#current limiting diode

Explore tagged Tumblr posts

Text

Tesla’s Genius: Direct Current Without a Commutator!

In 1888, Tesla made waves by patenting his alternating current (AC) system, which proved far superior to Thomas Edison’s direct current (DC) for long-distance power transmission. The real kicker? He did it without a commutator. This clunky mechanical device was used to reverse the current direction to make DC flow in one direction, but it was notoriously unreliable, prone to wear, and inefficient. Tesla sidestepped this by using high-frequency AC and a rotating magnetic field to generate a more reliable current without the mechanical hassle. After revolutionizing AC with his commutator-free approach, Nikola Tesla wasn’t ready to rest on his laurels. He turned his attention to a new challenge that many physicists of his day thought was impossible: creating direct current (DC) without using a commutator. As always, Tesla wasn’t concerned with traditional boundaries; he was determined to push the limits of what was thought possible.

Tesla’s Ingenious Method

In 1889, Tesla took things even further with a groundbreaking idea. He proposed a method to produce DC without using a commutator. He described how he “sifted” the alternating current into different branches of the circuit. Here’s how he did it:

1. Sifting the Current: Tesla used the concept of directing the AC waves so that the positive and negative halves of the wave were separated. He set up the circuit so that AC waves of one sign (positive or negative) would pass through one branch, while the waves of the opposite sign would go through another. This separation allowed him to create smooth, continuous DC from the AC input.

2. Electrical and Electromagnetic Methods: Tesla proposed two main methods for achieving this. One involved using electrical devices like batteries to create a counteracting electromotive force, which would oppose the AC waves and help separate them. The other method used electromagnetic fields to create active opposition within the circuit, guiding the AC waves into different branches.

3. Magnetic Method: Another method Tesla described used strong permanent magnets and soft iron or steel laminations. By carefully calculating the amount of magnetic metal, Tesla created a setup where the magnetic field interacted with the AC in such a way that allowed continuous currents to be extracted.

Historical Context

Here’s an important note: While Tesla did indeed demonstrate a method for converting AC to DC without a commutator, it’s crucial to understand the broader historical context. Rectification methods—both mechanical and electronic—developed independently over time and were not solely based on Tesla’s innovations. It wasn’t until more than a decade later that practical AC-to-DC conversion technologies, such as vacuum tubes and silicon diodes, became mainstream.

Tesla’s approach did, however, lay the groundwork for modern power electronics by eliminating the need for mechanical parts, making DC conversion more efficient and durable. The principles he introduced continue to influence technologies we use today, from phone chargers to large-scale industrial power systems.

So, the next time you plug in your phone or marvel at the sleek electronics in your home, remember that Tesla’s 1889 breakthrough was a significant step forward. It’s just another example of how Nikola Tesla was light-years ahead of his time!

44 notes

·

View notes

Text

LED headlights are almost too bright - will brighter headlights be the norm?

There is a real trend towards brighter headlights, but at the same time, technology and regulators are struggling to balance lighting with safety. Here is a detailed analysis of whether brighter headlights will become the norm and the factors that influence this trend:

The current state of LED headlight brightness

Modern LED headlights can already produce more than 2,000-8,000 lumens, far exceeding traditional halogen lamps (1,000-1,500 lumens) and HID lamps (3,000-5,000 lumens). Their high efficiency, long life and color temperature close to daylight (4,000-6,500K) make them the first choice. However, their brightness often causes glare to oncoming vehicles, posing a safety hazard.

Drivers for brighter headlights

Safety needs: Studies show that more than 50% of traffic accident deaths occur at night, which drives the demand for higher lighting. LEDs improve visibility by projecting light farther (e.g., more than 325 feet for an IIHS “good” rating).

Regulatory standards: Agencies such as SAE and NHTSA (via FMVSS 108) now prioritize adaptive lighting systems that adjust brightness based on road conditions, so that high beams are “always on” and don’t dazzle others.

Consumer preferences: Bright, white LED lighting is associated with premium models (think Audi, Nissan GT-R), which has prompted automakers to adopt similar design philosophies in mainstream models.

Mitigating overbrightness

While brightness continues to increase, innovations are aimed at reducing glare: Anti-glare notches: Nissan’s adaptive low-beam headlights feature holes in the “notch” that dim the light when oncoming vehicles are illuminated, while maintaining brightness in other areas.

Matrix LED systems: These systems split the light beam into multiple zones, dynamically dimming areas that could dazzle pedestrians or other drivers.

Improved optics: Precision reflectors and lenses focus light more precisely and reduce scatter. For example, SNGL bulbs use advanced adjustable light pattern technology to improve visibility and reduce dark areas while meeting glare limits.

Regulatory and technical challenges

Glare complaints: Too bright LED lights can cause discomfort and temporary vision loss. The Insurance Institute for Highway Safety (IIHS) rates headlights based on coverage and glare control, with only 43% of 2023 models receiving a "good" rating.

Thermal management: High-power LEDs generate heat, which reduces efficiency and life. SAE standards require that LED brightness must remain ≥80% over the rated service life, even in the presence of thermal stress.

Standardization: Global regulations (e.g., UNECE, FMVSS) are evolving to address adaptive lighting, but harmonized standards remain a challenge.

Future Trends

Laser and OLED Lighting: Laser diodes (used in Audi's premium models) provide brighter, farther beams, while OLEDs enable ultra-thin, glare-free designs.

Intelligent Systems: AI-driven headlights can adjust in real time to traffic conditions, weather, and road geometry.

Tougher Testing: Enhanced photometric testing (e.g., beam pattern and glare) may become mandatory.

Conclusion Driven by safety needs and technological advances, brighter headlights will become the norm. However, their adoption depends on adaptive control, regulatory compliance, and public acceptance of glare reduction systems. The industry is moving to smart brightness - maximizing illumination where it's needed while minimizing risk to others.

For drivers, this means safer nighttime travel, but also the responsibility to ensure that aftermarket upgrades (e.g., SNGL SH70P2 Projector-Specific) comply with local laws to avoid penalties or dangerous glare.

#led lights#car lights#led car light#youtube#led auto light#led light#led headlights#led headlight bulbs#ledlighting#young artist#brightness#LED headlight brightness#brighter headlights#race cars#electric cars#cars#classic cars#car#carlos sainz#truck#bmw#lamborghini#porsche#audi#vehicle#autonomous vehicle headlights#older vehicles#auto#automotive#autos

4 notes

·

View notes

Text

Semiconductor devices for high-temperature environments exceeding 800°C

Silicon (Si) semiconductors are ubiquitous in electrical appliances and play an essential role in our daily lives. However, in high-temperature environments exceeding 300°C, such as underground resource drilling, space exploration, and engine peripherals, improved semiconductor materials are required because of the limited operational temperature range of Si devices. Wide-bandgap semiconductors are preferable for high-temperature electronics. Currently, aluminum nitride (AlN) crystals are among the most attractive materials for high-temperature devices because they possess larger bandgap energy in comparison to other semiconductors. Numerous studies have reported AlN diodes and transistors that can operate at temperatures above room temperature. However, the maximum operating temperatures of these AlN devices are limited to 500°C or lower owing to technical problems associated with electrical characterization systems. This study, published in Applied Physics Express, presents the fabrication and evaluation of high-quality AlN-layered diodes and transistors using a novel electrical characterization system capable of functioning at temperatures up to 900°C.

Read more.

#Materials Science#Science#Semiconductors#High temperature materials#Silicon#Aluminum nitride#Aluminum#Nitrides

15 notes

·

View notes

Text

Understanding the Functionality of Samsung Refrigerator PCB Main Assembly

Samsung refrigerators have become essential appliances in modern households, offering innovative features and advanced technologies to ensure food preservation and convenience. The (Printed Circuit Board) PCB Main Assembly serves as the brain of the refrigerator, coordinating various functions and ensuring optimal performance.

Components of the Refrigerator PCB Main Assembly

The Refrigerator PCB Main Assembly consists of several essential components, each playing a crucial role in the refrigerator's operation.

Microcontroller: It is the central processing unit (CPU) and the computer performs programmed instructions to coordinate communication between the components.

Sensors: The ambient parameters (temperature, humidity, door status) supply critical information for regulation.

Relays: You control the flow of electricity to the compressor, fan motors, and defrost heater.

Capacitors: It will help you store the electrical energy and help to regulate voltage, and guarantee that the PCB is operating reliably.

Resistors: Protect sensitive components from harm by limiting the flow of electricity across certain circuits.

Diodes: Allow current to flow exclusively in one direction to avoid reverse polarity and safeguard components from damage.

Connectors: Facilitate electrical connections between the PCB and other refrigerator components to ensure seamless integration.

Working Principle PCB Main Assembly

The PCB Main Assembly operates on a set of programmed instructions that determine its behavior depending on sensor input and user command. The micro controller continuously monitors sensor input such as the reading of the temperature from the refrigerator compartment, and freezer. The microcontroller controls the transition of the compressor on, or off or the speed of the fan and also the defrost cycles based on the sensor data as to how to keep the temperature and humidity at the optimal level. In addition to the other refrigerator components, for example, display panel and user interface, the PCB Main Assembly provides feedback and enables users’’ interaction. The PCB Main Assembly incorporates safety features of overload protection and temperature sensors to protect the refrigerator from damage and to protect the user.

Communication Protocols

Data can be communicated to other components through microcontrollers by communication protocols like UART (Universal Asynchronous Receiver Transmitter), SPI (Serial Peripheral Interface), and I2C (Inter Integrated Circuit).

UART is used to transfer real-time data from a microcontroller to external devices like display panels and temperature sensors.

There is a power of communication SPI and I2C for the communication of integrated circuits associated with the PCB Main Assembly for efficient data transfer and synchronization between components.

Troubleshooting and Maintenance

Common issues with the Samsung Refrigerator PCB Main Assembly include sensor failures, relay malfunctions, and power supply issues, which can affect the refrigerator's performance.

To solve PCB Main Assembly problems, we can use diagnostic methods, like running self-tests and checking the error code.

The assembly can stay longer depending on the main, such as cleaning dust and debris from the PCB and securing appropriate ventilation.

The PCB Main Assembly is an important component of the Samsung refrigerator systems since it organizes several functions to contribute to the overall efficiency of the refrigerator and food preservation. Fore-knowledge of the PCB Main Assembly and the way it is constructed can assist users in likely managing problems in their fridges.

2 notes

·

View notes

Text

Reading more about inrush current control techniques now, all I knew before this was that you use Negative Temperature Coefficient parts to control it without affecting overall efficiency too much.

I've never had to design a board that drew much power, or didn't just use an off the shelf power supply. Power supply design is black magic so even major companies usually just buy certified open frame units to avoid redoing a ton of regulatory work, it's what's best for everyone. All the appliances at First Job just had a 24V Great Wall open frame units jammed in there, plus consumer 12V supplies for the network gear.

You can do some clever things involving having the NTC take itself out of the loop with a relay and a zener diode if you have really high efficiency targets to hit or you don't want to fry your NTC as the current picks up. I love these kinds of self-contained feedback tricks, they're super handy. And of course there's digital current controllers for high precision applications.

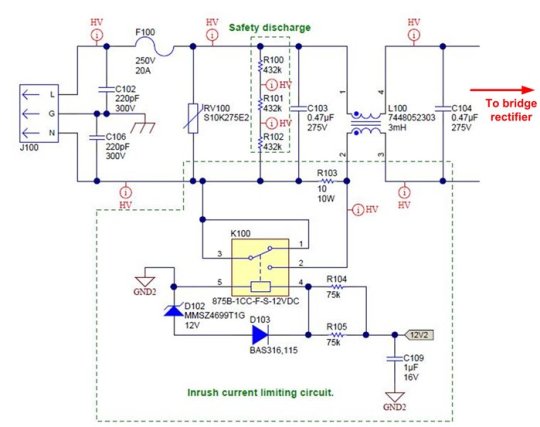

Figure 5 shows the relay circuit for a 1kW power supply. The relay is initially turned off. During power up, the input current flows through a 10Ω/10W cement resistor. Once the power supply is energized, a regulated bias voltage, 12V2, turns on the relay to minimize the power dissipation on the current-limiting circuit during normal operation.

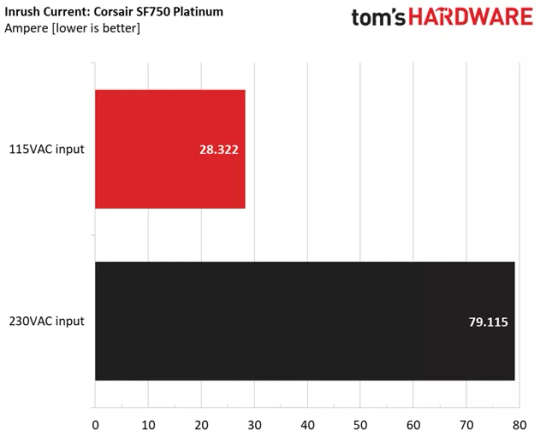

Anyway. Reading specs it looks like there's a systematically higher inrush current in computer PSU's when you connect them to 230V, which is probably just Ohm's Law at work. A lot of supplies with really good 110V inrush limiting have utterly dogshit 230V inrush limiting.

An interesting problem I realize this might cause is that, because most tech reviewers are Americans with 110V, they won't pick this up as often. E.g. the highly recommended SF750 from Corsair has fantastic 120V inrush of ~30A but on 230W it's almost 80A, which would definitely trip a lot of home breakers.

10 notes

·

View notes

Text

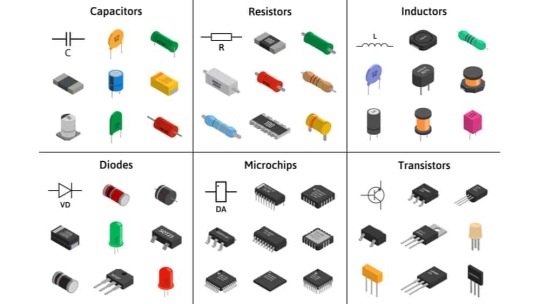

Electronics Components and Uses:

Here is a list of common electronics components and their uses:

Resistor:

Use: Limits or controls the flow of electric current in a circuit.

Capacitor:

Use: Stores and releases electrical energy; used for filtering, timing, and coupling in circuits.

Inductor:

Use: Stores energy in a magnetic field when current flows through it; used in filters, transformers, and oscillators.

Diode:

Use: Allows current to flow in one direction only; used for rectification, signal demodulation, and protection.

Transistor:

Use: Amplifies and switches electronic signals; fundamental building block of electronic circuits.

Integrated Circuit (IC):

Use: Contains multiple electronic components (transistors, resistors, capacitors) on a single chip; used for various functions like amplification, processing, and control.

Resistor Network:

Use: A combination of resistors in a single package; used in applications where multiple resistors are needed.

Potentiometer:

Use: Variable resistor that can be adjusted to control voltage in a circuit; used for volume controls, dimmer switches, etc.

Varistor:

Use: Protects electronic circuits from excessive voltage by acting as a voltage-dependent resistor.

Light-Emitting Diode (LED):

Use: Emits light when current flows through it; used for indicator lights, displays, and lighting.

Photodiode:

Use: Converts light into an electric current; used in light sensors and communication systems.

Zener Diode:

Use: Acts as a voltage regulator by maintaining a constant voltage across its terminals.

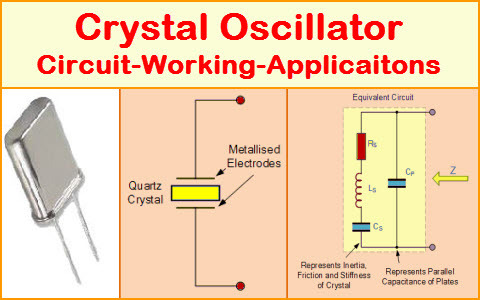

Crystal Oscillator:

Use: Generates a stable and precise frequency; used in clocks, microcontrollers, and communication devices.

Transformer:

Use: Transfers electrical energy between two or more coils through electromagnetic induction; used for voltage regulation and power distribution.

Capacitive Touch Sensor:

Use: Detects touch or proximity by changes in capacitance; used in touchscreens and proximity sensing applications.

Voltage Regulator:

Use: Maintains a constant output voltage regardless of changes in input voltage or load; used for stable power supply.

Relay:

Use: Electromagnetic switch that controls the flow of current in a circuit; used for remote switching and automation.

Fuse:

Use: Protects electronic circuits by breaking the circuit when current exceeds a certain value; prevents damage from overcurrent.

Thermistor:

Use: Resistor whose resistance changes with temperature; used for temperature sensing and compensation.

Microcontroller/Microprocessor:

Use: Processes and controls electronic signals; the brain of many electronic devices and systems.

fig:google-electronics

fig:google-electronics

fig:Crystal-Oscillator

This list covers some of the basic electronic components, and there are many more specialized components used for specific applications within the field of electronics.

#electronic#electricity#electric vehicles#electric cars#engineering#semiconductors#wireless#cables#electronics#smartphone#hardware

4 notes

·

View notes

Text

hello! someone very sensitive to flicker here! what's going on here is a notable difference in the speed at which LEDs and incandescent light sources turn on and off. when an incandescent or fluorescent bulb turns on, it generally takes around 100ms to warm up or cool off when turned on or off, respectively, making the change in brightness gradual. when these sorts of bulbs are directly driven by AC at 50 or 60Hz, this amount of time is an order of magnitude longer than the amount of time between the pulses of electrical current, resulting in the brightness fluctuating, but only a relatively small & harmless amount (which can still be noticeable to photosesitive individuals such as myself). LEDs are a whole different beast, taking at most only a couple of milliseconds to turn on (white LEDs generally take more time due to their phosphors and single-wavelength LEDs generally take less time) an order of magnitude less than the time between "pulses" of AC, resulting in the diode going from off to basically full blast and back off every cycle of current, giving them an extremely unpleasant flicker. given that LEDs are much better in so many ways than fluorescent or incandescent bulbs, this downside may seem pretty minor, but it can cause many negative effects for many people, not limited to those who are particularly photosensitive. there is a solution however! a full-bridge rectifier is a simple & cheap circuit to convert AC power to DC, which if inserted between the power source and the LED, removes the flickering altogether, resulting in a longer lifespan as the diode won't be turning off & on constantly, which can cause it to degrade faster, as well as making LED lighting much safer! there are a good amount of LED lights out there being run through rectifiers, but unfortunately most LEDs are still being directly run by AC, making christmas lights & other decorations potentially quite harmful, depending on the viewer.

This is one of those things where the discourse is just completely broken. Both of these takes are shit and no one is concerned about the actual problem.

Republicans want to bring back incandescents because they just want to trigger the libs and have decided light bulbs are woke.

And the "LEDs are fine" crowd are throwing people with flicker sensitivities under the bus. And, no, you don't have to be "pretty far on the spectrum" to notice a difference. And even if you did... why in the world is this person so dismissive of the millions of autistic folks?

LEDs, for the most part, are superior to incandescent bulbs. Collectively they save people billions of dollars in energy costs and greatly reduce fossil fuel use. You have more options for color and brightness. You can control them with your phone. LEDs are fantastic.

Unfortunately there is a design flaw that makes LEDs hard to use for certain people. Due to AC power, most LEDs have a 60hz refresh rate. Meaning they turn off and on 60 times per second. With incandescents this didn't matter because the filament didn't have time to lose its glow between cycles.

Most people cannot see this flicker in LEDs. But there are millions of people who are sensitive to it and it can cause migraines and discomfort.

The solution is definitely not to go back to incandescents. There are flicker free LEDs and I think with some regulation we could make sure all LEDs are flicker free or at least make sure flicker free bulbs are easy to find and not priced at a premium.

Thankfully there is a group testing bulbs to find the ones that will most likely cause no discomfort. They call themselves the Flicker Alliance and their website has a pretty decent selection of tested and approved bulbs.

So if you feel like your LED bulbs might be causing you distress, that is a good resource to try. I think there is also something you can do to make sure the LED drivers are using DC power, but I haven't really looked into that.

9K notes

·

View notes

Text

What ESD device should I use for 3.7V Li-Ion surge protection?

In the rapidly developing TWS and smart wearable market, limited by the size of the product and the threat of static electricity and surges in the instant of the battery contact switch, a precise protection of the ESD device is needed to ensure the safety of the power supply IC, from static electricity, surge threats.

The product supports surge 45A, and maintains a margin, support surge voltage greater than 100V, in harsh environments can also be guaranteed to work normally.

Compared with ESD5651N-2/TR, Leiditech Electronics has a greater ipp capability of 1 0A current and a better delivery time, please request samples.

Leiditech Electronics is committed to becoming a leading brand in electromagnetic compatibility (EMC) solutions and component supply. We offer a wide range of products, including ESD, TVS, TSS, GDT, MOV, MOSFET, Zener diodes, and inductors. With an experienced R&D team, we provide personalized customization services to deliver the highest quality EMC solutions tailored to our customers’ needs.

If you’d like to learn more or have any questions, don’t hesitate to reach out:

Visit us at [en.leiditech.com]

#EMCProtection #ESDSafety #WearableTech #Leiditech #SmartDevices #SurgeProtection #ElectronicsDesign #BatterySafety #TWSInnovation #PowerProtection #IoTSecurity #TechSolutions #LiIonBattery #ElectronicsEngineering

0 notes

Text

Zener Barrier Market: Industry Growth Analysis, Opportunities and Challenges, 2025–2032

MARKET INSIGHTS

The global Zener Barrier Market size was valued at US$ 234 million in 2024 and is projected to reach US$ 378 million by 2032, at a CAGR of 7.0% during the forecast period 2025-2032. The U.S. market accounted for approximately 28% of global revenue in 2024, while China’s market is anticipated to grow at a higher CAGR of 7.2% through 2032.

Zener Barriers are intrinsic safety devices used in hazardous areas to limit energy flow and prevent ignition of flammable gases or dust. These critical components employ Zener diodes to maintain safe voltage and current levels in instrumentation circuits, serving as protective interfaces between safe and hazardous areas. The market comprises two primary types: Detection Side barriers for sensor connections and Isolation Side barriers for actuator control.

Market growth is primarily driven by stringent safety regulations in oil & gas and chemical industries, where explosion-proof equipment is mandated. The Detection Side segment currently holds 62% market share due to widespread sensor networks in process industries. Recent developments include Pepperl+Fuchs’ 2023 launch of IS+ series barriers with enhanced diagnostics, responding to Industry 4.0 integration demands. Omega Engineering, Turck Inc., and Sensotronic System dominate the competitive landscape, collectively holding 45% market share through comprehensive product portfolios serving diverse industrial applications.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Intrinsic Safety Solutions in Hazardous Industries to Accelerate Market Growth

The global Zener Barrier market is experiencing significant growth due to increasing safety regulations in explosive environments. Industries such as oil & gas, chemicals, and mining are mandated to implement intrinsic safety barriers to prevent ignition risks from electrical equipment. Recent data indicates that over 60% of industrial accidents in hazardous areas originate from electrical sparks, driving adoption of certified safety components like Zener barriers. Furthermore, advancements in barrier technology that offer improved reliability while reducing installation complexity are gaining traction across industries with stringent safety requirements.

Growing Industrial Automation Investments to Boost Market Expansion

Industrial automation adoption across process industries is creating robust demand for safety interfaces like Zener barriers. As factories implement more connected sensors and instrumentation in classified zones, the need for reliable signal protection grows exponentially. The manufacturing sector alone is projected to account for nearly 35% of total Zener barrier installations by 2026. Major automation providers are increasingly bundling safety barriers with their control systems, making adoption more seamless for end-users while ensuring compliance with IEC and ATEX standards.

Additionally, the expanding renewable energy sector presents new opportunities. Solar farms and battery storage facilities require specialized protection for monitoring systems, creating demand for weather-resistant and high-temperature Zener barriers. Integration with IIoT platforms is also driving innovation, enabling remote diagnostics and predictive maintenance capabilities that extend product lifespans.

MARKET RESTRAINTS

High Initial Costs and Complex Certification Processes Limit Market Penetration

While Zener barriers provide critical safety functions, their adoption is restrained by substantial upfront investment requirements. Obtaining necessary certifications for hazardous area installations often involves extended testing periods and compliance documentation, delaying product launches. Industry estimates suggest certification costs can represent 15-20% of total project expenses for safety system integrators, creating barriers to market entry.

Competition from Alternative Protection Methods Impacts Market Share

Emerging technologies like galvanic isolators and fiber-optic interfaces present competitive challenges to traditional Zener barriers. These alternatives often offer advantages in specific applications, such as higher voltage isolation or immunity to electromagnetic interference. For environments requiring minimal power transmission, these solutions are capturing market share, particularly in new facility designs where legacy systems don’t dictate the protection approach.

MARKET CHALLENGES

Technical Complexity in Customization Presents Implementation Hurdles

Designing Zener barriers for specialized industrial applications requires precise engineering to balance safety performance with signal integrity. Many modern process applications demand custom voltage and current ratings to interface with proprietary equipment, creating design challenges. Field failures due to improper specification continue to account for nearly 12% of total service calls industry-wide, highlighting the technical complexities involved.

Other Challenges

Supply Chain Vulnerabilities Semiconductor shortages continue to impact production lead times, with some manufacturers reporting 30% longer delivery cycles for critical components. While the situation has improved from pandemic-era disruptions, supply chain fragility remains an ongoing operational challenge.

Skill Gap in Maintenance Personnel Growing technological sophistication in safety systems outpaces workforce training programs. Many facilities lack technicians qualified to properly maintain and troubleshoot advanced Zener barrier installations, potentially compromising system reliability.

MARKET OPPORTUNITIES

Smart Factory Initiatives Create Demand for Next-Generation Safety Solutions

Industry 4.0 implementations are driving demand for Zener barriers with digital communication capabilities. New product developments integrate diagnostics and condition monitoring features that align with predictive maintenance strategies. Early adopters report 40% reductions in unplanned downtime when using these intelligent safety interfaces, creating compelling ROI arguments for upgrading legacy systems.

Emerging Markets Present Untapped Growth Potential

Developing economies implementing stricter industrial safety regulations represent significant growth opportunities. Regions in Asia-Pacific and the Middle East are investing heavily in process safety infrastructure as they modernize industrial bases. Market analysis indicates these areas could account for over 50% of new installations by 2028 as safety standards converge with global norms.

ZENER BARRIER MARKET TRENDS

Expanding Industrial Safety Regulations to Drive Market Growth

The increasing implementation of stringent industrial safety regulations worldwide is significantly boosting the demand for Zener barriers, particularly in hazardous environments such as oil & gas facilities and chemical plants. Recent updates to international safety standards like IEC 60079 and ATEX directives have mandated advanced intrinsic safety solutions, with Zener barriers emerging as a preferred choice due to their cost-effectiveness and reliability. The global market for these safety devices is projected to grow at a compound annual growth rate of approximately 5.8% between 2024 and 2032, reflecting the tightening compliance requirements across industries.

Other Trends

Integration with Industry 4.0 Systems

The ongoing Industry 4.0 revolution is creating substantial opportunities for Zener barrier manufacturers to develop smart, connected solutions. Modern barriers are increasingly being equipped with diagnostic capabilities and communication interfaces that enable real-time monitoring of safety parameters. This technological upgrade is particularly crucial for process industries where equipment failure can lead to catastrophic consequences. The mining sector, which accounts for over 15% of Zener barrier applications, has shown particularly strong adoption of these advanced solutions due to extreme operating conditions.

Emerging Markets Gaining Momentum

Developing economies across Asia and Latin America are demonstrating accelerated adoption of Zener barriers, driven by rapid industrialization and modernization of safety infrastructure. Countries like India and Brazil have implemented rigorous safety norms that align with international standards, creating substantial market opportunities. Meanwhile, technological partnerships between global manufacturers and regional players are facilitating knowledge transfer and localization of production, which is expected to reduce costs by an estimated 10-15% in these markets over the next five years.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Manufacturers Focus on Innovation and Safety Compliance to Gain Market Share

The global Zener Barrier market exhibits a moderately consolidated structure, with established industrial automation and safety solution providers dominating revenue share. Pepperl+Fuchs emerges as a market leader, leveraging its extensive expertise in intrinsic safety barriers and strong foothold across process industries. The company holds approximately 22% of the global Zener Barrier market, owing to its certified explosion-proof solutions compliant with ATEX and IECEx standards.

Omega Engineering and Turck Inc. collectively account for nearly 30% market share, benefiting from their diversified product lines that serve both hazardous area classifications (Zone 0/1/2). These players continue to invest in R&D to develop advanced barriers with improved current-limiting capabilities and enhanced diagnostic features.

The market sees intensified competition as participants expand into emerging industries beyond traditional oil & gas applications. While large corporations focus on integrated safety solutions, mid-size specialists like Sensotronic System are gaining traction through customized barrier designs for niche applications in pharmaceutical and food processing environments.

Recent developments indicate strategic shifts toward digital integration, with leading players incorporating smart monitoring capabilities into traditional Zener barriers. This technological evolution is expected to redefine competitive dynamics, particularly in regions like Europe and North America where functional safety standards are becoming more stringent.

List of Key Zener Barrier Manufacturers Profiled

Pepperl+Fuchs (Germany)

Omega Engineering (U.S.)

Turck Inc. (U.S.)

Sensotronic System (Germany)

R. STAHL (Germany)

PR electronics (Denmark)

MTL Instruments (U.K.)

Phoenix Contact (Germany)

Eaton Corporation (Ireland)

Zener Barrier Market

Segment Analysis:

By Type

Detection Side Segment Dominates the Market Owing to Its Critical Role in Hazardous Area Protection

The market is segmented based on type into:

Detection Side

Isolation Side

By Application

Oil and Gas Industry Leads Due to High Demand for Intrinsic Safety Solutions

The market is segmented based on application into:

Oil and Gas Industry

Mining Industry

Power Industry

Chemical Industry

Others

By End User

Industrial Sector Holds Major Share for Plant Safety Compliance Requirements

The market is segmented based on end user into:

Industrial

Commercial

Public Infrastructure

Regional Analysis: Zener Barrier Market

North America The North American Zener barrier market is characterized by stringent safety regulations, particularly in the oil & gas and chemical sectors, where intrinsic safety standards like NEC, CEC, and ATEX are strictly enforced. The U.S. accounts for over 65% of the regional market share due to well-established hazardous area industries and high adoption of explosion-proof solutions. Recent investments in process automation and IIoT integration in manufacturing further drive demand for advanced Zener barriers with diagnostic capabilities. However, cost sensitivity among small enterprises remains a challenge for premium products.

Europe Europe’s mature industrial automation sector drives consistent demand for ATEX/IECEx-certified Zener barriers across Germany, France, and the UK. The energy sector transition towards renewables has created new application areas in wind and solar power installations, while traditional chemical plants continue modernization efforts. The region leads in smart barrier adoption, with Pepperl+Fuchs and Turck dominating the competitive landscape. EU’s Green Deal initiatives are pushing manufacturers toward low-power consumption designs with improved certification compliance, though supply chain disruptions occasionally impact delivery timelines.

Asia-Pacific APAC represents the fastest-growing Zener barrier market, projected to exceed 7.5% CAGR through 2032, fueled by China’s booming industrial sector and India’s expanding refinery capacities. While basic single-channel barriers dominate price-sensitive markets, Japan and South Korea increasingly adopt multi-functional barriers with SIL certifications. The lack of uniform safety standards across developing nations creates quality concerns, though China’s GB3836 certifications are gaining regional traction. Infrastructure investments under Belt & Road initiatives are opening new hazardous-area applications in power transmission and mining sectors.

South America South America’s market growth remains moderate but stable, tied closely to Brazil’s oil & gas sector recovery and Argentina’s lithium mining expansion. While economic volatility limits capital expenditures, mandatory safety upgrades in aging refineries sustain demand. The region shows growing preference for locally assembled barriers to circumvent import duties, though technical expertise gaps in complex installations persist. Chile and Colombia emerge as niche markets with specialized mining applications, but currency fluctuations continue to challenge multinational suppliers’ pricing strategies.

Middle East & Africa MEA’s market is bifurcated between Gulf Cooperation Council (GCC) megaprojects and African mining expansions. Saudi Arabia and UAE lead with hazardous area investments in oil refineries and chemical parks, where high-specification barriers are mandatory. Meanwhile, South Africa and Nigeria show increased adoption in mining safety systems, though budget constraints favor refurbished units. The region faces logistical challenges in spare part availability, driving demand for ruggedized designs with extended warranties, while infrastructure gaps in sub-Saharan Africa limit market penetration beyond major industrial hubs.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Zener Barrier markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global Zener Barrier market was valued at USD million in 2024 and is projected to reach USD million by 2032.

Segmentation Analysis: Detailed breakdown by product type (Detection Side, Isolation Side), application (Oil & Gas, Mining, Power, Chemical), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America (USD million in 2024), Europe, Asia-Pacific (fastest-growing), Latin America, and Middle East & Africa.

Competitive Landscape: Profiles of leading players including Omega, Pepperl +Fuchs, Turck Inc., and Sensotronic System, with top five companies holding approximately % market share in 2024.

Technology Trends & Innovation: Assessment of evolving safety standards, integration with IIoT systems, and advancements in intrinsic safety barriers.

Market Drivers & Restraints: Evaluation of factors like industrial safety regulations, hazardous area applications, along with challenges like supply chain constraints.

Stakeholder Analysis: Strategic insights for manufacturers, system integrators, and end-users in process industries.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/global-video-sync-separator-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silicon-rings-and-silicon-electrodes_17.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ceramic-bonding-tool-market-investments.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/coaxial-panels-market-challenges.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/oled-and-led-automotive-light-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/gas-cell-market-demand-for-ai-chips-in.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/digital-demodulator-ic-market-packaging.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/nano-micro-connector-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/single-mode-laser-diode-market-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silicon-rings-and-silicon-electrodes.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/battery-management-system-chip-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/scanning-slit-beam-profiler-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/atomic-oscillator-market-electronics.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/plastic-encapsulated-thermistor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ceramic-bonding-tool-market-policy.html

0 notes

Text

Closing in on superconducting semiconductors

New Post has been published on https://sunalei.org/news/closing-in-on-superconducting-semiconductors/

Closing in on superconducting semiconductors

In 2023, about 4.4 percent (176 terawatt-hours) of total energy consumption in the United States was by data centers that are essential for processing large quantities of information. Of that 176 TWh, approximately 100 TWh (57 percent) was used by CPU and GPU equipment. Energy requirements have escalated substantially in the past decade and will only continue to grow, making the development of energy-efficient computing crucial.

Superconducting electronics have arisen as a promising alternative for classical and quantum computing, although their full exploitation for high-end computing requires a dramatic reduction in the amount of wiring linking ambient temperature electronics and low-temperature superconducting circuits. To make systems that are both larger and more streamlined, replacing commonplace components such as semiconductors with superconducting versions could be of immense value. It’s a challenge that has captivated MIT Plasma Science and Fusion Center senior research scientist Jagadeesh Moodera and his colleagues, who described a significant breakthrough in a recent Nature Electronics paper, “Efficient superconducting diodes and rectifiers for quantum circuitry.”

Moodera was working on a stubborn problem. One of the critical long-standing requirements is the need for the efficient conversion of AC currents into DC currents on a chip while operating at the extremely cold cryogenic temperatures required for superconductors to work efficiently. For example, in superconducting “energy-efficient rapid single flux quantum” (ERSFQ) circuits, the AC-to-DC issue is limiting ERSFQ scalability and preventing their use in larger circuits with higher complexities. To respond to this need, Moodera and his team created superconducting diode (SD)-based superconducting rectifiers — devices that can convert AC to DC on the same chip. These rectifiers would allow for the efficient delivery of the DC current necessary to operate superconducting classical and quantum processors.

Quantum computer circuits can only operate at temperatures close to 0 kelvins (absolute zero), and the way power is supplied must be carefully controlled to limit the effects of interference introduced by too much heat or electromagnetic noise. Most unwanted noise and heat come from the wires connecting cold quantum chips to room-temperature electronics. Instead, using superconducting rectifiers to convert AC currents into DC within a cryogenic environment reduces the number of wires, cutting down on heat and noise and enabling larger, more stable quantum systems.

In a 2023 experiment, Moodera and his co-authors developed SDs that are made of very thin layers of superconducting material that display nonreciprocal (or unidirectional) flow of current and could be the superconducting counterpart to standard semiconductors. Even though SDs have garnered significant attention, especially since 2020, up until this point the research has focused only on individual SDs for proof of concept. The group’s 2023 paper outlined how they created and refined a method by which SDs could be scaled for broader application.

Now, by building a diode bridge circuit, they demonstrated the successful integration of four SDs and realized AC-to-DC rectification at cryogenic temperatures.

The new approach described in their recent Nature Electronics paper will significantly cut down on the thermal and electromagnetic noise traveling from ambient into cryogenic circuitry, enabling cleaner operation. The SDs could also potentially serve as isolators/circulators, assisting in insulating qubit signals from external influence. The successful assimilation of multiple SDs into the first integrated SD circuit represents a key step toward making superconducting computing a commercial reality.

“Our work opens the door to the arrival of highly energy-efficient, practical superconductivity-based supercomputers in the next few years,” says Moodera. “Moreover, we expect our research to enhance the qubit stability while boosting the quantum computing program, bringing its realization closer.” Given the multiple beneficial roles these components could play, Moodera and his team are already working toward the integration of such devices into actual superconducting logic circuits, including in dark matter detection circuits that are essential to the operation of experiments at CERN and LUX-ZEPLIN in at the Berkeley National Lab.

This work was partially funded by MIT Lincoln Laboratory’s Advanced Concepts Committee, the U.S. National Science Foundation, U.S. Army Research Office, and U.S. Air Force Office of Scientific Research.

0 notes

Text

How To Connect Solar Panels To Inverters?

For many customers who purchase solar power systems for the first time, the most concerned issue after purchasing a solar inverter is often: "How to correctly and safely connect solar panels to the inverter?" This step not only determines whether the system can operate normally, but also affects the efficiency and service life of the entire project.

As a professional solar inverter source factory, Xindun shares the key knowledge and operation steps of connecting solar panels to inverters through this article, which is suitable for wholesalers, engineers, system integrators, etc. who want to install by themselves or need to understand the system wiring method.

Clarify the connection type of the solar system

Before formal wiring, you first need to clarify the wiring method of the solar panel. There are usually two basic methods:

Series: increase the system voltage and keep the current unchanged

Parallel: increase the system current and keep the voltage unchanged

Which method you choose depends on the inverter specifications, battery system design, cable distance and load requirements you use. For example, Xindun's low voltage 12V/24V system often uses parallel connection, while high voltage MPPT hybrid inverters mostly use series connection.

Description of series wiring method

In series connection, the "positive pole" of the solar panel is connected to the "negative pole" of the next panel, so that the voltage is superimposed in sequence. This method is suitable for scenarios where the input voltage needs to be increased, such as Xindun's high voltage string hybrid inverter (such as 3KW/5KW/8KW 48V models).

Advantages:

1. The system voltage is high, the current is low, the cable loss is reduced, and it is suitable for long distance transmission.

2. It is more suitable for installation on unobstructed roofs or open spaces with sufficient light.

Notes:

1. The number of panels in series cannot exceed the maximum input voltage limit of the inverter;

2. If one panel is blocked, it may affect the output of the entire string. It is recommended to use an MPPT controller or bypass diode.

Description of parallel wiring method

In parallel connection, the positive pole of each solar panel is connected to the positive pole, and the negative pole is connected to the negative pole, so that the current is superimposed and the voltage remains unchanged. This method is suitable for Xindun's low voltage solar inverter (such as 12V/24V system) and distributed small systems.

Advantages:

1. If a certain panel is blocked or fails, it will not affect other components;

2. It is more suitable for installation environments with variable shadows or for novice users.

Notes:

1. Parallel connection increases the system current, so make sure to use appropriate busbars and overcurrent protection;

2. The total current cannot exceed the maximum carrying current of the controller or inverter.

Typical installation steps (applicable to off grid systems with batteries)

The Xindun off grid or hybrid inverter system supports self installation. It is recommended to strictly follow the following steps to ensure safe operation of the system:

1. Install solar panels

Fix the solar panels in a sunny and unobstructed location (such as a south facing roof). Use a special bracket to ensure wind and corrosion protection, and the angle is recommended to be adjusted according to the local latitude.

2. Connect MPPT or PWM solar charge controller

Most of Xindun's all in one machines have built in MPPT solar charge controllers, and no external connection is required. However, if it is an independent controller, it needs to be placed between the solar panel and the battery to ensure stable charging and discharging and prevent overcharging or reverse connection.

3. Connect the battery to the inverter

Connect the positive (+) and negative (–) terminals of the battery to the DC input port of the inverter. Turn off the inverter power before wiring, and use a fuse or circuit breaker of the corresponding specification.

4. Connect the solar panel to the inverter (or solar controller)

After connecting the solar panels in series or parallel, connect their output to the PV input of the inverter (or MPPT solar controller). Note that the connector uses the MC4 standard interface and confirm the polarity is correct.

I hope the connection method provided by Xindun above can help you connect correctly. If you have any questions, please feel free to contact us.

0 notes

Text

How do BMW's new laser headlights work and what advantage do they have over other headlight technologies?

BMW's laser headlights represent a groundbreaking leap in automotive lighting technology, combining advanced physics with intelligent safety systems. Here's a detailed breakdown of their working principles and key advantages over traditional lighting technologies:

1. Core Technology & Working Principle BMW's Laserlight system does not directly project laser beams onto the road but uses lasers to generate intense white light through a multi-stage process:

Laser Activation: Three blue laser diodes (wavelength ~450nm) emit high-intensity beams.

Mirror Reflection: The laser beams are directed through a series of mirrors within the headlamp assembly.

Phosphor Conversion: The blue lasers strike a lens filled with yellow phosphorus, triggering a chemical reaction that converts the light into bright white light (5,500–6,000K color temperature).

Diffusion & Projection: The white light is diffused to reduce glare and projected via a reflector bowl, achieving a focused beam.

This method produces 10x brighter light than LEDs while maintaining safety for human eyes and animals.

2. Key Advantages Over Traditional Technologies Feature Laserlight LED/Other Tech Brightness 600m max range (vs. 300m for LED) Limited by lower lumen density Energy Efficiency 30% less energy than LEDs Higher power consumption Beam Precision Laser-guided adaptive focus Fixed or less dynamic patterns Component Size Diodes 1/100th LED size (10μm) Bulky heat sinks required Lifespan 50,000–100,000 hours 30,000–50,000 hours (LED)

3. Intelligent Safety & Adaptive Features

Anti-Dazzle Control: Infrared cameras detect oncoming traffic and automatically dim/redirect beams.

Dynamic Light Spot: Focuses on obstacles (e.g., pedestrians, animals) up to 300ft (92m) ahead.

GPS-Enabled Steering: Syncs with navigation to pre-illuminate turns.

Speed-Activated Logic: Only activates at >60 km/h to avoid urban glare.

4. Design & Sustainability Benefits

Compact Housing: Smaller components allow sleeker headlight designs (e.g., BMW i8's slim profile).

Heat Management: Minimal heat output reduces cooling demands vs. LED/Xenon.

Material Innovation: Uses 0.7mm hardened glass layers for 50% weight reduction.

5. Limitations & Future Outlook

High Cost: Currently limited to premium models (e.g., X7, 8 Series).

Regulatory Hurdles: Required 7+ years for U.S. road approval.

Emerging Competitors: Audi's DML matrix lights challenge with pixel-level control.

BMW continues refining this technology, with plans to expand it to motorcycles and mid-tier vehicles by 2026. While not replacing LEDs entirely, laserlights redefine nighttime driving safety and efficiency for high-performance applications.

#led lights#car lights#led car light#youtube#led auto light#led headlights#led light#led headlight bulbs#ledlighting#young artist#car culture#cars#race cars#classic cars#car#suv#vehicle#automobile#muscle car#car light#yellow headlights#headlamp#headlight#car lamp#lamp#laser headlights#other headlight#bmw#bmw cars#vintage car

4 notes

·

View notes

Text

Training for the Skies: Becoming a Solar Drone Panel Inspection Expert

The rapid adoption of solar drone panel inspection technology has created a new frontier in the renewable energy industry. As more solar farms integrate drones into their maintenance routines, the demand for skilled professionals who can operate these advanced systems is skyrocketing. Becoming a solar drone panel inspection expert requires a unique blend of aviation knowledge, technical proficiency, and an understanding of solar PV systems.

This isn't just about flying a drone; it's about mastering the art of data collection, interpretation, and application to ensure the optimal performance of solar assets. For individuals looking to enter a dynamic and growing field, or for existing solar technicians seeking to upskill, specialized training is the key.

More Than Just Flying: The Multi-faceted Skillset

A successful solar drone panel inspection expert needs to possess a diverse range of skills and knowledge:

Drone Piloting Proficiency:

Flight Operations: This includes understanding drone mechanics, pre-flight checks, safe launch and landing procedures, and emergency protocols.

Navigation and Maneuvering: Precision flight is crucial for consistent data collection, especially in complex environments or near obstacles.

Regulatory Compliance: Knowledge of local and national aviation regulations (e.g., FAA Part 107 in the US, DGCA in India) is non-negotiable for legal and safe operation. This includes understanding airspace restrictions, altitude limits, and licensing requirements.

Solar PV System Fundamentals:

Panel Anatomy and Function: A deep understanding of how solar panels work, their components (cells, strings, bypass diodes, junction boxes), and common failure modes is essential.

Electrical Concepts: Basic knowledge of voltage, current, resistance, and how they relate to panel performance and faults (e.g., open circuits, short circuits).

Understanding Performance Issues: The ability to correlate drone-collected data with potential electrical or physical issues impacting energy generation.

Sensor and Payload Expertise:

Thermal Imaging: Understanding the principles of infrared thermography, how to interpret thermal images (identifying hotspots, cool spots, uniform temperature), and the factors that influence thermal data accuracy (emissivity, environmental conditions).

RGB Camera Operation: Knowing how to capture high-resolution visual data, ensuring proper focus, lighting, and coverage for detailed defect identification.

Advanced Sensors: Familiarity with multispectral cameras or other specialized payloads if used for more advanced analysis.

Data Analysis and Reporting:

Software Proficiency: Hands-on experience with drone flight planning software, data processing software (e.g., DJI Terra, Pix4D), and AI-powered analytics platforms that automatically identify defects.

Data Interpretation: The critical skill of translating raw thermal and visual data into actionable insights for maintenance teams. This involves recognizing different fault signatures and understanding their severity.

Report Generation: Creating clear, concise, and comprehensive inspection reports with geo-tagged images, thermal maps, and recommended actions.

Where to Get Trained: Pathways to Expertise

Several avenues exist for aspiring solar drone panel inspection professionals:

Specialized Drone Training Academies: Many drone training centers now offer dedicated courses for solar panel inspection. These courses typically cover general drone piloting, specific solar PV system knowledge, thermal imaging principles, and data processing software.

Manufacturer-Specific Training: Drone manufacturers (e.g., DJI, Autel) often provide training on their specific platforms and associated software, which can be highly valuable for those using their equipment.

Online Courses and Certifications: A growing number of online platforms offer self-paced courses, sometimes leading to certifications, in drone operations and thermal imaging for industrial applications, including solar.

PV Industry Associations and Workshops: Renewable energy associations may host workshops or seminars on new technologies like drone inspection, offering insights and networking opportunities.

In-house Training for Solar Companies: Larger solar O&M (Operations & Maintenance) companies are increasingly developing their own in-house training programs to upskill their existing workforce.

Key Components of a Comprehensive Training Program:

A robust training program for solar drone panel inspection should include:

Theory and Classroom Instruction: Covering aviation regulations, solar PV principles, thermal imaging theory, and data analysis concepts.

Hands-on Flight Practice: Extensive practical flight time, including simulated and real-world inspection scenarios, emphasizing precise flight paths and consistent data capture.

Software Workshops: Practical sessions on flight planning, data acquisition, and post-processing software, including AI-driven analytics.

Case Studies and Troubleshooting: Analyzing real-world inspection data and learning to diagnose and propose solutions for various panel faults.

Safety Protocols: Emphasizing safety procedures, risk assessment, and emergency responses specific to solar farm environments.

The Future of the Solar Drone Expert:

As drone technology continues to evolve, incorporating more autonomy, AI integration, and advanced sensor capabilities, the role of the solar drone panel inspection expert will become even more sophisticated. These professionals will be at the forefront of ensuring the efficiency, reliability, and profitability of the world's growing solar energy infrastructure. Investing in the right training today is investing in a high-demand career path at the heart of the renewable revolution.

0 notes

Text

Rethinking Power: The Real Story Behind IGBT Rectifiers

In a world that increasingly runs on precise, clean, and efficient power, the components managing electrical conversion have quietly evolved into silent heroes. Among them, IGBT rectifiers are not just electronic components—they're the backbone of modern industrial energy management.

But let’s take a step back.

When most people think of rectifiers, their minds go to clunky, heat-generating boxes in power rooms. When they hear “IGBT,” they might vaguely associate it with transistors or semiconductors. But the convergence of IGBT technology with rectification isn't just a minor engineering upgrade—it's a game-changer for how we design everything from EV chargers to steel plants.

Let’s explore this through a fresh lens—not just what IGBT rectifiers are, but why they matter, how they work, and what makes them irreplaceable in high-performance environments.

What Are IGBT Rectifiers, Really?

At the core, rectifiers convert AC (alternating current) to DC (direct current). That’s not new. What is new is the use of Insulated Gate Bipolar Transistors (IGBTs) in that process.

Traditionally, rectification was handled using diodes and thyristors. These worked well but had limitations in speed, control, and efficiency. Enter IGBTs—a hybrid semiconductor device combining the fast switching of a MOSFET with the high voltage handling of a bipolar transistor.

So, IGBT rectifiers are essentially intelligent rectification systems. They provide:

Precision: Regulated, ripple-free DC output.

Efficiency: Higher energy conversion with minimal heat loss.

Control: Real-time adaptability in load conditions.

Compact Design: Less bulky compared to traditional systems.

Think of it as the difference between flipping a light switch and using a dimmer with programmable automation. That’s the leap IGBT tech gives to rectifiers.

Why Now? Why IGBT Rectifiers Matter More Than Ever

We're in the midst of several overlapping revolutions:

The EV boom needs ultra-fast charging with precise voltage/current control.

The renewable energy surge requires smart inverters and converters to store and balance variable power.

Smart factories and Industry 4.0 demand real-time, programmable power systems that talk to the cloud.

IGBT rectifiers are the perfect fit for this new energy landscape.

Let’s say you’re running a manufacturing unit that relies on variable frequency drives (VFDs), robotic arms, and programmable logic controllers (PLCs). Traditional rectifiers might get the job done, but IGBT-based systems will optimize your power usage, reduce downtime, and offer predictive maintenance insights. In short, they don’t just work—they think.

Key Advantages of IGBT Rectifiers: Beyond the Basics

High Power Factor & Low Harmonics Unlike older thyristor-based setups, IGBT rectifiers operate at higher frequencies and reduce total harmonic distortion (THD), making them grid-friendly and compliant with IEEE-519 standards.

Regenerative Capability IGBT-based rectifiers can feed excess energy back into the grid or battery systems, increasing overall energy efficiency—something that’s becoming essential in closed-loop industrial applications.

Compact, Modular Designs With IGBT rectifiers, system integrators can fit more power in less space. That’s critical in EV charging stations, medical equipment, and aerospace technologies.

Real-Time Digital Control Thanks to microcontroller-based architecture, these rectifiers can be monitored, tuned, and diagnosed remotely. Maintenance becomes smarter, faster, and safer.

A Human Story: Real-World Use Case

Let’s humanize this for a second.

Imagine a precision medical device manufacturer in Pune. They need a clean, stable DC supply to power their sensitive electronics—something even a tiny ripple could disrupt. They tried conventional SCR-based rectifiers. But the noise, inefficiency, and lack of control led to frequent failures.

Then they adopted IGBT rectifiers from a specialized vendor. Instantly, they saw:

30% reduction in energy waste.

Improved product consistency.

Remote control over power settings during off-hours.

Now, that’s more than engineering. That’s impact.

Debunking the Myths

“IGBTs are too complex and expensive.”

Yes, the upfront cost is higher than diode or SCR rectifiers. But when you factor in operational savings, power quality, cooling costs, and space savings, IGBT rectifiers often pay for themselves within a year.

“They’re overkill for standard industrial applications.”

That’s changing. What was “high-end” five years ago is now mainstream. The same way LED bulbs replaced CFLs, IGBT rectifiers are replacing their older counterparts, even in medium-scale industries.

“Maintenance is tricky.”

On the contrary, the digital nature of IGBT systems allows predictive diagnostics. That means fewer surprises, fewer shutdowns, and more data-driven control.

Where to Use IGBT Rectifiers

EV Charging Infrastructure

Battery Energy Storage Systems (BESS)

Railway Traction Systems

Industrial Automation and Robotics

Welding & Electrolysis Equipment

Data Centers & High-Performance Computing

Whether you’re a CTO building a next-gen plant or an energy consultant advising on efficiency, IGBT rectifiers deserve a place in your power strategy.

Future-Proofing with IGBT: What’s Next?

We’re entering an age where software-defined power systems will become the norm. IGBT rectifiers, integrated with IoT modules and AI-based controls, will become smarter, more predictive, and even self-healing in the event of fluctuations.

Imagine a grid-tied factory where your rectifier “knows” when to store energy, when to feed back, and when to auto-calibrate based on ambient temperature. This isn’t a pipe dream—it’s already in pilot projects across Europe and East Asia.

And the beauty? It all begins with IGBT rectifiers.

Final Thoughts: More Than a Component

A rectifier might seem like a simple cog in the machine. But with IGBT technology, it becomes the nervous system—sensing, responding, optimizing. In the years to come, the industries that thrive will be those that embrace this leap.

So next time you're designing or upgrading a power system, don’t just think about volts and amps. Think intelligence, efficiency, and future-readiness.

0 notes

Text

Global Laser Markable Label Stock Market Research Report 2025-2032

The global Laser Markable Label Stock Market demonstrates robust growth, with its valuation reaching $413 million in 2024. According to comprehensive market analysis, the market is projected to expand at a CAGR of 4.7%, achieving approximately $596 million by 2032. This steady progression is largely fueled by expanding applications across food & beverage, pharmaceutical, and industrial sectors where durable, high-contrast product identification is becoming mission-critical.

Laser markable label stocks represent a technological leap in product identification, enabling permanent marking without inks or consumables. Their ability to withstand extreme environments while maintaining readability makes them indispensable for supply chain integrity. As industries prioritize sustainability and traceability, manufacturers are increasingly innovating with advanced polymer formulations and metal substrates to meet diverse application needs.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/292065/global-laser-markable-label-stock-market

Market Overview & Regional Analysis

North America commands the market with 38% revenue share, driven by stringent FDA regulations and widespread adoption in pharmaceutical labeling. The region's advanced manufacturing base and emphasis on anti-counterfeiting measures create ideal conditions for laser label technologies. However, growth rates in Asia-Pacific are accelerating at nearly twice the North American pace as electronics manufacturers and automotive suppliers modernize their identification systems.

Europe maintains strong demand through its industrial and automotive sectors, particularly in Germany's precision engineering hubs. Meanwhile, Latin America and Middle East markets show promising potential, though infrastructure limitations currently constrain adoption rates to about half the global average. Japan and South Korea demonstrate exceptional technology absorption, with laser label penetration exceeding 32% in electronics manufacturing applications.

Key Market Drivers and Opportunities

The market thrives on three transformational trends: regulatory mandates for product traceability, Industry 4.0 integration, and sustainability initiatives. Food safety regulations now drive 45% of new deployments, particularly in meat and dairy product tracking. Pharmaceutical serialization requirements contribute another 28% of demand growth. Emerging opportunities lie in microelectronics labeling, where laser-marked UID codes enable component-level traceability in 5G and IoT device manufacturing.

Circular economy initiatives present compelling opportunities, as laser marking eliminates ink waste and enables material recycling without label contamination. Forward-looking manufacturers are developing laser-sensitive substrates compatible with biodegradable packaging. The medical device sector represents another high-growth avenue, where sterilization-resistant labels are becoming standard for implant tracking and surgical instrument management.

Challenges & Restraints

While the technology offers clear advantages, adoption barriers persist. Equipment costs remain prohibitive for small manufacturers, with complete laser marking systems requiring $25,000-$150,000 capital investment. Material limitations also constrain applications - certain plastics degrade under laser energy, while some metals require specialized coatings for effective marking. Supply chain disruptions for critical components like laser diodes further complicate market expansion in price-sensitive regions.

Regulatory fragmentation presents another challenge, with varying label requirements across industries and geographies complicating global product strategies. Emerging alternative technologies like UV-curable inks and digital watermarks continue competing for market share in price-driven applications where permanence isn't critical. Labor skill gaps in laser system operation also create implementation friction, particularly in developing markets.

Market Segmentation by Type

Plastic Material

Metal Material

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/292065/global-laser-markable-label-stock-marketMarket Segmentation by Application

Food & Beverage

Pharmaceutical

Personal Care

Retailers and Supermarkets

Market Segmentation and Key Players

3M

NIPPON CARBIDE INDUSTRIES CO., INC.

BRADYID

Camcode

CCL

Tesa

HellermannTyton

LinTec

Avery Dennison

UPM Raflatac

Brady Corporation

Report Scope

This report provides a comprehensive analysis of the global laser markable label stock market from 2024 through 2032, featuring granular insights across product types, applications, and regional markets. The research encompasses:

Market size quantification with 10-year projections

Technology adoption curves by industry vertical

Regulatory impact analysis across key jurisdictions

Material innovation tracking, including bio-based substrates

The study also delivers detailed competitive intelligence, including:

Market share assessments of leading suppliers

Product portfolio benchmarks

Strategic initiative mapping

Technology roadmap analysis

Customer adoption patterns

Detailed survey findings reveal industry priorities regarding:

Material performance requirements

System integration challenges

Total cost of ownership considerations

Future capability needs

Get Full Report Here: https://www.24chemicalresearch.com/reports/292065/global-laser-markable-label-stock-market

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

Plant-level capacity tracking

Real-time price monitoring

Techno-economic feasibility studies

With a dedicated team of researchers possessing over a decade of experience, we focus on delivering actionable, timely, and high-quality reports to help clients achieve their strategic goals. Our mission is to be the most trusted resource for market insights in the chemical and materials industries.

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch

Other Related Reports:

0 notes

Text

Silicon Carbide Power Semiconductors Market to Hit $11.7 Billion by 2035

The global silicon carbide (SiC) power semiconductors market was valued at US$ 1.8 billion in 2024 and is projected to expand at a robust compound annual growth rate (CAGR) of 19.0% over the forecast period from 2025 to 2035, reaching US$ 11.7 billion by the end of 2035. This remarkable growth is underpinned by the superior electrical and thermal properties of SiC-based devices, which enable high‐efficiency power conversion, compact form factors, and reliable operation under elevated temperatures and voltages. As industries pivot toward electrification, renewable energy integration, and high‐performance computing, SiC power semiconductors are poised to become foundational components in next‐generation power electronic architectures.

Market Drivers & Trends

Growing Demand for Electric Vehicles (EVs): The surge in global EV sales—from US$ 255.5 billion in 2023 to an estimated US$ 2,108.8 billion by 2033—is a primary catalyst for SiC device uptake. EV powertrains rely heavily on SiC MOSFETs and diodes in traction inverters, onboard chargers, and battery management systems. These components deliver higher power density, faster switching, and reduced thermal management requirements compared to conventional silicon technologies.

Need for Fast Charging Infrastructure: Rapid charging stations require compact, high‑power density converters that can handle high voltages and currents with minimal losses. SiC-based modules offer up to 30% efficiency improvements and significantly lower cooling system complexity, enabling smaller footprints and faster charge times for both public and residential charging units.

Shift Toward Renewable Energy: The integration of solar and wind power into the grid demands inverters capable of operating at high voltages and temperatures with minimal downtime. SiC inverters and power modules are emerging as the technology of choice for utility-scale and distributed renewable installations, driven by national decarbonization targets and favorable government incentives.

Industrial Electrification and Automation: Advanced motor drives, uninterruptible power supplies (UPS), and robotics systems benefit from the fast switching and compact design of SiC devices. This trend is accelerating in manufacturing sectors striving for higher throughput, lower energy costs, and reduced physical plant footprints.

Latest Market Trends

Integration of SiC in 5G Infrastructure: As telecom operators expand 5G networks, the demand for efficient power amplifiers in Base Station Units (BSUs) and power supplies in data centers is driving the adoption of SiC components.

Emergence of Hybrid Silicon–SiC Modules: Manufacturers are introducing hybrid modules that combine SiC devices with conventional silicon circuits to optimize cost and performance, particularly for mid‐voltage applications below 600 V.

Advancements in Packaging and Thermal Management: Innovative packaging solutions such as direct-bonded copper (DBC) substrates and advanced heat sink integrations are enhancing power density and reliability for automotive and industrial modules.

Key Players and Industry Leaders

Leading players in the SiC power semiconductor space include, but are not limited to:

Wolfspeed, Inc.: A pioneer in SiC wafer and device production, focusing on high-performance MOSFETs and diodes.

Infineon Technologies AG: Known for its CoolSiC™ MOSFET portfolio and strategic partnerships in the EV charging domain.

STMicroelectronics N.V.: Developer of the fourth-generation SiC MOSFET technology optimized for traction inverter applications.

ON Semiconductor Corp.: Producer of the EliteSiC™ M3e series targeting automotive on-board chargers and industrial converters.

ROHM Co. Ltd and Renesas Electronics Corp.: Investing heavily in R&D to expand SiC product footprints across voltage and power ranges.

Recent Developments

September 2024: STMicroelectronics unveiled its fourth-generation SiC MOSFET technology, setting new benchmarks for conduction loss and switching performance. The device is purpose-built for high‐voltage traction inverters in electric vehicles.

July 2024: ON Semiconductor launched the EliteSiC M3e family of MOSFETs, delivering up to 20% cost-per-kW reductions and enhanced thermal cycling robustness for industrial and automotive customers.

April 2025: Wolfspeed inaugurated its latest 150 mm SiC wafer fabrication line in North Carolina, USA, aiming to quadruple SiC wafer output by 2026.

Market Opportunities

Emerging EV Markets: Rapid EV adoption in Southeast Asia, Latin America, and Eastern Europe presents greenfield opportunities for SiC suppliers to establish distribution networks and localized manufacturing partnerships.

Grid-Interactive Renewable Installations: Utility-scale solar-plus-storage projects are seeking high-efficiency power modules for energy arbitrage and grid stabilization services.

Aerospace & Defense Electrification: Electrified propulsion systems in drones, aircraft auxiliary power units (APUs), and military ground vehicles are beginning to leverage SiC semiconductors for weight reduction and improved reliability.