#edinburgh icons

Text

#edinburgh#edinburgh Scotland#dean village#vscocam#finally got the iconic shot#travel#Scotland#moody#mine

1K notes

·

View notes

Text

Edinburgh (5/26)

x

#harry styles#hslot#edinburgh#harry icons#harry layouts#icons harry styles#harry styles packs#harry lockscreen#harry gif#harry styles wallpaper#layout harry styles#harry styles pictures#harry styles icons#gif harry styles#harry styles lockscreen#lockscreens#love on tour

275 notes

·

View notes

Text

Kam said “Bolt ya rocket” during WANGBT 😂💀

It means “f**k off” or “go away”

#HE IS ICONIC#taylor swift#the eras tour#red#we are never ever getting back together#eras tour#the eras tour edinburgh

18 notes

·

View notes

Text

october 30, 2023 — colton hill, edinburgh

#lily evans and brianna fraser my style icons rn#redhead#autumn#fall#dark academia#light academia#autumn fashion#style#mine#face#shout out to my friend for taking these amazing photos of me#photography#edinburgh#colton hill#scotland#studyblr#study abroad#lily potter

11 notes

·

View notes

Text

February 1965

Queen Elizabeth II, accompanied by the Duke of Edinburgh, during their visit to Ethiopia and Sudan

#such great photos#what an icon she was#how i miss her smile#😭#and what an iconic couple they were#legends#queen elizabeth ii#prince philip#duke of edinburgh#philibet

31 notes

·

View notes

Text

1987 | Prince Edward, the now Duke of Edinburgh, talking to Cliff Richard at It's A Royal Knockout event.

by Mirrorpix

7 notes

·

View notes

Text

Anne’s fashion that I’d wear, Part 1/?

The things I’d do to have a look through Anne’s clothing archive 😭😭🥰

#I’d wear every single piece from these photos#fashion icon#70s fashion has me in a chokehold#they don’t make clothes like these anymore#she's so beautiful#pretty princess#i’m on the hunt for a long wool coat but I’m unsuccessful so far#princess anne#princess royal#tim laurence#timothy laurence#prince philip#duke of edinburgh

7 notes

·

View notes

Text

Ewan McGregor and Kelly Macdonald in "Trainspotting"(1996)

Renton, deeply immersed in the Edinburgh drug scene, tries to clean up and get out, despite the allure of the drugs and influence of friends.

#Ewan McGregor#Kelly Macdonald#Trainspotting#1996#film#movie#Edinburgh#Scotalnd#British cinema#90s#low life#iconic film#Renton#Diane#drug culture#cult classic#based on a novel#crime#drama#friends#friendships#relationships#just rewatched

3 notes

·

View notes

Text

Ooh! A wonderful interview with Rich Keeble who played Mr. Arnold (the one with the Doctor Who Annual :)) in S2! :)❤

Q: In Good Omens 2 you play Mr. Arnold, who runs the music shop on Whickber Street. Were you a fan of Good Omens before joining the cast, and is it challenging to take on such an iconic story which is already loved by a huge fanbase?

A: “There’s always pressure if you’re working on something with an existing fanbase and people might have an idea already as to how you should be approaching something. To be honest I was aware of the show but I hadn’t actually seen it before I was asked to get involved. I knew it was something special though! I remember talking to Tim Downie [Mr. Brown] about how when you tape for certain things you know if something’s a “good one”. Of course by the time I was on set I’d watched Season 1 and read the book.

I had an interesting route into the show actually: I was asked at the last minute to read the stage directions at the tableread on Zoom, and Douglas [Mackinnon] the director called me up to discuss pronunciations of the character names etc. To prepare further I quickly watched the first episode on Prime Video, and I was very quickly drawn into it. A couple of hours later I was on a Zoom call with David [Tennant], Michael [Sheen] (with his bleached hair), Neil [Gaiman], Douglas and the whole team, including Suzanne [Smith] and Glenda [Mariani] in casting. After that readthrough I asked my agent to try and see if she could shoehorn me in and she came back with a tape for Mr. Arnold saying “you play the piano don’t you…?” They wanted me to demonstrate my musical playing ability, so I rented a rehearsal studio room in Brixton for an hour and filmed myself playing piano (and drums just in case), then I did my scenes a couple of different ways and I guess it wasn’t too terrible!”

Q: During episode five you mimed to music written by series composer David Arnold alongside a real string quartet – this must have been very immersive! How did it feel to work with David, and bring the ball to life?

A: “I actually didn’t meet David Arnold sadly, but I did work with Catherine Grimes, the music supervisor who is lovely. David was at the London screening but I missed an opportunity to go and say hello to him which I kicked myself about.

I remember before I was in Scotland there was a bit of uncertainty as to whether I would need to play anything for real or not, so I practised every day playing loads of Bach and other music I thought was era-appropriate just in case they asked me to do anything on the fly. So yes, it was very immersive as you say! They sent me three pieces of music to learn which I practised in my Edinburgh apartment on a portable folding keyboard thing I bought. They introduced me to the string quartet (John, Sarah, Alison and Stephanie) and I tried to hang out with them when I could. On the day we all had earpieces to mime to. I had to mime while listening out for a cue from Nina [Sosanya] from across the room, then deliver my dialogue and carry on playing, which was tricky! The quartet and I helped each other out actually: Douglas would say something like “let’s go from a minute into the second piece of music”, I’d look at the sheet music and whisper “where the hell is that?” and one of the quartet would say “we think that’s bar 90” or something. Here’s a little bit of trivia: the shooting overran and the string quartet couldn’t make the last day, so they found some incredible lookalikes to replace them for the scene when we get lead out of the bookshop through all the demons, although I think they also kept them deliberately off camera.”

Q: What did you think of your music shop when you first saw the set? Did you have a favourite poster or prop?

A: “I thought it was incredible! It could’ve been an actual music shop with all the instruments hanging up with the “Arnold’s” price tags on. The attention to detail was incredible, well IS incredible as I understand it’s all still there. It’s hard to pick a favourite to be honest. I did a little video walkaround on my phone at the time so maybe I’ll post that if I won’t get in trouble. Interestingly the shop interior itself was elsewhere on the set to the shop entrance you see from the street. You walk out of Aziraphale’s shop, over the road, through the door of the music shop and… there’s nothing.”

Q: Mr. Arnold is tempted into the ball by a Doctor Who Annual and is playing the theme in the music shop scene – are you a fan of Doctor Who in real life? And what was it like making those jokes and references in front of the Tenth Doctor David Tennant?

A: “I’ve always dipped in and out of Doctor Who over the years since Sylvestor McCoy, who was doing it when I first became aware of it when I was growing up. Even if you’re not a fan it’s one of those shows you can’t really get away from, so doing that particular scene in front of David was really fun, and of course Douglas had directed Doctor Who as well. Apart from the amusing situation of two supposed Doctor Who fans talking about Doctor Who without realising they’re in the company of a Doctor Who, I also seem to remember Michael being the one to suggest that he would deliver his “due to problems at the BBC” line directly to David.

Oh, and I think it was actually my idea to grab the annual off the harpsichord before joining the queue behind Crowley at the end of the ballroom scene (which we’d shot weeks earlier at this point). When we were blocking it out and rehearsing I knew I had to leave my position and get to the front for my “surrender the angle” line, and then later it just felt like I wouldn’t leave without the annual so I ran back through everyone to grab it. Nobody seemed to have a problem with me doing that so I just carried on doing it when we shot it! I do remember it being a fun set with Douglas and the team being very open to suggestions.”

Q: How did you balance filming both Good Omens and BBC Ghosts at the same time?

A: “Luckily both shows were a joy to work on, and everyone seems to know about both of them. We were shooting them in early 2022 and I also had a little part in an ITV drama called ‘Stonehouse’, starring Matthew Macfadyen. I usually never know when I’m working next so to have three great TV jobs at once was very unusual. There was all this date juggling and I actually almost had to turn down Ghosts due to clashes. Luckily both shows had to move some dates so it worked out. But yes, I spent two weeks up in Scotland shooting all that Good Omens ballroom stuff, then I came back down to London to do Ghosts, knowing I’d be back up to shoot my scenes in the music shop in a couple of weeks. Now, when I found out who was playing my wife in Ghosts I couldn’t believe it: Caroline Sheen – Michael Sheen’s cousin! She was amazing and that was another great set in general. I say “set”, but it’s all filmed in that house which surprised me. I’d worked with Kiell [Smith-Bynoe] and Jim [Howick] before, and Charlotte [Ritchie] was in the Good Omens radio play a few years ago and a big fan of the book. Charlotte’s very musical of course and we got talking about my folding keyboard I had for practising my Good Omens stuff, and she ended up setting it up in the house for us to have a play on!

Now, when we’d shot all our internal scenes there was this big storm forecast, and our external scenes were scheduled for the day of the storm, so that had to be moved into the next week. It meant I ended up shooting those scenes outside the house, then going straight back up to Scotland to shoot the Good Omens music shop scene the next day! When I mentioned to Michael I’d just worked with Caroline he said “ooh she’s in Ghosts is she!” and revealed that she’d texted him about me which was rather surreal. Then later after the Ghosts wrap party Kiell gave me a part in his Channel 4 Blap, so at the time I felt like I was killing it career wise, but the industry quietened a bit after that and my workload eased off over the year so I was in my overdraft by November.”

Q: What are your plans for the future – can we expect to see you in something else soon?

A: “This year, after a bit of a quiet start, I was very fortunate to work on a Disney+ show called Rivals which stars… David Tennant! I think I’m allowed to say my character is called Brian, and I shot five episodes so that was another really amazing job, and great to work with David again (I told him he must be my good luck charm, although I hope he’s not sick of me). That should be out at some point in late 2024. Other than that I’ve filmed a few other bits I presume will be out next year, one of which is called Truelove on Channel 4 which actually looks really good. That starts early January. Of course now Season 3 of Good Omens has been greenlit, I would love Neil and the gang to have me back on that… but I can only keep my fingers crossed!”

#good omens#gos2#season 2#swirlywords#rich keeble#mr arnold#2ep5#2i5i4#2i5i15#bts#photos#bts photos#interview#rich keeble interview#rivals#skittles#eric#disposable demon#paul adeyefa#ann louise ross#demon skittles#donna preston#mrs sandwich#tim downie#mr brown#magic shop#fun fact#s2 interview

715 notes

·

View notes

Text

The long, bloody lineage of private equity's looting

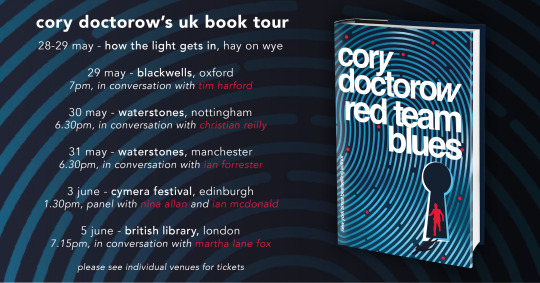

Tomorrow (June 3) at 1:30PM, I’m in Edinburgh for the Cymera Festival on a panel with Nina Allen and Ian McDonald.

Monday (June 5) at 7:15PM, I’m in London at the British Library with my novel Red Team Blues, hosted by Baroness Martha Lane Fox.

Fans of the Sopranos will remember the “bust out” as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the lives of the business’s workers, customers and suppliers. When the mafia does this, we call it a bust out; when Wall Street does it, we call it “private equity.”

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency. When a finance bro’s presentation on why Olive Garden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs. But the bro was working for Starboard Value, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

Starboard Value’s game was straightforward: buy a business, load it with debt, sell off its physical plant — the buildings it did business out of — pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed. They pulled it with Red Lobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

The bust out tactic wasn’t limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet. Why did Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce. That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

https://prospect.org/economy/vulture-capitalism-killed-sears/

Same goes for Toys R Us: it wasn’t Amazon that killed the iconic toy retailer — it was the PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

https://www.washingtonpost.com/news/business/wp/2018/06/01/how-can-they-walk-away-with-millions-and-leave-workers-with-zero-toys-r-us-workers-say-they-deserve-severance/

It’s a good racket — for the racketeers. Private equity has grown from a finance sideshow to Wall Street’s apex predator, and it’s devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in. Today, the PE sector loves a rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more “efficient.” In reality, a rollup’s strength is in eliminating competition. When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

They can also borrow. A quirk of the credit markets is that a standalone small business is valued at about 3–5x its annual revenues. But if that business is part of a large firm, it is valued at 10–20x annual turnover. That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company’s balance sheet as an asset worth $10–20m. That’s $10–20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire. Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

PE’s most ghastly impact is felt in the health care sector. Whole towns’ worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures. Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children’s mouths, filling them full of root-canals.

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create “the future of healthcare.”

https://hcpea.org/#!event-list

As bad as PE is for healthcare, it’s worse for long-term care. PE-owned nursing homes are charnel houses, and there’s a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered (and isn’t needed, because the patients aren’t dying!). These fake “hospices” get huge payouts from medicare — and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the “club deal,” is devouring the medical supply business. Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn’s department stores, Harrah’s, and Old Country Joe. Now it’s doing the same to medical supplies:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

Private equity is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

https://pluralistic.net/2021/08/16/die-miete-ist-zu-hoch/#assets-v-human-rights

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America’s desperately undersupplied housing stock will be beyond repair. It’s a bust out.

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

https://pluralistic.net/2022/02/04/up-your-nose/#rail-barons

Where did PE come from? How can these people look themselves in the mirror? Why do we let them get away with it? How do we stop them?

Today in The American Prospect, Maureen Tkacik reviews two new books that try to answer all four of these questions, but really only manage to answer the first three:

https://prospect.org/culture/books/2023-06-02-days-of-plunder-morgenson-rosner-ballou-review/

The first of these books is These Are the Plunderers: How Private Equity Runs — and Wrecks — America by Gretchen Morgenson and Joshua Rosner:

https://www.simonandschuster.com/books/These-Are-the-Plunderers/Gretchen-Morgenson/9781982191283

The second is Plunder: Private Equity’s Plan to Pillage America, by Brendan Ballou:

https://www.hachettebookgroup.com/titles/brendan-ballou/plunder/9781541702103/

Both books describe the bust out from the inside. For example, PetSmart — looted for $30 billion by RaymondSvider and his PE fund BC Partners — is a slaughterhouse for animals. The company systematically neglects animals — failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death. Though PetSmart has its own vet clinics, the company doesn’t want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death. PetSmart is also too cheap to cremate the animals, so its traumatized staff are ordered to smuggle the dead, rotting animals into random dumpsters.

All this happened while PetSmart’s sales increased by 60%, matched by growth in the company’s gross margins. All that money went to the bust out.

https://www.forbes.com/sites/antoinegara/2021/09/27/the-30-billion-kitty-meet-the-investor-who-made-a-fortune-on-pet-food/

Tkacik says these books show that we’re finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices. Today, books like these paint these “investors” as the monsters they are — crooks whose bust ups are crimes, not clever finance hacks.

Take the Carlyle Group, which pioneered nursing home rollups. As Carlyle slashed wages, its workers suffered — but its elderly patients suffered more. Thousands of Carlyle “customers” died of “dehydration, gangrenous bedsores, and preventable falls” in the pre-covid years.

https://www.washingtonpost.com/business/economy/opioid-overdoses-bedsores-and-broken-bones-what-happened-when-a-private-equity-firm-sought-profits-in-caring-for-societys-most-vulnerable/2018/11/25/09089a4a-ed14-11e8-baac-2a674e91502b_story.html

KKR, another PE monster, bought a second-hand chain of homes for mentally disabled adults from another PE company, then squeezed it for the last drops of blood left in the corpse. KKR cut wages to $8/hour and increased shifts to 36 hours, then threatened to have workers who went home early arrested and charged with “patient abandonment.” Many of these homes were often left with no staff at all, with patients left to starve and stew in their own waste.

PE loves to pick on people who can’t fight back: kids, sick people, disabled people, old people. No surprise, then, that PE loves prisons — the ultimate captive audience. HIG Capital is a $55b fund that owns TKC Holdings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired Aramark, owned by PE giant Warburg Pincus, whose food was so inedible that it provoked riots. TKC got a million bucks extra to take over the food at Michigan’s Kinross Correctional Facility, then, incredibly, made the food worse. A chef who refused to serve 100 bags of rotten potatoes (“the most disgusting thing I’ve seen in my life”) was fired:

https://www.wzzm13.com/article/news/local/michigan/prison-food-worker-i-was-fired-for-refusing-to-serve-rotten-potatoes/69-467297770

TKC doesn’t just operate prison kitchens — it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria. The prisoners buy this food with money they make working in the prison workshops, for $0.10–0.25/hour. Those workshops are also run by TKC.

Tkacic traces private equity back to the “corporate raiders” of the 1950s and 1960s, who “stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO.”

The most famous of these raiders was Eli Black, who took over United Fruit with this gambit — a company that had a long association with the CIA, who had obligingly toppled democratically elected governments and installed dictators friendly to United’s interests (this is where the term “banana republic” comes from).

Eli Black’s son is Leon Black, a notorious PE predator. Leon Black got his start working for the junk-bonds kingpin Michael Milken, optimizing Milken’s operation, which was the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses. Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

It got so bad that the Business Roundtable complained about the practice to Congress, calling Milken, Black, et al, “a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth.”

Black stabbed Milken in the back and tanked his business, then set out on his own. Among the businesses he destroyed was Samsonite, “a bankrupt-but-healthy company he subjected to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and hideous schemes to induce employees to buy its worthless stock.”

The money to buy Samsonite — and many other businesses — came through a shadowy deal between Black and John Garamendi, then a California insurance commissioner, now a California congressman. Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money “from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc.”

Black ended up getting all kinds of favors from powerful politicians — including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to Jeffrey Epstein for reasons that remain opaque.

Black’s shady deals are a marked contrast with the exalted political circles he travels in. Despite private equity’s obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulance services to infrastructure from PE-owned companies, with disastrous results. Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder SteveS chwarzman declared, “It’s a war. It’s like when Hitler invaded Poland in 1939.”

Since we’re on the subject of Hitler, this is a good spot to bring up Monowitz, a private-sector satellite of Auschwitz operated by IG Farben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht. I’d never heard of Monowitz, but Tkacik’s description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slave laborers from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves down the 4.5m stretch of road to the facility. So the company bought 25,000 slaves — preferring children, who were cheaper — and installed them in a co-located death-camp called Monowitz:

https://www.commentary.org/articles/r-tannenbaum/the-devils-chemists-by-josiah-e-dubois-jr/

Monowitz was — incredibly — worse than Auschwitz. It was so bad, the SS guards who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork — Farben refused, citing the cost. The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben’s investors.

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp. And Farben’s subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz’s gas chambers.

Tkacik’s point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money — and they were even worse. The banality of evil gets even more banal when it’s done in service to maximizing shareholder value.

As Farben historian Joseph Borkin wrote, the company “reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted”:

https://www.scribd.com/document/517797736/The-Crime-and-Punishment-of-I-G-Farben

Farben’s connection to the Nazis was a the subject of Germany’s Master Plan: The Story of Industrial Offensive, a 1943 bestseller by Borkin, who was also an antitrust lawyer. It described how Farben had manipulated global commodities markets in order to create shortages that “guaranteed Hitler’s early victories.”

Master Plan became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

Seen in that light, the plunderers of today’s PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It’s a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can’t even close the carried interest tax loophole, how can we hope to do anything meaningful?

“Carried interest” comes up in every election cycle. Most of us assume it has something to do with “interest payments,” but that’s not true. The carried interest loophole relates to the “interest” that 16th-century sea captains had in their cargo. It’s a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it’s still on the books tells you everything you need to know about whether our political class wants to do anything about PE’s plundering.

Notwithstanding Tkacik’s (entirely justified) skepticism of the weaksauce remedies proposed in these books, there is some hope of meaningful action. Private equity’s rollups are only possible because they skate under the $101m threshold for merger scrutiny. However, there is good — but unenforced — law that allows antitrust enforcers to block these mergers. This is the “incipiency standard” — Sec 7 of the Clayton Act — the idea that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still act to block it if it creates an incipient monopoly.

https://pluralistic.net/2022/12/16/schumpeterian-terrorism/#deliberately-broken

The US has a new crop of aggressive — fearless — top antitrust enforcers and they’ve been systematically reviving these old laws to go after monopolies.

That’s long overdue. Markets are machines for eroding our moral values: “In comparison to non-market decisions, moral standards are significantly lower if people participate in markets.”

https://web.archive.org/web/20130607154129/https://www.uni-bonn.de/Press-releases/markets-erode-moral-values

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

Catch me on tour with Red Team Blues in Edinburgh, London, and Berlin!

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/06/02/plunderers/#farbenizers

[Image ID: An overgrown graveyard, rendered in silver nitrate monochrome. A green-tinted businessman with a moneybag in place of a head looms up from behind a gravestone. The right side of the image is spattered in blood.]

#pluralistic#kkr#lootersprivate equity#plunderers#books#reviews#monsters#nazis#godwin's law#godwins law#auschwitz#ig farben#pe#business#barbarians#united fruit#carried interest#corporate raiders#junk bonds#michael milliken#ensemble cast#carlyle group#monowitz#leon black

1K notes

·

View notes

Text

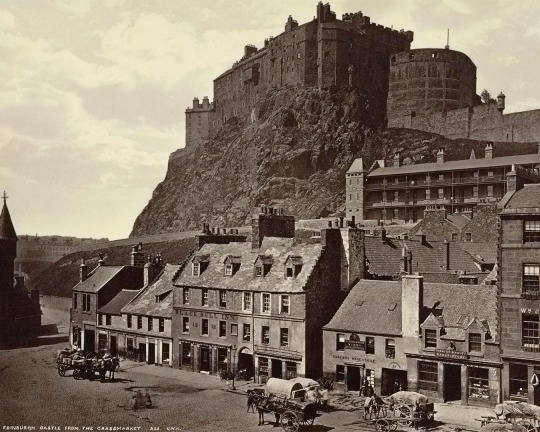

The Grassmarket, Edinburgh, circa 1865, with the majestic silhouette of Edinburgh Castle gracing the horizon. Step back in time with this captivating glimpse into the past, where history unfolds against the backdrop of an iconic Scottish landmark.

Photo: Cornell University Library

307 notes

·

View notes

Text

British Royal Family - The Duchess of Edinburgh (Global Ambassador for the International Agency for the Prevention of Blindness) walks across the iconic Abbey Road zebra crossing (made famous by The Beatles album cover) after attending the Orbis Visionaries Reception at Abbey Road Studios in London, England. Orbis is an international eye care charity working across the world to end avoidable blindness. (Photo by Max Mumby) | April 24, 2024

#royaltyedit#theroyalsandi#duchess of edinburgh#duchess sophie#sophie duchess of edinburgh#british royal family#my edit

167 notes

·

View notes

Text

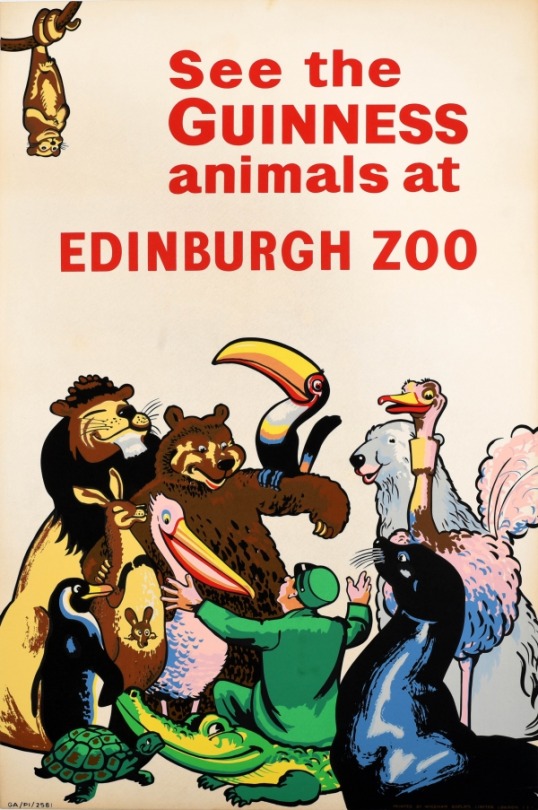

'See the Guinness Animals at Edinburgh Zoo'

Edinburgh Zoo poster featuring the iconic Guinness animals used in advertisements (c. 1950). Artwork by John Gilroy.

#vintage poster#1950s#John Gilroy#edinburgh zoo#edinburgh#guinness#animals#zoo#bear#pelican#toucan#lion#penguin#crocodile#seal#ostrich#polar bear#kangaroo#joey#sloth#zookeeper#scotland#Toucan

56 notes

·

View notes

Text

4 September 1971

Queen Elizabeth II and the Duke of Edinburgh at Burghley for the European Three-Day Event Championship.

#what an iconic photo#i love this#i miss them#queen elizabeth ii#prince philip#duke of edinburgh#philibet

39 notes

·

View notes

Text

Today is World Heritage Day

Oiginally known as the International Monuments and Sites Da it is a global celebration of this planet’s heritage. It’s all about increasing the awareness of the importance of the diversity of cultural and natural heritage and preserving this heritage for future generations..

In Scotland we’re lucky enough to have no less than six UNESCO World Heritage Sites. they are;

St Kilda.

The remote Hebridean island archipelago is one of only two-dozen global locations with World Heritage Status for both natural and cultural significance.

The archipelago shares this honour with natural and cultural wonders such as the Historic Sanctuary of Machu Picchu in Peru and Mount Athos in Greece.

I'd love to visit, but it is a wee bit too expensive for me.

Edinburgh Old and New Towns.

Some people have asked me which part of Edinburgh is covered by this title, well the simple answer is all of it!

The capital is a city of many eras, and its World Heritage Site comprises both the old and new towns. The Auld Toon has preserved much of its medieval street plan and Reformation-era buildings along the wynds of the Royal Mile.

The (relatively) New town contrasts this perfectly with neoclassical and Georgian architecture in regimented order.

Antonine Wall.

I've explored many parts of the wall. Constructed around 142 AD by the Romans, the Antonine Wall marked the north-west frontier of their empire. Stretching from the Firth of Forth and the Firth of Clyde, the Antonine Wall separated the civilised Romans from the wild Caledonians.

The Heart of Neolithic Orkney

I've not visited The Northen Isles as yet, plans were in the early stages to go this year, but my friend ended up in hospita and is still recuprating, hopefully we can get something sorted when she becomes more able.

The Orkney mainland is synonymous with archaeology. It boasts the mysterious standing stones at the Ring of Brodgar and megaliths at Standing Stones of Stenness, as well as the 5,000-year-old settlement of Skara Brae and chambered cairn and passage grave of Maeshowe. Together these four sites form the heart of Neolithic Orkney, which was given World Heritage status in 1999.

The Forth Bridge

I remember as a bairn drawing and painting the bridge with a steam train going over it, but the train going over the "bumps!"

One of our most iconic and beloved bridges, the Forth Bridge was named a World Heritage Site in 2015 just after its 125th anniversary. The bridge was one of the most ambitious projects of its kind ever attempted at the time. When it opened it had the longest single cantilever bridge span in the world.

New Lanark

The last mill closed in the 1960s but a restoration programme saved the 18th-century village from falling into dilapidation.

It is an early example of utopian socialism in Scotland as well as a planned settlement – making New Lanark an important milestone in the historical development of urban planning. I have never visited, I must say I much prefer my ruined castles and abbeys.

113 notes

·

View notes

Text

08/03-04/2024 Weekend OFMD Recap

TLDR; David Jenkins; Rhys Darby; Taika Waititi; Samba Schutte; Ruibo Qian; Rachel House Dominic Burgess; Nathan Foad; Articles; Fan Spotlight; OFMD Colouring Pages; Our Flag Means Fanfiction; Love Notes; Daily Darby/Today's Taika

Okay yall, I ended up being up all night for days with a grumpy kiddo so I am yet again behind, I'm really sorry. Here's the weekend recap. Aug 5 will go out tonight if I have to chug espresso for the next 4 hours!

== David Jenkins ==

Source: David Jenkins Twitter

== Rhys Darby ==

Our Captain is out in Edinburgh Scotland! Doing his Live Cryptid Factor show with Dan Scheiber and Buttons!

Lots of short videos on his Instagram Stories:

The Cryptid Factor Live - Edinburgh - Buttons CraftTime

The Cryptid Factor Live in Edinburgh - Dan's Book

The Cryptid Factor Live In Edinburgh - The Crypid Factor

The Cryptid Factor Live In Edinburgh - The Caves

Source: Rhys Darby's Instagram

Source: petrichorpond On Twitter (per @mon-ster-chen's Post)

= Astras TV Awards Nominee =

Rhys has been Nominated for BEST ACTOR in a Streaming Comedy Series in the Astra TV Awards! The TV Awards ill be held on Aug 18th so keep your eyes peeled around then!

Source: Hollywood Creative Alliance Instagram

== Taika Waititi ==

Happy Wedding Anniversary to Taika and Rita! (Aug 4th 2022). They were caught smooching out in London recently <3

Source: Instagram

== Samba Schutte ==

No context, but Samba called it "Man in the Mirror"

Source: Samba Schutte's Instagram

== Nathan Foad ==

Nathan's weekly Saturday Celebration

Source: Nathan Foad's Instagram Stories

= Ruibo Qian =

Just some stills from the Ms. Holmes/Ms. Watson BTS I wanted to include cause they're adorable.

Source: OldGlobe's BTS Video

= Rachel House =

So these are a week old but I found them via a more recent post from someone else there, so putting them in today! Rachel out with friends <3

Source: Instagram

= Dominic Burgess =

Dominic sending us goodnight cat pictures. What a guy <3

Source: Dominic Burgess' Twitter

== Articles ==

Thank you to @adoptourcrew for highlighting this article!

https://telltaletv.com/2024/03/20-iconic-queer-and-trans-characters-of-color-on-tv/

Source: Adopt Our Crew Twitter

https://screenrant.com/tv-shows-always-recommend-good-regardless-genre/

Source: Adopt Our Crew Twitter

== Fan Spotlight ==

= OFMD Colouring Pages =

Another set of colouring pages from our fab friend @patchworkpiratebear - I love that we're getting multiple versions each time now! These are super cool!

Source: PatchworkPirateBears Tumblr: Teacups / Flag

= Our Flag Means Fanfiction =

Another episode of the Omegaverse! This time hosted by Tessa! Check them out on your favorite listening platforms here!

Source: Our Flag Means Fanfiction Instagram

== Love Notes ==

Hey Lovelies!!! Found this really adorable artist this weekend and I thought I'd share them with you because they really express a lot of things that I tend to think--- like how much I love you all, seriously, did you know you're fucking FANTASTIC?? and fucking BRILLIANT AND AMAZING AND TALENTED!?

Whenever I'm stuck doing work, or other family/life stuff, I always come back to thinking about this awesome fandom, and how much I miss talking too you all and how much I love all the crazy stuff you all get up to every day! I haven't been interacting as much because it's really hard for me to focus with so much going on (yay neurodivergence!)-- but please know I'm watching and laughing, and crying and smiling, and wishing you all the best and cheering you on! Hope the end of the weekend and beginning of the week is treating you wonderfully <3 Take care lovelies!

instagram

instagram

instagram

== Daily Darby / Today's Taika ==

Just needing some of the Cinnamon Sugar, Salt and Pepper boys smiling together for this one <3 Gifs courtesy of more of our gif-masters @eddie-redcliffe and @thunderwingdoomslayer!

#rhys darby#daily ofmd recap#ofmd daily recap#taika waititi#rita ora#samba schutte#nathan foad#rachel house#dominic burgess#dan schreiber#leon kirkbeck#the cryptid factor'#save ofmd#our flag means death#ofmd#adopt our crew#adopt our crew crewmates#ofmd colouring pages#our flag means fanfiction#ruibo qian#tv astra awards

40 notes

·

View notes