#financecareer

Text

We are hiring for the position of Investor Reporting Specialist for a Leading Financial Company in Gurgaon. Are you a postgraduate or C.A. with a strong finance background? Join us and take your career to new heights! Apply now!

#FinanceCareer#FinancialJobs#CA#CAJobs#FinancialReporting#HiringAlert#JobOpportunity#Gurgaon#Recruitment#JobsIndia#job#jobalert#SpectrumTalentManagement#SpectrumTalent

2 notes

·

View notes

Text

Create and Sell your Online Courses in India

https://finmaestros.com/create-and-sell-your-online-courses-in-india

#education#finance#investment#money#india#career#financecareer#e learning#teaching#online teaching#courses#sell courses

0 notes

Text

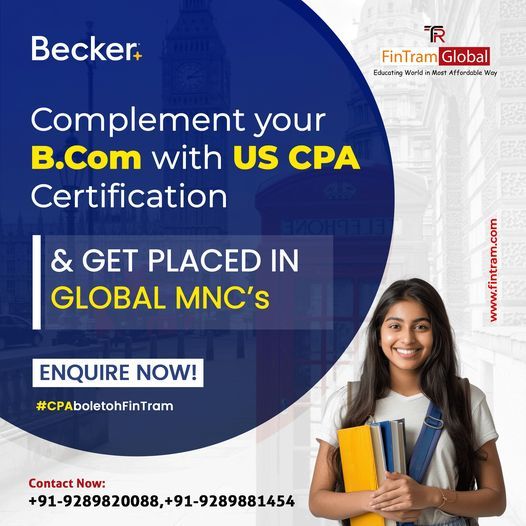

Complement your B.Com with a US CPA Certification! Elevate your career in accounting to new heights by pursuing the prestigious CPA designation. Expand your knowledge, enhance your skills, and open doors to global opportunities in finance and accounting.

Enquire Now: https://fintram.com/us-cpa-course/

1 note

·

View note

Text

📈 Ready to kickstart your finance career?

Join Mentor Techsystems and become a Financial Management Expert!

You can download the app

https://play.google.com/store/apps/details?id=co.diaz.gxgya&pli=1

https://apps.apple.com/in/app/myinstitute/id1472483563

For more information, reach out to us at +91 8282824781 or +91 8282826381

Visit our website at www.mentortechsystems.com

Don't miss out on this incredible opportunity! 💡✨

0 notes

Text

#CPA#USCPA#AccountingCareer#GlobalCareer#CareerOpportunities#CPAMasterclass#CPACertification#CPAExam#AccountingJobs#CareerDevelopment#ProfessionalDevelopment#FinanceCareer#CPAUSA#Accounting#GlobalCPA See less

0 notes

Text

Decoding Financial Advisor Salaries: How Much Do Financial Advisors Make?

Are you intrigued by the world of finance and considering a career as a financial advisor? One of the burning questions you might have is, “How much do financial advisors make?” Understanding the earning potential in this field is crucial when contemplating your career path. Let’s delve into the intricate details of financial advisor salaries to give you a comprehensive insight into this rewarding profession.

Factors Affecting Financial Advisors’ Earnings

Experience and Expertise: In the financial advisory realm, experience often correlates with higher earnings. Entry-level advisors may earn a moderate income, while seasoned veterans or those with specialized expertise tend to command higher fees.

Client Base: The size and composition of an advisor’s client base play a significant role in determining their earnings. Advisors catering to high-net-worth individuals or corporate clients typically earn more due to the complexity and value of the services rendered.

Compensation Structures: Financial advisors can earn through various compensation models, such as fee-only, commission-based, or a combination of both. Fee-only advisors charge clients a flat fee or hourly rate, while commission-based advisors earn a percentage from the financial products they sell.

Geographical Location: Earnings of financial advisors vary based on their location. Advisors in urban areas or financial hubs might earn more due to higher living costs and demand for their services compared to those in rural or less economically vibrant areas.

How much do financial advisors make on average?

The income of financial advisors spans a wide range, influenced by the aforementioned factors. According to the U.S. Bureau of Labor Statistics (BLS) data, as of the latest available information in 2022, the median annual wage for personal financial advisors was around $89,330. To better understand how much do financial advisors make, it is important to know this figure can fluctuate significantly based on individual circumstances.

For instance, entry-level advisors might start with a median income closer to $50,000, whereas experienced advisors in affluent markets can surpass the six-figure mark, reaching several hundred thousand dollars annually. Top-tier advisors serving elite clientele or managing large investment portfolios may even earn in the millions.

Compensation Structures

Commission-Based Earnings: Advisors relying on commissions often earn a percentage of the products they sell, such as insurance policies, mutual funds, or investment products. This model’s income fluctuates based on sales volume and product type, potentially leading to higher earnings during bull markets.

Fee-Only Earnings: Fee-only advisors charge clients directly for their services, irrespective of the financial products recommended. Their income is more stable and less dependent on market fluctuations. Hourly rates or flat fees for financial planning, portfolio management, or consultation are common in this structure.

Hybrid Models: Some advisors employ a hybrid compensation model, combining fees and commissions. This allows them to diversify income sources and cater to diverse client needs.

Detailed Analysis of Compensation Structures

Commission-Based Models: While potentially lucrative during prosperous market conditions, advisors relying solely on commissions face scrutiny regarding conflicts of interest, as recommendations might be influenced by commission rates rather than clients’ best interests.

Fee-Only Structures: This model aligns the advisor’s interests with the clients’, fostering trust and transparency. Fee-only advisors often charge an annual percentage of assets under management (AUM), ensuring their income grows as clients’ portfolios do.

Hybrid and Retainer Models: Advisors combining fees and commissions or charging retainer fees offer a blend of services, appealing to a broader client base and diversifying income sources.

Challenges Impacting Earnings

Market Volatility: Fluctuations in financial markets can affect advisors’ earnings, especially for those heavily reliant on commissions tied to market performance.

Regulatory Changes: Changes in regulations or compliance standards may impact compensation models or increase administrative burdens, affecting advisors’ time and income.

Client Acquisition and Retention: Building a robust client base and retaining clients is crucial. Advisors spend significant time and resources acquiring new clients, impacting their overall income.

Additional Factors Impacting Financial Advisors’ Income

Education and Certifications: Advisors with advanced degrees, such as an MBA or a Certified Financial Planner (CFP) designation, often command higher fees. These credentials signify expertise, instill trust, and can lead to better-paying opportunities.

Specialization and Niche Expertise: Advisors specializing in niche areas like estate planning, retirement, tax management, or socially responsible investing may attract a specific clientele willing to pay premium fees for their specialized knowledge.

Business Structure and Independence: Self-employed advisors or those working for independent firms might have higher earning potential compared to those employed by larger financial institutions due to greater control over fee structures and client relationships.

Technology and Innovation: Utilizing innovative tools and technology in financial planning can enhance efficiency and client services, potentially attracting higher-paying clients seeking advanced solutions.

Evolving Landscape and Future Earnings Trends

Robo-Advisors and Technology Disruption: The rise of robo-advisors and automated investment platforms has disrupted traditional advisory services. However, human advisors who leverage technology to enhance their services can still thrive and command higher fees for personalized guidance.

Sustainability and ESG Investing: With an increasing focus on environmental, social, and governance (ESG) factors, advisors specializing in sustainable investing might witness a surge in demand, potentially leading to higher earnings.

Regulatory Changes and Compliance Costs: Ongoing regulatory changes, especially in fiduciary standards, might impact advisors’ earnings by increasing compliance costs or altering compensation structures to align with client interests.

Other Challenges for Financial Advisors

Client Trust and Communication: Building and maintaining trust with clients is vital. Advisors adept at effective communication and building strong relationships tend to retain clients longer, ensuring a steady income stream.

Continual Professional Development: Staying updated with industry trends, and regulations, and acquiring new skills through ongoing education ensures advisors remain competitive and can offer high-value services, positively impacting earnings.

Summing up:

Financial advisors’ earnings encompass a spectrum influenced by a myriad of factors, from education, specialization, and compensation models to emerging trends and regulatory changes. While the median income provides a baseline, the potential for higher earnings exists for those who leverage expertise, adapt to market shifts, and foster strong client relationships. Navigating the complexities of financial advising not only offers the potential for substantial income but also presents the opportunity to positively impact clients’ lives by guiding them toward financial security and prosperity.

Also Read: Securing an Email Infrastructure: Best Practices for Mail Transfer Agents

#FinancialAdvisors#Earnings2024#FinanceCareer#WealthManagement#FinancialPlanning#FutureofFinance#InvestmentInsights#CareerPath

0 notes

Text

We are Hiring Sr. Financial Analyst

Are you a skilled financial analyst with 2 to 8 years of experience? Join us and be part of a dynamic, growth-focused environment. Your expertise will be valued, your career will flourish, and your contributions will be recognized.

Ready to elevate your financial career? Submit your application today!

Job Description - https://bizessence.com.au/jobs/senior-financial-analyst/

#bizessence#financialanalysis#financialanalyst#financecareer#jobs#financejobs#workwithus#careeropportunity#mumbaijobs#punejobs#chennaijobs#bengalurujobs#india

0 notes

Text

Delve into Our Recent Article : CPA: The Key to Financial Management Success!

#CPA#FinancialManagement#ProfessionalDevelopment#FinanceCareer#FinancialExpertise#CPACareer#Accounting#FinancialLeadership#CareerOpportunities#FinancialSuccess#CPAExam#BusinessFinance#AccountingEducation#FinancialPlanning#CPACommunity#FinancialGrowth#AccountingStandards#EthicalFinance#FinancialStrategies#CPAInsights

1 note

·

View note

Text

DIPIFR Package

Strengthen your IFRS concepts with our online modules and

IFRS training material , study material , video lectures of 180 hrs.

SET of 4 books , pen/Google drive .

Register now.

For more details , contact us on

[email protected]

+91 8421438047

Visit us on : https://finproconsulting.in/

#accaifrs#ifrsexamination#financecareer#enhanceyourknowledge#finpro#learn#grow#workglobally#accountingcareer

0 notes

Text

#AccountantJobs#HiringAccountants#JobOpportunity#AccountingCareer#SaudiArabiaJobs#AccountingJobSearch#FinanceJobs#JobOpening#CareerOpportunity#AccountingPosition#JobPosting#JobSeekers#Employment#NowHiring#FinanceCareer#JobSearchSA#AccountantLife#WorkOpportunity#JobAlert#FinanceProfessionals

0 notes

Text

🌟 Seeking a Career in Finance? 📊💼

Looking to pursue a rewarding career in finance? Check out this insightful article on SelfGrowth.com titled "A Roadmap to Pursue a Career in Finance"! 📚💡

🔍 Explore Different Roles: Discover the diverse career paths within the finance industry and find the perfect fit for your skills and interests.

🎓 Gain Essential Qualifications: Learn about the educational requirements and key skills that can give you a competitive edge in the finance job market.

💼 Network and Internships: Uncover effective strategies for building professional connections and securing valuable internship experiences to kickstart your finance journey.

📚 Develop a Strong Foundation: Build a solid knowledge base in areas like financial analysis, accounting, economics, and investment principles.

📈 Continuous Learning: Stay ahead of the curve by pursuing ongoing professional development through certifications, workshops, and online courses.

🚀 Navigate Career Progression: Get insights into different stages of a finance career and strategies for advancing to higher roles.

💡 Don't miss this roadmap to success in finance! Read the article here: [link to the article]

🌐 Unlock your potential in the finance industry and share this post with others who are passionate about finance! 💼🔓

0 notes

Photo

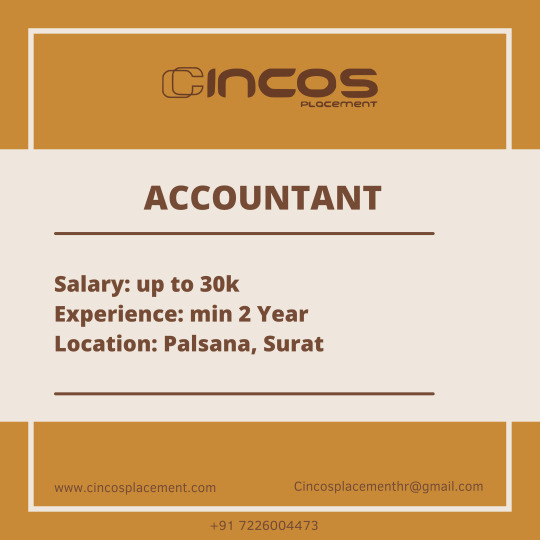

Join Our Team as an Accountant

Contact Us

Person : Sumit Yadav

Phone : +91 7226004473

Email : [email protected]

Web : www.cincosplacement.com

#AccountingJobs#HiringAccountant#FinanceCareer#JobOpening#AccountingOpportunity#AccountantWanted#SuratJobs#CareerGrowth#FinancialManagement#JobSearch

0 notes

Video

Unlock Your Finance Career Potential! Check out our latest video featuring the Top 10 Finance Certifications that can give you a competitive edge in the industry! Whether you're a beginner or an experienced professional, these certifications will help take your career to the next level.

0 notes

Text

Is Finance a Good Career Path in USA?

Finance is one of the most lucrative career fields in the United States. It is a broad field that encompasses a range of activities related to money management, investment, and risk assessment. A career in finance can be highly rewarding, both professionally and financially. However, it is also a highly competitive field that demands a specific set of skills and expertise. In this article, we will explore whether finance is a good career path, how to make a career in finance, the career path in finance, top jobs and companies hiring in the finance field, and other essential information to help you make an informed decision about your career.

How to Make a Career in Finance in USA?

To make a career in finance, you must have a strong foundation in finance and accounting principles. A bachelor’s degree in finance, accounting, economics, or a related field is the first step towards building a career in finance. Some entry-level jobs in finance, such as financial analyst, may only require a bachelor’s degree. However, to advance your career in finance, you may need to pursue a master’s degree in finance, accounting, or business administration (MBA).

You should also develop your analytical and problem-solving skills, as they are critical in finance. Additionally, developing your communication and interpersonal skills is essential, as most finance jobs involve working in teams, presenting financial reports, and interacting with clients. Read more

1 note

·

View note

Video

youtube

US CPA Certification Course - To take charge of your finance career

0 notes

Text

Is Finance a Good Career Path for You? A Detailed Guide

So you want to be a financier? It's a great career choice! But before you make any decisions, it's important to ask yourself some tough questions. What are your goals? What are your strengths and weaknesses? And most importantly, what do you enjoy doing? In this blog post, we will explore all of these topics and more. We'll help you decide is finance a good career path for you?, and give you some tips on how to get started!

What career in finance is the best?

There are many different types of finance jobs, and each has its own pros and cons. It's important to decide which one is right for you based on your skills, interests, and goals. Here are a few of the most popular finance careers:

Investment Banking:

If you're good with numbers and have an interest in business, investment banking might be the perfect fit. Investment bankers help companies raise capital by issuing and selling securities. They also advise clients on mergers and acquisitions and provide other financial services.

Commercial Banking:

Commercial banks offer a wide range of services to businesses and individuals, including loans, mortgages, credit cards, and savings accounts. If you enjoy working with people and helping them meet their financial needs, commercial banking might be the right career for you.

Financial Planning:

If you're good with money and have a head for numbers, financial planning could be the perfect career for you. Financial planners help individuals and businesses map out their financial goals and create plans to achieve them. They also offer advice on investing, taxes, and insurance.

Asset Management:

Asset managers work with clients to invest their money in a way that meets their financial goals. If you're interested in the stock market and have a head for numbers, asset management might be the right career for you.

What are the benefits of a career in finance?

There are many benefits to pursuing a career in finance. Here are a few of the most popular:

-High earning potential: With the right skills and experience, you can earn a very high salary in finance.

-Job security: Finance is a stable industry, and there will always be a demand for financial services.

-Career advancement: There are many opportunities for career advancement in finance.

-Flexibility: Many finance jobs offer flexible hours and the ability to work from home.

What are the drawbacks of a career in finance?

Like any career, there are also some drawbacks to working in finance. Here are a few of the most popular:

-Long hours: Many finance jobs are very demanding and can require long hours.

-Stressful: Finance can be a very stressful industry, and some jobs can be high-pressure.

-Competition: There is a lot of competition for jobs in finance.

So, is finance a good career choice?

Is finance a good career path? There is no easy answer to this question. It depends on your skills, interests, and goals. If you're good with numbers and have an interest in business or investments, finance might be a good fit for you. However, it's important to weigh the pros and cons before making any decisions.

Why do finance jobs pay so well?

Finance jobs tend to pay very well because they are in high demand and require a lot of skills and experience. With the right skills and experience, you can earn a very high salary in finance.

What are the most common finance jobs?

There are many different types of finance jobs, but some of the most common include investment banking, commercial banking, financial planning, and asset management.

What skills do you need for a career in finance?

To succeed in finance, you will need strong math skills and the ability to analyze data. You will also need to be good with people and have excellent communication skills.

Is finance a good career path?

Finance is a stable industry, and there will always be a demand for financial services. However, like any career, there is always some risk of job loss.

What are the best finance companies to work for?

There are many great finance companies to work for, but some of the most popular include Goldman Sachs, JP Morgan, and Merrill Lynch.

What are the biggest finance companies?

The biggest finance companies in the world include Goldman Sachs, JP Morgan, and Bank of America.

What is the future of finance?

The future of finance is uncertain, but there will always be a demand for financial services. Technology is changing the way that finance works and jobs may be lost to automation in the future. However, there will also be new opportunities created by technology, and the finance industry is expected to grow in the coming years.

Read the full article

0 notes