#cashless transaction

Text

Not every thing needs to be online or paperless or digitized. Call me a boomer but I am sick and tired of being asked to scan, download an app or book an appointment online.

#berry rambles#And that goes for cashless transactions too#let me carry my cash and my coins#DO NOT get me started on QR code menus

2 notes

·

View notes

Text

GmaxEpay: Revolutionizing Digital Payments for a Seamless Financial Future

In today’s rapidly evolving digital landscape, the need for secure, efficient, and accessible financial services has never been greater. As businesses and consumers alike demand quicker and more reliable ways to handle transactions, fintech companies are stepping up to meet these needs. Among the leaders in this transformative wave is GmaxEpay, a fintech company dedicated to making digital payment systems accessible and affordable for everyone.

0 notes

Text

الدفع الالكتروني - الطريق إلي الاقتصاد غير النقدي في مصر

الدفع الالكتروني – الطريق إلي الاقتصاد غير النقدي في مصر

الدفع الالكتروني – الطريق إلي الاقتصاد غير النقدي في مصر

المؤلف: raghda saied

جامعة 6 اكتوبر

المستخلص:

تتناول هذه الدراسة دور المنصات التي تمثل تقنيات الدفع الرقمية الجديدة في مصر، والتي تنقل مصر من الاقتصاد الذي يهيمن عليه النقد إلى الاقتصاد غير النقد، وكذلك الخلفية النظرية للاقتصاد غير النقدي في مصر، وأيضا دور البنك المركزي في…

#Cash-based economy#cashless economy#digital transaction#E-payments#internet banking.#mobile wallets#محافظ الهاتف المحمول#المدفوعات الإلكترونية#المعاملات الرقمية#الاقتصاد غير النقدي#الخدمات المصرفية عبر الإنترنت

0 notes

Text

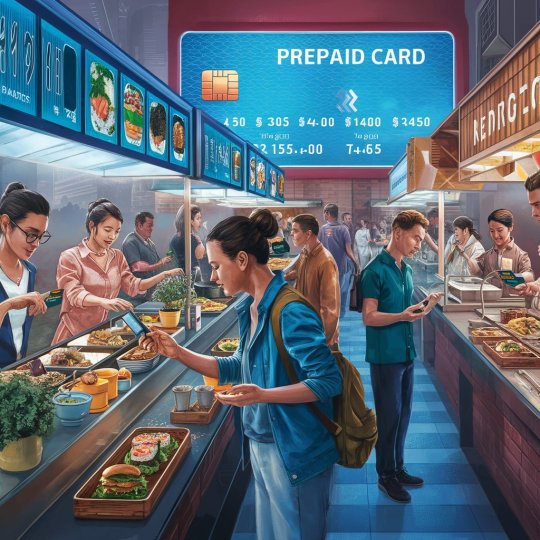

Prepaid Cards Revolutionize Cashless Dining in Food Courts

Introduction to Prepaid Cards

In today's fast-paced world, convenience is paramount, especially when it comes to dining out. Prepaid cards have emerged as a revolutionary solution, offering a seamless and efficient way to enjoy cashless dining experiences. The concept of prepaid cards is not new, but their integration into food courts has sparked a significant shift in consumer behavior.

Cashless Dining Trends

The global trend towards cashless transactions has gained momentum in recent years, driven by advancements in technology and changing consumer preferences. In food courts, where speed and convenience are key, the adoption of cashless payment methods has become increasingly prevalent.

Challenges in Traditional Payment Methods

Traditional payment methods, such as cash or credit/debit cards, pose several challenges in food court settings. Cash transactions can lead to long queues and delays, while credit/debit card payments may be inconvenient for both consumers and vendors due to processing fees and minimum purchase requirements.

The Emergence of Prepaid Cards in Food Courts

To address these challenges, food courts are embracing prepaid card systems, revolutionizing the way customers pay for their meals. By preloading funds onto a card, customers can enjoy quick and hassle-free transactions, eliminating the need for cash or physical cards.

How Prepaid Cards Work

Prepaid cards operate on a simple premise: customers load funds onto their cards either online or at designated kiosks within the food court. They can then use these funds to make purchases at any participating vendor within the food court.

Advantages of Prepaid Cards in Food Courts

The benefits of prepaid cards in food courts are manifold. For consumers, they offer unmatched convenience and speed, allowing them to make purchases with a simple tap or swipe. Additionally, prepaid cards provide consumers with greater control over their spending, helping them stick to their budgets more effectively.

For food court operators, prepaid cards streamline transaction processing, reducing wait times and enhancing overall efficiency. By centralizing payments through a single platform, vendors can also gain valuable insights into consumer behavior and preferences, enabling them to tailor their offerings accordingly.

Enhanced Customer Experience

One of the key advantages of prepaid cards in food courts is the enhanced customer experience they provide. By minimizing wait times and offering seamless transactions, prepaid cards ensure that customers spend less time queuing and more time enjoying their meals.

Moreover, prepaid cards enable food court operators to implement customized loyalty programs, rewarding customers for their continued patronage. By offering incentives such as discounts or freebies, operators can further enhance the overall dining experience and foster customer loyalty.

Security and Safety Measures

Security is a top priority in any payment system, and prepaid cards are no exception. With robust encryption protocols and built-in fraud detection mechanisms, prepaid card systems offer consumers peace of mind knowing that their financial information is safe and secure.

Additionally, prepaid cards eliminate the need for consumers to carry large amounts of cash, reducing the risk of theft or loss. In the event that a card is lost or stolen, most prepaid card providers offer 24/7 customer support and the ability to freeze or deactivate the card remotely.

Adoption and Acceptance

The adoption of prepaid cards in food courts is steadily increasing, driven by the growing demand for cashless payment options. As more consumers become accustomed to the convenience and benefits of prepaid cards, food court vendors are increasingly recognizing the need to offer these payment methods to remain competitive.

Impact on Business Operations

From a business perspective, the integration of prepaid card systems can have a transformative impact on operations. By automating transaction processing and streamlining administrative tasks, vendors can reduce overhead costs and improve overall efficiency.

Moreover, prepaid card systems provide vendors with valuable data insights, allowing them to track sales trends, identify popular menu items, and target specific customer demographics more effectively. This data-driven approach enables vendors to make informed decisions that drive business growth and profitability.

Future Trends and Innovations

Looking ahead, the future of prepaid cards in food courts looks promising, with continued advancements in technology driving innovation and customization. From mobile payment solutions to personalized loyalty programs, vendors are constantly seeking new ways to enhance the customer experience and stay ahead of the competition.

Challenges and Concerns

Despite the many benefits of prepaid cards, there are also challenges and concerns that must be addressed. Chief among these is the need to ensure consumer privacy and data security. As prepaid card systems become more sophisticated, it is essential for vendors to implement robust privacy policies and security measures to protect customer information.

Additionally, accessibility remains a concern for some consumers, particularly those who may not have access to smartphones or digital payment methods. To address this issue, food courts must ensure that alternative payment options are available to accommodate all customers.

Case Studies and Success Stories

Numerous food courts around the world have already embraced prepaid card systems with great success. From small-scale vendors to large multinational chains, businesses of all sizes have reported significant improvements in transaction processing times, customer satisfaction, and overall revenue.

For example, a recent case study conducted by a major food court operator found that the implementation of prepaid card systems resulted in a 30% increase in sales and a 20% reduction in wait times. These impressive results demonstrate the tangible benefits that prepaid cards can

offer to both consumers and businesses alike.

Consumer Education and Awareness

Despite the growing popularity of prepaid cards, there is still a need for consumer education and awareness. Many consumers may be unfamiliar with how prepaid cards work or may have misconceptions about their usage and benefits. As such, food courts must invest in educational campaigns to inform consumers about the advantages of prepaid cards and how to use them effectively.

Conclusion

In conclusion, prepaid cards are revolutionizing the way consumers pay for their meals in food courts. By offering unmatched convenience, speed, and security, prepaid cards are transforming the dining experience for both customers and vendors alike. As the adoption of prepaid cards continues to grow, food courts are poised to reap the benefits of improved efficiency, increased revenue, and enhanced customer satisfaction.

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91 9810078010 or by email at [email protected]. Thank you for your interest in our services.

FAQs

1. Are prepaid cards accepted at all vendors in the food court?

Yes, prepaid cards can typically be used at any participating vendor within the food court.

2. Can I reload funds onto my prepaid card?

Yes, most prepaid card systems allow users to reload funds either online or at designated kiosks within the food court.

3. Is my personal information secure when using a prepaid card?

Yes, prepaid card systems employ robust security measures to protect customer information and prevent unauthorized access.

4. Are there any fees associated with using a prepaid card?

Some prepaid card providers may charge nominal fees for certain services, such as reloading funds or replacing lost or stolen cards.

5. Can I earn rewards or loyalty points with a prepaid card?

Yes, many prepaid card systems offer rewards or loyalty programs that allow users to earn points or discounts on their purchases.

#prepaid cards#cashless dining#food courts#payment methods#prepaid card systems#consumer convenience#customer experience#cashless transactions#digital payments#financial security#loyalty programs#transaction processing#data analytics#customer education#privacy concerns#business efficiency#innovation#technology integration#consumer awareness#case studies#success stories#FAQs#blogging#digital trends#restaurant industry#financial technology#prepaid card benefits#prepaid card acceptance

0 notes

Text

Digital Payments Dominance: How India Leads the Way in Cashless Transactions?

Digital Payments for India leading the way in Cashless Transactions.

#Digitalpayments #Cashlesstransactions

#technology

#digitalpay #electronicpayment #cryptocurrency #blockchaintechnology

India has become an eco-center for the development of new technology. The days are gone when India was only a customer support center for Western societies.

India is the powerhouse for embracing world-developed technologies, be it in railways, airports, or any other sector. We don’t work without the involvement of technology.

And one such revolutionizing technology is digital payments. The…

View On WordPress

0 notes

Text

basically begging people to pay w credit cards so i dont have to count the drawer at the end of the night (in one hour)

1 note

·

View note

Text

I illustrated this piece: Person Uses Smart Watch to Purchase Merchandise Using Contactless Payment, Cashless Payment

This stock image is available royalty-free from Getty Images/iStock, Shutterstock, Alamy, and Adobe Stock.

This vector image is scalable to any size and was illustrated December 4, 2023.

https://www.istockphoto.com/vector/person-uses-smart-watch-to-purchase-merchandise-using-contactless-payment-cashless-gm1831032321-550786146

#stock image#stock illustration#art#illustration#transaction#cashless#contactless#payment#credit card reader#smartwatch#merch

0 notes

Text

ATMs & CRMs – Unveiling Their Benefits in India’s Evolving Payment Landscape | AGS India

Both ATMs and CRMs facilitate various banking transactions, CRMs offer the additional functionality of cash recycling, making them more advanced and sophisticated machines.

#Billing software#Billing Machine#Fintech company#Digital payments#cash payment#cash management services#online payment systems#Cash transit#QR code payment#cashless transaction in India#Digital payment solutions#payment company#RFID solutions#Payment solutions#fuel management system#cashless payment#fraud prevention#Banking automation#retail automation#Banking outsourcing

0 notes

Text

Discover how cashless payment systems are propelling business growth in Dubai. This insightful blog explores the transformative impact of cashless transactions, enhancing convenience, security, and efficiency. Explore the innovative technologies behind these systems and how they're shaping Dubai's business landscape. Embrace the future of commerce and harness the potential of cashless payments for your business.

0 notes

Text

Online money typically refers to digital currencies or digital forms of payment used for transactions conducted over the internet. There are several types of online money:

online money free--https://tinyurl.com/yc6zxvay

1. Cryptocurrencies: Cryptocurrencies like Bitcoin, Ethereum, and others are decentralized digital currencies that use cryptography to secure transactions and control the creation of new units. They operate on blockchain technology and offer a decentralized and secure way of transferring value online.

2. Digital Payment Systems: These systems enable electronic transactions between individuals or businesses. Examples include PayPal, Venmo, Google Pay, Apple Pay, and various other online payment platforms. These systems typically link to bank accounts or credit cards to facilitate transactions.

3. Electronic Funds Transfer (EFT): EFT refers to the transfer of funds between different bank accounts electronically. It allows individuals and businesses to send and receive money online directly from their bank accounts.

4. Mobile Payment Apps: With the widespread use of smartphones, mobile payment apps have gained popularity. These apps, such as Apple Pay, Google Pay, and Samsung Pay, enable users to make payments using their mobile devices by linking their bank accounts, credit cards, or other payment methods.

When engaging in online money transactions, it is crucial to prioritize security by using reputable platforms, ensuring the legitimacy of sellers or recipients, and protecting personal and financial information.

#what are the top 5 types of digital payments in india?#what are the types of transactions in bank?#msc in digital currency#earn money online#different types of digital wallets#the future of digital currency#digital currency#make money online#how to make money online without investment#how to make money online for free#online transaction limit for income tax#benefits and types of cashless payment methods#how to make money online with no money

1 note

·

View note

Text

#cashless payments#Japan#credit card fraud#financial systems#security#financial transactions#digital finance#financial crime.

0 notes

Text

How to Create UPI ID: A Step-by-Step Guide

How to Create UPI ID: A Step-by-Step Guide

Do you want to know how to create UPI ID? Get all your queries solutions.

UPI or Unified Payment Interface is a payment system that allows users to transfer money from one bank account to another instantly. It is a popular payment method in India, and more and more people are using it to make digital payments. To use UPI, you need to create a UPI ID, which is a virtual payment address. In this…

View On WordPress

#Bank transfer through UPI#Cashless transactions in India#Digital payments in India#Easy UPI ID creation#How to set up UPI#Indian payment systems#Online money transfer in India#Secure UPI transactions#UPI for beginners#UPI ID creation#UPI mobile payments#upi payment app#UPI payment security tips#upi payment system#UPI registration process

1 note

·

View note

Text

ARE YOU READY TO SCAN YOUR ID AND TO HAVE YOUR SOCIAL RATING CONFIRMED BEFORE YOU BUY GAS? CHINA DOES!

"👀 You can only fill up your car with petrol in China after confirming your social rating."

Or the alternative - electric vehicles? All are connected to the web and the authorities have ability to shut down your vehicles remotely if social rating is not acceptable. A digital ID and cashless society with all transactions monitored by the government is a real threat to our individual freedoms!

#socialism#the great awakening#government corruption#democrats#world economic forum#leftism#marxism#leftists#left wing#communism memes#wef#illegal immigration#bill gates#donald trump#fkh

226 notes

·

View notes

Text

Fintech bullies stole your kid’s lunch money

I'm coming to DEFCON! On Aug 9, I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On Aug 10, I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Three companies control the market for school lunch payments. They take as much as 60 cents out of every dollar poor kids' parents put into the system to the tune of $100m/year. They're literally stealing poor kids' lunch money.

In its latest report, the Consumer Finance Protection Bureau describes this scam in eye-watering, blood-boiling detail:

https://files.consumerfinance.gov/f/documents/cfpb_costs-of-electronic-payment-in-k-12-schools-issue-spotlight_2024-07.pdf

The report samples 16.7m K-12 students in 25k schools. It finds that schools are racing to go cashless, with 87% contracting with payment processors to handle cafeteria transactions. Three processors dominate the sector: Myschoolbucks, Schoolcafé, and Linq Connect.

These aren't credit card processors (most students don't have credit cards). Instead, they let kids set up an account, like a prison commissary account, that their families load up with cash. And, as with prison commissary accounts, every time a loved one adds cash to the account, the processor takes a giant whack out of them with junk fees:

https://pluralistic.net/2024/02/14/minnesota-nice/#shitty-technology-adoption-curve

If you're the parent of a kid who is eligible for a reduced-price lunch (that is, if you are poor), then about 60% of the money you put into your kid's account is gobbled up by these payment processors in service charges.

It's expensive to be poor, and this is no exception. If your kid doesn't qualify for the lunch subsidy, you're only paying about 8% in service charges (which is still triple the rate charged by credit card companies for payment processing).

The disparity is down to how these charges are calculated. The payment processors charge a flat fee for every top-up, and poor families can't afford to minimize these fees by making a single payment at the start of the year or semester. Instead, they pay small sums every payday, meaning they pay the fee twice per month (or even more frequently).

Not only is the sector concentrated into three companies, neither school districts nor parents have any meaningful way to shop around. For school districts, payment processing is usually bundled in with other school services, like student data management and HR data handling. For parents, there's no way to choose a different payment processor – you have to go with the one the school district has chosen.

This is all illegal. The USDA – which provides and regulates – the reduced cost lunch program, bans schools from charging fees to receive its meals. Under USDA regs, schools must allow kids to pay cash, or to top up their accounts with cash at the school, without any fees. The USDA has repeatedly (2014, 2017) published these rules.

Despite this, many schools refuse to handle cash, citing safety and security, and even when schools do accept cash or checks, they often fail to advertise this fact.

The USDA also requires schools to publish the fees charged by processors, but most of the districts in the study violate this requirement. Where schools do publish fees, we see a per-transaction charge of up to $3.25 for an ACH transfer that costs $0.26-0.50, or 4.58% for a debit/credit-card transaction that costs 1.5%. On top of this, many payment processors charge a one-time fee to enroll a student in the program and "convenience fees" to transfer funds between siblings' accounts. They also set maximum fees that make it hard to avoid paying multiple charges through the year.

These are classic junk fees. As Matt Stoller puts it: "'Convenience fees' that aren't convenient and 'service fees' without any service." Another way in which these fit the definition of junk fees: they are calculated at the end of the transaction, and not advertised up front.

Like all junk fee companies, school payment processors make it extremely hard to cancel an automatic recurring payment, and have innumerable hurdles to getting a refund, which takes an age to arrive.

Now, there are many agencies that could have compiled this report (the USDA, for one), and it could just as easily have come from an academic or a journalist. But it didn't – it came from the CFPB, and that matters, because the CFPB has the means, motive and opportunity to do something about this.

The CFPB has emerged as a powerhouse of a regulator, doing things that materially and profoundly benefit average Americans. During the lockdowns, they were the ones who took on scumbag landlords who violated the ban on evictions:

https://pluralistic.net/2021/04/20/euthanize-rentier-enablers/#cfpb

They went after "Earned Wage Access" programs where your boss colludes with payday lenders to trap you in debt at 300% APR:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

They are forcing the banks to let you move your account (along with all your payment history, stored payees, automatic payments, etc) with one click – and they're standing up a site that will analyze your account data and tell you which bank will give you the best deal:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

They're going after "buy now, pay later" companies that flout borrower protection rules, making a rogues' gallery of repeat corporate criminals, banning fine-print gotcha clauses, and they're doing it all in the wake of a 7-2 Supreme Court decision that affirmed their power to do so:

https://pluralistic.net/2024/06/10/getting-things-done/#deliverism

The CFPB can – and will – do something to protect America's poorest parents from having $100m of their kids' lunch money stolen by three giant fintech companies. But whether they'll continue to do so under a Kamala Harris administration is an open question. While Harris has repeatedly talked up the ways that Biden's CFPB, the DOJ Antitrust Division, and FTC have gone after corporate abuses, some of her largest donors are demanding that her administration fire the heads of these agencies and crush their agenda:

https://prospect.org/power/2024-07-26-corporate-wishcasting-attack-lina-khan/

Tens of millions of dollars have been donated to Harris' campaign and PACs that support her by billionaires like Reid Hoffman, who says that FTC Chair Lina Khan is "waging war on American business":

https://prospect.org/power/2024-07-26-corporate-wishcasting-attack-lina-khan/

Some of the richest Democrat donors told the Financial Times that their donations were contingent on Harris firing Khan and that they'd been assured this would happen:

https://archive.is/k7tUY

This would be a disaster – for America, and for Harris's election prospects – and one hopes that Harris and her advisors know it. Writing in his "How Things Work" newsletter today, Hamilton Nolan makes the case that labor unions should publicly declare that they support the FTC, the CFPB and the DOJ's antitrust efforts:

https://www.hamiltonnolan.com/p/unions-and-antitrust-are-peanut-butter

Don’t want huge companies and their idiot billionaire bosses to run the world? Break them up, and unionize them. It’s the best program we have.

Perhaps you've heard that antitrust is anti-worker. It's true that antitrust law has been used to attack labor organizing, but that has always been in spite of the letter of the law. Indeed, the legislative history of US antitrust law is Congress repeatedly passing law after law explaining that antitrust "aims at dollars, not men":

https://pluralistic.net/2023/04/14/aiming-at-dollars/#not-men

The Democrats need to be more than The Party of Not Trump. To succeed – as a party and as a force for a future for Americans – they have to be the party that defends us – workers, parents, kids and retirees alike – from corporate predation.

Support me this summer on the Clarion Write-A-Thon and help raise money for the Clarion Science Fiction and Fantasy Writers' Workshop!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/07/26/taanstafl/#stay-hungry

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#fintech#ed-tech#finance#usury#payment processing#chokepoints#corruption#monopoly#cfpb#consumer finance protection bureau

208 notes

·

View notes

Text

I'm sure some people with lots of fancy degrees from business "school" probably have access to harder data than me but I went to a concert recently where the venue proudly boasted being Completely Cashless at all of its food/drink/merch tables and based on the chatter in the crowd that cannot possibly have made them additional money. Absolutely everybody hated it. The cashiers found it exhausting. The customers found it exhausting. It did not speed up the process, at all.

Most people who actually agreed to buy something with their card walked away saying that they guess this is It For Them because they didn't want to have to put a lot of purchases on their card. People had brought wads of cash with them to keep to a budget. There were "reverse ATMs" for these people to deposit their cash and receive a disposable debit card with that amount of money on them. Absolutely zero lines for these things because nobody at all was using them. Nobody looking to get smashed on overpriced drinks at a concert or spend $40 on a T-Shirt is looking to add a second step to that process.

Again, maybe some people who've "studied" business and economics might have some hard data that shows that overall Cashless Transactions do increase profits but the "we hate cashless and are consequently spending less money than we otherwise would've" vibes at this event were PALPABLE.

81 notes

·

View notes

Text

What are the differences between RideBoom and Indrive in terms of pricing, quality of service, and features offered for corporate clients?

RideBoom and InDriver (formerly known as InDrive) are both ride-sharing platforms that offer transportation services to customers. While they have similarities in terms of their business models, there are some differences between them in terms of pricing, quality of service, and features offered for corporate clients.

Pricing:

RideBoom: RideBoom offers competitive pricing for its ride-sharing services. The fares are determined based on factors such as distance traveled, time taken, and demand-supply dynamics. They also provide various payment options, including cashless transactions through digital wallets and electronic payment methods [2].

InDriver: InDriver stands out by allowing passengers to negotiate fares directly with drivers. This unique feature gives passengers more control over the pricing and ensures transparency and fairness in determining the ride cost [3].

Quality of Service:

RideBoom: RideBoom is committed to providing reliable, convenient, and affordable transportation solutions. They prioritize safety by implementing robust safety protocols and technologies, including stringent driver screening processes, real-time trip monitoring, and emergency assistance features within the app. They also focus on delivering a personalized customer experience by leveraging advanced data analytics and machine learning technologies [2].

InDriver: InDriver emphasizes community involvement and aims to create a sense of trust and reliability. They allow users to see mutual friends or contacts they have in common with drivers, enhancing safety and accountability. InDriver also provides driver profiles with ratings, vehicle details, and reviews, allowing passengers to choose their preferred driver based on these factors [3].

Features for Corporate Clients:

RideBoom: It is unclear from the available search results whether RideBoom specifically offers features tailored for corporate clients. However, as a leading ride-sharing company, they may have partnerships or programs in place to cater to the transportation needs of corporate clients. Further research or contacting RideBoom directly would provide more information on this aspect.

InDriver: There is no specific information available regarding features offered by InDriver for corporate clients in the search results. It is recommended to conduct further research or reach out to InDriver directly for more details on their offerings for corporate clients.

#rideboom#rideboom app#delhi rideboom#ola cabs#biketaxi#uber#rideboom taxi app#uber driver#ola#uber taxi

24 notes

·

View notes