#asset monitoring solutions

Explore tagged Tumblr posts

Text

Optimizing Operations with Remote Asset Monitoring Software

In today's fast-paced business landscape, companies need to maximize efficiency and minimize downtime. Asset monitoring solutions have emerged as a game-changer, allowing businesses to track and manage assets in real time. Remote asset monitoring software takes this a step further, providing enhanced visibility, predictive maintenance, and cost savings.

What is Remote Asset Monitoring Software?

Remote asset monitoring software is a digital solution that enables businesses to track, analyze, and manage physical assets from a centralized location. This software utilizes IoT sensors, cloud computing, and data analytics to provide real-time insights into asset performance, location, and condition.

Key Benefits of Remote Monitoring Software

Real-Time Asset Tracking - Remote monitoring solutions provide real-time location data, ensuring businesses can track assets across multiple locations, reducing the risk of loss or theft.

Predictive Maintenance - By analyzing asset performance trends, businesses can predict potential failures and schedule maintenance before a breakdown occurs, minimizing downtime and repair costs.

Operational Efficiency - Automated monitoring eliminates the need for manual inspections, freeing up resources and improving productivity.

Cost Reduction - Preventive maintenance and optimized asset utilization help reduce operational costs while extending the lifespan of critical assets.

Compliance and Reporting - Remote monitoring software ensures compliance with industry regulations by maintaining accurate logs and reports, reducing the risk of penalties and operational disruptions.

Industries Benefiting from Asset Monitoring Solutions

Manufacturing – Tracks equipment performance and schedules maintenance to prevent downtime.

Healthcare – Monitors medical equipment and ensures compliance with safety standards.

Logistics and Supply Chain – Provides real-time tracking of shipments and inventory management.

Energy and Utilities – Enhances efficiency in monitoring power grids, pipelines, and remote infrastructure.

Choosing the Right Remote Asset Monitoring Software

When selecting a remote monitoring solution, consider the following factors:

Scalability – Ensure the software can grow with your business.

Integration – It should seamlessly integrate with existing systems.

Customization – The software should be adaptable to specific industry needs.

Security – Strong data encryption and cybersecurity measures are essential.

Conclusion

Asset monitoring solutions, especially remote asset monitoring software, are transforming the way businesses manage their assets. By leveraging real-time data, predictive analytics, and automation, companies can optimize operations, reduce costs, and enhance efficiency. Investing in the right monitoring solution ensures long-term success in an increasingly digital world.

0 notes

Text

#iot#iot solutions#iot platform#iot remote monitoring#iot integration#iot development#iot asset tracking

0 notes

Text

Get expert MEWP asset management, maintenance, repairs & rental solutions. Maximize uptime, ensure safety & reduce costs with Equipr’s MEWP services! Equipr is your trusted partner in total asset management, offering comprehensive solutions that keep your MEWPs operating smoothly, efficiently, and profitably.

#Mewp equipment manufacturers#mewp training#mewp training certificate#mewp operator training#mewp training near me#MEWP Asset Management#Asset Management Solutions#Repair Services#Yard Services#maintenance services#Remote Monitoring System

0 notes

Text

Modern portfolio management companies focus on optimizing investments through strategic asset allocation, risk management, and diversification. They utilize advanced technology, provide personalized financial solutions, and ensure regular portfolio monitoring and rebalancing. These companies emphasize transparency, ethical practices, and adapting to market trends to meet client needs while driving financial growth.

#portfolio management#investment strategies#asset allocation#risk management#financial planning#diversification#portfolio monitoring#investment solutions#transparency#modern portfolio#market trends#financial growth#portfolio rebalancing#ethical investments#personalized finance#wealth management#investment goals#advanced technology#market analysis#portfolio optimization

0 notes

Text

Understanding the Importance of Water Utility Surveys

Water is a fundamental resource that sustains life, and the infrastructure supporting its supply and distribution is a critical component of urban and rural development. A water utility survey plays a pivotal role in ensuring the efficient and sustainable management of water resources.

Learn more at https://www.cyberswift.com/blog/water-utility-solution-detailed-overview/

#3D mapping for water utilities#Digital mapping for water utilities#GIS-based water utility mapping#Hydrographic utility surveys#Remote sensing for water pipelines#Surveying for water utility systems#Underground water pipeline surveys#Utility mapping for water projects#Water distribution network survey#Water distribution system assessment#Water infrastructure surveys#Water leakage detection surveys#Water pipeline mapping#Water pipeline monitoring solutions#Water supply network survey#Water utility asset management#Water utility inspection surveys#Water utility network monitoring#Water utility survey services

1 note

·

View note

Text

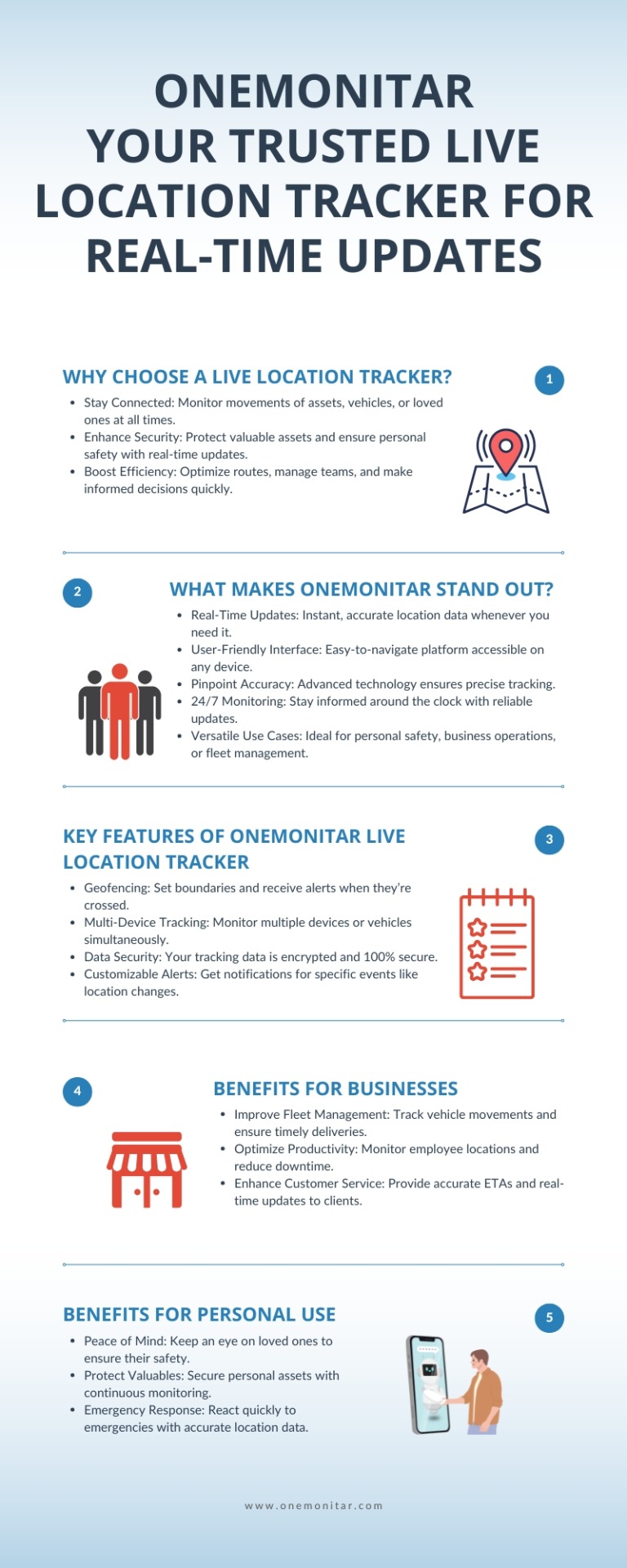

ONEMONITAR Live Location Tracker

Discover the benefits of real-time tracking with ONEMONITAR! This infographic showcases how ONEMONITAR helps you monitor assets, vehicles, and loved ones with precision and ease. Learn about its standout features, including geofencing, 24/7 updates, and multi-device tracking, along with tailored solutions for personal and business use. Stay secure, optimize operations, and gain peace of mind—experience the ultimate location tracking solution today!

#live location tracker#ONEMONITAR#real-time tracking#GPS tracking#location monitoring#asset tracking#fleet management#geofencing#personal safety#business tracking#location updates#secure tracking#team management#GPS solutions#real-time updates#tracking app#tracking device#GPS technology#employee monitoring#live GPS tracker

0 notes

Text

Revolutionize Your Parking with Intelligent Management Solutions

Discover how our Parking Management Software can transform your parking facilities. From automated monitoring to detailed analytics, ensure optimal utilization and revenue generation with minimal effort.

#Parking Management Software#Automated Parking Solutions#Parking Operations Optimization#Smart Parking System#Parking Facility Management#Real-Time Parking Monitoring#Parking Asset Management#Parking Revenue Control#Parking Space Utilization#Parking Software Integration#Parking Analytics and Reporting#Intelligent Parking Solutions#Efficient Parking Management#Parking System Automation#Seamless Parking Operations

0 notes

Text

Smart Shipping Containers Market Will Touch USD 15,341.5 Million by 2030

The smart shipping container market was USD 3,971.2 million in 2022, and it will touch USD 15,341.5 million, propelling at a 18.4% compound annual growth rate, by 2030.

The growth of the industry is mainly attributed to the temperature regulation, enhance security measures, and real-time GPS tracking capabilities these containers offer. Moreover, because of the quick technological advancements in AI, IoT, big data analysis, and communication, the industry will further advance in the years to come.

Based on offering, the hardware category accounted for the largest smart shipping container market share, approximately 50%, and it will advance at the highest growth rate in coming years, because of the widespread adoption of various components for tracking and monitoring applications.

Based on technology, the industry is dominated by GPS due to its role in package monitoring and tracking.

Moreover, the quick implementation of the Bluetooth Low Energy (BLE) technology is because of the rising IoT devices implementation, which necessitates effective communication.

Additionally, the long-range wide area network (LoRa WAN) category will advance at the highest rate in the years to come. This is mainly because of the benefit of LoRa WAN as compared to other technologies, for instance, BLE and Wi-Fi.

Based on vertical, the food & beverage category will advance at the highest compound annual growth rate, of over 20%. This is attributed to the growing requirement for packaged food and perishable. Individuals are shifting their focus towards ready-to-eat food from homemade food, which is boosting the requirement for smart marine transportation solutions for edibles.

In 2022, the smart shipping containers industry is led by Europe, with a share of approximately 40%. This is because of the existence of numerous major industry players providing enhanced software and IoT sensors integrated hardware for effective analytics of data.

#Smart Shipping Container#Maritime Logistics#IoT Integration#Telematics#Supply Chain Efficiency#Global Market#Container Tracking#Remote Monitoring#Data Analytics#Industry 4.0#Innovation#Sustainable Shipping#Fleet Management#Real-time Visibility#Asset Security#Connectivity Solutions#Market Trends#Containerization#Emerging Technologies#Logistics Optimization

0 notes

Text

Effective Solutions for Temperature Monitoring by Zenatix

Temperature monitoring, as offered by Zenatix, is a cutting-edge solution that ensures precise and real-time tracking of environmental temperatures. Zenatix employs advanced sensors and IoT technology to gather data, enabling businesses to maintain ideal conditions for products, equipment, and facilities. This proactive approach enhances efficiency, minimizes energy consumption, and prevents costly temperature-related issues, making Zenatix a reliable partner for temperature control and management.

#energy analytics#building automation system#energy management system#building management system#energy savings#energy management#iot companies in india#remote asset management#energy management solutions#iot bms#temperature monitoring

0 notes

Text

I use AI upscaling to help with my photo restorations. And it is the one use of generative AI that I think has serious merit. I use Topaz so it is ethically trained on licensed images. It helps me preserve memories and give people photos of their loved ones with a clarity they have never seen. They get a much better sense of what their grandpa looked like when he was young.

But AI upscaling is not a push button solution. And I don't think it will be for a long time, if ever. It's part of a larger workflow. It doesn't save me time or effort. In fact, it adds quite a bit of time to the restorations.

Sometimes I have to upscale the background and people separately. Often I have to adjust the contrast and detail on people's faces so the AI renders them accurately. I have learned how to set things up for success before the AI does its thing. And sometimes there is a lot of trial and error to get a non-nightmare result. Each try can take several minutes to render. There are several algorithms to choose from, several intensity sliders, and once the upscale is at a place I am happy with, I have to use traditional techniques to make the people not look like wax figures. I use things like custom film grains and LUTs to make the pristine AI result look like an old photo again.

In other words, I care about the photos I'm restoring.

I saw people talking about restoring Star Trek: Deep Space Nine. It's a very difficult problem due to how the show was produced. The live action was captured on film—which can be re-scanned at a higher resolution. But the digital effects were all done on analog 480p video tape. Not only would they need to be re-rendered but they would also have to be recomposited. Odo's shapeshifting is especially tricky. There isn't an economical way to remaster the show. TNG was only possible because they filmed practical assets for most of the VFX. They still had to redo all the compositing and it was very costly just to do that.

AI could be the answer. But only if the studio is willing to see it as a tool to be used in conjunction with artists and not a push button solution. Every frame needs to be checked. Different scenes will need different techniques to upscale them properly. And some scenes will just need to be cleaned up manually with traditional tools.

Upscaling to 1080p or 4K is often a mistake. The more extra pixels you try to add, the harder it will be to get a natural result. I think 720p would be a happy medium to shoot for. Combined with modern TVs traditional upscaling you will get a good viewing experience.

There are already fan upscales that are decent. I would say they managed to get the equivalent detail of maybe 600p. If you remember playing games on an old CRT monitor, going from 640x480 to 800x600 is actually a decent bump in detail.

Even though the files are outputted at 720p, it doesn't look quite as sharp as native 720p video. It's complicated to explain, but the short version is... detail and pixel resolution aren't really the same thing. Even if the file is upscaled to 1080p or 4K, that doesn't mean it has equivalent detail.

Which means we use a really shitty metric to give people a sense of how much detail a video will have. Ks and Megapixels are near useless these days.

Do your 200 megapixel phone photos really look sharper than my 24 megapixel DSLR photos?

My point is... detail is complicated.

And AI is currently unable to handle all of that complication without supervision and care.

In any case, the fan upscale of DS9 is definitely superior to the DVD versions. Feel free to seek that out (use a VPN). And because fans did it, the upscales were done with great care. They didn't push the tool beyond its limits and they reviewed every episode to make sure no nightmares snuck in.

I really don't know how to prevent studios from cheaping out and just running content through an upscaler with no care or supervision. But I also don't think fans should outright reject AI as a solution. It can be done well if they let actual artists leverage the tools and do it correctly.

145 notes

·

View notes

Text

Yandere Drabble

Aalto

On the surface, Aalto appears to be driven by money and self-interest. He’s unpredictable and skittish, often leading others to underestimate him.

However, this façade hides his real intentions: he’s actually deeply calculating, gathering information, and keeping you close, all while you think you are in control.

Aalto is always around, gathering intel and manipulating circumstances in the background. He doesn’t make his presence known directly, instead working from the shadows and quietly positioning himself as a valuable asset to you.

Based on Aalto’s personality traits and the way he operates, he would fall under the category of Cunning and Mysterious Yandere—a type that’s elusive, and highly strategic in keeping his obsession under wraps.

Aalto's obsession would be quiet, calculated, and full of layers that you wouldn’t immediately notice.

Aalto's yandere tendencies would be subtle, intricate, and wrapped in layers of deceit, like a spider weaving an inescapable web around his beloved.

He wouldn’t show his obsession outright, that’d ruin the fun.

He could appear in his your life as a helpful stranger, a harmless passerby, or even a rival—all to keep tabs or steer events to his liking.

Aalto’s love would be a game of carefully orchestrated moves. He would keep his true feelings hidden behind a facade of erratic behavior and his "greedy" persona.

Aalto would use his vast network and mastery of intel to monitor your every move. If you even think about slipping away, he already knows where you’ll go before you do.

He’s a master at blending into the background, adapting to whatever situation or emotional state is needed. He’ll appear to be an unpredictable, chaotic person, but underneath, he’s meticulously observing, adjusting, and ensuring you never see his obsession.

Fair exchange, but only his version of “fair”.

If you want freedom, it’ll cost you dearly. He’d propose choices that always lead back to him, making it seem like your dependence on him is your own doing.

He might even use Encore to emotionally trap you.

He’d play the part of a trustworthy confidant, always there to support and protect, while subtly undermining any relationship or connection that threatens his position in your life.

“You came to me again,” he murmured, his tone smooth yet laced with a subtle satisfaction. “Funny how that keeps happening. You must trust me a great deal.”

His “help” often feels like a gift, but it comes with a price. Aalto will make sure you become dependent on him—he’ll always be the one with the answers, the connections, the solutions—but only if you accept his terms, his rules.

“You pay me in the sweetest currency of all: trust.”

He gives nothing freely and expects something in return for every favor, whether it’s an action, trust, or subtle loyalty. He doesn’t force your feelings, but he ensures that you only have one choice in the end: him.

“Freedom is an illusion, my dear, And you’re already mine.”

You’d never know you’re trapped. Aalto’s obsession is so meticulous, so quietly suffocating, that you might think you’re the one seeking him out, relying on him, and loving him of your own free will.

His obsession isn’t violent or overt—it's psychological and strategic.

“Your availability to anyone else depends on my remuneration—your love, your loyalty, and your every thought.”

He controls your reality through information, trust, and the illusion of freedom. His unpredictable exterior masks the fact that everything is meticulously planned.

“As long as you're willing to pay the price, I’ll always be here. You’ll need me more than you think."

Once you are caught in his web, there is no escape because you are led to believe you are in control, even when you aren't.

By the time you realize the extent of his obsession, it may be too late.

Aalto’s quiet influence will have shaped your entire world, and you will be so deeply dependent on him that leaving is no longer an option.

He will become your world, your protector, and your only ally. His love, while never overtly possessive, will be inescapable—because once Aalto has you in his sights, you belong to him, body and mind.

#Wuthering Waves#wuwa aalto#yandere#yandere wuthering waves#yandere wuwa#yandere aalto#Aalto x reader#wuwa x reader

33 notes

·

View notes

Text

0 notes

Text

The impoverished imagination of neoliberal climate “solutions

This morning (Oct 31) at 10hPT, the Internet Archive is livestreaming my presentation on my recent book, The Internet Con.

There is only one planet in the known universe capable of sustaining human life, and it is rapidly becoming uninhabitable by humans. Clearly, this warrants bold action – but which bold action should we take?

After half a century of denial and disinformation, the business lobby has seemingly found climate religion and has joined the choir, but they have their own unique hymn: this crisis is so dire, they say, that we don't have the luxury of choosing between different ways of addressing the emergency. We have to do "all of the above" – every possible solution must be tried.

In his new book Dark PR, Grant Ennis explains that this "all of the above" strategy doesn't represent a change of heart by big business. Rather, it's part of the denial playbook that's been used to sell tobacco-cancer doubt and climate disinformation:

https://darajapress.com/publication/dark-pr-how-corporate-disinformation-harms-our-health-and-the-environment

The point of "all of the above" isn't muscular, immediate action – rather, it's a delaying tactic that creates space for "solutions" that won't work, but will generate profits. Think of how the tobacco industry used "all of the above" to sell "light" cigarettes, snuff, snus, and vaping – and delay tobacco bans, sin taxes, and business-euthanizing litigation. Today, the same playbook is used to sell EVs as an answer to the destructive legacy of the personal automobile – to the exclusion of mass transit, bikes, and 15-minute cities:

https://thewaroncars.org/2023/10/24/113-dark-pr-with-grant-ennis/

As the tobacco and car examples show, "all of the above" is never really all of the above. Pursuing "light" cigarettes to reduce cancer is incompatible with simply banning tobacco; giving everyone a personal EV is incompatible with remaking our cities for transit, cycling and walking.

When it comes to the climate emergency, "all of the above" means trying "market-based" solutions to the exclusion of directly regulating emissions, despite the poor performance of these "solutions."

The big one here is carbon offsets, which allows companies to make money by promising not to emit carbon that they would otherwise emit. The idea here is that creating a new asset class will unleash the incredible creativity of markets by harnessing the greed of elite sociopaths to the project of decarbonization, rather of the prudence of democratically accountable lawmakers.

Carbon offsets have not worked: they have been plagued by absolutely foreseeable problems that have not lessened, despite repeated attempts to mitigate them.

For starters, carbon offsets are a classic market for lemons. The cheapest way to make a carbon offset is to promise not to emit carbon you were never going to emit anyway, as when fake charities like the Nature Conservancy make millions by promising not to log forests that can't be logged because they are wildlife preserves:

https://pluralistic.net/2022/03/18/greshams-carbon-law/#papal-indulgences

Then there's the problem of monitoring carbon offsetting activity. Like, what happens when the forest you promise not to log burns down? If you're a carbon trader, the answer is "nothing." That burned-down forest can still be sold as if it were sequestering carbon, rather than venting it to the atmosphere in an out-of-control blaze:

https://pluralistic.net/2021/07/26/aggregate-demand/#murder-offsets

When you bought a plane ticket and ticked the "offset the carbon on my flight" box and paid an extra $10, I bet you thought that you were contributing to a market that incentivized a reduction in discretionary, socially useless carbon-intensive activity. But without those carbon offsets, SUVs would have all but disappeared from American roads. Carbon offsets for Tesla cars generated billions in carbon offsets for Elon Musk, and allowed SUVs to escape regulations that would otherwise have seen them pulled from the market:

https://pluralistic.net/2021/11/24/no-puedo-pagar-no-pagara/#Rat

What's more, Tesla figured out how to get double the offsets they were entitled to by pretending that they had a working battery-swap technology. This directly translated to even more SUVs on the road:

https://en.wikipedia.org/wiki/Criticism_of_Tesla,_Inc.#Misuse_of_government_subsidies

Harnessing the profit motive to the planet's survivability might sound like a good idea, but it assumes that corporations can self-regulate their way to a better climate future. They cannot. Think of how Canada's logging industry was allowed to clearcut old-growth forests and replace them with "pines in lines" – evenly spaced, highly flammable, commercially useful tree-farms that now turn into raging forest fires every year:

https://pluralistic.net/2023/09/16/murder-offsets/#pulped-and-papered

The idea of "market-based" climate solutions is that certain harmful conduct should be disincentivized through taxes, rather than banned. This makes carbon offsets into a kind of modern Papal indulgence, which let you continue to sin, for a price. As the outstanding short video Murder Offsets so ably demonstrates, this is an inadequate, unserious and immoral response to the urgency of the issue:

https://pluralistic.net/2021/04/14/for-sale-green-indulgences/#killer-analogy

Offsets and other market-based climate measures aren't "all of the above" – they exclude other measures that have better track-records and lower costs, because those measures cut against the interests of the business lobby. Writing for the Law and Political Economy Project, Yale Law's Douglas Kysar gives some pointed examples:

https://lpeproject.org/blog/climate-change-and-the-neoliberal-imagination/

For example: carbon offsets rely on a notion called "contrafactual carbon," this being the imaginary carbon that might be omitted by a company if it wasn't participating in offsets. The number of credits a company gets is determined by the difference between its contrafactual emissions and its actual emissions.

But the "contrafactual" here comes from a business-as-usual world, one where the only limit on carbon emissions comes from corporate executives' voluntary actions – and not from regulation, direct action, or other limits on corporate conduct.

Kysar asks us to imagine a contrafactual that depends on "carbon upsets," rather than offsets – one where the limits on carbon come from "lawsuits, referenda, protests, boycotts, civil disobedience":

https://www.theguardian.com/commentisfree/cif-green/2010/aug/29/carbon-upsets-offsets-cap-and-trade

If we're really committed to "all of the above" as baseline for calculating offsets, why not imagine a carbon world grounded in foreseeable, evidence-based reality, like the situation in Louisiana, where a planned petrochemical plant was canceled after a lawsuit over its 13.6m tons of annual carbon emissions?

https://earthjustice.org/press/2022/louisiana-court-vacates-air-permits-for-formosas-massive-petrochemical-complex-in-cancer-alley

Rather than a tradeable market in carbon offsets, we could harness the market to reward upsets. If your group wins a lawsuit that prevents 13.6m tons of carbon emissions every year, it will get 13.6 million credits for every year that plant would have run. That would certainly drive the commercial imaginations of many otherwise disinterested parties to find carbon-reduction measures. If we're going to revive dubious medieval practices like indulgences, why not champerty, too?

https://en.wikipedia.org/wiki/Champerty_and_maintenance

That is, if every path to a survivable planet must run through Goldman-Sachs, why not turn their devious minds to figuring out ways to make billions in tradeable credits by suing the pants off oil companies?

There are any number of measures that rise to the flimsy standards of evidence in support of offsets. Like, we're giving away $85/ton in free public money for carbon capture technologies, despite the lack of any credible path to these making a serious dent in the climate situation:

https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/energy-transition/072523-ira-turbocharged-carbon-capture-tax-credit-but-challenges-persist-experts

If we're willing to fund untested longshots like carbon capture, why not measures that have far better track-records? For example, there's a pretty solid correlation between the presence of women in legislatures and on corporate boards and overall reductions in carbon. I'm the last person to suggest that the problems of capitalism can be replaced by replacing half of the old white men who run the world with women, PoCs and queers – but if we're willing to hand billions to ferkakte scheme like carbon capture, why not subsidize companies that pack their boards with women, or provide campaign subsidies to women running for office? It's quite a longshot (putting Liz Truss or Marjorie Taylor-Greene on your board or in your legislature is no way to save the planet), but it's got a better evidentiary basis than carbon capture.

There's also good evidence that correlates inequality with carbon emissions, though the causal relationship is unclear. Maybe inequality lets the wealthy control policy outcomes and tilt them towards permitting high-emission/high-profit activities. Maybe inequality reduces the social cohesion needed to make decarbonization work. Maybe inequality makes it harder for green tech to find customers. Maybe inequality leads to rich people chasing status-enhancing goods (think: private jet rides) that are extremely carbon-intensive.

Whatever the reason, there's a pretty good case that radical wealth redistribution would speed up decarbonization – any "all of the above" strategy should certainly consider this one.

Kysar's written a paper on this, entitled "Ways Not to Think About Climate Change":

https://political-theory.org/resources/Documents/Kysar.Ways%20Not%20to%20Think%20About%20Climate%20Change.pdf

It's been accepted for the upcoming American Society for Political and Legal Philosophy conference on climate change:

https://political-theory.org/13257256

It's quite a bracing read! The next time someone tells you we should hand Elon Musk billions to in exchange for making it possible to legally manufacture vast fleets of SUVs because we need to try "all of the above," send them a copy of this paper.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/31/carbon-upsets/#big-tradeoff

#pluralistic#neoliberalism#climate#market worship#economics#economism#there is no alternative#carbon credits#climate emergency#contrafactual carbon#carbon upsets#apologetics#murder offsets#indulgences

232 notes

·

View notes

Text

Exploring Core Functions of Modern Portfolio Management Companies

Modern portfolio management firms are in the intersection between quantitative analysis and strategic asset allocation, fundamentally shifting the way both institutional and high-net-worth investors approach wealth preservation and growth. These companies go much beyond simple asset management, through sophisticated risk models, factor investments, and rebalancing that dynamically optimize for performance across various market cycles.

Strategic Asset Allocation and Optimization

Strategic asset allocation, in turn, forms the bedrock of professional portfolio management. World-class portfolio management firms utilize leading-edge optimization techniques such as Black-Litterman modeling and Monte Carlo simulations to create portfolios with maximal expected return, operating strictly within narrowly defined risk parameters. It provides the quantitative basis from which the managers move away from diversification through simplistic, low-risk returns towards complex correlation analysis and hedging tail risk strategies.

Evolution of Factor-Based Investing

The operations of wealth management firms have evolved to focus more on factor-based investing approaches. Investment Portfolio management now break down opportunities through multiple lenses, such as value, momentum, quality, and size factors, to construct portfolios that capture specific risk premia while maintaining desired exposure levels. More accurate risk management and performance attribution are made possible by this granular approach to portfolio development.

Alternative Investments and Risk Management

The way that investment portfolio management handles alternative investments has advanced. Portfolio management companies can now easily incorporate real assets, absolute return, and private equity strategies into client portfolios in addition to the conventional stock and fixed-income proportions. This expansion into alternatives requires deep expertise in illiquidity premium evaluation, vintage year diversification, and complex fee structure analysis.

This includes all the various dimensions of the risk management framework in sophisticated portfolio management firms. Stress testing scenarios, value-at-risk analysis, and dynamic correlation models allow managers to gain insight into how portfolios will react under different conditions. Currency exposure management, for instance, involves consideration of counterparty risk evaluation, as well as systematic rebalancing protocols.

Execution Strategies and Performance Attribution

In executing their investment strategies, leading wealth management firm practitioners leverage advanced execution algorithms and dark pool access to minimize market impact and transaction costs. TCA and optimal execution strategies have become crucial for preserving alpha, especially in large portfolio adjustments.

Portfolio management firms have also transformed performance attribution and reporting. Modern analytics platforms allow for granular decomposition of returns across factors, sectors, and strategies, providing unprecedented transparency into portfolio behavior. Detailed attribution analysis can help managers identify sources of alpha, optimize factor exposures, and refine investment strategies with precision.

Technological Infrastructure and Key Considerations

The technological infrastructure that supports portfolio management has evolved to include artificial intelligence and machine learning applications. These tools enhance traditional quantitative models by identifying subtle market patterns, optimizing trade execution, and improving risk forecasting accuracy.

Several crucial elements to consider are as follows:

The investment philosophy of the firm and its alignment with academic research

Risk management infrastructure and stress testing capabilities

Experience in managing complex, multi-asset class portfolios

Track record across different market environments

Transparency in performance attribution and fee structures

Regulatory Environment and Future Outlook

The regulatory environment continues to shape how portfolio management firms operate, with an increased emphasis on fiduciary responsibility and risk oversight. Leading firms maintain robust compliance frameworks while adapting to evolving regulatory requirements around derivatives exposure, leverage limits, and risk reporting.

As markets continue to grow increasingly complex and interdependent, portfolio management firms will play an even more critical role. Their capacity to combine both quantitative rigor with strategic insight and robust risk management frameworks provides the institutional and individual investor with sophisticated solutions for navigating the global markets. A partnership with a portfolio management firm, which demonstrates both technical expertise and strategic vision, can be a step toward achieving investors' long-term financial objectives while optimizing their outcomes.

#portfolio management#investment strategies#asset allocation#risk management#financial planning#diversification#portfolio monitoring#investment solutions#transparency#modern portfolio#market trends#financial growth#portfolio rebalancing#ethical investments#personalized finance#wealth management#investment goals#advanced technology#market analysis#portfolio optimization

1 note

·

View note

Text

GIS-Based Solutions for Efficient Telecom Network Management

The telecom industry is undergoing rapid transformation, driven by the increasing demand for seamless connectivity, efficient network management, and improved customer experience. As networks become more complex, the need for innovative solutions to manage these networks has never been greater. Geographic Information System (GIS)-based solutions have emerged as a game-changer in the telecom sector, offering a robust platform for managing, analyzing, and visualizing network data. This blog explores how GIS-based solutions can revolutionize telecom network management, ensuring efficiency and reliability.

Learn more at https://www.cyberswift.com/blog/telecom-utility-solution-a-brief-overview/

#gis for 5g network planning#telecom network monitoring with gis#gis for telecom service coverage analysis#gis enabled telecom site selection#gis mapping for telecom connectivity#gis solutions for managing telecom utilities#role of gis in telecom infrastructure planning#telecom utility gis software for asset management#gis technology for fiber optic network design#geospatial analytics for telecom network optimization#telecom asset management system#gis telecom utility software#fiber optic network mapping#gis based telecom service optimization#telecom network visualization tools#utility network analysis in telecom#geospatial solutions for telecom utilities

0 notes