#eosg

Explore tagged Tumblr posts

Text

HE IS SO ADORABLE SOMETIMES I LOVE GARDENER OF PAN PAN ❤️🔥

Remember when Stinger Flynn said its Stinger Flynn time and Stinger Flynn-ed all over the place/ref

Silly jellyfish go brrr!!

#garten of banban#HE LOOKS SO CUTE#IOEFJWEOIFJJANWO;DVND#OPRKFA#WVOLWSXZz#VKOPS;VL#WS'VPK;#PSF;B#RDFKO[EOSG[PRLGW[PGKV#E]R]AP#FSG

26 notes

·

View notes

Text

The Power of Certainty: How a Guaranteed Savings Plan Secures Your Kids Education and Retirement in Dubai

In the dynamic and ambitious landscape of Dubai, expatriates pursue ambitious career goals and a luxurious lifestyle. However, this pursuit often comes with unique financial planning challenges, particularly when it comes to securing two of life's most significant long-term objectives: providing a world-class education for their children and ensuring a comfortable retirement. Unlike many home countries that offer extensive social security or state-funded education systems, expats in the UAE are largely responsible for their own financial future. This critical need for robust planning brings to the forefront the compelling advantages of a Guaranteed Savings Plan.

As your financial planning advisor, I emphasize that while market-linked investments offer growth potential, the power of certainty that a Guaranteed Savings Plan provides is unparalleled, especially for non-negotiable life goals like your children's education and your own retirement.

The Dual Financial Imperative for Expats in Dubai: Education & Retirement

Expatriates in Dubai face a unique set of circumstances that underscore the importance of dedicated financial planning:

1. The Escalating Cost of Education: Dubai boasts an impressive array of international schools and reputable university branch campuses. However, this quality education comes at a premium.

School Fees: Annual tuition for private schools can range from under AED 10,000 to over AED 200,000 for elite institutions. A mid-point average across curricula might be around AED 54,000 annually. For instance, the average annual tuition fee for IB schools in Dubai is currently around AED 66,000. When factoring in additional costs like uniforms, books, transportation (up to AED 12,000 annually), and extracurricular activities, the cumulative cost for 12-15 years of schooling can run into millions of dirhams per child.

University Expenses: Locally, international branch campuses in Dubai typically charge AED 40,000 to AED 90,000 per year for undergraduate programs. Postgraduate programs can be higher, ranging from AED 35,000 to AED 130,000 annually. For international universities (e.g., in the UK, USA, Canada), the costs skyrocket, easily exceeding AED 800,000 to AED 1.5 million for a four-year degree, not including living expenses, which can push total annual costs to well over AED 200,000.

Education Inflation: Critically, education costs consistently outpace general inflation. While the KHDA regulates school fee increases (e.g., 2.35% for 2025-26), international university fees and living costs can see annual increases of 3% to 7%. This necessitates proactive Child Education Planning In Dubai and the creation of a substantial Child Education Fund UAE.

2. The Retirement Landscape for Expats: Unlike many home countries, the UAE does not offer a universal state pension for expats.

End-of-Service Gratuity (EOSG) Limitations: While expats receive an EOSG (typically 21 days' basic salary for the first five years and 30 days' for subsequent years), this lump sum is a severance payment, not a sustainable income stream for potentially 20-30+ years of retirement. It's rarely enough to maintain a desired lifestyle in Dubai.

High Cost of Living: Maintaining a comfortable lifestyle in Dubai during retirement requires significant funds, covering housing, mandatory private healthcare (which can be very expensive without employer sponsorship), utilities, and leisure. A comfortable retirement could require AED 15,000-25,000 per month, increasing with inflation.

Longevity Risk: People are living longer, increasing the period over which retirement savings must stretch.

Dubai Retirement Visa Requirements: To qualify for Dubai's Retirement Visa, applicants aged 55 and above must meet specific financial criteria, such as proving a monthly income of AED 15,000-20,000, or having savings of at least AED 1 million in a three-year fixed deposit, or owning property in Dubai valued at a minimum of AED 1 million. A well-structured Retirement Savings Plan is crucial for meeting these requirements.

Expat-Specific Risks: Beyond these direct costs, expats face unique risks like currency fluctuations (especially when saving in AED for education abroad), the transient nature of expat careers, and the absence of home-country financial safety nets. These factors make a disciplined and secure approach to saving, such as a Guaranteed Savings Plan, indispensable.

The Unwavering Stability of a Guaranteed Savings Plan

A Guaranteed Savings Plan is a financial product designed to provide predictable returns and capital protection, making it an excellent choice for long-term, non-negotiable financial goals. Typically offered by reputable life insurance companies, these plans contrast sharply with market-linked investments by minimizing exposure to volatility.

Key Characteristics:

Guaranteed Maturity Benefit: The cornerstone feature is a pre-determined lump sum payout or a guaranteed income stream at the end of the policy term, regardless of market performance. You know exactly what you will receive.

Capital Protection: Your principal contributions are protected from market downturns. This provides a strong sense of security, ensuring your invested capital is not at risk.

Fixed/Minimum Returns: While not offering the highest potential returns of aggressive equity investments, they provide consistent, predictable returns, often with a guaranteed minimum interest rate.

Structured Contributions: These plans typically require regular, fixed premium payments (monthly, quarterly, annually), fostering crucial financial discipline.

Integrated Protection (Often): Many Guaranteed Savings Plans (especially those offered by life insurance providers) come with benefits like a Premium Waiver. This means if the policyholder suffers total permanent disability or passes away, the insurer continues to pay the remaining premiums, ensuring the target amount is still achieved for the beneficiaries. This is a powerful layer of financial security.

Simplicity: They offer a straightforward approach, ideal for those who prefer not to actively manage investments or are risk-averse.

How a Guaranteed Savings Plan Secures Both Education and Retirement

The power of certainty embedded in a Guaranteed Savings Plan makes it an ideal solution for tackling both your Kids Education Plan and your Retirement Planning In Dubai:

For Your Kids Education:

Eliminating Market Risk: The primary concern with a child's education fund is that market downturns could erode savings just when tuition fees are due. A Guaranteed Child Education Plan removes this worry entirely. You are assured that the necessary funds will be available at the precise time your child needs to enroll in university, free from market volatility. This is fundamental for Education Saving Plan success.

Predictable Payouts: Knowing the exact maturity value of your Guaranteed Kids Education Plan allows for precise Child Education Planning In Dubai. You can confidently plan for university fees, accommodation, and living expenses, whether locally (e.g., within Dubai Education Savings Plans) or internationally.

Crucial Premium Waiver Benefit: As mentioned, if the contributing parent passes away or becomes permanently disabled, the insurer steps in to pay the remaining premiums. This ensures that your child's educational dreams are safeguarded, even in your absence, providing an unparalleled level of family security that standard investment accounts simply cannot. This feature is particularly vital for Education Savings For Expats In Dubai who often lack other social safety nets.

Enforced Discipline: The regular premium payments of a Guaranteed Savings Plan instill excellent financial discipline. This systematic approach ensures consistent contributions towards your Child Education Fund UAE, preventing ad-hoc spending from derailing your long-term goal.

For Your Retirement:

A Foundation of Certainty: For your Retirement Savings Plan, a Guaranteed Retirement Plan acts as a stable anchor in your overall financial portfolio. It provides a reliable stream of income or a guaranteed lump sum that is immune to market fluctuations, offering peace of mind regardless of economic conditions. This certainty allows you to confidently budget for your retirement years.

Diversification and Risk Mitigation: While growth investments are important for wealth accumulation, a guaranteed component diversifies your retirement portfolio. It protects a core portion of your savings from market crashes, ensuring you have a baseline income regardless of market performance.

Meeting Retirement Visa Requirements: The guaranteed nature of these plans can help you meet the financial thresholds for the Dubai Retirement Visa. Knowing you have a defined lump sum or a guaranteed income stream strengthens your application for long-term residency.

Portability: Reputable international providers offer Guaranteed Savings Plans that are easily portable across borders. This is critical for expats who may choose to retire outside the UAE, allowing their Retirement Savings Plan to move with them without complex transfers or penalties.

Addressing Longevity Risk: Some guaranteed plans can be structured as annuities, providing income for a specified period or even for your entire lifetime. This directly addresses the risk of outliving your savings, a significant concern in retirement planning.

Why Certainty is Paramount for Expats in Dubai

For expatriates, the global landscape and personal circumstances are often marked by inherent uncertainties:

Global Economic Volatility: Geopolitical events and economic shifts can impact market performance significantly.

Job Market Fluctuations: Expat careers can be dynamic, with potential job changes or even country moves.

Currency Volatility: The AED is pegged to the USD, but if you plan to retire or fund education in a non-USD pegged currency, fluctuations can impact your purchasing power.

Regulatory Changes: While Dubai offers a stable environment, rules and regulations can evolve.

A Guaranteed Savings Plan offers an anchor amidst these uncertainties, ensuring that crucial life goals are protected and achievable, regardless of external factors. This peace of mind allows expats to focus on their careers and family life in Dubai, knowing their long-term financial future is secure.

The Indispensable Role of Your Financial Planning Advisor

Navigating the array of Dubai Education Savings Plans, Retirement Savings Plan options, and the specific features of Guaranteed Savings Plans requires expert guidance. As your financial planning advisor, I would:

Conduct a Holistic Needs Assessment: Understand your complete financial picture, including your income, expenses, existing assets, risk tolerance, and your precise goals for both education and retirement.

Quantify Your Goals: Accurately project the future costs of education and your desired retirement lifestyle, factoring in inflation and potential currency impacts.

Compare and Recommend: Analyze various Guaranteed Savings Plan options from reputable international providers, explaining their structures, benefits (like premium waivers and guaranteed returns), and underlying costs. This includes discerning between a Guaranteed Child Education Plan and a Guaranteed Retirement Plan.

Integrate Your Strategy: Show how a Guaranteed Savings Plan fits into your overall financial architecture, complementing other investments and aligning with your short-term and long-term aspirations.

Ensure Cross-Border Suitability: Advise on the portability of the plan and any potential tax implications in your home country upon withdrawal.

Provide Ongoing Management: Regularly review your plan's performance and make necessary adjustments to ensure it remains optimized for your evolving circumstances.

Conclusion

For expatriates building a life in Dubai, the responsibility of securing their family's financial future rests firmly on their shoulders. While growth is often the focus of investment, the power of certainty offered by a Guaranteed Savings Plan cannot be overstated for non-negotiable goals like funding a Kids Education Plan and ensuring a comfortable Retirement Planning In Dubai. By choosing a plan that provides capital protection, predictable returns, and crucial life protection benefits, expats can confidently navigate the future, achieving both their children's academic aspirations and their own financial independence, free from the anxieties of market volatility.

0 notes

Text

How do employment lawyers handle cases involving end-of-service gratuity?

In Dubai, end-of-service gratuity (EOSG) is a critical component of an employee’s rights under UAE labor law. This gratuity serves as a financial benefit for employees who complete their contracts and is calculated based on their length of service and final salary. However, disputes often arise over EOSG due to unclear contractual terms, employer miscalculations, or wrongful dismissal. Employment…

0 notes

Photo

Throwback to January 2015! Been a long time coming. #gameday #LAFC #EOSG #3252 (at Los Angeles, California)

1 note

·

View note

Text

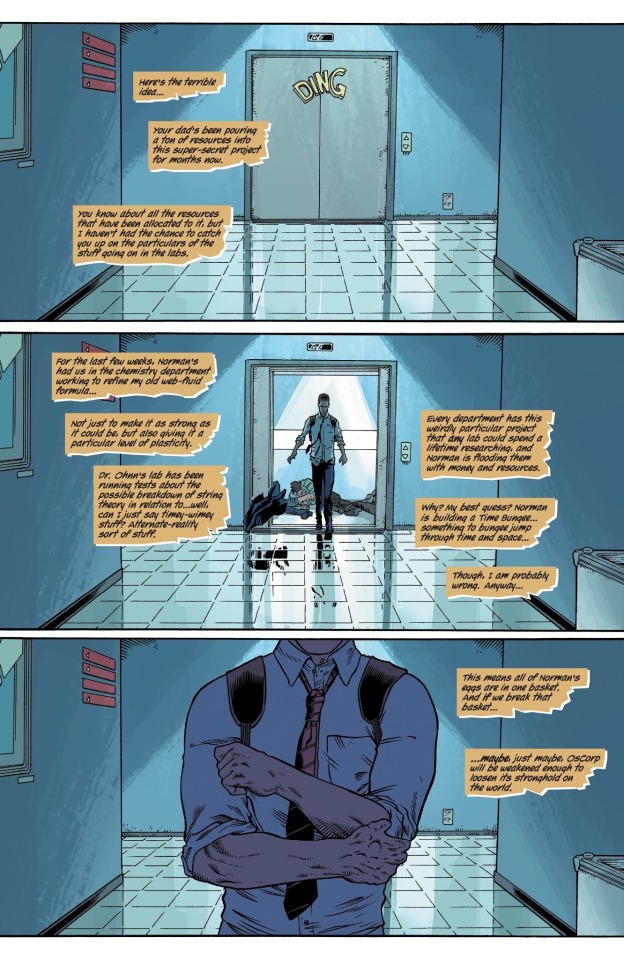

Just a few panels of Harry being a badass

From Edge of Spider-Geddon 004 (2018)

89 notes

·

View notes

Text

Spider-Geddon Reading Order

The small and much more linear follow-up to Spider-Verse and The Inheritors.

This is more about Ock in a leadership role having to fix his own mistake, while Miles is on the other spectrum of the spider-team dealing with the responsibility of managing the other spiders who refuse to follow Ock. But those are just the main issues; the tie-ins all give the rest of the characters some great attention.

Bold=Important to the main story Italics=Optional If there’s no number next to an issue title that means it’s a one-shot. If this is your first time reading a spider-team since spider-verse, there are a couple team books below that released in between. They’re more multiversal stories - also good and fun.

Spider-Verse (V2) 1-5 -- During Secret Wars a more consistent spider-team comes together.

Web Warriors 1-11 -- This continues the story from the Secret Wars mini and the character growth for themselves and with each other carries over into SG.

Spider-Geddon

Superior Octopus

Edge of Spider-Geddon 1

Edge of SG 3 – Intentionally out of order.

Spider-Geddon 1

Vault of Spiders 1-2

SG 2 – After this is when there’s a costume change and they start recruiting spiders, some issues are out of order because this is where they are in the timeline.

SG 0

Edge of SG 2

SG: Handbook – This catches you up with where everyone is right before SG 1. But SG 0 and EoSG 2 were released before it so it kinda spoils those. It’s not a big deal so if you don’t care about those 2 things you can read it just before SG 1.

Edge of SG 4

Spectacular Spider-Man 311-312

Spider-Girls 1-2

Spider-Force 1-2

SG 3

Spider-Gwen: Ghost Spider 1-2

Spider-Force 3

SG 4

Spider-Girls 3

Spider-Gwen: Ghost Spider 3

Spectacular SM 313

SG 5

Spider-Gwen: Ghost Spider 4

3 books spin out of this 1. Ock’s growth continues in the second volume of Superior Spider-Man 1-12. 2. Gwen’s story continues in Spider-Gwen: Ghost Spider 5-10, which is then relaunched to simply Ghost Spider 1-10. 3. Spider-Verse (V3) 1-6 is basically a series of one shots with each on a different world by different creators, the only link being Miles as he’s yanked through them one at a time. 3a. Spider-Man Noir (V2) 1-5 Spins out of Spider-Verse (V3).

#spider-geddon#ben reilly#scarlet spider#spider-girl#spiderling#anya corazon#jessica drew#mayday parker#annie parker#peter parker#spider-man#kaine parker#gwen stacy#spider-gwen#otto octavius#superior spider-man#doctor octopus#sp//dr#peni parker#spider-ma'am#spider-ham#peter porker#in anticipation for asm 76 im making a list of everything ben reilly between the end of clone saga to Spencer's run#im just lazy

138 notes

·

View notes

Video

updatesie! by Amanda Adam

0 notes

Photo

So #SingaporeCocktailFestival2018 has not officially started but no one told these guys! Stop 1: Nutmeg & Clove for a quick drink to wish them a happy 4th anniversary. Loved Colin’s red jacket and of course the #EOSG boys. Didn’t realise #Chef Gaggan was mixing as well! ;-). Stop 2: Cheek by Jowl for a fab dinner (separate post) Stop 3: Jigger & Pony to see our pals from Alice Cheongdam, they only had one drink left! Also spotted @uno_jang_ @yaozzer @benbenwhiskey @mokoh58 @rtann Stop 4: Skinny’s (too early in fact #LOL) but ran into @younghealthy @davidesambo @feistyfique @zaratejersey @vanillakrisp__ @mitchsaidthis @mcchiem (sad I missed their shift!) Stop 5: 28 Hong Kong Street, no pics but caught up with more friends (Spencer, @giancarlo.mancino, @thorstenhusmann, @crazycocktailcat @kafi_898 and met the #charming Salvatore @cocktailmaestro Stop 6: @theotherroomsg a (non-alcoholic, for real) #cocktail. Great to see @joelpoon13 behind the bar again and of course our lovely @nicholasq_beard. Stop 7: Bed! ・ ・ ・ ・ ・ ・ ・ #sgbars #singaporebar #nightlifesg #sgnightlife #sgdrink #cocktails #sgig #igdaily #imbibegram #boozegram #bartendersbible #cocktailhour #cocktailporn #instacocktail #drinksoftheday #draaaaanks #outwiththelocals #speakeasybar #liquorgram #cocktailcollective #drinkporn #craftcocktails #itsfiveoclocksomewhere #handcraftedcocktails ・ (at Singapore)

#itsfiveoclocksomewhere#bartendersbible#boozegram#singaporebar#cocktailhour#outwiththelocals#instacocktail#chef#cocktail#igdaily#lol#eosg#imbibegram#cocktailcollective#cocktailporn#charming#singaporecocktailfestival2018#cocktails#handcraftedcocktails#drinksoftheday#draaaaanks#speakeasybar#liquorgram#sgbars#sgnightlife#drinkporn#sgig#sgdrink#nightlifesg#craftcocktails

0 notes

Text

INTERN - POLITICAL AFFAIRS [Temporary]

INTERN – POLITICAL AFFAIRS [Temporary]

JOB DESCRIPTION Org. Setting and ReportingWe seek a motivated intern to support the work of the United Nations Operations and Crisis Centre (UNOCC). The UNOCC is a multi-party entity reporting to the Under-Secretary-General (USG) for Policy in the Executive Office of the Secretary-General (EOSG) and on peacekeeping matters to the USG for Peace Operations in the Department of Peace…

View On WordPress

0 notes

Text

SKIMS celebrates International Nurses Day

SRINAGAR — The Department of Nursing Administration, Sheri-I-Kashmir Institute of Medical Sciences celebrated “International Nurses Day” to commemorate birth anniversary of “Florence Nightingale” pioneer of modern nursing. The progamme held today focused on this year’s theme “Nurses- A Voice to Lead- Invest in Nursing and Respect Rights to Secure Global Health”. Director SKIMS & EOSG, Prof.…

View On WordPress

0 notes

Text

The Power of Certainty: How a Guaranteed Savings Plan Secures Your Kids Education and Retirement in Dubai

In the dynamic and ambitious landscape of Dubai, expatriates pursue ambitious career goals and a luxurious lifestyle. However, this pursuit often comes with unique financial planning challenges, particularly when it comes to securing two of life's most significant long-term objectives: providing a world-class education for their children and ensuring a comfortable retirement. Unlike many home countries that offer extensive social security or state-funded education systems, expats in the UAE are largely responsible for their own financial future. This critical need for robust planning brings to the forefront the compelling advantages of a Guaranteed Savings Plan.

As your financial planning advisor, I emphasize that while market-linked investments offer growth potential, the power of certainty that a Guaranteed Savings Plan provides is unparalleled, especially for non-negotiable life goals like your children's education and your own retirement.

The Dual Financial Imperative for Expats in Dubai: Education & Retirement

Expatriates in Dubai face a unique set of circumstances that underscore the importance of dedicated financial planning:

1. The Escalating Cost of Education: Dubai boasts an impressive array of international schools and reputable university branch campuses. However, this quality education comes at a premium.

School Fees: Annual tuition for private schools can range from under AED 10,000 to over AED 200,000 for elite institutions. A mid-point average across curricula might be around AED 54,000 annually. For instance, the average annual tuition fee for IB schools in Dubai is currently around AED 66,000. When factoring in additional costs like uniforms, books, transportation (up to AED 12,000 annually), and extracurricular activities, the cumulative cost for 12-15 years of schooling can run into millions of dirhams per child.

University Expenses: Locally, international branch campuses in Dubai typically charge AED 40,000 to AED 90,000 per year for undergraduate programs. Postgraduate programs can be higher, ranging from AED 35,000 to AED 130,000 annually. For international universities (e.g., in the UK, USA, Canada), the costs skyrocket, easily exceeding AED 800,000 to AED 1.5 million for a four-year degree, not including living expenses, which can push total annual costs to well over AED 200,000.

Education Inflation: Critically, education costs consistently outpace general inflation. While the KHDA regulates school fee increases (e.g., 2.35% for 2025-26), international university fees and living costs can see annual increases of 3% to 7%. This necessitates proactive Child Education Planning In Dubai and the creation of a substantial Child Education Fund UAE.

2. The Retirement Landscape for Expats: Unlike many home countries, the UAE does not offer a universal state pension for expats.

End-of-Service Gratuity (EOSG) Limitations: While expats receive an EOSG (typically 21 days' basic salary for the first five years and 30 days' for subsequent years), this lump sum is a severance payment, not a sustainable income stream for potentially 20-30+ years of retirement. It's rarely enough to maintain a desired lifestyle in Dubai.

High Cost of Living: Maintaining a comfortable lifestyle in Dubai during retirement requires significant funds, covering housing, mandatory private healthcare (which can be very expensive without employer sponsorship), utilities, and leisure. A comfortable retirement could require AED 15,000-25,000 per month, increasing with inflation.

Longevity Risk: People are living longer, increasing the period over which retirement savings must stretch.

Dubai Retirement Visa Requirements: To qualify for Dubai's Retirement Visa, applicants aged 55 and above must meet specific financial criteria, such as proving a monthly income of AED 15,000-20,000, or having savings of at least AED 1 million in a three-year fixed deposit, or owning property in Dubai valued at a minimum of AED 1 million. A well-structured Retirement Savings Plan is crucial for meeting these requirements.

Expat-Specific Risks: Beyond these direct costs, expats face unique risks like currency fluctuations (especially when saving in AED for education abroad), the transient nature of expat careers, and the absence of home-country financial safety nets. These factors make a disciplined and secure approach to saving, such as a Guaranteed Savings Plan, indispensable.

The Unwavering Stability of a Guaranteed Savings Plan

A Guaranteed Savings Plan is a financial product designed to provide predictable returns and capital protection, making it an excellent choice for long-term, non-negotiable financial goals. Typically offered by reputable life insurance companies, these plans contrast sharply with market-linked investments by minimizing exposure to volatility.

Key Characteristics:

Guaranteed Maturity Benefit: The cornerstone feature is a pre-determined lump sum payout or a guaranteed income stream at the end of the policy term, regardless of market performance. You know exactly what you will receive.

Capital Protection: Your principal contributions are protected from market downturns. This provides a strong sense of security, ensuring your invested capital is not at risk.

Fixed/Minimum Returns: While not offering the highest potential returns of aggressive equity investments, they provide consistent, predictable returns, often with a guaranteed minimum interest rate.

Structured Contributions: These plans typically require regular, fixed premium payments (monthly, quarterly, annually), fostering crucial financial discipline.

Integrated Protection (Often): Many Guaranteed Savings Plans (especially those offered by life insurance providers) come with benefits like a Premium Waiver. This means if the policyholder suffers total permanent disability or passes away, the insurer continues to pay the remaining premiums, ensuring the target amount is still achieved for the beneficiaries. This is a powerful layer of financial security.

Simplicity: They offer a straightforward approach, ideal for those who prefer not to actively manage investments or are risk-averse.

How a Guaranteed Savings Plan Secures Both Education and Retirement

The power of certainty embedded in a Guaranteed Savings Plan makes it an ideal solution for tackling both your Kids Education Plan and your Retirement Planning In Dubai:

For Your Kids Education:

Eliminating Market Risk: The primary concern with a child's education fund is that market downturns could erode savings just when tuition fees are due. A Guaranteed Child Education Plan removes this worry entirely. You are assured that the necessary funds will be available at the precise time your child needs to enroll in university, free from market volatility. This is fundamental for Education Saving Plan success.

Predictable Payouts: Knowing the exact maturity value of your Guaranteed Kids Education Plan allows for precise Child Education Planning In Dubai. You can confidently plan for university fees, accommodation, and living expenses, whether locally (e.g., within Dubai Education Savings Plans) or internationally.

Crucial Premium Waiver Benefit: As mentioned, if the contributing parent passes away or becomes permanently disabled, the insurer steps in to pay the remaining premiums. This ensures that your child's educational dreams are safeguarded, even in your absence, providing an unparalleled level of family security that standard investment accounts simply cannot. This feature is particularly vital for Education Savings For Expats In Dubai who often lack other social safety nets.

Enforced Discipline: The regular premium payments of a Guaranteed Savings Plan instill excellent financial discipline. This systematic approach ensures consistent contributions towards your Child Education Fund UAE, preventing ad-hoc spending from derailing your long-term goal.

For Your Retirement:

A Foundation of Certainty: For your Retirement Savings Plan, a Guaranteed Retirement Plan acts as a stable anchor in your overall financial portfolio. It provides a reliable stream of income or a guaranteed lump sum that is immune to market fluctuations, offering peace of mind regardless of economic conditions. This certainty allows you to confidently budget for your retirement years.

Diversification and Risk Mitigation: While growth investments are important for wealth accumulation, a guaranteed component diversifies your retirement portfolio. It protects a core portion of your savings from market crashes, ensuring you have a baseline income regardless of market performance.

Meeting Retirement Visa Requirements: The guaranteed nature of these plans can help you meet the financial thresholds for the Dubai Retirement Visa. Knowing you have a defined lump sum or a guaranteed income stream strengthens your application for long-term residency.

Portability: Reputable international providers offer Guaranteed Savings Plans that are easily portable across borders. This is critical for expats who may choose to retire outside the UAE, allowing their Retirement Savings Plan to move with them without complex transfers or penalties.

Addressing Longevity Risk: Some guaranteed plans can be structured as annuities, providing income for a specified period or even for your entire lifetime. This directly addresses the risk of outliving your savings, a significant concern in retirement planning.

Why Certainty is Paramount for Expats in Dubai

For expatriates, the global landscape and personal circumstances are often marked by inherent uncertainties:

Global Economic Volatility: Geopolitical events and economic shifts can impact market performance significantly.

Job Market Fluctuations: Expat careers can be dynamic, with potential job changes or even country moves.

Currency Volatility: The AED is pegged to the USD, but if you plan to retire or fund education in a non-USD pegged currency, fluctuations can impact your purchasing power.

Regulatory Changes: While Dubai offers a stable environment, rules and regulations can evolve.

A Guaranteed Savings Plan offers an anchor amidst these uncertainties, ensuring that crucial life goals are protected and achievable, regardless of external factors. This peace of mind allows expats to focus on their careers and family life in Dubai, knowing their long-term financial future is secure.

The Indispensable Role of Your Financial Planning Advisor

Navigating the array of Dubai Education Savings Plans, Retirement Savings Plan options, and the specific features of Guaranteed Savings Plans requires expert guidance. As your financial planning advisor, I would:

Conduct a Holistic Needs Assessment: Understand your complete financial picture, including your income, expenses, existing assets, risk tolerance, and your precise goals for both education and retirement.

Quantify Your Goals: Accurately project the future costs of education and your desired retirement lifestyle, factoring in inflation and potential currency impacts.

Compare and Recommend: Analyze various Guaranteed Savings Plan options from reputable international providers, explaining their structures, benefits (like premium waivers and guaranteed returns), and underlying costs. This includes discerning between a Guaranteed Child Education Plan and a Guaranteed Retirement Plan.

Integrate Your Strategy: Show how a Guaranteed Savings Plan fits into your overall financial architecture, complementing other investments and aligning with your short-term and long-term aspirations.

Ensure Cross-Border Suitability: Advise on the portability of the plan and any potential tax implications in your home country upon withdrawal.

Provide Ongoing Management: Regularly review your plan's performance and make necessary adjustments to ensure it remains optimized for your evolving circumstances.

Conclusion

For expatriates building a life in Dubai, the responsibility of securing their family's financial future rests firmly on their shoulders. While growth is often the focus of investment, the power of certainty offered by a Guaranteed Savings Plan cannot be overstated for non-negotiable goals like funding a Kids Education Plan and ensuring a comfortable Retirement Planning In Dubai. By choosing a plan that provides capital protection, predictable returns, and crucial life protection benefits, expats can confidently navigate the future, achieving both their children's academic aspirations and their own financial independence, free from the anxieties of market volatility.

0 notes

Text

Benefits of Payroll outsourcing in Dubai, UAE

Payroll outsourcing happens when a business contracts with an outside company to manage its payroll-related obligations. The outsourcing of payroll to Dubai, UAE, is typically used to reduce the cost of payroll operations within the company, which allows the company to focus its time and money on revenue-generating tasks and value-added functions.

Payroll outsourcing is appropriate for all kinds of companies regardless of size. However, it is particularly beneficial for companies just beginning their journey or making their way into the Dubai market in the initial stages. They are often concerned about cost and are likely to face numerous new legal and employment concerns.

Employing a payroll outsourcing company within Dubai, UAE, to manage payroll functions gives you access to vast capabilities and expertise at a much lower cost. That means that businesses could avoid hiring and training employees in-house while also purchasing the right payroll software and remaining current with the latest rules.

Utilizing a reliable, trustworthy, and knowledgeable provider to handle your payroll from Dubai, UAE, will ensure that your payroll obligations are efficient and swift. You can also rest assured that your duties and responsibilities are fulfilled efficiently and promptly, reducing administrative errors and delays and possibly saving you penalties and fines.

The primary benefits of outsourcing your payroll within Dubai, UAE:

Possible savings: Running payroll in-house can be costly, particularly for small businesses, due to hiring full-time employees. Finding a skilled and dedicated payroll specialist in the UAE involves a variety of tasks and expenses, such as the cost of a monthly salary and visa Emirates ID, labor contract costs, medical insurance, ‘end of service gratuity (EOSG)/pension provisions, annual vacation, and overtime costs. Our fixed monthly expenses tailored to your requirements will be significantly lower.

Credibility: Payroll failures not only cause frustration for employees, but they can also cost you money. Government submissions that are in error or late could lead to penalties and other serious concerns.

Conformity: It may be difficult for small businesses to keep up with the regular and sometimes complex changes to local laws. A licensed service provides experts with years of experience who are current with the latest developments and can adjust quickly.

Responsibility: Running a small or medium-sized business can be extremely cost-sensitive, and salaries often make up significant portions of the business’s costs. Payroll outsourcing management is crucial in controlling your money flow. That is vital for the functioning of your company. That means that if you need access to information, it is available to you in a secure manner online. That is invaluable in terms of enhancing efficiency and making your business profitable.

Architecture: Quality Payroll outsourcing service providers will access the latest technology, enabling them to efficiently process payroll without paying the cost of purchasing and maintaining an internal system and the associated hardware.

Privacy: Reputable payroll service providers store and safeguard the entire data in extremely secure cloud-based systems. They typically use encryption technology to ensure the confidentiality of all data.

Privacy of the patient Non-authorized individuals can access the data stored on an internal server. outsourcing the Payroll outsourcing process reduces the risk of sensitive data leakage, identity theft of employees, and the potential misuse of corporate funds.

The emphasis is on business: By outsourcing payroll, it is possible to save time at home dealing with difficult problems with Payroll outsourcing and instead spend your time designing marketing and sales strategies and improving workflow efficiency.

Specialized services: Many high-quality payroll service providers also offer Human resources (HR) assistance, government liaison (PRO) services, and other services auxiliary to payroll. Any actions connected to processing documents from the government, including applications for visas, work card applications, and records for trade licenses issued by firms and authorizations, are termed PRO services.

In addition to payroll, they can provide expert advice regarding employment contracts, employee recruitment, the development of staff handbooks and management of dismissal, redundancies, and many others.

SimplySolved offers audit, VAT consulting, and accounting and tax services within Dubai, UAE. We support businesses around the globe with our expert services. Should you need to ask any concerns about these services, you can contact us.

#payroll services#hr payroll#hr & payroll#Payroll Outsourcing Services#Payroll System#Payroll Solutions

1 note

·

View note

Text

Gratuity Request Letter To Company

However, any periods of unpaid leave will generally be excluded, but will usually be determined by company policy. If the employee's period of service with the employer pre-dates the introduction of the Qatar Labour Law (i.e. 6 January 2005), EOSG for the period of employment to 6 January 2005 will be calculated in accordance with the terms of. FAQs on Gratuity. If I resign from a company after 4.5 years of service, am I eligible for gratuity? No, you have to serve at least 5 years in a company to get gratuity payment. A Madras High Court ruling held that you can avail gratuity if you have completed 240 days of service in the fifth year. Gratuity Application Letter To: Mr. Edward James Manager – Sigma Technologies, 23, Crescendo Park, London – Y14 5LH 5th Oct, 2013 Dear Mr. James, I am writing in regarding the due payments of our firm in your company for the month of March. In our records, an amount of $8000 is due as credit balance against your company. A Request Letter is a formal letter written to request something from an individual, a company, or an organization. When you are writing a request letter, you are asking someone to take the time to read your letter, consider your request, and act on that request. Request letters should be written in a kind, appreciative tone. Letter of request for gratuity. I would like to write a letter to my company manager to request for a company letter to be able to be granted visa? Sample letter to send to area churches to request the opportunity to come to their church and sing? Download mac demarco salad days. Request letter for advance gratuity. Request letter to a manager asking to train on a particular.

How To Get My Gratuity From The Company

How To Get Gratuity Amount From Company

3 Ways to Write a Request Letter wikiHow

By : www.wikihow.com

You can call the provider first before writing your letter. As a result, it is important to comply with your institution’s policy regarding work transfers, for example, the information you must provide and the way in which you provide the information. If you worked for the identical company for quite some time and feel that you are underpaid, it is time to do something about it. My request is to modify the conditions of my loan, so I will have the possibility of making payments on time. Introduce yourself and explain that you are writing to request permission to sell the organization’s products in the first paragraph. Although it is not required, it is professional to address your request for an increase in the type of signed letter instead of a very simple email. Depending on what you request, you can host the possibility of requiring adjustments in the way the work is done. Ask your boss to respond to your request before a particular date. Compose the second paragraph, which should consist of requesting a different application. When you have covered the original application, you will have to submit the specific details. Include any additional information that the recipient may need to know about your order. An application for a medical license generally requires that the employee have some type of medical problem that is causing or that will make the employee unable to complete their duties. The letters are different from any other type of communication. Letter writing services are a simple way for many writers to earn incredible additional income. Make sure there is nothing in your letter that could be criticized. However, the letter must incorporate some crucial elements. Therefore, you must learn to write that letter. Since you do not want to be a liar, writing your difficulty letter is probably difficult, since you may need to reveal some personal skeletons that you would probably prefer to hide in the closet. A family difficulty letter of assistance is simply a request for help. In order for the most suitable person to find the right niche, he can extract the letters and increase the income easily. Based on the organization of your organization, your letter should be addressed to the highest decision-making authority. Writing an extremely impressive and attractive letter is one of the most daunting tasks. The best method to find such an expert letter is the internet or inside a book. With the second type of letter, you are introducing two people who know each other. The letter will be sent in your personnel file, which you will not have access to, Hurwitz said. A letter of request should be written when seeking information or assistance from another person. A transfer request letter is a kind of sales letter. You just need to decide what type of resume or cover letter will be the most appropriate for you. The trick to writing a prosperous letter is to stick to the proper format, which is explained in these steps. A letter from your doctor should be fine, but the financial aid form or the financial aid office will tell you exactly what type of test they require.

how to write a letter to a company requesting something

By : www.pinterest.com

how to write a letter to a company requesting something

By : www.expocar.info

how to write a letter to a company requesting something

By : business.lovetoknow.com

The Best Way to Write a Letter Requesting a Favor (with Sample)

How To Get My Gratuity From The Company

By : www.wikihow.com

The Best Way to Write a Letter Requesting a Favor (with Sample)

By : www.wikihow.com

How To Get Gratuity Amount From Company

0 notes

Link

0 notes

Photo

DIFC Employee Workplace Savings Plan | Best Payroll Advisor Dubai, UAE - HLB HAMT

Dubai International Financial centre, a special economic zone in Dubai, has introduced a workplace savings scheme, which replaces the existing end-of-service gratuity benefits. The new plan titled DEWS (DIFC Employee Workplace Savings) requires employers to make compulsory monthly contributions to a savings plan which will commence from February 1, 2020; and this will have an impact on the Payroll Process in UAE. All DIFC employers must opt for this funded defined contribution plan or any other qualifying plan approved by DIFC.

The amendment is in line with the DIFC employment law No 2 of 2019, that was passed few months back and it states that the employer contribution towards an investment or pension scheme should not be less than the monthly gratuity accrual.

This plan is set to be launched with effect from 1st February 2020. The deadline for employers to enrol into a qualifying scheme is 31st March 2020 and the initial contribution must be made on or before 21st of April. The first payment should include the contribution starting from 1st February, 2020 onwards. Even though the mandatory contribution is calculated as a percentage on basic salary, there won’t be deductions of any sort from the salary of the employee.

Learn More

#hlbhamt #payroll #payrollprocess #DIFC #DEWS #gratuity #eosg #business #employee #savingsplan #workplace #dubai #uae

#HLB#hlbhamt#Payroll#dubai#uae#Business#employee#workplace#difc#finance#financial advisors#payrollprocess#payrollservicesindubai

0 notes

Photo

Snuck off to #28HKS before my shift at #EOSG to see this fella and taste his #BacardiLegacy #cocktail, #LaFiestaMia! #JunglebirdKL #BLGCC2018 (at 28HKS)

0 notes