#automated ledger

Explore tagged Tumblr posts

Text

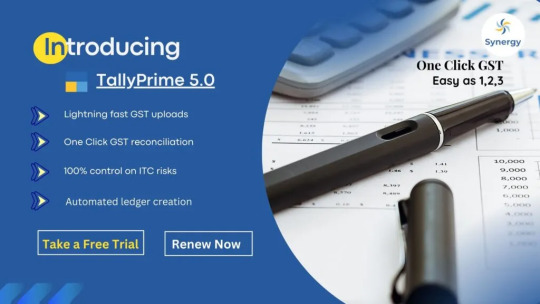

Benefits of Upgrading to Tally Prime 5.0 for Your Business

Upgrading to Tally Prime 5.0 presents a unique opportunity for businesses to enhance their financial management and streamline their operations. With the Tally Prime 5.0 download available, users can access a range of robust features designed to elevate their accounting processes. From small startups to large enterprises, the versatility offered by Tally Prime 5.0 makes it a suitable choice for companies across various sectors. By embracing this latest version, businesses not only improve their efficiency but also gain the flexibility needed to adapt to the demands of an ever-changing commercial landscape.

One of the standout aspects of Tally Prime 5.0 is its user-friendly interface and simplified navigation. Users can expect to save precious time on routine accounting tasks, thanks to enhancements that allow for quicker access to essential features. This upgrade also introduces advanced reporting capabilities, enabling businesses to generate insightful analyses of their financial health seamlessly. With the new tools and analytics at their disposal, decision-makers can expect to make more informed choices, ultimately driving growth and profitability.

Additionally, Tally Solutions has integrated cutting-edge technology into this update, enhancing security and data integrity. Businesses can rest assured that their sensitive financial information is well protected, thanks to improved encryption and backup features. This emphasis on security provides peace of mind for users, allowing them to focus on their core operations without the worry of data breaches. The new features and benefits accompanying Tally Prime 5.0 make it easier than ever to manage various aspects of a business while ensuring robust protection against potential threats.

In conclusion, the decision to upgrade to Tally Prime 5.0 is one that can significantly benefit organizations looking to maximize their operational efficiency and safeguard their financial data. The combination of a user-friendly interface, advanced reporting tools, and enhanced security measures positions this software as a leading solution in the accounting field. With the Tally Prime 5.0 download readily available, businesses are encouraged to leverage the new features and benefits with Tally Solutions, ensuring they remain competitive in today’s dynamic marketplace.

#TallyPrime 5.0#TallyPrime upgrade#accounting software#business management software#TallyPrime features#TallyPrime benefits#financial management#GST compliance#data security#automated ledger#Tally solution

0 notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

Build the Future of Gaming with Crypto Casino Development Solutions

#In a world where innovation drives the gaming industry#the rise of crypto casino game development is reshaping the way players and developers think about online gambling. This is because blockch#allowing developers and entrepreneurs to create immersive#secure#and decentralized casino experiences in unprecedented ways. This is not a trend; it's here to stay.#The Shift towards Crypto Casinos#Imagine a world that could be defined by transparency#security#and accessibility for your games. That's precisely what crypto casino game development is trying to bring to the table. Traditionally#online casinos have suffered because of trust issues and minimal choices for payment options. This changes with blockchain technology and c#Blockchain in casino games ensures that all transactions are secure#transparent#and tamper-proof. Thus#players can check how fair a game is#transfer money into and out of the account using cryptocurrencies#and maintain anonymity while playing games. It is not only technologically different but also culturally. This shift appeals to a whole new#What Makes Crypto Casino Game Development Unique?#Crypto casino game development offers features that set it apart from traditional online casinos. Let’s delve into some of these groundbrea#Decentralization and TransparencyBlockchain-powered casinos operate without centralized control#ensuring all transactions and game outcomes are verifiable on a public ledger. This transparency builds trust among players.#Enhanced SecurityWith smart contracts automating processes and blockchain technology securing transactions#crypto casinos significantly reduce the risk of hacking and fraud.#Global AccessibilityCryptocurrencies break the barriers that traditional banking systems have#making it possible for players from around the world to participate without having to think about currency conversion or restricted regions#Customizable Gaming ExperiencesDevelopers can customize crypto casino platforms with unique features such as NFT rewards#tokenized assets#and loyalty programs#making the game more interesting and personalized.#Success Story of Real Life#Crypto casino game development has already brought about success stories worldwide. Among them

1 note

·

View note

Text

Breaking News: Ripple Introduces Key Updates for Enhanced AMM Functionality on XRP Ledger

In a bid to continually refine and optimize the XRP Ledger (XRPL), Ripple's development team unveils proposed changes addressing a technical intricacy within the recently introduced Automated Market Maker (AMM). These adjustments, designed to tackle a specific challenge related to trading fees below 0.01%, underscore Ripple's commitment to fostering a cutting-edge and seamless blockchain experience.

The successful passage of the XLS-30D amendment marked a significant milestone for XRPL, introducing the AMM feature to the ledger. This achievement was not without challenges, requiring an impressive 80% consensus among the decentralized Unique Node List (dUNL) validators. The rigorous consensus-building process exemplifies XRPL's robust governance model, ensuring that pivotal amendments receive thorough scrutiny and endorsement.

The proposed changes emerge from meticulous integration testing, revealing a potential delay in certain AMM transactions when trading fees fall below 0.01%. The enhancements focus on refining how inner objects identify default fields, ensuring that the AMM functions optimally in various scenarios. By addressing this technical glitch, Ripple aims to guarantee smoother and more efficient transactions, reinforcing XRPL's reputation for reliability.

Prominent validators, including Ripple, Bithomp, and Alloy Networks, played a significant role in supporting the XLS-30D amendment, emphasizing the widespread belief in the transformative potential of the AMM within the XRPL ecosystem.

With the scheduled deployment on February 14, the XLS-30D amendment is poised to bring tangible improvements to the XRPL. Beyond rectifying technical intricacies, this enhancement is expected to unlock novel opportunities for XRP holders, allowing them to actively participate as liquidity providers and earn passive income through the innovative AMM feature. The evolution of XRPL continues, guided by Ripple's dedication to pushing the boundaries of blockchain technology.

0 notes

Text

Brian Barrett at Wired (02.27.2025):

If you’ve felt overwhelmed by all the DOGE news, you’re not alone. You’d need too much cork board and yarn to keep track of which agencies it has occupied by now, much less what it’s doing there. Here’s a simple rubric, though, to help contextualize the DOGE updates you do have time and energy to process: It’s worse than you think. DOGE is hard to keep track of. This is by design; the only information about the group outside of its own mistake-ridden ledger of “savings” comes from media reports. So much for being “maximally transparent,” as Elon Musk has promised. The blurriness is also partly a function of the speed and breadth with which DOGE has operated. Keeping track of the destruction is like counting individual bricks scattered around a demolition site.

You may be aware, for instance, that a 19-year-old who goes by “Big Balls” online plays some role in all this. Seems bad. But you may have missed that Edward Coristine has since been installed at the nation’s top cybersecurity agency. And the State Department and the Small Business Administration. And he has a Department of Homeland Security email address and, by the way, also had a recent side gig selling AI Discord bots to Russians. See? Worse than you think. [...] Similarly, you’ve likely heard that the United States Agency for International Development has been gutted and the Consumer Financial Protection Bureau has been put on ice. All true, all bad. But here’s what that means in practice: Fewer people globally have access to vaccines than they did a month ago. More babies are being born with HIV/AIDS. From here on out, anyone who gets ripped off by payday loan companies—or, say, social media platforms moonlighting as payments services—has lost their most capable defender. Keep going. The thousands of so-called probationary employees DOGE has fired included a significant number of experienced workers who had just been promoted or transferred. National Science Foundation staffing cuts and proposed National Institutes of Health grant limits will combine to kneecap scientific research in the United States for a generation. Terminations at the US Department of Agriculture have sent programs designed to help farmers into disarray. On Wednesday, the Food and Drug Administration canceled a meeting that would have given guidance on this year’s flu vaccine composition. It hasn’t been rescheduled.

Don’t care about science or vaccines? The Social Security Administration is reportedly going to cut its staff in half. The Department of Housing and Urban Development is going to be cut by as much as 84 percent. Hundreds of workers who keep the power grid humming in the Pacific Northwest were fired before a scramble to rehire a few of them. The National Parks Service, the Internal Revenue Service, all hit hard. So don’t make any long-term bets on getting your checks on time, keeping your lights on, buying a home for the first time, or enjoying Yosemite. Don’t assume all the things that work now will still work tomorrow.

Speaking of which, let’s not forget that DOGE has fired people working to prevent bird flu and to safeguard the US nuclear arsenal. (The problem with throwing a chainsaw around is that you don’t make clean cuts.) The agencies in question have reportedly tried to hire those workers back. Fine. But even if they’re able to, the long-term question that hasn’t been answered yet is, Who would stay? Who would work under a regime so cocksure and incompetent that it would mistakenly fire the only handful of people who actually know how to take care of the nukes? According to a recent report from The Bulwark, that brain drain is already underway. And this is all before the real reductions in force begin, mass purges of civil servants that will soon be conducted, it seems, with an assist from DOGE-modified, automated software. The US government is about to lose decades of institutional knowledge across who knows how many agencies, including specialists that aren’t readily replaced by loyalists.

Wired has a solid article on how bad the DOGE-ificiation of government has gotten.

#DOGE#Elon Musk#Edward Coristine#Musk Coup#Trump Administration II#Department of Government Efficency

108 notes

·

View notes

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

284 notes

·

View notes

Text

The enshittification of garage-door openers reveals a vast and deadly rot

I'll be at the Studio City branch of the LA Public Library on Monday, November 13 at 1830hPT to launch my new novel, The Lost Cause. There'll be a reading, a talk, a surprise guest (!!) and a signing, with books on sale. Tell your friends! Come on down!

How could this happen? Owners of Chamberlain MyQ automatic garage door openers just woke up to discover that the company had confiscated valuable features overnight, and that there was nothing they could do about it.

Oh, we know what happened, technically speaking. Chamberlain shut off the API for its garage-door openers, which breaks their integration with home automation systems like Home Assistant. The company even announced that it was doing this, calling the integration an "unauthorized usage" of its products, though the "unauthorized" parties in this case are the people who own Chamberlain products:

https://chamberlaingroup.com/press/a-message-about-our-decision-to-prevent-unauthorized-usage-of-myq

We even know why Chamberlain did this. As Ars Technica's Ron Amadeo points out, shutting off the API is a way for Chamberlain to force its customers to use its ad-beshitted, worst-of-breed app, so that it can make a few pennies by nonconsensually monetizing its customers' eyeballs:

https://arstechnica.com/gadgets/2023/11/chamberlain-blocks-smart-garage-door-opener-from-working-with-smart-homes/

But how did this happen? How did a giant company like Chamberlain come to this enshittening juncture, in which it felt empowered to sabotage the products it had already sold to its customers? How can this be legal? How can it be good for business? How can the people who made this decision even look themselves in the mirror?

To answer these questions, we must first consider the forces that discipline companies, acting against the impulse to enshittify their products and services. There are four constraints on corporate conduct:

I. Competition. The fear of losing your business to a rival can stay even the most sociopathic corporate executive's hand.

II. Regulation. The fear of being fined, criminally sanctioned, or banned from doing business can check the greediest of leaders.

III. Capability. Corporate executives can dream up all kinds of awful ways to shift value from your side of the ledger to their own, but they can only do the things that are technically feasible.

IV. Self-help. The possibility of customers modifying, reconfiguring or altering their products to restore lost functionality or neutralize antifeatures carries an implied threat to vendors. If a printer company's anti-generic-ink measures drives a customer to jailbreak their printers, the original manufacturer's connection to that customer is permanently severed, as the customer creates a durable digital connection to a rival.

When companies act in obnoxious, dishonest, shitty ways, they aren't merely yielding to temptation – they are evading these disciplining forces. Thus, the Great Enshittening we are living through doesn't reflect an increase in the wickedness of corporate leadership. Rather, it represents a moment in which each of these disciplining factors have been gutted by specific policies.

This is good news, actually. We used to put down rat poison and we didn't have a rat problem. Then we stopped putting down rat poison and rats are eating us alive. That's not a nice feeling, but at least we know at least one way of addressing it – we can start putting down poison again. That is, we can start enforcing the rules that we stopped enforcing, in living memory. Having a terrible problem is no fun, but the best kind of terrible problem to have is one that you know a solution to.

As it happens, Chamberlain is a neat microcosm for all the bad policy choices that created the Era of Enshittification. Let's go through them:

Competition: Chamberlain doesn't have to worry about competition, because it is owned by a private equity fund that "rolled up" all of Chamberlain's major competitors into a single, giant firm. Most garage-door opener brands are actually Chamberlain, including "LiftMaster, Chamberlain, Merlin, and Grifco":

https://www.lakewoodgaragedoor.biz/blog/the-history-of-garage-door-openers

This is a pretty typical PE rollup, and it exploits a bug in US competition law called "Antitrust's Twilight Zone":

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

When companies buy each other, they are subject to "merger scrutiny," a set of guidelines that the FTC and DoJ Antitrust Division use to determine whether the outcome is likely to be bad for competition. These rules have been pretty lax since the Reagan administration, but they've currently being revised to make them substantially more strict:

https://www.justice.gov/opa/pr/justice-department-and-ftc-seek-comment-draft-merger-guidelines

One of the blind spots in these merger guidelines is an exemption for mergers valued at less than $101m. Under the Hart-Scott-Rodino Act, these fly under the radar, evading merger scrutiny. That means that canny PE companies can roll up dozens and dozens of standalone businesses, like funeral homes, hospital beds, magic mushrooms, youth addiction treatment centers, mobile home parks, nursing homes, physicians’ practices, local newspapers, or e-commerce sellers:

http://www.economicliberties.us/wp-content/uploads/2022/12/Serial-Acquisitions-Working-Paper-R4-2.pdf

By titrating the purchase prices, PE companies – like Blackstone, owners of Chamberlain and all the other garage-door makers – can acquire a monopoly without ever raising a regulatory red flag.

But antitrust enforcers aren't helpless. Under (the long dormant) Section 7 of the Clayton Act, competition regulators can block mergers that lead to "incipient monopolization." The incipiency standard prevented monopolies from forming from 1914, when the Clayton Act passed, until the Reagan administration. We used to put down rat poison, and we didn't have rats. We stopped, and rats are gnawing our faces off. We still know where the rat poison is – maybe we should start putting it down again.

On to regulation. How is it possible for Chamberlain to sell you a garage-door opener that has an API and works with your chosen home automation system, and then unilaterally confiscate that valuable feature? Shouldn't regulation protect you from this kind of ripoff?

It should, but it doesn't. Instead, we have a bunch of regulations that protect Chamberlain from you. Think of binding arbitration, which allows Chamberlain to force you to click through an "agreement" that takes away your right to sue them or join a class-action suit:

https://pluralistic.net/2022/10/20/benevolent-dictators/#felony-contempt-of-business-model

But regulation could protect you from Chamberlain. Section 5 of the Federal Trade Commission Act allows the FTC to ban any "unfair and deceptive" conduct. This law has been on the books since 1914, but Section 5 has been dormant, forgotten and unused, for decades. The FTC's new dynamo chair, Lina Khan, has revived it, and is use it like a can-opener to free Americans who've been trapped by abusive conduct:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

Khan's used Section 5 powers to challenge privacy invasions, noncompete clauses, and other corporate abuses – the bait-and-switch tactics of Chamberlain are ripe for a Section 5 case. If you buy a gadget because it has five features and then the vendor takes two of them away, they are clearly engaged in "unfair and deceptive" conduct.

On to capability. Since time immemorial, corporate leaders have fetishized "flexibility" in their business arrangements – like the ability to do "dynamic pricing" that changes how much you pay for something based on their guess about how much you are willing to pay. But this impulse to play shell games runs up against the hard limits of physical reality: grocers just can't send an army of rollerskated teenagers around the store to reprice everything as soon as a wealthy or desperate-looking customer comes through the door. They're stuck with crude tactics like doubling the price of a flight that doesn't include a Saturday stay as a way of gouging business travelers on an expense account.

With any shell-game, the quickness of the hand deceives the eye. Corporate crooks armed with computers aren't smarter or more wicked than their analog forebears, but they are faster. Digital tools allow companies to alter the "business logic" of their services from instant to instant, in highly automated ways:

https://pluralistic.net/2023/02/19/twiddler/

The monopoly coalition has successfully argued that this endless "twiddling" should not be constrained by privacy, labor or consumer protection law. Without these constraints, corporate twiddlers can engage in all kinds of ripoffs, like wage theft and algorithmic wage discrimination:

https://pluralistic.net/2023/04/12/algorithmic-wage-discrimination/#fishers-of-men

Twiddling is key to the Darth Vader MBA ("I am altering the deal. Pray I don't alter it further"), in which features are confiscated from moment to moment, without warning or recourse:

https://pluralistic.net/2023/10/26/hit-with-a-brick/#graceful-failure

There's no reason to accept the premise that violating your privacy, labor rights or consumer rights with a computer is so different from analog ripoffs that existing laws don't apply. The unconstrained twiddling of digital ripoff artists is a plague on billions of peoples' lives, and any enforcer who sticks up for our rights will have an army of supporters behind them.

Finally, there's the fear of self-help measures. All the digital flexibility that tech companies use to take value away can be used to take it back, too. The whole modern history of digital computers is the history of "adversarial interoperability," in which the sleazy antifeatures of established companies are banished through reverse-engineering, scraping, bots and other forms of technological guerrilla warfare:

https://www.eff.org/deeplinks/2019/10/adversarial-interoperability

Adversarial interoperability represents a serious threat to established business. If you're a printer company gouging on toner, your customers might defect to a rival that jailbreaks your security measures. That's what happened to Lexmark, who lost a case against the toner-refilling company Static Controls, which went on to buy Lexmark:

https://www.eff.org/deeplinks/2019/06/felony-contempt-business-model-lexmarks-anti-competitive-legacy

Sure, your customers are busy and inattentive and you can degrade the quality of your product a lot before they start looking for ways out. But once they cross that threshold, you can lose them forever. That's what happened to Microsoft: the company made the tactical decision to produce a substandard version of Office for the Mac in a drive to get Mac users to switch to Windows. Instead, Apple made Iwork (Pages, Numbers and Keynote), which could read and write every Office file, and Mac users threw away Office, the only Microsoft product they owned, permanently severing their relationship to the company:

https://www.eff.org/deeplinks/2019/06/adversarial-interoperability-reviving-elegant-weapon-more-civilized-age-slay

Today, companies can operate without worrying about this kind of self-help measure. There' a whole slew of IP rights that Chamberlain can enforce against you if you try to fix your garage-door opener yourself, or look to a competitor to sell you a product that restores the feature they took away:

https://locusmag.com/2020/09/cory-doctorow-ip/

Jailbreaking your Chamberlain gadget in order to make it answer to a rival's app involves bypassing a digital lock. Trafficking in a tool to break a digital lock is a felony under Section 1201 of the Digital Millennium Copyright, carrying a five-year prison sentence and a $500,000 fine.

In other words, it's not just that tech isn't regulated, allowing for endless twiddling against your privacy, consumer rights and labor rights. It's that tech is badly regulated, to permit unlimited twiddling by tech companies to take away your rightsand to prohibit any twiddling by you to take them back. The US government thumbs the scales against you, creating a regime that Jay Freeman aptly dubbed "felony contempt of business model":

https://pluralistic.net/2022/10/23/how-to-fix-cars-by-breaking-felony-contempt-of-business-model/

All kinds of companies have availed themselves of this government-backed superpower. There's DRM – digital locks, covered by DMCA 1201 – in powered wheelchairs:

https://www.eff.org/deeplinks/2022/06/when-drm-comes-your-wheelchair

In dishwashers:

https://pluralistic.net/2021/05/03/cassette-rewinder/#disher-bob

In treadmills:

https://pluralistic.net/2021/06/22/vapescreen/#jane-get-me-off-this-crazy-thing

In tractors:

https://pluralistic.net/2022/05/08/about-those-kill-switched-ukrainian-tractors/

It should come as no surprise to learn that Chamberlain has used DMCA 1201 to block interoperable garage door opener components:

https://scholarship.law.marquette.edu/cgi/viewcontent.cgi?article=1233&context=iplr

That's how we arrived at this juncture, where a company like Chamberlain can break functionality its customers value highly, solely to eke out a minuscule new line of revenue by selling ads on their own app.

Chamberlain bought all its competitors.

Chamberlain operates in a regulatory environment that is extremely tolerant of unfair and deceptive practices. Worse: they can unilaterally take away your right to sue them, which means that if regulators don't bestir themselves to police Chamberlain, you are shit out of luck.

Chamberlain has endless flexibility to unilaterally alter its products' functionality, in fine-grained ways, even after you've purchased them.

Chamberlain can sue you if you try to exercise some of that same flexibility to protect yourself from their bad practices.

Combine all four of those factors, and of course Chamberlain is going to enshittify its products. Every company has had that one weaselly asshole at the product-planning table who suggests a petty grift like breaking every one of the company's customers' property to sell a few ads. But historically, the weasel lost the argument to others, who argued that making every existing customer furious would affect the company's bottom line, costing it sales and/or fines, and prompting customers to permanently sever their relationship with the company by seeking out and installing alternative software. Take away all the constraints on a corporation's worst impulses, and this kind of conduct is inevitable:

https://pluralistic.net/2023/07/28/microincentives-and-enshittification/

This isn't limited to Chamberlain. Without the discipline of competition, regulation, self-help measures or technological limitations, every industry in undergoing wholesale enshittification. It's not a coincidence that Chamberlain's grift involves a push to move users into its app. Because apps can't be reverse-engineered and modified without risking DMCA 1201 prosecution, forcing a user into an app is a tidy and reliable way to take away that user's rights.

Think about ad-blocking. One in four web users has installed an ad-blockers ("the biggest boycott in world history" -Doc Searls). Zero app users have installed app-blockers, because they don't exist, because making one is a felony. An app is just a web-page wrapped in enough IP to make it a crime to defend yourself against corporate predation:

https://pluralistic.net/2023/08/27/an-audacious-plan-to-halt-the-internets-enshittification-and-throw-it-into-reverse/

The temptation to enshitiffy isn't new, but the ability to do so without consequence is a modern phenomenon, the intersection of weak policy enforcement and powerful technology. Your car is autoenshittified, a rolling rent-seeking platform that spies on you and price-gouges you:

https://pluralistic.net/2023/07/24/rent-to-pwn/#kitt-is-a-demon

Cars are in an uncontrolled skid over Enshittification Cliff. Honda, Toyota, VW and GM all sell cars with infotainment systems that harvest your connected phone's text-messages and send them to the corporation for data-mining. What's more, a judge in Washington state just ruled that this is legal:

https://therecord.media/class-action-lawsuit-cars-text-messages-privacy

While there's no excuse for this kind of sleazy conduct, we can reasonably anticipate that if our courts would punish companies for engaging in it, they might be able to resist the temptation. No wonder Mozilla's latest Privacy Not Included research report called cars "the worst product category we have ever reviewed":

https://foundation.mozilla.org/en/privacynotincluded/articles/its-official-cars-are-the-worst-product-category-we-have-ever-reviewed-for-privacy/

I mean, Nissan tries to infer facts about your sex life and sells those inferences to marketing companies:

https://foundation.mozilla.org/en/privacynotincluded/nissan/

But the OG digital companies are the masters of enshittification. Microsoft has been at this game for longer than anyone, and every day brings a fresh way that Microsoft has worsened its products without fear of consequence. The latest? You can't delete your OneDrive account until you provide an acceptable explanation for your disloyalty:

https://www.theverge.com/2023/11/8/23952878/microsoft-onedrive-windows-close-app-notification

It's tempting to think that the cruelty is the point, but it isn't. It's almost never the point. The point is power and money. Unscrupulous businesses have found ways to make money by making their products worse since the industrial revolution. Here's Jules Dupuis, writing about 19th century French railroads:

It is not because of the few thousand francs which would have to be spent to put a roof over the third-class carriages or to upholster the third-class seats that some company or other has open carriages with wooden benches. What the company is trying to do is to prevent the passengers who can pay the second class fare from traveling third class; it hits the poor, not because it wants to hurt them, but to frighten the rich. And it is again for the same reason that the companies, having proved almost cruel to the third-class passengers and mean to the second-class ones, become lavish in dealing with first-class passengers. Having refused the poor what is necessary, they give the rich what is superfluous.

https://www.tumblr.com/mostlysignssomeportents/731357317521719296/having-refused-the-poor-what-is-necessary-they

But as bad as all this is, let me remind you about the good part: we know how to stop companies from enshittifying their products. We know what disciplines their conduct: competition, regulation, capability and self-help measures. Yes, rats are gnawing our eyeballs, but we know which rat-poison to use, and where to put it to control those rats.

Competition, regulation, constraint and self-help measures all backstop one another, and while one or a few can make a difference, they are most powerful when they're all mobilized in concert. Think of the failure of the EU's landmark privacy law, the GDPR. While the GDPR proved very effective against bottom-feeding smaller ad-tech companies, the worse offenders, Meta and Google, have thumbed their noses at it.

This was enabled in part by the companies' flying an Irish flag of convenience, maintaining the pretense that they have to be regulated in a notorious corporate crime-haven:

https://pluralistic.net/2023/05/15/finnegans-snooze/#dirty-old-town

That let them get away with all kinds of shenanigans, like ignoring the GDPR's requirement that you should be able to easily opt out of data-collection without having to go through cumbersome "cookie consent" dialogs or losing access to the service as punishment for declining to be tracked.

As the noose has tightened around these surveillance giants, they're continuing to play games. Meta now says that the only way to opt out of data-collection in the EU is to pay for the service:

https://pluralistic.net/2023/10/30/markets-remaining-irrational/#steins-law

This is facially illegal under the GDPR. Not only are they prohibited from punishing you for opting out of collection, but the whole scheme ignores the nature of private data collection. If Facebook collects the fact that you and I are friends, but I never opted into data-collection, they have violated the GDPR, even if you were coerced into granting consent:

https://www.nakedcapitalism.com/2023/11/the-pay-or-consent-challenge-for-platform-regulators.html

The GDPR has been around since 2016 and Google and Meta are still invading 500 million Europeans' privacy. This latest delaying tactic could add years to their crime-spree before they are brought to justice.

But most of this surveillance is only possible because so much of how you interact with Google and Meta is via an app, and an app is just a web-page that's a felony to make an ad-blocker for. If the EU were to legalize breaking DRM – repealing Article 6 of the 2001 Copyright Directive – then we wouldn't have to wait for the European Commission to finally wrestle these two giant companies to the ground. Instead, EU companies could make alternative clients for all of Google and Meta's services that don't spy on you, without suffering the fate of OG App, which tried this last winter and was shut down by "felony contempt of business model":

https://pluralistic.net/2023/02/05/battery-vampire/#drained

Enshittification is demoralizing. To quote @wilwheaton, every update to the services we use inspires "dread of 'How will this complicate things as I try to maintain privacy and sanity in a world that demands I have this thing to operate?'"

https://wilwheaton.tumblr.com/post/698603648058556416/cory-doctorow-if-you-see-this-and-have-thoughts

But there are huge natural constituencies for the four disciplining forces that keep enshittification at bay.

Remember, Antitrust's Twilight Zone doesn't just allow rollups of garage-door opener companies – it's also poison for funeral homes, hospital beds, magic mushrooms, youth addiction treatment centers, mobile home parks, nursing homes, physicians’ practices, local newspapers, or e-commerce sellers.

The Binding Arbitration scam that stops Chamberlain customers from suing the company also stops Uber drivers from suing over stolen wages, Turbotax customers from suing over fraud, and many other victims of corporate crime from getting a day in court.

The failure to constrain twiddling to protect privacy, labor rights and consumer rights enables a host of abuses, from stalking, doxing and SWATting to wage theft and price gouging:

https://pluralistic.net/2023/11/06/attention-rents/#consumer-welfare-queens

And Felony Contempt of Business Model is used to screw you over every time you refill your printer, run your dishwasher, or get your Iphone's screen replaced.

The actions needed to halt and reverse this enshittification are well understood, and the partisans for taking those actions are too numerous to count. It's taken a long time for all those individuals suffering under corporate abuses to crystallize into a movement, but at long last, it's happening.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/09/lead-me-not-into-temptation/#chamberlain

Image: Cryteria (modified) https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0 https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#monopolists#anticircumvention#myq#home assistant#pay or consent#enshittification#surveillance#autoenshittification#privacy#self-help measures#microsoft#onedrive#twiddling#comcom#competitive compatibility#interop#interoperability#adversarial interoperability#felony contempt of business model#darth vader mba

376 notes

·

View notes

Note

Last year I worked at a small student led handicraft store run by my university and it was originally supposed to be a temporary pop-up run by the lecturers who led the events management course. It was the best job I’d ever had - which isn’t saying much because every other job I’ve had has been horrendous and traumatising in ways I can’t even describe - so of course I was overjoyed when they told us they were extending our temporary contracts by a year and keeping the shop open indefinitely.

At that point things started going downhill. The uni stopped promoting the shop at all so our customer numbers dropped dramatically, and the uni’s PR department refused to let us utilise the shop’s social media page despite asking one of the employees to manage the social media and making her take on extra hours. They refused to make the necessary changes in order to make it the permanent storefront they envisioned - All our bookkeeping for every single purchase had to be written in a paper ledger and then copied and reformatted into a dozen different stock and accounting spreadsheets on a laptop, for every single individual item in each sale, before we could take payment, because they refused to pay for software that would automate it, so a single transaction could take anywhere between 5-20 minutes depending on what the person was buying. Many customers ended up getting frustrated and just walked off.

We started haemorrhaging stockists as the uni didn’t pay them fairly or on time, despite pestering from both stockists and floor staff. Even now, nearly 6 months after the whole thing shut down, some stockists still haven’t been paid. The uni took such a huge amount of commission from each sale (nearly 3 times the industry standard!) that the stockists making products couldn’t afford to pay themselves fairly without doubling or tripling the prices of their work, which fucked up their sales. Most people didn’t even earn enough to cover production costs for their work.

I was maybe the only person on the entire staff who actually had any significant retail and customer facing experience, having worked in the fast food and retail industries for ~4 years before I started at the shop, and it was abysmal. The events management faculty who were supposed to be running it had no customer facing experience and did nothing to help when problems came up - they treated it like a temporary event rather than a permanent shopfront and we had so little support and oversight it was awful. We had to take on full management responsibility despite it being well above our pay grade because they refused to hire an experienced manager or supervisor - while trying to man the store we would also have to do admin, liaise with clients and stockists, accounting, stock input, paying for essential supplies with our own money because the Uni refused to approve them, organising our own shifts and pay, making social media content, and arranging cover for if someone was ill or had an emergency. Instead of any reasonable support they sent us a horribly overworked postgrad intern who was working between 5-6 different departments and could only actually be in the store maybe one hour a month, had no idea what she was doing, and was so overworked that she eventually had a breakdown and quit.

This issue was compounded because they’d only ever let us put two employees on each shift - they refused to pay enough for staff numbers above that despite being so busy in the first few months that we couldn’t keep up, and told us that for safety reasons both employees had to be there to open the shop- so if somebody was late or didn’t show up the other person wouldn’t be able to work either. If one person was on a double shift and the second person’s replacement for second shift wasn’t on time, the person on the double wouldn’t be able to leave for a lunch break, and the person on the single would have to stay extra time. There were several employees that would spend the entire shift doing fuck all - one guy was at least two hours late every single shift, and bought his XBOX with him every time, and spent the entire time he was working with his feet propped up on the counter playing GTA. The university genuinely didn’t care about the shop or its success enough to even give him a disciplinary.

It was awful, especially because there were a small group of us who were both stockists and floor staff, and were genuinely invested in the shop’s success. But our contracts ran till the end of the academic year, and the pay was really decent compared to a lot of jobs in the area, and it was stable and above minimum wage, so we (the staff) really did try to make it work, but we were set up to fail. Eventually we were barely making a sale a day, and then it dropped to a sale a week.

When they closed the shop, right before the end of the semester when people’s rent would be due, they gave us 10 days’ notice - which went against our contract - and no redundancy pay. Most people had had shifts for the next 8-9 weeks already scheduled, which we never got to work. We never got our holiday pay or the Christmas bonus they’d promised us 9 months prior. It was such short notice that several people couldn’t find new jobs in time, couldn’t scrape enough together to pay their bills and rent on time, and they didn’t even have the decency to tell us we were losing our jobs in person - they sent out a single email to one of the girls who helped organise shifts, and she had to post it in the staff group chat.

And the sad thing? It was still the best, least stressful job I’ve ever had. It was the only job I’ve had that didnt actually make me want to die. I miss it like hell. It was the only job I’ve had that paid me above the legal minimum wage. I’m physically disabled, and it was the only job I’ve ever had that actually followed through on the reasonable adjustments and disability accommodations they’d promised me.

But the way it was run it wasn’t fair or sustainable , and it shouldn’t have ended the way it did.

Posted by admin Rodney

52 notes

·

View notes

Text

The Rise of Crypto Casinos: A New Era in Gambling

The gambling industry has undergone a remarkable transformation over the centuries, evolving from rudimentary dice games in ancient civilizations to the glitzy casinos of Las Vegas. Today, the rise of the crypto casino represents a new chapter in this storied history, blending cutting-edge blockchain technology with the timeless thrill of wagering. Platforms like Jups.io are at the forefront of this revolution, offering players a secure, transparent, and decentralized gaming experience that traditional casinos struggle to match. This article explores how crypto casinos emerged, their technological foundations, and why they are reshaping the gambling landscape.

The origins of gambling trace back thousands of years, with evidence of dice games in Mesopotamia and betting on chariot races in ancient Rome. These early forms of gambling were social activities, often tied to cultural or religious events. Fast forward to the 17th century, when the first modern casinos appeared in Europe, formalizing gambling into structured venues. The 20th century saw the rise of Las Vegas and Atlantic City, where opulent casinos became synonymous with luxury and risk. However, these traditional setups had limitations—centralized operations, high fees, and concerns over fairness. Enter the crypto casino, a game-changer that leverages blockchain to address these issues.

Cryptocurrency, pioneered by Bitcoin in 2009, introduced a decentralized financial system that prioritized security and anonymity. By the mid-2010s, developers recognized the potential of integrating blockchain with online gambling, giving birth to the crypto casino model. Unlike traditional online casinos, which rely on centralized servers and fiat currencies, crypto casinos operate on blockchain networks, ensuring transparency through immutable ledgers. Jups.io exemplifies this model, offering games like slots, poker, and roulette, all powered by cryptocurrencies such as Bitcoin and Ethereum. Players can verify the fairness of each game through provably fair algorithms, a feature that builds trust in an industry often plagued by skepticism.

The technological underpinnings of crypto casinos are what set them apart. Blockchain ensures that every transaction—whether a deposit, wager, or withdrawal—is recorded transparently, reducing the risk of fraud. Smart contracts, self-executing agreements coded on the blockchain, automate payouts and game outcomes, eliminating the need for intermediaries. This not only lowers operational costs but also allows platforms like Jups.io to offer competitive bonuses and lower house edges. Moreover, the use of cryptocurrencies enables near-instant transactions, a stark contrast to the delays often experienced with bank transfers in traditional online casinos.

The appeal of crypto casinos extends beyond technology. They cater to a global audience, unrestricted by geographic boundaries or banking regulations. Players from regions with strict gambling laws can participate anonymously, thanks to the pseudonymous nature of cryptocurrencies. Additionally, crypto casinos attract tech-savvy younger generations who value innovation and digital assets. The integration of decentralized finance (DeFi) principles, such as staking rewards or yield farming, into some platforms adds another layer of engagement, blurring the lines between gaming and investment.

However, the rise of crypto casinos is not without challenges. Regulatory uncertainty looms large, as governments grapple with how to oversee decentralized platforms. Volatility in cryptocurrency markets can also affect players’ bankrolls, though stablecoins like USDT are increasingly used to mitigate this risk. Despite these hurdles, the trajectory of crypto casinos points upward, driven by relentless innovation and growing adoption.

In conclusion, the crypto casino represents a bold fusion of gambling’s rich history with the transformative power of blockchain. Platforms like Jups.io are leading the charge, offering players an unparalleled blend of security, fairness, and excitement. As cryptocurrency continues to permeate mainstream finance, crypto casinos are poised to redefine the future of gambling, one block at a time.

13 notes

·

View notes

Text

What is the Difference Between a Smart Contract and Blockchain?

In today's digital-first world, terms like blockchain and smart contract are often thrown around, especially in the context of cryptocurrency, decentralized finance (DeFi), and Web3. While these two concepts are closely related, they are not the same. If you’re confused about the difference between a smart contract and blockchain, you’re not alone. In this article, we’ll break down both terms, explain how they relate, and highlight their unique roles in the world of digital technology.

1. Understanding the Basics: Blockchain vs Smart Contract

Before diving into the differences, let’s clarify what each term means.

A blockchain is a decentralized digital ledger that stores data across a network of computers.

A smart contract is a self-executing program that runs on a blockchain and automatically enforces the terms of an agreement.

To put it simply, blockchain is the infrastructure, while smart contracts are applications that run on top of it.

2. What is a Blockchain?

A blockchain is a chain of blocks where each block contains data, a timestamp, and a cryptographic hash of the previous block. This structure makes the blockchain secure, transparent, and immutable.

The key features of blockchain include:

Decentralization – No single authority controls the network.

Transparency – Anyone can verify the data.

Security – Tampering with data is extremely difficult due to cryptographic encryption.

Consensus Mechanisms – Like Proof of Work (PoW) or Proof of Stake (PoS), which ensure agreement on the state of the network.

Blockchains are foundational technologies behind cryptocurrencies like Bitcoin, Ethereum, and many others.

3. What is a Smart Contract?

A smart contract is a piece of code stored on a blockchain that automatically executes when certain predetermined conditions are met. Think of it as a digital vending machine: once you input the right conditions (like inserting a coin), you get the output (like a soda).

Smart contracts are:

Self-executing – They run automatically when conditions are met.

Immutable – Once deployed, they cannot be changed.

Transparent – Code is visible on the blockchain.

Trustless – They remove the need for intermediaries or third parties.

Smart contracts are most commonly used on platforms like Ethereum, Solana, and Cardano.

4. How Smart Contracts Operate on a Blockchain

Smart contracts are deployed on a blockchain, usually via a transaction. Once uploaded, they become part of the blockchain and can't be changed. Users interact with these contracts by sending transactions that trigger specific functions within the code.

For example, in a decentralized exchange (DEX), a smart contract might govern the process of swapping one cryptocurrency for another. The logic of that exchange—calculations, fees, security checks—is all written in the contract's code.

5. Real-World Applications of Blockchain

Blockchains are not limited to cryptocurrencies. Their properties make them ideal for various industries:

Finance – Fast, secure transactions without banks.

Supply Chain – Track goods transparently from origin to destination.

Healthcare – Secure and share patient data without compromising privacy.

Voting Systems – Transparent and tamper-proof elections.

Any situation that requires trust, security, and transparency can potentially benefit from blockchain technology.

6. Real-World Applications of Smart Contracts

Smart contracts shine when you need to automate and enforce agreements. Some notable use cases include:

DeFi (Decentralized Finance) – Lending, borrowing, and trading without banks.

NFTs (Non-Fungible Tokens) – Automatically transferring ownership of digital art.

Gaming – In-game assets with real-world value.

Insurance – Auto-triggered payouts when conditions (like flight delays) are met.

Legal Agreements – Automatically executed contracts based on input conditions.

They’re essentially programmable agreements that remove the need for middlemen.

7. Do Smart Contracts Need Blockchain?

Yes. Smart contracts depend entirely on blockchain technology. Without a blockchain, there's no decentralized, secure, and immutable platform for the smart contract to run on. The blockchain guarantees trust, while the smart contract executes the logic.

8. Which Came First: Blockchain or Smart Contract?

Blockchain came first. The first blockchain, Bitcoin, was introduced in 2009 by the anonymous figure Satoshi Nakamoto. Bitcoin’s blockchain didn’t support smart contracts in the way we know them today. It wasn’t until Ethereum launched in 2015 that smart contracts became programmable on a large scale.

Ethereum introduced the Ethereum Virtual Machine (EVM), enabling developers to build decentralized applications using smart contracts written in Solidity.

9. Common Misconceptions

There are many misunderstandings around these technologies. Let’s clear a few up:

Misconception 1: Blockchain and smart contracts are the same.

Reality: They are separate components that work together.

Misconception 2: All blockchains support smart contracts.

Reality: Not all blockchains are smart contract-enabled. Bitcoin’s blockchain, for example, has limited scripting capabilities.

Misconception 3: Smart contracts are legally binding.

Reality: While they enforce logic, they may not hold legal standing in court unless specifically written to conform to legal standards.

10. Benefits of Using Blockchain and Smart Contracts Together

When used together, blockchain and smart contracts offer powerful advantages:

Security – Combined, they ensure secure automation of processes.

Efficiency – Remove delays caused by manual processing.

Cost Savings – Eliminate middlemen and reduce administrative overhead.

Trustless Interactions – Parties don't need to trust each other, only the code.

This combination is the backbone of decentralized applications (DApps) and the broader Web3 ecosystem.

11. Popular Platforms Supporting Smart Contracts

Several blockchain platforms support smart contracts, with varying degrees of complexity and performance:

Ethereum – The first and most widely used platform.

Solana – Known for speed and low fees.

Cardano – Emphasizes academic research and scalability.

Polkadot – Designed for interoperability.

Binance Smart Chain – Fast and cost-effective for DeFi apps.

Each platform has its own approach to security, scalability, and user experience.

12. The Future of Blockchain and Smart Contracts

The future looks incredibly promising. With the rise of AI, IoT, and 5G, the integration with blockchain and smart contracts could lead to fully automated systems that are transparent, efficient, and autonomous.

We may see:

Global trade systems are using smart contracts to automate customs and tariffs.

Self-driving cars using blockchain to negotiate road usage.

Smart cities are where infrastructure is governed by decentralized protocols.

These are not sci-fi ideas; they are already in development across various industries.

Conclusion: A Powerful Partnership

Understanding the difference between smart contracts and blockchain is essential in today's rapidly evolving digital world. While blockchain provides the secure, decentralized foundation, smart contracts bring it to life by enabling automation and trustless execution.

Think of blockchain as the stage, and smart contracts as the actors that perform on it. Separately, they're impressive. But together, they're revolutionary.

As technology continues to evolve, the synergy between blockchain and smart contracts will redefine industries, reshape economies, and unlock a new era of digital transformation.

#coin#crypto#digital currency#finance#invest#investment#bnbbro#smartcontracts#decentralization#decentralizedfinance#decentralizedapps#decentralizedfuture#cryptocurrency#btc#cryptotrading#usdt

2 notes

·

View notes

Text

Online Bookkeeping Services by Mercurius & Associates LLP

In today’s fast-paced digital economy, accurate and efficient financial management is crucial for every business. Whether you're a startup, small enterprise, or a growing company, keeping track of your finances is vital for sustainability and success. That’s where Mercurius & Associates LLP steps in with its online bookkeeping services — blending technology, expertise, and reliability to manage your books with precision.

Why Bookkeeping Matters

Bookkeeping is the foundation of any business’s financial health. It involves recording, classifying, and organizing all financial transactions so that businesses can:

Monitor their financial position

Ensure regulatory compliance

Make informed decisions

File accurate tax returns

Plan for growth and investment

Yet, many businesses struggle to keep up with bookkeeping due to time constraints, lack of in-house expertise, or outdated processes.

Benefits of Online Bookkeeping Services

Online bookkeeping is a game-changer for modern businesses. It offers:

Real-time access to financial data

Cloud-based solutions for anytime, anywhere access

Cost-effective services compared to in-house staff

Scalability as your business grows

Increased accuracy through automated tools

Secure data storage with regular backups

By outsourcing bookkeeping to professionals, businesses can focus more on core operations while ensuring their books are in order.

Why Choose Mercurius & Associates LLP?

At Mercurius & Associates LLP, we specialize in providing online bookkeeping services tailored to your business needs. Here’s what sets us apart:

1. Experienced Professionals

Our team comprises skilled accountants and finance experts who understand the nuances of bookkeeping across industries. We ensure compliance with Indian and international accounting standards.

2. Customized Solutions

We understand that no two businesses are the same. Our bookkeeping services are tailored to suit your industry, size, and specific requirements.

3. Technology-Driven Approach

We leverage cloud-based platforms like QuickBooks, Zoho Books, Xero, and Tally for seamless and accurate bookkeeping. Integration with your existing systems is quick and hassle-free.

4. Transparent Reporting

You receive regular financial reports that help you track performance, manage cash flow, and plan strategically. Our detailed reports include profit and loss statements, balance sheets, and cash flow summaries.

5. Data Security

We implement best-in-class data protection protocols to ensure your financial information is secure and confidential.

Services We Offer

Daily, weekly, or monthly transaction recording

Bank and credit card reconciliation

Accounts payable and receivable management

General ledger maintenance

Payroll processing support

GST return preparation and filing

Financial reporting and analysis

Industries We Serve

Our online bookkeeping services are ideal for:

Startups & Entrepreneurs

E-commerce Businesses

Healthcare Professionals

Legal Firms

Retail & Wholesale Businesses

IT & Software Companies

NGOs and Trusts

Get Started with Mercurius & Associates LLP

Outsourcing your bookkeeping doesn’t mean losing control. With Mercurius & Associates LLP, you gain a partner who brings clarity, accuracy, and efficiency to your financial operations.

Let us handle your books while you focus on growing your business.

📞 Contact us today to learn more about our online bookkeeping services or to request a free consultation.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#income tax#taxation#foreign companies registration in india#auditor#ap management services

2 notes

·

View notes

Text

Best 10 Blockchain Development Companies in India 2025

Blockchain technology is transforming industries by enhancing security, transparency, and efficiency. With India's growing IT ecosystem, several companies specialize in blockchain development services, catering to industries like finance, healthcare, supply chain, and gaming. If you're looking for a trusted blockchain development company in India, here are the top 10 companies in 2025 that are leading the way with cutting-edge blockchain solutions.

1. Comfygen

Comfygen is a leading blockchain development company in India, offering comprehensive blockchain solutions for businesses worldwide. Their expertise includes smart contract development, dApps, DeFi platforms, NFT marketplaces, and enterprise blockchain solutions. With a strong focus on security and scalability, Comfygen delivers top-tier blockchain applications tailored to business needs.

Key Services:

Smart contract development

Blockchain consulting & integration

NFT marketplace development

DeFi solutions & decentralized exchanges (DEX)

2. Infosys

Infosys, a globally recognized IT giant, offers advanced blockchain solutions to enterprises looking to integrate distributed ledger technology (DLT) into their operations. Their blockchain services focus on supply chain, finance, and identity management.

Key Services:

Enterprise blockchain solutions

Smart contracts & decentralized apps

Blockchain security & auditing

3. Wipro

Wipro is known for its extensive research and development in blockchain technology. They help businesses integrate blockchain into their financial systems, healthcare, and logistics for better transparency and efficiency.

Key Services:

Blockchain consulting & strategy

Supply chain blockchain solutions

Smart contract development

4. Tata Consultancy Services (TCS)

TCS is a pioneer in the Indian IT industry and provides robust blockchain solutions, helping enterprises optimize business processes with secure and scalable decentralized applications.

Key Services:

Enterprise blockchain development

Tokenization & digital asset solutions

Decentralized finance (DeFi) applications

5. Hyperlink InfoSystem

Hyperlink InfoSystem is a well-established blockchain development company in India, specializing in building customized blockchain solutions for industries like finance, gaming, and supply chain.

Key Services:

Blockchain-based mobile app development

Smart contract auditing & security

NFT marketplace & DeFi solutions

6. Tech Mahindra

Tech Mahindra provides blockchain-as-a-service (BaaS) solutions, ensuring that businesses leverage blockchain for improved transparency and automation. They focus on finance, telecom, and supply chain industries.

Key Services:

Blockchain implementation & consulting

dApp development & smart contracts

Digital identity management solutions

7. Antier Solutions

Antier Solutions is a specialized blockchain development firm offering DeFi solutions, cryptocurrency exchange development, and metaverse applications. They provide custom blockchain solutions for startups and enterprises.

Key Services:

DeFi platform development

NFT & metaverse development

White-label crypto exchange development

8. HCL Technologies

HCL Technologies offers enterprise blockchain development services, focusing on improving security, efficiency, and automation across multiple sectors.

Key Services:

Blockchain-based digital payments

Hyperledger & Ethereum development

Secure blockchain network architecture

9. SoluLab

SoluLab is a trusted blockchain development company working on Ethereum, Binance Smart Chain, and Solana-based solutions for businesses across industries.

Key Services:

Smart contract & token development

Decentralized application (dApp) development

AI & blockchain integration

10. Mphasis

Mphasis provides custom blockchain solutions to enterprises, ensuring secure transactions and seamless business operations.

Key Services:

Blockchain for banking & financial services

Smart contract development & deployment

Blockchain security & risk management

Conclusion

India is emerging as a global hub for blockchain technology, with companies specializing in secure, scalable, and efficient blockchain development services. Whether you're a startup or an enterprise looking for custom blockchain solutions, these top 10 blockchain development companies in India provide world-class expertise and innovation.

Looking for the best blockchain development partner? Comfygen offers cutting-edge blockchain solutions to help your business thrive in the decentralized era. Contact us today to start your blockchain journey!

2 notes

·

View notes

Text

Your Bank Hates You—Here’s Why Bitcoin Doesn’t

Banks have spent centuries perfecting the art of making money off their customers while keeping them financially dependent. They wrap themselves in an image of trust and stability, but the truth is simple: banks exist to extract as much profit as possible from you while giving as little as possible in return. And most people never question it.

Bitcoin, on the other hand, doesn’t need you to trust it. It operates on pure mathematics, transparency, and a fixed supply that no institution can manipulate. It’s time to pull back the curtain on the traditional banking system and understand why Bitcoin flips the script.

The Big Lie: Your Money Isn’t Really Yours

When you deposit money in a bank, you assume it’s still your money. In reality, the moment it enters their system, it becomes theirs. You are nothing more than an unsecured creditor—your money is a liability on their books, and they can use it however they see fit. They lend it out, invest it in risky ventures, and rake in billions in profits, all while giving you a pathetic fraction of a percent in interest.

And if you ever try to withdraw a large sum? Suddenly, the bank wants to ask questions. Where did you get this money? Why do you need it? They may even limit how much you can take out at once. It’s not about security—it’s about control.

The Racket: How Fractional Reserve Banking Works

One of the biggest scams ever legalized is fractional reserve banking. This system allows banks to hold only a small fraction of customer deposits while lending out the rest. In the U.S., banks used to be required to keep about 10% in reserve. Today? That requirement is zero. They can lend out nearly all of your deposited money, creating money out of thin air.

This system fuels inflation, artificially expands credit, and increases systemic risk. And guess who pays the price when it collapses? Not the banks—they get bailed out. You, the customer, are left with devalued savings, rising costs, and financial instability.

Bitcoin doesn’t play that game. There is no fractional reserve system. You own what you hold, and no one can lend it out behind your back.

The Bank Fees & Interest Rate Scam

Banks are masters of the nickel-and-dime game:

Overdraft fees punish you for not having money by taking more of your money.

Loan interest rates skyrocket while banks borrow from the Federal Reserve at near-zero rates.

ATM fees charge you for accessing your own money.

Wire transfer fees? A tax on moving your money, even though the process is mostly automated.

Meanwhile, inflation erodes your savings, and banks laugh all the way to... well, the bank.

Bitcoin? No middlemen. No arbitrary fees. No interest rates designed to squeeze you dry. Just peer-to-peer transactions, secured by a decentralized network.

Enter Bitcoin: Opting Out of the Madness

Bitcoin offers something revolutionary:

A fixed supply of 21 million coins—no central bank can print more.

Self-custody—you hold your own money, no permissions needed.

Instant transactions with minimal fees, no matter where you are in the world.

A global, decentralized network that no government or institution can manipulate.

Unlike banks, Bitcoin doesn’t require you to trust it. You can verify every transaction, every supply issuance, every rule of the system. There are no hidden fees, no fine print, no “policy changes” that suddenly take away your access.

The Transparency Factor: Bitcoin vs. Banks

Banks operate in secrecy. They loan out your deposits, make high-risk bets, and when things go wrong, they change the rules or beg for a bailout. The 2008 financial crisis showed us exactly how fragile and corrupt the system really is.

Bitcoin, on the other hand, runs on a public ledger. Every transaction is verifiable. No insider deals, no backroom manipulations, no hidden schemes. You don’t have to take anyone’s word for it—the system is open-source, and anyone can audit it.

The Takeaway: Banks Need You, But You Don’t Need Banks

The traditional banking system thrives on ignorance. It wants you to remain dependent, obedient, and financially illiterate. But Bitcoin offers a way out.

With Bitcoin, you are your own bank. You decide when and how to access your wealth. You don’t need permission, you don’t need intermediaries, and you certainly don’t need to beg for access to what’s already yours.

Your bank hopes you never wake up to this reality.

Bitcoin is the wake-up call.

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#FinancialFreedom#BanksAreScams#FractionalReserveBanking#SoundMoney#CryptoRevolution#OptOut#Decentralization#FixTheMoneyFixTheWorld#YourKeysYourCoins#MoneyPrinterGoBrrr#NoMoreMiddlemen#TickTockNextBlock#cryptocurrency#blockchain#finance#globaleconomy#digitalcurrency#financial education#financial experts#unplugged financial#financial empowerment

2 notes

·

View notes