#bearish scenarios

Text

VeChain Sets Ambitious Price Goals: Analyst Forecasts VET's Rally to $3

VeChain's VET has exhibited remarkable 108% growth since September 23 but faces a 4.43% decline in January 2024, contrasting with the upward trends of Bitcoin and Ethereum. VeFam, a community-driven VeChain-focused account, sets ambitious VET targets at $0.5 in a bearish scenario, $1 in a neutral scenario, and $3+ in a bullish scenario. Despite the optimistic forecasts by VeFam, the volatile nature of crypto markets suggests cautious optimism for investors. VeChain, a significant player in the cryptocurrency market, is currently the subject of ambitious price predictions by VeFam, a community-driven account with a focus on VeChain. These forecasts, emerging during a period of market resurgence, outline potential price milestones for VeChain (VET) under different market scenarios. However, amidst this optimism, it is essential to examine the market dynamics and the realistic potential of these predictions.

VeChain's journey in the crypto market has resembled a rollercoaster. The token experienced a notable upswing of 108% from September to December 2023, climbing from $0.01 to $0.03. However, this impressive growth faced a minor setback in January 2024, with a 4.43% decrease in value. This decline contrasts with the continued growth of other major cryptocurrencies like Bitcoin and Ethereum, which have seen increases of 8.50% and 13.64%, respectively, during the same period.

VeFam's projections for VeChain are notably bullish. In the bearish scenario, VeChain is expected to reach $0.5, signifying a significant leap from its current value and marking a 1,424% increase. The neutral scenario suggests a potential rise to $1, a milestone VeChain has previously approached but not surpassed. The most optimistic, bullish scenario sets VeChain's price at over $3, requiring a monumental 9,049% increase from its current price. This would position VeChain among the top cryptocurrencies in terms of valuation. Notably, VET has been trading at $0.03296, according to CoinGecko data.

While these predictions present an optimistic outlook for VeChain, they come with a caveat. The cryptocurrency market is renowned for its volatility and unpredictability, making such forecasts speculative at best. Investors and market observers should approach these predictions with caution. The past performance of VeChain, combined with the dynamic nature of the crypto market, suggests that while these targets are not impossible, they are by no means guaranteed.

While VeFam's predictions for VeChain provide an optimistic view of its future, maintaining a realistic understanding of the crypto market's volatility is crucial. Investors and enthusiasts should perceive these projections as possibilities rather than certainties, considering the ever-changing landscape of the cryptocurrency world.

#VeChain#VET#cryptocurrency market#price targets#VeFam#bullish scenarios#bearish scenarios#neutral scenarios#market dynamics#volatility#unpredictable#optimistic outlook#speculative forecasts#Bitcoin#Ethereum#market resurgence#cryptotale

0 notes

Note

Do you think the democrat could rebound if they lose this election? I don't know the data of the general public (and I'm aware of how different the opinions on the internet can be from them), but I feel like if they lose the second most winnable election ever, they'll shatter every bit of credibility they have left

I don't think the Democratic party is on the verge of collapse, if that's what you're asking. As an organization right now it's probably more stable and in better financial shape than the Republican party (not that I think the Republican party is on the brink of collapse, either). The U.S. has an unusually strong two-party system, and the Democratic party is old, large, and well-organized, so by default any electoral opposition to the Republican party is going to coalesce around the Democratic party. Which, as the Republicans drift further right, is not going away soon; there's no scenario where Trump wins 500 EVs and 60% of the vote. He's just not very popular.

I think sentences like "I feel like if they lose the second most winnable election ever, they'll shatter every bit of credibility they have left" sort of betrays the fact that you belong to a very particular constituency, and one which is not representative of the majority of the Democratic coalition, which is pretty diverse. There are plenty of moderates and centrist-maybe-slightly-left types who probably don't think the Democratic party has *any* kind of "credibility" problem. Progressives are not the whole of their base (and not all progressives are so bearish on the party).

(I'm not saying you have to love the Democrats, just remember that if you vote for a political party, no matter who you are, people just like you are probably not the entirety of their constituency, and people just like you probably aren't enough to win elections on.)

The bigger worry for the Democrats would be a Republican-dominated SCOTUS and Republican trifecta fucking with the electoral system even further, like endorsing the Independent State Legislature doctrine or something. Considering every absurd nightmare legal scenario from SCOTUS people can think of seems to be coming true lately, I worry about that more than I do about some kind of purely internal, institutional collapse of the Democratic party, or major constituencies deserting it en masse.

93 notes

·

View notes

Text

Storm2k user wxman57 is an experienced professional meteorologist and generally regarded as a fairly conservative one - not a hype guy and if anything overly bearish - and he's saying that Helene could produce up to 30 feet of storm surge if it were to strike Apalachee Bay, assuming predictions of size and forward speed verify. 30 feet of storm surge is beyond unsurvivable - it would represent a record for the Atlantic basin, surpassing Hurricane Katrina's record of approx. 28 feet in Mississippi.

This isn't to say that that exact scenario will play out, but even 60-80% of that would be enough to inundate 2-storey buildings along the coastline. I normally wouldn't share a statement this dramatic, but this is a direct quote from a trusted professional with access to reliable modeling software.

5 notes

·

View notes

Text

⭐ Bitcoin on February 18th 2023 🚀✨

The price as I'm writing this is $24,470 per btc.

youtube

Astro 🔮💫

Venus is approaching a conjunction to Bitcoin's moon in Aries starting today, then subsequently Jupiter (On March 2nd). This likely points to a boost in people's investments (especially the jupiter conjunction). The stock market is likely to rally as well. Venus rules money & investments.

Super positive for bitcoin 👍

Cup & Handle Pattern:

- Invalidation vs. Breakout zones: $24,300 ❌ & $24,950 ✅

- Triple Bullish Scenario ♉♉♉

Cup Handle - 4h chart

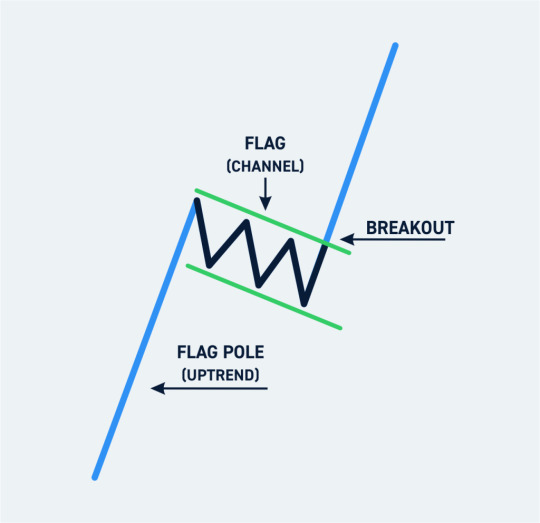

Bull flag - 1h chart

W-pattern (2x-bottom) - 15m chart

-=-=-=-

1: 💹 Trends

Monthly, we are in a downtrend 📉.

Meaning, we can expect prices less than $17,000 Bitcoin in the next 12 months.

Weekly, we are in an uptrend 📈.

Meaning we can expect prices higher than $25,300 Bitcoin within the next 8 weeks

So long as we close Sunday above $23,900 btc (So far, ✅)

Daily, we are in an uptrend* 📈

IF we close the day above $24,300 BTC. (@ 7pm EST)

However yesterday, we have made lower highs than the 15th, when we retested $25,000. Which is bearish.

4h we are in a seeming downtrend. Marked by a distinct lower high in the chart. Simply one strong candle downwards on this timeframe is confirmation and We are looking horrendous for Bitcoins price over the next 3 days.

Right now, it seems we are in this ambiguous/pivotal energy like yesterday. So it's a time for relative inaction. Volume is eerie and low at the moment. Not much pressure from either the bull or the bears 😐

Hourly, we are in a downtrend 📉

Meaning we can expect prices lower than $24,300 bitcoin within the next day.

That is just the fact of the matter... Despite that we are forming a sort of distribution pattern known as a bull flag. A sort of last minute attempt to break the down trend. If that is validated, this could lead us powerfully to our next leg up. The measured move would lead us precisely to our next target: $26,250 dollar btc. ⚠️

The bull flag would be confirmed by any intraday closure above the "pole" of the flag: ~ 24,950. Usually by bullish candles with high volume

2: 🔮 Conclusion

I am in a small long position as of the bottom of the bullflag Entered at ~$24,480. I will add more once there is confirmation of a breakout. Placing my stop-loss price at the bottom of the flag (channel).

And taking some profits at $25K!

3: 💰 Current Portfolio

18.5% USDs (+8.65%)

17.15% BTC (-4%)

64.35% Alts (-4.65%)

In Alts [24% is ETH 🔵, 17% is BNB 🟡, Rest is a combination of ADA, LINK, LTC & SHIB]

That's all For now!

2 notes

·

View notes

Text

Option Chain Analysis Strategies for Successful Trading

Option chain analysis is a crucial tool for traders and investors seeking to understand market sentiment, price movements, and volatility in the stock and derivative markets. It involves analyzing the data of call and put options at various strike prices for a particular underlying asset, typically displayed in a tabular format known as an option chain. This analysis helps traders make informed decisions on whether to buy or sell options contracts based on the available information regarding open interest, volume, implied volatility, and premiums.

ICFM (Institute of Career in Financial Market) offers specialized training in option chain analysis as part of its broader financial market education programs. Through its expert-led courses, ICFM aims to equip traders with the knowledge and skills required to interpret option chain data effectively. This helps individuals understand market sentiment, identify potential reversals or trends, and plan their trades accordingly. The training provided by ICFM covers essential aspects like open interest analysis, strike price selection, and how various factors such as time decay and volatility impact option prices.

One of the primary focuses of ICFM's option chain analysis training is teaching participants how to use data from the option chain to gauge the strength of market trends. For example, a high level of open interest at certain strike prices may indicate strong support or resistance levels, giving traders valuable insights into price action. The course also covers the relationship between put-call ratios and market sentiment, offering practical strategies for both bullish and bearish market conditions.

ICFM s training programs often include live market demonstrations, case studies, and real-time analysis to ensure that participants can apply theoretical concepts in actual trading scenarios. By learning how to analyze option chains, traders can better anticipate price movements, manage risk, and maximize their trading opportunities.

In summary, option chain analysis is a powerful technique for making data-driven trading decisions, and ICFM provides comprehensive training to help individuals master this skill. Whether you're an experienced trader looking to refine your strategy or a beginner seeking to understand the complexities of options trading, ICFM s programs offer the knowledge and practical insights needed to succeed in the financial markets.

#Option chain analysis#Option chain analysis course#Option trading course#Option trading courses#Option trading classes#Option trading classes in Delhi#Option trading institute

0 notes

Text

GigDece Price Prediction 2024-2025: What Investors Should Know

With the rapid evolution of the cryptocurrency market, new and innovative projects are constantly emerging. One such project gaining attention is GigDece, a decentralized platform focused on redefining how gig economy services are managed and delivered using blockchain technology. As we look towards 2024-2025, what can investors expect from GigDece in terms of price and market potential?

Overview of GigDece

GigDece aims to revolutionize the gig economy by providing a secure and transparent platform for freelancers and clients to connect. Leveraging blockchain technology, GigDece offers features such as smart contracts for secure payments, decentralized identity verification, and a marketplace for gig services. Its native token, GIG Token, is used for transactions within the ecosystem, staking, and governance.

Factors Influencing GigDece Price

1. Market Adoption and Partnerships

The success of GigDece hinges on its adoption within the gig economy sector. Strategic partnerships with existing freelancing platforms or collaborations with large companies could significantly boost the token's utility and, subsequently, its value. If GigDece can secure such partnerships in 2024, we could see a substantial increase in GIG demand.

2. Technological Developments

Continued innovation is crucial for GigDece. Upcoming platform upgrades, the introduction of new features like AI-driven job matching, and enhanced user experience can attract more users to the platform. A robust development roadmap and successful implementation of new technologies will likely have a positive impact on the token price.

3. Market Sentiment and Crypto Trends

The overall sentiment of the cryptocurrency market can also influence GIGD's price. Bullish market conditions often lead to increased investments across altcoins, while bearish conditions can lead to a decline. Keeping an eye on Bitcoin’s performance and regulatory news will be essential for predicting short-term movements.

GigDece Price Prediction for 2024

Given the current market conditions and assuming steady growth in adoption, GIGD could potentially see a moderate increase in price by mid-2024. A conservative estimate would place the token around a 50-100% increase from its current price, assuming that no major disruptions occur in the broader crypto market.

GigDece Price Prediction for 2025

By 2025, if GigDece successfully expands its user base and forges significant partnerships, the token could experience exponential growth. A bullish scenario could see GIGD reaching new all-time highs, potentially increasing by 300-500% compared to its 2024 price. However, this is contingent on positive developments and a supportive regulatory environment.

Conclusion

GigDece presents an interesting investment opportunity within the growing gig economy and blockchain sectors. However, like all investments, it comes with risks. Investors should stay informed about the project's progress and the broader market trends to make informed decisions.

Read more: https://gigdece.com

✔️ Telegram: https://t.me/gigdeceuk

✔️ Facebook: https://facebook.com/gigdeceofficial

✔️ YouTube: https://youtube.com/@gigdeceofficial

✔️ Instagram: https://instagram.com/gigdece/

✔️ Twitter: https://x.com/gigdece

Stay connected with us for exclusive updates! 🔔

0 notes

Text

Potential Impact of Declining US Bank Reserves on Bitcoin’s Surge

Key Points

U.S. bank reserves may temporarily fall, potentially leading to a liquidity increase benefiting Bitcoin.

Bitcoin’s dominance in the cryptocurrency market has surged, indicating potential for a significant rally.

Bitcoin [BTC] is showing signs of potential growth as market conditions suggest a possible increase in liquidity. Analyst Tomas on X has predicted a temporary drop in U.S. bank reserves to their lowest level in over four years, which could lead the Federal Reserve to halt Quantitative Tightening (QT).

When QT is stopped, it could result in a significant liquidity boost that may benefit risk assets like Bitcoin. This possible scenario has sparked optimism in the market, with many predicting a rise in Bitcoin’s price as the Federal Reserve adjusts its policies in response to economic changes.

Short-Term and Long-Term Holders

In addition, Short-Term Holders are showing resilience, with only 4.46% in loss, indicating no immediate signs of market capitulation. Historically, local bottoms in Bitcoin’s price occur when this percentage reaches around -60%. The low percentage of loss among Short-Term Holders suggests a stable market without panic or forced selling.

However, Long-Term Holders have experienced a decrease in their overall profit margin, with 58.27% still in profit, down from a peak of 74% in March. This decrease may suggest that while Bitcoin remains profitable for many, a potential bearish trend could emerge if profit margins continue to weaken.

Bitcoin’s Market Dominance

Bitcoin’s dominance in the cryptocurrency market has risen to over 57.86%, its highest level since April 2021. This increase in dominance strongly suggests that Bitcoin is leading the market and may be on the verge of a significant rally. As Bitcoin continues to outperform other cryptocurrencies, this shift could have a major impact on the broader crypto ecosystem in the long term.

Investors are closely watching this crucial moment for signs of further movement in Bitcoin’s favor. Bitcoin’s growing market share might set the stage for future gains and drive prices higher soon.

0 notes

Text

Centfx

he silver price is getting closer to its goal. Today's forecast is 04-09-2024.

The price of silver clearly declined as it moved toward our anticipated target of 27.62$, displaying a bullish bias influenced by stochastic positivity. It may now test the important resistance of 28.55$ before declining once more. Because of this, the bearish scenario will persist unless the barrier is broken and the price closes above it on a daily basis. It should be noted, however, that breaking 27.62$ will increase the negative pressure on the price, with its next target being 27.15$.

Today's trading range is predicted to be between the resistance at 28.40$ and the support at 27.60$.

#forexdubai #forexmalaysia #centfx #forexindonesia #forexindicators

0 notes

Text

US Spot BTC ETFs Record Two-Day Cash Outflow, Pushing Bitcoin Price Under $60K

Key Points

Bitcoin (BTC) price fluctuates amid midterm economic outlook, with a recent drop to $58K but gradual rise since August 5 market crash.

US-based spot Bitcoin ETFs record two consecutive days of cash outflows after significant cash inflows last week.

The price of Bitcoin (BTC) has been oscillating between bullish and bearish trends in the context of the midterm economic outlook. Despite a recent decline from $65K to just above $58K, the premier cryptocurrency has been on a steady upward trajectory since the market crash on August 5. However, the Bitcoin price is still caught in a macro correction that started earlier this year after it hit an all-time high of approximately $73.7K.

Technical Analysis and Future Predictions

From a technical perspective, the Bitcoin price has been forming an inverted triangle, typically followed by a significant bullish surge. The weekly Relative Strength Index (RSI) has been consolidating above 50 percent over the past two months, despite the noticeable bearish sentiment. If the Bitcoin price action in the 2024/2025 bull market mirrors previous cycles, the fourth quarter and the first half of next year could see a bullish trend.

In the coming weeks, the Bitcoin price could fall below $55K before rebounding towards a new all-time high in the following months. Additionally, Bitcoin’s fear and greed index has fallen below 30 percent, suggesting many investors are deeply concerned about potential crypto capitulation in September.

Spot Bitcoin ETFs’ Performance

US-based spot Bitcoin ETFs have recorded two consecutive days of cash outflows after substantial cash inflows last week. On Tuesday, they ended an eight-day cash inflow after reporting $127 million in cash outflows, largely driven by ARK 21Shares Bitcoin ETF (ARKB). ARKB led other spot BTC ETF issuers on Wednesday, with a cash outflow of around $105 million. Consequently, the US-based spot BTC ETFs have net assets under management of about $54.32 billion.

Moreover, Hong Kong spot Bitcoin ETFs have not seen any significant cash inflow since August 22. This suggests that the liquidity flow to Bitcoin products has significantly decreased compared to earlier this year. On-chain data indicates that more short-term Bitcoin holders have accelerated profit-taking recently. However, the supply of Bitcoin at centralized exchanges remains at a multi-year low, implying that long-term investors continue to hold in anticipation of bullish sentiments ahead.

The Overall Market Scenario

The Bitcoin price has demonstrated a positive correlation with the altcoin market, following the approval of spot Ethereum and Solana ETFs in the US and Brazil respectively. The expected interest rate cuts in the United States, following the dovish outlook from the Fed last week, in addition to the upcoming US elections will likely trigger bullish sentiment for the entire crypto space in the subsequent months.

0 notes

Text

The Economic Impact of Geopolitical Conflicts on Global Commodities and Currencies

Introduction

The global markets have been significantly influenced by recent geopolitical events. This analysis focuses on the economic impact of these events, particularly the Israel-Hamas conflict, and their implications on various commodities and currencies.

Market Overview

The market landscape has been shaped by several key events, including the Israel-Hamas ceasefire talks, Ukraine's peace summit, a global Windows cyber outage, and Trump’s rising influence in US election polls. These events have collectively created a volatile trading environment, with the Israel-Hamas conflict being a major focus. The interconnected nature of these events underscores the importance of understanding geopolitical risk in global market analysis.

Geopolitical Tensions and Economic Implications

The Israel-Hamas conflict has resulted in increased demand for military-related metals such as silver, palladium, and gold. Investors are turning to these metals as safe-haven assets amidst rising tensions. Public sentiment in Israel is pushing for peace, but the government's actions suggest a more complex agenda, impacting market stability. The increased demand for military assets has significantly influenced commodity prices, reflecting the broader economic implications of the conflict. This scenario exemplifies how geopolitical risks can translate into tangible market movements and influence global supply chains.

Commodity Analysis

Gold prices have surged to new highs, driven by expectations of a FED rate cut in September. This increase is seen as part of a broader trend, with potential for continued growth. Silver prices, after a significant retraction, are poised for a rise due to increased military demand and geopolitical tensions. The potential impact of a Trump victory also adds to the anticipation of rising silver prices. These movements highlight the role of precious metals as a hedge against geopolitical and economic uncertainties.

Currency Analysis

The USD shows signs of consolidation, with technical analysis suggesting a potential drop. The GBP has shown strength, benefiting from a weaker dollar and demonstrating potential for further gains. The AUD remains bullish, with potential consolidation or drops expected ahead of the FED rate announcement. The NZD faces challenges but could see bullish movements as September cuts approach. The EUR maintains strength, with technical corrections expected before further rises. The JPY, having peaked, could see further gains but remains on BoJ intervention watch. The CHF shows strength, respecting bearish structures with potential for growth. The CAD remains weak, with a Bank of Canada rate cut likely to influence its direction.

These currency trends reflect broader economic and political dynamics, with each currency's performance influenced by its domestic policies and international relations. The EUR's strength, for example, is tied to economic recovery efforts within the Eurozone and its trade policies.

Financial News and Future Outlook

Key financial updates from the US, Europe, and the UK, including PMI reports, the BOC rate statement, and US GDP data, are set to shape the market in the coming weeks. These events, coupled with ongoing geopolitical tensions, will play a significant role in determining market trends. Investors should be prepared to adjust their strategies based on these updates, considering the broader geopolitical context.

Conclusion

The current market conditions, influenced by a mix of geopolitical events and economic factors, require investors to remain vigilant and adaptive. Continued analysis and strategic decision-making will be essential in navigating the evolving market landscape. Understanding the broader geopolitical context is crucial for making informed investment decisions, as these events can have far-reaching impacts on market stability and growth prospects. Investors must stay informed and ready to respond to new developments, ensuring their portfolios remain resilient in a rapidly changing global environment.

0 notes

Note

do polls of the whole country tell us anything? don't you need to look at swing states?

National polls aren't useless, because movement in polls tends to correlate. If a national poll moves a couple points in one direction or another, that will tend to correlate with some degree of movement in several states. As I understand it, though, certain subgroups of states (e.g., ones with similar demographics) have much closer correlations in how their polls move, so that a shift in the polls in one Sun Belt state should correspond to a similar shift in the polls in another. This means you can make predictions like "If Donald Trump wins Virginia, he's probably winning a crushing victory nationally," because his performance in Virginia should correlate to his performance in many other states.

Swing state polls are very valuable, but keeping those correlations in mind helps to understand whether a swing state poll is an outlier or not. If a poll shows a shift in a certain direction, but that's not correlated with similar movement in similar states, it's worth questioning of that poll is accurate. Ditto if the poll shows unusual breakdown of results in demographic subgroups: if Trump is winning (say) 30% of young black voters, given the way demographics and party alignment usually break down, he should be winning a massive margin with other groups.

One reason I am not so bearish on Biden is that my understanding is that a lot of polls have had these demographic anomalies, with Trump's lead coming largely from support among younger, politically disengaged voters of color, and Biden, apparently, doing well with demographics like older whites. It is not a coincidence, in this view, that Trump seems to be performing unusually well with demographics that are particularly hard to poll in the modern polling landscape--response rates to telephone polls are very low among millennials and gen Z--and while there are various ways you can try to compensate for non-response bias, those depend on your model of the electorate.

Now, I am not extremely confident about this, because I am the furthest thing in the world from a polling expert, but as I understand it, there are two possible situations here:

One: the polls are broadly correct, and Trump is ahead. The election in November, if current trends continue, will feature a historic realignment of voters along demographic lines like age and race of the likes not seen since the 1960s (called "depolarization" by some commentators), perhaps driven by the rise in far-right internet media and social media.

Two: the polls are broadly incorrect, and we should be more agnostic about the state of the race, or even assume Biden is a little ahead, because such a massive realignment is extremely unlikely to have occurred in only two years since the 2022 midterms (where no such realignment was in evidence, and Democrats broadly overperformed polls), and polling right now is plagued by historically low response rates in the same key demographics that give Trump his lead.

Some commentators, including commentators whose field is polling, seem to want to have it both ways: the demographic crosstabs are wrong, but the top-line polling numbers are right. I'm not sure how this can be true. On top of that, big political realignments usually take time (i.e., we should have at minimum seen some evidence of this coming in 2022), and are unlikely to occur in a race where both candidates have been president before.

So on balance I think the second scenario is more likely. Now, I am not a stats person, nor particularly knowledgeable about polls; all of this opinion is second-hand from other commentators. As such, I am not going to claim any kind if ironclad certainty about this, and you're perfectly entitled to rub it in my face if I turn out to be totally wrong. And if I do stumble across someone who does know the polls really well with an explanation of why I'm wrong (even just at the level of "you are factually wrong, here's why the crosstabs are actually perfectly normal") I may well revise my opinion.

#one critique of this position i have seen#and which i think is valid#is that it strongly resembles the 'poll unskewing' from 2020#but the poll unskewers had a different methodology AIUI#(basically denying that *any* swing in opinion could be taking place)#and believing the polls were broadly correct didn't require positing any unusual realignments in voting behavior#this election is different#and both 'polls are wrong' and 'polls are right' have surprising implications!

39 notes

·

View notes

Text

Candlestick formation & swing moves duration to determine trading momentum:

Dua hal yang dapat kita lihat untuk mengetahui apakah momentum di market sedang akselerasi atau deselerasi adalah dengan memperhatikan dua elemen yang paling penting yaitu candlestick formation dan swing moves duration.

Ketika harga melakukan akselerasi dalam bullish market scenario atau bearish market scenario, candlestick formation diwujudkan dengan candle yang memiliki volume besar (big body candle tanpa wick) yang mana menunjukkan tingginya volume dari para pembeli atau penjual. Biasanya diwujudkan dengan bullish engulfing atau bearish engulfing sehingga durasi yang dibutuhkan jauh lebih cepat. Momentum tersebut menunjukkan kepercayaan diri dari pembeli atau penjual untuk mempertahankan tren harga yang ada.

Ketika harga melakukan deselerasi dalam bullih market scenario atau bearish market scenario, candlestick formation diwujudkan dengan candle yang memiliki volume kecil (small body candle dengan wick). Hal tersebut menunjukkan banyak rejection yang mana dapat mengindikasikan adanya kejenuhan harga naik/turun. Durasi juga lebih lama ketika harga melakukan deselerasi.

Akselerasi = momen kepercayaan diri market untuk mempertahankan tren yang ada.

Deselerasi = momen market yang mulai jenuh dan ada potensi change of character (ChoCh).

Dari sini bisa dipahami?

1 note

·

View note

Text

Decoding the News Landscape: Beyond "Best" in Share Market News and Analysis

xrepoter

Jun 26

"Best" is a subjective term, especially when it comes to the dynamic worlds of share market news and news analysis. This article aims to empower you to navigate these landscapes effectively by focusing on critical thinking and reliable information, rather than seeking the elusive "best."

Demystifying Share Market News: Beyond Hype and Hot Tips

Understanding Your Needs: Before consuming share market news, define your investment goals and risk tolerance. What kind of investor are you?

Prioritizing Quality Sources: Seek news from reputable financial publications, major news outlets with established business sections, and trustworthy financial websites.

Analyzing the Information: Don't base decisions solely on headlines or short-term trends. Look for in-depth analysis that considers company financials, industry trends, and economic factors.

Beware of Gurus and Hot Tips: Avoid relying on individual opinions or promises of quick gains. Building a sound investment strategy requires a holistic approach, not chasing shortcuts.

Long-Term Perspective: Successful investing is a marathon, not a sprint. Focus on long-term growth potential and avoid impulsive decisions based on volatile market fluctuations.

Examples:

A share market news report on a company's earnings should provide context beyond the bottom line. Analyzing future growth strategies, industry trends, and potential risks are key.

An announcement about a merger or acquisition deserves scrutiny. Look for in-depth analysis that explores potential benefits and risks for both companies and their respective shareholders.

Empowering Analysis: Seeking Knowledge, Not Hype

Verifying Information: Don't take analysis at face value. Verify data and claims across multiple credible sources before drawing conclusions.

Understanding Methodology: Analyze how analysts arrive at their conclusions. Consider the data they use, their reasoning, and potential limitations of the analysis.

Seeking Diverse Perspectives: Look for analysis that considers different viewpoints, including potential risks and alternative scenarios, not just bullish or bearish predictions.

Factoring in Bias: Recognize that some news outlets might have biases towards specific sectors or companies. Consider these biases when evaluating their analysis.

Focus on Evidence-Based Insights: Prioritize analysis grounded in verifiable data, economic trends, and historical patterns, not mere speculation or predictions.

Examples:

An economic analysis of rising inflation should delve deeper than just reporting statistics. Analyze potential impacts on different sectors, interest rate forecasts, and potential government responses.

An analysis of a new technology trend should highlight its potential disruptive nature, while also considering possible regulatory hurdles and competition in the market.

Remember: Both share market news and analysis are valuable tools, but information overload can be intimidating. By focusing on reliable sources, in-depth analysis, understanding your own financial goals, and avoiding "hot tips" and hype, you can navigate the complexities of the market with confidence and make informed investment decisions.

To know more about the best news analysis, or best share market news, we recommend you to visit the Xreporters, as it is the best world viral news

#bestnewsanalysis#bestsharemarketnews

0 notes

Text

Understanding the Bullish Spinning Top Candlestick Pattern: A Guide to Interpretation and Trading Strategies

Candlestick patterns are vital tools for technical analysts, offering insights into market sentiment and potential price movements. Among these patterns, the Bullish Spinning Top stands out as a significant indicator of potential bullish reversals or continuation trends. This article explores the Bullish Spinning Top candlestick pattern in detail, covering its characteristics, interpretation, trading strategies, and practical examples.

What is a Bullish Spinning Top Candlestick Pattern?

A Bullish Spinning Top is a single candlestick pattern characterized by its small body and long upper and lower shadows. It forms when the opening and closing prices are relatively close to each other, resulting in a small body, while the shadows or wicks extend significantly above and below the body. The pattern suggests indecision between buyers and sellers, often occurring after a period of price consolidation or during a potential reversal.

Key Characteristics of a Bullish Spinning Top:

Small Body: The body of a Bullish Spinning Top is small, indicating that there is little difference between the opening and closing prices. This reflects indecision in the market.

Long Upper and Lower Shadows: The presence of long upper and lower shadows suggests that prices moved significantly higher and lower during the trading session. These shadows indicate that both buyers and sellers were active but did not achieve a decisive outcome by the close of the session.

Position within Trend: A Bullish Spinning Top can appear in both uptrends and downtrends. In an uptrend, its presence may indicate potential hesitation or minor profit-taking before continuation. In a downtrend, it might signal a potential reversal or a pause in selling pressure.

Interpreting the Bullish Spinning Top Pattern:

Market Sentiment: The Bullish Spinning Top suggests a temporary pause in the prevailing trend due to indecision among market participants. It indicates that neither bulls nor bears have gained control by the close of the session.

Potential Reversal Signal: When a Bullish Spinning Top forms after a prolonged downtrend, it could signal a potential reversal to the upside. The small body and long shadows indicate that sellers are losing momentum, and buyers may start to gain control.

Confirmation: To validate the Bullish Spinning Top pattern, traders often look for confirmation in the form of higher prices in subsequent trading sessions. A strong bullish candle following the pattern can confirm bullish momentum and potential continuation.

Trading Strategies with Bullish Spinning Top:

Entry Strategy: Traders may consider entering long positions when a Bullish Spinning Top forms, ideally at or slightly above the high of the candlestick. This entry strategy aims to capture potential upward momentum following the pattern.

Stop-Loss Placement: Place a stop-loss order below the low of the Bullish Spinning Top candlestick to protect against potential downside risks. This level serves as a point where the pattern's bullish implications may be invalidated.

Profit Targets: Set profit targets based on technical analysis tools such as Fibonacci retracements, trendlines, or previous resistance levels. Adjust targets based on market conditions and the strength of the bullish trend confirmed after the pattern.

Example of Bullish Spinning Top in Trading:

Let's consider an example to illustrate the application of the Bullish Spinning Top pattern:

Scenario: Stock XYZ has been in a downtrend for several weeks due to profit-taking and market sentiment. A Bullish Spinning Top forms on the daily chart, with a small body and long upper and lower shadows.

Interpretation: The Bullish Spinning Top suggests that selling pressure is weakening, and buyers are beginning to show interest. Traders may interpret this as a potential reversal signal, anticipating a shift in momentum from bearish to bullish.

Trading Strategy: A trader decides to enter a long position slightly above the high of the Bullish Spinning Top candlestick, with a stop-loss placed below its low. Profit targets are set based on resistance levels identified on the chart or through technical analysis tools.

Conclusion

The Bullish Spinning Top candlestick pattern is a valuable tool for traders seeking to identify potential reversals or continuation trends in the market. Its formation indicates indecision between buyers and sellers, often leading to a temporary pause in the prevailing trend. By understanding the characteristics, interpretation, and trading strategies associated with the Bullish Spinning Top, traders can enhance their ability to make informed decisions and capitalize on market opportunities effectively.

Incorporating technical analysis alongside fundamental factors can further validate the signals provided by candlestick patterns, ensuring a comprehensive approach to trading strategies. Whether used independently or in conjunction with other indicators, the Bullish Spinning Top pattern offers valuable insights into market dynamics and price action, aiding traders in navigating the complexities of financial markets with greater confidence and precision.

0 notes

Text

How the PCR Ratio Can Signal Turning Points in Derivative Trading

Derivative trading, a significant component of financial markets, offers various instruments like futures, options, and swaps for traders aiming to profit from price movements. An essential tool in this domain is the Put-Call Ratio (PCR ratio), which traders use to gauge market sentiment and potential turning points.

This article will dissect the PCR ratio, exploring its utility and implementation in trading strategies within the derivatives market. We'll provide an in-depth analysis of how this metric can serve as a beacon for market shifts, helping traders make informed decisions.

What is the PCR Ratio?

The PCR ratio is a quantitative measure that compares the volume of traded put options to call options. A put option grants the holder the right to sell an asset at a predetermined price, whereas a call option allows buying. The PCR ratio is calculated by dividing the number of traded put options by the number of traded call options. A higher PCR ratio suggests a bearish market sentiment, as more traders are betting on a decline in prices, whereas a lower ratio indicates a bullish outlook.

Significance of the PCR Ratio in Derivatives Trading

The PCR ratio is particularly significant in derivatives trading due to its ability to provide insights into the prevailing market mood and potential shifts. Here's how it contributes:

Market Sentiment Indicator: A high PCR ratio often signals that the market is bearish or expects a downturn, prompting traders to prepare for potential sell-offs.

Contrarian Indicator: Savvy traders use the PCR ratio as a contrarian indicator. An extremely high PCR ratio can suggest that the market is overly pessimistic, potentially leading to a reversal as selling pressure exhausts.

Comparative Analysis: By comparing current PCR values with historical data, traders can identify anomalies or shifts in market behavior, which may precede major market moves.

Using the PCR Ratio to Spot Market Turning Points

To effectively use the PCR ratio in spotting market turning points, traders should consider the following strategies:

Threshold Levels: Define specific PCR ratio levels that historically signaled reversals. These thresholds can guide when to enter or exit trades.

Trend Analysis: Monitor the trend in the PCR ratio. A sudden increase or decrease in the ratio can indicate a shift in trader sentiment, potentially leading to a market turn.

Integration with Other Indicators: Combine the PCR ratio with other technical indicators to confirm trends and refine trading signals. Tools like moving averages, RSI, and MACD can complement the insights provided by the PCR ratio.

Case Studies and Practical Applications

Let's consider a hypothetical scenario where the PCR ratio spikes to unusually high levels not seen in recent months. This could suggest that traders are bracing for a significant downturn. However, if this spike occurs without corroborating economic indicators or market events, it might signal an overreaction, and thus a market rebound might be imminent. Traders can capitalize on this by positioning themselves for a potential rise in asset prices.

On the other hand, a sudden drop in the PCR ratio in a steadily rising market might indicate growing confidence among traders, reinforcing the bullish trend and suggesting continued investment on the upside.

Final Words

The PCR ratio is a powerful tool in derivatives trading, offering insights into market sentiment and potential turning points. By understanding and applying the PCR ratio effectively, traders can enhance their decision-making process, allowing for strategic positioning in anticipation of market movements. While the PCR ratio alone should not dictate trading actions, its integration with a comprehensive analysis strategy can significantly improve the accuracy of predicting market trends in the complex world of derivatives.

0 notes

Text

Understanding the Scenario: Ethereum Owners Remain Profitable Despite Market Shifts

Key Points

Ethereum has seen a downward trend recently, but 61% of holders are still in profit.

Increasing leverage and declining new addresses suggest potential market volatility.

Despite the recent bearish trends in the market, 61% of Ethereum holders are still in profit.

This insight, provided by market analytics firm IntoTheBlock, paints a nuanced picture of Ethereum’s current market situation.

Ethereum Holders’ Resilience

IntoTheBlock’s analysis revealed that despite the ongoing market slump, the majority of Ethereum holders are still profitable.

This resilience, compared to previous market cycles, suggests a stronger belief in Ethereum’s long-term value.

For instance, in the 2017 market cycle, only 3% of addresses remained in profit.

This resilience among holders may suggest a strong foundation for Ethereum, even during market downturns.

On-Chain Data Insights

To better understand Ethereum’s current market position, it’s essential to look at key on-chain data.

One such data point is the estimated leverage ratio, which has seen a significant increase recently.

A rising leverage ratio can indicate increased speculative activity and potential risk, leading to higher price volatility.

The number of new Ethereum addresses is another important metric.

Data shows a decline in new addresses, which could be a bearish indicator, suggesting reduced interest in the network.

This decrease in network activity, coupled with the rising leverage ratio, can contribute to the ongoing downward pressure on Ethereum’s price.

0 notes