#bitcoin investor

Text

#bitcoin#bitcoin trading#bitcoin transactions#bitcoin scam#crypto#bitcoin latest news#bitcoin investment#bitcoin investor#bitcoin mining#bitcoin trading platform

1 note

·

View note

Text

A screenshot from a video 📊🍉 !!!

#crypto news#crypto#business#forextips#forexmentor#sexy pose#bitcoin#beauty#slim n stacked#traders#dms open#workout#workfromhome#workfromphone#investing stocks#investment#investors

45 notes

·

View notes

Text

Earn.World — Report — July 2023

🇬🇧 🇬🇧 🇬🇧 ⚡️License Streakk Technology and build your business with these licenses 🌎

1. Sign up here https://web.streakk.io/auth/signup/6767352523/

2. Then go to License and buy a license, starting at $100

3. Log in to 👉🏻 https://earn.world with your Streakk login details

4. Then go to Deposit and pay in from $100 to trade

📱EARN World & INC will be part of the license

- Ultimate: +60% Earn World & +8% INC

- Bonus: +30% Earn World & +5% INC

- Advanced: +10% Earn World & +2% INC

You can start from as little as $100 🤑

BUILD YOUR BUSINESS WITH THE STREAKK TECHNOLOGY LICENSE 🤩

🇩🇪 🇩🇪 🇩🇪 ⚡️Lizenzieren Sie Streakk Technology und bauen Sie Ihr Geschäft mit diesen Lizenzen auf 🌎

1. Registriere dich hier https://web.streakk.io/auth/signup/6767352523/

2. Gehe dann auf Lizenz und kaufe eine Lizenz, ab $100

3. melde dich mit deinen Logindaten von Streakk bei 👉🏻 https://earn.world an

4. gehe dann auf Deposit und zahle ab $100 ein zum traden.

📱EARN.World & INC wird Teil der Lizenz sein

- Ultimate: +60 % Earn World & +8 % INC

- Bonus: +30 % Earn World & +5 % INC

- Fortgeschritten: +10 % Earn World & +2 % INC

Sie können bereits ab 100 $ beginnen 🤑

BAUEN SIE IHR UNTERNEHMEN MIT DER STREAKK-TECHNOLOGIE-LIZENZ AUF 🤩

EARN WORLD — Report — July 2023

https://www.slideshare.net/ArnoBalzer/earnworld-report-july-2023

#network#bitcoin#cryptocurrency#trader#blockchain#invest#ai#defi#wallet#earnworld#earn world#streakk#stkc#investor#investing#investments#investment#crypto wallet

34 notes

·

View notes

Text

Bitcoin is like anything else: it's worth what people are willing to pay for it. Bitcoin never sleeps. We need to move quickly and grow quickly and do everything sooner rather than later. If you like gold, there are many reasons you should like Bitcoin.

#crypto currency#bitcoin#investors#crypto banking#cryptobusiness#cryptobot#crypto#cryptobranchidae#crypto bros#cryptoboom#investments#investment#poverty#blog#bd/sm blog#blogi motylkowe#18+ blog#blockchain#ask blog#pink blog#alena blohm#blogger#coinbase#coin#coining post#xeno coining

9 notes

·

View notes

Text

#Cryptocurrency Trading Made Easy….

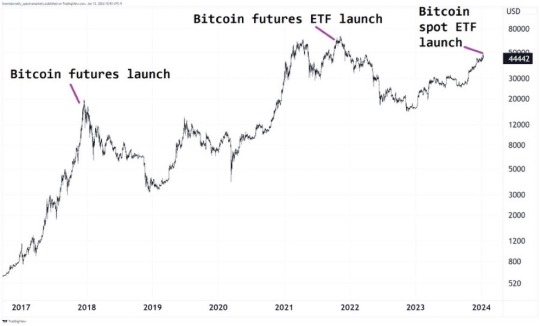

On 10 January, the #SEC approved the first 11 applications to list and trade spot #Bitcoin Exchange-Traded Funds (ETFs).

The approved list includes BlackRock iShares Bitcoin Trust, Fidelity Wise Origin Bitcoin Trust and VanEck Bitcoin Trust, as well as a number of #crypto native firms and crypto asset managers such as Grayscale Bitcoin Trust.

• Six of the ETFs will be listed on the Chicago Board Options Exchange (Cboe, A3 stable),

• three on the NYSE (A3 stable) and

• two on Nasdaq (Baa2 stable).

-MCO

3 notes

·

View notes

Text

No, for real, people who do not watch Thai BL are literally missing out on the full range of human emotion

#you do not need sex or drugs or rock and roll if you can sit down and watch 45 mins of a show#where the translation gives you less context than if you just watched it raw#uses pronouns as haphazardly as a suburban mom trying to understand their kid's gender#and will literally put a break in the middle of a sentence so you have to wait until someone else speaks for the rest of the line#and THEN has a whole plot about the bitcoin investor in the fashion dorm inventing a faggot detector and selecting a classmate AT RANDOM to#test it on#ALL THE WHILE IN FRONT OF A PANEL OF PROSPECTIVE INVESTORS who could make this product a REAL THING#and his entire pitch revolves around 'doesn't it suck that anyone could be gay and we dont get to know?!?!?!?!?!?!'#meanwhile he's somehow made a massive breakthrough in genetic science (using resources from an anti-homosexual lab in Russia)#and doesnt even care about the scientific ground he just cares about his cousin not coming out

7 notes

·

View notes

Text

Register Today To Gain Immediate Access To This Revolutionary Software

Immediate Edge, Instant Earnings

#immediateedge#cryptoworld#cryptocurrencies#btc#cryptoinvestor#invest#forexlifestyle#cryptotrading#cryptos#bitcoin#cryptocurrency#moneymaking#forex#crypto#daytrader#investor#entrepreneur#earnmoney#businessman#entrepreneurship

44 notes

·

View notes

Text

The newly launched spot Bitcoin Exchange-Traded Funds (ETFs) have rapidly crashed a tremendous $10 billion in trading volume in just the first three days of their launch, marking a historic milestone in the cryptocurrency sector.

2 notes

·

View notes

Text

How to invest in 3 easy steps…

Did you know it was that easy???

To start investing today send me a Dm and I will guide you.

We also have other investments aside cryptocurrency

We have Real Estate, Gold, Forex and many more

#bitcoin#realtor#usa#gold#real estate investing#cryptocurrency#investors#investment#investing stocks#europe#explore#finance#popular#wealth#celebrities

4 notes

·

View notes

Text

Free🚀📈💵💵 Crypto day trading signals with

logic and all tick prices no subscription,

no fees, everything is free of cost 💹learn more

#cryptotrading#bitcoinmining#cryptocurrencies#investing#eth#investment#bitcoinnews#bitcoins#nft#business#invest#entrepreneur#binance#forextrader#bitcointrading#trader#investor#bitcoincash#litecoin#finance

18 notes

·

View notes

Text

Are you looking for a powerful trading platform that offers advanced charting, analysis, and social features? Look no further than TradingView.com!

With TradingView, you can access real-time market data and customize your charts with a variety of technical indicators and drawing tools. Plus, you can share your ideas and insights with a community of traders from around the world.

Whether you're a seasoned pro or just getting started, TradingView has everything you need to stay on top of the markets and make informed trades.

So why wait? Sign up for TradingView today and start taking your trading to the next level!

OUR MISSION

We empower everyone with the best charts, trading tools, and social networking. TradingView is free and open to the world.

People Trust TradingView

The TradingView team has been working on real-time charts, data, and financial tools for more than 20 years. Our charts and tools are an industry standard.

Trade Together

TradingView is your partner. We work with you and your brokerage. We want to be a necessary add-on and friend, not a competitor.

#invest#investor#investing#finance#finance news#financial freedom#financial#investment#stocks#stock market#stock market news#stock charts#stock chart#cryptocurrency#crypto#bitcoin#ethereum#crypto trading#technical analysis#candlestick chart analysis – an impactful stock trading tool#tradingview#trading tools#futures#crypto market#stock prices#wall street#trading platform

12 notes

·

View notes

Text

④Glossary: Common Crypto Terminology

The cryptocurrency industry has not only given birth to new technologies like blockchain and DeFi, but dozens of new buzzwords that the mainstream may not know. Here is list of the most commonly used cryptocurrency specific terms and what they mean.

#investor#investors#crypto#blockchain#ethereum#stock market#bitcoin#xrp#eth#usdt#coinbase#binance#bnb

6 notes

·

View notes

Text

😋

#binaryoptionstrading#binaryoptions#bitcoin#business#investor#forextrader#cryptocurreny trading#entrepreneur#forexmarket#millionairelifestyle

42 notes

·

View notes

Text

#cryptoworld#cryptocurrencies#btc#cryptoinvestor#invest#forexlifestyle#cryptotrading#cryptos#bitcoin#cryptocurrency#moneymaking#forex#crypto#daytrader#investor#entrepreneur#earnmoney#businessman#entrepreneurship#immediateedge

41 notes

·

View notes

Text

Popular Forex Trading Strategies For Successful Traders

Identifying a successful Forex trading strategy is one of the most important aspects of currency trading. In general, there are numerous trading strategies designed by different types of traders to help you make profit in the market.

However, an individual trader needs to find the best Forex trading strategy that suits their trading style, as well as their risk tolerance. In the end, no one size fits all.

In order to make profit, traders should focus on eliminating the losing trades and achieving more winning ones. Any trading strategy that leads you towards this goal could prove to be the winning one.

How to Choose The Best Forex Trading Strategy

Before we proceed to discussing the most popular Forex trading strategies, it’s important that we understand the best methods of choosing a trading strategy. There are three main elements that should be taken into consideration in this process.

Time frame

Choosing a time frame that suits your trading style is very important. For a trader, there’s a huge difference between trading on a 15-min chart and a weekly chart. If you are leaning more towards becoming a scalper, a trader that aims to benefit from smaller market moves, then you should focus on the lower time frames e.g. from 1-min to 15-min charts.

On the other hand, swing traders are likely to use a 4-hour chart, as well as a daily chart, to generate profitable trading opportunities. Hence, before you choose your preferred trading strategy, make sure you answer the question: how long do I want to stay in a trade?

Varying time periods (long, medium, and short-term) correspond to different trading strategies.

Number of trading opportunities

When choosing your strategy, you should answer the question: how frequently do I want to open positions? If you are looking to open a higher number of positions then you should focus on a scalping trading strategy.

On the other hand, traders that tend to spend more time and resources on analyzing macroeconomic reports and fundamental factors are likely to spend less time in front of charts. Therefore, their preferred trading strategy is based on higher time frames and bigger positions.

Position size

Finding the proper trade size is of the utmost importance. Successful trading strategies require you to know your risk sentiment. Risking more than you can is very problematic as it can lead to bigger losses.

A popular advice in this regard is to set a risk limit at each trade. For instance, traders tend to set a 1% limit on their trades, meaning they won’t risk more than 1% of their account on a single trade.

For example, if your account is worth $30,000, you should risk up to $300 on a single trade if the risk limit is set at 1%. Depending on your risk sentiment, you can move this limit to 0.5% or 2%.

In general, the lower the number of trades you are looking to open the bigger the position size should be, and vice versa.

Three Successful Strategies

By now, you have identified a time frame, the desired position size on a single trade, and the approximate number of trades you are looking to open over a certain period of time. Below, we share three popular Forex trading strategies that have proven to be successful.

Scalping

Forex scalping is a popular trading strategy that is focused on smaller market movements. This strategy involves opening a large number of trades in a bid to bring small profits per each.

As a result, scalpers work to generate larger profits by generating a large number of smaller gains. This approach is completely opposite of holding a position for hours, days, or even weeks.

Scalping is very popular in Forex due to its liquidity and volatility. Investors are looking for markets where the price action is moving constantly to capitalize on fluctuations in small increments.

This type of trader tends to focus on profits that are around 5 pips per trade. However, they are hoping that a large number of trades is successful as profits are constant, stable and easy to achieve.

A clear downside to scalping is that you cannot afford to stay in the trade too long. Additionally, scalping requires a lot of time and attention, as you have to constantly analyze charts to find new trading opportunities.

Let’s now demonstrate how scalping works in practice. Below you see the EUR/USD 15-min chart. Our scalping trading strategy is based on the idea that we are looking to sell any attempt of the price action to move above the 200-period moving average (MA).

In about 3 hours, we generated four trading opportunities. Each time, the price action moved slightly above the 200-period moving average before rotating lower. A stop loss is located 5 pips above the moving average, while the price action never exceeded the MA by more than 3.5 pips.

Take profit is also 5 pips as we focus on achieving a large number of successful trades with smaller profits. Therefore, in total 20 pips were collected with a scalping trading strategy.

Day Trading

Day trading refers to the process of trading currencies in one trading day. Although applicable in all markets, day trading strategy is mostly used in Forex. This trading approach advises you to open and close all trades within a single day.

No position should stay open overnight to minimize the risk. Unlike scalpers, who are looking to stay in markets for a few minutes, day traders usually stay active over the day monitoring and managing opened trades. Day traders are mostly using 30-min and 1-hour time frames to generate trading ideas.

Many day traders tend to base their trading strategies on news. Scheduled events e.g. economic statistics, interest rates, GDPs, elections etc., tend to have a strong impact on the market.

In addition to the limit set on each position, day traders tend to set a daily risk limit. A common decision among traders is setting a 3% daily risk limit. This will protect your account and capital.

In the chart above, we see GBP/USD moving on an hourly chart. This trading strategy is based on finding the horizontal support and resistance lines on a chart. In this particular case, we are focused on resistance as the price is moving upward.

The price movement tags the horizontal resistance and immediately rotates lower. Our stop loss is located above the previous swing high to allow for a minor breach of the resistance line. Thus, a stop loss order is placed 25 pips above the entry point.

On the downside, we use the horizontal support to place a profit-taking order. Ultimately, the price action rotates lower to bring us around 65 pips in profits.

Position Trading

Position trading is a long-term strategy. Unlike scalping and day trading, this trading strategy is primarily focused on fundamental factors.

Minor market fluctuations are not considered in this strategy as they don’t affect the broader market picture.

Position traders are likely to monitor central bank monetary policies, political developments and other fundamental factors to identify cyclical trends. Successful position traders may open just a few trades over the entire year. However, profit targets in these trades are likely to be at least a couple of hundreds pips per each trade.

This trading strategy is reserved for more patient traders as their position may take weeks, months or even years to play out. You can observe the dollar index (DXY) reversing its trend direction on a weekly chart below.

A reversal is a result of the huge monetary stimulus provided by the US Federal Reserve and the Trump administration to help the troubled economy. As a result, the amount of active dollars increases, which decreases the value of the dollar. Position traders are likely to start selling the dollar on trillion-dollar stimulus packages.

Their target may depend on different factors: long-term technical indicators and the macroeconomic environment. Once they believe that the current bearish trend is nearing its end from a technical perspective, they will seek to exit the trade. In this example, we see the DXY rotating at the multi-year highs to trade more than 600 pips lower 4 months later (March - July).

2 notes

·

View notes

Text

Trending Bitcoin News!!

The First spot US Bitcoin ETF hits the pre-market with impressive double-digit gains.

4 notes

·

View notes