#decentralized exchange software development services

Explore tagged Tumblr posts

Text

Decentralised Exchange Development in 2025: Build Smarter, Trade Better

A decentralised exchange (DEX) is a p-to-p marketplace that allows users to trade crypto without requiring custody. Remove the middleman from the money transfer process. Traditionally, banks, brokers, payment processors, and others function as intermediaries facilitating the exchange of assets through secure blockchain smart contracts. Businesses can create blockchain-based platforms under their own branding and with their own customisations with the assistance of our decentralised exchange development company. Everything can be altered to meet the needs of our clients. Even after the job is completed, we provide round-the-clock assistance and support.

For more details - https://www.clarisco.com/decentralized-exchange-development

Book a Free Demo - https://www.clarisco.com/contact

#decentralized exchange development company#decentralized exchange application development#decentralized exchange development services#decentralized exchange software development company#decentralized exchange software development services#defi exchange development company#defi exchange development services#defi exchange platform development company#decentralized exchange development

0 notes

Text

Top Reasons to Hire a Decentralized Exchange Development Company Today

Introduction

Decentralized finance (DeFi) has increasingly changed the way individuals engage with financial institutions in the past few years. Centralized cryptocurrency exchanges and traditional banking are being replaced by open and peer-to-peer options. The core of this revolution is decentralized exchanges (DEXs) — mechanisms that enable users to exchange cryptocurrencies without an intermediary.

Yet constructing a secure, high-performing DEX is not a simple task. It requires profound technical expertise, regulatory savvy, and a solid market understanding. This is the space where a decentralized exchange development company comes to the forefront.

What Is a Decentralized Exchange Development Company?

A DEX development company is a firm that specializes in developing blockchain-based DEX platforms. These companies offer everything one requires to deploy and run a successful decentralized crypto exchange – from design to deployment and more.

Services usually include:

DEX Platform Architecture & UI/UX Design

Smart Contract Development & Integration

Liquidity Pool & AMM Integration

Decentralized exchange software development

KYC/AML compliance implementation

Security audits and testing

Post-launch upgrades & ongoing maintenance

Collaborating with the appropriate development team ensures your DEX is strong, scalable, and prepared to compete in today's rapidly changing DeFi environment.

Top Reasons to Partner with a Decentralized Exchange Development Company

Industry ExpertiseA leading DEX exchange development company has extensive experience in blockchain protocols such as Ethereum, Binance Smart Chain, Tron, and Solana. They have worked with various token standards, DEX models (such as AMMs and order books), and on-chain mechanisms.

Their expertise guides you through problems in smart contract development, tokenomics, liquidity integration, and much more.

Custom DEX SolutionsEach company is different. Whether a startup or a seasoned business, a company specializing in decentralized exchange development can customize solutions to your business's specific requirements.

You have the option to choose:

White-label DEX solutions (faster launch, reduced cost)

Custom-built platforms (fully customized and scalable)

They also assist with feature development such as multi-wallet support, staking, governance models, cross-chain trading, and admin dashboards.

Improved Security FeaturesSecurity is not negotiable in DeFi. Professional DEX developers keep their primary focus on:

Smart contract audits

Anti-bot measures

Multi-signature wallet functionality

KYC/AML protocols

Fraud prevention features

They aim to shield platform owners and end-users from hacking, phishing, and loss of funds.

Faster Time to MarketWith reusable code modules, tried-and-tested frameworks, and agile principles, a skilled team will launch your DEX sooner than a run-of-the-mill developer.

This translates to:

Faster launch

Lower cost

Early-mover advantage in your space

Regulatory Guidance & ComplianceRegulations of crypto can be a minefield. A decentralized exchange development company keeps you compliant with local and international laws.

This entails:

KYC/AML integration

Licensing guidance

Tax reporting tools

Jurisdictional risk assessments

Having this guidance from day one prevents expensive penalties or shutdowns down the line.

Post-Launch Support & UpgradesDeveloping a DEX isn't a once-and-done task. It requires:

Continuous bug fixes

Security patches

Feature updates

Market-driven changes (such as token listing or new protocols)

Continuous support means your platform grows with the industry.

Why Justtry Technologies?

Here at Justtry Technologies, we offer decentralized exchange development services that extend far beyond coding. We are partnership-oriented with your project.

Why customers rely on us:

Expertise in developing secure and scalable DEX platforms, tried and tested

Intensive understanding of smart contracts and blockchain architecture

Clear communication and project monitoring

Launch support and future-proof upgrades

Personalized solutions centered around your business objectives

Whether you need to develop on Ethereum, Binance Smart Chain (BEP20), or Solana, our team of experts provides high-quality, timely results.

We don't only build platforms. We build trust.

Conclusion

Employing a decentralized exchange development company is more than a technical decision — it's strategic. With expert expertise, solid security, and a partner who shares your vision, your DEX platform is much more likely to thrive.

Whether you're starting a new crypto project or expanding an existing one, the right development partner offers expertise, trustworthiness, and sanity.

Get in touch with us today to arrange a complimentary consultation and discover how we can help you realize your decentralized exchange.

#Decentralized exchange development services#decentralized crypto exchange development#dex exchange development company#Decentralized exchange software#Decentralized Crypto Exchange Platform

0 notes

Text

#Decentralized Exchange Development Services#DeFi Exchange Development#DEX Development#DeFi Exchange Development Company#Decentralized Exchange Development#Decentralized Exchange Development Company#Decentralized Exchange Software#Decentralized Exchange Software Development#Decentralized Crypto Exchange Software#Decentralized Cryptocurrency Exchange Development#DEX Development Company

0 notes

Text

How businesses can earn revenue by launching a Perpetual Exchange?

In the world of cryptocurrency, perpetual exchanges have emerged as a lucrative avenue for businesses to generate revenue. But what exactly is a perpetual exchange, and how can businesses benefit from launching one? Let's delve into the basics.

A perpetual exchange, in simple terms, is a platform where traders can buy and sell cryptocurrencies without an expiration date. Unlike traditional exchanges where trades are executed within a set timeframe, perpetual exchanges allow for continuous trading, hence the term "perpetual." This flexibility attracts traders who seek round-the-clock access to the crypto market.

For businesses looking to capitalize on this growing trend, launching a perpetual exchange can be a strategic move. By leveraging decentralized crypto perpetual exchange software, provided by leading crypto perpetual exchange development company, Plurance, businesses can establish their own decentralized exchange platform tailored to their specific needs.

So, how exactly can businesses earn revenue through a perpetual exchange?

Trading Fees: One of the primary revenue streams for perpetual exchanges is through trading fees. Every trade executed on the platform incurs a small fee, which accumulates over time. By attracting a large user base and facilitating high trading volumes, businesses can generate substantial revenue from these fees.

Leverage Trading: Perpetual exchanges often offer leverage trading options, allowing traders to amplify their positions with borrowed funds. While this increases the risk for traders, it also presents an opportunity for businesses to earn revenue through interest on leveraged trades.

Market Making: Businesses can act as market makers on their own exchange, providing liquidity by continuously buying and selling assets. In return for this service, market makers earn a spread on each trade, contributing to the exchange's revenue.

Listing Fees: Cryptocurrency projects seeking exposure often pay listing fees to have their tokens listed on popular exchanges. By offering a platform for token listings, businesses can earn revenue through these fees while also expanding their exchange's asset offerings.

Token Sales and IEOs: Perpetual exchanges can host token sales or initial exchange offerings (IEOs) for new cryptocurrency projects. By facilitating these fundraising events, businesses can earn revenue through participation fees or a percentage of the tokens sold.

Conclusion:

Launching a perpetual exchange presents businesses with a lucrative opportunity to tap into the growing crypto market. Plurance provides the best crypto perpetual exchange software that helps businesses to create a decentralized exchange tailored to their needs and capitalize on various revenue streams. By staying innovative and responsive to market demands, businesses can position themselves for long-term success in the dynamic world of cryptocurrency exchanges.

Contact us to get a free demo of Decentralized Perpetual Exchange Software!

#Crypto Perpetual Exchange Development Company#Crypto Perpetual Exchange Development#Crypto Perpetual Exchange Development Services#Decentralized Perpetual Exchange Software#Crypto Perpetual Exchange Software

0 notes

Text

Decentralized Finance Development Services Mobiloitte offers Defi development services that can help you create a custom Defi platform that meets your specific needs and requirements.

#goose defi#DeFi Lending & Borrowing Software#Defi Lending and Borrowing Platform Development Company#defi lending and borrowing platform development#amm defi platform#amm defi#DeFi Lending & Borrowing Platform#defi exchange development#Automated market maker defi#Decentralized Finance on Binance Smart Chain#defi staking platform development#defi token development company#defi token development#defi development#what is defi crowdfunding#defi development services#defi wallet development solutions#DeFi Crowdfunding Platform#DeFi Crowdfunding Platform Development#benefits of defi crowdfunding#defi development company#defi software#defi consulting#decentralized financial assistance#types of crowdfunding

0 notes

Text

In the fall of 2020, as crypto scammers and thieves began to realize the full potential of a financial privacy tool called Tornado Cash—a clever new system capable of shuffling users' funds to cut the trail of crypto transactions recorded on the Ethereum blockchain—Alexey Pertsev, one of the creators of that service, sent a note to his fellow cofounders about this growing issue. He suggested crafting a standard response to send to victims pleading with Tornado Cash for help with stolen funds laundered through their service. “We must compose a message that we will send to everyone in similar cases,” Pertsev, the then-27-year-old Russian living in the Netherlands, wrote to his colleagues.

Tornado Cash cofounder Roman Semenov answered three minutes later with a draft of their stock response—essentially pointing to the fact that the service's novel design meant it ran on the Ethereum blockchain, not on any server they owned, and was thus out of their hands. “It is a decentralized software protocol that no one entity or actor can control,” the message read. “For that reason, we are unable to assist with respect to any issues relating to the Tornado Cash protocol.”

That statement would remain Tornado Cash's position two days later when hackers affiliated with the North Korean government stole roughly $275 million worth of coins from the crypto exchange KuCoin and funneled a portion of the loot through Tornado Cash to cover their tracks. Tornado Cash would maintain that stance as, according to Dutch prosecutors, a billion-plus dollars more of stolen funds flowed through the service over the next two years, part of at least $2.3 billion in total funds from criminal and sanctioned sources that made up more than 30 percent of the service's overall transactions from 2019 to 2022.

Now, two years after Pertsev's arrest and indictment for money laundering, that “out-of-our-hands” decentralization defense has become one of the central arguments for his innocence. On Tuesday, it will be put to the test when a panel of three Dutch judges rules on the criminal charges that could send Pertsev to prison for years. Privacy advocates believe the result of the case—the first of two, as the New York prosecution of another Tornado Cash cofounder, Roman Storm, is expected to go to trial this coming September—could also shape the future of cryptocurrency privacy and may determine the limits of services like Tornado Cash or other open source software creations to offer a safe haven from financial surveillance.

Dutch prosecutors have accused Pertsev of essentially creating the perfect money laundering machine by designing Tornado Cash to work as a set of “smart contracts”—a type of decentralized service made possible by Ethereum's unique features, in which code is copied to the thousands of Ethereum nodes that store the cryptocurrency's blockchain—and thus preventing Tornado Cash's creators from identifying or controlling who used the service to hide the origins and destinations of their funds.

Pertsev's defenders, on the other hand, point out that those properties are also exactly what makes Tornado Cash such a powerful tool for privacy. “This is the entire point of a decentralized system,” says Sjors Provoost, a Dutch cryptocurrency developer and author of Bitcoin: A Work in Progress, who attended Pertsev's trial. “These are completely clashing worldviews. There's the worldview of privacy and decentralization, and there's the government worldview of surveillance, in which you need to be able to check every transaction.”

Since US and Dutch prosecutors indicted Tornado Cash's cofounders and the US Treasury sanctioned the service in 2022, the case has become a cause célèbre in some cryptocurrency circles, many of whose adherents argue that a guilty verdict could not only damage financial privacy but also set a dangerous precedent that developers of open source software can be held liable for the actions of those who use their tools. Ethereum's inventor, Vitalik Buterin, has noted publicly that he used Tornado Cash to anonymize a donation to Ukraine following Russia's invasion, as an example of the service's legitimate use for privacy. US National Security Agency whistleblower Edward Snowden has compared Tornado Cash's functioning on the Ethereum's blockchain to a water fountain built in a park—a kind of public utility where “you push a button and privacy comes out”—and has called the crackdown on Tornado Cash and its cofounders “deeply illiberal and profoundly authoritarian."

Yet the Dutch prosecutors and Netherlands' financial law enforcement agency, known as FIOD, which led the investigation of Pertsev, argue that the case isn't actually about a fundamental conflict between privacy and security, or liability for open source code, or any other larger principle. Instead, they say, it's about Pertsev's specific, informed decisions to enable thieves on an enormous scale. “It's all about the choices of our suspect,” M. Boerlage, the case's lead prosecutor, tells WIRED in an interview. “He made choices writing the code, deploying the code, adding features to the ecosystem. Choice after choice after choice, all while he knew that criminal money was entering his system. So it's not about code. It's about human behavior.”

A Room Without a Lock—or Walls

Dutch prosecutors contend that, despite the Tornado Cash creators' claims, they did exert control over it. Aside from its decentralized “smart contract” design, they point to Tornado Cash's web-based user interface for interacting with its blockchain-based smart contract: a fully centralized tool running on infrastructure the creators built and managed, which nonetheless had no monitoring or safeguards to prevent its abuse by criminals for money laundering. In fact, prosecutors found that during the time of their investigation, 93.5 percent of users sent their transactions to Tornado Cash through that web interface, which was far simpler to use than directly interacting with the blockchain-based service.

Pertsev's defense didn't respond to WIRED's repeated requests for an interview. But his lead defense attorney, Keith Cheng, has countered that there would have been no point in monitoring or blocking users on that web interface when anyone could circumvent the website altogether to interact directly with the smart contract or even to build their own interface. “The Tornado Cash smart contracts could be accessed directly at any point of time,” Cheng told an audience at the ETHDam cryptocurrency conference in Amsterdam last year. “Implementing checks within the surrounding infrastructure is akin to adding extra locks to a door that lacks surrounding walls.”

The prosecution points out that Tornado Cash could have at least tried to put locks on that door, given that the vast majority of their users, both legitimate and criminal, were walking through it. More fundamentally, they argue that it was Pertsev's decision to put into place a system that he knew from the start would include basic elements he couldn't control. “Building and deploying something unstoppable is also a decision,” says Boerlage.

That question of decentralization and control nonetheless makes the Tornado Cash case a far less straightforward prosecution than those against the founders of simpler bitcoin-based “mixer” services like Bitcoin Fog or Helix, which were similarly intended to prevent cryptocurrency tracing. In each of those earlier cases, the administrators—now both convicted of money laundering conspiracy—hid their connections to the services. By contrast, Pertsev and his cofounders appear to have been confident enough in their remove from the money launderers who used Tornado Cash that they operated fully in the open, under their real names. “This complete transparency does not exactly indicate criminal activity,” Pertsev's attorney Cheng told ETHDam.

At the same time, the prosecution argues that Pertsev was both aware of and untroubled by the millions and ultimately billions of dollars in stolen cryptocurrency flowing through Tornado Cash, which reached a peak in the spring of 2022. They argue that Pertsev continued to maintain and develop pieces of the system—such as its centralized frontend—even as the service was used to launder the stolen funds from 36 distinct cryptocurrency heists, many of which prosecutors say he and his cofounders discussed in their communications. In the meantime, he also profited handsomely, in part from Tornado Cash's issuing its own crypto token, ultimately making more than $15 million and buying himself a Porsche.

When North Korean hackers stole more than $600 million from the blockchain-based game Axie Infinity in March of 2022, Tornado Cash cofounder Semenov wrote anxiously to Pertsev and Storm that “the fucking disaster is about to begin,” perhaps fearing that their service would be used by the perpetrators of that massive heist, as it already had been in well over a dozen others. Pertsev weighed in 10 minutes later, writing “noticed after 5 days, lol," an apparent reference to how long it seemed to have taken Axie Infinity to discover the theft. Sure enough, less than a week later, hundreds of millions of dollars in stolen Axie Infinity funds began to pour into Tornado Cash.

Prosecutors have pointed to Pertsev's “lol” as a sign of his flippant disregard for the victims whose funds, they argue, he was helping to launder. His defense has countered that he was merely expressing surprise.

That same month, perhaps in response to the growing spotlight on Tornado Cash's use by criminals, Pertsev and his cofounders did, in fact, implement a free tool from blockchain analysis firm Chainalysis that would block transactions from sanctioned Ethereum addresses via their web interface. The prosecution has pointed out that the free tool was easily circumvented—hackers could merely move their stolen coins to a different address before sending them into Tornado Cash—and described the effort as “too little and too late."

In their statement to the court, Dutch prosecutors suggest a different solution, if Pertsev had actually cared about Tornado Cash's exploitation by criminals. “What was the simplest option? Take the UI offline and stop advertising. Plain and simple,” they write. “Stop offering the service.”

In the conclusion of that same statement to the court, they point out that under Dutch law the maximum prison sentence for money laundering at the scale Pertsev allegedly committed is eight years, and they ask that Pertsev be sentenced to five years and four months if he's found guilty.

The Tornado Rolls On

Cryptocurrency advocates focused on privacy and civil liberties will be closely watching the outcome of Pertsev's case, which many see as a bellwether for how Western law enforcement and regulators will draw the line between financial privacy and money laundering—including in some immediate cases to follow.

The US trial of Tornado Cash's Storm in a New York court later this year, as well as the US indictment last month of the founders of Samourai Wallet, which prosecutors say offered similar privacy properties to Tornado Cash's, are more likely to directly set precedents in US law. But Pertsev's case may suggest the direction those cases will take, says Alex Gladstein, the chief strategy officer for the Human Rights Foundation and an advocate of bitcoin's use as a human rights tool.

“What happens in the Netherlands will color the New York case, and the Tornado Cash cases are really going to color the outcome of the Samourai case,” Gladstein says. “These cases are going to be historic in the precedents they set.”

Gladstein, like many crypto privacy supporters, argues that anyone weighing the value of tools like Tornado Cash should look beyond its use by hackers to countries like Cuba, Venezuela, and India, where activists and dissidents need to hide their financial transactions from repressive governments. “For human rights activists, it’s essential that they have money the government can’t surveil,” Gladstein says.

Regardless of the verdict in Pertsev's case or that of his cofounder Roman Storm in the fall, Tornado Cash's founder's core argument—that Tornado Cash's underlying infrastructure has always been out of their hands—has proven to be correct: Tornado Cash lives on.

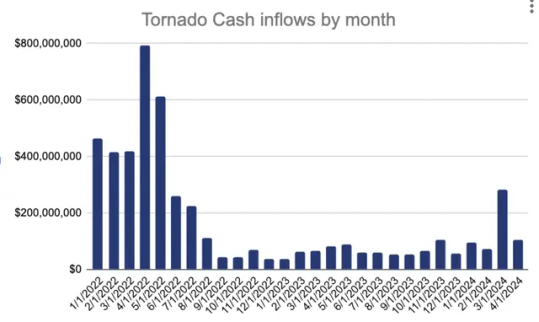

True to its promise of decentralization, Tornado Cash still persists after its cofounders indictment in the fall of last year—and is now out of their control. In March, $283 million flowed into the service. Courtesy of Chainalysis

When the tool's centralized web-based interface went offline last year in the wake of US sanctions and the two cofounders' arrests—Roman Semenov, for now, remains free—Tornado Cash transactions dropped by close to 90 percent, according to Chainalysis. But Tornado Cash has remained online, still functioning as a decentralized smart contract. In recent months, Chainalysis has seen its use tick up again intermittently. More than $283 million flowed into the service just in March.

In other words, whether it represents a public utility for financial privacy and freedom or an uncontrollable money laundering machine, its creators' claim has borne out: Tornado Cash remains beyond their control—or anyone's.

9 notes

·

View notes

Text

Why Bitcoin Over Others?

In a world where thousands of cryptocurrencies seem to appear overnight, it’s easy to lump them all together and label them “just another digital coin.” But doing so misses a crucial point: not all digital assets are created equal. Bitcoin, the original cryptocurrency, stands distinctly apart from the rest. Its history, security, decentralization, and unwavering principles set it on a pedestal far above the flood of imitators. Today, we’ll explore what makes Bitcoin so special—and why it remains the cornerstone of the entire crypto movement.

1. Immaculate Conception and Fair Launch Bitcoin emerged during the aftermath of the 2008 financial crisis, introduced by an unknown individual or group under the pseudonym Satoshi Nakamoto. Unlike many cryptocurrencies that began with pre-mines, venture capital backing, or a charismatic founder front and center, Bitcoin was offered to the world at large with no special advantages for early insiders. Its code was released as open-source software, and anyone could join, mine, and participate. This clean, decentralized birth means there’s no central authority pulling the strings—just a global, diverse community contributing to its growth.

2. Proven Security and Longevity One of the greatest strengths of Bitcoin is its track record. For over a decade, it has operated without needing to “restart” or rewrite its ledger, all while withstanding countless hacking attempts and periods of extreme volatility. Its security model, powered by a vast network of miners performing billions of computational operations per second, has made it incredibly resistant to attacks. This longevity and resilience place Bitcoin in a unique category—no other digital asset has maintained such unshakeable network security for so long.

3. True Decentralization Decentralization is a buzzword often tossed around, but few truly deliver. Bitcoin’s network is spread across the entire globe, with miners, node operators, and developers from all walks of life. No government, company, or consortium controls the network; transactions require no permission and no central gatekeeper. Other cryptocurrencies frequently rely on small teams, foundation boards, or single points of failure. Bitcoin’s decentralized architecture ensures it remains censorship-resistant, neutral, and truly belongs to everyone and no one.

4. Predictable Monetary Policy At the heart of Bitcoin’s monetary policy is a simple but powerful principle: scarcity. There will never be more than 21 million bitcoins, a limit enforced by Bitcoin’s code. This fixed supply contrasts sharply with fiat currencies, which central banks can inflate at will, and with many cryptocurrencies that tweak their monetary policy mid-flight. The reliability of Bitcoin’s halving cycles—where the reward for mining new coins is cut in half roughly every four years—imposes discipline and predictability. This scarcity and transparency help position Bitcoin as “digital gold,” a store of value that transcends borders and politics.

5. Network Effects and Brand Recognition Bitcoin’s first-mover advantage has allowed it to capture the imagination of individuals, institutions, and even some governments. Over time, it has built an unparalleled brand, becoming shorthand for the very concept of digital money. As a result, infrastructure—from exchanges and custodial services to payment processors and lending platforms—has matured around Bitcoin first. Its network effects are self-reinforcing: the more people use and trust Bitcoin, the more robust and valuable it becomes, further attracting new users.

6. Conservative Upgrades and Steady Evolution Unlike many projects that chase trends, implement flashy features prematurely, or pivot narratives every few months, Bitcoin evolves slowly and deliberately. Changes to the Bitcoin protocol undergo intense scrutiny and thorough debate before being adopted. This conservative approach preserves the network’s stability and reliability. Instead of overhauling the system haphazardly, Bitcoin relies on Layer 2 solutions like the Lightning Network to improve efficiency and speed without compromising core principles.

7. A Cultural and Philosophical Touchstone Beyond technology, Bitcoin represents an idea—a rejection of the status quo of endless money printing, centralized oversight, and financial exclusion. It’s a rallying point for those who value privacy, autonomy, sound money, and freedom from the arbitrary decisions of central authorities. This cultural and philosophical dimension is something many altcoins lack. While others may attempt to graft meaning onto their projects, Bitcoin naturally embodies these principles through its origin story, infrastructure, and committed global community.

Conclusion: The Gold Standard of Digital Assets As the cryptocurrency landscape continues to expand, it’s crucial to separate substance from hype. While plenty of coins promise faster transactions, flashy features, or quick gains, few can claim the foundation of trust, resilience, and true decentralization that Bitcoin offers. Bitcoin isn’t just another coin; it’s the benchmark by which all other digital assets are measured.

In choosing Bitcoin over others, you aren’t merely picking a cryptocurrency—you’re aligning yourself with a robust, time-tested network built on transparency, fairness, and sound monetary principles. Amidst an ever-growing sea of digital assets, Bitcoin remains the unwavering beacon lighting the way toward financial sovereignty.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#DigitalGold#CryptoEducation#BitcoinOverAltcoins#CryptoCommunity#FinancialFreedom#Decentralization#BlockchainTechnology#SoundMoney#CryptoRevolution#Altcoins#BitcoinStandard#HODL#FutureOfFinance#DigitalCurrency#BitcoinAdvocate#CryptoBlog#WhyBitcoin#BitcoinVsAltcoins#financial empowerment#globaleconomy#unplugged financial#blockchain#financial education#finance#financial experts

4 notes

·

View notes

Text

Launch Your Own Crypto Platform with Notcoin Clone Script | Fast & Secure Solution

To launch your own cryptocurrency platform using a Notcoin clone script, you can follow a structured approach that leverages existing clone scripts tailored for various cryptocurrency exchanges.

Here’s a detailed guide on how to proceed:

Understanding Clone Scripts

A clone script is a pre-built software solution that replicates the functionalities of established cryptocurrency exchanges. These scripts can be customized to suit your specific business needs and allow for rapid deployment, saving both time and resources.

Types of Clone Scripts

Centralized Exchange Scripts: These replicate platforms like Binance or Coinbase, offering features such as order books and user management.

Decentralized Exchange Scripts: These are designed for platforms like Uniswap or PancakeSwap, enabling peer-to-peer trading without a central authority.

Peer-to-Peer (P2P) Exchange Scripts: These allow users to trade directly with each other, similar to LocalBitcoins or Paxful.

Steps to Launch Your Crypto Platform

Step 1: Define Your Business Strategy

Market Research: Identify your target audience and analyze competitors.

Unique Value Proposition: Determine what sets your platform apart from others.

Step 2: Choose the Right Clone Script

Evaluate Options: Research various clone scripts available in the market, such as those for Binance, Coinbase, or P2P exchanges. Customization: Ensure the script is customizable to meet your specific requirements, including branding and features.

Step 3: Development and Deployment

Technical Setup: Collaborate with developers to set up the necessary infrastructure, including blockchain integration and wallet services.

Security Features: Implement robust security measures, such as two-factor authentication and encryption, to protect user data and transactions.

Step 4: Compliance and Regulations

KYC/AML Integration: Ensure your platform complies with local regulations by integrating Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

Step 5: Testing and Launch

Quality Assurance: Conduct thorough testing to identify and fix any bugs or vulnerabilities.

Launch: Once testing is complete, launch your platform and start marketing it to attract users.

Advantages of Using a Notcoin Clone Script

Cost-Effective: Using a pre-built script is generally more affordable than developing a platform from scratch.

Faster Time to Market: Notcoin Clone scripts are ready to deploy, significantly reducing development time.

Customization Options: Most scripts allow for extensive customization, enabling you to tailor the platform to your needs.

Conclusion

Launching your own cryptocurrency platform with a Notcoin clone script is a viable option that can lead to a successful venture in the growing crypto market. By following the outlined steps and leveraging the advantages of Notcoin clone scripts, you can create a robust and secure trading platform that meets user demands and regulatory requirements.

For further assistance, consider reaching out to specialized development companies that offer Notcoin clone script and can guide you through the setup process

#cryptotrading#notcoin#notcoinclonescript#cryptocurrencies#crypto exchange#blockchain#crypto traders#crypto investors#cryptonews#web3 development

3 notes

·

View notes

Text

Binance: World’s largest exchange

To gain further insight into Binance, it is necessary to first comprehend the notion of cryptocurrencies. Despite its boom, a lot of people these days are unaware of what cryptocurrencies actually are. A cryptocurrency is a kind of digital or virtual money that is protected by cryptography and is very difficult to fake or spend twice. Blockchain-based decentralized networks underpin a large number of coins.

In terms of the amount of cryptocurrency traded every day, Binance is the biggest cryptocurrency exchange in the world.[2] It is registered in the Cayman Islands and was established in 2017.

Changpeng Zhao, a developer who had previously worked on high-frequency trading software, launched Binance. China was the original home of Binance, but as cryptocurrency regulation in China grew, the company relocated its offices outside of the country.

Following the Chinese government's prohibition on cryptocurrency trading in September 2017, the company was compelled to exit the country. Since then, it has offices in Taiwan and Japan. Currently, Malta serves as its base.

The goal of Binance is to attract as many users as possible. The exchange offers enough currencies and functionality to satisfy experienced traders while remaining user-friendly enough for beginners. For cryptocurrency traders of practically any experience level, I would suggest Binance.

The biggest cryptocurrency trading platform worldwide is called Binance.1. It is not very user-friendly, despite having a wide range of trading options and features. Depending on their level of experience and education, investors may encounter a challenging learning curve when using Binance.

Binance provides a vast range of trading options, such as an amazing assortment of market charts and hundreds of cryptocurrencies, through its desktop or mobile dashboards. In addition, a range of order types and trading alternatives, such as options and futures, are available to users. Only more than 65 cryptocurrencies are accessible to American consumers, and many services and possibilities are unavailable in the country.

Binance offers a thorough learning platform, an NFT platform, and more in addition to its tools and services. US clients don't seem to have access to the NFT marketplace just now.

Only more than 65 of the more than 365 cryptocurrencies that Binance offers for trading are accessible in the United States. It also supports a range of fiat currencies, such as USD, EUR, AUD, GBP, HKD, and INR, for users who are located abroad. Binance offers an extensive selection of cryptocurrency pairs based on your region.

Binance Coin (BNB), VeChain (VET), Harmony (ONE), VeThor Token (VTHO), Dogecoin (DOGE), and Matic Network (MATIC) are a few of the cryptocurrencies that are available on Binance U.S. Furthermore, Binance accepts well-known cryptocurrencies like:

Dash (DASH)

Cosmos (ATOM)

Compound (COMP)

Bitcoin (BTC)

Ethereum (ETH)

Litecoin (LTC)

Cardano (ADA)

For more information>>

#CryptoExchange#Binance#Cryptocurrency#Blockchain#CryptoTrading#CryptocurrencyExchange#Bitcoin#Finance#CryptoNews

4 notes

·

View notes

Text

U.S. Internet of Things (IoT) Market Size to Hit USD 118.24 Bn by 2030

The U.S. Internet of Things (IoT) market share remains one of the most mature and dynamic ecosystems globally. Valued at USD 98.09 billion in 2022, the market is projected to grow from USD 118.24 billion in 2023 to USD 553.92 billion by 2030, registering a compound annual growth rate (CAGR) of 24.7% during the forecast period. The U.S. Internet of Things (IoT) market refers to the ecosystem of interconnected physical devices, sensors, software, and network infrastructure that enables the collection, exchange, and analysis of data across a wide range of industries. These devices are embedded with computing technology that allows them to monitor environments, automate processes, and communicate with other systems and users in real-time.

Key Market Highlights: • Market Size (2022): USD 98.09 billion • Projected Size (2030): USD 553.92 billion • CAGR (2023–2030): 24.7% • Growth Drivers: Technological maturity, innovation leadership, and extensive IoT adoption across industries.

Leading U.S. Companies in the IoT Space: • Cisco Systems, Inc. • Amazon Web Services (AWS) • Microsoft Corporation • Intel Corporation • Qualcomm Technologies, Inc. • Hewlett Packard Enterprise (HPE) • IBM Corporation • Google LLC • Oracle Corporation • PTC Inc.

Request For Sample PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/u-s-internet-of-things-iot-market-107392

Market Dynamics:

Strategic Market Drivers: • Expansion of smart city infrastructure supported by federal and state governments. • Increasing deployment of industrial IoT (IIoT) for manufacturing automation and predictive maintenance. • Growth in consumer IoT, including connected homes, wearables, and personal health tracking devices. • Advancements in 5G, AI, and edge computing fueling real-time, decentralized data processing.

Major Opportunities: • Healthcare IoT for remote patient monitoring, smart diagnostics, and hospital asset management. • Smart grid and energy optimization systems led by clean energy policies. • Transportation and mobility solutions such as connected vehicles and V2X communication. • Federal funding for infrastructure modernization and cybersecurity in IoT environments.

Market Applications: • Smart manufacturing • Connected healthcare and telemedicine • Smart homes and consumer IoT • Fleet and supply chain management • Environmental and agricultural monitoring • Retail automation and customer behavior tracking

Deployment Models & Connectivity: • Deployment Types: Cloud-based, on-premises, hybrid, and edge-enabled solutions • Connectivity: 5G, Wi-Fi 6, LPWAN (LoRa, NB-IoT), Bluetooth, Zigbee, and satellite IoT

Key Market Trends: • Surging interest in cybersecure IoT ecosystems and zero-trust architecture. • Integration of artificial intelligence (AI) with IoT for autonomous decision-making. • Proliferation of IoT-as-a-Service (IoTaaS) and managed IoT platforms. • Increased focus on sustainability and green IoT solutions for emissions tracking and resource efficiency.

Speak to Analyst: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/u-s-internet-of-things-iot-market-107392

Recent Industry Developments: May 2023 – Amazon Web Services (AWS) expanded its IoT TwinMaker platform, enabling faster digital twin deployment for industrial and logistics enterprises across the U.S.

August 2023 – Cisco launched its U.S.-focused IoT Operations Dashboard for real-time device tracking, configuration management, and anomaly detection at enterprise scale.

About Us: Fortune Business Insights delivers powerful data-driven insights to help businesses navigate disruption and capitalize on emerging trends. We specialize in delivering sector-specific intelligence, customized research, and strategic consulting across a wide range of industries. Our team empowers organizations with clarity, foresight, and a competitive edge in a fast-moving technological landscape.

Contact Us: US: +1 833 909 2966 UK: +44 808 502 0280 APAC: +91 744 740 1245 Email: [email protected]

#U.S. Internet of Things Market Share#U.S. Internet of Things Market Size#U.S. Internet of Things Market Industry#U.S. Internet of Things Market Driver#U.S. Internet of Things Market Growth#U.S. Internet of Things Market Analysis#U.S. Internet of Things Market Trends

0 notes

Text

Top 5 Custom Software Development Companies in the USA

In an era where off-the-shelf software often falls short, businesses are increasingly turning to custom-built solutions that align with their specific goals, workflows, and challenges. Whether it's about enhancing operational efficiency, delivering intuitive user experiences, or ensuring scalability, custom software development in the USA is the backbone of digital success.

With a vast number of service providers across the United States, choosing the right development partner can be overwhelming. To simplify your search, we’ve curated a list of the Top 5 Custom Software Development Companies in the USA—firms known for delivering robust, forward-thinking solutions that drive measurable results.

Transform Your Business with Tailored Software—Book Your Free Strategy Session with The HubOps Now!

Top 5 Custom Software Development Companies in the USA

Here’s a look at the top firms leading the way in custom software development:

The HubOps Key Strength: End-to-end scalable software built for your industry

Intellectsoft Key Strength: Enterprise-grade digital transformation

BairesDev Key Strength: Agile development with nearshore expertise

Toptal Key Strength: Access to elite freelance developers

Iflexion Key Strength: Two decades of custom software excellence

1. The HubOps

Tagline: Empowering Innovation Through Tailored Software

Overview: The HubOps is setting new standards in the U.S. software development landscape. Known for its strategic thinking, user-centric design, and future-ready technologies, The HubOps delivers high-impact software solutions tailored to unique business needs.

Core Services:

Artificial Intelligence (AI): Enabling data-driven automation and intelligent business decisions.

Machine Learning (ML): Facilitating smart, adaptive systems that improve over time.

Blockchain: Enhancing security and transparency through decentralized architectures.

AR/VR Development: Building immersive solutions for education, training, and entertainment.

SaaS Solutions: Scalable cloud-based applications for seamless user access.

Mobile App Development: Custom apps for iOS and Android with intuitive interfaces.

API Integration: Smooth data exchange and interoperability between systems.

Why Choose The HubOps?

Agile methodologies with iterative progress

Transparent pricing and flexible engagement

Sector expertise in fintech, retail, logistics, and healthcare

Proven global client success stories

Ongoing maintenance and performance optimization

Looking for an innovative and dependable partner? The HubOps checks all the boxes.

2. Intellectsoft

Overview: Intellectsoft has carved a niche by helping large enterprises transition to digital-first operations. Their team excels in delivering secure, scalable, and innovative software for complex enterprise environments.

Key Capabilities:

Custom enterprise-grade solutions

Advanced blockchain and IoT integrations

AR/VR technology implementation

Cloud migration and IT consulting

Specialized industry services in healthcare and construction

3. BairesDev

Overview: BairesDev leverages its nearshore model to offer high-quality software development with U.S.-aligned time zones. This allows for real-time collaboration and faster delivery without compromising on quality.

Core Offerings:

Agile and scalable software development

UX/UI design and comprehensive QA

Cloud-native architecture and AI implementation

Staff augmentation to quickly scale projects

4. Toptal

Overview: Toptal connects businesses with a global network of elite freelance developers and designers. Their flexible model is ideal for startups and companies needing short-term, high-caliber expertise.

Highlights:

On-demand access to the top 3% global tech talent

UI/UX, AI, and full-stack development support

Product managers and engineers are available for the project

Rapid team deployment and scalability

5. Iflexion

Overview: With over two decades in the industry, Iflexion combines technical depth with business insight. Their solutions are stable, secure, and tailored for enterprise-scale operations.

Main Services:

End-to-end software development lifecycle

Business intelligence and analytics platforms

eCommerce and customer portal solutions

CRM/ERP integrations

Mobile and web development at scale

Why Custom Software?

Custom software goes beyond the limitations of generic tools. It’s designed specifically for your organization’s goals, giving you:

Better performance and scalability

Seamless integration with existing workflows

A competitive edge in your market

Long-term cost savings through reduced inefficiencies

Final Verdict

All five companies listed here are recognized for excellence, innovation, and reliability. However, the HubOps emerges as the most versatile and client-centric partner, offering a powerful blend of agile delivery, personalized service, and cutting-edge technology.

If you're seeking a partner to help future-proof your business with custom digital solutions, The HubOps should be at the top of your list.

Get a Free Consultation with The HubOps Today. Let them help you craft software that grows with your business and delivers measurable results.

Frequently Asked Questions

Q1. Why choose custom software over off-the-shelf products? Custom software is tailored to your needs, offering better functionality, performance, and competitive differentiation.

Q2. What’s the typical cost of a custom software project in the USA? Costs vary, typically ranging from $20,000 to $250,000+ depending on project size, scope, and technology stack.

Q3. How long does custom software development take? Timelines usually fall between 3 to 9 months. Agile practices allow phased launches and faster results.

Q4. What sets The HubOps apart from other software firms? Client-first strategies, advanced tech stack, industry-specific expertise, and an agile approach make The HubOps a top-tier choice.

Q5. Which industries benefit the most from custom development? Sectors like healthcare, finance, logistics, education, retail, and manufacturing gain tremendous value from tailored solutions.

0 notes

Text

Top Decentralized Crypto Exchange Providers to Consider in 2025

As the world of cryptocurrency continues to evolve, decentralized exchanges (DEXs) are becoming increasingly popular. These platforms provide users with enhanced security, anonymity, and full asset control. For businesses and entrepreneurs looking to enter the market, partnering with a top-tier crypto exchange development company is essential to build a secure, scalable, and feature-rich platform. Let’s explore the leading decentralized crypto exchange providers to consider in 2025 and what makes them stand out.

Why Choose a Decentralized Exchange Platform?

Decentralized crypto exchanges offer significant advantages over centralized exchanges, including:

Enhanced Security: No central point of failure reduces the risk of hacking.

User Autonomy: Users maintain control of their private keys and assets.

Global Accessibility: Trade digital assets without geographical restrictions.

Transparency: Transactions are recorded on a public blockchain for full visibility.

Lower Fees: Reduced transaction costs by eliminating intermediaries.

Partnering with the right decentralized exchange development company can ensure your platform leverages these benefits while delivering a seamless user experience.

Key Features of a Robust DEX Platform

When considering a crypto exchange platform development company, look for providers that offer:

High Liquidity Solutions: Automated market makers (AMMs) and liquidity pools.

Smart Contract Integration: Secure, self-executing contracts for trustless transactions.

Multi-Currency Support: Compatibility with multiple blockchains and tokens.

User-Friendly Interface: Simplified design for traders of all experience levels.

Cross-Chain Trading: Interoperability for trading assets across different blockchains.

Governance Mechanisms: Allowing token holders to participate in decision-making processes.

These features ensure your decentralized exchange software is competitive and ready for market demand.

Top Decentralized Crypto Exchange Providers in 2025

Justtry Technologies

Renowned as a top crypto exchange development company, Justtry Technologies specializes in end-to-end decentralized exchange development services. They provide tailored solutions, including smart contract audits, liquidity management, and wallet integration. Their expertise in decentralized exchange software ensures high performance and scalability.

Blockchain Innovators

A leading decentralized exchange development company known for their expertise in DeFi solutions. They offer customizable platforms with advanced trading tools, staking features, and comprehensive security protocols.

CryptoForge Solutions

Expert crypto exchange developers in India, CryptoForge Solutions delivers high-performance DEX platforms with robust security protocols, lightning-fast transactions, and seamless multi-chain compatibility.

DEX Builders

This dex exchange development company focuses on building highly scalable platforms with features like perpetual swaps, multi-chain support, and governance tokens. They also offer extensive post-launch support and feature enhancements.

ChainCode Labs

A crypto exchange platform development company that excels in building decentralized exchanges with seamless user onboarding, advanced analytics, and real-time order books. They specialize in creating decentralized crypto exchange platforms tailored to niche markets.

Example of a Successful DEX

One standout example is Uniswap, a decentralized crypto exchange platform that revolutionized the DeFi space. By utilizing AMMs and allowing users to provide liquidity, Uniswap set a benchmark for DEX functionality and simplicity. Aspiring exchanges can draw inspiration from Uniswap’s model while incorporating unique features, such as cross-chain trading or governance tokens, to stand out in the market.

How to Choose the Right Development Partner

Selecting the best cryptocurrency exchange development service involves assessing factors like:

Experience & Expertise: Proven track record in decentralized exchange development.

Customization Capabilities: Ability to tailor features to your project’s needs.

Security Protocols: Implementation of multi-layer security measures, including cold storage and multi-signature wallets.

Regulatory Compliance: Knowledge of global regulations to ensure legal compliance.

Post-Launch Support: Ongoing maintenance, feature upgrades, and bug fixes to keep your platform competitive.

Final Thoughts

The demand for decentralized exchange platforms is only set to grow in 2025. You can launch a secure, innovative, and user-friendly platform that meets market expectations by partnering with a reliable decentralized exchange development company. Whether you’re looking for crypto exchange platform development, decentralized exchange software, or comprehensive decentralized exchange development services, the providers listed above are well-equipped to bring your vision to life.

Are you ready to build the next big DEX? Start by choosing a development partner that aligns with your goals, understands the evolving crypto landscape, and can deliver a future-proof solution!

#Decentralized Crypto Exchange Platform#Decentralized exchange software#dex exchange development company#Decentralized Exchange Development Service#decentralized crypto exchange development#crypto exchange platform development#Cryptocurrency exchange development service#crypto exchange platform development company#crypto exchange development company

0 notes

Text

How Crypto Exchange Development Services Are Transforming Digital Trading

In the ever-evolving digital economy, cryptocurrency trading has emerged as a revolutionary force, redefining the way assets are exchanged, stored, and valued. Central to this transformation is the rise of crypto exchange development services — specialized solutions designed to build secure, scalable, and feature-rich trading platforms. These services have not only enabled the growth of thousands of new exchanges worldwide but have also significantly enhanced the security, efficiency, and accessibility of digital trading.

This blog explores how crypto exchange development services are transforming the digital trading landscape and what it means for entrepreneurs, investors, and the global financial ecosystem.

The Foundation: What Are Crypto Exchange Development Services?

Crypto exchange development services refer to the end-to-end process of building digital platforms that facilitate the trading of cryptocurrencies like Bitcoin, Ethereum, and other tokens. These services typically include:

Custom exchange platform development (CEX/DEX/hybrid)

Integration of crypto wallets and payment gateways

Smart contract development and auditing

Liquidity management and order book systems

Security infrastructure (2FA, KYC, AML, encryption)

Admin dashboards and user interface design

Ongoing maintenance and upgrades

With these services, entrepreneurs and businesses can launch exchanges tailored to their target markets and business models without starting from scratch.

Enabling Decentralization and Financial Inclusion

One of the most profound impacts of crypto exchange development services is the democratization of financial access. In traditional finance, intermediaries like banks, brokers, and clearinghouses control access to markets. Crypto exchanges — especially decentralized ones (DEXs) — remove these middlemen, giving users direct control over their assets.

This decentralized architecture allows:

Unbanked populations to engage in digital finance using only internet-connected devices.

Lower fees and faster transactions by eliminating institutional overhead.

Peer-to-peer (P2P) trading models that foster trustless exchanges.

In this way, crypto exchange development is not just a technological advancement but a movement toward global financial inclusivity.

Customization and Innovation at Scale

Today’s trading environment demands tailored experiences. From institutional investors to casual traders, users seek platforms that meet their specific needs — whether it's low latency, mobile-first trading, NFT integrations, or staking features.

Crypto exchange developers respond to this need by offering highly customizable platforms. This includes:

White-label crypto exchange software for faster deployment

Cross-platform compatibility (web, Android, iOS)

Multi-currency and multi-language support

Advanced trading tools like AI-powered bots, charting libraries, and real-time analytics

DeFi integrations such as yield farming, lending, and liquidity pools

This scalability and adaptability are accelerating the spread of digital trading across industries and geographies.

Security as a Cornerstone

Security concerns have long plagued the crypto space. Hacks, scams, and data breaches have cost billions in losses. As a result, security has become a core component of modern crypto exchange development services.

Top-tier developers implement a multi-layered security strategy, including:

End-to-end encryption

Multi-signature wallets

Cold wallet storage for user funds

KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance tools

DDoS protection and regular penetration testing

Smart contract auditing to eliminate vulnerabilities

By embedding robust security from the start, developers foster trust and regulatory compliance — both essential for mainstream adoption.

Driving Liquidity and Market Depth

A thriving exchange needs liquidity — the ability to buy or sell assets without causing major price swings. Without liquidity, even the most well-designed platform can falter.

Crypto exchange development services often incorporate liquidity aggregation tools and market-making bots that automatically balance order books and attract volume. Some developers offer partnerships or integrations with global liquidity providers to help new exchanges hit the ground running.

Increased liquidity leads to:

Tighter spreads and more accurate pricing

Higher user retention and trading volume

Improved scalability and profitability for platform owners

Thus, liquidity management is not just a technical issue — it’s a critical success factor.

Regulatory Alignment and Compliance Support

As governments and financial authorities increase scrutiny on crypto operations, compliance has become non-negotiable. Crypto exchange development services now embed tools and workflows to help businesses stay ahead of regulatory requirements.

This includes:

Automated KYC/AML integrations

Geo-restriction systems for regulatory segmentation

Tax reporting and transaction auditing modules

Support for GDPR and data privacy protocols

By building compliance into the DNA of the exchange, developers help reduce legal risks and make exchanges more attractive to institutional players and regulators alike.

Speeding Up Time-to-Market

In the fast-moving world of crypto, time is money. A project that takes 12 months to launch may miss the market window entirely. To address this, many developers offer white-label crypto exchange solutions — pre-built platforms that can be customized, branded, and launched in a fraction of the time.

Benefits of white-label solutions include:

Faster deployment (as little as a few weeks)

Reduced development costs

Battle-tested performance and security

Ongoing technical support and upgrades

This has dramatically lowered the barrier to entry for startups, allowing more players to enter and compete in the digital trading arena.

Paving the Way for the Future of Finance

As blockchain and Web3 evolve, crypto exchange development services are integrating new trends and technologies:

AI and machine learning for predictive analytics and automated trading

Tokenization of real-world assets (stocks, real estate, art)

NFT trading platforms and marketplaces

Cross-chain bridges for asset interoperability

Modular architectures for DAO-based governance

These advancements are helping shape the next generation of financial infrastructure — open, programmable, and community-driven.

Final Thoughts

Crypto exchange development services are not merely about building trading platforms — they are about redefining how the world interacts with value. From empowering the unbanked to enabling new business models and promoting financial sovereignty, these services are at the heart of the blockchain revolution.

As crypto adoption continues to grow, the demand for sophisticated, secure, and scalable exchange platforms will only increase. Businesses and entrepreneurs looking to stake their claim in the digital economy would do well to understand the transformative potential of these services — and partner with the right development team to bring their vision to life.

In a digital age where control, access, and innovation matter more than ever, crypto exchange development services are building the bridges to the future of trading.

1 note

·

View note

Text

What Is a DApp and Why Is It Central to Blockchain Development Services UAE?

In just a few years, the United Arab Emirates shot to the top of the global blockchain chart. A mix of clear laws, an ambitious national agenda, and an insatiable appetite for fresh ideas keeps money streaming into decentralized tech.

At the heart of this movement sits one shining star: the Decentralized Application, usually called DApp.

So, what exactly is a DApp, and why has it become essential for almost every blockchain project in the UAE?

Let's take a closer look and see why DApps are more than just a buzzword; they are fast becoming a cornerstone of the UAEs digital makeover.

A DApp is an application hosted directly on a public blockchain instead of locked on a corporate server. Unlike Instagram, Netflix, or any other service that relies on one company for control, DApp stands alone because tiny self-running programs called smart contracts take over as soon as agreed rules are met.

- Decentralization: Data and processing are spread across the whole chain, so nothing lives in a single central folder.

- Smart Contracts: Guidelines are coded in a way that's set in stone, so they can’t be adjusted on a bad day or swapped out after a last-minute brainstorming session.

- Token Economy: Most DApps create their own tokens, letting users pay fees, vote on changes, and earn rewards whenever they join.

- Open Source: Most of these decentralized apps keep their code public, so anyone can scan it for bugs, suggest fixes, or even clone the project.

By cutting out middlemen, DApps offer a clear, secure, and censorship-proof way to run software, and that promise is pushing their rapid rise across the UAE.

Why Are DApps Key for Blockchain Development in the UAE?

1. Keeping Step with the UAE's Blockchain-First Vision

Under the Dubai Blockchain Strategy and the Emirates Blockchain Strategy 2021, the federal government is steadily swapping public services and business tasks for blockchain-backed solutions.

A big piece of this plan calls for DApps in:

Identity verification

Supply chain transparency

Property and land registration

Healthcare data management

Digital payments and wallets

Plugging DApps into so many government and market workflows is sparking demand for local dev teams that can build to national standards and meet fast-moving business goals.

2. Security and Transparency for High-Stakes Industries

The UAE hosts finance, real-estate, energy, and logistics-businesses that depend on trust and clean data. Ordinary apps can be hacked, altered, or frozen at peak hours. DApps, however, run on locked blockchains and public ledgers, so users see proof they can't dispute. When coders build well, a DApp can promise:

full traceability on every shipment

records no one can tamper with

voting totals sealed the moment they are cast

lending circles that function without banks

Because of these wins, UAE blockchain teams now chase industry-specific, bullet-proof DApps.

3. Tokenization and Fresh Business Models

Most DApps offer tokens that turn everyday exchanges into something richer. Whether loyalty coins, shared ownership, or DeFi tools, tokens open the door to:

reward apps that keep shoppers coming back

platforms that let anyone buy a small piece of real estate

governance where holders vote on new rules

bonuses for choosing clean power

These token-powered projects are booming in the UAE, riding the Gulf fin-tech surge.

DApps lie at the core of Web3, allowing people to trade, chat, and save data without a middleman. While the region pilots Metaverse ideas-from Dubai's Metaverse Assembly to various digital twins-these apps drive:

virtual land shops

shared identities and avatars

NFT tickets for events

social hubs beyond big tech

Forward-looking UAE companies now partner with blockchain teams to ready themselves for this next-gen online world.

Across the Emirates, decentralized apps (DApps) are already making a real splash. Here's a look at the action:

- Real Estate Tokenization

Developers use DApps to break expensive buildings into tokenized shares. Each token stands for a small piece of the property, letting everyday investors chip in. The system runs KYC steps on its own and keeps a clear, tamper-proof ledger, so everyone knows who owns what. The result is faster sales and many more people able to join the real-estate market.

- Decentralized Voting Platforms

Public elections and private board votes now run on smart-rule apps that save each ballot on an open ledger. Because anyone can check the code, people trust the result, and outside tampering gets very hard.

- Health Data DApps

Some hospitals are piloting chain apps that let patients and doctors own their medical files. Records move easily between clinics but stay private, matching the UAEs push for modern, safe health tech.

- Blockchain-Based Logistics Merchants track boxes, review invoices, and verify documents in real time with shipping apps. Clear sight at every port powers the UAEs huge trade business and keeps goods moving fast and fair.

4. Why Businesses in the UAE Are Turning to Custom DApp Development

The United Arab Emirates welcomes new tech regulations, its people live online, and the government pushes fresh ideas. Ready-made apps still tempt firms, yet they never line up perfectly with local ways of working. Because of that gap, building a custom decentralized app (DApp) has become the go-to move for:

An architecture that can grow with one industry.

Full compliance with UAE data and crypto laws.

Smooth links to local banks and payment gateways.

Interfaces that speak Arabic, English, and more.

A single easy experience for Web2 visitors and Web3 wallets.

Pick the right team, and your DApp will meet today's goals and quickly adjust to tomorrow's UAE tech scene.

5. How to Begin Your Blockchain Project in the UAE

Thinking about your first DApp? Follow this clear, step-by-step plan:

Define the Use Case. Decide exactly what problem you want to fix and check if decentralization adds real value.

Choose the Blockchain Platform Ethereum, Polygon, BNB Smart Chain, or another ledger each brings its own strengths and costs.

Hire Expert Developers Work with a studio skilled in smart contracts, friendly UX/UI, and the protocols you choose.

Prototype and Test Build a quick model, watch people use it, and tweak it based on what they say.

Do this, and you can roll out a DApp that works, feels safe, and fits local rules.

Deploy and Scale After launch, listen, adjust the code fast, and let speed and users grow.

A reliable dev partner guides you, keeping your DApp secure, legal, and noticed.-

Partner with the Right Blockchain Firm in the UAE

As banks, hotels, and other sectors rush to release DApps, skilled builders are in high demand. WDCS Technology is here.

At WDCS Technology we design blockchain tools in the UAE, delivering custom DApps that lock down security, stretch with traffic, and respond the moment users click launch.

Our services include:

Full-cycle DApp development

Smart contract design and audit

Token creation and integration

UI/UX for Web3 platforms

Private and public blockchain solutions

From a smooth NFT store to DeFi plumbing or an in-house app, our local insight and solid tech skills help you succeed in the UAE.

#blockchain development services#blockchain services#blockchaintechnology#blockchian#hire blockchain development in uae#blockchain development#technology

0 notes

Text

Decentralized Finance Development Services

Defi is a decentralized finance platform that allows users to lend, borrow, and trade cryptocurrency without the need for a third-party intermediary. Mobiloitte offers Defi development services that can help you create a custom Defi platform that meets your specific needs and requirements. With our expert team of developers, we can help you launch a Defi platform that is secure, scalable, and easy to use.

#goose defi#DeFi Lending & Borrowing Software#Defi Lending and Borrowing Platform Development Company#defi lending and borrowing platform development#amm defi platform#amm defi#DeFi Lending & Borrowing Platform#defi exchange development#Automated market maker defi#Decentralized Finance on Binance Smart Chain#defi staking platform development#defi token development company#defi token development#defi development#what is defi crowdfunding#defi development services#defi wallet development solutions#DeFi Crowdfunding Platform#DeFi Crowdfunding Platform Development#benefits of defi crowdfunding#defi development company#defi software#defi consulting#decentralized financial assistance#types of crowdfunding

0 notes

Text

What Innovations Are Shaping the Future of Fintech Platforms?

The fintech industry is transforming at an unprecedented pace, fueled by advancements in technology and evolving customer expectations. From mobile wallets to blockchain-based lending, innovations in fintech software development are not only improving financial accessibility but also redefining how consumers and businesses interact with financial systems. As the demand for seamless, secure, and efficient fintech services grows, several key innovations are emerging as game-changers in the development of future-ready fintech platforms.

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are at the forefront of modern fintech innovation. These technologies are being integrated into fintech platforms to enhance personalization, detect fraud, automate financial advice, and improve decision-making. For instance, robo-advisors powered by AI analyze user behavior and risk appetite to offer tailored investment strategies. ML algorithms are also vital in credit scoring, where they assess a borrower’s creditworthiness beyond traditional credit scores by analyzing alternative data sources. In the realm of fintech software development, incorporating AI not only improves user engagement but also enhances operational efficiency.

2. Blockchain and Decentralized Finance (DeFi)

Blockchain technology has revolutionized the way data is stored, verified, and exchanged in financial transactions. By ensuring transparency, immutability, and decentralization, blockchain enables secure peer-to-peer transactions without intermediaries. Decentralized Finance (DeFi) platforms leverage smart contracts to provide services like lending, borrowing, and trading in a trustless environment. These innovations are reshaping traditional banking models and pushing fintech platforms towards more open and inclusive systems. For developers, blockchain introduces new paradigms in fintech software development, including tokenization, digital identity verification, and decentralized exchanges.

3. Open Banking and API Integrations

Open banking is redefining how banks and third-party providers collaborate. Through secure API integrations, fintech platforms can access user data (with consent) from multiple banks to offer consolidated services such as budgeting, credit comparisons, or personalized offers. This approach promotes competition and innovation in the financial sector. API-driven architecture is now a cornerstone of fintech services, allowing seamless interoperability between different financial institutions and service providers. It also supports faster onboarding, real-time transactions, and integration with external platforms like e-commerce or insurance.

4. Cloud Computing and SaaS Models

Cloud technology has become essential in fintech software development for its scalability, cost-efficiency, and flexibility. Fintech startups and enterprises alike are leveraging cloud-based platforms to deploy and manage applications in real time. The Software-as-a-Service (SaaS) model allows companies to deliver financial solutions on a subscription basis, enabling quicker time-to-market and lower infrastructure costs. Cloud-native fintech platforms benefit from better disaster recovery, real-time analytics, and easier maintenance. This trend is driving digital transformation across the fintech landscape.

5. Biometric Authentication and Enhanced Cybersecurity

With increasing digital transactions, security remains a top concern. Innovations in biometric authentication—such as fingerprint scanning, facial recognition, and voice identification—are improving the safety and user experience of fintech platforms. In parallel, cybersecurity technologies such as behavioral biometrics, end-to-end encryption, and secure coding practices are being embedded into fintech software development to prevent fraud and data breaches. Strong security frameworks help build user trust, which is essential for the growth of any fintech solution.

6. Embedded Finance

Embedded finance is an emerging innovation that integrates financial services directly into non-financial platforms. For example, e-commerce websites offering buy-now-pay-later (BNPL) services or ride-sharing apps providing micro-insurance. By embedding fintech services within daily-use applications, companies can deliver seamless financial experiences without requiring users to visit traditional banks or separate platforms. This trend is expected to drive significant growth in fintech adoption, particularly in sectors like retail, logistics, and healthcare.

7. Real-Time Payments and Digital Currencies

Real-time payment systems are transforming the speed and efficiency of financial transactions. Whether it’s peer-to-peer transfers or instant settlements for businesses, real-time payments improve cash flow and user satisfaction. In addition, the rise of Central Bank Digital Currencies (CBDCs) and stablecoins is setting the stage for new monetary ecosystems. These digital currencies can be integrated into fintech platforms to provide faster, more secure, and low-cost cross-border transactions. For developers, supporting multiple currencies and payment channels is becoming a crucial aspect of fintech software development.

8. Data Analytics and Predictive Insights

The use of big data and predictive analytics enables fintech platforms to offer smarter, data-driven services. From risk assessment to customer behavior analysis, analytics tools are guiding strategic decisions and personalizing user journeys. Fintech firms that harness data effectively can optimize marketing campaigns, reduce operational costs, and uncover new revenue streams. Predictive analytics is particularly useful in fraud detection, financial planning, and dynamic pricing of financial products.

Conclusion

The future of fintech platforms is being shaped by a confluence of groundbreaking technologies and consumer-centric innovations. From AI-powered personalization to blockchain-based security, these advancements are laying the foundation for more inclusive, efficient, and transparent financial systems. As the industry evolves, embracing these innovations becomes crucial for maintaining a competitive edge.