#cryptofuture

Explore tagged Tumblr posts

Text

A perfect choice for blockchain enthusiasts, cryptocurrency supporters, and those who appreciate decentralized innovation.

👉 Get yours today!

#Bitcoin#Crypto#Blockchain#SatoshiMystery#BTC#Cryptocurrency#DecentralizedFinance#DigitalGold#HODL#CryptoInvestor#BitcoinBeliever#FinancialRevolution#HODLgang#CryptoFuture#Web3

4 notes

·

View notes

Text

Cutoshi Price Prediction: Will $CUTO Reach $1 by 2025?

Cutoshi, a new meme coin, has been gaining attention in the cryptocurrency community. As of December 2024, the $CUTO token is priced at $0.031, with its presale stages selling out ahead of schedule

The presale has raised significant funds, indicating strong investor interest. Some projections suggest that $CUTO could reach approximately $1 by the end of 2025, driven by factors such as its unique MemeFi protocol and growing community support

Market Dynamics and Investor Sentiment

The cryptocurrency market is highly volatile, and while some analysts are optimistic about $CUTO's potential, others advise caution. It's essential for investors to conduct thorough research and consider market trends before making investment decisions.

Conclusion

While the prospect of $CUTO reaching $1 by 2025 is intriguing, it's crucial to approach such predictions with caution. The cryptocurrency market's volatility means that prices can fluctuate rapidly. Investors should stay informed and make decisions based on comprehensive analysis.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Visit For Detail Update on Cutoshi Price Prediction

#Cutoshi price prediction#CutoshiPricePrediction#CUTO#Cutoshi#CryptoPrediction#MemeCoin#DeFi#Cryptocurrency#CryptoNews#Blockchain#CryptoMarket#CryptoInvesting#CryptoCommunity#CryptoTrends#CryptoAnalysis#CryptoForecast#CryptoUpdates#CryptoInsights#CryptoBuzz#CryptoTalk#CryptoWorld#CryptoInvestors#CryptoTrading#CryptoExperts#CryptoOpinions#CryptoForecasting#CryptoSpeculation#CryptoProspects#CryptoFuture#CryptoPotential

3 notes

·

View notes

Text

The Year of Bitcoin: Why 2025 Could Be a Turning Point

The start of 2025 has set the stage for what may be Bitcoin’s most transformative year yet. The events of 2024, from significant corporate acquisitions to milestones in adoption, have positioned Bitcoin as a central player in the evolving financial landscape. With growing economic instability, technological advancements, and shifting narratives, Bitcoin is poised to reach new heights in both relevance and adoption.

Setting the Stage

In 2024, Bitcoin witnessed several pivotal moments. Institutional interest soared, adoption among individuals continued to grow, and countries started exploring Bitcoin as a hedge against economic uncertainty. As we enter 2025, the momentum is unmistakable. Bitcoin is no longer merely a speculative asset—it is becoming a cornerstone of financial innovation and security.

The Macro Environment

The global economy is in a state of flux. Rising inflation and growing distrust in fiat currencies have left governments and central banks scrambling for solutions. In this environment, Bitcoin’s fixed supply and decentralized nature offer a stark contrast to the instability of traditional systems. As more people recognize its value as a store of wealth, Bitcoin’s role in the global financial system is expanding.

Adoption Trends: A Billion-Dollar Vote of Confidence

December 2024 was a monumental month for corporate Bitcoin adoption. In just the first 10 days, U.S. companies invested a staggering $3.26 billion into Bitcoin.

MicroStrategy, the largest corporate holder of Bitcoin, acquired 21,550 BTC worth $2.1 billion, bringing its total holdings to 423,650 BTC valued at $25.6 billion.

Marathon Digital, a leading Bitcoin mining firm, added 11,774 BTC for around $1.1 billion, boosting its total to 40,435 BTC worth $3.9 billion.

Riot Platforms, a Bitcoin infrastructure company, acquired 705 BTC worth $68.45 million.

These investments underscore the confidence U.S. companies have in Bitcoin as a long-term store of value. They also signal a broader shift in institutional attitudes toward Bitcoin as an essential financial asset.

A Historic Milestone: Bitcoin Enters the Nasdaq-100

In another major development, MicroStrategy joined the Nasdaq-100 Index on December 23, 2024, standing alongside titans like Apple, Microsoft, and Tesla. This milestone not only highlights MicroStrategy’s success but also validates Bitcoin’s integration into traditional financial systems.

Founded over 30 years ago as an enterprise software company, MicroStrategy transitioned into a Bitcoin powerhouse under the leadership of Executive Chairman Michael Saylor. Since 2020, the company has amassed over 423,000 BTC worth $42 billion, becoming the largest corporate holder of the scarce digital asset. Its inclusion in the Nasdaq-100 symbolizes Bitcoin’s growing credibility and mainstream acceptance.

The Strategic Bitcoin Reserve

In a groundbreaking move, the incoming Trump administration has announced plans to create a strategic Bitcoin reserve. This initiative aims to position the United States as a leader in the digital asset space while safeguarding its financial future. By holding Bitcoin as a reserve asset, the government signals its confidence in Bitcoin’s long-term value and utility. Such a policy could set a precedent for other nations, accelerating global adoption and further solidifying Bitcoin’s status as a global store of value.

Technological Advancements

Bitcoin’s infrastructure continues to evolve. The Lightning Network, which facilitates instant and low-cost Bitcoin transactions, is gaining widespread adoption, enabling new use cases like micropayments and decentralized financial services. Upgrades like Taproot and innovations in Ordinals have also enhanced Bitcoin’s privacy, scalability, and functionality. These advancements are transforming Bitcoin from a simple store of value to a versatile tool for global commerce.

The Narrative Shift

Bitcoin’s narrative is evolving. Once seen primarily as a speculative investment, it is now recognized as a tool for financial sovereignty and inclusion. Younger generations, who grew up in an era of financial crises and technological disruption, are driving this shift. For them, Bitcoin represents not just an asset but a movement—a way to opt out of traditional systems and build a fairer, more transparent financial future.

Challenges to Watch

Despite its progress, Bitcoin faces significant challenges. Regulatory uncertainty remains a critical hurdle, with governments worldwide grappling with how to classify and regulate Bitcoin. Competing narratives, such as the rise of central bank digital currencies (CBDCs), also pose a threat. Additionally, the debate over Bitcoin’s energy consumption continues, though proponents argue that it’s driving innovation in renewable energy.

Why 2025 Could Be the Year of Bitcoin

As we look ahead, it’s clear that 2025 holds immense potential for Bitcoin. With institutional adoption accelerating, technological innovations reshaping its utility, and the macroeconomic landscape driving demand, Bitcoin is on the brink of a new era.

For individuals and institutions alike, the message is clear: stay informed, get involved, and embrace Bitcoin as a cornerstone of the future financial system. The revolution is underway, and 2025 could be the year Bitcoin proves it is here to stay.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#Blockchain#FinancialRevolution#DigitalAssets#CryptoAdoption#Bitcoin2025#MacroEconomics#BitcoinMining#CryptoNews#Nasdaq100#BitcoinReserve#DigitalGold#Decentralization#CryptoInnovation#BitcoinMilestones#CryptoFuture#MoneyRevolution#HODL#LightningNetwork#financial empowerment#globaleconomy#finance#financial experts#digitalcurrency#financial education#unplugged financial

2 notes

·

View notes

Text

💼🔐 Binance’s CZ is changing the game! Now you can secure your crypto legacy with the new ‘Will Function’ – because your assets should live on, even when you don’t. 💎🚀 Plan smart. Stay safe. Leave a legacy.

#CryptoWill#Binance#CryptoLegacy#CZBinance#CryptoSecurity#BinanceWillFunction#SecureYourCrypto#CryptoFuture#Web3#CryptoNews#DigitalAssets#BlockchainRevolution#ViralCrypto#CryptoTrending

0 notes

Text

SECURE YOUR FUTURE IN CRYPTO WITH KoYofund! In today’s volatile markets, having an AI-powered co-pilot can make all the difference:

Adaptive Market Analysis – Leverage machine learning to spot emerging trends.

Risk-Adjusted Strategies – Optimize returns while controlling downside.

Continuous Oversight – Automated 24/7 portfolio health checks.

Discover how KoYofund’s next-generation platform transforms crypto investing into a smarter, safer experience.

www.koyofund.com

#CryptoAI#InvestSmart#KoYofund#CryptoTrends#AITrading#BlockchainTech#DeFi#CryptoPortfolio#Web3Investing#Fintech#CryptoFuture#AltcoinStrategy#MachineLearning#CryptoSecurity

1 note

·

View note

Text

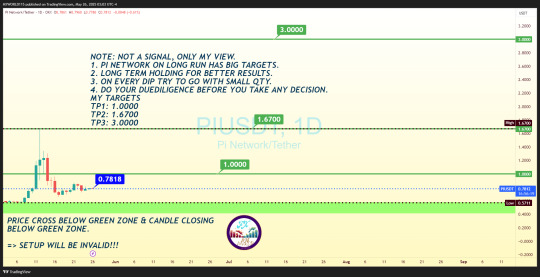

Why Is Pi Network Price Prediction Important For Investors?

This in-depth Pi Network price prediction analysis highlights key levels to watch for in 2025. Traders and investors seeking Pi Coin forecasts will find clear TP targets of $1.00, $1.67, and $3.00. The setup is valid only if the price stays above the green support zone. Learn the importance of long-term holding strategies, risk management using small quantity buys on dips, and how due diligence plays a crucial role in Pi Network investing. Whether you're a new crypto enthusiast or a seasoned investor, understanding this Pi Network price setup can help guide your strategy. Explore why Pi Network price matters and how technical analysis reveals future trends. This Pi price chart offers a unique look into potential breakout opportunities and invalidation signals for informed trading.

#CryptoInvesting#PiNetworkPrediction#ToTheMoonPi#PiNetwork#PiCoin#CryptoPrediction#CryptoFuture#BlockchainRevolution#AltcoinGems#NextBitcoin#InvestInCrypto#SmartInvesting#CryptoInvestors#FinancialFreedom#WealthBuilding#InvestmentTips#CryptoPortfolio#InvestorMindset#PassiveIncomeStreams

0 notes

Photo

🚪 A new door is opening in the world of crypto. Welcome $Focoin — fast, scalable, and ready to lead on the blockchain. Are you stepping in?

0 notes

Text

Cryptocurrency Regulations In The UAE: Navigating The Future of Digital Finance

Explore the evolving landscape of cryptocurrency regulations in the UAE, where innovation meets compliance. This guide delves into legal frameworks, government initiatives, and the future of digital finance. Stay informed about how the UAE is positioning itself as a global hub for blockchain technology and secure cryptocurrency investments.

#sabindia#cryptouae#uaeblockchain#digitalfinance#cryptoregulations#blockchainuae#cryptolaw#fintechuae#uaefinance#cryptomarket#cryptonews#dubaicrypto#digitalassets#cryptotrading#cryptocompliance#uaeinvestment#blockchainregulations#cryptofuture#uaeeconomy#cryptocurrency2025#cryptolegalframework

0 notes

Text

Creating a Utility-Driven Cryptocurrency Coin That Attracts Real Users

Cryptocurrency has evolved beyond speculative investments into real-world utilities that drive adoption. While thousands of coins exist, only a few successfully attract real users. This guide explores how to create a utility-driven cryptocurrency that gains genuine traction.

Real-World Use Cases of Utility-Driven Cryptocurrencies

Cryptocurrencies gain real traction when they offer practical, real-world solutions. Here are some examples of utility-driven coins that have successfully attracted users:

Payment Solutions

Bitcoin (BTC): Widely accepted as a store of value and payment method.

Litecoin (LTC): Faster and cheaper alternative for transactions.

XRP (XRP): Used for cross-border remittances with low fees.

Decentralized Finance (DeFi)

Ethereum (ETH): Backbone of the DeFi ecosystem, enabling smart contracts.

Aave (AAVE): A decentralized lending and borrowing protocol.

Uniswap (UNI): Leading decentralized exchange (DEX) platform.

Supply Chain and Logistics

VeChain (VET): Ensures authenticity and transparency in supply chains.

Waltonchain (WTC): Focuses on IoT and blockchain integration for logistics.

Gaming and NFTs

Axie Infinity (AXS): Popular play-to-earn gaming ecosystem.

Enjin Coin (ENJ): Powers blockchain-based gaming assets.

Decentraland (MANA): Virtual real estate and metaverse-based economy.

Data and Oracles

Chainlink (LINK): Provides reliable, tamper-proof data feeds for smart contracts.

The Graph (GRT): Decentralized indexing protocol for blockchain data.

Challenges and Future Trends

While utility-driven cryptocurrencies offer immense potential, several challenges persist. Overcoming these hurdles is crucial for long-term success.

Challenges

Scalability Issues: High transaction fees and slow processing times hinder adoption.

Regulatory Uncertainty: Governments worldwide impose differing crypto regulations.

Security Risks: Smart contract vulnerabilities and hacking threats.

User Adoption: Many people still lack knowledge or access to crypto services.

Market Volatility: Price fluctuations can impact real-world usability.

Future Trends

Layer 2 Scaling Solutions: Technologies like Optimistic Rollups and zk-Rollups will enhance transaction efficiency.

Regulatory Clarity: More governments will establish clear guidelines for crypto adoption.

Mass Adoption of DeFi: Traditional finance may integrate blockchain-based lending and investment.

Increased Enterprise Adoption: Companies will integrate blockchain for transparency and efficiency.

Interoperability Between Blockchains: Seamless asset transfers across different chains will become the norm.

Conclusion

Creating a successful utility-driven cryptocurrency requires careful planning, strong technological foundations, and real-world use cases. From selecting the right blockchain to designing robust tokenomics and implementing effective marketing strategies, every aspect plays a crucial role in driving adoption. By overcoming existing challenges and adapting to future trends, developers can ensure their cryptocurrency attracts real users and sustains long-term growth.

0 notes

Text

💰 The Evolution of Money: Are You Keeping Up? 🚀

From barter to paper money, and now to digital assets—money has constantly evolved. But have you?

🌍 Why Crypto is the Future: 🔹 Decentralized & Secure: No central authority, no manipulation. 🔹 Borderless Transactions: Send & receive funds anywhere, instantly. 🔹 Inflation-Proof: Limited supply means your assets retain value. 🔹 Financial Freedom: You control your money, not the banks!

📈 Crypto isn’t just an investment—it’s a revolution! Don't get left behind. Embrace the future with DeCryptox!

🌐 Learn more: www.decryptox.com

0 notes

Text

Why Hyper-Bitcoinization is Closer Than We Think

The world is on the cusp of a massive shift—a shift that could redefine how we think about money, store value, and exchange goods globally. This transformation, often referred to as hyper-Bitcoinization, is the process by which Bitcoin becomes the dominant form of money, replacing fiat currencies on a global scale. While this idea may have once seemed distant, several key factors suggest that hyper-Bitcoinization could be much closer than we think.

Bitcoin ETFs: A Major Catalyst

One of the clearest signs that hyper-Bitcoinization is approaching is the approval of Bitcoin ETFs (Exchange-Traded Funds). ETFs make it easier for institutional investors and everyday people to gain exposure to Bitcoin without having to hold the asset directly. This is a game-changer because it removes many of the technical barriers and trust issues that have held back adoption in the past.

With ETFs, we’re witnessing a flood of capital entering the Bitcoin market from traditional financial players who would otherwise be wary of buying Bitcoin on exchanges. This influx of capital could dramatically boost Bitcoin’s market cap and legitimacy. As more ETFs are approved, Bitcoin's reputation as a serious asset class will only grow, bringing hyper-Bitcoinization closer to reality.

Nation-States Warming Up to Bitcoin

We’re also seeing the beginning stages of nation-state adoption. El Salvador has already made Bitcoin legal tender, and other countries are considering similar moves. The implications of this are enormous. Bitcoin isn’t just a digital asset; it's becoming a national asset for countries looking to hedge against inflation, financial instability, or reliance on the U.S. dollar.

Beyond El Salvador, countries like Argentina, Turkey, and even large economies like Russia and China are exploring the use of Bitcoin, either for mining, trading, or reserve assets. As more countries adopt Bitcoin, an arms race could develop, where nations will rush to be the first to establish a Bitcoin standard. This potential competition among nation-states could fast-track hyper-Bitcoinization as countries scramble to secure their positions in a new Bitcoin-powered global economy.

Rising Distrust in Traditional Financial Systems

The world’s financial systems are facing unprecedented challenges. Rising debt levels, inflation, and questionable central bank policies are eroding trust in traditional currencies. People are growing increasingly aware that the money in their bank accounts is losing value over time. Centralized control over money is revealing its flaws, and more individuals are looking for alternatives.

Bitcoin, with its decentralized nature and finite supply, presents the perfect antidote to the problems plaguing fiat currencies. Unlike fiat money, which can be printed at will, Bitcoin’s hard cap of 21 million coins ensures that it remains deflationary over time. This scarcity makes it an attractive option for individuals, institutions, and now even governments looking to preserve wealth. As the cracks in the global financial system widen, Bitcoin is stepping in as a viable and reliable alternative.

The Network Effect and Bitcoin's Growing User Base

Bitcoin’s network effect is another crucial element driving us toward hyper-Bitcoinization. The more people use Bitcoin, the more valuable it becomes. This isn't just because of its price but because of the infrastructure being built around it. Payment systems, applications, and services are springing up around Bitcoin at a rapid pace, making it easier and more practical for everyday transactions.

The Lightning Network, for example, allows for faster, cheaper Bitcoin transactions, solving one of the most common criticisms of Bitcoin—that it’s too slow or expensive for everyday use. As this technology matures and adoption continues to grow, the global shift toward Bitcoin will only accelerate.

How to DCA Into Bitcoin: A Simple Strategy for Everyone

While all these trends point to hyper-Bitcoinization, the average person might wonder how they can get involved in Bitcoin without risking everything on price volatility. This is where Dollar-Cost Averaging (DCA) comes in—a simple, effective strategy for gradually accumulating Bitcoin over time.

What is DCA?

DCA involves investing a fixed amount of money into Bitcoin at regular intervals, regardless of its price. Instead of trying to time the market, which can be stressful and ineffective, DCA allows you to spread out your investment, buying Bitcoin whether the price is high or low.

Why DCA Works in Bitcoin

Bitcoin is notoriously volatile, with massive price swings that can be intimidating to new investors. DCA helps smooth out these fluctuations by allowing you to buy in at various price points over time. This reduces the risk of buying at the “wrong” time and gives you exposure to Bitcoin's long-term upward trend.

Practical Steps to Start DCAing

Set a Budget: Determine how much you can comfortably invest regularly, whether it's weekly, bi-weekly, or monthly.

Pick a Platform: Many exchanges offer automatic recurring purchases, making it easy to DCA without manually placing each order.

Stick to the Plan: Bitcoin’s price may rise or fall dramatically in the short term, but sticking to a DCA strategy ensures you’re continually building your position.

The Long-Term Benefits of DCA

Over time, DCA can help you accumulate more Bitcoin without the stress of trying to predict price movements. Given Bitcoin’s potential to replace fiat currencies in a hyper-Bitcoinized world, even small regular investments could result in significant long-term gains. DCA into Bitcoin is a straightforward way to participate in this financial revolution.

Conclusion: Hyper-Bitcoinization is Closer Than We Think

The world is changing, and Bitcoin is at the center of this transformation. The approval of Bitcoin ETFs, increasing nation-state interest, the rising distrust in traditional financial systems, and Bitcoin’s growing network effect are all signals that hyper-Bitcoinization could happen sooner than we think. Whether you’re a seasoned investor or just getting started, the opportunity to be a part of this financial revolution is here. By incorporating strategies like DCA, anyone can position themselves for the incredible potential of a hyper-Bitcoinized future.

Now is the time to take Bitcoin seriously. The writing is on the wall: the shift is happening, and hyper-Bitcoinization is not some far-off fantasy but an approaching reality. Will you be ready when it arrives?

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#HyperBitcoinization#Cryptocurrency#FinancialRevolution#BitcoinAdoption#DCA#CryptoFuture#BlockchainTechnology#DecentralizedFinance#DigitalCurrency#BitcoinETFs#SoundMoney#FinancialIndependence#InvestingInBitcoin#NewFinancialEra#blockchain#finance#financial experts#unplugged financial#financial education#financial empowerment#globaleconomy

3 notes

·

View notes

Text

🚨 BlackRock makes it clear: Bitcoin adoption is just getting started! 🌍 Institutions are only beginning to tap into the crypto revolution. Are you ready for what’s next? 🚀

#CryptoNews#InstitutionalCrypto#Blockchain#Bitcoin#CryptoFuture#CryptoInvesting#CryptoBuzz#cryptocommunity

0 notes

Text

The Future of Crypto: What’s Next for Bitcoin and Altcoins?

Cryptocurrency has revolutionized the financial landscape, with Bitcoin leading the charge. Over the years, altcoins have emerged as strong contenders, offering unique use cases and technological advancements. As we step into a new phase of the digital economy, what lies ahead for Bitcoin and altcoins? Let’s explore the trends and opportunities shaping the future of crypto.

Bitcoin: The Digital Gold Evolution

Bitcoin remains the king of cryptocurrencies, often compared to digital gold. With increasing institutional adoption, BTC continues to be a safe haven for investors seeking protection against inflation. However, the future of Bitcoin extends beyond just being a store of value.

Scalability and Layer 2 Solutions: The Lightning Network is making Bitcoin transactions faster and cheaper, paving the way for mass adoption in everyday transactions.

Institutional Adoption: Major corporations and investment funds are integrating Bitcoin into their portfolios, reinforcing its position as a long-term asset.

Regulatory Developments: Governments worldwide are working on crypto regulations, which could further legitimize Bitcoin and attract more mainstream investors.

Altcoins: Innovation and Utility

While Bitcoin dominates the market, altcoins bring innovation through blockchain technology. Many of these projects are addressing real-world problems and expanding the use cases of crypto.

Smart Contracts & DeFi Growth: Ethereum, Solana, and other blockchain networks are fueling decentralized finance (DeFi), enabling permissionless financial services like lending, staking, and yield farming.

GameFi & Metaverse Expansion: Blockchain gaming and virtual worlds are gaining traction, creating new economic models within digital ecosystems.

Sustainability & Eco-Friendly Solutions: Green blockchain projects are emerging to reduce energy consumption, addressing environmental concerns tied to proof-of-work (PoW) mining.

The Role of Emerging Tokens in the Crypto Space

With the evolution of crypto, new projects are stepping in to solve existing challenges. One such promising innovation is the UPB Token, which is designed to bridge the gap between usability and scalability in blockchain-based financial transactions. As adoption grows, forward-thinking investors are eyeing projects that offer real utility and future growth potential.

What’s Next? The Road Ahead

The crypto landscape is rapidly evolving, with several key trends shaping its future:

Mass Adoption of Blockchain Technology: Governments and enterprises are integrating blockchain for transparency and efficiency.

Stablecoins & CBDCs (Central Bank Digital Currencies): Digital currencies issued by central banks could coexist with decentralized crypto assets.

Interoperability Between Blockchains: Seamless cross-chain transactions will make crypto ecosystems more connected and efficient.

Final Thoughts

The future of Bitcoin and altcoins is promising, with technology and adoption driving innovation. While Bitcoin solidifies its role as a digital asset, altcoins are shaping the decentralized future. Investors and crypto enthusiasts should keep an eye on emerging tokens like UPB Token, which contribute to the ongoing evolution of the crypto industry.

As the industry matures, the opportunities for growth and financial inclusion continue to expand, making it an exciting time for both seasoned and new investors in the crypto space.

#upbtoken#CryptoFuture#BitcoinNews#AltcoinSeason#BlockchainTech#blockchain#crypto#bitcoin#share market#marketing#earnings

0 notes

Text

𝐖𝐢𝐥𝐥 𝐂𝐫𝐲𝐩𝐭𝐨 𝐌𝐚𝐤𝐞 𝐌𝐢𝐥𝐥𝐢𝐨𝐧𝐚𝐢𝐫𝐞𝐬 𝐢𝐧 2025?

Cryptocurrency has captured the world’s attention, and by 2025, it could make millionaires out of smart investors. In this video, we dive into the factors that could drive massive wealth, from institutional adoption to the rise of DeFi, NFTs, and more! Will Bitcoin reach $500K? Are altcoins the next big thing? Find out how to navigate this exciting, yet risky market.

Watch https://youtube.com/shorts/8E5VWHOSzWQ

#CryptoMillionaires#Bitcoin2025#DeFi#Altcoins#CryptoPredictions#NFTs#CryptoInvesting#Blockchain#InvestingTips#CryptoFuture

1 note

·

View note

Text

KoyoFund: Your Expert Guide!

With KoyoFund, you don’t need to be an expert to succeed in Web3.

Our platform provides cutting-edge strategies crafted by industry professionals to help you: 🔹 Make informed decisions in the ever-evolving Web3 space. 🔹 Maximize your investment potential with carefully tailored solutions. 🔹 Navigate the complexities of decentralized finance (DeFi) with ease.

Our team’s experience and advanced tools are designed to give you a competitive edge, whether you’re just getting started or looking to diversify your crypto portfolio.

Web3 is Changing the Game As traditional financial systems evolve, Web3 is opening new doors for wealth creation and management. But with this revolution comes risk.

That’s where KoyoFund comes in – helping you navigate the volatile landscape with expert-backed strategies to protect and grow your assets.

Let’s Build a Smarter Investment Future Together. 👉 Start now: www.koyofund.com

Start Your Web3 Investment Journey Today!

#CryptoIndexFund#SmartInvesting#Web3Finance#JapanCrypto#DigitalAssets#CryptoFuture#DeFiInvesting#BlockchainWealth#koyofund

1 note

·

View note