#charles specs wright

Explore tagged Tumblr posts

Video

youtube

Bye Bye Blackbird - Red Garland Trio

Bye Bye Blackbird - Red Garland Trio Red Garland - piano Jimmy Rowser - bass Charles "Specs" Wright - drums Recorded: October 2, 1959, The Prelude Club, New York City

23 notes

·

View notes

Text

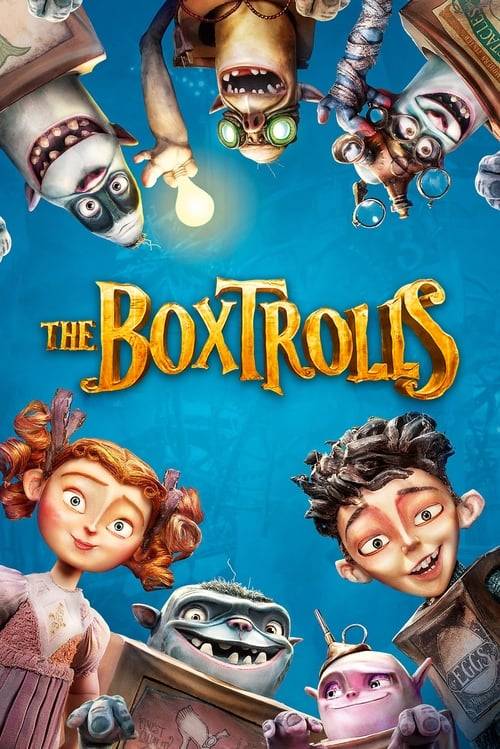

An orphaned boy raised by underground creatures called Boxtrolls comes up from the sewers and out of his box to save his family and the town from the evil exterminator, Archibald Snatcher. Credits: TheMovieDb. Film Cast: Archibald Snatcher (voice): Ben Kingsley Eggs (voice): Isaac Hempstead-Wright Winnie Portley-Rind (voice): Elle Fanning Fish / Wheels / Bucket (voice): Dee Bradley Baker Lady Cynthia Portley-Rind (voice): Toni Collette Lord Portley-Rind (voice): Jared Harris Mr. Trout (voice): Nick Frost Mr. Pickles (voice): Richard Ayoade Mr. Gristle (voice): Tracy Morgan Herbert Trubshaw (voice): Simon Pegg Oil Can / Knickers (voice): Nika Futterman Fragile / Sweets (voice): Pat Fraley Clocks / Specs (voice): Fred Tatasciore Sir Langsdale (voice): Maurice LaMarche Sir Broderick / Male Workman 1 / Male Workman 2 (voice): James Urbaniak Boulanger / Male Aristocrat (voice): Brian George Female Aristocrat (voice): Lori Tritel Shoe / Sparky (voice): Steve Blum Female Townsfolk 1 / Female Townsfolk 2 (voice): Laraine Newman Background Boy (voice): Reckless Jack Baby Eggs (voice): Max Mitchell Film Crew: Screenplay: Irena Brignull Director: Graham Annable Adaptation: Anthony Stacchi Novel: Alan Snow Music: Dario Marianelli Animation: Travis Knight Screenplay: Adam Pava Animation: Stephen Bodin Animation: Malcolm Lamont Animation: Matias Liebrecht Animation: Brian Leif Hansen Animation: Payton Curtis Animation: Joon Soo Song Animation: Adam Lawthers Animation: Shane Prigmore Animation: Chris Tootell Animation: Kyle Williams Animation: Mike Hollenbeck Animation: Danail Kraev Animation: Kristien Vanden Bussche Animation: Adam Fisher Animation: Anthony Straus Animation: Sean Burns Animation: Mael Gourmelen Animation: David Vandervoort Animation: Dan MacKenzie Animation Supervisor: Brad Schiff Animation: Kevin Parry Adaptation: Phil Dale Producer: David Bleiman Ichioka Animation: Jon David Buffam Animation: Rachelle Lambden Animation: Gabe Sprenger Animation: Philippe Tardif Animation: Ian Whitlock Animation: Daniel Alderson Animation: Charles Greenfield Animation: Jason Stalman Casting: Mary Hidalgo Line Producer: Matthew Fried Sculptor: Toby Froud Visual Effects Coordinator: Jeremy Fenske Choreographer: Nicole Cuevas Visual Effects Coordinator: Claudia Amatulli Sculptor: Benjamin William Adams Set Designer: Emily Greene Additional Editing: Ralph Foster Visual Effects Editor: Todd Gilchrist Set Designer: Carl B. Hamilton Sculptor: Scott Foster Production Design: Paul Lasaine Production Coordinator: Jocelyn Pascall Editor: Edie Ichioka Art Direction: Curt Enderle Editorial Coordinator: Dave Davenport Art Department Coordinator: Zach Sheehan CG Supervisor: Rick Sevy Music Supervisor: Maggie Rodford Music Editor: James Bellany Songs: Eric Idle Visual Effects Supervisor: Steve Emerson Costume Design: Deborah Cook Production Manager: Dan Pascall Additional Writing: Vera Brosgol Post Production Supervisor: David Dresher Editorial Manager: Trevor Cable Visual Effects Supervisor: Brian Van’t Hul Additional Editing: Christopher Murrie Director of Photography: John Ashlee Prat Set Designer: Polly Allen Robbins Visual Effects Producer: Annie Pomeranz Sound Re-Recording Mixer: Ren Klyce ADR Voice Casting: Barbara Harris Gaffer: James WilderHancock Modeling: Paul Mack Publicist: Maggie Begley Sound Re-Recording Mixer: Tom Myers Production Design: Michel Breton Prop Designer: Alan Cook Animation: Paul Andrew Bailey Assistant Art Director: Phil Brotherton Executive In Charge Of Post Production: Ben Urquhart First Assistant Director: Samuel Wilson Layout: Daniel R. Casey Layout: Simon Dunsdon Orchestrator: Geoff Alexander Set Dresser: Duncan Gillis Third Assistant Director: David J. Epstein Animation: Anthony Elworthy Animation: Dan Ramsay Animation: Jan-Erik Maas CG Animator: Carolyn Vale Digital Compositors: Daniel Leatherdale Digital Compositors: James McPherson Foley Editor: Thom Brennan Production Illustrator: Ean McNamara Sound Effects Editor: David C. Hughes Finance: Erin Baldwin Finance: Jason Bryant CG Animator: Jeff Croke Con...

View On WordPress

#based on novel or book#duringcreditsstinger#parent child relationship#stop motion#Top Rated Movies#unlikely friendship

2 notes

·

View notes

Photo

Art Blakey Percussion Ensemble (Drum Suite, 1957)

Art Blakey – drums

Ray Bryant – piano

Candido Camero – bass, bongos, congas, vocals

Sabu Martinez – bongos, congas, vocals

Philly Jo Jones – drums

Oscar Pettiford – bass, cello

Specs Wright – drums, timpani, gong, vocals

Image source: x

#art blakey#art#art blakey percussion ensemble#drum suite#1957#ray bryant#candido camero#sabu martinez#louis martinez#philly joe jones#oscar pettiford#specs wright#charles specs wright#jazz#music

2 notes

·

View notes

Text

Monday Nights At Birdland

Lee Morgan(tp) 1938-1972

Curtis Fuller(tb) 1934-

Hank Mobley(ts) 1930-1986

Billy Root(ts)

Ray Bryant(p)

Tommy Bryant(b)

Charles 'Specs' Wright(ds)

Recorded at Birdland,New York City,1958

ニューヨークの名ジャズクラブ「バード・ランド」にて。月曜日の夜は、本来は休館日。毎週のように若手ミュージシャンによる熱いジャムセッションが行われていた。Symphony Sidの渋い声も必聴

3 All the Things You Are

tb→ts→tp(4:50)→ts→pf

Lee Morganの力強いソロ 当時19歳!

5 There will be Another You

tsのソロは10人のインディアンっぽい tpは4:10頃から 緊張感というか鬼気迫るようなソロ うますぎる

1 note

·

View note

Text

Missouri Bid Bonds

The listed below short article is a good intro to bid bonds. Bid bonds, as you are mindful, are bonds used in the building market. These bonds ensure that if somebody bids on a project, and is granted the contract, then they will move forward with performing under the regards to the contract.

See the below post for more great details. You can see the initial article here:

https://swiftbonds.com/bid-bond/missouri-2/

Missouri Bid Bonds

What is a Bid Bond in Missouri?

A bid bond is a type of surety bond, which guarantees that the bidder will accept the project and complete the contract according to its terms. The bid bond provides assurance to the project owner that the bidder has the ability and wherewithal to complete the job once you are selected after the bidding process. The simple reason is that you need one so that you get the contract. But the larger question is why are more owners/developers requiring a bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes experienced contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to finish the job. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Missouri Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Missouri?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges: 1) We do charge for Overnight fees 2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in MO?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Missouri. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

Bond Amount Needed Fee <$800,000 2-3% >$800,000<$1,500,00 1.5-3% >$1.500,000 1-3%

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Missouri?

We make it easy to get a contract bid bond. Just click here to get our Missouri Bid Bond Application. Fill it out and then email it and the Missouri bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We will review each application for bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a great success rate in getting our clients surety bonds at the very best rates possible.

What is a Missouri Bid Bond?

A bid bond is a bond that assures that you will accept the work if you win the contract. The bid fee (usually five or ten percent) is a damages calculation that is paid when you win the bid, but then refuse the work.

Find a Bid Bond near Me

Typically, a bid bond and performance/payment bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is risk security for the benefit of the owner.

Who Gets the Surety Bid Bond?

The general contractor is the corporation that obtains the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the bid bond is written by the surety. This is also known as bonding a business.

We provide surety bid bonds in each of the following counties:

Adair Andrew Atchison Audrain Barry Barton Bates Benton Bollinger Boone Buchanan Butler Caldwell Callaway Camden Cape Girardeau Carroll Carter Cass Cedar Chariton Christian Clark Clay Clinton Cole Cooper Crawford Dade Dallas Daviess De Kalb Dent Douglas Dunklin Franklin Gasconade Gentry Greene Grundy Harrison Henry Hickory Holt Howard Howell Iron Jackson Jasper Jefferson Johnson Knox Laclede Lafayette Lawrence Lewis Lincoln Linn Livingston Macon Madison Maries Marion McDonald Mercer Miller Mississippi Moniteau Monroe Montgomery Morgan New Madrid Newton Nodaway Oregon Osage Ozark Pemiscot Perry Pettis Phelps Pike Platte Polk Pulaski Putnam Ralls Randolph Ray Reynolds Ripley St. Charles St. Clair Ste. Genevieve St. Francois St. Louis St. Louis City Saline Schuyler Scotland Scott Shannon Shelby Stoddard Stone Sullivan Taney Texas Vernon Warren Washington Wayne Webster Worth Wright

And Cities: St. Louis Kansas City Springfield Columbia Branson Joplin Jefferson City Saint Charles Saint Joseph Independence

See our Montana Bid Bond page here. More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Learning More About Applying and Finding The Right Bid Bonds For Your Needs

Bid Bonds can be complicated to apply for, especially if you don’t understand how they work. Most individuals consider this as insurance, but it’s actually a type of guarantee that the principal will perform their work properly for the obliged. Insurance companies usually offer a Surety Bid Bond, but you cannot call it insurance because its function is different. Most individuals will require you to get a bid bond before they consider your services as it is a form of guarantee to them.

If you’d like to consider applying for a bid bond or other bonds, you must understand how they work. We will provide you information on the importance of Bid Bonds and how they actually work.

The Importance Of A Surety Bid Bond

Bid Bonds will always be in demand to protect the public because it is a kind of assurance that your obligations and duties will be completed. Most states require you to get a license surety bond to ensure that your company will adhere to state code and laws and you get a contract bond to guarantee that a public project will be completed. A Surety Bid Bond is meant for the obliged since they are the ones that are being protected, but it will also benefit you because the clients will trust you and your work. There are thousands of bonds right now and the type of bond that you are trying to find will depend upon your situation.

The Primary Purpose Of A Surety Bid Bond

Bid Bonds are a three-party agreement between the principal, the obliged and the surety company. The principal is the employer or company which will perform the work and the obliged is known as the project owner. Construction companies will almost always be required by law to acquire Bid Bonds if they’re chosen for a public project. The government will require a construction company to get a host of bonds before they work on a certain project. The bond will ensure that the sub-contractors and the other workers will be paid even if the contractor defaults. The contractor will cover the losses, but when they reach their limit, the duty will fall to the surety company.

How To Apply For A Surety Bid Bond

Bid Bonds are provided by insurance providers, but there are standalone surety businesses that focus on these products. A surety company must be licensed by a state Department of Insurance.

It won’t be easy to apply for a bond since the applicants will have to go through a process that is comparable to applying for a loan. The bond underwriters will look into the credit profile of the applicant, their financial history and other key factors.

It means that there is a chance that you won’t be approved for a bid bond, particularly if the bond underwriters see something from your credit rating that makes them think you will be a risk.

How Much Will You Spend?

You cannot put an exact cost on a Surety Bid Bond because the cost is affected by numerous factors like the bond type, bond amount, where it will likely be issued, contractual risk, credit history of the applicant and more. There are thousands of different bonds available today and the cost will depend on the bond that you want to get. The amount of the bond will be a factor because you could select a $10,000 bond or a $25,000 bond or higher.

If you already have a credit history of 700 and above or very near this number, you can be eligible for the standard bonding market and you will need to pay 1 to 4 percent of the Surety Bid Bond amount. It means that if you obtain a $10,000 bond, you only have to pay $100 to $400 for the interest.

Your Application For A Bid Bond Could Be Rejected

There is a possibility that your bid bond request will be refused by the surety company since it will depend upon the information that they can get from the background check. If the surety company thinks that it will be a risk to give you a bid bond, they will deny your application. Your credit history is one of the most important factors to be approved for a bid bond because if you have a bad credit history, it shows a risk of default on the bond.

You CAN get a bid bond even if you have a bad credit score, but most likely you will pay an interest rate upwards of 10 to 20 percent.

If you plan to get a Surety Bid Bond, make certain you understand what is required prior to deciding. It is not easy to apply for, but if you know more about them, it will be a little bit easier to be approved.

A Deeper Look At Quote Bonds in Building A Bid Bond is a type of surety bond utilized to guarantee that a contractor bidding on a job or task will get in into the contract with the obligee if awarded.

A Bid Bond is issued in the quantity of the contract quote, with the similar requirements as that of an Efficiency Bond.

All About Bid Bonds in Building And Construction The origins of our service was closely connected with the provision of efficiency bonds to the contracting market. Somewhat greater than one a century back, the federal authorities grew to end up being alarmed concerning the high failure fee amongst the private companies it was using to bring out public building projects. It found that the private specialist usually was insolvent when the job was awarded, or grew to become insolvent earlier than the obstacle was completed. Accordingly, the federal government was continuously entrusted incomplete initiatives, and the taxpayers had actually been required to cover the additional costs emerging from the contractor's default.

The standing of your surety firm is essential, due to the fact that it ensures you that when you have problems or if worse involves worst you'll have a dependable partner to rely on and receive aid from. We work just with T-listed and a-rated business, probably the most dependable corporations in the market.

Typically no, they are separate. Nevertheless, bid bonds mechanically turn into performance bonds in case you are awarded the agreement.

What Is A Construction Surety Bond? The origins of our service was thoroughly linked with the provision of performance bonds to the contracting market. Even if some tasks do not require cost and efficiency bonds, you will require to get bonded finally since the majority of public efforts do need the bonds. The longer a little specialist waits to get bonded, the more durable it will be because there will not be a observe report of fulfilling the mandatory requirements for bonding and performing bonded work.

The only restrict is the greatest bond you may get for one particular task. The aggregate limitation is the whole quantity of bonded work offered you perhaps can have without hold-up.

The Importance Of Quote Bonds near You Arms, generators, radio towers, tree removal, computer systems, softward, fire alarms, decorative work, scaffolding, water towers, lighting, and resurfacing of current roads/paved locations. Bid bonds in addition function an extra warranty for task owners that a bidding professional or subcontractor is qualified to perform the task they're bidding on. There are two causes for this.

https://swiftbonds.com/bid-bond/missouri-2/

0 notes

Text

Missouri Bid Bonds

The listed below short article is a good intro to bid bonds. Bid bonds, as you are mindful, are bonds used in the building market. These bonds ensure that if somebody bids on a project, and is granted the contract, then they will move forward with performing under the regards to the contract.

See the below post for more great details. You can see the initial article here:

https://swiftbonds.com/bid-bond/missouri-2/

Missouri Bid Bonds

What is a Bid Bond in Missouri?

A bid bond is a type of surety bond, which guarantees that the bidder will accept the project and complete the contract according to its terms. The bid bond provides assurance to the project owner that the bidder has the ability and wherewithal to complete the job once you are selected after the bidding process. The simple reason is that you need one so that you get the contract. But the larger question is why are more owners/developers requiring a bid bond? The simple answer is risk. Given the uncertainty of the marketplace, which includes experienced contractors closing their doors, to municipalities filing bankruptcy (or just slow paying), has led to owners being afraid that their contractors will be unable to finish the job. So, they require a some protection.

Just fill out our bond application here and email it to [email protected] – click here to get our Missouri Bid Bond Application

A bid bond is issued as part of a bid by a surety bond company to the project owner. The owner is then assures that the winning bidder will take on the contract under the terms at which they bid.

Most bid bonds contain a bid percentage (usually 5% or 10%, is forfeited if you don’t accept the job).

How much does a Bid Bond Cost in Missouri?

Swiftbonds does not charge for a bid bond (with two exceptions, see below). The reason that we don’t charge for a bid bond is that we will charge for the P&P bond if you get the job. The cost of a bid bond can vary widely depending on the amount of coverage that is required (see below).

Two exceptions for bid bond charges: 1) We do charge for Overnight fees 2) We will charge you if there is NOT going to be a bond on the contract.

How much do bonds cost in MO?

Bond prices fluctuate based on the job size (that is, it’s based on the cost of the underlying contract). The cost of a bond is estimated through a couple of back-of-the-envelope calculations. In general, the cost is approximately three percent (3%) for jobs under $800,000 and then the percentage is lower as the contract amount increases. We work diligently to find the lowest premiums possible in the state of Missouri. Please call us today at (913) 286-6501. We’ll find you the very best rate possible for your maintenance bond or completion bond. Things that can affect this pricing are the perceived risk of the job, the financial position of the entity being bonded, plus other factors.

Bond Amount Needed Fee <$800,000 2-3% >$800,000<$1,500,00 1.5-3% >$1.500,000 1-3%

These rates are for Merit clients, Standard rates are higher

How do I get a Bid Bond in Missouri?

We make it easy to get a contract bid bond. Just click here to get our Missouri Bid Bond Application. Fill it out and then email it and the Missouri bid specs/contract documents to [email protected] or fax to 855-433-4192.

You can also call us at (913) 286-6501. We will review each application for bid bonds and then submit it to the surety that we believe will provide the best bid bond for your company. We have a great success rate in getting our clients surety bonds at the very best rates possible.

What is a Missouri Bid Bond?

A bid bond is a bond that assures that you will accept the work if you win the contract. The bid fee (usually five or ten percent) is a damages calculation that is paid when you win the bid, but then refuse the work.

Find a Bid Bond near Me

Typically, a bid bond and performance/payment bond are done together in the same contract by the surety. This way, the owner of the project is assured that the project can be completed pursuant to the terms of the contract and that it will not be liened by any contractor. The bond is risk security for the benefit of the owner.

Who Gets the Surety Bid Bond?

The general contractor is the corporation that obtains the bond. It is for the benefit of the owner (or in the case of government contract work, the governmental entity). It’s the general contractor that has to apply for the bond and be underwritten before the bid bond is written by the surety. This is also known as bonding a business.

We provide surety bid bonds in each of the following counties:

Adair Andrew Atchison Audrain Barry Barton Bates Benton Bollinger Boone Buchanan Butler Caldwell Callaway Camden Cape Girardeau Carroll Carter Cass Cedar Chariton Christian Clark Clay Clinton Cole Cooper Crawford Dade Dallas Daviess De Kalb Dent Douglas Dunklin Franklin Gasconade Gentry Greene Grundy Harrison Henry Hickory Holt Howard Howell Iron Jackson Jasper Jefferson Johnson Knox Laclede Lafayette Lawrence Lewis Lincoln Linn Livingston Macon Madison Maries Marion McDonald Mercer Miller Mississippi Moniteau Monroe Montgomery Morgan New Madrid Newton Nodaway Oregon Osage Ozark Pemiscot Perry Pettis Phelps Pike Platte Polk Pulaski Putnam Ralls Randolph Ray Reynolds Ripley St. Charles St. Clair Ste. Genevieve St. Francois St. Louis St. Louis City Saline Schuyler Scotland Scott Shannon Shelby Stoddard Stone Sullivan Taney Texas Vernon Warren Washington Wayne Webster Worth Wright

And Cities: St. Louis Kansas City Springfield Columbia Branson Joplin Jefferson City Saint Charles Saint Joseph Independence

See our Montana Bid Bond page here. More on Surety Bid Bonds https://swiftbonds.com/bid-bond/.

Learning More About Applying and Finding The Right Bid Bonds For Your Needs

Bid Bonds can be complicated to apply for, especially if you don’t understand how they work. Most individuals consider this as insurance, but it’s actually a type of guarantee that the principal will perform their work properly for the obliged. Insurance companies usually offer a Surety Bid Bond, but you cannot call it insurance because its function is different. Most individuals will require you to get a bid bond before they consider your services as it is a form of guarantee to them.

If you’d like to consider applying for a bid bond or other bonds, you must understand how they work. We will provide you information on the importance of Bid Bonds and how they actually work.

The Importance Of A Surety Bid Bond

Bid Bonds will always be in demand to protect the public because it is a kind of assurance that your obligations and duties will be completed. Most states require you to get a license surety bond to ensure that your company will adhere to state code and laws and you get a contract bond to guarantee that a public project will be completed. A Surety Bid Bond is meant for the obliged since they are the ones that are being protected, but it will also benefit you because the clients will trust you and your work. There are thousands of bonds right now and the type of bond that you are trying to find will depend upon your situation.

The Primary Purpose Of A Surety Bid Bond

Bid Bonds are a three-party agreement between the principal, the obliged and the surety company. The principal is the employer or company which will perform the work and the obliged is known as the project owner. Construction companies will almost always be required by law to acquire Bid Bonds if they’re chosen for a public project. The government will require a construction company to get a host of bonds before they work on a certain project. The bond will ensure that the sub-contractors and the other workers will be paid even if the contractor defaults. The contractor will cover the losses, but when they reach their limit, the duty will fall to the surety company.

How To Apply For A Surety Bid Bond

Bid Bonds are provided by insurance providers, but there are standalone surety businesses that focus on these products. A surety company must be licensed by a state Department of Insurance.

It won’t be easy to apply for a bond since the applicants will have to go through a process that is comparable to applying for a loan. The bond underwriters will look into the credit profile of the applicant, their financial history and other key factors.

It means that there is a chance that you won’t be approved for a bid bond, particularly if the bond underwriters see something from your credit rating that makes them think you will be a risk.

How Much Will You Spend?

You cannot put an exact cost on a Surety Bid Bond because the cost is affected by numerous factors like the bond type, bond amount, where it will likely be issued, contractual risk, credit history of the applicant and more. There are thousands of different bonds available today and the cost will depend on the bond that you want to get. The amount of the bond will be a factor because you could select a $10,000 bond or a $25,000 bond or higher.

If you already have a credit history of 700 and above or very near this number, you can be eligible for the standard bonding market and you will need to pay 1 to 4 percent of the Surety Bid Bond amount. It means that if you obtain a $10,000 bond, you only have to pay $100 to $400 for the interest.

Your Application For A Bid Bond Could Be Rejected

There is a possibility that your bid bond request will be refused by the surety company since it will depend upon the information that they can get from the background check. If the surety company thinks that it will be a risk to give you a bid bond, they will deny your application. Your credit history is one of the most important factors to be approved for a bid bond because if you have a bad credit history, it shows a risk of default on the bond.

You CAN get a bid bond even if you have a bad credit score, but most likely you will pay an interest rate upwards of 10 to 20 percent.

If you plan to get a Surety Bid Bond, make certain you understand what is required prior to deciding. It is not easy to apply for, but if you know more about them, it will be a little bit easier to be approved.

A Deeper Look At Quote Bonds in Building A Bid Bond is a type of surety bond utilized to guarantee that a contractor bidding on a job or task will get in into the contract with the obligee if awarded.

A Bid Bond is issued in the quantity of the contract quote, with the similar requirements as that of an Efficiency Bond.

All About Bid Bonds in Building And Construction The origins of our service was closely connected with the provision of efficiency bonds to the contracting market. Somewhat greater than one a century back, the federal authorities grew to end up being alarmed concerning the high failure fee amongst the private companies it was using to bring out public building projects. It found that the private specialist usually was insolvent when the job was awarded, or grew to become insolvent earlier than the obstacle was completed. Accordingly, the federal government was continuously entrusted incomplete initiatives, and the taxpayers had actually been required to cover the additional costs emerging from the contractor's default.

The standing of your surety firm is essential, due to the fact that it ensures you that when you have problems or if worse involves worst you'll have a dependable partner to rely on and receive aid from. We work just with T-listed and a-rated business, probably the most dependable corporations in the market.

Typically no, they are separate. Nevertheless, bid bonds mechanically turn into performance bonds in case you are awarded the agreement.

What Is A Construction Surety Bond? The origins of our service was thoroughly linked with the provision of performance bonds to the contracting market. Even if some tasks do not require cost and efficiency bonds, you will require to get bonded finally since the majority of public efforts do need the bonds. The longer a little specialist waits to get bonded, the more durable it will be because there will not be a observe report of fulfilling the mandatory requirements for bonding and performing bonded work.

The only restrict is the greatest bond you may get for one particular task. The aggregate limitation is the whole quantity of bonded work offered you perhaps can have without hold-up.

The Importance Of Quote Bonds near You Arms, generators, radio towers, tree removal, computer systems, softward, fire alarms, decorative work, scaffolding, water towers, lighting, and resurfacing of current roads/paved locations. Bid bonds in addition function an extra warranty for task owners that a bidding professional or subcontractor is qualified to perform the task they're bidding on. There are two causes for this.

https://swiftbonds.com/bid-bond/missouri-2/

0 notes

Video

youtube

Ray Bryant Trio - Golden Earrings (1957)

Personnel: Ray Bryant (piano), Ike Isaacs (bass), Charles "Specs" Wright (drums) from the album 'RAY BRYANT TRIO' (Prestige Records)

0 notes

Video

youtube

Lee Morgan,Hank Mobley - 02 "All the Things You Are"

Lee Morgan (tp) Curtis Fuller (tb) Hank Mobley (ts) Billy Root (ts, brs) Ray Bryant (p) Tommy Bryant (b) Charles "Specs" Wright (ds)

Recorded live at "Birdland", NYC Apr 21, 1958

7 notes

·

View notes