#deflationary asset

Text

For the past 25 years, Japan’s central bank and government have found common cause in trying to end deflationary pressures that have been seen as a drag on economic growth. Now that they are succeeding, the verdict is in: People don’t like it.

Under standard economic theory, high levels of deficit spending coupled with ultra-low interest rates should almost inevitably lead to higher rates of inflation—usually a problematic outcome for most economies. But Japan has become the poster child for the risks of the opposite problem, persistent price and wage deflation.

Former U.S. Federal Reserve Chairman Ben Bernanke was a strong advocate of action by the Bank of Japan (BOJ). “Addressing the deflation problem would bring substantial real and psychological benefits to the Japanese economy, and ending deflation would make solving the other problems that Japan faces only that much easier,” he said in an address to the Japan Society of Monetary Economics in May 2003, when he was still just a member of the Fed board. At stake, he said, was not just the economic health of Japan “but also, to a significant degree, the prosperity of the rest of the world.” His worries of a similar deflationary trap in the United States were one of the reasons he would later propose as Fed chairman the massive quantitative easing, or QE, program following the 2007-08 global financial crisis.

To achieve this, the BOJ first tried ultra-low interest rates and, when that failed, zero interest rates and finally negative interest rates. In addition, there were various programs to encourage lending, including special funding to banks that lend to smaller companies with growth potential and to banks that increased their lending by a certain amount. The lending initiatives ran into two primary obstacles: Japanese banks only want to lend money to companies that don’t need it (big companies in Japan sit on massive cash holdings), and with such low rates, the cost of initiating and servicing the loans outweighed the profits in terms of interest payments.

The ultimate plan to defeat all this came from the affable Haruhiko Kuroda, appointed in 2013 by newly elected Prime Minister Shinzo Abe as the head of the BOJ. Kuroda, a former Finance Ministry official who was therefore an outsider within the central bank, threw caution to the wind. He would, he promised, create 2 percent inflation in two years by doubling the BOJ’s balance sheet.

Moving beyond the Fed’s QE, Japan would have QQE, adding in the idea of qualitative to quantitative easing, meaning that the bank would not buy just government bonds but also riskier assets. The result was indeed a massive expansion in the balance sheet, in effect monetizing the government’s steady diet of fiscal overspending equal to around 30 percent of the total budget each year. Even though the balance sheet more than quadrupled over Kuroda’s 10-year term, the idea of a “virtuous cycle” of higher wages driving higher prices remained elusive for almost all of his tenure, with the consumer price index stuck around zero.

This was to change but not because of any central bank policy. Instead, it was due mainly to the world’s recent No. 1 game-changer: COVID-19. With higher import costs and supply chain disruptions, higher prices, albeit at a modest level by global standards, became visible in virtually every sector of the economy. By January 2023, the consumer price index jumped to 4 percent, the highest level since 1981 and well over the 2 percent target set by the BOJ. Within this, hotel prices have surged, rising 63 percent as foreign tourists again pack central Tokyo and Kyoto. For Japanese shoppers, much of the impact has been in the form of “shrinkflation” as food producers try to hide the higher costs. A bag of coffee in central Tokyo can still be found for around $4—it’s just that the same package now holds 40 percent less coffee. No wonder major food packaging companies saw their earnings jump 33 percent last year.

As a result, stagnant wages finally have started to show signs of movement as a shrinking workforce, good economic growth, and skills shortages have bid up salaries. Wages in October 2023 were up 1.5 percent year-on-year, and union workers logged average increases of 3.6 percent in their spring round of labor negotiations.

So why isn’t everyone happy? The reality is that the two growth lines have resulted in a steady decline in real wages adjusted for inflation. According to government figures, real wages fell for 20 consecutive months up to November 2023, registering a 3 percent decline year-on-year.

“People are not stupid,” said Jesper Koll, a global ambassador for the Monex Group and one of Japan’s best-known economists. “The 30 years of deflation have come to an end, but are the Japanese people getting the kind of inflation they want?”

Indeed, while deflation has had policymakers gnashing their teeth as Japan became relatively poorer (some tech jobs pay better in Vietnam than in Japan today), it was good for salaried workers who saw their pay rise modestly while prices would fall around 1 percent annually. The new scenario is more complex. As workers in any inflationary economy can attest, wages almost always rise more slowly than retail prices. One BOJ official in the pre-Kuroda days in 2012 said privately that their surveys showed people preferred deflation even as the central bank was trying to stamp it out.

The sticker shock of rising prices has been an unwanted blow to Prime Minister Fumio Kishida, who is facing a crisis in confidence for no clear reason—except that people don’t seem to like his administration. Kishida and U.S. President Joe Biden could no doubt commiserate on that front.

Last fall, when the government’s approval ratings fell below the “danger zone” of 30 percent—the figure that often heralds a party search for a fresh face as prime minister—Kishida started handing out cash that the government didn’t have, offering subsidies to limit the impact of higher prices in energy and utilities. Even this backfired badly, raising allegations that he was trying to buy his way back to popularity.

“What people are frustrated with is that he increases spending all the time but has no program to pay for it. The Japanese people are rational with their money—they don’t go out on spending sprees,” Koll said.

Kishida, who took office in October 2021, now has support of just above 20 percent by most polls, with two-thirds of respondents saying they disapprove of his administration. This would normally make him ripe for removal by the party elders who effectively control the ruling Liberal Democratic Party (LDP). That has been the model ever since the party was founded in 1955 and helped the LDP to remain in power for all but six years since then.

But Kishida may well survive for a while. The latest in a string of scandals also involves other senior figures in the LDP over potentially illegal fundraising, which has had the effect of shrinking the pool of potential successors. There is also no clear replacement for Kishida who would satisfy both the more liberal and hawkish wings of the party, part of the reason he got the job in the first place.

Another open question is whether Kishida—or a successor—will get to actually see an end to the 25 years of deflationary pressures. The latest inflation figures show a softening in price increases, with core inflation (without fresh food prices) rising just 2.5 percent in November 2023, its lowest in 16 months. That may be good news for consumers, but it has some economists skeptical over whether the economy has really turned the corner toward self-sustaining wage-price increases or if the new figures point to a consumer slowdown that would lead to a downturn. The focus will be on this spring’s union wage negotiations, where both the workers and the government are hopeful that increases will finally put workers ahead of inflation, at least for now. The companies that would have to pay for this have shown less enthusiasm.

But some economists remain skeptical. “I would venture that the wage hike to come during next spring’s negotiations won’t quite reach the level expected,” Takahide Kiuchi, an economist at the Nomura Research Institute and a former BOJ board member, wrote in a November report. He said this may prompt the BOJ to hold off on any changes to its negative rates. Japan remains the only country to maintain ultra-low rates as other advanced economies have switched to tighter money policies as inflation surged.

At the same time, Kiuchi noted, delaying for too long means the bank’s balance sheet will continue to grow as it buys bonds to keep yields at zero or below. This will increase the risks to its own financial position if interest rates rise in the future, since the massive holdings would plummet in value. With the balance sheet now larger than Japan’s annual GDP, the implications could be severe, a polite way of saying that it would face insolvency. If that happened, the government would be forced to bail it out. But the government is already using the BOJ to pay for its own financial excesses.

It’s all enough to leave the average Japanese yearning for the good old days of deflation.

17 notes

·

View notes

Text

Bitcoin’s Dwindling Supply: The Halving Mechanism and Its Impact on Scarcity

Bitcoin is more than just a digital currency—it’s a groundbreaking financial system built around a unique feature: its limited supply. Unlike fiat currencies that can be printed endlessly, Bitcoin’s supply is capped at 21 million BTC. This scarcity is driven by Bitcoin's halving mechanism, a process that cuts the block rewards for miners in half approximately every four years. With each halving, the supply of new Bitcoin entering circulation decreases, creating a dynamic of growing demand and shrinking supply.

What is the Halving Mechanism?

The halving mechanism is embedded in Bitcoin's code and is designed to happen after every 210,000 blocks are mined, roughly every four years. This mechanism ensures that over time, fewer and fewer Bitcoin are produced, leading to increased scarcity. When Bitcoin was first launched in 2009, the reward for mining a block was 50 BTC. Since then, the block reward has been halved multiple times:

2012: The reward dropped to 25 BTC.

2016: It was halved again to 12.5 BTC.

2020: The reward shrunk to 6.25 BTC.

2024: Following the most recent halving, the block reward now stands at 3.125 BTC.

How the Halving Reduces Daily Bitcoin Supply

The halving mechanism significantly impacts the number of Bitcoin mined each day. In the beginning, with 50 BTC rewarded per block, approximately 7,200 BTC were mined daily. After each halving, this number dropped:

2012: About 3,600 BTC were mined daily.

2020: Roughly 900 BTC were mined per day.

2024: Currently, with a block reward of 3.125 BTC, only 450 BTC are mined daily.

As the block reward continues to shrink, the daily Bitcoin production will become even smaller. By 2036, 99% of all Bitcoin will have been mined, leaving only 1% of Bitcoin to be mined over the following century. This drastic reduction in new supply is one of the most important aspects of Bitcoin’s scarcity and long-term value.

The Economic Impact of Bitcoin’s Scarcity

Bitcoin's design ensures that its supply will only become scarcer over time, making it more valuable. Much like precious commodities such as gold, the limited availability of Bitcoin positions it as a deflationary asset—one whose value increases as supply tightens and demand rises. Each halving intensifies this dynamic, putting upward pressure on Bitcoin's price as fewer coins are available for purchase or use.

With the next halving scheduled for 2028, Bitcoin’s daily production will fall to 225 BTC per day. By the time the final Bitcoin is mined, around the year 2140, the block reward will be reduced to just one satoshi—the smallest unit of Bitcoin, equivalent to 0.00000001 BTC. At this point, miners will no longer receive new Bitcoin as rewards, but they will be compensated with transaction fees to continue securing the network.

The Future of Bitcoin’s Supply: What Happens After 99% is Mined?

By the year 2036, we will have reached a major milestone—99% of all Bitcoin will have been mined. As we approach this point, the effects of Bitcoin's diminishing supply will become increasingly apparent. As supply decreases, demand is expected to grow, especially as more institutional investors and governments begin to adopt Bitcoin as a reserve asset.

After 2036, only 1% of Bitcoin will remain to be mined, with rewards decreasing at an exponential rate after each subsequent halving. As we move closer to the final halving and the ultimate limit of 21 million BTC, Bitcoin’s value as a scarce, deflationary asset will likely continue to grow, making it a critical store of value for individuals, institutions, and possibly even nation-states.

Bitcoin’s Halving and Its Role in Financial Sovereignty

The halving mechanism is more than just a technical feature—it is the foundation of Bitcoin's scarcity, which gives it its revolutionary potential. With fiat currencies facing the constant threat of inflation due to excessive money printing, Bitcoin stands out as a deflationary alternative that cannot be devalued by any central authority. Its predictable supply schedule makes it a safe haven for those seeking financial sovereignty and protection against inflationary pressures.

As Bitcoin’s supply dwindles, its role in the global financial system will only become more prominent. The halving mechanism ensures that Bitcoin remains scarce, creating a unique economic environment where supply and demand dynamics continuously drive its value higher.

Conclusion: The Power of Bitcoin’s Scarcity

Bitcoin’s halving mechanism is a crucial factor in its long-term success as a deflationary, scarce asset. Each halving reduces the number of new Bitcoin introduced into circulation, making the asset more valuable over time. As we move closer to the year 2036, when 99% of all Bitcoin will have been mined, the scarcity narrative will become even more pronounced. With the final reward being just one satoshi, Bitcoin’s hard cap of 21 million BTC guarantees its place as one of the most scarce and valuable financial assets in the world.

In a world of ever-expanding fiat currencies and government-controlled financial systems, Bitcoin offers a new way forward—a scarce, decentralized, and deflationary asset that empowers individuals with true financial sovereignty.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#BitcoinHalving#Crypto#Cryptocurrency#BTC#BitcoinScarcity#DigitalGold#Blockchain#BitcoinEconomics#Hodl#BitcoinSupply#FinancialFreedom#BitcoinMining#Satoshi#BitcoinEducation#SoundMoney#Scarcity#DeflationaryAsset#financial education#globaleconomy#unplugged financial#digitalcurrency#financial experts#financial empowerment#finance

2 notes

·

View notes

Text

Which Memecoins Could Make You a Millionaire This Year?

Introduction

The cryptocurrency market is no stranger to wild fluctuations and incredible stories of overnight wealth. Among the many types of digital assets, memecoins have carved out a unique niche. Born from internet memes and cultural phenomena, these tokens often start as jokes but can transform into serious investments. This year, several memecoins have captured the market’s attention with their potential to generate substantial returns. In this blog, we’ll explore which memecoins could potentially make you a millionaire in 2023 and why they are worth considering.

Understanding Memecoins

What Are Memecoins?

Memecoins are a type of cryptocurrency that typically derives value from their association with internet memes or cultural trends. Unlike traditional cryptocurrencies that often have strong use cases or technological foundations, memecoins thrive on community engagement and viral marketing. Their success is driven largely by social media buzz and the collective enthusiasm of their communities.

Why Invest in Memecoins?

While memecoins are often viewed as high-risk, high-reward investments, they offer unique opportunities. Their low initial cost allows for substantial holdings, and their potential for rapid, viral growth can lead to significant returns. However, it’s crucial to approach these investments with caution and conduct thorough research.

Top Memecoins to Watch in 2023

Dogecoin (DOGE)

The Original Memecoin

Dogecoin started as a joke in 2013, inspired by the popular “Doge” meme featuring a Shiba Inu dog. Despite its humorous origins, Dogecoin has become a staple in the crypto community, known for its active and loyal fan base.

Why Dogecoin?

Celebrity Endorsements: High-profile endorsements from figures like Elon Musk have boosted Dogecoin’s visibility and credibility.

Community Support: Dogecoin has a large and engaged community that drives its adoption and use.

Real-World Use Cases: Increasing acceptance of Dogecoin for transactions and tipping in various platforms adds to its value proposition.

Shiba Inu (SHIB)

The Dogecoin Killer?

Shiba Inu was created as a direct competitor to Dogecoin, often dubbed the “Dogecoin Killer.” It has quickly risen in popularity and amassed a significant following.

Why Shiba Inu?

Tokenomics: Shiba Inu has a large supply and a robust burning mechanism to reduce the number of tokens in circulation, potentially increasing value.

Decentralized Ecosystem: SHIB supports its own decentralized exchange, ShibaSwap, which adds utility to the token.

Community Engagement: Like Dogecoin, Shiba Inu benefits from a passionate and active community.

SafeMoon (SAFEMOON)

The Deflationary Token

SafeMoon introduced a unique tokenomics model designed to encourage holding and discourage selling. It includes a reflection mechanism that redistributes fees to existing holders.

Why SafeMoon?

Tokenomics: SafeMoon’s deflationary model can increase scarcity and potentially drive up value.

Development Roadmap: The SafeMoon team has an ambitious roadmap, including plans for a blockchain, exchange, and wallet.

Community and Marketing: Effective marketing and a strong community presence contribute to SafeMoon’s ongoing popularity.

Samoyedcoin (SAMO)

Solana’s Memecoin

Samoyedcoin is one of the leading memecoins on the Solana blockchain. Inspired by the Samoyed dog breed, this token leverages Solana’s high-speed transactions and low fees.

Why Samoyedcoin?

Fast Transactions: Solana’s high throughput ensures quick and cost-effective transactions.

Growing Ecosystem: As Solana gains traction, memecoins on this blockchain, like SAMO, benefit from increased visibility and adoption.

Active Community: A dedicated community helps drive the token’s growth and engagement.

Dogelon Mars (ELON)

A Space-Themed Meme

Dogelon Mars combines themes of Elon Musk, Dogecoin, and Mars exploration. It has carved out a unique niche within the memecoin landscape.

Why Dogelon Mars?

Unique Branding: The space exploration theme appeals to many within the crypto community.

Charitable Initiatives: Part of the project’s mission includes donating to space exploration research.

Community-Driven: The token has a strong, supportive community that promotes its adoption and use.

Floki Inu (FLOKI)

Inspired by Elon Musk’s Dog

Floki Inu, inspired by Elon Musk’s pet dog Floki, aims to create a DeFi ecosystem combined with NFTs.

Why Floki Inu?

Celebrity Connection: The association with Elon Musk’s dog boosts its appeal.

DeFi and NFT Integration: Plans to integrate DeFi and NFTs add potential utility and value.

Marketing Campaigns: Aggressive marketing strategies have increased awareness and interest.

Strategies for Investing in Memecoins

Do Your Research

Before investing in any memecoin, it’s essential to conduct thorough research. Look into the token’s history, development team, community support, and market performance. Websites, whitepapers, and community forums can provide valuable insights.

Diversify Your Portfolio

Diversification is key to managing risk in any investment portfolio. Spread your investments across multiple memecoins and other types of cryptocurrencies. This strategy can help mitigate potential losses if one investment doesn’t perform well.

Stay Updated

The crypto market is highly dynamic, and staying informed is crucial. Follow news and updates related to your memecoin investments. Social media channels, especially Twitter and Reddit, can provide real-time information and community sentiment.

Be Cautious with Hype

While memecoins thrive on hype, it’s important to approach them with caution. Avoid making investment decisions based solely on social media buzz. Analyze the fundamentals and consider the long-term potential of the token.

Understand the Risks

Memecoins are known for their volatility. Prices can fluctuate dramatically within short periods. Be prepared for significant price swings and invest only what you can afford to lose.

Use Secure Wallets

Ensure your investments are stored in secure wallets. Hardware wallets and reputable software wallets offer the best security features. Avoid keeping large amounts of cryptocurrency on exchanges for extended periods due to security risks.

Have a Clear Exit Strategy

Define your financial goals and establish a clear exit strategy. Determine at what profit levels you will sell part or all of your holdings. Similarly, set stop-loss levels to minimize potential losses.

Engage with the Community

Active participation in the community can provide valuable insights and keep you informed about the latest developments. Join discussions on platforms like Reddit, Discord, and Telegram to stay connected with other investors and the development team.

Monitor Whale Movements

Large holders, or “whales,” can significantly impact the price of memecoins. Monitor transactions of large wallets to anticipate potential price movements. Tools like Whale Alert can help track these activities.

Stay Patient and Disciplined

Patience and discipline are essential for successful investing. Avoid making impulsive decisions based on short-term market movements. Stick to your investment strategy and remain focused on your long-term goals.

And yes...Before investing in memecoins,

Keep create your favorite memecoins tokens in just less than three seconds without any extensive programming knowledge,

Visit : solanalauncher.com

If you need more Guide about this platform, Feel free to ask!!

Our team is ready to assist you!!!

Conclusion

The world of memecoins offers exciting opportunities for investors willing to navigate its high-risk, high-reward landscape. Dogecoin, Shiba Inu, SafeMoon, Samoyedcoin, Dogelon Mars, and Floki Inu are among the top memecoins to watch this year. Each of these tokens has unique features and strong community support that contribute to their potential for significant returns.

By conducting thorough research, diversifying your investments, staying informed, and maintaining a clear strategy, you can increase your chances of achieving financial success with memecoins. Remember, while the potential for high returns is real, so are the risks. Invest wisely, stay engaged with the community, and keep a long-term perspective to navigate the volatile but rewarding world of memecoins.

As the cryptocurrency market continues to evolve, memecoins will undoubtedly play a significant role in shaping its future. Embrace the opportunities, stay informed, and you might find yourself among the next wave of memecoin millionaires. Happy investing!

2 notes

·

View notes

Text

Bitcoin's role in the future of finance

In the ever-evolving landscape of finance, one digital currency has captured the world's attention like no other: Bitcoin. Since its inception in 2009, Bitcoin has transcended from being a mere experimental concept to a transformative force, challenging traditional financial systems and reshaping our perception of money. As we navigate through the complexities of the modern financial world, it's imperative to understand Bitcoin's role in shaping the future of finance.

Bitcoin's Rise to Prominence: Bitcoin's journey from obscurity to prominence has been nothing short of remarkable. Introduced by the pseudonymous Satoshi Nakamoto, Bitcoin was envisioned as a decentralized digital currency, free from the control of central authorities such as banks or governments. Its underlying technology, blockchain, revolutionized the way transactions are recorded and verified, offering transparency, security, and immutability.

Initially met with skepticism and skepticism, Bitcoin gradually gained traction among tech enthusiasts, libertarians, and early adopters seeking an alternative to traditional fiat currencies. As its utility and acceptance grew, Bitcoin's value soared, attracting mainstream attention and investment from institutional players and retail investors alike.

Bitcoin's Role in the Future of Finance: Now, as we stand on the precipice of a new era in finance, Bitcoin's significance cannot be overstated. Here's how Bitcoin is poised to shape the future of finance:

Decentralization and Financial Inclusion: At the heart of Bitcoin lies its decentralized nature, which empowers individuals to take control of their financial destinies. Unlike traditional banking systems, where intermediaries dictate transactions and impose fees, Bitcoin allows for peer-to-peer transactions without the need for intermediaries. This decentralization fosters financial inclusion by providing access to banking services for the unbanked and underbanked populations worldwide.

Hedge Against Inflation and Economic Uncertainty: In an era marked by economic volatility and uncertainty, Bitcoin offers a hedge against inflation and currency devaluation. With a finite supply of 21 million coins, Bitcoin is immune to the whims of central banks and government policies that often erode the value of fiat currencies. As central banks continue to print money to stimulate economies, Bitcoin's scarcity and deflationary nature make it an attractive store of value and a hedge against economic downturns.

Innovation in Financial Services: Bitcoin's underlying technology, blockchain, has paved the way for innovative financial services and applications. From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs) and smart contracts, Bitcoin's ecosystem continues to expand, offering new avenues for investment, lending, and asset management. These innovations have the potential to democratize finance, making it more accessible and inclusive for individuals worldwide.

Global Payments and Remittances: As a borderless digital currency, Bitcoin facilitates fast, low-cost cross-border payments and remittances. Unlike traditional banking systems, which are plagued by high fees and long processing times, Bitcoin enables instant transactions without the need for intermediaries. This has significant implications for global commerce, enabling businesses to streamline payments and expand their reach to new markets.

Institutional Adoption and Mainstream Acceptance: In recent years, we've witnessed a surge in institutional adoption of Bitcoin, with major corporations and financial institutions incorporating Bitcoin into their investment portfolios. This institutional endorsement not only lends credibility to Bitcoin but also paves the way for mainstream acceptance. As more businesses and individuals embrace Bitcoin, its role in the future of finance is poised to become even more pronounced.

Conclusion: In conclusion, Bitcoin's role in the future of finance is multifaceted and profound. From decentralization and financial inclusion to innovation and global payments, Bitcoin has the potential to reshape the way we perceive and interact with money. As we embrace the digital revolution, Bitcoin stands at the forefront, offering a glimpse into a future where financial empowerment and freedom reign supreme. As we embark on this journey, one thing is clear: Bitcoin is not just a digital currency; it's a catalyst for change, ushering in a new era of finance for generations to come.

How will Bitcoin be used in the future?

In the ever-evolving landscape of digital currencies, Bitcoin stands tall as a pioneer, offering a glimpse into the future of finance. But how will Bitcoin be used in the future? Let's delve into the possibilities and potential of this groundbreaking cryptocurrency.

Global Transactions and Remittances: Bitcoin's borderless nature makes it ideal for facilitating international transactions and remittances. As traditional banking systems struggle with high fees and lengthy processing times, Bitcoin offers a faster, more cost-effective alternative. In the future, we can expect to see Bitcoin used as a primary means of transferring value across borders, empowering individuals and businesses alike.

Store of Value: With its finite supply and decentralized nature, Bitcoin has emerged as a reliable store of value akin to digital gold. As economic uncertainty looms and traditional fiat currencies face inflationary pressures, Bitcoin offers a hedge against depreciation. In the future, we may witness a significant portion of wealth stored in Bitcoin, safeguarding against currency devaluation and economic downturns.

Mainstream Adoption: While Bitcoin has already gained widespread recognition, its adoption is poised to skyrocket in the future. As more merchants accept Bitcoin as a form of payment and financial institutions integrate it into their services, Bitcoin will become increasingly accessible to the masses. This mainstream adoption will fuel its use in everyday transactions, from purchasing goods and services to receiving salaries.

Financial Inclusion: Bitcoin has the potential to bridge the gap between the banked and unbanked populations, particularly in developing countries. individuals who have been excluded from the formal financial system, fostering greater financial inclusion and economic empowerment.

Smart Contracts and Decentralized Finance (DeFi): Bitcoin's underlying technology, blockchain, enables the creation of smart contracts and decentralized finance applications. In the future, we can expect to see Bitcoin utilized in a variety of DeFi platforms, offering innovative financial services such as lending, borrowing, and trading. These decentralized applications will revolutionize traditional financial systems, providing greater accessibility and transparency to users.

Hedging Against Geopolitical Risks: As geopolitical tensions rise and governments impose sanctions, Bitcoin provides a means of circumventing restrictions on capital flows. In the future, we may see individuals and businesses turn to Bitcoin as a hedge against geopolitical risks, preserving their wealth in a borderless and censorship-resistant asset.

Integration with Central Bank Digital Currencies (CBDCs): While Bitcoin operates independently of central banks, it may complement the emerging trend of central bank digital currencies (CBDCs). In the future, we could see interoperability between Bitcoin and CBDCs, facilitating seamless exchange between digital and traditional currencies.

In conclusion, the future of Bitcoin is filled with promise and potential. From facilitating global transactions to fostering financial inclusion, Bitcoin is poised to revolutionize the way we think about money. As we embrace this digital frontier, Bitcoin will continue to shape the future of finance, empowering individuals, businesses, and economies worldwide.

What is the future of long term Bitcoin?

In the ever-evolving realm of cryptocurrencies, Bitcoin stands as the pioneer, the trailblazer that ignited a digital revolution. From its inception in 2009 by the mysterious Satoshi Nakamoto to its current status as a trillion-dollar asset, Bitcoin has captured the imagination of investors, tech enthusiasts, and economists alike. But what does the future hold for long-term Bitcoin? Let's embark on a journey to unravel the mysteries and explore the potential trajectory of this digital gold.

As we gaze into the crystal ball of cryptocurrency, one thing becomes clear: Bitcoin's long-term future is intricately tied to its ability to adapt and overcome challenges. Like any revolutionary technology, Bitcoin has faced its fair share of hurdles, from scalability issues to regulatory scrutiny. Yet, with each obstacle, Bitcoin has emerged stronger, more resilient, and more ingrained in the fabric of our digital economy.

So, what can we expect from long-term Bitcoin? Let's delve into the key factors that will shape its future:

Adoption and Integration: The widespread adoption of Bitcoin as a mainstream asset class is perhaps the most crucial determinant of its long-term success. As more institutions, corporations, and individuals embrace Bitcoin as a store of value and hedge against traditional financial systems' uncertainties, its long-term viability strengthens. With the recent trend of institutional adoption and the emergence of Bitcoin-based financial products, such as ETFs, the path towards mainstream acceptance becomes clearer.

Technological Advancements: The underlying technology behind Bitcoin, the blockchain, continues to evolve at a rapid pace. From scalability solutions to privacy enhancements, ongoing developments in blockchain technology promise to address Bitcoin's current limitations and unlock new possibilities. Layer 2 solutions like the Lightning Network offer faster and cheaper transactions, making Bitcoin more practical for everyday use.

Regulatory Clarity: Regulatory uncertainty has been a lingering shadow over Bitcoin's journey. However, as governments worldwide grapple with the complexities of cryptocurrency regulation, clarity begins to emerge. Clear and balanced regulatory frameworks can provide legitimacy and stability to the Bitcoin market, paving the way for greater institutional involvement and investor confidence.

Market Dynamics: The dynamics of the cryptocurrency market play a pivotal role in shaping Bitcoin's long-term trajectory. Price volatility, market sentiment, and macroeconomic factors all influence Bitcoin's price movements. However, as Bitcoin matures and its market cap grows, it becomes less susceptible to manipulation and wild price swings, leading to a more stable long-term outlook.

Global Socioeconomic Trends: Bitcoin's future is intertwined with broader socioeconomic trends, such as the shift towards digitalization, the erosion of trust in traditional financial institutions, and the quest for financial sovereignty. As individuals seek alternative forms of money and value preservation, Bitcoin's role as a decentralized, censorship-resistant asset becomes increasingly relevant.

In conclusion, the future of long-term Bitcoin is a tale of resilience, innovation, and adaptation. While challenges remain, Bitcoin's journey from obscurity to ubiquity reflects its intrinsic value and disruptive potential. As we navigate the ever-changing landscape of cryptocurrency, one thing is certain: Bitcoin's legacy will endure, shaping the future of finance and technology for generations to come.

2 notes

·

View notes

Text

By Michael Roberts

While the leaders ‘talked turkey,’ the economic reality is that U.S. efforts to strangle the Chinese economy are not working. Western ‘experts’ continue their never-ending message that China is close to a debt collapse. If this were really so, then Biden and American capital would have nothing to worry about – but they do worry, and rightly so.

In previous posts, I have argued that it was a big mistake by the Chinese CP leaders to adopt the Western capitalist model for urban development. But this does not mean China is about to have a deflationary crash. China’s net debt to GDP ratio (debt burden) is only 12% of the average in the G7 economies. The state holds huge financial assets, so it can easily manage this property slump.

#China#xi jinping#joe biden#apec#imperialism#socialism#cpc#capitalist reforms#New Cold War#economy#Struggle la Lucha

6 notes

·

View notes

Note

What do you think of bringing back the gold standard so our money is actually backed by something with real value?

this is something i feel very strongly about and so i might become a bit impassioned and i just want you to know ahead of time that when i talk about "you" i am referring to gold bugs in general, not specifically you anon. i mean, you might be a gold bug but i don't want to make any assumptions.

with all that said....

returning to the gold standard has to be one of the stupidest fucking ideas i've ever heard of and i've never heard a single convincing argument for why we should except for some vague gesticulating at this or that problem and blaming it on us getting off the gold standard without any real evidence.

i can't address everything but let me walk you through a few things so maybe you can get an idea of what i'm talking about.

first and foremost, i want to address what you specifically said in your ask. "actually backed" by something with "real value." i'm sorry but what "real value" does gold have? outside of maybe electronics, what do we do with it? where is the "real value"? we hoard it? wear it as jewelry? is that what "real value" means to you? maybe there are things i'm overlooking. i'm sure gold does have other practical uses. but it's not why people collect gold. people collect gold because it's rare and pretty and doesn't tarnish.

no. this is real value:

real value is found in your factories, the workers in those factories, the machines they operate, your farmers and the food they produce, the land they work, the transportation infrastructure, the guns and soldiers that wield them, etc. /that/ is real value. and i hate (read: love) to break it to you but america's got all of that in spades. and that's what backs the us dollar. all of america's /real/ productive wealth. and that, my friend, is of infinitely more value than a bit of gold. the us dollar is a religious symbol. a representation of not just america's near omnipotence, but also our trust in america's destiny.

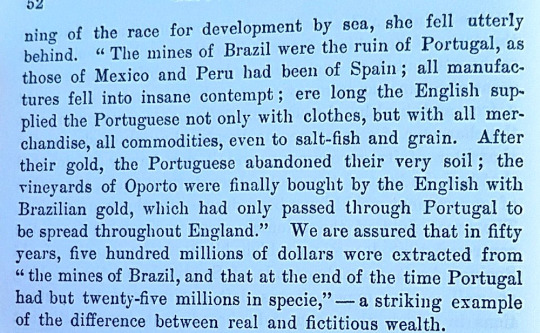

seriously. spain was a tragedy. it had a world's worth of wealth in its borders. and what did they do? they didn't invest in their country's domestic production, i'll tell you that much. why bother /building/ things when you can just /buy/ them from other countries?? it's so much simpler! and just like that, spain (and portugal, as mentioned) gave way to england and the netherlands both of whom /did/ use their newfound capital to invest in domestic production.

"but gold prevents inflation!" you might be saying. sure, in a sense. though obviously there are historical examples of new sources of gold being discovered and destabilizing economies (like the ones mentioned above) but let's ignore that. yes. gold is supposed to prevent inflation. how? by being deflationary. and who does deflation benefit the most? creditors, that's right. deflation increases the value of money which increases the value of a bank's reserves, loans, investments, and other assets. it increased the real value of debt owned by banks making it more difficult for debtors to pay off their debt.

in the latter half of the 19th century this was one of the biggest debates in america. between a gold standard and the "free silver" and "greenback" movements. both the greenback and silverite movements were farmer-laborer populist movements who believed the gold standard benefited bankers and fought for more expansionary monetary policies. the gold standard was deflationary and constricted the economy. it was bad news all around, except for the bankers (who controlled most of the gold in case you thought your average joe did).

so farmers and laborers (read: the common people) instead advocated for unlimited silver coinage (whose real value was less than its face, essentially making it semi-fiat) and/or totally fiat greenbacks to counteract the deflationary effects of a gold standard by stimulating spending and investment, reducing the real burden of debts, making credit more accessible to common folk, increasing flexibility and independence of monetary policy, no resource constraints, minimal speculation, the multiplier effect, etc. deflation is absolutely catastrophic on the economy, but small and stable amounts of inflation mean the economy is growing.

the free silver/greenback movements believed that control of monetary policy should shift away from banks with large gold reserves to the democratic control of the people through government fiat. the government issuing its own currency would also mean the government would be less reliant on borrowing from banks which means banks would have less influence over government.

and i can keep going but this should be enough to help you understand why the gold standard is stupid as fuck. gold bugs will say "the gold standard prevents economic crises!!" but all it takes is a brief glance at 19th century america and the multitude of economic crises to know it's bullshit. the gold standard may be deflationary (which itself is very bad btw, for reasons i mentioned above) but it does not immunize economies from crisis like they want you to believe. meanwhile, giving the government a wide range of tools to flexibly deal with economic crises /does/ mitigate crises and bring stability.

when on the gold standard we were having a new depression every other decade or so. the last depression we went through was 100 years ago.

there is literally no good argument for returning to a gold standard except stupid nostalgia, delusion, and being duped by propaganda from people with large gold reserves (like bankers) who would benefit.

you would not benefit.

5 notes

·

View notes

Text

To foretell the future, think like a banker

The banker's guide to owning it all

To foretell the future, think like a banker

Ishkabibble

To extort the maximum value from a population, when one has control of monetary system, leverage the laws of supply and demand. Use deflation, inflation, and hyperinflation all as tools to transfer wealth. All have a place and a purpose.

The banker's guide to owning it all

Become majority lender in an economy of people with assets you want.

Encourage indebtedness by loaning generously while securing on assets of interest.

Loosen lending standards until the assets you seek to capture are attached. (this makes the economy debt dependent)

Once debts are significant for the bulk of the population, sharply tighten lending standards. <-- Economic shock - Onset of deflation

Backstop losses with public guarantees if possible. This is gravy if one can get it. (Fannie and Freddie guarantees, for example)

Permit default 'without risk' on the assets you wish to sieze to maximize wealth transfer. (stall foreclosure, stay repossession orders etc)

Stall the economy to maximize default positions and deplete private liquidity. <-- We are here

Successively ratchet the economy downhill, while bettering secured positions.

In a series of large actions, sieze all security for default. Target the assets of greatest interest first. (This deals a heavy economic blow and can help cause the ratcheting required for step 8.)

Transfer asset ownership, but retain prior owners as renters where possible. (This reduces public lashback and helps maintain the asset for resale)

Once the bulk of assets of transferred, write them down to leverage the public financial backstop.

Buy up as many remaining assets on the cheap as possible. Hide this action.

Hyperinflate to destroy the external claims on wealth. <-- Onset of hyperinflation (This destroys treasuries, gov't bonds, currency. Ensures free title on new assets. May cause war.)

Stabilize the currency or devise a new one, resume lending at a reasonable pace. Sell the assets back, secured of course, at your chosen price in new currency.

Hyperinflation is only a risk to the wealthy if the population has the assets. Make note of that statement. It is key to timing the shift from deflation to hyperinflation.

I combined known events of the 1930s with those of other collapses and this is the model that results. Instead of positioning myself as a victim of the collapse, I positioned as the one that would profit.

The approach is reverse engineered, so it may not be entirely accurate. I expect it is close.

Ethics aside for the moment, one might consider the following in order of execution:

Eliminate secured debt.

Store preps to carry you through steps 8-13.

Secure precious metals for when the currency is collapsing. At that time, assets will become very cheap in terms of both gold and silver.

Exchange for assets while public stampedes into PMs in a panic.

If the gold price rises too high for your tastes, loan sums of cash against assets of much greater worth. Ensure you have a first on the security.

For those of limited means, directing capital can be very important. This model is deflationary while assets are transferred. It relies on limiting the panic in this period as well. From this, we can gather that accomodation is likely to remain available. Food will become a larger percentage of household spending (due to income reduction), and guns won't help against this enemy (protection will still matter though, as always). This can help prioritize where limited prep funds are spent.

For those with excess, items three and four may feel ethically questionable. Remember that private ownership of most of these assets will not survive this process with or without your involvement. Following in the footsteps of the banks directs some of their windfall to you... instead of them. I am personally comfortable with only the first three of the steps listed above. The fourth is a difficult one. I could only do that if I knew a bank was going to loan the money and complete the fleecing in my absence. But even then, I don't think I would take on the roll of aggressor.

I am bullish on both gold and silver from the point destruction of the dollar picks up momentum. For the immediate future, TPTB will jack the price all over the place to shake out the speculators. The choice to hold gold or silver must be based on market fundamentals, not the gamed valuation systems.

I am bullish on both gold and silver, but most bullish on silver. To an untrained eye, $1000 in silver looks like a LOT more than $1000 in gold. The market will soon become saturated with untrained buyers. They will be panicked and buying in haste. They won't know what to buy based on research or sound fundamentals, rather they will respond based on visual cues and heuristics. A suitcase of silver may buy a house because it looks like a lot, while the equal value in gold will not. As well, those little plastic sleeves will be big money makers. They will ensure a case filled with any PM looks more tangible. Less will become more when well packaged.

Emulating the actions of a banker would enable you to share in their spoils. It's hard to ensure you will have the dry powder to spend in step 12, and there's risk that a twist on this strategy could still come forth. But if it holds true, your suggestion would be effective.

h

1 note

·

View note

Video

youtube

High Demand Equals High Gold Prices

There are two worlds that treasure gold, for two different reasons. The production of jewelry is the biggest source of the yellow metal demand. But not all of them represent a precious thing to wear. On one side, there is the Middle East and India. For the women there, gold is a wealth store. We think of retirement money, but those women see gold as their pension. As expected, the price of click here gold is significant and this target is sensitive to big changes.

The other side is the First World. Both Europeans and North Americans consider gold for adornment jewelry. This market covers wealthy customers that react less to price swings, unlike the investment buyers. But there is still a rational reaction to increases. World Gold Council showed that in the first half of 2010 the total demand of the yellow metal rose by 36%. Now we take a look back at the two worlds; the investment demand reports a rise of 118%.

Over the last decade, gold turned to be the best performing asset. But will the price continue to rise? Thirty years ago, the precious metal closed at US$850 an ounce. At today's dollar, the price should be US$2,358, to equal its nominal high from 1980. In September, the price was at US$1,250. One could say that the metal is, once again, acting as a safe haven during hard times. Gold shows its best gloss during inflation. But in deflationary times, there could be an opportunity for it, especially if you are looking for undervalued shares of gold companies.

There is a proved leverage to a higher gold price. It is no secret it consists of gold mining stocks. Gold juniors are the key in this new gold rush. The world's currencies might be trash, but the gold is definitely cash. Gold reserves are not forever, so producers need to replace them in a very competitive market. That is why juniors with safe yellow metal ounces in the ground will be most hunted.

5 notes

·

View notes

Text

How to Customize Your Pump Fun Clone Script for Maximum Engagement

In crypto, keeping hold of attention and grabbing is utmost for overall success. It shows that a jovial coin can have influences under the right angle as evidenced by popularity increase of meme coins alongside those pump projects. Customizing your Pump Fun Clone Script for maximum engagement is one of the most critical steps in building a thriving project. This article will delve into how you can modify your clone script to attract more users, keep them entertained, and create an engaging environment around your cryptocurrency.

1. Unique Branding and Design

Although your clone script has a basic framework, it is important that customization begins with giving your project a unique identity. Make this currency one of a kind by using its own logo, interesting color patterns and creative graphics. What story or character does this meme coin tell? To distinguish oneself from other numerous currencies on the market, one should use a playful and memorable design complemented by strong branding.

By working with designers, you will create a unified style for your website, social media platforms as well as the coin’s logo which will lead to immediate recognition.

2. Customize Tokenomics to Match Your Community’s Expectations

The way your coin’s future is seen by investors can lead to their engagement. Therefore it is important to tailor tokenomics according to what people want. This means modifying total supply, rewarding system, burning rate and inflation control mechanisms.

For audiences who enjoy greater returns the advisable mode would be integrating staking mechanisms or distribution models which favor holders of the coin. For enhancing deflationary appeal one might consider including periodic combustion events that increase scarcity and hence value.

3. Integrate Gamification Features

The process of gamification has been a major component of several successful meme coins. Thus, it would be more engaging for users if you customize your pump fun clone script by including elements such as ,reward systems, badges, challenges and leaderboards.

Make sure that there are rewards for holding coins during specified periods of time.

Create daily or weekly challenges enabling users earn additional tokens.

Use leaderboards to indicate the highest investors or most active members in the community to win unique NFTs or other rewards.

4. Incorporate NFTs for Added Value

The exciting addition of Non-Fungible Tokens (NFTs) will make your project more valuable. You can include options for NFT minting in the customized clone script where users can create and trade their own unique digital assets that are tethered to your coin. Additionally, you could further engage the community by offering exclusive NFTs as a reward for the devoted holders.

For users that possess a specific quantity of your coin over a long period or promote it through marketing channels such as memes and fan art, make limited edition NFTs specifically for them.

5. Build a Strong Community Platform

Typically, a feeling of togetherness is central to coupling. To foster these connections one can use clone scripts that have such features as forum applications or social media communities therein or even through chat rooms created via these sites. If conversations are managed well by the community around a project then this can increase user retention and engagement.

Alternatively you could integrate platforms like Discord or Telegram directly into your web page so that people can easily get involved in the discussions, contribute their thoughts and pose questions.

6. Interactive Voting and Governance Systems

Let your community have a say in the governance of your clone script through a DAO-style decision making process. This would entail users voting for upcoming upgrades, new functionalities or any desired changes to the tokenomics. With this feature, you would empower your users while keeping them active since they partake in shaping the course of the project.

Give users the chance to suggest and vote on proposals such as future rewards distribution plans, possible partnerships or even fresh meme themes for the coin. By so doing, you would create an impression of belongingness and increase loyalty among its members.

7. Keep It Fun with Regular Meme Contests and Events

For meme-related currencies, the heart of the project is all about fun and jokes. Personalize your pump fun duplicate to hold competitions for memes, rewards programs and community gatherings. Set up these contests via your social network or on your webpage giving prizes such as tokens or special non-fungible tokens to those who take part in them.

Start a meme challenge every week rewarding the best performing or hottest meme with a given number of coins. This ensures that users remain involved as well as serves as a viral marketing strategy since they will be sharing their memes within their circles.

8. Incorporate Real-Time Analytics and User-Friendly Dashboards

It’s crucial to maintain user interest through providing them with explicit visibility of their investments and project growth. Right here on the platform happens real-time portfolio monitoring, market analytics, and transaction history provision – so tailor your script accordingly. This way, users will remain hooked by getting as much information as they can get from different angles rather than just the monetary one.

Offer tailored dashboards indicating profits, losses, and future rewards in correspondence with their actions.

Conclusion

Your Pump Fun Clone Script customization is not a mere technical issue, it is rather an avenue for developing an interactive and attractive surrounding for your users. You can come up with a meme coin or pump project that seizes people’s attention and earns their loyalty by incorporating personalized features, community-driven aspects as well as entertaining gamification.

0 notes

Text

Turn $1 Into $1,000 With These 3 Leading Solana Rivals - Notice Today Online

https://www.merchant-business.com/turn-1-into-1000-with-these-3-leading-solana-rivals/?feed_id=200718&_unique_id=66e76cdb1ff1b

#GLOBAL - BLOGGER

BLOGGER

Unlocking the secrets of turning a small investment into a substantial gain, this article explores the potential of three cryptocurrencies poised to rival Solana. Delve into the world of digital assets and discover which tokens have the potential for significant upward movement. Find out which coins could be the next big movers in the crypto space.CYBRO Presale Climbs Past $2 Million: A One-in-a-Million DeFi Investment OpportunityCYBRO is capturing the attention of crypto whales as its exclusive token presale quickly surges above $2 million. This cutting-edge DeFi platform offers investors unparalleled opportunities to maximize their earnings in any market condition.Experts predict a potential ROI of 1200%, with CYBRO tokens available at a presale price of just $0.03 each. This rare, technologically advanced project has already attracted prominent crypto whales and influencers, indicating strong confidence and interest.Holders of CYBRO tokens will enjoy lucrative staking rewards, exclusive airdrops, cashback on purchases, reduced trading and lending fees, and a robust insurance program within the platform.With only 21% of the total tokens available for this presale and approximately 80 million already sold, this is a golden opportunity for savvy investors to secure a stake in a project that’s truly one in a million.AAVE: Powering the Next Wave of Decentralized FinanceAave is a game-changer in the DeFi world. It allows users to lend, borrow, and earn interest on crypto assets in a decentralized manner without middlemen. Operating on the Ethereum blockchain, Aave leverages smart contracts to enhance trust and security. With support for 17 different cryptocurrencies, it offers versatile use cases, including innovative flash loans that require no collateral and must be repaid within seconds.The AAVE token adds further value by providing fee waivers, voting rights, and serves as collateral. With a robust Safety Module and deflationary tokenomics, Aave looks very promising for bullish growth in the current market. This could be a great opportunity for those looking to invest in DeFi.Big Gains Ahead? Jupiter (JUP) Poised to Revolutionize Solana DeFi LandscapeJupiter (JUP) is one of the top swap engines on the market, bringing vital liquidity to the Solana platform. The team is growing its DeFi lineup with exciting tools like Limit Orders and Perpetuals Trading. By offering such advanced features, Jupiter has the potential to become a key player in the DeFi space. Considering its innovative technology and expanding reach, Jupiter could be an attractive investment in the current market cycle, especially with the prospect of an approaching altcoin season.LUNC: Terra Classic’s Bullish Potential in the Altcoin SeasonLUNC, formerly known as LUNA, is part of Terra Classic, a blockchain protocol that uses stablecoins tied to real-world currencies like the U.S. dollar and the South Korean won. Launched in 2019, Terra Classic aims to provide fast, affordable global payments with the stability of fiat and the security of Bitcoin. After its split and rebranding in 2022, there are exciting prospects for LUNC.With its strong technology and innovative approach, LUNC could be a standout during this altcoin season. The team’s focus on stability and fast transactions might attract more users and lead to significant price growth. The coin looks promising in the current bullish market cycle.ConclusionWhile AAVE, JUP, and LUNC have less potential in the short term, CYBRO stands out for its advanced technology. This DeFi platform offers investors opportunities to maximize earnings with AI-powered yield aggregation on the Blast blockchain. Features such as lucrative staking rewards, exclusive airdrops, and cashback on purchases enhance the user experience with seamless deposits and withdrawals.

Prioritizing transparency, compliance, and quality, CYBRO is attracting significant interest from crypto whales and influencers, making it a promising project.Site: https://cybro.ioTwitter: https://twitter.com/Cybro_ioDiscord: https://discord.gg/xFMGDQPhrBTelegram: https://t.me/cybro_io

http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/09/53553100382_44ac178629_o.jpg

Unlocking the secrets of turning a small investment into a substantial gain, this article explores the potential of three cryptocurrencies poised to rival Solana. Delve into the world of digital assets and discover which tokens have the potential for significant upward movement. Find out which coins could be the next big movers in the crypto … Read More

0 notes

Text

Turn $1 Into $1,000 With These 3 Leading Solana Rivals - Notice Today Online - #GLOBAL

https://www.merchant-business.com/turn-1-into-1000-with-these-3-leading-solana-rivals/?feed_id=200717&_unique_id=66e76cda0a0ac

Unlocking the secrets of turning a small investment into a substantial gain, this article explores the potential of three cryptocurrencies poised to rival Solana. Delve into the world of digital assets and discover which tokens have the potential for significant upward movement. Find out which coins could be the next big movers in the crypto space.CYBRO Presale Climbs Past $2 Million: A One-in-a-Million DeFi Investment OpportunityCYBRO is capturing the attention of crypto whales as its exclusive token presale quickly surges above $2 million. This cutting-edge DeFi platform offers investors unparalleled opportunities to maximize their earnings in any market condition.Experts predict a potential ROI of 1200%, with CYBRO tokens available at a presale price of just $0.03 each. This rare, technologically advanced project has already attracted prominent crypto whales and influencers, indicating strong confidence and interest.Holders of CYBRO tokens will enjoy lucrative staking rewards, exclusive airdrops, cashback on purchases, reduced trading and lending fees, and a robust insurance program within the platform.With only 21% of the total tokens available for this presale and approximately 80 million already sold, this is a golden opportunity for savvy investors to secure a stake in a project that’s truly one in a million.AAVE: Powering the Next Wave of Decentralized FinanceAave is a game-changer in the DeFi world. It allows users to lend, borrow, and earn interest on crypto assets in a decentralized manner without middlemen. Operating on the Ethereum blockchain, Aave leverages smart contracts to enhance trust and security. With support for 17 different cryptocurrencies, it offers versatile use cases, including innovative flash loans that require no collateral and must be repaid within seconds.The AAVE token adds further value by providing fee waivers, voting rights, and serves as collateral. With a robust Safety Module and deflationary tokenomics, Aave looks very promising for bullish growth in the current market. This could be a great opportunity for those looking to invest in DeFi.Big Gains Ahead? Jupiter (JUP) Poised to Revolutionize Solana DeFi LandscapeJupiter (JUP) is one of the top swap engines on the market, bringing vital liquidity to the Solana platform. The team is growing its DeFi lineup with exciting tools like Limit Orders and Perpetuals Trading. By offering such advanced features, Jupiter has the potential to become a key player in the DeFi space. Considering its innovative technology and expanding reach, Jupiter could be an attractive investment in the current market cycle, especially with the prospect of an approaching altcoin season.LUNC: Terra Classic’s Bullish Potential in the Altcoin SeasonLUNC, formerly known as LUNA, is part of Terra Classic, a blockchain protocol that uses stablecoins tied to real-world currencies like the U.S. dollar and the South Korean won. Launched in 2019, Terra Classic aims to provide fast, affordable global payments with the stability of fiat and the security of Bitcoin. After its split and rebranding in 2022, there are exciting prospects for LUNC.With its strong technology and innovative approach, LUNC could be a standout during this altcoin season. The team’s focus on stability and fast transactions might attract more users and lead to significant price growth. The coin looks promising in the current bullish market cycle.ConclusionWhile AAVE, JUP, and LUNC have less potential in the short term, CYBRO stands out for its advanced technology. This DeFi platform offers investors opportunities to maximize earnings with AI-powered yield aggregation on the Blast blockchain. Features such as lucrative staking rewards, exclusive airdrops, and cashback on purchases enhance the user experience with seamless deposits and withdrawals.

Prioritizing transparency, compliance, and quality, CYBRO is attracting significant interest from crypto whales and influencers, making it a promising project.Site: https://cybro.ioTwitter: https://twitter.com/Cybro_ioDiscord: https://discord.gg/xFMGDQPhrBTelegram: https://t.me/cybro_io

http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/09/53553100382_44ac178629_o.jpg

BLOGGER - #GLOBAL

0 notes

Text

China’s recently announced GDP target for 2024 remains unchanged from last year, at 5 percent. But even if the country hits that number, its economic problems run deep. In January, China published economic data for the last quarter of 2023 which put its annual GDP growth rate at 5.2 percent, beating the government target. Yet, to put things in perspective, China’s real GDP growth rate from 2011 to 2019 averaged 7.3 percent while 2001-10 saw average growth of 10.5 percent.

After the figures dipped in 2020 to 2.2 percent owing to COVID-19, expectations for post-pandemic recovery were high. This was rooted in the assumption that China lifting its dynamic zero-COVID policy in January 2023 would unlock pent-up demand in the economy, which remained suppressed during the two-year-long lockdown. But that hasn’t happened. Some observers even doubt the recently released GDP data’s authenticity and suspect the numbers are far below the official figures.

But even if the figures are accurate, the wider trends of the Chinese economy suggest a worrying state of affairs. To begin with, this was the first time since 2010 that China’s real GDP growth rate exceeded its nominal GDP growth rate (4.8 percent). The nominal growth rate is calculated on the previous year’s numbers without accounting for inflation. Discounting inflation is necessary to remove any distortion arising from a mere increase in the prices of goods and services. Thus, the real GDP figure is calculated after adjusting for inflation to reflect the increase in output of goods and services. This is also the number economists and governments refer to when stating GDP growth numbers.

Usually, the nominal growth rate should be higher than the real growth rate. But in a deflationary year, the real growth rate can give a distorted picture, because deflation or negative inflation amplifies the real numbers. Thus, the fact that China’s real GDP number exceeded its nominal number indicates that Beijing’s gross value of output in real terms was amplified thanks to negative inflation, i.e. a general decrease in the prices of goods and services. If not for deflation, China’s real GDP growth in 2023 would have been even lower and would have certainly missed the national target of 5 percent.

The news on China’s gross fixed capital formation (GFCF) isn’t encouraging either. The term refers to the acquisition of fixed assets such as land and machines or equipment intended for production of goods and services. It is one of the four components of GDP (besides exports, household consumption, and government expenditure) and a measure of investment in the economy. For decades, China relied on a high GFCF rate to power its economy, but it has witnessed a sustained decline under President Xi Jinping’s leadership. For reference, the GFCF growth rate in the last 9 years (2014-22) averaged 6.7 percent as compared to 13 percent in the 21 years before that (1994-2014). It hit over 10 percent only on four occasions in the last nine years, once in 2021 thanks only to a significantly low base due to the pandemic year.

The bulk of this investment came from the real estate sector, which constituted a quarter of China’s total investments in fixed assets. Between 1994 and 2014, the sector witnessed a year-on-year growth rate of around 30 percent. But in the last eight years, the property sector has witnessed average growth of only 4.2 percent—and shrank by 10 percent from 2021 to 2022.

In part, the drop in investment can be attributed to the conscious decision of the central leadership under Xi to deflate the property bubble, which had become unsustainable, and reallocate and redirect capital from speculative to more productive forces. The decelerating impact this decision has had on China’s GDP has forced leadership to reverse its policies to some degree, trying to prop up the bubble. But the forced deflation is now proving too resistant to change, as is evident from the 2023 numbers that suggest the real estate sector shrunk by 9.6 percent.

But that’s not the only reason for the drop in investment. In the past year, China’s economy has witnessed an increasing securitization of its development. On numerous occasions, including at the 20th Party Congress in 2022 and the Two Sessions in 2023, Xi has underlined that the idea of development cannot be isolated from that of security. In a meeting of the Chinese Communist Party’s National Security Commission last year, Xi reiterated the need to “push for a deep integration of development and security.”

Consequently, in the first half of 2023, Chinese authorities carried out a series of crackdowns on foreign and domestic consultancy companies that offered consultancy services to help overseas businesses navigate China’s challenging regulatory environment. The infamous instances included raids on U.S. companies Mintz in March and Bain & Company in April. In May, Shanghai-based consultancy Capvison saw its offices raided for stealing state secrets and transferring sensitive information to its foreign clients. Weeks later, China’s Cyberspace Administration announced that U.S. chip giant Micron failed to obtain security clearance for its products.

This need to put security over the economy further became apparent in China’s revision of its counter-espionage law, which came into effect in July 2023. The updated law not only broadens and dilutes the definition of espionage but also confers wide-ranging powers on local authorities to seize data and electronic equipment on account of suspicion. China’s new developmental security approach, which manifested in its crackdown on foreign and domestic consultancies alike, has spooked private investors since then.

The government has issued repeated assurances to both domestic and foreign investors to improve the business environment and spur investment. However, investment in fixed assets by private holding companies has been declining since 2018. It briefly rebounded in 2021, only to drop again in 2022. The data for 2023, although not yet updated, is unlikely to pick up.

In contrast, investment by the state has gone up to compensate for the decline in private investment. But this can’t be a substitute in the long run for two reasons. First, rising government debt at a time when private investment is declining can lead to crowding out of capital, thereby shrinking the resource pool for private businesses. And second, the government has already stretched itself as its debt-to-GDP ratio rose to 55.9 percent in 2023. Given the mounting debt situation, there exists very little room for the government to even sustain, let alone expand, its current expenditure.

The data on China’s net exports suggests their contribution to GDP, although steadily picking up since recording a low in 2018, is unlikely to return to the glory years of 2001-14. While China will continue to be a leading export nation, the contribution of net exports to its growth rate might not be high. Poor external demand also means that export-oriented investments will see a decline, thereby pulling the overall investment rates further down albeit with a lag.

China’s strategy in the wake of this situation has been to seek to boost domestic consumption and household spending. Yet for domestic consumption to emerge as a new engine of growth requires not only sustaining its previous momentum but also increasing its share as a percentage of GDP to compensate for the loss of growth due to falling investment (in property and export-oriented sectors) rate.

However, a look at China’s household consumption expenditure as a percentage of GDP suggests that it has remained significantly low compared to other consumption-driven advanced and emerging economies. For instance, in both the United States and India, household consumption makes up more than 55 percent of GDP. In contrast, China’s household consumption has historically hovered around 40 percent—and dropped to 37 percent in 2022.

To add to the misery, the growth of China’s household consumption expenditure is also declining in the wake of a pandemic that left the public deeply insecure about their financial future. For ten years (2010-19), growth remained stable at around 10 percent before the pandemic forced the household consumption growth rate to drop to zero in 2020. After recording an uptick in 2021from that low, the growth rate dropped again in 2022. The negative difference between the nominal and real GDP in 2023, indicative of deflation, further confirmed the sluggish demand in the economy.

Thus, domestic consumption seems unlikely to be able to fuel China’s growth. The rising unemployment rate, declining consumer confidence, aging population, and rising dependence ratio will further burden any attempt to raise China’s consumption.

These trends may be baked in the near to medium term. China will not see a return to the high growth rates witnessed in 1980-2010 and will instead stabilize near 4 percent. This will likely derail China’s plan to transition from a middle- to a high-income country and certainly dent Xi’s dream of transforming China into an advanced socialist country. The much-dreaded fear of the “middle-income trap” is real for China.

3 notes

·

View notes

Text

The Role of Bitcoin in the Global Financial Shift: A New Era of Truth-Based Markets

The world is on the brink of a massive financial transformation, one that will forever change the way we think about money, value, and the very dynamics of the global economy. For centuries, fiat currencies and centralized control over monetary policy have dominated the financial landscape, distorting prices and economic behaviors. But today, with the rise of Bitcoin, a new paradigm is emerging—one that offers not just an alternative, but a revolutionary shift towards a decentralized, sound money system where prices will, for the first time, reflect the truth.

The Growing Instability of Traditional Financial Systems

Fiat currencies, controlled by governments and central banks, have long been the cornerstone of global trade and economic policy. But with endless money printing, rising inflation, and increasing national debts, the very foundation of these systems is showing cracks. Central banks, through their manipulation of interest rates and currency supplies, are eroding trust in the financial system. We see it every day in the form of inflation eroding our savings and rising costs of living.

What happens when fiat loses its grip? People are already searching for answers, and Bitcoin is emerging as the clear frontrunner.

Bitcoin: A Global Solution

Bitcoin offers something no fiat currency ever could—absolute scarcity and decentralization. With its 21 million hard cap, Bitcoin is deflationary by nature, meaning it cannot be manipulated or inflated away by any government or institution. This built-in scarcity makes it a hedge against inflation and a store of value that transcends borders and politics.

But Bitcoin is more than just a hedge. It’s a permissionless, borderless network that anyone can access. No one needs approval from a bank or a government to use Bitcoin. This gives individuals across the globe, especially in underbanked regions, the power to participate in the global economy.

The Shift in Power: Decentralization at Its Core

One of the most exciting aspects of Bitcoin is how it’s redistributing financial power. In the traditional system, financial power is centralized in the hands of governments and financial institutions. They decide who has access to wealth, how much money is worth, and who can trade with whom. With Bitcoin, this control is shattered. Now, individuals hold the keys to their wealth—literally. No one can freeze, seize, or manipulate your Bitcoin if it’s held securely in your wallet.

This decentralization shifts power from centralized authorities to individuals, giving people true control over their financial destiny. As more individuals and institutions embrace Bitcoin, we are witnessing the beginning of a global power shift.