#bank forex

Text

$Yen plunges to 38-year low vs $USD! Explore: https://markets.tradermade.com/breaking/yen-in-freefall-to-38-year-low. Experts eye intervention as USD strengthens. Will Japan step in?

2 notes

·

View notes

Text

Lost your money online? Call Costner Recovery for an Expert Advice

If you have been victim of an online fraud, then consult costner recovery for expert advice. With us, you can find guidance and hope. Our skilled experts are available to help you navigate the difficulties of a financial setback and provide individualized rehabilitation plans. Give us a call now to schedule a private consultation and start the process of getting back what is truly yours. You can reply on Costner Recovery to guide you along the route to fund recovery services.

2 notes

·

View notes

Text

Real Account Forex is Provided by Forex4Money to Traders.

Forex4Money provides their clients with real account forex. Open a live forex account with us if you want to boost your forex profits and start taking use of our vast training videos, online tutorials, PDF instructions, and glossaries.

7 notes

·

View notes

Text

Wong said in a statement that her aim in risk-management was to try to unwind a hedge in whole or in part from time to time to take advantage of movements in exchange rates.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#agnes wong#risk management#exchange rate#forex market#banking#finance#lending#loans

0 notes

Text

In May 1992 Frank Conroy wrote a 'comfort' letter on behalf of Rob Douglass:

To whom it may concern

As managing director of Westpac, I write to clarify certain matters which pertain to the reputation of Mr R.H.V Douglass and arise out of his position as managing director of Partnership Pacific Limited ('PPL'), a wholly owned subsidiary of the bank.

The bank employed Mr Douglass between May 1983 and December 1986 as general manager, merchant banking. One of his duties was to take up the position of managing director of PPL from late 1984. That role involved responsibility for the seven divisions of PPL. The divisions reported to Mr Douglass through the general manager of PPL. The board of directors of PPL met on a monthly basis. It consisted of senior Westpac personnel, the chairman being the then deputy managing director of Westpac.

Mr Douglass had the ultimate responsibility within PPL for a foreign currency product which involved the management of clients' foreign currency exposures and was in vogue throughout the banking community during the 1980s. As is now well known, banks and their clients had difficulties in coping with the market environment which developed after deregulation of exchange controls in 1983 and gave rise to extraordinary volatility of the Australian dollar. PPL experienced its own internal difficulties, both with staff and computer systems. In 1985, Mr Douglass engaged the bank's solicitors, Allen Allen & Hemsley, to advise on the procedures to be established and documentation.

In 1987, the bank asked Allen Allen & Hemsley to carry out a review of the foreign currency product marketed by PPL. The result of the initial review is reported in what later became known as the 'Westpac Letters'. It is wrong that Mr Douglass has suffered as a result of being named in these 'Westpac Letters'. I believe that Mr Douglass, in his administration of PPL, acted as a reasonable person of integrity could be expected to have acted in the current state of knowledge of the market. The opinions of Mr Douglass and his version of events were not available to the author of the 'Westpac Letters', but have been made available to me. They cause me to think that the wholly negative assessment of Mr Douglass's performance in relation to the foreign currency product presented in the 'Westpac Letters' is not warranted.

It is my earnest wish, both personally and on behalf of the bank, that Mr Douglass should continue his career free from any negative associations arising out of his time with the bank or PPL.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#may#90s#1990s#20th century#frank conroy#letter#rob douglass#clarification#managing director#ppl#partnership pacific ltd#subsidiary#december#80s#1980s#general manager#banking#finance#lending#loans#foreign currency#board of directors#responsibility#volatility#forex market#solicitor

0 notes

Text

Comparing the Economic Legacy of Finance Ministers P. Chidambaram and Nirmala Sitharaman: A Decade of Transformation

A Comparative Analysis of Finance Ministers: P. Chidambaram vs. Nirmala Sitharaman

Introduction

The role of a finance minister in any country is pivotal, determining the trajectory of economic growth, fiscal stability, and overall national prosperity. India, being one of the largest economies in the world, has seen significant changes under the stewardship of different finance ministers. Two…

#Bank NPAs#Corruption in India#Forex Reserves#GDP Growth#Indian Economy#Infrastructure Spending#Nirmala Sitharaman#P. Chidambaram#Tax Exemptions#Wealth Creation

0 notes

Text

BoE Rate Decision Tomorrow! https://markets.tradermade.com/forex/hold-or-hike-boe-interest-rate-decision-to-influence-gbp. Hold, hike, or dovish turn? BoE's decision will significantly impact the British pound (#GBP). Hold, hike, or dovish? GBP's fate depends on the BoE's choice. BoE faces a tricky balance between inflation and economic growth. #Inflation BoE's decision depends on Inflation data, labor market strength, and global uncertainty. #UKEconomy Stay tuned for the BoE's decision!

0 notes

Text

Bangladesh's Net Forex Reserves Rise Above $16 Billion, Surpassing IMF Target

Bangladesh’s net foreign exchange reserve has risen to $16 billion, exceeding the $14.7 billion target set for June by the International Monetary Fund (IMF), according to the Bangladesh Bank.

As of June 30, the gross reserve stood at $21.83 billion, up from $19.4 billion on June 26, based on the Balance of Payments and International Investment Position Manual (BPM6), reported Bangladesh Bank…

View On WordPress

0 notes

Text

Discover 13 Key Benefits of the Niyo Global DCB Savings Account

Are you looking for a savings account that offers unparalleled benefits for international transactions and travel? The Niyo Global DCB Savings Account, a collaborative offering by Niyo and DCB Bank, is designed to cater to your global financial needs. Here’s everything you need to know about this exceptional savings account.

Key Features of Niyo Global DCB Savings Account

Zero Forex…

View On WordPress

#digital onboarding#Niyo Global DCB Savings Account#zero forex markup#high-interest savings account#DCB Bank#international transactions#Niyo app#spend-based lounge access#24x7 customer support#Niyo coins#EPF balance tracking#travel insurance#mutual fund investment#VISA exchange rates#global access#exclusive cashback offers#virtual debit card#Travel Perks#Techmin Consulting

0 notes

Text

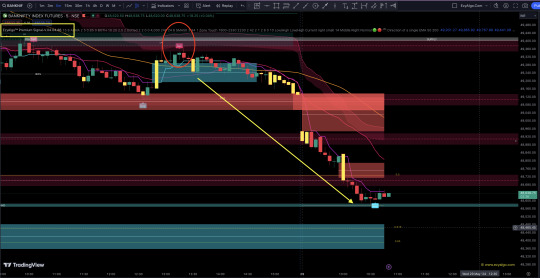

NIFTYBANK.NSE (BankNifty) Chart Update- Our Prediction On 27 May 2024 by the (EzyAlgo) Premium Signal Indicator

NIFTYBANK.NSE (BankNifty) Chart Update- Our Prediction On 27 May 2024, a notable spinning top candle indicated market indecision within a 400-500 point range. However, on 29 May 2024, the market opened below this range and moved decisively, achieving a target of approximately 500-600 points. This movement was confirmed by the (EzyAlgo) Premium Signal Indicator.

Updated Analysis:

Spinning Top Candle (27 May 2024): Initially indicated indecision within a 400-500 point range.

Breakout (29 May 2024): Market opened below the range and moved decisively.

Target Achieved: Approximately 500-600 points movement.

Indicator Confirmation: EzyAlgo Premium Signal Indicator confirmed the move.

Trading Implications:

Breakout Strategy: The decisive move below the range provided a clear breakout signal, leading to a significant price movement.

Indicator Use: Utilizing tools like the EzyAlgo Premium Signal Indicator can help confirm trading signals and improve decision-making.

By staying alert to breakout signals and leveraging reliable indicators, traders can capitalize on significant market moves effectively.

This strategy aims to provide a robust framework for identifying trading opportunities and optimizing trades

Get Access to EzyAlgo indicators: https://ezyalgo.com/Join our Free Telegram Channel: https://t.me/EzyAlgoSolutions

#stock market#nifty50#option trading#nifty option tips#niftytrading#technical analysis#economy#finance#forex trading#forexsignals#banknifty#bank nifty

0 notes

Text

TAX CLEARANCE CERTIFICATE REQUIRED TO OBTAIN FOREIGN CURRENCY FROM BANKS

#forex#foreignexchange#taxation#taxlaw#nigeriantaxation#nigerianlaw#law#tcc#taxclearance#taxclearancecertificate#aaLawsng#avielavenantelawpractice#banking#finance

0 notes

Text

By August 1986 it had blown out to $1,646,000, more than double the original amount.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quote#westpac#edna carew#nonfiction#loans#lending#banking#finance#forex market#august#80s#1980s#20th century#debt

0 notes

Text

The report noted that, given the volatile exchange rate environment, further substantial devaluations in the $A could not be ruled out. It went on:

A major cause of concern is the lack of complete product knowledge by most people handling OCLs (this extends to administrative areas). Account managers appear uncertain as to the appropriate steps to take as losses caused by the $A depreciation is a relatively new situation, over which they have no power to manage or control (unlike an overdraft facility where cheques can be returned, and position crystallised). Most OCL borrowers are considered good customers of the bank – there appears to exist a high level of optimism by both customers and managers in that a solid $A appreciation is only a matter of time. Borrowers (and many managers) are of the view that if a loan is on a bullet repayment basis [payment on maturity] the only forex rate that matters is the one prevailing at the time of the maturity of the facility.

"Westpac: The Bank That Broke the Bank" - Edna Carew

#book quotes#westpac#edna carew#nonfiction#report#volatile#exchange rate#devaluation#ocl#loans#lending#banking#finance#forex market

1 note

·

View note

Text

Dutch bank predicts Philippine economy will grow 5.4% this year

ING, a bank and financial services firm based in the Netherlands, published its forecast that the economy of the Philippines will grow by 5.4% this year, according to a Manila Bulletin news report.

To put things in perspective, posted below is an excerpt from the Manila Bulletin news report. Some parts in boldface…

Dutch bank ING is projecting a moderate 5.4 percent growth for the Philippines…

View On WordPress

#Asia#bank#banking#blogger#blogging#business#business news#capitalism#Carlo Carrasco#commerce#Dutch#economic dynamism#economic growth#economics#economy#Economy of the Philippines#finance#foreign exchange (FOREX)#geek#gross domestic product (GDP)#ING#interest rates#Manila Bulletin#money#Netherlands#news#Philippines#Philippines blog#Pinoy#Southeast Asia

0 notes

Text

Cheapest International Forex Bank Rates

0 notes

Text

Breaking: Bank of Canada expected to cut interest rates today! https://markets.tradermade.com/forex/bank-of-canada-poised-for-rate-cut-today. This move could significantly impact the Canadian Dollar (Loonie). Analysts predict a quarter-point rate cut, bringing the key rate down to 4.25%. This move aims to stimulate the Canadian economy amidst slowing growth. #Canada. Market participants are closely watching the BoC's monetary policy statement for clues on future rate decisions. The Loonie's performance could be affected.

0 notes