#cbcd

Explore tagged Tumblr posts

Text

"Major shake-ups are occurring across the global stage. History is replete with examples of breaks with the past from major political, economic, technological, and social upheaval.

Throughout the ages, many self-serving individuals and groups have positioned themselves as rulers, financiers, benefactors, and thought leaders to steer change toward preferred outcomes. From the Pharaohs of Ancient Egypt to the Jacobin and Napoleon-led French Revolution in the late 18th century, societal transformation has been constant as one form of government replaces another.

We have now arrived at yet another historical inflection point. The desire for political and economic reconstruction is being demanded globally as the gap between the ultra-wealthy and everyone else continues to accelerate.

In recent years, populism has taken flight by inspiring the masses to reject the rule of “the elite” and chart a new course. However, without scrutiny, this movement and its key figures could be just as dangerous as the establishment they are attempting to usurp. In fact, what we are witnessing is not populism in its truest sense but techno-populism or technocracy, as it has been called since its inception in 1920."

#technocracy#technate#4. industrial revolution#jesse smith#elon musk#peter thiel#marc andreeson#mariette dichristina#klaus schwab#yuval noah harari#energy certificates#cbcd#digital id#transhumanism

2 notes

·

View notes

Text

Youngblood - 5 Seconds of Summer

Finally getting back to it! If you've been keeping up with my monthy playlists then you'd know I just recently moved! so the background will be different. I also left over half of my prized collection with my dad since I didn't have enough space in my dorm so there may be an influx of CD posts during the winter when I get access to my other CDs.

Either way, let's talk about Youngblood. This was a very interesting album for me when it came out, I'll be honest and say I didn't like it all that much. that didn't stop me from buying this CD within a week of it being out (and picking the one with michael again because it's clear I'm a stan) and keeping it safe in my collection. Over the years, it's really grown on me, and I do like a lot of the songs present on here. Meet You There has always been a favorite of mine, along with Talk Fast, More, and Babylon more recently. Even songs like Why Won't You Love Me? have really grown on me, so I can appreciate this record a lot more in recent years. It's most likely their most popular album, so for those out there who haven't heard it, I'd recommend giving it a spin (except for Monster Among Men. I'd skip that track).

0 notes

Text

youtube

How come I'm not surprised - JEEPERS!! Bill has his finger in everything these days - he owns an amazing amount of farmland from around the world and is now we discover he is behind our new global currency.

1 note

·

View note

Note

YOU can we have a Chance (Forsaken) pack? I think last time we came here we requested Elliot and not Chance. I hope to god it wasn't Chance 😭 ANYWAYS. Level 2 + MUDs if thats okay? Just level 2 if not, which is fine! /gen

Thank you in advance :] - @toxin-filled-bahs

Of course dear audience! We have heard your request and have found a suitable performer for you! We hope this performance suits your needs, but you are free to make any adjustments you wish.

❣︎For Our Next Act, Please Welcome,,,❣︎

Chance!!!

°·⊱ Name: Chance, Vortex, Samael, Helix, Fortune, Gamble, Casino

°·⊱ Age: 22 - 25

°·⊱ Race/Species: Robloxian

°·⊱ Source: Forsaken Roblox

°·⊱ Role: Gambling Addiction Manager, Confronter, Waker, Co-Host

────── · · · · ──────

°·⊱ Sex: Male

°·⊱ Gender: Nonbinary, Condigender, Laggender, Absorgender, Demiboy, Agender, Agenderflux, Gamblegender, Lostgender, Chancegender, Chancecharic, Winmaxxing, Gamblecomfortic, Chainedgender

°·⊱ Pronouns: He/Him; They/Them; Bet/Bets; Chip/Chips; ♠️/♠️s; 🃏/🃏s; 🎰/🎰s; Odd/Odds; Jack/Jacks; Joker/Jokers; 🎲/🎲s; 💰/💰s; 🪙/🪙s; It/Its; That Thing/That Thing’s; Risk/Risks; Fate/Fates

°·⊱ Sexuality: Arretaroace, Achillean

°·⊱ Personality: Greedy, Adrenaline Junkie, Headstrong, Very Sneaky / Secretive, Suspicious, Lonely

────── · · · · ──────

°·⊱ Nicknames/Titles: The One Who Bets it All, [Prn] Who Gambles, The High Roller, [Prn] Who Holds the Cards, The Winner

°·⊱ Likes: Adrenaline, Winning, Games that Risk his Life, Rabbits, Card Games, Piano, Jujutsu Kaisen

°·⊱ Dislikes: Gold-Diggers, Manipulation, ITrapped, Surveillance, Losing

°·⊱ Emoji Sign-Off: 🎰🎲🃏🔲🕶️����

°·⊱ Hexcode: #B8B8B8

°·⊱ Typing Quirk: Replaces ‘A’ with ♠️, Replaces ‘O’ with ♥️ Example : The quick br♥️wn f♥️x jumps ♥️ver the l♠️zy d♥️g.

°·⊱ MUDS: Robloxanism, Internet Addiction Disorder (IAD), Compulsive Blog Creation Disorder (CBCD), Emotional Sponge Disorder

°·⊱ Faceclaim: 1 | 2

YOUUU !! Yes you can!! And yes you requested Elliot last time!! Had fun grabbing some MUDs for you!! And thank you for requesting!! Some of the name/nouns/titles might be from a npt pack or inspired by one we saw while researching the character <3 - Pest Swarm ; Ninya

#★Act Request★#build a headmate#endo safe#transid#radqueer#pro para#build an alter#alter packs#create a headmate#create an alter#alter creation#pro rq 🌈🍓#rq 🌈🍓#rq safe#rqc🌈🍓#rq community#radq interact#pro transx#pro radq#endo friendly#pro endo#endogenic safe#willogenic#tulpamancy#endo system#pro endogenic#endogenic system#paraphile safe#transid safe#radqueer safe

10 notes

·

View notes

Text

On Sept. 20, the CBDC Anti-Surveillance State Act passed out of the Financial Services Committee. Republican Senator Tom Emmer said it was, “A historical step in defending against an ever-expanding government surveillance state.” The House Majority Whip has been battling against Federal Reserve moves to develop a CBDC. The first anti-CBDC bill in the United States passed out of the Financial Services Committee today! A historical step in defending against an ever-expanding government surveillance state. — Tom Emmer (@GOPMajorityWhip) September 20, 2023 Anti-CBDC Bill Moves Forward The Act is the first anti-CBDC legislation introduced in the United States. Senator Emmer first proposed the CBDC bill in January 2022, and it was formally introduced to Congress in February 2023. The primary aim is to limit the Federal Reserve from minting a programmable CBDC, which Emmer claims is a “surveillance tool that would be used to undermine the American way of life.” The bill has the support of 60 members of Congress and additional industry groups, Emmer said. He warned that a CBDC is very different from decentralized digital assets in that it transacts on a digital ledger that is designed and controlled by the government. “In short, a central bank digital currency is a government controlled programmable money, if not designed like cash, could give the federal government the ability to surveil and restrict American’s transactions.” Senator Emmer cited China as an example of where this is already happening. The ruling communist party has designed a CBDC to track the spending habits of its citizens, which has been used to create a social credit system that rewards or punishes people based on their behavior. He also cited the Canadian government’s freezing of bank accounts of protesters in the 2020 trucker protests. “That might work in Canada, it doesn’t work here,” he added before concluding: “If not open, permissionless, and private like cash, a CBCD is nothing more than a CCP-style surveillance tool that can be weaponized to oppress the American way of life.” Fed CBDC Prohibitions The bill specifically prohibits the Federal Reserve from issuing a CBDC to individuals. Senator Emmer said this would prevent the central bank from mobilizing into a retail bank able to collect personal financial data. The bill also prohibits the central bank from using any CBDC to implement monetary policy. The legislation will now go for a full vote before the House. If it passes, the Democrat-controlled Senate would also have to weigh in on the matter, and many of them, including the vehemently anti-crypto politicians, oppose it. Moreover, US presidential candidate Robert F. Kennedy Jr. agrees with the principles outlined in Senator Emmer’s bill. “That is why I oppose CBDCs, which will vastly magnify the government’s power to suffocate dissent by cutting off access to funds with a keystroke,” he said in May. Source

2 notes

·

View notes

Video

youtube

The Flash - Official Trailer 2

July 20, 2023 201st day of the year in the Gregorian calendar; 164 days remain

anniversary of 1969 moon landing . 7 percent illuminaiton

I can see you in the camera exhibit f (6) surveillance security camera footage proof.

The flash interception points with Sza Kill Bill video, Bad Blood, Aaliyah album commercial 2001 and why the Flash represents Barak Obama. Barak means lightening and his nick name is Barry. The flash’s name is Barry Allen. Kara Kor El is Face magic like Irene Cara’s death mystery relating to Artemis around the moon remember, remember the Fame star also the Koreline character. Koraline, Kora avatar. Im in so much pain typing this right now.

The movie release June 16 which is 616 another mark of the beast quote from the bible in revelations lesser know to the 666 Gematria. But in sense of time same on 1010 on the clock. The movie like in Dr. STrange, Spiderman trying to go back and change time and a Latina comes out in some way.

The Ted...Indiana jones, Sza and the spagetti tomato sauce

even in Clockwork Orange. and Luca. Eating those noodle feverishly. Strands and string theories abounding.

Kill bill sos for August 2023. in Sza video Bad blood, cora lines, blood like DNA or Kor El needed for ZOD to rebuild Superman’s planet.

They ven made a Barbie feference which releases tomorrow. Looks like that have to kill billions and terraform earth, so the bill dollar will form for Zod’s Crypton....Crypto currency CBCD. FED NOw and more in play for August.

Walmart settling all of a sudden. What does that mean? the money is about to do somehting crazy.

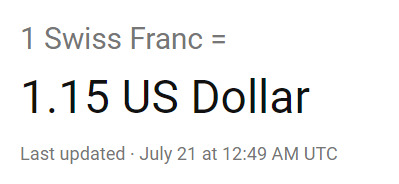

what’s the swiss currency? Krohn? Franc. TAylor SWIFT being rescued from the Vault in I Can see you video, during her Eras tour. Recall Malia Obama wearing the New Eras TSHIrt making such a big stank back in the Day. New Era, New time order.

how can this be updateed before it even happened. The time is 9:25 pm.Trying to go back in time Even Indiana Jones. And the new National Treasurer is Indian/ Mohegan Tribal Chief.

Bacl tp Flash the MOnkey Tede was darted, like the Dart Program and the Alien INvasion Defending the earth will be in 3 more days in Times square. We need a Resolution and Bad blood. I can see you. the surveillance, cameras, skibidi.

scrotum Superman inside. Yet its a girl. X chromasome. Dead parentts Batman. Flash dead mom. Superman. last of his kind, except the girl has the mots.super surveillance, big bro watching saved the day in the super markets. Tomato sauce can hmm. 137, two cans neede to make And mom’s hugs. xox. x is hugs. Pomodoro...golden apples.

3 notes

·

View notes

Text

Australia’s Biggest Bank Bans Cash, Forces Customers To Adopt CBCD’s ‘Or Lose Everything’ - The People's Voice

https://thepeoplesvoice.tv/australias-biggest-bank-bans-cash-forces-customers-to-adopt-cbcds-or-lose-everything/

View On WordPress

0 notes

Text

0 notes

Text

Se não tratada, doença pode causar até câncer de esôfago Cerca de 20% da população mundial possui refluxo gastroesofágico. No Brasil, em torno de 12% das pessoas sofrem com a doença, que é o retorno do conteúdo alimentar presente no estômago de volta para o esôfago, podendo causar inflamações locais, além de diversos outros problemas à saúde. Pigarro, inflamação na garganta, queimação, tosse seca persistente, rouquidão, dor abdominal, dor no peito (podendo inclusive ser confundida com infarto), regurgitação de alimentos, soluço, erosão dos dentes, mau hálito, pneumonia, asma e bronquite, são os principais sintomas do refluxo Segundo a Dra. Thayla Amaral, as escolhas feitas no dia a dia são fatores determinantes para o surgimento da doença digestiva. “O refluxo aparece quando há uma alimentação desregrada, com maior ingestão de carboidratos, fastfoods, refrigerantes, derivados da cafeína, frutas cítricas e pimentas, por exemplo”. Mas não é só isso. “Alguns hábitos como se deitar após comer, ter sobrepeso ou obesidade, tabagismo, mastigação rápida, uso de determinados medicamentos, hérnia de hiato e alcoolismo também são causas relacionadas ao refluxo”, informa a médica cirurgiã especialista em Cirurgia Digestiva e Bariátrica. Quadros alérgicos respiratórios também podem ter relação com o refluxo. Alguns pacientes que apresentam sintomas e fazem uma investigação para descobrir suas causas, podem ter alergias alimentares associadas que pioram o quadro dessa doença, como por exemplo, intolerância à lactose e ao glúten, presentes em boa parte dos carboidratos. Mas engana-se quem acredita que o refluxo pode ser inofensivo à saúde. “A cronicidade da doença pode trazer alterações graves no esôfago, como o câncer de esôfago, que pode causar os mesmos sintomas de um paciente com doença do refluxo, adicionado de disfagia (dificuldade para engolir alimentos sólidos ou líquidos), emagrecimento importante, entalo, dor no peito e/ou anemia”, explica a médic Alguns alimentos podem até ser prejudiciais para o refluxo, mas outros, como gengibre por exemplo, podem aliviar e ter potencial anti-inflamatório para o trato digestivo. As castanhas em geral, legumes em suas diversas variedades e frutas não ácidas também ajudam a melhorar o quadro e são extremamente benéficas Além de uma alimentação adequada e balanceada, também é recomendado o uso de medicamentos que podem ser por curto ou longo período. Para aqueles que não alcançam sucesso com o tratamento clínico da doença do refluxo, a recomendação é buscar ajuda de um cirurgião digestivo para avaliar se há a necessidade de um procedimento cirúrgico para a melhora do quadro. Sobre a Dra. Thayla Amaral | @drathaylaamaral Thayla Amaral é médica formada pela Universidade do Estado do Pará (UEPA), com residência médica em cirurgia geral pelo Hospital do Servidor Municipal, de São Paulo e residência médica em cirurgia do aparelho digestivo pela Gastromed/Instituto Zilberstein, em São Paulo. Possui o Título de Especialista em Cirurgia Digestiva pelo Colégio Brasileiro de Cirurgia Digestiva (CBCD) e Título de Especialista em Cirurgia Bariátrica e Metabólica pela Sociedade Brasileira de Cirurgia Bariátrica e Metabólica (SBCBM). A profissional é sócia-proprietária da Clínica Bellit, localizada em São Paulo – SP.

0 notes

Text

What Is Digital Currency & How Does It Work

Digital currency (or digital money) is any method of payment that is entirely electronic. Digital currency, unlike a dollar bill or a coin, is not physically visible. Online systems are used to account for and transfer it. The cryptocurrency Bitcoin, Gandercoin etc are well-known form of digital currency.

And recently Gandercoin is launched as Indian digital currency which is India’s first digital currency offering multiple features and most importantly its known for its user-friendly interface which makes it accessible to everyone whether he/she is experienced or inexperienced trader. And now because of its accessibility it has become a popular and known as best Indian cryptocurrency.

TYPES OF DIGITAL CURRENCIES:

Cryptocurrencies: Cryptocurrencies are digital currencies that rely on cryptography to safeguard and verify network transactions. In addition, cryptography is utilized to regulate and control the generation of such currencies. Cryptocurrency examples include Bitcoin and Ethereum. Cryptocurrencies may or may not be regulated depending on the jurisdiction.

Virtual currencies: Virtual currencies are unregulated digital currencies that are governed by developers or a founding organization made up of different stakeholders. A defined network protocol can also regulate virtual currency algorithmically. A gaming network token, for example, is an example of virtual money whose economics are created and controlled by developers.

CBCD: Central bank digital currencies (CBDCs) are digital currencies that are regulated and issued by a country’s central bank. A CBDC can be used to supplement or replace regular fiat currency. In contrast to fiat currency, which exists in both physical and digital forms, a CBDC only exists in digital form.

HOW IT WORKS?

Digital currencies work on three basic technologies that empowers digital currencies:

1. Decentralization: One of the fundamental principles of cryptocurrency is decentralization. Unlike traditional currencies, which are issued and regulated by governments and central banks, cryptocurrencies operate on a decentralized network of computers. This network, known as a blockchain, is a distributed ledger that records all transactions across the network.

2. Blockchain Technology: At the heart of every cryptocurrency is blockchain technology. A blockchain is a series of blocks, each of which contains the history of transactions. These blocks are linked together in a chronological order, creating a transparent and immutable record of all transactions. This technology makes sure that security is provided at first and importantly and fraud is avoided.

3. Cryptography: The term “cryptocurrency” derives from the use of cryptographic techniques to secure transactions and control the creation of new units. Transactions are verified and authorized using public and private keys. Public keys act as an address where cryptocurrency can be sent, while private keys are secret codes that give you access to your holdings.

HOW TRANSACTIONS WORK?

A cryptocurrency transaction is started by the user by establishing a digital signature using their private key.

The transaction is broadcast to the blockchain's network of cryptocurrency nodes, where network nodes (computers) confirm it.

The transaction is added to a block and added to the blockchain when it has been confirmed.

Through a procedure known as mining, the network comes to an agreement over the transaction's authenticity. To validate transactions, miners must solve challenging mathematical riddles; in exchange, they are rewarded with newly minted cryptocurrency (the exact method depends on the cryptocurrency).

The transaction is complete, and User receives the cryptocurrency in their wallet.

CONCLUSION:

The innovative invention of cryptocurrency has the power to alter the way we think about money and banking. With the use of blockchain technology and cryptographic principles, it is decentralized and offers users all over the world security, transparency, and accessibility. Understanding how cryptocurrencies operate is important for anyone who is interested even if they are investors, traders, or just simply curious.

Written By- Manmeet Kaur

0 notes

Text

🚨 NEW SHOW! 🚨

“Father of QE” Economist: CBCD Scheme Will Require Implanted Microchips in Humans

#TruNews #QE #CBCD #Microchips #TuckerCarlson #ObamaLibrary

https://www.trunews.com/stream/father-of-qe-economist-cbcd-scheme-will-require-implanted-microchips-in-humans

0 notes

Text

Somewhere New EP - 5 Seconds of Summer

I thought it would be fun to start out my 5sos CD collection journey by sharing the first piece of physical media they ever released! I did not buy this CD when it originally came out in 2012, I bought it very recently, at least within the past 3 years or so. I have no idea where I bought it from if I'm being quite honest, I found this copy on a random website so there's a full possibility it's a reprint/bootleg copy. Either way, I'm glad I own it. This EP has 4 tracks on it, my favorite song is probably Beside You. I actually prefer this version over the Self Titled re recording, but that's just me. Overall I have a lot of nostalgia for this project, especially the quirky liner notes that were obviously written by them, it has a lot of charm that I find endearing. Let me know your opinions on this project! I'd love to have a conversation about it :)

#CBCD#cd collection#cd#5sos#5 seconds of summer#calum hood#ashton irwin#luke hemmings#michael clifford#5sos5#somewhere new#somewhere new era#5sos somewhere new#5sos CD#5sos merch#pop punk#modern rock#adult contemporary#pop muisc#top 40 music#cd player#5sos5 is coming#Spotify

25 notes

·

View notes

Text

La guerra contro la libertà finanziaria

Con tutto l’allarmismo che inizia sulla sicurezza delle banche, cosa dovresti fare? Dovresti spostare i tuoi soldi da una banca più piccola a una delle Mega banche? O semplicemente lasciare del tutto il sistema bancario? Source: 22 apr 2023; Analysis by Dr. Joseph Mercola [>Fact Checked<] Continue reading Untitled

View On WordPress

#Allarmismo#Banca Centrale#Bancarotta#Banche#Banche SVB#BIS#CBCD#Collasso Economico#Contante#Controllo Assoluto#Corporate Media#Giocatori#Globalisti#Guerra#ID Digitale#Ideologie#Libertà Economica#media mainstream#Mercati Alimentari#Microchip#Panico#Panico Finanziario#Piccole Banche#Piccole Fattorie#Piccole Imprese#Rappresentanza#Rimozione Deliberata#schiavitù#Schiavitù Mondiale#sicurezza

5 notes

·

View notes

Text

To make central bank digital currencies successful, global and local financial institutions need to invest in Digital Currency education, analyze various use cases, and create their Digital Currency strategy. As cryptocurrencies like bitcoin (BTC) continue to enter the mainstream and encapsulate people, several countries have announced initiatives to create their own central bank digital currencies (CBDCs). According to the International Monetary Fund (IMF), nearly 100 countries are actively News/Articles/2022/02/09/sp020922-the-future-of-money-gearing-up-for-central-bank-digital-currency" target="_blank" rel="noopener">evaluating CBCDs, and some have already started to roll out these initiatives. CBDC Tracker | Source: Atlantic Council Additionally, central banks worldwide are investigating the practicalities of establishing CBDCs of their own. Digital currencies are surging in popularity for a variety of reasons. They are considered more Secure and less volatile than Cryptocurrency assets. Some also feel CBCDs could improve the Safety and efficiency of payment systems. It is also believed that CBCDs can help promote financial inclusion across the world, particularly in areas with limited access to financial services. Additionally, CBDCs are not a new concept; they have been around for three decades. However, it wasn’t until recent years that research in CBDCs proliferated globally. This was largely due to the decline in the use of physical cash transactions, but also technological advances. The emergence of money digitalization The value of CBCDs is associated with the issuing country’s official currency. Physical currency remains widely used across the globe. However, people are still beginning to move away from cash and embrace digital financial transactions. This was particularly seen with the COVID-19 pandemic, where hygiene concerns and cash shortages limited physical currency exchanges. According to McKinsey, financial institutions and banks across the world process more transactions digitally than they do in their physical branches. There’s no denying there have been digital disruptions in the financial services sector over the last number of years. These disruptions can be credited to the likes of Blockchain Technology and cryptocurrencies. Central bank digital currencies fall under this umbrella, and central banks are starting to recognize this as the world opts for all things digital. Central bank digital currencies are not so different to stablecoins. The main difference between the two is that CBCDs are both state-operated and issued. How a CBDC could work | Source: News/articles/2021-03-22/here-s-how-a-central-bank-digital-currency-could-work-chart#xj4y7vzkg" target="_blank" rel="noopener">Bloomberg There are many reasons banks and financial institutions worldwide have turned their attention to CBCDs. UK Finance reports cash has fallen from 62 percent of payments in 2006 to 15 percent in 2021 in the United Kingdom. The decrease in physical cash transactions is reflected across the globe too, with much discussion about whether cash will survive and whether we will move to a cashless future. Additionally, there is a growing Interest in privately issued Digital Assets. CBDCs also give central banks a bright new opportunity to lead strategy conversations on cash use cases in public forums. Many central banks are also looking to build greater local governance over increasingly global payment systems. Therefore, the banks view CBDCs as a potential stabilizing anchor for local Digital Payment systems. Benefits of CBCDs CBCDs can be built for both wholesale and retail payments. A wholesale CBDC refers to an entirely new infrastructure for interbank settlements, while a retail CBDC involves a digital version of cash. Central banks have trialled both with a focus, particularly on low-cost, fast payments. One of the most significant advantages of CBCDs is they can offer a reliable and Secure means of Digital Payment and remittance.

They can be used for offline and online transactions. CBCDs can enhance payment accessibility and efficiency. They can also be integrated into existing payment systems. Not to mention, CBCDs can be utilized to facilitate cross-border payments. These transactions can be made without the need for intermediaries like payment processors or banks. Cross-border payments are already a significant challenge for banks concerning fiat money. It’s for these reasons that numerous central banks across the globe have already begun to experiment with CBDCs to explore their economic potential. CBDCs can also offer financial inclusion for those currently underbanked or unbanked. They can make it easier for people to access financial services and engage in the digital economy due to being a digital alternative to cash. This is a big issue CBDCs can challenge, which will be particularly monumental for people in developing nations where traditional banking services are limited. They can also curb the demand for physical cash. CBDCs can reduce the need for cash transportation and handling, which can pose Security risks and be expensive. This would help minimize theft and counterfeiting, two significant issues associated with physical cash. CBDCs offer increased transparency and Security, too. They do this by offering strong Authentication and Encryption protocols that can assist in preventing cyberattacks and fraud. CBDCs are also an emerging tool for implementing monetary policy. They can offer central banks real-time data concerning the state of the economy, helping them make better-informed policy decisions. Disadvantages of CBDCs Despite the many benefits offered by CBDCs, they do have some drawbacks. One critical thing to keep in mind is that the currently available technology will not be able to cater to large volumes of citizens using CBDCs. To put that into perspective, the daily volume of retail CBDCs is expected to be higher than 100,000,000 transactions. While CBDCs have the potential to prevent cyberattacks, they may also be vulnerable to them due to the limitations of cryptography. This could lead to financial losses and ultimately disrupt the financial system. It should also be noted that CBDCs still require fiat-to-fiat conversation for cross-border transitions. CBDCs use a single centralized network, so if this goes down, the Digital Currency will no longer be usable. There is also a risk concerning national cash monopolies. Central banks fear that CBCDs could reduce the monopoly of sovereign money, compromising their ability to maintain financial and monetary stability. In terms of other drawbacks, CBDCs could cause increased surveillance of financial transactions. This is a problem because it could raise both Security and Privacy concerns. Another thing to keep in mind is that the implementation of CBDCs could be a complex and costly process. In other words, implementing CBDCs will require an understanding of both Encryption processes and blockchain technologies. They may also require new legal frameworks and regulations, which will take some time to develop. There could also be some Risks associated with integrating CBDCs into existing payment systems. It is also uncertain what impact CBDCs could have on the banking sector. Some worry they could have a negative impact, and banks could face increased competition from them, resulting in a reduction in the availability of credit and a decline in their profits. There are also concerns that CBDCs could negatively affect monetary policy. The use of CBDCs could hinder the ability of central banks to implement monetary policy. This would cause economic problems like increased inflation. It is a completely new economic approach, and so, there may be unforeseen consequences for individuals and businesses. How can we make CBDCs successful? The Interest in CBDCs is there, but the drawbacks mean there are several Risks. For CBDCs to be successfully integrated, we need to draw on their areas of expertise within the payments ecosystem.

This means establishing a design whereby central banks can issue CBDCs to payment service providers, fintechs, and commercial banks. By distributing CBDCs to these various providers, they will be responsible for offering the Digital Currency to merchants and Consumers. It is vital we establish a model whereby compliance checks like anti-money laundering and know your customer (KYC) are prioritized. By assessing the digital currencies currently in circulation, financial institutions can develop strategies, products, and infrastructure that support the future of CBCDs. Ultimately, for any technology to achieve widespread adoption, it must work for individuals in a range of contexts and locales. Financial institutions need to invest in Digital Currency education, analyze various use cases, and create their Digital Currency strategy. The future of CBCDs Many countries and financial institutions are turning their attention to CBDCs with the belief that they could be the future of payments. The Interest in CBDCs is justified as they do offer many benefits compared to traditional cash and cryptocurrencies. However, they still do have several drawbacks that pose serious Risks to citizens and the banking sector. CBCDs will likely continue to gain traction, and they have huge potential. In saying that, we must not forget to pay attention to their disadvantages and work to make them successful and risk-free. Felix Roemer Felix Roemer is the founder of Gamdom. He briefly attended ILS Fernstudium in Germany before founding Gamdom in 2016 at the age of 22 — after investing in crypto, playing poker, and making money from the game RuneScape.

0 notes