#challenges of CGTMSE scheme

Explore tagged Tumblr posts

Text

CGTMSE scheme: Full form, eligibility criteria, subsidies, and more

The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme is an initiative that plays a crucial role in promoting entrepreneurship and fostering the growth of Micro, Small, and Medium Enterprises (MSMEs) in India. This scheme, introduced by the Government of India and the Small Industries Development Bank of India (SIDBI), aims to provide financial assistance and credit facilities to MSMEs by offering guarantees on their loans. In this article, we will delve into the details of the CGTMSE scheme, including its full form, eligibility criteria, subsidies, and more.

Understanding the full Form of the CGTMSE scheme

CGTMSE stands for the Credit Guarantee Fund Trust for Micro and Small Enterprises scheme. The primary objective of this scheme is to facilitate access to credit for MSMEs, which often face challenges in obtaining loans due to a lack of collateral or inadequate credit history. By providing guarantees on credit facilities extended to eligible enterprises, the CGTMSE scheme aims to mitigate the risk for financial institutions and encourage them to lend to MSMEs.

Eligibility criteria for the CGTMSE scheme

To avail the benefits of the CGTMSE scheme, enterprises must meet certain eligibility criteria. Under the scheme, MSMEs are classified based on their investment in plant and machinery or equipment for manufacturing enterprises, and service sector enterprises. The turnover and investment limits for micro, small, and medium enterprises are defined by the Government of India and are periodically revised.

The scheme encompasses both manufacturing and service sector enterprises, including retail units, ensuring a wide range of businesses can benefit from it. It covers industries such as textiles, food processing, engineering, information technology, healthcare, and more.

Benefits and subsidies under CGTMSE scheme

The CGTMSE scheme provides several benefits and subsidies to eligible MSMEs. One of the primary benefits is the guarantee cover provided on credit facilities extended to these enterprises. The guarantee cover typically ranges from 50-85% of the sanctioned loan amount, depending on the category of the enterprise. This guarantee encourages banks and other financial institutions to extend credit to MSMEs, as it minimises the risk associated with lending to these enterprises.

This scheme covers both term loans and working capital loans. This allows MSMEs to access funds for various purposes, including purchasing machinery, expanding infrastructure, meeting working capital requirements, and more. The scheme provides flexibility to enterprises, enabling them to address their specific financial needs.

Additionally, the scheme offers subsidies on guarantee fees and annual service fees payable by the MSMEs. This helps reduce the financial burden on the enterprises and makes the scheme more affordable and accessible.

Application process for CGTMSE scheme

The application process for the CGTMSE scheme is relatively straightforward. MSMEs interested in availing the benefits of the scheme need to approach eligible lending institutions, such as banks, financial institutions, or Non-Banking Financial Companies (NBFCs). These institutions are registered with CGTMSE as Member Lending Institutions (MLIs).

The application requires the submission of certain documents and information, such as proof of identity, proof of address, financial statements, project reports, and other relevant details. The lending institutions assess the viability and creditworthiness of the enterprise based on these documents.

Once the application is submitted, the lending institution forwards it to the CGTMSE for approval. The CGTMSE evaluates the application and, upon approval, issues the necessary guarantee to the lending institution. The entire process, from application submission to approval, is usually completed within a reasonable timeframe.

Limitations and challenges of CGTMSE scheme

While the CGTMSE scheme has been instrumental in facilitating credit access for MSMEs, it also faces certain limitations and challenges. One limitation is the exclusion of certain types of enterprises from the scheme, such as educational institutions, agricultural activities, self-help groups, and more. Additionally, the risk assessment and default management processes pose challenges for the effective implementation of the scheme.

Another challenge is the limited awareness and outreach of the CGTMSE scheme. Many MSMEs, especially in rural and remote areas, remain unaware of the scheme's existence and its potential benefits. Addressing these limitations and challenges is crucial to ensure the scheme reaches its full potential and benefits a larger number of deserving enterprises.

Disclaimer: Please note that the information provided in this article is intended for general informational purposes only and should not be construed as professional advice or relied upon as a substitute for consultation with qualified experts. The accuracy, completeness, and timeliness of the information presented in this article may vary and are based on the knowledge and resources available at the time of writing, which may not be comprehensive or up-to-date.

0 notes

Text

Collection Security: What Cgtmse provides

In a world of trade financing, security security has long been a significant obstacle to many micro, small and medium -sized businesses (MSME). However, the Credit Guarantee Fund Trust for micro and small businesses has emerged as a gaming switch, and provides a unique solution of this challenge through the CGTMSE scheme.

Understand the CGTMSE scheme

The CGTMSE scheme, also known as the Credit Guarantee scheme for MSMEs , was launched in August 2000 by the Ministry of Micro, Small and Medium Enterprises (MSME) in collaboration with Small Industries Development Bank of India (SIDBI). Its primary goal is to provide security-free loans to MSMEs, encourage banks and other financial institutions.

Important features in the CGTMSE scheme

Security -free loan

One of the main benefits of the CGTMSE scheme is that it allows MSME to get a loan without the need for security or third-party guarantee. It is especially beneficial for first generation entrepreneurs and companies, who may not have enough assets to introduce as security.

Loan amount and coverage

Under the CGTMSE scheme, MSMES can use loans up to Rs. 50 million. The scheme provides a guarantee ribs of up to 85% of the loan amount, based on the borrower category. For example, female entrepreneurs, north -eastern units and microbia with a credit limit of up to Rupee. You can enjoy extended coverage up to 5 Lakh 80%.

Eligible borrower

The plan is open to both new and existing MSME that engages in construction or service activities. However, it includes some areas such as educational institutions, self -help groups and agricultural activities.

Annual warranty fee

The CGTMSE scheme requires an annual warranty fee, which has reduced significantly over the years to make MSME more accessible. For example, fees for loans up to Rs. 1 crore is reduced to 0.37%.

How the CGTMSE scheme works

When an MSME applies for a loan through a participating financial institution, the institution evaluates the viability of the business and on approval, and limits the loan. CGTMSE then provides a guarantee coverage for part of the loan, reduces the risk to the lender. When it comes to defaulting, the CGTMSE refunds the lender for the guaranteed part.

CGTMSE scheme impact

The CGTMSE scheme has a major impact on the MSME region in India. By eliminating security requirements, it has opened new ways to reach credit for businesses and expanding operations. This has not only promoted economic development, but has also created many employment opportunities.

conclusion

The CGTMSE scheme is a powerful tool for MSME that wants to secure funding without the burden of security security. By providing guarantee coverage and reducing the risk of lenders, it has made the credit more accessible and cheap for small and medium -sized businesses. As the backbone of the Indian economy, MSME can now focus on growth and innovation, and know that they have financial help they need.

Therefore, if you are the owner of an MSME or an ambitious entrepreneur, the CGTMSE scheme is definitely worth finding. This can be the key to unlock the full potential of your business and achieve your entrepreneurial dreams.

#cgtmse loan process#cgtmse scheme#credit guarantee scheme for msmes#msme loan guarantee#government schemes for msmes#msme subsidy programs#small business loans india#startup funding india#collateral-free loans india#finance

0 notes

Text

MSME Loans Made Simple: Fast & Trusted Solutions by Vibho Associates

In today's competitive economy, Micro, Small, and Medium Enterprises (MSMEs) form the backbone of India's economic growth. They generate employment, foster innovation, and contribute significantly to GDP. However, one of the biggest hurdles MSMEs face is access to timely and sufficient financing. That’s where Vibho Associates comes into play with its fast, reliable, and customer-centric MSME loan solutions.

Understanding MSME Loans

MSME loans are specialized financial products aimed at supporting the unique needs of small and medium-sized businesses. These loans can be used for a variety of purposes, including:

Business expansion

Purchasing equipment and machinery

Working capital requirements

Inventory management

Technology upgrades

With the right financial support, MSMEs can boost their operations and compete effectively in both domestic and international markets.

Challenges MSMEs Face in Securing Loans

Many small businesses struggle with loan approval due to:

Lack of collateral

Limited credit history

Complex documentation

Delayed processing

Unfavorable interest rates

Vibho Associates addresses these challenges with a customer-first approach, ensuring that every entrepreneur gets a fair chance to grow.

Why Choose Vibho Associates for MSME Loans?

1. Speedy Processing:

Time is money, especially in business. Vibho Associates is known for its quick turnaround time, from loan application to disbursal. Most loans are approved within 48-72 hours, subject to documentation.

2. Minimal Documentation:

Forget the endless paperwork. Vibho Associates simplifies the process with a minimal documentation requirement, allowing you to focus on running your business.

3. Personalized Support:

Each MSME is unique. The experts at Vibho Associates offer personalized financial consultation to understand your needs and suggest the best loan product.

4. Competitive Interest Rates:

With partnerships across leading banks and NBFCs, Vibho Associates ensures competitive interest rates that fit your budget and repayment capacity.

5. Trusted by Thousands:

With a strong track record and numerous happy clients, Vibho Associates has built a reputation as a trusted MSME loan facilitator in India.

Types of MSME Loans Offered

Vibho Associates offers a variety of loan products to cater to different MSME needs:

Working Capital Loans: To meet day-to-day operational costs.

Term Loans: For purchasing machinery, property, or infrastructure expansion.

Line of Credit: Flexible credit facility for recurring business needs.

Equipment Finance: For buying new or upgrading existing machinery.

Invoice Financing: Get loans against unpaid invoices to maintain cash flow.

Eligibility Criteria

Though eligibility may vary slightly based on the lender, the general criteria include:

Business should be registered as an MSME

Operational history of at least 1 year (for some products)

Valid business PAN card and GST registration

Minimum annual turnover as specified by the lender

Required Documents

Identity & address proof

Business registration documents

Bank statements (last 6-12 months)

ITR and financial statements

GST returns

How to Apply with Vibho Associates?

The application process is simple and can be initiated both online and offline:

Consultation: Speak with a loan advisor from Vibho Associates.

Document Submission: Share the necessary documents.

Loan Assessment: Your application is assessed for eligibility.

Approval & Disbursal: Once approved, funds are disbursed quickly to your bank account.

Real Success Stories

Many businesses have benefited from Vibho Associates’ MSME loans. From local manufacturers in tier-2 cities to small tech startups, Vibho has empowered entrepreneurs to expand, invest in innovation, and create jobs.

Government Schemes for MSMEs

Vibho Associates also assists clients in availing government-backed MSME loan schemes such as:

CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises)

PMEGP (Prime Minister’s Employment Generation Programme)

MUDRA Loans under the Pradhan Mantri Mudra Yojana

These schemes offer benefits like collateral-free loans, interest subsidies, and flexible repayment terms.

Why MSME Loans Are More Important Than Ever

Post-pandemic recovery, rising digitization, and global economic opportunities make it crucial for MSMEs to invest in technology, talent, and infrastructure. MSME loans act as the fuel to power this growth engine.

With rising demand and growing competition, access to quick and affordable financing can mean the difference between stagnation and growth.

Final Thoughts

Vibho Associates is committed to supporting the dreams and ambitions of India's MSME sector. Whether you're a manufacturer, retailer, trader, or service provider, Vibho has a loan solution tailored just for you.

MSME Loans are no longer complex. With Vibho Associates, they are fast, trusted, and hassle-free.

#MSMELoan#BusinessLoan#SmallBusinessSupport#LoanForBusiness#MSMEIndia#StartupFinance#EntrepreneurSupport#FinancialGrowth#BusinessFunding#SMELoan

0 notes

Text

Fueling Growth: Understanding MSME Loans in India

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of the Indian economy, contributing significantly to employment generation, manufacturing output, and exports. However, one of the biggest challenges MSMEs face is access to timely and affordable credit. This is where MSME loans step in—tailored financial products that provide small businesses with the working capital and long-term funds they need to grow and compete.

What is an MSME Loan?

An MSME loan is a form of business financing provided to micro, small, and medium enterprises for various purposes, such as business expansion, purchasing machinery, working capital, or managing cash flow. These loans are offered by banks, Non-Banking Financial Companies (NBFCs), and fintech lenders, often under schemes supported by the Government of India, like CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) and PMEGP (Prime Minister’s Employment Generation Programme).

Key Features of MSME Loans

Loan Amount: MSME loans can range from ₹50,000 to ₹2 crore or more, depending on the lender and the borrower’s profile.

Tenure: Usually between 12 months to 5 years, with flexible repayment schedules.

Collateral-Free: Many MSME loans are unsecured, especially those covered under government guarantee schemes.

Quick Disbursal: Some NBFCs and digital lenders offer instant approval and fund disbursal within 24–72 hours.

Competitive Interest Rates: Interest rates vary from 9% to 25%, depending on the lender, business health, and credit score.

Types of MSME Loans

Working Capital Loans: For day-to-day operational expenses like inventory, wages, and rent.

Term Loans: For long-term business investments like equipment purchase or infrastructure expansion.

Line of Credit (Overdraft): A revolving credit facility to manage irregular cash flow.

Equipment Financing: Specifically for purchasing new machinery or upgrading existing tools.

Government-Backed Loans: Under schemes like MUDRA, Stand-Up India, and PMEGP.

Eligibility Criteria

Though criteria vary slightly across lenders, the general requirements include:

Business should be classified as an MSME under the Udyam Registration.

Minimum 1 year of business vintage (some lenders require 3 years).

Valid business documents like GST registration, trade license, and bank statements.

Good credit history (CIBIL score of 650+ preferred).

MSME Loan Application Process

1. Assessment & Documentation

Start by evaluating your business needs and gathering documents such as:

Aadhaar, PAN card

Business registration proof

GST returns

Last 6–12 months of bank statements

2. Apply Online or Offline

You can apply through a bank, NBFC, or fintech platform. Many lenders offer a digital application process with minimal paperwork.

3. Verification and Approval

The lender assesses your creditworthiness and business performance. If approved, you receive a sanction letter.

4. Loan Disbursal

Funds are typically credited directly to your business bank account.

Final Thoughts

Access to finance is the lifeline for any growing enterprise. MSME loans empower small businesses to scale operations, embrace innovation, and compete globally. Whether you're a budding entrepreneur or an established small manufacturer, the right loan at the right time can transform your business journey.

With increasing digitalization and government support, securing an MSME loan today is simpler than ever—fueling not just businesses, but the future of India's economy.

0 notes

Text

Collateral-Free Business Loans for Startups in India – Get Funded Instantly in 2025!

Looking to expand your business but stuck with funding issues? You’re not alone. In 2025, more Indian entrepreneurs than ever are searching for instant, collateral-free business loans that can be approved online, with no income proof, no security, and low interest rates.

Whether you're a startup dreaming big or a small business needing quick working capital, this guide offers all the practical insights and comparisons to help you choose the best business loan options in India today.

Why Business Loans Are Booming in 2025

The Indian startup ecosystem and SME sector are growing rapidly, but access to capital remains a hurdle. Traditional banks often demand heaps of paperwork, collateral, and a strong credit score. But that’s changing fast in 2025, with fintechs, NBFCs, and even government initiatives offering:

Instant digital loan for business

Collateral-free business loan application

Loan against property for business expansion

Funding options for startups in India with no income proof

Common Problems Entrepreneurs Face When Seeking Business Loans

Let’s address the real challenges:

“How do I get a business loan online without a CIBIL score?”

“I need a short-term loan for daily business expenses—where do I apply?”

“Are there any micro-loans for small businesses like mine?”

“Which lender offers the lowest interest rate for a business loan in India?”

We’ve compiled this in-depth guide to help you solve all of these problems—fast.

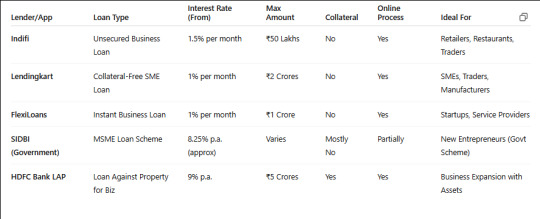

Top 5 Instant & Collateral-Free Business Loans in India – 2025

Funding Options for Startups in India – 2025 Overview

Startups with zero revenue or early traction often find it hard to get traditional funding. Here's what they can do in 2025:

Government Loan Scheme for New Entrepreneurs – Like the Stand-Up India Scheme, Mudra Loans, and PMEGP, which support new businesses with subsidized loans.

NBFCs and Fintechs – Offering instant digital loans for business without heavy documentation.

Startup Accelerators – Many offer grants, seed funding, and convertible debt.

Loan Against Property for Business – For those with real estate assets but no steady income proof.

“In 2025, over 70% of startup loans are now digitally approved—often within 24 to 48 hours.”

Microloans for Small Businesses – What You Should Know

If you run a local business, like a small store, salon, or Kirana, you can access micro loans starting from just ₹10,000. These are usually:

Short-term (3 to 12 months)

Offered by NBFCs, banks, or even UPI-based apps

Approved with minimal documentation

Platforms like Paytm Business Loan, KreditBee, and NeoGrowth are leading this segment in 2025.

How to Get a Business Loan Online in 2025 (Step-by-Step)

Applying for a business loan has never been easier. Here’s how:

Choose Your Loan Type – Short-term, long-term, micro, or loan against property.

Select a Lender or App – Compare interest rates, tenure, and eligibility.

Fill Out the Digital Application – Using PAN, Aadhaar, bank statements.

Upload Documents Digitally – Or use Aadhaar-based e-KYC.

Get Instant Approval – Many platforms offer loans within 24–48 hours.

No need to visit a bank

Zero collateral needed for most digital loans

No income proof required for select NBFCs

Commercial Loan for Business Expansion – Who Should Apply?

If you’re looking to scale operations, buy inventory, or expand branches, consider:

Loan Against Property for Business – High amount, longer tenure

Unsecured Commercial Loans – Quick processing but lower amount

Government Schemes like CGTMSE – For MSME expansion without collateral

Pro Tip: Combine a short-term working capital loan with a long-term commercial loan for better flexibility.

Short-Term Loans for Daily Business Expenses

Running low on working capital? Need funds to pay salaries or manage operations?

Apply for short-term loans like:

Working Capital Loans

Overdraft Facilities

Line of Credit for Small Businesses

These loans range from ₹50,000 to ₹10 Lakhs and are often approved within hours by NBFCs.

Government Loan Scheme for New Entrepreneurs – 2025 Update

Here are the 3 top-performing government-backed loan schemes in India this year:

PMEGP (Prime Minister’s Employment Generation Programme)

Up to ₹25 lakhs

Subsidy up to 35%

For new manufacturing & service businesses

MUDRA Loans (Under PMMY)

Shishu (up to ₹50,000), Kishor (up to ₹5L), Tarun (up to ₹10L)

For small and micro-businesses

No collateral required

Stand-Up India Scheme

Loans between ₹10L–₹1Cr

For SC/ST and women entrepreneurs

Collateral-free under CGTMSE

Frequently Asked Questions (FAQs)

1. Which loan is best for a startup in India with no income proof?

NBFCs like Lendingkart and FlexiLoans offer instant loans without income proof if you have decent bank statements or digital transactions. MUDRA loans are also ideal.

2. What is the lowest interest rate for business loans in India in 2025?

Government schemes offer starting rates from 8.25% p.a. Private lenders and NBFCs offer from 1% per month (i.e., ~12% annually).

3. Can I get a loan for business expansion using property?

Yes, most banks like HDFC, ICICI, and Axis offer loan against property for business purposes up to ₹5 Crores.

4. Are there collateral-free options for small businesses?

Absolutely. Most fintech lenders now offer collateral-free business loan applications with fast approval.

5. How fast can I get an online business loan in India?

With digital lenders, approval can be instant, and disbursal may happen within 24–48 hours, depending on document verification.

Final Thoughts

2025 is the best time for Indian entrepreneurs to take control of their financial growth. Whether you're launching a new venture, managing daily cash flow, or expanding operations, there’s a loan tailored to your needs.

From instant digital loans and micro business loans to government-backed schemes and low-interest funding, the options are wide—and accessible. And the best part? Most don’t need collateral or extensive paperwork.

“Don’t let a lack of capital stop your business dreams. The right funding option is just a few clicks away.”

#commercial loan for business expansion#lowest interest rate for business loan in India#micro loans for small businesses#funding options for startups in India#government loan scheme for new entrepreneurs#loan against property for business#how to get a business loan online#instant digital loan for business#collateral-free business loan application#short-term loan for daily business expenses

0 notes

Text

Udyam Registration: A Must for Small Businesses to Access Loans

Introduction

In the fast-evolving business landscape of India, small businesses face numerous challenges—one of the most pressing being access to finance. Small businesses often require loans to thrive, whether for expanding operations, managing cash flow, or investing in technology. However, obtaining these loans can be difficult without the proper credentials or support from financial institutions. Enter Udyam Registration, a simple yet powerful tool that can make a significant difference for small businesses seeking financial support. Introduced by the Ministry of Micro, Small, and Medium Enterprises (MSME) in 2020, Udyam Registration is a government initiative designed to help small businesses formalize their operations and gain access to various government schemes and benefits, including crucial financial aid.

What is Udyam Registration?

Udyam Registration is an online registration system for Micro, Small, and Medium Enterprises (MSMEs). The registration process involves providing basic details about your business, such as the type of business, number of employees, turnover, and investment in plant and machinery. Upon successful registration, businesses are issued a unique Udyam Registration Number (URN), which serves as an official recognition of the business as an MSME in India.

The registration process is free and entirely online, requiring no physical documentation. However, businesses must meet certain criteria regarding investment limits and annual turnover to qualify:

Micro Enterprises: Investment up to Rs. 2.5 crore and turnover up to Rs.10 crore.

Small Enterprises: Investment up to Rs. 25 crore and turnover up to Rs. 100 crore.

Medium Enterprises: Investment up to Rs.125 crore and turnover up to Rs. 500 crore.

Why is Udyam Registration Essential for Small Businesses Seeking Loans?

Small businesses often struggle to access loans due to a variety of reasons, including a lack of proper documentation, low credit scores, and high perceived risks. In this environment, Udyam Registration becomes a vital tool for overcoming these barriers and improving access to credit.

1. Eligibility for Government Loan Schemes

One of the biggest advantages of Udyam Registration is that it opens the door to various government-backed loan schemes. These schemes are designed specifically to support MSMEs and provide access to capital with lower interest rates, longer repayment terms, and minimal paperwork. Some of the prominent government loan schemes that Udyam-registered businesses can avail of include:

Pradhan Mantri Mudra Yojana (PMMY): This scheme provides financial assistance to small businesses in the form of MUDRA loans, which are available under three categories—Shishu (up to ₹50,000), Kishore (₹50,000 to ₹5 lakh), and Tarun (₹5 lakh to ₹10 lakh). Udyam-registered businesses have better access to these loans, which are often offered without collateral.

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE): Under this scheme, Udyam-registered businesses can avail themselves of collateral-free loans, which can significantly reduce the hurdles to securing financing.

Stand-Up India Scheme: This scheme aims to promote entrepreneurship among women and SC/ST entrepreneurs. Udyam-registered businesses owned by these groups are eligible for financial assistance under this scheme.

National Small Industries Corporation (NSIC) Subsidy: Udyam-registered businesses can avail of financial assistance and subsidies for the purchase of machinery, technology, and working capital.

By registering with Udyam, small businesses increase their eligibility for these schemes, which can provide the necessary financial backing for growth and expansion.

2. Easier Loan Approval and Processing

When a business is Udyam-registered, it signals to financial institutions and banks that the business is recognized by the government and is compliant with the relevant regulations. Lenders often hesitate to extend credit to businesses that are not registered because they are perceived as risky investments. Udyam Registration helps eliminate this uncertainty by providing a verified and credible source of business data, including investment levels, turnover, and industry type. This registration also means that the business will be compliant with taxation and other regulatory requirements, which further reassures lenders. As a result, the loan approval process becomes smoother and faster, with fewer delays in processing.

3. Access to Collateral-Free Loans

One of the biggest obstacles that small businesses face when seeking loans is the requirement for collateral. Many businesses, particularly micro-enterprises, do not have assets that can be pledged as collateral, making it nearly impossible to secure traditional loans. However, with Udyam Registration, small businesses become eligible for collateral-free loans under schemes like CGTMSE, which are backed by the government.

4. Improved Creditworthiness

For businesses, creditworthiness is one of the most important factors that influence loan approval. Small businesses that are Udyam-registered tend to have a more structured financial record and better access to government schemes, which improves their credit score over time. Lenders look favorably upon businesses with a solid financial foundation and a track record of repayment. Udyam registration helps businesses maintain proper financial records, comply with taxation norms, and build a positive reputation in the market. All these factors contribute to improved creditworthiness, making it easier for businesses to access loans with favorable terms.

5. Tax Benefits and Lower Interest Rates

Udyam-registered businesses are eligible for various tax benefits and subsidies, which can improve cash flow and reduce operational costs. These financial advantages can, in turn, make it easier for businesses to meet loan repayment schedules, further boosting their credibility with lenders. Additionally, banks and financial institutions often offer lower interest rates and better terms to businesses that are registered under Udyam. The registration reflects government endorsement, which reduces perceived risks, allowing businesses to access capital at more affordable rates.

Note: The Udyam portal now allows you to easily print Udyam Certificate.

Conclusion

Udyam Registration is a game-changer for small businesses in India looking to access loans and financial support. By formally registering as an MSME, businesses unlock a range of benefits, from eligibility for government-backed loan schemes to easier access to collateral-free loans and lower interest rates. In a highly competitive market, securing timely financial assistance is crucial for the growth and survival of small businesses. Udyam Registration not only increases your chances of loan approval but also strengthens your business's creditworthiness, paving the way for long-term success.

0 notes

Text

https://www.psbloansin59minutes.com/knowledge-hub/msme-loan-subsidy-cgtmse-scheme

Boost Your Business with the MSME Loan Subsidy Scheme – CGTMSE

MSMEs are the backbone of economic growth, yet securing funding remains a challenge due to limited financial history and lack of collateral. The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) bridges this gap by providing collateral-free loans, ensuring small businesses get the support they need. Empower your business with hassle-free funding and turn your entrepreneurial dreams into reality! 🚀

Apply today and take your MSME to new heights!

#digitalloanapproval#digital approval#business loan#loans#psbloansin59minutes#small business#onlinepsbloans#psb59#business#msme loan

0 notes

Text

The Udyam Advantage: Boosting Your MSME's Credibility and Competitive

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of India's economy, contributing significantly to GDP, employment, and innovation. However, these businesses often face challenges such as limited access to credit, lack of market recognition, and regulatory complexities. The Indian government introduced the udyam certificate download pdf system to address these issues and provide a structured framework for MSME growth.

Udyam Registration offers a range of benefits that enhance the credibility and competitiveness of MSMEs. In this article, we will explore how registering under Udyam can empower your business and help it thrive in a competitive market.

Understanding Udyam Registration

Udyam Registration is an initiative by the Ministry of Micro, Small, and Medium Enterprises (MSME) to streamline the classification and recognition of MSMEs in India. It replaces the earlier Udyog Aadhaar Memorandum (UAM) and ensures a simplified, paperless, and cost-effective registration process.

Eligibility CriteriaAn enterprise can register as an MSME under Udyam based on its investment in plant and machinery or equipment and annual turnover:

Micro Enterprises: Investment up to Rs. 1 crore and turnover up to Rs. 5 crore.

Small Enterprises: Investment up to Rs. 10 crore and turnover up to Rs. 50 crore.

Medium Enterprises: Investment up to Rs. 50 crore and turnover up to Rs. 250 crore.

Advantages of Udyam Registration

1. Enhanced Credibility and Market RecognitionOne of the biggest advantages of Udyam Registration is increased credibility among customers, suppliers, and financial institutions. A registered MSME is recognized as a legitimate business entity, making it easier to gain trust and secure deals.

Example: If you are an MSME looking to collaborate with larger corporations, Udyam Registration strengthens your profile and increases your chances of being considered for partnerships.

2. Easy Access to Credit and Financial Assistance

MSMEs often struggle with inadequate funding, making it difficult to scale operations. Udyam-registered businesses can access various government-backed financial schemes, including:

Collateral-Free Loans: Under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme, businesses can avail loans without the need for collateral.

Lower Interest Rates: Many banks and NBFCs offer reduced interest rates for Udyam-registered MSMEs, easing financial burdens.

Subsidies on Patent Registration and ISO Certification: To encourage innovation and quality standards, the government provides financial assistance for obtaining patents and ISO certifications.

3. Priority in Government Tenders and Procurement

The government has mandated that a certain percentage of tenders be allocated exclusively to MSMEs. With Udyam Registration, businesses get priority in public procurement, increasing their chances of securing government contracts.

Additionally, registered MSMEs are exempt from earnest money deposits (EMD) while applying for tenders, reducing financial strain.

4. Protection Against Delayed Payments

One of the significant challenges faced by MSMEs is delayed payments from buyers, which affects cash flow and business sustainability. Under the MSME Development Act, Udyam-registered businesses are entitled to:

Timely Payments: Buyers must settle invoices within 45 days of delivery.

Interest on Late Payments: If payments are delayed, the buyer is liable to pay compound interest (three times the bank rate).

Legal Protection: In case of disputes, MSMEs can approach the MSME Samadhaan portal for quick resolution.

ALSO READ:- udyam certificate download

5. Tax and Compliance Benefits

Udyam Registration offers several tax benefits, including:

Subsidized GST Rates: Many MSME products and services attract lower GST rates.

Direct Tax Exemptions: Certain expenses incurred by MSMEs are eligible for tax deductions.

Reimbursement of ISO Certification Fees: Promoting quality standards, the government reimburses costs associated with obtaining ISO certification.

6. Business Expansion and Export Benefits

For MSMEs looking to expand beyond domestic markets, Udyam Registration facilitates export promotion incentives such as:

Market Development Assistance (MDA): Helps MSMEs participate in trade fairs and exhibitions.

Subsidies on International Trade Fairs: The government provides financial support to MSMEs to showcase their products globally.

Access to Export Promotion Councils: MSMEs get membership in various export councils, increasing their reach to foreign buyers.

How to Register for Udyam

The Udyam Registration process is completely online and free of cost, making it accessible to all businesses. Here’s a step-by-step guide:

Step 1: Visit the Udyam Registration PortalGo to the official Udyam Registration website.

Step 2: Enter Aadhaar DetailsFor proprietorship firms, enter the proprietor’s Aadhaar number.

For partnership firms, enter the managing partner’s Aadhaar number.

For companies or LLPs, enter the authorized signatory’s Aadhaar number.

Step 3: Verify with OTPAn OTP will be sent to the registered mobile number linked to Aadhaar. Enter the OTP for verification.

Step 4: Provide Business InformationName and type of enterprise

PAN details (for businesses with turnover above Rs. 10 lakh)

Business address and bank details

Investment and turnover details

Step 5: Submit the ApplicationAfter entering all required details, submit the application. A unique Udyam Registration Number (URN) and e-certificate will be generated.

Common Myths and Misconceptions About Udyam Registration

1. Udyam Registration is Mandatory for All MSMEsFact: Udyam Registration is not mandatory, but it is highly recommended to avail government benefits.

2. Registration Involves a High FeeFact: The official registration process is completely free. Beware of third-party agents charging fees for registration.

3. Only Manufacturing Businesses Can RegisterFact: Both manufacturing and service-based enterprises can register under Udyam.

4. The Registration Process is ComplicatedFact: The process is simple, online, and paperless, requiring only Aadhaar and basic business details.

Conclusion

udyam aadhar download is a game-changer for MSMEs, providing them with the necessary credibility, financial support, and competitive edge to thrive in today’s dynamic business landscape. By registering under Udyam, MSMEs can unlock numerous benefits, from easier credit access to government contracts, tax exemptions, and legal protections.

#udyam registration#udyam registration online#print udyam certificate#apply udyam registartion#udyam registartion portal

0 notes

Text

Starting or expanding a business can be challenging without proper financial support, especially for small and medium enterprises (SMEs). The Government of India provides MSME (Micro, Small, and Medium Enterprises) loans to empower entrepreneurs and ensure business growth. If you’re looking to apply for msme loan, this comprehensive guide will walk you through the process and highlight everything you need to know.

What is an MSME Loan?

An MSME loan is a financial initiative introduced by the Government of India to support small businesses, startups, and entrepreneurs. These loans are often provided at lower interest rates and come with flexible repayment options to encourage economic growth and job creation.

Benefits of MSME Loans

Affordable Interest Rates: MSME loans often have subsidized interest rates, making them accessible for small businesses.

No Collateral: Many government-backed MSME loans do not require collateral, which reduces the risk for entrepreneurs.

Quick Processing: Applications are processed faster to meet urgent business needs.

Wide Range of Schemes: Entrepreneurs can choose from various schemes based on their requirements, such as Mudra Loan, Credit Guarantee Fund Scheme, and Stand-Up India.

Eligibility Criteria for MSME Loans

Before you begin the process to apply for an MSME loan, ensure your business meets these eligibility requirements:

Business Type: Your enterprise must fall under micro, small, or medium categories as defined by the Government of India.

Age of Business: Some schemes require a minimum operational period for eligibility.

Business Plan: A clear business plan demonstrating how the funds will be utilized.

Creditworthiness: A good credit score increases your chances of approval.

Steps to Apply for MSME Loan Online

The process of applying for an MSME loan has been simplified with digital platforms. Here’s how you can go about it:

Step 1: Prepare Essential Documents

Having your documents ready is the first step to a smooth application process. Commonly required documents include:

Business Registration Certificate

PAN Card and Aadhar Card

Bank Statements (Last 6 Months)

Income Tax Returns (Last 2-3 Years)

GST Registration Details

Detailed Business Plan

Step 2: Choose the Right Loan Scheme

Explore various government schemes for MSME loans to find one that suits your needs. Popular schemes include:

PM Mudra Yojana: For micro and small enterprises.

CGTMSE: Offers collateral-free loans.

Stand-Up India: For women and SC/ST entrepreneurs.

SIDBI Loans: Provided by Small Industries Development Bank of India for startups.

Step 3: Visit the Official Portal

To apply for MSME loans online, go to the official MSME portal or visit related bank websites.

Step 4: Fill in the Application Form

Provide your personal details such as name, contact number, and address.

Fill out business-related details like business type, turnover, and loan requirement.

Upload necessary documents in the required format.

Step 5: Submit and Track Application

Double-check the details before submitting your application.

Note down the reference number to track your application status.

Key Government Portals for MSME Loan Application

Udyam Registration Portal: For business registration and loan schemes.

Mudra Loan Portal: For micro and small business loans.

PSB Loans in 59 Minutes: A platform to get loan approvals within 59 minutes.

Tips for a Successful MSME Loan Application

Prepare a Solid Business Plan: Highlight how the funds will contribute to business growth.

Improve Credit Score: Maintain a good repayment history to build trust.

Choose the Right Loan Amount: Borrow what you can repay comfortably.

Be Transparent: Provide accurate and complete information during the application process.

Common Challenges in Applying for MSME Loans

Insufficient Documentation: Missing documents can delay approval.

Low Credit Score: A poor credit history can lead to rejection.

Scheme Mismatch: Applying under the wrong scheme reduces chances of approval.

How to Overcome Rejection?

Review Rejection Reasons: Understand why your application was denied.

Improve Documentation: Ensure all paperwork is accurate and up-to-date.

Seek Professional Help: Consult financial advisors to rectify issues.

Advantages of Applying Online

Convenience: Apply from anywhere without visiting a bank.

Faster Processing: Digital applications are processed quicker.

Transparency: Real-time tracking of loan applications.

Conclusion

Applying for an MSME loan online is a straightforward process when you follow the right steps. The government has made several efforts to ensure financial assistance reaches small businesses, empowering them to thrive. With proper preparation, a clear business plan, and the right scheme, securing an how to apply msme loan online can be the stepping stone for your entrepreneurial success.

#msme loan apply online#how to apply for msme loan#apply for msme loan#how to apply msme loan online#apply for msme loan online

0 notes

Text

MSME Registration: A Comprehensive Guide to Empowering Small Businesses

Micro, Small, and Medium Enterprises (MSMEs) play a pivotal role in driving economic growth, generating employment, and fostering innovation in any country. To support and encourage these enterprises, governments worldwide, including India, have introduced MSME registration schemes. This article delves into the nuances of MSME registration, its benefits, the registration process, and its significance for small businesses.

What is MSME Registration?

MSME registration is a government initiative aimed at classifying businesses into micro, small, and medium enterprises based on their investment and turnover. This classification ensures that these businesses receive appropriate benefits and incentives designed to promote their growth and sustainability.

Key Definitions:

Micro Enterprises: Investment up to ₹1 crore and turnover up to ₹5 crore.

Small Enterprises: Investment up to ₹10 crore and turnover up to ₹50 crore.

Medium Enterprises: Investment up to ₹50 crore and turnover up to ₹250 crore.

Why is MSME Registration Important?

Access to Financial Benefits: Registered MSMEs can avail of various government subsidies, low-interest loans, and tax exemptions.

Ease of Business Operations: MSME registration simplifies processes like opening bank accounts, applying for tenders, and securing funding.

Market Protection: Certain government tenders and procurement processes are exclusively reserved for MSMEs.

Legal Safeguards: MSMEs are protected under the Micro, Small, and Medium Enterprises Development Act (MSMED), ensuring timely payments and redressal of grievances.

Benefits of MSME Registration

1. Credit and Finance Access:

Registered MSMEs enjoy easier access to credit due to government-backed schemes and partnerships with financial institutions. Initiatives like the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) provide collateral-free loans.

2. Tax Benefits:

Tax holidays and exemptions are provided to registered MSMEs, reducing their financial burden and enabling them to reinvest in business growth.

3. Government Subsidies:

Subsidies on electricity bills, patent registration, and barcode registration are offered to encourage operational efficiency.

4. Reduced Interest Rates:

Banks often provide loans to MSMEs at lower interest rates, facilitating capital acquisition and expansion.

5. Protection Against Delayed Payments:

MSMEs have the legal right to claim interest on delayed payments from buyers, ensuring cash flow stability.

How to Register as an MSME?

MSME registration is a straightforward online process designed to ensure accessibility and ease of use for entrepreneurs.

Step 1: Visit the Official Portal

The registration process begins on the official Udyam Registration Portal (https://udyamregistration.gov.in/).

Step 2: Provide Business Details

Name and type of enterprise (proprietorship, partnership, etc.).

Aadhaar number of the business owner.

PAN card and GSTIN details (if applicable).

Step 3: Classification and Financial Information

Enter investment and turnover details to determine the business’s classification as micro, small, or medium.

Step 4: Verification and Submission

Once all details are filled, verify the information and submit the application. An acknowledgment and unique registration number will be provided upon successful submission.

Challenges Faced by MSMEs

Despite the benefits of MSME registration, many small businesses encounter hurdles:

Lack of Awareness: Many entrepreneurs are unaware of the registration process and its associated benefits.

Complex Documentation: Incomplete or incorrect documentation can delay the registration process.

Limited Technological Access: Small business owners in rural areas often face challenges in accessing online registration portals.

Delayed Payments: Despite legal safeguards, MSMEs frequently face payment delays from large corporations, affecting their liquidity.

Recent Updates and Initiatives for MSMEs

Governments continually update policies to make MSME registration more beneficial. Recent initiatives include:

Emergency Credit Line Guarantee Scheme (ECLGS): Designed to provide financial support to MSMEs during crises like COVID-19.

Atmanirbhar Bharat Abhiyan: Encourages self-reliance among Indian MSMEs by promoting domestic production and reducing dependency on imports.

Digitalization Drive: Initiatives to educate MSMEs on digital tools for registration, marketing, and operations.

Tips for MSMEs Post-Registration

Maintain Accurate Financial Records: Ensure compliance with investment and turnover limits to retain MSME status.

Leverage Government Schemes: Stay informed about updates and avail of benefits like subsidies, grants, and training programs.

Focus on Innovation: Invest in research and development to stay competitive in the market.

Adopt Digital Marketing: Use online platforms to increase visibility and reach a larger audience.

Conclusion

MSME registration is a gateway to numerous benefits and opportunities for small businesses. It not only provides financial and operational support but also fosters a conducive environment for growth and innovation. Entrepreneurs should prioritize registration to unlock the full potential of their businesses. By staying informed about updates and leveraging the benefits, MSMEs can significantly contribute to economic development and achieve long-term sustainability.

0 notes

Text

How to Utilize a CGTMSE Loan: A Step-by-Step Guide

Starting or expanding a business in India typically involves substantial funding, which is a challenge to MSMEs. and start-ups, especially where they lack assets to employ as collateral. The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) offers relief through its CGTMSE scheme, under which entrepreneurs can take collateral-free loans to propel their business growth. Here is this exhaustive guide that will guide you through the procedure for getting a CGTMSE loan, eligibility, benefits, and application, so that you can access this robust government scheme for MSMEs for pursuing your entrepreneurial dreams.

What is the CGTMSE Scheme?

CGTMSE scheme, or the Credit Guarantee Fund Trust for Micro and Small Enterprises, is a flagship programme launched in 2000 by the Government of India jointly with the Ministry of Micro, Small and Medium Enterprises (MoMSME) and the Small Industries Development Bank of India (SIDBI). The primary objective of this credit guarantee programme is to facilitate business lending by providing MSME loan guarantees to lending institutions and encouraging them to extend collateral-free loans in India to micro and small businesses (MSEs).

Under the CGTMSE scheme, eligible businesses can avail loans up to ₹5 crore without collateral security or third-party guarantee. In the event of default, the scheme gives 75-85% guarantee of the loan, reducing lenders' risk and making finance accessible for MSMEs and startups. This has been revolutionary in small business loans in India, and first-time entrepreneurs and companies have been able to innovate and grow.

Benefits of the CGTMSE Loan

The CGTMSE loan has several advantages that make it attractive for MSME loans for startup enterprises and startup business loans. It provides collateral-free loans, meaning no collateral security is necessary, a significant roadblock for small businesses with limited assets. This is ideal for MSMEs and startups that wish to expand without mortgaging property or other assets. MSME credit guarantee scheme covers 75-85% of the loan amount for loans of up to ₹50 lakh, and a maximum of 50% for retail trade or loans of over ₹50 lakh and up to ₹5 crore. For women entrepreneurs and businesses in the Northeast Region (NER), the coverage can be raised to 80-90%. With a higher loan limit of ₹5 crore (from ₹2 crore in April 2023), MSMEs can avail large working capital funds, machinery acquisition, business expansion, or technology upgradation. The scheme charges minimal CGTMSE fees, ranging from an annual guarantee fee of 0.37% to 1.35% of the loan amount, depending on the loan size and borrower category. Small-ticket financing up to ₹10 lakh has a nominal fee, being economical. MSMEs engaged in manufacturing, services, and retail trade (50% coverage) are covered under the CGTMSE scheme except for agriculture, self-help groups, and educational and training institutions. As it reduces lenders' risk, the guarantee scheme encourages entrepreneurship, enabling startup financing in India and funding MSME support programs by the Indian government.

Eligibility for CGTMSE Loans

To take advantage of a CGTMSE loan, businesses need to satisfy specific eligibility criteria as specified under the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006. Those who can borrow such loans include new and existing micro and small enterprises (MSEs) engaged in manufacturing, services, or retail trade. Startups which have been identified by Department for Promotion of Industry and Internal Trade (DPIIT) are also eligible under the Credit Guarantee Scheme for Startups (CGSS) with a maximum limit of ₹20 crore. Business entities that may be eligible are proprietary companies, partnerships, limited liability partnerships (LLPs), private companies, or public companies. Farms, self-help groups (SHGs), schools, and training institutions are not eligible. They must be registered as MSMEs under the Udyam Portal with a valid Udyam registration number. The borrowers must have an Income Tax Permanent Account Number (IT-PAN) except in case of loans up to ₹5 lakh. The loans may be taken for working capital, growth of the business, acquisition of machinery, or technology upgradation but not for personal expenditure.

The RTI full form (Right to Information) has no relationship with the CGTMSE scheme but can be applied in the case of asking for transparency on the process of the scheme or approvals under the RTI Act, 2005.

CGTMSE Loan Process: How to Apply for CGTMSE

Applying for a CGTMSE loan is an easy but comprehensive procedure. Go through the following steps to avail CGTMSE for startups or MSMEs. First, prepare a solid business plan outlining the project's financial viability, objectives, and funding requirements. This is instrumental in convincing lenders of your business potential. Secondly, visit one of the participating banks, non-banking financial company (NBFC), or financial institution registered with CGTMSE. Key Member Lending Institutions (MLIs) include State Bank of India (SBI), HDFC Bank, ICICI Bank, Bank of Baroda, and Ujjivan Small Finance Bank. A complete list may be accessed on the CGTMSE website (www.cgtmse.in). Attach loan application with required documents like duly filled CGTMSE loan application form, recent passport size photographs, Udyam registration certificate, GST registration certificate (if any), business incorporation or company registration certificate, detailed business project report, financial statements for the last 2-3 years (profit and loss, balance sheet) in case of an existing business, bank statements for the last six months, KYC documents (PAN card, Aadhaar card, passport, or driving license), proof of address (utility bills, rental agreement, or passport), and letter requesting CGTMSE loan cover. The lender will further analyze the loan application by evaluating the business viability, creditworthiness, and CGTMSE guideline adherence. On sanctioning the loan, MLI applies for guarantee cover through the use of the CGTMSE login portal. The borrower must pay the CGTMSE fee (guarantee and service fee) to initiate coverage. The guarantee then begins with payment by crediting the fee into CGTMSE's account. After approval by CGTMSE, the MLI discharges the loan to the account of the borrower. In case of term loans, guarantee is for the term; for working capital, it is for five years or a certain period. Pay the annual CGTMSE charges (if any) and follow the repayment schedule of the lender. In default, MLI can trigger the guarantee after 18 months lock-in period, if the account is NPA.

CGTMSE Fee and Fee Structure

CGTMSE fee is a combination of an annual guarantee fee (AGF) and a service fee paid in advance in the initial year and subsequently every year. The fee structure is based on the loan amount and classification of the borrower. For up to ₹5 lakh loans, the charge is 0.37% per annum for micro-enterprises (85% coverage). Up to ₹10 lakh loans incur a nominal charge, generally 0.75% per annum. For ₹10 lakh to ₹5 crore loans, the charge is 1.35% per annum (75-85% coverage, 50% for retail trade). Concessional rates and up to 90% coverage are provided for women entrepreneurs and Northeast Region (NER) units. The fee can be waived off for Zero Defect Zero Effect (ZED) certified units or for units in specified locations. Fee particulars are mentioned in the CGTMSE Scheme Document on the web.

Recommendations to Improve Your Chances of Getting a CGTMSE Loan

Ensure your project report is detailed, highlighting the growth opportunities of the business as well as repayability. Have a good credit score because lenders review creditworthiness during appraisal. Enroll your firm on the Udyam Portal beforehand to avoid delays in eligibility verification. Choose an MLI who has experience of handling CGTMSE loans in the past to make the application process easier. Seek the help of a financial advisor or chartered accountant to ensure all documents are accurate and complete. By following these steps and taking the advantage of the CGTMSE scheme, MSMEs and startups are able to get the financing they need in order to thrive in India's competitive marketplace. Click on the official CGTMSE website or consult with a participating lender in order to start your process for obtaining a collateral-free loan.

#cgtmse loan process#cgtmse scheme#credit guarantee scheme for msmes#msme loan guarantee#government schemes for msmes#msme subsidy programs#small business loans india#startup funding india#collateral-free loans india#finance

0 notes

Text

Starting or expanding a business can be challenging without proper financial support, especially for small and medium enterprises (SMEs). The Government of India provides MSME (Micro, Small, and Medium Enterprises) loans to empower entrepreneurs and ensure business growth. If you’re looking to how to apply msme loan, this comprehensive guide will walk you through the process and highlight everything you need to know.

What is an MSME Loan?

An MSME loan is a financial initiative introduced by the Government of India to support small businesses, startups, and entrepreneurs. These loans are often provided at lower interest rates and come with flexible repayment options to encourage economic growth and job creation.

Benefits of MSME Loans

Affordable Interest Rates: MSME loans often have subsidized interest rates, making them accessible for small businesses.

No Collateral: Many government-backed MSME loans do not require collateral, which reduces the risk for entrepreneurs.

Quick Processing: Applications are processed faster to meet urgent business needs.

Wide Range of Schemes: Entrepreneurs can choose from various schemes based on their requirements, such as Mudra Loan, Credit Guarantee Fund Scheme, and Stand-Up India.

Eligibility Criteria for MSME Loans

Before you begin the process to apply for an MSME loan, ensure your business meets these eligibility requirements:

Business Type: Your enterprise must fall under micro, small, or medium categories as defined by the Government of India.

Age of Business: Some schemes require a minimum operational period for eligibility.

Business Plan: A clear business plan demonstrating how the funds will be utilized.

Creditworthiness: A good credit score increases your chances of approval.

Steps to Apply for MSME Loan Online

The process of applying for an MSME loan has been simplified with digital platforms. Here’s how you can go about it:

Step 1: Prepare Essential Documents

Having your documents ready is the first step to a smooth application process. Commonly required documents include:

Business Registration Certificate

PAN Card and Aadhar Card

Bank Statements (Last 6 Months)

Income Tax Returns (Last 2-3 Years)

GST Registration Details

Detailed Business Plan

Step 2: Choose the Right Loan Scheme

Explore various government schemes for MSME loans to find one that suits your needs. Popular schemes include:

PM Mudra Yojana: For micro and small enterprises.

CGTMSE: Offers collateral-free loans.

Stand-Up India: For women and SC/ST entrepreneurs.

SIDBI Loans: Provided by Small Industries Development Bank of India for startups.

Step 3: Visit the Official Portal

To apply for MSME loans online, go to the official MSME portal or visit related bank websites.

Step 4: Fill in the Application Form

Provide your personal details such as name, contact number, and address.

Fill out business-related details like business type, turnover, and loan requirement.

Upload necessary documents in the required format.

Step 5: Submit and Track Application

Double-check the details before submitting your application.

Note down the reference number to track your application status.

Key Government Portals for MSME Loan Application

Udyam Registration Portal: For business registration and loan schemes.

Mudra Loan Portal: For micro and small business loans.

PSB Loans in 59 Minutes: A platform to get loan approvals within 59 minutes.

Tips for a Successful MSME Loan Application

Prepare a Solid Business Plan: Highlight how the funds will contribute to business growth.

Improve Credit Score: Maintain a good repayment history to build trust.

Choose the Right Loan Amount: Borrow what you can repay comfortably.

Be Transparent: Provide accurate and complete information during the application process.

Common Challenges in Applying for MSME Loans

Insufficient Documentation: Missing documents can delay approval.

Low Credit Score: A poor credit history can lead to rejection.

Scheme Mismatch: Applying under the wrong scheme reduces chances of approval.

How to Overcome Rejection?

Review Rejection Reasons: Understand why your application was denied.

Improve Documentation: Ensure all paperwork is accurate and up-to-date.

Seek Professional Help: Consult financial advisors to rectify issues.

Advantages of Applying Online

Convenience: Apply from anywhere without visiting a bank.

Faster Processing: Digital applications are processed quicker.

Transparency: Real-time tracking of loan applications.

Conclusion

Applying for an MSME loan online is a straightforward process when you follow the right steps. The government has made several efforts to ensure financial assistance reaches small businesses, empowering them to thrive. With proper preparation, a clear business plan, and the right scheme, securing an msme loan apply online can be the stepping stone for your entrepreneurial success.

#how to apply msme loan#msme loan apply#msme loan apply online#msme loan online#apply for msme loan online#apply for msme loan

0 notes

Text

How MSMEs Can Benefit from Udyam Registration in the Long Run

Let's talk about the backbone of our economy, MSMEs, whose contribution can't be described in a few words. Unfortunately, they ended up facing challenges to survive, but the government has decided to address such challenges to let them thrive.

Well, it's Udyam Registration, or a simplified registration process that's more like a paperless, streamlined, and transparent mechanism. Get ready to explore the long-term benefits that you can expect from Udyam registration.

What is Udyam Registration?

Udyam Registration can be described as a government initiative launched by the Ministry of MSMEs with an aim to simplify the MSME registration process. Such an online process lets the business get registered easily by providing few basic details. The portal can integrate information from the GST and Income Tax databases to eliminate the requirement of any physical documentation.

When it comes to the classification of MSMEs, they can be classified as per the turnover and investment made in machinery and plants. This ensures that businesses of various scales can benefit from tailored government support. However, it's mandatory for you to get registered for availing benefits under the government policies and schemes.

Long-Term Benefits of Udyam Registration for MSMEs

1) Eligibility for Government Schemes and Subsidies

With Udyam registration, you become eligible for a range of government schemes that can improve your business efficiency and reduce operational costs. The schemes are mainly designed to support the long-term development and growth of businesses like yours. We've mentioned some key schemes:

Credit Linked Capital Subsidy Scheme (CLCSS): CLCSS can aid you to upgrade your technology as it provides subsidies on capital investments. As a registered MSME, you can access subsidies of more than 15% on equipment and machinery purchases to foster technological modernization.

Pradhan Mantri Employment Generation Programme (PMEGP): In urban and rural areas, the PMEGP provides financial assistance for creating new employment opportunities through MSMEs. After getting registered, your enterprise can be eligible for capital subsidies.

MSME SAMADHAAN: With MSME SAMADHAAN, you can resolve any delayed payments from buyers to ensure financial stability and better cash flow management.

Market Development Assistance (MDA): Now, you can be a part of international trade fairs and exhibitions by using the MDA scheme. You can expect subsidies on the cost of travel and stall rent to expand your customer base and explore global markets.

2) Tax and Other Fiscal Benefits

There is an array of tax incentives that are entitled to MSMEs. As a registered MSME, you can avail of fiscal benefits:

Concessions on Electricity Bills: In India, some states provide registered MSMEs a concession on electricity tariffs. As a result, it can lower operational costs mainly for manufacturing businesses.

Direct Tax Benefits: Being a registered enterprise, you can claim deductions on profits linked to specific activities and schemes to reduce your overall tax liability.

Reduced Patent Fees: If you're engaged in product development and innovation, you can expect substantial discounts on patent registration fees. It can aid you in protecting your intellectual property at a much lower cost.

3) Access to Financial Support and Credit Facilities

Are you struggling to secure loans due to a lack of adequate documentation and formal recognition? Fortunately, Udyam registration can address the issue, as it makes businesses eligible and credible for financial institutions and government schemes. By being a registered MSME, you can enjoy long-term financial benefits:

Lower Interest Rates: Generally, NBFCs and banks provide lower interest rates to registered MSMEs as they are more credible. It can make the borrowing more affordable by reducing the cost of capital.

Collateral-Free Loans: There are schemes like CGTMSE that allow your registered enterprise to avail collateral-free loans. In case you're lacking assets to offer as security, then it can alleviate your burden.

Subsidies on Interest: There are government schemes that offer interest subsidies that you can access to promote sustainable growth and lower your financial burden.

4) Improved Market Access and Export Opportunities

After getting registered, you can open your door to better market access, mainly in the context of exports and government tenders. Below we've mentioned how you can benefit:

Exemption from Earnest Money Deposit (EMD): As a registered enterprise, you are exempt from paying any EMD while participating in government tenders. Thus, it can lower the upfront financial commitment that is required to bid for contracts.

Preference in Government Tenders: There is a certain percentage of government procurement reserved for MSMEs. You can receive special preferences to bid for government contracts that can expand your business and secure large orders.

Export Promotion: A range of export promotion subsidies and schemes are available for registered MSMEs. Initiatives like MEIS can provide you incentives to tap into the international market to aid in diversifying and expanding your customer base.

5) Access to Skill Development and Training Programs

Among MSME workers, the government is keen on promoting skill development to let them remain competitive in the global market. As a registered enterprise under Udyam, you can gain access to various skill development and training provided by the Ministry of MSMEs.

Generally, the programs are tailored to only special industries and sectors. It is done to improve businesses their operational efficiency, adopt new technologies, and aid in upskilling their workforce.

Conclusion

So, it's your turn to use such a powerful tool that can let you thrive in a competitive market of MSMEs. We would suggest you take full advantage of the opportunity to set yourself up for an enduring success. In the end, Udyog Aadhaar is not only a regulatory requirement but your gateway to a world full of opportunities.

0 notes

Text

Exploring Udyam Registration: A Key to MSME Success in 2025

Introduction

India’s Micro, Small, and Medium Enterprises (MSMEs) play a pivotal role in the nation’s economy, contributing significantly to employment generation, innovation, and GDP growth. However, these businesses often face numerous challenges, from limited access to finance and technology to regulatory hurdles. To address these concerns and empower small businesses to thrive, the Indian government introduced Udyam Registration, an initiative aimed at simplifying the registration process for MSMEs and unlocking a range of benefits. As we move into 2025, the role of Udyam Registration in driving MSME success becomes even more critical.

What is Udyam Registration?

Udyam Registration is an online process introduced by the Ministry of Micro, Small, and Medium Enterprises (MSME) in 2020. It replaced the previous Udyog Aadhaar system and aims to simplify the registration process for MSMEs. This registration provides small businesses with an official identity under the MSME category, making them eligible for a range of government benefits, schemes, and incentives. It is an easy-to-use portal that requires minimal documentation, making it accessible for businesses of all sizes.

Why Udyam Registration Is Crucial for MSMEs in 2025

1. Access to Government Schemes and Financial Support

One of the primary reasons MSMEs should consider Udyam Registration is the access it provides to a plethora of government schemes and subsidies. In 2025, as the government continues to support the growth of MSMEs, businesses registered under Udyam will be eligible for a range of benefits that can help them overcome financial challenges and grow their operations. Some of these benefits include:

Collateral-Free Loans: Udyam-registered MSMEs can apply for Mudra Loans and Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), which provide loans without requiring collateral. This is particularly beneficial for businesses that may not have significant assets to offer as security.

Tax Benefits and Exemptions: Registered MSMEs can avail themselves of tax exemptions and other financial incentives provided by the government. These include lower GST rates, income tax exemptions, and eligibility for Income Tax subsidies.

Subsidies for Technology and Equipment: Udyam Registration also opens the door to financial assistance for purchasing new technology and machinery under schemes like the Technology Upgradation Fund Scheme (TUFS), which helps MSMEs modernize their operations.

2. Boosting Digital Transformation

As we move into 2025, the digital revolution continues to transform the business landscape. MSMEs need to adopt digital technologies to stay competitive, improve operational efficiency, and reach a broader customer base. Udyam Registration is an important enabler of this digital shift. Registered businesses gain eligibility for various government schemes that promote digital adoption, such as the Digital MSME Scheme and the National Digital MSME Programme. These programs help MSMEs implement digital tools like e-commerce platforms, cloud-based ERP systems, digital marketing strategies, and more.

3. Improved Credibility and Market Access

In today’s competitive market, credibility and visibility are essential. Udyam Registration helps MSMEs establish their legitimacy, which is crucial for building trust with customers, suppliers, investors, and partners. The Udyam Certificate is recognized by both the government and private sector entities, making it easier for MSMEs to collaborate with large corporations and secure government contracts. With Udyam Registration, businesses can also participate in tendering opportunities for government projects, which are often reserved exclusively for MSMEs. This opens up lucrative business opportunities for small enterprises to expand their market reach and grow their customer base.

4. Fostering Innovation and R&D

The government is increasingly focusing on innovation and research and development (R&D) as key drivers of economic growth. Udyam-registered businesses have access to schemes that promote R&D and innovation within the MSME sector, such as the Innovation and Technology Support Scheme and the MSME Innovation Scheme. These initiatives provide financial support to MSMEs that wish to invest in new product development, process innovation, and technological upgrades. By enabling MSMEs to access funding for R&D, Udyam Registration helps these businesses stay ahead of the curve, improve product quality, and cater to evolving customer demands.

5. Enabling Regulatory Compliance and Ease of Doing Business

India’s regulatory landscape can be complex for small businesses, with compliance requirements often being cumbersome and time-consuming. However, Udyam Registration simplifies compliance by ensuring that businesses meet the necessary MSME criteria, making them eligible for various government benefits. Additionally, the Udyam portal is an online platform that provides an easy-to-use interface for self-registration, reducing paperwork and the need for intermediaries. It allows businesses to update their registration details and download the Udyam Certificate at any time. This simplifies the process of staying compliant and managing business operations in line with regulatory requirements.

Note: Update Udyam Certificate in just a few easy steps.

Conclusion

As we approach 2025, Udyam Registration has become an indispensable tool for MSMEs in India. The process, which was designed to simplify registration and provide benefits to small businesses, is now a critical enabler of growth and digital transformation. By registering, businesses can access funding, government schemes, tax incentives, and tools that will help them innovate, scale, and stay competitive in the digital age. For small business owners looking to secure a brighter future and grow their enterprises, Udyam Registration is not just a formality—it's the key to unlocking opportunities and ensuring long-term success in 2025 and beyond. Don't miss out on the benefits; register today and take your business to new heights.

0 notes

Text

How MSME Registration Can Unlock New Business Opportunities for Steel Manufacturers

India’s steel manufacturing industry has been growing rapidly, driven by strong demand in sectors like construction, automotive, infrastructure, and energy. However, many steel manufacturers, especially small and medium-sized enterprises (SMEs), face challenges such as high costs, limited access to financing, and stiff competition.

One powerful solution to these challenges is registering as a Micro, Small, and Medium Enterprise (MSME) under the Government of India’s MSME Act. MSME online registration can unlock new business opportunities and provide significant benefits that can help steel manufacturers level up their operations.

So, why not explore how MSME registration can be a game-changer for steel manufacturers looking to grow their business.

1. Access to Financial Support and Credit Facilities

One of the biggest benefits of MSMEs registration for steel manufacturers is improved access to finance. Many steel businesses struggle with working capital management due to the high upfront costs of raw materials, machinery, and technology. MSME registration can ease these concerns by providing access to several government schemes that offer loans at lower interest rates and longer repayment periods.

Key Benefits:

Priority lending: Banks are mandated to prioritise lending to MSMEs, making it easier to secure financing.

Subsidised interest rates: Registered MSMEs are eligible for loans with interest rates that are significantly lower than market rates, reducing financial burdens.