#damani

Text

Some sketches before work.. Damani (He/she) / Raitha(They/He) /Techno(They/Them)

#damani#Riatha#Techno#.png#golden wip#damanis design by indig0trolls#and Raitha n Techno by roetrolls!

7 notes

·

View notes

Text

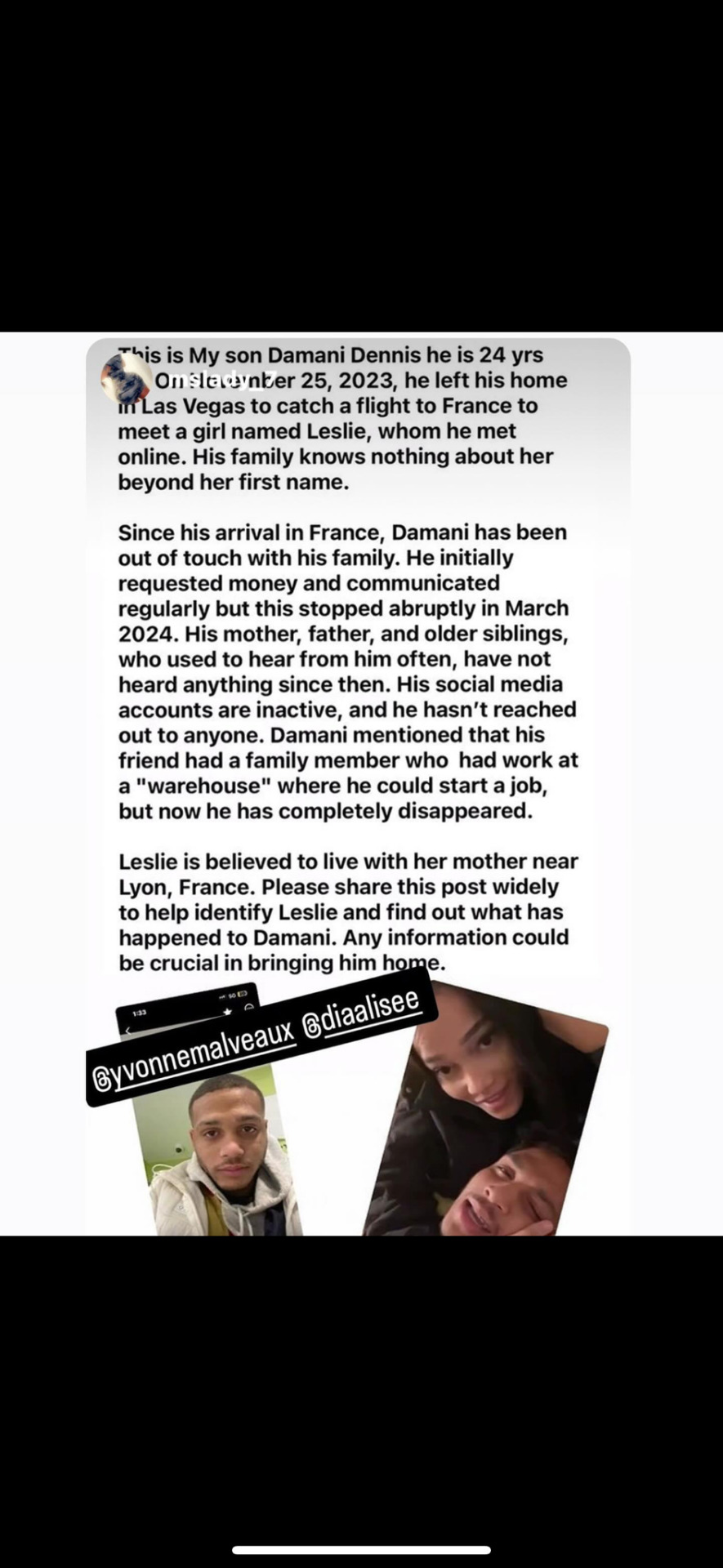

#france#europe#missing#lyon#lyon france#leslie#Damani#human trafficking#drug trade#drug trafficking#missing person

0 notes

Text

first look at the spongebob musical's UK tour, beginning 5th april, 2023! 💛

#the spongebob musical#the spongebob musical UK tour#spongebobedit#theatreedit#broadwayedit#irfan damani#lewis cornay#chrissie bhima#divina de campo#hannah lowther#tom read wilson#richard j hunt

257 notes

·

View notes

Text

TW: missing eye imagery, implied poisoning, shirtless man, possible eye strain?

\o/ color palettes !! used 'em to get back into the groove of things

palettes borrowed from @color-palettes <3

#mars is an artist!#art#digital art#original character#oc art#geckos mfs#oc: ranger#oc: calbach#oc: damani#oc: perrci#oc: aletta (not mine)#color palette

13 notes

·

View notes

Text

Hulu's "Wu-Tang: An American Saga" Third/Final Season Key Art And Date Announcement

Hulu’s “Wu-Tang: An American Saga” Third/Final Season Key Art And Date Announcement

The Hulu Original series “Wu-Tang: An American Saga” returns for its third and final season with three episodes on Wednesday, February 15, 2023. New episodes will follow every Wu-Wednesday, with the finale dropping on April 5, 2023.

SYNOPSIS: Off the release of their debut album and their continued rise to fame, we follow the Wu-Tang Clan over the course of their five-year plan as they face and…

View On WordPress

#Ashton Sanders#Damani Sease#Dave East#Johnell Young#Julian Elijah Martinez#Marcus Callender#Shameik Moore#Siddiq Saunderson#T.J. Atoms#Uyoata Udi#Wu-Tang: An American Saga#Zolee Griggs

2 notes

·

View notes

Text

Radhakishan Damani Portfolio, Shareholdings & Investments: An In-Depth Look

Radhakishan Damani, a legendary figure in the Indian stock market, is best known as the founder of Avenue Supermarts, the parent company of the DMart retail chain. His investment strategies, characterized by patience and a keen eye for value, have earned him a reputation as one of India's most successful investors. In this article, we explore the key components of Damani's portfolio, shareholdings, and investments, with detailed insights from Finology Ticker.

Understanding Radhakishan Damani’s Investment Approach

Damani’s investment philosophy is rooted in identifying companies with strong fundamentals, competent management, and significant growth potential. He tends to hold his investments for the long term, allowing the benefits of compounding to enhance his returns. His portfolio is a blend of established, stable companies and promising growth stocks.

Key Holdings in Radhakishan Damani’s Portfolio

1. Avenue Supermarts Ltd. (DMart)

Sector: Retail

Description: DMart is the cornerstone of Damani's portfolio. The company operates a highly efficient chain of hypermarkets and supermarkets across India, known for its customer-centric approach and low-cost operations. DMart’s impressive financial performance and consistent growth make it a flagship investment for Damani.

2. VST Industries Ltd.

Sector: Tobacco

Description: VST Industries is a major player in the tobacco sector, producing a wide range of tobacco products. Damani’s investment in VST Industries highlights his preference for companies with stable revenue streams and regular dividend payouts.

3. India Cements Ltd.

Sector: Cement

Description: India Cements is one of the largest cement manufacturers in India. With its extensive production capacity and distribution network, the company has a significant presence in the market. Damani’s long-term stake in India Cements reflects his confidence in the infrastructure and construction sectors’ growth prospects.

4. Trent Ltd.

Sector: Retail

Description: Trent operates several retail brands, including Westside and Zudio. The company’s diverse product offerings and strategic growth plans make it an attractive investment in Damani’s portfolio.

5. Blue Dart Express Ltd.

Sector: Logistics

Description: Blue Dart is a leading logistics and courier service provider in India. Known for its extensive network and reliable services, Blue Dart is a strategic investment for Damani, leveraging the growing demand for logistics solutions.

6. Sundaram Finance Ltd.

Sector: Financial Services

Description: Sundaram Finance offers a variety of financial products, including loans, insurance, and asset management. The company’s prudent management and consistent performance align with Damani’s investment philosophy.

7. 3M India Ltd.

Sector: Diversified

Description: 3M India operates in multiple sectors, including healthcare, consumer goods, and industrial products. The company’s innovative approach and diversified revenue streams make it a valuable part of Damani’s portfolio.

8. United Breweries Ltd.

Sector: Beverages

Description: Known for its flagship brand Kingfisher, United Breweries is a dominant player in the alcoholic beverages market. Its strong market position and consistent growth have made it a significant holding in Damani’s portfolio.

Insights from Finology Ticker

Finology Ticker provides a comprehensive overview of Radhakishan Damani's portfolio, shareholdings, and investments. The platform offers detailed information on the performance and financial metrics of the companies in his portfolio, including current share prices, market capitalization, price charts, and balance sheets. This data allows investors to analyze Damani’s investment strategies and the rationale behind his stock selections.

Conclusion

Radhakishan Damani’s portfolio is a reflection of his disciplined investment strategy and deep understanding of market dynamics. His focus on companies with strong fundamentals and growth potential has consistently delivered impressive returns. For investors and market enthusiasts, studying Damani’s portfolio, as detailed on Finology Ticker, provides valuable insights into effective investment strategies and potential market opportunities. By examining his shareholdings and investments, one can gain a better understanding of the principles that drive long-term success in the stock market.

#radhakishan Damani#radhakishan damani portfolio#radhakishan damani stocks#portfolio of radhakishan Damani#radhakishan damani penny stocks

0 notes

Text

Damani is Ex Mortus' and H4LO's manager.. Nepo baby + spoiled privilege. Usually, he can score whatever gig, venue, security, and requests that the group might want. She usually uses the opportunity to get hammered after their set + check is written (contract requires payment deal). May or may not have encouraged/influenced Nakaous hardcore party attitude lmao

#Damani#golden info#H4lo includes: Riaske.. Ace.. Ritual#Ex mortus: Milo.. Nakaou.. Wicata.. Katz and Mickey#Kirean floats between the two#Masayo and Arturo are kinda like security/heavy lifting with equipmemt n setting it up#Astera does NOT GIVE A FUCCKKKK (shes allowed to do whatever she wants forever)#.txt

2 notes

·

View notes

Text

Handling the Undead (Håndtering av udøde) (2024) Thea Hvistendahl

June 27th 2024

#handling the undead#håndtering av udøde#2024#thea hvistendahl#renate reinsve#anders danielsen lie#Bjørn Sundquist#Inesa Dauksta#Bente Børsum#Olga Damani#Kian Hansen#Bahar Pars#Dennis Østry Ruud

1 note

·

View note

Text

Key Factors Behind Radhakishan Damani’s Investment Decisions

Introduction

Damani is a name with a sagacity of the Indian stock market. His investment decisions and strategies are not just successful but serve as a blueprint for aspiring investors.

He founded Dmart, a major retail corporation, and became renowned as a seasoned investor in the Indian equity market. His portfolio has been studied and envied by many. To read more about Radhakishan Daman's portfolio and net worth, read our blog on Altius Investech.

The blog would highlight his strategic moves contributing to the notable success while offering valuable insights to investors.

Long-term investment mindset

With his long-term investment horizon, unlike traders focusing on short-term gains, Damani has invested in various companies for numerous years.

The philosophy and approach of purchasing and holding onto stocks from fundamentally strong companies lets him earn benefits from steady growth, dividend payouts, and appreciation of long-term capital.

Avenue Supermarts, the parent company of DMart, highlights a great example demonstrating the exponential growth attained from long-term holdings.

Damani has also invested in Chennai Super Kings – an IPL franchise backed by India Cements Limited. With an illustrious history, they have participated in a record 10 finals, won a record five IPL titles in 2010, 2011, 2018, 2021, and 2023, and qualified for the playoffs 12 times out of the 14 seasons they have played in, which is more than any other franchise.

To have your hands-on gains that we can vouch for, buy csk unlisted shares from Altius Investech starting from just ₹ 153.

Value in Investments

Damani looks out for companies that are undervalued as per their actual worth. Buying the stocks at prices lower than their real, intrinsic value, makes him position himself for considerable gains once the market corrects the undervaluation. The method needs a deeper understanding of the fundamentals of business, involving debt levels, competitive advantages, and revenue streams.

No to High-debt companies

A significant factor in his investment strategies is an aversion to organizations with high debt levels. Instead, he seeks companies with stronger cash flows and manageable debt. The conservativeness shields his investments from risks linked with high leverage, especially during economic downturns, causing stable returns.

Market Timing

What needs to be acknowledged is the way Damani times his entry or exit from businesses, impeccably. He willingly buys stocks when the market shows pessimistic values and sells as per his interest. For example, his entry into some specific apparel or cement stocks during the time of market lows let him reap considerable gains with the recovery of these sectors.

Market Cycles

Damani’s interpretation and understanding of the market cycles significantly contribute to his success. Through effective studies levied on investor behavior and market patterns, he can anticipate market dynamic shifts. The capability of reading the market makes him adjust his strategies as per the prevailing economic scenario.

Business Fundamentals

The decisions he makes in his processes analyze business procedures to invest only in companies having strong management, sustainable advantages, and clear strategies for growth. Instead of market speculation, he identifies companies offering potential and stability, irrespective of conditions of market volatility.

Diversification

With important holdings in the investments and retail sectors, Damani’s portfolio remains diverse across different industries. Diversification helps in the mitigation of risks as poor performance of one stock or sector is compensated by the gains or stability of the rest. This counts as a classic strategy that served him well over the decades.

Network and Mentorship

A close-knit group consisting of seasoned investors as friends and mentors, including the famous Rakesh Jhunjhunwala, gives him a network providing him with robust exchanges of strategies and ideas, and refining his investment tactics and decisions.

Conclusion

Several disciplined approaches happen to focus on value investing, fundamental analyses, and cautious approaches for debt as well as market timing, making a huge figure to emulate in the world of investment.

Investors who intend to mirror his success must understand and implement these principles as a step forward in earning significant returns in the volatile world of trading stocks. To further diversify and grow your investment, consider investing in unlisted shares on Altius Investech, a platform known for its promising opportunities.

0 notes

Text

production photos from the UK tour of the spongebob musical, photos by mark senior.

#the spongebob musical#the spongebob musical UK tour#divina de campo#hannah lowther#lewis cornay#chrissie bhima#irfan damani#tom read wilson

102 notes

·

View notes

Text

redrew reaction images with my ocs \o/

#mars is an artist!#art#digital art#oc art#original character#geckos mfs#oc: ranger#oc: calbach#oc: damani

5 notes

·

View notes

Text

Absorbing

THE SPONGEBOB MUSICAL

Grand Theatre, Wolverhampton, Tuesday 27th June 2023

The wildly successful cartoon series is brought to colourful life in this new hit musical. Rather than dress in large suits, like Disneyland mascots, the characters are adapted to fit their human performers. Such is the genius of the design, they are all instantly recognisable to even the most casual Spongebob…

View On WordPress

#Chrissie Bhima#Divina De Campo#Grand Theatre Wolverhampton#Irfan Damani#Lewis Cornay#Rebecca Liserwski#Reece Kerridge#review#Sarah Freer#Tara Overfield Wilkinson#The Spongebob Musical#Theo Reece#Tom Read Wilson

1 note

·

View note