#Central bank digital currencies

Text

youtube

#How Central Banks Are Innovating to Secure Your Financial Future#@KudosKuber"#upsc#gk#ias#cbdc#baking#USA#CANADA#UK#UAE#cnbc#joumanna bercetche#central bank digital currency#central bank digital currencies#cbdcs#federal reserve#bank of england#bank of italy#european central bank#ecb#cryptocurrency news#bitcoin elon musk#bitcoin tesla#digital dollar#digital yuan#bank for international settlements#future of money#digital wallet#cryptocurrency wallet

0 notes

Text

Nadcab Labs - Leading the Charge in CBDC Development for Banking Efficiency

In an era where digital transformation is reshaping the financial landscape, Central Bank Digital Currencies (CBDCs) are emerging as a pivotal innovation. Spearheaded by pioneering entities like Nadcab Labs, the integration of CBDCs into the global monetary system is not just a trend but a revolution that aims to solidify banking systems through the leverage of near real-time data.

CBDCs represent a digital form of a country's fiat currency, issued and regulated by the central bank. This innovative monetary tool is designed to enhance the efficiency of financial transactions, offering a secure and highly efficient alternative to traditional banking systems. The advent of CBDCs is a testament to the evolving demands of the digital economy, requiring transactions that are faster, more transparent, and accessible.

The cornerstone of CBDCs lies in their ability to leverage near real-time data. This capability ensures an unprecedented level of transparency and security in financial transactions. By utilizing blockchain technology or similar decentralized ledgers, CBDCs enable the tracking of transactions instantaneously, reducing the risk of fraud and ensuring the integrity of the financial system.

For banking systems, the introduction of CBDCs offers a multitude of benefits. Firstly, it significantly reduces the cost and time associated with money transfers and settlements. Traditional banking transactions, especially cross-border payments, can be costly and time-consuming due to the involvement of multiple intermediaries. CBDCs streamline this process, enabling direct and immediate transactions between parties.

Moreover, CBDCs have the potential to enhance financial inclusion. With a significant portion of the global population still unbanked or underbanked, CBDCs can provide an accessible platform for financial services, requiring only a mobile device. This accessibility is crucial for empowering individuals and businesses in remote or marginalized communities, thereby fostering a more inclusive economy.

Another critical aspect of CBDCs is their potential to stabilize financial systems during times of economic uncertainty. By providing central banks with an additional tool for implementing monetary policy, CBDCs can facilitate more direct and effective interventions in the economy. For instance, in scenarios requiring stimulus measures, central banks could directly distribute digital currency to citizens, ensuring immediate impact.

Nadcab Labs, among other innovators in this space, is at the forefront of developing and deploying CBDC solutions. Their expertise in blockchain technology and deep understanding of the financial sector enable them to create CBDC platforms that are not only secure and efficient but also tailored to the specific needs of central banks and their respective economies.

In conclusion, CBDCs offer a transformative potential for the global financial system. By leveraging near real-time data, they promise to enhance the efficiency, security, and inclusivity of monetary transactions. As institutions like Nadcab Labs continue to lead the way, the integration of CBDCs into banking systems worldwide marks a significant step towards a more agile, transparent, and equitable financial future.

0 notes

Text

The Future of Blockchain Tech and Crypto in 2023

The Future of Blockchain Tech and Crypto in 2023

Blockchain technology and cryptocurrencies have been making headlines in the past few years, with innovations, challenges and opportunities emerging in various sectors and industries. As we enter 2023, what can we expect from this dynamic and evolving field? Here are some of the trends and developments that might shape the future of blockchain and crypto in the next year.

– Decentralized…

View On WordPress

#blockchain#blockchain education#blockchain governance#blockchain technology#CBDCs#Central Bank Digital Currencies#crypto#cryptocurrency#decentralised finance#DeFi#NFTs#Non-fungible tokens

0 notes

Text

Four Nations Embrace Ripple's Innovative CBDC Platform: A Closer Look

Ripple, a prominent player in blockchain-based payment technology, recently unveiled its enhanced Ripple CBDC Platform, a comprehensive solution designed to support central banks, governments, and financial institutions in issuing their own central bank digital currencies (CBDCs). This avant-garde platform taps into the transformative potential of blockchain technology, the backbone of the XRP…

View On WordPress

#Blockchain Technology#Central Bank Digital Currencies#Cross-border Payments#Digital Currency#Global Adoption#Ripple CBDC Platform#XRP Ledger

0 notes

Text

Crypto Had An Impact In 2022: Some Governments Officially Recognized And Approved Virtual Currencies

Crypto Had An Impact In 2022: Some Governments Officially Recognized And Approved Virtual Currencies:

Governments all across the globe have felt pressure to regulate cryptocurrency as its use is growing in popularity. Though some nations have been wary of crypto at various points in time, many others have warmed up to the idea and even embraced it. New legal frameworks and crypto regulations have…

View On WordPress

#central bank digital currencies#crypto regulations#cryptocurrencies in Singapore#government and cryptocurrency#regulate cryptocurrency#virtual currencies

0 notes

Text

EXPLORING THE FOUNDATIONS OF INDIAN DEMOCRACY: A GUIDE TO THE CONSTITUTION OF INDIA

Introduction

The Constitution of India came into force on January 26, 1950, when it was adopted by the Constituent Assembly. The final draft of the constitution was completed on December 15, 1947 and was submitted for approval to the Constituent Assembly in two parts. This document has been amended many times since its implementation and is still undergoing amendments today. It’s important for…

View On WordPress

#Bitcoin#Blockchain#business#Central bank digital currencies#CONSTITUTION OF INDIA#costitution#Cryptocurrency#Decentralized ledger#Digital transformation#Distributed technology#Economic inequality#Economic policy#economics#excise duty#Financial inclusion#Financial services Payment systems Financial regulation#Financial system#Financial technology#Financial transactions#Fintech#Goods and Services Tax#Goods and Services Tax tax reform indirect taxes value-added tax service tax excise duty GST Council GST rates input tax credits tax complia#Green finance#GST Council#GST rates#INDIA#Indian economy#indirect taxes

1 note

·

View note

Video

undefined

tumblr

* WARNING : CRUDE LANGUAGE *

The Toronto Dominion bank (Canadian Bank) is going digital.

219 notes

·

View notes

Text

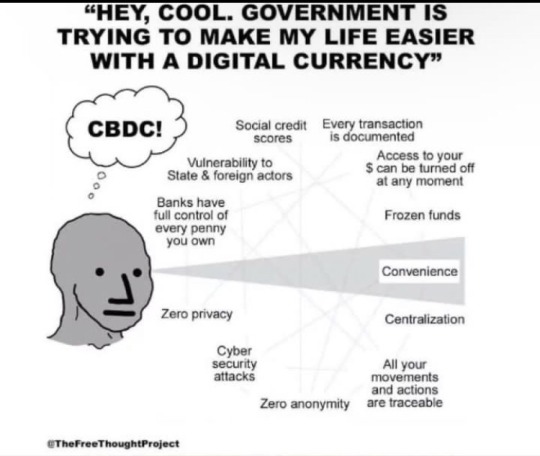

The WEF seems aware that CDBCs are a controversial proposition, and may be trying to not only control the optics regarding the depth of its involvement, but provide a more sinister alternative.

Read More: https://thefreethoughtproject.com/technology/wef-report-supports-cbdc-and-digital-id-urges-public-private-collaboration-in-finance

#TheFreeThoughtProject #TFTP

#the free thought project#tftp#police state#wef#world economic forum#digital ID#CBDC#Central Bank Digital Currency

6 notes

·

View notes

Text

#usa today#us politics#usa news#usa politics#us news#us economy#central bank#digital currency#united states

3 notes

·

View notes

Text

#cabecera#CBDC’s#digital currency#banking#centralization#WEF#one world government#age of convenience

10 notes

·

View notes

Text

#saudi arabia#petrodollar#us dollar#global economy#oil trade#currency exchange#digital currency#project mbridge#international trade#economic shift#bitcoin transactions#cross-border payments#distributed ledger technology#central banks#global finance

4 notes

·

View notes

Text

Digital Currencies in 2024: The Future of Money and Technology

Description

Digital currencies, often referred to as cryptocurrencies, have revolutionized the financial landscape. As we move into 2024, their influence continues to expand, reshaping everything from international trade to individual financial empowerment. In this article, we’ll explore the evolution of digital currencies, highlight their most prominent features, and delve into the future trends that could shape the world of finance

Understanding Digital Currencies

Digital currencies are decentralized, internet-based forms of money that use cryptographic technology to ensure secure, peer-to-peer transactions. Unlike traditional fiat currencies controlled by central banks, cryptocurrencies such as Bitcoin, Ethereum, and Ripple (XRP) operate on blockchain technology—a transparent ledger that records all transactions.

The Rise of Bitcoin and Altcoins

Bitcoin, introduced in 2009, is the first and most widely known cryptocurrency, often dubbed “digital gold.” Over the years, Bitcoin has grown in both value and adoption, serving as a store of value and an investment vehicle.

Other digital currencies, called altcoins, have emerged to challenge Bitcoin's dominance. Ethereum, for instance, introduced smart contracts that automate processes and revolutionized decentralized applications (DApps). In 2024, DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens), primarily built on Ethereum, continue to attract attention, reshaping the way digital assets are traded and owned

"Unlock your next big opportunity—click the link now and take the first step toward success!"

Top Benefits of Digital Currencies

Digital currencies offer several advantages over traditional financial systems, making them an appealing choice for both investors and everyday users.

Decentralization: Cryptocurrencies are not controlled by any government or financial institution. This ensures users have full control over their assets and are not subject to centralized authorities.

Security: Blockchain technology makes it extremely difficult to alter transaction records, providing a high level of security against fraud and hacking.

Low Transaction Costs: Traditional cross-border payments often involve high fees, especially for international transfers. Cryptocurrencies offer much lower transaction fees, making them attractive for global transactions.

Financial Inclusion: Digital currencies provide access to financial services for people without access to traditional banking. In 2024, millions of unbanked individuals globally are benefiting from using digital wallets and decentralized platforms.

The Most Popular Cryptocurrencies in 2024

In addition to Bitcoin and Ethereum, several other cryptocurrencies are making waves in 2024, including:

Ripple (XRP): Known for its efficient cross-border payment solutions.

Cardano (ADA): Gaining popularity due to its focus on sustainability and scalability in blockchain technology.

Solana (SOL): A fast, scalable platform for decentralized apps and crypto services.

Polygon (MATIC): Enhancing Ethereum’s scalability and enabling cheaper transactions

"Unlock your next big opportunity - click the link now and take the first step towards success!"

The Role of Central Bank Digital Currencies (CBDCs)

Another significant trend in 2024 is the rise of Central Bank Digital Currencies (CBDCs). Unlike decentralized cryptocurrencies, CBDCs are issued and regulated by central banks. Governments across the globe are now exploring their own digital currencies to improve financial efficiency, transparency, and inclusivity. Countries like China with its Digital Yuan, and the European Union with the Digital Euro, have made substantial progress.

CBDCs aim to combine the benefits of cryptocurrency—such as faster, cheaper transactions—with the security and stability of traditional fiat currencies.

Key Trends for Digital Currencies in 2024

As digital currencies continue to evolve, here are some of the key trends shaping their future:

Mass Adoption: In 2024, businesses and institutions worldwide are increasingly accepting cryptocurrencies as a legitimate form of payment, with more retailers integrating crypto-payment solutions.

Web3 and Decentralized Apps (DApps): With the growth of Web3, digital currencies are playing a crucial role in decentralized applications, creating new ways for users to interact with the internet, without intermediaries.

Regulation: Governments are paying more attention to regulating cryptocurrencies, ensuring consumer protection while promoting innovation in the space.

Sustainability Initiatives: The environmental impact of cryptocurrency mining has been a concern, but newer cryptocurrencies like Cardano and Solana are making strides in energy-efficient blockchain solutions

"Unlock your next big opportunity - click the link now and take the first step towards success!"

The Future of Digital Currencies

Looking ahead, digital currencies are likely to continue their upward trajectory, integrating further into everyday life. We can expect advancements in privacy coins like Monero (XMR), which prioritize user anonymity, and growth in interoperability between different blockchain platforms.

Another development to watch in 2024 is the expansion of tokenization, where real-world assets like real estate, stocks, and commodities are being digitized and traded on blockchain platforms.

Investing in Cryptocurrencies in 2024

For investors, digital currencies offer both opportunities and risks. The cryptocurrency market is known for its volatility, but long-term believers view it as a hedge against inflation and a chance to participate in the future of finance. Experts advise diversifying one’s portfolio, researching projects carefully, and staying informed about regulatory changes.

Conclusion

Digital currencies are more than just a trend—they represent a fundamental shift in how we perceive and use money. As we move through 2024, the continued development of blockchain technology, increased adoption of cryptocurrencies, and the integration of digital assets into financial systems will shape the future of the global economy.

For those looking to stay ahead, understanding the potential of digital currencies, exploring opportunities for investment, and adapting to this fast-evolving world are key steps to navigating the new financial landscape

"Unlock your next big opportunity - click the link now and take the first step towards success!"

#cryptocurrency#bitcoin#Ethereum#Blockchain technology#Decentralized finance (DeFi)#Central Bank Digital Currency (CBDC)#Digital wallet#Smart contracts#altcoins#tokenization#web3#DeFi applications#nfts#Crypto regulation#Cryptocurrency exchange

0 notes

Text

How Elites Will Collapse America Like Rome (Tone: 100)

September 3rd, 2024 by @TomBilyeu

How Elites Will Collapse America Like Rome: BlackRock, Trump vs Kamala & Market Crash | Whitney Webb

ABOUT THIS VIDEO:

This video discusses the potential collapse of the United States, drawing parallels to the fall of the Roman Empire. Whitney Webb, an investigative journalist, explores the role of influential entities like BlackRock in shaping U.S. fiscal…

View On WordPress

#BlackRock#CBDCs#central bank#digital currency#digital economy#Donald Trump#economic collapse#Economic Policy#elite influence#Financial Crisis#financial freedom#financial surveillance#fiscal policy#fiscal response#Kamala Harris#market crash#programmable money#stablecoins#U.S. debt crisis#U.S. economy#U.S. Politics#Wall Street#wealth inequality#wealth transfer

0 notes

Text

Exploring the Potential and Challenges of Blockchain Technology

"Learn about the revolutionary technology of blockchain and how it has the potential to transform industries in our latest blog.#blockchain #technology #digitalledger #decentralized #transformation #finance #supplychain #healthcare #voting

Blockchain is a decentralized, distributed ledger technology that has the potential to revolutionize a number of industries. Here is a full, detailed blog on the topic of blockchain:

What is Blockchain?

Blockchain is a digital ledger of transactions that is distributed across a network of computers. Each transaction is recorded as a block, and these blocks are linked together in a chain, hence…

View On WordPress

#Bitcoin#Blockchain#Central bank digital currencies#Cryptocurrency#Decentralized ledger#Digital currency#Distributed technology#Economic inequality#Ethereum#Financial technology#Financial transactions#Fintech#Monetary policy#MONEY#Smart contracts#STORY

1 note

·

View note

Text

The Central Bank Digital Currency (CBDC) puts India, a nation undergoing a digital revolution, to the point where it has more than shown its preparedness to welcome the future of money. The country is in a great position to seize the significant advantages this ground-breaking invention has to provide.

0 notes