#difference between fd and sip

Explore tagged Tumblr posts

Text

SIP vs FD: Which Investment Option is Right for You?

If you're navigating your investment journey in 2025, you've probably asked yourself: should I opt for a systematic investment plan or a fixed deposit? Both are time-tested instruments but serve very different goals. With expert guidance from a trusted Wealth Management Company in India, you can better understand the difference between FD and SIP and make an informed choice that aligns with your financial vision.

What is a Systematic Investment Plan (SIP)?

A systematic investment plan is a tool that lets you invest a fixed amount into mutual funds at regular intervals—monthly, quarterly, or even weekly. It’s a great way to develop financial discipline and grow wealth over time. For first-time investors or those seeking personalized guidance, connecting with a reliable SIP distributor in Gurgaon can make the process smoother and more effective.

Key Advantages:

Affordable Entry Point: Start with as little as ₹500 per month.

Power of Compounding: Small amounts invested consistently can snowball into significant returns.

Rupee Cost Averaging: Mitigates market volatility by averaging out purchase costs over time.

Common types of SIP:

Regular SIP – Fixed amount at fixed intervals.

Top-up SIP – Gradually increase your contribution.

Flexible SIP – Adjust payments as per your cash flow.

Perpetual SIP – Continues until manually stopped.

What is a Fixed Deposit (FD)?

A fixed deposit is a traditional savings product offered by banks and NBFCs. You invest a lump sum for a fixed tenure at a guaranteed interest rate.

Benefits of FDs:

Capital Safety: Zero market risk.

Fixed Returns: Predictable interest earnings.

Customizable Tenure: Ranging from 7 days to 10 years.

Popular types of fixed deposit:

Cumulative FD – Interest paid at maturity.

Non-cumulative FD – Interest paid monthly, quarterly, or annually.

Tax-saving FD – Comes with a 5-year lock-in and tax deduction under 80C.

Which is better: SIP or FD? For long-term wealth creation, a systematic investment plan offers potentially higher returns. For capital protection and stable income, fixed deposits are ideal.

SIP vs FD: The Core Differences (In Pointers)

Risk Profile

SIP: Market-linked; carries moderate to high risk depending on the mutual fund category.

FD: Virtually risk-free; backed by bank guarantees and deposit insurance.

Returns

SIP: Potentially higher returns over the long term, especially with equity-based funds.

FD: Fixed returns, typically around 6–7% as of 2025.

Flexibility

SIP: Highly flexible—you can start, pause, modify, or stop your investment anytime.

FD: Rigid structure; early withdrawal may attract penalties or reduced interest.

Investment Method

SIP: Involves periodic investments (monthly, quarterly, etc.) that build wealth gradually.

FD: Requires a one-time lump sum deposit at the beginning of the term.

Liquidity

SIP: Highly liquid for open-ended funds; funds can usually be withdrawn within a couple of days.

FD: Less liquid; breaking an FD before maturity often results in penalties.

Taxation

SIP: Gains are taxed as short-term or long-term capital gains depending on the holding period.

FD: Interest earned is fully taxable under "Income from Other Sources."

Suitability

SIP: Best suited for long-term goals like retirement, education, or wealth accumulation.

FD: Ideal for short-term savings or risk-averse individuals seeking capital protection.

Who Should Choose What?

First-Time Investors: A systematic investment plan helps you enter the market slowly and safely.

Conservative Savers: FDs offer the peace of mind of guaranteed returns.

Goal-Oriented Investors: SIPs are better for long-term goals like retirement or education.

Risk-Averse Retirees: FDs ensure capital preservation and steady income.

For personalized advice, a Wealth Management Company in India like BellWether can tailor a hybrid strategy for you.

Blog-Specific CTA for BellWether

At BellWether, we don’t just offer financial products—we offer clarity. Whether you're just starting your first systematic investment plan, curious about blending SIPs with fixed deposits, or want to know the exact types of SIP that match your goals, our experts are here for you.

FAQs

1. How often should I review my SIP portfolio? Ideally, review your SIP portfolio every 6 months or during major life events like marriage, childbirth, or job changes. Markets evolve, and so should your investment strategy.

2. Can I break a fixed deposit before maturity? Yes, you can. But banks usually charge a penalty or offer a lower interest rate on premature withdrawal. Some banks also offer sweep-in accounts for better liquidity.

3. Are SIPs suitable for short-term goals? Not always. Since SIPs are market-linked, short-term returns can be volatile. For goals under 1–2 years, consider liquid funds or FDs instead.

4. What is the best age to start a systematic investment plan? There’s no ideal age, but the earlier you start, the better. Even a ₹1,000 SIP started at age 25 can potentially grow into a significant corpus by age 50.

5. Do FDs offer better tax benefits than SIPs? Only tax-saving FDs offer 80C benefits but come with a 5-year lock-in. SIPs in ELSS funds also offer 80C benefits with a shorter 3-year lock-in and better post-tax returns.

#systematic investment plan#difference between fd and sip#types of sip#types of fixed deposit#SIP distributor in Gurgaon#Wealth Management Company in India

0 notes

Text

Shady: Dom Pascal x Reader

Tagging: @kmc1989 @buckysteveloki-me @emma-dawson @noxytopy @toasted-stiletto

Companion piece to:

Miami - Dom reflects on what brought the two of you back to Chicago.

Slutty - You remind Dom that he has a wife to come home to.

Masochist - Dom proves himself to be a masochist when it comes to work.

Handcuffs (NSFW) - Dom earns your forgiveness the only way he knows how.

Resting Bitch Face - Dom and you face off over Bishop.

It’s late when Dom gets in, far later than he promised you. He’d had to take a shower before he got home, wash away the evidence of his involvement with Bishop’s car fire, the one that had led to him being arrested.

When he steps inside the house, he notices you’ve left the hall lamp on, a sign that you’ve gone to bed. You don’t like to sleep in the dark anymore, not since Miami and truly he doesn’t blame you, especially not after the day you’ve had.

He unlaces his boots in the entrance way and ascends the stairs as quietly as possible. He slips into the bedroom, leaving the door ajar so you can see the light if you wake up in the night.

His gaze comes to rest on you, curled up into a ball on your side of the bed. You’re wearing his old Miami FD t-shirt, your Glock resting on the nightstand, in arm’s reach. It’s something else you used to do after the shooting, it’s the only way you felt safe.

He strips his clothes off, tossing them into the laundry hamper before he climbs under the sheets with you. His arm wraps around your waist, drawing you into the shelter of his body as he buries his face into the curve of your throat.

“I know you’re not asleep.” He murmurs into your ear.

It’s the tension of your muscles, the rigidity of your form. You’re usually pliant, relaxed.

“We’re going to have to move again aren’t we?” You say softly as his palms sooth over you. “It’s not going to stop-”

“I took care of it.” He tells you, his cheek coming to rest upon yours. His five o’clock shadow brushes against your jaw, grazing your skin. “He can’t hurt us anymore, he can’t hurt you.”

“Dom…” You whisper and he holds you a little tighter.

“This is one of those times where I’m gonna ask you not to ask any questions ok?” He says, his voice rough. “There was a car fire in his garage, they found some of his shady shit and it allowed them access to his house where they found more shady shit. That’s the summary of it. He was arrested and he’s going to prison for a very long time.”

“Shady shit?” You question because his baby, she just can’t help herself.

“Cuban cigars.” He tells you, your fingers threading through his as you guide his hand to the place where your heart resides, still beating inside your chest. “Half a million dollars in his safe.”

He feels the relief as you tuck yourself in a little closer, his fingertips tracing over the marks that mar your skin. His words are the difference between sleeping in this bed with you to night or spending the evening in a jail cell for falsifying evidence because there’s some things that even you can’t forgive.

“I don’t care if you created a car fire to give them cause.” You tell him as you settle against him. “So long as you didn’t plant evidence we’re good.”

“Where would I find half a mill and a cabinet of illegally imported Cubans?” He mumbles into the curve of your throat. “Trust me, the two of us would have been in the Bahamas smoking them if that was the case.”

“The Bahamas part doesn’t sound so bad.” You sigh drowsily. “Sunshine in the winter, sipping cocktails on the beach, skinny dipping like we did in Fiji.”

“Oh Fiji, that was…” He has no words to describe what the two of you got up to in Fiji, it was beyond transcendent. “We should take a vacation soon, put all this bullshit in the rearview.”

“Hm.” You agree as you feel yourself slipping away into sleep. “We really should.”

Love Dom? Don’t miss any of his stories by joining the taglist here.

Before you join the taglist make sure to read the rules here as you otherwise you won’t be added.

Interested in supporting me? Join my Patreon for Bonus Content!

Like My Work? - Why Not Buy Me A Coffee

28 notes

·

View notes

Text

Best Investment Options for NRIs in 2025: A Comprehensive Guide

Non-Resident Indians (NRIs) have always viewed India as a promising investment destination, thanks to its robust economic growth, diverse asset classes, and evolving financial landscape. In 2025, with global markets facing volatility and India’s economy showing resilience, NRIs have a wide array of investment options tailored to different risk appetites and financial goals. Here’s a detailed look at the best investment avenues for NRIs this year.

1. Mutual Funds: Versatile and High-Growth Potential

Mutual funds remain a top choice for NRIs due to their flexibility, professional management, and potential for high returns. Equity mutual funds are ideal for those seeking aggressive growth, while debt funds offer more stable returns with lower risk. Hybrid funds, combining both, help balance risk and reward. NRIs can invest in mutual funds through NRE or NRO accounts, with many fund houses providing seamless online platforms and SIP options for regular, disciplined investing. However, investors should be mindful of tax implications in both India and their country of residence123.

2. Fixed Deposits: Safe and Predictable Returns

For risk-averse NRIs, fixed deposits (FDs) continue to be a reliable option. NRE FDs are particularly attractive as they offer tax-free interest in India and full repatriability, making them suitable for those looking to grow savings while maintaining liquidity. NRO FDs, on the other hand, are best for managing income sourced in India, such as rent or pension, though the interest is taxable in India123.

3. Government Bonds and PSU Bonds: Stability and Security

Government bonds and Public Sector Undertaking (PSU) bonds are backed by sovereign guarantees, making them among the safest investment options. These instruments offer stable returns and are ideal for capital preservation. Treasury bills and government bonds can have tenures ranging from a few months to several decades, catering to different investment horizons. Certificates of Deposit (CDs) are also available, though not all are freely repatriable, so it’s important to check with your bank2.

4. Direct Equity: High Returns, Higher Risk

Investing directly in Indian equities offers the highest potential returns but comes with increased volatility. NRIs can participate in the stock market via a Portfolio Investment Scheme (PIS) account linked to a Demat account. While long-term gains are taxed at 10%, short-term gains attract a 15% tax. Direct equity is best suited for financially savvy NRIs willing to actively manage their investments234.

5. Real Estate: Tangible and Appreciating Asset

Real estate remains a favorite among NRIs, offering long-term capital appreciation and rental income. In 2025, luxury and commercial properties in cities like Mumbai, Delhi NCR, and Bengaluru are witnessing significant growth. For those seeking a more passive approach, Real Estate Investment Trusts (REITs) provide exposure to commercial properties with the added benefit of liquidity and diversification. REITs typically offer returns between 8% and 12% per annum35.

6. National Pension Scheme (NPS): Retirement Planning

NPS is a government-backed retirement savings product that offers disciplined, long-term wealth creation. It provides tax benefits and allows flexible investment options across equity, corporate bonds, and government securities. On retirement, a significant portion of the corpus is tax-free, making it an attractive choice for NRIs planning their retirement2.

7. Emerging Themes: Sectoral Bets and Alternative Investments

NRIs can also consider sector-specific investments in areas like renewable energy, e-commerce, and infrastructure, which are expected to drive India’s next phase of growth. Gold, Alternative Investment Funds (AIFs), and Portfolio Management Services (PMS) are other avenues for diversification and tailored wealth management64.

0 notes

Text

Fixed Deposit vs Life Insurance: Which is Better for Your Financial Goals?

When planning your financial future, it's essential to choose the right investment and protection tools. Two commonly considered options are Fixed Deposits (FDs) and Life Insurance. While both serve important roles, they cater to different needs and goals. In this blog, we compare Fixed Deposits and Life Insurance to help you make an informed decision.

What is a Fixed Deposit?

A Fixed Deposit is a financial instrument offered by banks and non-banking financial companies (NBFCs) where you can invest a lump sum of money for a fixed tenure at a predetermined interest rate. It is a low-risk investment option ideal for conservative investors.

Key Features of Fixed Deposits:

Guaranteed returns

Flexible tenure (7 days to 10 years)

Low risk

Taxable interest income

Not linked to market performance

What is Life Insurance?

Life Insurance is a contract between you and the insurance provider, where the insurer promises to pay a designated beneficiary a sum of money upon the insured person's death or after a certain period. Life insurance is primarily a protection tool, though some plans offer savings and investment benefits.

Key Features of Life Insurance:

Financial security for family

Tax benefits under Section 80C and 10(10D)

Can include investment components (e.g., ULIPs, endowment plans)

Long-term commitment

May involve higher costs for pure protection plans

Which One Should You Choose?

It depends on your financial goals:

Choose Fixed Deposits if your priority is capital preservation and short-term financial planning.

Opt for Life Insurance if your goal is to secure your family's future and receive tax benefits.

Pro Tip: For a well-balanced financial portfolio, it's smart to include both — use fixed deposits for emergency funds and life insurance for long-term protection.

Consider Mutual Funds as an Alternative

If you're looking for better returns than fixed deposits and more flexibility than traditional life insurance plans, mutual funds can be a strong option. With Systematic Investment Plans (SIPs), you can invest regularly and build wealth over time while enjoying the benefits of market-linked growth.

Final Thoughts

Both Fixed Deposits and Life Insurance play critical roles in financial planning, but they serve different purposes. Assess your financial goals, risk appetite, and investment horizon before choosing between the two. And don’t forget to explore mutual funds for a diversified and growth-oriented approach to investing.

0 notes

Text

Mutual Funds vs. Fixed Deposits: Which is the Better Investment?

Summary:

When deciding between mutual funds and fixed deposits, the choice depends on your financial goals and risk appetite. Fixed deposits offer guaranteed returns and safety but have lower interest rates that may not always beat inflation. On the other hand, mutual funds, especially equity funds, provide higher returns over the long term but come with market risks.

Mutual funds are also more tax-efficient, offering benefits like long-term capital gains exemptions and indexation benefits, whereas FD interest is fully taxable. In terms of liquidity, mutual funds generally allow easier withdrawals, while FDs often come with penalties for premature closure.

If you prioritize stability and fixed returns, FDs are the better choice. However, if you aim for higher growth, tax benefits, and long-term wealth creation, investing in the best SIP for investment in mutual funds is the smarter move. Ultimately, the right investment depends on your risk tolerance and financial planning strategy.

When it comes to investing your hard-earned money, two of the most common options in India are mutual funds and fixed deposits (FDs). While one offers the potential for high returns, the other guarantees safety and stability. But which one is better for you? Should you choose the best mutual fund to invest in SIP, or should you stick to the safety of an FD?

The answer isn’t one-size-fits-all—it depends on your financial goals, risk appetite, and investment horizon. In this blog, we’ll break down the key differences between mutual funds and fixed deposits, helping you make an informed decision.

1. Returns: Fixed vs. Market-Linked Growth

Fixed Deposits: Safe but Limited Returns

A fixed deposit is a safe and predictable investment. You deposit a lump sum amount with a bank or financial institution for a fixed period at a predetermined interest rate. The rate is guaranteed, which means you know exactly how much you’ll earn by the end of the tenure.

However, FD rates in India have been declining over the years. Currently, most banks offer interest rates between 5% and 7% per annum, which may not always beat inflation. This means that while your money grows, its purchasing power might decrease over time.

Mutual Funds: Higher Returns with Market Risks

On the other hand, mutual funds invest in a mix of equities, debt, or a combination of both, depending on the fund type. Since mutual funds are linked to market performance, they have the potential to generate significantly higher returns compared to FDs.

For example, equity mutual funds have historically delivered returns between 10% and 15% per annum over the long term. However, these returns are not guaranteed, and they can fluctuate based on market movements.

If you’re looking for a balance of safety and returns, debt mutual funds can be a good alternative, as they invest in government securities and corporate bonds, offering returns higher than FDs but with lower risk than equity funds.

2. Risk Factor: Stability vs. Market Fluctuations

Fixed Deposits: Low Risk, Guaranteed Returns

FDs are ideal for risk-averse investors who prioritize capital protection. Your money is safe, and you’ll receive fixed returns regardless of market ups and downs.

However, the downside is that the returns are lower, and there’s a risk of losing out to inflation. If inflation is at 6% and your FD offers a 5.5% return, your real return is actually negative.

Mutual Funds: Higher Risk, Higher Reward

Mutual funds, particularly equity funds, come with market risks. Their returns depend on stock market performance, which can be volatile. However, investing for the long term reduces risk, as markets tend to grow over time.

If you’re new to mutual funds and want a stable way to enter, the best SIP for investment (Systematic Investment Plan) allows you to invest small amounts regularly, reducing the impact of market fluctuations.

3. Liquidity: Which is Easier to Withdraw?

Fixed Deposits: Lock-in Period Restrictions

FDs come with a fixed tenure, which can range from a few months to several years. While premature withdrawal is allowed, it often comes with a penalty, reducing the effective return.

Mutual Funds: Easy Withdrawals, But Watch for Exit Loads

Mutual funds generally offer higher liquidity compared to FDs. You can redeem your investment anytime, with the amount credited to your account within a few days. However, some mutual funds may charge an exit load (a small fee for early withdrawals) if you redeem too soon.

If liquidity is a priority, liquid mutual funds or debt mutual funds are good alternatives, as they allow quick withdrawals with minimal or no exit loads.

4. Taxation: Which Option is More Tax-Efficient?

Fixed Deposits: Interest is Fully Taxable

Interest earned from FDs is fully taxable as per your income tax slab. If you’re in the highest tax bracket, you could lose up to 30% of your FD earnings to taxes, making the net return even lower.

Mutual Funds: Tax-Efficient Growth

Mutual funds enjoy better tax benefits. If you invest in equity mutual funds, you pay zero tax on gains up to ₹1 lakh per year. Anything above that is taxed at 10% long-term capital gains tax (LTCG).

Debt mutual funds are taxed at 20% after indexation if held for more than three years, which still makes them more tax-efficient than FDs.

For investors looking to save on taxes, ELSS (Equity Linked Savings Scheme) mutual funds are the best option, as they offer tax deductions under Section 80C while generating high returns.

5. Who Should Choose What?

Fixed Deposits are Best for You If:

✔️ You prioritize safety and guaranteed returns over high growth. ✔️ You need to invest for a short-term goal (less than 3 years). ✔️ You don’t want to take any market-related risks.

Mutual Funds are Best for You If:

✔️ You are comfortable with some level of risk for higher returns. ✔️ You are investing for a long-term goal (5+ years). ✔️ You want a tax-efficient investment with better liquidity. ✔️ You are looking for the best SIP for investment to grow your wealth systematically.

Conclusion: Which One Wins?

There’s no single winner in the mutual funds vs. fixed deposits debate—it all depends on your financial goals and risk tolerance. If you want security and fixed returns, go for an FD. But if you’re looking for higher returns, tax benefits, and long-term wealth creation, mutual funds are the way to go.

For new investors, a great way to start is by choosing the best mutual fund to invest in SIP, which allows gradual investment with lower risks. And if you’re still unsure, consulting an asset management company in mutual funds can help you find the right investment strategy.

0 notes

Text

Top 5 Investment Plans for 5 Years: A Comprehensive Guide

Investing wisely can pave the way for financial freedom and long-term growth. For those looking to invest with a medium-term horizon, a 5-year investment plan offers an ideal balance between risk and reward. In this guide, we’ll explore the best options for a 5-year investment plan to help you achieve your financial goals.

1. Fixed Deposits (FDs)

Fixed Deposits remain one of the safest investment options. Banks and financial institutions offer fixed interest rates, ensuring guaranteed returns over the investment period.

Low Risk, Guaranteed ReturnsFixed deposits offer a fixed return on investment, typically ranging between 5% to 7%. They provide certainty and are ideal for risk-averse investors.

Flexible TenureYou can choose the tenure, ranging from a few months to 5 years. The interest is paid either monthly or at maturity, depending on the investor’s choice.

2. Public Provident Fund (PPF)

Public Provident Fund is a government-backed savings scheme. It offers tax benefits under Section 80C and guarantees safe, steady returns.

Tax-Free ReturnsOne of the biggest advantages of PPF is the tax-free interest. The interest rate usually hovers around 7%-8%, making it a reliable option for long-term wealth generation.

15-Year Lock-In Period with 5-Year WithdrawalAlthough PPF has a 15-year lock-in period, partial withdrawals are allowed after the 5th year, making it an excellent option for those planning for a 5-year investment horizon.

3. Equity Mutual Funds

For investors looking for higher returns, equity mutual funds offer an opportunity to invest in stocks and benefit from market growth. While these funds come with higher risks, the potential returns are much more significant.

Diversified PortfolioEquity mutual funds invest in a broad range of stocks, diversifying the risk. Over a 5-year period, equity mutual funds have historically provided returns ranging between 10% to 15%.

Systematic Investment Plan (SIP)Through SIPs, investors can regularly contribute a fixed amount, making it easy to invest even in small amounts. Over time, this helps mitigate market volatility.

4. National Savings Certificate (NSC)

National Savings Certificate is another government-backed investment scheme. It offers guaranteed returns and is suitable for conservative investors.

Fixed Interest RateNSC provides a fixed interest rate of around 6.8%, ensuring steady returns. The interest is compounded annually and payable at maturity.

Safe and Secure InvestmentBeing a government-backed scheme, NSC offers a secure and risk-free investment option, ideal for those who prioritize safety over returns.

5. Balanced Mutual Funds

Balanced Mutual Funds, also known as hybrid funds, invest in both equity and debt instruments. These funds aim to balance risk and reward, making them a great option for moderate-risk investors.

Equity and Debt MixBy investing in a mix of equities and fixed-income securities, balanced mutual funds offer stable returns while capitalizing on market growth.

Ideal for 5-Year HorizonThese funds typically offer returns in the range of 8% to 12%, providing a moderate-risk investment option for those with a 5-year horizon.

Conclusion

Selecting the right investment plan for a 5-year period requires careful consideration of risk appetite, financial goals, and the returns you wish to achieve. Fixed Deposits, PPF, Equity Mutual Funds, NSC, and Balanced Mutual Funds are all strong contenders, each catering to different risk profiles and objectives. Make an informed choice to ensure your money grows efficiently over the next 5 years.

0 notes

Text

Mastering Investments: A Closer Look at Step-Up SIP, SIP vs PPF, Small vs Large Cap Funds, and FD vs Life Insurance

Investing wisely is critical for securing your financial future, but with so many options, it's easy to feel overwhelmed. This guide dives deep into four powerful financial tools: Step-Up SIP, SIP vs PPF, Small vs Large Cap Funds, and FD vs Life Insurance. Understanding these tools and strategies can help you make better decisions tailored to your financial goals.

What is Step-Up SIP?

A Step-Up SIP (Systematic Investment Plan) is a variation of the traditional SIP where you can gradually increase your investment amount over time. This option is perfect for those expecting an increase in their income and want their investments to grow accordingly. It combats the risk of inflation and improves returns without making significant adjustments to your monthly budget.

For example, suppose you begin with a SIP of ₹5,000 per month and opt for a 10% annual increase. By year two, your monthly investment increases to ₹5,500, helping you accumulate more wealth over time.

Benefits of Step-Up SIP:

Gradual wealth accumulation

Flexible to income growth

Combats inflation effectively

If you’re looking for a long-term investment that adapts to your changing financial situation, Step-Up SIP could be a smart choice.

SIP vs PPF: A Comparative Analysis

SIP (Systematic Investment Plan) and PPF (Public Provident Fund) are two popular investment vehicles in India, but they serve different purposes.

SIP: Investment in mutual funds through periodic installments. Offers higher returns but comes with a certain level of risk.

PPF: A government-backed scheme with fixed interest rates and a lock-in period of 15 years. Ideal for risk-averse investors.

SIP:

Returns: Market-linked, usually higher returns over time.

Risk: Moderate to high.

Liquidity: Higher liquidity; early withdrawal allowed with a penalty.

PPF:

Returns: Fixed (current rate ~7.1%).

Risk: Zero risk (government-backed).

Liquidity: Lock-in period of 15 years; partial withdrawal allowed after six years.

Conclusion: If you prefer long-term wealth creation and can handle some risk, go for SIP. However, if safety and stable returns are your top priorities, PPF is a better option.

Small vs Large Cap Funds: Choosing the Right Fit

When deciding between Small Cap and Large Cap Funds, understanding their core differences is key.

Small Cap Funds: Invest in smaller companies with the potential for rapid growth. These funds are riskier but can offer substantial returns if the companies perform well. Ideal for aggressive investors with a high-risk appetite.

Large Cap Funds: Invest in well-established companies with stable performance records. Though the growth rate may not be as explosive, these funds are less volatile and provide steady returns, making them suitable for conservative investors.

Which Should You Choose?

If you're a risk-taker seeking high returns, Small Cap Funds might align with your investment goals. Conversely, if you prefer stability, Large Cap Funds are a safer bet. A balanced portfolio often includes both types to mitigate risk while enjoying growth opportunities.

FD vs Life Insurance: Securing Financial Stability

While Fixed Deposits (FD) and Life Insurance serve different purposes, many people still find themselves confused between the two. Here's how they stack up:

FD: A savings tool that offers guaranteed returns on a fixed interest rate over a specified period. FDs are low-risk but only focus on wealth accumulation.

Life Insurance: Provides financial protection for your loved ones in the event of your death. Some policies also include an investment component, like ULIPs (Unit Linked Insurance Plans), combining protection and wealth generation.

FD:

Returns: Fixed and guaranteed.

Risk: Extremely low risk.

Liquidity: Can break FD early with a penalty.

Life Insurance:

Coverage: Offers life cover, securing your family’s financial future.

Investment: Some policies also provide investment options like ULIPs, balancing protection with wealth generation.

Conclusion:

If your goal is to grow wealth safely, FD is a great choice. However, if your priority is family security with some potential for growth, life insurance provides a dual benefit.

Final Thoughts

Investing is not a one-size-fits-all approach. Whether it's the flexibility of Step-Up SIP, the security of PPF, the growth potential of Small Cap Funds, or the safety of FD, each option has a unique role in your financial planning. Carefully assess your risk appetite, financial goals, and investment horizon to choose the right combination for your portfolio.

By understanding and leveraging these tools effectively, you can take a significant step toward financial freedom.

0 notes

Text

Arbitrage Funds or Fixed Deposits: Which is Better?

When it comes to securing your financial future, choosing the right investment vehicle is crucial. For many investors in India, fixed deposits (FDs) have been a go-to option due to their safety and guaranteed returns. However, with the evolving financial landscape, arbitrage funds have emerged as an attractive alternative. As a Mutual Fund Fistributor in India, we aim to shed light on the benefits and drawbacks of both options to help you make an informed decision.

Understanding Arbitrage Funds and Fixed Deposits

Arbitrage Funds:

Arbitrage funds are a type of mutual fund that capitalize on price differences between the cash and derivative markets to generate returns. They buy in the cash market and sell in the futures market, aiming to profit from the price discrepancy. These funds are typically less risky compared to pure equity funds and are classified as equity funds for tax purposes.

Fixed Deposits:

Fixed deposits are a traditional investment option offered by banks and financial institutions. They provide a fixed rate of interest over a predetermined period, making them a low-risk investment. The principal amount is safe, and returns are guaranteed, which makes FDs a preferred choice for conservative investors.

Comparing Returns

Arbitrage Funds:

Arbitrage funds usually offer higher returns than fixed deposits, especially in a volatile market where price discrepancies are more frequent. While the returns are not as high as pure equity funds, they are generally better than most debt instruments.

Fixed Deposits:

FDs provide a fixed interest rate, which can range between 5-7% per annum, depending on the bank and tenure. The returns are stable and predictable, making FDs suitable for risk-averse investors.

Tax Efficiency

Arbitrage Funds:

One of the significant advantages of arbitrage funds is their tax efficiency. They are treated as equity funds for tax purposes. If held for more than one year, the gains are considered long-term capital gains (LTCG) and taxed at 10% beyond an exemption limit of ₹1 lakh. Short-term capital gains (STCG) are taxed at 15%.

Fixed Deposits:

Interest earned on fixed deposits is fully taxable as per the investor's income tax slab rate. This can significantly reduce the post-tax returns, especially for those in higher tax brackets.

Liquidity

Arbitrage Funds:

Arbitrage funds offer higher liquidity compared to FDs. Investors can redeem their units at any time, although it is advisable to hold them for at least one year to benefit from favorable tax treatment.

Fixed Deposits:

While FDs can be broken before maturity, doing so typically incurs a penalty and results in a lower interest rate. This makes FDs less liquid compared to arbitrage funds.

Risk Factors

Arbitrage Funds:

Although arbitrage funds are considered low-risk, they are not entirely risk-free. Market conditions can affect the availability of arbitrage opportunities, impacting returns. However, the risk is still lower than pure equity funds.

Fixed Deposits:

FDs are virtually risk-free as they are not affected by market fluctuations. The principal amount and interest are guaranteed, providing a high level of security for investors.

Other Alternatives

For those considering systematic investment plans (SIPs), exploring the best SIP provider is crucial to ensure consistent and efficient returns. While arbitrage funds can be a part of your SIP portfolio, it's also essential to look into other investment options like P2P lending in India and Equity basket to diversify your portfolio.

P2P Lending India:

Peer-to-peer lending is an alternative investment avenue where you can lend money directly to borrowers in return for interest. This can offer higher returns compared to traditional investments but comes with its own set of risks.

Equity All Rounder:

Investing in well-rounded equity basket that perform consistently across market conditions can provide balanced growth and stability to your portfolio.

Conclusion

In conclusion, whether arbitrage funds or fixed deposits are better for you depends on your financial goals, risk tolerance, and investment horizon. Arbitrage funds offer higher returns and tax efficiency, making them suitable for investors looking for moderate risk and better post-tax returns. On the other hand, fixed deposits provide safety and guaranteed returns, ideal for conservative investors seeking stability.

We recommend diversifying your portfolio to balance risk and reward effectively. Consult with a financial advisor to tailor an investment strategy that aligns with your specific needs and objectives.

#best mutual fund distributor#personal financial planning in jabalpur#best sip provider#mutual fund distributor in india#p2p services#mutual fund distributor india#mutual fund distributor#mutual fund expert in jabalpur#top mutual fund distributor

0 notes

Text

What is Equity Investment: Meaning, Types and How to Start

WHAT IS EQUITY INVESTING AND WHY IS IT ESSENTIAL?

Quite often it is exciting to hear stories of how certain stocks in India have multiplied manifold over the last 10-15 years. It is also interesting to see how global and Indian investors have made their fortunes in the equity markets.

Before we get into equity investment, there is an important aspect of risk-return trade-off that we must understand. Compared to bonds and FDs, equity investment is riskier and more volatile. But equities also have the potential for higher returns. The BSE Sensex, which represents 30 of the most liquid stocks on the BSE, has grown from 100 to 66,000 in the last 44 years. That is compounded annual returns of 15.9% each year over the last 44 years. It may not have happened each year, but if you had stuck on, you would have made a lot of profits. That is the core of long term investment in equities.

As the legendary mathematician, Euclid told King Ptolemy, “Your Highness, there is no royal route to geometry.” Similarly, there is no royal route to equity investing. To invest in equity calls for planning, analysis, and the willingness to stay put for the long term.

First things first: What is equity?

Equity is the risk capital for any business. When we buy equity or shares or stocks (they all mean the same), we become part owners of the company. It may be small, but it is still ownership. Returns in equity come from dividends distributed by the company and capital gains when the stock price goes above the purchase price. So, equity is ownership, and as the owner, the equity shareholder has potential to earn higher returns with a higher risk.

That brings us to the next practical question, how to invest in equity? For investing in equity in India, need to open a trading account with a broker and a demat account. Remember, trading account is for transactions and demat account is for holding the shares. Both these accounts are mandatory, as per SEBI regulations. And thanks to digital India, understanding the process of how to open demat account and trading account has become a lot quicker and simpler these days.

Types of equity investment

If you thought that opening a trading and demat account and buying shares was the only way to invest in equities, think again. Here are some other ways of participating in different types of equity shares, apart from direct investing.

A very popular way of investing in equities is the mutual funds route. You can invest in lumpsum or even monthly SIPs.

You can invest in preference shares of a company, which is between a pure equity share and a bond.

It is possible to take on higher risk and invest in private equity (PE), where you actually invest in start-ups.

You can also buy equities via index investing; through index funds and index ETFs (exchange traded funds) mirroring the market as a whole.

Why to invest in equities?

When you decide to invest in equities, your close friends and relatives may caution you about equities being risky. They are correct, to an extent. Equities entail higher risk, but do you know what is the biggest risk? It is not taking enough risk when you can afford it. It is looking beyond the risk of investing in share market.

If at the age of 25, you put all your money in bank deposits, your money may be safe, but it will yield nothing after inflation. Equities, not only beat inflation, but also create wealth in the long term. For example, by putting Rs. 5,000 a month in an equity fund giving 14% a year for 25 years, you end up with Rs. 1.36 crore on an investment of Rs. 15 lakhs. That is the power of sustained long-term investment in equities.

Key benefits of investing in equity shares

How do investors benefit by investing in equity shares? Here is a sampler.

Equities are the most reliable asset class to create wealth over 8-10 years and above.

A portfolio of 8-10 stocks can diversify risk. Alternatively, you may opt for an equity mutual fund.

Transfer of shares is simple and can be done by giving instructions online.

You can monitor the portfolio value live on your trading platform 24X7.

Equities are taxed lower compared to FDs and bonds.

How to start investing in equities?

The first step is to understand the risk and return in equities. Once you are mentally prepared for equities, the next step is to open a trading account and demat account with a broker and activate online trading.

Once you fund your trading account, you are all set to invest in equities. Don’t get carried away by tips and rumours on multi-baggers. Rely on solid research to identify quality stocks, monitor these stocks, and stick to them for the long haul. Equities manage risk and returns much better in the long run.

Risks of stock market investing

Stock market or equity investing is more volatile and unpredictable in the short term, but more consistent over the long term. Secondly, buy quality stocks or rely on the power of equity mutual funds. Thirdly, be patient with equities. Don’t expect miracles to happen. If you want instant gratification, stock market is not the place to be. Lastly, factors outside your control can often hit equities. You may have little control over what is happening in Russia or Israel. The best way to manage the risk of investing in share market is to diversify your portfolio.

Equity is not a luxury but a necessity if you want to create wealth in the long run. As Warren Buffett summed it up in his 1987 letter to shareholders: “In the short run, stock market is like voting machine, but in the long run it works like a weighing machine.”

Source: https://www.sbisecurities.in/blog/all-about-equity-investment

0 notes

Text

HATCHERY LORE

[center][b][font=Engravers MT][size=7]Boutique lore![/size][/b][/font][/center] [columns][img]https://static.wikia.nocookie.net/flightrising/images/f/fd/Region_Light.png[/img][nextcol]It was a warm summer evening, nearing sunset, when Berlie found himself roaming the Sunbeam Ruins. He was on a voyage, traveling the lands in hopes of taking the first steps towards finally achieving a dream he'd had since childhood: owning and running a boba shop! The ruins had been the target destination for his voyage ever since hearing how busy and bustling the area got during the summer, especially on the day of the summer solstice. It would be an amazing area for business and he would be able to conduct research on the dragons that passed through his shop, getting to learn more about them and their customs. Since he was a boy, Berlie had always had a fascination for researching dragons, the different breeds, and how customs varied between them. He'd also always loved drinking, making, and experimenting with boba, so why not put himself in a position where he could do it all? [/columns]

[center][img]https://i.imgur.com/cP69oES.png[/img][/center]

[columns]

Noticing that sunset would be upon him in a matter of minutes, Berlie decided to make his way towards the Mirrorlight Promenade. He'd heard stories of how beautiful it was at sunrise and sunset and wanted to experience it for himself. As Berlie sat, boba in hand, watching the sunset and all the reflections and refractions of the Promenade, he thought he noticed something moving in the corner of his vision. The creatures in this area weren't known to be hostile towards humans, so what's the worst that could happen, right? Before much deliberation could occur, his curiosity took over and he decided to investigate. As he inched closer, Berlie noticed the tip of a clay-colored tail covered in taupe fur, with the rest of the creature hidden behind a column within the ruins. [nextcol][img]https://static.wikia.nocookie.net/flightrising/images/5/55/Mirrorlight_Promenade.png[/img] [/columns] [center] [img]https://i.imgur.com/cP69oES.png[/img][/center]

[columns]

[img]https://www1.flightrising.com/dgen/preview/dragon?age=0&body=106&bodygene=162&breed=22&element=3&eyetype=2&gender=0&tert=110&tertgene=140&winggene=163&wings=95&auth=53e6462899e6e83c8b36d7bd2d14eb6692715e97&dummyext=prev.png[/img][nextcol]

He recognized the tail structure almost immediately. He'd done extensive research on the breed and it happened to be his favorite of the ancients. As he knew that Aethers were the more curious and experimental breed of the bunch, he figured he could lure it out with his boba. So, he placed it near the column and began his wait. Just as he suspected, it didn't take very long. Only seconds later, the furry head of a hatchling Aether emerged from behind the column. Berlie had never seen one in person, and anyone who could see him would be able to tell just from his expression. Berlie was in awe. The dragon looked just as it had in the textbooks, albeit slightly larger than the pages made it seem. The hatchling inched closer to the cup of boba, just as awe-stricken at the sight of Berlie and the unknown substance. The hatchling cautiously craned its head toward the straw and took a sip. [/columns]

[center] [img]https://i.imgur.com/cP69oES.png[/img][/center]

[columns]

It was obvious that the hatchling enjoyed his first experience with what Berlie thought to be the best drink in existence. After taking his initial sip, the Aether looked up at Berlie for no more than three seconds before returning to the drink and finishing the entire thing. Although the last of Berlie's boba was just stolen, he knew it was worth it for the opportunity to witness something this extraordinary. The Aether drank the boba with no knowledge of what it was or what it could do to him, a risk that Berlie was convinced no other breed would have thought to take. Berlie thought Sagittarius would be a fitting name for such an adventurous creature. After asking the Aether and receiving what Berlie interpreted as a yip of approval, it was settled. From then on, Sagittarius followed Berlie wherever he went. Whether it was for the companionship or the boba, Berlie didn't know, but either way there were no complaints on his part. Berlie decided that it would be a good idea to open his boba shop within the ruins, with Sagittarius as his co-founder. From that day on, Berlie and Sagittarius were the best of friends and spent their time creating and experimenting with new and crazy flavors of boba, selling it to the dragons that passed through, and becoming popular among those in the area. Berlie was able to follow his dream of making boba and researching dragons, and better yet, he got to do it with an amazing companion![nextcol][center][url=https://www1.flightrising.com/forums/baz/3269223][img]https://64.media.tumblr.com/f89ca9c30fb6f48570340dcd24f0e7e8/b4f70577925c1ea7-0a/s250x400/62ba70e43f2000fdf9cb0c6041e46f1b0cc5ff17.png[/img][/url][/center][/columns]

0 notes

Text

Overcoming Common Challenges in Wealth Creation Planning

Let’s face it—wealth creation planning sounds simple in theory: save more, invest smartly, and watch your money grow. But in real life? Not so easy. From rising expenses to emotional spending, the road is full of potholes that slow or even derail progress.

Whether you're starting from scratch or trying to restructure your finances post-pandemic, overcoming these hurdles is possible—with the right strategies. Let’s unpack the most common challenges in wealth creation planning and how to handle them with confidence.

1. Inconsistent Savings = Missed Opportunities

A major barrier in wealth creation planning is irregular saving habits. People often wait until the month ends to save “whatever is left.” Spoiler: It rarely works.

Solution: Automate your savings. Set up a monthly SIP or recurring deposit. Pay yourself first—before spending on anything else.

2. Lack of Financial Literacy

Many people still rely on outdated or hearsay financial advice. This lack of education is one of the biggest blocks to overcoming financial hurdles.

Solution: Follow credible personal finance sources, attend webinars, or consult a wealth management company. Learning the basics of investing and budgeting goes a long way in building confidence.

3. One Basket, All the Eggs

Investing all your money in one asset class—like only real estate or FDs—limits your growth potential and increases risk.

Solution: Diversify smartly. A healthy mix of equity, debt, gold, and even global assets makes your wealth creation strategies more resilient.

4. Emotional and Impulsive Investing

Reacting to news, trends, or peer pressure can lead to impulsive decisions, derailing your progress.

Solution: Stick to your financial goals. If the stock market dips, review your plan but don’t panic. Regularly scheduled check-ins (quarterly or yearly) work better than daily monitoring.

5. No Emergency or Risk Management Plan

Unexpected health issues or job loss can instantly wipe out savings if not planned for. This is a massive gap in most people’s wealth creation planning.

Solution: Build an emergency fund equal to at least 3–6 months of expenses. Add term and health insurance to your risk management arsenal.

6. No Plan, Just Hope

Wishing for financial independence without a roadmap won’t help you grow your wealth. Yet, most people don’t track where their money is going or set long-term goals.

Solution: Create a written financial plan with short-term, mid-term, and long-term targets. It keeps you focused, motivated, and prepared for detours.

What are the top challenges in wealth creation planning?

The main challenges include inconsistent savings, lack of financial literacy, poor diversification, emotional investing, and no risk management. Tackling these with structured strategies and expert advice ensures long-term wealth growth.

FAQs

1. What’s the ideal age to start wealth creation planning? You can start as early as your 20s. The earlier you begin, the more time your investments have to grow through compounding, even with small monthly contributions.

2. Can I do wealth creation planning without hiring a financial advisor? Yes, but only if you’re confident about your financial knowledge. Otherwise, a professional can help you avoid costly mistakes and accelerate results.

3. How do I protect my wealth from inflation? Investing in asset classes like equity, mutual funds, and inflation-indexed bonds can help outpace inflation and maintain your purchasing power.

4. What’s the difference between saving and investing? Saving is about parking your money in low-risk instruments for short-term goals. Investing is using money to earn returns over time for long-term growth.

5. Why do most people fail to follow through on their financial plans? Because they lack consistency, accountability, and updates. That’s why having periodic reviews or an advisor is key to sticking with your wealth creation strategy.

#wealth creation planning#overcoming financial hurdles#grow your wealth#wealth creation strategies#wealth management company

0 notes

Text

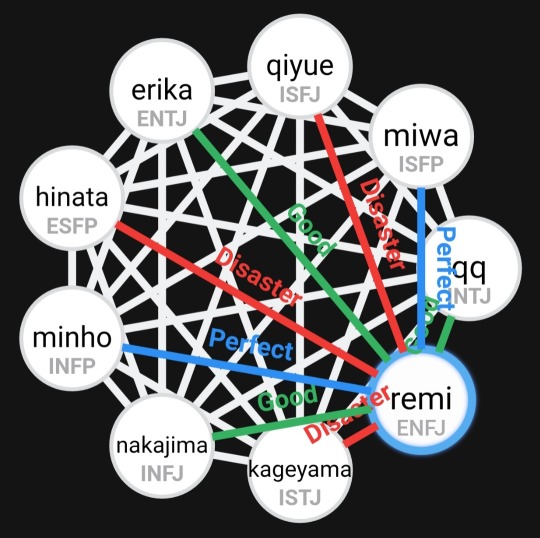

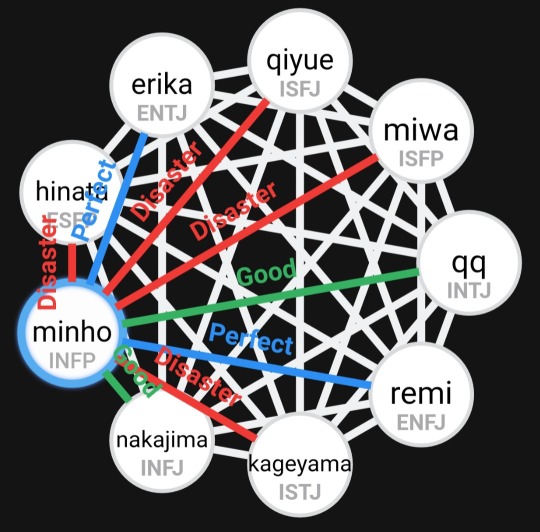

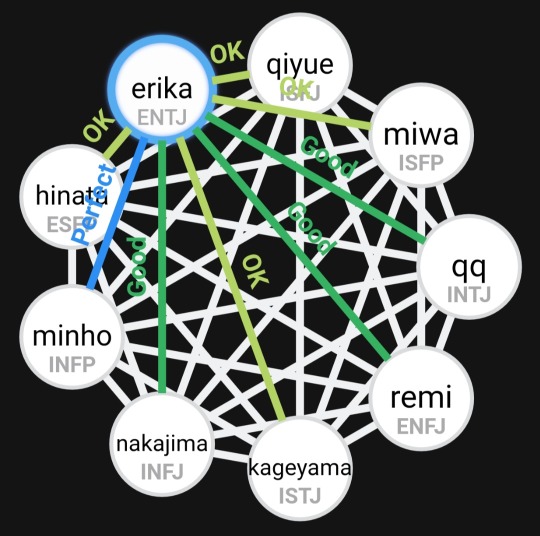

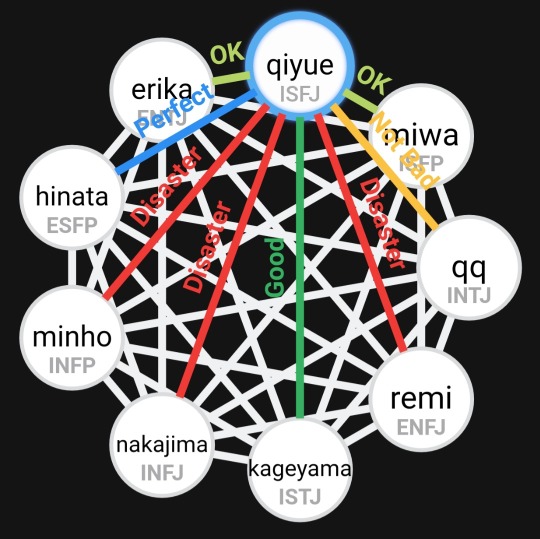

fd&l — mbti compatibility

so while perusing through my homepage on tumblr, i stumbled across this link to see how compatible you are with other mbti types so i thought it would be cool to put the gang into the system to see what they're compatibility is like (i keyed quqi in as qq cuz... i literally based her off me... but anYWAY let's get into it!) so here are the results!

warning: contains spoilers from the story!

— quqi and everyone else

quqi is the most compatible with minho (along with remi, nakajima, and erika) and... huh. that's interesting. they will be the kind to sit down together at a cat café, sip tea, and watch everyone else is trying to get a cat in their arms.

quqi is also the most compatible with erika and that gets me wondering, how would they act if the kageyama love triangle thing was out of the window? they would definitely be the most toxic bunch to hang around and will make you cry with the sharpest words AHAHAHA they'd make a great villain duo, honestly.

not forgetting remi and nakajima in the lineup! it's already canon that they get along well and are the strongest power trio in the entire series. we stan!

— remi and everyone else

remi and minho confirmed as a perfect match? HELL YEAH. 100% soulmates right there, we love to see it!

the fact that she'd make disatrous matches with kageyama, hinata, and qiyue tho... much to think about... considering how she's fooling around with hinata most of the time, it really makes you wonder...

also in an alternate universe, remi would be miwa's girlfriend and they would be dating. iconic fashion duo. i will not be accepting any other arguments, case closed. they're also super compatible because these two are literally the ones playing cupid. they will legit coordinate dates for them and everything and be the hypest wingwomen you'll ever meet omg.

— kageyama and everyone else

kageyama and hinata being a perfect match? wbk besties! they're powerful both on- and off-court, who else can compare to them?

i love how kageyama and nakajima would be a disaster together AHAHAHA THE SITE HAS SPOKEN. THEY REALLY CANNOT GET ALONG. they're 100% the type to fight like how suho and seojun do in the kdrama adaptation AHAHAHA

kageyama would be terrible with minho for many reasons. minho is too soft spoken and thinks differently from kageyama. they wouldn't be able to compromise and would be trying their best but failing to come up with a solution that satisfies both parties that even minho's given up.

— nakajima and everyone else

as for nakajima having either good matches or disaster pairings... no words... truly scary HAHAHA there's literally no inbetween. though the pairing between him and erika makes a lot of sense because they used to date. also he and remi are iconic, they're always saving quqi's ass from something, anything. she could be lost down the street and their senses would be tingling like "this dumb kid is lost AGAIN" but they will find her and pick her up with lots of love and listen to her ramble about how she thinks her gps is broken <33

— minho and everyone else

minho and hinata being a horrible match is really funny because hinata, with his high energy, would tire minho out. minho would rather sit down and relax with a nice cup of coffee but hinata would run to the nearest amusement park and ride everything and won't go home until he's done so. please don't let them go on a date together, minho will call it quits within an hour <//3

MINHO AND QIYUE BEING INCOMPATIBLE IS ACCURATE because they will never see eye-to-eye on things. they're constantly at each other's necks (not physically but via words yk) and remi and quqi will have to step in to separate the both of them. i literally wrote a bonus oneshot which features their dynamic but it's to be posted after the series is completed so you guys will have to wait :")

— hinata and everyone else

hinata and qiyue being a perfect match is pretty spot-on because they annoy the hell out of kageyama and quqi together. if the lovebirds were on a date, they're most likely to third wheel and make comments of how they shouldn't do any pda and make anyone else feel so single (cue kageyama smacking hinata and telling him to shut up).

— erika and everyone else

erika and minho's match makes me laugh so hard cuz idk i really can't see them being together. hm, maybe it's actually possible. since minho is very shy and quiet, erika can be the one doing all of the talking and rescuing him out from difficult situations.

— qiyue and everyone else (i've expanded on most of her relationships already)

— miwa and everyone else (i've expanded on most of her relationships already)

CONCLUSION: erika won this post. this wasn't a competition, but she ended up winning. she only has perfect, good, and okay matches (not even a single 'not bad' match is seen). which makes sense since she's the most outgoing character in the series (hinata is a close second, followed by remi), so she would be pretty friendly with the entire gang. n e wAYS, that's all for today's ramble hehe remember to tune in next time!

bonus: the extroverts (remi, hinata, and erika (should atsumu (entp) be added into this friend group??? there's not really much interaction between him and anyone outside of the volleyball club since they barely meet unless they end up eating lunch together by coincidence so...)) hang out together in an alternate universe whereby there's no drama, and they're best buddies. they enjoy frequenting arcades and they're surprisingly really good at the games that most people think that they have somehow found a way to cheat the system.

0 notes

Text

The Difference Between Fixed and Mutual Funds

Topic of discussion is fixed deposit vs mutual fund. We see the older generation always asking the younger generation to put their money in a fixed deposit in a bank because they seem safe whereas investing in a mutual fund or stock market sounds risky. Explaining the depths in detail the Mutual Fund SIP Advisor has briefly discussed the differences between both. Also, the Mutual Fund SIP Advisor has provided clear definitions with the probability of risks involved in the subjects. Giving clear and up to the mark information, one must go to the Mutual Fund Sip Advisor for any doubt or query.

Now the question must arise in the minds of the reader that what is exactly risky. The probability of losing money is higher in the stock market with respect to banks hence it is risky. But the bigger fact is the interest rates given by the banks are always less than the inflation rates which in reality means that people lose money by keeping their money in banks with respect to earning the so called interest over it and locking the money for such a big amount of time.

Let us get clear on definitions first:

What are Fixed Deposits?

·In fixed deposits, there is no pooling of money by a group of investors. Instead, as the name suggests, it involves generating interest by keeping a sum of money fixed for a certain period or tenor.·This tenor usually ranges from one year to five years.

·Fixed deposits are beneficial as the rate of interest paid is higher than that of a savings account.

·This interest, combined with the principal, is returned to you at the maturity period.

·You can invest as little as Rs.25, 000 in a fixed deposit with minimal documentation.

What are Mutual Funds?

·A mutual fund is where many investors come together with a common goal of increasing their money.

·Investment is made in equities, bonds, money market instruments and/or other securities.

·The income earned through these investments is then equally distributed among the investors. This is done after deducting the expenses incurred.

In a nutshell, after giving the data important for the investor of either FD inclination or MF inclination, one thing is sure shot, one must be investing in order to stay financially healthy. Now as for where to go, then the choice is yours, you know the best. Choose your future wisely by considering all the facts and hence, take a long-term decision.

Investors who put their money in safe bets such as bank fixed deposits and gold saw better returns than mutual funds, equity and real estate investors in 2018. A one-year bank fixed deposit (FD) earned a return upwards of 6.5 per cent along with capital safety, whereas gold gave a return of 7.1 per cent in 2018.

However, before the end I need to write this last statement, which is always true.

Mutual Fund investments will be subject to market risks. Any mutual fund listed in the document does not guarantee fund performance or its underlying creditworthiness. Do read the mutual fund document thoroughly before investing. Specific investment needs and other factors have to be taken into account while designing a mutual fund portfolio.

0 notes

Text

Smart Investment Strategies: Understanding Step-up SIP, SIP vs PPF, FD vs Life Insurance, and Small vs Large Cap Funds

Investing is an essential part of wealth creation and financial security. However, with countless investment options available, choosing the right one can be daunting. Whether you’re looking for consistent returns, tax benefits, or long-term growth, understanding the differences between various investment vehicles can help you make informed decisions. In this blog, we’ll explore four key investment options: Step-up SIP, SIP vs PPF, FD vs Life Insurance, and Small vs Large Caps Funds. By the end, you’ll have a clearer understanding of which strategy aligns with your financial goals.

What is Step-up SIP?

A Systematic Investment Plan (SIP) allows investors to regularly invest a fixed sum into mutual funds, which enables disciplined investing. However, a Step-up SIP, also known as a Top-up SIP, takes it a step further by allowing investors to gradually increase their investment amount at predefined intervals. This unique feature helps combat inflation and increases returns over time.

Benefits of Step-up SIP:

Beat Inflation: As living expenses rise, increasing your SIP contributions can help keep your investments ahead of inflation.

Enhance Returns: By increasing your investment regularly, you take advantage of the power of compounding, ultimately maximizing your returns.

Affordability: Since Step-up SIPs allow you to start with a smaller amount and gradually increase it, they are a great option for those just beginning their financial journey.

Step-up SIPs are ideal for investors who anticipate higher income in the future and want to align their investments with their rising earnings. If your goal is long-term wealth accumulation, Step-up SIP can be an effective tool to ensure steady growth.

SIP vs PPF: Which One is Better?

When it comes to choosing between SIP and Public Provident Fund (PPF), both have their unique benefits and cater to different investor profiles. Let’s break down the comparison:

Systematic Investment Plan (SIP):

Market-linked returns: SIPs are primarily linked to equity or debt mutual funds, and the returns are subject to market performance. While this makes SIPs riskier, they also have the potential for higher returns.

Liquidity: SIP investments in equity mutual funds are more liquid compared to PPF. You can redeem your funds whenever needed.

Taxation: SIP investments in Equity Linked Savings Schemes (ELSS) offer tax benefits under Section 80C of the Income Tax Act. However, the returns are taxable.

Public Provident Fund (PPF):

Guaranteed returns: PPF offers a fixed interest rate determined by the government. This makes it a safer investment with guaranteed returns.

Tax benefits: Investments in PPF are eligible for deductions under Section 80C, and the returns are tax-free.

Lock-in period: PPF has a 15-year lock-in period, which means you cannot easily access the funds in the short term.

Verdict: If you’re risk-averse and prefer guaranteed returns with tax benefits, PPF is the safer bet. However, for long-term growth and higher potential returns, SIP is a better option, particularly if you’re comfortable with market volatility.

FD vs Life Insurance: Understanding the Difference

Fixed Deposits (FD) and Life Insurance serve entirely different purposes. Let’s explore their distinctions:

Fixed Deposits (FD):

Safety: FD is a low-risk investment option provided by banks. It offers guaranteed returns on a fixed sum over a specific period.

Returns: The interest rate on FD is fixed and does not fluctuate with the market. Typically, the returns range between 5-7% annually.

Taxation: The interest earned from FD is fully taxable.

Liquidity: FDs can be broken before maturity, but penalties may apply.

Life Insurance:

Purpose: Life insurance primarily provides financial security to your dependents in the event of your untimely death. It should not be considered an investment in the traditional sense.

Returns: Unlike FDs, life insurance policies offer a combination of life coverage and returns, especially in endowment or Unit Linked Insurance Plans (ULIPs). However, the returns are generally lower than other investment options.

Tax benefits: Premiums paid towards life insurance are eligible for tax deductions under Section 80C, and the death benefit is tax-free.

Verdict: FDs are designed for short-term investment with guaranteed returns, while life insurance provides long-term financial security. If you’re looking for safety and liquidity, go with an FD. If protecting your family is a priority, life insurance is crucial.

Small vs Large Cap Funds: Where to Invest?

Mutual funds can be categorized based on the market capitalization of the companies they invest in, leading to two popular categories: small-cap and large-cap funds.

Small Cap Funds:

High Risk, High Reward: Small-cap funds invest in smaller companies with high growth potential. While these funds can generate significant returns, they also carry higher risk due to market volatility.

Volatility: Small-cap funds are more susceptible to market fluctuations, making them suitable for aggressive investors with a high-risk tolerance.

Large Cap Funds:

Stability: Large-cap funds invest in well-established, large companies with stable performance records. These companies are often market leaders and provide relatively stable returns with lower risk.

Lower Returns: While large-cap funds are safer, their returns may not be as high as small-cap funds in a bull market.

Verdict: Your choice between small and large-cap funds depends on your risk appetite. If you’re seeking stability and steady returns, large-cap funds are ideal. On the other hand, if you’re willing to take on more risk for potentially higher gains, small-cap funds are a better choice.

Conclusion

Choosing the right investment strategy depends on your financial goals, risk tolerance, and time horizon. Whether you’re opting for Step-up SIP to enhance your wealth over time, comparing SIP vs PPF for long-term savings, deciding between FD vs Life Insurance for safety and protection, or analyzing Small vs Large Cap Funds for growth, understanding these options can empower you to make smarter financial decisions. Diversification across these investment vehicles may also help in balancing risk and reward, creating a more resilient financial portfolio for the future.

0 notes

Text

Arbitrage Funds or Fixed Deposits: Which is Better?

When it comes to securing your financial future, choosing the right investment vehicle is crucial. For many investors in India, fixed deposits (FDs) have been a go-to option due to their safety and guaranteed returns. However, with the evolving financial landscape, arbitrage funds have emerged as an attractive alternative. As a Mutual Fund Fistributor in India, we aim to shed light on the benefits and drawbacks of both options to help you make an informed decision.

Understanding Arbitrage Funds and Fixed Deposits

Arbitrage Funds:

Arbitrage funds are a type of mutual fund that capitalize on price differences between the cash and derivative markets to generate returns. They buy in the cash market and sell in the futures market, aiming to profit from the price discrepancy. These funds are typically less risky compared to pure equity funds and are classified as equity funds for tax purposes.

Fixed Deposits:

Fixed deposits are a traditional investment option offered by banks and financial institutions. They provide a fixed rate of interest over a predetermined period, making them a low-risk investment. The principal amount is safe, and returns are guaranteed, which makes FDs a preferred choice for conservative investors.

Comparing Returns

Arbitrage Funds:

Arbitrage funds usually offer higher returns than fixed deposits, especially in a volatile market where price discrepancies are more frequent. While the returns are not as high as pure equity funds, they are generally better than most debt instruments.

Fixed Deposits:

FDs provide a fixed interest rate, which can range between 5-7% per annum, depending on the bank and tenure. The returns are stable and predictable, making FDs suitable for risk-averse investors.

Tax Efficiency

Arbitrage Funds:

One of the significant advantages of arbitrage funds is their tax efficiency. They are treated as equity funds for tax purposes. If held for more than one year, the gains are considered long-term capital gains (LTCG) and taxed at 10% beyond an exemption limit of ₹1 lakh. Short-term capital gains (STCG) are taxed at 15%.

Fixed Deposits:

Interest earned on fixed deposits is fully taxable as per the investor's income tax slab rate. This can significantly reduce the post-tax returns, especially for those in higher tax brackets.

Liquidity

Arbitrage Funds:

Arbitrage funds offer higher liquidity compared to FDs. Investors can redeem their units at any time, although it is advisable to hold them for at least one year to benefit from favorable tax treatment.

Fixed Deposits:

While FDs can be broken before maturity, doing so typically incurs a penalty and results in a lower interest rate. This makes FDs less liquid compared to arbitrage funds.

Risk Factors

Arbitrage Funds:

Although arbitrage funds are considered low-risk, they are not entirely risk-free. Market conditions can affect the availability of arbitrage opportunities, impacting returns. However, the risk is still lower than pure equity funds.

Fixed Deposits:

FDs are virtually risk-free as they are not affected by market fluctuations. The principal amount and interest are guaranteed, providing a high level of security for investors.

Other Alternatives

For those considering systematic investment plans (SIPs), exploring the best SIP provider is crucial to ensure consistent and efficient returns. While arbitrage funds can be a part of your SIP portfolio, it's also essential to look into other investment options like P2P lending in India and Equity basket to diversify your portfolio.

P2P Lending India:

Peer-to-peer lending is an alternative investment avenue where you can lend money directly to borrowers in return for interest. This can offer higher returns compared to traditional investments but comes with its own set of risks.

Equity All Rounder:

Investing in well-rounded equity basket that perform consistently across market conditions can provide balanced growth and stability to your portfolio.

Conclusion

In conclusion, whether arbitrage funds or fixed deposits are better for you depends on your financial goals, risk tolerance, and investment horizon. Arbitrage funds offer higher returns and tax efficiency, making them suitable for investors looking for moderate risk and better post-tax returns. On the other hand, fixed deposits provide safety and guaranteed returns, ideal for conservative investors seeking stability.

We recommend diversifying your portfolio to balance risk and reward effectively. Consult with a financial advisor to tailor an investment strategy that aligns with your specific needs and objectives.

#best mutual fund distributor#personal financial planning in jabalpur#best sip provider#mutual fund distributor in india#p2p services#mutual fund distributor india#mutual fund distributor#mutual fund expert in jabalpur#top mutual fund distributor

0 notes

Text

How to invest money in your 20s in India

1. Mutual Funds

Mutual Funds are money that is pooled together by many investors and managed professionally by a fund manager. It's a trust that collects money on behalf of investors who share a common investment goal. The money can be invested in equities or bonds, as well as other financial instruments. Each investor owns a percentage of the fund's total assets.

Mutual funds can be a great investment option for early-stage investors, as they are easy and affordable to research and purchase. Most mutual funds require a minimum lump-sum investment of Rs. 1000 to Rs. Investors can invest as little as Rs. These funds allow investors to start a SIP for as low as Rs.100 each month. High-risk Mutual funds can offer annualized returns up to 30-35%. Section 80C allows mutual funds to be exempt from tax.

These are the top Mutual Funds that you can invest in.

ICICI Prudential Focused Bluechip Equity Fund

Aditya Birla Sun Life Small & Midcap Fund

Tata Equity PE Fund

HDFC Monthly Income Plan- MTP

L&T Tax Advantage Fund

2. Life Insurance Policies

The younger and more healthy you are, the less expensive life insurance will be. Because you get older, your chances of developing health problems that can increase the cost or make you uninsurable are higher. Life insurance policies are essential in your 20s.

Life insurance can be a smart financial decision. It provides a safety net for your loved one and beneficiaries in the event of your death. Your family might be dependent on your income, and you may have large educational loan debts. Your premium will not change if you purchase a policy for more than 30 years when you are still in your 20s. If you wait 15 years, your premium will increase. It is a good idea to buy insurance policies as soon as possible. You should have the following insurance plans in your portfolio:

Life insurance

Health Insurance

Personal accident/Disability coverage

Financial experts recommend against investing in Life Insurance policies as they have had poor returns.

3. Shares/ETFs

Simply put, investing in shares is like investing in businesses. You buy shares in a company and invest your money in its business. In return, the company pays dividends. Your investment in the company will increase as the company performs well.

Your 20s is a great age to learn about the share market and how you can invest in shares of different companies. Although the stock market can be volatile, it is crucial to identify the best companies to invest in. This is done by performing fundamental analysis as well as technical analysis of the company’s share price over time.

The right company can be very profitable over the long-term if you invest in it. For example, if 1 Lakh INR was invested in HAVELLS shares back in 2005, it would have grown 100x to 1 Crore by 2021. This is why it's important to invest in the right stocks in order to get more returns.

ETFs, also known as Exchange Traded Funds, are security products that track an Index sector or commodity. However, they can be bought or sold on the same stock exchange as regular stocks. NIFTY 50, a benchmark Indian stock exchange index, is the weighted average 50 largest Indian companies that are listed on the National Stock Exchange. These indexes can be invested in just like shares of any other company. Indexes are used to measure the performance of a particular sector, commodity, or asset and therefore are less risky than investing in shares.

4. Purchasing a House/ Investing in Real Estate

Buying a house is probably the biggest life goal for Indians between the ages group 22 to 45. A 2019 survey by Aspiration Index found that Indians aged 22 to 45 consider buying a house and saving money for their children's education to be the top long-term goals. A house is a good investment choice. A home is the most tangible asset that you can invest in, given India's obsession with tangible assets. Owning a home has the obvious financial advantage of price appreciation, which builds home equity. A home purchase can also bring tax benefits. Section 24 of the I-T Act allows interest deductions up to Rs 2 Lakh, which includes 1/5th interest earned during construction.

Although buying a home in your early years of working life can seem overwhelming, as you may not have sufficient capital to make a downpayment on a house during this time, it is possible to save enough money in your late 20s and start saving up for the down payment so that you can consider purchasing a house.

5. Fixed Deposits (FDs) and Recurring Deposits

Fixed deposits are a great way to increase savings while maintaining maximum safety. You can make a lump sum deposit with your bank/financier, and then choose the tenure that suits you best. The tenure ends and the deposit earns interest for the duration of the term at the rate you have set.

Like an emergency fund, it is always a good idea to have a short-term savings plan. You can keep an RD for 6 months to one year, which will ensure you have enough cash on hand. Many banks offer interest rates between 6% and 7%.

If you are looking for low-risk investment options that offer both security and liquidity, FDs or RDs can be a good option. You can begin investing in these instruments as early as your 20s.

6. Investing in Precious metals – Gold/Silver