#cfa architecture

Explore tagged Tumblr posts

Text

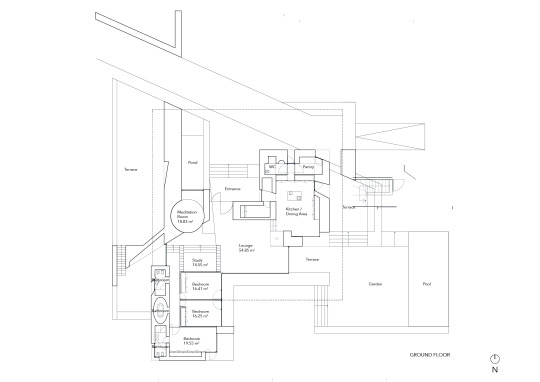

Santarém Residence, Santarém, Portugal,

CFA Architecture

#art#design#architecture#interior design#interiors#luxury lifestyle#retreat#portugal#santarem#cfa architecture#luxury house#luxury home#country house

270 notes

·

View notes

Text

#Sénégal #Pétrole #Économie #Sangomar L'exploitation du champ pétrolier de Sangomar marque une étape décisive pour l'économie nationale, avec des volumes de production qui dépassent les prévisions initiales. Les données indiquent une extraction de près de 17 millions de barils pour l'année 2024, avec une projection ascendante estimée �� plus de 30 millions de barils pour l'exercice suivant. Cette dynamique de production, qui a déjà injecté des centaines de milliards de francs CFA dans les coffres de l'État au début de l'année 2025, positionne le pays devant une opportunité de développement sans précédent. La manne financière issue de cette ressource naturelle est considérable et porte en elle la promesse d'une transformation structurelle profonde, à condition que les revenus soient judicieusement orientés vers des projets porteurs de croissance durable et inclusive pour l'ensemble de la population. Face à cette nouvelle ère de prospérité, la principale interrogation réside dans la capacité des institutions à orchestrer une gouvernance exemplaire. La gestion des revenus pétroliers requiert une transparence absolue et une rigueur infaillible pour déjouer les risques souvent associés à une richesse soudaine. L'enjeu est de taille : il s'agit de convertir cette richesse brute en un capital productif pérenne, en investissements stratégiques dans les infrastructures, l'éducation, la santé et la diversification économique. La mise en place de mécanismes de contrôle robustes et de reddition de comptes est impérative pour garantir que chaque franc généré contribue effectivement au progrès collectif et préserve le pays des écueils de la dépendance aux hydrocarbures, un phénomène observé dans d'autres nations productrices. La réflexion stratégique s'oriente vers la création d'instruments financiers dédiés, tels que des fonds souverains, destinés à préserver une partie de cette richesse pour les générations futures et à stabiliser l'économie face à la volatilité des marchés mondiaux. Parallèlement, une question fondamentale demeure celle de la valorisation locale de la ressource. Le développement d'une industrie de raffinage nationale est une nécessité économique criante. Une telle orientation permettrait non seulement de satisfaire la demande énergétique intérieure à moindre coût, mais aussi de créer une chaîne de valeur ajoutée locale, génératrice d'emplois qualifiés et de nouvelles compétences techniques, maximisant ainsi les retombées positives de l'exploitation pétrolière sur le tissu économique national. Le contexte international et les relations avec les partenaires privés constituent le quatrième pilier de cette nouvelle architecture économique. Le différend fiscal qui a récemment émergé avec l'opérateur principal du gisement met en lumière la complexité des enjeux et la nécessité d'une diplomatie économique avisée. Il est crucial pour l'État de défendre fermement ses intérêts souverains et d'assurer une juste répartition des revenus, tout en maintenant un climat de confiance et de sécurité juridique indispensable pour attirer et conserver les investissements étrangers. La capacité du pays à naviguer avec habileté dans ces négociations déterminera sa crédibilité sur la scène internationale et sa faculté à bâtir des partenariats équilibrés et mutuellement bénéfiques sur le long terme. Read the full article

0 notes

Text

Why Behavioral Finance is the Future of Wealth Management?

Finance is a field where numbers may speak, but it’s human behavior that often calls the shots. For decades, conventional wealth management has focused on asset allocation, market forecasting, and portfolio performance. However, a new era is emerging that understands the psyche of investors & their investing habits. Enter behavioral finance, a field that blends psychology and economics to explain why individuals often act irrationally with their money. As financial markets become more complex and investor behavior more scrutinized, behavioral finance is rapidly positioning itself as the cornerstone of future-focused asset management.

The Human Element in Financial Decision-Making

No matter how sophisticated an algorithm is, it cannot fully account for fear, greed, overconfidence, or herd mentality. These emotional triggers are deeply ingrained in human behavior and can significantly influence financial decisions. According to a 2023 report by Morningstar, nearly 50% of investors admitted to making impulsive decisions during market volatility. This aligns with findings from the CFA Institute, which shows that behavioral biases can lead to suboptimal investment choices and long-term financial losses.

Wealth management is not merely about maximizing returns. It's about guiding clients through market highs and lows, helping them stay committed to long-term goals despite emotional fluctuations. Behavioral finance provides a roadmap for understanding and managing these client behaviors.

Bridging the Gap Between Logic and Emotion

The classic models in wealth management have long assumed that investors are rational beings who seek to maximize utility. However, real-world investing tells a different story. Clients may panic during a downturn, chase trends during a bull market, or avoid risk entirely after a loss. Behavioral finance acknowledges this dichotomy and provides frameworks to manage it.

Techniques such as mental accounting, loss aversion mitigation, and choice architecture are being actively adopted by modern financial advisors. These tools allow portfolio management professionals to guide clients toward better decision-making by structuring options and framing choices in psychologically sound ways.

Personalized Client Engagement

In the U.S., where client expectations are evolving rapidly, behavioral finance is becoming a competitive differentiator. High-net-worth individuals and institutional investors alike demand more than just spreadsheets and performance reviews. They seek advisors who understand their values, financial anxieties, and behavioral patterns.

Firms leveraging behavioral finance can create deeply personalized investment strategies. For example, some advisors now use psychometric assessments to categorize client risk tolerance, not just based on age or income but on personality traits and decision-making styles. This enables a more tailored approach to wealth management that fosters stronger advisor-client relationships.

Technology as an Enabler

Digital platforms and AI-driven tools are accelerating the integration of behavioral finance into wealth management. Fintech innovations are allowing firms to gather behavioral data in real-time, identify biases, and offer personalized nudges to keep investors on track.

Companies like Betterment and Vanguard have begun incorporating behavioral nudges into their platforms to prevent panic selling or excessive trading. These features help investors adhere to long-term strategies while reducing emotional reactivity. In a 2022 Deloitte survey, 64% of U.S.-based private banking firms cited behavioral data analytics as a top priority for digital transformation.

Mitigating Risk in a Volatile Market

Economic turbulence and geopolitical instability have underscored the need for advisors to move beyond historical data and predictive models. Behavioral finance enables wealth managers to anticipate how clients might react under pressure and develop preemptive strategies.

Whether it's through scenario planning, behavioral coaching, or stress-testing portfolios for emotional triggers, advisors can minimize irrational behavior that leads to poor outcomes. In this way, behavioral finance enhances the resilience of wealth management strategies and strengthens client trust during turbulent times.

Educating the Investor

Empowering clients with behavioral insights can lead to more informed and confident decision-making. Many U.S. wealth management firms are now incorporating behavioral education into their client onboarding and review processes. By helping clients understand their own cognitive biases, advisors can foster a culture of awareness and accountability.

For example, educating clients about the sunk cost fallacy or recency bias can help them avoid costly mistakes. It's not just about managing portfolios, it’s about cultivating smarter investors who are aligned with their own long-term goals.

Regulatory and Ethical Implications

Behavioral finance also aligns well with the growing regulatory focus on fiduciary duty and ethical advising. The U.S. Securities and Exchange Commission (SEC) has emphasized the importance of personalized advice that serves the client’s best interest. Integrating behavioral insights allows wealth managers to offer solutions that are both ethical and effective.

When advisors use behavioral tools responsibly, they enhance transparency and reduce the risk of mis-selling or overtrading. It fosters a client-centric approach that builds lasting trust and complies with emerging regulatory standards.

The Competitive Edge

As wealth management becomes increasingly commoditized, behavioral finance offers a unique value proposition. Advisors who can navigate the emotional terrain of investing are better positioned to deliver lasting value. According to a 2023 report by PwC, 72% of U.S. investors say they would prefer working with an advisor who understands their behaviors and values.

This growing preference signals a shift in how success is measured in wealth management. It’s no longer just about beating the market, it’s about understanding the investor.

Conclusion:

Behavioral finance is not a passing trend; it’s a paradigm shift. As the wealth management industry evolves to meet the nuanced demands of modern investors, integrating psychological insight will become non-negotiable. For C-suite leaders, startup founders, and financial managers, this presents both a challenge and an opportunity: to rethink the traditional models and embrace a more human-centered approach. In a sector built on trust and foresight, the ability to understand what truly drives financial decisions could be the defining skill of the next generation of financial advisory professionals.

Uncover the latest trends and insights with our articles on Visionary Vogues

0 notes

Text

The Great Debate: CFA or FRM — Which One Fits the Future of Finance?

Everything within finance is going through a radical change. With inflationary pressures and geopolitical instability accompanied by cyber threats and AI-enhanced trading platforms, risk is nigh everywhere. The choice has become ever more complex between studying for the CFA or the FRM. Both are globally credible and immensely effective in placing their holders, but into opposite paths. The appreciation designation has brought the CFA Course in Boston back into focus as professionals seek to balance investment insight with risk intelligence for any potential consideration in finance.

Understanding the Foundations

CFA is considered the gold standard in investment management. Charterholders learn everything from portfolio construction to equity and fixed-income analysis, ethics, and corporate finance. That is why it is a birthright for many who choose advancement of portfolios, investment research, wealth advisory, or asset management careers.

FRM specializes into the inner workings of Risk. Risk managers would typically become knowledgeable about credit, market, operational, and liquidity risk, which is exactly what makes it ideal for positions within the bank, regulatory authorities, or any other roles under risk management.

Both programs are equally rigorous but nevertheless cater to different areas of finance. CFA focuses on the creation of investment strategies, while FRM focuses on the protection of those strategies from failure.

Career Relevance over the Next Five Years

Traditional financial analysts are rapidly being replaced by increasingly hybrid professionals—those who are able to analyze markets while also understanding risk dynamics in all their complexity. In a recent GARP report, it was noted that after 2023, with global volatility, AI-integrated risk models, and rising compliance requirements, enrollments for the FRM program bolstered over 30% rise.

The Institute does not lag in the modernization of course content. Newly introduced features comprise machine learning, alternative data analysis, and ESG investing. This indicates that even the most legacy institutions are embracing the new tech-and-regulation-heavy world.

Both designations are quite big yet the one thing which stands apart is investment centric CFA and risk centric FRM.

What Recruiters Really Want

Modern employers hire for skills and not just for degrees. Knowledge of risk would enable a CFA charterholder to put in the shadow of a general analyst. On the other hand, a well-rounded FRM candidate with a firm grasp of valuation models could actually do very well in a strategic advisory field.

The CFA tends to lead in investment banking, equity research, and fund management. On the other hand, the FRMs work well in the internal audit teams, regulatory agencies, treasury departments, and fintech platforms where robust risk systems are an absolute uncompromising requirement.

So which stream suits you? Should you be inclined to look deep into analyzing company performance and crafting long-term strategies, then CFA could be a natural fit. FRM, on the other hand, could easily be your calling if you are interested in stress testing, risk modeling, or compliance architecture.

Study Commitment and Exam Rigor

The CFA program looks for candidates who are willing to wade through three levels and at least 300 hours per level of study. It covers an enormous syllabus, which can include financial reporting, derivatives, ethics, fixed income, etc. This makes it a program meant to last for many years.

The FRM, on the other hand, has two parts. The firs has the advantage of being short; however, it consists of some intense mathematics with a focus on risk management frameworks and modeling.

The other component is the issue of flexibility. CFA provides lower specialization, thus offering a greater view of finance. Therefore, it can be taken by students who are not yet sure what specialization to take. FRM, on the other hand, is more specialized and thus fantastic for professionals leaning on risk management.

A Changing Global Financial Environment

Companies all over the world are cushioning their financial infrastructure. Banks deploy AI to predict market anomalies, while more asset managers are hiring candidates with dual skills of being both strategists and risk managers. In this kind of environment, certified professionals are not just respected-they are indispensable.

This explains the rising demand for globally recognized programs that can be accessed locally. Programs integrating traditional finance theories and modern risk insights are preparing professionals for today's highly variable market setting.

Conclusion: Know Your Goal Before Choosing the Badge

The decision between the CFA and FRM is not a matter of which has more prestige. Instead, it really entails matching a certificate to the direction of an individual's career track.

Are you drawn more to investment portfolio building or defending against uncertainty? Performance or prediction? Both provide you with elite knowledge; the deciding factor is the goal you will be pursuing.

As the demand for hands-on, regionally accessible programs increases. One such program is the CFA training program in Boston, preparing finance professionals with a toolkit that allows them to prosper, not just in today's tumultuous markets but also in an ever-evolving world of finance.

0 notes

Text

assignment name: fantastic vista

tools: procreate, ipad

description: a redesigning of the “identogo” building in the style of cottagecore.

feedback: “cottagecore” is the romanticization of (mostly) european rural living. it is an amalgamation of several architectural styles, including the tudor style; arts and crafts architecture, such as the works of cfa voysey: norman and flemish vernacular architecture; and buildings with folly in pastoral style such as marie antoinette’s “hameau de la reine.” it frequently features the use of flowers, vines, shrubs, and the feeling of being enveloped by greenery.

reference images:

1 note

·

View note

Text

Top 10 highest paying jobs in the world 2024

Here is a list of the top 10 highest-paying jobs around the globe

The pursuit of lucrative careers often drives professional aspirations. With technological advancements and globalization reshaping industries, some professions command exceptional salaries that reflect their critical importance and specialized skill sets.

Whether you’re a seasoned professional seeking a career shift or a recent graduate planning your future, understanding which roles offer the highest financial rewards can guide your career decisions.

In this article, we’ll explore the top 10 highest-paying jobs around the globe, per report from Nexford.

1. Cardiologist

Role: Specializes in diagnosing and treating cardiovascular diseases.

Requirements: Bachelor’s degree; medical school; residency in internal medicine; board certification in cardiology.

Average Salary: $324,760

2. Surgeon

Role: Performs surgical procedures to treat diseases and conditions.

Requirements: Bachelor’s degree; medical school; residency; medical license; board certification.

Average Salary: $297,851

3. Psychiatrist

Role: Specializes in diagnosing and treating mental illnesses and emotional disorders.

Requirements: Bachelor’s degree; medical school; residency in psychiatry; medical license; board certification.

Average Salary: $255,812

4. Chief Executive Officer (CEO)

Role: Oversees company operations, makes major corporate decisions, and communicates with the board of directors.

Requirements: Bachelor’s degree in business or related field; advanced degrees like an MBA; extensive experience in leadership and strategic planning.

Average Salary: $197,747

5. Senior Software Engineer

Role: Designs, implements, and maintains complex software systems.

Requirements: Bachelor’s degree in computer science; expertise in programming languages like Java, Python, or C++; experience with frameworks and version control systems.

Average Salary: $194,220

6. Corporate Lawyer

Role: Provides legal advice and services to businesses on various legal matters.

Requirements: Bachelor’s degree; law school and JD; bar exam; specialization in corporate law.

Average Salary: $149,68

7. Investment Banker

Role: Facilitates financial transactions, advises on strategies, manages mergers, and raises capital.

Requirements: Bachelor’s degree in finance or related field; securities licenses; understanding of financial markets; certifications like CFA recommended.

Average Salary: $144,633

8. Cloud Architect

Role: Designs and manages cloud computing architecture.

Requirements: Bachelor’s degree in computer science or IT; relevant certifications (e.g., AWS, Azure); skills in IaC tools and cloud networking.

Average Salary: $144,000

9. Internet of Things (IoT) Architect

Role: Designs and implements the architecture of IoT systems.

Requirements: Bachelor’s degree in computer science or related field; proficiency in programming languages; knowledge of networking, embedded systems, and IoT security.

Average Salary: $131,646

10. Petroleum Engineer

Role: Specializes in the exploration, extraction, and production of oil and natural gas.

Requirements: Bachelor’s degree in petroleum engineering or related field; internships; knowledge of programming and simulation tools; certification.

Average Salary: $130,523

#Cardiologist#Surgeon#Psychiatrist#Chief Executive Officer#Senior Software Engineer#Corporate Lawyer#Investment Banker#Cloud Architect#Internet of Things (IoT) Architect#Petroleum Engineer#sage response#nigeria#likesforlike

0 notes

Text

Terracotta+

Using #sustainable materials like #terracotta in cooling devices and rooms during summers is an excellent #idea.

Since it's an easily available and sustainable material. Terracotta, which is a type of fired clay, has natural cooling properties and has been used traditionally in various cultures for its ability to moderate temperature.

#sustainable.

There are various applications where this rustic material is used.

-Use terracotta tiles on #floors and #walls to absorb heat during the day and radiate it back into the room at #night, providing a natural #cooling effect.

-Design #passive cooling systems using terracotta elements, such as evaporative cooling walls or towers.

-Integrate terracotta #louvers or #screens to provide shade and allow for natural ventilation, promoting airflow while minimizing direct #sunlight exposure.

-Create DIY #evaporative #coolers using terracotta pots. This involves placing water-absorbing terracotta pots in front of a #fan, allowing the breeze to evaporate water from the pots and cool the air.

-Consider combining terracotta with other materials in ceiling designs to enhance both aesthetic appeal and #thermalcomfort performance.

-Incorporate #green roofs with terracotta planters to introduce #vegetation, which aids in temperature regulation through natural insulation and evapotranspiration.

Combining traditional knowledge with modern design principles can result in effective and eco-friendly cooling solutions.

#terracotta #earthenware #art #architecture #sustainabledesign #sustainabledevelopment #lowcost #coolingsystem #facadelighting #landscape #planters #pots #flooring #wastemanagement #wasterecycling #carbonfootprint #netzero2050 #netzerocarbon #stone #clay #g20summit2023 #g20india #hydrocarbon #energysaving #energyefficiency #energymanagement #energyefficient #renewableenergy #renewablerevolution

Tharun Sai Sameer Z Ar. June Chow Emmanuel Egbuchulam [3D Artist] Mohammad Reza Akbari Ayushi Yadav Adil Aboobakar, CFA Azhar Fatmi artnet Sustainable Smart City Sustainable Design Network Mahindra Susten Solar O/M Team Shop Sustentável Sabu Francis Rahul Tyagi Turn The Tables Architects ARCHITECT@WORK New Delhi Municipal Council (NDMC) Noida International Airport NOIDA POWER COMPANY LIMITED Tata Neu Renewable Power Vipul Organics Limited Shell University of Strathclyde Sonali Bhagwati Diamond Schmitt Zaha Hadid Architects Nitin Gupta 42mm Architecture Morphogenesis Architecture

#architecture#art#design#interior design#landscape#nature#project#photography#sustainable#architectdesign#terracotta

1 note

·

View note

Text

Discovering Dori: Cultural Odyssey

Welcome to the enchanting city of Dori, a true treasure nestled in the heart of Burkina Faso. This vibrant city, filled with rich cultural heritage and breathtaking landscapes, promises an enthralling adventure for travel enthusiasts keen on an authentic experience. Get lost in the captivating local culture, treat your palate to delightful local cuisine, and embark on adrenaline-pumping activities that are sure to leave you captivated. Join us in uncovering the wonders of this hidden gem.

When to Go

Dori is a city that enjoys a tropical climate, marked by a clear distinction between the dry and rainy seasons. To fully enjoy the beauty of the city, plan your trip during the dry season, usually from October to April. This period offers a comfortable temperature range of 25 to 30 degrees Celsius, ideal for outdoor sightseeing and exploration.

How to Get There

Getting to Dori is an adventure on its own. The city is well-connected by road, and you can either hire a car or take a taxi from Ouagadougou, the capital of Burkina Faso. The journey covers an approximate distance of 400 kilometers, typically taking around 7 hours. If you prefer a quicker alternative, domestic flights are available from Ouagadougou to the Dori Airport.

Where to Stay

Dori boasts a range of accommodations suited to every traveler’s needs, from quaint guesthouses to beautiful eco-lodges. For an immersive experience, try out a traditional mud-brick house, where you can enjoy the unique architecture and experience the traditional lifestyle firsthand.

What to Do and See

- Immerse Yourself in Vibrant Culture: Experience Dori’s heart by immersing yourself in the local culture. Visit the bustling Dori market, where a riot of colors, aromatic spices, and traditional crafts beckon. Engage with the friendly locals, understand their customs, indulge in traditional music and dance performances, and let their warmth and hospitality mesmerize you. - Gastronomic Delights: Dori’s cuisine is a true reflection of its rich history and diverse cultural influences. Feast on delightful local delicacies such as tô (a thick millet or corn porridge), riz gras (a flavorful rice dish), and the famous poyo (fermented millet beer). Traverse local food stalls and restaurants to savor an array of vibrant flavors that will tantalize your taste buds. - Embark on Adventurous Excursions: Dori offers a feast for thrill-seekers with a spectrum of exciting activities. Explore the striking red cliffs of Gobnangou, delve into hidden caves adorned with ancient rock paintings, hike through the wildlife-rich Arli National Park, and witness a magical sunset over the Sahelian sand dunes. - Connect with History: Uncover Dori’s historical significance by visiting the Grand Mosque, renowned for its architectural splendor. Wander through the ancient ruins of Loropéni, a UNESCO World Heritage Site, and marvel at the well-preserved stone walls that whisper tales of the Mossi Kingdom.

Tips for a Memorable Visit

- Dress modestly and adhere to local customs and traditions. Always seek permission before photographing people. - Learn a few basic French phrases to enhance your interaction with the locals. - Stay hydrated and protect yourself from the sun by using sunscreen, wearing a hat, and carrying a water bottle.

Money and Nightlife

The official currency is the West African CFA franc. Carry enough cash as not all establishments accept card payments. As the sun sets, Dori comes to life with energetic musical performances filled with traditional music, dance, and the infectious energy of the locals.

Transport and Shopping

Getting around Dori is best done by hiring a local taxi or riding a motorbike, known as a zemidjan. Always negotiate the fare before starting your journey. Don’t miss exploring the local markets for unique handicrafts, woven fabrics, and traditional jewelry, perfect as souvenirs of your memorable stay in Dori.

Conclusion

Dori, with its vibrant culture, tantalizing cuisine, and exciting adventures, offers an unforgettable travel experience. Dive deep into the cultural fabric, savor the traditional cuisine, and embark on exhilarating adventures that stir your wanderlust. With open arms, Dori, the hidden gem of Burkina Faso, invites you to a world of breathtaking beauty and heartwarming experiences. Read the full article

1 note

·

View note

Text

Top 20 Toughest Exams in World

Here is a list of some of the toughest exams in world, based on various factors such as difficulty level, competition, and passing rate:

United States Medical Licensing Examination (USMLE)

Chartered Financial Analyst (CFA)

Certified Public Accountant (CPA)

Graduate Record Examination (GRE)

Law School Admission Test (LSAT)

National Council Licensure Examination (NCLEX) for Registered Nurses (RN)

Graduate Management Admission Test (GMAT)

International English Language Testing System (IELTS)

Series 7 Exam (FINRA General Securities Representative Exam)

Joint Entrance Examination (JEE)

Fundamentals of Engineering (FE) Exam

Certified Information Systems Security Professional (CISSP)

Actuarial Examinations

Architecture Registration Exam (ARE)

The Defense Language Aptitude Battery (DLAB)

Test of English as a Foreign Language (TOEFL)

Uniform CPA Examination

Armed Services Vocational Aptitude Battery (ASVAB)

The California Bar Exam

Civil Service Examination

United States Medical Licensing Examination (USMLE)

The United States Medical Licensing Examination (USMLE) is a three-step examination for medical licensure in the United States. It is sponsored by the Federation of State Medical Boards (FSMB) and the National Board of Medical Examiners (NBME). The USMLE assesses a physician's ability to apply knowledge, concepts, and principles, and to demonstrate fundamental patient-centred skills, that are important in health and disease and constitute the basis of safe and effective patient care.

Step 1 of the USMLE focuses on the basic sciences and covers anatomy, physiology, biochemistry, microbiology, pharmacology, and pathology. Step 2 CK (Clinical Knowledge) assesses the medical knowledge and clinical skills necessary to provide patient care under supervision. Step 2 CS (Clinical Skills) assesses the ability of a physician to gather and interpret information and to communicate effectively with patients, their families, and healthcare professionals. Step 3 of the USMLE evaluates a physician's ability to apply medical knowledge and understanding of biomedical and clinical science essential for the unsupervised practice of medicine.

The USMLE is widely regarded as one of the toughest exams in the world, and its passing is mandatory for medical students seeking licensure to practice medicine in the United States.

Chartered Financial Analyst (CFA)

The Chartered Financial Analyst (CFA) program is a professional designation offered by the CFA Institute to finance and investment professionals. The CFA program is considered one of the most challenging and prestigious designations in the financial industry, and it is recognized globally as a benchmark of excellence.

To become a CFA charter holder, candidates must pass three levels of exams, each of which covers a specific body of knowledge in the field of finance and investments. The exams are designed to test the candidate's knowledge of investment management, financial analysis, portfolio management, and ethical and professional standards.

The CFA exams are renowned for their difficulty, with a low passing rate, and are considered some of the toughest exams in the world. The curriculum covers a broad range of topics, including economics, financial reporting and analysis, equity and fixed-income investments, alternative investments, and portfolio management.

In addition to passing the exams, candidates must also meet the CFA Institute's professional and ethical conduct requirements, including relevant work experience and continuing professional development. Obtaining the CFA designation requires a significant commitment of time and effort, and it is widely recognized as a hallmark of achievement in the financial industry.

Certified Public Accountant (CPA)

The Certified Public Accountant (CPA) is a professional designation in the field of accounting that is awarded by the American Institute of Certified Public Accountants (AICPA) to individuals who pass the Uniform CPA Examination and meet other requirements set by the state boards of accountancy.

The CPA Exam is widely regarded as one of the toughest professional exams, and it covers a wide range of topics, including auditing and attestation, financial accounting and reporting, regulation, and business environment and concepts. The exam is designed to test the candidate's knowledge of accounting principles, regulations, and practices, as well as their ability to apply that knowledge to real-world scenarios.

Graduate Record Examination (GRE)

The Graduate Record Examination (GRE) is a standardized test that is used by graduate schools and business schools as part of the admission process. The GRE is designed to measure verbal reasoning, quantitative reasoning, and analytical writing skills that are acquired over a long period of time and that are not related to any specific field of study.

The GRE is a computer-based test that is offered year-round at testing centres around the world. The test is divided into three sections: Verbal Reasoning, Quantitative Reasoning, and Analytical Writing. The Verbal and Quantitative Reasoning sections each have a score range of 130 to 170, in one-point increments. The Analytical Writing section is scored on a scale of 0 to 6, in half-point increments.

The GRE is considered to be a challenging exam, and it requires a significant amount of preparation, including a thorough review of math concepts, vocabulary, and essay-writing techniques. The Verbal and Quantitative Reasoning sections of the GRE are designed to test a broad range of skills, and they require a strong foundation in mathematics, vocabulary, and critical thinking. The Analytical Writing section requires strong writing skills, including the ability to articulate complex ideas clearly and concisely.

Law School Admission Test (LSAT)

The Law School Admission Test (LSAT) is a standardized test used by law schools in the United States and Canada as part of the admission process. The LSAT is designed to assess the critical reading and analytical skills that are necessary for success in law school and in the legal profession.

The LSAT is a half-day, standardized test that is administered four times a year at designated testing centres around the world. The test consists of multiple-choice questions and an unscored writing sample. The multiple-choice section of the LSAT is divided into four parts: Reading Comprehension, Analytical Reasoning, Logical Reasoning, and an unscored experimental section.

The LSAT is widely considered to be one of the toughest standardized tests, and it requires a significant amount of preparation and practice. The test is designed to measure a broad range of skills, including critical reading, analytical reasoning, and logical thinking, and it requires a strong foundation in verbal and analytical skills.

National Council Licensure Examination (NCLEX) for Registered Nurses (RN)

The National Council Licensure Examination (NCLEX) is a standardized exam that is used to evaluate the competency of individuals seeking to become registered nurses (RNs) in the United States. The NCLEX is administered by the National Council of State Boards of Nursing (NCSBN) and is used by state boards of nursing to determine whether an individual is eligible for licensure as an RN.

The NCLEX is a computer-based exam that is designed to test a candidate's knowledge and understanding of nursing practices and procedures. The exam covers a wide range of topics, including pharmacology, health promotion and maintenance, management of care, and reduction of risk potential.

Graduate Management Admission Test (GMAT)

The Graduate Management Admission Test (GMAT) is a standardized test used by graduate business schools as part of the admission process. The GMAT is designed to measure a candidate's skills in critical thinking, problem-solving, and data analysis, which are essential for success in a graduate business program.

The GMAT is a computer-based test that is administered year-round at designated testing centers around the world. The test consists of four sections: Verbal Reasoning, Quantitative Reasoning, Integrated Reasoning, and an Analytical Writing Assessment. The Verbal and Quantitative Reasoning sections each have a score range of 0 to 60, and the Integrated Reasoning and Analytical Writing sections each have a score range of 0 to 8.

International English Language Testing System (IELTS)

The International English Language Testing System (IELTS) is a standardized test used to assess the English language proficiency of individuals who plan to study or work in English-speaking countries. The test is designed to measure an individual's ability to understand and use the English language in academic and professional settings.

The IELTS is offered in two formats: the Academic format, which is intended for individuals who plan to study at a higher education institution, and the General Training format, which is intended for individuals who plan to work or undertake training in an English-speaking country.

The IELTS test consists of four components: Listening, Reading, Writing, and Speaking. The Listening, Reading, and Writing sections are completed in one sitting, while the Speaking section is conducted with a trained examiner on a separate day. The test takes a total of 2 hours and 45 minutes to complete.

The IELTS is considered to be a challenging test, and it requires a significant amount of preparation and practice. The test covers a wide range of topics and requires a strong understanding of grammar, vocabulary, and comprehension skills.

The IELTS is widely recognized by universities, employers, and governments around the world, and it is considered an important factor in the admission process for many academic and professional programs. A strong score on the IELTS can demonstrate an individual's ability to communicate effectively in English, which can be essential for success in a variety of academic and professional settings.

Series 7 Exam (FINRA General Securities Representative Exam)

The Series 7 Exam, also known as the FINRA General Securities Representative Exam, is a standardized test administered by the Financial Industry Regulatory Authority (FINRA) in the United States. The Series 7 Exam is required for individuals who wish to become registered representatives of broker-dealers and sell securities such as stocks, bonds, and mutual funds.

The Series 7 Exam is a computer-based test that covers a wide range of topics related to the securities industry, including types of securities, federal securities laws, the structure of the securities industry, investment strategies, and ethical and professional practices. The test consists of 125 multiple-choice questions, and test-takers have 225 minutes to complete the exam.

The Series 7 Exam is considered to be a challenging test, and it requires a significant amount of preparation and study. Individuals must complete a training program and pass the Series 7 Exam before they are eligible to sell securities in the United States.

Joint Entrance Examination (JEE)

The Joint Entrance Examination (JEE) is a competitive entrance exam in India for admission to undergraduate engineering programs offered by top engineering colleges across the country, including the Indian Institutes of Technology (IITs).

The JEE consists of two exams: JEE Main and JEE Advanced. JEE Main is the first stage of the entrance exam, and it is open to all candidates who have completed their Class 12 (or equivalent) exams. The top performers on JEE Main are eligible to take JEE Advanced, which is the second and final stage of the exam.

JEE Main is a computer-based test that assesses a candidate's understanding of physics, chemistry, and mathematics. The exam consists of 90 multiple-choice questions, and test-takers have three hours to complete the exam.

Fundamentals of Engineering (FE) Exam

The Fundamentals of Engineering (FE) Exam is a standardized test for individuals who are in the early stages of their engineering careers. The FE Exam is the first step toward becoming a licensed Professional Engineer (PE) in the United States.

The FE Exam is designed to assess a candidate's understanding of basic engineering principles, including mathematics, science, engineering fundamentals, and engineering design. The exam covers a wide range of topics, including:

Mathematics (e.g. calculus, differential equations)

Chemical engineering

Civil engineering

Electrical engineering

Environmental engineering

Mechanical engineering

The FE Exam is a computer-based test, and test-takers have six hours to complete the exam. The exam consists of 110 multiple-choice questions, and it is offered year-round at Pearson VUE testing centres in the United States and internationally.

The FE Exam is considered to be a challenging test, and it requires a significant amount of preparation and study. The exam covers a wide range of topics, and test-takers must have a strong understanding of basic engineering principles and their practical applications.

Passing the FE Exam is an important step toward becoming a licensed PE, and it demonstrates a candidate's mastery of the fundamental principles of engineering. It also demonstrates a candidate's commitment to their chosen profession and their ability to apply their knowledge to real-world engineering problems.

Certified Information Systems Security Professional (CISSP)

The Certified Information Systems Security Professional (CISSP) is a globally recognized certification for information security professionals. The CISSP is administered by (ISC)², a non-profit organization that provides education and certification programs in information security.

The CISSP certification is designed to assess a candidate's knowledge and understanding of information security, including:

Security and risk management

Asset security

Security engineering

Communications and network security

Identity and access management

Security assessment and testing

Security operations

Software development security

To become a CISSP-certified professional, individuals must have at least five years of professional experience in at least two of the eight domains of information security. The CISSP exam consists of 250 multiple-choice questions and is six hours long.

Actuarial Examinations

Actuarial examinations are a series of exams that aspiring actuaries must pass in order to become fully qualified professionals. Actuaries are professionals who use mathematics, statistics, and financial theory to study and solve problems related to insurance and other financial risks.

The actuarial examinations are administered by actuarial organizations, such as the Society of Actuaries (SOA) and the Casualty Actuarial Society (CAS). The exams cover a wide range of topics, including probability, statistics, financial mathematics, and the financial and actuarial models used in the insurance industry.

The actuarial exams are considered to be challenging and demanding, requiring extensive preparation and study. The exams are designed to test a candidate's knowledge and understanding of the underlying principles and concepts of actuarial science.

Architecture Registration Exam (ARE)

The Architecture Registration Exam (ARE) is a standardized exam for individuals seeking to become licensed architects in the United States. The ARE is administered by the National Council of Architectural Registration Boards (NCARB) and is required for licensure in most states.

The ARE covers a wide range of topics related to the practice of architecture, including:

Project management and practice

Programming and analysis

Project planning and design

Construction documents and services

Building systems

Site planning and design

The ARE is a computer-based exam, and test-takers have five hours to complete each division of the exam. There are currently seven divisions of the ARE, each of which covers a specific aspect of the practice of architecture.

The Defense Language Aptitude Battery (DLAB)

The Defense Language Aptitude Battery (DLAB) is a standardized test administered by the United States Department of Defense to assess an individual's aptitude for learning a foreign language. The DLAB is used to determine an individual's suitability for learning a foreign language as part of their military duties.

The DLAB is a multiple-choice exam that assesses an individual's ability to recognize sounds, learn vocabulary, and understand grammar patterns in a foreign language. The test measures a person's ability to learn a language, rather than their proficiency in a specific language.

The DLAB is widely recognized as a challenging and demanding exam, and it requires individuals to have a high level of aptitude for learning foreign languages. The DLAB is designed to assess an individual's ability to learn languages quickly, and it is used to determine which military personnel are best suited for language-related duties.

Test of English as a Foreign Language (TOEFL)

The Test of English as a Foreign Language (TOEFL) is a standardized exam designed to assess the English proficiency of non-native speakers of English. The TOEFL is widely recognized and accepted by colleges and universities, government agencies, and businesses around the world.

The TOEFL assesses an individual's ability to understand and use English in an academic setting. The exam measures a candidate's abilities in reading, writing, speaking, and listening in English, and it provides a comprehensive assessment of their English language skills.

The TOEFL is a computer-based exam, and it typically takes four hours to complete. The exam consists of four sections: Reading, Listening, Speaking, and Writing. The questions in each section are designed to assess different aspects of English proficiency, and they are designed to simulate real-life academic and linguistic scenarios.

Uniform CPA Examination

The Uniform CPA Exam, also known as the Certified Public Accountant (CPA) Exam, is a standardized exam that assesses the knowledge and skills of individuals seeking to become licensed Certified Public Accountants (CPAs) in the United States. The CPA Exam is developed and administered by the American Institute of Certified Public Accountants (AICPA) in partnership with the National Association of State Boards of Accountancy (NASBA).

The CPA Exam is a computer-based exam, and it consists of four sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). The questions in each section are designed to test a candidate's knowledge of the principles and practices of accounting and financial reporting, as well as their ability to apply this knowledge to real-world situations.

Armed Services Vocational Aptitude Battery (ASVAB)

The Armed Services Vocational Aptitude Battery (ASVAB) is a standardized exam that is used to assess the knowledge and skills of individuals who are interested in enlisting in the United States military. The ASVAB is administered by the Department of Defense, and it is used to determine an individual's aptitude for various military occupations.

The ASVAB is a multiple-choice exam that consists of ten subtests that cover a range of subjects, including mathematics, verbal reasoning, and science. The subtests are designed to assess an individual's abilities in areas that are relevant to military occupations, such as mechanical comprehension, spatial reasoning, and arithmetic reasoning.

The ASVAB is considered to be a challenging and demanding exam, and it requires individuals to have a high level of knowledge and skills in a variety of subjects. The ASVAB is widely recognized and respected in the military, and it is a valuable asset for individuals who are seeking to enlist in the military and pursue a career in the military.

The California Bar Exam

The California Bar Exam is a standardized exam that is required for individuals who are seeking to become licensed to practice law in the state of California. The exam is administered by the State Bar of California, and it is used to assess an individual's knowledge of California law as well as their ability to apply that knowledge to real-world situations.

The California Bar Exam is a two-day exam that consists of the following components: the first day is the written portion, which includes six one-hour essays and two three-hour performance tests, and the second day is the multiple-choice portion, known as the Multistate Bar Examination (MBE). The MBE covers subjects such as contracts, torts, property, evidence, and constitutional law.

The California Bar Exam is considered to be a challenging and demanding exam, and it requires individuals to have a comprehensive understanding of California law as well as the skills necessary to apply that knowledge to real-world situations. The California Bar Exam is widely recognized and respected in the legal community, and it is a valuable asset for individuals who are seeking to become licensed to practice law in California.

Civil Service Examination

The Civil Service Examination, also known as the Civil Service Exam, is a standardized test used to assess the eligibility of individuals for certain civil service positions in many countries, including the Philippines, India, and the United States. The test is designed to measure an individual's general knowledge, skills, and aptitudes that are relevant to the position they are seeking.

In the Philippines, the Civil Service Examination is administered by the Civil Service Commission and is required for individuals who are seeking to obtain a position in the Philippine government. The examination covers a range of subjects, including general knowledge, English proficiency, and specific subject matter related to the position being sought.

In India, the Civil Service Examination has also known as the Indian Administrative Service (IAS) exam and is conducted by the Union Public Service Commission (UPSC). The exam is considered to be one of the toughest and most competitive exams in India, and it is used to determine eligibility for various high-level positions in the Indian government.

In the United States, the Civil Service Examination is used by federal, state, and local government agencies to assess the eligibility of individuals for certain civil service positions. The examination can cover a range of subjects, including general knowledge, English proficiency, and specific subject matter related to the position being sought.

The Civil Service Examination is considered to be a challenging and demanding exam, and it requires individuals to have a strong general knowledge, good English proficiency, and the necessary skills and aptitudes for the position they are seeking

Note that this list is subjective and the difficulty of an exam may vary depending on an individual's background and abilities.

Originally posted on - LinkedIn

#exam#world#toughest#toughest exam#toughest exams#toughest exam in world#education#technical#article#tutuorial

4 notes

·

View notes

Photo

SOHO Studio Office Call 8888918229 #luxuryoffice #studio #puneblogger #dubailife #dubai #luxurylife #consulting #chartedaccountant #cfa #architecture www.nimbleland.co.in (at EON IT Park - Kharadi) https://www.instagram.com/p/Bz7H5xopmck/?igshid=a5q6r9fuca0e

#luxuryoffice#studio#puneblogger#dubailife#dubai#luxurylife#consulting#chartedaccountant#cfa#architecture

0 notes

Text

#Sénégal #Pétrole #Économie #Sangomar L'exploitation du champ pétrolier de Sangomar marque une étape décisive pour l'économie nationale, avec des volumes de production qui dépassent les prévisions initiales. Les données indiquent une extraction de près de 17 millions de barils pour l'année 2024, avec une projection ascendante estimée à plus de 30 millions de barils pour l'exercice suivant. Cette dynamique de production, qui a déjà injecté des centaines de milliards de francs CFA dans les coffres de l'État au début de l'année 2025, positionne le pays devant une opportunité de développement sans précédent. La manne financière issue de cette ressource naturelle est considérable et porte en elle la promesse d'une transformation structurelle profonde, à condition que les revenus soient judicieusement orientés vers des projets porteurs de croissance durable et inclusive pour l'ensemble de la population. Face à cette nouvelle ère de prospérité, la principale interrogation réside dans la capacité des institutions à orchestrer une gouvernance exemplaire. La gestion des revenus pétroliers requiert une transparence absolue et une rigueur infaillible pour déjouer les risques souvent associés à une richesse soudaine. L'enjeu est de taille : il s'agit de convertir cette richesse brute en un capital productif pérenne, en investissements stratégiques dans les infrastructures, l'éducation, la santé et la diversification économique. La mise en place de mécanismes de contrôle robustes et de reddition de comptes est impérative pour garantir que chaque franc généré contribue effectivement au progrès collectif et préserve le pays des écueils de la dépendance aux hydrocarbures, un phénomène observé dans d'autres nations productrices. La réflexion stratégique s'oriente vers la création d'instruments financiers dédiés, tels que des fonds souverains, destinés à préserver une partie de cette richesse pour les générations futures et à stabiliser l'économie face à la volatilité des marchés mondiaux. Parallèlement, une question fondamentale demeure celle de la valorisation locale de la ressource. Le développement d'une industrie de raffinage nationale est une nécessité économique criante. Une telle orientation permettrait non seulement de satisfaire la demande énergétique intérieure à moindre coût, mais aussi de créer une chaîne de valeur ajoutée locale, génératrice d'emplois qualifiés et de nouvelles compétences techniques, maximisant ainsi les retombées positives de l'exploitation pétrolière sur le tissu économique national. Le contexte international et les relations avec les partenaires privés constituent le quatrième pilier de cette nouvelle architecture économique. Le différend fiscal qui a récemment émergé avec l'opérateur principal du gisement met en lumière la complexité des enjeux et la nécessité d'une diplomatie économique avisée. Il est crucial pour l'État de défendre fermement ses intérêts souverains et d'assurer une juste répartition des revenus, tout en maintenant un climat de confiance et de sécurité juridique indispensable pour attirer et conserver les investissements étrangers. La capacité du pays à naviguer avec habileté dans ces négociations déterminera sa crédibilité sur la scène internationale et sa faculté à bâtir des partenariats équilibrés et mutuellement bénéfiques sur le long terme. Read the full article

0 notes

Text

CFA Meets Fintech: Why Charterholders Are Thriving in the Age of Disruption

An earthquake in the world of finance: We witnessed the emergence of AI-based trading platforms and DeFi, completely changing the old order. One segment of finance professionals continues growing far above the average: the CFA charterholders.

What makes them so special, you ask? Perhaps a rare combination of technical aptitude, ethical moorings, and strategic outlook. While fintech metamorphoses the traditional roles, CFA charterholders are not just accelerating ahead-they are the changemakers.

Where Finance and Tech Conjoin

Words coined, or better jargon; truely, these invective measures would soon rectify the investment, lending, and analysis financial landscape. Billions in assets are managed by robo-advisors, blockchain propelled the transparency revolution in transactions and AI models are predicting market shifts faster than anything ever.

This innovation wave, therefore, requires people who can unlock complex data streams, interpret fiduciary standards, and make informed decisions in a hazy scene. In walks the CFA charter.

They offer more than just technical expertise; they also train in ethical reasoning, risk analysis, and long-term investment approaches that smooth operations on the far side of this uncertain technology horizon. Their responsibilities are rapidly expanding, from helping companies craft compliant DeFi models to overlooking the operation of AI-powered investment platforms.

The CFA Charter: A Strategic Fintech Asset

Due to changes in industry demand, the CFA curriculum has also adapted. In recent years, modules on fintech, machine learning, and alternative data have been added—ensuring charterholders are fluent in the tools shaping tomorrow's finance.

A 2024 report by the research firm Finextra showed that firms valued CFA charterholders for roles in fintech risk, product development, and digital portfolio management. They were once largely relegated to courses of study such as investment banking or asset management; today they have branched into tech startups, regulatory agencies, and digital asset platforms.

And that trend is no longer a world trend; these cities host it. This has, for example, produced interest in specialized education from the increasing demand for finance professionals set within innovative ecosystems. Those inclined towards a finance career now fill the CFA courses in Boston, where the city provides a unique blend of forging ties between finance and the avant-garde tech sector.

Most Fresh Momentum: What New In 2025?

Well, we are observing an already unusual turn in a new year. That's what a recent Nasdaq report shouts out-how fintech-focused investment firms seem to be going crazy recruiting cross-disciplinary talent. Hot trends include AI-enhanced risk assessment, tokenized asset strategies, and ESG-centric robo platforms-all now being filled hot by charterholders in roles supporting those kinds of endeavors.

Meanwhile, CFA Institute is churning out resource after resource for members to learn about blockchain architecture and ethical AI practice, as demand continues to grow. Charterholders can now get fintech micro-credentials and global event access on digital currencies and smart contracts.

What Charterholder Still Wins

Human judgment as matched by CFA charter within a world continuously threatened by automation displacing traditional roles has never been more important. Machine learning can process data to a small extent-but it cannot distill the gray areas of systemic risk, interpret meaning from seasoned intuition, and consider shifts in geopolitics.

CFA charterholders know how to ask questions about data rather than just report it. This reflex, however, in conjunction to their understanding of behavioral paradigms and capital markets, makes them essential navigators in a contemporary much-more tangled ecosystem.

Conclusion

Certainly, the fintech revolution will not stop here-and this is, of course, a nice thing for the evolving CFA charterholder. No more than the world where boundaries between finance and technology disappear tend to be sturdy.

And given the regions where this mix would especially be evident, such as the East Coast-that indeed was where finance and innovation co-existed: most of the professionals keen on availing themselves of such growth in the reaching out through structured learning options like CFA Training Program in Boston, where conventional finance meets much of tech-driven market reality.

Charterholders are not only withstanding disruption: they have turned the concept inside out regarding what it means to lead through it.

0 notes

Text

Alone, Together | My End and My Beginning: Epilogue 2 | Morgan Rielly

WARNING: THIS POST CONTAINS AN IMAGE THAT I HAVE MADE/DOCTORED SO THAT IT LOOKS LIKE IT’S FROM A MAGAZINE CALLED “TORONTO LIFE” (A REAL MAGAZINE) THAT CONTAINS A FACE CLAIM FOR BEE. IF YOU DON’T WANT TO SEE IT, SKIP PAST! IT’S A QUARTER OF A WAY THROUGH THE EPILOGUE.

July 2022

“I still can’t believe you’re engaaaaaaaaaaaaaged,” Angie wrapped her arms around Bee for what seemed like the umpteenth time that night as they stood out on the deck. Rocco and Clarette had thrown Morgan and Bee an engagement party at their house and had somehow invited the whole team and some of Bee’s work colleagues. Clarette was in heaven hosting for everyone. The team was in heaven gorging on the Italian food Rocco and Clarette catered in. Bee was sure Rocco had showed someone his vegetable garden.

“Can you believe?” Bee mimicked Jonathan Van Ness dramatically. “It’s finally happening.”

“It’s happening when it’s supposed to be happening,” Angie said. “You lived your life first. You accomplished your professional goals first. It was important for you to accomplish those things before marriage. You’re a fucking CFA, Bee. Morgan had better wife’d you up. Not like he can do any better.”

“Hey! That’s my fiancé you’re talking about!” Bee giggled.

“I know. And I love him. But it’s true.”

Bee rolled her eyes playfully at Angie’s words. “He bought us a house in Forest Hill, Angie.”

“You’re going to live in Forest Hill, Bee,” Angie gritted her teeth into a facetious smile. “Mason and I will be there every weekend.”

“Obviously.”

“Stealing all your food.”

“Of course.”

“Swimming in your pool. If you guys build a pool.”

“Better start buying more bathing suits.”

“Our kids will be best friends just like we are.”

Bee smiled. “Naturally. Like there’s any other option.”

***

***

December 2022

“Is there a way I can keep all these flowers after the wedding? Fuck,” Angie asked as she flipped through Rachel Clingen’s lookbook and the sketches that had been prepared for Bee. Bee had gone to see her a few weeks ago with Aryne, who was adamant that Rachel to the floral décor for the wedding. She didn’t disappoint. “This is going to look stunning.”

“I know, right? I can’t believe how good she is.”

“She’s great. It’s literally everything you said you wanted and she somehow made it come to life. And in the Grand Banking Hall? All that beautiful old architecture and then this? Literally every magazine should be begging you to profile it because it’s gonna look beautiful.”

Bee couldn’t help but chuckle. She had a much better relationship with the media now than she did when she first started dating Morgan, and she was much more comfortable around photographers or the press – especially in terms of hers or the Lady Leafs charity work – but she was always, always a bit weary. She wouldn’t want people she didn’t know at her wedding. A magazine had already approached her asking to profile the interiors of their house once it was completed, but she politely declined. Maybe she’d change her mind in the future, but she didn’t think so. “Rachel’s gonna put it up on her website. So is Mango – the photographers. I think that’s enough.”

“I think I’m gonna need a giant photo too to hang over my fireplace.”

“I think we should blow up this one instead,” Bee smiled, digging into her purse to retrieve the envelope she was planning to give to Angie this whole time.

Angie looked at her weirdly. She took the envelope from her, opening in slowly, only to reveal a photograph – perhaps the most important photograph: the first one they ever took together. It was in university, during a exam study session at E.J. Pratt Library. There was a stack of books beside both Bee and Angie. A girl they were friends with at the time had taken it, though they weren’t in touch now. “Oh my God,” Angie snorted as she inspected the photograph. “Look how awful my curls looked.”

“I still fell in love with you,” Bee winked.

Angie gave her another look. “So did Mason, surprisingly,” she quipped. “God, we were so young. We’re only eighteen here!”

“Remember how we stayed so late they kicked us out because they were closing?” Bee asked. Angie nodded her head. “Do you remember what you said to me after we packed up?”

Angie thought back. Bee watched as the gears in her head began to shift, and as the realization dawned on her, her brows furrowed. “I said ‘When I’m your maid of honour, I’m going to tell everyone the story of how I helped you pass this exam’,” she said.

Bee smiled. “So are you ready to do that or what?”

Angie pursed her lips to keep from crying, but when she looked at Bee, Bee could see a tear in her eye. “Obviously.”

***

“Hi my beautiful Isabella! Hi! Hi!” Bee smiled wide as she saw Isabella chilling in her Bumbo on the counter. “Are you happy to see Tia Bee?”

“BAH!” Isabella Tavares babbled happily, smiling. “Bah bah bah!”

“Bah bah bah!” Bee mimicked. “How’s my darling princess?”

“Darling princess is fine now that she’s burped,” Aryne smiled as she finished folding a dishtowel and lay it back on the counter. “Jace! Come say hi to Tia Bee!”

Bee heard the quick flutter of his steps as he ran to her from the family room. “Hi Tia Bee!” he screamed loudly, crashing into her legs and giving her a hug. Bee picked him up and held him in her arms as she kissed him dramatically all over his face, causing him to giggle profusely.

“How’s my prince doing?”

“Good.”

“What are you playing?”

“I play with my Lego.”

“What are you building?”

“I build a car.”

“Can you finish building your car and then show me?”

“Okay!” he said, wigging out of her arms and running back to his place on the carpet in the family room.

Bee turned back to Aryne, who was watching the whole encounter unfold. “What’s that in your hand?” Aryne asked.

“Oh, I got your mail for you,” Bee said absent-mindedly, handing her the envelope. “Just one thing in there.”

“Oh, thanks,” Aryne said as she began to tear it open. Bee looked on as she did, a small smile on her face. Like clockwork, Aryne’s eyes furrowed as she saw what was in the envelope: a card that had the first picture taken of them together, from a game at Scotiabank Arena. “What’s this?”

“Will you open it?”

Aryne flipped the card open on command, reading the words that Bee wrote. The more she read, the more her eyes began to well up with tears. “You want me to be your bridesmaid?”

“Of course I do,” Bee said softly. “I can’t imagine you not being up there with me, Aryne.”

Aryne began crying. She outstretched her arms as she walked around the island to hug Bee, squeezing her tightly. “I love you so much.”

***

“Oh…oh, Briony,” Shirley gasped as Bee walked out in the last dress. It was the first one they had chosen, but the last one Bee was trying on. From beside Shirley, Clarette put her hands over her mouth. “Briony, I…I’m speechless.”

“It’s looks good?” she asked nervously, patting down the delicate lace.

“It’s stunning,” Shirley nodded. “It’s perfect, sweetheart.”

“It’s the one,” Clarette said. “It’s so beautiful, mignonette. The lace is exquisite. The…the…everything.”

Bee turned to Angie, only to see her eyes red with tears. “What do you think?”

Angie shook her head, unable to find the words. She continued to shake her head until she could. “You’re the most beautiful thing I’ve ever seen,” she said between sniffles. “Morgan’s gonna absolutely die.”

Bee turned around, looking at herself in the full-length mirror, most of the most important women in her life behind her. She saw the lace draped over her body and sprawling train behind her, delicate but elegant. The v-neck framed her chest and shoulders perfectly, the fabric draping over her hips. As she stared at herself, she pictured herself holding a bouquet. She pictured herself at the end of an aisle, a crowd of people standing in front of her. When the sales associate swooped in and placed a veil on her, the vision was complete. She pictured herself walking down the aisle. She pictured herself walking, making eye contact with the guests. She pictured Morgan at the top of the aisle staring back at her, smiling. She pictured Angie smiling. Aryne smiling.

“Is this the dress?” the sales associate asked.

Bee smiled. This is the dress.”

February 2023

“Hey Andy?”

“Yeah Bee?”

“Do you mind if I ask you something?”

“Of course. What is it?”

“Can…can you sit down?”

Andy stopped moving. He had been preparing a glass of water for himself, but he stopped as he looked at Bee and recognized how serious her tone was. “Is everything alright?”

“Everything’s fine, I just…I just want you to sit,” she repeated, going so far as to move the chair so he could follow her command.

He sat down slowly. “What’s going on?”

“Um. So listen,” she began nervously. “I know…you know…you know that I don’t have a dad – well I have a dad, I just don’t know my dad – and, well – I, uh, I – God, this isn’t coming out right at all,” she shook her head, her thoughts getting the best of her.

“Bee, calm down, it’s alright,” Andy said. “It’s just me.”

She nodded her head and took a deep breath. “You know how much I love you, and how much I appreciate you being there for me since the beginning of mine and Morgan’s relationship. And, well, I’m doing the father-daughter dance with Rocco during the reception, but I wanted you – I would love it if you could walk me down the aisle.”

“Oh, Bee…” Andy cooed, a giant smile overtaking his face. “Of course I’ll walk you down the aisle.”

“Really?”

“Are you kidding? Of course,” he repeated, reaching out to hug her. “I have two sons, Bee. I never thought I’d be able to get the opportunity. And now you’re able to give it to me.”

Saturday July 22 2023

CLICK HERE TO SEE MORGAN AND BEE’S WEDDING

“Be careful!”

“How do I get this thing off?”

“It’s delicate!”

“I know! I can’t get the – do I do the buttons or the zipper first?!”

“There’s only buttons, Morgan!” Bee exclaimed, giggling.

“Then what the hell is this?! What is – oh,” he stopped dramatically. “Oh, I gotta – okay – I – here we go,” he muttered as he began to unbutton the dress as quickly as his big thumb and drunken mind would let him. He knew he shouldn’t have had that last round of shots with Jake. “Jesus, how many buttons are there on this thing?!”

“It’s gotta stay on, doesn’t it?”

“NO! It’s gotta COME OFF!” he exclaimed, causing Bee to burst out into laughter. “It’s my wedding night, damnit! I WANNA HAVE SEX WITH MY WIFE! HOT, STEAMY SEX!”

“Is that what we’re gonna do? I thought we were just gonna put on our pyjamas,” Bee looked behind her, winking.

Morgan gave her a death stare. “Don’t even joke about that, Bumblebee,” he finished unbuttoning her dress. “Now get out of this thing so I can fuck you, please.”

“You need to be patient,” she instructed in as stern a voice as she could muster. “This thing is thousands of dollars. I can’t just whip it off, step out of it, and leave it on the floor or chair.”

“You can, you just decide not to.”

“I won’t, because it cost almost ten thousand dollars and it’s the most sentimental piece of clothing I will ever have.”

Morgan grumbled as he collapsed on the bed, still in his shirt and pants. He began unbuttoning his shirt as he watched Bee slip out of the dress slowly, making sure she located its hanger on the curtain rod before she did so. At the sight of Bee standing with no bra and only white lace panties, Morgan could feel his cheeks flush. “White, Bumblebee?”

“Was I going to wear any other colour?”

“You’ve got a mouth on you tonight.”

“Guess I should put it to good use, huh?” she arched her brow.

Morgan’s eyebrows rose. “Mrs. Rielly…” he began, shaking his head. The feeling of calling her that would never get old, he thought quickly. “Now that you’ve pinned me down with marriage you think you can talk to me like that?”

“Oh, I’ll pin you down alright.”

Morgan stuffed his hand down his pants. To him, there was no point in waiting anymore. She was standing there looking like that and he was too much of an impatient drunk to care. “Get over here, baby. Get over here now.”

“Patience.”

“I have no patience. Get over here!”

Bee took her time. She wanted to tease him; make him wait. She wanted him to groan in frustration and whine in anger. It was working. His look of frustration and overall unhappiness with how slow she was going was apparent on his face. When she finally climbed onto the bed, he picked himself up from his annoyance and practically lunged towards her, wrapping an arm around her body and pulling her down with him, causing her to yelp in laughter. He began placing light butterfly kisses on her exposed skin, smiling at every giggle that escaped her mouth.

“I’m never gonna get tired of saying that,” Morgan mumbled against her skin.

“What? Get over here?” she giggled out.

“Noooo,” he chastised. “Mrs. Rielly. You’re finally Mrs. Rielly.”

“Finally,” she smiled. “I can’t believe it either. This is the best day of my life.”

“This is the best day of my life,” Morgan repeated. “Can’t believe I landed such a fox.”

“Can’t believe I landed such a hunk.”

Morgan smiled sheepishly as he finally kissed her on the lips, slow and sensual and all encompassing. “I love you so much, Briony Rielly.”

#morgan rielly#morgan rielly imagine#morgan rielly imagines#morgan rielly fic#morgan rielly fan fic#toronto maple leafs#toronto maple leafs imagine#toronto maple leafs imagines#toronto maples leafs fic#toronto maple leafs fan fic#nhl#nhl imagine#nhl imagines#nhl fic#nhl fan fic#hockey#hockey imagine#hockey imagines#hockey fic#hockey fan fic#alone together series

128 notes

·

View notes

Text

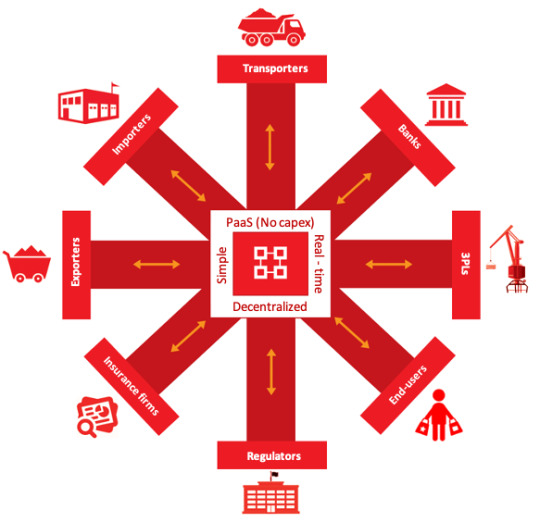

Review OBORTECH (OBOT)

OBORTECH - Smart logistics hub

A FULLY DIGITAL ECOSYSTEM FOR YOUR SUPPLY CHAIN

OBORTECH aims to increase the performance and efficiency of current logistics services with the power of Blockchain and IoT. OBOT token serves as a bridge between DeFi and digital supply chain solution offered by OBORTECH called Smart Hub.

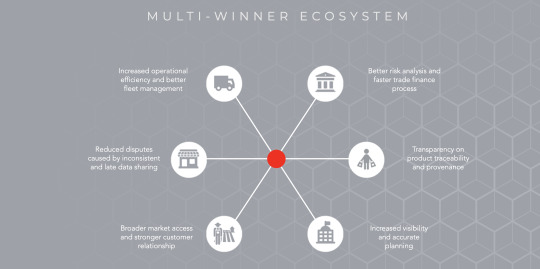

MULTI-WINNER ECOSYSTEM

Better risk analysis and faster trade finance process

Increased operational efficiency and better fleet management

Reduced disputes caused by inconsistent and late data sharing

Transparency on product traceability and provenance

Broader market access and stronger customer relationship

Increased visibility and accurate planning

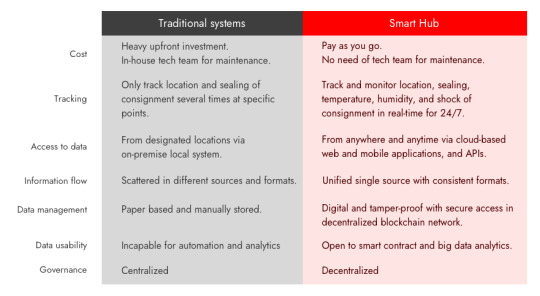

OBORTECH's Smart Hub VS Traditional systems

THE SMART HUB OFFERS

Blockchain and cloud powered communication hub

Accessible via easy to use web and mobile user interfaces, and an open API, the Smart Hub brings together supply chain actors, and enable their supply chains to share information, collaborate, conduct data analysis, and validate product traceability in real-time on a trusted platform.

Tamper-proof, unified and online document exchange

The Smart Hub allows secure sharing and exchange of documents with supply chain partners using blockchain powered version control. Authorized parties to any shipment can immediately see when changes have been made, and by whom, along a shipment journey.

IoT based real-time visibility and tracking

IoT sensors are installed on containers/trucks and transmit data to the Smart Hub dashboard to track valuable shipments, monitor their key physical measurements, and protect high-value products against theft. A client gets positioning data for shipment in real-time, irrespective of the shipping carrier they choose.

Open and decentralized networking marketplace

Based on the blockchain based trusted network established among the Smart Hub participants, the marketplace ecosystem will enable verification and scoring of stakeholders in supply chain without the need for third-party credentials. Moreover, the marketplace is a blockchain based decentralized ecosystem that enables buying, selling and exchanging of services without the need of intermediaries among the users.

OBOT DEFI

FOR DIGITAL SUPPLY CHAIN

Smart Hub transaction fee

OBOT token will be used for paying Transaction fee of bundled services offered by the Smart Hub. Every transaction revenue received by OBOT is split in the following way: 5% for token burns, 20% for marketing & community building, 5% for Non-Profit activities, and 70% for Network Admin fee.

Contract bonus

OBOT token can be used for promoting contract performances between the Smart Hub users. Users collaborating via the Smart Hub can convert some portion of their contract funding into OBOT tokens and allocate them in Escrow Contract as a bonus payment.

Crowdfunding

Members of the Smart Hub can launch crowdfunding activities to OBOT token holders in the Smart Hub Marketplace. It will be done either by lending with algorithmic interest rate protocol based on calculation of member score/rating or by pledging (similar to Kickstarter) between creators and backers based on Escrow Contract and performance tracking in the Smart Hub’s blockchain network.

Exchanging services

OBOT token will be used in the Smart Hub Marketplace when its users exchange services among them. The Smart Hub Marketplace is a blockchain based decentralized ecosystem that enables buying, selling and exchanging of services without the need of intermediaries among the Smart Hub users.

Member rewarding

The Smart Hub members will be rewarded by OBOT tokens based on their score/rating in the Marketplace. Members will be scored/rated by various ways based on blockchain data and performance histories in the Smart Hub network.

Governance

OBOT token allows holders to participate in Governance decisions of the Smart Hub Marketplace. They can exercise voting rights on policies of member enrollment, service exchanges, and crowdfunding activities of the Marketplace.

With OBOT tokens, the Smart Hub users can enjoy rewards like express delivery and extra care of products during shipments via the Smart Hub network. Get your OBOT tokens today by participating in our IEO

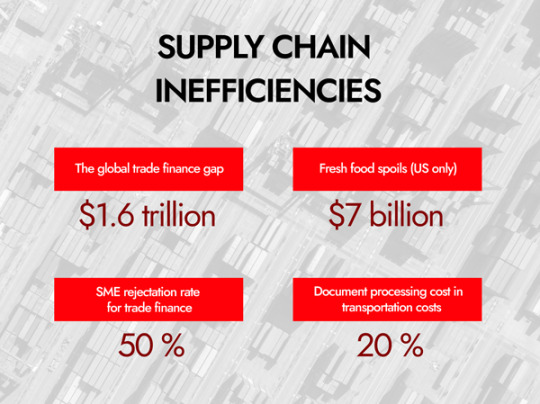

The manual and paper based processes often used in Supply Chain Industries are time consuming and also result in a lot of extra maintenance costs.

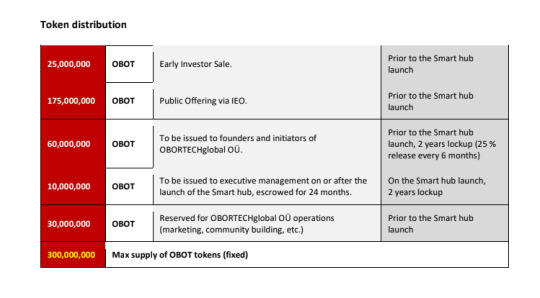

IEO starts on Probit from 10th March 2021

Starting price: ETH 0.000015

Invest upto 1 ETH, get 50% more bonus OBOT tokens

Invest between 1ETH - 2 ETH, get 100% more bonus OBOT token

Invest more than 2 ETH, get 200% more bonus OBOT tokens

ROAD MAP

TEAM

Tamir Baasanjav: CEO and Founder