#finance function comparison

Explore tagged Tumblr posts

Text

Accounts Receivable Management: Outsource or Handle Internally?

Managing accounts receivable effectively is crucial for maintaining healthy cash flow. But as businesses grow, the question arises: should you keep your AR function in-house or opt for accounts receivable outsourcing? Let’s break down the pros and cons to help you decide.

In-house AR management gives businesses more control over their processes. However, it also comes with significant costs—salaries, software, training, and overhead. The risk of human error and delayed collections can also increase without a dedicated team.

On the other hand, when you outsource receivables, you gain access to experienced professionals who specialize in accounts receivable management. These experts use the latest tools and techniques to follow up on invoices efficiently and reduce your Days Sales Outstanding (DSO).

Outsourcing also means lower costs in the long run. Cost-effective AR solutions help businesses save money by eliminating the need for internal infrastructure and support systems. Plus, outsourced providers offer scalability, which is essential for businesses experiencing growth or seasonal fluctuations.

Another key advantage of accounts receivable outsourcing is faster processing and fewer errors. Automation and standardized procedures help streamline the workflow and improve overall accuracy.

Ultimately, the choice depends on your business goals. If maintaining tight internal control is your priority and resources are available, in-house may work. But for most growing companies, outsourcing delivers better efficiency, scalability, and cost savings.

When comparing in-house vs outsourced accounting, outsourcing stands out as the smarter and more strategic choice for long-term success in today’s competitive environment.

#in-house vs outsourced accounting#accounts receivable outsourcing#cost-effective AR solutions#accounts receivable management#finance function comparison

0 notes

Text

What is adaptive functioning?

directly inspired by this post by @five-thousand-loaves-of-bread

In short, adaptive functioning is a holistic view of someone's ability to adjust and change their behaviour in different environments and situations. This is a term primarily used to discuss people with developmental and intellectual disabilities and how they fare in comparison to their peers.

Someone's adaptive functioning is measured in three domains, which is why I called it holistic. All of these domains, separately and together, can affect someone's adaptive functioning.

There's the conceptual domain, the social domain, and the practical domain.

Conceptual domain: This refers to a person's cognitive skills, including their aptitude for knowledge acquisition, logical and critical thinking skills.

Social domain: This refers to a person's interpersonal skills. That includes things like the ability to understand other people's thoughts and emotions, the ability to create and maintain healthy interpersonal relationships, the ability to understand social situations and make judgements on them, and the ability to communicate in interpersonal relations.

Practical domain: This is where things like activities of daily living would come in. The practical domain measures how much a person can carry out daily tasks independently. Yes it includes things like shopping for food, maintaining hygiene, making meals. But overall you can think of it as the ability of self-management. Being able to keep track of what you need to do and when, initiate those tasks, plan for future tasks, manage your finances and time to make tasks possible, etc. There's a lot of organisation that goes into the practical domain.

Well how does it differ from basic and instrumental activities of daily living (b&iADLs)?

While ADLs are part of how we measure adaptive functioning, they can also be entirely distinct. ADLs are about being able to independently carry out regular activities.

Basic ADLs woule include self maintenance or self care tasks that are daily necessities. Things like brushing, showering, toileting, feeding oneself, dressing oneself, walking independently, transferring oneself. These are things that are directly related to one's immediate wellbeing and basic needs.

Instrumental ADLs include more long-term maintenance and self care, like going shopping and meal prepping, managing money, managing transport to places, managing medications, managing housecare and chores. Being able to do iADLs dramatically improves one's quality of life and allows them to live independently, work jobs, and such.

When measuring ADLs, we only consider whether or not someone can do them or not. This doesn't necessarily measure their overall ability or what sort of care they will need, because that depends on the reasons why they can't perform these activities. This can be a measurement of someone's support needs, but it's not comprehensive.

For example if someone can't meal prep because they don't have the ability to grip kitchen utensils, certain adaptive equipment or pre-cut foods can facilitate them being able to do this. They still can't perform that iADL without intervention or support.

If someone can't meal prep because they don't understand that knives are dangerous and will hurt themselves, or they can't connect that chopping some carrots will eventually lead to having vegetable soup because of cognitive difficulties, or simply don't understand that meal prepping is a necessity and can't direct their attention to anything that doesn't immediately intrest them, they still can't perform that iADL. Sometimes their cognitive issues may mean that they don't have the ability to independently manage tasks that need to be doing in order to facilitate necessities such as meals. This would be because of low adaptive functioning. The support they would need for cooking might be constant supervision, or to be disallowed from cooking altogether and have other people prepare meals.

Likewise if someone has no ability to hold utensils, depending on why, they might need a different method to get food into their mouth. Someone without the ability to understand the steps of feeding, such as getting food on the spoon, opening the mouth, chewing, swallowing they struggle with the same bADL. But the intervention needed to make feeding possible would be different. A carer might have to feed them, remind them to open their mouth, close their mouth, chew and swallow for each bite.

In these situations considering only the fact that someone cannot perform an ADL doesn't really represent what support needs that they have. It's not a comprehensive measurement of support needs specifically, even if it is an indication of impairment. If we understand adaptive functioning and what it means, then we can better understand the support needs of disabled people. We will understand that someone might have low adaptive functioning but is able to do certain ADLs and someone with high adaptive functioning might not be able to perform certain ADLs. We can also understand the difficulties, barriers, and support needs of intellectual and/or developmentally disabled people.

260 notes

·

View notes

Text

who decides the future of hextech?

Hot take: I don't think Hextech functions like a scrappy tech startup at all. I know the Arcane writers have made this comparison themselves, but it doesn't really track with what we see in the show.

It's made pretty clear that Jayce and Viktor have at best limited control over what direction Hextech goes in. In a city that's hostile to and suspicious of magic, they need the continued goodwill of the Council, and the wealthy families who sit on the Council, for their work to continue to exist at all. And that shapes how Hextech develops.

For the first 6-10 years of its existence (however long you think the S1 timeskip is), Hextech consists of one (1) project: the Hexgates. A major piece of international transit infrastructure, utilizing a brand-new technology that no one knew was even possible a few years earlier, and requiring a massive financial outlay for construction years before seeing any profits. Frankly, taking that from the very first shaky proof of concept to a fully functioning piece of infrastructure in less than 10 years is astonishing. This isn't like inventing Facebook; this is equivalent to creating the internet itself.

An infrastructure project on the scale of the Hexgates could be entirely state-funded (and therefore state-controlled, answering to the Council). But from the dialogue and visual storytelling, I think it's reasonable to infer that Hextech functions more like a public-private partnership.

In the modern era, PPPs have come to be associated with privatization and neoliberal capitalism. But funding infrastructure development this way was common in the 19th century too, closer to the time period from which Arcane draws its steampunk-ish inspiration.

So who's picking up the tab? I think it's some combination of government funding from the Council and private funding from Mel Medarda and the Kirammans.

We see one other Kiramman-funded infrastructure project in the show: the Undercity ventilation system.

And, as we see in that case, what may seem like a purely benevolent investment for the good of the city as a whole comes with a very high potential for control. (And where do the Hexgate plans end up at the end of the show? In the Kiramman family vault, accessible only with the Kiramman key.)

The Kiramman family crest is all over Hextech at Progress Day. It's prominent on the stage when Jayce speaks, positioned as equal to his own House.

Cassandra Kiramman introduces Jayce's speech, and Jayce gets trotted around the Kiramman family tent like a show pony beforehand.

The Kiramman crest is also on the box containing the hexgems, which makes me suspect that the facility needed to process the gemstones is either owned or financed by the Kirammans.

Mel's influence is more subtle. There's no Medarda crest on anything associated with Hextech; once you learn a bit about Mel's relationship with her family, that is not surprising. But clearly Mel feels comfortable speaking to other investors on behalf of Hextech, without feeling the need to run it by Jayce or Viktor first.

I think this exchange implies that (1) getting additional, outside investors is something new that they haven't done to finance earlier rounds of Hextech development, and (2) Mel is planning ahead in case the Council doesn't like the direction Hextech is going next and they need to secure additional funding.

I wouldn't be surprised if Mel was the one who steered them toward shipping and long-distance trade as a marketable use for Hextech in the first place, something many of the councillors seem to have an economic stake in.

Throughout this whole scene with Jayce and Mel, the Hexgate model sitting on her desk is very prominent. It's the first thing we see in the scene; the color and lighting make it stand out; and it appears in the frame in multiple shots. It's the thing that's always there between them.

Mel and Cassandra Kiramman are also councilors, and along with Heimerdinger they are Hextech's main allies on the Council--3 out of 7. Jayce and Viktor really can't afford to piss off any of them...which gets complicated when they want opposite things.

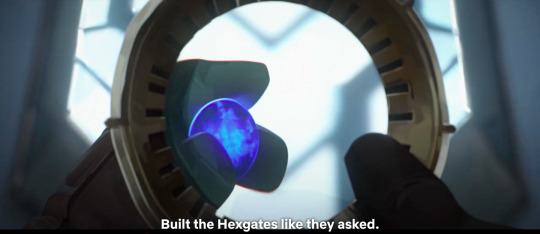

At the time of Progress Day, Hextech is at a turning point.

This conversation implies that they have not had a lot of freedom to develop and build whatever they wanted in the years during the timeskip. It's an interesting reversal of the dynamic we saw from them in 1.02 and 1.03. This time Jayce is the one forging ahead, confident they can get what they want, while Viktor is the one pointing out obstacles. (This is also the first time we see Viktor's face post-timeskip and register how much sicker he's become, which...oof.)

Regardless of how much they talk about "bringing magic to the people," I think it's notable that both their little spiels focus on how these inventions would increase worker productivity. This is a presentation designed for people who are thinking about their bottom line. And they seem to expect that any new developments with Hextech will have to be given Council approval before they can proceed.

(I think all of this puts the Hexcore in a slightly different light, too. It's quite possibly the first Hextech device since Jayce's original prototype that they've built without thinking about the pitch meeting. It's not a single-purpose object with an immediate, obvious use. In the beginning, it seems to recapture some of that original sense of wonder and discovery. And Viktor built it. I can see how he would be protective of his creation even before things Got Weird with it.)

And then, of course, everything goes off the rails. The gemstone gets stolen; Jayce gets pulled onto the Council. And after that point, every new Hextech object that Jayce makes is a weapon.

Jayce and Viktor's arc can be read as a story about the hubris of scientists thinking they can control forces they don't understand and anticipate every possible consequence, or a story about their naivete in thinking they could keep their research somehow above politics in a world full of conflict. And it's not not about those things. But it can also be read as a story about how discovery, creativity, and people's natural altruistic impulses get constrained by capitalism, and how often innovation is only valued if it can be made to serve war or profit.

(As for who controls the future of Hextech after the end of the show? With Viktor, Jayce, Mel and Heimerdinger all gone from Piltover...Caitlyn, probably. A detail I would love to see someone use in a fic.)

94 notes

·

View notes

Text

idk who needs to hear this but one of the reasons why right-wing conservatism is currently so entrenched in the united states is because the US has a unique structure and culture between the legislative and executive branches which means that the executive and thus enforcement are currently functionally unaccountable to congress (trump's second admin has very much exposed for those of us watching that things like "power of the purse" are purely handshake arrangements when push comes to shove, apparently all you need to do to execute an administrative coup is just ignore the legislature and the judiciary and do whatever the fuck you want). many other democracies have parliamentary systems where the executive branch of government is comprised of legislators and parties that win legislative elections have to form their own governments (sometimes even by coalition since in other countries, you can actually have multiple political parties with different political ideologies).

American federalism also heavily delegates a lot of powers to individual states in such a way that would be wholly unthinkable in other countries that practice some degree of administrative federation. things like "human rights" are really not meant to be determined by smaller governing bodies within a country - the fact that we do this to this degree in the US is insane. this level of administrative federation essentially streamlines the process of corruption for bad actors and makes it very easy to entrench themselves in local/state governments. this is what the right-wing has been doing for about the last 15 years since the "tea party" and it has proven to be incredibly effective because there are no functional checks and balances at local and state levels to prevent things like gerrymandering, campaign finance violations, and general malfeasance/corruption (it can take YEARS for things like this to be exposed via the courts, by which point the damage is often already done). this is, in large part, the legacy of slavery in this country as well as half-measures to try to "resolve" it ex. caving to jim crow bullshit post-reconstruction to attempt to smooth the transition.

in a general sense, the difference between the presidential and parliamentary systems can be read about here:

but I think specifically in the United States, especially when making comparisons to how our recent election went versus, say, the recent Canadian election or the recent Australian election, it's important to keep in mind that political power is functionally and structurally different in Canada and Australia because they use a parliamentary system to form a government, and a lot of work has been done by some very fucking evil people to ensure that the electoral system in the United States is vastly under-powered by design in terms of being able to oust bad actors based on the will of the governed.

6 notes

·

View notes

Text

Hi I'm here to talk about Ukraine vs. Palestine because I hate myself and having a peaceful blog

I've seen more than one weird bad faith take comparing the Russo-Ukrainian War to what's happening in the Gaza Strip, so let's look at the wartime numbers. As of 2024, Ukraine has 2.2 million military personnel and the 31st strongest passport, granting access to 148 countries. They're currently engaged in an accession deal with the European Union and the US sent them 77.8 million dollars in military financing ALONE, outside of the financial aid sent under USAI. Ukraine has been recognized outside of Soviet satellite status by the UN since 1991. 10,500 civilian casualties have been estimated, according to OXFAM, including about 600 children since February 2022. Also, Ukraine is very much under Genocide Emergency currently (updated link thanks to @kyitsya). I made a post with sources about Russia's attempts to destroy Ukrainian culture here that everyone reblogging this one should also reblog.

The POPULATION of Gaza before the beginning of the Israeli bombardment in October 2023 was .1 million people more than the Ukrainian military. They have no sovereign status at the UN. Their passport is 99th in the world and there are only 41 countries that are visa free. There has not been a free election in Gaza since 2007. There is no functional standing army, just the NSF (That has US support, btw)which is also essentially a police force of less than 11,000 people. Even accepting the IDF claim that 15,000 militants have been killed since the October 7th attack, that's approximately 20,000 non-combatants killed, taking into account the UN's altered data. Even after the UN revised data, 14,500 children have been killed. in EIGHT MONTHS. Gaza is experiencing a Genocide Emergency as well (as is Israel, because of the attacks on October 7th).

Militarily, Ukraine is being well supplied and supported. They have a still-functioning government and a standing military as well as international support. Gaza...has none of that. There needs to be a ceasefire, an international consensus going forward, and a sustainable, long term solution that allows for a sovereign Palestine (Including the end of illegal settlements in the West Bank), free and fair elections, and free movement in and out of Palestinian territories for Palestinians. I do not have a solution, I am simply a historian who teaches World History after 1500. But this is not sustainable, and bad faith comparisons and whataboutisms are NOT the move here.

Some FAQ RE collective punishment and US sanctions on Ukrainian use of US armaments below the cut!

But yxlenas, October 7th was a terrorist attack!

Yeah. It was. 1200 people were murdered because of their Jewishness, including a pretty prominent left wing peace activist. (Notice Israel is also currently experiencing a genocide emergency) and Hamas is a designated terrorist organization who definitely does not treat the civilians it is supposed to be governing in any sort of humane or safe way. The ICC issued warrants for those it believes to be responsible for the orchestration of the October 7th terrorist attacks alongside their warrants for Netanyahu and Yoav Gallant. But literally nothing excuses collective punishment (this is a WAR CRIME) which is what expert opinion has declared Israel's actions in the Gaza strip.

But yxlenas, we don't let Ukraine use US weapons on Russian targets inside Russia!

You're right, we don't. Allow me to direct you to Encyclopedia Britannica's article on the Cold War for an explanation as to why we don't do that.

But yxlenas, the bombing of Dresden killed between 25,000-250,000 civilians and helped us defeat the Nazis!

You're right! And it's literally referred to as a campaign of TERROR BOMBING and is considered one of the most controversial Allied decisions of the entire war. Israel also has an AI algorithm to target Hamas militants that is 90% accurate. With tech like that there's very little excuse to be bombing the way they're bombing that ISN'T collective punishment with the goal of eliminating the Palestinian presence in Gaza. Itamar Ben Gvir, the minister of National Security (who is threatening to resign, by the way, good fucking riddance), is actively advocating for the resettlement of Gaza.

#Any antisemitic or islamophobic clowning on this post will be deleted and blocked#don't fuck with me#israel hamas war#Gaza strip#russian invasion of ukraine#not a damn person is going to read this lmao#Palestine

14 notes

·

View notes

Text

The Critical Importance of Financial Education in the Age of Bitcoin

Imagine a world where you have complete control over your money, free from banks and government interference. This isn't a far-off dream—it's the reality that Bitcoin is creating. But with great power comes great responsibility, and that's where financial education becomes crucial. In this post, we'll explore why understanding Bitcoin is essential in today's rapidly evolving financial landscape.

The Current State of Financial Education

Financial literacy rates paint a sobering picture. According to a 2020 FINRA study, only 34% of Americans could answer 4 out of 5 basic financial literacy questions correctly. This lack of understanding often leads to poor financial decisions, leaving people vulnerable to economic uncertainties. As digital currencies gain prominence, this knowledge gap becomes even more critical.

Why Bitcoin Requires Financial Education

Bitcoin, the world's first decentralized digital currency, operates on a complex blockchain network. While its potential benefits are significant, understanding its unique characteristics is crucial:

Volatility: Bitcoin's price can fluctuate wildly. In 2021 alone, it saw a 64% increase followed by a 50% drop within months.

Security: Transactions are secured through cryptography, with ownership maintained via private keys.

Decentralization: Unlike traditional currencies, Bitcoin isn't controlled by any central authority.

Benefits of Understanding Bitcoin

Hedge Against Inflation: With a fixed supply of 21 million coins, Bitcoin is designed to be inflation-resistant.

Investment Opportunities: While volatile, Bitcoin has shown significant long-term growth potential.

Financial Freedom: Bitcoin enables peer-to-peer transactions without intermediaries, offering unprecedented financial autonomy.

Real-World Applications

Bitcoin isn't just a speculative asset. In countries like El Salvador, it's legal tender. Remittance services like BitPesa use Bitcoin to reduce transaction costs for international money transfers in Africa.

Common Misconceptions

Let's debunk some myths:

"Bitcoin is only used for illegal activities": While cryptocurrencies have been used illicitly, legitimate uses far outweigh illegal ones.

"Bitcoin has no intrinsic value": Its value comes from its utility as a decentralized, borderless payment system and its scarcity.

Environmental Concerns

It's important to address the energy consumption debate surrounding Bitcoin mining. While Bitcoin does consume significant energy, innovations in renewable energy mining are addressing these concerns.

Comparison with Other Cryptocurrencies

While Bitcoin was the first, thousands of cryptocurrencies now exist. Ethereum, for example, offers smart contract functionality, while Litecoin aims for faster transaction speeds.

Challenges in Bitcoin Education

Complexity: The technology can be daunting for newcomers.

Misinformation: The crypto space is rife with unreliable information.

Regulatory Uncertainties: Regulations vary widely across jurisdictions.

Strategies for Improving Bitcoin Literacy

Educational Resources: Leverage reputable online courses and books. Websites like Bitcoin.org offer comprehensive guides.

Community Engagement: Join forums like r/Bitcoin or attend local meetups.

Practical Experience: Start with small transactions to build familiarity.

Expert Insight

"Bitcoin is not just an asset, it's a new financial system with its own rules. Understanding these rules is crucial for anyone looking to participate in the future of finance," says Andreas Antonopoulos, a leading Bitcoin educator.

Practical First Steps

Set up a small Bitcoin wallet (try Exodus or Green Wallet).

Buy a small amount of Bitcoin on a reputable exchange like Coinbase or Kraken.

Try making a small transaction to experience how it works.

The Role of Influencers and Educators

Platforms like Unplugged Financial play a crucial role in demystifying Bitcoin. By providing clear, accurate information, these educators help bridge the knowledge gap and empower individuals.

Conclusion

As Bitcoin continues to reshape the financial landscape, understanding its principles, benefits, and challenges is vital. By investing time in financial education, you can make informed decisions and potentially harness the power of Bitcoin to achieve greater financial freedom. Remember, in the world of Bitcoin, knowledge truly is power.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#FinancialEducation#Crypto#Cryptocurrency#DigitalCurrency#Blockchain#FinancialFreedom#Investment#Decentralization#BitcoinEducation#CryptoCommunity#Money#Finance#FinancialLiteracy#BitcoinInvesting#CryptoKnowledge#BitcoinBenefits#FutureOfFinance#FinancialIndependence#unplugged financial#globaleconomy#financial education#financial empowerment#financial experts

4 notes

·

View notes

Text

Understanding the FTSE Stock Market: A Gateway to UK Investments

The FTSE stock market is one of the most recognized financial benchmarks in the world, particularly for those interested in the performance of the United Kingdom’s corporate sector. FTSE, short for Financial Times Stock Exchange, represents a range of indexes, the most famous being the FTSE 100. This index comprises the 100 largest companies listed on the London Stock Exchange (LSE) by market capitalization. Understanding how the FTSE stock market functions is essential for investors seeking exposure to UK equities and for tracking the economic health of British industry.

A Brief History of the FTSE Stock Market

The FTSE stock market was launched in 1984 as a joint venture between the Financial Times and the London Stock Exchange. Initially, the FTSE 100 was introduced as a way to monitor the top-performing companies in the UK. Over time, more indexes were created, such as the FTSE 250, FTSE All-Share, and FTSE AIM (Alternative Investment Market), each serving different market segments.

The FTSE 100 began with a base level of 1,000 points. Today, it often fluctuates between 7,000 and 8,000 points, influenced by global and domestic events, economic policies, and market sentiment.

How the FTSE Stock Market Works

At its core, the FTSE stock market operates by tracking the performance of listed companies. The FTSE 100 index, for example, is weighted by market capitalization. This means that larger companies like Shell, HSBC, and AstraZeneca have a more significant influence on the index’s overall movement than smaller firms.

The index is reviewed quarterly, ensuring that it remains a true representation of the largest companies in the UK. Companies may be added or removed based on their share value and market performance.

Investors use the FTSE as a benchmark for portfolio performance or as a tool for passive investment through ETFs (exchange-traded funds) and index funds that mirror the FTSE indexes.

Why the FTSE Stock Market Matters

The FTSE stock market serves multiple purposes. For institutional investors, it provides a reliable barometer for the UK's corporate landscape. For individual investors, it's a guide for investing in blue-chip British companies.

Moreover, changes in the FTSE 100 can signal shifts in economic trends. For example, during times of economic uncertainty like Brexit or the COVID-19 pandemic, the FTSE experienced notable volatility, reflecting investor concerns. Conversely, strong performance often signals investor confidence and economic growth.

Investing in the FTSE

There are several ways to invest in the FTSE stock market:

Individual Stocks: Investors can buy shares in companies listed on the FTSE 100 or other FTSE indexes.

ETFs and Index Funds: These funds track the performance of the FTSE index and offer diversified exposure with lower risk.

Pension Funds: Many UK pension schemes are heavily invested in FTSE-listed companies, meaning many citizens already have indirect exposure.

Investing in the FTSE can offer relatively stable returns, especially when focusing on dividend-paying companies. However, like any market, it’s not immune to risk and requires strategic planning.

Global Influence and Comparisons

The FTSE stock market is often compared to other major global indexes, such as the S&P 500 in the United States or the Nikkei 225 in Japan. While the FTSE is more concentrated in sectors like energy, finance, and pharmaceuticals, it lacks the heavy tech weighting seen in U.S. indexes.

This makes the FTSE an appealing diversification tool for global investors who are overexposed to technology-heavy markets.

Future of the FTSE Stock Market

Looking ahead, the FTSE stock market faces both challenges and opportunities. The transition to a greener economy, the impact of artificial intelligence, and geopolitical shifts will likely influence the performance of FTSE-listed companies.

Additionally, as ESG (Environmental, Social, and Governance) factors gain traction, companies listed on the FTSE will need to adapt to remain competitive and attractive to socially conscious investors.

Conclusion

The FTSE stock market remains a cornerstone of the global financial landscape. Whether you're a seasoned investor or a newcomer, understanding its mechanisms, history, and role in the global economy is essential. With diversified sectors, historical resilience, and broad investor interest, the FTSE continues to offer valuable insights and opportunities in the world of finance.

0 notes

Text

Unlock Instant Living: 9 Steps to Securing Your Ready-to-Move-In Apartment in Bengaluru

Skip the wait, skip the stress — step into your dream home today.

1. Define Your Dream (and Your Dollars)

Picture your perfect morning: coffee on a sunlit balcony, or a quiet corner office just steps away? Jot down must-haves — balcony views, extra bedroom, home-office nook — and map out a realistic budget. Factor in stamp duty, legal fees, interiors and moving costs so there are no surprises later.

2. Fall in Love with Bengaluru’s Neighborhoods

Each pocket of the city has its own vibe:

Whitefield & Manyata Tech Park — Seamless tech-park commute

Koramangala & Indiranagar — Cafés, nightlife, co-working hotspots

Jayanagar & Sadashivanagar — Leafy streets and established amenities

Consider your daily routines — office, schools, hospitals — and upcoming infrastructure that could boost resale value.

3. Zero In on Ready-to-Move Projects

Visit developer websites — such as BHADRA Group at bhadragroup.com — and leading property portals. Filter strictly for “ready-to-move” or “immediate possession” listings. BHADRA Group currently features seven boutique projects across the city, including:

BHADRA Landmark #3, Girinagar BasavanaGudi

BHADRA Landmark #3/01, Jayanagar 8th Block

BHADRA Landmark #37, Jayanagar 4th Block

BHADRA Landmark #14/1, Haudin Road

BHADRA Landmark #14, Mahalakshmi Layout

BHADRA Landmark #5, Girinagar BasavanaGudi

BHADRA Landmark #153, off MG Road

Compile floor plans, unit sizes, price per square foot and any special offers in a single spreadsheet for easy comparison.

4. Book Visits (Real or Virtual)

Seeing is believing:

On-site visits at different times of day reveal light, ventilation and noise.

Virtual tours (360° videos or high-def walkthroughs) are lifesavers if you’re out of town.

Use a consistent checklist — corridor widths, lift wait times, garden upkeep — to score each visit.

5. Inspect Every Nook and Cranny

A finished apartment can still hide flaws. Check:

Tile alignment and grout

Paint finish uniformity

Seals on windows, doors and plumbing

Functionality of sockets and taps

For peace of mind, hire a certified inspector to prepare a snag list before you sign off.

6. Size Up the Amenities

A glossy clubhouse means nothing if it’s poorly maintained. Visit:

Gym and pool during peak hours

Landscaped gardens and children’s play areas

Party halls, guest suites and co-working lounges

Make sure you’ll actually enjoy — and use — what you’re paying for.

7. Dot Your I’s and Cross Your T’s

Legal due diligence is non-negotiable:

RERA registration and status

Environmental and fire safety clearances

Land title and encumbrance checks

Fully vetted sale agreement clauses

A property lawyer can spot pitfalls in payment schedules, possession dates and maintenance escalations.

8. Negotiate Like a Pro

Ready-to-move units often include incentives. Arm yourself with market comparables and ask for:

Stamp duty reductions

Free covered parking

Corpus fund concessions

Fit-out or furnishing credits

Flexible payment plans

A swift decision — and proof of financing — can give you extra leverage.

9. Seal the Deal and Move In

Once contracts are signed:

Secure property insurance

Book a reliable moving company

Schedule handover and collect keys

Do a final walkthrough to confirm all repairs

Then simply step across the threshold — and start living your Bengaluru dream.

Ready to Unlock Instant Possession?

Partner with trusted developers like BHADRA Group, stay organized, and act decisively. Your key to a ready-to-move-in Bengaluru apartment is just nine steps away — why wait?

0 notes

Text

Top Benefits of Working with a Flight API Provider for Seamless Travel Bookings

When it comes to running a travel-related business, offering seamless and up-to-date flight information is essential. That’s where a Flight API Provider becomes crucial. With the rapid advancements in technology, businesses in the travel sector are continuously seeking ways to improve their services, streamline operations, and enhance customer experiences. A Flight API Provider can help you achieve all these goals by offering easy access to flight data and booking solutions.

What is a Flight API Provider?

A Flight API Provider delivers a set of tools and services that allow travel businesses to integrate flight-related functionalities into their platforms. These functionalities may include flight search, booking capabilities, price comparisons, real-time availability updates, and more. Instead of manually tracking and updating flight information, a Flight API Provider allows businesses to pull data from global flight databases, making the process of booking and managing flights much more efficient. With the support of a Flight API Provider, you can offer your customers an easy way to find flights, book tickets, and manage their travel - all through your website or app. This results in a smoother, more user-friendly experience, which is crucial in today’s competitive travel market.

The Benefits of Partnering with a Flight API Provider

Access to Real-Time Data

One of the major advantages of working with a Flight API Provider is the ability to access real-time flight data. This includes up-to-the-minute updates on flight availability, pricing, and any changes that might occur. With this level of accuracy, your customers can trust the information they see on your platform, leading to a better overall experience.

Streamlined Integration

Integrating a Flight API Provider into your platform is straightforward, thanks to the user-friendly interfaces provided by many API platforms. Whether you're running a travel agency, a flight comparison website, or an app that facilitates travel bookings, the integration process is designed to be simple, reducing development time and costs.

Enhanced Customer Experience

When you use a Flight API Provider, you empower your customers to find and book their flights directly through your platform. With features like flight search filters, instant booking confirmation, and even price comparisons, customers will enjoy a seamless experience that saves them both time and effort. This helps to build trust and encourages repeat business.

How API Market Can Help You Find the Best Flight API Provider

At API Market, we offer a global digital marketplace where you can easily discover, purchase, and integrate APIs for your business. Whether you're looking for a Flight API Provider or other APIs in domains like finance, healthcare, or e-commerce, our platform provides everything you need to expand and enhance your offerings. Our easy-to-use interface, coupled with robust search capabilities, ensures you can find the right API to meet your business's needs. By partnering with a Flight API Provider from API Market, you can ensure your customers have access to the latest flight information and booking capabilities with just a few clicks.

Takeaway

In today’s fast-paced travel industry, partnering with a Flight API Provider can make all the difference in providing a seamless, efficient, and user-friendly service to your customers. API Market makes it easy to find and integrate these solutions into your business. Whether you're just starting or scaling up, we have the tools you need to stay ahead in the competitive travel market. Visit our website at API Market and start exploring the best flight APIs today!

0 notes

Text

Odoo vs SAP ERP Software: A Strategic Comparison for Kuwaiti Businesses

In an era where digital transformation is not just a trend but a business imperative, Kuwaiti enterprises are accelerating their shift toward intelligent, integrated systems. From oil & gas to retail, logistics, and finance, organizations across Kuwait are adopting powerful ERP platforms to streamline operations, enhance agility, and future-proof their growth.

Two names dominate the ERP landscape: Odoo and SAP. At Centrix Plus-a leading Odoo ERP implementation partner in Kuwait-we’re frequently asked, “Which ERP is right for our business?”

This blog unpacks the foundational differences, key features, and practical considerations that can help you choose the ERP system that aligns with your goals, budget, and local compliance needs.

1. Odoo vs SAP ERP: A Quick Overview

Feature

Odoo ERP

SAP ERP

Origin

Open-source (2005)

Proprietary (1972)

Type

Modular, open-source

Structured, commercial suite

Pricing

Budget-friendly, scalable

High licensing and implementation costs

Target Market

Startups, SMEs, and large firms

Primarily large enterprises

Implementation

Faster, flexible

Lengthy, complex

Customization

High (open-source)

Limited without added cost

2. Why Odoo ERP Is Winning Ground in Kuwait

Odoo ERP is gaining strong traction in Kuwait, and for good reason. Its modular design, affordable pricing, and localization capabilities make it a compelling option for businesses seeking growth without compromising on control or compliance.

Key Advantages:

Modular Flexibility: Activate only the modules you need-Finance, Inventory, CRM, HR, etc.

Middle East Localization: Built-in support for Arabic language, VAT, and Zakat regulations.

Budget-Friendly: No hefty license fees; pay only for what you use.

Seamless Integration: Connects easily with government portals and third-party apps.

Centrix Plus Insight: We've deployed Odoo for a wide range of businesses-from Salmiya’s bustling retail scene to logistics hubs in Shuwaikh. Across sectors, results have included quicker rollouts, leaner operations, and measurable ROI.

3. SAP ERP: Global Reputation, Local Limitations

SAP is synonymous with enterprise-grade ERP and is widely adopted by multinational corporations. Its extensive modules and robust architecture cater well to large-scale operations.

Key Strengths:

Comprehensive Scope: Manages all enterprise functions end-to-end.

Built-in Analytics: Strong business intelligence tools for data-driven decisions.

Global Legacy: Trusted by Fortune 500 companies for decades.

The Kuwaiti Reality:

SAP’s steep licensing costs, rigid structure, and longer deployment cycles often deter SMEs and mid-sized businesses in Kuwait that require nimble, cost-effective solutions aligned with regional market dynamics.

4. Odoo ERP: Tailored for Kuwait’s Business Environment

Kuwait Vision 2035 is driving innovation and economic diversification, pushing companies to embrace scalable digital tools. Odoo aligns seamlessly with this vision.

Why Kuwaiti Businesses Prefer Odoo:

Cost-Effective: Suits startups and growth-focused companies.

Highly Customizable: Industry-specific modules for logistics, construction, retail, and finance.

Local Compliance: Arabic UI, VAT support, and integrations with local systems.

Rapid Deployment: Get up and running in weeks, not quarters.

5. Kuwaiti Case Study: Odoo in Action

A local trading company approached Centrix Plus to upgrade its ERP infrastructure. After evaluating both SAP and Odoo, they chose Odoo for its:

Lower implementation and ownership cost

Fast deployment timeline

Compatibility with POS and banking systems

Results Achieved:

35% faster order processing

20% drop in operational costs

Complete VAT compliance

6. Final Recommendation: Which ERP Suits You?

Business Scenario

Recommended ERP

SME or startup in Kuwait

Odoo ERP

Large enterprise with global ops

SAP ERP

Need fast, cost-effective rollout

Odoo ERP

Complex, industry-specific functions

SAP ERP

Arabic language & VAT compliance

Odoo ERP

Limited in-house IT capabilities

Odoo ERP

7. Why Centrix Plus Is Kuwait’s Trusted Odoo ERP Partner

At Centrix Plus, we don’t just implement ERP-we engineer growth. With deep domain knowledge and local expertise, we deliver Odoo solutions that are agile, scalable, and tailored for the Kuwaiti business ecosystem.

Our Key Differentiators:

In-depth understanding of Kuwait’s business and regulatory landscape

Full Arabic and bilingual user interface support

GCC-compliant VAT and financial modules

Faster deployment with minimal disruption

Continuous support, training, and updates

Whether you operate a logistics firm in Ahmadi, a retailer in Hawalli, or a construction company in Jahra, we can optimize your operations with a fully localized Odoo ERP system.

8. Ready to Transform Your Business with Odoo?

ERP isn’t just a software decision’s a strategic growth lever. If you're looking for a future-ready, flexible, and cost-efficient ERP platform for your business in Kuwait, Odoo ERP from Centrix Plus is the solution you need.

Contact us today for a no-obligation consultation and live product demo. Let’s work together to build smarter, faster, and more agile businesses across Kuwait.

0 notes

Text

Tesla CEO Salary vs. Chase CEO Salary: A Comparison

Executive reimbursement is a subject that frequently sparks debate and curiosity, mainly while evaluating the salaries of CEOs at main agencies. Two such figures that frequently come into the highlight are the Tesla CEO income and the Chase CEO income. Both leaders oversee incredibly successful corporations, but their repayment packages mirror their respective industries, business models, and private contributions to their organizations' boom and achievement.

The Tesla CEO Salary: A Performance-Based Approach

The Tesla CEO Salary is well known for its unique, overall performance-based shape. Elon Musk, the CEO of Tesla, no longer receives a conventional income like most executives. Instead, Musk's reimbursement package deal is tied to stock alternatives and overall performance milestones. The Tesla CEO's earnings are structured in a way that rewards him primarily based on the enterprise's ability to attain ambitious objectives, along with revenue growth, market value, and production goals. This version aligns Musk's financial pastimes with the lengthy-time period fulfillment of Tesla, as opposed to receiving constant annual repayment.

How the Chase CEO Salary Compares

On the other hand, the Chase CEO Salary follows a greater conventional structure. Jamie Dimon, the CEO of JPMorgan Chase, earns a mix of base pay, general performance rewards, and inventory-primarily based incentives. The Chase CEO profits reflect Dimon's great management role inside, certainly one of the biggest financial institutions in the international. While Dimon's repayment is excessive, it is nonetheless noticeably modest compared to other CEOs within the finance quarter, who frequently offer hefty bonuses tied to profitability and stock overall performance. His package deal is a reflection of JPMorgan Chase's strong and mature business version.

Performance Metrics Driving Tesla CEO Salary

The structure of the Tesla CEO profits is based totally closely on performance metrics, ensuring that Elon Musk's reimbursement is tied to Tesla's boom. This is an unconventional method that has been lauded with the aid of a few for its consciousness of delivering cost for shareholders. The Tesla CEO earnings are designed to incentivize Musk to force innovation and supply significant milestones for Tesla, which include growing car manufacturing potential and improving profitability. In this way, the performance-based total structure has come to be a version for different companies seeking to align CEO reimbursement with employer performance.

The Traditional Structure of Chase CEO Salary

In comparison, the Chase CEO profits follow an extra conventional method, with a set base revenue complemented by means of annual performance bonuses. These bonuses are tied to diverse monetary metrics, including quarterly and annual profits, the financial institution's return on equity, and normal sales growth. The Chase CEO profits are designed to ensure Jamie Dimon's compensation reflects JPMorgan Chase's strong overall performance in the banking and financial offerings zone. Dimon has performed a vital function in guiding the organization through each economic downturn and duration of the boom.

Comparing the Salary Structures: Innovation vs Tradition

When comparing the Tesla CEO's profits to the Chase CEO's income, a clear difference emerges in terms of shape and the factors that have an effect on compensation. While the Chase CEO salary is tremendously strong and predictable, tied to a mixture of base income and performance-based bonuses, the Tesla CEO profits offer a more radical technique. Elon Musk's salary is nearly completely primarily based on his potential to fulfill aggressive goals, which rewards him in the form of stock alternatives rather than.

Find out more today, visit our site.

Cisco CEO Salary

Nike revenue breakdown

0 notes

Text

Top Reasons ComputerWorks Clients Prefer Adagio Accounting Software

For growing businesses, choosing the right accounting software isn’t just about features—it’s about finding a solution that fits seamlessly with operations, scales with growth, and offers the control that finance teams demand. That’s why so many clients of ComputerWorks choose Adagio Accounting Software to power their financial operations.

Known for its reliability, modular structure, and batch-oriented processing, Adagio Accounting Software has become the preferred choice for mid-sized businesses that have outgrown basic bookkeeping tools like QuickBooks but aren’t ready for the complexity (or cost) of full-scale ERP systems.

1. Designed for Financial Precision and Audit-Readiness

One of the top reasons ComputerWorks clients lean toward Adagio Accounting Software is its robust audit trail. Adagio uses batch-style processing, meaning users must explicitly post transactions, which adds a layer of control and accountability. This setup reduces errors and ensures financial integrity—an essential feature for companies subject to regulatory audits or financial scrutiny.

With Adagio, every entry is traceable, making it easier for accountants and auditors to verify transactions without digging through disconnected systems or spreadsheets.

2. Powerful Financial Reporting Capabilities

While many accounting platforms require third-party tools for customized reporting, Adagio Accounting Software includes its own advanced financial statement generator. Clients appreciate the flexibility it provides—whether they need department-level reports, consolidated statements, or multi-year comparisons.

ComputerWorks ensures that each client’s reporting needs are mapped during implementation, allowing stakeholders to view financial data in the format that best supports their decision-making.

3. Modular and Scalable for Growing Companies

Adagio isn’t a one-size-fits-all solution. Its modular architecture allows businesses to choose only the components they need—such as Ledger, Payables, Receivables, Inventory, and more—then add on as they grow.

This modularity is a key reason clients stick with Adagio Accounting Software over time. With support from ComputerWorks, businesses can expand their system capabilities without needing to replace their core infrastructure.

4. Seamless Integration with Existing Systems

Many mid-sized businesses use vertical market software or industry-specific tools. Adagio Accounting Software can be configured to integrate with a variety of third-party platforms, giving clients the flexibility to maintain their existing workflows.

ComputerWorks plays a critical role here, leveraging its in-house technical expertise to tailor integrations that align with client-specific requirements.

5. Exceptional Support and Training from ComputerWorks

Adopting new accounting software can be intimidating, but ComputerWorks ensures that the transition is smooth. Their team offers personalized onboarding, training, and ongoing technical support—helping clients fully utilize the power of Adagio Accounting Software.

Many clients cite ComputerWorks’ responsiveness, depth of product knowledge, and real-world accounting experience as deciding factors in both choosing Adagio and staying with it long term.

Conclusion

Choosing accounting software is a strategic decision—and for many mid-sized organizations, Adagio Accounting Software strikes the ideal balance between control, functionality, and affordability. Combined with the expert guidance and implementation support from ComputerWorks, it becomes a powerful tool for financial management, compliance, and growth.

If your business is ready to move beyond entry-level systems and gain deeper control over financial data, it’s time to explore how Adagio Accounting Software, supported by ComputerWorks, can deliver long-term value and confidence.

0 notes

Text

HireLATAM vs Lathire: A 2025 Comparison for Latin American Outsourcing

As remote hiring and nearshore outsourcing grow, US companies are looking to Latin America for top tech and business talent. Platforms like HireLATAM and Lathire specialize in this Latin American market. In this comparison of “HireLATAM vs Lathire,” we’ll examine how these two services stack up on key factors: talent offerings (developers, designers, and more), vetting processes, regions served, speed of service, pricing and cost savings, platform usability, and support. The goal is to help you understand which solution might fit your hiring needs.

Both platforms promise big savings and access to bilingual, time-zone-aligned teams. For example, Lathire boasts that North American companies can save “up to 80%” on payroll by hiring LatAm professionals (often under $2,000/month). Indeed, industry data show U.S. tech salaries of ~$90K/year versus ~$30–40K for equivalent Latin American talent. HireLATAM similarly highlights 70–80% cost savings. Beyond cost, Latin American talent offers strong English skills and cultural fit, making it a popular outsourcing choice

In this post we’ll neutrally compare each platform’s strengths and trade-offs. In the end, you’ll see why many clients find Lathire’s AI-driven model and all-inclusive pricing especially compelling, all without ignoring HireLATAM’s reliable service approach. Let’s dive in.

Talent Pools & Roles (Developers, Designers, etc.)

Both platforms recruit a wide range of roles across tech and business functions, but there are some differences in focus. Technology & Developers: Lathire’s marketplace features software engineers (backend, frontend, full-stack), DevOps, data scientists, QA, AI engineers, and more. HireLATAM similarly covers developers and IT roles, matching US firms with “top-tier remote talent” in software, DevOps, QA, and IT support. Both emphasize tech skills alongside bilingual communication.

Designers & Creative: Lathire explicitly markets creative talent. For instance, Lathire’s site showcases sample candidates labeled “UX/UI Designer” and “Graphic Designer” from Mexico. These profiles indicate Lathire actively recruits designers for UI/UX, graphic, and related roles. HireLATAM mainly highlights marketing/design under its industries (digital marketing) and tech sections, but it does not emphasize designers by name on its homepage. In practice, both can source UI/UX or graphic designers through their marketing or tech categories, but Lathire’s marketing highlights (e.g. sample profiles) give it an edge in explicitly covering design talent.

Sales, Marketing, & Business Roles: Beyond tech, both services cover typical business functions. Lathire’s talent pool spans sales development, customer support, growth leads, content marketing, community managers, and more (see Lathire menu). HireLATAM’s offerings also include customer service, virtual assistants, finance/accounting, property management, and sales roles. For example, HireLATAM’s FAQ notes it fills positions in customer service, virtual assistance, sales, marketing, finance, and even property management.

Administrative & Finance: Lathire explicitly lists roles like HR professionals, administrative assistants, accountants, and bookkeepers, etc. HireLATAM similarly recruits VAs, bookkeepers, and analysts (the hire-latam developers page mentions virtual bookkeepers and analysts trained in US practices).

In summary: both platforms provide a broad spectrum, from remote tech talent (developers, devops, data, AI) to creative/designers, sales & marketing, and administrative/finance. Lathire’s site tends to show detailed categories (including designers), while HireLATAM emphasizes quick access to “skilled professionals from Latin America, across various roles”. A quick rundown:

Tech: Developers, DevOps, QA, Data/AI – available on both.

Design/Creative: Lathire specifically lists UX/UI and graphic designers.

Sales/Support: Sales reps, support specialists – both platforms cover these. (HireLATAM highlights a sales representative from Honduras on its site).

Marketing: Social media, content, SEO – HireLATAM details SEO/ads roles, Lathire covers digital marketing under its menu.

Admin/Operations: Virtual assistants, project managers – Lathire and HireLATAM both recruit VAs, PMs, operations staff.

Finance/Legal: Lathire lists accountants, bookkeepers, paralegals. HireLATAM covers finance pros and offers legal/immigration positions.

This broad coverage means you can use either to staff cross-functional teams. In particular, Lathire’s curated platform of “top 3% LatAm talent” explicitly includes tech and non-tech alike. HireLATAM’s recruiting model also promises candidates from a range of industries (marketing, finance, IT, etc.).

Candidate Vetting & Hiring Process

Lathire’s approach: Lathire positions itself as an AI-driven talent marketplace. Candidates in its pool have been prescreened so companies can hire immediately. Once you sign up, Lathire walks you through setting up a hiring profile by importing your job description or using AI tools to create one. Its AI-powered matching (“AI Magic”) then finds likely fits within ~24 hours. All Lathire talent is pre-vetted: they have detailed profiles and often have completed an AI-powered video interview as part of Lathire’s vetting process. Lathire highlights that candidate evaluations are “auto-generated and manually assessed” after interviews, ensuring quality. In short, you can immediately browse or receive AI-suggested candidates from a pool of ~10,000+ pre-vetted Latin American professionals.

HireLATAM’s approach: HireLATAM follows a more traditional recruiting service model. After an initial kickoff call to define your role, HireLATAM advertises the job, collects applications, and thoroughly screens candidates on your behalf. They then present a shortlist of 2–3 pre-vetted candidates, typically within 2–3 weeks of the process start. Their vetting focuses on skills tests, cultural fit, English proficiency, and background checks (their FAQ notes screening for “English fluency, tech readiness, cultural fit”). HireLATAM promises only the top few candidates make it to the client, and they offer a 90-day replacement guarantee if a hire doesn’t work out.

In practice: Lathire lets clients search and screen via the platform (plus optional white-glove help), whereas HireLATAM does the searching/screening for you. For example, Lathire claims its pre-vetted pool lets companies hire in as little as 24 hours, and it can deliver a custom shortlist within 1–2 days. HireLATAM, on the other hand, estimates candidate presentations in about 2–3 weeks. A third-party review notes HireLATAM’s model is best for quick, one-off hires in Latin America, underscoring its focus on fast, limited-volume recruitment.

Talent Quality: Both emphasize high-quality candidates. Lathire’s tagline is “top LATAM talent”and it calls itself the “largest pre-vetted pool of Latin American talent.” HireLATAM likewise markets “top pre-vetted remote talent” in LATAM. Both screen for English skills and experience. Notably, HireLATAM explicitly vets for English, tech skills, and U.S. experience. Lathire’s pool is curated so that “elite LatAm talent” is ready to go. Ultimately, both promise strong candidates, but Lathire’s AI tools aim to speed up matching, while HireLATAM’s recruiters manually ensure only a few top candidates are sent to you.

Time-to-Hire & Speed

A key difference is how fast you can hire. Lathire claims extremely fast turnaround: because its talent are “available to start immediately,” you can hire in as little as 24 hours. Their “How It Works” section shows a 3-step flow: set up your profile, use AI to match within 24 hours, and start working (Lathire handles HR/payroll). This is enabled by their always-on platform and pre-screened talent pool.

HireLATAM’s timeline is longer. Their process is more linear: schedule an initial call, let them search and interview, then get candidate interviews. It typically takes 2–3 weeks to deliver qualified candidates. (One review notes HireLATAM’s timespan as ~2-3 weeks from kickoff to shortlisting.) The trade-off is that HireLATAM does upfront work to find candidates, whereas Lathire’s instant pool means much faster matches.

In bullet form:

Lathire: Matches found within 24–48 hours using AI. Custom shortlist often in 1–2 days. Hire anytime on demand.

HireLATAM: Candidates presented in about 2–3 weeks after kickoff call. More structured schedule, suited for planned hires.

So if speed is crucial (urgent role, tight deadlines), Lathire’s model has a clear advantage. If you have a bit more lead time or prefer a hands-off search, HireLATAM still moves relatively quickly for a recruiting service.

Pricing & Cost Comparison

Lathire Pricing: Lathire offers two main models. Its Monthly Staffing plan costs about $1,999 USD per month per hire (all-inclusive). That flat fee covers everything: the contractor’s pay, taxes, benefits (if any), HR, compliance, and even international payroll. In other words, you pay one rate and Lathire handles the rest. They also offer a Direct Hire/buyout option (custom pricing) with a one-time fee, featuring a 30-day risk-free trial, but details are customized. For simplicity, the headline is that regular hires run ~$2K/month each, total. Lathire’s site emphasizes this is roughly 80% less than a U.S. salary for an equivalent position. Their cost comparison chart shows a typical US hire ~$104K/yr vs LatHire ~$21K including benefits.

HireLATAM Pricing: HireLATAM uses flat placement fees. The standard rates (2025) are $3,200 USD for the first hire and $2,700 for each additional hire. In addition, you pay a $500 deposit per hire upfront. The fee is only due once the placement is made. (They also have enterprise subscription plans for high-volume hiring.) Importantly, HireLATAM’s fees do not automatically cover payroll or ongoing management. Instead, they offer an optional $199/month per hire service to administer contractor payments.

Comparison Summary: Lathire’s plan may cost slightly more on paper per month ($2K vs $2,700 one-time), but includes continuous management. Over a year, $2K/mo is $24K plus minimal extras, far below the US equivalent. HireLATAM’s placement fee ($3,200) is charged per hire, so multiple hires add up. However, if you only need one short-term hire, a one-off fee might seem simpler. Note that any payroll or benefits beyond placement are additional with HireLATAM, whereas Lathire covers those (they explicitly handle “cross-border payments at no extra cost”).

Also, Lathire requires no upfront deposit (just a first month’s payment), unlike HireLATAM’s $500 deposit per role. HireLATAM’s 90-day guarantee is longer than Lathire’s 30-day trial, which may provide extra confidence for risk-averse clients. But remember, Lathire’s monthly staffing plan allows you to replace talent at any time, giving similar flexibility.

Overall, if you plan long-term remote staffing, Lathire’s subscription-style pricing and all-in-one service often yields greater value. If you want purely intermittent hires, HireLATAM’s flat fee might look cheaper at first glance, though you may pay more over time or for additional services.

Platform & User Experience

Lathire (LatHire): Lathire is fundamentally a self-service online platform powered by AI. Clients create an account and fill in role details; the system then provides AI-matched candidates. Its “How It Works” section highlights an easy online setup (importing your job description) and rapid matching (24h). The platform offers candidate search, AI screening, and even video interview tools. They stress you have “total hiring guidance” with a dedicated account manager and white-glove support, yet the workflow is digital. The UI (based on site screenshots) shows detailed talent profiles and the ability to browse a pool of 10,000+ pre-vetted workers.

HireLATAM: In contrast, HireLATAM’s website markets a service, not a client portal. There is no public “talent marketplace” interface for customers to browse. Instead, clients sign up for a consultation or “Have us hire” service. All candidate sourcing is handled by HireLATAM’s team. Their site explains the recruiting process (calls, screening, interviews) but doesn’t show an interactive system. In other words, HireLATAM is more of a recruitment agency model, whereas Lathire is a tech-enabled marketplace.

Ease of Use: If you prefer clicking through profiles and using tech tools, Lathire’s platform can be very convenient: AI recommendations, self-service filters, and a dashboard for roles. HireLATAM is easier if you simply want a human recruiter to do the work for you (no software to learn, just emails/calls). HireLATAM’s process is more hands-off on your part – after the first call, you wait for candidate interviews. Lathire, however, shines if you want direct access to candidates (you can interview or manage them via the platform immediately).

Citing the sites: Lathire explicitly invites clients to “start exploring our talent pool” and says hiring is “as easy as signing up to our platform”. HireLATAM’s focus is on scheduling and screening (e.g. “we’ll present 2–3 candidates for you to interview”).

Customer Support & Guarantees

Both companies offer supportive guarantees and assistance, but with different emphasis:

Support: Lathire advertises “Premium White-Glove Support” and a dedicated account manager for each client. Their marketing promises personalized help through the entire process: from shortlisting to compliance. Even though it’s a platform, they emphasize a human touch. HireLATAM likewise provides a recruitment consultant/team, but it’s built into their flat-fee service. They don’t list dedicated managers on the site, but the process (kickoff calls, candidate follow-ups) implies hands-on support. In practice, both assign someone to manage your account, but Lathire is more explicit about it.

Guarantees: HireLATAM’s big selling point is its 90-day replacement guarantee on hires. If a placed candidate leaves or isn’t a fit within 90 days, they’ll find a replacement at no extra charge. Lathire’s standard trial (for direct hire) is 30 days risk-free, shorter, but still a safeguard. However, with Lathire’s monthly model you could simply replace at any time since it’s rolling month-to-month.

Customer Experience: Both platforms include client FAQs and highlight time-zone/cultural alignment as benefits. HireLATAM’s FAQ explicitly notes that its Latin talent is highly educated and English-fluent. Lathire’s site similarly emphasizes English proficiency and US time-zone compatibility. Feedback sections on Lathire’s site (trusted by brands, testimonial images) aim to build confidence, though we won’t use testimonials here as per guidelines.

In summary, both promise reliable support. Lathire adds a tech spin to customer service (AI interviews, analytics), while HireLATAM leans on personal recruiting service.

Why Lathire Often Wins (Neutral Perspective)

To stay fair, both platforms have merits. HireLATAM’s approach is solid for straightforward staffing, especially if you want the recruiter to handle everything. Their fast placement promise (2–3 weeks) and 90-day guarantee are reassuring.

However, Lathire generally has an edge in key areas:

Speed: With Lathire’s pre-vetted pool and AI tools, you can often get candidates in 1–2 days, not weeks. This can cut project delays and headcount gaps dramatically.

Cost Efficiency: Lathire’s inclusive $2K/month rate typically undercuts the equivalent value of HireLATAM’s fees (which total ~$3,700 for one hire including deposit). Over time, Lathire’s model scales more cheaply for teams of 2+ hires.

All-Inclusive Service: Everything from payroll to compliance is built into Lathire’s plan. HireLATAM adds fees for things like payroll admin, and you must handle contractor management unless you pay extra.

Talent Breadth: Lathire explicitly covers a wider set of roles on its user-friendly platform (e.g. highlighting designers and niche tech roles). While HireLATAM can likely find similar talent, you go through their process rather than self-selecting candidates.

Platform & Data: Lathire’s technology (AI matching, video interviews, searchable database) streamlines hiring in an innovative way. HireLATAM is more manual.

Transparency: With Lathire, you see profiles and know exactly how costs break down (and even compare Lathire vs local hire costs in their chart). HireLATAM’s pricing is transparent but their process is less visible (you don’t see candidates until they send them).

That said, Lathire’s shorter guarantee (30 days) vs HireLATAM’s 90-day might concern some. But Lathire’s monthly staffing flexibility partly compensates: you’re not locked in a 90-day contract. Plus, Lathire’s lower monthly rates mean any mismatch is cheaper in absolute terms.

Overall, for companies seeking speed, flexibility, and tech-driven hiring of Latin American talent, Lathire tends to stand out. HireLATAM remains a good choice for firms who prefer a traditional recruiting agency approach for Latin America and value a longer post-hire warranty.

Conclusion

Outsourcing to Latin America offers big perks: nearshore time zones, bilingual teams, and major cost savings. Both HireLATAM and Lathire tap into this trend by connecting U.S. companies with vetted LatAm professionals.

In our “HireLATAM vs Lathire” review, we’ve seen that:

Both cover broad roles: From developers and designers to sales, marketing, and administrative staff (Lathire even highlights creative designers).

Vetting is strong on both sides: Lathire uses AI and pre-screening; HireLATAM uses human recruiters and tests.

Hiring speed differs: Lathire can match talent within 24–48 hours versus HireLATAM’s ~2–3 weeks.

Pricing models differ: Lathire’s all-inclusive $1,999/mo staffing plan vs HireLATAM’s $3,200 placement fee + $500 deposit (plus extra payroll fees if used).

Support & guarantees: Lathire provides a 30-day trial and dedicated account manager; HireLATAM offers a longer 90-day replacement guarantee.

For most use-cases, Lathire edges ahead due to its combination of fast turnaround, lower all-in costs, and tech-driven platform. It excels at building vetted remote teams quickly, an asset for companies that need agile scaling. However, if you prefer paying per hire and value HireLATAM’s guarantee, their service may suit you.

In any case, both platforms enable effective Latin American outsourcing, bridging the U.S. talent gap with skilled, cost-efficient professionals. By weighing the points above, you can decide which approach aligns best with your hiring strategy.

Need help hiring top LATAM talent? Get in touch with LatHire today.

#hire python developers#hire latam talent#hire python talent#hire remote developers#hire latam#entrepreneur

0 notes

Text

What is a Centralized Exchange: Full Comparison Guide

The cryptocurrency industry has become more popular than ever in the last few years. However, trading cryptocurrencies is not without risks, and traders need to know what they are doing. Prices can rise and fall at lightning speed. The high risk is the reason why some people stay away from cryptocurrencies, while others actively engage in them.

In order to trade cryptocurrencies, you will need an account on a cryptocurrency exchange. There are two types of trading platforms: create centralized crypto exchange ( CEX) and decentralized exchanges (DEX). In this guide, we will explain what a centralized exchange is and how it works. But we will also touch on DEX, explain what it is and how it differs from centralized exchanges.

What is a Centralized Exchange?

A centralized crypto exchange, or CEX, is an online platform for trading cryptocurrencies. As the name suggests, this type of trading platform is centralized. It has a centralized governing body – usually the company that created it. Centralized exchanges were the first type of crypto exchange.

Initially, CEXs were anonymous and did not require traders to reveal their identity. However, as more and more people started using these exchanges, global financial regulators became concerned about the anonymity of the exchanges, and so the situation has now changed. Now, users must verify their identity in order to trade.

Centralized exchanges are known for offering a wide range of orders for better trading. CEXs offer limit orders , stop losses , stop-limit orders , margin trading , and leveraged trading . Most exchanges store most of their assets in cold storage. This means that the assets are not connected to the internet and cannot be stolen. The only thing that can be stolen is the funds stored in so-called “hot” wallets.

Hot wallets store funds that are used to provide liquidity and user assets. That is why we recommend withdrawing your funds after trading is complete. If the assets are in a personal wallet, they are much more difficult to steal. But in general, CEX is quite safe, with many security protocols in place to protect your funds.

How Does CEX Work?

CEX is quite easy to use and uses similar registration methods to those used on traditional financial platforms. To register, you need to create an account, verify your identity, and deposit some money. Once this process is completed, you can trade freely. For example, you can place a market order, which will be placed in the platform’s order book. As soon as a sell order appears in the order book that matches your buy order, they are matched and the trade is executed.

Just like traditional finance, where there are maker fees and taker fees, crypto trading also has transaction fees. Transaction fees are the main source of income for centralized exchanges.

What Services Does a Centralized Exchange Offer?

CEX serves several functions in crypto trading. These include order matching, custody services for user assets, and clearing counterparty functions.

We have already discussed how order matching works. So, when you want to buy cryptocurrency, you place a buy order. If you want to sell cryptocurrency, you place a sell order. The orders are stored in the order book, where they wait to be matched. If someone wants to sell the same amount that you are buying, the system will match your orders. For its services, the exchange charges a transaction fee. So, you are not buying cryptocurrency from the exchange, but from another trader. The exchange simply acts as an intermediary.

Now let's discuss the role of the exchange as a clearing counterparty. This feature helps protect the privacy/personal data of users by matching orders with the order book. As stated above, technically, users are buying cryptocurrency from other users. However, to protect the user's identity, the transaction is conducted on behalf of the exchange, not the user.

Finally, CEX also provides custody services for both fiat and cryptocurrency. We have already mentioned this. When you deposit money into an account, the exchange ensures its safety. So, your funds are in custodial storage. When you buy cryptocurrency, it is stored in your exchange wallet. Until you transfer it to your personal wallet, the cryptocurrency remains in the custody of the exchange.

Advantages of Centralized Exchanges

Centralized crypto exchanges have many advantages, which is why they are still extremely popular. For example, they are very easy to use, although this was not always the case. As centralized exchanges gained popularity, their user interface was simplified. Today, the CEX user interface is so simple that even a novice user can easily understand it.

Exchanges also offer support and protection, which is extremely important for less experienced traders. Users can trade on exchanges knowing that their funds are safe. It is also worth noting that if the platform is hacked and funds are stolen, the exchanges will cover your losses.

Additionally, CEX offers a wide range of products and services in one place, making it easier for users to manage their assets. Some platforms offer staking, NFT marketplaces, huge liquidity, launchpads, P2P exchanges, and more.

Disadvantages of Centralized Exchanges

Unfortunately, centralized exchanges also have a few drawbacks. They may not be too critical, but they are important to be aware of.

So, we mentioned that centralized exchanges can become a target for scammers and your funds can be stolen. Centralized platforms invest heavily in security protocols, but sometimes hackers still find a way to hack them. In most cases, hacks are caused by human error, not by a system vulnerability. The best thing you can do is not to store funds on CEX after trading is done. Instead, withdraw them to a personal wallet where they will be safer. And even better, store your money in cold storage (hardware wallet), as this is considered the safest way to store digital assets.