#excise duty in india

Text

இந்திய சட்டங்கள் மற்றும் இந்தியாவில் சட்டப்பூர்வ தீர்வுகள்

இந்தியா வளமான கலாச்சார பாரம்பரியம் கொண்ட பல்வேறு நாடு. இந்திய சட்ட அமைப்பு உலகின் பழமையான சட்ட அமைப்புகளில் ஒன்றாகும், மேலும் இது பல ஆண்டுகளாக உருவாகி வருகிறது. குடிமக்களின் உரிமைகளைப் பாதுகாக்கவும் நீதியை உறுதிப்படுத்தவும் இந்தியாவில் பல்வேறு சட்டங்கள் மற்றும் சட்டப் பரிகாரங்கள் உள்ளன.

இந்திய சட்டங்கள்

இந்திய சட்ட அமைப்பு இந்தியாவில் வாழ்க்கையின் பல்வேறு அம்சங்களை ஒழுங்குபடுத்துவதற்கும்…

View On WordPress

#The Acquired Territories (Merger) Act 1960#The Additional Duties Of Excise (Textiles And Textile Articles) Act 1978#The Administration of Evacuee Property (Central) Rules1950#The Administration of Evacuee Property Act 1950#The Advocates Welfare Fund Act 2001#The African Development bank Act 1983 The Banking Regulation Act 1949#The Agricultural And Processed Food Products Export Development Authority Act 1985#The Agriculturists Loans Act 1884#The Airports Economic Regulatory Authority Of India Act 2008#The All India Council For Technical Education 1987#The All India Institute Of Medical Science Act 1956#The Anand Marriage Act 1909#The Ancient Monuments and Archaeological Sites and Remains Act 1958#The Ancient Monuments Preservation Act 1904#The Anti-Hijacking Act 1982#The Antiquities and Art Treasures Act 1972#The Architects Act 1972#The Arms Act 1959#The Arya Marriage Validation Act 1937#The Banking Regulation (Amendment) and Miscellaneous Provisions Act 2004#The Benami Transactions(Prohibitions) Act 1988#The Biological Diversity Act 2002#The Cantonments Act 2006#The Carriage By Air Act 1972#The Carriage by Road Act 2007#The Cencus Act 1948#The Central Boards Of Revenue Act 1963#The Central Excise Act 1944#The Central Reserve Poilce Force 1949#The Central Road Fund Act 2000

0 notes

Text

EXPLORING THE FOUNDATIONS OF INDIAN DEMOCRACY: A GUIDE TO THE CONSTITUTION OF INDIA

Introduction

The Constitution of India came into force on January 26, 1950, when it was adopted by the Constituent Assembly. The final draft of the constitution was completed on December 15, 1947 and was submitted for approval to the Constituent Assembly in two parts. This document has been amended many times since its implementation and is still undergoing amendments today. It’s important for…

View On WordPress

#Bitcoin#Blockchain#business#Central bank digital currencies#CONSTITUTION OF INDIA#costitution#Cryptocurrency#Decentralized ledger#Digital transformation#Distributed technology#Economic inequality#Economic policy#economics#excise duty#Financial inclusion#Financial services Payment systems Financial regulation#Financial system#Financial technology#Financial transactions#Fintech#Goods and Services Tax#Goods and Services Tax tax reform indirect taxes value-added tax service tax excise duty GST Council GST rates input tax credits tax complia#Green finance#GST Council#GST rates#INDIA#Indian economy#indirect taxes

1 note

·

View note

Text

Today marks the 20th death anniversary of Uma Devi Khatri aka #TunTun. She was a well-known singer and actress, famous for being the first female comedian in Hindi cinema. Uma was born in 1923 in a small village near Amroha, Uttar Pradesh, India. Tragically, her parents and brother were killed over a land dispute. Uma lost her family when she was very young and had to live as a maid with relatives. Despite these hardships, Uma's life changed when she met Akhtar Abbas Kazi, an Excise Duty Inspector, who supported and encouraged her. During the India-Pakistan partition, Kazi moved to Lahore, but Uma went to Bombay (now Mumbai) to pursue a singing career in movies. They later married in Bombay in 1947. Uma bravely approached composer Naushad Ali in Bombay, asking for a chance to sing, and he gave her an opportunity. She debuted as a singer in the film "Wamiq Azra" (1946) and quickly made a name for herself. Uma had a series of hit songs in the 1940s, including in the movie "Dard" (1947). Her singing career flourished, and she became one of the top playback singers. However, as music styles changed, she found it hard to compete with newer singers. Naushad suggested she try acting, and she debuted in the film "Babul" (1950) alongside Dilip Kumar, where she got her stage name "Tun Tun." Tun Tun became a famous comic actor, appearing in many films over the next decades, including with stars like Amitabh Bachchan. She acted in about 198 films in various languages, becoming a well-loved figure in Bollywood comedy. Her last film appearance was in "Kasam Dhande Ki" (1990). Tun Tun's name became a cultural reference in India, often associated with comic characters.

9 notes

·

View notes

Text

Indirect Tax

Recent changes in Indirect Tax

Indirect taxes are taxes that are assessed by Government on goods and services, rather than on individualities or businesses directly. These taxes are collected by businesses from consumer when they buy goods or services, and also remitted to the government. Indirect taxes are often referred to as consumption taxes because they are based on consumption of goods and services rather than income or wealth. Indirect taxes can take many forms, including sales taxes, value-added taxes (VAT), excise taxes, and tariffs.

During the Union Budget of 2023 “Amrit Kaal”, It was the very first time when the indirect tax proposals were presented before the direct tax proposals. In the Proposal of indirect tax Presented in the Union Budget of 2023 there were 4 major changes which caught the attention of the citizens.

Following are the 4 major changes:

Customs Perspective: In the Union Budget, to promote the ‘Make in India’ campaign and give to a boost to domestic manufacturing and enhance exports, the government and our FM has proposed few changes in the rate of import duties. The import duties on electric chimneys and cigarettes will now be more expensive, while on the other hand import of gold, silver, platinum, coin, etc., will be cheaper. Also, some exemption has been proposed towards goods or machinery used for manufacturing of lithium-ion battery.

GST Returns To Be Filed Within Three Years: GSTR 1, GSTR 3B and GSTR 9and GSTR 9C would now be restricted for filing, post expiry of three years from the due date of filing of the relevant GST return. Until now, there was no threshold on time for filing GST return and any taxpayer could file belated returns along with interest and late fees. However, going forward, in future these dates have been locked so as to have clarity on the timelines for litigation.

Widening of Scope of OIDAR: The Online Information and Database Access and Retrieval (OIDAR) services were brought under the tax bracket in the service tax regime and subsequently, in the GST regime. However, due to some exceptions in OIDAR and non-taxable online recipient, multiple services were escaping tax. In order to remove those exceptions, the Budget proposes to amend both the definitions and make OIDAR a wider segment for taxability purpose.

Taxability of High Sea Sales and Out-And-Out Sales: Out-and-out sales and high-sea sales were inserted in schedule III of the CGST Act, 2017 with effect from Feb. 1, 2019. However, the GST authorities were demanding GST from July 1, 2017 to Jan. 31, 2019. So to clarify this ambiguity and confusion, the budget has stated that such insertion will be with retrospective effect from July 1, 2017. This is a relief for taxpayers who are undergoing a litigation on these aspects. However, if the taxpayer has already paid the taxes for such period on the specified sales, the Budget has clearly specified that no refund of such tax can be claimed.

Although there are other changes as well but from Tax perspective the above 4 are major changes.

2 notes

·

View notes

Text

Nirmala Sitharaman's prediction for India's economy as IMF cuts global growth

Nirmala Sitharaman said growth will be among the top priorities of the Narendra Modi government and attention will be paid to sustaining the momentum that the Indian economy has got coming out of the Covid-19 pandemic.

Union finance minister Nirmala Sitharaman, who is in the US to attend the annual meetings of the International Monetary Fund (IMF) and the World Bank, on Tuesday forecasted India’s growth rate to be around 7 per cent this financial year.

Sitharaman said growth will be among the top priorities of the Narendra Modi government and attention will be paid to sustaining the momentum that the Indian economy has got coming out of the Covid-19 pandemic.

Her statement comes even as the IMF, in its latest projection, predicted India’s GDP growth to be 6.8 per cent — down from a January projection of 8.2 per cent and in July estimate of 7.4 per cent. However, despite the slowdown, India would remain the fastest-growing major economy.

The IMF said on Tuesday global growth is expected to slow further next year, downgrading its forecasts as countries grapple with the fallout from Russia’s invasion of Ukraine, spiraling cost-of-living and economic downturns.

The world economy has been dealt multiple blows, with the war in Ukraine driving up food and energy prices following the coronavirus outbreak, while soaring costs and rising interest rates threaten to reverberate around the globe.

“I am aware that growth forecasts around the world are being revised lower. We expect India’s growth rate to be around 7 per cent this financial year. More importantly, I am confident of India’s relative and absolute growth performance in the rest of the decade,” she said addressing a gathering in Washington.

Sitharaman, however, observed that the Indian economy is not exempt from the impact of the world economy. “No economy is,” she said.

“After the unprecedented shock of the pandemic, came the conflict in Europe with its implications for energy, fertiliser and food prices. Now, synchronised global monetary policy is tightening in its wake. So, naturally, growth projections have been revised lower for many countries, including India. This triple shock has made growth and inflation a double-edged sword,” Sitharaman said.

After the Russia-Ukraine conflict started in February 2022, there was a sharp increase in food and energy prices. India had to ensure that the rising cost of living did not lead to lower consumption through erosion of purchasing power.

“We addressed these multiple and complex challenges through a variety of interventions. One, India ramped up its vaccine production and vaccination. India has administered over 2 billion doses of vaccine produced domestically. Two, India’s digital infrastructure ensured the delivery of targeted relief Third, in 2022, after the conflict erupted in Europe, we ensured adequate availability of food and fuel domestically, lowered import duties on edible oil and cut excise duties on petrol and diesel. The central bank has acted swiftly to ensure that inflation did not get out of hand and that currency depreciation was neither rapid nor significant enough to lead to a loss of confidence,” the minister said.

Sitharaman said India is discussing with different countries to make Rupay acceptable in their nations.

“Not just that, the UPI (Unified Payments Interface), the BHIM app, and NCPI (the National Payments Corporation of India) are all now being worked in such a way that their systems in their respective country, however, robust or otherwise can talk to our system and the inter-operability itself will give strength for Indians expertise in those countries,” she said.

2 notes

·

View notes

Text

GST in Gurgaon: A Comprehensive Guide to Compliance and Benefits

The Goods and Services Tax (GST) has revolutionized the tax machine in India, simplifying the complex internet of indirect taxes. For companies in Gurgaon, one of the maximum unexpectedly developing industrial hubs, information the nuances of GST is essential for seamless operation & increase. Adya Financial 'll provide a complete guide on GST in Gurgaon, along with its implications for businesses, registration approaches, and the way it is able to affect the hospitality industry, including luxury inn rooms in Dehradun and similar establishments.

Introduction to GST in India

The Goods and Services Tax (GST) become added in India on July 1, 2017, to unify a couple of oblique taxes right into unmarried, complete machine. It replaced taxes like Value Added Tax (VAT), Central Excise Duty, Service Tax, and different local levies. This simplification has made the tax machine greater obvious & less difficult to control, particularly for groups with multi-state operations like the ones in Gurgaon.

GST is levied at the supply of goods & offerings at every degree of the supply chain, from production to the final consumer. Its middle idea is to get rid of the "cascading effect" of taxes, because of this product is taxed most effective on the point of consumption.

Types of GST

Before diving into the specifics for Gurgaon, it’s essential to understand the 4 most important types of GST:

CGST (Central Goods and Services Tax): Levied by using the important government on intra-state transactions.

SGST (State Goods and Services Tax): Levied by using the kingdom authorities on intra-country transactions.

IGST (Integrated Goods and Services Tax): Levied on inter-country transactions.

UTGST (Union Territory Goods and Services Tax): Applicable for Union Territories like Chandigarh, Andaman and Nicobar Islands, & so forth.

Why GST is Important for Businesses in Gurgaon

Gurgaon, now formally known as Gurugram, has emerged as a chief enterprise hub, home to several multinational groups, startups, and industries spanning throughout IT, actual estate, finance, and hospitality. The advent of GST in Gurgaonplays essential position inside the ease of doing commercial enterprise on this metropolis by using:

Simplifying Taxation: GST has replaced a multitude of indirect taxes with one uniform tax, considerably lowering compliance burden for corporations in Gurgaon.

Increased Transparency: With GST, groups can now avail Input Tax Credit (ITC) for taxes paid on items & offerings used in their operations, reducing their usual tax legal responsibility.

Boost to the Hospitality Sector: Hotels & lodges, such as the ones imparting luxurious hotel rooms in Dehradun, enjoy the GST regime. GST simplifies the tax structure for hotels, ensuring that each agencies and customers understand their tax liabilities more truely.

GST Registration Process for Businesses in Gurgaon

Any enterprise operating in Gurgaon, with an annual turnover exceeding ₹40 lakh (₹20 lakh for service vendors), should check in for GST. The technique is entirely on line, making it less complicated for organizations to conform without travelling tax offices.

Steps to Register for GST:

Visit the GST Portal: Begin online gst registration in gurgaon by using journeying the reliable GST internet site (www.Gst.Gov.In).

Filing the Application: You will want to fill out Form GST REG-01. Ensure all info which includes the commercial enterprise name, sort of enterprise, & PAN are entered successfully.

Submission of Documents: Provide important documents like PAN card, Aadhaar card, enterprise registration proof, bank account information, and photos of the owner or enterprise companions.

Verification and Approval: Once submitted, the utility may be proven by means of tax authorities. Upon approval, you'll be issued unique GST Identification Number (GSTIN).

Completion: After acquiring your GSTIN, you are required to record GST returns often.

GST Compliances for Businesses in Gurgaon

Complying with GST guidelines is vital for groups to keep away from penalties and make certain clean operations. Here are some key compliances for GST in Gurgaon:

Monthly/Quarterly Filing of Returns: Depending on the enterprise length and turnover, groups need to report both monthly or quarterly GST returns. The paperwork consist of GSTR-1 (sales info), GSTR-3B (summary return), & GSTR-9 (annual return).

Payment of Taxes: GST is payable month-to-month or quarterly, relying at the form of enterprise. Delayed payments can result in interest & penalties.

Input Tax Credit (ITC): One of the foremost advantages of GST is the capacity to assert credit score for taxes paid on purchases. However, to claim ITC, businesses have to safeguard right document-preserving and matching of buy and income invoices.

Compliance with E-invoicing: For huge organizations, e-invoicing is mandatory. This ensures transparency & curbs tax evasion by means of digitizing the invoicing method.

GST Rates for Various Sectors in Gurgaon

GST quotes vary across industries, making it vital for businesses to live up to date. For groups in Gurgaon, mainly in hospitality, manufacturing, & IT, knowledge those costs is crucial for accurate tax compliance.

Hospitality Sector: Hotels with room price lists underneath ₹1,000 are exempt from GST. For room tariffs among ₹1,000 & ₹7,500, the GST charge is 12%, at the same time as tariffs above ₹7,500 are taxed at 18%. Resorts & comfort hotels, consisting of those providing luxury motel rooms in Dehradun, fall into this class.

Manufacturing Sector: The fashionable GST charge for production groups in Gurgaon is 18%. However, vital objects and meals merchandise may additionally attract a decrease price of 5%.

Information Technology (IT): The GST fee for IT services is 18%, making it vital for tech companies in Gurgaon to conform with this fee structure for software and IT-associated services.

The Role of GST in Boosting the Hospitality Industry

Gurgaon, being a major business & leisure destination, has seen its hospitality industry thrive under GST. The tax structure has brought transparency to hotel tariffs and increased accountability. Moreover, businesses in the hospitality sector, such as those managing luxury hotel rooms in Dehradun, can easily calculate & charge GST, ensuring that guests have a clear understanding of the tax component in their bills.

Additionally, the availability of Input Tax Credit (ITC) on goods and services used by hotels (like food, maintenance, & utilities) has led to cost reductions, allowing hotels to offer competitive pricing without compromising on quality.

Common Challenges for Businesses in Gurgaon Under GST

While GST has simplified the taxation system, agencies in Gurgaon face some demanding situations:

Frequent Updates to GST Laws: The Indian GST system undergoes common adjustments, which may be difficult for agencies to preserve track of. Staying up to date with the modern-day adjustments in tax slabs, ITC guidelines, and compliance requirements is vital.

Mismatch of Invoices: Many organizations face difficulties with invoice matching in the course of ITC claims. This can put off the refund manner & result in coins float troubles.

Penalties for Non-Compliance: Failing to comply with GST submitting or charge deadlines can cause consequences, which can also have an effect on small & medium-sized businesses the most.

Benefits of GST for Gurgaon’s Economy

Despite those demanding situations, GST has positively impacted Gurgaon’s economic system in numerous approaches:

Increased Efficiency: The streamlined tax process beneath GST has decreased paperwork and administrative hurdles for businesses.

Reduced Tax Evasion: GST’s digital infrastructure has curtailed tax evasion by making each transaction traceable.

Boost to Trade and Commerce: The ease of doing commercial enterprise in Gurgaon has stepped forward because of GST, attracting foreign investments & increasing the nearby financial system.

Enhanced Consumer Confidence: For purchasers, GST brings clarity to the tax shape, as they now recognize the precise amount of tax being paid on goods and services.

Conclusion

For corporations in Gurgaon, know-how & complying with gst registration in Gurgaon isn't always just a felony duty but vital issue of smooth operations and increase. Whether you’re walking a small startup or dealing with a series of luxury inn rooms in Dehradun, staying up to date with GST guidelines will make sure your commercial enterprise prospers on this competitive landscape.

By simplifying the tax shape, reducing redundancies, & bringing transparency, GST has paved the manner for corporations in Gurgaon to enlarge & flourish. With the right techniques in area, organizations can leverage GST for each compliance and profitability.

0 notes

Text

GST Compliance Solutions Simplifying Complex Tax Regulations

In an era of rapid cross-border business growth, understanding and complying with tax laws has become more difficult than ever. The Goods and Services Tax (GST) is one such tax regime that is changing the way business is done, especially in countries like India, Australia and Canada. However, complex GST rules can often overwhelm business owners, especially small and medium enterprises (SMEs). This is where GST compliance solutions come in, helping businesses navigate the complexity of tax compliance with ease.

In this article, we will explore various aspects of GST compliance, challenges faced by businesses and how GST compliance solutions can simplify this complex tax law. Whether you are a business owner, an accountant, or just anyone interested in understanding GST, this comprehensive guide will provide valuable insight.

Understanding GST: A Brief Overview

GST or Goods and Services Tax is an indirect tax on the supply of goods and services. It is a comprehensive, multi-channel, destination-based tax that has replaced earlier indirect taxation by both the central and state governments The main objective of GST is to provide the tax system facilitated and created a single market by increasing taxes.

Key Features of GST:

Exceptions: GST includes VAT, service tax, excise duty, and various other taxes.

Multi-stage: GST is collected at every stage of the supply chain from manufacturing to end-consumption.

Destination: Taxes are collected where goods are consumed rather than produced, ensuring that revenue is distributed based on consumption.

Importance of GST Compliance

Complying with GST rules is important for businesses to avoid penalties, maintain good reputation and ensure smooth operations. Non-compliance can result in significant fines, legal challenges, and business outages. Therefore, companies need to understand the intricacies of GST and abide by the rules and deadlines.

Highlights of GST Compliance:

Timely filing of GST Returns: Companies must file GST returns on a regular basis, based on their income and other factors. Missing the deadline can result in penalties and interest.

Accurate Records: Maintaining accurate records of all transactions, invoices and returns is essential for GST compliance. This ensures that the Investment Tax Credit (ITC) has been properly claimed.

Proper Tax Accounting: To avoid underpaying or overpaying tax, businesses should accurately account for GST on their goods and services.

E-invoicing Compliance: E-invoicing is a must for businesses with fixed invoices. It involves the generation of invoices in a standardized manner, which are then uploaded to an official channel for verification.

Common Challenges in GST Compliance

Despite the benefits of GST, compliance can be a challenge for businesses, especially SMEs. Some common complications are:

Complex Tax Laws: GST laws can be complex, and are frequently amended and updated. Keeping up with these changes can be challenging, especially for small businesses with limited resources.

Multiple Registrations: Multinational companies may need to register for GST in each country, increasing the administrative burden.

Input Tax Credit (ITC) Reconciliation: Reconciling input tax credits with supplier data can be time consuming and errors are prone.

Costs of Compliance: The costs of hiring staff, investing in software and managing compliance processes can be high, especially for SMEs.

Technology Implementation: Adopting new technologies such as e-invoice compliance software can be challenging for businesses that are not tech savvy.

How GST Compliance Solutions can Help

The GST compliance solution is designed to simplify the process of GST compliance. This solution uses technology to automate aspects of GST compliance, reducing the burden on businesses and ensuring consistency.

Benefits of GST Compliance Solution:

Automation of Processes: GST compliance solutions automate tasks such as return filing, invoice generation, tax calculation etc., reducing the risk of human error.

Real-time Updates: This solution provides real-time updates on changes in GST laws, ensuring that businesses are in compliance with the latest regulations.

Simplified ITC Reconciliation: GST compliance solutions simplify the process of matching input tax with supplier data, reducing the chances of contradiction will come to him.

Lower Costs: By automating compliance processes, companies can reduce hiring costs and control manual processes.

Ease of Use: Many GST compliance solutions are user-friendly, making it easy for businesses to adopt and integrate into their existing systems.

Top Features to Look for in a GST Compliance Solution

When choosing a GST compliance solution, it’s important to consider the features that will best meet your business needs. Here are some of the top things to look for:

Return Filing Automation: Look for solutions that automate GST returns, reducing the time and effort required to meet compliance deadlines.

Invoice Integration: Make sure the solution supports e-invoicing, so you can create and upload invoices in the required format.

ITC Reconciliation: A good GST compliance solution should provide tools to reconcile input tax with supplier data, thereby reducing errors.

Real-time Compliance Alerts: Choose a solution that provides real-time alerts of compliance deadlines, regulatory changes, and important updates.

Easy-to-use Interface: The solution should be easy to use, with an intuitive interface that allows regulatory tasks to be picked up and managed efficiently.

Options: Look for customizable solutions to meet the specific needs of your business, such as handling multiple GST registrations or integration with your existing accounting software.

Data Security: Make sure the solution offers robust data security features such as encryption and regular backups to protect your sensitive information.

Choosing the Right GST Compliance Solution for your Business

Choosing the right GST compliance solution is important to ensure your business is GST compliant. Here are some tips for making the right choice:

Determine your Business Needs: Start by looking at the specific compliance requirements of your business, such as the number of transactions, the complexity of your business, and the level of expertise required.

Compare Features: Compare features of various GST compliance solutions and find one that provides you with the functionalities you need, such as return filing, e-invoicing, and ITC matching.

Ensure Scalability: Ensure the solution can scale with your business as it grows, accommodates increased transaction volumes and other compliance requirements.

Consider Costs: Determine the cost of the solution, including any setup fees, subscription fees, and ongoing maintenance costs. Find solutions that provide value for money without compromising quality.

Read Reviews and Testimonials: Look for reviews and testimonials from other companies that have implemented the solution. This provides insight into the effectiveness and reliability of the solution.

Request a Demo: If possible, request a demo of the solution to see how it works and whether it meets your business needs.

GST Compliance Solutions: Best Practices

Once you’ve identified a GST compliance solution, it’s important to use it effectively to maximize your returns. Here are some best practices to follow.

Train Your Team: Make sure your team is properly trained on how to implement GST compliance solutions. This will guide them through the process more effectively and reduce the chances of error.

Integrate Existing Systems: Integrate GST compliance solutions into your existing accounting and ERP systems to streamline processes and improve data accuracy.

Check Compliance Regularly: Check your GST compliance process regularly to make sure everything is running smoothly. Use the reporting features of the solution to track compliance status and identify any issues.

Stay Updated On Changes: Stay up-to-date with any changes to GST laws and regulations, and ensure your GST compliance solutions are updated accordingly.

Take Professional Advice: If you are unfamiliar with any aspect of GST compliance, seek advice from a tax professional. They can help you navigate complex regulations and ensure your business stays compliant.

Future GST Compliance: Trends to Watch

As technology continues to evolve, so will the tools and solutions available to comply with GST. Here are some things to watch out for in the future in terms of GST compliance:

AI and Machine Learning: AI and machine learning are set to play a key role in automating GST compliance processes, improving accuracy and reducing the time required for compliance tasks.

Blockchain Technology: Blockchain has the potential to transform GST compliance by providing a secure, transparent and immutable record of transactions. This can reduce fraud and improve the accuracy of compliance data.

Cloud-Based Solutions: Cloud-based GST compliance solutions provide flexibility, scalability and accessibility, making it easy for businesses to manage compliance from anywhere.

Enhanced Government Digitization: Governments are increasingly adopting digital technologies for tax collection and compliance. Companies will need to stay updated on these developments and ensure their compliance solutions align with government policy.

Enhanced Data Analytics: Advanced data analytics tools will help businesses gain deeper insights into their GST compliance processes, allowing them to spot trends, identify issues and make informed decisions.

Conclusion

GST compliance is key to running a successful business, but it can be difficult and time-consuming. Fortunately, GST compliance solutions are available to simplify the process, reduce errors and ensure your business remains compliant with the latest regulations. By understanding the basics and applying best practices when looking for GST compliance solutions, you can confidently navigate the complexities of GST and focus on growing your business.

0 notes

Text

Benefits of GST Registration for Businesses in Chennai

GST Registration in Chennai: A Comprehensive Guide

Chennai, the capital of Tamil Nadu, is a thriving business hub, home to a range of industries from IT and manufacturing to textiles and retail. To operate legally and benefit from the tax system, businesses in Chennai must adhere to the Goods and Services Tax (GST) regulations. This article offers a comprehensive guide to GST Registration in Chennai, explaining its benefits, process, eligibility, and requirements.

What is GST?

The Goods and Services Tax (GST) is an indirect tax system introduced in India in July 2017. It subsumes multiple taxes like VAT, service tax, and excise duty into one unified tax, simplifying compliance and promoting ease of doing business. GST applies to the supply of goods and services and is mandatory for businesses that exceed specific turnover limits.

Who Should Register for GST in Chennai?

GST registration is mandatory for businesses and individuals who meet the following criteria:

Turnover Threshold:

Businesses with an annual turnover exceeding ₹40 lakhs (₹10 lakhs for particular category states) must register for GST.

For service providers, the turnover threshold is ₹20 lakhs.

Interstate Business:

If your business involves the supply of goods or services between states, GST registration is mandatory, irrespective of turnover.

E-Commerce Sellers:

If you sell products or services through e-commerce platforms like Amazon, Flipkart, or your website, GST registration is required.

Voluntary Registration:

Even if you don't meet the turnover threshold, you can voluntarily register for GST to avail of input tax credit and appear more credible to your customers.

Benefits of GST Registration

Legal Compliance:

GST registration ensures that your business operates legally and avoids any penalties or fines for non-compliance.

Input Tax Credit:

Businesses can claim input tax credits on purchases, allowing them to reduce their tax liability.

Expansion Opportunities:

Registered businesses can expand their operations across India without worrying about state-specific tax laws.

Enhanced Credibility:

Having a GST registration number adds to your business credibility, especially when dealing with larger enterprises or government contracts.

Documents Required for GST Registration in Chennai

The following documents are required to complete GST registration in Chennai:

PAN Card of the business or applicant

The Aadhaar Card of the applicant

Proof of business address: This could be a rent agreement, electricity bill, or property tax receipt.

Bank account details: A copy of a cancelled cheque or the first page of your bank passbook.

Digital Signature Certificate (DSC) for companies and LLPs

Incorporation certificate or partnership deed for businesses

Passport-size photograph of the applicant

Step-by-Step Process for GST Registration in Chennai

Follow these steps to complete GST registration in Chennai:

Step 1: Visit the GST Portal

Go to the official GST website https://www.gst.gov.in and click on the ‘Services’ tab. Under ‘Registration,’ choose ‘New Registration.’

Step 2: Fill in the Application

You’ll be asked to provide the following details:

PAN card number

Email ID and mobile number (to receive OTPs)

State and district where your business is located After filling in these details, click ‘Proceed.’

Step 3: Verification of Contact Details

You will receive OTPs on the mobile number and email address you provided. Enter the OTP to verify your contact details.

Step 4: Provide Business Details

Fill in details such as the trade name, constitution of the business, principal place of business, and additional place of business, if applicable.

Step 5: Upload Documents

Upload the required documents, such as proof of business address, PAN card, Aadhaar card, and bank details.

Step 6: Submit the Application

After reviewing the information you provided, apply to individuals using Digital Signature (DSC) or Electronic Verification Code (EVC).

Step 7: Receive ARN

Once the application is submitted, an Application Reference Number (ARN) will be generated. You can use this number to track the status of your application.

Step 8: Approval and GSTIN

If the authorities find your application in order, your GST Registration will be approved, and you will receive your GST Identification Number (GSTIN).

GST Registration Fees in Chennai

There is no government fee for GST registration. However, if you prefer to seek the assistance of professionals, they may charge a fee for their services.

Penalties for Non-Compliance

Failure to register for GST when required can result in penalties. The penalty for not registering is 10% of the tax due, subject to a minimum of ₹10,000. In cases of deliberate evasion, the penalty can go up to 100% of the tax due.

Conclusion

Registering for GST is a crucial step for businesses operating in Chennai. It ensures compliance with the law, offers tax benefits, and enhances credibility. The process is straightforward and can be done online, making it convenient for businesses of all sizes. Whether you are starting a new business or expanding an existing one, GST registration is an essential step towards success in the competitive Chennai market.

0 notes

Text

The Advantages of GST in India: A Simple Guide

The Goods and Services Tax (GST) was introduced in India on July 1, 2017, to simplify the way businesses pay taxes. GST replaced several old taxes like VAT, Service Tax, and Excise Duty with one unified system. This change has brought many benefits for businesses across the country. If you’re thinking of starting a business or expanding your current one, getting a new GST registration can help you take full advantage of these benefits.

1. Simplified Tax System

Before GST, businesses had to deal with many different taxes at both the Central and State levels. This made it difficult and confusing to manage. GST has simplified things by combining all these taxes into one. With new GST registration, businesses now have a much easier time keeping track of taxes and complying with regulations.

2. No More Tax on Tax

Before GST, businesses often ended up paying tax on top of tax at different stages of production and distribution. This made products more expensive for consumers. GST has solved this problem by allowing businesses to claim tax credits for the taxes they’ve already paid, which lowers the overall cost. With new GST registration, your business can save money by avoiding these extra taxes.

3. Access to a Bigger Market

GST has made it easier for businesses to operate across India without worrying about different state taxes. This means businesses can reach more customers across the country. A new GST registration allows you to sell your products or services anywhere in India without facing additional tax barriers.

4. Better Logistics and Lower Costs

In the past, businesses had to set up warehouses in different states to avoid interstate taxes. GST has removed the need for this, allowing companies to streamline their operations. With new GST registration, your business can save money on logistics, making your supply chain more efficient.

5. Easy and Transparent Compliance

GST is a digital tax system, meaning all registrations, returns, and payments are done online. This has made tax compliance much easier and more transparent. By getting a new GST registration, your business can easily stay on top of tax obligations, reducing the risk of fines or legal issues.

6. Boost to the Economy

GST has helped bring more businesses into the formal economy, which has increased tax revenues for the government. This, in turn, helps fund public services and infrastructure. For your business, new GST registration can enhance credibility and open up new opportunities, such as easier access to loans and government incentives.

7. Benefits for Consumers

GST has also benefited consumers by reducing the overall tax burden on goods and services, making them more affordable. Since GST rates are the same across the country, consumers pay a uniform tax, no matter where they buy the product.

Conclusion

GST has made a big difference for businesses in India by simplifying taxes, reducing costs, and making it easier to expand into new markets. Getting a new GST registration is the first step to taking full advantage of these benefits. Whether you’re starting a new business or looking to grow an existing one, being part of the GST system can help you succeed in today’s competitive market.

0 notes

Text

In today’s rapidly evolving business landscape, compliance with government regulations is not just a requirement but a necessity. One such critical compliance for businesses in India is the Goods and Services Tax (GST) registration. Whether you’re a small startup or a large corporation, GST registration is mandatory for businesses that meet certain criteria. However, navigating the complexities of GST can be daunting, and that’s where a professional GST registration consultant like Legalari in Ghaziabad comes into play.

Understanding GST and Its Importance

The Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. It was introduced on July 1, 2017, replacing multiple indirect taxes like VAT, service tax, and excise duty. GST is designed to streamline the tax structure in India and create a unified market by eliminating the cascading effect of taxes on the cost of goods and services.

GST registration is compulsory for businesses whose turnover exceeds a specified threshold. Failure to register for GST can result in heavy penalties and legal complications. Therefore, it’s essential for businesses to ensure they are compliant with GST regulations to avoid any legal hassles.

Why Choose Legalari for GST Registration?

Legalari is a leading GST registration consultant in Ghaziabad, offering a wide range of services to help businesses navigate the complexities of GST. With years of experience and a team of highly skilled professionals, Legalari has established itself as a trusted name in the industry. Here’s why you should choose Legalari for your GST registration needs:

1. Expert Guidance

Navigating the GST registration process can be confusing, especially for those who are new to it. Legalari’s team of experts is well-versed in the latest GST regulations and provides step-by-step guidance to ensure your registration is smooth and hassle-free. From determining your eligibility for GST registration to filing the necessary paperwork, Legalari takes care of everything.

2. Comprehensive Services

Legalari offers a comprehensive range of GST-related services beyond just registration. These include GST return filing, GST compliance, GST audit assistance, and more. By choosing Legalari, you get access to a one-stop solution for all your GST-related needs, allowing you to focus on growing your business while they handle the compliance aspects.

3. Timely and Efficient Service

Time is of the essence when it comes to GST registration and compliance. Delays can lead to penalties and other legal issues. Legalari understands this and ensures that your GST registration is completed in a timely and efficient manner. Their streamlined process and use of advanced technology enable them to deliver fast results without compromising on quality.

4. Customized Solutions

Every business is unique, and so are its GST needs. Legalari takes the time to understand your business and provides customized solutions that cater to your specific requirements. Whether you’re a small business, a startup, or a large enterprise, Legalari tailors its services to meet your needs and ensure full compliance with GST regulations.

5. Affordable Pricing

Legalari believes in providing top-notch services at affordable prices. They offer competitive pricing for their GST registration and related services, ensuring that businesses of all sizes can access high-quality professional assistance without breaking the bank. Transparency in pricing is a core value at Legalari, so you can be assured that there are no hidden charges.

The GST Registration Process with Legalari

Legalari has simplified the GST registration process to make it as seamless as possible for their clients. Here’s a quick overview of the steps involved:

1. Consultation: The process begins with a consultation where Legalari’s experts assess your business’s eligibility for GST registration and gather the necessary information.

2. Document Collection: Legalari assists you in collecting and organizing all the required documents, such as PAN, Aadhaar, business address proof, and bank account details.

3. Application Filing: Once all the documents are in place, Legalari files your GST registration application on your behalf through the official GST portal.

4. Follow-Up: Legalari’s team closely monitors the status of your application and addresses any queries or issues raised by the GST authorities.

5. GSTIN Issuance: Upon successful verification, your GST registration will be approved, and you will receive your GST Identification Number (GSTIN). Legalari ensures that you receive your GSTIN promptly.

Why GST Compliance Matters

Compliance with GST regulations is crucial for maintaining the credibility and reputation of your business. Non-compliance can result in penalties, interest on unpaid taxes, and even legal action. By choosing Legalari as your GST registration consultant, you are taking a proactive step towards ensuring that your business remains compliant with all GST regulations, thereby avoiding any potential legal issues.

Conclusion

Legalari stands out as a reliable and professional GST registration consultant in Ghaziabad, offering a comprehensive suite of services to help businesses navigate the complexities of GST. Their expertise, commitment to timely service, and affordable pricing make them the ideal partner for businesses looking to ensure full GST compliance.

Whether you are a new business looking to register for GST or an established company seeking assistance with GST compliance, Legalari is here to help. With Legalari by your side, you can focus on what you do best — growing your business — while they take care of your GST needs.

0 notes

Text

E-Invoice GST Software

There are a number of options obtainable when you're seeking one of the best GST billing software program in your company. We've produced an inventory of the Best GST billing software in India to make your search simpler. These solutions each supply distinctive options and advantages to satisfy the necessities of enterprises of various sizes. Businesses should take into account a quantity of elements while selecting a GST billing software program, including the software program's usability, safety, scalability, and cost. To keep present with adjustments in GST rules and laws, it's also important to choose out a software provider that provides reliable customer support and frequent upgrades - restaurant management software.

You may even use it to keep away from wasting time and decrease errors by comparing your financial institution's transactions and invoices. You can easily compute GST, generate invoices, and automate your billing procedures. It functions at a nationwide degree to substitute most of the nationwide and state tax systems like VAT, service tax, excise responsibility, etc. Indeed, the invoicing software program for sole merchants is very versatile and suitable for freelancers, consultants, small companies, and enormous enterprises. Its configurable options cater to many enterprise necessities and workflows. Mechanically calculating taxes as indicated by preset rates and guidelines, the invoicing software program makes the method of making taxable invoices easier - online restaurant software.

A variety of features that simplify your financial duties are available in one of the best GST billing software programs, starting from automated tax computations to simple bill preparation. Our free GST software will allow you to to do all your day by day billing activities efficiently. With our online GST billing software, you can access all your corporation knowledge from anywhere, anytime, and from any device. With the help of free GST billing software solution, business owners can perform quite so much of features such as invoicing, tax calculation, billing, bookkeeping and rather more. For more information, please visit our site https://billingsoftwareindia.in/restaurant-billing-software/

0 notes

Text

Understanding GST: A Beginner's Guide for Local Entrepreneurs

Introduction to GST

Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services across India. Introduced on July 1, 2017, GST replaced a host of indirect taxes previously levied by the central and state governments. It aims to simplify the taxation process and create a single, unified market across the country.

Why GST?

Before GST, businesses in India faced numerous indirect taxes such as VAT, excise duty, service tax, and others. This multiplicity of taxes led to a cascading effect, where taxes were levied on top of other taxes, increasing the overall tax burden on businesses. GST addresses these issues by introducing a single tax structure, eliminating the cascading effect, and making compliance more straightforward.

Key Components of GST

GST is divided into three main components:

Central Goods and Services Tax (CGST): Collected by the Central Government on intra-state sales (e.g., a sale within Chandigarh).

State Goods and Services Tax (SGST): Collected by the State Government on intra-state sales.

Integrated Goods and Services Tax (IGST): Collected by the Central Government on inter-state sales (e.g., a sale from Chandigarh to Delhi).

Understanding GST Rates

GST has different tax slabs that apply to various goods and services:

0%: Essential goods like fruits, vegetables, and books.

5%: Items like clothing, footwear, and processed food.

12%: Goods like mobile phones and business class air tickets.

18%: Services such as telecommunications, IT services, and restaurant bills.

28%: Luxury items like automobiles and high-end electronics.

Who Needs to Register for GST?

Registration Thresholds:

Businesses with a turnover exceeding ₹20 lakh (₹10 lakh for special category states) must register for GST.

Inter-state suppliers must register regardless of turnover.

E-commerce operators facilitating online sales need to register.

Benefits of GST Registration:

Legal Recognition: GST Registration in Chandigarh businesses gain legal recognition as suppliers of goods or services.

Input Tax Credit: Ability to claim input tax credit on purchases, reducing tax liability.

Competitive Edge: Enhances business credibility and competitiveness in the market.

Step-by-Step Process for GST Registration

Prepare Documents:

PAN Card of the business or owner

Proof of business registration or incorporation certificate

Identity and address proof of promoters/directors

Bank account statement/cancelled cheque

Digital signature

Online Registration:

Visit the GST Portal.

Click on "Services" > "Registration" > "New Registration."

Fill in the required details, including PAN, mobile number, and email.

Receive OTP for verification.

Complete Part A of the registration form (GST REG-01).

Note down the Temporary Reference Number (TRN).

Complete Registration:

Log in using the TRN.

Fill in Part B of the registration form.

Upload necessary documents.

Submit the application using DSC (Digital Signature Certificate) or EVC (Electronic Verification Code).

Receive GSTIN:

The application is verified by the GST officer.

Upon approval, receive the GST Identification Number (GSTIN).

Filing GST Returns

Registered businesses must file GST returns regularly. The types of returns include:

GSTR-1: Monthly return for outward supplies.

GSTR-2A: Auto-drafted return for inward supplies.

GSTR-3B: Summary return of monthly transactions.

GSTR-9: Annual return consolidating all transactions for the year.

Compliance Tips:

Timely Filing: Ensure returns are filed on time to avoid penalties.

Accurate Data: Maintain accurate records of sales, purchases, and input tax credits.

Use Technology: Leverage GST software to automate filing and compliance.

Benefits of GST for Local Entrepreneurs

Reduced Tax Burden:

Elimination of multiple taxes simplifies compliance and reduces the overall tax burden.

Improved Cash Flow:

Input tax credit mechanism allows businesses to claim credit on taxes paid for inputs, improving cash flow.

Enhanced Market Reach:

Uniform tax rates across states enable easier inter-state trade and market expansion.

Boost to Startups:

Lower compliance costs and a simplified tax structure benefit startups and small businesses.

Transparency and Accountability:

GST fosters transparency and accountability in the tax system, reducing corruption.

Challenges and Solutions

Challenges:

Complexity of Compliance: Understanding and managing GST compliance can be challenging for new entrepreneurs.

Technical Issues: Online registration and filing may present technical challenges.

Solutions:

Seek Professional Help: Engage GST consultants in Chandigarh or experts for guidance.

Utilize Software Solutions: Leverage technology to streamline GST processes and compliance.

Conclusion

Understanding GST is crucial for local entrepreneurs in Chandigarh. It simplifies the tax structure, reduces compliance costs, and opens up new opportunities for business growth. By registering for GST and adhering to compliance requirements, entrepreneurs can enjoy the benefits of this unified tax system, positioning their businesses for success in the competitive market landscape.

0 notes

Text

GST Registration Online: Documents Required, Limits, Fees, Process, and Penalties

What is GST Registration

Businesses whose revenue exceeds the GST threshold limit of Rs.40 lakh, Rs.20 lakh, or Rs.10 lakh, as applicable, must register as a normal taxable person. It’s called GST registration.

Certain firms must register under GST. If the organization does business without registering for GST, it is an infraction punishable by significant fines.

GST registration normally takes between two and six business days. Team Taxring can help you become GST registered faster in three simple steps.

Who is required to register for GST?

GST enrollment is obligatory for the following individualities and businesses

Businesses with periodic development above — ₹ 40 lakhs( ₹ 20 lakhs for special order countries)

Service Providers with periodic development above — ₹ 20 lakhs( ₹ 10 lakhs for special order countries)

3.Exemptions: It’s worth noting that these thresholds do not apply to organizations who only sell GST-exempt products or services.

Previously Registered Entities: Entities that were registered under previous tax regimes (such as Excise, VAT, and Service Tax) must migrate and register under the GST regime.

Casual Taxable realities Undertaking taxable force sometimes

realities under Rear Charge Medium Paying duty under rear charge

Input Service Distributors & Agents Distributing input services

E-Commerce Platforms Drivers or aggregators

Non-Resident Taxable realities Engaging in taxable force within India

Supplier’s Agents Representing top suppliers

E-Commerce Suppliers Offering goods or services through e-commerce aggregators

Online Service Providers Delivering online services from outside India to individuals in India( banning those formerly registered under GST) Note realities dealing simply in GST- exempted goods or services are pure from these thresholds.

All about the GST registration process.

The GST portal allows you to register for GST. To apply for GST registration, complete Form REG-01 on the GST portal and follow the steps detailed in our article “How to Apply for GST Registration?”

However, Taxing GST registration services can assist you in getting your business GST registered and obtaining your GSTIN.

Taxiing T professionals will advise you on the GST applicability and compliances for your business, as well as help you register for GST.

Documents required for GST registration

Documents required for GST Registration for Company ,for LLP , for Patnership , for Propritership

include the applicant’s PAN and Aadhaar card

Please provide proof of business registration or incorporation certificate,

as well as identity and address proof of promoters/directors with photographs.

Proof of business address,

bank account statement, and cancelled cheque.

Required documents include a digital signature,

letter of authorization, and board resolution for the authorized signatory. Read more

Read also

GST Return filing

What is GST Notice & Types of GST Notice?

What is DSC How to get Digital signature certificate?

Income tax e-filing & Income Tax Audit

Budget 2024 Income tax slab

#income tax#gst#gst services#gstreturns#gst registration#accounting services#online gst registration

1 note

·

View note

Text

How Can TaxDunia.com Services Benefit Small Businesses in GST Filing?

Goods and Services Tax (GST) is an all-encompassing, multi-phase, destination-oriented tax imposed on each stage of value addition. Introduced in India on July 1, 2017, GST has replaced many indirect taxes that previously existed in the country, such as VAT, service tax, and excise duty. It is designed to create a single, unified market by eliminating the cascading effect of taxes, thereby reducing the tax burden on end consumers.

Key Features of GST:

Comprehensive: GST is levied on both goods and services.

Multi-Stage: It is collected at every stage of the supply chain, from the production to the point of sale.

Destination-Based: The tax is collected at the point of consumption rather than the point of origin.

Value Addition: GST is levied on the value addition at each stage of production and distribution.

Benefits of GST Return Filing Services:

Expert Guidance: Professionals who are well-versed in GST laws provide accurate and timely advice.

Error-Free Filing: Minimizes the risk of errors in GST returns, reducing the chances of penalties and notices from tax authorities.

Time-Saving: Frees up business owners’ time to focus on their core operations instead of dealing with complex tax compliance.

Compliance: Ensures that businesses comply with all GST regulations and filing deadlines, avoiding legal hassles.

Seamless Process: Streamlines the entire process of GST registration, return filing, and handling refunds.

Cost-Effective: Helps businesses save money by avoiding penalties and interest on late filings or inaccuracies.

Small businesses in India often face numerous challenges, especially when it comes to managing taxes and complying with regulatory requirements. One of the most critical areas where small businesses need assistance is in the filing of Goods and Services Tax (GST) returns. This is where TaxDunia.com comes in, providing comprehensive GST return filing services that can significantly benefit small businesses. In this blog, we’ll explore how TaxDunia.com services can help small businesses navigate the complexities of GST filing and ensure compliance.

Simplifying GST Return Filing

GST return filing can be a daunting task for small businesses, especially those without dedicated accounting departments. TaxDunia.com offers a streamlined and user-friendly platform for GST return filing services in India. This service simplifies the entire process, making it easy for small business owners to file their returns accurately and on time. With the help of TaxDunia.com, businesses can avoid the pitfalls of manual filing and reduce the risk of errors.

Expert Assistance and Guidance

One of the standout features of TaxDunia.com is the expert assistance and guidance provided by their team of professional accountants. These experts have in-depth knowledge of GST laws and regulations, ensuring that businesses receive accurate and up-to-date advice. Whether it’s understanding the nuances of GST or dealing with complex filing requirements, the expert team at TaxDunia.com is always ready to help.

Comprehensive GST Services

TaxDunia.com offers a wide range of GST-related services, including GST registration service, GST return filing, and more. For small businesses looking to get started with GST, TaxDunia.com provides a hassle-free GST registration service, ensuring that businesses are registered correctly and efficiently. This comprehensive approach ensures that all GST-related needs are met under one roof, making it easier for businesses to manage their tax obligations.

Cost-Effective Solutions

For small businesses, managing costs is crucial. TaxDunia.com offers cost-effective solutions for GST filing, ensuring that businesses can comply with GST regulations without breaking the bank. The platform offers various pricing plans tailored to the needs of small businesses, providing affordable options for professional GST services.

Ensuring Compliance and Avoiding Penalties

Non-compliance with GST regulations can result in hefty penalties and fines. TaxDunia.com ensures that businesses remain compliant by providing timely reminders and updates about filing deadlines. By using TaxDunia.com services, businesses can avoid the stress and financial burden of late filings and non-compliance penalties.

Time-Saving and Efficient

For small business owners, time is an invaluable asset. TaxDunia.com online GST return filing service is designed to save time and increase efficiency. The platform’s automated processes and user-friendly interface allow businesses to complete their GST filings quickly and accurately, freeing up time to focus on other important aspects of their operations.

Personalized Support

Every business is unique, and so are its GST filing needs. TaxDunia.com offers personalized support tailored to the specific requirements of each business. Whether it’s a small retailer or a growing startup, TaxDunia.com ensures that each client receives customized solutions that meet their unique needs.

Real-Time Tracking and Updates

Keeping track of GST filings and payments can be challenging. TaxDunia.com provides real-time tracking and updates, allowing businesses to monitor the status of their GST returns and payments. This transparency helps businesses stay informed and in control of their tax obligations.

Data Security and Confidentiality

When handling financial information, security and confidentiality are of utmost importance. TaxDunia.com employs robust security measures to protect sensitive business data. Businesses can trust that their financial information is secure and confidential when using TaxDunia.com services.

Seamless Integration with Accounting Systems

Numerous small businesses rely on accounting software to oversee their finances. TaxDunia.com offers seamless integration with popular accounting systems, making it easy to transfer data and streamline the GST filing process. This integration avoids manual data entry and lowers the chance of mistakes.

Reducing Administrative Burden

Managing GST filings can be administratively burdensome for small businesses. TaxDunia.com services reduce this burden by handling all aspects of GST return filing. This allows businesses to focus on their core operations without getting bogged down by administrative tasks.

Scalability for Growing Businesses

As small businesses grow, their GST filing needs may become more complex. TaxDunia.com offers scalable solutions that can grow with the business. Whether it’s handling increased transaction volumes or navigating new regulatory requirements, TaxDunia.com provides the support businesses need at every stage of their growth.

Enhancing Financial Planning

Accurate GST filings are essential for effective financial planning. TaxDunia.com services ensure that businesses have a clear and accurate picture of their GST obligations, helping them plan their finances more effectively. This can lead to better cash flow management and more informed business decisions.

Building Trust with Stakeholders

Compliance with GST regulations builds trust with stakeholders, including customers, suppliers, and investors. By using TaxDunia.com professional GST services, businesses can demonstrate their commitment to regulatory compliance, enhancing their reputation and credibility.

Access to the Latest GST Updates

GST laws and regulations are constantly evolving. TaxDunia.com stays up-to-date with the latest changes and ensures that businesses are informed about new developments. This proactive approach helps businesses stay compliant and avoid potential issues arising from regulatory changes.

Streamlining Tax Refunds

For businesses eligible for GST refunds, navigating the refund process can be complex. TaxDunia.com simplifies this process by handling all aspects of GST refund claims, ensuring that businesses receive their refunds quickly and efficiently.

Supporting Business Growth

Ultimately, TaxDunia.com GST services support the growth and success of small businesses. By taking the hassle out of GST filing and ensuring compliance, TaxDunia.com allows businesses to focus on their growth strategies and achieve their business goals.

Taxdunia.com Tax Advisors

Tax advisors play a crucial role in managing finances and ensuring tax efficiency. Whether you are an individual taxpayer, a small business owner, or handling complex financial affairs, their expertise can guide you through the complexities of the tax system and help you meet your financial goals.

Partnering with TaxDunia.com as your tax advisor offers numerous advantages:

Expertise

Our team of top income tax advisors has deep knowledge of tax laws and regulations, providing personalized advice that fits your unique financial circumstances. From business registration to income tax return filing, our experts deliver comprehensive consultancy services to ensure compliance and optimize your tax strategy for maximum benefit.

Tax Savings

Tax advisors utilize their expertise to identify opportunities for reducing your tax liability and maximizing your savings.

Compliance

Tax advisors ensure that you stay compliant with tax laws, helping you avoid penalties and legal issues.

Peace of Mind

Having a leading income tax consultant manage your tax matters brings peace of mind. With TaxDunia.com handling your taxes, you can be confident that your tax affairs are being managed efficiently and effectively, allowing you to concentrate on what matters most — growing your business.

Conclusion

In conclusion, TaxDunia.com offers a range of benefits for small businesses in India looking to manage their GST obligations efficiently and effectively. From simplifying the GST return filing process to providing expert guidance and support, TaxDunia.com is a valuable partner for small businesses. By using TaxDunia.com services, businesses can ensure compliance, save time and money, and focus on what they do best — growing their business.

Whether it’s availing of GST return filing services in India, getting a GST registration service, or using the online GST return filing platform, TaxDunia.com has the expertise and resources to meet all your GST-related needs. Don’t let the complexities of goods and services tax filing hold your business back. Trust TaxDunia.com to handle your GST obligations so you can concentrate on achieving your business objectives.

TaxDunia.com provides a reliable and efficient solution for all GST-related needs, ensuring that businesses remain compliant while focusing on their growth and success. Whether you need help with GST registration service, online GST return filing, or any other aspect of goods and services tax filing, TaxDunia.com is your trusted partner.

Other Link

Top Income Tax Consultants

Private Limited Company Registration

One Person Company Registration Service in India

Trademark Registration in India

TDS Return Filing Service in India

Copyright Registration in India

#Gst Return Filing Services in India#Gst Registration Service#Online Gst return filing#goods and services tax filing#income tax#taxdunia#finance#tax consultants#itr filling#gst filling#itr filing#gst return

0 notes

Text

Understanding Goods and Services Tax (GST)

Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. It is designed to replace various indirect taxes and simplify the tax system in India. In this article, we will explore the basics of GST, its impact on consultancy services, and the dual GST model.

What is Goods and Services Tax (GST)?

GST is a unified tax system that aims to bring all indirect taxes under one umbrella. It is levied on the supply of goods and services and is applicable across India. The introduction of GST has streamlined the tax structure, making it easier for businesses and consumers to comply with tax regulations.

Key Features of GST

Comprehensive Tax: GST replaces multiple indirect taxes like VAT, service tax, and excise duty.

Multi-Stage: It is levied at every stage of production and distribution.

Destination-Based: Tax is collected at the point of consumption, not the point of origin.

Input Tax Credit: Businesses can claim credit for the tax paid on inputs, reducing the tax burden.

The Dual GST Model

India follows a dual GST model, which means both the central and state governments have the authority to levy GST. This model is divided into three types of taxes:

Central GST (CGST): Collected by the central government on intra-state supplies.

State GST (SGST): Collected by the state government on intra-state supplies.

Integrated GST (IGST): Collected by the central government on inter-state supplies and imports.

GST on Consultancy Services

Consultancy services, like other services, fall under the purview of GST. The tax rate for consultancy services is typically 18%, which includes both CGST and SGST for intra-state transactions or IGST for inter-state transactions.

Impact on Consultancy Services

Transparency: GST has brought more transparency to the tax system, making it easier for consultancy firms to manage their finances.

Input Tax Credit: Consultancy firms can claim input tax credit on the GST paid on their expenses, reducing the overall tax burden.

Compliance: Firms need to comply with GST regulations, including timely filing of returns and maintaining proper documentation.

Benefits of GST

Simplification: GST simplifies the tax structure by merging various indirect taxes into one.

Reduced Tax Burden: Input tax credit helps businesses reduce their tax liability.

Increased Compliance: A unified tax system encourages better compliance and reduces tax evasion.

Boost to Economy: GST aims to create a unified market, promoting economic growth and development.

Conclusion

Goods and Services Tax (GST) is a significant reform in India's tax system, designed to simplify the tax structure and promote economic growth. Understanding GST, including its impact on consultancy services and the dual GST model, is essential for businesses and consumers alike. By streamlining tax compliance and reducing the tax burden, GST aims to create a more transparent and efficient tax system in India.

#GoodsAndServicesTax#GST#ConsultancyServices#DualGSTModel#GSTIndia#TaxSystem#InputTaxCredit#GSTCompliance#IndirectTax

0 notes

Text

A Comprehensive Guide to GST Verification

The Goods and Services Tax (GST) is a landmark reform in the Indian taxation system, introduced to streamline the indirect tax structure and bring about greater transparency in business transactions. Since its implementation, GST has revolutionised how businesses operate, ensuring a more uniform tax regime nationwide.

As GST becomes an integral part of the business landscape, the need for accurate GST verification has emerged as a critical aspect of compliance and financial integrity. This guide aims to provide an in-depth understanding of GST verification, its processes, challenges, and benefits.

Understanding GST (Goods and Services Tax)

The Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax levied on every value addition. GST has subsumed various indirect taxes previously imposed by the central and state governments, including excise duty, VAT, and service tax. This unified tax structure simplifies the tax system, reduces the cascading effect of taxes, and promotes ease of doing business.

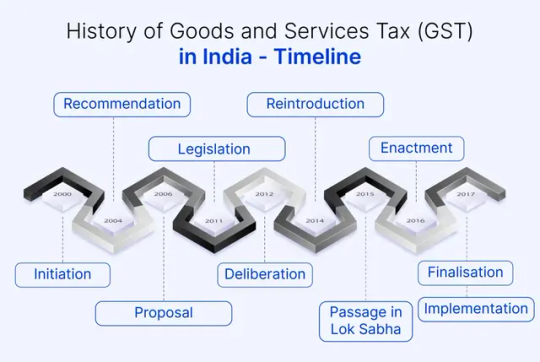

The journey of GST in India began in 2000 when a committee was set up to draft the law. After several years of deliberation and amendments, the GST Bill was finally passed in the Parliament in 2017, and GST was implemented on July 1, 2017. Since its inception, GST has undergone numerous amendments to address industry concerns and streamline processes.

History of Goods and Services Tax (GST) in India - Timeline

Key Components of GST

GST is divided into several components to ensure a fair distribution of tax revenue between the central and state governments:

Central Goods and Services Tax (CGST): Levied by the central government on intra-state supplies of goods and services.

State Goods and Services Tax (SGST): Levied by the state government on intra-state supplies of goods and services.

Integrated Goods and Services Tax (IGST): Levied on inter-state supplies of goods and services and is collected by the central government.

Union Territory Goods and Services Tax (UTGST): Levied on the supply of goods and services in Union Territories.

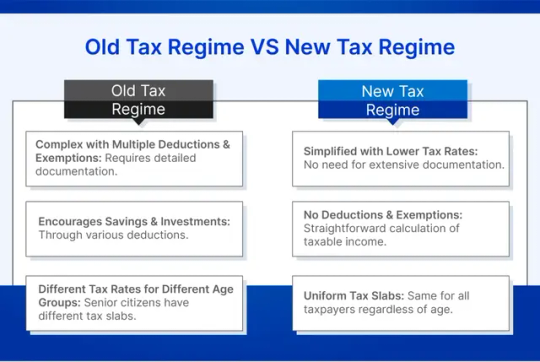

Old Tax Regime and New Tax Regime

Old Tax Regime Overview

The old tax regime in India is characterized by its complexity and numerous exemptions and deductions that taxpayers can claim to reduce their taxable income. It has been in place for many years and has evolved with changes and additions to tax laws.

Features

Income Tax Slabs: The old regime has different tax slabs based on age categories, including those below 60 years, senior citizens (60-80 years), and super senior citizens (above 80 years).

Exemptions and Deductions:

Section 80C: Deductions up to INR 1.5 lakh for investments in PPF, EPF, life insurance premiums, and other specified instruments.

Section 80D: Deductions for medical insurance premiums.

Section 24(b): Deductions on home loan interest.

House Rent Allowance (HRA): Exemption on HRA based on rent paid and salary structure.

Standard Deduction: For salaried individuals.

Other Deductions: Various other deductions for education loans, donations to charitable institutions, and more.

Complexity: The old regime requires taxpayers to maintain records and proofs for all exemptions and deductions claimed, making it relatively complicated.

Advantages

Tax Savings: Numerous exemptions and deductions allow taxpayers to significantly reduce their taxable income.

Encouragement for Savings and Investments: Various deductions encourage taxpayers to invest in specific financial instruments and savings schemes.

Disadvantages

Complexity: Managing and documenting the various exemptions and deductions can be cumbersome.

High Compliance Requirement: Taxpayers must be well-versed with tax laws and maintain proper documentation.

Old Tax Slab

Income up to INR 2.5 lakh: NIL

Income from INR 2.5 lakh to INR 5 lakh: 5%

Income from INR 5 lakh to INR 10 lakh: 20%

Income from INR 10 lakh and above: 30%

New Tax Regime Overview

Introduced in the Union Budget 2020, the new tax regime offers simplified tax slabs with lower rates but without most of the exemptions and deductions available under the old regime. It aims to simplify the tax filing process and reduce the compliance burden.

Features

Income Tax Slabs: The new regime provides different tax slabs with lower rates but does not differentiate based on age.

No Exemptions and Deductions: Most exemptions and deductions available in the old regime are not applicable in the new regime.

Optional: Taxpayers can choose between the old and new regimes based on what is more beneficial for them.

New Tax Slabs (FY 2020-21 onwards)

Income up to INR 2.5 lakh: NIL

Income from INR 2.5 lakh to INR 5 lakh: 5%

Income from INR 5 lakh to INR 7.5 lakh: 10%

Income from INR 7.5 lakh to INR 10 lakh: 15%

Income from INR 10 lakh to INR 12.5 lakh: 20%

Income from INR 12.5 lakh to INR 15 lakh: 25%

Income above INR 15 lakh: 30%

Advantages

Simplicity: The absence of numerous exemptions and deductions simplifies the tax filing process.

Lower Tax Rates: For many taxpayers, the lower tax rates can result in tax savings even without claiming deductions.

Disadvantages

No Incentives for Savings and Investments: The lack of deductions may discourage taxpayers from investing in specific financial instruments or savings schemes.

Comparison Required: Taxpayers must calculate their tax liability under both regimes to determine which is more beneficial.

Old Tax Regime VS New Tax Regime

Choosing Between the Two

Taxpayers must assess their income, available exemptions, and deductions to decide which regime is more beneficial. Generally:

Old Regime: Beneficial for those with significant exemptions and deductions.

New Regime: Suitable for those who prefer simplicity and have fewer deductions to claim.

GST Registration

Eligibility Criteria for GST Registration:

GST registration is mandatory for businesses whose turnover exceeds a specified threshold limit, which varies for goods and services. Additionally, companies such as e-commerce operators, casual taxable persons, and input service distributors must register for GST regardless of turnover.

Step-by-Step Guide to GST Registration

Visit the GST Portal: Access the GST registration page on the official GST portal.

Fill Part-A of the Form: Provide basic details such as PAN, mobile number, and email ID.

Verification: An OTP will be sent to your mobile number and email for verification.

Fill Part-B of the Form: Enter detailed business information, including business address, bank account details, and the principal place of business.

Upload Documents: Submit required documents such as proof of business address, bank account statement, and identity proof.