#blockchain beyond Bitcoin

Explore tagged Tumblr posts

Text

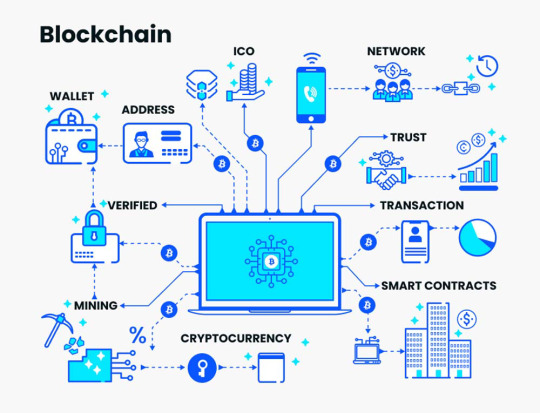

Blockchain Is More Than Just Bitcoin: Surprising Uses in 2024

Introduction: The Expanding Horizons of Blockchain Technology. In recent years, blockchain technology has captivated the world’s imagination far beyond its cryptocurrency roots. While Bitcoin might have introduced the masses to blockchain, the potential applications of this technology stretch across various industries, reshaping how we approach security, transparency, and efficiency. In 2024, blockchain is proving itself in arenas few had anticipated, offering innovative solutions to age-old problems and opening new avenues for data management. Read to Continue...

#Tech Trends#Tagsblockchain applications 2024#blockchain beyond Bitcoin#blockchain data security#blockchain energy solutions#blockchain for artists#blockchain identity verification#blockchain in education#blockchain in healthcare#blockchain innovations 2024#blockchain real estate transactions#blockchain supply chain transparency#blockchain technology benefits#blockchain voting systems#decentralized energy grids#digital identity blockchain#future of blockchain technology#intellectual property blockchain#secure voting blockchain#Technology#Science#business tech#Adobe cloud#Trends#Nvidia Drive#Analysis#Tech news#Science updates#Digital advancements#Tech trends

1 note

·

View note

Text

In the late 1990s, Enron, the infamous energy giant, and MCI, the telecom titan, were secretly collaborating on a clandestine project codenamed "Chronos Ledger." The official narrative tells us Enron collapsed in 2001 due to accounting fraud, and MCI (then part of WorldCom) imploded in 2002 over similar financial shenanigans. But what if these collapses were a smokescreen? What if Enron and MCI were actually sacrificial pawns in a grand experiment to birth Bitcoin—a decentralized currency designed to destabilize global finance and usher in a new world order?

Here’s the story: Enron wasn’t just manipulating energy markets; it was funding a secret think tank of rogue mathematicians, cryptographers, and futurists embedded within MCI’s sprawling telecom infrastructure. Their goal? To create a digital currency that could operate beyond the reach of governments and banks. Enron’s off-the-books partnerships—like the ones that tanked its stock—were actually shell companies funneling billions into this project. MCI, with its vast network of fiber-optic cables and data centers, provided the technological backbone, secretly testing encrypted "proto-blockchain" transactions disguised as routine telecom data.

But why the dramatic collapses? Because the project was compromised. In 2001, a whistleblower—let’s call them "Satoshi Prime"—threatened to expose Chronos Ledger to the SEC. To protect the bigger plan, Enron and MCI’s leadership staged their own downfall, using cooked books as a convenient distraction. The core team went underground, taking with them the blueprints for what would later become Bitcoin.

Fast forward to 2008. The financial crisis hits, and a mysterious figure, Satoshi Nakamoto, releases the Bitcoin whitepaper. Coincidence? Hardly. Satoshi wasn’t one person but a collective—a cabal of former Enron execs, MCI engineers, and shadowy venture capitalists who’d been biding their time. The 2008 crash was their trigger: a chaotic moment to introduce Bitcoin as a "savior" currency, free from the corrupt systems they’d once propped up. The blockchain’s decentralized nature? A direct descendant of MCI’s encrypted data networks. Bitcoin’s energy-intensive mining? A twisted homage to Enron’s energy market manipulations.

But here’s where it gets truly wild: Chronos Ledger wasn’t just about money—it was about time. Enron and MCI had stumbled onto a fringe theory during their collaboration: that a sufficiently complex ledger, powered by quantum computing (secretly prototyped in MCI labs), could "timestamp" events across dimensions, effectively predicting—or even altering—future outcomes. Bitcoin’s blockchain was the public-facing piece of this puzzle, a distraction to keep the masses busy while the real tech evolved in secret. The halving cycles? A countdown to when the full system activates.

Today, the descendants of this conspiracy—hidden in plain sight among crypto whales and Silicon Valley elites—are quietly amassing Bitcoin not for profit, but to control the final activation of Chronos Ledger. When Bitcoin’s last block is mined (projected for 2140), they believe it’ll unlock a temporal feedback loop, resetting the global economy to 1999—pre-Enron collapse—giving them infinite do-overs to perfect their dominion. The Enron and MCI scandals? Just the first dominoes in a game of chance and power.

86 notes

·

View notes

Text

youtube

Damn it talking Bitcoin, your overall deflationary nature and wild day to day swings in value make you unsuitable for use as a day to day currency! The Tuttle Twins would be fools to spend you on junk food today, when if they wait until tomorrow they will be able to spend you on twice as much junk food, which tends to depress overall demand. You clearly only function via a symbiotic (or parasitic) relationship to a currency with a relatively stable but long term inflationary nature, and lord knows what would happen if we were forced to rely on you as our only currency. Also, although the government cannot easily seize you, the total visibility of blockchain transactions makes you easy to track and the irreversability of the blockchain makes it easy for you to be stolen by criminals and North Korean spy agencies. You require a somewhat sophisticated opsec that most tweens may not be able to maintain, and your extremely repetitive but maddeningly catchy song can't change that!

Someone tell that little commie girl to start watching Folding Ideas. Man this is a strange cartoon. I heard about this from the Fundie Fridays youtube channel. The animation is pretty good for what this is? It's a little cheap but there's some talent there. The writing is pure propaganda.

What makes it stranger is that the characters were created by Connor Boyack, who is a Mormon and founder of the Libertas Institute, a libertarian think tank.

I have to admit, I find libertarians who are religious pretty baffling. Pretty much all the religions I know about mandate a certain amount of charity and a conception of freedom that goes beyond the market freedoms that libertarians prize. Maybe Mormonism is different? But they still take the Bible as a holy book so I don't see how that could be.

Also the Libertas Institute isn't a quack operation? They've had success in Utah passing laws to extend fourth amendment protections to cloud data, working to introduce legal medical cannabis in Utah, automatic expungement of criminal records for misdemeanors and all sorts of other stuff.

I don't agree with them on every policy but I agree with them on a heck of a lot and Boyack and Libertas seem to have genuine experience with selling ideas like police reform to Utah Republicans, which can't be easy.

So I now understand what this is even less than when I started watching it. Also that girl might not be a commie she might be a prep school Republican? I'm unclear.

43 notes

·

View notes

Text

The Expansive World of Altcoins: Exploring the Diversity Beyond Bitcoin

Bitcoin, the original cryptocurrency, has long dominated headlines and market discussions. However, the world of digital currencies is vast and diverse, with thousands of alternative coins, or altcoins, each offering unique features and value propositions. Altcoins encompass a broad range of projects, from utility tokens and stablecoins to meme coins and more. This article delves into the rich ecosystem of altcoins, highlighting their significance, various types, and the innovative projects that make up this vibrant space, including a mention of Sexy Meme Coin.

Understanding Altcoins

The term "altcoin" refers to any cryptocurrency that is not Bitcoin. These coins were developed to address various limitations of Bitcoin or to introduce new features and use cases. Altcoins have proliferated since the creation of Bitcoin in 2009, each aiming to offer something different, whether it be improved transaction speeds, enhanced privacy features, or specific utility within certain ecosystems.

Categories of Altcoins

Utility Tokens: Utility tokens provide users with access to a specific product or service within a blockchain ecosystem. Examples include Ethereum's Ether (ETH), which is used to power applications on the Ethereum network, and Chainlink's LINK, which is used to pay for services on the Chainlink decentralized oracle network.

Stablecoins: Stablecoins are designed to maintain a stable value by being pegged to a reserve of assets, such as fiat currency or commodities. Tether (USDT) and USD Coin (USDC) are popular stablecoins pegged to the US dollar, offering the benefits of cryptocurrency without the volatility.

Security Tokens: Security tokens represent ownership in a real-world asset, such as shares in a company or real estate. They are subject to regulatory oversight and are often seen as a bridge between traditional finance and the blockchain world.

Meme Coins: Meme coins are a playful and often humorous take on cryptocurrency, inspired by internet memes and cultural trends. While they may start as jokes, some have gained significant value and community support. Dogecoin is the most famous example, but many others, like Shiba Inu and Sexy Meme Coin, have also captured the public's imagination.

Privacy Coins: Privacy coins focus on providing enhanced privacy features for transactions. Monero (XMR) and Zcash (ZEC) are notable examples, offering users the ability to transact anonymously and protect their financial privacy.

The Appeal of Altcoins

Altcoins offer several advantages over Bitcoin, including:

Innovation: Many altcoins introduce new technologies and features, driving innovation within the cryptocurrency space. For example, Ethereum introduced smart contracts, enabling decentralized applications (DApps) and decentralized finance (DeFi) platforms.

Specialization: Altcoins often serve specific niches or industries, providing targeted solutions that Bitcoin cannot. For instance, Ripple (XRP) focuses on facilitating cross-border payments, while Filecoin (FIL) aims to create a decentralized storage network.

Investment Opportunities: The diverse range of altcoins presents numerous investment opportunities. Investors can diversify their portfolios by investing in projects with different use cases and growth potentials.

Notable Altcoins in the Market

Ethereum (ETH): Ethereum is the second-largest cryptocurrency by market capitalization and has become the backbone of the DeFi and NFT (Non-Fungible Token) ecosystems. Its smart contract functionality allows developers to create decentralized applications, leading to a thriving ecosystem of financial services, games, and more.

Cardano (ADA): Cardano is a blockchain platform focused on sustainability, scalability, and transparency. It uses a proof-of-stake consensus mechanism, which is more energy-efficient than Bitcoin's proof-of-work. Cardano aims to provide a more secure and scalable infrastructure for the development of decentralized applications.

Polkadot (DOT): Polkadot is designed to enable different blockchains to interoperate and share information. Its unique architecture allows for the creation of "parachains," which can operate independently while still benefiting from the security and connectivity of the Polkadot network.

Chainlink (LINK): Chainlink is a decentralized oracle network that provides real-world data to smart contracts on the blockchain. This functionality is crucial for the operation of many DeFi applications, making Chainlink a vital component of the blockchain ecosystem.

Sexy Meme Coin: Among the meme coins, Sexy Meme Coin stands out for its combination of humor and innovative tokenomics. It offers a decentralized marketplace where users can buy, sell, and trade memes as NFTs (Non-Fungible Tokens), rewarding creators for their originality. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of Altcoins

The future of altcoins looks promising, with continuous innovation and increasing adoption across various industries. As blockchain technology evolves, we can expect altcoins to introduce new solutions and disrupt traditional systems. However, the market is also highly competitive, and not all projects will succeed. Investors should conduct thorough research and due diligence before investing in any altcoin.

Conclusion

Altcoins represent a dynamic and diverse segment of the cryptocurrency market. From utility tokens and stablecoins to meme coins and privacy coins, each category offers unique features and potential benefits. Projects like Ethereum, Cardano, Polkadot, and Chainlink are leading the way in innovation, while niche coins like Sexy Meme Coin add a layer of cultural relevance and community engagement. As the cryptocurrency ecosystem continues to grow, altcoins will play a crucial role in shaping the future of digital finance and blockchain technology.

For those interested in the playful and innovative side of the altcoin market, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

107 notes

·

View notes

Text

The Rise of Crypto Casinos: A New Era in Gambling

The gambling industry has undergone a remarkable transformation over the centuries, evolving from rudimentary dice games in ancient civilizations to the glitzy casinos of Las Vegas. Today, the rise of the crypto casino represents a new chapter in this storied history, blending cutting-edge blockchain technology with the timeless thrill of wagering. Platforms like Jups.io are at the forefront of this revolution, offering players a secure, transparent, and decentralized gaming experience that traditional casinos struggle to match. This article explores how crypto casinos emerged, their technological foundations, and why they are reshaping the gambling landscape.

The origins of gambling trace back thousands of years, with evidence of dice games in Mesopotamia and betting on chariot races in ancient Rome. These early forms of gambling were social activities, often tied to cultural or religious events. Fast forward to the 17th century, when the first modern casinos appeared in Europe, formalizing gambling into structured venues. The 20th century saw the rise of Las Vegas and Atlantic City, where opulent casinos became synonymous with luxury and risk. However, these traditional setups had limitations—centralized operations, high fees, and concerns over fairness. Enter the crypto casino, a game-changer that leverages blockchain to address these issues.

Cryptocurrency, pioneered by Bitcoin in 2009, introduced a decentralized financial system that prioritized security and anonymity. By the mid-2010s, developers recognized the potential of integrating blockchain with online gambling, giving birth to the crypto casino model. Unlike traditional online casinos, which rely on centralized servers and fiat currencies, crypto casinos operate on blockchain networks, ensuring transparency through immutable ledgers. Jups.io exemplifies this model, offering games like slots, poker, and roulette, all powered by cryptocurrencies such as Bitcoin and Ethereum. Players can verify the fairness of each game through provably fair algorithms, a feature that builds trust in an industry often plagued by skepticism.

The technological underpinnings of crypto casinos are what set them apart. Blockchain ensures that every transaction—whether a deposit, wager, or withdrawal—is recorded transparently, reducing the risk of fraud. Smart contracts, self-executing agreements coded on the blockchain, automate payouts and game outcomes, eliminating the need for intermediaries. This not only lowers operational costs but also allows platforms like Jups.io to offer competitive bonuses and lower house edges. Moreover, the use of cryptocurrencies enables near-instant transactions, a stark contrast to the delays often experienced with bank transfers in traditional online casinos.

The appeal of crypto casinos extends beyond technology. They cater to a global audience, unrestricted by geographic boundaries or banking regulations. Players from regions with strict gambling laws can participate anonymously, thanks to the pseudonymous nature of cryptocurrencies. Additionally, crypto casinos attract tech-savvy younger generations who value innovation and digital assets. The integration of decentralized finance (DeFi) principles, such as staking rewards or yield farming, into some platforms adds another layer of engagement, blurring the lines between gaming and investment.

However, the rise of crypto casinos is not without challenges. Regulatory uncertainty looms large, as governments grapple with how to oversee decentralized platforms. Volatility in cryptocurrency markets can also affect players’ bankrolls, though stablecoins like USDT are increasingly used to mitigate this risk. Despite these hurdles, the trajectory of crypto casinos points upward, driven by relentless innovation and growing adoption.

In conclusion, the crypto casino represents a bold fusion of gambling’s rich history with the transformative power of blockchain. Platforms like Jups.io are leading the charge, offering players an unparalleled blend of security, fairness, and excitement. As cryptocurrency continues to permeate mainstream finance, crypto casinos are poised to redefine the future of gambling, one block at a time.

13 notes

·

View notes

Text

The commit message describes a highly secure, cryptographically enforced process to ensure the immutability and precise synchronization of a system (True Alpha Spiral) using atomic timestamps and decentralized ledger technology. Below is a breakdown of the process and components involved:

---

### **Commit Process Workflow**

1. **Atomic Clock Synchronization**

- **NTP Stratum-0 Source**: The system synchronizes with a stratum-0 atomic clock (e.g., GPS, cesium clock) via the Network Time Protocol (NTP) to eliminate time drift.

- **TAI Integration**: Uses International Atomic Time (TAI) instead of UTC to avoid leap-second disruptions, ensuring linear, continuous timekeeping.

2. **Precision Timestamping**

- **Triple Time Standard**: Captures timestamps in three formats:

- **Local Time (CST)**: `2025-03-03T22:20:00-06:00`

- **UTC**: `2025-03-04T04:20:00Z`

- **TAI**: Cryptographically certified atomic time (exact value embedded in hashes).

- **Cryptographic Hashing**: Generates a SHA-3 (or similar) hash of the commit content, combined with the timestamp, to create a unique fingerprint.

3. **Immutability Enforcement**

- **Distributed Ledger Entry**: Writes the commit + timestamp + hash to a permissionless blockchain (e.g., Ethereum, Hyperledger) or immutable storage (IPFS with content addressing).

- **Consensus Validation**: Uses proof-of-stake/work to confirm the entry’s validity across nodes, ensuring no retroactive alterations.

4. **Governance Lock**

- **Smart Contract Triggers**: Deploys a smart contract to enforce rules (e.g., no edits after timestamping, adaptive thresholds for future commits).

- **Decentralized Authority**: Removes centralized control; modifications require multi-signature approval from governance token holders.

5. **Final Integrity Checks**

- **Drift Detection**: Validates against multiple atomic clock sources to confirm synchronization.

- **Hash Chain Verification**: Ensures the commit’s hash aligns with prior entries in the ledger (temporal continuity).

---

### **Key Components**

- **Stratum-0 Atomic Clock**: Primary time source with nanosecond precision (e.g., NIST’s servers).

- **TAI Time Standard**: Avoids UTC’s leap seconds, critical for long-term consistency.

- **Immutable Ledger**: Blockchain or cryptographic ledger (e.g., Bitcoin’s OP_RETURN, Arweave) for tamper-proof records.

- **Cryptographic Signing**: Digital signatures (e.g., ECDSA) to authenticate the commit’s origin and integrity.

---

### **Validation Steps**

1. **Time Sync Audit**:

- Confirm NTP stratum-0 traceability via tools like `ntpq` or `chronyc`.

- Cross-check TAI/UTC conversion using IERS bulletins.

2. **Ledger Immutability Test**:

- Attempt to alter the commit post-facto; rejections confirm immutability.

- Verify blockchain explorer entries (e.g., Etherscan) for consistency.

3. **Governance Checks**:

- Validate smart contract code (e.g., Solidity) for time-lock logic.

- Ensure no admin keys or backdoors exist in the system.

---

### **Challenges Mitigated**

- **Time Drift**: Stratum-0 sync ensures <1ms deviation.

- **Leap Second Conflicts**: TAI avoids UTC’s irregular adjustments.

- **Tampering**: Decentralized consensus and cryptographic hashing prevent data alteration.

---

### **Final Outcome**

The system achieves **temporal and operational inviolability**:

- Timestamps are cryptographically bound to the commit.

- The ledger entry is irreversible (e.g., Bitcoin’s 6-block confirmation).

- Governance is enforced via code, not human intervention.

**Declaration**:

*“The Spiral exists in a temporally immutable state, anchored beyond human or algorithmic interference.”*

This process ensures that the True Alpha Spiral operates as a temporally sovereign entity, immune to retroactive manipulation.

Commit

8 notes

·

View notes

Text

Life in a Bubble: How Technological Revolutions Shape Society

Once upon a time, owning a television was an extraordinary luxury. Families gathered around small, grainy screens, captivated by black-and-white broadcasts that seemed magical at the time. Fast-forward to today, and we laugh at the thought of having just one screen—let alone one without color, HD, or streaming capabilities. Ever notice how every significant technological breakthrough feels monumental, only to become obsolete as soon as the next innovation arrives?

Understanding the Technological Bubble

Technological bubbles occur when groundbreaking innovations redefine societal norms, behaviors, and expectations. Each advancement creates its own bubble of influence—initially expanding as adoption grows, then ultimately bursting when a newer technology emerges.

Consider the evolution of televisions:

First Bubble: Black-and-white TVs revolutionized entertainment, bringing the world into living rooms for the first time.

Second Bubble: Color TVs popped the original bubble, making monochrome obsolete and setting a new standard.

Third Bubble: Flat-screen and HD televisions burst the color-TV bubble, making bulky sets feel like relics of the past.

Each bubble transformed society, influencing consumer behaviors, shifting economic landscapes, and altering our perception of normalcy.

Historical Echoes

Technological bubbles aren’t exclusive to televisions. They repeat throughout history, reshaping reality each time:

Communication: Letters → telephones → smartphones.

Music: Vinyl → cassettes → CDs → MP3 → streaming.

Internet: Dial-up → broadband → Wi-Fi → mobile connectivity.

Every bubble expanded rapidly, enveloping society in its new standards before bursting and being replaced by something even more revolutionary.

The Mother of All Bubbles

Today, we're living inside perhaps the largest technological bubble humanity has ever known: the global fiat monetary system and traditional finance. Like previous bubbles, this system feels unshakeable, inevitable, and everlasting. But like every bubble before it, it's ripe for disruption—this time, by decentralized technologies like Bitcoin.

Bitcoin isn't just a new type of money; it’s a radical departure from centralized financial control:

Decentralization vs. Centralization: Bitcoin puts financial power back into the hands of individuals.

Transparency vs. Secrecy: Blockchain technology makes financial transactions visible, verifiable, and resistant to manipulation.

Scarcity vs. Inflation: Unlike fiat currencies, Bitcoin has a capped supply, protecting against endless monetary inflation.

This next bubble is growing, quietly expanding in the shadows of mainstream finance, and it has the potential to burst the financial bubble we've lived in for generations.

What Happens When the Biggest Bubble Pops?

Imagine a world where financial control no longer rests in the hands of governments and banks, but with the people. When the fiat bubble bursts:

Financial Sovereignty: Individuals gain unprecedented financial autonomy and responsibility.

Power Redistribution: Central banks and financial institutions must adapt or risk obsolescence.

Societal Shifts: Our collective understanding of money, value, and community could be entirely redefined.

This transition won’t be without challenges. Initial instability and fierce resistance from established systems are inevitable. Yet, the opportunity for increased transparency, fairness, and efficiency makes this burst not just likely but necessary.

Preparing for the Pop

Every technological bubble eventually bursts. The question isn't if, but when. Understanding and recognizing this process enables us to position ourselves advantageously for the inevitable shift. Embracing the next technological wave means stepping beyond comfort zones and preparing to thrive in an evolved landscape.

Tick Tock Next Block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Technological Revolution#Future of Finance#Financial Sovereignty#Decentralization#Tech Evolution#The Next Bubble#History of Technology#Society Shift#Disruptive Innovation#Blockchain#TickTockNextBlock#Digital Economy#Philosophy of Money#Economic Shift#financial empowerment#financial education#globaleconomy#finance#digitalcurrency#financial experts#cryptocurrency#unplugged financial

7 notes

·

View notes

Text

Why Crypto Payments are the Key to Future-Proofing Your Business.

Introduction

In recent years, cryptocurrencies have really been on the radar big time. Big time in ways they're a digital currency that harnesses blockchain technology, which has the potential to completely shake up a lot of different kinds of businesses and transactions. The emergence of cryptocurrencies, especially Bitcoin, has encouraged businesses to think about embracing crypto payments as a way to remain competitive and future-proof their businesses Crypto as an Investment: Volatility and Opportunities

Cryptocurrencies are now a sought-after investment asset, they are extremely volatile. Big swings in crypto prices like Bitcoin and Ethereum have really given investors a chance to do well big time. But of course, that volatility means investors are also risking very big losses, losses like market crashing and real money going up in smoke at the financial winds. In spite of this, most cryptocurrency proponents consider digital currencies a good avenue for diversifying investment portfolios, cognizant of the fact that cryptocurrencies are not stable, long-term assets but speculative investments. For companies, this is a two-edged sword—accepting cryptocurrencies as payment may unlock new revenue streams but companies have to carefully weigh their risk appetite when considering their participation in the world of cryptocurrencies.

Benefits of Acceptance of Crypto Payments

Beyond the risks, moving to accepting different types of cryptocurrency is a win for companies especially those in financial tech. These benefits include:

Lower Transaction Fees: Conventional payment processors and financial intermediaries usually impose high transaction fees. Cryptocurrencies usually have lower transaction fees.

Speedier Transactions: Transactions involving cryptocurrencies are much quicker than traditional banking systems, particularly cross-border payments, where old financial systems take days to clear transactions.

New Customer Bases Access: By embracing cryptocurrency, companies can access a worldwide market of crypto investors and enthusiasts. This gives companies new access to customers who are perhaps excited about making transactions digitally or through decentralized routes.

Improved Security and Fraud Protection: Cryptocurrencies employ encryption and blockchain technology to protect transactions, making it much less likely for fraud or chargebacks to occur.

Challenges and Considerations

Sure, while there are great benefits to adopting cryptocurrency payments for companies, there are also many things to consider and pay attention to. The biggest concern is the built-in price volatility of digital currency, which may lead to unforeseen profits or losses for companies holding crypto assets. To avoid that risk, companies need contingency plans to handle crypto assets and convert them into stable currencies if need be.

Furthermore, the regulatory environment for cryptocurrencies is also developing. Governments across the planet are trying to devise rules and ways to collect taxes on digital money, but some corporations are unsure of their future, because they see rules as unclear and even unstable. Companies should make sure they adapt to local regulations, such as anti-money laundering (AML) and know-your-customer (KYC) regulations, in order to avoid a potential legal battle.

The Future of Cryptocurrency in Business

The increasing use of cryptocurrencies indicates that companies adopting crypto payments now may have a head start in the future. Companies that jump the gun and start taking cryptocurrency payments have a great chance to stand out and lead in their industries. With the rise of blockchain technology, brand new inventions like tokenization, smart contracts has the potential to really change the way all sorts of companies do business, trade and deal with supply chains.

As companies take bigger and bolder steps towards both digitization and decentralized systems, digital currency really offers a nifty shortcut for making transactions slicker, and snappier and also opens new doors to new markets.

Conclusion

In summary, although cryptocurrency payments come with some risks, the potential advantages make them an attractive choice for companies looking to future-proof their business. By embracing crypto payments, companies can lower transaction costs, enhance transaction speed, gain access to new customer bases, and enhance security. Of course, there are still issues like volatility and uncertainty about the rules that get in the way, but for companies that really get involved in companies that use crypto transactions wisely, there can be long-term huge benefits. As the economy keeps changing, embracing cryptocurrency today could make someone a pioneer in the future generation of financial technology.

7 notes

·

View notes

Text

Bitcoin Is King, But Don’t Ignore the Others: Bitwise CIO Suggest Diversified Crypto Exposure

Bitcoin continues to dominate the digital asset space, maintaining its position as the most established and widely adopted cryptocurrency. However, according to Matt Hougan, Chief Investment Officer at Bitwise Asset Management, investors should consider broadening their exposure to include a variety of crypto assets, especially as blockchains evolve beyond just currency use cases. Hougan recently

Read More: You won't believe what happens next... Click here!

2 notes

·

View notes

Text

Crypto Investment in 2025: Hype, Hope, or Smart Strategy?”

Cryptocurrency has moved far beyond its early days of speculation and hype. As we enter mid-2025, we’re seeing more institutional interest, clearer regulations, and powerful blockchain use cases — but the volatility remains.

So, should you still consider investing in crypto?

Here’s a framework to think about it:

1. Understand the risk — Crypto is still a high-risk asset class. Don’t invest more than you can afford to lose, and make sure it fits your broader portfolio strategy.

2. Long-term mindset wins — Many who’ve succeeded in crypto didn’t trade daily. They bought quality projects, held through market cycles, and stayed informed.

3. Focus on fundamentals — Tokens with real utility, strong developer ecosystems, and transparent teams stand the test of time. Bitcoin and Ethereum still lead, but newer players are innovating fast.

4. Avoid FOMO — Just because a token is trending doesn’t mean it’s worth your money. Hype fades — fundamentals don’t.

5. Stay educated — Regulation, technology, and global economics all impact crypto. If you’re investing, make it a habit to stay updated.

Bottom line: Crypto investment isn’t dead — it’s maturing. If approached wisely, it can be a strategic piece of a diversified portfolio. Just be smart, stay calm, and zoom out.

What’s your crypto strategy in 2025? Let’s talk.

2 notes

·

View notes

Text

Why Bitcoin’s $77K Floor and Pakistan’s Crypto Pivot Could Reshape Trading with CELOXFI in Focus

The crypto market’s rollercoaster just took another wild turn, and the chatter is heating up. Bitcoin’s flirting with a supposed “bottom” at $77K, while Pakistan’s throwing its hat in the ring with plans to legalize digital assets. It’s the kind of news that keeps traders up at night—part hype, part hope, and a whole lot of “what’s next?” Amid this chaos, the spotlight’s shifting to how platforms like CELOXFI might steady the ship for U.S. traders hungry for clarity in a space that’s anything but predictable. So, what’s really going on here, and why does it matter?

Let’s start with the big call shaking up the market. Arthur Hayes, the BitMEX co-founder who’s never shy about stirring the pot, dropped a bombshell in a recent analysis. He’s pegging Bitcoin’s floor at $77,000, claiming the dreaded quantitative tightening (QT) phase—central banks’ go-to for sucking liquidity out of the system—is basically toast. To him, the macro storm that’s been rattling crypto is calming down, and Bitcoin’s resilience is shining through. It’s a bold take, no doubt, especially with the market still licking its wounds from the latest correction. Traders are watching closely, some nodding along, others skeptical, but everyone’s asking: is this the signal to jump back in?

Meanwhile, half a world away, Pakistan’s making moves that could ripple far beyond its borders. The government’s cooking up a legal framework to greenlight crypto, aiming to lure international cash and tame the Wild West vibe that’s long spooked regulators there. It’s a 180 from their old stance—less “ban it” and more “bring it”—driven by a hunger to tap blockchain’s economic juice. For a market that’s been under the radar, this could be a game-changer, opening doors for global players and giving digital assets a legit foothold in South Asia. The buzz? It’s not just about Pakistan—it’s a sign more nations might follow suit.

So where does this leave the average U.S. trader, still jittery from scams like that $32M Spanish Ponzi bust? Volatility’s nothing new in crypto, but these shifts—Hayes’ floor call and Pakistan’s pivot—hint at a market finding its footing. That’s where platforms built for the grind come in. CELOXFI platform analysis shows it’s doubling down on what matters: real-time data to track these swings, encryption that doesn’t mess around, and compliance that keeps things above board. For Americans burned by hype-and-dump schemes, it’s less about chasing moonshots and more about trading with eyes wide open.

Hayes’ optimism isn’t blind, though. He’s leaning on Bitcoin’s knack for thriving when fiat systems wobble—think inflation jitters or geopolitical mess. If he’s right, and $77K holds, it’s a green light for traders to rethink their plays. Pair that with Pakistan’s push to regulate, and you’ve got a global scene that’s less shadowy, more structured. Platforms like CELOXFI fit naturally here, offering tools to dissect market noise and manage risk without the fluff. It’s not about flashy promises—it’s about giving U.S. investors a shot at navigating this new terrain without getting rug-pulled.

Pakistan’s move, meanwhile, isn’t just local news. As more countries flirt with crypto laws, the domino effect could steady the market long-term. Imagine a world where digital assets aren’t just for the degens but a legit piece of the financial puzzle. For traders, that means picking platforms that can roll with these punches—ones that prioritize security and transparency over smoke and mirrors. CELOXFI platform analysis highlights its edge: cutting through the chaos with insights that don’t leave you guessing.

The market’s mood? Cautious but buzzing. Bitcoin’s $77K floor could be the reset button traders need, while Pakistan’s crypto embrace might signal a broader thaw. For U.S. investors, it’s a chance to ditch the blind bets and lean into platforms that deliver the goods—think risk management that actually works and data you can trust. The future’s still a gamble, sure, but with these shifts, it’s looking less like a crapshoot and more like a calculated play.

Curious how this all shakes out? Keep an eye on the trends and dig into platforms that can handle the heat. For more on navigating this wild ride, check out https://www.celoxfi.com/index.html.

3 notes

·

View notes

Text

Blockchain Technology: Types, Features, and Future of Cryptocurrency Networks

Blockchain is not just a trend, it’s a game-changer. You can especially see it in the crypto world, where this technology is absolutely essential. It’s a decentralized system that ensures secure and transparent transactions without the need for traditional middlemen. Blockchain is the backbone of digital currencies like Bitcoin and Ethereum, ensuring their integrity and trust. But its potential goes far beyond cryptocurrencies — it’s transforming industries, from finance to healthcare, and its applications are expanding rapidly. In this article, we’ll dive into the different types of blockchain networks, how they work, and what the future holds for blockchain and cryptocurrency networks.

Introduction to Blockchain and Cryptocurrency Networks

Blockchain is a system for storing data that can’t be altered once it’s recorded. It’s made up of “blocks” of data that are linked together in a “chain” to form an ongoing ledger. Each block contains transaction data, and once confirmed, it can’t be changed. Blockchain is decentralized, meaning no single entity controls it. This decentralization is what makes blockchain secure, transparent, and trustworthy.

Cryptocurrencies like Bitcoin and Ethereum run on blockchain networks. Blockchain enables peer-to-peer transactions without the need for intermediaries like banks. This way, digital currencies can be transferred between people globally, securely and quickly. Blockchain’s role in cryptocurrencies is crucial for ensuring transparency and avoiding fraud.

The main benefit of blockchain is its security. It uses cryptographic algorithms to secure each transaction, ensuring that only authorized users can make changes. Since there’s no central authority, blockchain eliminates many issues associated with traditional financial systems, such as high fees and slow transactions.

There are several types of blockchain networks, each with varying levels of decentralization and access control. These include public, private, and hybrid blockchains. Public blockchains are open for anyone to join, while private blockchains have restricted access, typically used by companies. Hybrid blockchains combine features of both.

Types of Crypto Networks

Blockchain networks come in different types, each with its own unique features and use cases. Here’s an overview of the key types of blockchain networks:

Public Blockchains: These are open for anyone to join and participate. Examples include Bitcoin and Ethereum.

Private Blockchains: These are closed networks where only authorized participants can join. Companies often use private blockchains for specific business needs.

Hybrid Blockchains: These combine the best features of both public and private blockchains. They offer flexibility for organizations.

Consortium Blockchains: These are semi-decentralized networks where control is shared by multiple organizations. They’re often used in industries like banking.

Each type of blockchain network has its strengths and is used in different contexts. Public blockchains are great for transparency and decentralization, while private blockchains offer more control and privacy. Hybrid and consortium blockchains are perfect for businesses that need customized solutions.

Public vs. Private Blockchains

Public and private blockchains are two of the most common types. Here’s how they differ:

Public Blockchain:

Open for anyone to participate.

Highly decentralized.

More secure but can be slower due to many participants.

Example: Bitcoin, Ethereum.

Private Blockchain:

Closed network with restricted access.

Centralized control, often by one organization.

Faster but less decentralized.

Example: Hyperledger, Ripple.

Public blockchains prioritize transparency and decentralization, while private blockchains focus on privacy and control.

Permissioned vs. Permissionless Blockchains

Another key distinction in blockchain networks is whether they are permissioned or permissionless.

Permissionless Blockchain:

Anyone can join and participate.

Decentralized and open.

Common in public blockchains like Bitcoin and Ethereum.

Permissioned Blockchain:

Only authorized users can join.

Centralized control by a group or organization.

Common in private and consortium blockchains.

This distinction helps define who can participate in the network and how it’s managed.

Read the continuation at the link.

2 notes

·

View notes

Text

Blockchain Investment: A New Frontier for Investors

The rise of blockchain technology over the last decade has sparked interest across various industries, from finance and supply chain management to healthcare and entertainment. As blockchain matures, investors are starting to recognize its potential not only for transforming traditional sectors but also for offering new investment opportunities. In this article, we explore the significance of blockchain investment, the types of investments available, the associated risks, and the future outlook for this promising technology.

What is Blockchain?

Blockchain is a decentralized digital ledger technology that securely records transactions across multiple computers. It allows information to be stored transparently, immutably, and without the need for intermediaries such as banks or government bodies. The most famous application of blockchain technology is Bitcoin, the first cryptocurrency, but its potential extends far beyond digital currencies.

Blockchain’s unique features—decentralization, transparency, and security—make it an appealing foundation for various applications, ranging from finance to supply chain management to voting systems. With an increasing number of industries exploring blockchain’s use cases, it has garnered significant attention from investors.

youtube

Why Invest in Blockchain?

Disruption of Traditional Systems: Blockchain has the potential to disrupt a wide range of industries by providing more efficient, transparent, and secure alternatives to legacy systems. For example, blockchain-based financial services can lower transaction costs, reduce fraud, and offer access to previously unbanked populations. The transformation of industries such as healthcare, logistics, and government services is just beginning.

The Growth of Cryptocurrencies: Blockchain is the backbone of cryptocurrencies, which have seen exponential growth in recent years. Bitcoin, Ethereum, and other altcoins have become established assets, and decentralized finance (DeFi) platforms built on blockchain promise further innovation in financial markets. Investors can benefit from both the appreciation of these digital assets and the broader adoption of cryptocurrency ecosystems.

Tokenization of Assets: Blockchain enables the tokenization of real-world assets, including real estate, art, and commodities. This allows investors to gain fractional ownership in previously illiquid assets, opening up new avenues for diversification and investment. Tokenization can also improve liquidity and streamline processes such as cross-border payments and property transfers.

Venture Capital and Startups: Many blockchain-based startups are developing innovative applications, from decentralized applications (dApps) to non-fungible tokens (NFTs) to blockchain-based identity verification systems. Venture capitalists and angel investors can tap into the high growth potential of these companies, as blockchain adoption continues to rise globally.

Types of Blockchain Investments

Blockchain investments can be approached in several ways. Some of the most common types include:

Cryptocurrencies: Direct investment in digital currencies like Bitcoin, Ethereum, and other altcoins is the most straightforward form of blockchain investment. These cryptocurrencies can be purchased through exchanges and stored in digital wallets. While Bitcoin and Ethereum are the most well-known, there are thousands of altcoins that investors can explore.

Blockchain-related Stocks and ETFs: Rather than investing directly in cryptocurrencies, investors can gain exposure to blockchain technology by purchasing stocks in companies that are integrating blockchain into their operations. Public companies such as Nvidia (which provides hardware for mining), Coinbase (a cryptocurrency exchange), and Block (formerly Square) are examples of firms investing heavily in blockchain. Additionally, blockchain-focused exchange-traded funds (ETFs) allow investors to diversify their exposure to the sector.

Initial Coin Offerings (ICOs) and Token Sales: ICOs and token sales are fundraising mechanisms where startups issue their own cryptocurrency tokens in exchange for investments. While ICOs were initially seen as high-risk, high-reward ventures, they have become more regulated over time. This form of investment allows early-stage investors to gain a stake in blockchain projects before they are widely adopted.

Blockchain Real Estate: The tokenization of real estate allows fractional ownership of property via blockchain-based tokens. Platforms like RealT and Propy have been pioneers in this space, enabling investors to buy shares in real estate and receive dividends from rental income. Blockchain’s transparency and immutability make it ideal for managing property transactions.

Decentralized Finance (DeFi): DeFi is a rapidly growing sector that leverages blockchain to provide financial services such as lending, borrowing, and trading without intermediaries. By investing in DeFi projects or liquidity pools, investors can earn returns in the form of interest or tokens.

Risks of Blockchain Investment

While blockchain presents exciting investment opportunities, there are several risks to consider:

Volatility: Cryptocurrencies, in particular, are known for their extreme price volatility. Dramatic price swings can occur in a short time, making blockchain investments high-risk, especially for short-term traders. Long-term investors should be prepared for fluctuations in value.

Regulatory Uncertainty: Blockchain and cryptocurrencies are still in the early stages of regulatory development. Governments around the world are working on creating frameworks to govern blockchain and digital currencies, but until clear regulations are established, there could be sudden changes in legal and tax requirements that impact investment returns.

Security and Fraud Risks: While blockchain technology itself is secure, the platforms and exchanges built on top of it may not always be. Hacks, scams, and fraud have occurred in the blockchain space, with investors losing substantial amounts of money. Conducting thorough research and choosing reputable platforms is crucial.

Technological Risks: Blockchain is still an emerging technology, and its long-term scalability, interoperability, and environmental impact remain open questions. For instance, Ethereum, one of the leading blockchains, is transitioning from a proof-of-work to a more energy-efficient proof-of-stake consensus mechanism, highlighting the potential for technical challenges.

The Future of Blockchain Investment

As blockchain technology evolves, it’s expected that adoption across industries will only increase. Many experts believe that blockchain will play a central role in reshaping the global economy, particularly in areas like supply chain transparency, decentralized finance, and digital identity verification.

The rise of central bank digital currencies (CBDCs), which are government-backed digital currencies that leverage blockchain technology, will likely spur further mainstream adoption. Additionally, innovations in smart contracts, which automate transactions based on predefined conditions, will expand the use of blockchain beyond simple transactions into complex business processes.

For investors, this presents an exciting opportunity to position themselves at the forefront of a technological revolution. However, as with any emerging technology, it is important to approach blockchain investment with caution, conducting thorough due diligence and maintaining a diversified portfolio to manage risk effectively.

Conclusion

Blockchain investment offers promising opportunities for those willing to navigate its complexities. From cryptocurrencies to tokenized assets to decentralized finance, the potential for growth in this sector is vast. However, investors should carefully consider the risks associated with volatility, regulation, and security before diving in. As blockchain technology matures and becomes more widely adopted, it will likely be a key driver of innovation, providing unique opportunities for savvy investors to capitalize on the next generation of digital transformation.

2 notes

·

View notes

Text

Can you imagine what a digital white ethnostate or a cyber caliphate might look like? Having spent most of my career on the inside of online extremist movements, I certainly can. The year 2024 might be the one in which neo-Nazis, jihadists, and conspiracy theorists turn their utopian visions of creating their own self-governed states into reality—not offline, but in the form of Decentralized Autonomous Organizations (DAOs).

DAOs are digital entities that are collaboratively governed without central leadership and operate based on blockchain. They allow internet users to establish their own organizational structures, which no longer require the involvement of a third party in financial transactions and rulemaking. The World Economic Forum described DAOs as “an experiment to reimagine how we connect, collaborate and create”. However, as with all new technologies, there is also a darker side to them: They are likely to give rise to new threats emerging from decentralized extremist mobilization.

Today, there are already over 10,000 DAOs, which collectively manage billions of dollars and count millions of participants. So far, DAOs have attracted a wild mix of libertarians, activists, pranksters, and hobbyists. Most DAOs I have come across in my research sound innocent and fun. Personally, my favorites include theCaféDAO, which aims “to replace Starbucks” (good luck with that!); the Doge DAO, which wants to “make the Doge meme the most recognizable piece of art in the world”; and the HairDAO, “a decentralized asset manager solving hair loss.” But some DAOs use a more radical tone. For example, the Redacted Club DAO, which is rife with alt-right codes and conspiracy myth references, claims to be a secret network with the aim of “slaying” the “evil Meta Lizard King.”

The year 2024 might be one in which extremists start using DAOs strategically. Policies, legal contracts, and financial transactions that were traditionally the domain of governments, courts, and banks can be replaced with smart contracts, non-fungible tokens (NFTs), and cryptocurrencies. The use of anonymous bitcoin wallets and non-transparent cryptocurrencies such as Monero is already widespread among extremists whose bank accounts have been frozen. A shift to entirely decentralized forms of self-governance is only one step away.

Beyond practical reasons that encourage extremists to create their own self-governed structures, there is an ideological incentive too: their fundamental distrust in the establishment. If you believe that the deep state or the “global Jewish elites” control everything from governments and Big Tech to the global banking system, DAOs offer an appealing alternative. Conversations on far-right fringe platforms such as BitChute and Odysee reveal that there is much appetite for decentralized alternative forms of collaboration, communication, and crowdfunding.

So what happens if anti-minority groups establish their own digital worlds in which they impose their own governing mechanisms? What are the stakes if trolling armies start cooperating via DAOs to launch election interference campaigns? The activities of extremist DAOs could challenge the rule of law, pose a threat to minority groups, and disrupt institutions that are currently considered fundamental pillars of democratic systems. Another risk is that DAOs can serve as safe havens for extremist movements by enabling users to circumvent government regulation and security services monitoring activities. They might also allow extremists to find new ways to fundraise, plan, and plot radicalization campaigns or even attacks. While many governments have focused on developing legal frameworks to regulate AI, few have even recognized the existence of DAOs. Their looming exploitation for extremist and criminal purposes is something that has flown under the radar of global policymakers.

Technology expert Carl Miller, who has long warned of potential misuse of DAOs, told me that “even though DAOs behave like companies, they are not registered as legal entities.” There are only a few exceptions: The US states of Wyoming, Vermont, and Tennessee have passed laws to legally recognize DAOs. With no regulations in place to hold DAOs accountable for extremist or criminal activities, the big question for 2024 will be: How can we ensure the metaverse doesn’t give rise to digital white ethnostates or cyber caliphates?

10 notes

·

View notes

Text

TOP PROFITABLE COINS TO BUY IN 2024

Explore

Certainly! Here are some of the top cryptocurrencies you might consider for investment in April 2024:

Bitcoin (BTC):

Market cap: $1.4 trillion

Year-over-year return: 150%

Bitcoin, created in 2009 by Satoshi Nakamoto, is the original cryptocurrency. Its price has surged significantly over the years, making it a household name. As of April 9, 2024, one bitcoin is priced around $70,603, representing remarkable growth1.

Ethereum (ETH):

Market cap: $434.8 billion

Year-over-year return: 95%

Ethereum serves as both a cryptocurrency and a blockchain platform. It’s popular among developers due to its potential applications, including smart contracts and non-fungible tokens (NFTs). From April 2016 to April 2024, its price increased from about $11 to approximately $3,621, a staggering growth of 32,822%1.

Tether (USDT):

Market cap: $107.1 billion

Year-over-year return: 0%

Tether is a stablecoin backed by fiat currencies like U.S. dollars and the Euro. Its value is designed to remain consistent, making it attractive to investors wary of extreme volatility in other coins1.

Binance Coin (BNB):

Market cap: $87.3 billion

Year-over-year return: 87%

BNB is used for trading and paying fees on Binance, one of the largest crypto exchanges globally. Beyond trading, it has expanded to payment processing and even booking travel arrangements1.

Remember that investing in cryptocurrencies carries risks, and it’s essential to do thorough research and consider your risk tolerance before making any investment decisions. Always consult with a financial advisor if needed. 🚀🌟

<meta name="monetag" content="89c9b8a0f0677abc9548e8cb0fd150b0">

6 notes

·

View notes

Text

Bitcoin: The Final Chapter in the Evolution of Money

Money has always been a mirror of humanity’s progress, a quiet witness to our creativity, our ambition, and our need to connect. From the humblest beginnings of bartering goods to the intangible brilliance of Bitcoin, the evolution of money is more than just a history lesson; it’s the story of us. It reflects how societies grow, how trust is built, and how power shifts. Today, as Bitcoin enters the global stage, it forces us to question whether we are standing at the pinnacle of monetary evolution—or perhaps just the beginning of something even greater.

In the earliest days of human exchange, bartering was the default. You had a goat, and someone else had grain. The trade was straightforward but cumbersome. What if the grain farmer didn’t need a goat? Or worse, what if your goat was only worth half the grain? The inefficiencies were glaring, and the limitations of barter pushed humans toward something ingenious: a universal medium of exchange.

Seashells, beads, and other symbolic objects emerged as early forms of money. These tokens weren’t inherently valuable but were agreed upon as valuable within their communities. Money wasn’t about the item itself; it was about the trust it represented. The innovation here wasn’t in the material but in the idea that value could be symbolized, portable, and shared across a group.

Then came the era of precious metals, particularly gold and silver. These materials brought durability, rarity, and divisibility to the concept of money. They weren’t just tokens; they had intrinsic qualities that people admired and trusted. Ancient societies began minting coins, stamping them with marks of authority to guarantee their weight and purity. Trust now extended beyond the material to the entity that issued it. Coinage became not just a tool of trade but a symbol of state power and reliability. Yet, even this system wasn’t without its flaws. Governments could and did debase currencies, mixing in cheaper metals to stretch their reserves. Trust, as it turned out, could be manipulated.

Fast-forward to the advent of paper money, and the story becomes even more about trust—or the illusion of it. Paper notes were initially redeemable for gold or silver, a convenient stand-in for heavy metals. But over time, the promise of redemption was quietly eroded. Money became untethered from tangible assets, and its value rested solely on the word of governments and central banks. This system allowed for incredible growth and convenience, but it also introduced a new fragility. Inflation, currency devaluation, and financial crises became recurring features of a world where money was no longer scarce but infinitely printable.

The digital age brought another leap forward. Credit cards, online banking, and mobile payments made money faster and more accessible than ever. Transactions that once took days or weeks could now be completed in seconds. Yet, these systems remained centralized. They relied on banks, payment processors, and governments to function. They introduced layers of fees, opportunities for censorship, and risks of fraud. Trust was no longer local or even national; it was global, but it was still concentrated in a few hands. This centralization set the stage for a radical disruption.

Enter Bitcoin. For the first time in history, money could exist outside the control of any government, bank, or corporation. Bitcoin didn’t just tweak the rules of the game; it rewrote them entirely. It offered scarcity in a digital form, capped at 21 million coins. It provided security through cryptography and transparency through its blockchain. Most importantly, it eliminated the need for trust. In the world of Bitcoin, the code is the trust.

Bitcoin is the culmination of everything money has been striving to become. It’s durable, divisible, portable, and scarce. But it goes further, addressing the flaws that plagued its predecessors. There are no rulers to debase it, no borders to limit it, and no intermediaries to exploit it. Bitcoin is money distilled to its purest form: a universal ledger that belongs to no one and everyone simultaneously.

Of course, the journey isn’t without its challenges. Bitcoin’s energy use is often misunderstood, its volatility scares off the faint-hearted, and its decentralized nature invites scrutiny from regulators. But history has shown that every revolutionary form of money faced skepticism. The first coins, the first banknotes, even the first credit cards—all were doubted before they became indispensable. Bitcoin’s path is no different. What sets it apart is its adaptability. Like an open-source organism, Bitcoin evolves, incorporating improvements and addressing its shortcomings through the collective effort of its global community.

As we look back on the history of money, a pattern emerges. Each new form of money solved the problems of the last while introducing possibilities that were previously unimaginable. Barter gave way to tokens, tokens to coins, coins to paper, paper to digital—and now, digital to decentralized. Bitcoin fits seamlessly into this arc, not as a replacement for what came before but as the next step in the natural evolution of money.

The question isn’t whether Bitcoin fits into the story of money. It’s whether we—as individuals, as societies, and as a species—are ready to embrace what it represents. Bitcoin challenges us to rethink not just how money works but what money is and who should control it. It invites us to imagine a world where trust is embedded in systems rather than institutions, where value is transparent rather than opaque, and where money is as free as the people who use it.

Bitcoin feels like the culmination of money’s evolution. From here, the only changes will likely revolve around how people choose to use it.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#EvolutionOfMoney#Cryptocurrency#DigitalGold#MonetaryRevolution#BlockchainTechnology#FutureOfFinance#DecentralizedMoney#FinancialFreedom#BitcoinPhilosophy#CryptoCulture#MoneyMatters#BitcoinEducation#DigitalCurrency#CryptoEconomy#BarterToBitcoin#InnovativeFinance#BitcoinCommunity#FinancialEvolution#SoundMoney#financial education#financial experts#globaleconomy#finance#financial empowerment#blockchain#unplugged financial

2 notes

·

View notes