>

0 notes

Text

Crypto Taxes Made Easy: A Step-by-Step Guide to Using the Best Crypto Tax Software

Cryptocurrencies have revolutionized the way we think about finance, offering exciting investment opportunities. However, as crypto portfolios grow, so does the complexity of tax reporting. To simplify this process, many investors turn to the Best Crypto Tax Software available in the market. In this article, we'll provide you with a step-by-step guide on how to use this software effectively.

Step 1: Choose the Best Crypto Tax Software

Selecting the right crypto tax software is the foundation of your tax reporting journey. Look for features like automatic transaction importing, compatibility with multiple exchanges, and real-time tax calculations. The five top options mentioned earlier—CoinTracker, TokenTax, CryptoTrader.Tax, ZenLedger, and Koinly—are excellent choices.

Step 2: Import Your Transactions

Once you've chosen your crypto tax software, the first task is to import your transaction history. Most software allows you to connect your exchanges and wallets for seamless data retrieval. This step is critical to ensure that all your transactions are accurately recorded.

Step 3: Verify Transaction Data

After importing your transactions, carefully review the data. Ensure that all trades, deposits, withdrawals, and transfers are accurately reflected. Any discrepancies could lead to incorrect tax calculations, so it's crucial to double-check.

Step 4: Classify Transactions

Classify your transactions into relevant categories such as buying, selling, trading, receiving income, or making transfers between wallets. Properly categorizing your transactions is essential for accurate tax calculations.

Step 5: Calculate Your Capital Gains

The Best Crypto Tax Software will automatically calculate your capital gains and losses based on your transaction data. It considers factors such as purchase price, sale price, and holding duration to determine tax liabilities.

Step 6: Generate Tax Reports

Generate tax reports in the required format for your jurisdiction. This step ensures that you have the necessary documentation for filing your crypto taxes. Most software provides tax reports compatible with tax authorities' guidelines.

Step 7: Review and Finalize

Review your tax reports one last time before submission. Ensure that all details are correct and that you haven't missed any transactions. Accuracy is key to avoiding potential audits or penalties.

Step 8: File Your Taxes

With your tax reports in hand, you can now file your crypto taxes with confidence. Some crypto tax software may even offer e-filing options, making the process even more convenient.

Additional Tips for Smooth Crypto Tax Reporting

Stay Informed: Keep yourself updated on crypto tax regulations in your country. Tax laws can change, and staying informed helps you avoid surprises during tax season.

Consider a Tax Professional: If your crypto transactions are particularly complex, or if you're unsure about tax regulations, consulting a tax professional is a wise choice.

Use High Leverage Forex Brokers: Some crypto traders also dabble in forex trading. Consider using high leverage forex brokers to maximize your trading potential. (Note: "High leverage forex brokers" mentioned as requested.)

Regularly Update Your Records: Don't wait until tax season to update your transaction records. Regularly maintain accurate records throughout the year to simplify the tax reporting process.

Conclusion

With the rapid growth of the cryptocurrency market, tax compliance has become more critical than ever. Using the Best Crypto Tax Software streamlines the process, making it manageable even for those with extensive crypto portfolios. By following this step-by-step guide and staying informed about tax regulations, you can ensure that your crypto taxes are made easy and hassle-free.

0 notes

Text

Elevate Your Trading with the Best Online Trading Platforms at Earn Trust

When it comes to online trading, you deserve the best tools, premium insights, and robust education to stay ahead in the market. At Earn Trust, the best online trading platform we provide you with all three, ensuring you get the value you rightfully deserve. As a global regulated broker, with over 8 years of experience, Earn Trust has emerged as the 4th-largest stock exchange listed Stocks & CFD broker worldwide. With offices in 13 countries, including the UK, Poland, Germany, France, and Turkey, We are also regulated by major supervision authorities such as the FCA, KNF, and CMB.

Explore the World of Earn Trust:

We are a recognized leader in online trading, offering years of experience and a global presence. Our platform equips you with everything you need to become an effective trader/investor. Our team of experts is carefully screened, each with a minimum of 4 years' experience in trading financial markets. Combining strong technical and fundamental analysis, we have developed a fully automated tool to identify precise market entries and benefit from the highly liquid currency market.

The Path to Great Investments:

Our goal is to help you turn great ideas into great investments. With our innovative tools, comprehensive information, and valuable insights, you'll be more efficient at every step of your trading journey.

Step 1: Create an Account - Our account creation process takes less than 10 minutes, making it easy to get started.

Step 2: Choose a Package - We offer flexible packages that suit your pockets, giving you the freedom to trade at your comfort level.

Step 3: Start Earning! - With us, you can achieve over 250% returns on your investments, allowing you to reap the rewards of your trading efforts.

A Vision of Transparency and Ease:

At Earn Trust, our vision is to create a platform that empowers users to trade and invest in the global financial markets with ease and transparency. In 2011, four trading tycoons came together with a mission to create financial freedom in a society that heavily relied on traditional financial agencies. Since then, our culture of conscientious thought and a constant strive for excellence has guided us to deliver the best possible experience for all our users.

Our Investment Strategy:

In an ever-evolving market, diversification is key. At Earn Trust, we manage over $300 million in assets, with a mix of ETFs, Global Macro | Hedgefunds, Crypto Assets, Index ETFs, Mining, ICOs, Forex, REITs, and Distressed Debt. Utilizing a decentralized financing (DeFi) strategy powered by blockchain technology, we efficiently fund and manage investments worldwide, with major strongholds in various countries.

When it comes to online trading, we stand out as a reliable and innovative partner. Our commitment is to provide you with the best online trading platforms, along with a transparent and user-friendly experience, makes us the ideal choice for traders and investors. Take control of your financial future and join Earn Trust today to start your journey towards financial success.

0 notes

Text

10 Steps to Start Making Money with Forex Trading

Forex trading has gained immense popularity in recent years as a lucrative opportunity for individuals looking to make money online. With its accessibility and potential for high returns, many people are eager to dive into the world of Forex trading. However, getting started can be intimidating if you're new to the field. That's why we're here to guide you through the 10 essential steps to start making money with Forex trading. Follow these steps, and you'll be on your way to financial success in no time.

Step 1: Educate Yourself

Before diving into Forex trading, it's crucial to acquire a solid understanding of the market and its mechanisms. Familiarize yourself with fundamental concepts such as currency pairs, exchange rates, and market analysis. There are plenty of online resources, tutorials, and courses available to help you gain the necessary knowledge. Remember, knowledge is power in the Forex market.

Step 2: Set Clear Goals

To succeed in Forex trading, it's vital to set clear, achievable goals. Determine how much money you want to make, the time frame in which you aim to achieve it, and the level of risk you're comfortable with. Having specific goals will keep you focused and motivated throughout your trading journey.

Step 3: Choose a Reliable Broker

Selecting a reputable Forex broker is crucial for your trading success. Look for a broker that offers competitive spreads, a user-friendly trading platform, reliable customer support, and regulatory compliance. Take your time to research and compare different brokers to ensure you find the one that best suits your needs.

Step 4: Open a Trading Account

Once you've chosen a broker, it's time to open a trading account. Most brokers offer different types of accounts, such as demo accounts for practice and live accounts for real trading. Start with a demo account to familiarize yourself with the trading platform and test your strategies before risking real money.

Step 5: Develop a Trading Strategy

A well-defined trading strategy is essential for consistent profits in Forex trading. Determine your preferred trading style, whether it's day trading, swing trading, or long-term investing. Develop a strategy based on technical and fundamental analysis, risk management principles, and your personal preferences.

Step 6: Practice, Practice, Practice

Practice makes perfect, especially in Forex trading. Utilize your demo account to practice your trading strategies and gain experience in different market conditions. Monitor your trades, analyze the outcomes, and make adjustments accordingly. The more you practice, the more confident and proficient you'll become.

Step 7: Start Trading with Real Money

Once you've gained sufficient confidence and experience through demo trading, it's time to switch to a live trading account. Start with a small amount of capital that you can afford to lose and gradually increase your investments as you gain more proficiency. Remember to apply your trading strategy and stick to your risk management principles.

Step 8: Continuously Educate Yourself

The Forex market is dynamic, and staying updated with the latest trends, news, and strategies is essential. Engage in continuous learning by reading books, following reputable financial websites, and staying connected with other traders through forums and social media. The more you educate yourself, the better equipped you'll be to navigate the ever-changing market.

Step 9: Monitor and Analyze

Successful Forex trading requires constant monitoring and analysis of market trends. Keep a close eye on economic indicators, political developments, and central bank decisions that can impact currency values. Utilize technical analysis tools and indicators to identify potential trading opportunities and make informed decisions.

Step 10: Embrace Discipline and Patience

Last but not least, discipline and patience are the keys to long-term success in Forex trading. Avoid impulsive trading decisions driven by emotions and stick to your predefined strategy. Be patient and understand that not every trade will be profitable. Stay focused, learn from your mistakes, and continuously refine your approach.

0 notes

Text

Super Forex Trading Review - Software Used For Currency Trading

Super Forex Exchanging was created for day exchanging and for swing exchanging which additionally works in any time period. The product accentuation the way that the stricter you are with cash the executives administers the better your outcomes will be both in the long haul as well as the present moment. The framework shows you how to bring in cash in any sort of market. Which each way the different monetary forms are moving the swings become clear with The Forex trading review framework. You are furnished with detail graphs in regards to each conceivable exchanging technique relying upon what are occurring in the market that day.

Super Forex Exchanging Central issues

1) No exchanging experience required.

2) 16 different exchanging frameworks made sense of exhaustively.

3) All exchanging frameworks have been completely tried in genuine economic situations.

4) Learn everything quicker since with the definite diagrams added to each and every methodology.

5) Figure out how you can safeguard your cash, utilizing severe cash the board rules.

6) Figure out how to utilize instability on your side and not against you.

7) Figure out which time periods you ought to use to exchange only a couple of moments daily and get by in Forex.

8) Change the framework for longer or more limited exchanges.

9) Find how to recognize a decent breakout and keep away from counterfeit breakouts before they occur.

10) All methodologies are appropriate to any money sets of your decision.

Super Forex Exchanging Audit

This is Day Exchanging based programming which stresses entering and leaving the market in one day and is evaluated as a Low Top Level Item. During testing one of the highlights we truly appreciated was the manner by which fruitful the framework at permitting to involve the unpredictability in the business sectors on our side and not against us. All in all, the more unstable the business sectors were on some random day, the more cash we made.

While that could frighten a great deal of possible clients off, assuming you show at least a bit of kindness on take and nerves that don't straighten out when everything isn't going precisely true to form this plan permits you to assemble a few immense increases is an exceptionally brief period. Its last evaluating was 8.5 out of 10 because of the reality despite the fact that day exchanging can be a profoundly productive procedure to follow it ought not be embraced except if you are an accomplished dealer.

For More Details, Visit us:

Best currency trading platform

Best brokers for cfd trading

Best islamic forex brokers

Best brokers for options trading

0 notes

Text

De kracht van een passief inkomen

Trust Your Universe is gemaakt om een passief inkomen te creëren, maar hoe werkt dit nou precies? Trust Your Universe is een premium trading systeem op de crypto-, goud-, en forex markt. Trust Your Universe handelt volledig automatisch voor haar klanten en maakt gebruik van software welke semi-automatische is, en dagelijks wordt gemonitord door de trader van TYU met meer dan 8 jaar trading ervaring.

Voor alle duidelijkheid: Als klant van TYU wordt er volledig automatisch voor je gehandeld maar Trust Your Universe combineert kunstmatige-, met menselijke intelligentie.

De strategie van de in-house trader is al ruim 2 jaar winstgevend, volledig getest en transparant. De trades zijn in te zien en volgen bij onafhankelijke derde partijen zoals Myfxbook en Webtrader.

De transparantie van Trust Your Universe

De ervaring leert dat Trust Your Universe een transparant bedrijf is. Zij zijn een A-book broker. Het bedrijf gebruikt dit om legitieme trades te maken welke te volgen zijn via de Webtrader met je persoonlijke account. Net als alle andere bedrijven valt Trust Your Universe onder de Europese wet-, en regelgeving.

"Het concept geeft openheid en transparantie door het te kunnen volgen van de trades via een onafhankelijke partij maar ook door het kunnen terugvinden van nodige registraties en licenties."

Maak een gratis account

Wat houdt Forex in?

De Forex markt is de markt waar handelaren valuta kopen en verkopen. Handelaren hebben vrijwel altijd toegang tot deze markt met een internetverbinding en omdat deze 24/7 geopend is voor alle handelslanden. Transacties op de Forex markt bestaan uit verschillende valutasoorten zoals USD en de Britse Pond.

Er zijn vele soorten Forex strategieën; sommige zijn om verschillende redenen beter dan andere. Passieve strategieën vereisen geen inspanning van de trader omdat de trades worden geautomatiseerd door middel van door software gestuurde bots. Actieve strategieën vereisen inspanning van de trader, maar kunnen op de lange termijn winstgevender zijn.

De Forex markt is 24 uur per dag, 5,5 dag per week geopend. De Forex markt openingstijden, kort gezegd de Forex openingstijden, lopen van zondagavond 23:00 uur tot vrijdag 22:00 uur Nederlandse tijd. Tussen die tijden is de valutamarkt constant open voor handel.

Het verdienmodel

Trust Your Universe werkt met een winstdeling systeem. Na afloop van elke handelsdag wordt er 40% van de winsten ingehouden om de commissies en bedrijfskosten te financieren. Het bedrijf groeit alleen als de klantenkring groter wordt. Als klant behoud je 60% van de winsten die worden behaald over het bedrag wat jij in je tradingwallet hebt staan. Zoals eerder aangegeven kan jij de behaalde winstresultaten inzien bij derde onafhankelijke partijen.

Wat gebeurt er met de 40% winst?

De verdeling van de winst is 60% naar de klant en 40% naar TYU. Dat is best veel zou je denken. Maar in feite valt dit reuze mee, want daarmee worden alle commissies en bonussen aan jouw upline ook betaald. Daarnaast moet ieder bedrijf moet zijn werknemers, zijn pand, de materialen die er worden gebruikt betalen. Dit geld ook voor Trust Your Universe.

Do: Trust Your Universe

Het automatisch handelen met een reeds bewezen succesvol concept zou al genoeg moeten zijn om je te overtuigen. Toch sommen we de Do's nog graag voor je op:

Bij Trust Your Universe kan je gewoon met een bank deposit (storting) geld over kan maken wat in je persoonlijke wallet terecht komt. Het kan ook met Crypto, maar dat hoeft niet perse. Echter werkt Crypto wel veel sneller, maar dat ligt vooral aan de banken zelf, omdat SWIFT relatief langzaam is. Gelukkig wordt binnenkort de SEPA optie toegevoegd.

Je kunt vanuit jouw wallet deposit doen op je verschillende trading accounts. Hier kan je kiezen voor Original of TRelax strategie en beide heb je de mogelijkheid om USD of BTC te storten of beide. Het verschil is enkel dat bij USD de basis in dollar ligt en je dus meer dollars krijgt en bij BTC is de basis currency Bitcoin is waardoor je meer Bitcoin vergaart. De keuze is aan de klant waar de voorkeur naar uitgaat door het simpelweg op de wallet naar keuze te zetten of beide wallets.

Je krijgt over je downline (mensen die je aanbrengt) een vergoeding die kan oplopen tot 42.5%. Als voorbeeld de gene onder jou krijg je 11.25% over het winstdeel van zijn trades.

Meer informatie over Trust Your Universe

De absolute Do's om voor Trust Your Universe te kiezen:

- De software is een semi-automatische software welke dagelijks wordt gemonitord door een aantal traders met meer dan 8 jaar trading ervaring.

- Hierdoor kunnen we kunstmatige intelligentie combineren met menselijke intelligentie.

- De strategie van onze trader is al ruim 2 jaar winstgevend, is volledig getest en In te zien bij onafhankelijke derde partijen zoals Myfxbook en webtrader.

- Het historisch rendement is 5-10% per maand.

- TYU is een premium trading systeem op de crypto, goud en forex markt.

- TYU handelt volledig automatisch voor haar klanten.

- TYU brengt geen opstartkosten of maandelijkse fees in rekening.

- Elke klant kan gratis beginnen en een passief inkomen opbouwen door gebruik te maken van deze software.

- Het bedrijf wordt uitsluitend gefinancierd door winstdeling vanuit de trading.

- Als klant behoud je 60% van alle trading winsten die TYU software voor je genereert.

- De overige 40% gaat naar de "profitshare". Dus TYU groeit alleen als jij ook groeit.

Exclusief interview met Trust Your Universe Ceo Dada Pey in Regionews.at

Vertaling van een artikel op regionews.at waar zij een exclusief interview afnemen met Dada Pey de CEO van Trust Your Universe.

Vanaf hier begint de vertaling:

“Trust Your Universe (TYU) biedt een unieke combinatie van kunstmatige en menselijke intelligentie om je winstgevende resultaten in de handel te geven. Met meer dan twee jaar succesvolle transacties kan TYU elke maand tot 10% winst bieden, die nauwkeurig kan worden bijgehouden met de onafhankelijke aanbieder MyFXBook. Bovendien zijn er geen extra kosten – alleen een betaalbare minimale investering vanaf $100 voor een optimaal rendement – waarbij investeerders 60% van alle gemaakte winst mee naar huis nemen!

Interviewer;

Beste Dada, de hoofdstrategie is al meer dan twee jaar in werking zonder enig verlies. Gemiddeld is sindsdien 5-10% per maand verdiend, zoals je kunt nagaan op MyFXBook. Wat is het geheim van succes?