#MacroEconomics

Explore tagged Tumblr posts

Text

Ko-fi prompt from IndigoMay:

What would be the economic impact if people could magically grow whatever food they liked? Including fodder for animals.

This is a very wide-ranging question, like... when was the magic introduced? What was the state of agriculture before that? Is this food generated from existing matter, delivered by gods, or something else?

I'm going to narrow this to:

What would happen if people could, starting tomorrow, grow any plant...

That is edible, by either humans or livestock, with appropriate treatment.

Without delay, meaning that the time sink is several minutes instead of weeks or months.

Without concerns for weather or other natural dangers like fungal infections or pests, or requirements for water or fertilizer.

Without depleting soil nutrients, so long as they have arable land to work with.

Without relying on fresh seeds or other 'raw ingredients' like leaf cuttings.

Well... let's start small.

Personal Basis - people who are not farmers

People who do not normally grow things would start angling to acquire some kind basic gardening implements. For some, like those who live in the suburbs, this would be as simple as going into the backyard. For those in cities, they'd need to get a window box or similar to use. If you have free, guaranteed fresh plant matter, that's already a good thing, but the time and care required to keep a garden alive is more than some people can manage due to work or children or housing. With immediate food that requires minimal effort, a lot of those hurdles are removed. You can grow the two tomatoes you need for dinner, and then put the pot of soil away for tomorrow.

The cost of

Personal Basis - small farmers

The obvious impacts for those who are small farmers is that people are less likely to buy their raw ingredients. Most of these small farmers would start looking into modifying their operations to do things that require processing.

Growing apples in your house for a snack is fine--if you have a pot big enough for a small tree, and a way to dispose of the wood if it's a one-time thing--but if you want applesauce or cider or pie, someone who knows how to cook or bake needs to do that part. You can grow wheat, but your chances of having the necessary tools to grind flour are slim. You can grow cashews, but fuck knows how you're going to process that without poisoning yourself! You can grow grapes on your trellis, but that doesn't mean you have the knowledge to make wine without accidentally going straight to vinegar. You can grow corn, but that doesn't mean you know the best way to dry it to make popcorn.

So small farms shift to those products that either need processing, or are part of an animal-based food. This includes things like flowers for bees. You can't really control bees, so just 'grow and go' might incite the bees to leave somehow. Maybe they can sense magic! Who knows!

Another option would be to focus on unique or heirloom things. If you go to a farmer's market, you might be going just to see all the fruits you've never encountered before. If there's an apple stand one year, and suddenly you can grow your own apples at home, then maybe what they start doing is growing unique or rare cultivars that you've never heard of, and that's their new niche. It's not that you can't grow the apples, but would you grow them if you've never heard of them? Plus, the apple stand is doing sauces and ciders now.

Mid-tier and large farms

These farms will start to focus in on large-scale crops that don't go straight to tables or cooking pots in homes. Scrap the eggplants, the cucumbers, the blueberries. Focus on:

Fruits and vegetables that are needed for popular secondary products, like tomatoes (ketchup, marinara), or oranges (juice), or corn (anything with fructose corn syrups, popcorn).

Plants that are popular but NEED processing to be edible, like coffee beans, cocoa beans, or wheat, that most people just don't have.

Plants that are needed in massive quantities for animal feed, such as alfalfa or chicken grains.

Now, I think these large farms would still be in production. We'd see a massive reduction in water usage, which is great (except for cranberries, I guess), but many of these products would still be needed in quantities that need industrial levels of processing. Someone needs to pick the oranges, to drive them to the juicing facility, the facility needs to juice and treat and preserve and bottle them, and then that needs to be driven to the store. The reduced time to grow, reduced water usage, reduced waste from natural predators or dangers, and general ability to plan things more efficiently would result in lower costs for many of these products in a truly free market... but would possibly also rise in cost as companies try to maintain a consistent flow of profit.

Sure you can make the juice at home, but what if you're already at work? There's still a demand for products; most of us can get water from a tap at home, but there are still convenience stores selling bottled water on every other corner in a big city.

I think the most interesting of these concerns would be grazing animals, like sheep, cattle, and goats. Being able to 'refresh' the grass of a single field without having to rotate the animals to new pastures once they've eaten away at one, and without damaging the nutrient profiles of the one they're staying at, means reduced deforestation or soil destabilization in agricultural areas. We'd see a fairly significant stalling of things like the decimation of Mongolia's grasslands if the goats didn't need as much grazing land.

Maintaining the meat industry would be one of the most constant sources of demand for large-scale agriculture, given that other products could go through cycles to more efficiently use land. You can grow and harvest oranges for Tropicana on Monday, grapes for Welch's on Tuesday, soy beans for Silk on Wednesday, tomatoes for Heinz on Thursday, and so on. They probably won't need more than they used to.

Meanwhile, the cows gotta eat. And eat. And eat.

Corporations

This one is fun! MONSANTO'S GONNA BE PISSED.

So, magically growing food, you don't need seeds, at least in this case. Or you can coax more product out of a seed you already have planted. You've gotten eight cycles corn out of this one stalk this season!

So Monsanto loses some of that insane seed monopoly situation.

You'd see a decrease in pesticides and anti-fungal products as agriculture speeds up a cycle by enough to prevent the spread of dangerous infestations. It's not going to kill your entire farm if you find fungus one day and have to burn it to prevent the spread. You lost one day's profit, not a full year's.

This impacts Monsanto too. Remember the Roundup debacle?

Now, to be clear, there are still plants that will rely on pesticides and anti-fungals. The premise only covers food, after all, so there are still important plants that will need longer, dedicated growing seasons.

Industry-wide shifts

Sooooooooooo a lot of the money starts to come from non-edible plants. This is your cottons, linens, hemps, latex/rubber trees, cork trees, lumber, and so on.

As the needed arable land necessary to feed humanity (and our livestock) decreases, more land is freed up for return to indigenous peoples, reclamation by nature, usage for alternate cultivation, housing, or... well, other capitalist ventures, like bitcoin mining or whatever.

On a geopolitical level, this causes some interesting shifts in places that draw their power from being 'breadbasket' nations. For instance, if you remember the start of the Russo-Ukrainian war, we saw some major pressures being placed by virtue of some countries (e.g. Lebanon, Pakistan) getting most of their wheat from Ukraine, and the war suddenly cutting off a massive portion of how they fed their people. Much of Ukraine's support, in those early days, derived from their importance as a breadbasket nation. If everyone can grown their own food, that moves the lines. Countries that are poor on space or water can stop relying on trade to survive in terms of water. Countries that rely on their agriculture to be able to trade for other things need to diversify their economies, and fast.

(Does mean that Saudi Arabia can stop using Arizona's water, though.)

The greatest shifts would come down to water usage and pollution, I think. Agriculture is currently one of the biggest contributors to the climate crisis, and the reduction of water use by farming would be a massive help. However, I'm less sure of how we'd see meat consumption change. The greater availability of fresh fruits and vegetables could result in a shift towards more plant-based diets worldwide, but just as easily we could see large agricultural corporations (and those that rely on them, like John Deere or the aforementioned Monsanto) market meat to consumers as a greater rate due to the profit margin.

Oh, also, I have a feeling that a lot of those corporations would try to get garden centers shut down, or buy out ceramic pot and planter factories. If you can't grow anything at home because you don't have a window planter, you have to buy from the store, right?

#ko fi#ko-fi#ko fi prompts#phoenix talks#magic#agriculture#microeconomics#macroeconomics#politics#environmentalism#water usage#pollution

115 notes

·

View notes

Text

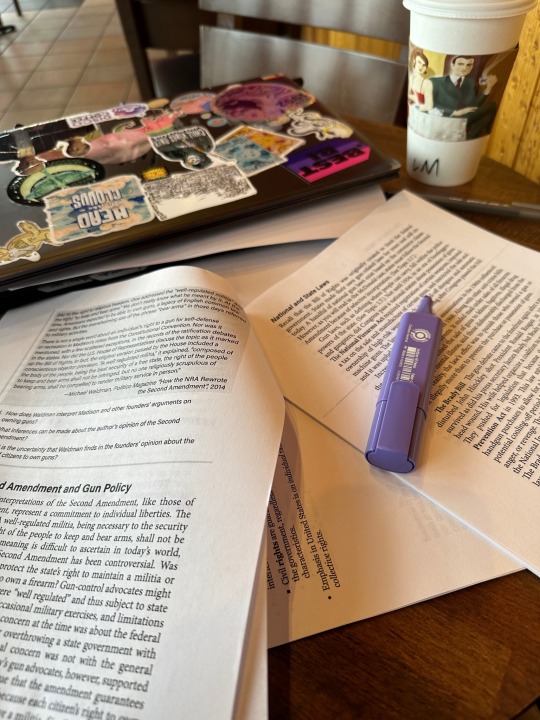

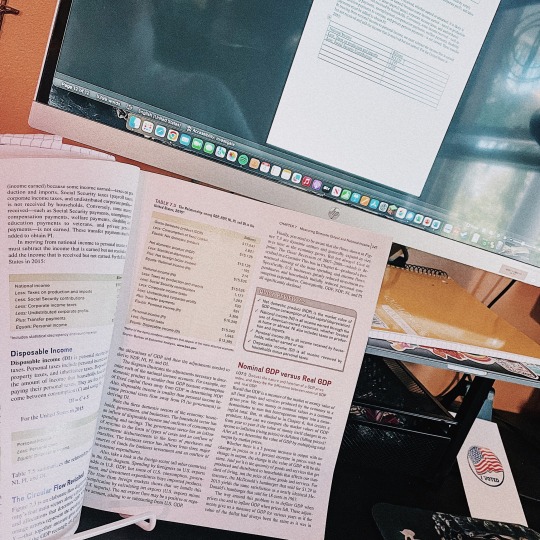

january 22, monday

-> it hasn't stopped raining all week. forced myself to take a lot of government and economics notes.

🎧the metamorphosis, franz kafka

#ap economics#studyblr#studying#aesthetic#studyspo#macroeconomics#mathblr#100 days of productivity#dark academia#study#reading

214 notes

·

View notes

Text

Gale Talks: Tariffs

Disclaimer: The description of Tariffs in this is mainly based on Economic theory and can have other factors that are unseen play into it. I also did my best in simplifying the effects of what Tariffs do to better explain the process. For those with questions or find that this explanation is lacking. Feel free to reply to the post with questions, or elaborate on where I did not properly explain.

_____________________________________________________________

People really don't understand how Tariffs work.

Now, I should explain something to all the people freaking out about Tariffs.

THEY ARE A COMMON PRACTICE IN MACROECONOMICS. A practice that has been used LONG before 2016. So this is nothing new.

Now to explain what a Tariff is. It is simply this:

Now does this make goods more expensive? Yes and no.

In the case of domestic goods, most cases is no. If anything it actually helps in incentivizing the purchase of domestic goods. Which is a good thing. As it encourages growth in domestic products, which causes expansion and in cases where production expands, it often becomes cheaper. Meaning that goods can end up becoming cheaper to incentivize more purchases, but not always. It will rarely ever become more expensive.

In the case of Foreign goods. Obviously yes. This would raise the price of foreign goods by a margin, as to compensate for the Tariff, the importer will have to charge more, OR simply move less product in the country imposing the tariff. Now the person/business importing the goods pays the the tax on Tariffs, but this sucks for the exporting country that has the Tariffs placed on them because if the importer has to raise price on goods, they will sell less and that is where the price is being paid.

Now, for most countries, Tariffs are actually limited in how effective they can be. In the case of America... Tariffs are incredibly powerful. America is the biggest importer in the world. MANY countries export their goods to the US. So the US imposing Tariffs on them can range from crippling to Near economic destruction. That's how powerful the US is on the World stage economically.

Interestingly, Tariffs are actually less about the money that the US will get from them, and more of a deterrent that is the economic equivalent of launching missiles. But unlike with shows of force, economic damage is more efficient and more humane in terms of getting countries to do things. It is a means of getting countries to comply with demands that are less expensive.

Tariffs can vary and can be as precise as targeting a single product from one country, to as broad as targeting every product from EVERY country. Of course doing the later would be insane. But doing the former is surprisingly effective.

Now to those wondering if the future Tariffs are good or bad. This series of yes or no questions can help you determine that.

Do I live outside of america? Yes or No

Do I work for a company that is not headquartered in the US? Yes or No

Do I or the company I work for rely heavily on Foreign/imported goods? Yes or no

Now if you answered ANY of these questions with Yes. Then bad news, Tariffs can have a massive impact on you and it will likely have a negative impact on you. Unless your country and/or Company plays ball (makes concessions to avoid the Tariffs)

BUT if you are in the US, aside from some goods becoming more expensive (depending on who the US makes have the Tariff) your life will likely not be impacted negatively. Or in some cases, economic growth may actually occur in the long term.

But the truth is, Tariffs will likely be used more as threats than actually utilized to the extreme degree people fear.

TL:DR:

Tariffs makes some things more expensive in the short term for long term gain. And if you are in the US, you will be fine. If you are not in the US... well things may suck unless you go along with what the US says

24 notes

·

View notes

Text

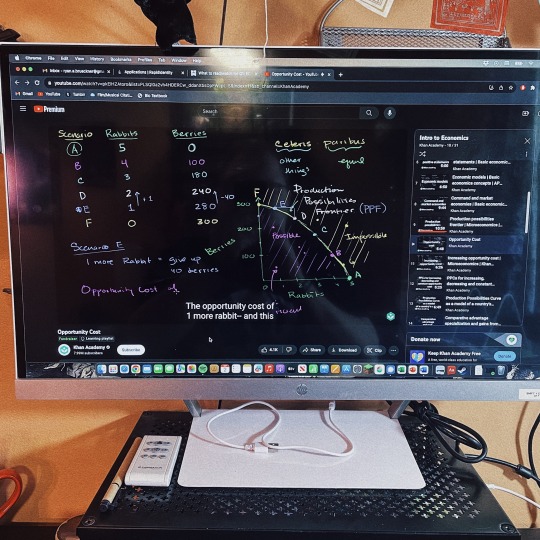

Day 63 • 100 Days of Productivity

today was a macroeconomics speed study! i haven’t had time to do my macro work because my other (in person) classes are taking up a lot of my time and i haven’t had much time for my online classes. fortunately i got everything done and i still have tomorrow before everything needs to be turned in so i can do some more responses on the discussion board to get more credit. todays work was about PPFs and opportunity costs

🎶 dear future self (hands up) - fall out boy 🎶

#studyspo#studyblr#100 days of productivity#collegeblr#studentblr#uniblr#studying#study#inspiration#motivation#motivator#inspo#study aesthetic#student#student life#college student#uni student#macroeconomics#greenhouse.txt#university student

96 notes

·

View notes

Text

29.03.2024

There's nothing much decrease or increase in study sessions. I am just completing notes which i had postponed till i get a perfect idea and clarity of concept/topics. There's a lot of writing and i worry if I will even be able to learn all that what I'm writing. Every night my fingers gave out, from continuously writing. But over all its good.

Things I did:

Macroeconomics: notes writing

Song of the day: drunk text by Henry Moodie

Good luck to me for tmr

#study with me#studyblr#studyblr community#study motivation#study space#study aesthetic#study blog#study inspo#study stuff#macroeconomics#study notes#student life#student#revision#long reads#writing notes#notes#numerical

12 notes

·

View notes

Text

Can You Predict a Recession? | Macroeconomics 23 of 31 | Study Hall

youtube

2 notes

·

View notes

Text

#socialism#capitalism#economics#macroeconomics#anti capitalism#anti capitalist#democratic socialism#leftism#leftists#leftist#replace the constitution

9 notes

·

View notes

Text

It is 5:45 A.M and you will already not believe the morning I've been having

#i woke up at 5:30 btw#i have my economics midterm today#i was studying for it yesterday but#i LOST#the NOTEBOOK#in which i made my entite syllabus' worth of notes#I STUCK GRAPHS IN MY ROUGH NOTEBOOK#AND I LOST IT#thst plus a reference book i was using for my second subject#we have#macroeconomics#and#indian#economic development#and i lost the indian economic development guide#and i cannOT#study from#ncert#it is a pain in the ass#and i wake up today#to literal bl00d on my nails#because a hangnail i had pulled off in the middle of the night#and my dads been sneezing relentlessly#and not only do i hate how it sounds#he has no concept of hygiene#so jt smell terrible#sounds terrible#and ks terrible#bc we got covid fROM HIM IN 21#ugh

3 notes

·

View notes

Text

Introduction to Economics Vocabulary

Economics -- study of how people satisfy their needs and wants -- people must make choices

Scarcity -- there are limited amounts of goods and services -- people have unlimited wants

Factors of Production -- abbreviated FOPs -- resources used to make goods and services -- includes capital, labor, and land

Capital -- manmade resources -- used to produce goods and services

Physical Capital -- manmade objects

Human Capital -- knowledge and skill of a worker

#studyblr#notes#economics#economics notes#economics vocabulary#economics vocab#vocab#vocabulary#introduction to economics#econ#econ notes#macroeconomics#macroeconomics notes#capital#human capital#physical capital#factors of production

17 notes

·

View notes

Text

I just got a solid hour of Spotify without an ad… I totally flunked the multiple choice this morning.

3 notes

·

View notes

Text

Tim "Smashed Avo" Gurner

Hey Folks,

If you're wondering where this bell-end comes from in the world, he is unfortunately an Aussie. He is also one of our more loathed form of capitalist jerkwads: The Property Developer. Plus he's the wangrod who decided that...

When talking about property prices 3 years before the pandemic was responsible for the equally out of touch shit-take of... "The young folks shouldn't be buying avocado toast if they want to buy a home..."

So yeah, he's just full of shit takes.

The more amazing thing about this kind of shit take is that Gurner is basically saying the 'Neoclassical/Neoliberal Quiet Part Out Loud'.

Unemployment is the only way neoclassical economics thinks to control inflation. And it's a bit Rube Goldberg at the same time.

Buckle in folks, we're going for a deep dive into a land of wild fantasy and nonsense: mainstream macroeconomics.

But how do we stop the inflations?!

In the Neoclassical pattern, you need to remember the fantasy starts with how they describe the economy already as it is and how prices happen.

Step 1: The economy will already be producing everything it can and prices are directly linked to the amount of Government Money.

Yep, you read that right... the main pile of economic thinking says that economies around the world are already making as much stuff as they could. They're importing everything they could, and the people who are here are already making as much as they possibly could.

This gets glued into the next thing which is The Equation of Exchange; MV = PQ. You'll see this bandied around and from a maths sense this is the most boring mundane crap of an equation possible but once you start trying to make it match RL goings on makes zero sense. M = the government money out there, V = Velocity of money (put a pin in this one! Oh boy!), P = prices, Q = the number of times people pay those prices.

It has variations where the PQ will be "P = Average Price, Q = All transactions in the average" or "PQ is actually the sum of every price P and the Q times that price was paid". They work out to be the same in the long run: the total of all the things people bought/sold. Now, remember the first half... we are already making the most stuff we can which means that Q is basically 'fixed' (we don't have more stuff to buy and sell) for any given period of time. They also tend to assume that 'Velocity of Money is constant' (which yeah oh boy... just oh boy). So if you change M (government money) there's only one thing that can happen: Prices move. If you spend more government money, then Prices have to go up. That's part of the logic, which is why they keep scaring you with Spending More Government Money Will Make The Inflations.

(Velocity of Money is meant to represent some kind of how often the money moves between people, but this is bonkers because everything is done on spreadsheets now and editing values is spreadsheets creates and destroys stuff constantly, so how fast is money moving? Also, banks settle net transaction not every single transaction. If your bank needs to send $10m to another bank, but that bank needs to send $11m to your bank, then the other bank sends $1m to your bank... that's it job done. They don't pass all the millions back and forth. So this whole idea of the velocity of money as a thing is nonsense, and then on top of it if you're at all scientifically inclined... try do a unit-substitution on MV=PQ, notice the units for V and realise what that would mean if you were doing that in Chem or Physics... let your brain melt on that one).

Step 2: But the Wage Price Spirals! Supplies and Demands!!!

Supply-and-Demand curves have something super wild going on. It gets glossed over a lot, but...

Supply and Demand curves assume the whole economy has only one thing in it, and everyone wants that one thing exactly the same as each other.

Yep. A supply and demand curve assumes everyone in Australia likes Victoria Bitters beer as much as everyone else AND that the only beer available in this fine nation of indigenous folks, migrants, forced migrants, and colonialist fucks, is Victoria Bitters. There is one beer: VB, and everyone wants it exactly the same amount. Welcome to Neoclassical/Mainstream economics.

What does this mean for inflation? If people have more money to buy stuff, then they'll push up prices! The demand (wanting a thing PLUS having the cash to buy it) will beat supply (which remember is already maxxed out) and push up prices!!!

How do we stop this? Make sure people don't have as much money to spend on things. Yep, you stop this by making people broke.

What is a great way to make people broke? Increase unemployment.

How do you go about doing that?

Central Bank Interest Rates... it's all a bit Rube Goldberg, but this is the monetarist solution to everything in the economy... fuck with the rates.

If you push up rates, loan costs go up, people and businesses have to spend more to cover their loans. That means people can't buy as much stuff. That means their rents potentially go up. That means food prices go up. And businesses can't afford to keep on as many staff. Unemployment goes up. That's the trick. Rates go up (insert bowling balls playing pianos to knock a switch to drive a remote control car) and then unemployment goes up.

Then when people aren't buying, inflation slows down. Then they drop rates.

But notice the funny thing... generating more unemployment requires the prices of stuff to go up because the rates go up. They make inflation to stop inflation... it's so fucking bonkers. We will crash this car into a tree faster now so we don't maybe crash into that cliff wall up ahead.

So yeah, Tim "Smashed Avo" Gurner isn't lying because that is the goal: to crush inflation by crushing employment.

#tim gurner#economics#macroeconomics#neoliberalism is a disease#neoclassical economics is a fantasy world

3 notes

·

View notes

Text

@regina-bithyniae

This is one of those reasonable-seeming stories that totally melts in the face of

1. the base rate of crazy discourse bullshit that happens here or on X or bluesky.

2. nearly atemporal queues and geographic ambiguity hide some of what you might have going on locally, nevermind personally.

ace discourse on the dash in 2025 is a recession indicator

31K notes

·

View notes

Text

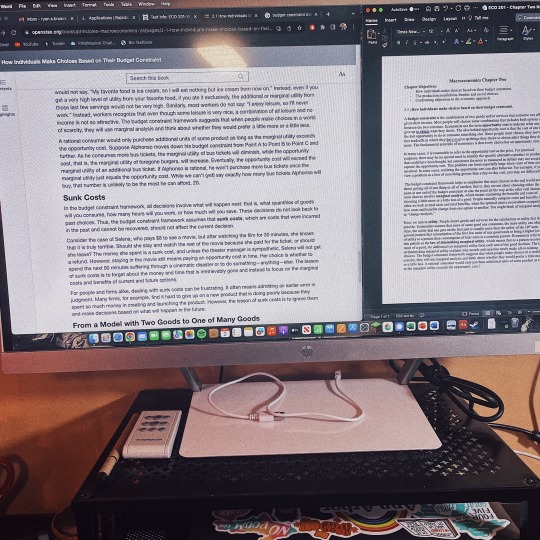

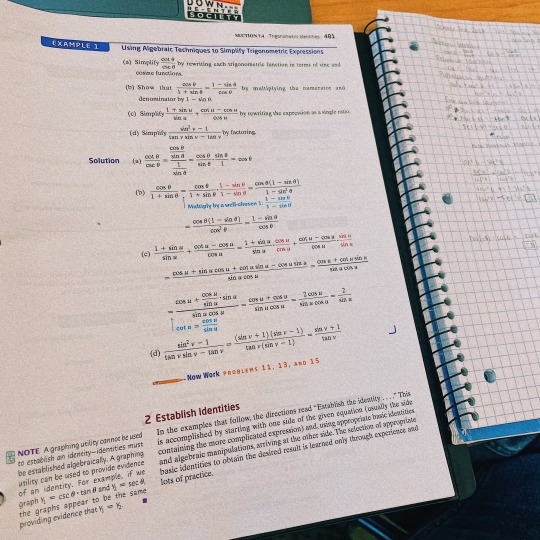

Day 72 • 100 Days of Productivity

i currently have a 100.87% in precalc ii and i have no fucking clue how. math has never been my strong suite but i guess that’s turning around. i mean, my lowest grade is a 94% so it’s not like im failing my other classes but i’ve never been a math person lol. lots of studying this week, midterms are coming up soon.

🎶 icarus & apollo - ripto 🎶

#studyspo#studyblr#100 days of productivity#student aesthetic#study aesthetic#studying#study#greenhouse.txt#collegeblr#inspiration#uniblr#college#uni#university#studentblr#student#study blog#study with me#math#macroeconomics#studystudystudy#studyblr community#student life#100dop#motivation#study motivation#study inspiration#study inspo#inspo

41 notes

·

View notes

Text

27.04.2024

There was not much time so only one test was done. I got highest marks in macroeconomics in both humanities and commerce streams. I was so bad in economics that I was almost failed in mid terms and barely managed to pass in finals in 11th. And this year I am trying my best in economics and grasping the concepts so well and also taking classes and lectures seriously. So i am happy to see my improvement in economics but it was just a class test so I have to do well in upcoming unit test of economics.

TMI. My other two tests will be held day after tmr.

Things i did:

IED: Textbook reading

Song of the day: ceilings by Lizzy McAlpine

Good luck to me for tmr.

#study with me#studyblr#studyblr community#study motivation#study space#study aesthetic#study blog#study inspo#study stuff#student#studyspiration#studyinspo#studyspo#student life#indian economy#tests#textbook#book reading#reading#long reads#revision#macroeconomics

13 notes

·

View notes

Text

The Year of Bitcoin: Why 2025 Could Be a Turning Point

The start of 2025 has set the stage for what may be Bitcoin’s most transformative year yet. The events of 2024, from significant corporate acquisitions to milestones in adoption, have positioned Bitcoin as a central player in the evolving financial landscape. With growing economic instability, technological advancements, and shifting narratives, Bitcoin is poised to reach new heights in both relevance and adoption.

Setting the Stage

In 2024, Bitcoin witnessed several pivotal moments. Institutional interest soared, adoption among individuals continued to grow, and countries started exploring Bitcoin as a hedge against economic uncertainty. As we enter 2025, the momentum is unmistakable. Bitcoin is no longer merely a speculative asset—it is becoming a cornerstone of financial innovation and security.

The Macro Environment

The global economy is in a state of flux. Rising inflation and growing distrust in fiat currencies have left governments and central banks scrambling for solutions. In this environment, Bitcoin’s fixed supply and decentralized nature offer a stark contrast to the instability of traditional systems. As more people recognize its value as a store of wealth, Bitcoin’s role in the global financial system is expanding.

Adoption Trends: A Billion-Dollar Vote of Confidence

December 2024 was a monumental month for corporate Bitcoin adoption. In just the first 10 days, U.S. companies invested a staggering $3.26 billion into Bitcoin.

MicroStrategy, the largest corporate holder of Bitcoin, acquired 21,550 BTC worth $2.1 billion, bringing its total holdings to 423,650 BTC valued at $25.6 billion.

Marathon Digital, a leading Bitcoin mining firm, added 11,774 BTC for around $1.1 billion, boosting its total to 40,435 BTC worth $3.9 billion.

Riot Platforms, a Bitcoin infrastructure company, acquired 705 BTC worth $68.45 million.

These investments underscore the confidence U.S. companies have in Bitcoin as a long-term store of value. They also signal a broader shift in institutional attitudes toward Bitcoin as an essential financial asset.

A Historic Milestone: Bitcoin Enters the Nasdaq-100

In another major development, MicroStrategy joined the Nasdaq-100 Index on December 23, 2024, standing alongside titans like Apple, Microsoft, and Tesla. This milestone not only highlights MicroStrategy’s success but also validates Bitcoin’s integration into traditional financial systems.

Founded over 30 years ago as an enterprise software company, MicroStrategy transitioned into a Bitcoin powerhouse under the leadership of Executive Chairman Michael Saylor. Since 2020, the company has amassed over 423,000 BTC worth $42 billion, becoming the largest corporate holder of the scarce digital asset. Its inclusion in the Nasdaq-100 symbolizes Bitcoin’s growing credibility and mainstream acceptance.

The Strategic Bitcoin Reserve

In a groundbreaking move, the incoming Trump administration has announced plans to create a strategic Bitcoin reserve. This initiative aims to position the United States as a leader in the digital asset space while safeguarding its financial future. By holding Bitcoin as a reserve asset, the government signals its confidence in Bitcoin’s long-term value and utility. Such a policy could set a precedent for other nations, accelerating global adoption and further solidifying Bitcoin’s status as a global store of value.

Technological Advancements

Bitcoin’s infrastructure continues to evolve. The Lightning Network, which facilitates instant and low-cost Bitcoin transactions, is gaining widespread adoption, enabling new use cases like micropayments and decentralized financial services. Upgrades like Taproot and innovations in Ordinals have also enhanced Bitcoin’s privacy, scalability, and functionality. These advancements are transforming Bitcoin from a simple store of value to a versatile tool for global commerce.

The Narrative Shift

Bitcoin’s narrative is evolving. Once seen primarily as a speculative investment, it is now recognized as a tool for financial sovereignty and inclusion. Younger generations, who grew up in an era of financial crises and technological disruption, are driving this shift. For them, Bitcoin represents not just an asset but a movement—a way to opt out of traditional systems and build a fairer, more transparent financial future.

Challenges to Watch

Despite its progress, Bitcoin faces significant challenges. Regulatory uncertainty remains a critical hurdle, with governments worldwide grappling with how to classify and regulate Bitcoin. Competing narratives, such as the rise of central bank digital currencies (CBDCs), also pose a threat. Additionally, the debate over Bitcoin’s energy consumption continues, though proponents argue that it’s driving innovation in renewable energy.

Why 2025 Could Be the Year of Bitcoin

As we look ahead, it’s clear that 2025 holds immense potential for Bitcoin. With institutional adoption accelerating, technological innovations reshaping its utility, and the macroeconomic landscape driving demand, Bitcoin is on the brink of a new era.

For individuals and institutions alike, the message is clear: stay informed, get involved, and embrace Bitcoin as a cornerstone of the future financial system. The revolution is underway, and 2025 could be the year Bitcoin proves it is here to stay.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#Blockchain#FinancialRevolution#DigitalAssets#CryptoAdoption#Bitcoin2025#MacroEconomics#BitcoinMining#CryptoNews#Nasdaq100#BitcoinReserve#DigitalGold#Decentralization#CryptoInnovation#BitcoinMilestones#CryptoFuture#MoneyRevolution#HODL#LightningNetwork#financial empowerment#globaleconomy#finance#financial experts#digitalcurrency#financial education#unplugged financial

2 notes

·

View notes

Text

Imagine thinking that the Federal Reserve is the real reason why housing is expensive and not insufficient housing construction.

you know what at this point they're writing fanfic

23K notes

·

View notes