#but i expected the ratio to skew way more in his favor

Text

using my credentials as a top .1% mitski listener for two years in a row i have brought you mitski KL classifications

recommendations/strong matches are bolded

Laurel Hell // Be The Cowboy // Puberty 2 // Bury Me At Makeout Creek // Retired from a Sad, New, Career in Business // Lush

Keith

Everyone

Valentine, Texas

Stay Soft

Love Me More

A Pearl

A Horse Named Cold Air

Blue Light

Washing Machine Heart

I Bet on Losing Dogs

Thursday Girl

I Will

I Don't Smoke

First Love/Late Spring

Humpty

I Want You

Strawberry Blond

Wife

Door

Lance

The Only Heartbreaker

There's Nothing Left For You

Working For The Knife

Nobody

Me and My Husband

Lonesome Love

Remember My Name

Fireworks

A Burning Hill

Texas Reznikoff

Townie

Francis Forever

Carry Me Out

Goodbye, My Danish Sweetheart

Brand New City

Abbey

Both/either/interchangeable

Heat Lightning

Geyser

Come Into The Water

Pink in the Night

Two Slow Dancers

Once More to See You

anything not listed has been given careful consideration but would be too much of a reach to apply to them and/or is too personally about experiences of the human condition mitski herself has lived

Im open to healthy debate on any of these but just know i come armed with explanations for all

#i never realized how many references to knives she makes. because whenever i hear abt a knife i think of keith LOL#and apparently i disrespect mitski enough to make this listing but i DO respect her enough to omit some of her most intense ones#(i am a white woman i am NOT about to file Your Best American Girl LOL)#and a few of hers are about old flames/lost love which is obviously not the vibe we need here#still may draw a piece for each album but not sure. puberty 2 lacks any real close matchups (as u can see i omitted almost all of it)#obviously not a lot of Lush made it on here either because that ones for the girls#mitski when she writes about the horrors of being a woman#there was more lance than i thought! keith is very mitski coded#but i expected the ratio to skew way more in his favor#just shows mitskis talent and range i guess#klance#mitski

144 notes

·

View notes

Text

Groups of characters that are all boys and two girls suck. Sometimes it's 2 boys and 2 girls and then it's OK I guess. Doesn't stop me from enjoying the media, and loving the characters, but here in the year 2022, why do we still have so much media (popular media specifically, and this is important) with 2-girl-2-or-more-boy groups?

That's not the point. The point is: it's become more common for trans characters to exist/be explicit. Outside of canon, in fanon, characters have been headcanoned as trans for a while. Love it. All four it. At the end of the day, all these characters being trans is more important than my complaint.

Whatever. The point: it is usually one of the 2 girls that ends up being trans, skewing the gender ratio in the group even more. Imo it doesn't matter to any one specific media what their gender ratio is, but when it happens that we now only have one girl in a group of 3+ boys, my enjoyment of the media goes down a little bit. Not a lot! Still love it because I don't understand gender anyways, I'm agender, can't wrap my head around it, but I view this progressive media as having something in common with older movies/books/whatever back when the cast was all male with a token female. Usually the token girl isn't as much a disrespectful stereotype like she used to be, but my autistic brain says, "Why only one pretty lady?"

Because I'm posting this without waiting to compile a list, I'm just going to say the 2 I can think of at the moment that made me post this.

Umbrella Academy (I love Elliot Page, his character transitioned because he did so my frustration of making Alison the only girl in the sibling group is flimsy and doesn't really hold up any more than if there had been a more even divide of genders to begin with there would be less of a dramatic ratio within the Umbrellas. Yes, I know Klaus is nonbinary, but that still leaves 5:1:1 gender ratio in favor of the boys)

Homestuck (get the fuck out of here with your psychic damage or 'what did you expect to it's homestuck shitty blah blah I LIKE Homestuck. This one is also flimsy because in the epilogues when Roxy transitioned to nonbinary, masc-presenting, I absolutely loved it but was a little uncomfortable about it. Now I realized it's because I related to Roxy most out of all characters and I was on the edge of doing exactly as they would (using they because even though I do love he-pronoun Roxy he is not canon and only partly relevant and Roxy does use They/Them sometimes, and with all the time stuff being relevant I'm going after the average) and I didn't need to be called out like that before my egg hatched/broke/whatever.

*John is June now, it went the other way with the Beta kids, that balances things out again and I LOVE June. The other character I related to so much was him, and my gender is somewhere between all versions of John/June/Roxy.

Again, my complaint is not that I want less trans boys in media or fandom, I just want more trans girls and genderqueer characters. Fuck it. No one is cis now.

2 notes

·

View notes

Text

Is Investing in the Stock Market Gambling?

Now and then, I hear someone say that stock market investing is gambling. Is this true or false?

A good friend of mine, with the stock trading alias of the Lone Ranger, told me that her relative said investing in Penny Stocks is gambling.

Gambling is, by definition, the activity or practice of playing a game of chance for money or other stakes.

Let’s take a step back, this implication, that investing in the stock market is gambling, is often a sentiment expressed by people who believe that making money is not likely. The result for most people will be a loss. Furthermore, there may be little basis for a sound investment in some stocks, such as penny stocks, since investing theory indicates that a company’s financials may not be in line with a sound business model.

The points above are somewhat reflected in the paper titled, “Who Gambles in the Stock Market?” by Alok Kumar.[1]

In the paper, Kumar identifies lottery-type stocks by using lottery tickets (the most common form of gambling) as a reference. Lottery tickets have very low prices relative to a high potential payoff. They have low negative expected returns, and the prize distribution has exceptionally high variance. Most importantly, they have a minuscule probability of a huge reward and a huge chance of a small loss.

To identify lottery-type stocks, Kumar characterizes stocks with low prices, high volatility, and investor sentiment skewness. The author has more precise terms that many people have never seen before.

For example, he uses the term idiosyncratic volatility where Investopedia defines idiosyncratic risk in the following way:

“Idiosyncratic risk refers to the inherent factors that can negatively impact individual securities or a very specific group of assets. The opposite of Idiosyncratic risk is a systematic risk, which refers to broader trends that impact the overall financial system or a very broad market.”[2]

In other words, there may be high volatility of oil company security due to pipeline breaks. This may result in an adverse price move. Conversely, if a large oil field is discovered, this may cause a positive price move. The result is the high volatility of the stock price. When these events happen for a particular company more than once, there may be a skewed perception of the company unrelated to the company’s fundamentals. People may invest in them thinking that the large moves will happen again, especially if it’s a low priced stock, AKA Penny Stock.

Interestingly enough, Kumar’s paper does have a table that characterizes lottery-type stocks. Table 2, titled Basic Characteristics Of Lottery-Type Stocks, reports that there are 1500 lottery-type stocks, 1500 non-lottery-type stocks, and 9000 stocks in the middle.

So what are the characteristics of a lottery-type stock?

The table reports that the firm size average is very low with an average market capitalization of 31 million, low institutional ownership at 7.35%, a relatively high book to market ratio 0.681, and lower liquidity. These stocks are also younger, with a mean age of about six years. They have low analyst coverage, most don’t have dividends, they have significantly higher volatility, higher skewness, and lower prices.

The author goes on to report that lottery-type stocks are concentrated heavily in the energy, mining, financial services, biotechnology, and technology sectors and the lowest concentration of lottery stocks is in the utilities, consumer goods, and restaurant sectors.

Given the fact that there are lottery-type stocks and non-lottery-type stocks, how likely, in general, is a trader or investor to make money in the Stock market? Remember the sentiment we discussed earlier, that most people lose money in the stock market, which is similar to the feature of lottery tickets with their negative expected return.

According to the Tradeciety:

“Profitable day traders make up a small proportion of all traders – 1.6% in the average year. However, these day traders are very active – accounting for 12% of all day trading activity.”[3]

That doesn’t sound encouraging, but this may be a problem with trading frequently.

What about the long term, buy and hold investing as Warren Buffett does? His favorite holding period is forever.[4]

I made the most money in the stock market in paper gains when I picked outstanding diversified funds, ignored them when the market was misbehaving, and held them long term. Many famous investors have made money through the buy and hold strategy, such as Warren Buffett, Jack Bogle, John Templeton, Peter Lynch, and Benjamin Graham.

In my opinion, market fluctuations are unpredictable most of the time. Sometimes you can see the writing on the wall; for example, the Corona crash seemed evident in my opinion. The virus itself was a surprise, though, and so was the financial crash of 2008.

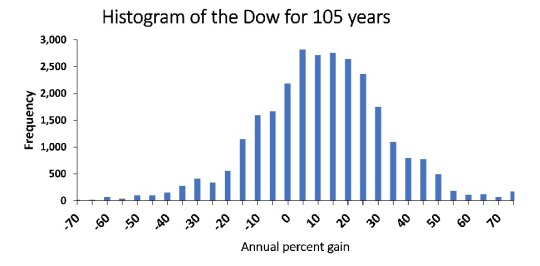

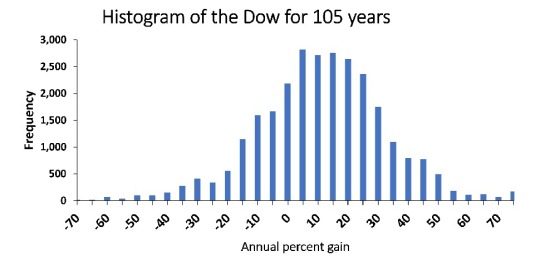

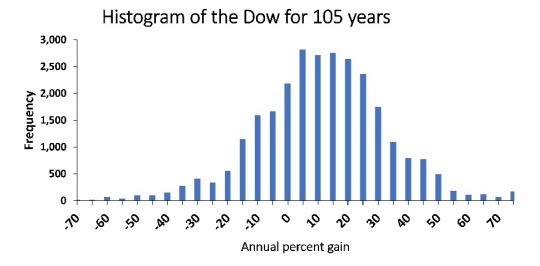

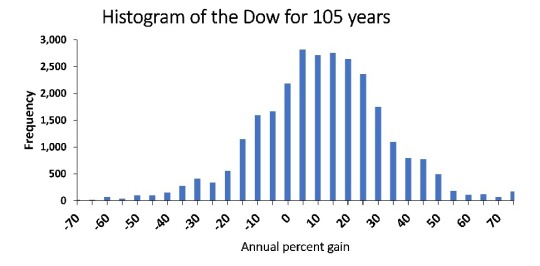

The market has something going for it that favors long term investing. This may end someday, but historically the market goes up over time and always recovers from a crash. (We are almost out of the Corona Crash with the S&P and NASDAQ making new highs. We are waiting on the DOW which is close). In my book Crash Proof Your Investment, I developed a historical histogram chart that shows this favoritism.

The vertical axis may look confusing. What does it mean?

I calculated the rolling annualized returns by using one year of data. But the annual return is calculated for each market day, so the one year of data slides like a window to collect a new day and dispense of an old one. There were 251 trading days in 2018, which means there are 251 annual return values.

Over 105 years, there are about 26,355 (251 x 105 = 26,355) annual return values.

The horizontal axis depicts the annual percentage gain. By looking at the 0 percent annual bar, you can see that 0 percent annual return happened a little less than 3,000 times in 105 years.

Disappointing returns for the long investor!

More importantly, the graph shows that the market has positive returns more frequently because the bulk of the bars in the graph are above 0 percent annual return.

The market is skewed! Five percent, ten percent, and fifteen percent annual returns are the most frequent.

There are even some outliers at a 70 percent annual return and above.

To put these numbers in perspective, let’s answer the question: How long will it take an investment to double in the market?

The average return was 9 percent? If we assume that is the fixed rate of return for every year that the investment is in the market, then we can use the Rule of 72 to answer the question.

The Rule of 72 is an equation that provides you with the length of time an investment will take to double. In our case we would divide 72 by our fixed rate of 9.

Our answer shows us it will double every eight years. Impressive!

If the graph is still confusing, there is still hope. Check out the excellent article on Investopedia called “Rolling Return.”[5]

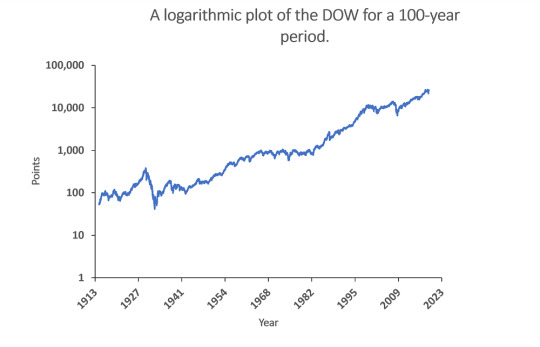

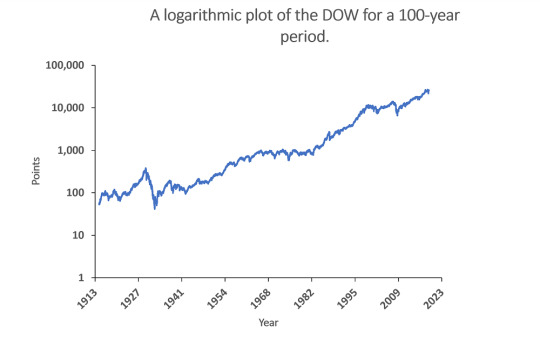

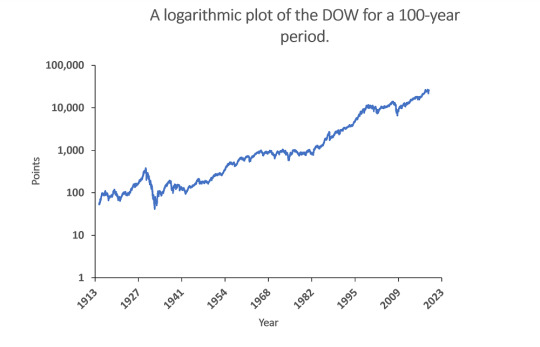

A more familiar chart is the one shown below:

The trend is undoubtedly up. So this indicates that there may be something to buy and hold for the long term.

Finally, from the paper by Kumar, four-factor models for the stock market return are mentioned. A somewhat simplified explanation of this model is in the Investopedia article titled, Fama and French Three-Factor Model[6]. The article states that:

“Nobel Laureate Eugene Fama and researcher Kenneth French, former professors at the University of Chicago Booth School of Business, attempted to better measure market returns and, through research, found that value stocks outperform growth stocks. Similarly, small-cap stocks tend to outperform large-cap stocks. As an evaluation tool, the performance of portfolios with a large number of small-cap or value stocks would be lower than the CAPM result, as the Three-Factor Model adjusts downward for observed small-cap and value stock out-performance.”[7]

Later on the article reports:

“Fama and French highlighted that investors must be able to ride out the extra short-term volatility and periodic underperformance that could occur in a short time. Investors with a long-term time horizon of 15 years or more will be rewarded for losses suffered in the short term. Using thousands of random stock portfolios, Fama and French conducted studies to test their model and found that when size and value factors are combined with the beta factor, they could then explain as much as 95% of the return in a diversified stock portfolio.”[8]

So as you can see from the Investopedia article and the work of Fama and French, long term investing offsets short term losses that a day trader or short term trader might experience.

In the book Intelligent investor, which is one of the seeds of Warren Buffett’s massive fortune, there is commentary from Zweig’s section that says

“Like casino gambling or betting on the horses, speculating in the market can be exciting or even rewarding (if you happen to get really lucky). But it’s the worst imaginable way to build your wealth. That’s because Wall Street, like Las Vegas or the racetrack, has calibrated the odds so that the house always prevails, in the end, against everyone who tries to beat the house at its own speculative game.

On the other hand, investing is a kind of a unique kind of casino—one where you cannot lose in the end, so long as you play only by the rules that put the odds squarely in your favor. People who invest make money for themselves; people who speculate make money for their brokers. And that, in turn, is why Wall Street perennially downplays the durable virtues of investing and hypes the gaudy appeal of speculation.”[9]

In summary, we have discovered that there are lottery-type stocks that resemble gambling in the stock market and there are investing strategies where the outcome is more likely to be profitable. So investing in the stock market is not gambling—keyword investing. But there are plenty of opportunities to gamble with securities in the stock market. These tend to be, but are not limited to, penny stocks.

That’s all for now; good luck with your financial goals,

Dr. Paul Keller.

The Financial Master Series Books

Crash Proof Your Investment

The Beginner’s Guide to Rental Property Investing

Stock Market Masters

Notes:

[1]Kumar, Alok. “Who Gambles in the Stock Market?” The Journal of Finance 64, no. 4 (2009): 1889-933. Accessed September 14, 2020. http://www.jstor.org/stable/27735154.

[2] https://www.investopedia.com/terms/i/idiosyncraticrisk.asp

[3] https://www.tradeciety.com/24-statistics-why-most-traders-lose-money/

[4] https://www.montycampbell.com/article/what-warren-buffett-really-means-when-he-says-his-favorite-holding-period-is-forever/

[5] Chen, J. (2020, January 29). Rolling Returns Definition. Retrieved from https://www.investopedia.com/terms/r/rollingreturns.asp.

[6] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[7] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[8] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[9] Benjamin Graham, Intelligent Investor.

Bibliography:

Campbell, M. (2018, February 03). What Warren Buffett Really Means When He Says His Favorite Holding Period Is “Forever”! Retrieved September 14, 2020, from https://www.montycampbell.com/article/what-warren-buffett-really-means-when-he-says-his-favorite-holding-period-is-forever/

Chen, J. (2020, April 23). Idiosyncratic Risk: Why a Specific Stock Is Risky Right Now. Retrieved September 14, 2020, from https://www.investopedia.com/terms/i/idiosyncraticrisk.asp

Graham, B., & Zweig, J. (2003). The intelligent investor: A book of practical counsel. NY, NY: HarperBusiness.

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Kumar, Alok. “Who Gambles in the Stock Market?” The Journal of Finance 64, no. 4 (2009): 1889-933. Accessed September 14, 2020. http://www.jstor.org/stable/27735154

Rolf, Witbooi, Mataruse, M., Sm, Anonymous, Burguet, M., & Ahmad. (2020, April 10). Why Most Traders Lose Money – 24 Surprising Statistics. Retrieved September 14, 2020, from https://www.tradeciety.com/24-statistics-why-most-traders-lose-money

#stocks #stockmarket #investment #investing #realestate #trading #dalio #minervini #warrenbuffett #valueinvesting #author #financialmaster #habits #stockmarketcrash #rentalproperty

source https://drpaulkeller.com/gambling-stocks/

source https://drpaulkeller.blogspot.com/2020/09/is-investing-in-stock-market-gambling.html

0 notes

Text

Is Investing in the Stock Market Gambling?

Now and then, I hear someone say that stock market investing is gambling. Is this true or false?

A good friend of mine, with the stock trading alias of the Lone Ranger, told me that her relative said investing in Penny Stocks is gambling.

Gambling is, by definition, the activity or practice of playing a game of chance for money or other stakes.

Let’s take a step back, this implication, that investing in the stock market is gambling, is often a sentiment expressed by people who believe that making money is not likely. The result for most people will be a loss. Furthermore, there may be little basis for a sound investment in some stocks, such as penny stocks, since investing theory indicates that a company’s financials may not be in line with a sound business model.

The points above are somewhat reflected in the paper titled, “Who Gambles in the Stock Market?” by Alok Kumar.[1]

In the paper, Kumar identifies lottery-type stocks by using lottery tickets (the most common form of gambling) as a reference. Lottery tickets have very low prices relative to a high potential payoff. They have low negative expected returns, and the prize distribution has exceptionally high variance. Most importantly, they have a minuscule probability of a huge reward and a huge chance of a small loss.

To identify lottery-type stocks, Kumar characterizes stocks with low prices, high volatility, and investor sentiment skewness. The author has more precise terms that many people have never seen before.

For example, he uses the term idiosyncratic volatility where Investopedia defines idiosyncratic risk in the following way:

“Idiosyncratic risk refers to the inherent factors that can negatively impact individual securities or a very specific group of assets. The opposite of Idiosyncratic risk is a systematic risk, which refers to broader trends that impact the overall financial system or a very broad market.”[2]

In other words, there may be high volatility of oil company security due to pipeline breaks. This may result in an adverse price move. Conversely, if a large oil field is discovered, this may cause a positive price move. The result is the high volatility of the stock price. When these events happen for a particular company more than once, there may be a skewed perception of the company unrelated to the company’s fundamentals. People may invest in them thinking that the large moves will happen again, especially if it’s a low priced stock, AKA Penny Stock.

Interestingly enough, Kumar’s paper does have a table that characterizes lottery-type stocks. Table 2, titled Basic Characteristics Of Lottery-Type Stocks, reports that there are 1500 lottery-type stocks, 1500 non-lottery-type stocks, and 9000 stocks in the middle.

So what are the characteristics of a lottery-type stock?

The table reports that the firm size average is very low with an average market capitalization of 31 million, low institutional ownership at 7.35%, a relatively high book to market ratio 0.681, and lower liquidity. These stocks are also younger, with a mean age of about six years. They have low analyst coverage, most don’t have dividends, they have significantly higher volatility, higher skewness, and lower prices.

The author goes on to report that lottery-type stocks are concentrated heavily in the energy, mining, financial services, biotechnology, and technology sectors and the lowest concentration of lottery stocks is in the utilities, consumer goods, and restaurant sectors.

Given the fact that there are lottery-type stocks and non-lottery-type stocks, how likely, in general, is a trader or investor to make money in the Stock market? Remember the sentiment we discussed earlier, that most people lose money in the stock market, which is similar to the feature of lottery tickets with their negative expected return.

According to the Tradeciety:

“Profitable day traders make up a small proportion of all traders – 1.6% in the average year. However, these day traders are very active – accounting for 12% of all day trading activity.”[3]

That doesn’t sound encouraging, but this may be a problem with trading frequently.

What about the long term, buy and hold investing as Warren Buffett does? His favorite holding period is forever.[4]

I made the most money in the stock market in paper gains when I picked outstanding diversified funds, ignored them when the market was misbehaving, and held them long term. Many famous investors have made money through the buy and hold strategy, such as Warren Buffett, Jack Bogle, John Templeton, Peter Lynch, and Benjamin Graham.

In my opinion, market fluctuations are unpredictable most of the time. Sometimes you can see the writing on the wall; for example, the Corona crash seemed evident in my opinion. The virus itself was a surprise, though, and so was the financial crash of 2008.

The market has something going for it that favors long term investing. This may end someday, but historically the market goes up over time and always recovers from a crash. (We are almost out of the Corona Crash with the S&P and NASDAQ making new highs. We are waiting on the DOW which is close). In my book Crash Proof Your Investment, I developed a historical histogram chart that shows this favoritism.

The vertical axis may look confusing. What does it mean?

I calculated the rolling annualized returns by using one year of data. But the annual return is calculated for each market day, so the one year of data slides like a window to collect a new day and dispense of an old one. There were 251 trading days in 2018, which means there are 251 annual return values.

Over 105 years, there are about 26,355 (251 x 105 = 26,355) annual return values.

The horizontal axis depicts the annual percentage gain. By looking at the 0 percent annual bar, you can see that 0 percent annual return happened a little less than 3,000 times in 105 years.

Disappointing returns for the long investor!

More importantly, the graph shows that the market has positive returns more frequently because the bulk of the bars in the graph are above 0 percent annual return.

The market is skewed! Five percent, ten percent, and fifteen percent annual returns are the most frequent.

There are even some outliers at a 70 percent annual return and above.

To put these numbers in perspective, let’s answer the question: How long will it take an investment to double in the market?

The average return was 9 percent? If we assume that is the fixed rate of return for every year that the investment is in the market, then we can use the Rule of 72 to answer the question.

The Rule of 72 is an equation that provides you with the length of time an investment will take to double. In our case we would divide 72 by our fixed rate of 9.

Our answer shows us it will double every eight years. Impressive!

If the graph is still confusing, there is still hope. Check out the excellent article on Investopedia called “Rolling Return.”[5]

A more familiar chart is the one shown below:

The trend is undoubtedly up. So this indicates that there may be something to buy and hold for the long term.

Finally, from the paper by Kumar, four-factor models for the stock market return are mentioned. A somewhat simplified explanation of this model is in the Investopedia article titled, Fama and French Three-Factor Model[6]. The article states that:

“Nobel Laureate Eugene Fama and researcher Kenneth French, former professors at the University of Chicago Booth School of Business, attempted to better measure market returns and, through research, found that value stocks outperform growth stocks. Similarly, small-cap stocks tend to outperform large-cap stocks. As an evaluation tool, the performance of portfolios with a large number of small-cap or value stocks would be lower than the CAPM result, as the Three-Factor Model adjusts downward for observed small-cap and value stock out-performance.”[7]

Later on the article reports:

“Fama and French highlighted that investors must be able to ride out the extra short-term volatility and periodic underperformance that could occur in a short time. Investors with a long-term time horizon of 15 years or more will be rewarded for losses suffered in the short term. Using thousands of random stock portfolios, Fama and French conducted studies to test their model and found that when size and value factors are combined with the beta factor, they could then explain as much as 95% of the return in a diversified stock portfolio.”[8]

So as you can see from the Investopedia article and the work of Fama and French, long term investing offsets short term losses that a day trader or short term trader might experience.

In the book Intelligent investor, which is one of the seeds of Warren Buffett’s massive fortune, there is commentary from Zweig’s section that says

“Like casino gambling or betting on the horses, speculating in the market can be exciting or even rewarding (if you happen to get really lucky). But it’s the worst imaginable way to build your wealth. That’s because Wall Street, like Las Vegas or the racetrack, has calibrated the odds so that the house always prevails, in the end, against everyone who tries to beat the house at its own speculative game.

On the other hand, investing is a kind of a unique kind of casino—one where you cannot lose in the end, so long as you play only by the rules that put the odds squarely in your favor. People who invest make money for themselves; people who speculate make money for their brokers. And that, in turn, is why Wall Street perennially downplays the durable virtues of investing and hypes the gaudy appeal of speculation.”[9]

In summary, we have discovered that there are lottery-type stocks that resemble gambling in the stock market and there are investing strategies where the outcome is more likely to be profitable. So investing in the stock market is not gambling—keyword investing. But there are plenty of opportunities to gamble with securities in the stock market. These tend to be, but are not limited to, penny stocks.

That’s all for now; good luck with your financial goals,

Dr. Paul Keller.

The Financial Master Series Books

Crash Proof Your Investment

The Beginner’s Guide to Rental Property Investing

Stock Market Masters

Notes:

[1]Kumar, Alok. “Who Gambles in the Stock Market?” The Journal of Finance 64, no. 4 (2009): 1889-933. Accessed September 14, 2020. http://www.jstor.org/stable/27735154.

[2] https://www.investopedia.com/terms/i/idiosyncraticrisk.asp

[3] https://www.tradeciety.com/24-statistics-why-most-traders-lose-money/

[4] https://www.montycampbell.com/article/what-warren-buffett-really-means-when-he-says-his-favorite-holding-period-is-forever/

[5] Chen, J. (2020, January 29). Rolling Returns Definition. Retrieved from https://www.investopedia.com/terms/r/rollingreturns.asp.

[6] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[7] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[8] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[9] Benjamin Graham, Intelligent Investor.

Bibliography:

Campbell, M. (2018, February 03). What Warren Buffett Really Means When He Says His Favorite Holding Period Is “Forever”! Retrieved September 14, 2020, from https://www.montycampbell.com/article/what-warren-buffett-really-means-when-he-says-his-favorite-holding-period-is-forever/

Chen, J. (2020, April 23). Idiosyncratic Risk: Why a Specific Stock Is Risky Right Now. Retrieved September 14, 2020, from https://www.investopedia.com/terms/i/idiosyncraticrisk.asp

Graham, B., & Zweig, J. (2003). The intelligent investor: A book of practical counsel. NY, NY: HarperBusiness.

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Kumar, Alok. “Who Gambles in the Stock Market?” The Journal of Finance 64, no. 4 (2009): 1889-933. Accessed September 14, 2020. http://www.jstor.org/stable/27735154

Rolf, Witbooi, Mataruse, M., Sm, Anonymous, Burguet, M., & Ahmad. (2020, April 10). Why Most Traders Lose Money – 24 Surprising Statistics. Retrieved September 14, 2020, from https://www.tradeciety.com/24-statistics-why-most-traders-lose-money

#stocks #stockmarket #investment #investing #realestate #trading #dalio #minervini #warrenbuffett #valueinvesting #author #financialmaster #habits #stockmarketcrash #rentalproperty

source https://drpaulkeller.com/gambling-stocks/

source https://drpaulkeller2.tumblr.com/post/629298460450029569

0 notes

Text

Is Investing in the Stock Market Gambling?

Now and then, I hear someone say that stock market investing is gambling. Is this true or false?

A good friend of mine, with the stock trading alias of the Lone Ranger, told me that her relative said investing in Penny Stocks is gambling.

Gambling is, by definition, the activity or practice of playing a game of chance for money or other stakes.

Let’s take a step back, this implication, that investing in the stock market is gambling, is often a sentiment expressed by people who believe that making money is not likely. The result for most people will be a loss. Furthermore, there may be little basis for a sound investment in some stocks, such as penny stocks, since investing theory indicates that a company’s financials may not be in line with a sound business model.

The points above are somewhat reflected in the paper titled, “Who Gambles in the Stock Market?” by Alok Kumar.[1]

In the paper, Kumar identifies lottery-type stocks by using lottery tickets (the most common form of gambling) as a reference. Lottery tickets have very low prices relative to a high potential payoff. They have low negative expected returns, and the prize distribution has exceptionally high variance. Most importantly, they have a minuscule probability of a huge reward and a huge chance of a small loss.

To identify lottery-type stocks, Kumar characterizes stocks with low prices, high volatility, and investor sentiment skewness. The author has more precise terms that many people have never seen before.

For example, he uses the term idiosyncratic volatility where Investopedia defines idiosyncratic risk in the following way:

“Idiosyncratic risk refers to the inherent factors that can negatively impact individual securities or a very specific group of assets. The opposite of Idiosyncratic risk is a systematic risk, which refers to broader trends that impact the overall financial system or a very broad market.”[2]

In other words, there may be high volatility of oil company security due to pipeline breaks. This may result in an adverse price move. Conversely, if a large oil field is discovered, this may cause a positive price move. The result is the high volatility of the stock price. When these events happen for a particular company more than once, there may be a skewed perception of the company unrelated to the company’s fundamentals. People may invest in them thinking that the large moves will happen again, especially if it’s a low priced stock, AKA Penny Stock.

Interestingly enough, Kumar’s paper does have a table that characterizes lottery-type stocks. Table 2, titled Basic Characteristics Of Lottery-Type Stocks, reports that there are 1500 lottery-type stocks, 1500 non-lottery-type stocks, and 9000 stocks in the middle.

So what are the characteristics of a lottery-type stock?

The table reports that the firm size average is very low with an average market capitalization of 31 million, low institutional ownership at 7.35%, a relatively high book to market ratio 0.681, and lower liquidity. These stocks are also younger, with a mean age of about six years. They have low analyst coverage, most don’t have dividends, they have significantly higher volatility, higher skewness, and lower prices.

The author goes on to report that lottery-type stocks are concentrated heavily in the energy, mining, financial services, biotechnology, and technology sectors and the lowest concentration of lottery stocks is in the utilities, consumer goods, and restaurant sectors.

Given the fact that there are lottery-type stocks and non-lottery-type stocks, how likely, in general, is a trader or investor to make money in the Stock market? Remember the sentiment we discussed earlier, that most people lose money in the stock market, which is similar to the feature of lottery tickets with their negative expected return.

According to the Tradeciety:

“Profitable day traders make up a small proportion of all traders – 1.6% in the average year. However, these day traders are very active – accounting for 12% of all day trading activity.”[3]

That doesn’t sound encouraging, but this may be a problem with trading frequently.

What about the long term, buy and hold investing as Warren Buffett does? His favorite holding period is forever.[4]

I made the most money in the stock market in paper gains when I picked outstanding diversified funds, ignored them when the market was misbehaving, and held them long term. Many famous investors have made money through the buy and hold strategy, such as Warren Buffett, Jack Bogle, John Templeton, Peter Lynch, and Benjamin Graham.

In my opinion, market fluctuations are unpredictable most of the time. Sometimes you can see the writing on the wall; for example, the Corona crash seemed evident in my opinion. The virus itself was a surprise, though, and so was the financial crash of 2008.

The market has something going for it that favors long term investing. This may end someday, but historically the market goes up over time and always recovers from a crash. (We are almost out of the Corona Crash with the S&P and NASDAQ making new highs. We are waiting on the DOW which is close). In my book Crash Proof Your Investment, I developed a historical histogram chart that shows this favoritism.

The vertical axis may look confusing. What does it mean?

I calculated the rolling annualized returns by using one year of data. But the annual return is calculated for each market day, so the one year of data slides like a window to collect a new day and dispense of an old one. There were 251 trading days in 2018, which means there are 251 annual return values.

Over 105 years, there are about 26,355 (251 x 105 = 26,355) annual return values.

The horizontal axis depicts the annual percentage gain. By looking at the 0 percent annual bar, you can see that 0 percent annual return happened a little less than 3,000 times in 105 years.

Disappointing returns for the long investor!

More importantly, the graph shows that the market has positive returns more frequently because the bulk of the bars in the graph are above 0 percent annual return.

The market is skewed! Five percent, ten percent, and fifteen percent annual returns are the most frequent.

There are even some outliers at a 70 percent annual return and above.

To put these numbers in perspective, let’s answer the question: How long will it take an investment to double in the market?

The average return was 9 percent? If we assume that is the fixed rate of return for every year that the investment is in the market, then we can use the Rule of 72 to answer the question.

The Rule of 72 is an equation that provides you with the length of time an investment will take to double. In our case we would divide 72 by our fixed rate of 9.

Our answer shows us it will double every eight years. Impressive!

If the graph is still confusing, there is still hope. Check out the excellent article on Investopedia called “Rolling Return.”[5]

A more familiar chart is the one shown below:

The trend is undoubtedly up. So this indicates that there may be something to buy and hold for the long term.

Finally, from the paper by Kumar, four-factor models for the stock market return are mentioned. A somewhat simplified explanation of this model is in the Investopedia article titled, Fama and French Three-Factor Model[6]. The article states that:

“Nobel Laureate Eugene Fama and researcher Kenneth French, former professors at the University of Chicago Booth School of Business, attempted to better measure market returns and, through research, found that value stocks outperform growth stocks. Similarly, small-cap stocks tend to outperform large-cap stocks. As an evaluation tool, the performance of portfolios with a large number of small-cap or value stocks would be lower than the CAPM result, as the Three-Factor Model adjusts downward for observed small-cap and value stock out-performance.”[7]

Later on the article reports:

“Fama and French highlighted that investors must be able to ride out the extra short-term volatility and periodic underperformance that could occur in a short time. Investors with a long-term time horizon of 15 years or more will be rewarded for losses suffered in the short term. Using thousands of random stock portfolios, Fama and French conducted studies to test their model and found that when size and value factors are combined with the beta factor, they could then explain as much as 95% of the return in a diversified stock portfolio.”[8]

So as you can see from the Investopedia article and the work of Fama and French, long term investing offsets short term losses that a day trader or short term trader might experience.

In the book Intelligent investor, which is one of the seeds of Warren Buffett’s massive fortune, there is commentary from Zweig’s section that says

“Like casino gambling or betting on the horses, speculating in the market can be exciting or even rewarding (if you happen to get really lucky). But it’s the worst imaginable way to build your wealth. That’s because Wall Street, like Las Vegas or the racetrack, has calibrated the odds so that the house always prevails, in the end, against everyone who tries to beat the house at its own speculative game.

On the other hand, investing is a kind of a unique kind of casino—one where you cannot lose in the end, so long as you play only by the rules that put the odds squarely in your favor. People who invest make money for themselves; people who speculate make money for their brokers. And that, in turn, is why Wall Street perennially downplays the durable virtues of investing and hypes the gaudy appeal of speculation.”[9]

In summary, we have discovered that there are lottery-type stocks that resemble gambling in the stock market and there are investing strategies where the outcome is more likely to be profitable. So investing in the stock market is not gambling—keyword investing. But there are plenty of opportunities to gamble with securities in the stock market. These tend to be, but are not limited to, penny stocks.

That’s all for now; good luck with your financial goals,

Dr. Paul Keller.

The Financial Master Series Books

Crash Proof Your Investment

The Beginner’s Guide to Rental Property Investing

Stock Market Masters

Notes:

[1]Kumar, Alok. “Who Gambles in the Stock Market?” The Journal of Finance 64, no. 4 (2009): 1889-933. Accessed September 14, 2020. http://www.jstor.org/stable/27735154.

[2] https://www.investopedia.com/terms/i/idiosyncraticrisk.asp

[3] https://www.tradeciety.com/24-statistics-why-most-traders-lose-money/

[4] https://www.montycampbell.com/article/what-warren-buffett-really-means-when-he-says-his-favorite-holding-period-is-forever/

[5] Chen, J. (2020, January 29). Rolling Returns Definition. Retrieved from https://www.investopedia.com/terms/r/rollingreturns.asp.

[6] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[7] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[8] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[9] Benjamin Graham, Intelligent Investor.

Bibliography:

Campbell, M. (2018, February 03). What Warren Buffett Really Means When He Says His Favorite Holding Period Is “Forever”! Retrieved September 14, 2020, from https://www.montycampbell.com/article/what-warren-buffett-really-means-when-he-says-his-favorite-holding-period-is-forever/

Chen, J. (2020, April 23). Idiosyncratic Risk: Why a Specific Stock Is Risky Right Now. Retrieved September 14, 2020, from https://www.investopedia.com/terms/i/idiosyncraticrisk.asp

Graham, B., & Zweig, J. (2003). The intelligent investor: A book of practical counsel. NY, NY: HarperBusiness.

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Kumar, Alok. “Who Gambles in the Stock Market?” The Journal of Finance 64, no. 4 (2009): 1889-933. Accessed September 14, 2020. http://www.jstor.org/stable/27735154

Rolf, Witbooi, Mataruse, M., Sm, Anonymous, Burguet, M., & Ahmad. (2020, April 10). Why Most Traders Lose Money – 24 Surprising Statistics. Retrieved September 14, 2020, from https://www.tradeciety.com/24-statistics-why-most-traders-lose-money

#stocks #stockmarket #investment #investing #realestate #trading #dalio #minervini #warrenbuffett #valueinvesting #author #financialmaster #habits #stockmarketcrash #rentalproperty

source https://drpaulkeller.com/gambling-stocks/

0 notes

Text

Is Investing in the Stock Market Gambling?

Now and then, I hear someone say that stock market investing is gambling. Is this true or false?

A good friend of mine, with the stock trading alias of the Lone Ranger, told me that her relative said investing in Penny Stocks is gambling.

Gambling is, by definition, the activity or practice of playing a game of chance for money or other stakes.

Let’s take a step back, this implication, that investing in the stock market is gambling, is often a sentiment expressed by people who believe that making money is not likely. The result for most people will be a loss. Furthermore, there may be little basis for a sound investment in some stocks, such as penny stocks, since investing theory indicates that a company’s financials may not be in line with a sound business model.

The points above are somewhat reflected in the paper titled, “Who Gambles in the Stock Market?” by Alok Kumar.[1]

In the paper, Kumar identifies lottery-type stocks by using lottery tickets (the most common form of gambling) as a reference. Lottery tickets have very low prices relative to a high potential payoff. They have low negative expected returns, and the prize distribution has exceptionally high variance. Most importantly, they have a minuscule probability of a huge reward and a huge chance of a small loss.

To identify lottery-type stocks, Kumar characterizes stocks with low prices, high volatility, and investor sentiment skewness. The author has more precise terms that many people have never seen before.

For example, he uses the term idiosyncratic volatility where Investopedia defines idiosyncratic risk in the following way:

“Idiosyncratic risk refers to the inherent factors that can negatively impact individual securities or a very specific group of assets. The opposite of Idiosyncratic risk is a systematic risk, which refers to broader trends that impact the overall financial system or a very broad market.”[2]

In other words, there may be high volatility of oil company security due to pipeline breaks. This may result in an adverse price move. Conversely, if a large oil field is discovered, this may cause a positive price move. The result is the high volatility of the stock price. When these events happen for a particular company more than once, there may be a skewed perception of the company unrelated to the company’s fundamentals. People may invest in them thinking that the large moves will happen again, especially if it’s a low priced stock, AKA Penny Stock.

Interestingly enough, Kumar’s paper does have a table that characterizes lottery-type stocks. Table 2, titled Basic Characteristics Of Lottery-Type Stocks, reports that there are 1500 lottery-type stocks, 1500 non-lottery-type stocks, and 9000 stocks in the middle.

So what are the characteristics of a lottery-type stock?

The table reports that the firm size average is very low with an average market capitalization of 31 million, low institutional ownership at 7.35%, a relatively high book to market ratio 0.681, and lower liquidity. These stocks are also younger, with a mean age of about six years. They have low analyst coverage, most don’t have dividends, they have significantly higher volatility, higher skewness, and lower prices.

The author goes on to report that lottery-type stocks are concentrated heavily in the energy, mining, financial services, biotechnology, and technology sectors and the lowest concentration of lottery stocks is in the utilities, consumer goods, and restaurant sectors.

Given the fact that there are lottery-type stocks and non-lottery-type stocks, how likely, in general, is a trader or investor to make money in the Stock market? Remember the sentiment we discussed earlier, that most people lose money in the stock market, which is similar to the feature of lottery tickets with their negative expected return.

According to the Tradeciety:

“Profitable day traders make up a small proportion of all traders – 1.6% in the average year. However, these day traders are very active – accounting for 12% of all day trading activity.”[3]

That doesn’t sound encouraging, but this may be a problem with trading frequently.

What about the long term, buy and hold investing as Warren Buffett does? His favorite holding period is forever.[4]

I made the most money in the stock market in paper gains when I picked outstanding diversified funds, ignored them when the market was misbehaving, and held them long term. Many famous investors have made money through the buy and hold strategy, such as Warren Buffett, Jack Bogle, John Templeton, Peter Lynch, and Benjamin Graham.

In my opinion, market fluctuations are unpredictable most of the time. Sometimes you can see the writing on the wall; for example, the Corona crash seemed evident in my opinion. The virus itself was a surprise, though, and so was the financial crash of 2008.

The market has something going for it that favors long term investing. This may end someday, but historically the market goes up over time and always recovers from a crash. (We are almost out of the Corona Crash with the S&P and NASDAQ making new highs. We are waiting on the DOW which is close). In my book Crash Proof Your Investment, I developed a historical histogram chart that shows this favoritism.

The vertical axis may look confusing. What does it mean?

I calculated the rolling annualized returns by using one year of data. But the annual return is calculated for each market day, so the one year of data slides like a window to collect a new day and dispense of an old one. There were 251 trading days in 2018, which means there are 251 annual return values.

Over 105 years, there are about 26,355 (251 x 105 = 26,355) annual return values.

The horizontal axis depicts the annual percentage gain. By looking at the 0 percent annual bar, you can see that 0 percent annual return happened a little less than 3,000 times in 105 years.

Disappointing returns for the long investor!

More importantly, the graph shows that the market has positive returns more frequently because the bulk of the bars in the graph are above 0 percent annual return.

The market is skewed! Five percent, ten percent, and fifteen percent annual returns are the most frequent.

There are even some outliers at a 70 percent annual return and above.

To put these numbers in perspective, let’s answer the question: How long will it take an investment to double in the market?

The average return was 9 percent? If we assume that is the fixed rate of return for every year that the investment is in the market, then we can use the Rule of 72 to answer the question.

The Rule of 72 is an equation that provides you with the length of time an investment will take to double. In our case we would divide 72 by our fixed rate of 9.

Our answer shows us it will double every eight years. Impressive!

If the graph is still confusing, there is still hope. Check out the excellent article on Investopedia called “Rolling Return.”[5]

A more familiar chart is the one shown below:

The trend is undoubtedly up. So this indicates that there may be something to buy and hold for the long term.

Finally, from the paper by Kumar, four-factor models for the stock market return are mentioned. A somewhat simplified explanation of this model is in the Investopedia article titled, Fama and French Three-Factor Model[6]. The article states that:

“Nobel Laureate Eugene Fama and researcher Kenneth French, former professors at the University of Chicago Booth School of Business, attempted to better measure market returns and, through research, found that value stocks outperform growth stocks. Similarly, small-cap stocks tend to outperform large-cap stocks. As an evaluation tool, the performance of portfolios with a large number of small-cap or value stocks would be lower than the CAPM result, as the Three-Factor Model adjusts downward for observed small-cap and value stock out-performance.”[7]

Later on the article reports:

“Fama and French highlighted that investors must be able to ride out the extra short-term volatility and periodic underperformance that could occur in a short time. Investors with a long-term time horizon of 15 years or more will be rewarded for losses suffered in the short term. Using thousands of random stock portfolios, Fama and French conducted studies to test their model and found that when size and value factors are combined with the beta factor, they could then explain as much as 95% of the return in a diversified stock portfolio.”[8]

So as you can see from the Investopedia article and the work of Fama and French, long term investing offsets short term losses that a day trader or short term trader might experience.

In the book Intelligent investor, which is one of the seeds of Warren Buffett’s massive fortune, there is commentary from Zweig’s section that says

“Like casino gambling or betting on the horses, speculating in the market can be exciting or even rewarding (if you happen to get really lucky). But it’s the worst imaginable way to build your wealth. That’s because Wall Street, like Las Vegas or the racetrack, has calibrated the odds so that the house always prevails, in the end, against everyone who tries to beat the house at its own speculative game.

On the other hand, investing is a kind of a unique kind of casino—one where you cannot lose in the end, so long as you play only by the rules that put the odds squarely in your favor. People who invest make money for themselves; people who speculate make money for their brokers. And that, in turn, is why Wall Street perennially downplays the durable virtues of investing and hypes the gaudy appeal of speculation.”[9]

In summary, we have discovered that there are lottery-type stocks that resemble gambling in the stock market and there are investing strategies where the outcome is more likely to be profitable. So investing in the stock market is not gambling—keyword investing. But there are plenty of opportunities to gamble with securities in the stock market. These tend to be, but are not limited to, penny stocks.

That’s all for now; good luck with your financial goals,

Dr. Paul Keller.

The Financial Master Series Books

Crash Proof Your Investment

The Beginner’s Guide to Rental Property Investing

Stock Market Masters

Notes:

[1]Kumar, Alok. “Who Gambles in the Stock Market?” The Journal of Finance 64, no. 4 (2009): 1889-933. Accessed September 14, 2020. http://www.jstor.org/stable/27735154.

[2] https://www.investopedia.com/terms/i/idiosyncraticrisk.asp

[3] https://www.tradeciety.com/24-statistics-why-most-traders-lose-money/

[4] https://www.montycampbell.com/article/what-warren-buffett-really-means-when-he-says-his-favorite-holding-period-is-forever/

[5] Chen, J. (2020, January 29). Rolling Returns Definition. Retrieved from https://www.investopedia.com/terms/r/rollingreturns.asp.

[6] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[7] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[8] https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

[9] Benjamin Graham, Intelligent Investor.

Bibliography:

Campbell, M. (2018, February 03). What Warren Buffett Really Means When He Says His Favorite Holding Period Is “Forever”! Retrieved September 14, 2020, from https://www.montycampbell.com/article/what-warren-buffett-really-means-when-he-says-his-favorite-holding-period-is-forever/

Chen, J. (2020, April 23). Idiosyncratic Risk: Why a Specific Stock Is Risky Right Now. Retrieved September 14, 2020, from https://www.investopedia.com/terms/i/idiosyncraticrisk.asp

Graham, B., & Zweig, J. (2003). The intelligent investor: A book of practical counsel. NY, NY: HarperBusiness.

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Hayes, A. (2020, March 05). Fama and French Three Factor Model Definition. Retrieved September 14, 2020, from https://www.investopedia.com/terms/f/famaandfrenchthreefactormodel.asp

Kumar, Alok. “Who Gambles in the Stock Market?” The Journal of Finance 64, no. 4 (2009): 1889-933. Accessed September 14, 2020. http://www.jstor.org/stable/27735154

Rolf, Witbooi, Mataruse, M., Sm, Anonymous, Burguet, M., & Ahmad. (2020, April 10). Why Most Traders Lose Money – 24 Surprising Statistics. Retrieved September 14, 2020, from https://www.tradeciety.com/24-statistics-why-most-traders-lose-money

#stocks #stockmarket #investment #investing #realestate #trading #dalio #minervini #warrenbuffett #valueinvesting #author #financialmaster #habits #stockmarketcrash #rentalproperty

from

https://drpaulkeller.com/gambling-stocks/

source https://drpaulkeller.weebly.com/blog/is-investing-in-the-stock-market-gambling

0 notes

Photo

Dear BAE,

I am 35 years old and worried I will never meet the love of my life and have kids! I am smart, successful and pretty - I don’t want to sound conceited, but I’ve worked hard to get where I am!

Some background: I am Muslim (Shia) and want to marry a Muslim despite having had horrible experiences dating Muslim men. For example, some of the Muslim men I’ve dated used my sect as an excuse it ‘wouldn’t work,’ or that their parents ‘wouldn’t accept’ me. Others didn’t seem to understand basic consent, and acted like holding hands was license to grope me!

This just hasn’t been my experience with non-Muslim men: the ones I’ve dated seemed respectful of my cultural/religious background, wanted to learn more about me, and about what made me comfortable. When I dated non-Muslim men, I felt I was being ‘wooed’, whereas Muslim men seem to be asking, “how will YOU convince ME you’re good enough?”

Moreover, non-Muslim men I’ve dated had no problem being honest about our relationships, whereas Muslim men seem to be in denial we’re dating, or have guilt about it, claiming it’s ‘sinful,’ and that I was somehow guilty of ‘luring’ them!

I just feel when I date Muslim men, there seems to be a power dynamic where he has more options than he can count, and I’m competing for his acceptance, like in an audition or interview. The problem is, I know I want to marry a Muslim because my faith and culture are important to me.

Do you think there’s a way to reconcile my two realities?

Losing (my man’s) religion

Dear Losing (my man’s) religion,

Ugh I feel you on that anxiety over “time’s running out” - time is no one’s friend, amirite? There’s so much we want to achieve and have in a limited amount of time. What you’ve got - a career, financial stability, professional success - are things others do not. And while others may have found a partner and had kids, how many can say they’ve achieved the success you have at your age? We all have different gifts and challenges at different stages of our lives. And you have so much to be proud of and thankful for.

That being said, I’m sorry you’ve had such disappointing experiences while searching for a Muslim partner. It must be frustrating - but more so hurtful - to be rejected based on your religious identity, and that too, from a community you consider your own.

You are too amazing not to be swept-off-your-feet wooed in love, or worse, have your feelings ignored while being scrutinized and discriminated against! This ‘dating’ doesn’t sound fun at all. But that’s what falling in love is supposed to be - if it weren’t exhilarating, how would we be willing to dive into such excruciating vulnerability?

It sounds like you’ve had better experiences with non-Muslim men who’ve shown more respect not just for your feelings, but for your religious and cultural backgrounds as well. We can take a moment to consider why - perhaps because they’re conscious your faith and culture differ from theirs, they realize sensitivity is a prerequisite to any relationship. Muslim men on the other hand, might be taking your sectarian difference for granted, and think it’s fair game to discriminate due to an entitled sense of ‘preference’ - one forgets it’s easy to discriminate against others and chalk it up to sheer choice when one is in the majority.

But setting the discrimination aside, you’ve also expressed disappointment with potential Muslim partners over a lack of transparency and honesty about your relationships, respect for your physical boundaries and consent, and their parental co-dependencies.

I sympathize with your disappointment over a lack of transparency. Honesty regarding the status of your relationship - with each other, and with others - is important not just for knowing that you’re both on the same page regarding your commitment, but also for being able to talk openly about expectations in your relationship, including physical ones. How do we even begin to talk about what we’re comfortable with physically if we can’t talk about what we’re comfortable with emotionally?

That leads to the importance of understanding consent, something even wider mainstream American culture is trying to understand in the wake of #MeToo. Muslims seem to have the added complications of guilt and denial around relationships, leaving us even more vulnerable to situations where our boundaries are violated and we don’t know how to respond.

Also, the need for mommy and daddy’s approval is an unhealthy codependency in our community that needs to be addressed. I can’t even begin to tackle all the consequences of that dynamic in this post, but maybe in future ones!

So, you feel like you’ve been offering yourself up for scrutiny to males who’ve acted like they have the final say in sexual selection. Girlfriend, let me remind you that throughout evolutionary biology, sexual selection has relied on females! Remember that the next time you feel like you don’t have any power in this situation!

There is no reason to serve yourself up for scrutiny - you are not in an interview trying to get the job of your date’s future wife. It’s as much a place for him to get to know you as it is for you! You’re both looking to see if you’re a good fit for each other.

Actually, it’s possible your experience with discrimination has made you feel like a second-class citizen within our community, without even being aware of it. It’s this subconscious classification that could be causing you to give your power over to someone else - something a woman as successful as yourself wouldn’t otherwise do.

But this reversed sexual selection - that females have to compete for male selection - goes hand in hand with patriarchy. This doesn’t mean Islam is patriarchal because God has decreed it such, but rather, because the vast majority of adherents might believe it should be.

Consider the allowed practice of polygamy. While it may not be a reality for most contemporary Muslims, it still informs the culture regarding gender statuses. Another consideration: the Muslim belief that a sign of the end of days will be a skewed gender ratio of 50 women to 1 man. (See, https://islamqa.org/hanafi/askimam/81124)

What do these beliefs do, besides fuel paranoia that there are not enough men in the world and that women will have to compete to obtain the scarce, valued male resource?

Recognize that this gender ratio falls flat in the face of global population stats which tell us there are currently 1.01 males to females. That means there are more men than women, and the numbers skew even higher in favor of males from birth until age 25 where it is 1.07. The male female ratio only goes down in favor of women after the age of 55, when it is 0.96 men to women. (see CIA factbook, https://www.cia.gov/library/publications/the-world-factbook/geos/xx.html).

That being said, would you consider pursuing more of the same good experiences you’ve had over those that may initially seem unnatural to you? For example, it sounds like you’re dating Muslim men you perhaps wouldn’t otherwise but for their “Muslim” label. These unnatural situations are indeed turning what should be fun dates into interviews that are just recipes for frustration, anxiety, and unhappiness.

While I respect your desire to want to only marry a Muslim man, I think it’s time to consider a few things: (1) what does that really mean, and (2) if you’re not finding what you’re looking for where you’re looking for it, is it time to look elsewhere?

First consider, what are the values you’re looking for in a partner? These are the values that are most important to YOU. There could be Muslim men who don’t have them, or non-Muslim men who do. Or non-Muslim men who are considering the Muslim faith, or actually have beliefs that are consistent with your values and faith, but are missing the label. Personally, I’ve known people in my life who didn’t call themselves Buddhist, but certainly had Buddhist beliefs, particularly about philosophies regarding ego and attachment. Is it more important what we call ourselves than what it is we practice?

All I’m saying is, don’t artificially shrink your dating pool!

There’s a lot of pressure you’re putting on yourself here: dating should be fun, enjoy yourself! And if you’re not enjoying yourself here, find a place where you are. Why? Because you have to re-introduce yourself to the joy in dating. Your attitude towards settling down seems to be scarred by your bad experiences, and the result is that your goal of meeting a partner is clouded with doubt, fear, and anxiety. If you can replace those feelings with positive ones through positive experiences, I know you will be closer to getting what you want, and enjoy yourself along the way.

Love,

BAE

1 note

·

View note

Text

Yes, America Is Rigged Against Workers

No other industrial country treats its working class so badly. And there’s one big reason for that.

The United States is the only advanced industrial nation that doesn’t have national laws guaranteeing paid maternity leave. It is also the only advanced economy that doesn’t guarantee workers any vacation, paid or unpaid, and the only highly developed country (other than South Korea) that doesn’t guarantee paid sick days. In contrast, the European Union’s 28 nations guarantee workers at least four weeks’ paid vacation.

Among the three dozen industrial countries in the Organization for Economic Cooperation and Development, the United States has the lowest minimum wage as a percentage of the median wage — just 34 percent of the typical wage, compared with 62 percent in France and 54 percent in Britain. It also has the second-highest percentage of low-wage workers among that group, exceeded only by Latvia.

All this means the United States suffers from what I call “anti-worker exceptionalism.”

Academics debate why American workers are in many ways worse off than their counterparts elsewhere, but there is overriding agreement on one reason: Labor unions are weaker in the United States than in other industrial nations. Just one in 16 private-sector American workers is in a union, largely because corporations are so adept and aggressive at beating back unionization. In no other industrial nation do corporations fight so hard to keep out unions.

The consequences are enormous, not only for wages and income inequality, but also for our politics and policy-making and for the many Americans who are mistreated at work.

Sign up for our newsletter

The Progressive Party is on the pulse of US politics and provide you the progressive news.

SIGN UP

To be sure, unions have their flaws, from corruption to their history of racial and sex discrimination. Still, Jacob S. Hacker and Paul Pierson write of an important, unappreciated feature of unions in “Winner-Take-All Politics”: “While there are many ‘progressive’ groups in the American universe of organized interests, labor is the only major one focused on the broad economic concerns of those with modest incomes.”

As workers’ power has waned, many corporations have adopted practices that were far rarer — if not unheard-of — decades ago: hiring hordes of unpaid interns, expecting workers to toil 60 or 70 hours a week, prohibiting employees from suing and instead forcing them into arbitration (which usually favors employers), and hamstringing employees’ mobility by making them sign non-compete clauses.

HELP PROGRESSIVES CONTINUE TO WIN

CONTRIBUTE NOW

America’s workers have for decades been losing out: year after year of wage stagnation, increased insecurity on the job, waves of downsizing and offshoring, and labor’s share of national income declining to its lowest level in seven decades.

Numerous studies have found that an important cause of America’s soaring income inequality is the decline of labor unions — and the concomitant decline in workers’ ability to extract more of the profit and prosperity from the corporations they work for. The only time during the past century when income inequality narrowed substantially was the 1940s through 1970s, when unions were at their peak of power and prominence.

Many Americans are understandably frustrated. That’s one reason the percentage who say they want to join a union has risen markedly. According to a 2018 M.I.T. study, 46 percent of nonunion workers say they would like to be in a union, up from 32 percent in 1995. Nonetheless, just 10.5 percent of all American workers, and only 6.4 percent of private-sector workers, are in unions.

Progressives’ Picks

‘Insulin is our oxygen’: Bernie Sanders rides another campaign bus to Canada

Small Donors Make Big Difference for Progressive Party

Medicare-for-All Plan Detailed: Improves Health Care, Cuts Costs

Keep our progressive movement going strong

But this desire to unionize faces some daunting challenges. In many corporations, the mentality is that any supervisor, whether a factory manager or retail manager, who fails to keep out a union is an utter failure. That means managers fight hard to quash unions. One study found that 57 percent of employers threatened to close operations when workers sought to unionize, while 47 percent threatened to cut wages or benefits and 34 percent fired union supporters during unionization drives.

Corporate executives’ frequent failure to listen to workers’ concerns — along with the intimidation of employees — can have deadly results. On April 5, 2010, a coal dust explosion killed 29 miners at Massey Energy’s Upper Big Branch coal mine in West Virginia. A federal investigation found that the mine’s ventilation system was inadequate and that explosive gases were allowed to build up. Workers at the nonunion mine knew about these dangers. “No one felt they could go to management and express their fears,” Stanley Stewart, an Upper Big Branch miner, told a congressional committee. “We knew we’d be marked men and the management would look for ways to fire us.”

The diminished power of unions and workers has skewed American politics, helping give billionaires and corporations inordinate sway over America’s politics and policymaking. In the 2015-16 election cycle, business outspent labor $3.4 billion to $213 million, a ratio of 16 to 1, according to the nonpartisan Center for Responsive Politics. All of the nation’s unions, taken together, spend about $48 million a year for lobbying in Washington, while corporate America spends $3 billion. Little wonder that many lawmakers seem vastly more interested in cutting taxes on corporations than in raising the minimum wage.

There were undoubtedly many reasons for Donald Trump’s 2016 victory, but a key one was that many Americans seemed to view him as a protest candidate, promising to shake up “the system” and “drain the swamp.” Many voters embraced Mr. Trump because they believed his statements that the system is rigged — and in many ways it is. When it comes to workers’ power in the workplace and in politics, the pendulum has swung far toward corporations.

Reversing that won’t be easy, but it is vital we do so. There are myriad proposals to restore some balance, from having workers elect representatives to corporate boards to making it easier for workers to unionize to expanding public financing of political campaigns to prevent wealthy and corporate donors from often dominating.

America’s workers won’t stop thinking the system is rigged until they feel they have an effective voice in the workplace and in policymaking so that they can share in more of the economy’s prosperity to help improve their — and their loved ones’ — lives.

This Piece Originally Appeared in www.nytimes.com

Read the full article

0 notes

Photo

#DAY351

The Book “Fooled by Randomness” in Three Sentences

Summary by James Clear

Randomness, chance, and luck influence our lives and our work more than we realize. Because of hindsight bias and survivorship bias, in particular, we tend to forget the many who fail, remember the few who succeed, and then create reasons and patterns for their success even though it was largely random. Mild success can be explainable by skills and hard work, but wild success is usually attributable to variance and luck.

Fooled by Randomness summary

This is my book summary of Fooled by Randomness by Nassim Nicholas Taleb. My notes are informal and often contain quotes from the book as well as my own thoughts. This summary also includes key lessons and important passages from the book.

According to Taleb, the book's most popular chapter was Chapter 11, the one in which he compressed all the literature on the topic of miscalculating probability.

Important point: “it's more random than we think, not it is all random.” Chance favors preparedness, but it is not caused by preparedness (same for hard work, skills, etc.)

“This business of journalism is just about entertainment, particularly when it comes to radio and television.”

As much as we want to “keep it simple, stupid” … It is precisely the simplification of issues that are actually very complex, which can be dangerous.

“Things that happen with little help from luck are more resistant to randomness.”

“Mild success can be explainable by skills and labor. Wild success is attributable to variance.”

One common theory for why people pursue leadership is because of “social emotions” which cause others to be influenced by a person due to small, almost imperceptible physical signals like charisma, gestures, and gait.

This has also been shown via evolutionary psychology: when you perform well in life, you get all “puffed up” in the way you carry yourself, the bounce in your step, etc. From an evolution standpoint this is great because it becomes easier to spot the most successful / desirable mate.

The concept of alternative histories is particularly interesting. If you were to relive a set of events 1000 times, what would the range of outcomes be? If there is very little variance in your alternative histories (i.e. You chose to become a dentist and you will probably make more or less the same amount of money and live a similar lifestyle all 1000 times), then you are in a relatively non- random situation. Meanwhile, if there is a very wide range of normal results when considering 1,000 variations (entrepreneurs, traders, etc.), then it is a very random situation.

The quality of a choice cannot be judged just by the result. (I first learned this in baseball. Just because a pitch you call or play you call doesn't work out doesn't make it a poor choice. It could have been the right call, but bad luck. Or vice versa.)

“Certainty is something that is likely to take place across the highest number of different alternative histories. Uncertainty concerns events that should take place in the lowest number of them.”

You should think carefully about getting more insurance / shielding yourself from events that — although unlikely — could be catastrophic. You essentially want to insulate yourself from terrible random accidents.

We have a tendency to see risks against specific things as more likely than general risks (dying in a terrorist attack while traveling vs. dying on your next trip, even though the second includes the first). We seem to overvalue the things that trigger an emotional response and undervalue the things that aren't as emotional.

We are so mentally wired to overvalue the sensational stories that you can “realize informational gains by dispensing with the news.”

Fascinating famous Swiss study of the amnesia patient who couldn't remember doctor's name but did remember him pricking her hand with a pin.

“Every man believes that he is quite different.”

It's better to value old, distilled thoughts than “new thinking” because for an idea to last so long it must be good. That is, old ideas have had to stand the test of time. New ideas have not. Some new ideas will end up lasting, but most will not.