#banks day 26.4

Text

Our party guests have been generous in providing everything the baby will need. I suspect my parents are responsible for purchasing a good chuck of it. Maia and I are directed to the gift table to open our gifts. My cousin Terra comes over with yet another gift. I can tell that Maia is almost overwhelmed by all the love everyone has shown her. She deserves it.

(Full post available to read on my website)

29 notes

·

View notes

Text

Aggregate news of Palestine For April 21, 2024.

Aljazeera News:

Videos show widespread damage from Israel’s deadly West Bank raids.

Blurb:

Israeli forces have killed more than a dozen Palestinians during a three-day raid on the Nur Shams refugee camp, which has left the occupied West Bank city of Tulkarem in ruins. (Video embedded in article)

Nearly 200 bodies found in mass grave at hospital in Gaza’s Khan Younis

Excerpt:

Palestinian civil defence crews have uncovered a mass grave inside the Nasser Medical Complex in Gaza’s Khan Younis, with 180 bodies recovered so far, Al Jazeera has learned, as Israel has continued bombardment of the devastated coastal enclave for more than six months.

[...]

In a statement late on Saturday, Palestinian emergency services said: “Our teams continue their search and retrieval operations for the remaining martyrs in the coming days as there are still a significant number of them.”

[...]

Israel’s war on Gaza has killed more than 34,000 Palestinians, according to local health officials, devastated Gaza’s two largest cities and left a swath of destruction across the territory.

At least two-thirds of the casualties are children and women. It also says the real toll is likely higher as many bodies are stuck beneath the rubble left by air strikes or are in areas that are unreachable for medics.

Eye on Palestine:

[Image from video, Many Palestinians holding covered dead bodies during a packed open-air funeral]

The funeral of the Palestinians who were killed by the occupation forces in Nour Shams camp in Tulkarm. (HishamAbuShadrah from instagram, reposted on Eye On Palestine)

[Image of building on fire, from video]

Israeli settlers attacked the village of Burqa, east Ramallah.

مستوطنون يهاجمون قرية برقة شرق رام الله

(From Eye on Palestine)

CNN:

Israel concludes deadly West Bank raid as war devastates Gaza.

Summary blurb:

The US House of Representatives has approved $26.4 billion in aid to Israel, as part of a wider package of foreign aid, which still needs to pass the Senate.

The Israeli military concluded one of its largest offensives in the occupied West Bank since October 7 on Sunday, saying it killed 10 "terrorists." The Palestinian health ministry and Wafa news agency said 14 people, including a child, were killed in the raid, which left a path of destruction.

Elsewhere in the West Bank, Israeli settlers killed an ambulance driver trying to transport Palestinians who had been attacked, according to the Palestine Red Crescent Society. A spike in violence by extremist settlers in the occupied territory has led to more sanctions by the US and EU.

Strikes between Israel and Iran this month spiked fears of a widening regional conflict in the Middle East, but the two sides appear to be stepping back for now.

51 notes

·

View notes

Text

Signature Bank Was Seized After Leaders Caused ‘Crisis of Confidence’

According to New York officials, the government seized Signature Bank on Sunday after regulators lost faith in management.

A representative for the state's Department of Financial Services said in an email statement on Tuesday that the bank had failed to deliver trustworthy and consistent data, leading to a serious crisis of confidence in the bank's leadership. "Based on the bank's existing condition and capacity to conduct business in a safe and sound way on Monday, the decision was made to take possession of the bank and turn it over to the FDIC."

The Federal Deposit Insurance Corp. took over the company and established a bridge bank to serve customers after the DFS placed Signature into receivership. According to a person familiar with the situation, the third-largest bank failure in American history occurred as a result of a Friday increase in customer withdrawals totaling around 20% of the company's deposits.

Both a bridge bank spokesman and former CEO Joseph DePaolo did not immediately reply to requests for comment.

Former US congressman and member of Signature's board of directors Barney Frank claimed to have a different understanding of how things transpired.

In an interview, Frank stated, "I'm surprised. "That wasn't how I understood where we were," she said.

Frank claimed that although executives eventually managed to get control of the situation, data regarding the bank's balance sheet was volatile as management dealt with outflows. He claimed that although he wasn't directly involved in the discussions with regulators, executives had briefed him and the other members.

By Sunday morning, according to Frank, the bank's executives thought they had met the demand for the data and had obtained the necessary money from other sources as well as the discount window. He reaffirmed his conviction that the bank might have reopened on Monday and expressed his continued suspicion that the bank's readiness to interact with cryptocurrency companies was the cause of its shutdown.

A DFS representative claimed that the decision "had nothing to do with cryptocurrency" and noted that the organization "has been facilitating well-regulated crypto activity for several years, and is a national model for regulation of the space."

According to the former lawmaker, as of Sunday morning, deposit outflows had stabilized. Nonetheless, the DFS spokeswoman stated that "large withdrawal requests" would continue to be pending and increase throughout the weekend.

According to the individual with knowledge of the situation, Signature lost 20% of its deposits on Friday as customers fled to larger competitors after hearing about the failure of SVB Financial Group's banking division.

The individual, who wished to remain anonymous because they were talking about a personal situation, didn't give precise amounts for how much was taken from the bank. Yet, as of March 8, Signature claimed in a statement that it had deposits totaling about $89.2 billion. It would mean around $17.8 billion was removed in a single day. Contrarily, on Thursday, Silicon Valley Bank of SVB received withdrawal requests totaling $42 billion from investors and depositors, according to a regulatory filing.

According to the filing from last week, Signature has $26.4 billion in "marketable liquid securities" and $4.54 billion in cash on its balance sheet.

The unreported outflows give an idea of the difficulties regulators and bank executives faced over the weekend as federal authorities attempted to arrange liquidity solutions and reassure depositors.

Adrienne Harris, Superintendent of the New York Department of Financial Services, stated at a press conference on Monday, "We knew we were going to have to take action over the weekend so they could operate on Monday because of the volume of outflows we witnessed on Friday.

Ran Eliasaf claimed to be one of the depositors who took money out of the New York-based Signature. Providing short-term and construction financing for multifamily homes, condos, senior housing facilities, and nursing homes, he serves as managing partner of Northwind Group, a New York-based commercial real estate private equity company.

Eliasaf sent the following message to his team on Friday at approximately 10:30 a.m. New York Times when he observed the effects of SVB's demise: "It's better to be safe than sorry." He instructed them to transfer "tens of millions of dollars' worth" of deposits from Signature to JPMorgan Chase & Co., Bank of America Corp., and a few other smaller financial institutions.

(In the third paragraph, failure size is increased. In the eighth paragraph of a previous version of this story, the date was fixed.)

Read the full article

0 notes

Text

Market Talk - August 6, 2022

ASIA:

China’s consumer inflation could soon surpass 3%, CICC said. A global inflation wave that has largely bypassed the world’s second-largest economy may eventually hit prices there. Consumer price inflation in China has remained relatively low compared to soaring costs seen elsewhere as demand remains squeezed by strict Covid control policies and sporadic outbreaks. China’s consumer price index has risen rapidly in the past few months and is poised to exceed 3% from last year, according to analysts at China International Capital Corp. That would beat the government’s target of around 3% for this year, which poses a challenge. for authorities already struggling to balance a fragile economic recovery.

The major Asian stock markets had a mixed day today:

- NIKKEI 225 increased 73.37 points or 0.26% to 28,249.24

- Shanghai increased 9.91 points or 0.31% to 3,236.93

- Hang Seng decreased 156.17 points or -0.77% to 20,045.77

- ASX 200 increased 5.00 points or 0.07% to 7,020.60

- Kospi increased 2.30 points or 0.09% to 2,493.10

- SENSEX increased 465.14 points or 0.80% to 58,853.07

- Nifty50 increased 127.60 points or 0.73% to 17,525.10

The major Asian currency markets had a mixed day today:

- AUDUSD increased 0.00685 or 0.99% to 0.69803

- NZDUSD increased 0.00556 or 0.89% to 0.62816

- USDJPY decreased 0.174 or -0.13% to 134.837

- USDCNY decreased 0.00437 or -0.06% to 6.76213

Precious Metals:

l Gold increased 13.63 USD/t oz. or 0.77% to 1,787.78

l Silver increased 0.740 USD/t. oz or 3.72% to 20.615

Some economic news from last night:

Japan:

Adjusted Current Account increased from 0.01T to 0.84T

Bank Lending (YoY) (Jul) increased from 1.3% to 1.8%

Current Account n.s.a. (Jun) decreased from 0.128T to -0.132T

New Zealand:

Inflation Expectations (QoQ) decreased from 3.3% to 3.1%

Some economic news from today:

Japan:

Economy Watchers Current Index (Jul) decreased from 52.9 to 43.8

Singapore:

Foreign Reserves USD (MoM) (Jul) decreased from 314.3B to 288.2B

EUROPE/EMEA:

The Bank of England raised interest rates by the most in a quarter of a century, even as it predicted the UK economy would slip into recession later this year, underscoring the urgency for global central banks to tackle rising inflation. The hike in rates to 1.75% from 1.25% was the largest since 1995 and the first half-point increase since the bank’s independence in 1997. The move reflects recent rate hikes by the Federal Reserve and the European Central Bank, reflecting concerns that the longer inflation persists, the harder it will be to reduce. While a half-point increase was widely expected, dire warnings about the fragility of the British economy and stagflation, the toxic combination of no economic growth and inflation, caught markets by surprise. The British pound fell against the dollar immediately after the announcement before paring its losses and the yield on Britain’s benchmark 10-year bond fell.

The major Europe stock markets had a green day:

l CAC 40 increased 52.09 points or 0.80% to 6,524.44

l FTSE 100 increased 42.63 points or 0.57% to 7,482.37

l DAX 30 increased 113.76 points or 0.84% to 13,687.69

The major Europe currency markets had a mixed day today:

- EURUSD increased 0.0016 or 0.16% to 1.01943

- GBPUSD increased 0.00101 or 0.08% to 1.20815

- USDCHF decreased 0.0057 or -0.59% to 0.95540

Some economic news from Europe today:

Swiss:

Unemployment Rate n.s.a. (Jul) remain the same at 2.0%

Unemployment Rate s.a. (Jul) remain the same at 2.2%

Euro Zone:

Sentix Investor Confidence (Aug) increased from -26.4 to -25.2

US/AMERICAS:

The US Senate passed the Inflation Reduction Act in a close 51-50 vote. All Republicans voted no, while all Democrats supported the plan. The $430 billion package will go toward climate change, albeit not associated with inflation, health care costs, and additional corporate taxes. Most of the budget ($300 billion) will go directly to climate change initiatives, including clean energy incentives to ask farmers to lower emissions. Large corporations will fact a 15% minimum tax to help cover the plan. One positive aspect is that Medicate may negotiate with pharmaceutical companies for the first time to lower inflated drug costs.

US Market Closings:

- Dow advanced 29.07 points or 0.09% to 32,832.54

- S&P 500 declined 5.13 points or -0.12% to 4,140.06

- Nasdaq declined 13.1 points or -0.1% to 12,644.46

- Russell 2000 advanced 19.38 points or 1.01% to 1,941.21

Canada Market Closings:

- TSX Composite advanced 49.04 points or 0.25% to 19,669.17

- TSX 60 declined -0.13 of a point or -0.01% to 1,186.11

Brazil Market Closing:

- Bovespa advanced 1,930.35 points or 1.81% to 108,402.27

ENERGY:

The oil markets had a mixed day today:

l Crude Oil increased 1.692 USD/BBL or 1.90% to 90.702

l Brent increased 1.495 USD/BBL or 1.58% to 96.415

l Natural gas decreased 0.4769 USD/MMBtu or -5.91% to 7.5871

l Gasoline increased 0.0363 USD/GAL or 1.27% to 2.8919

l Heating oil decreased 0.0352 USD/GAL or -1.09% to 3.1807

The above data was collected around 14:37 EST on Monday

l Top commodity gainers: Lumber (7.68%), Palm Oil(4.98%), Palladium (5.61%) and Oat (7.66%)

l Top commodity losers: Zinc (-1.71%), Orange Juice (-3.50%), Natural Gas (-5.91%) and Heating Oil (-1.09%)

The above data was collected around 14:43 EST on Monday.

BONDS:

Japan 0.169%(+0.4bp), US 2’s 3.22% (-0.032%), US 10’s 2.7682% (-7.18bps); US 30’s 3.00% (-0.063%), Bunds 0.8930% (-6.8bp), France 1.4380% (-5.7bp), Italy 3.04% (+1.5bp), Turkey 16.28% (-17bp), Greece 3.083% (+9.3bp), Portugal 1.9410% (-2.5bp); Spain 2.021% (-2bp) and UK Gilts 1.9520% (-9.8bp).

Original Article

Original Article Here:

Read the full article

0 notes

Text

TSX golds stocks to buy amid rising inflation: KNT, YRI & G

Gold prices normally increase in inflationary settings. Thus, gold stocks could perform well in comparison to other sectors. On Wednesday, the latest report by Statistics Canada revealed that the annual inflation rate spiked to 7.7 per cent in May, marking the fastest rate of rising consumer prices in over four decades.

Highlights

Amid rising volatility, gold could act as a suitable inflation hedge.

The average Canadian’s life is becoming more expensive due to rising inflation.

Statistics Canada revealed that the annual inflation rate spiked to 7.7 per cent in May.

Gold prices normally increase in inflationary settings. Thus, Gold stocks could perform well in comparison to other sectors. On Wednesday, the latest report by Statistics Canada revealed that the annual inflation rate spiked to 7.7 per cent in May, marking the fastest rate of rising consumer prices in over four decades.

The average Canadian’s life is becoming more expensive due to the rising gas, food, and travel prices. Since January 1983, the cost of goods and services in Canada has not increased as swiftly. This has increased pressure on the Bank of Canada to increase interest rates in the coming weeks to control inflation.

Amid rising macroeconomic volatility, gold continues to be favoured as a suitable inflation hedge by some analysts due to its long-term association with equities markets. There is a great chance that an investment won’t be enough to support an investor’s retirement years if it cannot produce returns that outperform inflation.

As inflationary circumstances continue to intensify, we’ll explore the following gold stocks that you might want to add to your portfolio.

K92 Mining Inc. (TSX:KNT)

At the time of writing, the KNT stock had returned 27.4 per cent to shareholders since the start of 2022. Meanwhile, the KNT stock surged five per cent in the past week.

In Q1 2022, K92 posted record financial results regarding cash balance and monthly throughput. The company achieved a record cash position of US$ 79.9 million and strengthened its balance sheet.

Meanwhile, K92 achieved strong quarterly gold equivalent production of 28,188 oz in Q1 2022. For the three months ended March 31, the company’s throughput averaged 1,219 tonnes per day, a record for K92.

Net income for the gold mining company was US$ 14.1 million in the first quarter of this year.

Yamana Gold Inc. (TSX:YRI)

It is one of Canada’s largest precious metals companies and operates in various countries like Brazil and Argentina. On May 31, Gold Fields Limited announced that it would acquire Yamana at a valuation of US$ 6.7 billion.

Yamana’s first-quarter net earnings stood at US$ 57.8 million, and adjusted net earnings were US$ 83.6 million. Meanwhile, the cash flow from operating activities was US$ 151.7 million.

The company said its gold equivalent ounces production in Q1 2022 was in line with the expectations. Meanwhile, the gold production of 210,533 ounces exceeded the plan.

In the last six months, the YRI stock has soared 26.4 per cent and 25 per cent YTD.

Augusta Gold Corp. (TSX:G)

Augusta Gold’s main activities include buying and exploring gold assets. The company’s business operations are in Las Vegas, Nevada and on June 14, it announced that it had closed the acquisition of the Reward Project. Meanwhile, Augusta Gold acquired a low-cost Heap Leach Gold Project near its project in Nevada in April. The G stock commenced trading on the Toronto Stock Exchange in March 2021. Augusta Gold stock has returned around 44 per cent to shareholders quarter-to-date (QTD) and 49 per cent in the last six months.

0 notes

Text

MasterCard Inc. (NYSE: MA) To Phase Out Magnetic Strip Cars, Partners With Markaaza and AvidXchange raises $660 million

Payments company MasterCard Inc. (NYSE: MA) is ready to do away with magnetic strip credit and debit cards phasing out the swiping payment method, which has become obsolete with the emergence of the latest chip-based cards.

Magnetic stripe cards have been in use for decades, but technological development has resulted in a shift towards safe chip-based cards. The chip cards allow the user just to slot the card into a reader or hold it over a payment terminal simplifying the whole process. Most importantly, chip cards offer enhanced security and real-time approval, making it easier for merchants to accept payments.

The fight against climate change continues globally, and collaborations are important ways of investing in innovative ways of inspiring collective action to fight climate change. For example, Islamic financial institution Premier Bank has entered the Priceless Planet Coalition launched by MasterCard last year to unite consumers, merchants, financial institutions, and cities to address climate change by restoring 100 million trees in 2025.

Mastercard in partnership with Markaaz

The company and MarKaaz have signed a partnership in which the Markaaz platform will access MasterCard products and services to help small businesses. Access to the powerful tools, services, and data the companies will partner to allow users to save money and time in the identification of partners. On average small businesses spend 17 days per year in verification and re-verifying themselves for all they need.

AvidXchnage raises $660 million in IPO

AvidXhnage Holdings Inc. raised $660 million through IPO pricing shares at the top marketed range. The company's backers include MasterCard and venture investor Peter Thiel, and it sold 26.4 million shares for $25 per share after selling 22 million shares for $23 for $25. Based on outstanding listed shares, AvidXchange had a market value of around $4.9 billion. Its CEO Michael Praeger controls a 7.4% stake, the second-largest, with Bain Capital Ventures controlling over 12% of the shares following the IPO. MasterCard Venture Holdings will control 6.5%.

Read the full article

0 notes

Text

I walk over to my cousins Terra and Bri.

Wade: Hey, y’all! Thanks so much for coming.

Terra: I wouldn’t miss it.

Brianna: Congrats, Dub - I almost can’t believe you’re about to be a father.

Wade: Me neither. It’s all surreal. And I’m not sure I’m ready.

Terra: Is anyone ever ready?

Brianna: Right! I hope to know that feeling one day. By the way, I have someone that I want you to meet!

Wade: Yeah, okay. I’m looking forward to it.

As the rest of the guests arrive, I lead the way into the nicely decorated venue, wondering how Ma even found this place.

32 notes

·

View notes

Text

The Chase Files Daily Newscap 3/6/2020

Good Morning #realdreamchasers! Here is your daily news cap Wednesday 3RD June, 2020. There is a lot to read and digest so take your time. Remember you can read full articles via Barbados Government Information Service (BGIS), Barbados Today (BT), or by purchasing a Daily Nation Newspaper (DN).

PM ANNOUNCES RECOVERY BONDS, LOW-COST HOUSING SCHEME – Workers in the private sector are to be offered a chance to invest in the country’s recovery but at a lower interest rate than the BOSS bond scheme for civil servants, the Prime Minister said today. She also announced a low-cost housing programme for those public workers who earn below the threshold for converting part of their paycheque into bonds. For private sector workers, a Pandemic Solidarity Fund is to be used to shore up the National Insurance Scheme’s finances, she revealed at a meeting with civil servants on the BOSS – the Barbados Optional Saving Scheme at the Wildey Gymnasium. The announcement came in response to a question from a public servant who queried why the proposed Government bonds were not being offered to the wider public. Last Thursday, Mottley revealed that the NIS had so far received 41,836 jobless benefit claims and had paid out $26.4 million to 23,735 people. The PM said: “What you are getting from the Government of Barbados is a fixed rate bond, so it is five per cent fixed for the life of the bond. People ask why not the whole country, why we aren’t making it available to the whole country. “Other things and other instruments will come to be made available and maybe not even at the same level as this because really and truly an employer treats employees better than they treat anyone else for the most part” With the World Health Organization (WHO) having warned against a second wave of COVID-19 infections, there was a need for a similar initiative from Government, she added. “So we may have to go back to the market with a Pandemic Solidarity Bond for the NIS in the future and in that one that would be more open to the whole public. “Its terms and conditions would be similar, it may not be the five per cent, it maybe four or four and a quarter [per cent] or whatever, but the point is that there is going to be another opportunity beyond this for those who are non-public servants.” In a further announcement, the Prime Minister also disclosed a separate programme for public servants earning less than $3,000 monthly, when asked why they were not being asked to take part in the BOSS. She said a housing programme for low-income earners would soon be launched and those workers would be targeted and given a chance to own their own homes. Mottley said: “I don’t know how to look at a police constable who may be earning $2,800 a month, but people want to sell them land at $25 a square foot. “So that one of the ways that we can increase capital works is by getting the housing programme going and the best way to get the housing programme going is to have people to need to buy houses or to have houses built. “If people under $36,000 want to participate I think we have said that we will accommodate them, but we are conscious that that is the category of person for the most part that we need to enfranchise first in another way in this country and that is by making them homeowners in Barbados.” (BT)

TEACHERS GIVE SUPPORT FOR BONDS – Efforts to sell public servants on the terms and conditions of the Barbados Optional Savings Scheme (BOSS) through direct engagement appear to be bearing fruit particularly with teachers of public secondary schools. On Tuesday, Barbados Secondary Teachers Union (BSTU) President Mary Redman revealed that 92 per cent of its members who attended a virtual meeting with Government’s chief economic advisor Dr. Kevin Greenidge on Monday voted in favour of the arrangement that allows thousands of government workers to invest a percentage of their salaries in bonds. Despite suggestions from Opposition Leader Bishop Joseph Atherley that the presence of Government officials at such meetings is being used to intimidate, the robust discussions with the economic advisor are being lauded for providing much needed insight. “Many of the teachers felt much more comfortable about the programme after having that explanation and being exposed to the presentation from Dr Kevin Greenidge and after being able to question him one-on-one,” Redman told Barbados TODAY. So compelling were the arguments that they attracted support from most of the 180 teachers in attendance. “Ninety-two per cent of the members polled indicated that they were in support of the programme through a mechanism on Zoom that allows you to conduct a poll,” Redman indicated. The secondary school teachers were most concerned about their ability to adjust the percentage of their salary received in bonds with some indicating that they would be unable to meet Government’s requests, while others expressed interest in investing an even higher percentage of their pay in bonds. Some teachers noted concerns with salary deductions being poorly communicated through their secretary-treasurers’ offices and asked for assurances that the appropriate systems would be put in place to ensure that their individual arrangements would be properly honoured well before pay day. “Of definite concern was the capability of the existing bureaucracy to properly manage the adjustments of the salary in time for the end of month pay day through the established protocols of the secretary-treasurer and Smartstream. They wanted to ensure that there is no problem getting the final amounts and assurances that they would be truly shielded from further restructuring,” Redman explained. “Even some retired members wanted to know how they could be included in the scheme, given the low rates of interest they are currently contending with at the banks and the impact of those low rates on their quality of life,” she added. Under the BOSS initiative, public servants whose monthly take-home pay is more than $3,000 have the option of converting between seven per cent to as much as 17 per cent of their pay cheque into bonds. Those who earn less than $3,000 a month also have the option to invest in bonds if they choose but this is not mandatory. Those who are in a position to pay more into bonds can also do so. Those Government bonds will mature in four years at an interest rate of five per cent per annum in a bid to create approximately $100 million in fiscal space for capital spending amid the economic fallout from coronavirus. “The teachers recognise that they have the option to save what they can when they can within that 18-month period and so, they will make the decisions in relation to those parameters to best suit their own pockets,” Redman concluded. (BT)

CREDIT UNION BODY BACKS BOSS – The Barbados Co-operative Credit Union League (BCCUL) has given its support to Government’s Barbados Optional Savings Scheme (BOSS). Hally Haynes, president of the BCCUL, the representative body for credit unions on island, said the decision to take the option was left up to each member but the League felt a credit union member who opts to have a percentage of his salary in bonds was unlikely to be worse off than if they received all in cash. The BOSS initiative seeks to reduce Government’s wages bill by offering civil servants and those employed by state-owned entities a percentage of their salaries converted into four-year bonds for which they will receive five per cent interest. They will be allowed to trade them through the Central Bank of Barbados to entities or individuals in the private sector who may wish to purchase. Haynes, who joined a recent radio call-in programme discussion on the subject said: “We have to look at the features of the Barbados Optional Savings Scheme and when we look at the features, we realise it’s a four-year bond, short term, five per cent interest, interest paid every six months, no withholding tax on interest earned, it is fully tradable, it is guaranteed not to be restructured by the Government, and it has an early redemption clause after 24 months.” In those circumstances, Haynes added: “If the public worker who is a credit union member has a loan . . . that worker can take that bond to the credit union, use that bond to pay his loan commitment or mortgage . . . so he has not lost his position. He is in the same position as if he had received 100 per cent of his salary in cash.” “The member will not be worse off if he trades the bond through the credit union and gets back his cash. “In doing so, what will happen is that the credit union will earn interest of five per cent over the period of the bond. And the way credit unions operate that interest earned is part of the revenue at the end of the year, that same member who sold the bond to the credit union will still share in the surplus either by way of dividends or interest paid. “When we look at it overall, it is a question of options. Everybody has to examine the proposal and make informed financial decisions as it relates to the bond. We have been in consultation with the entire membership and we will be there to guide and give any information that is necessary,” Haynes said. While Government continues to face challenges from Opposition Senator Caswell Franklyn about the legality of the initiative, its chief economic advisor Dr Kevin Greenidge says Government needed to create a “$100 million fiscal space” for capital works programmes to “mop up” some of the more than 41,000 jobs that have been lost in the private sector due to the COVID-19 pandemic and kick start more economic activity on the island. (BT)

CHECK UP ON NIS, PAYE DEDUCTIONS, EMPLOYEES TOLD – Employers were today accused of not paying employees’ NIS or PAYE deductions, prompting Minister in the Ministry of Finance Ryan Straughn to urge workers to check with the National Insurance Scheme (NIS) and the Barbados Revenue Authority (BRA) from time to time to ensure the contributions are being paid up. Straughn did not say how much money was owed in NIS contributions or income tax. He also stopped short of saying whether any of the now 42,797 unemployed people are unable to receive unemployment benefits owing to delinquent employers. Straughn, who was leading off debate on the Catastrophe Fund Act during the morning session of Parliament, said he would encourage all workers to do period checks with the NIS and the BRA to ensure their NIS and Income Tax contributions were being paid as reflected on their payslips. He said: “It is the responsibility of every citizen to check and verify that any statutory obligations that are being taken from your salaries are being deposited at the appropriate institutions. “Over the course of the last few weeks as I have been doing tax clinics online, I have been asking people ‘can you confirm if this money that is shown here at the Revenue Authority on your account that you actually earned? “And the reality is that we have all taken things for granted that once the payroll slip is done and they send you the payroll and it go to the bank, we all take it for granted.” Straughn hinted that some employers could be using the current pandemic as an excuse not to pay those contributions. He told the House: “It is at these very times when people may be expecting to receive benefits only then to realize that no monies were deposited into their account for some time. I think it is important that employers and employees be responsible in managing this going forward. “Therefore, employees cannot simply absolve themselves of the responsibility of checking periodically to ensure their accounts are up to date.” The Finance Minister advised companies that were having trouble paying their employees’ contributions to contact the NIS and BRA to arrange a payment plan. Straughn said: “I want to urge those self-employed persons as well as those employers who have submitted the schedules but not necessarily the monies, that while we understand in this environment where we want to maintain as many jobs as possible that we have to find a workable solution that allows for people’s contributions to be made, for businesses to be compliant and that we can get as many self-employed people compliant with their National Insurance contribution such that if any of this is to ever happen again, that people would be clear as to what it is they will be eligible for “The House Chairman of Committees Dr Sonia Browne recommended that changes be made to the NIS to ensure self-employed people could access greater benefits. The backbench MP said: “I think the benefits need to be extended to sick leave. Self-employed people do get sick and I don’t know if it is a glitch at the NIS but self-employed people do get ill and need a little support. “Nothing is coming in to support them during that sickness that could be as short as two days to a lot of months depending on what is happening, and they do pay.” Self-employed individuals are entitled to sickness benefit, maternity benefit/grant, funeral grant, invalidity pension, old age contributory grant/pension and survivors’ benefit. While the features of those benefits are largely the same as those offered to employees, there are differences in the sickness benefit and the maternity benefit. Self-employed individuals are not entitled to unemployment and employment injury because they do not contribute to those funds, according to the NIS. (BT)

JOBLESS CLAIMS A STRAIN ON NIS – The National Insurance Scheme (NIS) is under pressure, with close to 43 000 unemployment claims filed to date as a result of the COVID-19 pandemic. The disclosure was made by Minister in the Ministry of Finance Ryan Straughn, who told the House of Assembly yesterday it was critical to get most of the unemployed Barbadians back to work. He maintained that the run on the NIS funds was not sustainable. Introducing the Catastrophe (Amendment) Bill 2020, Straughn said the health crisis had caused major disruption of businesses, resulting in about a third of Barbados’ approximately 145 000-strong workforce being out of work. (DN)

HUSBANDS: LET HOME DRUMS BEAT FIRST IN COVID-19 RECOVERY – Minister in the Ministry of Foreign Trade today urged Barbadians to buy Bajan to aid pandemic recovery even as she noted the hundreds of millions the country earns from its trade with CARICOM. As Parliament debated the Catastrophe Fund, MP for St James South Sandra Husbands, predicted that given its performance over the last two years, the economy will recover from the current downturn emanating from the COVID-19 pandemic. Husbands said the Catastrophe Fund will benefit Barbados once it is used to keep businesses afloat. She said: “COVID-19 can push a major “reset” button for Barbados, and the businesses that will apply to it should use it as a means to strive for the common good. “In that regard, they must remember that their survival will depend on the ability of other local companies to keep people employed. “So I believe they should make buying local goods and services their first priority, and ultimately those from our CARICOM neighbours.” On the subject of CARICOM, Husbands noted: “Barbados earns over $300 million a year throug the Caribbean Single Market and Economy owing to our capacity to seek goods and services to OECS and CARICOM member states. “We have a common destiny and if we can support each other in the aftermath of COVID-19 we can guarantee our survival. No one is coming to rescue us, we need to save ourselves.” Husbands praised the two-year-old administration for having faced eight controversies since it came to power and “managed to overcome them all”. She said: “I cannot imagine what would have happened to Barbados in the current COVID-19 environment if the previous administration was still in charge. “COVID came at a time when our Government’s economic team was working hard on restructuring our debt, had granted salary increases to public workers, as well as increased welfare support and tax concessions. “We were setting the stage for positive growth, but now COVID-19 has left us $450 million short in revenue, our tourism industry has closed down and we have 43,000 people unemployed, more than at any other time in our history.” (BT)

NAME CHANGE IN TOWN PLANNING SHAKEUP –The Town and Country Development Planning Department is to be renamed the Planning and Development Department and the Chief Town Planner’s post is to be abolished, among a number of major changes to the Government’s town planning agency, Minister of Economic Affairs Marsha Caddle has disclosed. The Chief Town Planner is to be replaced by the Director of the Planning and Development department, she said, adding that changes are coming to the operations and speed of which things are done by the department. As the Minister piloted the Planning and Development (Amendment) Bill in the House of Assembly, the St Michael South Central MP said the changes were aimed at making the department more efficient. A major change is having the same application number throughout the entire process. She said: “Applicants felt that they wanted an approval before going to the detailed design drawings. We agreed we would do it in two phases. “We go quickly through the planning and approval and use the same application number and attach that to the stage of the building permit when the drawings are required. You keep the same application number throughout the process.” Caddle said the changes were important steps that had to be taken at this time. She said: “We believe that these are important steps we have to take. These steps require some other changes. We need to change the title of the head of the Planning and Development department from Chief Town Planner to Director. The establishment of the one-stop system will require the current amendments that we are now debating. It will also require that we repeal and replace Health Services Implications 1969. It requires the revision and adoption of the Barbados Building Code and further capacity building in the Planning and Development Department which is underway.” “We will also increase of the timeframe of the delivery of decision by the Appeal Panel from 14 to 28 days. We did have some discussions and it was suggested that more time is required to adequately consider appeals.” There will be a different system in place for bigger projects with more “complex” designs, the Minister disclosed. Caddle said: “For more complex applications these will be appraised against the Building Code by independent external professionals. That’s important. The idea of a Building Code is something that has been discussed over and over for many years. A Building Code for Barbados has to be reviewed, agreed and out fully into force. This amendment allows us to do that. “The drawings will be registered with the department when approve and we will have independent professionals inspect the works at different stages and report to the department. The department will issue the final occupancy certificate and registers will be kept by the department. “These same external professionals will be required to have professional indemnity insurance in order to be registered under their relevant professional acts.” As it relates to the independent professionals they will be subject to disciplinary action if the need arises, she said. “The legislation that governs them has to be robust and that they are highly motivated to do their way in a responsible way. We also have penalties for professional misconduct among the professions that we are asking to be involved in the building control process,” Minister Caddle said. (BT)

FUNDS TO KEEP BUSINESSES AFLOAT –With about a third of the workforce now claiming unemployment during the COVID-19 pandemic, a Government Minister is stoutly defending a decision to assist businesses using the Catastrophe Fund. Minister in the Ministry of Finance Ryan Straughn insisted that Government had to take steps to “re-engineer” its resources to ensure that the majority of those currently displaced due to COVID-19, were back on the job in a relatively short time. As of Friday, there were some 42,797 unemployment claims by individuals who were displaced due to the pandemic. Straughn, who was leading off the debate on the Catastrophe Fund Bill in Parliament on Tuesday, described the COVID-19 global pandemic as perhaps the most devastating natural disaster that has happened to mankind. He said Government’s decision to therefore introduce a new Act to govern the Catastrophe Fund, which was first legislated in 2007, was to simply help businesses survive the pandemic and be able to hire people. “I want to make it clear to the country that what we are doing here today is not in any way to disadvantage any person in the country. It is not in anyway to take away from the fact that we will still continue to build the Catastrophe Fund, and for the very reasons we are making these amendments today is because we need now to ensure, as much as possible, that as many businesses can survive in this country [and] continue to employ persons,” explained Straughn. The new-look $50 million Catastrophe Fund, will provide financial aid to eligible self-employed individuals and qualifying businesses affected by a catastrophe. While there was a previous Act governing the Fund, which is funded by a 0.1 per cent of employee’s insurable monthly earnings, there has been a broadening of the definition of catastrophe in the new Act to include a pandemic, breach of cyber security and act of terrorism. A month ago Government announced that the fund would be used to keep businesses afloat in the form of a new $40 million VAT Loan Fund. Since that announcement, Opposition Leader Bishop Joseph Atherley and his team, as well as President of Solutions Barbados Grenville Phillips have voiced concern about the Catastrophe Fund being used to provide the one-year interest-free loans to businesses. However, Straughn dismissed those concerns today, stressing that the move was only one of several initiatives designed to allow for greater cash flow for businesses to quickly get unemployed people back into the workforce. “The Government’s responsibility is to ignore those cries and focus on channelling and getting everybody focused on what the solution is,” said Straughn, as he promised continued engagement with stakeholders. He said: “We are not taking the money and just giving it away. We have put some measures in place to improve the cash flow for businesses outside of any other mechanism they may employ from the bank or financial institutions, to ensure we can keep as many businesses afloat as possible.” He said while he expected some people to disagree with the use of the fund to help businesses, Government would do what it could to help as many people as possible to keep their “heads above water”. “Therefore, I say to Barbadians yes, the next few months, the next year will be tough, but we have crafted a response that is as inclusive as it can be in the current circumstances and while I know some may wish to criticise and they are free to criticise, at the end of the day our mission is to ensure that ordinary Barbadians can keep their heads above water,” said Straughn, who also dismissed objections to the newly-introduced Barbados Optional Savings Scheme (BOSS). Straughn also used the opportunity to reject suggestions that Prime Minister Mia Mottley should trim her 26-member Cabinet, saying the country should judge Government on the basis of its performance and not the size. “It is important that the country focuses on what is required to get everybody out of this hole rather than focusing on who they think should be tossed aside. The Government’s response is to keep every single Barbadian household afloat during this time so that we can all come out of this together and the reality is that it is going to be difficult,” said Straughn. The National Insurance Board is responsible for the management and investment of the Catastrophe Fund, and two committees will be established – the Physical Catastrophes Committee and the Economic Catastrophes Committee – for the consideration of and assessment of claims and granting of financial aid. (BT)

GOVT ‘RAIDING’ CATASTROPHE FUND – Leader of the Opposition Rev Joseph Atherley today accused Government of “raiding” the Catastrophe Fund even as fellow lawmakers moved to create it. The St Michael West MP was speaking in the House of Assembly on the Catastrophe Bill Fund, when he urged Government to use other alternatives to help struggling businesses. He urged that the fund should not be touched for now. Rev Atherley said: “I don’t support the approach of a raid on the Catastrophe Fund and the justification used as a premise for that. The money is going from the Catastrophe Fund to businesses who have filled their VAT returns. “You are taking about a certain level of business operation in Barbados. Why not facilitate the loan from the same VAT payments if current legislative arrangements don’t allow that why not make changes.” The leader of the People’s Party for Development said that there were other ways to find money, but insisted the Fund not be touched. He said: “We have seen waivers of VAT owed to Government and have been approved. So you waved multi-millions of dollars in VAT payments for the businesses, now you take the Catastrophe Fund to facilitate loans to businesses. “My question is: Can’t money derived through payment of VAT be used for this same purpose? There are businesses in Barbados right now that owe Government a lot of VAT. Rather than raid the Catastrophe Fund collect the VAT that had been long outstanding. The Opposition Leader said the money must be accessible should the country fall victim to a natural disaster. He told the House: “If the whole of Bush Hall Yard Gap, in your constituency or the whole of Savannah Road or Park Road is wiped out by some natural disaster impact you want to know that they are funds available immediately and urgently so to help with the response. We have to be careful in what we do.” But transport Minister William Duguid rose on a point of order asking that the word “raid” be struck from the record. He said “I could not in all decency allow the honourably member to suggest that the Government is mounting some sort of raid of the Catastrophe Fund. The pandemic we are facing is a catastrophe of the world. There is no suggestion that it is something that is simple. “It is not only a health crisis it is a significant economic crisis and if we have a fund set up there to protect the people of the country in catastrophe of which we are in then we have to be prepared to access it. It is not a raid. “For the honourable member to suggest it is a raid of some sort is clearly misleading the House. I ask that that kind of language be struck from the record.” In continuing to address the chamber after Dugiud interrupted, Atherley repeated the word “raid”. He declared: “I support any attempt to help businesses. But I am not sure that the way to do it properly and prudently includes what I see as a raid on a Catastrophe Fund set up for a specific purpose. “What I do have a problem with is the way it is being done I do not believe that the justification offered by spokespersons for the Government as to why a recourse should be made to the Catastrophe Fund in this instance is acceptable. I can only tell you how I feel, you may differ with me on that. (BT)

TRUST THE CHINESE A LITTLE MORE – Caribbean Governments have been told to get over their hang-ups about borrowing money from China. Dr Don Marshall, head of the Sir Arthur Lewis Institute for Social and Economic Studies (SALISES) at the Cave Hill Campus of the University of the West Indies (UWI) says China’s lending conditions are no more onerous than traditional lender nations or institutions such as the World Bank or the International Monetary Fund (IMF). Speaking at a recent SALISES Mona Campus-led discussion entitled Covid-19 and Fiscal Sustainability – Debt, Balance of Payment and Financing For Development, Marshall said too many Caribbean leaders were overly suspicious of borrowing from the Chinese at a time when and it was one of the leading providers of foreign direct investment to more than 100 countries. He argued that as regional Governments seek funding to prop up their economies that have been shattered by the effects of the global pandemic, he noted: “The IMF recognises China as well as its digital currency. “The post-Cold War hang up that we in the Caribbean and elsewhere seem to have that suggests to us that we ought to look to China . . . with suspicion while treating to traditional creditor nations in the West with open arms, we need to get away from that.” The UWI academic added: “We need to access financing on concessional terms and not just complain about the narrow GDP criteria used . . . on the part of the Paris Club to determine which countries will benefit from concessional loans and which by dint of being called middle-income countries have to go the capital markets and borrow expensively. “I am saying in this COVID-19 moment we are crossing the Rubicon. Global lending today is about patient capital, patient lending. It is about avoiding the volatility of the capital markets and it is an end to the game of performing for the credit rating agencies, only to pass [their] fiscal consolidation Litmus tests.” The SALISES Cave Hill head said the current economic environment demanded a higher level of state intervention to stabilize the economy in the face of the global shock caused by COVID-19. He added: “We in the region have to be insisting and lobbying . . . to encourage greater flexible financing. The IMF, China and other creditor nations and international lending institutions should agree to new forms and flexible financing.” (BT)

CITY STORES CRAWLING BACK TO NORMAL –Employees and owners of clothing stores today welcomed back customers after a ten-week break triggered by the COVID-19 pandemic. Having implemented the required protocols to prevent the spread of COVID-19, some store owners in The City who reported slow sales for the day told Barbados TODAY that they were experiencing mixed emotions. Many indicated that they were now counting thousands in losses as a result of having to close their shops for such a long period, while others said that though they were happy to be back in business, they were unsure what to expect as it relates to sales. Managing Director of Men’s Room, City Centre Mall David Wills said his business was hard-hit by the closure, considering that usually at this time of the year persons are shopping for formal attire for weddings and graduations. Nevertheless, Wills said he is contented to be able to open and is hoping for the best outcome. “Today we had a few customers and it was encouraging. We are doing a little Instagram and a little Facebook advertising reaching out to our customers and letting them know that we are open and encouraging them to come down. We got to keep the surfaces wiped down, the handles in the dressing rooms. We’ve got hand sanitizers and we have the alcohol sprays and we are encouraging everyone to wear a mask,” Wills said. An employee in Cave Shepherd sanitizing the handrail of the escalator. Val Richards of City Selection, also in City Centre Mall, said she spent the first day putting special provisions in place and keeping the faith that customers will come and shop in the coming days. Richards lamented that having to close the store was not easy considering that overhead expenses still have to be paid. “The money is not coming in and the utilities bills are coming, the rent is coming, so it’s kind of hard. Well by the grace of God we believe God will work out something for us. We just hope that by now and weekend things will pick back up and we will be able to pay some bills,” Richards said. Kaliyah Small of Genesis Boutique on Swan Street said she expected slow sales on the first day back out. Small said shoppers visited the store, particularly searching for clothing for work. “Here at Genesis we have a relationship with our customers so even though we were closed, they were still checking in. But I usually get orders online, so I don’t have to be in the building itself to be doing business. “It was tricky not having somebody here so people could pick up from the store and I would have to go and deliver. But it wasn’t too bad because people were still purchasing to go to work because everybody wasn’t home,” Small said. She added that while the store has implemented all relevant protocols to combat the spread of COVID-19, she was concerned about customers trying on clothing. An employee at Fitted Kings, Pyramid Mall, Swan Street said she was happy to be back at work though the sales seem to be “coming slowly”. The employee who gave her name as Anita said she hoped while Barbados has flattened the curve, there would not be a second wave of the COVID-19. Anita of Fitted Kings, Pyramid Mall, Swan Street organizing the clothing on display. Store Coordinator of Cave Shepherd Broad Street Mark Clarke said while the store officially reopened on May 21, today was the first day apparel was being sold. “Now that we are opened we don’t have a crowd but the customers that are entering the store are mainly gravitating to the first floor where these items are being sold. “As you could imagine we had to restructure our way of living and hence we had to formulate protocols for the store. So all customers are sanitized on entering the store, when trying apparel whether shoes or clothing their hands are sanitized, they are asked to maintain the mask on the face, they are given socks when trying shoes. There are protocols we have in place to make sure staff and customers are safe at all times,” Clarke said. (BT)

CADDLE COMMENDS CATASTROPHE FUND’S HEALTH COVER –Minister in the Ministry of Investment and Economic Affairs Marsha Caddle has backed Government’s decision to use the Catastrophe Fund to cover health risks such as COVID-19, saying the move is in keeping with current international trends. Speaking during debate on the bill in the House of Assembly today, Caddle dismissed a claim by Leader of the Opposition, Bishop Joseph Atherley that the pandemic was not to blame for the economic downturn. She said: “The international community has been treating COVID-19 as a catastrophe and they have all taken funds set aside for such purposes and expanded their reach to include pandemic mitigation.” The St Michael South Central MP noted that Barbados has expressed interest in joining the Inter-American Development Bank’s Contingent Credit Facility, which allows member nations to gain immediate access to liquidity in the face of natural disasters and other catastrophic events. Under the facility, countries have access to $600 million (US$300 million) or two per cent of their Gross Domestic Product, whichever is lower, in the event of natural disasters. The fund, which covers storms, tsunamis and long term environmental issues, including drought and beach erosion, has recently added health risk cover, Caddle noted. She said: “The COVID-19 pandemic has demonstrated that natural disasters are not the only way in which countries can receive ‘shocks’ that are out of their control. “While Government has responded rapidly to the pandemic, it is still on its transformation agenda, because we cannot lose sight of our agreement with the people of Barbados to transform their lives.” On the issue of housing, particularly for low-income workers, Caddle, said: “The Ministry of Housing has received resources to work towards building climate-resilient houses, and we also have a roof replacement programme which will be administered via the Urban Development Commission and other agencies. “There is a need for housing that is both affordable and resilient, because I recall when I did damage and loss assessments in the wake of natural disasters, all too often it was poor people’s homes that were destroyed as no one insisted on proper building standards, and most of the time these houses were uninsured and the people did not have any savings with which they could rebuild. Everyone must be part of the safety we want to build into this country.” (BT)

STATE AND CHURCH DISCUSSING PROTOCOLS – Church leaders across the island will be engaging Government in a discussion about the strict guidelines they will be required to follow as they again welcome congregations amid the COVID-19 pandemic. Barbados TODAY understands that at a virtual meeting scheduled for tomorrow with religious leaders and Minister of Labour and Social Relations Colin Jordan who has been assigned to deal with ecclesiastical affairs during the pandemic, church leaders will be asking for adjustments to be made to some of Government’s “heavier than usual requirements”. One major restriction the leaders will be objecting to is the fact that there shall be no communion service involving worshippers, but where doctrine allows, the Minister may take communion on behalf of the worshippers. Last Thursday, it was announced that churches and faith-based organisations will be permitted to resume services from June 1, 2020. On Saturday May 30, the Official Gazette published on the Government Information Service (GIS) website outlined the conditions under which services must take place, including the sanitizing of hands, temperature readings, and wearing of face masks. Government also requires that each worshipper has at least 40 square feet of space for himself in the church unless they are members of the same household, while services shall be no longer than one hour. No air-conditioning is to be used and windows and doors are to be kept open to allow for ventilation, while no hymnals, Bibles, leaflets or other materials shall be distributed to worshippers but worshipers may take their own. There shall be no separate service for children, including Sunday and Sabbath school, no choir during service and no group practice or performance for or at worship or prayers. Those church members over 70 who wish to attend church will have to be accommodated at a “special” service organised for them. Additionally, the protocols stipulate that there are to be no rituals that involve touching, including baptism or christening, laying on of hands, anointing, confirmation or dedication, while a record must be kept of all persons who attend every service and is to be available for inspection by the Chief Medical Officer or his designated officer. Meanwhile, where multiple services are held on the same day, there is to be at least one hour between services for a full sanitization of the interior of the church, including all internal and external bathrooms, fixtures and equipment. Where prayer mats are used, worshippers are to take their own mats. There is to be signage placed in conspicuous locations outside and within every church and the minister shall make announcements explaining the protocols to be followed before every service. Areas used by persons who become ill shall be closed for at least 24 hours and shall be thoroughly sanitized before use by others. Additionally, people with temperature over 37.5 degrees Celsius are not allowed to enter the church and persons who are coughing repeatedly, sneezing or exhibiting flu-like symptoms are also prohibited from attending. The restrictions have been a source of much discussion on call-in programmes and social media. People have been asking what happens if the church leader is 70 or older since persons in this age group can only attend a “special” service. Barbados TODAY reached out to a number of church leaders who admitted that they were not pleased with the restrictions but indicated they hoped the scheduled meeting would influence some adjustments to the guidelines. However, when contacted Chairman of the Barbados Christian Council Major Darrell Wilkinson said he was aware that several leaders are concerned about the restrictions. The main issue raised, he said, has been the restriction on communion. “But there is a general acceptance among us of the protocols. Yes we find that it seems a little tough especially the restriction on the time and the different responsibilities that were not there before. We haven’t had any definitive plan as yet; we are just discussing it briefly. But some of us are not yet ready to move towards the resumption of gathering because all the protocols are not in place. “We are still looking through them to see if there are any adjustments that can be made and then if there are we will make our presentation to the Government to see if there is anything they can do. But right now it remains as the Government puts it,” Major Wilkinson said. The leader of a Pentecostal ministry said they were pleased that Minister Jordan and his team have acknowledged that some churches are not happy with the restrictions and are willing to make themselves available for dialogue. The leader said they were particularly aggrieved about the restrictions on communion since several churches used disposal utensils during the session. “I don’t want to talk before the meeting. But it is like you having a baby in the womb and you cut the umbilical cord, that baby will die. The Lord’s Supper, communion, is the life of the church. The Bible says in the book of St John Chapter 6 that unless you eat his body and drink his blood you have no life in you. When the body is deprived of the Lord’s Supper there is no life in the church. And I am sure that every pastor and every worshipper is concerned about not being able to have communion,” the church leader said. (BT)

ATTORNEY GENERAL: MORE EFFICIENT ADMINISTRATION OF JUSTICE COMING – Expect the wheels of a modern judicial system to begin to run more smoothly and effectively soon, Attorney General Dale Marshall declared today as Government moved to bring the administration of the civil justice system into the realm of cyberspace. He sought to give the assurance as Parliament resumed at its temporary location at the Worthing Corporate Centre with debate on the Stamp Duty Amendment Bill and the Registration of Judgements Act. Marshall said the two pieces of legislation made provision for some legal procedures to be done online, thereby creating a greater level of efficiency in the system. “In our modern era, in other jurisdictions documents are filed electronically,” the AG said. “There is absolutely no reason why in our own jurisdiction we should be reluctant to embrace the concept of electronic filing.” The amendment to the Stamp Duty Act provides for stamps to be affixed to documents electronically, while the amendment to the Registration of Judgements Act provides for the electronic registration of High Court judgements. Marshall said changes to the stamp duty process would result in a more cost effective and speedy process for the judiciary. He told fellow lawmakers: “The other element is the registration of judgements. When a person gets a judgement you complete a form and you file it. You pay the filing fee and get a judgement registered. It is a paper-based process that doesn’t really facilitate searching to see if judgements are registered against you. And this too, we can do more effectively. “This amendment to the Registration of Judgements Act will allow the Registrar of the Supreme Court to maintain an electronic register of judgements. So we are trying to bring the administration of justice, and at the same time the practice of law into a modern era.” While recalling that Government had begun the process of modernizing the judicial system since coming to office two years ago, Marshall stressed that the work being done would not be the automatic end to delays in the courts. Said Marshall: “I reiterate that they are not the solution to the delays in the administration of justice, but we will certainly go a long way towards helping to make the system more efficient. “While these amendments will not solve those problems, they will certainly allow for even the judges to work more effectively.” Pointing out that for the current financial year Government had already issued most judges with new “very powerful” laptops, Marshall said “we now just have to put those last few things in place so that the delivery of justice can be brought into a modern era”. Adding that the technology was only “one side of things”, Marshall pointed to the appointment of judges over the past year, saying a lot of work had been done to transform the practice of the administration of justice. He said: “These things now have to be given an opportunity to yield fruit, but we can fail if we don’t grasp the opportunity to do those small things. “The system for e-filing was paid for in the last financial year and we are now just completing the legislative things that will allow it to work.” Marshall promised that when fully operational, in addition to the filing of affidavits in court cases, the online system would allow for the filing of applications for letters of administration, applications for letters testamentary and other documents requiring the registrar’s intervention. “I am confident that over time we will see a system that is working more efficiently and at this point, a system that is safer for all of us as we carry out our day to day activity,” the Attorney General told the House. (BT)

MAN INJURED IN SHOOTING AT DUNCANS –Police are carrying out investigations into a shooting incident in which a 55-year-old man was shot at Duncans, St Philip, around 7:30 p.m. on Monday. Vincent Thorne of Lower Duncans received a gunshot wound to the left side of his head by a man known to him. He was taken to the Queen Elizabeth Hospital by ambulance and is reportedly in a stable condition. Anyone who can provide any information that can assist with this investigation is asked to please contact District ‘C’ Police Station at 1 (246) 416-8200, Police Emergency 211, Crime Stoppers at 1-800 (TIPS) 8477 or any police station. (DN)

HERBALIST MAKING ‘EXTRA CHANGE’ FROM GANJA, FINED – Guyanese national Jagmohan Murray who has been residing here for over a decade admitted today to cultivating marijuana and to two counts of possession, possession with intent to supply and possession with intent to traffic the drug. And now with a $5,000 fine imposed which the 37- year-old, 1st Avenue Accommodation Road, Bush Hall, St Michael resident must pay within a three-month period, he is appealing to government to give him a “little land to do good farming”. The convicted man is facing six months in prison if the amount is not paid to the District ‘A’ Magistrates’ Court in the stipulated time. His lawyer Dave Porter said his client was contrite, pleaded guilty at the first opportunity and has thrown himself at the mercy of the court. “To my mind the amount of drugs is a small quantity and I am asking that under the circumstances a fine be imposed that is reasonable for him to have time to pay within a reasonable time,” Porter urged the court. Police executed a search at Murray’s residence on May 30 and found 867 seedlings of the illegal drug. Sergeant Robert Jones said the drugs weighed 600 grammes and had an estimated street value if $3,000. “Look, everything on me own. Me like marijuana herbs. I is a herbalist,” he told police at the time. When asked today by Magistrate Douglas Frederick the purpose for so much drugs Murray responded that he and his wife had been in an argument and he was put out. “I went and build a little shack in the bush and study how to make a little extra change,” said Murray who also said he was a “B class carpenter” and painter. “Something tell me I can become a farmer too. I started to plant it last year. I sell a little about $500 or $400. I know it illegal but I did not know it so much illegal. “I want the government to give me a little land to do good farming. Government give me a piece of land to motivate me to farm . . . . I will come back and pay the fine but I not coming back here,” he stated. On some of the counts Murray was jointly charged with his 46-year-old wife Roseann Maria Murray, of the same address. However, she pleaded not guilty to the offences of possession, possession with intent to supply and traffic of cannabis. She was granted bail in the sum of $3,000 to return to court on October 6. Her husband’s fine was imposed on the supply charge while he was convicted, reprimanded and discharged on all the other cannabis offences. (BT)

YOUNG MAN CHARGED WITH INJURING HIS MOTHER - A 23-year-old man was granted $4,000 bail when he appeared in court today. Tristan Hakeem Bourne, of Cummings Road, Brittons Hill, St Michael is accused of causing serious bodily harm to his mother Nicolette Bourne on May 30 with intent to maim, disfigure or disable her or cause serious bodily harm to her. He was not required to plead to the indictable charge when he appeared in the District ‘A’ Magistrates’ Court with his attorney-at-law Kendrid Sergeant. The accused must now live with another family member at Dalkeith Village and has been ordered to reappear before Magistrate Douglas Frederick on October 6. (BT)

NEIGHBOURS SETTLE FIGHT IN COURT – It will cost a 38-year-old man $2,000 for jump kicking his neighbour, sending him crashing through the door into the gallery. Barry Sylvester Coleman, of Apple Grove, Black Rock, St Michael has three months in which to pay Tyrone Bishop the money if he wants to avoid spending six months in prison. Magistrate Douglas Frederick also ordered that Coleman not cross paths or interfere with Bishop and imposed a bond for the next nine months to ensure that does not occur. If the convicted man disregards the order he will spend three months in prison. The two men rent rooms at the same address Sergeant Robert Jones informed the court. Bishop has been there for 19 years and Coleman for approximately 10 years. According to the prosecutor the two have been involved in several disputes in the past. On May 30 at about 7 p.m. the two were involved in a quarrel in the living room. During that time Bishop retaliated by throwing a ceramic vase at Coleman but missed him. But Coleman did not miss when he began cuffing Bishop about the neck and body, before “jump kicking him through the door into the gallery.” He then landed more cuffs about his neighbour before walking away leaving Bishop bleeding. The matter was reported and Bishop was taken to the Queen Elizabeth Hospital (QEH) were he was treated and released. “I plead guilty because I wrong,” Coleman told Magistrate Douglas today adding that “everything” occurred in the patio and not in the living room as stated. “The fight was like 30 seconds and the cuffs was in the head. We basically the same height. I jumped kick him but not in the neck. I does rent in the back part of the house . . . I can keep my distance from him,” Coleman explained. Bishop was also present today and said: “He was wrong I ain’t do he nothing. I curse he and I call he a strip dancer. I was in the chair relaxing and he kicked the chair.” He added that he wanted compensation for his injuries but was willing to give Coleman time to pay. “I have nine stitches in my mouth. I just want he keep far from me. I can’t work right now. I does work with a jack hammer. I doing wells. I want $2,000.” That matter was settled with the compensation order and the bond imposed by Magistrate Frederick. However at the end of the hearing Coleman was arrested while in court in connection with another matter and taken in handcuffs from the District ‘A’ No. 1 Magistrates’ Court by an officer. (BT)

SURETY FORFEITS $1 200 BUT SIGNS AGAIN FOR GRANDSON – A surety was ordered to forfeit $1 200 after her charge, Niko Jamarlo Gill, went missing from court for more than a year. However, moments later, the woman opted to sign Gill’s bail on a new charge in the District “A” Magistrates’ Court and hours later when he appeared in the District “D” Court recently. Gill, 29, of Barbarees Gardens, Barbarees Hill, St Michael, pleaded not guilty to having cannabis on May 23 when he appeared in the District “A” Court. Prosecutor Station Sergeant Crishna Graham, who objected to his release, said Gill no longer lived at the Barbarees Hill address. (DN)

‘TAKE LESSONS’ FROM GEORGE FLOYD PROTESTS – Local authorities are being urged to use the ongoing protests in the United States of America as a reminder not to take the country’s marginalized communities for granted, especially amid the ongoing outbreak of the COVID-19. Political scientists Dr Tennyson Joseph and Peter Wickham were reacting to the unfolding developments as millions of people in North America and across the globe observed #BlackoutTuesday on social media in solidarity with protesters. The action has been sparked by the death of African American George Floyd at the hands of Minneapolis Police. Social media timelines from Barbados also supported the blackout cause with a torrent of black squares, which replaced the usually colorful platforms of Facebook and Instagram – an indication that the cries against racial, social and economic injustices are being felt here as well. Among them were numerous influential Barbadians including Minister of Creative Economy, Culture, Youth and Sport John King, Minister of the Blue Economy Kirk Humphrey, Government Senator Lisa Cummins, and Barbados’ Consul General to Toronto Sonia Marville-Carter. Businesses also took part in the show of digital activism including Chefette Restaurants, City of Bridgetown Credit Union, RBs Chicken, and Woolworth. Dr Joseph, a senior lecturer at the University of the West Indies sees the developments in the U.S as a manifestation of the fight against a global social structure that continues to perpetuate poverty, racism and inadequate healthcare systems, among other issues. “We have to observe developments in the U.S because it is the most advanced capitalist country and when there are major conflagrations, contradictions and explosions in the major capitalist country within a global capitalist order, then we have to keep our eyes on possible implications for us,” Dr Joseph told Barbados TODAY. As a result, he cautioned local and regional governments against walking away from “projects of social upliftment”. “Since the 1980s, the dominant ideology told us that the role of the state was really to regulate the environment for capital accumulation and many of the other things that people demanded like access to healthcare, education, and equal treatment were seen as secondary. So when you have a movement and explosion that is putting those things back on the agenda, you need to pay attention. We cannot be fooled into thinking that we can just come out of this coronavirus situation and return to ‘normal’,” he added. Peter Wickham meanwhile, spoke more directly about a Barbadian society in which issues of police brutality and marginalization continue to affect those at the lower ends of the economic scale. “I think many people assume that because we are a black country where there is no black racial minority, that we don’t have those issues. But the fact is that we do have those issues and we have had them for many years. We seem to have dealt with them differently, but I think that this type of issue is an important demonstration of the fact that the issues are still alive and well in the world. “We in Barbados have similar issues that we need to address because for a long time, we have had police excesses that have been impacting on people who are economically vulnerable and we assume that the issues don’t exist here, but we have had our challenges in the past. It is nothing new and we could learn a lot from the exercises. “Ultimately, it has always been a question of economics and a lack of economic power. Persons who find themselves in these problems are often not treated well by authorities and the situation in Barbados is no different. Poor people face many of those abuses but because they don’t have the distinguishing characteristics of racial minority, we assume that those issues don’t exist,” he added. As the crisis wears on, Dr Joseph argues that the U.S is continuing to lose ground as a global superpower and moral authority as it continues to grapple with the treatment of its minority and most vulnerable groups. (BT)

The world is facing the rapid spread of the Covid-19 Coronavirus Pandemic. As we continue to do our part in Barbados please remember to stay home but on the days you have to go out wear your masks, practice social distancing (stand 6-10 feet away from each other), practice good daily hygiene, eat healthy, exercise and keep your mind active. There are 212 days left in the year Shalom! Follow us on Twitter, Facebook & Instagram for your daily news. #thechasefiles #dailynewscaps #bajannewscaps #newsinanutshell #coronavirusinbarbados #nationalresponse #dailynews #thechasefilesblog

0 notes

Text

Here Are The 50 US Housing Markets Already Turning Ugly

Here Are The 50 US Housing Markets Already Turning Ugly

Here Are The 50 US Housing Markets Already Turning Ugly

Plunging mortgage rates in late 2018 through 2019 wasn't enough to revive the housing market (despite the hope of 20-year homebuilder sentiment). Cracks are already starting to appear in many metro areas across the country, as a more profound slowdown could be imminent.

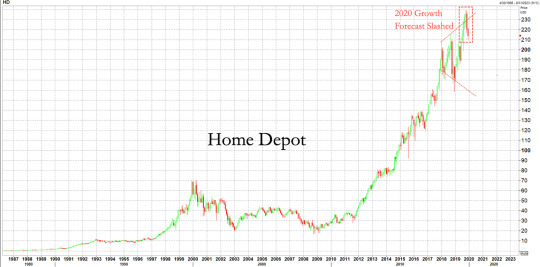

Last week, Home Depot ruined the party and pretty much declared that a housing boom in 2020 is non-existent.

The home-improvement chain cut its sales forecast for 2020, signaling that real estate and consumers could exhibit weakness in the year ahead.

Makers of Popeyes Ugly Christmas Sweater Say Trend Is Here to Stay

The disappointing 2020 forecast comes amid a report that 50 housing markets across the country are already showing signs of a downturn.

GOBankingRates evaluated 500 metro areas for high rates of foreclosures and underwater mortgages, variations in median home listing prices, the number of days homes are on the market, and the percentage of for-sale listings with price cuts, against the national average and determined the 50 most at-risk metro areas that are already turning south.