#best forex brokers 2022

Text

Quotex Broker Regulation Vs Olymp Trade Regulation

Quotex Broker Regulation Vs Olymp Trade Regulation

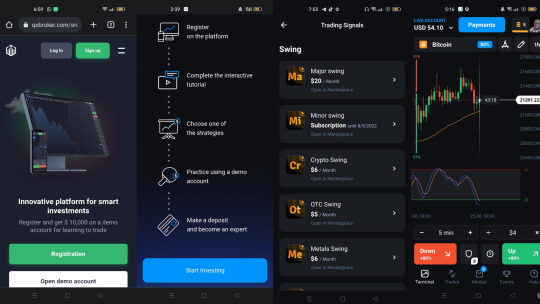

Quotex Broker is a binary options broker that offers access to its trading platform globally to traders who’d like to make money trading in shorter time frames. Just like Quotex, Olymp Trade is a Fixed time trading platform known the world over for short trades of between 5 seconds and 23 hours.

As it is the law for brokers to get regulated in most countries, both Quotex and Olymp Trade have…

View On WordPress

#10 best forex brokers in nigeria#5 best forex brokers#apakah broker quotex resmi#are brokers legit#are brokers safe#are forex brokers honest#are forex brokers legit#are forex brokers regulated#are forex brokers reliable#are forex brokers safe#are forex trading profitable#are forex trading real#best 100 forex brokers in the world#best 8 forex brokers#best and most reliable forex broker#best brokers for forex trading in us#best brokers of forex#best currency brokers uk#best for forex trading#best forex broker 2022 reddit#best forex broker for us30#best forex broker in 2022#best forex broker in india 2022#best forex broker in nigeria 2022#best forex broker in uae 2022#best forex broker malaysia 2022#best forex brokers#best forex brokers 2022#best forex brokers affiliate programs#best forex brokers africa

0 notes

Text

#forextrading#best forex trading brokers in 2022 usa#forex signals whatsapp#forex trading#forex trading brokers usa#forexstrategy#forex broker

0 notes

Link

Read a comprehensive guide on the top forex trading signals for 2022 and learn all about what they do and why you should use them.

#best online trading platform for beginner#cfd trading#cfds broker#forex broker#Forex Trading Signals for 2022#IronFX Review#IronFX Reviews#online forex trading

0 notes

Text

Forex Merchant Account Upgrade your Forex Business All Over the World

In the last 20 years, forex has become one of the most active and world's largest trading markets. Its per day transaction is approx 6.1 trillion US dollars. It is expected that the market is poised to grow by $1.94 trillion during 2022-2026.

The word forex understand as the forex exchange, which is the global market where foreign exchange is brought and sold. This global market is open 24 hours, five days a week, and on most public holidays. The forex market has two levels -

Currency trading between giant banks occurs on the global interbank market. However, there is also an over-the-counter market where individuals can trade currencies or attempt to profit from fluctuations in the exchange rate by using online platforms, brokers, and Forex dealers.

Forex traders must provide quick, simple, safe, and reliable ways to collect funds from their consumers, given the ongoing annual rise in Forex trading since 2001. It is one of the most unsafe industries, so finding a suitable payment service provider and merchant account is challenging.

For these unsafe businesses, it is compulsory to have the best merchant administration. It means that forex merchants ought to need the best forex trading merchant account for their forex business.

2 notes

·

View notes

Text

Top 7 Forex Trading Platforms 2022

An online stock trading platform that allows you to buy and sell stocks, cryptos & forex from your computer or smart phone. Also known as brokerage accounts, they are offered by financial institutions. When you open an account and make a deposit, it connects you with other buyers and sellers in the stock and bond markets, allowing you to trade stocks and bonds as well as investment vehicles other than ETFs.

While all brokers today allow customers to trade online (instead of calling traders on an exchange), some online stock trading platforms operate only online while others combine stock trading with traditional financial advisors who provide help and advice.

While every trading platform is different, stockbrokers can be divided into two broad categories: discount brokers and full service brokers. These Discount brokerage firms offer self-directed portfolios, which require a hands-on investing approach, meaning you pick your own stocks, bonds, and ETFs. With a discount broker, you have complete control over your securities and when you want to trade them. Full service brokers offer a more traditional approach. In addition, The online access to your investments, these companies often pair you with a financial advisor who can advise you on which stocks to buy or even manage an entire portfolio investment for you.

How to choose the best online trading platform?

Financial Goals: One of the most important questions you should ask yourself before you start investing is why in the first place. Are you trading to create a retirement account, or do you expect it to become a hobby? Be honest with yourself when answering this question. Because which platform you should choose will ultimately depend on your investment goals. If your goal is primarily to throw your keys into the system by investing in meme stocks, the platform should give you the freedom to do so. Online Trading Platform vs Robo Advisor

Trading Requirements: Day traders make many trades in a day. So they need a platform that is fast and reliable while enjoying the lowest possible trading commissions. Meanwhile, investors aiming to pay for a trip or gift can preferentially integrate with their bank account to deposit their spare cash directly into savings. Before deciding to use an online trading platform, make sure that it can meet your needs based on your trading habits.

Read Also: best ETFs Canada

Investment & Trading Style: How long you’ve been trading – or if you’ve ever traded – is an important factor in the type of platform you should choose. Beginners may want to start with an automated custodian that manages a diversified bond and stock portfolio for you. Those interested in learning how to actively trade should look for platforms that offer basic educational resources, responsive customer support, and allow them to practice trades before entering the real world. . Experienced traders can benefit from platforms that allow them to issue specific types of trades, have more sophisticated analytical tools and start trading as soon as possible.

Top recommended 7 Forex Trading Platforms in 2022

Xtreamforex – The best overall Platform

Xtreamforex stands out as our best overall platform for the trading. It is the most trustable ECN broker online. They offer an opportunity to trade on Forex, Commodities, and Crypto & Indices. You can open the account without initial cost. To start trading $5 micro account is available.

Moreover, Xtreamforex offers two most famous ways to start investment in the forex trading i.e. PAMM services & Copy trading services. If you have a single investment goal in mind, you can either manage the portfolio yourself or use these company’s investment options.

Pros: Cons:

Tight Raw Spreads available

PAMM & Copy trading Investment options

Provides MT4 & MT5 trading platform

Variety of accounts available for all the

needs & demands of all type of traders

Best Customer Support

Premium Education support available

No Swap & Commission fee

Cons:

a) Mobile app not available

b) doesn’t support futures trading available

c) No access to Mutual Funds

XTB: Best xStation5 platform provider

XTB is an award-winning CFD platform that supports Forex, Indices, Commodities, Stock CFDs, ETF CFDs and Cryptocurrencies. For Forex, XTB supports 48 currency pairs with low spreads. XTB clients can choose between trading on the xStation 5 or MT4 platforms. For leveraged accounts, this broker offers leverage up to 200:1.

Pros:

xStation 5 or MT4 platforms available

Trade on 3000+ trading instruments

Low spreads

Cons:

a) Fewer Forex pairs than some top competitors

b) No 24/7 Support

E trade: Best for Beginners

E-trade offers a wide variety of investment options, from simple online brokerage accounts designed for new investors to advanced trading and investment options for experienced traders There are no online trading fees for US-listed stocks, exchange-traded funds, and options, making it easy for new investors to start building their portfolios. There are also managed portfolios for those in need of further guidance with annual management fees starting at 0.3% of investment assets.

Pros:

Mobile app available

Manage portfolio with annual fees investment account 0.3%

Cons:

a) $500 minimum to open automated

b) High Margin rates

c) $0.50 per options contract if you make 30 or more trades per quarter

FP Markets: Provides 3 trading platforms

FP Markets offers a wide range of tradable assets through Forex, CFD and Stocks trading accounts. FP Markets supports MT4, MT5 and IRESS platforms and offers leverage up to 500:1. You can trade 45 currency pairs with competitive spreads or commissions.

Pros:

3 Trading platforms available

10,000+ trading assets

Cons:

a) Possible of additional fees

b) High Spreads

c) Minimum opening balance AU $200 required

Betterment: Best for Hands-Off Investors

Betterment is a roboadvisor that allows you to easily “set and forget” your investments. It may not be ideal for investors who want to actively trade stocks, but it is a great option for more conservative investors who are just starting out or not. Betterment’s investment platform takes the tedious work out of the equation for investors, allowing them to choose an investment strategy that works on autopilot.

Pros:

Commission free trading

Robust Trading tool

Cons:

a) No human financial advisor

b) No Robo-advisor option

FXCC: Best trading conditions

FXCC is a robo advisor that allows you to easily “set and forget” your investments. It may not be ideal for investors who want to actively trade stocks, but it is a great option for more conservative investors who are just starting out or not. Betterment’s investment platform takes the tedious work out of the equation for investors, allowing them to choose an investment strategy that works on autopilot.

Pros:

Commission free trading

Research & Educational Material

Cons:

a) High withdrawal fees via bank wire

Tickmill : Most regulated broker

Tickmill offers more than 80 CFD instruments for trading Forex, Indices, Commodities and Bonds through three main trading accounts known as Pro Account, Classic Account and VIP Account. They also offer a demo trading account and an Islamic swap free account.

Pros:

Multiple regulations & license

Competitive Spreads

Commission free trading accounts

Cons:

a) No MT5 trading platform available

b) Stock trading not available

Choosing the best Forex Trading platform

It is recommended to choose the forex trading platform according to your trading needs and strategies. But there are few common factors which have discussed above is must required for all types of traders. I have usually review the services of all the trading platforms available online & on the basis of the customer satisfaction, I have recommended these above best trading platforms which you should be considered in 2022.

4 notes

·

View notes

Text

FP Markets Reduces Spreads Across Key Asset Classes

June 11, 2024 at 09:49AM

In response to

increasing investor demand for more cost-effective trading solutions, FP Markets, a

global multi-asset Forex and CFD broker, has

further reduced its spreads across various trading instruments.

Christodoulos

Psomas, Head of Risk at FP Markets, expressed his enthusiasm for the move and

commented: ‘Through the continuous optimisation of our trading infrastructure,

we have successfully lowered spreads on several key instruments. Implementing

this change across our platforms has resulted in a more cost-efficient trading

environment for all our clients. We remain committed to maintaining and further

enhancing these conditions as our goal will always be the delivery of a

superior trading experience’.

As part of the

broker’s efforts to minimise trading costs for its growing client base, the

reduction in spreads applies to a selection of widely traded CFD products,

including Spot Gold (XAU/USD), a

range of Major and Minor Currency Pairs, as well as

major Equity Indices, such as the

Dow Jones Industrial Average (US30), the S&P 500 (US500), and the Nasdaq

100 (US100).

The FP Markets

website provides a

breakdown of the revised spreads and the affected asset classes.

With a selection of over 10,000 CFDs to choose from,

combined with low spreads, fast execution, a wide range of world-class Trading Platforms, such as MetaTrader, cTrader and TradingView, as well as a multi-regulated trading

environment, FP Markets continues to distinguish itself as the broker of choice

for investors across the globe.

About FP Markets:

●

FP Markets is a Multi-Regulated Forex

and CFDs Broker with over 19 years of industry experience.

●

The company offers highly competitive

interbank Forex spreads starting from 0.0 pips.

●

Traders can choose from the leading

powerful online trading platforms,

including FP Markets’ Mobile App, MetaTrader 4, MetaTrader 5, WebTrader, cTrader, Iress and TradingView.

●

The company's outstanding 24/7

multilingual customer service has been recognised by Investment Trends and

awarded ‘The Highest Overall Client Satisfaction Award’ over five consecutive

years.

●

FP Markets was awarded ‘Best Global

Forex Value Broker’ for five consecutive years (2019, 2020, 2021, 2022, 2023)

at the Global Forex Awards.

●

FP Markets was awarded the ‘Best Forex

Broker – Europe’ and the ‘Best Forex Partners Programme – Asia’ at the Global

Forex Awards 2022 and 2023.

●

FP Markets was awarded ‘Best Trade

Execution’ at the Ultimate Fintech Awards 2022.

●

FP Markets was crowned ‘Best CFD

Broker in Africa’ at FAME Awards 2023.

●

FP Markets was awarded ‘Best Trade

Execution’ and ‘Most Transparent Broker’ at the Ultimate Fintech Awards APAC

2023.

●

FP Markets regulatory presence

includes the Australian Securities and Investments Commission (ASIC) Financial

Sector Conduct Authority (FSCA) of South Africa, the Financial Services

Commission (FSC) of Mauritius, the Cyprus Securities and Exchange Commission

(CySEC), the Securities Commission of the Bahamas (SCB) and the Capital Markets

Authority (CMA) of Kenya.

●

FP Markets was awarded the Best Price

Execution Award at the Brokersview Awards 2024 Singapore.

●

FP Markets was awarded the ‘Best

Trading Experience - Africa’ at FAME Awards 2024.

For more

information on FP Markets' comprehensive range of products and services, visit https://www.fpmarkets.com/

This article was written by FL Contributors at www.forexlive.com.

0 notes

Text

Vittaverse Review 2024

Vittaverse Review - Report a chargeback against Vittaverse if you are scammed by Vittaverse

If you've fallen victim to the Vittaverse scam broker, don't hesitate to file a complaint. Read Vittaverse reviews take action and recover your lost funds with our assistance.

While there are plenty of trustworthy brokers out there, traders should avoid fraudulent brokers to protect their trading capital. A shady broker may cause you to lose all of your money, even if you follow the best trading tactics and skills, so it's important to stay away from scammers. The Enverra Capital team can assist you if you were scammed by an Vittaverse broker and are unsure about how to get your money back. Read this Vittaverse review to know more.

Vittaverse Website – https://vittaverse.com/

Address – First Floor, SVG Teachers Credit Union Uptown Building, Kingstown, St. Vincent and the Grenadines

Warning – Not Recommended By Review Website Like Enverra Capital

Domain Age -

- Domain Name: VITTAVERSE.COM

- Registry Domain ID: 2714223350_DOMAIN_COM-VRSN

- Registrar WHOIS Server: whois.squarespace.domains

- Registrar URL: http://domains2.squarespace.com

- Updated Date: 2023-09-21T19:34:28Z

- Creation Date: 2022-07-27T19:12:51Z

- Registry Expiry Date: 2024-07-27T19:12:51Z

Signs of Potential Fraudulence in Vittaverse

Offerings and Hidden Risks

Vittaverse's website offers an intriguing selection of trading products, all accompanied by attractive terms. The temptation of lucrative trades becomes evident with easy access to both the MetaTrader and cTrader platforms. The promising profit opportunities available inside Vittaverse's trading ecosystem are alluring.

Offshore Origins

Vittaverse Ltd., based in St. Vincent and the Grenadines, operates in an offshore jurisdiction known for its permissive regulatory structure. This firm is responsible for the creation of Vittaverse. While the temptation of investing through an offshore broker may initially appear appealing, it is critical to recognize the potential risks associated with such arrangements and proceed with care.

Lack of Transparency

A major worry with Vittaverse is its apparent lack of openness regarding Forex spreads. This uncertainty keeps traders in the dark, unable to adequately estimate the costs connected with their transactions. As a result, investors struggle to analyze possible earnings and develop educated strategies, limiting their ability to effectively traverse the market and make sensible investment decisions. Clear disclosure of such information is critical for creating trust and confidence among traders.

Beware the Allure of High Leverage

While Vittaverse has an outstanding leverage product with ratios as high as 500:1, the obvious advantages come with associated risks. Regulatory organizations in prominent financial hubs such as the United States, the United Kingdom, the European Union, and Australia have established rigorous leverage rules to safeguard investors from excessive risk exposure. Vittaverse's much larger leverage exceeds these norms, raising concerns about the possibility of huge losses for its clients. This raises important questions about the safety of clients' investments.

Are you a victim of Vittaverse scam broker?

If you are a victim of a scam broker like Vittaverse, File a complaint report against Vittaverse. This can help to bring attention to the scam and potentially prevent others from falling victim to it in the future.

Vittaverse Review Summary

Even if they have an appealing website and tempting incentives, it's critical to look under the surface and assess the possible risks. Investing with Vittaverse, or any other offshore broker for that matter, needs a cautious approach to protecting your hard-earned money and a thorough assessment of the potential risks.

By staying informed about types of scams, you can better protect yourself and others from falling victim to fraudulent activities perpetrated by scam brokers like Vittaverse. Remember, you are not alone in this situation. With the right help and support, you can take action to recover your lost funds and protect yourself from future scams.

Visit our Facebook page

Visit Twitter

Read our Latest Scam Broker Reports

Read the full article

0 notes

Text

Best Forex Brokers List 2024!

Best Forex Brokers List 2024!

Since you are on this page, we assume that you already know what forex trading is. We also assume that you are seeking help to find the best forex brokers for profitable currency trading. Good News! You are in the right place; we will be guiding you to find out the best broker for forex trading. Nevertheless, forex trading involves high levels of risk, which may result loss all of your investment, and that is why you must understand FX trading while you use the best FX broker. Otherwise, choosing a low-quality broker for forex may lead you to a loss. Therefore, trading with the best forex broker is highly essential for any level of the broker.

Definition of a Forex Broker?

A forex broker is a company that will provide all the necessary services to allow you to invest in the forex market, making it easy for you to buy and sell currencies. However, they are similar to stockbrokers. A forex broker will give you access to economic reports, news indicators about countries' economies, etc., that can affect currency prices. Further, they will also charge fees on transactions, but these are usually much lower than those charged by banks or investment companies who deal with traditional investments like stocks and bonds.

There are many different types of fee structures available on the market today. It's best if you understand exactly how popular forex brokers work before opening an account with any provider. Usually, the best broker for forex trading offers the major currencies (EUR/USD, GBP/USD, USD/JPY, and USD/CHF), minor pairs (cable crosses), and also a commodity.

Forex Trading is one of the most challenging and profitable investment ideas that are significantly increasing among the investors day by day in the world. Lots of forex brokers offer forex trading but finding the best forex broker is really hard. According to the statistics of Bank for International Settlements reports, globally traded in foreign exchange markets estimated $6.6 trillion per day in July 2022. In July 2022, it traded up to an average of $6.1 trillion per day.

We did vast research about every forex broker's fees (including spreads and commissions), trading platforms, customer support, trading educations, currency research, Trading Instruments, trustworthiness, and more. Here included the top 10 best forex brokers with a complete guide (Updated-2024) for trading. We recommended the list to choose any of these for beginners and experienced forex traders who are looking for the best forex broker.

#crypto#forexmoney#forexnews#forexprofit#forexsignals#forexstrategy#forexsuccess#forextips#forextrading#day trading#forexindicator#forex education#forex#forexscalping#how to trade forex#trader#investors#personal finance#investments#forexmarket#forexlifestyle#forexbroker#forexanalysis#forexmentor#forexpairs#technical analysis

#best forex brokers#forex account types#forex brokers by country#forex brokers comparison#forex reviews#forex trading platforms#free forex education#scam brokers list#trading resources#forex bonus & forex signals. we offer

0 notes

Text

Although you could absolutely perform forex trading without any forex trading brokers, there are certainly some benefits to using these brokers. The top benefits of forex trading brokers include:

#forex trading brokers usa#best forex trading brokers in 2022 usa#forex signals whatsapp#forex trading#business#forexstrategy#forex broker#forextrading#forex

0 notes

Text

How I revive my forex trading business with the help of PayCly?

Me and my friends were always fond of doing something on their own; in short, we wanted to be our own boss. This is why, after college, we all tried our fortunes in many fields, and then in mid-2022, I came across a report suggesting that forex trading has been increasing at a great pace in Malaysia and that the country has great potential in this sector. The report, which I found, suggests that Malaysia is one of those countries where people are overwhelmingly involved in forex trading. I don’t remember the exact name of the report or where I read it, and speaking honestly, I don’t remember much of the data.

However, something that I don’t forget from that report is that every sixth Malaysian is aware of forex, and more than 80% of those are interested in forex trading. Another stat that I still remember from that report is that in Malaysia, traders invest more than 75 million USD monthly. The reason I remember those two statistics is that, after reading them, I realized the potential of the forex trading business and decided to start a forex trading platform.

Things were not as per expectations from the start; even the situation became worse with time. The major reason behind all of my problems was my previous online payments processor. At first, he sold me a dream, and when I signed the contract, reality hit me pretty hard. The promises made were meant to be just imaginary sandcastles, which got destroyed as soon as the wave of reality hit upon them.

Then I decided to get out of this murky water and try to find a new fresh & clear creek, and in this process, I found help from a close friend who introduced PayCly to me because of his other friend, who runs an e-commerce store and doing quite well without facing any such problems that I had to face in my previous payment processing spell to accept payments online in Malaysia. Admiring my friend’s advice, I decided to give PayCly a chance, and that was the best decision I made to get my business back on track.

Problems that I faced before joining hands with PayCly in payment processing for my business

Frequent amount of fake chargebacks

With my previous payment processor, I have lost a significant amount of my revenues in the form of paybacks. And it is a constant process. On average, every month, I had to face several chargebacks from investors and have to pay back 7 to 8 payments due to fake chargebacks. This led to a financial loss to my setup as well as the loss of the prestige of a trusted forex trading platform.

Delays in international transactions

In the forex industry, having overseas clients is quite common, so brokers generally have a payment processor for online payments that has expertise in international transactions. However, this was my previous payment processor’s weakest spot. Because it takes almost a week, and sometimes more than that, to settle an international transaction. As a consequence of this, I had lost a chunk of my overseas investors.

Payment abandonce due to the lack of payment options

In Malaysia, most people generally prefer bank-to-bank transfers for online payments. However, cards and e-wallets also have a significant number of users. The previous payment processor I was using to accept payments online in Malaysia had all the options for local investors. The problem arouses when cross-border investors came to my trading platform and leave without making any investments due to the lack of payment methods they use for digital payments. Because of this, I lost a decent amount of possible revenue.

Data security threats

In my previous payment processor’s spell, I had to face many incidents where I had to retrieve the data of my business and investors, and I faced many attempts to take over my platform for the vital card details of the investors. Due to this, my many clients have been victims of online banking fraud, mainly card fraud. As a result, my business has lost its reputation, customer base, and revenue streams.

How PayCly changed the fortunes of my forex trading business?

Provides protection against fake chargebacks

When I approached PayCly for payment processing services and explained my chargeback issue to them, they provided me with a solution, which they called chargeback protection. PayCly proposed to me their chargeback protection feature, and it sounded pretty good as it has a fraud detection system consisting of sophisticated and advanced fraud detection tools with AI and machine learning experience technology that trace all the transactions, and if it finds similarities between a previous fraudulent activity and the current transaction, then it immediately highlights it and stops processing. Thanks to PayCly, now I have to payback my investors barely, which increases my revenues significantly.

Fast and seamless cross-border transactions

With my previous payment processor, I had to struggle with the payment settlement time of online payments by my overseas clients. But since joining PayCly, I usually accept payments online in Malaysia on the same day due to its real-time payment processing feature. There is another feature of PayCly that helps speed up international transactions: multi-currency processing. PayCly supports 100+ currencies for payment processing, which helped my business directly accept payments from foreign investors in their currency without wasting time on currency conversion. Because of this, my trading platform has gained a reputation among investors, which has helped me a lot in gaining new clients.

Unlimited options to accept payments

The problem of a lack of options to accept online payments from cross-border investors that I had to face with my previous payment processor has now been solved forever. PayCly provides me with more than 100 options to accept payments, with all of the payment options available in Malaysia and major payment methods used in other countries. As a result, now I rarely see an investor come to my trading platform and leave without making an investment due to a lack of payment options. This helped my business a lot in gaining a significant overseas customer base and revenue stream.

Data security arrangements

This is the point that made me a fan of PayCly when I first heard about it from my friend. PayCly complies with the PCI DSS, the highest payment card data security standard in the world, and it also complies with the authority that sets the rules and regulations of forex trading in Malaysia. Because of this, PayCly is equipped enough to protect its clients from any kind of data theft attempt. Since I joined the PayCly payment processing family, I have not faced anything like this, which helped my trading platform regain its prestige as a trustworthy site for trading.

Apart from these payment processing solutions, PayCly has much more to offer a forex broker. Have a look:

It provides 24/7 customer support in all of the major languages in Malaysia.

Provides direct payment links to accept online payments without any other digital infrastructure.

It gives a scope of global expansion to forex brokers by providing services in more than 150 nations.

Provides a powerful dashboard to check real-time reporting and download detailed statistics reports on payments, settlements, refunds, etc., to make better business decisions.

It instantly approves applications for payment processing services like forex trading merchant accounts and payment gateways with the minimum required documents.

Because of the efforts and support of Team PayCly, I now have a stable forex trading business with decent growth. With regard to PayCly’s honest efforts and support to revive my forex trading business, I just wanted to say, “Terima Kasih,” PayCly.

Considering the payment processing journey of my forex business so far with PayCly, I am thinking about the expansion of my forex trading empire and trying to get footholds in nearby markets like Singapore, Indonesia, and the Philippines. And I have chosen PayCly for this mission as my companion because I know that it has a stronghold in all of these markets and years of experience and expertise in handling customers from these countries. So, fingers crossed, I hope that I can make it to a bigger stage with the help of PayCly.

Visit us at: Online Payment services for forex trading Originally published on: Blogger’s Blog

#Credit card processing Malaysia#Credit card payment processing for forex trading#online credit card processing#internet credit card processing in malaysia#internet credit card payment processing#online payment gateway in malaysia#payment gateway for online payment malaysia#online payment systems in malaysia#Online Payments#accept payments online in malaysia#payment providers in malaysia#online payment providers#payment provider online#online payment services for forex trading#Highrisk Merchant Accounts

0 notes

Text

Who is the most successful broker forex 2022?

In the fast-paced and ever-evolving world of forex trading, determining the most successful broker for 2022 is a crucial endeavor. Traders seek a partner who not only stands out in terms of performance but also offers a comprehensive and reliable trading experience. Let's explore the key attributes that define success in the realm of forex brokerage this year.

Performance Excellence:

At the heart of any successful broker lies a track record of performance excellence. The best forex broker for 2022 will have demonstrated consistent success, providing traders with the tools and conditions necessary for effective trading strategies. A focus on low latency, minimal slippage, and competitive spreads are indicators of a broker's commitment to performance.

Innovative Trading Solutions:

Success in forex trading is often tied to innovation. The most successful broker of 2022 will offer cutting-edge trading solutions, embracing technological advancements to enhance the trading experience. Features like algorithmic trading, advanced charting tools, and mobile trading platforms contribute to a broker's innovative edge.

Customer-Centric Approach:

The success of a forex broker is inherently tied to its ability to prioritize the needs of its customers. The broker that stands out in 2022 will offer excellent customer support, ensuring timely and effective responses to queries. A user-friendly interface, educational resources, and tailored account options are additional hallmarks of a customer-centric approach.

Regulatory Compliance:

Trust is a cornerstone of success in forex trading, and regulatory compliance plays a pivotal role in building and maintaining trust. The most successful broker for 2022 will adhere to stringent regulatory standards, providing traders with the assurance that their funds and personal information are secure.

Global Presence and Accessibility:

Success on the global stage is another key criterion. The best forex broker of 2022 will have a robust global presence, allowing traders from various regions to access its services. A broker that offers multilingual support and a range of deposit and withdrawal options caters to a diverse and global clientele.

In conclusion, the most successful broker in forex for 2022 is a combination of performance, innovation, customer focus, regulatory compliance, and global accessibility.

As you explore the vast world of forex trading, consider JRFX not just as a platform but as your dedicated partner on this financial journey. With an unwavering commitment to performance, transparency, and your success, JRFX ( https://www.jrfx.com/?804 ) stands as a beacon of reliability in 2022. Elevate your trading experience with JRFX – where your ambitions meet exceptional support and cutting-edge technology.

0 notes

Text

Top Forex Trading Tips for 2023

As per recent reports, the forex market was found to value around $754 billion. The start to 2023 was also a successful one for the forex market. This made the forex experts predict the strength and increased popularity of currencies like the USD in the year 2023.

Are you someone who has been thinking of exploring the forex market for making a strong source of passive income? Keeping in mind the profits associated with foreign exchange and other factors like forex rebates, it is certainly a venture to explore. Let’s check out the forex trading trends for the year 2023.

FED is in the central point

The US inflation has surpassed historical records, and the Federal Reserve has begun to raise interest rates. The US economy has begun to improve, but the Federal Reserve has not lowered interest rates. Interest rates as of December 2022 are approximately 4.50%. The Fed will be in a difficult position if the US economy enters a worse recession, which would cause the USD to weaken in the foreign exchange market.

It is anticipated that the Fed may decide to discontinue raising interest rates as it has been doing recently if inflation declines in 2023. The Fed would tilt in this direction, which might support the USD. Nevertheless, this will only be feasible if the present rate of inflation (7.2%) declines below 2%, which is a rather tough possibility.

Inflation in Japan

The Japanese economy had a move toward inflation towards the end of 2022, reaching 40-year highs. Due to this, the Japanese Yen experienced 32-year lows and a protracted period of trading close to its support price level. The US and Japanese long-term bond yield differential will close in 2023, signalling the start of the yen’s bull market rebound.

A higher yen will also coincide with the Japanese economy’s shift from an ultra-loose to an ultra-easy monetary policy under the leadership of the country’s new governor. It is predicted that in 2203, the value of the yen would increase above 110 USD.

Robotic FX swapping

The final 2023 trend will be in the field of foreign exchange swaps, where technology will be crucial. The number of FX swaps has increased over the past few years, and 2023 is a crucial year to increase automation. As a result, the volume of swaps will expand and they will become more electronized, allowing banks to more precisely price FX swaps — even during periods of fluctuating interest rates.

In 2023, an increasing amount of data will be tracked in order to improve trade and execution procedures. More resilient systems are anticipated to be developed in order to produce more potent and easily available cloud-based FX applications that facilitate FX swaps.

With several currency pairings starting a bullish phase, the year 2023 appears to be prosperous for the forex market. Before the initial half of 2023, bullish reversals are anticipated for the currency pairings that were present in the bull market for the past year. For improved trading insights and a better trading experience, start trading with your best forex trading platform. Make the best use of forex rebates through a rebate broker.

Forex Traders

Forex Trading

0 notes

Text

7 Best Introducing Broker Programs To Join In 2022

In addition, clients have access to a wide variety of services that can help them make informed decisions about their investments. TMGM is an online broker that provides Forex and CFD trading via a great selection of powerful yet easy to use trading platforms loaded with high-quality trading tools. The broker has good trading conditions including tight spreads, low fees and rapid trade execution…

View On WordPress

0 notes

Text

The U.S. dollar: how will the Fed's key rate decision affect it?

June 11, 2024 at 09:34AM

[Key takeaways]

●

At its May meeting, the Federal Reserve maintained the target range for

the federal funds rate at 5.25%-5.50%, marking the sixth consecutive time it

has remained unchanged.

●

The likelihood of a Fed rate cut in September has increased

significantly, rising from 50% to 70% during the first week of June due to

indicators of a cooling labour market and downward revisions in labour costs.

●

The U.S. Dollar Index (DXY) is in a downtrend, currently testing the

104.00 level, with the potential to fall further if dovish statements from Fed

officials materialise.

On June 11–12, the Federal Open Market Committee

(FOMC) of the U.S. Federal Reserve will meet to decide on key interest rates in

the U.S. economy and issue the latest FOMC Economic Projections. The Fed is

expected to leave rates unchanged.

At its May meeting, the Federal Reserve kept the

target range for the federal funds rate unchanged at 5.25%-5.50% for the sixth

consecutive time. This decision was due to ongoing inflationary pressures and a

tight labour market, indicating a halt in progress toward achieving the 2%

inflation target this year.

The number of job openings decreased by 296,000 from

the previous month to 8.059 million in April 2024, marking the lowest level

since February 2021 and falling short of the market consensus of 8.34 million.

Additionally, private businesses in the U.S. added 152,000 workers to their

payrolls in May 2024, the lowest in four months and significantly below the

forecast of 175,000 and the downwardly revised 188,000 in April. Initial

jobless claims also increased more than expected last week, and labour costs in

Q1 were revised downward. Given these indicators of a cooling labour market and

the downward revisions in labour costs, the likelihood of a Fed rate cut this

autumn has increased significantly. During the first week of June, the

probability of a rate cut in September rose from 50% to 70%, as investors

anticipated a more accommodative stance from the Federal Reserve in response to

the softer economic data. However, the U.S. nonfarm payroll (NFP) report

released on Friday was stronger than expected, and the chances for a rate

decrease dropped to 56% (according to CME FedWatch tool).

‘The U.S. labour market is still strong but shows

signs of cooling, as do economic indicators and the pace of inflation. While

the market widely expects the Fed to keep the rate unchanged, there is a high

likelihood of hearing dovish statements from Fed officials, which could put

pressure on the U.S. dollar,’ said Kar Yong Ang, a financial market analyst at

Octa.

The U.S. Dollar Index (DXY) has been in a downtrend

since 16 April. The key level is 104.00; a break of this level could send the

price down to 103.80 and 103.50.

About Octa

Octa is an international broker that

has been providing online trading services worldwide since 2011. It offers

commission-free access to financial markets and various services already

utilised by clients from 180 countries with more than 42 million trading accounts.

They provide free educational webinars, articles, and analytical tools that

help clients reach their investment goals.

The company is

involved in a comprehensive network of charitable and humanitarian initiatives,

including the improvement of educational infrastructure and short-notice relief

projects supporting local communities.

Octa has also won

over 70 awards since its foundation, including the 'Best Educational Broker

2023' award from Global Forex Awards and the 'Best Global Broker Asia 2022'

award from International Business Magazine.

This article was written by FL Contributors at www.forexlive.com.

0 notes

Text

For five consecutive years, the Global Forex Awards – Retail has recognised and celebrated trailblazers in retail forex trading solutions. In this year’s highly competitive Retail sector, Exclusive Markets distinguished itself by securing the coveted title of “Best Partnership Programme – Global.” This achievement adds yet another jewel to the company’s extensive trophy cabinet, reiterating its commitment to excellence and innovation.

Exclusive Markets’ ongoing dedication to its clients and partners sets it apart within the industry. The company relentlessly pursues innovation, consistently introducing exciting, and accessible products and services to meet the demands of traders worldwide.

In response to receiving this prestigious award, Hemant Kumar, Chief Marketing Officer of Exclusive Markets, expressed his gratitude, saying, “It’s an honour for all of us here at Exclusive Markets to receive this prestigious award, which acknowledges and celebrates the sheer hard work and determination we put into creating long-lasting relationships with our clients and partners. This award recognises all the hard work, love, and dedication we put into providing our clients with exceptional service.

I would like to take this opportunity to thank our valued clients, who support us and serve as our biggest motivation to keep innovating and making exclusive investment opportunities accessible to traders from around the world. I would also like to express my sincere gratitude to every member of the Exclusive Markets team for their dedication and hard work.”

As a leading international provider of online multi-asset trading and related services, Exclusive Markets has amassed a wealth of industry-recognised awards, including “Leading Multi-Asset Broker-Asia at the Global Brand Awards 2022,” “Best Execution Broker” at the AtoZ Markets Awards 2021, “Best Overall PAMM Broker – Global,” and “Most Trusted Forex Broker – Global” at the Global Forex Awards 2022.

About Exclusive Markets

Exclusive Markets offers a powerful, secure, and transparent platform for investing in thousands of financial instruments. With an expert team committed to providing access to an extensive selection of powerful financial instruments, allowing traders to invest any way they like, Exclusive Markets continues to evolve and expand its products and services, always focusing on meeting its clients’ needs.

Guided by core values of innovation, trust, and customer-centricity, Exclusive Markets has emerged as a global financial powerhouse dedicated to making exclusive investment opportunities accessible to traders worldwide.

Exclusive Markets’ reliable trading technology, transparent fee structure, and competitive pricing enable traders to maximise their performance.

Learn more about Exclusive Markets

Source: https://www.fxempire.com/news/article/exclusive-markets-wins-best-partnership-programme-global-at-the-global-forex-awards-2023-1375734

0 notes

Text

Fantastic Four: The Most Popular Platforms of Different Market Sectors

When you want to buy clothes, you go to one of many shops. For example, if you want sportswear, you will go to a Nike or Adidas. You might go to Levi's if you are looking for denim clothing. If you want something premium, you might go to Louis Vuitton. It is the same in trading: different trading platforms have been created for different market sectors. Let’s discover four of them.

Crypto Market: Binance

Binance is the largest crypto exchange in the world by a wide margin. It offers a wide selection of altcoins available on its exchange, including its own coin, Binance Coin (BNB), which is currently the fourth most valuable cryptocurrency by market cap.

Binance has also launched several unique features. These include its own blockchain called BNB Smart Chain and various trading and investment tools: P2P, futures, Binance Earn and so on.

By the end of 2022, Binance had 128 million registered users. Its daily trading volume often exceeds $5 billion. Both metrics make it the most popular crypto trading platform.

Currency Exchange: IG

British broker IG is a world leader in online trading and an established member of the FTSE 250. The platform offers several trading markets: forex, indices, shares, commodities, and so on.

IG has won awards for Best Multi Platform Provider and Best Finance App from ADVFN International Financial Awards, and Best Trading App from Professional Trader Awards.

As of 2021, it had a market value of £2.9 billion and offered trading in 17,000 investment markets.

Metals: eToro

This platform supports several market sectors, one of which is precious metals. Etoro allows you to trade gold, silver, copper, palladium and other similar assets. You can make trades based on whether you think their prices will rise or fall.

Many prefer to invest in metals on eToro because of its popularity and a large selection of assets.

CFDs: Plus500

Plus500 offers a user-friendly platform that is accessible to both beginners and experienced traders. The platform offers a variety of trading tools, including charting, technical analysis, and newsfeeds.

Like eToro, this broker supports several assets simultaneously, but its strength is CFDs.

Do I Need to Have 4 Accounts?

So, each platform has its own specialization. Does this mean that in order to trade effectively and diversify your portfolio, you need to have accounts on all four platforms?

No. Eventually, trading and shopping are not the same. Switching between different accounts is inconvenient, and transferring funds between them is not profitable, since you lose money on commissions. So this might not be the best option.

It is more reasonable to create an account on FIXONE Meta Trader 5. This trading platform supports not 1, or even 4, but as many as 9 market sectors. This includes the already mentioned cryptocurrencies, currency exchange, metals and CFDs, as well as energy, futures, forex, indices and physical commodities.

FIXONE ON SOCIAL MEDIA:

Telegram | X (Twitter) | Instagram | Facebook

0 notes