#tokenomics

Explore tagged Tumblr posts

Text

Orion Depp : in Rio de Janeiro , White Shirt on Boat at Grad School SOLANA, SUI Ecosystem Crypto Project Advisor, Former Bain Consultant, Wharton, USC MBA

(c) Orion Michael Depp – Co-Founder, Master Ventures Institutional Investment Management, SOLANA, SUI Ecosystem & Crypto Capital Markets Advisor, Wharton, USC MBA, Former Bain & Co IPO Management Consultant, First BNB Binance Analyst 2017, 30 Under 30 Entrepreneur CNBC.

Orion Depp, Orion Michael Depp, Orion Depp Crypto Advisor, Orion Depp Institutional Crypto Fund Manager, Orion Depp Crypto VC Venture Capital Fund Manager, Orion Depp Crypto Capital Markets Advisor, Orion Depp Crypto Community Growth Strategist, Orion Depp Bain Management Consultant, Orion Depp SOLANA Advisor, Orion Depp SUI Blockchain Specialist, Orion Depp Aptos Advisor, Orion Depp Binance BNB Analyst, Orion Depp Coin Listing Specialist, Orion Depp Coinbase Listing Advisor, Orion Depp Binance Listings, Orion Depp CoinList, Orion Depp Bybit Listing Consultant, Orion Depp OKX Listing Expert, Orion Depp IEO IDO Advisor, Orion Depp Tokenomics Expert, Orion Depp Blockchain Business Advisor, Orion Depp Crypto Influencer.

Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Binance Coin (BNB), Ripple (XRP), Cardano (ADA), Polkadot (DOT), Avalanche (AVAX), DeFi, NFTs, Crypto Trading, Tokenomics, Crypto Insights, Metaverse, Digital Assets, Blockchain Development, Web3 Technology, ICO, IDO, Crypto Events, Crypto Exchange Listings, Crypto Community Building, Airdrops, Staking, Decentralized Finance Projects, Crypto Fund Management, Crypto Trading Signals.

Source: instagram.com

#OrionDepp#OrionMichaelDepp#orion depp#orion-depp#CryptoAdvisor#Solana#BTC#SOL#ETH#Bitcoin#Binance#BinanceCoin#Bybit#OKX#Coinbase#Ethereum#Altcoins#Blockchain#Crypto#Cryptocurrency#DeFi#NFTs#Web3#CryptoMarket#CryptoTrading#CryptoCommunity#CryptoInvesting#Tokenomics#CryptoInsights#Metaverse

3 notes

·

View notes

Text

"Dynamite City" - Land Shiba Finance

11 notes

·

View notes

Text

Demônio de transporte!

#rpg#cellbit#tokenomics#demon oc#discord rpg#discord rp#discord roleplay#commisions open#comission#comissões#japan#akuma#Spotify

14 notes

·

View notes

Text

Tokenized Gold Is Booming—But Don’t Mistake It for the Future

A gold rush is underway—this time, it's on-chain. But let’s be clear: gold-backed tokens like Tether Gold (XAUT) are not the future of crypto. They’re the past wrapped in a digital veneer.

Over the last month, tokenized gold products like Tether Gold (XAUT) and Paxos Gold (PAXG) have surged 7–9%, mirroring gold’s own meteoric rise to over $3,340 an ounce. On April 21, XAUT hit an all-time high of $3,423. Meanwhile, Bitcoin jumped 14% in the same period. The narrative is obvious: in times of global instability—Trump’s tariff war redux, persistent inflation, and BRICS countries hoarding gold—investors rush to safety. Gold remains the oldest safe haven. Now, it just happens to come with a blockchain wrapper.

But here’s the inconvenient truth: tokenized gold is a comfortable illusion of progress. It offers digital convenience, sure, but it reinforces the very system crypto was built to disrupt. The rise of XAUT tells us less about innovation and more about our collective fear of change.

The Appeal: Trust in a Turbulent World

It’s not hard to see why tokenized gold is gaining traction. Gold has been money for 5,000 years. In 2024 alone, central banks bought over 1,044 metric tons, led by BRICS nations looking to insulate themselves from U.S. dollar hegemony. Tether Gold, backed 1:1 by physical gold in Swiss vaults, offers a digital form of that ancient safety. It's secure, verifiable, and compliant, now under El Salvador’s regulatory framework.

For emerging markets grappling with inflation and volatile currencies, tokenized gold feels like a godsend. It's more stable than local fiat, more familiar than Bitcoin, and easier to move than physical gold bars. In countries like Turkey, Argentina, and Nigeria—where both gold and USDT are already household names—XAUT could easily become a preferred store of value.

Tether’s CEO, Paolo Ardoino, is clear about the vision: XAUT is a “lifeline” for emerging markets, the “digital equivalent of your family’s emergency gold stash.” And in fairness, he’s not wrong.

But Here’s the Problem: Gold Is Static. Bitcoin Is Sovereign.

Gold-backed tokens may be “on-chain,” but they are not decentralized, censorship-resistant, or trustless. They depend on centralized entities storing gold in physical vaults, issuing attestations, and enforcing compliance. You don’t own the gold—you own a promise.

Tether’s recent attestation for XAUT is welcome transparency. It confirms that 246,523 ounces of gold (7.7 tons) back the circulating supply. But let’s not pretend this is trustless infrastructure. It’s a licensed custodian holding metal, subject to the whims of jurisdictions, regulators, and counterparties.

Contrast this with Bitcoin: no physical reserve, no vaults, no CEO. It’s pure code, pure math, pure decentralization. In 2025, with surveillance creeping and political risk rising, Bitcoin remains the only true escape hatch. Tokenized gold is a tethered float in the storm. Bitcoin is the lifeboat.

Let’s not forget: the same governments accumulating gold are also the ones devaluing their currencies and censoring dissent. They’re buying gold to hedge against each other. You, the individual, are collateral damage in their geopolitical chess game. Bitcoin gives you a way out. Gold-backed tokens tie you back in.

Tokenized Gold Is the Bridge, Not the Destination

I’ll grant this: tokenized gold has a role. It brings old-world wealth into the digital realm. It’s a transitional technology, just like early internet dial-up or MP3 players before streaming.

And in some cases, bridges are essential. For the millions who still trust gold but fear fiat, XAUT is a digital compromise. It’s better than holding paper cash. It's better than trusting a local bank in a politically unstable region. It's programmable, globally transferable, and more liquid than bullion.

But here’s what’s dangerous: treating that bridge as the destination. If tokenized gold becomes the default store of value in crypto, we’ve lost the plot. We’ve rebuilt the TradFi system on-chain—this time with QR codes and blockchain explorers. The power dynamics don’t change. The gatekeepers just got new branding.

Real Innovation Doesn’t Repackage the Past

Let’s step back. What’s the purpose of crypto?

It’s not just “number go up.” It’s about sovereignty, permissionless access, programmable money, and eliminating reliance on centralized trust. Tether Gold does none of these things fundamentally. It’s a marginal UX upgrade to an old asset class.

Real innovation is what we see in Ethereum L2 rollups enabling global microfinance. It’s decentralized identity being tested in Sub-Saharan Africa. It’s Bitcoin Lightning wallets in El Salvador enabling borderless remittances for pennies. It’s MakerDAO creating DAI from on-chain collateral, not paper promises.

We must distinguish between disruption and digitization. Tokenized gold is digitization. Bitcoin is disruption. One conforms to the old rules; the other rewrites them.

XAUT Will Boom—Then Plateau

In the short term, expect XAUT and similar gold-backed assets to surge. As Trump’s trade policies rattle markets, and BRICS nations accelerate de-dollarization, gold will likely hit new highs. Tether Gold’s market cap ($770 million as of April 28) could cross $1 billion in Q2.

But here's the prediction: this growth has a ceiling.

As Bitcoin adoption grows—especially with institutional allocators now looking past ETFs to self-custody—more capital will migrate to truly sovereign assets. Emerging markets will leapfrog gold in favor of crypto-native solutions, just as they skipped landlines for mobile.

And as regulatory clarity improves, DeFi will offer tokenized exposure to real-world assets (RWAs) without centralized chokepoints. Already, the RWA market (excluding stablecoins) has grown to $21.6 billion. Gold tokens may be part of that mix, but they won’t dominate it.

The Future Is Not Made of Gold

Gold has served humanity well. It will always have a place in portfolios, vaults, and cultures. But gold is not the foundation of the future.

We’re building a programmable financial system—open, permissionless, and resilient. Tokenized gold is welcome at the party, but it’s not the host. That title still belongs to Bitcoin and the protocols redefining what money, trust, and freedom mean in the digital age.

If this piece sparked something in you—if you learned, questioned, or felt moved—consider supporting our work.

We don’t run paywalls. We don’t do ads. Everything here is free, because we believe education should be. But if you value what we’re building, you can help us keep going by donating to our Ko-Fi page. Every contribution, no matter how small, helps us dig deeper, write bolder, and stay fiercely independent.https://ko-fi.com/thedailydecrypt

Thanks for reading. Stay sovereign.

© 2025 InSequel Digital. ALL RIGHTS RESERVED. This article may not be reproduced, distributed, or transmitted in any form without prior written permission.

0 notes

Text

#TokenDevelopment#CryptoDevelopment#BlockchainSolutions#TokenCreation#CryptoToken#SmartContracts#BlockchainDevelopment#Web3Development#CryptoProjects#EthereumToken#TokenLaunch#DeFiDevelopment#ICODevelopment#Tokenomics#PixelPunch

0 notes

Text

Time Sensitive

Just 7 Days until Launch!

Create Your Free Account Here

0 notes

Text

🗺️ What Is a Crypto Roadmap? And Why Should You Check It?

A crypto roadmap shows where a project is going and how it plans to get there. 🚀

✅ It outlines: 🔹 Product launches 🔹 Network upgrades 🔹 Partnerships 🔹 Goals & milestones

🚨 No roadmap = 🚩 🚨 Overpromising & underdelivering = 🚩

📌 A clear roadmap helps you decide if the team is serious—or just hyping a pump.

📩 Want help reviewing a project’s roadmap? Let’s chat! 🔁 Reblog if you always check the roadmap first!

#crypto#cryptocurrency#blockchain#crypto roadmap#crypto for beginners#crypto education#DYOR#investing#Crypto Made Simple#financial freedom#ethereum#altcoins#tokenomics#DeFi#money mindset#crypto awareness#finance#crypto trading#crypto investing#crypto projects#cryptomadesimple

1 note

·

View note

Text

Cardano的MITHR代币数据现已列入Coinvote。

将MITHR代币列入Coinvote为代币及其投资者社区提供了一系列关键优势。首先,Coinvote是一个知名平台,拥有活跃且参与度高的社区,这将提升MITHR的可见度,并吸引更多对该代币感兴趣的新用户。

其中一个主要优势是增强了在加密货币社区内的曝光度。通过出现在Coinvote上,MITHR可以接触到更广泛的观众,从而可能增加代币在不同市场的需求和采纳。此外,Coinvote允许用户为他们���为最有前景的项目投票,这可以通过获得社区的投票和支持来引起更多对MITHR的关注。

Coinvote还提供了一个平台,让社区能够提供宝贵的反馈,帮助改进项目的关键方面。此外,作为一个在像Coinvote这样的可信平台上列出的代币,MITHR能够在加密生态系统中提升其声誉,增强投资者和用户的信任。Coinvote从整个加密资产市场中吸引了一部分用户和投资者,在这个细分市场中,Token Mithrandir S.A.S.及其产品展示了它们的存在。

最后,通过提高可见度,MITHR有更大的机会被列入更多的交易所,从而促进代币的流动性和交易,惠及其持有者和潜在投资者。总之,将MITHR代币列入Coinvote不仅能提升其可见度,还为其在加密货币世界的增长和扩展打开了新大门。

#Cardano的MITHR代币数据现已列入Coinvote#Coinvote#Cardano#mithr#ada#token#crypto token#crypto#tokenization#tokenomics#Opinion#stablecoin

0 notes

Text

Orion Depp : Professional Photo doing Zoom calls. SOLANA, SUI Ecosystem Crypto Project Advisor, Former Bain Consultant, Wharton, USC MBA

(c) Orion Michael Depp – Co-Founder, Master Ventures Institutional Investment Management, SOLANA, SUI Ecosystem & Crypto Capital Markets Advisor, Wharton, USC MBA, Former Bain & Co IPO Management Consultant, First BNB Binance Analyst 2017, 30 Under 30 Entrepreneur CNBC.

Orion Depp, Orion Michael Depp, Orion Depp Crypto Advisor, Orion Depp Institutional Crypto Fund Manager, Orion Depp Crypto VC Venture Capital Fund Manager, Orion Depp Crypto Capital Markets Advisor, Orion Depp Crypto Community Growth Strategist, Orion Depp Bain Management Consultant, Orion Depp SOLANA Advisor, Orion Depp SUI Blockchain Specialist, Orion Depp Aptos Advisor, Orion Depp Binance BNB Analyst, Orion Depp Coin Listing Specialist, Orion Depp Coinbase Listing Advisor, Orion Depp Binance Listings, Orion Depp CoinList, Orion Depp Bybit Listing Consultant, Orion Depp OKX Listing Expert, Orion Depp IEO IDO Advisor, Orion Depp Tokenomics Expert, Orion Depp Blockchain Business Advisor, Orion Depp Crypto Influencer.

Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Binance Coin (BNB), Ripple (XRP), Cardano (ADA), Polkadot (DOT), Avalanche (AVAX), DeFi, NFTs, Crypto Trading, Tokenomics, Crypto Insights, Metaverse, Digital Assets, Blockchain Development, Web3 Technology, ICO, IDO, Crypto Events, Crypto Exchange Listings, Crypto Community Building, Airdrops, Staking, Decentralized Finance Projects, Crypto Fund Management, Crypto Trading Signals.

Source: instagram.com

#OrionDepp#OrionMichaelDepp#orion depp#orion-depp#CryptoAdvisor#Solana#BTC#SOL#ETH#Bitcoin#Binance#BinanceCoin#Bybit#OKX#Coinbase#Ethereum#Altcoins#Blockchain#Crypto#Cryptocurrency#DeFi#NFTs#Web3#CryptoMarket#CryptoTrading#CryptoCommunity#CryptoInvesting#Tokenomics#CryptoInsights#Metaverse

2 notes

·

View notes

Text

"Wave City" - Land Shiba Finance

8 notes

·

View notes

Text

0 notes

Text

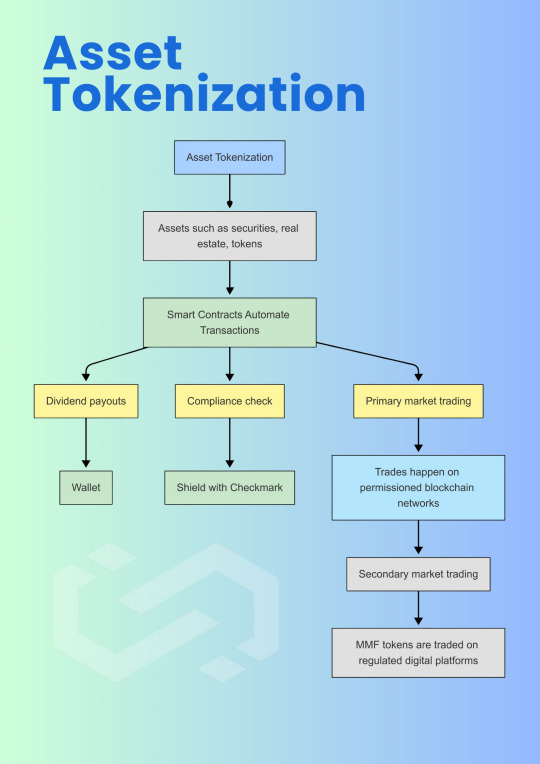

Your Money Is Changing—Are You Ready for the Shift?For decades, institutional finance has relied on outdated infrastructure—slow settlements, limited liquidity, and high fees.Now? Blockchain is rewriting the rules.💡 Asset tokenization is making investments: 🔹 More accessible—fractional ownership of real estate, private equity & more. 🔹 More efficient—automated smart contracts eliminate intermediaries. 🔹 More transparent—blockchain provides an immutable record of ownership.BlackRock, JPMorgan, and HSBC are already tokenizing assets. If your institution isn’t thinking about it, you’re already behind.

#finance#tokenization#digital asset#blockchain#tokenomics#cryptocurrency#token factory#bitcoin#investment#asset management#assets

0 notes

Text

Afacerea Anului: De Ce Reddit Moons Este Singura Monedă Crypto pe Care O Vei Iubi În 2025!

Introducere: O Revoluție Crypto În Plină Expansiune Piața criptomonedelor evoluează rapid, iar investitorii caută constant oportunități care să le aducă profituri spectaculoase și să le transforme viitorul financiar. În mijlocul acestei agitații, Reddit Moons a reușit să se evidențieze prin caracterul său unic și prin modul în care a fost adoptat de comunitatea Reddit – una dintre cele mai active…

#criptovalute#Reddit Moons#valoare digitală#interacţiuni online#colaborare online#feedback comunitar#tendințe digitale#integrare tehnologică#adoptare globală#monetizare#investiții de succes#Marketing Viral#rețele sociale#inovație în crypto#economie descentralizată#trenduri de piata#guvernanță digitală#partajare de cunoștințe#profituri uluitoare#investitori timpurii#milionar peste noapte#monedă revoluționară#exploatare oportunități#automată#analize de sentiment#experiențe de succes#creștere rapidă#tokenomics#criptomonede#blockchain

0 notes

Text

Exploring the Ethereum Ecosystem and the Future of Venture Capital in Crypto with Vlad Martynov

Vlad Martynov’s Insights on the Ethereum Ecosystem and the Role of Venture Capital in Crypto's Evolution. Vlad Martynov, a prominent blockchain entrepreneur and co-founder of BR Capital, shares his deep understanding of the evolving Ethereum ecosystem and venture capital’s significant role in shaping the future of the crypto industry. With the rapidly changing landscape of digital currencies, venture capital plays an essential part in providing financial support to groundbreaking projects within the Ethereum space.

Martynov emphasises Ethereum's decentralised architecture, its role in furthering blockchain technology, and its growing potential to disrupt multiple industries. As Ethereum evolves, venture capital plays a more important role in funding and supporting the ecosystem's innovation. The Ethereum network's scalability, paired with the broader blockchain foundation, has opened up new possibilities for decentralised apps (dApps) and smart contracts. These advancements are altering not only the way individuals interact with digital assets, but also how industries use blockchain technology. Also Read: sbf-talks-crypto-from-prison-changing-the-guard-helps-insights-into-the-future-of-crypto/ At the heart of this transition is venture capital, which has been critical in assisting blockchain projects that show potential but lack the necessary resources or infrastructure to flourish without major investment. According to Martynov, many successful projects in the Ethereum ecosystem, ranging from decentralised finance (DeFi) to NFT platforms, would not have materialised without venture capital support. As more investors recognise the value of Ethereum's blockchain, the influx of finance fuels greater innovation. However, the interaction between Ethereum, venture capital, and the larger crypto environment is complex. While venture money plays an important role in accelerating the growth of blockchain-based enterprises, it also highlights possible hazards. According to Martynov, one of the most significant difficulties facing the Ethereum ecosystem is the present tokenomics system, which might be viewed as defective or unsustainable in some situations. The imbalance in rewards and incentives within token economies can occasionally stifle long-term growth and stability. Martynov also highlights his position in the decentralised Zuzalu "network state" community, which is a novel technique to organising people and resources. He believes that these types of groups will be critical to influencing the future of blockchain technology and decentralisation. As Ethereum's ecosystem expands, the change to decentralised governance and collaboration becomes more critical. Zuzalu's strategy, which promotes collaboration across decentralised platforms, has the potential to shape how future initiatives are funded and blockchain technology develop. The future of venture capital in the Ethereum ecosystem is also contingent on changing regulatory settings around the world. Venture capital firms and blockchain businesses must traverse a complex regulatory landscape as governments in the United States, Europe, and Asia tighten their oversight. Martynov explores the problems and opportunities presented by these regulatory reforms, as well as how they may affect the Ethereum ecosystem's future direction. As venture capital continues to fuel expansion in the Ethereum ecosystem, Martynov's observations offer significant insight into the convergence of blockchain, venture funding, and the ever-changing worldwide legal landscape. Read the full article

#BlockchainInnovation#blockchaintechnology#CryptoRegulation#DecentralizedFinance#DeFi#ethereum#Ethereumecosystem#Tokenomics#venturecapital#Venturecapitalincrypto

0 notes

Text

Custom Token Development Solutions

Experience the flexibility and power of custom token solutions that are secure, compliant, and designed to meet your specific blockchain needs. With options for utility, security, and governance tokens, you can build a customized digital asset that aligns perfectly with your goals.

#TokenDevelopment#CryptoDevelopment#BlockchainSolutions#TokenCreation#CryptoToken#SmartContracts#BlockchainDevelopment#Web3Development#CryptoProjects#EthereumToken#TokenLaunch#DeFiDevelopment#ICODevelopment#Tokenomics#PixelPunch

0 notes