#Investment Banker

Text

youtube

youtube

youtube

youtube

youtube

youtube

youtube

youtube

youtube

youtube

#192.168.1.1#YouTube#ur#Spotify#Pandora#Box#.room#youtuber#EA#AA#OM#EM#Principal#MD#SM#she: i think he did it on purpose (split eye#Subject Matter Expert#Stakeholders#Owner#GOP#tyler: *sitting* sí intentionally fouls fast brk; dicks b4 🐥; wutz a woman gonna dew 'bout 'it seamstress.. ?#Ownership Classic#Investment Banker#Venture Capitalist#yeehaw 🤠#Lids#🧅⚾ 🎩 ⚾ 🥳 ⚾🧢⚾🎸⚾🐕⚾👛⚾&🦜&&🧅🪃🔂#MFM&️⃣8️⃣📟8️⃣🧮8️⃣🔢8️⃣️⃣ ⚙️

14 notes

·

View notes

Text

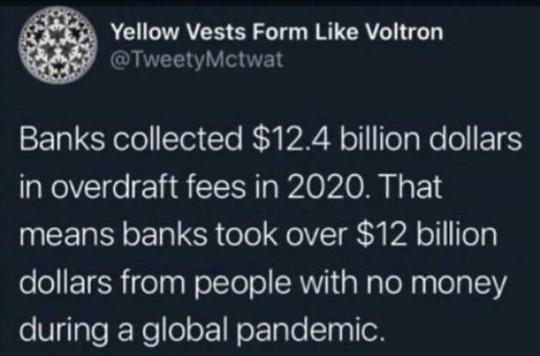

Credit Unions do treat customers a lot better than banks ever have.

#Credit Unions do treat customers a lot better than banks ever have.#creditunion#credit union#banks#bank#cba#bendigobank#commonwealth bank australia#nab#nationalaustraliabank#eat the rich#eat the fucking rich#class war#bankersarewankers#banking#banking cartel#bankers#investment banker#the banker#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#anti slavery

9 notes

·

View notes

Text

The Tenacious Five…

#my life#up close and personal#writers on tumblr#personal#author#washington#young entrepreneurs#independent author#amazon#kdpamazon#kdp publishing#barnes and noble#my first book#book publishing#independent artist#all money in#hot mommy#investment banker#cute mommy#cute face#single life#single mother#message me#older women and younger men#work selfie#book selfie#book lover#booklr#boss lady#female entrepreneurs

4 notes

·

View notes

Text

Biggest Investment Banking Deals of 2024: Analysis and Insights

The year 2024 has been a remarkable one for the investment banking industry, with several high-profile deals making headlines. These transactions not only reflect the dynamic nature of the global economy but also highlight the strategic maneuvers of major corporations. In this blog post, we will delve into the largest investment banking deals of 2024, providing analysis and insights into their significance and impact on the market.

The Rise of Mega Mergers

The Largest Investment Banking Deals 2024: A Closer Look

Mega mergers have dominated the investment banking landscape in 2024. These deals involve the consolidation of major corporations, resulting in entities with significant market power and influence. One of the largest investment banking deals of 2024 was the merger between two leading technology giants, which created a behemoth with unparalleled capabilities in artificial intelligence and cloud computing.

Strategic Rationale Behind Mega Mergers

The strategic rationale behind these mega mergers often includes achieving economies of scale, expanding market reach, and enhancing competitive positioning. By combining resources and expertise, companies can drive innovation and efficiency. The largest investment banking deals of 2024 exemplify how corporations are leveraging mergers to stay ahead in a rapidly evolving market.

Cross-Border Transactions: Expanding Global Footprints

Notable Cross-Border Deals in 2024

Cross-border transactions have been a significant trend in 2024, with companies seeking to expand their global footprints. One of the most notable cross-border deals involved a major pharmaceutical company acquiring a biotech firm in Europe. This acquisition not only provided access to new markets but also strengthened the company’s research and development capabilities.

Challenges and Opportunities in Cross-Border Deals

While cross-border deals offer substantial growth opportunities, they also come with challenges such as regulatory hurdles, cultural differences, and integration complexities. The largest investment banking deals of 2024 highlight the importance of thorough due diligence and strategic planning to navigate these challenges successfully.

Private Equity’s Role in Shaping the Market

Major Private Equity Deals of 2024

Private equity firms have played a pivotal role in shaping the investment banking landscape in 2024. These firms have been involved in some of the largest investment banking deals of 2024, including the acquisition of a leading consumer goods company. This deal underscored the growing influence of private equity in driving corporate transformations and value creation.

Strategies Employed by Private Equity Firms

Private equity firms often employ strategies such as leveraged buyouts, operational improvements, and strategic exits to maximize returns. The largest investment banking deals of 2024 demonstrate how private equity firms are adept at identifying undervalued assets and unlocking their potential through strategic interventions.

The Impact of Technology on Investment Banking Deals

Technology-Driven Transactions in 2024

Technology has been a driving force behind many of the largest investment banking deals of 2024. From fintech acquisitions to investments in artificial intelligence startups, technology-driven transactions have reshaped the industry. One notable deal involved a major financial institution acquiring a blockchain technology company to enhance its digital capabilities.

The Role of Innovation in Deal-Making

Innovation is at the heart of technology-driven transactions. Companies are increasingly looking to acquire cutting-edge technologies to stay competitive and meet evolving customer demands. The largest investment banking deals of 2024 highlight how innovation is influencing deal-making strategies and shaping the future of the industry.

Conclusion

The biggest investment banking deals of 2024 have showcased the dynamic nature of the global economy and the strategic maneuvers of major corporations. From mega mergers to cross-border transactions, private equity deals, and technology-driven acquisitions, these deals reflect the evolving landscape of investment banking. As we move forward, staying informed about these trends and understanding their implications will be crucial for industry professionals and investors alike.

0 notes

Text

A college dropout gets a job as a broker for a suburban investment firm and is on the fast track to success—but the job might not be as legitimate as it sounds.

Credits: TheMovieDb.

Film Cast:

Seth Davis: Giovanni Ribisi

Chris Varick: Vin Diesel

Abbie Halpert: Nia Long

Greg Weinstein: Nicky Katt

Richie O’Flaherty: Scott Caan

Judge Marty Davis: Ron Rifkin

Adam: Jamie Kennedy

Harry Reynard: Taylor Nichols

FBI Agent David Drew: Bill Sage

Michael Brantley: Tom Everett Scott

Jim Young: Ben Affleck

Seth’s Mother: Donna Mitchell

Neil Davis: André Vippolis

Jeff: Jon Abrahams

Mike the Casino Patron: Will McCormack

Broker: Kirk Acevedo

Michelle: Siobhan Fallon Hogan

Office Woman: Judy Del Giudice

FBI Director: Alex Webb

Kid: Mark Webber

Kid: Herbert Russell

Kid: Christopher Fitzgerald

Broker: Anson Mount

Gay Restaurant Patron: Neal Lerner

Sara Reynard: Taylor Patterson

Susan Reynard: Marsha Dietlein

Concierge: John Griesemer

Abbie’s Mother: Marjorie Johnson

JT Marlin Trainee (uncredited): Desmond Harrington

Todd (uncredited): Spero Stamboulis

JT Marlin Trainee (uncredited): Angelo Bonsignore

Sheryl: Lisa Gerstein

Film Crew:

Producer: Jennifer Todd

Producer: Suzanne Todd

Casting: John Papsidera

Art Direction: Mark White

Supervising Sound Editor: Frank Gaeta

Sound Re-Recording Mixer: John Ross

Sound Effects Editor: Benjamin L. Cook

Sound Re-Recording Mixer: Dorian Cheah

Sound Effects Editor: Roland N. Thai

Director of Photography: Enrique Chediak

Assistant Costume Designer: Jill Kliber

Writer: Ben Younger

Co-Producer: E. Bennett Walsh

Executive Producer: Richard Brener

Editor: Chris Peppe

Executive Producer: Claire Rudnick Polstein

Music Supervisor: Dana Sano

Sound Re-Recording Mixer: Joe Barnett

Original Music Composer: The Angel

Sound Effects Editor: Lisle Engle

Music Editor: Lise Richardson

Steadicam Operator: Will Arnot

First Assistant Editor: Elaine C. Andrianos

Production Design: Anne Stuhler

Art Direction: Roswell Hamrick

Costume Design: Julia Caston

Associate Producer: Pamela Post

Script Supervisor: Catherine Gore

First Assistant Camera: Aurelia Winborn

Still Photographer: David Lee

Set Decoration: Jennifer Alex Nickason

Key Hair Stylist: Quentin Harris

First Assistant Editor: Pamela Chmiel

Sound mixer: Peter Schneider

Production Coordinator: Rita Parikh

Movie Reviews:

0 notes

Text

Top 10 highest paying jobs in the world 2024

Here is a list of the top 10 highest-paying jobs around the globe

The pursuit of lucrative careers often drives professional aspirations. With technological advancements and globalization reshaping industries, some professions command exceptional salaries that reflect their critical importance and specialized skill sets.

Whether you’re a seasoned professional seeking a career shift or a recent graduate planning your future, understanding which roles offer the highest financial rewards can guide your career decisions.

In this article, we’ll explore the top 10 highest-paying jobs around the globe, per report from Nexford.

1. Cardiologist

Role: Specializes in diagnosing and treating cardiovascular diseases.

Requirements: Bachelor’s degree; medical school; residency in internal medicine; board certification in cardiology.

Average Salary: $324,760

2. Surgeon

Role: Performs surgical procedures to treat diseases and conditions.

Requirements: Bachelor’s degree; medical school; residency; medical license; board certification.

Average Salary: $297,851

3. Psychiatrist

Role: Specializes in diagnosing and treating mental illnesses and emotional disorders.

Requirements: Bachelor’s degree; medical school; residency in psychiatry; medical license; board certification.

Average Salary: $255,812

4. Chief Executive Officer (CEO)

Role: Oversees company operations, makes major corporate decisions, and communicates with the board of directors.

Requirements: Bachelor’s degree in business or related field; advanced degrees like an MBA; extensive experience in leadership and strategic planning.

Average Salary: $197,747

5. Senior Software Engineer

Role: Designs, implements, and maintains complex software systems.

Requirements: Bachelor’s degree in computer science; expertise in programming languages like Java, Python, or C++; experience with frameworks and version control systems.

Average Salary: $194,220

6. Corporate Lawyer

Role: Provides legal advice and services to businesses on various legal matters.

Requirements: Bachelor’s degree; law school and JD; bar exam; specialization in corporate law.

Average Salary: $149,68

7. Investment Banker

Role: Facilitates financial transactions, advises on strategies, manages mergers, and raises capital.

Requirements: Bachelor’s degree in finance or related field; securities licenses; understanding of financial markets; certifications like CFA recommended.

Average Salary: $144,633

8. Cloud Architect

Role: Designs and manages cloud computing architecture.

Requirements: Bachelor’s degree in computer science or IT; relevant certifications (e.g., AWS, Azure); skills in IaC tools and cloud networking.

Average Salary: $144,000

9. Internet of Things (IoT) Architect

Role: Designs and implements the architecture of IoT systems.

Requirements: Bachelor’s degree in computer science or related field; proficiency in programming languages; knowledge of networking, embedded systems, and IoT security.

Average Salary: $131,646

10. Petroleum Engineer

Role: Specializes in the exploration, extraction, and production of oil and natural gas.

Requirements: Bachelor’s degree in petroleum engineering or related field; internships; knowledge of programming and simulation tools; certification.

Average Salary: $130,523

#Cardiologist#Surgeon#Psychiatrist#Chief Executive Officer#Senior Software Engineer#Corporate Lawyer#Investment Banker#Cloud Architect#Internet of Things (IoT) Architect#Petroleum Engineer#sage response#nigeria#likesforlike

0 notes

Text

Investment banking is a highly lucrative career field that attracts many ambitious professionals. To enter the investment banking industry, one must typically follow a well-defined path involving education, internships, and networking. It is important to understand the various roles within investment banking and acquire the necessary skills and qualifications. Explain the detailed steps on how to become an investment banker, including the importance of obtaining relevant degrees, gaining practical experience through certification, and building a strong professional network.

#how to become investment banker#how to get into investment banking#investment banker#investment banking career path

0 notes

Text

Career Crossroads: Investment Banking vs. Other Financial Careers

Standing at the precipice of a career choice in finance can feel overwhelming. The world of finance offers a plethora of exciting opportunities, each with its own unique challenges and rewards. Two prominent paths that often cause initial confusion are investment banking and other financial careers. This blog delves into the distinctions between these exciting fields, helping you navigate your career crossroads.

Investment Banking: The Dealmakers

Investment banking is a fast-paced and demanding career focused on facilitating financial transactions for corporations and governments. Investment bankers act as intermediaries, connecting companies seeking capital with investors looking for lucrative opportunities. Their core responsibilities include:

Mergers and Acquisitions (M&A): Advising clients on mergers, acquisitions, and divestitures, structuring deals, and navigating the complex negotiation process.

Capital Markets: Assisting companies with raising capital through public offerings (IPOs) and debt issuance, ensuring they secure the best possible terms.

Financial Restructuring: Providing advisory services to companies in financial distress, including debt restructuring, bankruptcy proceedings, and turnaround strategies.

Investment Banking: A Life of Hustle and High Stakes

Investment banking is renowned for its long hours, intense work pressure, and highly competitive environment. It demands exceptional analytical skills, financial modeling expertise, and an unwavering commitment to client needs. Success in this field often translates to significant financial rewards and a prestigious career path.

Is Investment Banking for You?

Consider these factors before embarking on an investment banking career:

Do you thrive in a fast-paced, high-pressure environment?

Are you comfortable with long hours and intense workloads?

Do you possess excellent analytical and problem-solving skills?

Are you a strong communicator and negotiator?

Are you passionate about the financial markets?

If you answered yes to these questions, then investment banking might be a perfect fit. However, the financial world extends far beyond the realm of investment banking. Let's explore some alternative financial careers:

Beyond Investment Banking: Diverse Paths to Financial Success

The financial sector offers a multitude of rewarding career options beyond investment banking. Here are some prominent examples:

Financial Analysis: Financial analysts delve into financial data to assess a company's financial health and investment potential. They provide research reports and recommendations to investors, contributing to informed investment decisions.

Portfolio Management: Portfolio managers construct and manage investment portfolios for individuals or institutions, aiming to achieve optimal returns while managing risk.

Wealth Management: Wealth managers provide personalized financial advice and investment services to high-net-worth individuals and families.

Financial Technology (FinTech): The intersection of finance and technology presents exciting career opportunities in areas like online payments, blockchain technology, and algorithmic trading.

Risk Management: Risk management professionals identify, assess, and mitigate financial risks faced by organizations. This field requires a strong grasp of financial instruments and risk analysis techniques.

A Spectrum of Options: Finding Your Financial Niche

Each of these financial careers offers distinct challenges and rewards. Here's how to determine the best fit for you:

Identify your interests: Are you drawn to the analytical rigor of financial analysis, or do you prefer the personalized approach of wealth management?

Consider your skills: Do your strengths lie in research and data analysis, or are you a natural communicator and relationship builder?

Research career paths: Explore the educational requirements, work environment, and career progression associated with each financial career path.

Investing in Yourself with Investment banking course Mumbai

Regardless of your chosen path, a solid foundation in finance is crucial. Investment banking courses in Mumbai can equip you with the knowledge and skills necessary for success in diverse financial careers. These courses cover core financial concepts, valuation techniques, financial modeling, and industry best practices.

Investment Banking Course Mumbai: Building a Strong Financial Foundation

Here's how a cyber security course mumbai can empower you in the financial world:

Develop Financial Modeling Skills: Learn to build sophisticated financial models used for valuation, deal structuring, and investment decisions.

Master Financial Analysis Techniques: Sharpen your skills in analyzing financial statements, understanding key financial ratios, and assessing risk.

Gain Industry Knowledge: Investment banking courses in Mumbai provide insights into the workings of investment banks, the financial markets, and various financial products.

Enhance your Resume: Completing a reputed investment banking course in Mumbai demonstrates your commitment to a career in finance and can significantly enhance your job prospects.

Conclusion: Charting Your Financial Future

Investment banking offers a high prestige and lucrative career path, but it demands intense work pressure and a specific skillset. Other financial careers present exciting opportunities with varying work styles and educational requirements.

Choosing the Right Path:

Ultimately, the choice between investment banking and other financial careers depends on your individual personality, interests, and strengths. Here are some additional factors to consider:

Work-Life Balance: Investment banking is notorious for long hours and demanding schedules. Other financial careers may offer a better work-life balance, depending on the specific role and company.

Educational Requirements: While a bachelor's degree in finance or a related field is often the minimum requirement for most financial careers, investment banking may favor candidates with additional qualifications like an MBA or a Master's in Finance.

Exit Opportunities: Investment banking can be a stepping stone to other lucrative careers in private equity, hedge funds, or corporate finance. Other financial careers may offer different exit opportunities depending on the specific field.

Taking the First Step: Explore Investment Banking Courses in Mumbai

No matter which financial path you choose, investing in your education is crucial for success. Investment banking courses in Mumbai can provide a valuable head start, equipping you with the knowledge and skills you need to excel in a competitive financial landscape.

Beyond Investment Banking Courses:

Explore resources beyond traditional investment banking courses in Mumbai. Consider attending financial industry conferences, networking with professionals, and conducting informational interviews to gain firsthand insights into different financial careers.

Continuous Learning: A Key to Success

The financial sector is constantly evolving. Regardless of your chosen path, a commitment to continuous learning is essential. Stay updated on industry trends, regulatory changes, and new financial technologies.

Embrace the Journey: Your Financial Career Awaits

The world of finance offers a plethora of exciting and rewarding career options. By carefully considering your interests, skills, and career aspirations, you can navigate your career crossroads and embark on a fulfilling journey in the financial sector. Remember, investment banking courses in Mumbai can be a valuable tool in your financial toolkit, empowering you to take the first step towards a successful career.

0 notes

Text

Sir Patrick Bijou is a British investment banker, fund manager, philanthropist, speaker, venture capitalist and author.

0 notes

Text

William Baumner IV - Serves in Finance and Business Consulting

William Baumner IV Serves in Finance and Business Consulting. He Tries to Make a Difference in This World by Trying to Help as Many People Become Financially Responsible as Possible. William Baumner IV's Three College Degrees and 20 Years of Experience in the Finance Sector Helped Him Achieve His Dreams. Since William Baumner IV Entered the Finance Industry Around 30 Years Ago, He Has Gained Remarkable Experience. He Uses This Experience as a Finance Expert to Guest Lecture at Establishments Throughout the U.s. and Europe.

0 notes

Text

Revolutionize Your Investment Banking with MergerDomo: Your Gateway to Efficiency

Are you an investment banker seeking a secure, streamlined way to do business? Discover MergerDomo! Our platform, designed for professionals like you, simplifies finding counterparties and new mandates. With our cutting-edge marketplace, post deals and explore transactions from your workspace. Sign up today for a transformative banking experience!

#deal sourcing platform#investment banking deal sourcing#investment banking platform#investment banker#best investment opportunities#Business investment opportunities

0 notes

Text

Investment Banking

In the opinion of the Economic Times, “In 2021, investment banks of India make a record by earning Rs.2200 crore. The same year, investment bankers piled Rs. 776.7 crores in share sale fees. This share sale fee was three times more than the previous year. The year 2021 was pleasing for tech companies like Zomato and Paytm. They had more IPOs than in the year 2020. As a result, bankers’ fees increased. In 2021, acquisition banks made a lot of money by underwriting. At that time, many companies went public, due to which IPOs increased. The reason behind it was to raise capital or give investors withdrawal opportunities.

0 notes

Text

Real criminals don't rob banks. Real criminals build and buy banks.

#real criminals#real crime#war criminals#criminals#exclusive restaurant popular with bollywood celebs ‘served top banker dead rat’ before chef and manager arrested#bankers#banker sacked for defending hitler’s plan to kill all jews#investment banker#{{ the banker's bidding }}#banker#banks#banking#bank#anti capitalist#capitalism#capitalist dystopia#capitalist bullshit#capitalist hell#eat the rich#eat the fucking rich#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government

1 note

·

View note

Text

The Tenacious Five…..

#my life#up close and personal#writers on tumblr#college#personal#author#washington#young entrepreneurs#independent author#amazon#barnes and noble#kdpamazon#kdp publishing#christian women#christian books#children books#investment banker#female entrepreneurs#entreprenuership#basketball girl#athlete#college student#single life#single mother#tall girls#white girls gone black#white girl wednesday#cute smile#female model#beautiful model

4 notes

·

View notes

Text

Unlocking Success: Skills Every Investment Banker Should Develop

Introduction

Investment banking is a demanding and exhilarating field that requires a unique blend of technical expertise, interpersonal finesse, and strategic thinking. Whether you’re an aspiring analyst or a seasoned managing director, certain skills are essential for thriving in this competitive industry. In this blog post, we’ll delve into the key skills every investment banker should cultivate to unlock success.

1. Financial Modeling Mastery

1.1. The Foundation of Decision-Making

Financial models are the lifeblood of investment banking. As an investment banker, you’ll create intricate models to value companies, assess risk, and analyze potential deals. Key skills include:

Excel Proficiency: Mastering Excel functions, shortcuts, and macros.

Valuation Techniques: Understanding discounted cash flow (DCF), comparable company analysis (Comps), and precedent transactions.

Scenario Analysis: Navigating complex scenarios and stress-testing assumptions.

2. Effective Communication

2.1. Articulating Complex Ideas

Investment bankers communicate with clients, colleagues, and stakeholders daily. To excel, focus on:

Clear Presentations: Conveying complex financial concepts in simple, concise language.

Pitching Skills: Crafting compelling narratives for client meetings and deal pitches.

Listening Attentively: Understanding client needs and tailoring solutions accordingly.

3. Relationship Building

3.1. Nurturing Client Connections

Investment banking thrives on relationships. Cultivate these skills:

Client Management: Building trust, understanding client goals, and delivering value.

Networking: Attending industry events, conferences, and maintaining a robust professional network.

Negotiation: Balancing client interests and firm objectives.

4. Adaptability and Resilience

4.1. Thriving in a Dynamic Environment

Investment banking is unpredictable. Develop:

Adaptability: Embracing change, whether it’s market volatility or shifting deal dynamics.

Resilience: Bouncing back from setbacks, missed deals, or long hours.

Time Management: Juggling multiple tasks efficiently.

Conclusion:

Enroll in our Investment banking course Pune : Dive deeper into investment banking skills and learn how to excel in this dynamic field. Discover advanced techniques, stay updated on industry trends, and become a sought-after investment banking professional!

0 notes

Text

Investment Banker: Roles, Courses, Salary, Qualifications, & More

Investment Banker is a highly rewarding job with six-figure salaries, prestigious reputation, and limitless growth opportunities.

They assist corporations, governments, and other institutions in raising capital for various projects through issuing stocks and bonds. They provide advisory services on mergers and acquisitions, helping companies make strategic decisions.

An investment banker is a financial professional who plays a crucial role in the world of finance. Their expertise lies in analyzing financial data, conducting market research, and assessing risk to devise effective financial strategies. This demanding profession requires strong analytical skills, business acumen, and the ability to thrive under pressure. Investment bankers often work long hours, but the potential for high salaries and career advancement makes it an appealing career path for many finance enthusiasts.

0 notes